Похожие презентации:

Project Risk Management

1. Project Risk Management

Sections of this presentation were adaptedfrom A Guide to the Project Management

Body of Knowledge 4th Edition, Project

Management Institute Inc., © 2008

2. Risk Management

“The process involved with identifying,analyzing, and responding to risk. It

includes maximizing the results of positive

risks and minimizing the consequences of

negative events”

3. Why Do We Manage Risk?

Project problems can be reduced as muchas 90% by using risk analysis

Positives:

More info available during planning

Improved probability of success/optimum

project

Negatives:

Belief that all risks are accounted for

Project cut due to risk level

4. Key Terms

Risk Tolerance – The amount ofacceptable risk

Risk Adverse – Someone that does not

want to take risks

Risk Factors

Probability of occurrence

Range of possible outcomes (impact or

amount at stake

Expected Timing of event

Anticipated frequency of risk events from that

source

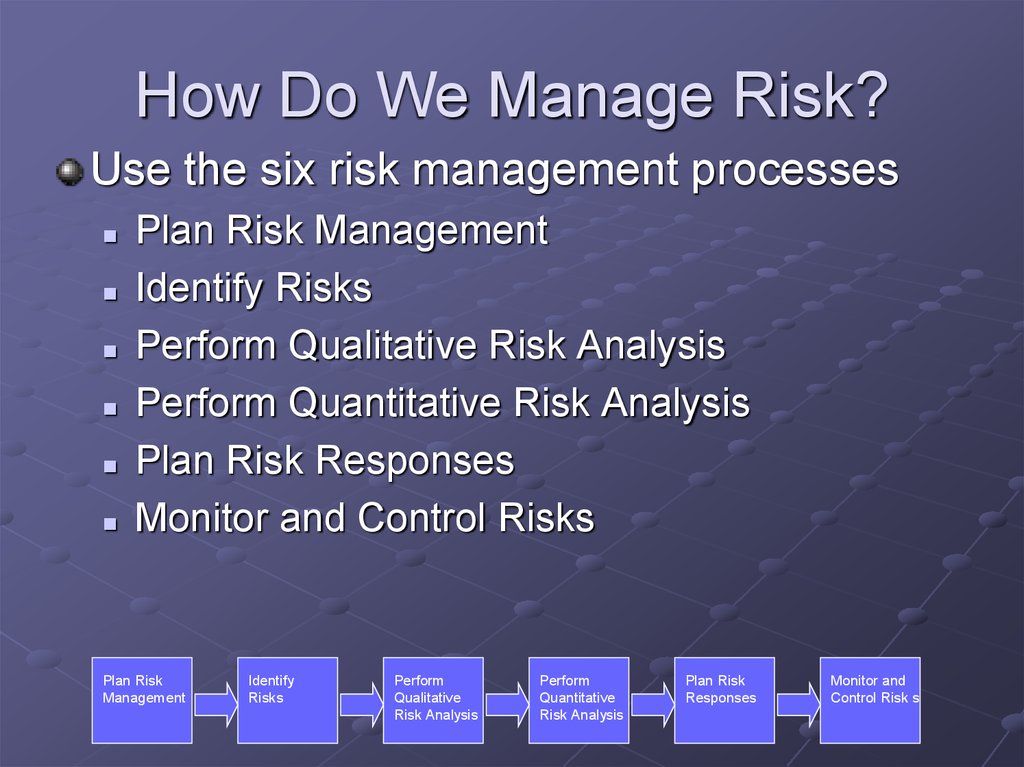

5. How Do We Manage Risk?

Use the six risk management processesPlan Risk Management

Identify Risks

Perform Qualitative Risk Analysis

Perform Quantitative Risk Analysis

Plan Risk Responses

Monitor and Control Risks

Plan Risk

Management

Identify

Risks

Perform

Qualitative

Risk Analysis

Perform

Quantitative

Risk Analysis

Plan Risk

Responses

Monitor and

Control Risk s

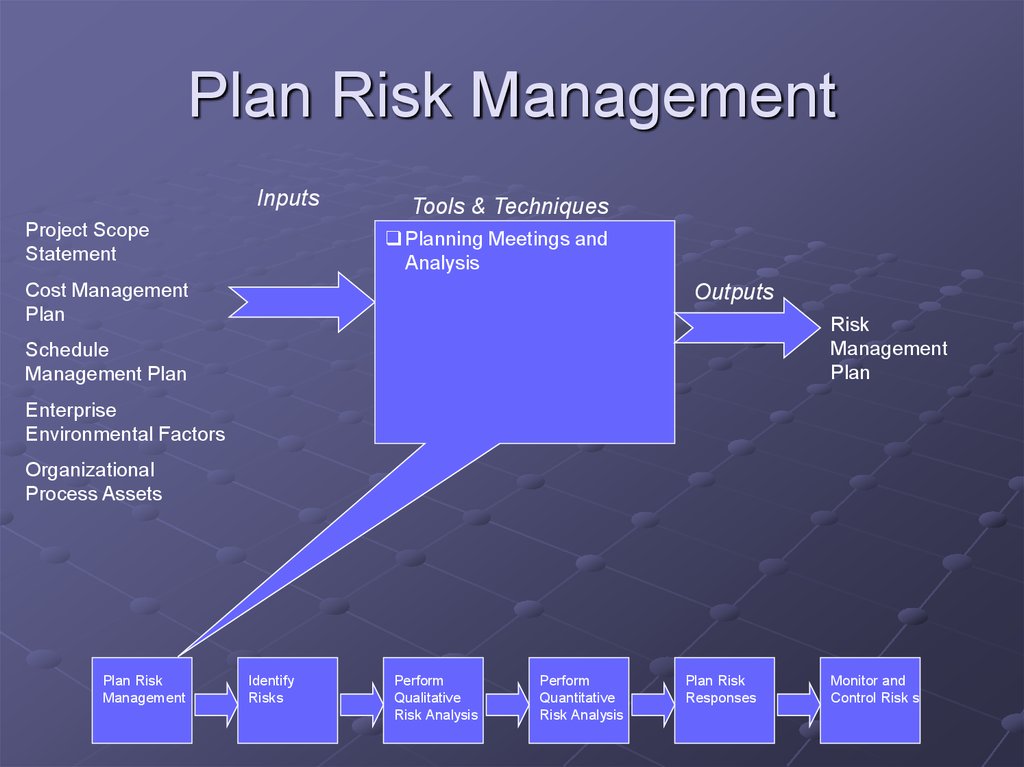

6. Plan Risk Management

InputsProject Scope

Statement

Tools & Techniques

Planning Meetings and

Analysis

Cost Management

Plan

Outputs

Risk

Management

Plan

Schedule

Management Plan

Enterprise

Environmental Factors

Organizational

Process Assets

Plan Risk

Management

Identify

Risks

Perform

Qualitative

Risk Analysis

Perform

Quantitative

Risk Analysis

Plan Risk

Responses

Monitor and

Control Risk s

7. What is a Risk Management Plan?

Methodology – Approach, tools, & dataRoles & Responsibilities

Budgeting – Resources to be put into risk

management

Timing – When and how often

Risk Categories – Risk Breakdown

Structure (RBS)

