Похожие презентации:

The Double-Entry System

1. The Double-Entry System

2. Measurement Issues

• Objective 1– Explain, in simple terms, the generally

accepted ways of solving the measurement

issues of recognition, valuation, and

classification

2–2

3. Measuring Business Transactions

Once accountants have determined atransaction has occurred, they must decide

• When the transaction occurred

– The recognition issue

• What value to place on the transaction

– The valuation issue

• How to categorize the components of the transaction

– The classification issue

2–3

4. Measurement Issues

Recognition issueValuation issue

Classification issue

• These issues underlie almost every major

decision in financial accounting

• Controversies exist; solutions are not cut and

dried

2–4

5. The Recognition Issue

• Recognition means the recording of atransaction

• Refers to the difficulty of deciding when

a business transaction occurred

• Point of recognition is important

because it affects the financial

statements

2–5

6. Point of Recognition for Sales and Purchases

• Sales and purchases of products– Usually recognized when title of property transfers

– Or, may set up a recognition point

• Predetermined time at which a transaction should be

recorded

• Sales and purchases of services

– Usually recognized when services have been

performed

– If services are performed over a long period of

time, may set up billing at specific points of time

• Transaction recorded at each billing

2–6

7. Business Event versus Business Transaction

• Business Event– Any occurrence related to the course of

running a business

• Business Transaction

– Economic event that affects the financial

position of a business entity

2–7

8. Business Events That …

Are Not Transactions• Customer inquires

about a service

• Ordering products

from suppliers

Are Transactions

• Customer buys a

service

• Receiving products

previously ordered

• Hiring new employees • Paying employees for

work performed

2–8

9. The Valuation Issue

• Focuses on assigning a monetary valueto a transaction

• Most controversial issue in accounting

• According to GAAP, use original cost

– Also called historical cost

• Practice of recording transactions at

cost follows the cost principle

2–9

10. Cost Principle

• The principle that a purchased asset shouldbe recorded at its actual cost

– Cost

• Exchange price associated with a business transaction at

the point of recognition

– Exchange price

• Amount a buyer is willing to pay and a seller is willing to

receive

• Is objective (not influenced by emotion or personal

feelings)

• Cost principle is used because cost is

verifiable

2–10

11. Applying the Cost Principle

1. Company A purchases building for $80,000Company A

• Records purchase of building at original cost (exchange price) of $80,000

2. Company A offers same building for sale for $120,000

3. Company A sells building to Company B for $110,000

Company A

• Records sale of building at sales

price (exchange price) of $110,000

and profit or loss is recognized

Company B

• Records purchase of building at

cost (exchange price) of

$110,000

Company A

Company B

Building

Building

Original purchase price

Listed sales price

Valuation for real estate taxes

Valuation for insurance

Offer 1

Offer 2

Final sales price

$ 80,000

120,000

75,000

90,000

100,000

105,000

110,000

Only amounts involved in business

transactions (exchanges of value)

are recorded in the company books

Original purchase price

$110,000

12. Analyzing Information

• Recall - the cost principle requires that a purchased assetis recorded at its actual cost, or the exchange price

• Exchange price

–The amount a buyer is willing to pay and a seller is willing to receive

for an exchange of value

–Is objective (not influenced by emotion or personal feelings)

Building

Original purchase price

Listed sales price

Valuation for real estate taxes

Valuation for insurance

Offer 1

Offer 2

Final sales price

$ 80,000

120,000

75,000

90,000

100,000

105,000

110,000

Exchange

of Value

Objective

Value

Exchange

Price

Yes

No

No

No

No

No

Yes

Yes

No

No

No

No

No

Yes

Yes

No

No

No

No

No

Yes

2–12

13. The Classification Issue

• Classification is the process of assigningtransactions to the appropriate accounts

• Proper classification depends on

– Correctly analyzing the effect of each transaction

on the business

– Maintaining a system of accounts that reflects that

effect

• The classification issue refers to the

uncertainties associated with assigning

transactions to the appropriate accounts

2–13

14. Discussion

Q. What three issues underlie mostaccounting decisions?

1. The recognition issue

When a transaction should be recorded

2. The valuation issue

What value should be placed on the

transaction

3. The classification issue

How the components should be categorized

2–14

15. Accounts and the Chart of Accounts

• Objective 2– Describe the chart of accounts and

recognize commonly used accounts

2–15

16. Accounts

• Used to record transaction data– Record data in a usable form

– Data can be quickly retrieved

• Separate account used for each

– Asset

– Liability

– Component of owner’s equity (includes

revenues and expenses)

2–16

17. General Ledger

• Group of company accounts• Sometimes simply referred to as the ledger

• Two types of systems

– Manual system

• Each account on separate page or card

• Pages or cards placed together in book or file

– Computerized system

• Accounts maintained on magnetic tapes or disks

2–17

18. Chart of Accounts

• List of account numbers with correspondingaccount names

• Helps identify accounts in the ledger

First digit in account number refers to major

financial statement classification

–

–

–

–

–

Assets

Liabilities

Owner's equity

Revenues

Expenses

2–18

19. Example of Account Numbering

1000 - 1999: asset accounts2000 - 2999: liability accounts

3000 - 3999: equity accounts

4000 - 4999: revenue accounts

5000 - 5999: cost of goods sold

6000 - 6999: expense accounts

7000 - 7999: other revenue (for example, interest income)

8000 - 8999: other expense (for example, income taxes)

2–19

20. Owner's Equity Accounts

• Revenue and expense accounts separated fromother owner's equity accounts

• Important for legal and financial reporting

purposes

– Owner's equity accounts represent how much interest

in the assets of a company the owner has

– Law requires that Capital and Withdrawal accounts be

separate from revenues and expenses for tax and

financial reporting

– Management needs a detailed breakdown of revenues

and expenses for budgeting and operating purposes

2–20

21. Account Titles

• Should describe what is recorded in theaccount

• An account name can be analyzed to

understand its purpose

– Identify account’s classification as asset, liability,

owner's equity, revenue, or expense

– Identify the type of transaction that gave rise to the

account

• Different companies may use different

account names for the same account

2–21

22. Discussion

Q. What is an account?A. Account

Means by which management accumulates

the effects of transactions

Basic storage unit for accounting data

Q. How is an account related to the

ledger?

