Похожие презентации:

Accounting and the Business Environment

1.

Chapter 1Accounting and the Business Environment

Zhou Hui, Ph.D., Associate Professor

Tel: 008618676480696

Email: zhouhuivivian@bnu.edu.cn

Copyright © 2012 Pearson Education, Inc. Publishing as Prentice Hall.

2.

AttendanceIndividual assignment

Group assignment

Final exam (week17-18)

Total

10 %

30 %

10 %

50 %

100%

Copyright © 2012 Pearson Education, Inc. Publishing as Prentice Hall.

3.

Why study Accounting?What did Warren Buffet about accounting?

October 24, 2007, Mr. Buffett was

interviewed by CCTV.

Reporter: "you read more than 10000

annual reports a year. Is that true?“

Buffet: "like other people reading newspapers, I read thousands

of them every year. I don't know how much I read. But like

PetroChina, I read the annual report of 2002 and 2003. Then I

decided to invest 500 million yuan in PetroChina. I have not met

the management or read the reports of analysts, but the annual

reports are easy to understand, and it is a good investment.

3-3

Copyright © 2012 Pearson Education, Inc. Publishing as Prentice Hall.

4.

Why study Accounting?Who should be blamed for the financial crisis?

During the 2008 financial crisis, criticisms of

the accounting field were widespread,

particularly from financial institutions.

The US Congress authorized an investigation

into the root causes of the crisis by the

Securities and Exchange Commission (SEC).

Financial institutions argued that fair value accounting was the cause

of the crisis. The accounting field maintained that it was not fair value

measurement that caused the financial crisis; fair value measurement

just accurately and timely reflected the problems in the crisis.

Following the investigation, it was determined that while fair value

accounting was not the primary cause of the financial crisis, it may

have played a contributing role.

3-4

Copyright © 2012 Pearson Education, Inc. Publishing as Prentice Hall.

5.

Core TextbookHorngren Accounting, 10th Edition, Pearson, 2017.

By Tracie Nobles, Brenda Mattison, Ella M. Matsumura.

American Accounting textbook

Supplementary Textbook

Financial Accounting 10th Edition,

By Weygandt, Kieso, Kimmel

American Accounting textbook

Financial Accounting and Reporting

By Elliott and Elliott

UK Accounting textbook

Copyright © 2012 Pearson Education, Inc. Publishing as Prentice Hall.

6.

Financial AccountingChapter 1 Accounting and the Business Environment

Chapter 2 Recording Business Transactions

Chapter 3 Adjustments

Chapter 4 Completing the Accounting Cycle

Chapter 5 Merchandising Operations and Inventory

Chapter 6 Receivables

Chapter 7 Plant Assets and Intangibles

Chapter 8 Liabilities

Chapter 9 Stockholder’s Equity for Corporations

Management Accounting

Chapter 10 Master Budget(we will see if we have time)

Copyright © 2012 Pearson Education, Inc. Publishing as Prentice Hall.

7.

Chapter 17

Copyright © 2012 Pearson Education, Inc. Publishing as Prentice Hall.

8.

Define accounting vocabularyDefine the users of accounting information

Describe the accounting profession and the

organizations that govern it

Identify the different types of business

organizations

Delineate the distinguishing characteristics

and organization of a proprietorship

8

Copyright © 2012 Pearson Education, Inc. Publishing as Prentice Hall.

9.

Apply accounting concepts and principlesDescribe the accounting equation, and define

assets, liabilities, and equity

Use the accounting equation to analyze

transactions

Basic form of financial statements

9

Copyright © 2012 Pearson Education, Inc. Publishing as Prentice Hall.

10.

1Define accounting vocabulary

10

Copyright © 2012 Pearson Education, Inc. Publishing as Prentice Hall.

11.

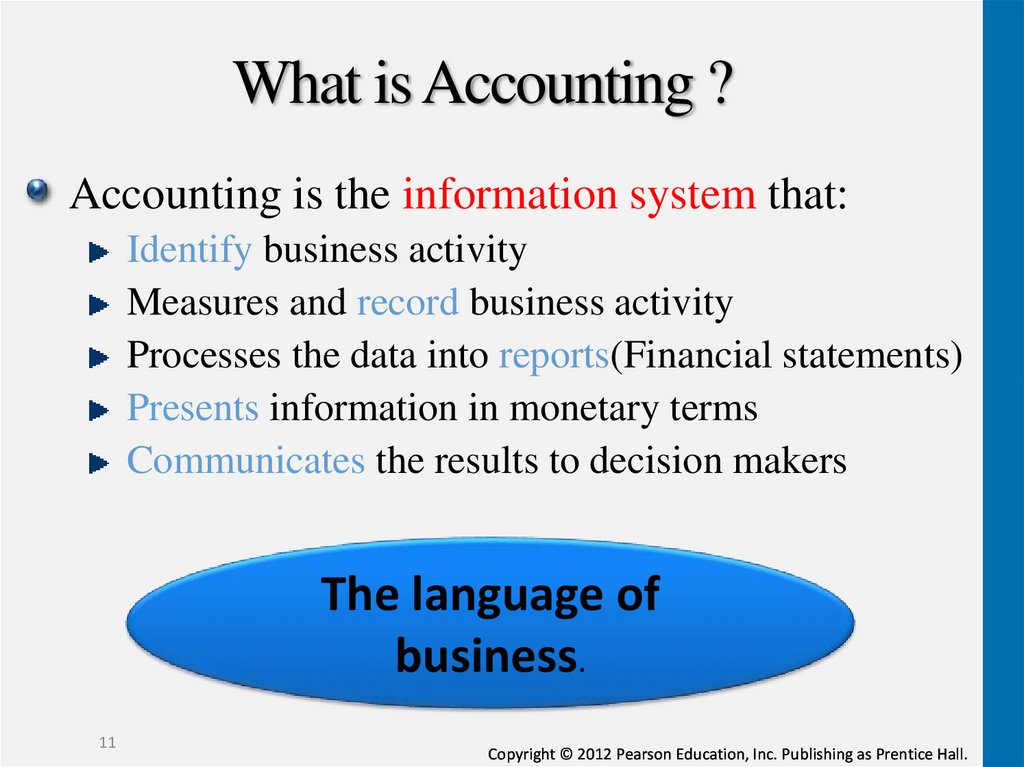

What is Accounting ?Accounting is the information system that:

Identify business activity

Measures and record business activity

Processes the data into reports(Financial statements)

Presents information in monetary terms

Communicates the results to decision makers

The language of

business.