Definitions – Risk probabilities and impact

8. What is a Risk Mgmt Plan (Cont’d)?

Probability and Impact MatrixStakeholder tolerances

Reporting formats

Tracking

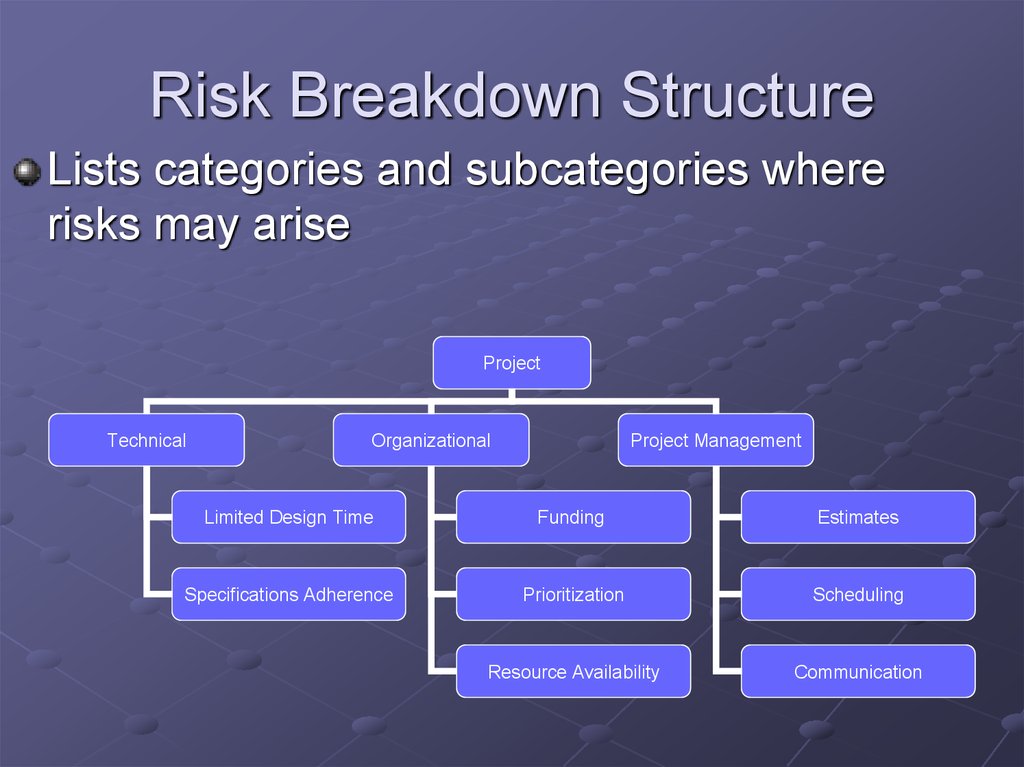

9. Risk Breakdown Structure

Lists categories and subcategories whererisks may arise

Project

Technical

Organizational

Project Management

Limited Design Time

Funding

Estimates

Specifications Adherence

Prioritization

Scheduling

Resource Availability

Communication

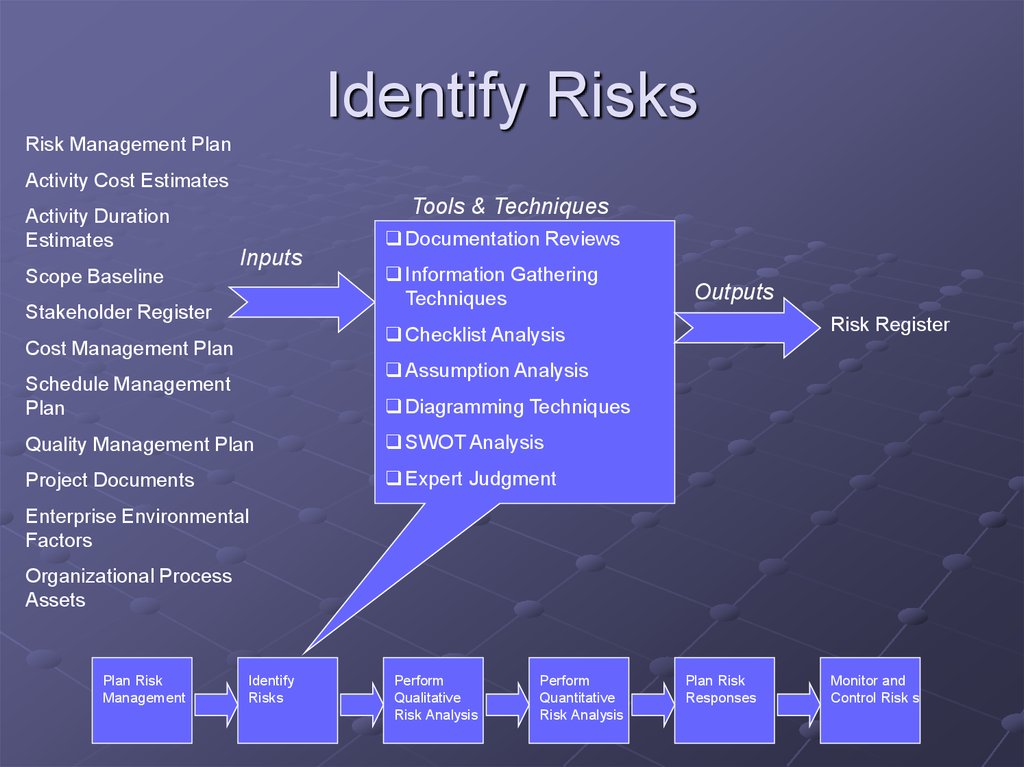

10. Identify Risks

Risk Management PlanActivity Cost Estimates

Activity Duration

Estimates

Scope Baseline

Tools & Techniques

Inputs

Stakeholder Register

Documentation Reviews

Information Gathering

Techniques

Outputs

Risk Register

Checklist Analysis

Cost Management Plan

Assumption Analysis

Schedule Management

Plan

Diagramming Techniques

Quality Management Plan

SWOT Analysis

Project Documents

