Похожие презентации:

Monitoring of consumer habits in DIY segment Moscow, St. Petersburg

1. Monitoring of consumer habits in DIY segment Moscow, St. Petersburg

Main resultsSource: GFK ad-hoc research “Segment Monitoring of Consumer Habits in

DIY Segment – Moscow, St. Petersburg”, September-October 2005

November 2005

Prepared by Natalia Starikova

2. Methodology

Castorama Russia Market ResearchMethodology

Representative survey of Moscow and St. Petersburg residents

Telephone interviews (CATI – Computer Assisted Telephone

Interviews)

Random sample – 1026 interviews (Moscow) and 1000 (St. Pet)

Target group: household member, taking part in choice of DIY

products

Fieldwork: September-October 2005

2

3. Management summary

Consumers want wide range, quality (fit for purpose), affordable prices,brands and services (especially in St. Pet.).

MARKETS are better at price, STORES at range, service and quality.

About 80% of respondents undertook some DIY this year, with 28% using

professional workers too.

Satisfaction levels of visiting outlets are high, but in absence of better

alternatives.

Castorama Russia Market Research

In Moscow KASHIRSKIY DVOR and STARIK KHOTTABYCH are the leaders of

DIY market in 2005: 31% of respondents bought from KD this year

(awareness – 77%), 22% - from SK (awareness – 76%).

In St. Petersburg MAKSIDOM is the absolute leader of the market with

95% awareness and 54% of purchases.

3

4. Management summary

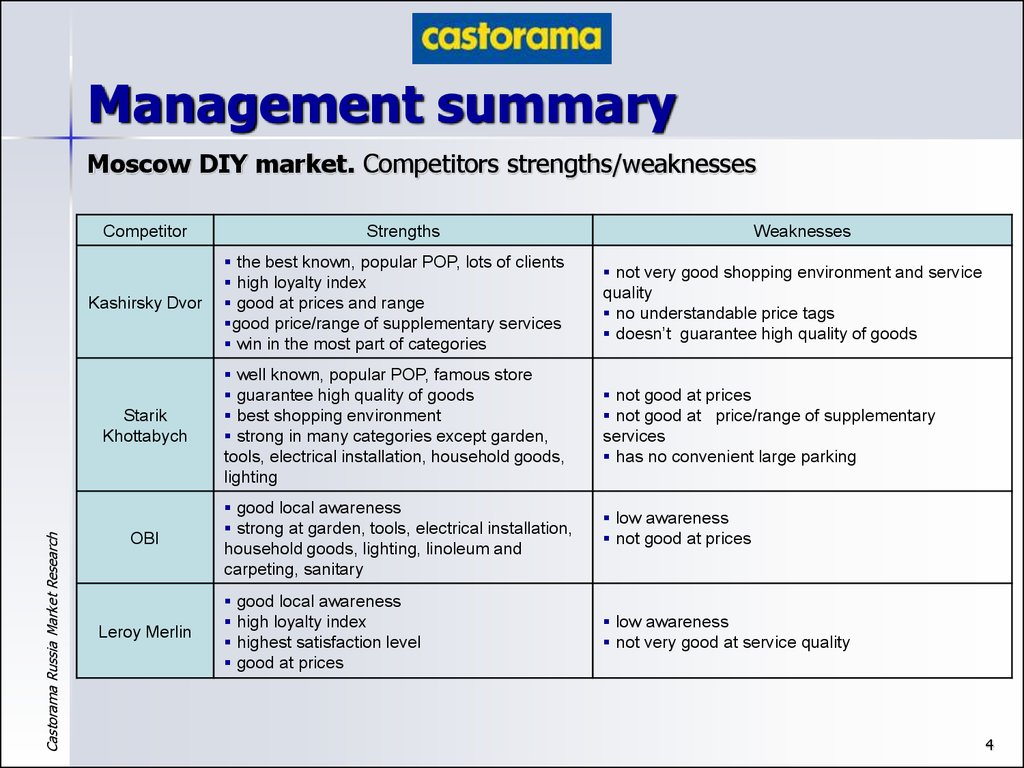

Moscow DIY market. Competitors strengths/weaknessesCastorama Russia Market Research

Competitor

Strengths

Weaknesses

Kashirsky Dvor

the best known, popular POP, lots of clients

high loyalty index

good at prices and range

good price/range of supplementary services

win in the most part of categories

not very good shopping environment and service

quality

no understandable price tags

doesn’t guarantee high quality of goods

Starik

Khottabych

well known, popular POP, famous store

guarantee high quality of goods

best shopping environment

strong in many categories except garden,

tools, electrical installation, household goods,

lighting

not good at prices

not good at price/range of supplementary

services

has no convenient large parking

OBI

good local awareness

strong at garden, tools, electrical installation,

household goods, lighting, linoleum and

carpeting, sanitary

Leroy Merlin

good local awareness

high loyalty index

highest satisfaction level

good at prices

low awareness

not good at prices

low awareness

not very good at service quality

4

5. Management summary

St. Petersburg DIY market . Competitors strengths/weaknessesCastorama Russia Market Research

Competitor

Strengths

Weaknesses

Maksidom

absolute leader of the market with 95%

awareness and 54% of purchases.