11

Copyright © 2012 Pearson Education, Inc. Publishing as Prentice Hall.

12.

THE ACCOUNTING PROCESSAccounting

Reports

Process data into

reports(financial statements)

SOFTBYTE

Annual Report

Identify transactions

(select economic events)

Measure and

record business

activities

Communicate and

Presents information

for decision makers.

Copyright © 2012 Pearson Education, Inc. Publishing as Prentice Hall.

13.

2Define the users of

accounting information

13

Copyright © 2012 Pearson Education, Inc. Publishing as Prentice Hall.

14.

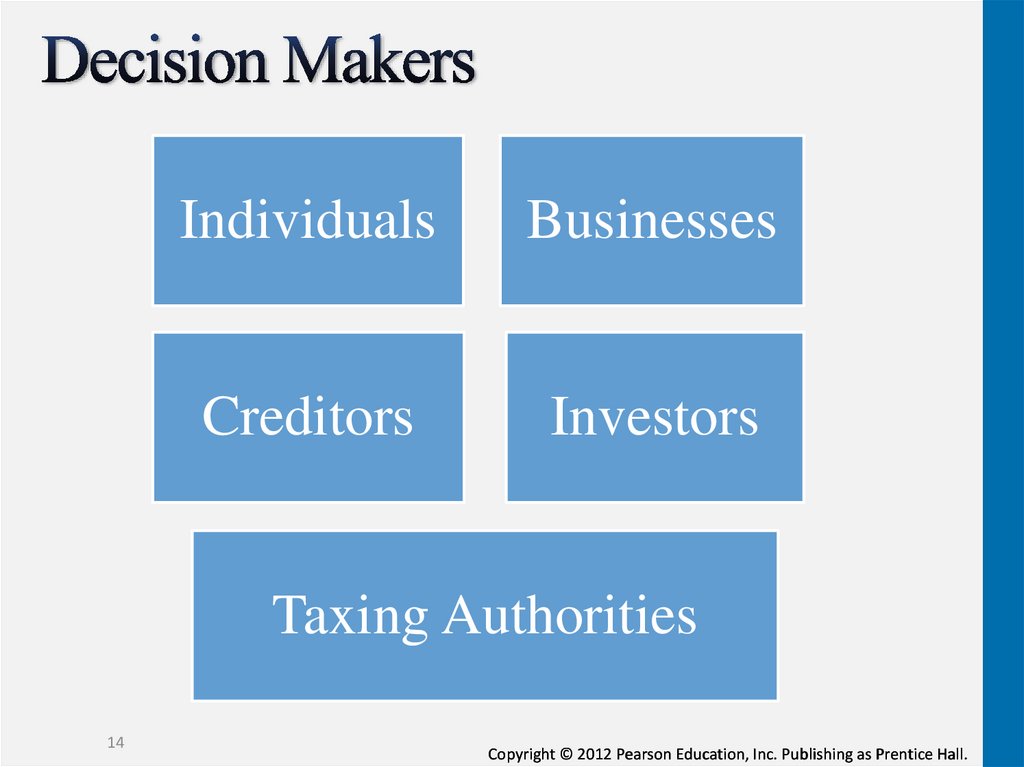

IndividualsBusinesses

Creditors

Investors

Taxing Authorities

14

Copyright © 2012 Pearson Education, Inc. Publishing as Prentice Hall.

15.

