Похожие презентации:

Uzbekistan’s BIT and Foreign Investment Law Disputes

1.

Uzbekistan’s BIT and Foreign Investment LawDisputes

Tashkent State University of Law

November 17-18, 2022

Carolyn Lamm, Hansel Pham

White & Case LLP

2.

Overview of Uzbekistan’s BITs, Model BIT,and FIL

3.

FDI in Uzbekistan2022

Investment

Climate

Statements:

Uzbekistan,

https://www.state.gov/reports/2022-investment-climate-statements/uzbekistan/

U.S.

Department

of

State,

available

at:

Uzbekistan has the potential to become a strong regional

economy:

–

A dynamic and entrepreneurial population, the largest in Central

Asia;

–

Good infrastructure;

–

Large potential consumer market.

In the past, most FDI was directed into the oil, gas, and

mining sectors.

–

In recent years, there has been trend towards increasing FDI in

manufacturing, production and distribution of electricity, tourism

and banking.

3

4.

FDI in Uzbekistan (cont’d)2022

Investment

Climate

Statements:

Uzbekistan,

https://www.state.gov/reports/2022-investment-climate-statements/uzbekistan/

U.S.

Department

of

State,

available

at:

Over the past five years, the GoU has made efforts to

improve the investment attractiveness of the Republic.

–

The GoU has modernized its legislation through the adoption of

the Law on Investments and Investment Activities and other acts

that streamlined interactions of investors with the state, reduced

the tax load, and liberalized access to certain commodities.

–

As a result, the inflow of FDI has grown from about US$ 2 billion in

2017 to over US$ 8 billion in 2021.

–

With the removal of major pandemic restrictions in 2021, GDP

grew 7.4 percent.

4

5.

President Shavkat Mirziyoyev onInvestment Policy in the Republic

Address

by

the

President

of

the

Republic

of

Uzbekistan

Shavkat

Mirziyoyev

www.un.int/uzbekistan/news/address-president-republic-uzbekistan-shavkat-mirziyoyev-oliy-majlis

to

Oliy

Majlis,

available

at:

https://

“It will not be an exaggeration to say that investments are driving engine of

country’s economy, or ‘it’s the heart of economy.’”

“The international experience demonstrates that those countries, which

pursue active investment policy, succeed in steady growth of their

economies.

–

In this view, we need to adjust allocation of business entities in free

economic zones and small industrial zones, improve organizationally and

legally providing them with incentives and preferences.

–

For the investors to feel themselves as comfortable as possible, it is

required to further liberalize the currency market.”

5

6.

BITs and TIPs of UzbekistanUzbekistan’s first BIT was signed in March 1992 (ChinaUzbekistan BIT), but has since been terminated

Currently, Uzbekistan is a party to 54 BITs, including the

most recent one with Belarus, signed on 1 August 2019

Uzbekistan is also a party to 5 treaties with investment

provisions (TIPs), including the 2004 US-Central Asia

TIFA

6

7.

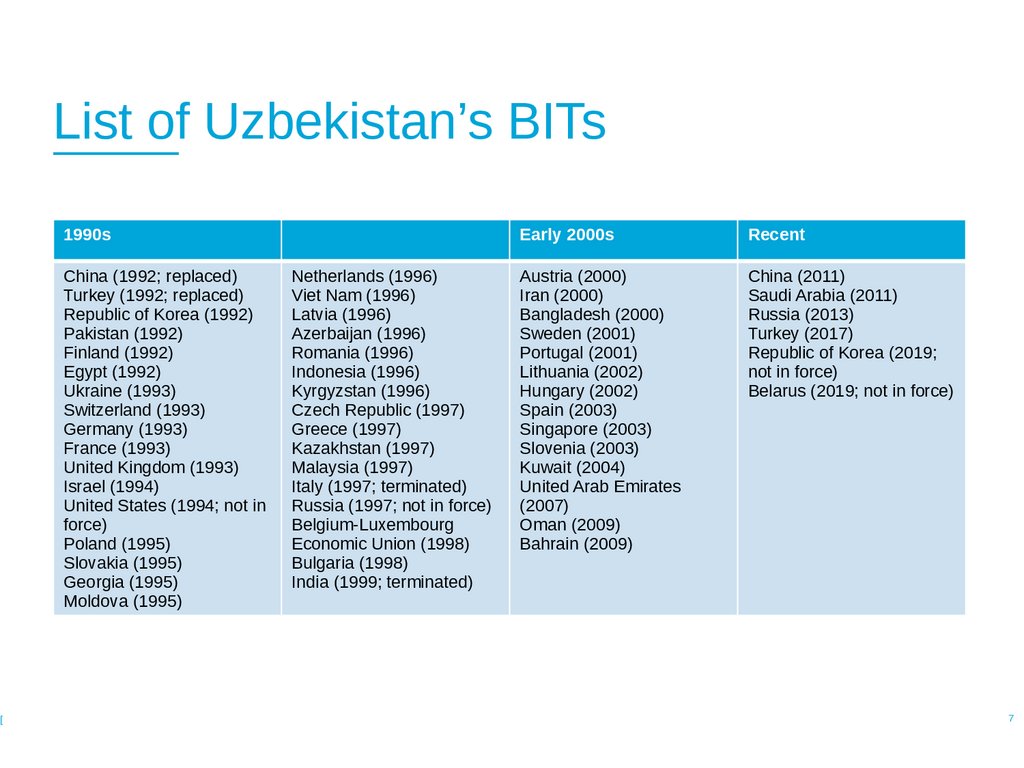

[List of Uzbekistan’s BITs

1990s

China (1992; replaced)

Turkey (1992; replaced)

Republic of Korea (1992)

Pakistan (1992)

Finland (1992)

Egypt (1992)

Ukraine (1993)

Switzerland (1993)

Germany (1993)

France (1993)

United Kingdom (1993)

Israel (1994)

United States (1994; not in

force)

Poland (1995)

Slovakia (1995)

Georgia (1995)

Moldova (1995)

Netherlands (1996)

Viet Nam (1996)

Latvia (1996)

Azerbaijan (1996)

Romania (1996)

Indonesia (1996)

Kyrgyzstan (1996)

Czech Republic (1997)

Greece (1997)

Kazakhstan (1997)

Malaysia (1997)

Italy (1997; terminated)

Russia (1997; not in force)

Belgium-Luxembourg

Economic Union (1998)

Bulgaria (1998)

India (1999; terminated)

Early 2000s

Recent

Austria (2000)

Iran (2000)

Bangladesh (2000)

Sweden (2001)

Portugal (2001)

Lithuania (2002)

Hungary (2002)

Spain (2003)

Singapore (2003)

Slovenia (2003)

Kuwait (2004)

United Arab Emirates

(2007)

Oman (2009)

Bahrain (2009)

China (2011)

Saudi Arabia (2011)

Russia (2013)

Turkey (2017)

Republic of Korea (2019;

not in force)

Belarus (2019; not in force)

7

8.