the best known, popular POP

highest loyalty index

highest satisfaction level

gives good ideas for renovation

nice shopping environment

convenient large parking

win in all categories

not good at prices

inconvenient working hours

problems with queues

Teks/

Stroimaster

good loyalty index

strong in the most part of categories except

garden and kitchen

confusion with two names

Rybinskaya

good loyalty index

affordable prices

large assortment

good price/range of supplementary services

strong in many categories except garden,

kitchen, decorative household goods, linoleum

and carpeting, lighting

not good shopping environment and

service quality

doesn’t guarantee high quality of

goods

no well-known brands

5

6. Content

Castorama Russia Market ResearchMoscow & St. Petersburg DIY market

–

–

–

–

–

–

–

–

–

–

Awareness

Purchases

Loyalty

Satisfaction with POP

Assessment of POP

Evaluation of stores & markets

POP image

POP for key categories

Competitors strengths & weaknesses

Consumer behavior

6

7. Moscow DIY market

Castorama Russia Market ResearchMoscow DIY market

7

8. Moscow DIY market

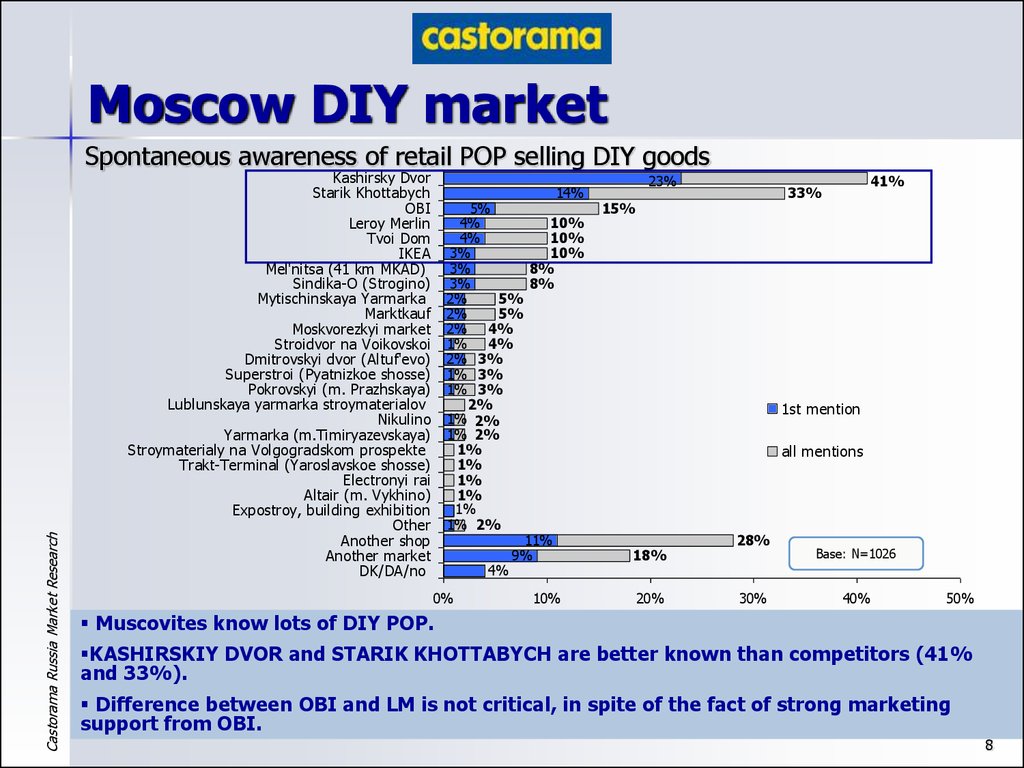

Castorama Russia Market ResearchSpontaneous awareness of retail POP selling DIY goods

Kashirsky Dvor

Starik Khottabych

OBI

Leroy Merlin

Tvoi Dom

IKEA

Mel'nitsa (41 km MKAD)

Sindika-O (Strogino)

Mytischinskaya Yarmarka

Marktkauf

Moskvorezkyi market

Stroidvor na Voikovskoi

Dmitrovskyi dvor (Altuf'evo)

Superstroi (Pyatnizkoe shosse)

Pokrovskyi (m. Prazhskaya)

Lublunskaya yarmarka stroymaterialov

Nikulino

Yarmarka (m.Timiryazevskaya)

Stroymaterialy na Volgogradskom prospekte

Тrakt-Теrminal (Yaroslavskoe shosse)

Electronyi rai

Аltair (m. Vykhino)

Expostroy, building exhibition

Other

Another shop

Another market

DK/DA/no

14%

5%

4%

10%

4%

10%

3%

10%

3%

8%

3%

8%

2%

5%

2%

5%

2% 4%

1% 4%

2% 3%

1% 3%

1% 3%

2%

1% 2%

1% 2%

1%

1%

1%

1%

1%

1% 2%

11%

9%

4%

0%

10%

23%

41%

33%

15%

1st mention

all mentions

18%

20%

28%

30%

Base: N=1026

40%

50%

Muscovites know lots of DIY POP.

KASHIRSKIY DVOR and STARIK KHOTTABYCH are better known than competitors (41%

and 33%).

Difference between OBI and LM is not critical, in spite of the fact of strong marketing

support from OBI.

8

9. Moscow DIY market

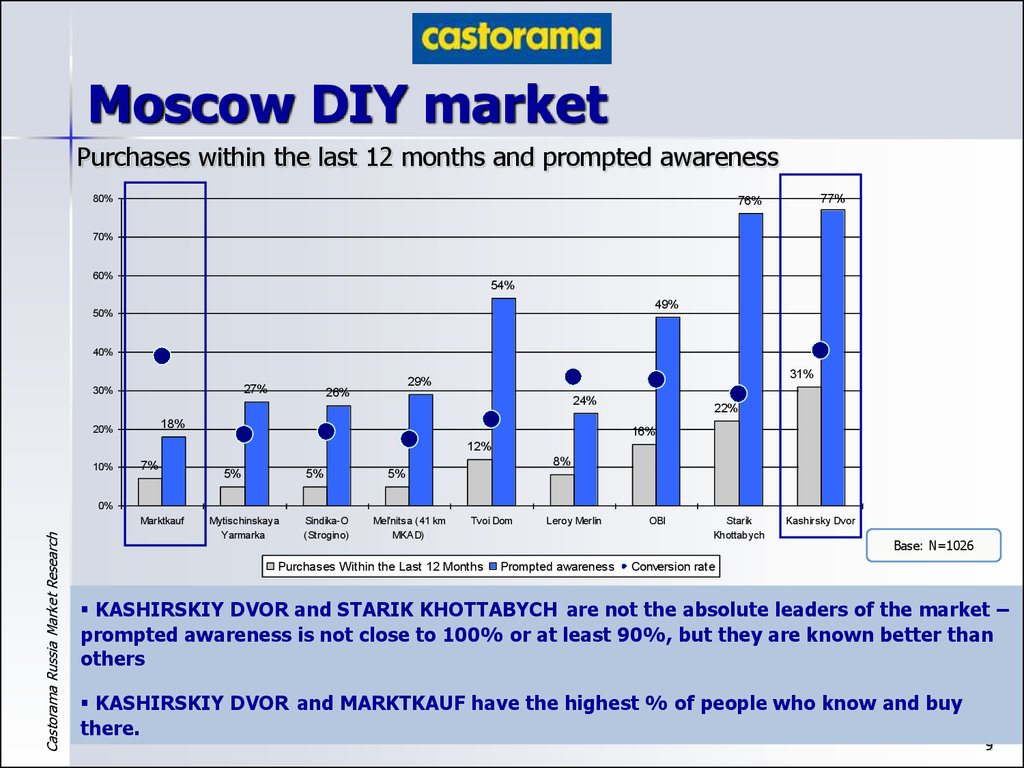

Purchases within the last 12 months and prompted awareness80%

77%

76%

70%

60%

54%

49%

50%

40%

27%

30%

31%

29%

26%

24%

18%

20%

22%

16%

12%

10%

7%

8%

5%

5%

5%

0%

Castorama Russia Market Research

Marktkauf

Mytischinskaya

Yarmarka

Sindika-O

(Strogino)