A. The ledger is a file or book in which the

company’s accounts are kept

2–22

23. The Double-Entry System: The Basic Method of Accounting

• Objective 3– Define double-entry system and state the

rules for double entry

2–23

24. Double-Entry System

• Based on principle of duality– Every economic event has two aspects that

balance, or offset, each other

– The two aspects represent

• Effort and reward

• Sacrifice and benefit

• Source and use

Example:

Pay cash to purchase supplies

Cash paid = effort, sacrifice, source

Supplies received = reward, benefit, use

2–24

25. Principle of Duality

• Each transaction recorded with at leastone debit and one credit

• Total amount of debits = total amount of

credits

• Whole system always in balance

• All accounting systems based on

principle of duality

2–25

26. The T Account

Three parts1. A title that describes the account

2. A left side, called the debit side

3. A right side, called the credit side

Title of Account

Debit

(left) side

Credit

(right) side

2–26

27. The T Account Illustrated

• In Chapter 1, Shannon Realty had severaltransactions that affected the Cash account

• Transactions can be summarized in T

accounts

– Record cash receipts (increases) on debit (left) side

– Record cash payments (decreases) on credit (right)

side

Title of

Account

Cash

Debit

(left)Receipts

side

Cash

(+)

Credit

(right)

side

Cash

Payments

(–)

2–27

28. Shannon Realty

1. Deposited $50,000 in a bank account in the name ofShannon Realty

2. Purchased a lot for $10,000 and a small building on a lot

for $25,000

3. Purchased office supplies for $500 on credit

4. Paid $200 of the $500 owed for supplies

5. Earned and received a commission of $1,500 in cash

Cash

(1) Debit 50,000

(left) side

(5)

1,500

Credit

35,000

(right) side

(4)

200

(2)

Transaction 3

does not affect

the Cash account

29. Shannon Realty (cont’d)

6. A $2,000 commission is earned, to be received later7. Received $1,000 from client for commission earned

earlier in the month

8. Paid $1,000 to rent equipment for office

9. Paid $400 in wages to part-time helper

10. Liability of $300 for utilities expense is recorded

11. Owner withdrew $600 in cash for personal use

Cash

Credit

35,000

(right) side

(4)

200

(1) Debit 50,000

(left) side

(5)

1,500

(2)

(7)

(8)

1,000

(9)

400

(11)

600

1,000

Transaction 6

does not affect

the Cash account

Transaction 10

does not affect

the Cash account

2–29

30. Footings and the Account Balance

• Footings– Working totals of columns

– Calculated at end of each month

• Account balance

– Difference between total debit footing and total

credit footing

– Also simply called the balance

– Debit balance recorded on left side of T account

– Credit balance recorded on right side of T account

2–30

31. Footings and the Account Balance (cont’d)

Total the debit sideof the T account

(1)

(5)

(7)

Cash

50,000 (2)

1,500 (4)

1,000 (8)

(9)

(11)

Total Debit

Footing

52,500

Bal.

Total the credit side

of the T account

35,000

200

1,000

400

600

37,200

Total Credit

Footing

15,300

Debit Account Balance

($52,500 - $37,200)

2–31

32. Analyzing and Processing Transactions

Rules of double-entry bookkeeping

1. Every transaction affects at least two

accounts

At least one account is debited and at least

one account is credited

2. Total debits must equal total credits

For each transaction

For whole system (all accounts as a group)

2–32

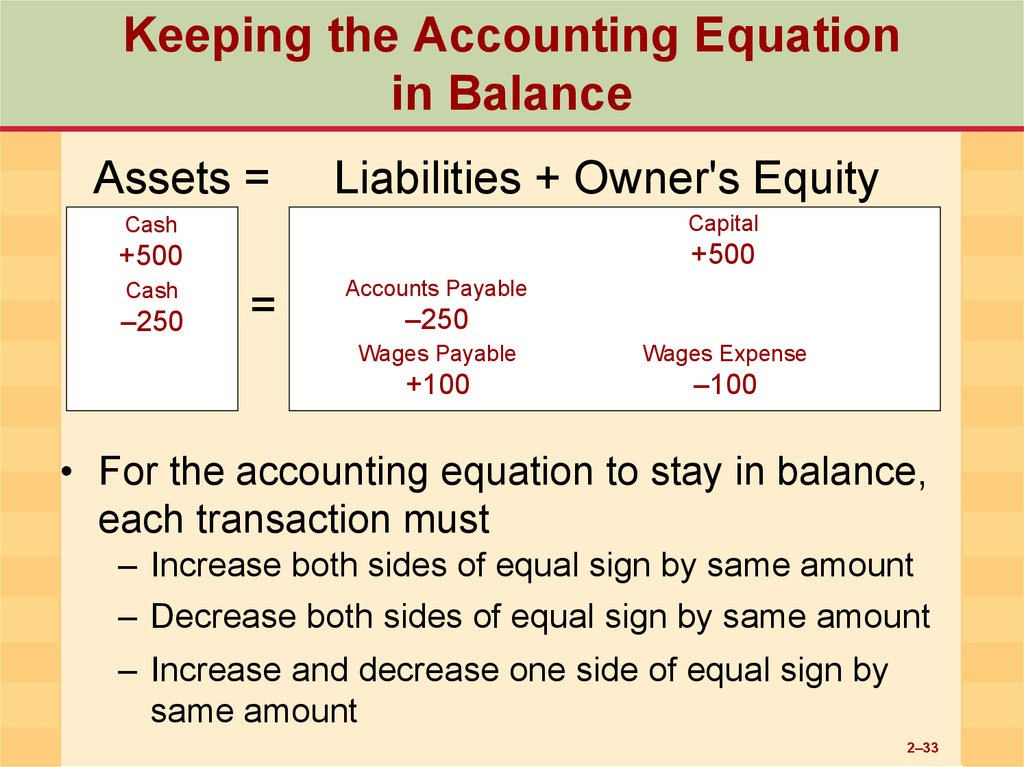

33. Keeping the Accounting Equation in Balance

Assets =Liabilities + Owner's Equity

Cash

Capital

+500

+500

Cash

–250

=

Accounts Payable

–250

Wages Payable

Wages Expense

+100

–100

• For the accounting equation to stay in balance,

each transaction must

– Increase both sides of equal sign by same amount

– Decrease both sides of equal sign by same amount

– Increase and decrease one side of equal sign by

same amount

2–33

34. Accounts and the Accounting Equation

AssetsCredit

Debit

for

for

Increases Decreases

(–)

(+)

=

Liabilities

Debit

Credit

for

for

Decreases Increases

(–)

(+)

+

Owner's

Equity

Debit

for

Decreases

(–)

Credit

for

Increases

(+)