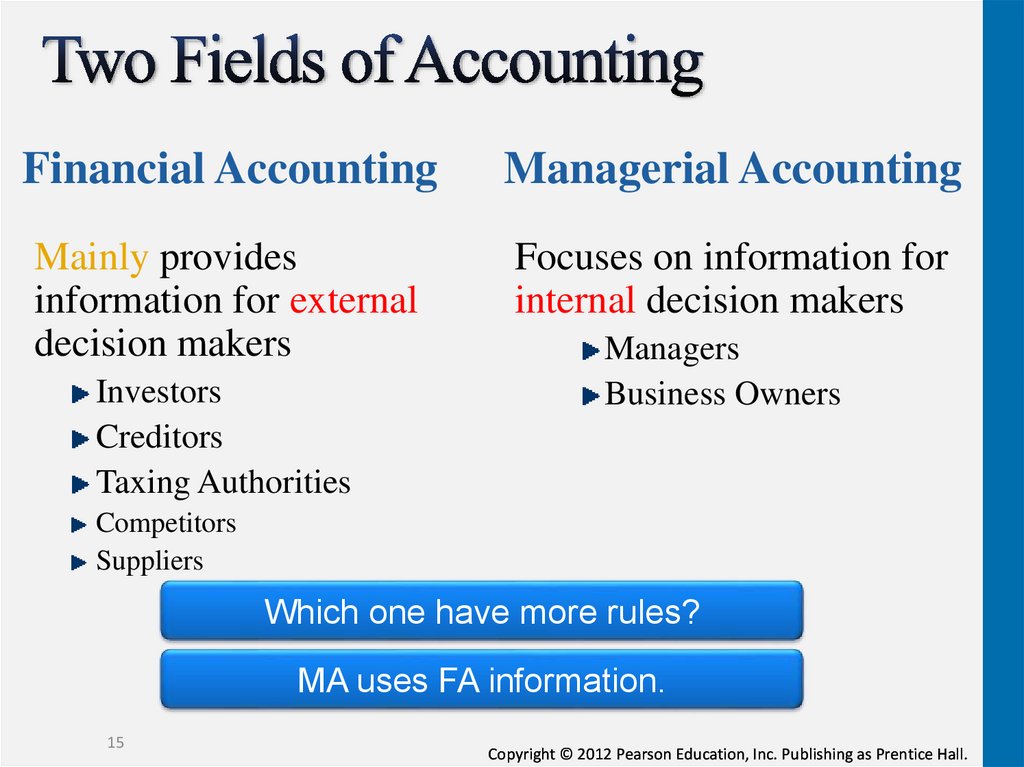

Financial AccountingManagerial Accounting

Mainly provides

information for external

decision makers

Focuses on information for

internal decision makers

Investors

Creditors

Taxing Authorities

Managers

Business Owners

Competitors

Suppliers

Which one have more rules?

MA uses FA information.

15

Copyright © 2012 Pearson Education, Inc. Publishing as Prentice Hall.

16.

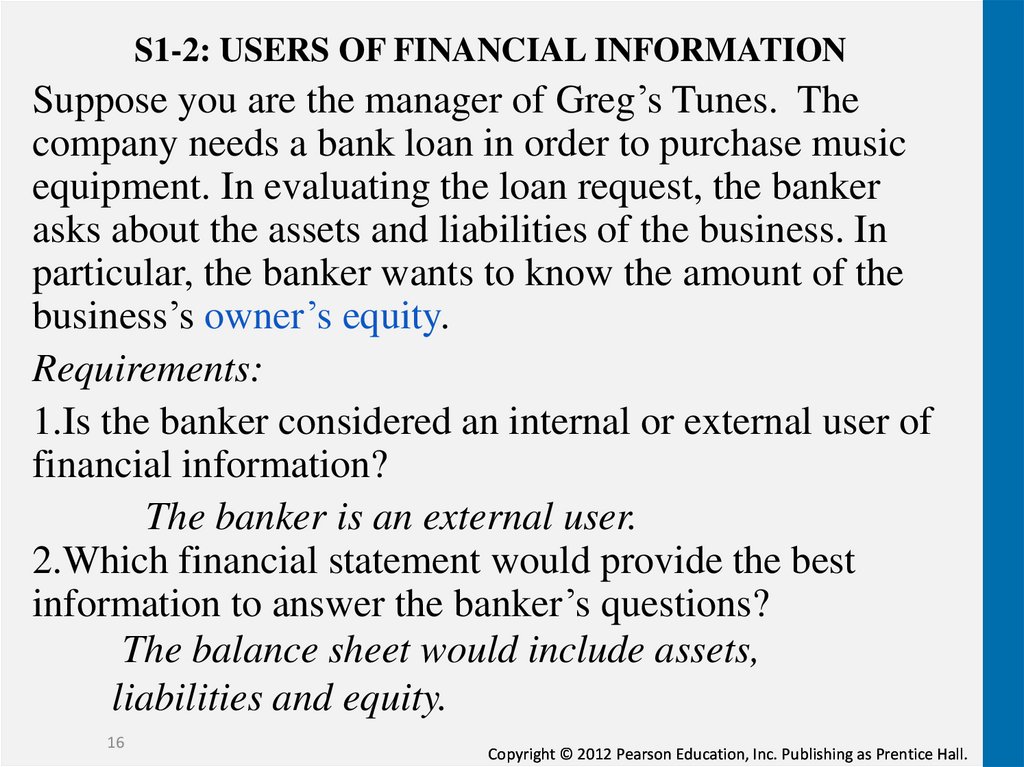

S1-2: USERS OF FINANCIAL INFORMATIONSuppose you are the manager of Greg’s Tunes. The

company needs a bank loan in order to purchase music

equipment. In evaluating the loan request, the banker

asks about the assets and liabilities of the business. In

particular, the banker wants to know the amount of the

business’s owner’s equity.

Requirements:

1.Is the banker considered an internal or external user of

financial information?

The banker is an external user.

2.Which financial statement would provide the best

information to answer the banker’s questions?

The balance sheet would include assets,

liabilities and equity.

16

Copyright © 2012 Pearson Education, Inc. Publishing as Prentice Hall.

17.

3Describe the accounting

profession and the organizations

that govern it

17

Copyright © 2012 Pearson Education, Inc. Publishing as Prentice Hall.

18.