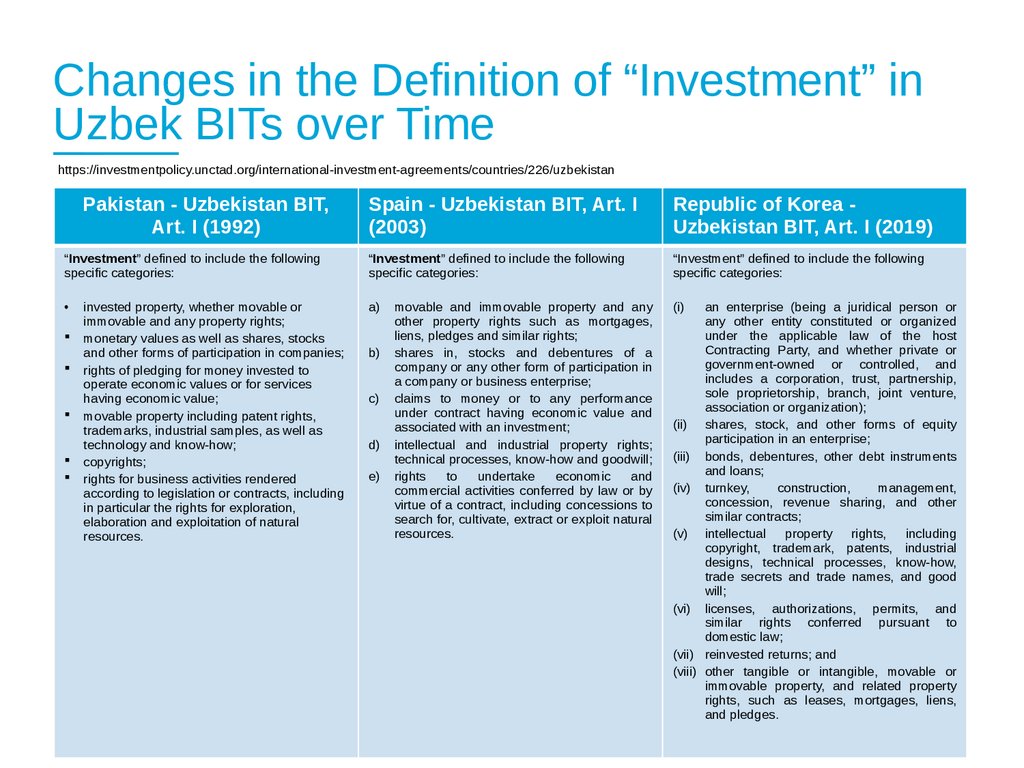

Changes in the Definition of “Investment” inUzbek BITs over Time

https://investmentpolicy.unctad.org/international-investment-agreements/countries/226/uzbekistan

Pakistan - Uzbekistan BIT,

Art. I (1992)

Spain - Uzbekistan BIT, Art. I

(2003)

Republic of Korea Uzbekistan BIT, Art. I (2019)

“Investment” defined to include the following

specific categories:

“Investment” defined to include the following

specific categories:

“Investment” defined to include the following

specific categories:

a)

(i)

invested property, whether movable or

immovable and any property rights;

monetary values as well as shares, stocks

and other forms of participation in companies;

rights of pledging for money invested to

operate economic values or for services

having economic value;

movable property including patent rights,

trademarks, industrial samples, as well as

technology and know-how;

copyrights;

rights for business activities rendered

according to legislation or contracts, including

in particular the rights for exploration,

elaboration and exploitation of natural

resources.

b)

c)

d)

e)

movable and immovable property and any

other property rights such as mortgages,

liens, pledges and similar rights;

shares in, stocks and debentures of a

company or any other form of participation in

a company or business enterprise;

claims to money or to any performance

under contract having economic value and

associated with an investment;

intellectual and industrial property rights;

technical processes, know-how and goodwill;

rights

to

undertake

economic

and

commercial activities conferred by law or by

virtue of a contract, including concessions to

search for, cultivate, extract or exploit natural

resources.

an enterprise (being a juridical person or

any other entity constituted or organized

under the applicable law of the host

Contracting Party, and whether private or

government-owned or controlled, and

includes a corporation, trust, partnership,

sole proprietorship, branch, joint venture,

association or organization);

(ii) shares, stock, and other forms of equity

participation in an enterprise;

(iii) bonds, debentures, other debt instruments

and loans;

(iv) turnkey,

construction,

management,

concession, revenue sharing, and other

similar contracts;

(v) intellectual property rights, including

copyright, trademark, patents, industrial

designs, technical processes, know-how,

trade secrets and trade names, and good

will;

(vi) licenses, authorizations, permits, and

similar rights conferred pursuant to

domestic law;

(vii) reinvested returns; and

(viii) other tangible or intangible, movable or

immovable property, and related property

rights, such as leases, mortgages, liens,

and pledges.

8

9.

Foreign Investment Law of UzbekistanLaw of the Republic of Uzbekistan “On Investments and Investment Activity” No. ZRU-598 dated 25 Dec. 2019, Preamble, Article 3

The new Uzbekistan’s Foreign Investment Law (FIL) was enacted in 2019

and entered into force in January 2020

The purpose of the FIL is to “regulate the relations in the areas of investment

and investment activities carried out by foreign and domestic investors.”

The term “investments” is defined as “tangible and intangible assets and

rights thereof, including the intellectual property rights, as well as

reinvestments by the investor bearing certain risks into the objects of social

sphere, entrepreneurial, scientific and other types of activities for profit.”

9

10.

Foreign Investment Law of UzbekistanLaw of the Republic of Uzbekistan “On Investments and Investment Activity” No. ZRU-598 dated 25 Dec. 2019, Art. 5

There are three types of investments under the FIL,

divided by their object:

–

Capital investments, including investments into creation and

recreation of fixed assets, e.g., new construction, modernization,

reconstruction, and technical retooling.

–

Financial investments, including investments in shares, corporate,

infrastructure, and state bonds and other securities; and

–

Social investments, including investment in human resources,

skills and industry experience, as all as other intangible benefits.

10

11.

Foreign Investment Law of UzbekistanLaw of the Republic of Uzbekistan “On Investments and Investment Activity” No. ZRU-598 dated 25 Dec. 2019, Art. 6

The FIL recognizes the following forms of investments:

–

Establishment of, and acquisition of shares or assets of legal entities;

–

Acquisition of securities;

–

Acquisition of concessions;

–

Acquisition of IP rights; and

–

Acquisition of the rights to land or the rights to use and possess other

natural resources

11

12.

Uzbek Model BITProf. Islambek Rustambekov, Bilateral Investment Treaties: Model BIT of Uzbekistan, Presentation for Bishkek Arbitration Days (5 June 2020)

In 2019, Uzbekistan began the process of preparing the

Model BIT, relying on its investor-state dispute settlement

experience and best practices

In developing its Model BIT, Uzbekistan relied on the

following key documents:

–

South African Development Community (SADC) Model Bilateral

Investment Treaty

–

India’s Model Text for Bilateral Investment Treaty

–

2015 UNCTAD Investment Policy Framework

–

2017 UNCTAD Global Action Menu for Investments Facilitation

12

13.

Main Goals of the Uzbek Model BITProf. Islambek Rustambekov, Bilateral Investment Treaties: Model BIT of Uzbekistan, Presentation for Bishkek Arbitration Days (5 June 2020); Draft

Model BIT of Uzbekistan, Preamble

To promote and facilitate sustainable economic development

To protect foreign investors from illegal expropriation and

nationalization, as well as to provide minimal and national standards

of treatment

To eradicate corruption and bribery in the process of establishing

and maintaining investments

To uphold human rights, labor laws and environmental protection

13

14.

Uzbek Model BIT: Definition ofInvestment and Investor

Draft Model BIT of Uzbekistan, Art. 1

Investment:

Investor:

“Any individual who is a natural person or a

“[A]n enterprise established, acquired,

permanent resident of a Party, according to

or expanded and subsequently

maintained and operated, in good faith, its laws, who has made an investment as

defined infra in the territory of the other

within the territory of one State by an

Party in accordance with that Party’s laws

investor of the other State, in

[…]

accordance with the law of the Host

Any legal entity, including companies,

Party in whose territory the

corporations, commercial associations

investment is made, which taken

provided that such legal entity is:

together with the assets directly owned

established or constituted or organized in

by the enterprise, contributes to the

sustainable development of the Host accordance with the laws of a Party;

having its headquarters and the center of its

Party and has the characteristics of

economic activity or principal place of

an investment such as the

commitment of capital or other similar business in the territory of that Party;

resources, the expectation of gain or that has made an investment as defined

infra in the territory of the other Party in

profit, the assumption of risk, and

accordance with that Parties’ laws.”

certain duration.”

14

15.

Innovative Provisions in the Uzbek ModelBIT

Draft Model BIT of Uzbekistan, Arts. 4, 19

The Model BIT of Uzbekistan contains several innovative provisions that

investors are expected to adhere to:

International human rights

International labor rights

International environmental standards

“Investors and investments shall not manage or operate the investments in a

manner that circumvents international environmental, labor and human rights . . .

Investors and Investments shall uphold human rights in the host State.”

“Investors and investments shall act in accordance with core labor standards as

required by the ILO Declaration on Fundamental Principles and Rights of Work,

1998.”

“Investors shall maintain an environmental management system.”

15

16.

Investment ArbitrationAgainst Uzbekistan

Cases

Brought

17.