Assets increase with debits

Liabilities and owner's equity increase with credits

Assets decrease with credits

Liabilities and owner's equity decrease with debits

2–34

35. Accounts and the Accounting Equation (cont’d)

Assets=

500

1,000

1,500

Liabilities

+

500

=

500

Owner's

Equity

1,000

+

1,000

If a debit increases assets

a credit must increase

liabilities or owner's equity

for the accounting equation to remain in balance

2–35

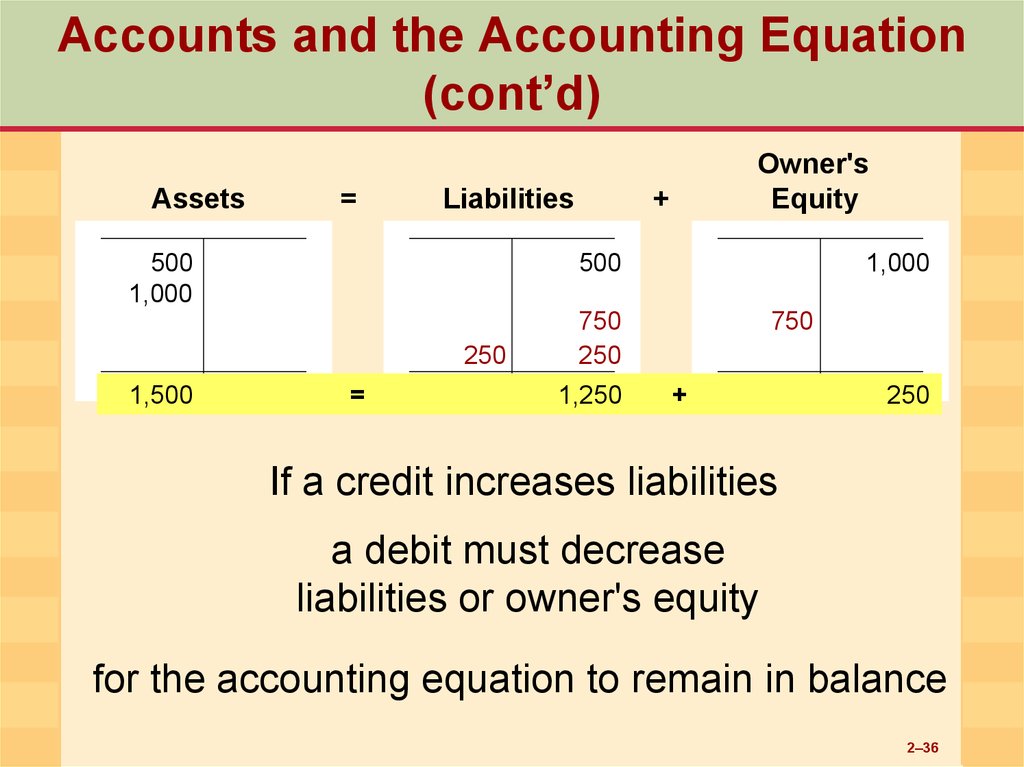

36. Accounts and the Accounting Equation (cont’d)

Assets=

Liabilities

500

1,000

+

500

250

1,500

Owner's

Equity

=

750

250

1,250

1,000

750

+

250

250

If a credit increases liabilities

a debit must decrease

liabilities or owner's equity

for the accounting equation to remain in balance

2–36

37. Components of Owner's Equity

• Capital• Withdrawals

• Revenues

• Expenses

2–37

38. Effects of Withdrawals, Revenues, and Expenses on Owner's Equity

Owner's EquityCapital –– Withdrawals

Withdrawals + Revenues – Expenses

• Withdrawals and expenses decrease owner's

equity

– Transactions that increase withdrawals or expenses

decrease owner's equity

• Revenues increase owner's equity

– Transactions that increase revenues increase owner's

equity

2–38

39. Expanding the Accounting Equation

Now that the components of owner's equity havebeen identified

Capital – Withdrawals + Revenues –– Expenses

And their effects on owner's equity are

understood

The accounting equation can be expanded to

include these components

Assets = Liabilities + Owner's Equity

2–39

40. Rearranging the Accounting Equation

Assets = Liabilities + Capital – Withdrawals + Revenues – ExpensesBecause Withdrawals and Expenses are deductions from

owner's equity, move them to the left side of the equation

Assets + Withdrawals + Expenses = Liabilities + Capital + Revenues

Accounts increased by debits = Accounts increased by credits

2–40

41. Analyzing and Processing Transactions

1. Analyze the transaction– Transactions are supported by source documents

– Determine accounts to use and effects of

transaction on accounts

2. Apply the rules of double entry

– Debits increase assets and decrease liabilities and

owner's equity

– Credits decrease assets and increase liabilities

and owner's equity

2–41

42. Analyzing and Processing Transactions (cont’d)

3. Record the entry– Record in chronological order in a journal

4. Post the entry

– Transfer dates and amounts from journal to

proper accounts in ledger

5. Prepare the trial balance

– Confirms that accounts are still in balance

2–42

43. Recording a Transaction in Journal Form

1. Date2. Debit account and debit amount recorded

on one line

3. Credit account and credit amount recorded

on next line, indented

Dr.

June 1

Cash

Notes Payable

Cr.

100,000

100,000

2–43

44. Posting Journal Entry to Accounts

JournalDr.

June 1 Cash

Cr.

100,000

Notes Payable

100,000

Ledger

Cash

June 1

100,000

Notes Payable

June 1

100,000

2–44

45. Discussion

Q. Why do debits, which decrease owner's equity, alsoincrease withdrawals and expenses, which are

components of owner's equity?

A. Withdrawals and expenses are deductions from

owner’s equity

Owner's equity is decreased by debits

Assets = Liabilities + Capital – Withdrawals + Revenues – Expenses

+ –

– +

+ –

– +

+ –

– +

Debit

Debit

Debit

Debit

↓ Cap

↓ OE

↑ Div

↓ OE

↓ Rev

↓ OE

↑ Exp

↓ OE

Transactions that increase withdrawals and expenses decrease owner's equity

2–45

46. Transaction Analysis Illustrated

• Objective 4– Apply the steps for transaction analysis

and processing to simple transactions

2–46

47. Investment in Company

BusinessJuly 1: Joan Miller invests $20,000 to start her own

Transaction advertising agency

Step 1

Analyze

Increase in assets

Increase in owner’s equity

Step 2

Apply rules

Debits increase assets (Cash)

Credits increase owner’s equity (Joan Miller,

Capital)

Step 3

Record

Dr.

July 1

Cash

Joan Miller, Capital

Cr.

20,000

20,000

2–47

48.

CashAccts. Receivable

Prepaid Insurance

Art Supplies

Art Equipment

Office Supplies

Office Equipment

Jul 1 20,000

Assets

Step 4

Post

Debit

Cash 20,000

Credit

Joan Miller,

Capital 20,000

Accts. Payable

Unearned Art Fees

Joan Miller, Capital

Advertising Fees Earned

Wages Expense

Utilities Expense

Telephone Expense

Owner's Equity

+

Liabilities

=

Prepaid Rent

Jul 1 20,000

Joan Miller, Withdrawals

2–48

49. Purchase Assets

BusinessJuly 2: Rents office and pays two months’ rent in

Transaction advance, $1,600

Step 1

Analyze

Increase in assets

Decrease in assets

Step 2

Apply rules

Debits increase assets (Prepaid Rent)

Credits decrease assets (Cash)

Dr.

Step 3

Record

July 2

Prepaid Rent

Cash

Cr.

1,600

1,600

2–49

50.