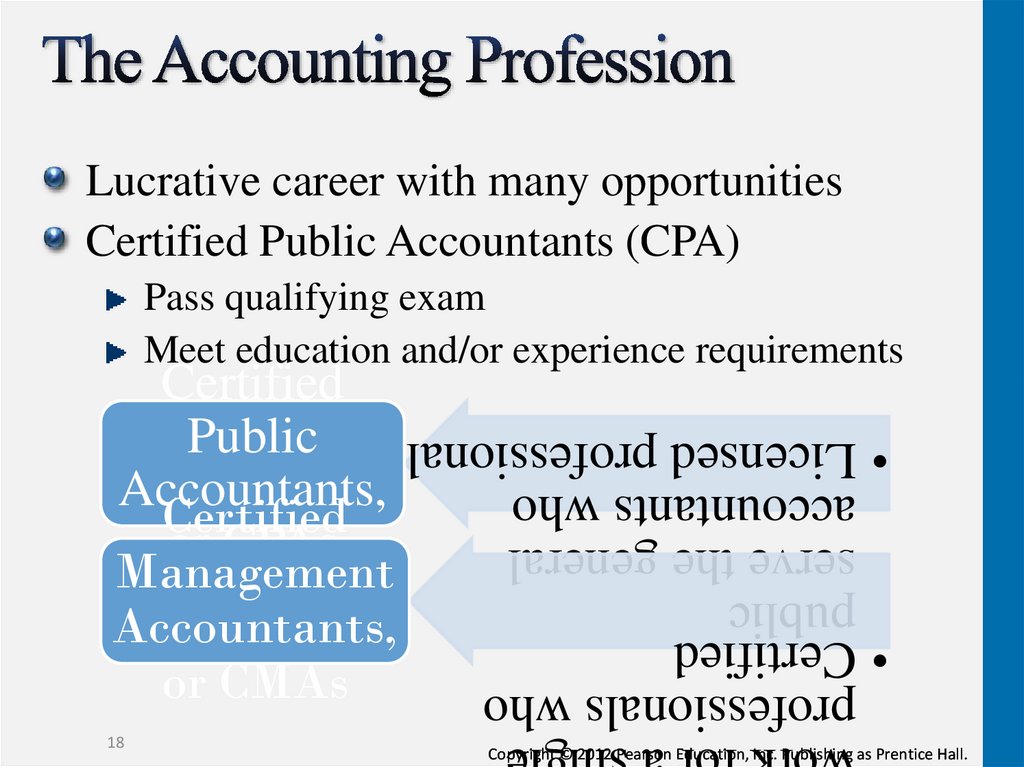

Lucrative career with many opportunitiesCertified Public Accountants (CPA)

Pass qualifying exam

Meet education and/or experience requirements

18

work for a single

professionals who

• Certified

public

serve the general

accountants who

• Licensed professional

Certified

Public

Accountants,

Certified

or CPAs

Management

Accountants,

or CMAs

Copyright © 2012 Pearson Education, Inc. Publishing as Prentice Hall.

19.

19Copyright © 2012 Pearson Education, Inc. Publishing as Prentice Hall.

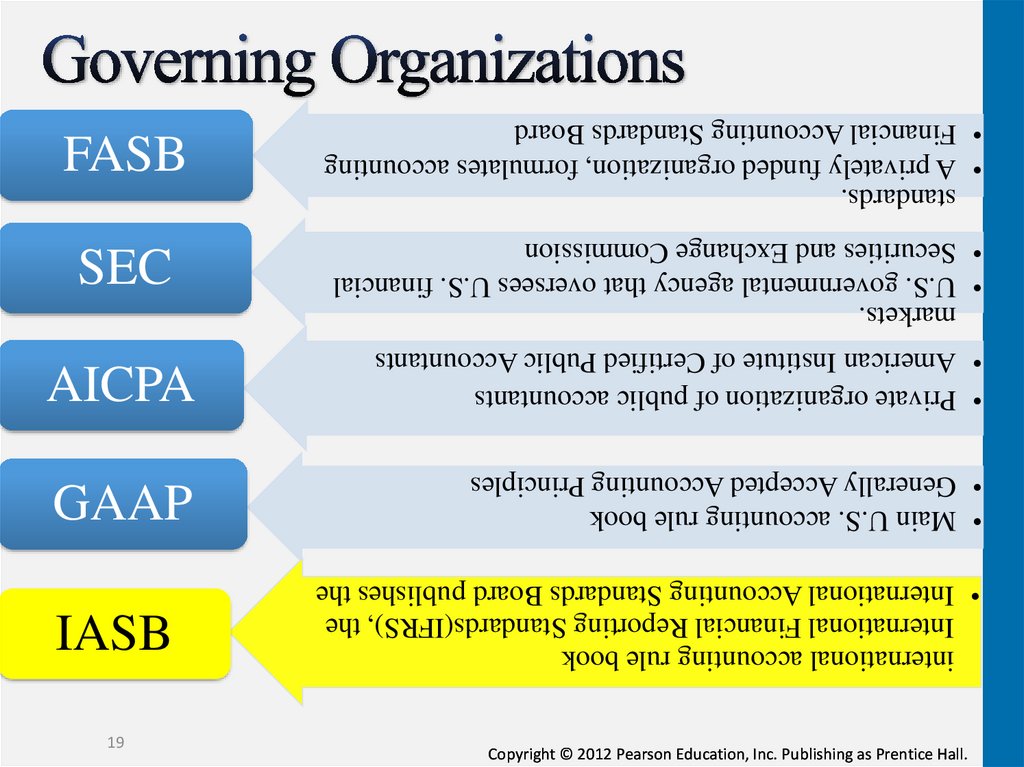

AICPA

• Private organization of public accountants

• American Institute of Certified Public Accountants

GAAP

• Main U.S. accounting rule book

• Generally Accepted Accounting Principles

IASB

international accounting rule book

International Financial Reporting Standards(IFRS), the

• International Accounting Standards Board publishes the

FASB

standards.

• A privately funded organization, formulates accounting

• Financial Accounting Standards Board

SEC

markets.

• U.S. governmental agency that oversees U.S. financial

• Securities and Exchange Commission

20.

