Похожие презентации:

Diagnostics of bankruptcy of an enterprise and measures to improve the efficiency of its activities

1.

FINAL QUALIFYING WORK"DIAGNOSTICS OF BANKRUPTCY OF AN

ENTERPRISE AND MEASURES TO IMPROVE

THE EFFICIENCY OF ITS ACTIVITIES"

A student of the 4th year of full-time education

areas of study 38.03.01 Economics

orientation (profile)

Finance, money circulation and credit

Lisitsyn Mikhail Evgenievich

Head: Candidate of Economics, Associate Professor

Merkulova Natalia Sergeevna

2.

The purpose of the final qualification work is todevelop recommendations for improving the

methodology for assessing potential bankruptcy

and the formation of ways to develop a specific

enterprise.

The object of research in the performance of the

final qualification work is the financial stability of

the enterprise and the possibility of its probable

bankruptcy, the subject is approaches and

methods of studying the indicator of financial

stability of the enterprise.

3.

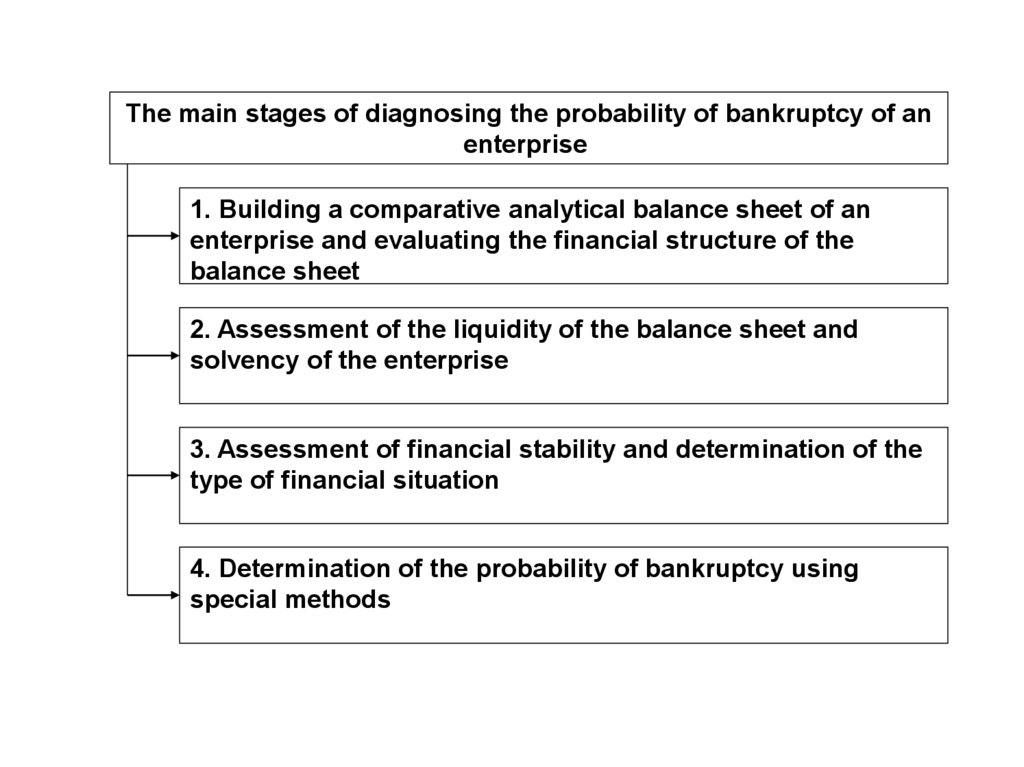

The main stages of diagnosing the probability of bankruptcy of anenterprise

1. Building a comparative analytical balance sheet of an

enterprise and evaluating the financial structure of the

balance sheet

2. Assessment of the liquidity of the balance sheet and

solvency of the enterprise

3. Assessment of financial stability and determination of the

type of financial situation

4. Determination of the probability of bankruptcy using

special methods

4.