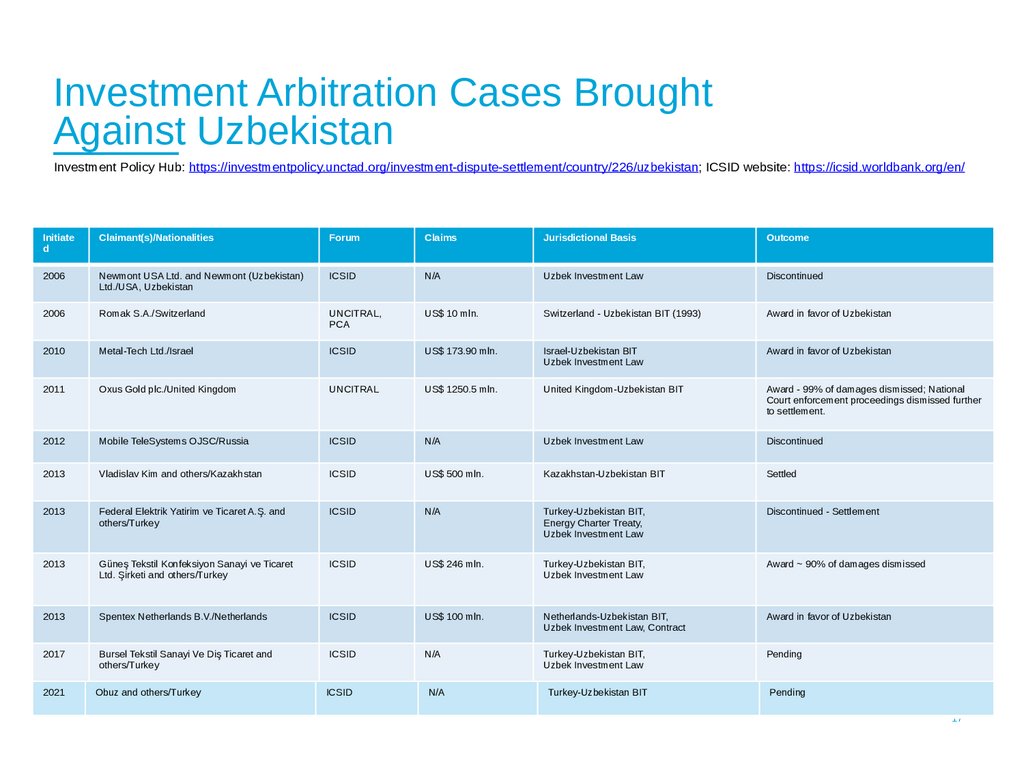

Investment Arbitration Cases BroughtAgainst Uzbekistan

Investment Policy Hub: https://investmentpolicy.unctad.org/investment-dispute-settlement/country/226/uzbekistan; ICSID website: https://icsid.worldbank.org/en/

Initiate

d

Claimant(s)/Nationalities

Forum

Claims

Jurisdictional Basis

Outcome

2006

Newmont USA Ltd. and Newmont (Uzbekistan)

Ltd./USA, Uzbekistan

ICSID

N/A

Uzbek Investment Law

Discontinued

2006

Romak S.A./Switzerland

UNCITRAL,

PCA

US$ 10 mln.

Switzerland - Uzbekistan BIT (1993)

Award in favor of Uzbekistan

2010

Metal-Tech Ltd./Israel

ICSID

US$ 173.90 mln.

Israel-Uzbekistan BIT

Uzbek Investment Law

Award in favor of Uzbekistan

2011

Oxus Gold plc./United Kingdom

UNCITRAL

US$ 1250.5 mln.

United Kingdom-Uzbekistan BIT

Award - 99% of damages dismissed; National

Court enforcement proceedings dismissed further

to settlement.

2012

Mobile TeleSystems OJSC/Russia

ICSID

N/A

Uzbek Investment Law

Discontinued

2013

Vladislav Kim and others/Kazakhstan

ICSID

US$ 500 mln.

Kazakhstan-Uzbekistan BIT

Settled

2013

Federal Elektrik Yatirim ve Ticaret A.Ş. and

others/Turkey

ICSID

N/A

Turkey-Uzbekistan BIT,

Energy Charter Treaty,

Uzbek Investment Law

Discontinued - Settlement

2013

Güneş Tekstil Konfeksiyon Sanayi ve Ticaret

Ltd. Şirketi and others/Turkey

ICSID

US$ 246 mln.

Turkey-Uzbekistan BIT,

Uzbek Investment Law

Award ~ 90% of damages dismissed

2013

Spentex Netherlands B.V./Netherlands

ICSID

US$ 100 mln.

Netherlands-Uzbekistan BIT,

Uzbek Investment Law, Contract

Award in favor of Uzbekistan

2017

Bursel Tekstil Sanayi Ve Diş Ticaret and

others/Turkey

ICSID

N/A

Turkey-Uzbekistan BIT,

Uzbek Investment Law

Pending

2021

Obuz and others/Turkey

ICSID

N/A

Turkey-Uzbekistan BIT

Pending

17

18.

Sectors Involved In Investment Treaty CasesAgainst Uzbekistan

Investment Policy Hub: https://investmentpolicy.unctad.org/investment-dispute-settlement/country/226/uzbekistan; ICSID website: https://icsid.worldbank.org/en/

Electricity / Gas

Federal Elektrik Yatirim ve

Ticaret A.Ş. and others

Shopping Centers

Güneş Tekstil and others

Mining

Oxus Gold; Newmont USA

Ltd. and Newmont

(Uzbekistan) Ltd.

Manufacturing

Metal-Tech Ltd.

Cotton / Textiles

Bursel Textil and Others;

Spentex Netherlands B.V.

Agriculture / Grain

Trading

Romak S.A.

Telecommunication

Mobile TeleSystems

OJSC

Cement

Vladislav Kim and others

18

19.

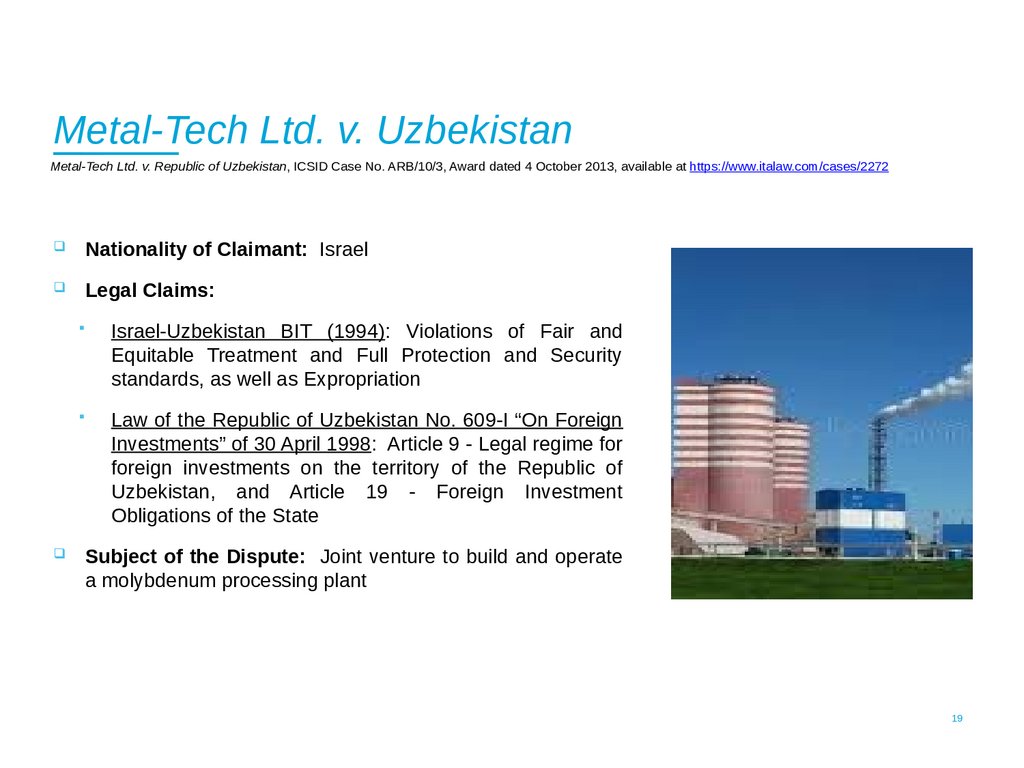

Metal-Tech Ltd. v. UzbekistanMetal-Tech Ltd. v. Republic of Uzbekistan, ICSID Case No. ARB/10/3, Award dated 4 October 2013, available at https://www.italaw.com/cases/2272

Nationality of Claimant: Israel

Legal Claims:

Israel-Uzbekistan BIT (1994): Violations of Fair and

Equitable Treatment and Full Protection and Security

standards, as well as Expropriation

Law of the Republic of Uzbekistan No. 609-I “On Foreign

Investments” of 30 April 1998: Article 9 - Legal regime for

foreign investments on the territory of the Republic of

Uzbekistan, and Article 19 - Foreign Investment

Obligations of the State

Subject of the Dispute: Joint venture to build and operate

a molybdenum processing plant

19

20.