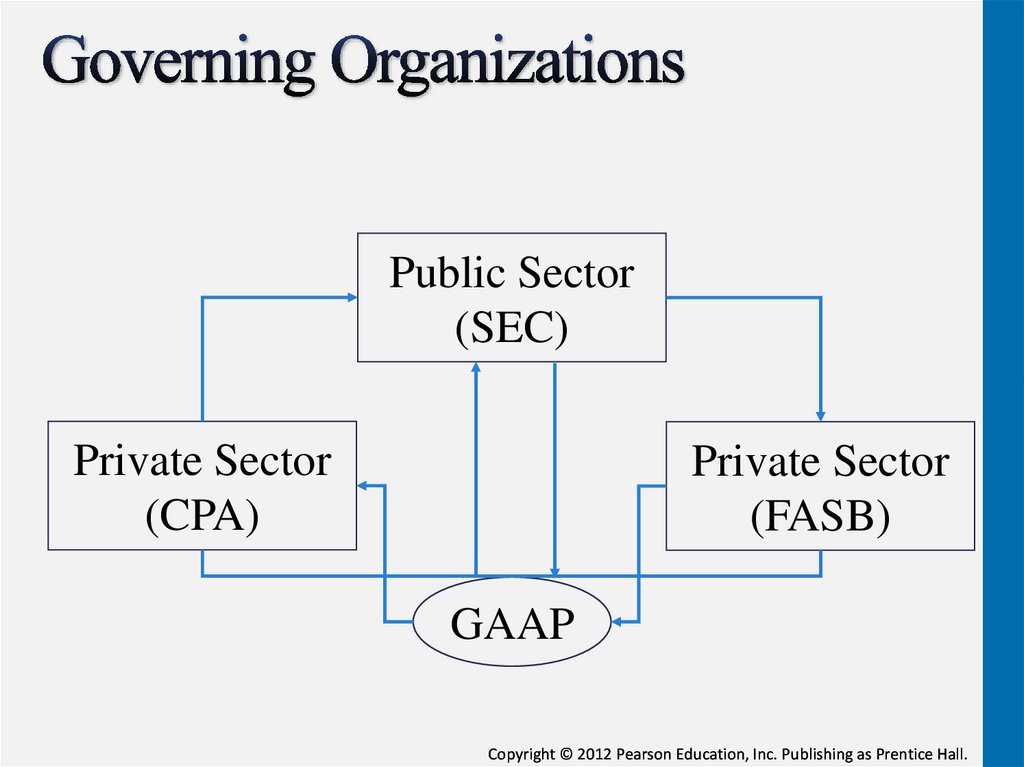

Public Sector(SEC)

Private Sector

(CPA)

Private Sector

(FASB)

GAAP

Copyright © 2012 Pearson Education, Inc. Publishing as Prentice Hall.

21.

4Identify the different types

of business organizations

21

Copyright © 2012 Pearson Education, Inc. Publishing as Prentice Hall.

22.

ProprietorshipPartnership

Corporation

Not-for-profit

Others

22

Copyright © 2012 Pearson Education, Inc. Publishing as Prentice Hall.

23.

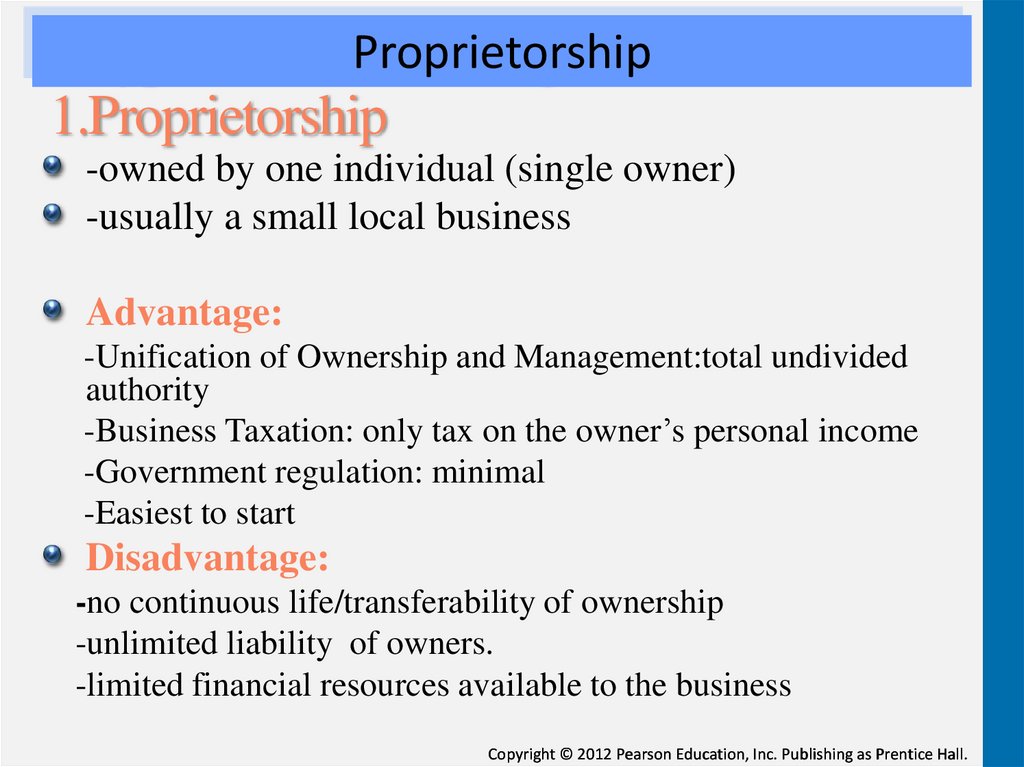

Proprietorship1.Proprietorship

-owned by one individual (single owner)

-usually a small local business

Advantage:

-Unification of Ownership and Management:total undivided

authority

-Business Taxation: only tax on the owner’s personal income

-Government regulation: minimal

-Easiest to start

Disadvantage:

-no continuous life/transferability of ownership

-unlimited liability of owners.

-limited financial resources available to the business

Copyright © 2012 Pearson Education, Inc. Publishing as Prentice Hall.