CashJul 1

20,000 Jul 2

Accts. Receivable

Prepaid Insurance

Art Supplies

Art Equipment

Office Supplies

Office Equipment

1,600

Assets

Step 4

Post

Prepaid Rent

1,600

=

Jul 2

Unearned Art Fees

Liabilities

Accts. Payable

Debit

Prepaid Rent 1,600

+

Credit

Cash

1,600

Owner's Equity

Joan Miller, Capital

Jul 1

Advertising Fees Earned

Wages Expense

Utilities Expense

Telephone Expense

20,000

Joan Miller, Withdrawals

2–50

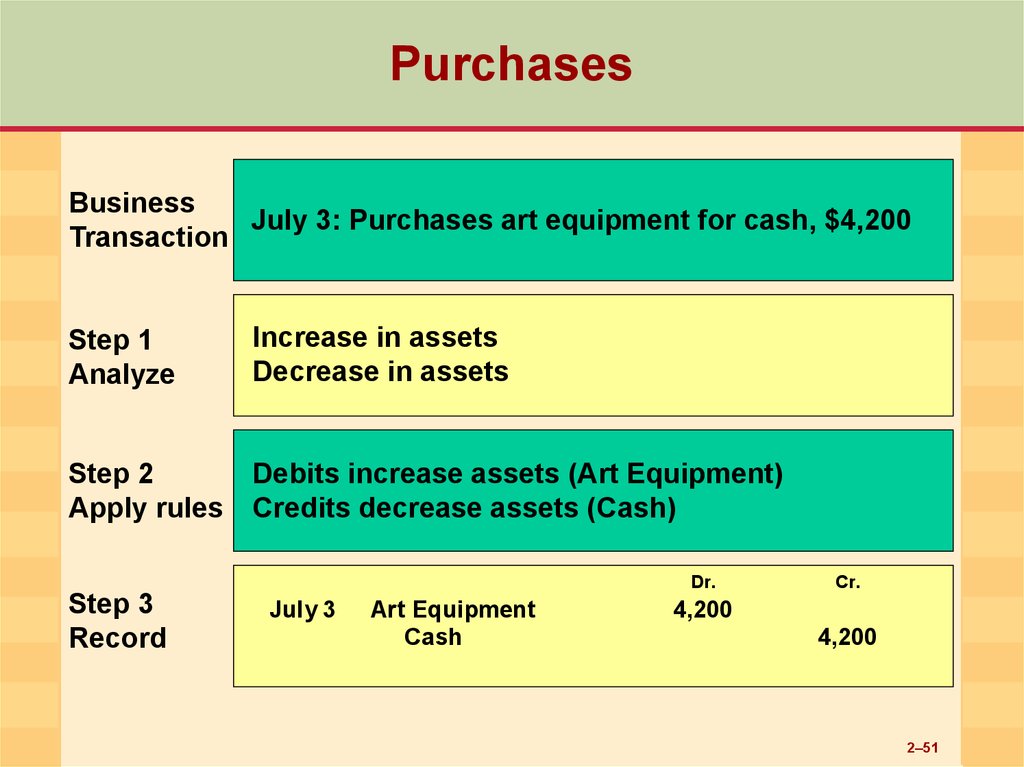

51. Purchases

BusinessJuly 3: Purchases art equipment for cash, $4,200

Transaction

Step 1

Analyze

Increase in assets

Decrease in assets

Step 2

Apply rules

Debits increase assets (Art Equipment)

Credits decrease assets (Cash)

Dr.

Step 3

Record

July 3

Art Equipment

Cash

Cr.

4,200

4,200

2–51

52.