Mel'nitsa (41 km

MKAD)

Tvoi Dom

Purchases Within the Last 12 Months

Leroy Merlin

Prompted awareness

OBI

Starik

Khottabych

Kashirsky Dvor

Base: N=1026

Conversion rate

KASHIRSKIY DVOR and STARIK KHOTTABYCH are not the absolute leaders of the market –

prompted awareness is not close to 100% or at least 90%, but they are known better than

others

KASHIRSKIY DVOR and MARKTKAUF have the highest % of people who know and buy

there.

9

10. Moscow DIY market

Castorama Russia Market ResearchAwareness in different districts

KASHIRSKIY DVOR and STARIK KHOTTABYCH are the leaders in the most part of districts.

LM and OBI have good local awareness.

10

11. Moscow DIY market

Professionals’ awareness and purchases60

50

48

45

40

34

34

30

21

20

17

21

17

17

14

17

17

17

14

10

Castorama Russia Market Research

10

7

0

Kashirskij Dvor

Starik Khottabych

OBI

Tvoi Dom

Awareness

Leroy Merlin

Sindika-O

(Strogino)

Mitishinskaja

Yarmarka

Melnitza (41 km

MKAD)

Purchases

KASHIRSKIY DVOR and STARIK KHOTTABYCH are the best known POP amongst

professionals/trade.

But at the same time the open markets (Sindika-O (Strogino), Mitishinskaja Yarmarka,

Melnitza (41 km MKAD) play quite an important role as well.

11

12. Moscow DIY market

Willingness to Recommend POP100%

35%

31%

90%

30%

26%

25%

70%

22%

60%

20%

16%

16%

50%

15%

40%

12%

11%

10%

7%

Castorama Russia Market Research

5%

80%

4%

7%

5%

3%

4%

7%

30%

8%

20%

5%

10%

0%

0%

Marktkauf

Mytischinskaya

Yarmarka

Sindika-O

(Strogino)

Tvoi Dom

Willingness to Recommend POS

Leroy Merlin

OBI

Purchases Within the Last 12 Months

Starik Khottabych

Kashirsky Dvor

Loyalty index

LEROY MERLIN and KASHIRSKIY DVOR have the highest loyalty index. People are satisfied

with the visit to these POPs and would recommend it to nears and dears.

The main issue for LM is low awareness.

12

13. Moscow DIY market

Satisfaction with POP – top two boxes4,5

90%

80%

4,4

70%

60%

41%

29%

51%

33%

27%

38%

50%

31%

38%

28%

4,3

21%

40%

4,1

30%

20%

10%

41%

33%

32%

35%

47%

46%

42%

43%

34%

45%

4

3,9

3,8

0%

Kashirskij Leroy Merlin

Dvor

Castorama Russia Market Research

4,2

Marktkauf

Mitishinskaja

Yarmarka

4 Satisfied

OBI

Melnitza (41 Sindika-O

Starik

km MKAD) (Strogino) Khottabych

5 Very satisfied

Tvoi Dom

Strojdrov na

Vojkovskoj

Mean

LEROY MERLIN has the highest overall satisfaction level.

OBI has good marks but mainly “4”, not “5”. There is an opportunity for them to improve.

В5. How satisfied are you in general with the outlet ______? Please, use a 5-point scale, where "5" stands for "completely satisfied" and "1 means "absolutely unsatisfied".

13

14. Moscow DIY market

Consumer Assessment of POP5

100

90

4,5

80

4

70

3,5

60

3

50

40

2,5

30

20

2

Top 2 boxes (4, 5) for 5-point scale + mean

1,5

10

1

Castorama Russia Market Research

0

Kashirskij Dvor

Starik Khottabych

Price level

Assortment

OBI

Service quality

Tvoi Dom

Marktkauf

Shopping enviroment

Leroy Merlin

Total satisfaction

All marks/grades are rather high (generally more than 4, except for prices).

Range is evaluated high in all POP except SK. Prices are not good at OBI, SK, Tvoi dom.

Service quality is not good at KD and OBI. Shopping environment is not good at KD.

Generally LM is evaluated better than others.

14

15. Moscow DIY market

Evaluation of Stores vs. MarketsStores

Markets

better assortment

better/lower prices

Castorama Russia Market Research

better quality of goods

better service level

Markets win on price, stores on service and quality. Range is equal. Thus, it’s important to

beat markets on price and we could be a real winner.