Overview: Metal-Tech Ltd. v. UzbekistanMetal-Tech Ltd. v. Republic of Uzbekistan, ICSID Case No. ARB/10/3, Award dated 4 October 2013, available at https://www.italaw.com/cases/2272

Core allegation: Uzbekistan expropriated Claimant’s interests in its joint venture and

treated Claimant unfairly and inequitably by canceling the JV’s rights to purchase raw

molybdenum materials and export refined product, and by initiating bankruptcy

proceedings of the JV

Core jurisdictional defenses: Claimant engaged in corruption and made fraudulent

and material misrepresentations to gain approval for its investment.

It also

implemented its investment unlawfully by enriching itself and defrauding the JV, its

Uzbek partners and the State

Decision: Award dated 4 October 2013, dismissing all claims for lack of jurisdiction

20

21.

Metal-Tech Award’s Dismissal Was GroundBreakingMetal-Tech Ltd. v. Republic of Uzbekistan, ICSID Case No. ARB/10/3, Award dated 4 October 2013, available at https://www.italaw.com/cases/2272

The Tribunal found that Metal-Tech paid bribes to facilitate the establishment of its

investment in Uzbekistan, and therefore dismissed all claims

Metal-Tech was the first ever investment treaty arbitration to be dismissed on the

grounds of corruption

The Award was nominated by GAR as the “Most Important Published Decision of

2013 in Jurisprudential Terms”

21

22.

Finding of Numerous Red Flags of CorruptionMetal-Tech Ltd. v. Republic of Uzbekistan, ICSID Case No. ARB/10/3, Award dated 4 October 2013, available at: https://www.italaw.com/cases/2272

Strikingly large amount of payments (USD 4 million) to consultants;

No proof of legitimate services provided by the consultants;

Consultants lacking in professional qualification to perform services for

which they were allegedly retained;

Sham consulting contracts designed to conceal true nature of relationship

among the parties to said contracts;

Lack of transparency of payee; and

Close connection of consultants with public officials in charge of claimant’s

investment.

22

23.

Oxus Gold v. Republic of UzbekistanOxus Gold v. Uzbekistan, UNCITRAL, Final Award dated 17 Dec. 2015, available at: https://www.italaw.com/sites/default/files/case-documents/italaw7238_2.pdf

Nationality of Claimant: United Kingdom

Legal Claims:

United Kingdom-Uzbekistan BIT (1993): Expropriation;

violation of the Fair and Equitable Treatment Standard;

breach of an obligation to refrain from arbitrary or

unreasonable measures; breach of the Full Security and

Protection Standard; breach of the Umbrella Clause

Subject of the Dispute: (1) Alleged rights in the Khandiza

mining deposit in southeastern Uzbekistan, and (2) a joint

venture with the Government to develop the Amantaytau

Goldfields site (“AGF”)

23

24.

Overview: Oxus Gold v. UzbekistanOxus Gold v. Uzbekistan, UNCITRAL, Final Award dated 17 Dec. 2015, available at: https://www.italaw.com/sites/default/files/case-documents/italaw7238_2.pdf

Core allegation:

Uzbekistan expropriated and failed to accord fair and equitable

treatment with respect to both the Khandiza Project and Phases I and II of the AGF project

Core defenses: With respect to Khandiza, the Claimant had no rights and no expectation

of obtaining any rights in the project. With respect to AGF, the State acted lawfully and in

accordance with its obligations under Uzbek and international law, including under the BIT

Decision: Award dated 17 December 2015, in which Uzbekistan successfully defeated

more than 99% of the Claimant’s US$ 1.34 billion claim

Attempted enforcement: Oxus Gold sought to enforce the arbitral award in multiple

jurisdictions, including in France and the United States

24

25.

Oxus Gold: The Khandiza ProjectOxus Gold v. Uzbekistan, UNCITRAL, Final Award dated 17 Dec. 2015, available at: https://www.italaw.com/sites/default/files/case-documents/italaw7238_2.pdf

The Tribunal found that Oxus did not have an unconditional right to develop the

Khandiza deposit

Rather, Oxus only had the right to enter into good faith negotiations with the

Government for the project, and had no expectation to any particular right from such

negotiations

The Tribunal thus rejected the Claimant’s claim of expropriation and breach of fair

and equitable treatment with respect to the Khandiza project

The Tribunal also rejected claims for breaches of the BIT’s full protection and security

clause and its umbrella clause

25

26.

Oxus Gold: Allegations on Phase I of the AGF ProjectOxus Gold v. Uzbekistan, UNCITRAL, Final Award dated 17 Dec. 2015, available at: https://www.italaw.com/sites/default/files/case-documents/italaw7238_2.pdf

Oxus alleged that the State had violated the BIT because, among other reasons,

The State required Oxus to pay additional funds through a Special Dividend

Agreement

The State refused to grant licenses to Oxus

The State conducted unjust audits and criminal investigations

The State unlawfully modified the tax regime

26

27.

Oxus Gold: Findings on Phase I of the AGF ProjectOxus Gold v. Uzbekistan, UNCITRAL, Final Award dated 17 Dec. 2015, available at https://www.italaw.com/sites/default/files/case-documents/italaw7238_2.pdf

The Tribunal rejected nearly all of Oxus’s claims for Phase I, finding that:

Oxus never previously complained about the Special Dividend Agreement

The State had justifiable reasons for refusing to grant licenses

The audits and criminal investigations were conducted lawfully

The Tribunal found only that the revocation of a VAT exemption in 2006 and 2009

violated the stabilization clause, and therefore breached the fair and equitable

treatment standard of the BIT

The Tribunal thus awarded US$ 10.3 million to Oxus

27

28.

Oxus Gold: Phase II of the AGF ProjectOxus Gold v. Uzbekistan, UNCITRAL, Final Award dated 17 Dec. 2015, available at: https://www.italaw.com/sites/default/files/case-documents/italaw7238_2.pdf

Oxus alleged that it had failed to obtain financing for Phase II of the AGF project due to the State’s

interference on two occasions:

First, in 2008, due to the State’s allegedly unjustified refusal to approve the Phase II feasibility

study

Second, in 2011, due to the audits, criminal investigations, and liquidation proceedings initiated

by the State

The Tribunal found that the State’s rationale for rejecting the feasibility study in 2008 was legitimate

The majority of the Tribunal found that the audits, criminal investigations, and liquidation

proceedings in 2011 were legitimate, and thus did not breach the fair and equitable treatment

standard

28

29.

Gunes Tekstil v. Republic of UzbekistanGunes

Tekstil,

et

al

v.

Uzbekistan,

ICSID

Case

No.

ARB/13/19;

MOJ

Press

Release

https://www.minjust.uz/ru/press-center/news/98501/;

GAR

Article

available

https://globalarbitrationreview.com/article/1209406/uzbekistan-liable-for-seizure-of-shopping-mall;

ICSID

Website

https://icsid.worldbank.org/cases/case-database/case-detail?CaseNo=ARB/13/19

Nationality of Claimants: Turkey

Legal Claims:

Turkey-Uzbekistan BIT (1992)

Energy Charter Treaty (1994)

Law of the Republic of Uzbekistan No. 609-I “On

Foreign Investments” of 30 April 1998

available

available

at:

at:

at:

Subject of the Dispute: Retail shopping centers

in Uzbekistan, including the Turkuaz Shopping

Center in Tashkent

29

30.