Expert Judgment

Enterprise Environmental

Factors

Organizational Process

Assets

Plan Risk

Management

Identify

Risks

Perform

Qualitative

Risk Analysis

Perform

Quantitative

Risk Analysis

Plan Risk

Responses

Monitor and

Control Risk s

11. Information Gathering Techniques

BrainstormingDelphi technique

Successive anonymous questionnaires on

project risks with responses summarized for

further analysis

Interviewing

Root cause identification

Strengths, weaknesses, opportunities, and

threats (SWOT) analysis

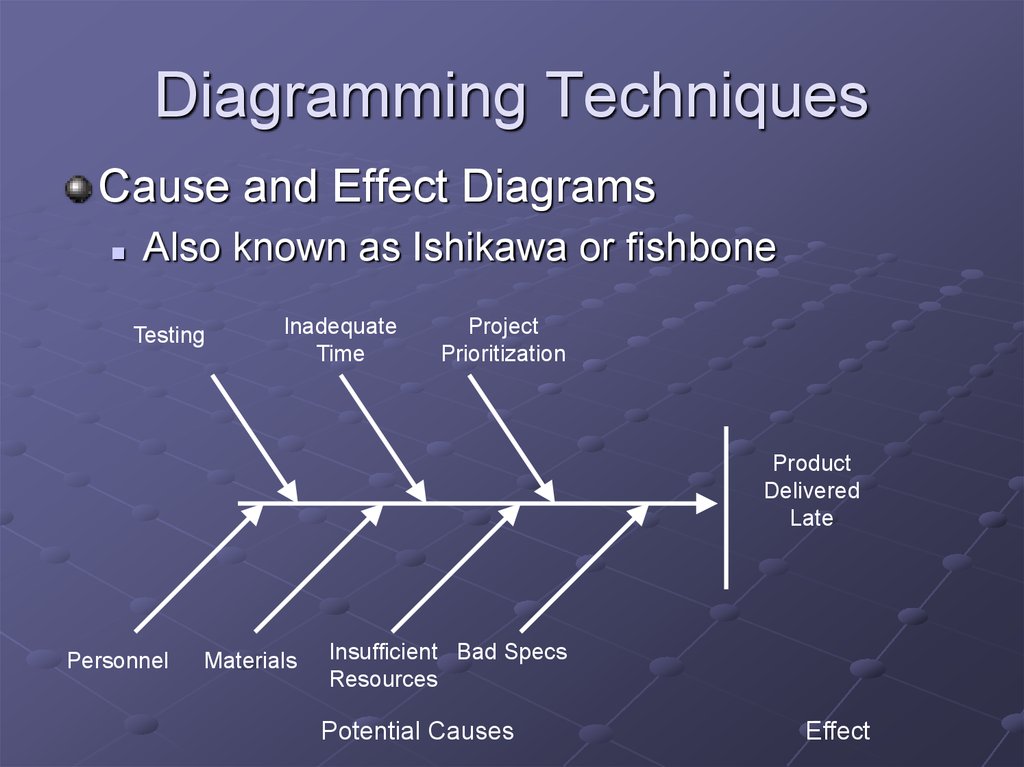

12. Diagramming Techniques

Cause and Effect DiagramsAlso known as Ishikawa or fishbone

Testing

Inadequate

Time

Project

Prioritization

Product

Delivered

Late

Personnel

Materials

Insufficient Bad Specs

Resources

Potential Causes

Effect

13. Risk Register

List ofIdentified risks

Potential responses

Root causes

Updated risk categories (if required)