24.

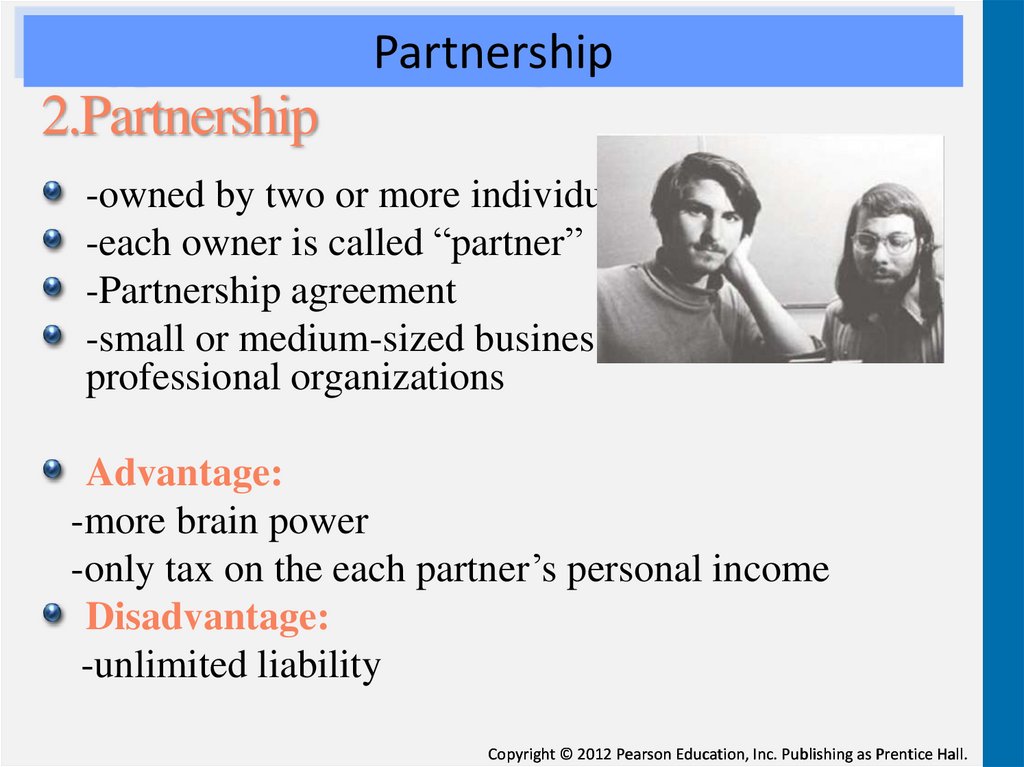

Partnership2.Partnership

-owned by two or more individuals

-each owner is called “partner”

-Partnership agreement

-small or medium-sized business,specifically,

professional organizations

Advantage:

-more brain power

-only tax on the each partner’s personal income

Disadvantage:

-unlimited liability

Copyright © 2012 Pearson Education, Inc. Publishing as Prentice Hall.

25.

Corporation3.Corporations

-ownership divided into shares of stock

-owned by shareholders/stockholders

Advantage:

-Separation of ownership and management

-large amounts of resources

-transferability of ownership relatively easy

-unlimited life

-limited liability of stockholders .

Copyright © 2012 Pearson Education, Inc. Publishing as Prentice Hall.

26.

Corporation3.Corporations

Disadvantage:

-separation of ownership and management

-extensive governmental regulation

-double taxation: corporate income tax and personal

income tax

Copyright © 2012 Pearson Education, Inc. Publishing as Prentice Hall.

27.

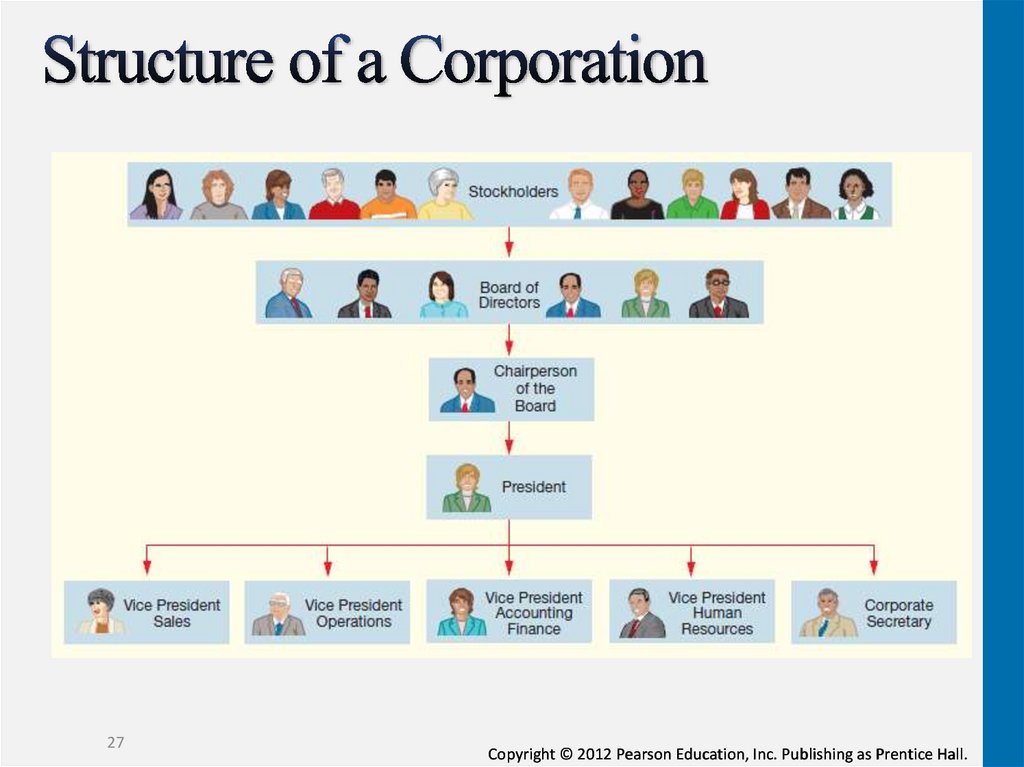

27Copyright © 2012 Pearson Education, Inc. Publishing as Prentice Hall.