CashJul 1

20,000 Jul 2

1,600

3

4,200

Accts. Receivable

Prepaid Insurance

Art Supplies

Art Equipment

Jul 3

Assets

Step 4

Post

Office Supplies

4,200

Office Equipment

Prepaid Rent

1,600

=

Jul 2

Unearned Art Fees

Liabilities

Accts. Payable

Debit

Art Equipment 4,200

+

Credit

Cash

4,200

Owner's Equity

Joan Miller, Capital

Jul 1

Advertising Fees Earned

Wages Expense

Utilities Expense

Telephone Expense

20,000

Joan Miller, Withdrawals

2–52

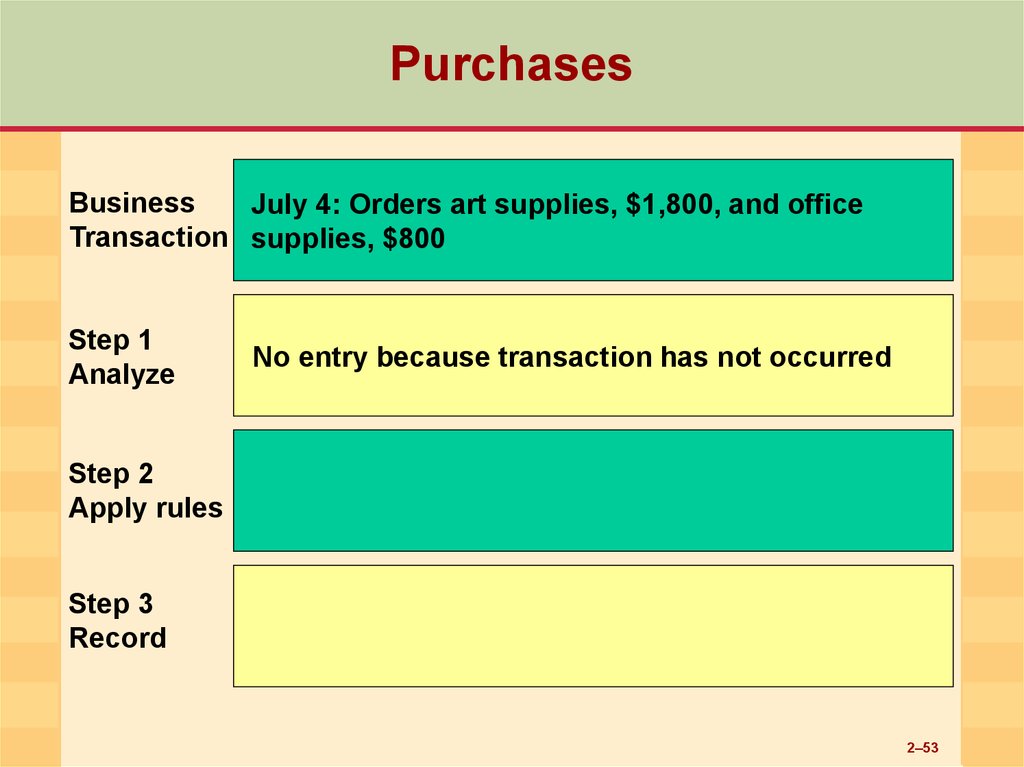

53. Purchases

BusinessJuly 4: Orders art supplies, $1,800, and office

Transaction supplies, $800

Step 1

Analyze

No entry because transaction has not occurred

Step 2

Apply rules

Step 3

Record

2–53

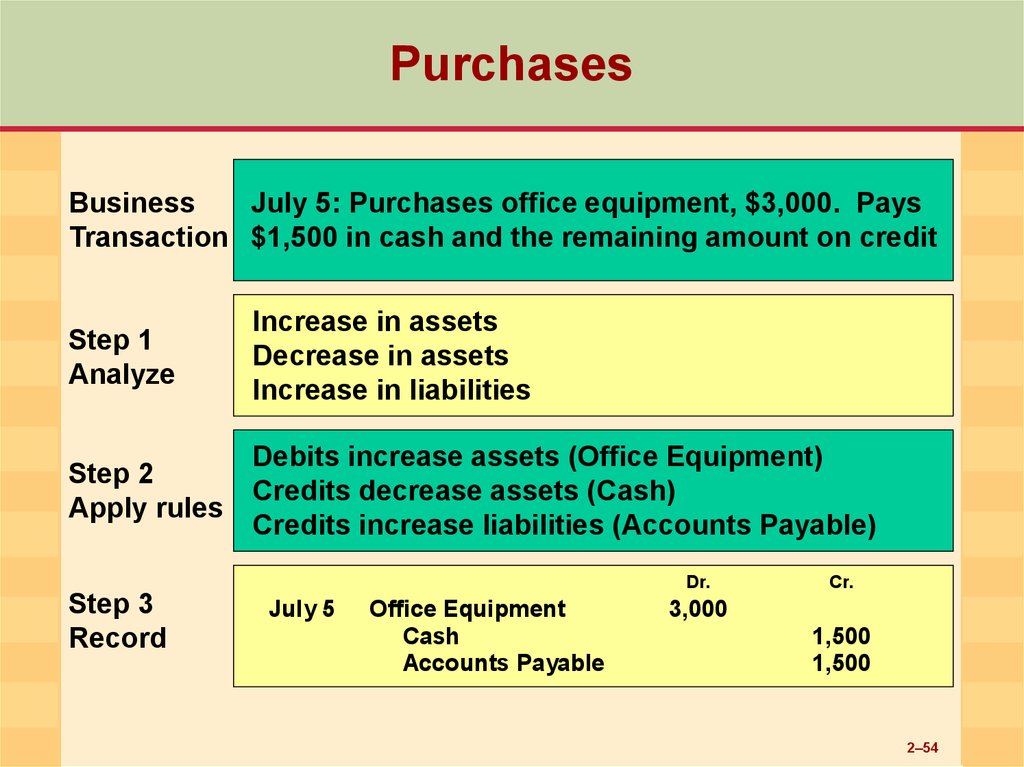

54. Purchases

BusinessJuly 5: Purchases office equipment, $3,000. Pays

Transaction $1,500 in cash and the remaining amount on credit

Step 1

Analyze

Increase in assets

Decrease in assets

Increase in liabilities

Step 2

Apply rules

Debits increase assets (Office Equipment)

Credits decrease assets (Cash)

Credits increase liabilities (Accounts Payable)

Dr.

Step 3

Record

July 5

Office Equipment

Cash

Accounts Payable

Cr.

3,000

1,500

1,500

2–54

55.

CashJul 1

20,000 Jul 2

3

1,600

4,200

5

1,500

Accts. Receivable

Prepaid Insurance

Art Supplies

Art Equipment

Jul 13

Assets

Step 4

Post

Office Supplies

4,200

Office Equipment

Jul 5 3,000

Prepaid Rent

1,600

=

Jul 2

Jul 5

Unearned Art Fees

1,500

+

Liabilities

Accts. Payable

Debit

Office Equipment 3,000

Credit

Cash

1,500

Accts. Payable 1,500

Owner's Equity

Joan Miller, Capital

Jul 1

Advertising Fees Earned

Wages Expense

Utilities Expense

Telephone Expense

20,000

Joan Miller, Withdrawals

2–55

56. Purchases

July 6: Purchases art supplies, $1,800, and officeBusiness

Transaction supplies, $800, on credit

Step 1

Analyze

Increase in assets

Increase in liabilities

Step 2

Apply rules

Debits increase assets (Art Supplies and Office

Supplies)

Credits increase liabilities (Accounts Payable)

Dr.

Step 3

Record

July 6

Art Supplies

Office Supplies

Accounts Payable

Cr.

1,800

800

2,600

2–56

57.

CashJul 1

20,000 Jul 2

Accts. Receivable

Prepaid Insurance

Art Supplies

Art Equipment

1,600

4,200

1,500

3

5

Jul 6

Assets

Step 4

Post

1,800

Office Supplies

Jul 6

800

Jul 13

4,200

Office Equipment

Jul 5

3,000

Prepaid Rent

1,600

=

Jul 2

Unearned Art Fees

Jul 5

1,500

6

2,600

+

Liabilities

Accts. Payable

Debit

Art Supplies 1,800

Office Supplies 800

Credit

Accts. Payable 2,600

Owner's Equity

Joan Miller, Capital

Jul 1

Advertising Fees Earned

Wages Expense

Utilities Expense

Telephone Expense

20,000

Joan Miller, Withdrawals

2–57

58. Purchase Assets

July 8: Pays for one-year life insurance policy,Business

Transaction effective July 1, $960

Step 1

Analyze

Increase in assets

Decrease in assets

Step 2

Apply rules

Debits increase assets (Prepaid Insurance)

Credits decrease assets (Cash)

Dr.

Step 3

Record

July 8

Prepaid Insurance

Cash

Cr.

960

960

2–58

59.

AssetsStep 4

Post

Cash

Jul 1

Accts. Receivable

20,000 Jul 2

3

5

1,600

4,200

1,500

8

960

Prepaid Insurance

Jul 8

Art Supplies

Jul 6

1,800

Office Supplies

Jul 6

800

960

Art Equipment

Jul 13

4,200

Office Equipment

Jul 5

3,000

Prepaid Rent

1,600

=

Jul 2

Jul 5

6

Unearned Art Fees

1,500

2,600

Credit

Cash 960

+

Liabilities

Accts. Payable

Debit

Prepaid Insurance 960

Owner's Equity

Joan Miller, Capital

Jul 1

Advertising Fees Earned

Wages Expense

Utilities Expense

Telephone Expense

20,000

Joan Miller, Withdrawals

2–59

60. Partial Payment of Liability

BusinessJuly 9: Pays Taylor Supply Company $1,000 of

Transaction amount owed

Step 1

Analyze

Decrease in liabilities

Decrease in assets

Step 2

Apply rules

Debits decrease liabilities (Accts. Payable)

Credits decrease assets (Cash)

Dr.

Step 3

Record

July 9

Accounts Payable

Cash

Cr.

1,000

1,000

2–60

61.

CashAccts. Receivable

20,000 Jul 2

Jul 1

Assets

Step 4

Post

3

5

8

1,600

4,200

1,500

960

9

1,000

Prepaid Insurance

Jul 8

Art Supplies

Jul 6

1,800

Office Supplies

Jul 6

800

960

Art Equipment

Jul 13

4,200

Office Equipment

Jul 5

3,000

Prepaid Rent

1,600

=

Jul 2

Jul 9

1,000 Jul 5

6

Unearned Art Fees

1,500

2,600

Credit

Cash 1,000

+

Liabilities

Accts. Payable

Debit

Accts. Payable 1,000

Owner's Equity

Joan Miller, Capital

Jul 1

Advertising Fees Earned

Wages Expense

Utilities Expense

Telephone Expense

20,000

Joan Miller, Withdrawals

2–61

62. Revenues

BusinessJuly 10: Performs service by placing

Transaction advertisements and collects fee of $1,400

Step 1

Analyze

Increase in assets

Increase in owner’s equity

Step 2

Apply rules

Debits increase assets (Cash)

Credits increase owner’s equity (Advertising Fees

Earned)

Dr.

Step 3

Record

July 10 Cash

Advertising Fees Earned

Cr.

1,400

1,400

2–62

63.