15

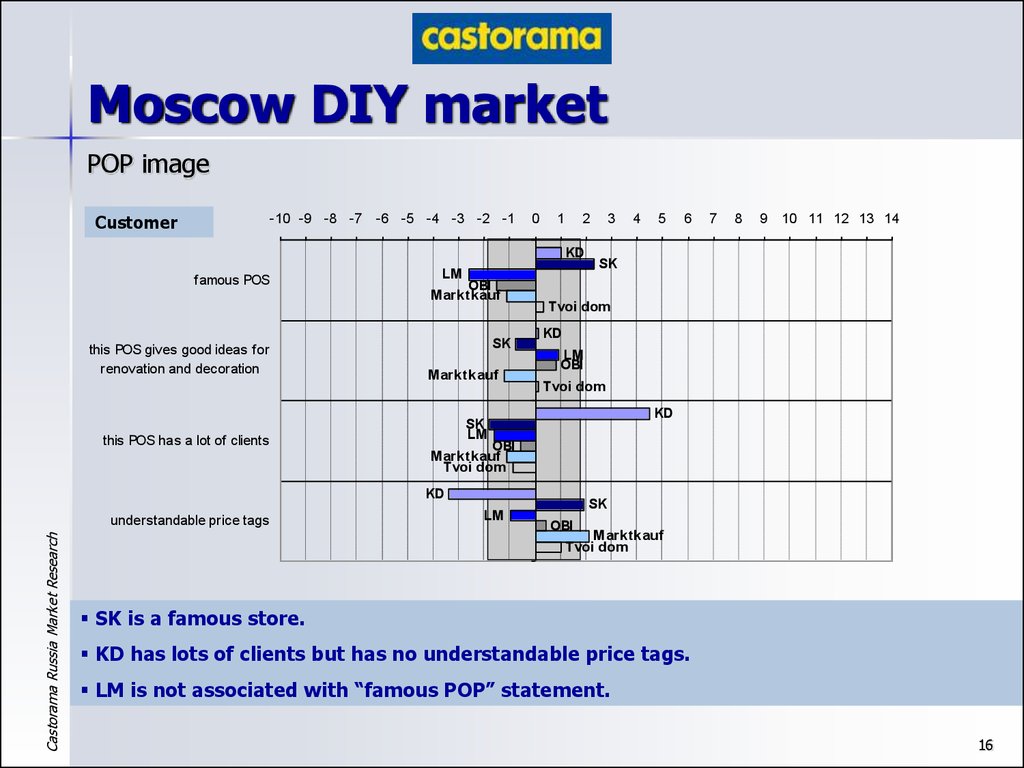

16. Moscow DIY market

POP image-10 -9 -8 -7 -6 -5 -4 -3 -2 -1

Customer

0

1

2

KD

famous POS

this POS gives good ideas for

renovation and decoration

this POS has a lot of clients

LM

OBI

Marktkauf

SK

Marktkauf

Castorama Russia Market Research

4

5

6

7

8

9 10 11 12 13 14

SK

Tvoi dom

KD

LM

OBI

Tvoi dom

KD

SK

LM

OBI

Marktkauf

Tvoi dom

KD

understandable price tags

3

LM

SK

OBI

Marktkauf

Tvoi dom

SK is a famous store.

KD has lots of clients but has no understandable price tags.

LM is not associated with “famous POP” statement.

16

17. Moscow DIY market

POP image-10 -9 -8 -7 -6 -5 -4 -3 -2 -1

Product

affordable prices

Tvoi dom

Marktkauf

OBI

KD

large assortment of DIY goods is

alw ays available / one can find

everything

Castorama Russia Market Research

4

5

6

7

8

9 10 11 12 13 14

OBI

Marktkauf

SK

OBI

Marktkauf

LM

SK

LM

Tvoi dom

KD

LM

Tvoi dom

KD

this POS guarantees high quality

of goods

3

2

1

KD

SK

availability of w ell-know n

brands

0

OBI

Marktkauf

LM

SK

Tvoi dom

KD is strongly associated with affordable prices and large assortment, but does not

guarantee high quality of goods.

on the contrary, SK wins on quality, but is not associated with “affordable” POP.

17

18. Moscow DIY market

POP imageServices/Staff

af f ordable price of supplementary

serv ices

av ailability of

supplementary serv ices

(deliv ery , saw cut, design, etc.)

conv enient working hours

no queues, f ast serv ice at pay desk

-10 -9 -8 -7 -6 -5 -4 -3 -2 -1 0

1

LM

OBI

Tvoi dom

Castorama Russia Market Research

5

6

7

8

9 10 11 12 13 14

Marktkauf

KD

SK

LM

Marktkauf

Tvoi dom

OBI

KD

SK

LM

OBI

Marktkauf

Marktkauf

OBI

Tvoi dom

Marktkauf

Tvoi dom

KD

polite and f riendly staf f

4

KD

SK

Tvoi dom

LM

KD

competent staf f

3

2

LM

OBI

KD

SK

SK

SK

LM

OBI Marktkauf

Tvoi dom

KD is strongly associated with good availability and prices of supplementary services, in

contrast to SK.

No POP is characterized as POP with competent and polite staff.

Tvoi Dom has the most convenient working hours.

18

19. Moscow DIY market

POP imageShopping

environment

-10 -9 -8 -7 -6 -5 -4 -3 -2 -1

SK

0

2

1

5

6

7

8

9 10 11 12 13 14

LM

OBI

Marktkauf

Tvoi dom

KD

conveniently reachable by

public transport

LM

OBI

Tvoi dom

KD

easy to orientate oneself in

a POS

KD

neatness inside the POS

and its neighborhood

Castorama Russia Market Research

4

KD

convenient large parking

KD

nice shopping environment /

nice to be in POS

3

SK

Marktkauf

SK

LM

OBI

Marktkauf

Tvoi dom

SK

LM

OBI

Marktkauf

Tvoi dom

SK

LM

OBI

Marktkauf

Tvoi dom

SK has the best shopping environment except convenient large parking, in contrast to KD

19

20. Moscow DIY market

Where people buy the key product categoriesCategories

Building

Deco

Castorama Russia Market Research

Flooring

Garden

Competitor #1

Competitor #2

Competitor #3

Construction materials (dry mixtures, filling

material, priming material)

Kashirsky Dvor

Starik Khottabych

Mel'nitsa (41 km

MKAD)

Wood (timber, lining, chipboard, window-sills,

plywood)

Kashirsky Dvor

Sindika-O (Strogino)

Mel'nitsa (41 km

MKAD)

Decorative household goods (sofa pillows,

curtains, photo frames, etc.)

Kashirsky Dvor

Starik Khottabych

Marktkauf

Finishing materials (wallpaper, paints)

Kashirsky Dvor

Starik Khottabych

OBI

Household goods (ironing boards, baskets for

linen, etc.)