28.

S1-4: TYPES OF BUSINESS ORGANIZATIONChloe Michaels plans on opening Chloe Michaels’

Floral Designs. She is considering the various types

of business organizations and wishes to organize

her business with unlimited life and limited liability

features. Additionally, Chloe wants the option to

raise additional equity easily in the future. Which

type of business organization will meet Chloe’s

needs best?

A corporation has all the requirements of Chloe’s

request. A corporation has an unlimited life,

shareholders have limited liability and additional

stock can be sold to raise additional equity.

28

Copyright © 2012 Pearson Education, Inc. Publishing as Prentice Hall.

29.

6Apply accounting concepts and

principles

29

Copyright © 2012 Pearson Education, Inc. Publishing as Prentice Hall.

30.

Generally Accepted Accounting PrinciplesGuidelines that govern accounting

Based on a conceptual framework

Goals include:

Provide useful information for investment and lending

decisions

30

Copyright © 2012 Pearson Education, Inc. Publishing as Prentice Hall.

31.

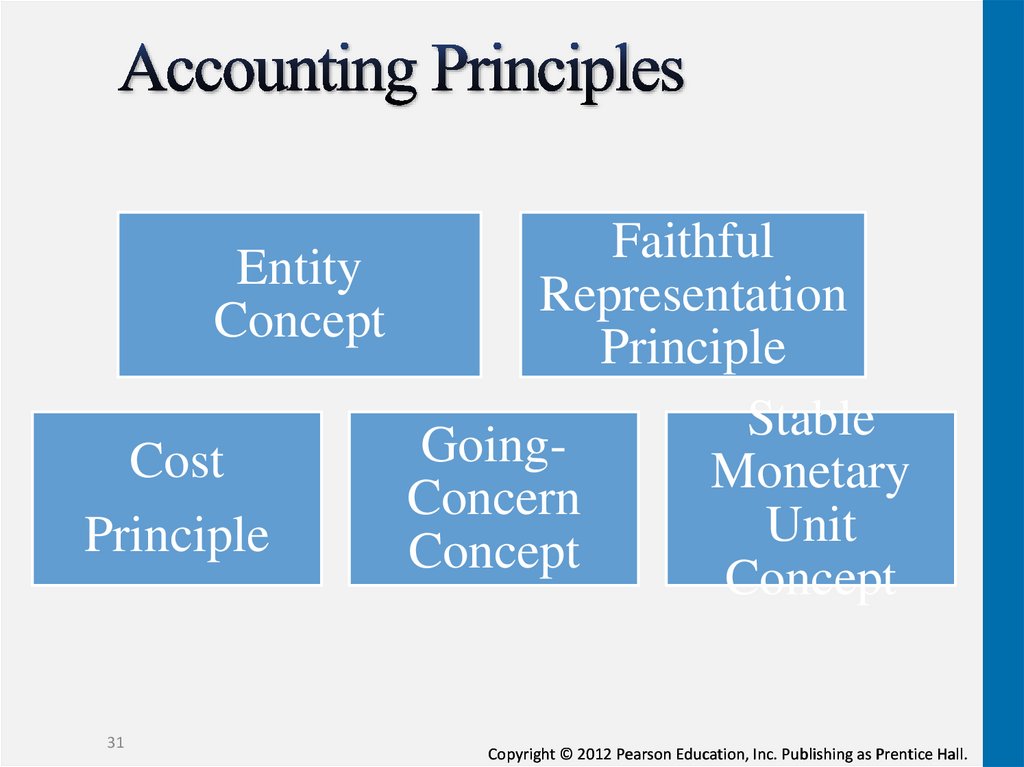

FaithfulEntity

Representation

Concept

Principle

Stable

GoingCost

Monetary

Concern

Unit

Principle

Concept

Concept

31

Copyright © 2012 Pearson Education, Inc. Publishing as Prentice Hall.

32.

Entity Concept• A business is separate from its owners

• All activities of an entity are kept and

recorded

separate from

the activities of

Faithful

Representation

Principle

owners and

other economic

entities.

• its

Accounting

information

is complete,

Cost

Principle

andhired

free from

material

error

• neutral,

accountant

by BMW.

stockholder

• Assets

are recorded

at historical

A of BMW

bought a car

using his money

purchase price

• land bought 10years ago at$1000, now

32

Copyright © 2012 Pearson Education, Inc. Publishing as Prentice Hall.

33.

Going-Concern• Assumption that business will remain in

operation for the foreseeable future

Stable Monetary Unit Concept

• In the U.S. amounts are recorded in

dollars

• The dollar is considered a stable unit of

measure

33

Copyright © 2012 Pearson Education, Inc. Publishing as Prentice Hall.

34.

7Describe the accounting equation,

and define assets, liabilities, and

equity

34

Copyright © 2012 Pearson Education, Inc. Publishing as Prentice Hall.