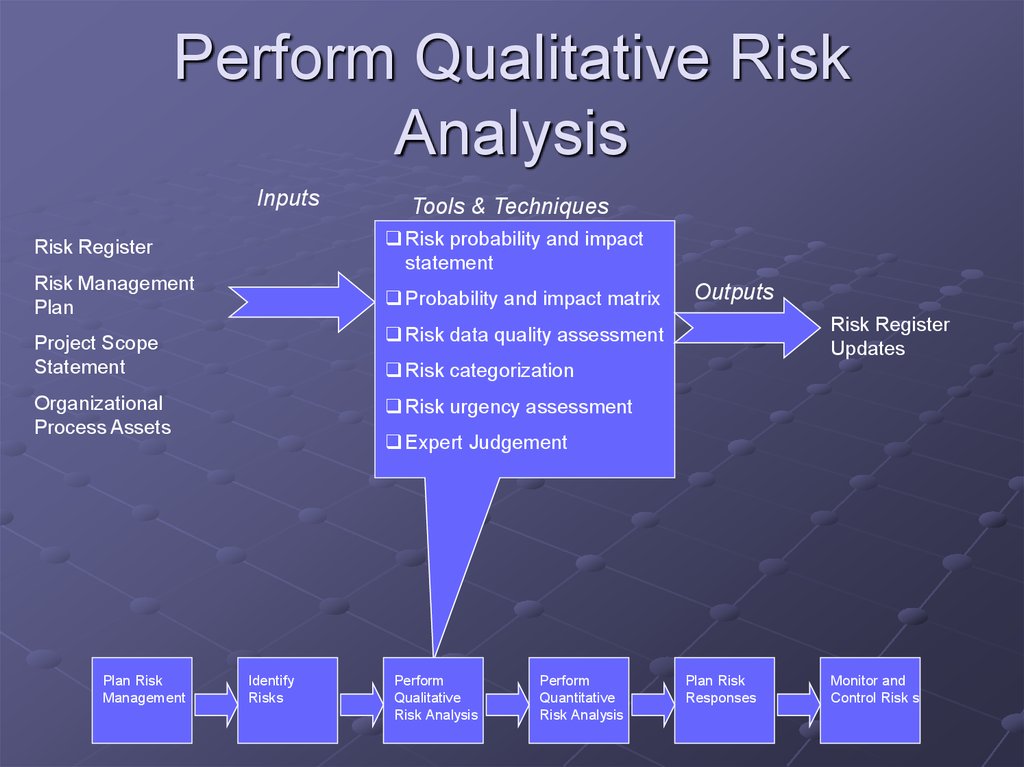

14. Perform Qualitative Risk Analysis

InputsTools & Techniques

Risk Register

Risk probability and impact

statement

Risk Management

Plan

Probability and impact matrix

Risk Register

Updates

Risk data quality assessment

Project Scope

Statement

Risk categorization

Risk urgency assessment

Organizational

Process Assets

Plan Risk

Management

Outputs

Expert Judgement

Identify

Risks

Perform

Qualitative

Risk Analysis

Perform

Quantitative

Risk Analysis

Plan Risk

Responses

Monitor and

Control Risk s

15. Methodologies

Probability and Impact MatrixBased on Failure Modes and Effects

Analysis (FMEA)

From 1950’s analysis of military systems

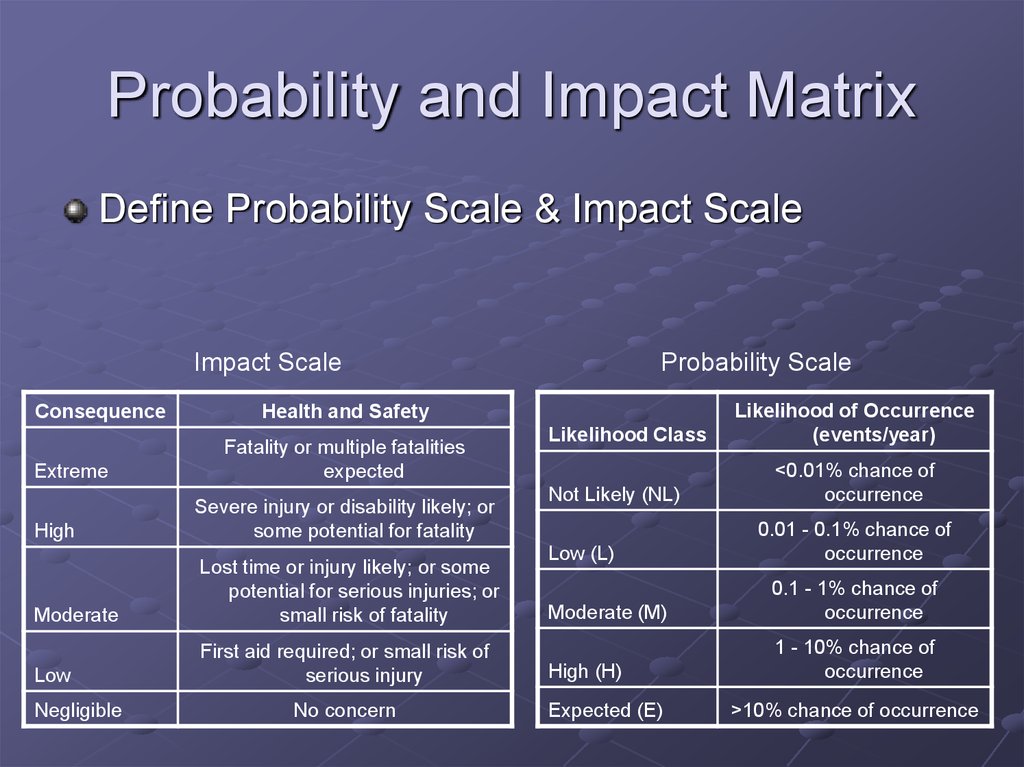

16. Probability and Impact Matrix

Define Probability Scale & Impact ScaleImpact Scale

Consequence

Extreme

Health and Safety

Fatality or multiple fatalities

expected

High

Severe injury or disability likely; or

some potential for fatality

Moderate

Lost time or injury likely; or some

potential for serious injuries; or

small risk of fatality

Low

First aid required; or small risk of

serious injury

Negligible

Probability Scale

No concern

Likelihood Class

Not Likely (NL)

Low (L)

Likelihood of Occurrence

(events/year)

<0.01% chance of

occurrence

0.01 - 0.1% chance of

occurrence

Moderate (M)

0.1 - 1% chance of

occurrence

High (H)

1 - 10% chance of

occurrence

Expected (E)