OBI

Marktkauf

Kashirsky Dvor

Lighting (chandeliers, lamp-brackets, lamps)

Kashirsky Dvor

OBI

Tvoi Dom

Ceramic tiles (for walls, floor)

Kashirsky Dvor

Starik Khottabych

Leroy Merlin

Linoleum or synthetic carpeting

Kashirsky Dvor

Starik Khottabych

OBI

Parquet, laminate, doors

Kashirsky Dvor

Leroy Merlin

OBI, Starik Khottabych

Garden plants and equipment

OBI

Kashirsky Dvor

Marktkauf

Electric and hand tools, hardware

Kashirsky Dvor

OBI

Sindika-O (Strogino)

Electrical installation (wires, sockets)

Kashirsky Dvor

OBI

Tvoi Dom

Kitchen

other stores

Leroy Merlin

Starik Khottabych

Sanitary ware and plumbing (e.g. bathtub, tubing,

faucets, toilet, etc.)

Kashirsky Dvor

Starik Khottabych

OBI

Hardware

Showrooms

20

21. St. Petersburg DIY market

Castorama Russia Market ResearchSt. Petersburg DIY market

21

22. St. Petersburg DIY market

Castorama Russia Market ResearchSpontaneous awareness of retail POP selling DIY goods

Maksidom

Stroimaster

Rybinskaya

Iskrasoft

Domovoi

Dom Laverna

TEKS

Stroitel

IKEA

Petrovych

Stroitorg

RIK

O'key

Lenta

Metrika

Season

Saturn

Starik Khottabych

Metro

Elis

other store

other open market

other

DK

-1%

35%

9%

7%

2%

5%

2%

4%

4%

1% 3%

1% 3%

1% 3%

1% 3%

1% 2%

58%

19%

19%

13%

12%

11%

10%

9%

1st mention

2%

2%

1%

1%

1%

1%

1%

all mentions

19%

38%

1% 2%

1%

Base: N=965

3%

5%

9%

19%

29%

39%

49%

59%

MAKSIDOM is an absolute leader with 58% spontaneous awareness. It has great level of

first mention – 35%.

Other POPs are not so popular.

22

23. St. Petersburg DIY market

Purchases within the last 12 months and prompted awareness100%

95%

90%

78%

80%

76%

70%

60%

54%

57%

56%

50%

50%

40%

30%

22%

25%

21%

20%

19%

14%

13%

12%

10%

5%

9%

3%

2%

Castorama Russia Market Research

0%

Maksidom

Rybinskaya

Stroimaster

Iskrasoft

Dom Laverna

Purchases Within the Last 12 Months

TEKS

Prompted awareness

Petrovych

Stroitorg

Metrika

Conversion rate

MAKSIDOM is the absolute leader of the market – prompted awareness is close to 100%.

In spite of high level of prompted awareness of ISKRASOFT and DOM LAVERNA people

don’t buy there.

23

24. St. Petersburg DIY market

Professionals’ awareness and purchases80

69

70

60

59

49

50

54

51

46

36

40

28

30

23

23

18

18

20

13

10

10

Castorama Russia Market Research

0

0

0

8

8

5

0

0

3

0

0

Maksidom

Ry binskay a Stroimaster

TEKS

Petrov y ch

Stroitel

Awareness

Domov oi

Dom

Lav erna

Iskrasof t

Stroitorg

Metrika

Saturn

Purchases

MAKSIDOM and RYBINSKAYA are the best known POS amongst professionals/trade. But in

terms of purchases TEKS is also one of the most popular POP.

But at the same time the storehouses like PETROVICH and SATURN play quite an

important role as well (share of trade there is about 30%).

24

25. St. Petersburg DIY market

Willingness to Recommend POP100%

60%

54%

90%

50%

80%

70%

40%

37%

60%

50%

30%

22%

40%

21%

19%

20%

30%

14%

11%

12%

11%

5%

Castorama Russia Market Research

20%

8%

10%

5%

4%

3%

2%

1%

10%

1% 2%

0%

0%

Maksidom

Rybinskaya

Stroimaster

Iskrasoft

Willingness to Recommend POS

Dom Laverna

TEKS

Petrovych

Purchases Within the Last 12 Months

Stroitorg

Metrika

Loyalty index

MAKSIDOM has the highest loyalty index. People are satisfied with the visit to this POP.

Other POPs (RYBISKAYA, STROIMASTER, METRIKA) have very good loyalty indices (50%)

as well.

25

26. St. Petersburg DIY market

Satisfaction with POP – top two boxes4,5

50

45

4,4

40

35

4,3

26

30

4,2

25

4,1

20

15

8

10

5

8

4

9

4

20

7

9

1

1

8

2

0

Castorama Russia Market Research

Maksidom

TEKS

Stroimaster

Stroitorg

4 Satisfied

Rybinskaya

2

Petrovych

5 Very satisfied

1

1

Metrika

6

Iskrasoft

3

3,9

6

3,8

Dom Laverna

Mean

MAKSIDOM has the highest satisfaction level.

The levels of satisfaction of TEKS, STROIMASTER, RYBISKAYA are on the same level, but

much lower than MAKSIDOM level.

В5. How satisfied are you in general with the outlet ______? Please, use a 5-point scale, where "5" stands for "completely satisfied" and "1 means "absolutely unsatisfied".