CashJul 1

10

Assets

Step 4

Post

Accts. Receivable

20,000 Jul 2

1,400

1,600

4,200

1,500

960

1,000

3

5

8

9

Prepaid Insurance

Jul 8

Art Supplies

Jul 6

Art Equipment

Jul 13

1,800

Office Supplies

Jul 6

960

4,200

Office Equipment

Jul 5

800

3,000

Prepaid Rent

1,600

=

Jul 2

Jul 9

1,000 Jul 5

6

Unearned Art Fees

1,500

2,600

Credit

Ad. Fees Earned 1,400

+

Liabilities

Accts. Payable

Debit

Cash 1,400

Owner's Equity

Joan Miller, Capital

Jul 1

20,000

Joan Miller, Withdrawals

Advertising Fees Earned

Jul 10

Wages Expense

1,400

Utilities Expense

Telephone Expense

2–63

64. Expenses

BusinessJuly 12: Pays secretary two weeks’ wages, $1,200

Transaction

Step 1

Analyze

Decrease in owner’s equity (increase in expenses)

Decrease in assets

Step 2

Apply rules

Debits decrease owner’s equity (increase Wages

Expense)

Credits decrease assets (Cash)

Dr.

Step 3

Record

July 12 Wages Expense

Cash

Cr.

1,200

1,200

2–64

65.

CashJul 1

10

Accts. Receivable

20,000 Jul 2

1,400

3

1,600

4,200

1,500

960

1,000

1,200

5

8

9

12

Assets

Step 4

Post

Prepaid Insurance

Jul 8

Art Supplies

Jul 6

Art Equipment

Jul 13

1,800

Office Supplies

Jul 6

960

4,200

Office Equipment

Jul 5

800

3,000

Prepaid Rent

1,600

=

Jul 2

Jul 9

1,000 Jul 5

6

Unearned Art Fees

1,500

2,600

Credit

Cash 1,200

+

Liabilities

Accts. Payable

Debit

Wages Expense 1,200

Owner's Equity

Joan Miller, Capital

Jul 1

20,000

Joan Miller, Withdrawals

Advertising Fees Earned

Jul 10

1,400

Utilities Expense

Wages Expense

Jul 12

1,200

Telephone Expense

2–65

66. Revenue

July 15: Accepts advance fee for artwork to beBusiness

done for another agency, $1,000

Transaction

(Payment received for future services)

Step 1

Analyze

Increase in assets

Increase in liabilities

Step 2

Apply rules

Debits increase assets (Cash)

Credits increase liabilities (Unearned Art Fees)

Dr.

Step 3

Record

July 15 Cash

Unearned Art Fees

Cr.

1,000

1,000

2–66

67.

CashJul 1

10

15

Accts. Receivable

20,000 Jul 2

1,400

3

1,000

5

1,600

4,200

1,500

960

1,000

1,200

8

9

12

Assets

Step 4

Post

Prepaid Insurance

Jul 8

Art Supplies

Jul 6

Art Equipment

Jul 13

1,800

Office Supplies

Jul 6

960

4,200

Office Equipment

Jul 5

800

3,000

Prepaid Rent

1,600

Debit

Cash

1,000

=

Jul 2

Jul 9

1,000 Jul 5

6

Unearned Art Fees

1,500

2,600

Jul 15

1,000

Credit

Unearned Art Fees 1,000

+

Liabilities

Accts. Payable

Owner's Equity

Joan Miller, Capital

Jul 1

20,000

Joan Miller, Withdrawals

Advertising Fees Earned

Jul 10

1,400

Utilities Expense

Wages Expense

Jul 12

1,200

Telephone Expense

2–67

68. Revenue

July 19: Performs advertising service for whichBusiness

payment will be collected at later date, $4,800

Transaction

(Revenue earned, to be received later)

Step 1

Analyze

Increase in assets

Increase in owner's equity (revenues)

Step 2

Apply rules

Debits increase assets (Accounts Receivable)

Credits increase owner's equity (Advertising Fees

Earned)

Dr.

Step 3

Record

July 19 Accounts Receivable

Advertising Fees Earned

Cr.

4,800

4,800

2–68

69.

CashJul 1

10

15

Assets

Step 4

Post

Accts. Receivable

20,000 Jul 2

1,400

3

1,000

5

8

9

12

1,600

4,200

1,500

960

1,000

1,200

Jul 19

Prepaid Insurance

Jul 8

4,800

Art Supplies

Jul 6

Art Equipment

Jul 13

1,800

Office Supplies

Jul 6

960

4,200

Office Equipment

Jul 5

800

3,000

Prepaid Rent

1,600

=

Jul 2

Jul 9

1,000 Jul 5

6

Unearned Art Fees

1,500

2,600

Jul 15

1,000

Credit

Ad. Fees Earned 4,800

+

Liabilities

Accts. Payable

Debit

Accts. Receivable 4,800

Owner's Equity

Joan Miller, Capital

Jul 1

20,000

Joan Miller, Withdrawals

Advertising Fees Earned

Jul 10

19

1,400

4,800

Utilities Expense

Wages Expense

Jul 12

1,200

Telephone Expense

2–69

70. Expenses

BusinessJuly 26: Pays secretary two more weeks’ wages,

Transaction $1,200

Step 1

Analyze

Decrease in owner's equity (increase in expenses)

Decrease in assets

Step 2

Apply rules

Debits decrease owner's equity (increase Wages

Expense)

Credits decrease assets (Cash)

Dr.

Step 3

Record

July 26 Wages Expense

Cash

Cr.

1,200

1,200

2–70

71.

CashJul 1

10

15

Assets

Step 4

Post

Accts. Receivable

20,000 Jul 2

1,400

3

1,000

5

8

9

12

1,600

4,200

1,500

960

1,000

1,200

26

1,200

Jul 19

4,800

Prepaid Insurance

Jul 8

Art Supplies

Jul 6

Art Equipment

Jul 13

1,800

Office Supplies

Jul 6

960

4,200

Office Equipment

Jul 5

800

3,000

Prepaid Rent

1,600

=

Jul 2

Jul 9

1,000 Jul 5

6

Unearned Art Fees

1,500

2,600

Jul 15

1,000

Credit

Cash 1,200

+

Liabilities

Accts. Payable

Debit

Wages Expense 1,200

Owner's Equity

Joan Miller, Capital

Jul 1

20,000

Joan Miller, Withdrawals

Advertising Fees Earned

Jul 10

19

1,400

4,800

Utilities Expense

Wages Expense

Jul 12

1,200

26

1,200

Telephone Expense

2–71

72. Expenses

BusinessJuly 29: Receives and pays utility bill, $200

Transaction

Step 1

Analyze

Decrease in owner's equity (increase in expenses)

Decrease in assets

Step 2

Apply rules

Debits decrease owner's equity (increase Utilities

Expense)

Credits decrease assets (Cash)

Dr.

Step 3

Record

July 29 Utilities Expense

Cash

Cr.

200

200

2–72

73.

CashJul 1

10

15

Assets

Step 4

Post

Accts. Receivable

20,000 Jul 2

1,400

3

1,000

5

8

9

12

26

1,600

4,200

1,500

960

1,000

1,200

1,200

29

200

Jul 19

4,800

Prepaid Insurance

Jul 8

Art Supplies

Jul 6

Art Equipment

Jul 13

1,800

Office Supplies

Jul 6

960

4,200

Office Equipment

Jul 5

800

3,000

Prepaid Rent

1,600

=

Jul 2

Jul 9

1,000 Jul 5

6

Unearned Art Fees

Jul 15

1,500

2,600

1,000

Credit

Cash 200

+

Liabilities

Accts. Payable

Debit

Utilities Expense 200

Owner's Equity

Joan Miller, Capital

Jul 1

Advertising Fees Earned

Jul 10

19

20,000

Joan Miller, Withdrawals

1,400

4,800

Utilities Expense

Jul 29

Wages Expense

Jul 12

26

1,200

1,200

Telephone Expense

200

2–73

74. Expenses

July 30: Receives (but does not pay) telephoneBusiness

bill, $140

Transaction

(Expense incurred, to be paid later)

Step 1

Analyze

Decrease in owner's equity (increase in expenses)

Increase in liabilities

Step 2

Apply rules

Debits decrease owner's equity (increase

Telephone Expense)

Credits increase liabilities (Accts. Payable)

Dr.