>10% chance of occurrence

17. Probability and Impact Plots

Rate eachrisk on

scales

then plot

on matrix

Develop

mitigation

technique

for risks

above

tolerance

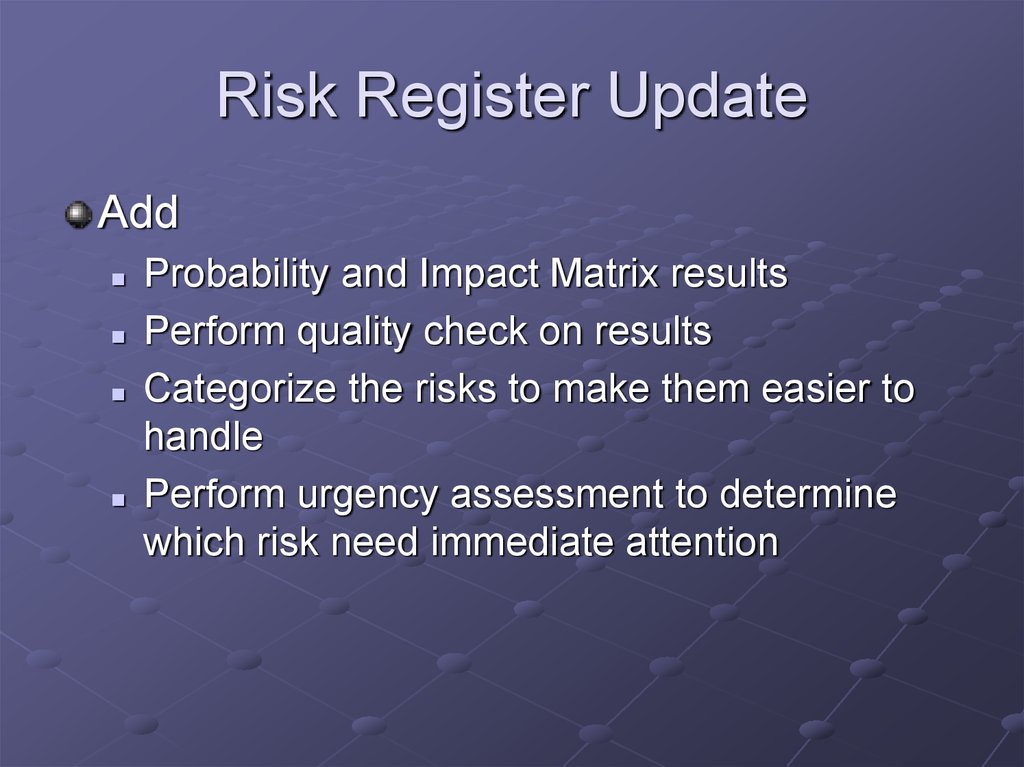

18. Risk Register Update

AddProbability and Impact Matrix results

Perform quality check on results

Categorize the risks to make them easier to

handle

Perform urgency assessment to determine

which risk need immediate attention

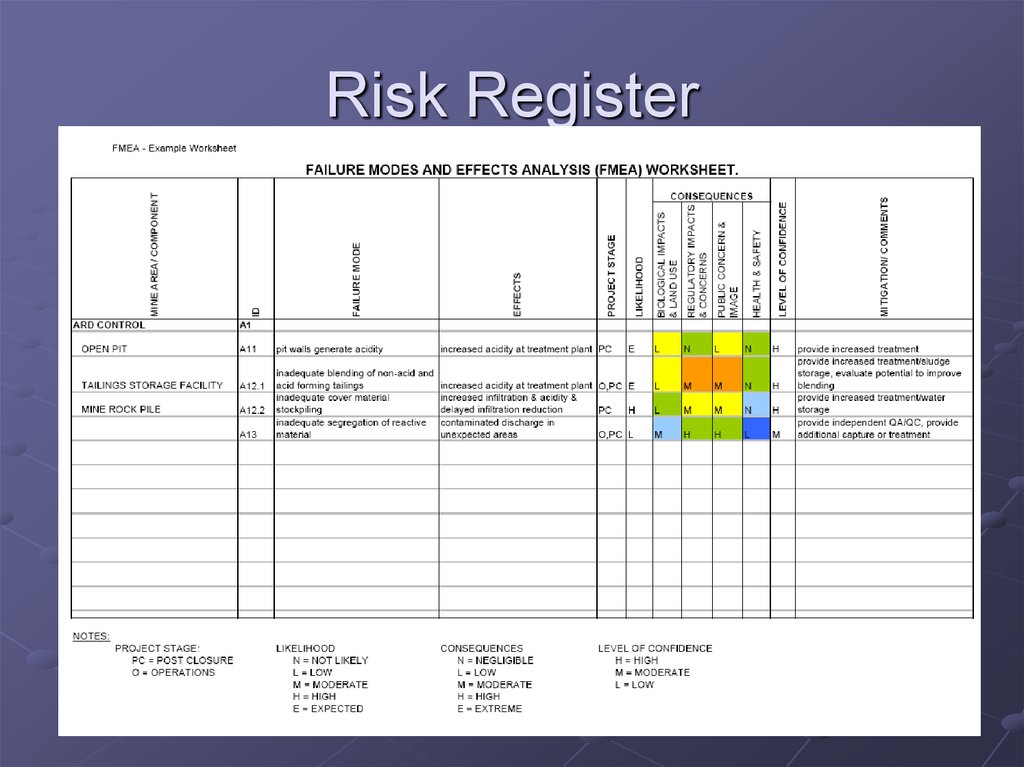

19. Risk Register

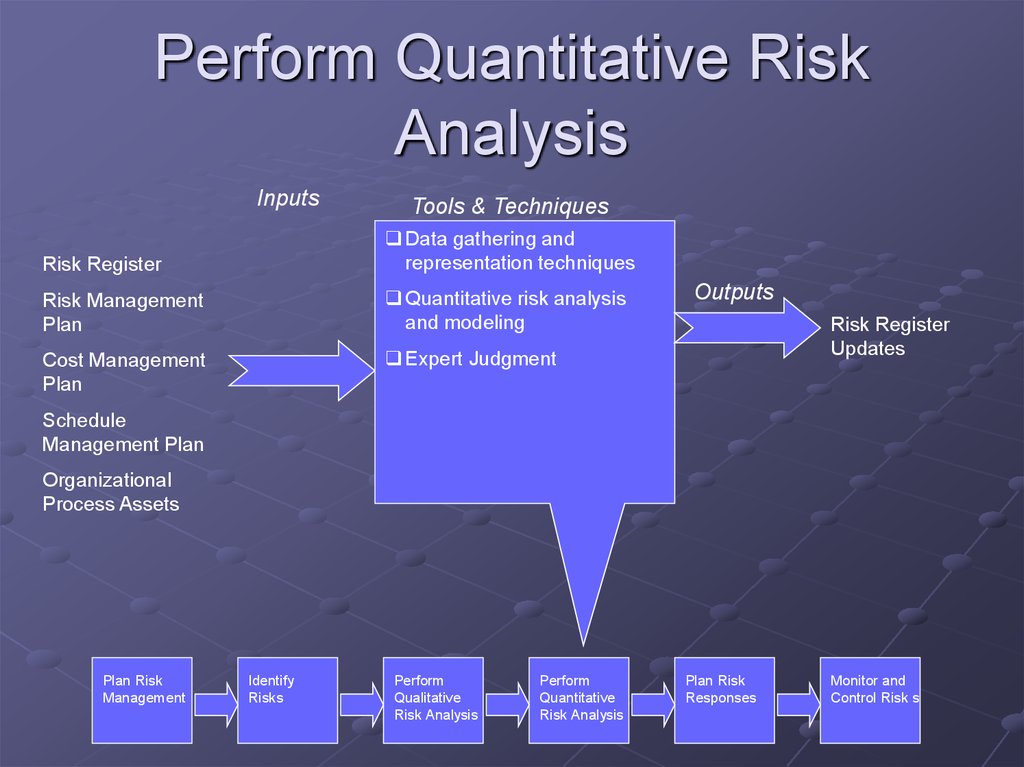

20. Perform Quantitative Risk Analysis

InputsTools & Techniques

Risk Register

Data gathering and

representation techniques