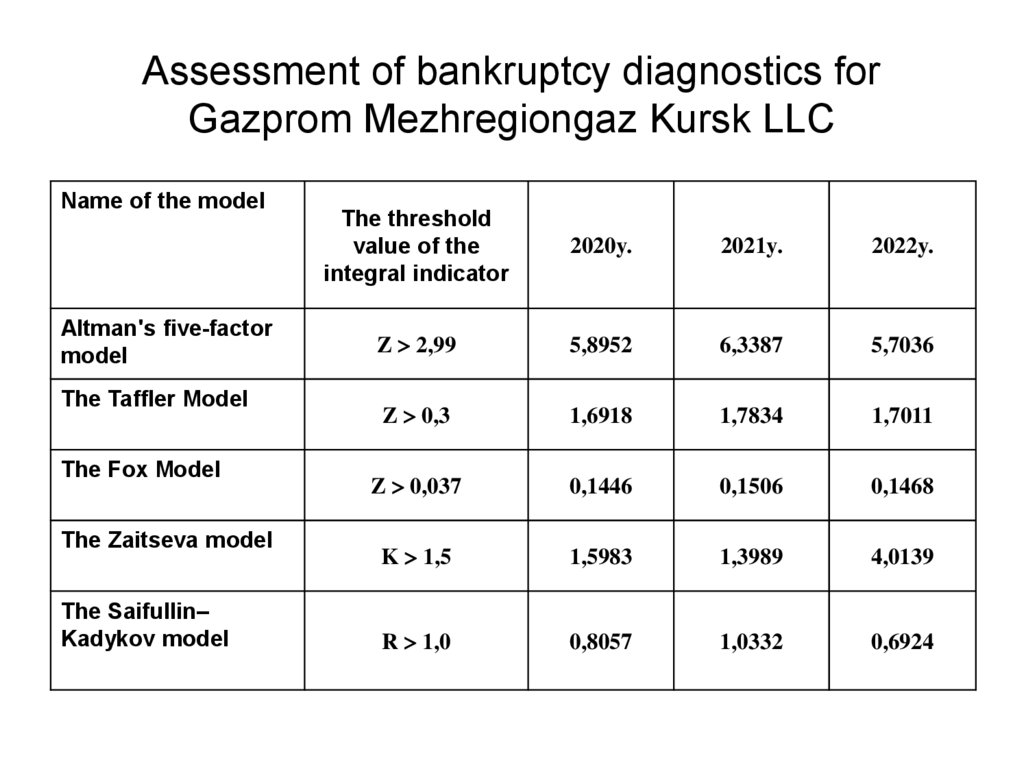

Assessment of bankruptcy diagnostics forGazprom Mezhregiongaz Kursk LLC

Name of the model

The threshold

value of the

integral indicator

2020y.

2021y.

2022y.

Altman's five-factor

model

Z 2,99

5,8952

6,3387

5,7036

The Taffler Model

Z 0,3

1,6918

1,7834

1,7011

The Fox Model

Z 0,037

0,1446

0,1506

0,1468

The Zaitseva model

K 1,5

1,5983

1,3989

4,0139

R 1,0

0,8057

1,0332

0,6924

The Saifullin–

Kadykov model

5.

Indicators characterizing the state of accountsreceivable of Gazprom Mezhregiongaz Kursk LLC

Indicator

2020y.

2021y.

2022y.

Accounts receivable, thousand

rubles.

851067

1209671

1700911

Revenue, thousand rubles.

10827000

12317498

12993700

Turnover ratio of accounts

receivable, times

12,7

10,2

7,6

Turnover period of accounts

receivable, days

28,7

35,8

47,7

6.

A comprehensive scheme of effective interaction between the territoriesof urban agglomerations and resource-supplying organizations

Resource-supplying

organizations

Developers (developers)

Municipal authorities

Comprehensive program for the development of engineering and communal

infrastructure systems: - targeted investment programs of the municipality

- investment programs of resource-supplying organizations

- measures to ensure energy efficiency and control

Adjustment of territorial planning taking into account the prospective development of the

main elements of infrastructure facilities

Analysis of the actual availability of engineering

and financial resources

Cooperation with the

developer, technical

connection to the networks

Construction of missing

infrastructure facilities (budget

financing)

7.

The following is expected to be the areas of increasingthe efficiency of Gazprom Mezhregiongaz Kursk LLC:

- conducting financial analysis from the perspective of

assessing the probability of bankruptcy based on an

integrated approach, taking into account various

factors of industry and market conditions;

- strengthening financial discipline in relation to

consumers of services by increasing control over

payment discipline;

- participation in urban development programs through

interaction with local authorities and management.

8.

The report is over, thank you for yourattention!

Экономика

Экономика