Overview: Gunes Tekstil v. UzbekistanGunes

Tekstil,

et

al

v.

Uzbekistan,

ICSID

Case

No.

ARB/13/19;

MOJ

Press

Release

https://www.minjust.uz/ru/press-center/news/98501/;

GAR

Article

available

https://globalarbitrationreview.com/article/1209406/uzbekistan-liable-for-seizure-of-shopping-mall;

ICSID

Website

https://icsid.worldbank.org/cases/case-database/case-detail?CaseNo=ARB/13/19

available

available

at:

at:

at

Core allegation: Uzbekistan expropriated Claimants’ investments in the Turkuaz

Shopping Center in Tashkent and other retail shopping centers, and failed to accord

fair and equitable treatment or full protection and security to the individual Claimants

and their employees during their arrest and detention during criminal investigations

and court proceedings

Core defenses: The Government complied with all international obligations,

including under the BIT and the Uzbek Investment Law

Decision: Award dated 4 October 2019 (not publically available), in which Uzbekistan

successfully reduced damages by 90% of the Claimants’ claimed value

30

31.

Key Findings: Gunes Tekstil v. UzbekistanGunes

Tekstil,

et

al

v.

Uzbekistan,

ICSID

Case

No.

ARB/13/19;

MOJ

Press

Release

https://www.minjust.uz/ru/press-center/news/98501/;

GAR

Article

available

https://globalarbitrationreview.com/article/1209406/uzbekistan-liable-for-seizure-of-shopping-mall;

ICSID

Website

https://icsid.worldbank.org/cases/case-database/case-detail?CaseNo=ARB/13/19

available

available

Rejected jurisdiction under the Foreign Investment Law

Rejected jurisdiction over three of the six Claimants who were not legitimate

at:

at:

at

“investors” in the country

Refused to consider any of Claimants’ claims with respect to physical rights

violations, including allegations of physical mistreatment

Dismissed, in their totality, Claimants’ request for US$ 180 million in moral damages

Awarded only US$ 26 million (excluding interest and costs), which was based almost

exclusively on the valuation calculated by the Tashkent Criminal Court in the

underlying criminal case in 2011

31

32.

Spentex Netherlands B.V. v. UzbekistanSpentex Netherlands, B.V. v. Republic of Uzbekistan, ICSID Case No. ARB/13/26; ICSID Website available at

https://icsid.worldbank.org/cases/case-database/case-detail?CaseNo=ARB/13/26; IA Reporter Article available at

https://www.iareporter.com/articles/in-newly-unearthed-uzbekistan-ruling-exorbitant-fees-promised-to-consultants-on-eve-of-tender-process-are-viewed-by-trib

unal-as-evidence-of-corruption-leading-to-dismissal-of-all-claims-under-dutch/

Nationality of Claimant:

owned by Indian investors)

Legal Claims:

Netherlands (ultimately

Netherlands-Uzbekistan BIT (1996)

Law of the Republic of Uzbekistan No. 609-I “On

Foreign Investments” of 30 April 1998

Investment Agreement

Subject of the Dispute:

processing plant

Cotton spinning and

32

33.

Overview: Spentex Netherlands B.V. v. UzbekistanSpentex Netherlands, B.V. v. Republic of Uzbekistan, ICSID Case No. ARB/13/26; ICSID Website, available at:

https://icsid.worldbank.org/cases/case-database/case-detail?CaseNo=ARB/13/26; IA Reporter Article, available at:

https://www.iareporter.com/articles/in-newly-unearthed-uzbekistan-ruling-exorbitant-fees-promised-to-consultants-on-eve-of-tender-process-are-viewed-by-tri

bunal-as-evidence-of-corruption-leading-to-dismissal-of-all-claims-under-dutch/

Core allegation: Uzbekistan expropriated Claimant’s interests in its cotton spinning

and processing plant, and treated Claimant unfairly and inequitably by revoking

various incentives and ultimately causing Claimant’s Uzbek entity to enter into

bankruptcy

Core defenses: Claimant engaged in corruption to gain approval for its investment.

With respect to the merits, the Government complied with all contractual and

international obligations, including under the BIT, the Foreign Investment Law, and the

Investment Agreement.

Decision: Award dated 27 December 2016 (not publically available), dismissing all

claims on the grounds of corruption in the making of the investment

33

34.

Finding of Numerous Red Flags of CorruptionSpentex Netherlands, B.V. v. Republic of Uzbekistan, ICSID Case No. ARB/13/26, Award dated 27 Dec. 2016 (not public); ICSID Website available at

https://icsid.worldbank.org/cases/case-database/case-detail?CaseNo=ARB/13/26; IA Reporter Article available at

https://www.iareporter.com/articles/in-newly-unearthed-uzbekistan-ruling-exorbitant-fees-promised-to-consultants-on-eve-of-tender-process-are-viewed-by-tri

bunal-as-evidence-of-corruption-leading-to-dismissal-of-all-claims-under-dutch/

“Strikingly high” payments to a Consultant;

Claimant’s failure to disclose the existence of consulting contracts to the

Tribunal;

The Consultant’s lack of qualifications in the sector in which they had

provided advice;

Lack of clarity over the services provided, coupled with Claimant’s failure to

provide supporting documentation; and

Lack of transparency in the payment of the funds to accounts in

Luxembourg and the British Virgin Islands, which are known for providing

“discreet banking services.”

34

35.

Federal Elektrik v. UzbekistanFederal Elektrik, et al. v. Republic of Uzbekistan, ICSID Case No. ARB/13/9; ICSID Website available at

https://icsid.worldbank.org/cases/case-database/case-detail?CaseNo=ARB/13/9; GAR Article available at

https://globalarbitrationreview.com/article/1227084/turkish-investor-discontinues-uzbekistan-claim

Nationality of Claimants: Turkey

Legal Claims:

Turkey-Uzbekistan BIT (1992)

Energy Charter Treaty (1994)

Law of the Republic of Uzbekistan No. 609-I “On

Foreign Investments” of 30 April 1998

Subject of the Dispute: Investment in Uzbekistan’s

domestic gas and electricity market, including to

provide an updated gas meter system

35

36.

Overview: Federal Elektrik v. UzbekistanFederal Elektrik, et al. v. Republic of Uzbekistan, ICSID Case No. ARB/13/9; ICSID Website available at

https://icsid.worldbank.org/cases/case-database/case-detail?CaseNo=ARB/13/9; GAR Article available at

https://globalarbitrationreview.com/article/1227084/turkish-investor-discontinues-uzbekistan-claim

Core allegation: Uzbekistan expropriated Claimants’ interests in a joint venture and

in cancelled several contracts to provide an upgraded electric and gas metering

system, and violated Uzbek and international law through the arrest and detention of

the joint venture’s Director

Core defenses: The Government complied with all contractual and international

obligations, including under the BIT, the ECT, and the Uzbek Investment Law

Decision: Decision on Jurisdiction and Liability dated 29 October 2018 (not publically

available); proceedings discontinued on 18 May 2020

36

37.

Main Advantages of Participation by the Republicof Uzbekistan in Dispute Settlement Procedures

Economic:

Positive investment climate attracts new foreign investments

ISDS in most cases allowed the Republic of Uzbekistan to minimize or even to

nullify financial losses in disputes

Reputational:

Openness to international and transparent methods of dispute settlement

successfully adds to Uzbekistan’s image as a part of global community

Uzbekistan is not seen as a “pariah” State

Political:

ISDS helps to depoliticize investment disputes and avoid negative effect on other

areas of communication and cooperation between the affected states

37

38.

Arbitral Proceedings39.