Step 3

Record

July 30 Telephone Expense

Accts. Payable

Cr.

140

140

2–74

75.

CashJul 1

10

15

Assets

Step 4

Post

Accts. Receivable

20,000 Jul 2

1,400

3

1,000

5

8

9

12

26

29

1,600

4,200

1,500

960

1,000

1,200

1,200

200

Jul 19

4,800

Prepaid Insurance

Jul 8

Art Supplies

Jul 6

Art Equipment

Jul 13

1,800

Office Supplies

Jul 6

960

4,200

Office Equipment

Jul 5

800

3,000

Prepaid Rent

1,600

=

Jul 2

Jul 9

1,000 Jul 5

Unearned Art Fees

6

1,500

2,600

30

140

Jul 15

1,000

140

Credit

Accts. Payable

140

+

Liabilities

Accts. Payable

Debit

Telephone Exp.

Owner's Equity

Joan Miller, Capital

Jul 1

Advertising Fees Earned

Jul 10

19

20,000

Joan Miller, Withdrawals

1,400

4,800

Utilities Expense

Jul 29

200

Wages Expense

Jul 12

26

1,200

1,200

Telephone Expense

Jul 30

140

2–75

76. Withdrawals

July 31: Joan Miller withdraws $1,400 from theBusiness

Transaction business for personal living expenses

Step 1

Analyze

Decrease in owner's equity

Decrease in assets

Step 2

Apply rules

Debits decrease owner's equity (increase Joan

Miller, Withdrawals)

Credits decrease assets (Cash)

Step 3

Record

Dr.

July 31 Joan Miller, Withdrawals

Cash

Cr.

1,400

1,400

2–76

77.

CashJul 1

10

15

Accts. Receivable

20,000 Jul 2

1,400

3

1,000

5

8

9

12

26

29

31

Assets

Step 4

Post

1,600

4,200

1,500

960

1,000

1,200

1,200

200

1,400

Jul 19

4,800

Jul 8

Art Supplies

Jul 6

Jul 13

Office Supplies

Jul 6

Office Equipment

Jul 5

800

3,000

Prepaid Rent

1,600

=

Liabilities

1,000 Jul 5

6

30

4,200

Unearned Art Fees

Jul 15

1,500

2,600

140

1,000

Debit

Joan Miller,

Withdrawals 1,400

Credit

Cash 1,400

+

Jul 9

960

Art Equipment

1,800

Jul 2

Accts. Payable

Prepaid Insurance

Owner's Equity

Joan Miller, Capital

Jul 1

1,400

Jul 10

19

20,000

Joan Miller, Withdrawals

Jul 31

Advertising Fees Earned

1,400

4,800

Utilities Expense

Jul 29

200

Wages Expense

Jul 12

26

1,200

1,200

Telephone Expense

Jul 30

140

2–77

78. Discussion

Q. Why does Joan Miller record theexpense for the telephone bill even

though she hasn’t paid it yet?

– An expense has been incurred for

telephone services used

– An obligation to pay exists

– Joan Miller records the expense and the

liability for the telephone service

2–78

79. The Trial Balance

• Objective 5– Prepare a trial balance and describe its

value and limitations

2–79

80. The Trial Balance

• For every amount debited, an equalamount must be credited

– Result: The total of debits and credits for

all the T accounts must be equal

• Trial balance is prepared to test this

– Usually prepared at the end of a month or

an accounting period

– Can be prepared anytime

2–80

81. Normal Account Balances

• Normal balance means usual balance• Refers to whether increases in the accounts

are made with debits or credits

– Accounts that are increased with debits have a

normal debit balance

– Accounts that are increased with credits have a

normal credit balance

• An account may have an “abnormal” balance

– Copy into the trial balance as it stands

2–81

82. Normal Account Balances and the Accounting Equation

Recall the basic accounting equation:Assets = Liabilities + Owner's Equity

Debit Credit

(+)

(–)

Debit Credit

(–)

(+)

Debit Credit

(–)

(+)

• Assets are increased by debits

• Liabilities and owner's equity are increased

by credits

2–82

83. Normal Account Balances and the Accounting Equation (cont’d)

However, when the basic accounting equationis expanded to include all the components of

owner's equity,

Assets = Liabilities + Capital – Withdrawals + Revenues – Expenses

+ –

– +

– +

+ –

– +

+ –

We see that Withdrawals and expense accounts

reduce owner's equity

2–83

84. Normal Account Balances and the Accounting Equation (cont’d)

Withdrawals and expenses can be moved to theleft side of the equation so that

Assets + Withdrawals + Expenses

+ –

+ –

+ –

=

Liabilities + Capital + Revenues

– +

– +

– +

Accounts increased by

debits

Accounts increased by

credits

Accounts with a

normal debit balance

Accounts with a

normal credit balance

2–84

85. Steps in Preparing a Trial Balance

1. List each T account that has a balance– Record debit balances in the left column

– Record credit balances in the right column

– List accounts in the order that they appear

in the ledger

2. Add each column

3. Compare the column totals

– Total debits should equal total credits

2–85

86. Joan Miller Advertising Agency

1. Determine the T account balances forJoan Miller Advertising Agency

– Use footings

2. Transfer account balances to the trial

balance

3. Total each column

4. Compare column totals

2–86

87.

CashAssets

20,000 Jul 2

3

1,400

1,000

5

8

9

12

26

29

31

1,600

4,200

1,500

960

1,000

1,200

1,200

200

1,400

22,400

13,260

9,140

Jul 19

4,800

Jul 9

Art Supplies

Jul 6

Jul 13

1,800

Office Supplies

Jul 6

1,500

2,600

140

1,000

4,240

Bal.

Office Equipment

Jul 5

800

Jul 2

1,600

Jul 15

1,000

1. Determine

account

balances

Advertising Fees Earned

Jul 10

19

20,000

Joan Miller, Withdrawals

1,400

3,000

Prepaid Rent

Bal.

Jul 31

4,200

3,240

Joan Miller, Capital

Jul 1

960

Art Equipment

Unearned Art Fees

1,000 Jul 5

6

30

+

Liabilities

Accts. Payable

Prepaid Insurance

Jul 8

=

Bal.

Owner's Equity

Joan Miller Advertising Agency

Jul 1

10

15

Accts. Receivable

1,400

4,800

200

Jul 12

26

6,200 Bal.