26

27. St. Petersburg DIY market

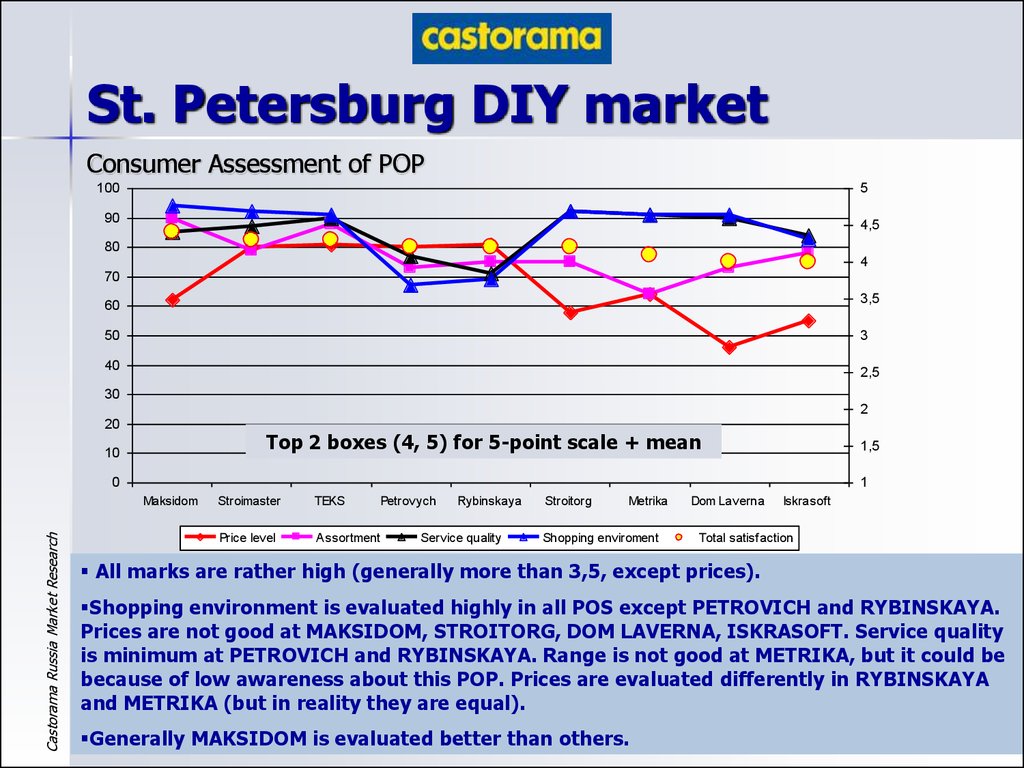

Consumer Assessment of POP100

5

90

4,5

80

4

70

60

3,5

50

3

40

2,5

30

2

20

Top 2 boxes (4, 5) for 5-point scale + mean

10

1,5

0

1

Castorama Russia Market Research

Maksidom

Stroimaster

TEKS

Price level

Assortment

Petrovych

Rybinskaya

Service quality

Stroitorg

Metrika

Shopping enviroment

Dom Laverna

Iskrasoft

Total satisfaction

All marks are rather high (generally more than 3,5, except prices).

Shopping environment is evaluated highly in all POS except PETROVICH and RYBINSKAYA.

Prices are not good at MAKSIDOM, STROITORG, DOM LAVERNA, ISKRASOFT. Service quality

is minimum at PETROVICH and RYBINSKAYA. Range is not good at METRIKA, but it could be

because of low awareness about this POP. Prices are evaluated differently in RYBINSKAYA

and METRIKA (but in reality they are equal).

Generally MAKSIDOM is evaluated better than others.

27

28. St. Petersburg DIY market

Evaluation of Stores vs. StorehousesStores

Storehouses

better

assortment

better/lower

prices

Castorama Russia Market Research

better quality of

goods

better service

level

STOREHOUSES win on price, STORES on service and range. Quality is equal. Thus it’s

important to beat storehouses on price, provide better services and we could be a real

winner.

28

29. St. Petersburg DIY market

POS image-8

Product

-7

-6

-5

-2

-3

-4

-1

0

3

2

1

4

5

6

Maksidom

Metrika

Rybinskaya

Teks

Stroimaster

availability of well-known brands

Castorama Russia Market Research

large assortment of DIY goods is

always available / one can find

everything

this POS guarantees high quality

of goods

9

10

11

Stroimaster

Maksidom

Metrika

Maksidom

Stroimaster

8

Rybinskaya

Teks

affordable prices

7

Teks

Rybinskaya

Metrika

Maksidom

Rybinskaya

Stroimaster

Metrika

Teks

RYBISKAYA is strongly associated with affordable prices and large assortment, but does

not guarantee high quality of goods and does not have well-known brands.

STROIMASTER also is associated with affordable prices.

MAKSIDOM has no affordable prices.

29

30. St. Petersburg DIY market

POP image-8

Services/Staff

-7

-6

-5

-4

-3

-2

-1

0

1

2

3

4

5

6

7

8

9

10

11

Maksidom

Rybinskaya

affordable price of supplementary

services

Teks

Stroim aster

Metrika

Maksidom

availability of

supplementary services

(delivery, saw cut, design, etc.)

Rybinskaya

Teks

Stroim aster

Metrika

Maksidom

Rybinskaya

convenient working hours

Teks

Stroim aster

Metrika

Maksidom

Rybinskaya

no queues, fast service at pay desk

Teks

Metrika

Stroim aster

Maksidom

Rybinskaya

Castorama Russia Market Research

competent staff

polite and friendly staff

Teks

Stroim aster

Metrika

Maksidom

Rybinskaya

Teks

Stroim aster

Metrika

RYBINSKAYA is strongly associated with good availability and prices of supplementary

services, in contrast to SK.

No POP is characterized as POP with competent and polite staff.

MAKSIDOM has the most INconvenient working hours and problems with queues. It’s an

opportunity for us to beat them.

30

31. St. Petersburg DIY market

POP imageShopping

environment

-8

-7

-6

-5

-2

-1

Stroimaster

Rybinskaya

conveniently reachable by public

transport

0

1

2

4

5

6

7

8

9

10

11

Maksidom

Teks

Maksidom

Teks

Maksidom

Rybinskaya

Teks

Metrika

Stroimaster

Stroimaster

Maksidom

Rybinskaya

nice shopping environment / Rybinskaya

nice to be in POS

3

Metrika

Metrika

easy to orientate oneself in a

POS

Castorama Russia Market Research

-3

Rybinskaya

convenient large parking

neatness inside the POS and its

neighborhood

-4

Teks

Stroimaster

Metrika

Maksidom

Teks

Stroimaster

Metrika

Generally RYBINSKAYA has the worst shopping environment.

MAKSIDOM is characterized by large parking and nice shopping environment.

Other POP have no specific attributes.

31

32. St. Petersburg DIY market

Where people buy the key product categoriesCategories

Building

Competitor #1

Competitor #2

Competitor #3

Construction materials (dry mixtures, filling

material, priming material)

Maksidom

TEKS/Stroimaster

Rybinskaya

Wood (timber, lining, chipboard, window-sills,

plywood)

Rybinskaya

Maksidom

TEKS/Stroimaster

Decorative household goods (sofa pillows,

curtains, photo frames, etc.)

Maksidom

TEKS/Stroimaster

Dom Laverna

Finishing materials (wallpaper, paints)

Maksidom

TEKS/Stroimaster

Rybinskaya

Household goods (ironing boards, baskets for

linen, etc.)