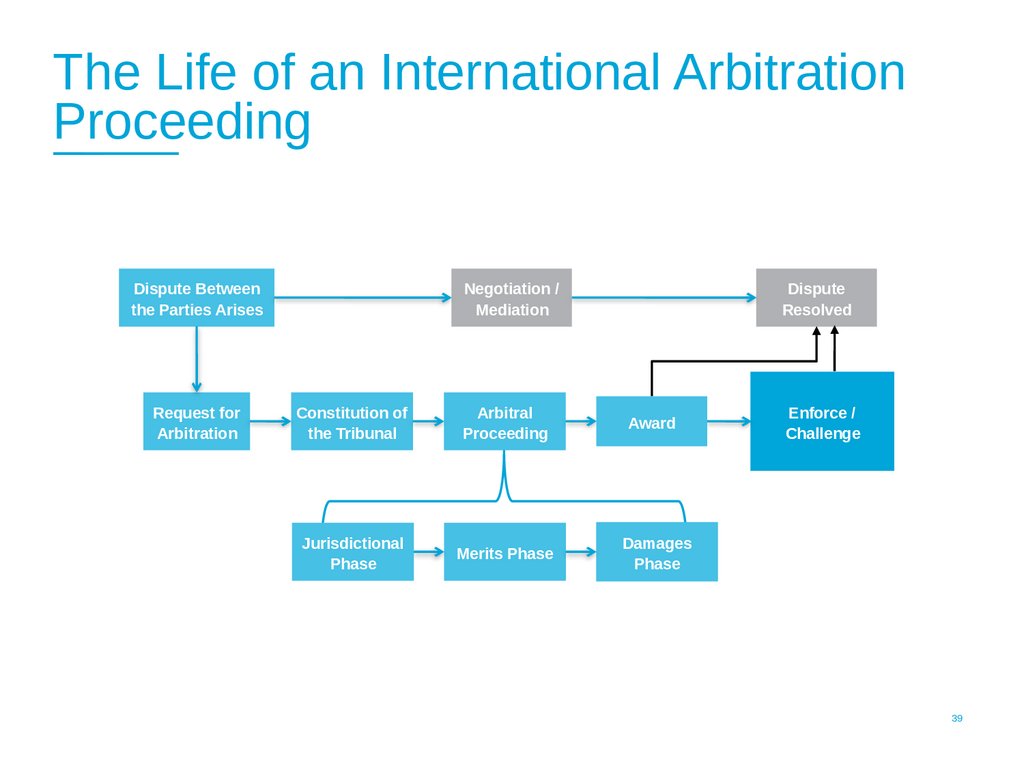

The Life of an International ArbitrationProceeding

Dispute Between

the Parties Arises

Request for

Arbitration

Negotiation /

Mediation

Dispute

Resolved

Constitution of

the Tribunal

Arbitral

Proceeding

Award

Jurisdictional

Phase

Merits Phase

Damages

Phase

Enforce /

Challenge

39

40.

Starting Point: Pre-Commencement ofProceedings

Early considerations for Respondent State include:

–

Who are the key representatives and relevant official State bodies

with knowledge of the Investor and involvement in the dispute?

–

Conduct jurisdictional enquiry and early assessment of claim

–

Choice of counsel / Importance of retaining counsel early

–

Any willingness to settle?

40

41.

Why Settle?Reasons for settling a case:

–

Maintain the commercial relationship with the other side

–

Confidential settlement (depending on the jurisdiction/forum)

–

Avoid costs/time of litigation/arbitration

–

Consider the case’s weaknesses

–

Avoid disclosure/discovery of documents or similar

41

42.

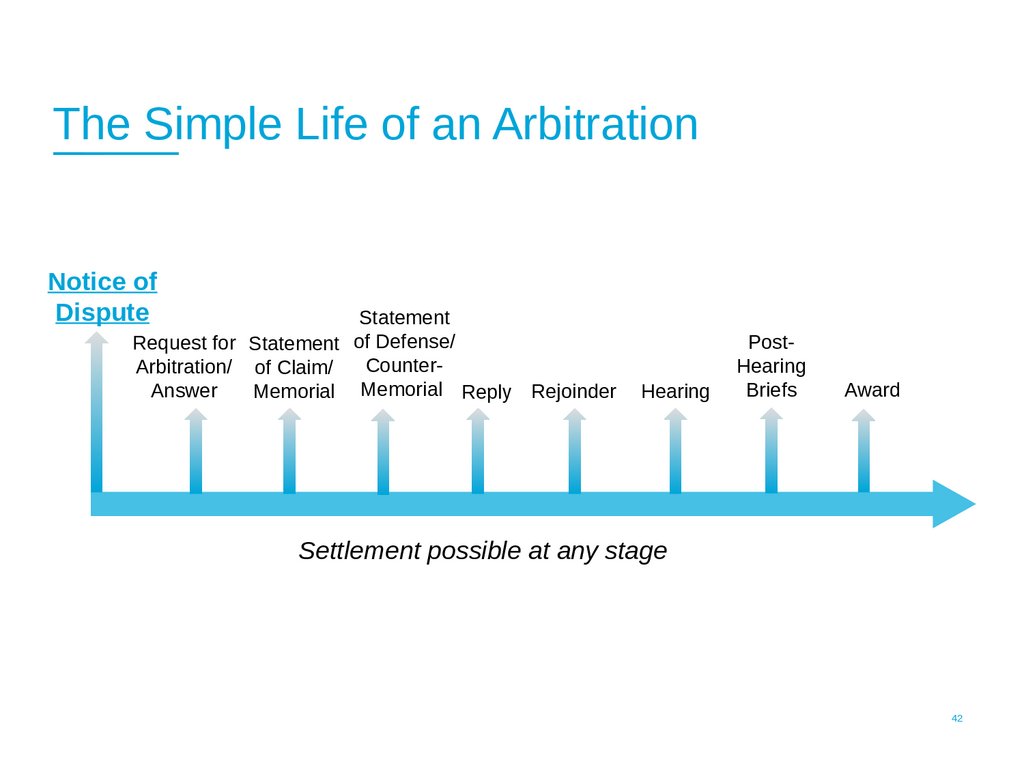

The Simple Life of an ArbitrationNotice of

Dispute

Statement

Request for Statement of Defense/

CounterArbitration/ of Claim/

Answer

Memorial Memorial Reply Rejoinder

Hearing

PostHearing

Briefs

Award

Settlement possible at any stage

42

43.

Notice of DisputeThe investor formally informs the State of the dispute

–

This may be the first time the central Government hears about the

dispute

Notice is commonly given in a formal letter referring to the

dispute resolution clause of the BIT (“trigger letter”)

–

Treaty may contain specific requirements

Other ways of giving notice of the dispute may also be effective

–

Paushok v. Mongolia: Claimants orally mentioned issues on multiple

occasions to government officials

43

44.

Request for ArbitrationAllows Respondent to make an early case assessment

and consider early disposition/jurisdictional challenges

ICSID Convention, Article 36(2):

–

“The request shall contain information concerning the issues in

dispute, the identity of the parties and their consent to arbitration

….”

Supporting documentation must be attached

44

45.

Significance of Selection of ArbitratorsSelected early in the process

–

Depends on institutional rules, but generally 90 days or as soon as

possible after the initiating submission (Request for Arbitration)

Choice of arbitrators is one of the key strategic decisions

in an arbitration

–

“An arbitration is only as good as the arbitrator”

One or three arbitrators (depending on size and

complexity of dispute)

46.