Utilities Expense

Jul 29

Wages Expense

1,200

1,200

2,400

Telephone Expense

Jul 30

140

2–87

88. Trial Balance

Joan Miller Advertising AgencyTrial Balance

July 31, 20xx

Cash

Accounts Receivable

Art Supplies

Office Supplies

Prepaid Rent

Prepaid Insurance

Art Equipment

Office Equipment

Accounts Payable

Unearned Art Fees

Joan Miller, Capital

Joan Miller, Withdrawals

Advertising Fees Earned

Wages Expense

Utilities Expense

Telephone Expense

$ 9,140

4,800

1,800

800

1,600

960

4,200

3,000

Record debit

balances in the

left column

Record credit

balances in the

right column

$ 3,240

1,000

20,000

1,400

Add each

column

6,200

2,400

200

140

$30,440

The trial balance

proves the ledger

is in balance

$30,440

Total debits = Total credits

2–88

89. Trial Balance (cont’d.)

• The trial balance proves whether or not theledger is in balance

– Total of all debits recorded = Total of all credits

recorded

• What it does not do

– Prove that all transactions were analyzed correctly

– Prove that amounts were recorded in the proper

accounts

– Detect whether transactions have been omitted

– Detect errors of the same amount made in both a

debit and a credit

2–89

90. Detecting Errors in the Trial Balance

• If the debit and credit columns are notequal, look for the following errors

– A debit entered as a credit, or visa versa

– An incorrectly computed account balance

– Error in carrying the account balance to the

trial balance

– Trial balance summed incorrectly

2–90

91. Detecting Errors in the Trial Balance (cont’d)

• If trial balance is out of balance by anamount divisible by 2

– Caused by recording an account with a

debit balance as a credit, or visa versa

• If trial balance is out of balance by an

amount divisible by 9

– Caused by transposing two numbers when

transferring an amount to the trial balance

2–91

92. Discussion

Q. Does the trial balance detect whethertransactions have been omitted?

A. No. The trial balance proves whether or not the

ledger is in balance (total debits = total credits).

It does not

1) Prove that all transactions were analyzed correctly

2) Prove that amounts were recorded in the proper

accounts

3) Detect whether transactions have been omitted

4) Detect errors of the same amount made in both a debit

and a credit

2–92

93. Recording and Posting Transactions

• Objective 6– Record transactions in the general journal

and post transactions from the general

journal to the ledger

2–93

94. The General Journal

• Why aren’t transactions entered directly intothe accounts?

– Since the debit is recorded in one account and the

credit in another, it would be very difficult to

• Identify individual transactions

• Find errors

• Solution

– Record all transactions chronologically in a journal

2–94

95. Journalizing

… is the process of recording transactions• General journal is the simplest and most

flexible

– Also called book of original entry

• Separate journal entry records each

transaction

2–95

96.

Journalizing TransactionsBusiness

July 6: Purchase art supplies, $1,800, and office

Transaction supplies, $800, on credit

Record in

Journal

1. The date

2. Names of accounts debited and dollar amounts on

same lines in debit column

3. Names of accounts credited (indented) and dollar

amounts on same lines in credit column

4. Explanation of transaction

5. Account identification numbers, if appropriate

General Journal

Date

Description

20xx

July 6 Art Supplies

Office Supplies

Accounts Payable

Purchase of art and office

supplies on credit

Page 1

Post.

Ref.

Debit

Credit

1,800

800

2,600

15–96

97. Journalizing Transactions (cont.)

Business July 8: Pays for one-year life insurance policy,Transaction effective July 1, $960

General Journal

Skip a line

between

each entry

Date

Description

20xx

July 6 Art Supplies

Office Supplies

Accounts Payable

Purchase of art and office

supplies on credit

8

Prepaid Insurance

Cash

Paid one-year life insurance

premium

Page 1

Post.

Ref.

Debit

Credit

1,800

800

2,600

960

960

• A compound entry has more than one debit or credit entry

• The July 6 entry is a compound entry because it has two

debit entries

2–97

98. General Ledger

• Used to record the details of each transaction• Used to update each account

• T account is a simple, direct form

• In practice, the ledger account form is used

• Advantage of ledger account form over T

account is that current balance of account is

always available

2–98

99. Ledger Account Form

General LedgerAccounts Payable

Date

Item

Post.

Ref.

Debit

Credit

Account No. 212

Balance

Credit

Debit

• Account title and number appear at top of account form

• The date appears in the first two columns (as in the journal)

• Item column is rarely used because explanations already appear

in the journal

• Post. Ref. column used to note journal page where the original

entry for the transaction can be found

• Dollar amount of entry is entered in appropriate debit or credit

column

• New account balance computed in final two columns after each

entry

2–99

100. Posting to the Ledger

General JournalDate

20xx

July

Page 2

Post.

Ref.

Description

30 Telephone Expense

Accounts Payable

Received bill for telephone

expense

Debit

Credit

2. Enter date of transaction

140

513

140

Enter journal page number

in Post. Ref. column

General Ledger

Accounts Payable

Date

20xx

July

Item

5

6

9

Post.

Ref.

J1

J1

J1

Debit

Credit

Account No. 212

Balance

Debit

Credit

1,500

2,600

1,500

4,100

3,100

1,000

General Ledger

Telephone Expense

Date

Item

Post.

Ref.

Debit

Credit

Account No. 513

Balance

Debit

Credit

20xx

July

30

J2

1. Locate debit account in the

ledger

3. Enter in Debit column

amount of debit from

journal

4. Calculate account balance

and enter in appropriate

Balance column

5. In journal Post. Ref.

column enter account

number to which amount

was posted

140

140

6. Repeat for credit entry

2–100

101. Posting to the Ledger (cont.)

General JournalDate

20xx

July

Page 2

Post.

Ref.

Description

30 Telephone Expense

Accounts Payable

Received bill for telephone

expense

Debit

Credit

140

513

212

140

Accounts Payable

Date

20xx

July

Item

5

6

9

30

J1

J1

J1

Debit

Credit

Account No. 212

Balance

Debit

Credit

1,500

2,600

1,500

4,100

3,100

140

3,240

1,000

J2

2. Enter date of transaction

Enter journal page number

in Post. Ref. column

General Ledger

Post.

Ref.

1. Locate credit account in the

ledger

3. Enter in Credit column

amount of credit from

journal

4. Calculate account balance

and enter in appropriate

Balance column

General Ledger

Telephone Expense

Date

Item

Post.

Ref.

Debit

Credit

Account No. 513

Balance

Debit

Credit

5. In journal Post. Ref. column

enter account number to

which amount was posted

20xx

July

30

140

140

J2

2–101

102.

Some Notes on PresentationDollar signs

are required

and are

placed before

the first

amount in

each column

Joan Miller Advertising Agency

Trial Balance

July 31, 20xx

Cash

Accounts Receivable

Art Supplies

Office Supplies

Prepaid Rent

Prepaid Insurance

Art Equipment

Office Equipment

Accounts Payable

Unearned Art Fees

Joan Miller, Capital

Joan Miller, Withdrawals

Advertising Fees Earned

Wages Expense

Utilities Expense

Telephone Expense

$ 9,140

4,800

1,800

800

1,600

960

4,200

3,000

$ 3,240

1,000

20,000

1,400

A ruled line

appears

before each

subtotal or

total

6,200

2,400

200

140

$30,440

$30,400

A double line

appears

under a final

total that has

been verified

2–102

Финансы

Финансы Программное обеспечение

Программное обеспечение