Maksidom

TEKS/Stroimaster

Dom Laverna

Lighting (chandeliers, lamp-brackets, lamps)

Maksidom

TEKS/Stroimaster

Dom Laverna

Ceramic tiles (for walls, floor)

TEKS/Stroimaster

Maksidom

Rybinskaya

Linoleum or synthetic carpeting

Maksidom

Iskrasoft

TEKS/Stroimaster

Parquet, laminate, doors

Maksidom

Rybinskaya

TEKS/Stroimaster

Garden plants and equipment

other POP

Maksidom

Electric and hand tools, hardware

Maksidom

TEKS/Stroimaster

Rybinskaya

Electrical installation (wires, sockets)

Maksidom

TEKS/Stroimaster

Rybinskaya

Kitchen

other POP

Maksidom

Sanitary ware and plumbing (e.g. bathtub,

tubing, faucets, toilet, etc.)

Maksidom

TEKS/Stroimaster

Castorama Russia Market Research

Deco

Flooring

Garden

Hardware

Showrooms

Rybinskaya

32

33. Moscow vs. St. Pet DIY market

Castorama Russia Market ResearchConsumer behavior

33

34. Moscow vs. St. Pet DIY market

POP Choice Criteria96

97

w ide assortment

95

96

guaranteed high quality of goods

93

good choice of w ell-know n brands

77

sales, discounts on certain goods, special offers

85

competent staff

93

83

convenient w orking hours

90

82

79

81

availability of supplementary services

polite staff

92

80

easy to orientate oneself in a POS / good inner space organization

78

no queue, fast service

78

nice shopping environment

74

proximity to home

64

conveniently located (in a place you usually pass, on the w ay)

91

81

70

69

conveniently reachable by public transport

87

80

72

conveniently reachable by car, convenient parking

Castorama Russia Market Research

95

94

95

affordable prices

68

74

70

62

61

close to other stores (part of a mall / shopping center)

0

10

20

Moscow

30

40

50

60

70

80

90

100

St. Pet

The most important choice criteria in both cities: assortment, quality, brands, prices. Then

follow special offers, staff, services. So the first four is a must, but higher rating for staff and

services are very important to get the customers.

In St. Pet STAFF and SERVICE are more important than in Moscow.

34

35. Moscow vs. St. Pet DIY market

Renovation within 12 monthsProfessional involvement

60%

28%

50%

40%

30%

20%

72%

10%

0%

Major reconstruction of

apartment

Renovation

Small renovation

jobs

Castorama Russia Market Research

Moscow

Design

improvement jobs

None of the above

Yes

No

St Pet

About 80% of respondents made renovation within the last 12 months.

Only about 30% made renovation with professionals’ help (in Moscow and St. Pet).

11% plan to make renovation during next 3 months in Moscow and 27% in St. Pet.

35

36. Moscow vs. St. Pet DIY market

Renovation works at dacha (last 12 months)60%

Dacha ownership

55%

50%

6%

8%

43%

40%

Moscow

30%

42%

50%

19%

20%

10%

St. Pet

14%

12%

16% 14%

12%

9% 7%

6%

42%

15%

52%

0%

House or sauna

construction

Repairs in a

house or in

sauna

Home or sauna Construction of

improvement

supplementary

jobs

buildings

Castorama Russia Market Research

Moscow

Repairs of

supplementary

buildings

None of the

above

Yes

No

Refuse to answer

St Pet

There are more dacha owners in Moscow.

But in St. Pet people made more renovation works at dacha.

36

37. Moscow vs. St. Pet DIY market

Usage of supplementary services offered by POP25%

Loading / delivery

7%

7%

Purchase on credit

Wood cutting and saw ing

11%

5%

2%

Designer services

4%

4%

3%

Serger (carpet edging)

3%

2%

Textile cutting / curtain sew ing

Baguet w orkshop

Castorama Russia Market Research

31%

1%

1%

Worktops production

1%

Coloring (paints mixing)

1%

0%

4%

6%

5%

10%

15%

Moscow

20%

25%

30%

35%

St. Pet

DELIVERY is the most popular service in both cities. PURCHASES ON CREDIT is #2.

Generally all services are more popular in St. Pet than in Moscow.

37

38. Moscow vs. St. Pet DIY market

Car ownership and Car usage for DIY purchases70%

60%

50%

62%

60%

51%

40%

44%

46%

42%

32%

25%

30%

20%

5%

10%

8% 8%

5%

3%

5%

0%

Yes

No

Refusal

yes, very

frequently

yes, sometimes,

w hen I need to

buy a lot

no

Car Usage for DIY Purchases

Car ow nership

Castorama Russia Market Research

yes, very

seldom, in

exceptional

cases

Moscow

St. Pet

Most of respondents in Moscow have a car, and 50% - in St. Pet.

Almost each respondent, who has a car, uses it for DIY purchases. So car parking is a

critical success factor.

38

39. Moscow vs. St. Pet DIY market

Leaflets delivered to mail box and attitude towards leaflets60%

57%

56%

51%

50%

43%

40% 40%

35%

40%

30%

24%

19%

20%

21%

9%

4%

10%

0%

Yes

No

DK / DA

I read these leaflets I read these leaflets I never read these

and use information

leaflets

from them

Castorama Russia Market Research

Leaflets Delivered to Mail Box

Attitude tow ards Leatlets

Moscow

St. Pet

About 50% of respondents in both cities receive leaflets.

In Moscow they are mostly from IKEA, OBI, SK. In St. Pet – from MAKSIDOM, IKEA,

ISKRASOFT.

Generally the attitude towards leaflets is positive.

39

40. Moscow vs. St. Pet DIY market

Spending for DIY goods30%

25%

20%

15%

10%

5%

0%

3 001 1 000 - 3 000

10 000 RUR

RUR

10 0001 20 000 RUR

more than

50 001 20 000 50 000 RUR 100 000 RUR 100 000 RUR

Castorama Russia Market Research

Share of the group Moscow

DK/ NA

Share of the group StPet

Average spending is about 19 800 RUR in Moscow and 16 700 RUR in St. Pet.

Consumers, which spend >20 000 RUR, make more than 73% of total spending. Thus

market is driven by projects not individual purchases (Moscow and St. Pet).