Additional Potential ArbitratorConsiderations

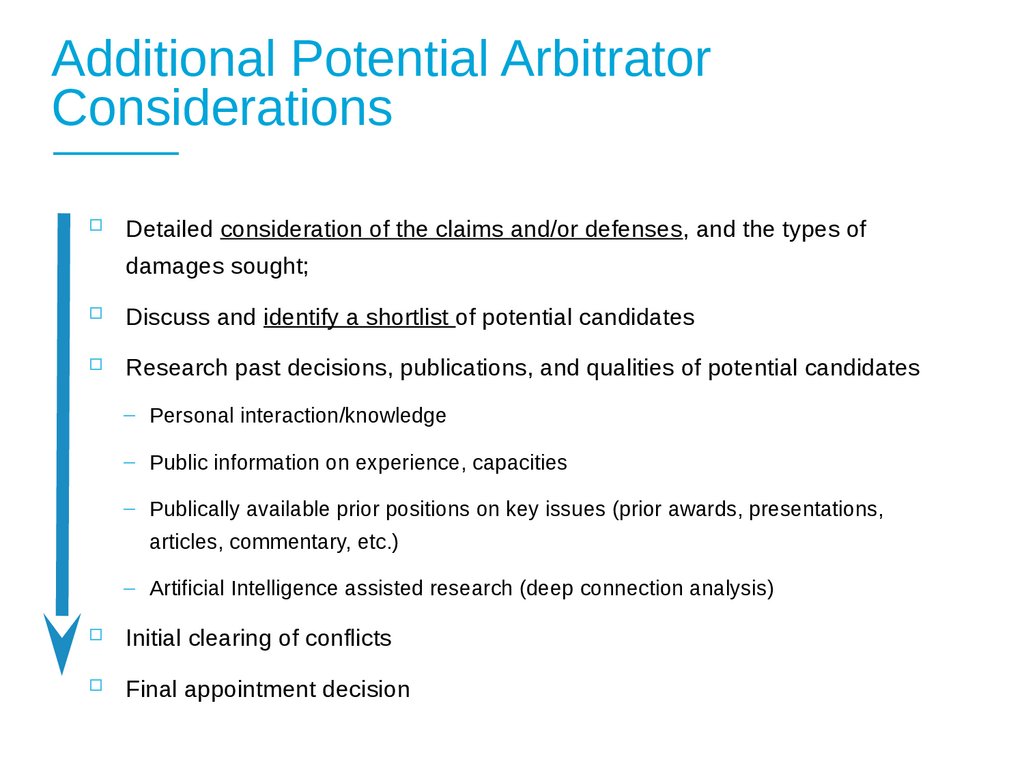

Detailed consideration of the claims and/or defenses, and the types of

damages sought;

Discuss and identify a shortlist of potential candidates

Research past decisions, publications, and qualities of potential candidates

– Personal interaction/knowledge

– Public information on experience, capacities

– Publically available prior positions on key issues (prior awards, presentations,

articles, commentary, etc.)

– Artificial Intelligence assisted research (deep connection analysis)

Initial clearing of conflicts

Final appointment decision

47.

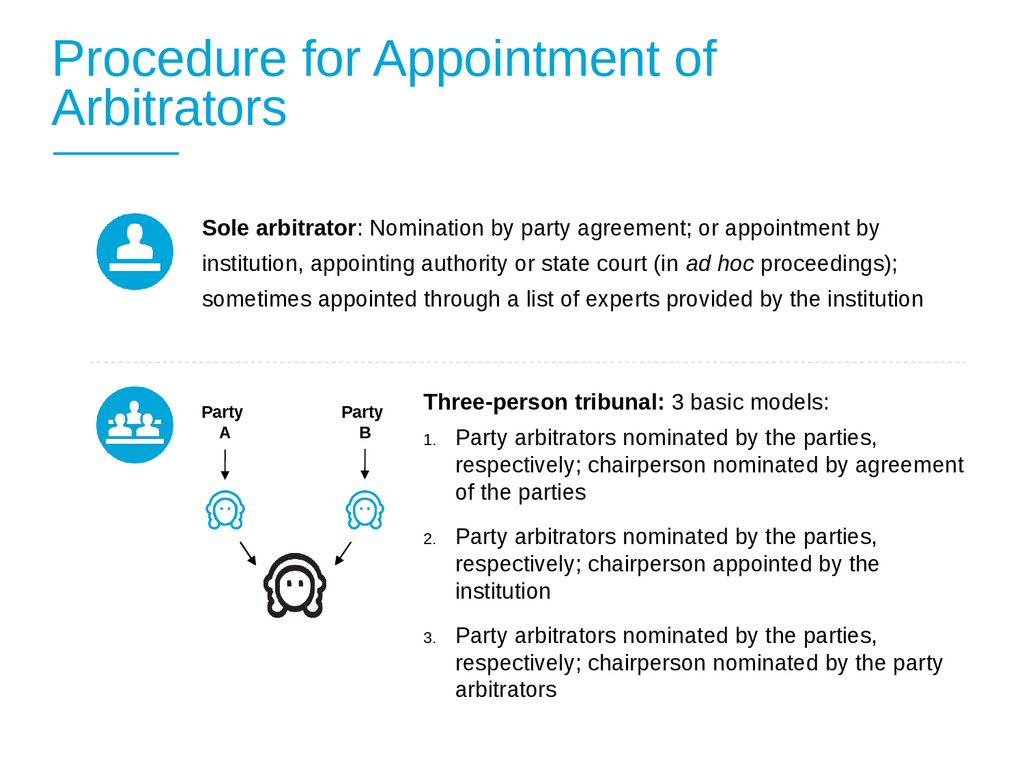

Procedure for Appointment ofArbitrators

Sole arbitrator: Nomination by party agreement; or appointment by

institution, appointing authority or state court (in ad hoc proceedings);

sometimes appointed through a list of experts provided by the institution

Party

A

Party

B

Three-person tribunal: 3 basic models:

1.

Party arbitrators nominated by the parties,

respectively; chairperson nominated by agreement

of the parties

2.

Party arbitrators nominated by the parties,

respectively; chairperson appointed by the

institution

3.

Party arbitrators nominated by the parties,

respectively; chairperson nominated by the party

arbitrators

48.

Appointment of Arbitrators by ICSIDICSID Arbitration Rule 18(1) (2022):

–

“If the Tribunal has not been constituted within 90 days after the

date of registration, or such other period as the parties may agree,

either party may request that the Chair appoint the arbitrator(s)

who have not yet been appointed pursuant to Article 38 of the

Convention.”

48

49.

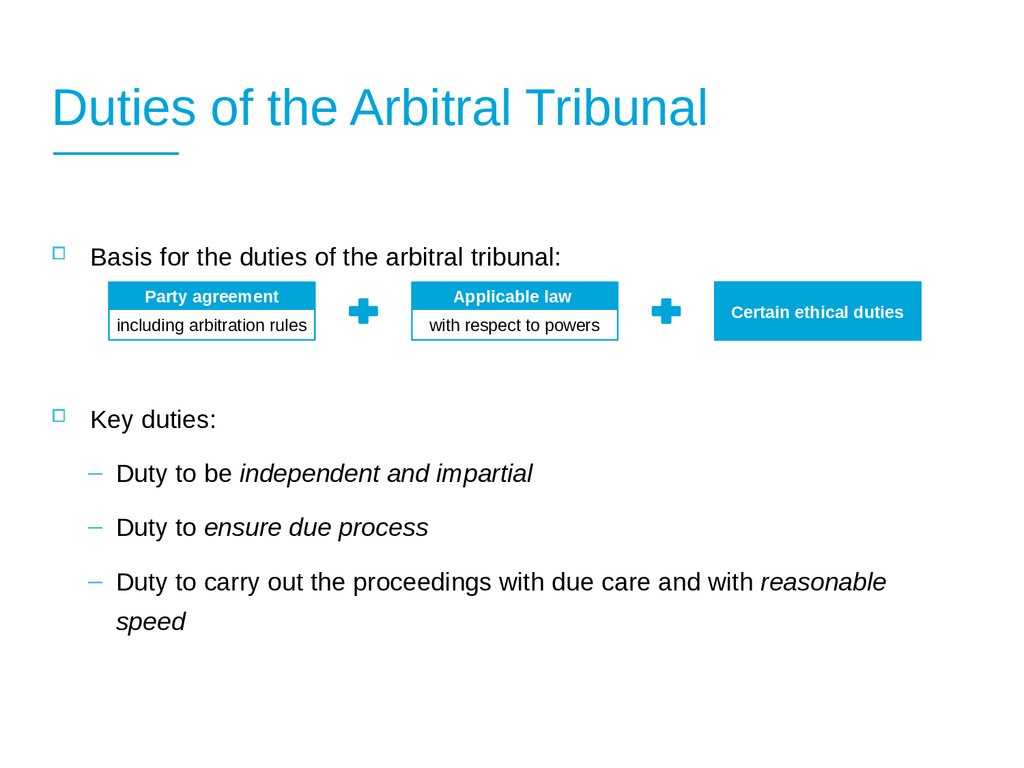

Duties of the Arbitral TribunalBasis for the duties of the arbitral tribunal:

Party agreement

Applicable law

including arbitration rules

with respect to powers

Certain ethical duties

Key duties:

– Duty to be independent and impartial

– Duty to ensure due process

– Duty to carry out the proceedings with due care and with reasonable

speed

50.