Risk Management

Plan

Quantitative risk analysis

and modeling

Cost Management

Plan

Expert Judgment

Outputs

Risk Register

Updates

Schedule

Management Plan

Organizational

Process Assets

Plan Risk

Management

Identify

Risks

Perform

Qualitative

Risk Analysis

Perform

Quantitative

Risk Analysis

Plan Risk

Responses

Monitor and

Control Risk s

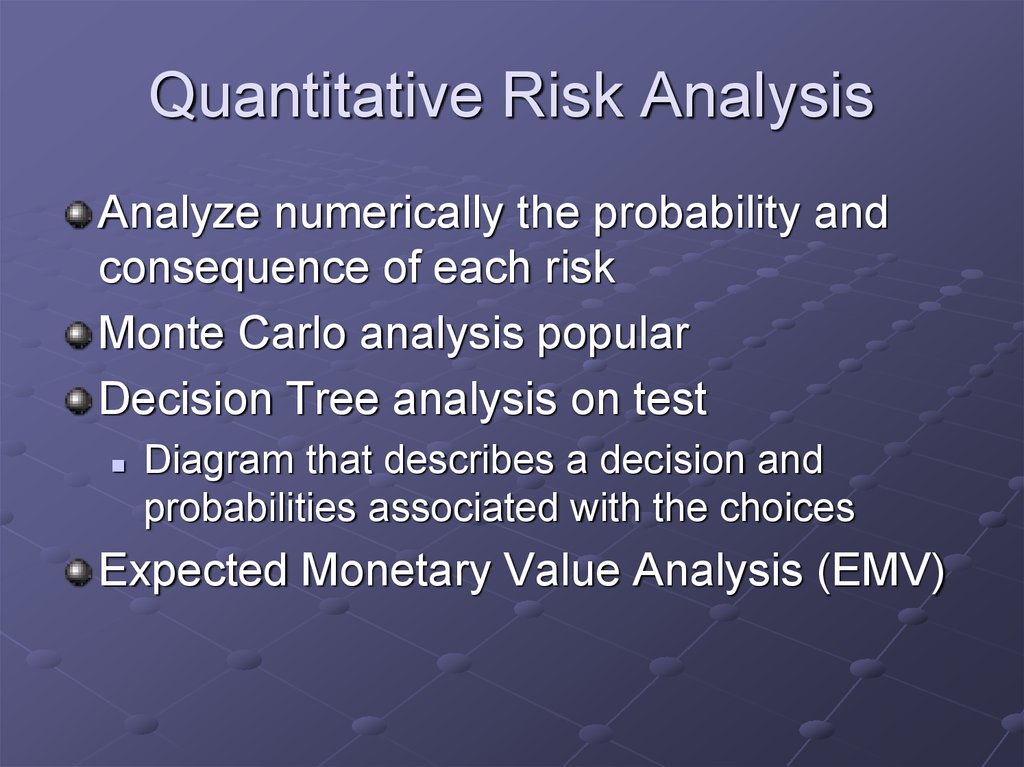

21. Quantitative Risk Analysis

Analyze numerically the probability andconsequence of each risk

Monte Carlo analysis popular

Decision Tree analysis on test

Diagram that describes a decision and

probabilities associated with the choices

Expected Monetary Value Analysis (EMV)