40

41. Moscow vs. St. Pet DIY market

Category purchases within the last 12 monthsLighting

Finishing materials

Sanitary w are and plumbing

Decorative household goods

Electrical installation

Construction materials

Household goods

Ceramic tiles

Electric and hand tools

Linoleum or synthetic carpeting

Garden plants and equipment

Parquet, laminate, doors

Wood

Kitchen

Castorama Russia Market Research

None of the above

0%

10%

20%

30%

Moscow

40%

50%

60%

70%

St. Pet

The most popular purchased categories are LIGHTING and FINISHING MATERIALS.

In St. Pet these categories are more popular than in Moscow, as well as CONSTRUCTION

MATERIALS.

DECORATIVE HOUSEHOLD GOODS are more purchased in Moscow

41

42. Moscow vs. St. Pet DIY market

Category spending, median RUR780

969

1882

2802

2961

2867

1440

4092

460

978

988

1970

943

1495

3813

Lighting

Finishing materials

Sanitary w are and plumbing

Decorative household goods

Electrical installation

Construction materials

Household goods

Ceramic tiles

1450

Electric and hand tools

Linoleum or synthetic carpeting

2893

3644

8060

5475

850

1070

Garden plants and equipment

5900

Parquet, laminate, doors

2719

Wood

8423

8275

21000

Castorama Russia Market Research

Kitchen

0

5000

10000

15000

Moscow

20000

25650

25000

30000

St. Pet

Respondents in Moscow spend more money for CERAMICS TILES and FLOORING than in St.

Pet, as well as for DECORATIVE HOUSEHOLD GOODS and WOOD.

The most expensive category is KITCHEN.

42

43. Moscow vs. St. Pet DIY market

Category share of spending70%

60%

50%

40%

30%

20%

10%

12%

10%

11%

9%

8%

6%

0%

Castorama Russia Market Research

Kitchen

Wood

Parquet,

laminate,

doors

1%

1%

Garden plants

and

equipment

Moscow Share of purchases

10%

7%

Linoleum or

synthetic

carpeting

4%

4%

Electric and

hand tools

St. Pet Purchases

13%

10%

Ceramic tiles

12%

5%

3%

2%

Household

goods

St. Pet Share of spending

6%

Construction

materials

3%

2%

Electrical

installation

13%

9%

16%

10%

7%

4%

3%

Decorative

household

goods

Sanitary w are

and plumbing

Finishing

materials

Lighting

Moscow Share of spending

In spite of the fact that the most popular categories is LIGHTING, it gives only 4-7% and of

total spending for category.

The most valuable categories are CERAMIC TILES, KITCHEN, FLOORING, SANITARY and

FINISHING MATERIALS.

The difference between Moscow and St. Pet is DECORATIVE HOUSEHOLD GOODS – in

Moscow it is more valuable category; SANITARY and FINISHING MATERIALS is more

valuable in St. Pet.

43

44. Appendix

Castorama Russia Market ResearchAppendix

44

45. Moscow DIY market

Sample descriptionGender

Household Size

Education

3% 4%

13%

3%

9%

8%

28%

55%

31%

3% 2%2%

10%

16%

44%

56%

Occupation

1%

2%

7%

10%

34%

37%

5%

18%

1 person

2 persons

male

secondary

3 persons

4 persons

5 and more persons

female

DK/ NA

Castorama Russia Market Research

20%

uncompleted higher

higher

DK/ NA

Children in Family

Age

secondary vocational/specialized

3%

Moscow Districts Covered

3%

10%

16%

32%

28%

53%

10%

35%

self-employed

top manager

middle manager

specialist with higher education without managing functions

office-worker without higher education

qualified worker / foreman, master

unskilled worker, general worker

pensioner (non-working)

housewife, incl. maternity leave

temporarily unemployed, looking for a job

DK/ NO

Income per capita

3%

10%

19%

7%

11%

14%

9%

9%

8%

10%

7%

16%

13%

14%

6%

7%

14%

10%

2%

25-30 y.o.

31-40 y.o.

41-50 y.o.

51-60 y.o.

1

2

3

none

DK/ NA

North

North-West

West

South-West

South

South-East

East

North-East

Central

Zelenograd

less than 3,000 RUR

3000 - 6,000 RUR

6000 - 8,000 RUR

8000 - 10,000 RUR

10.000 - 12,000 RUR

12.000 - 15,000 RUR

15.000 - 20,000 RUR

20.000 - 30,000 RUR

more than 30,000 RUR

DK / NA

45

46. St. Pet. DIY market

Sample descriptionGender

Household Size

Education

5% 4%

4%

3%

5%

3%

3%

1%

1%

13%

Occupation

12%

20%

8%

1%

7%

10%

44%

56%

23%

21%

36%

3 persons

4 persons

5 and more persons

DK/ NA

female

Children in Family

Age

14%

4%

1 person

2 persons

male

24%

32%

46%

incomplete secondary

secondary

secondary vocational/specialized

incomplete higher

higher

academic degree

refuse

St. Pet. Districts Covered

Businessman / self-employed / farmer

Top manager/Head/owner of a firm

Middle manager

Specialist with higher education without managing functions

Employee with secondary education

Skilled blue collar/unslilled blue collar

Retired, invalid

Housewife, incl maternity leave

Student, pupil

Unemployed,looking for a job

Refuse

Income per capita

Castorama Russia Market Research

6%

24%

16%

28%

29%

32%

6%

6%4% 5%

9%

4%

2%

10%

9%

58%

6%

7%

1%

2%

25-30

31-40

41-50

51-60

1 child

2 children

3 children

4 and more

None

refuse

0%

1%

2%

3%

6%

4%

8%

10%

1%

24%

8%

2%

3%

6%

1%

29%

Admiraltejskij

Vjiborgskij

Vasileostrovskij

Kalininskij

Kirovskij

Krasnogvardejskij

Kolpinskij

Krasnoselskij

Kronshtadskij

Kurortnij

Moskovskij

Nevskij

Petrogradskij

Primorskij

Petrodvorzovij

Pushkinskij

Frunzenskij

Central'nij

15%

14%

below 3000 rbl

from 3000 to 6000 rbl

from 6000 to 8000 rbl

from 8000 to 10.000 rbl

from 10.000 to 12.000 rbl

from 12.000 to 15.000 rbl

from 15.000 to 20.000 rbl

from 20.000 to 30.000 rbl

over 30.000 rbl

DK/refuse

46

Социология

Социология