First Session of the Arbitral TribunalPurpose to establish procedural details, including the schedule

–

Expect a generous timetable, especially for Respondent States

–

Tribunal usually circulates a draft in advance, asking the Parties to attempt agreement

Written phase of the proceedings:

–

Memorial-style submissions, including all evidence

Think about fact and expert witnesses early

–

Usually two rounds of written submissions (if no bifurcation)

–

Document production phase typically between the two rounds of written submissions

Decision on bifurcation of proceeding into jurisdiction/merits/quantum phases

50

51.

Consider BifurcationConsider bifurcation of proceeding into phases:

–

Jurisdiction

–

Merits

–

Quantum

Bifurcation will require additional written and oral submissions

stages for each phase of bi-/trifurcated proceedings

Potentially cost-saving, if claims are dismissed in an early

phase

51

52.

Example of a Briefing Schedule(Excerpt from Minutes of the First Session of an ICSID case)

52

53.

Facts are KeyMore often than not, arbitrations are lost or won on the

facts

–

In investment treaty disputes, treaty-related issues may cause

legal issues to be somewhat more important than in commercial

arbitration

–

Nonetheless, facts often are decisive in ISDS as well

More often than not, documents are the key form of

evidence for establishing the facts

53

54.

Documentary Evidence is Filed with theParties’ Submissions as Exhibits

Typically documents will be submitted with the written submissions (first and

second written submissions; expert reports and witness statements)

Cut-off date for submitting any further exhibits into the record, but out-oforder submission of exhibits generally allowed “for exceptional

circumstances”

54

55.

Identifying Relevant Documents toSupport Case

Identify all relevant documents and obtain them from

various Ministries and other Government agencies

Contemporaneous vs. created for the arbitration

Helpful and unhelpful documents

Authenticity

Document Management

Document Retention Policies

55

56.

Importance of Document ProductionAllows each party to obtain relevant and material evidence from the other

Because document requests must be relatively specific and targeted, it is

important to have a full understanding of the documentary evidence we

already have before making requests

Important to preserve and produce documents to avoid adverse inferences

or worse

56

57.

Adverse Inferences from NonProductionA party may ask the tribunal to draw adverse inferences from another party’s

failure to provide documents (see IBA Rules, Art. 9.6)

Tribunals infer that a document that is not produced is adverse to the

interests of the non-producing party when:

–

Without satisfactory explanation, that party fails to voluntarily produce the

requested document;

–

The party has not objected the production in due time; or

–

The party fails to produce a document ordered to be produced by the

tribunal

57

58.

Aspects of Government EvidenceGovernments have unique access and authority over documents and other evidence

–

Can invoke special privileges to avoid disclosure of politically sensitive information

Executive and deliberative privilege

State secrets and national security

Parallel criminal investigations and proceedings

Challenges of coordination and evidence production

–

Need to locate the government agencies and/or officers that have custody of such

documents

Documents may be located in various agencies across all levels of government

–

Importance of central record-keeping system

–

Governments need to consider implications for domestic freedom of information

legislation when producing documents

58

59.

Privileges for Government Evidence:Politically Sensitive Information

Considerations in play when determining whether privilege applies

–

Balance between keeping the information secret and disclosing the information for

the limited purpose of the arbitration

–

Documents related to core national security or military secrets are generally

privileged

Redaction may allow disclosure of some information

Where sensitive information is “so inextricably intertwined” with benign

information, redaction may not be feasible

–

Deliberative documents (e.g., cabinet deliberations) are more likely to be sensitive

and therefore privileged

–

Greater passage of time since the document was prepared generally weighs in

favour of disclosure

59

60.

Oral ProceedingsOpening Statements

Examination of Fact Witnesses

Examination of Experts

Tribunal’s Questions

Closing Arguments

60

61.

Post-Hearing SubmissionsPost-Hearing Briefs

–

Tribunals often request them (1 or 2 rounds)

–

Summary of the most important arguments

–

Address any new evidence and arguments resulting from the

hearing testimony

–

Answer any tribunal questions

Costs submissions

61

62.

Post-Award Remedies63.

Post-Award RemediesICSID Convention, Art. 52; ICSID Arbitration Rules, Rules 50, 52-55

ISDS awards are final and binding on the parties to the dispute

ICSID awards are subject to the limited post-award remedies

provided for in the ICSID Convention

–

No appeal

–

No challenge before local courts based on domestic law or other treaties

–

Annulment is an exceptional recourse to safeguard against the violation of

fundamental legal principles relating to the process

Non-ICSID awards are subject to set-aside in the courts of the

jurisdiction in which the arbitral seat is located

–

Grounds for set-aside are provided by the domestic law of that jurisdiction

Many jurisdictions have adopted the UNCITRAL Model Law on International Commercial Arbitration

63

64.

ICSID AnnulmentA party may apply for full or partial annulment of an ICSID award on the

basis of one or more of the following five grounds:

–

The Tribunal was not properly constituted;

–

The Tribunal has manifestly exceeded its powers;

–

There was corruption on the part of a member of the Tribunal;

–

There has been a serious departure from a fundamental rule of procedure; or

–

The award has failed to state the reasons on which it is based

64

65.

ICSID Annulment ProcedureICSID Convention, Art. 52(5); ICSID Arbitration Rules, Rules 53-54

As soon as possible after the application for annulment is registered, the

Chairman of the Administrative Council appoints three persons from the

Panel of Arbitrators to form an ad hoc Committee which will decide the

application for annulment

The Arbitration Rules apply, mutatis mutandis, to an annulment proceeding

(Arbitration Rule 53)

–

This means that the conduct of an annulment proceeding is similar to the conduct of an

arbitration, including a first session of the ad hoc Committee and a written and oral process

A party may request the stay of enforcement of the award pending the ad

hoc Committee’s annulment decision

65

66.

Outcome of the ICSID AnnulmentProceeding

ICSID Convention, Art. 53(2)

The ad hoc Committee’s decision on annulment may:

–

Reject the application for annulment, meaning that the award remains intact;

–

Uphold the application in respect of a part of the award, leading to a partial

annulment of the award; or

–

Uphold the application in respect to the entire award, meaning that the whole of the

award is annulled

The ad hoc Committee’s decision is not an award and is not subject

to any further annulment proceeding, although it is equated to an

award for purposes of its binding force, recognition and enforcement

66

67.

Recognition and Enforcement of ICSIDAwards

ICSID Convention, Arts. 53-54; Eiser et al. v. Spain, ICSID Case No. ARB/13/36, Judgment of the Federal Court of Australia [2020] FCA 157 dated 24

Feb. 2020

The ICSID Convention obliges the parties to an arbitration to “abide by and

comply with” awards rendered by ICSID tribunals

–

Article 54 of the ICSID Convention requires Contracting States to recognize ICSID awards as

binding

–

This requires a domestic court to confirm the legally binding nature of the award, that it has res

judicata effect, and to take the steps necessary under domestic law to give legal effect to the

award within the State’s domestic legal system

Contracting States are obliged to enforce the pecuniary obligations set out in

each ICSID award as though it were a final judgment of a court in that State

Appeal or review of ICSID awards other than through the mechanisms

provided for within the ICSID Convention is expressly excluded by Article

53(1)

–

This means that domestic courts are not permitted to scrutinize ICSID awards in the same

manner as is allowed under Article V of the New York Convention

67

68.

Enforcement of Non-ICSID AwardsIf Place of Arbitration and Enforcement Forum are located

within 170 States parties to the New York Convention

Courts have compulsory power to enforce the award

under the New York Convention, Article III:

–

“Each Contracting State shall recognize arbitral awards as binding

and enforce them in accordance with the rules of procedure of the

territory where the award is relied upon”

68

69.

Defenses Against Enforcement of NonICSID AwardsNew York Convention, Art. V:

–

Invalidity of the arbitration agreement or incapacity of the parties thereto;

–

Lack of notice to a party of the appointment of the arbitrator or of the arbitration

proceedings or other inability to present the case;

–

Inclusion in the award of matters outside the scope of submission to arbitration;

–

Impropriety in the composition of the arbitral authority or the arbitral procedure;

–

Set-aside or suspension of the award in the country, in which, or under the law of

which, the award was made;

–

Non-arbitrability of the subject matter;

–

Violation of the public policy of the State in which recognition and enforcement of the

award are sought.

69

Право

Право