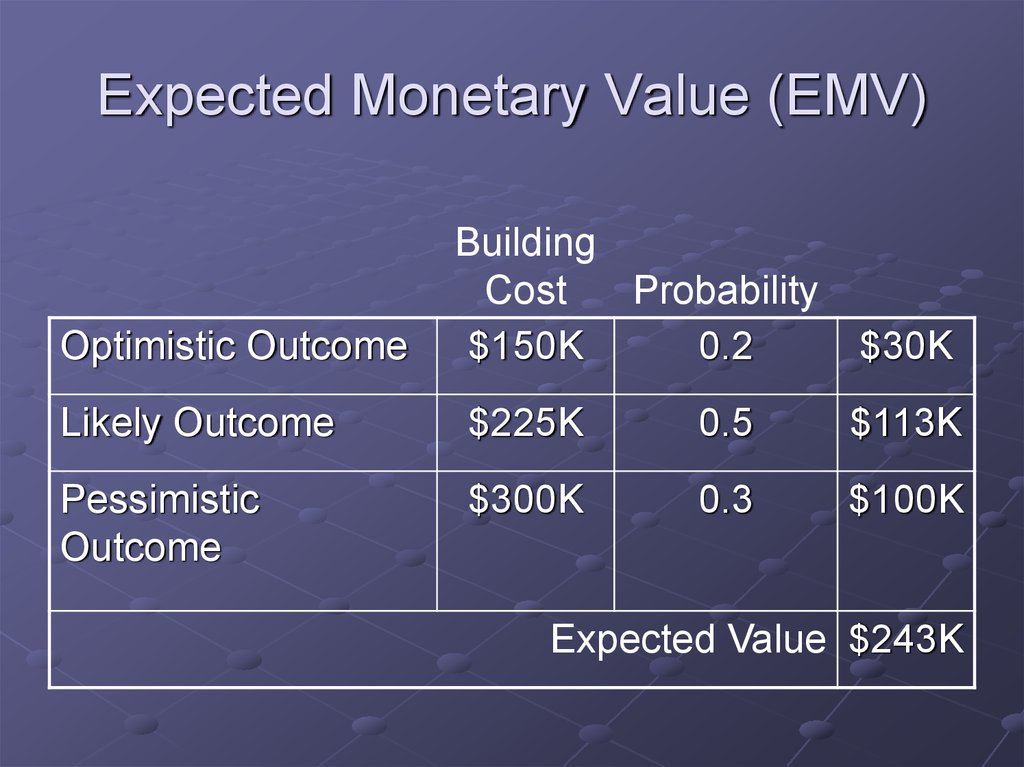

22. Expected Monetary Value (EMV)

Optimistic OutcomeBuilding

Cost

Probability

$150K

0.2

$30K

Likely Outcome

$225K

0.5

$113K

Pessimistic

Outcome

$300K

0.3

$100K

Expected Value $243K

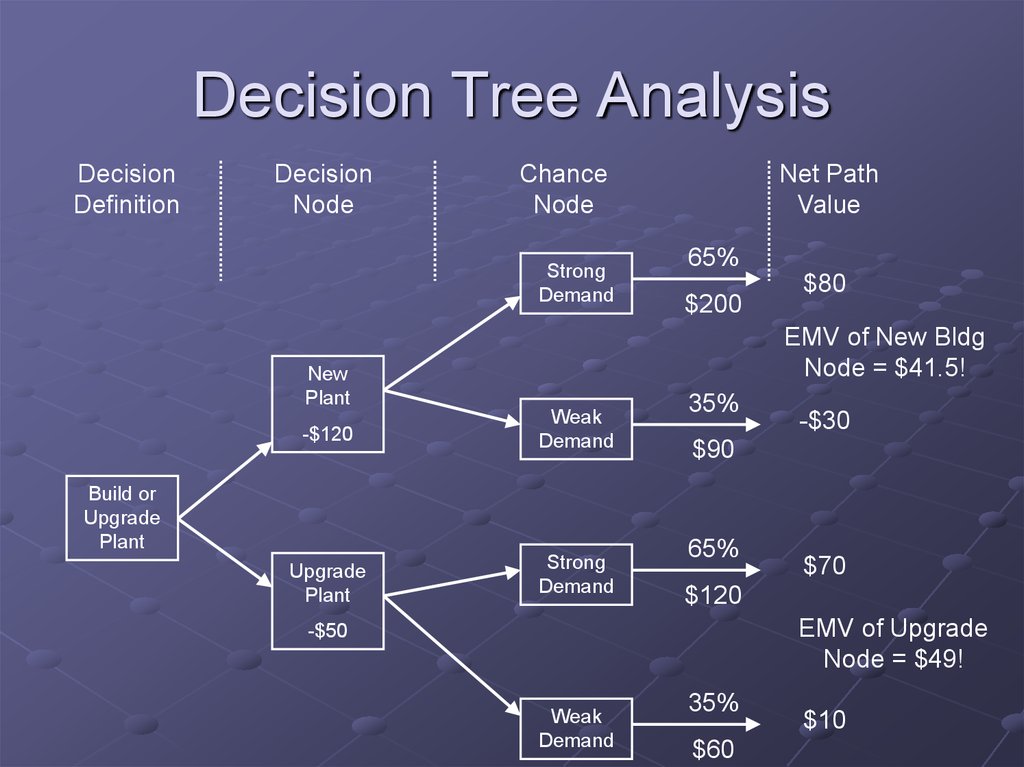

23. Decision Tree Analysis

DecisionDefinition

Decision

Node

Chance

Node

Strong

Demand

Net Path

Value

65%

$200

$80

EMV of New Bldg

Node = $41.5!

New

Plant

-$120

Weak

Demand

Upgrade

Plant

Strong

Demand

Build or

Upgrade

Plant

35%

-$30

$90

65%

$70

$120

EMV of Upgrade

Node = $49!

-$50

Weak

Demand

35%

$60

$10

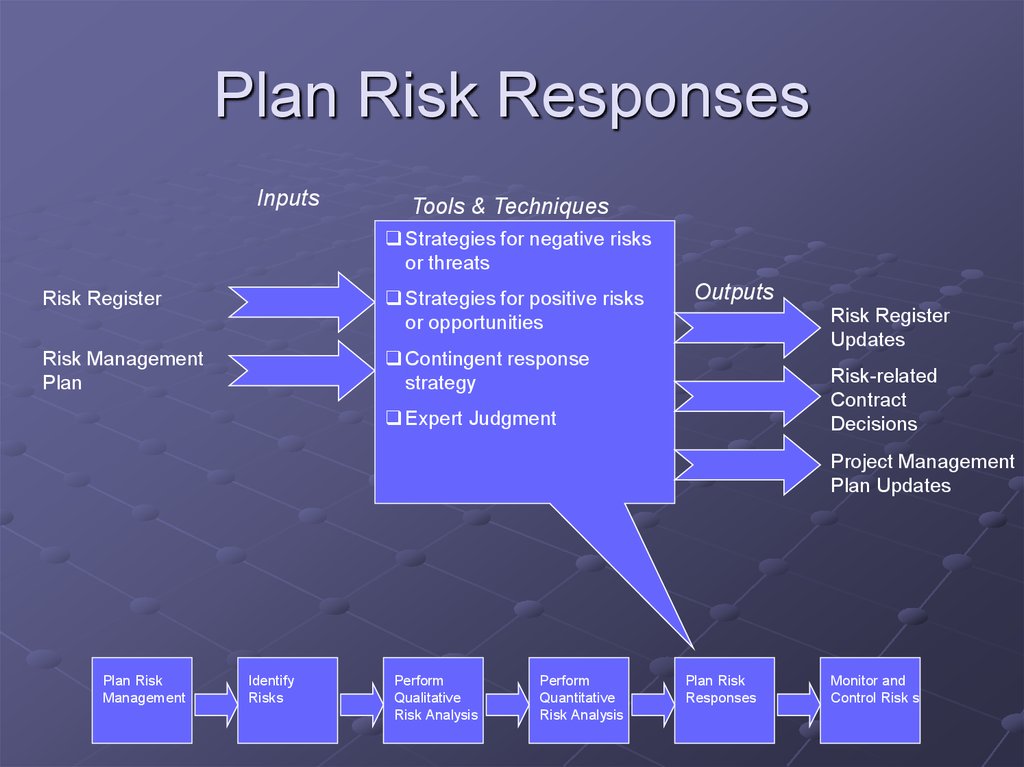

24. Plan Risk Responses

InputsTools & Techniques

Strategies for negative risks

or threats

Risk Register

Strategies for positive risks

or opportunities

Risk Management

Plan

Contingent response

strategy

Outputs

Risk Register

Updates

Risk-related

Contract

Decisions

Expert Judgment

Project Management

Plan Updates

Plan Risk

Management

Identify

Risks

Perform

Qualitative

Risk Analysis

Perform

Quantitative

Risk Analysis

Plan Risk

Responses

Monitor and

Control Risk s

25. Strategies

Negative Risks (or Threats)Avoid

Transfer

Mitigate

Acceptance

Positive Risks (or Opportunities)

Exploit

Share

Enhance

Acceptance

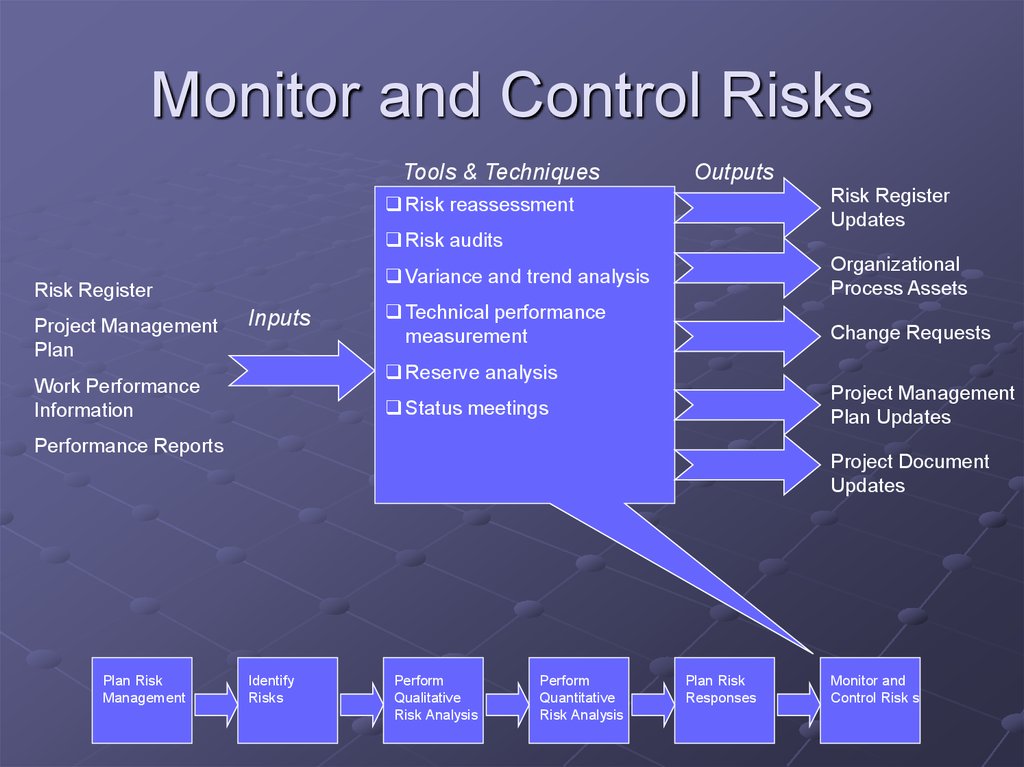

26. Monitor and Control Risks

Tools & TechniquesOutputs

Risk Register

Updates

Risk reassessment

Risk audits

Risk Register

Project Management

Plan

Organizational

Process Assets

Variance and trend analysis

Inputs

Technical performance

measurement

Change Requests

Reserve analysis

Work Performance

Information

Project Management

Plan Updates

Status meetings

Performance Reports

Plan Risk

Management

Project Document

Updates

Identify

Risks

Perform

Qualitative

Risk Analysis

Perform

Quantitative

Risk Analysis

Plan Risk

Responses

Monitor and

Control Risk s

Менеджмент

Менеджмент Английский язык

Английский язык