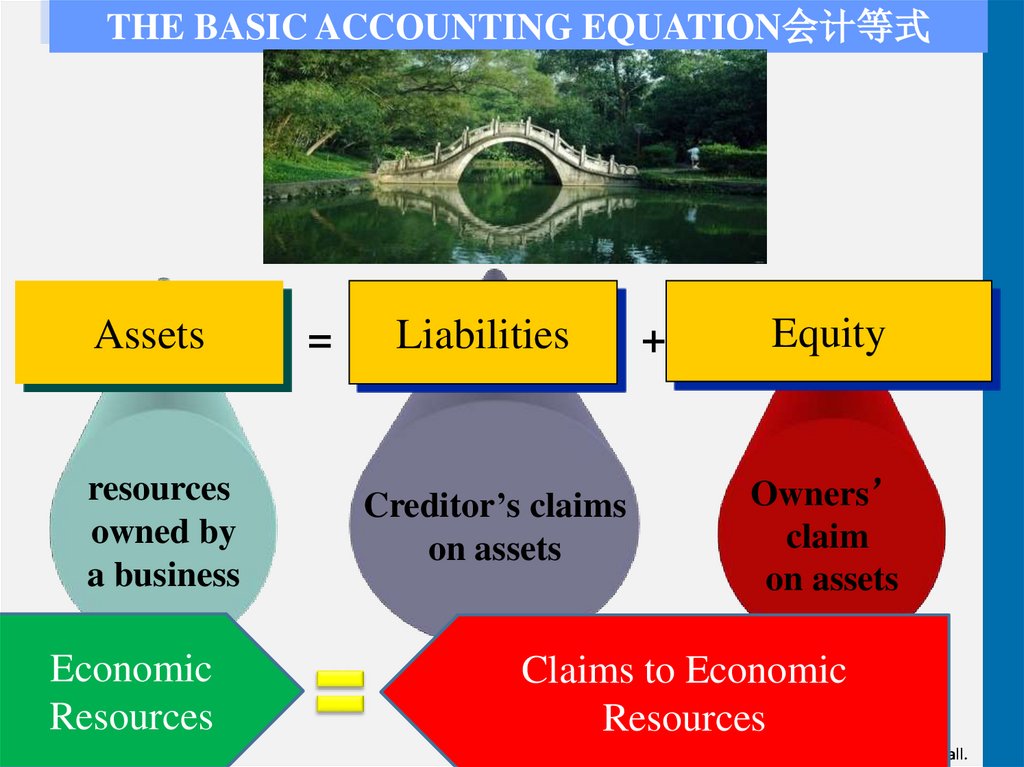

35.

THE BASIC ACCOUNTING EQUATION会计等式Assets

resources

owned by

a business

Economic

Resources

=

Liabilities

Creditor’s claims

on assets

+

Equity

Owners’

claim

on assets

Claims to Economic

Resources

Copyright © 2012 Pearson Education, Inc. Publishing as Prentice Hall.

36.

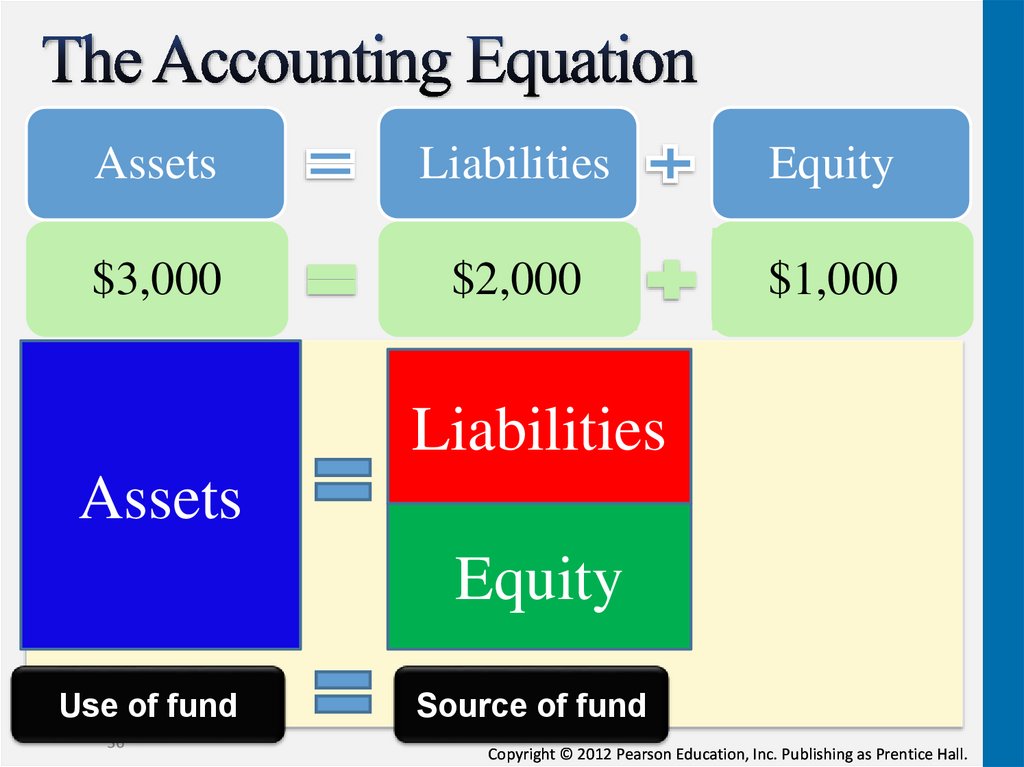

AssetsLiabilities

Equity

$3,000

$2,000

$1,000

Liabilities

Assets

Equity

Use of fund

36

Source of fund

Copyright © 2012 Pearson Education, Inc. Publishing as Prentice Hall.

37.

Economic resourcesBenefit the business in the future

Recorded at cost which is measurable

Examples:

Cash

Machine

Property, land

Furniture

Merchandise inventory

Accounts receivable

37

Copyright © 2012 Pearson Education, Inc. Publishing as Prentice Hall.

38.

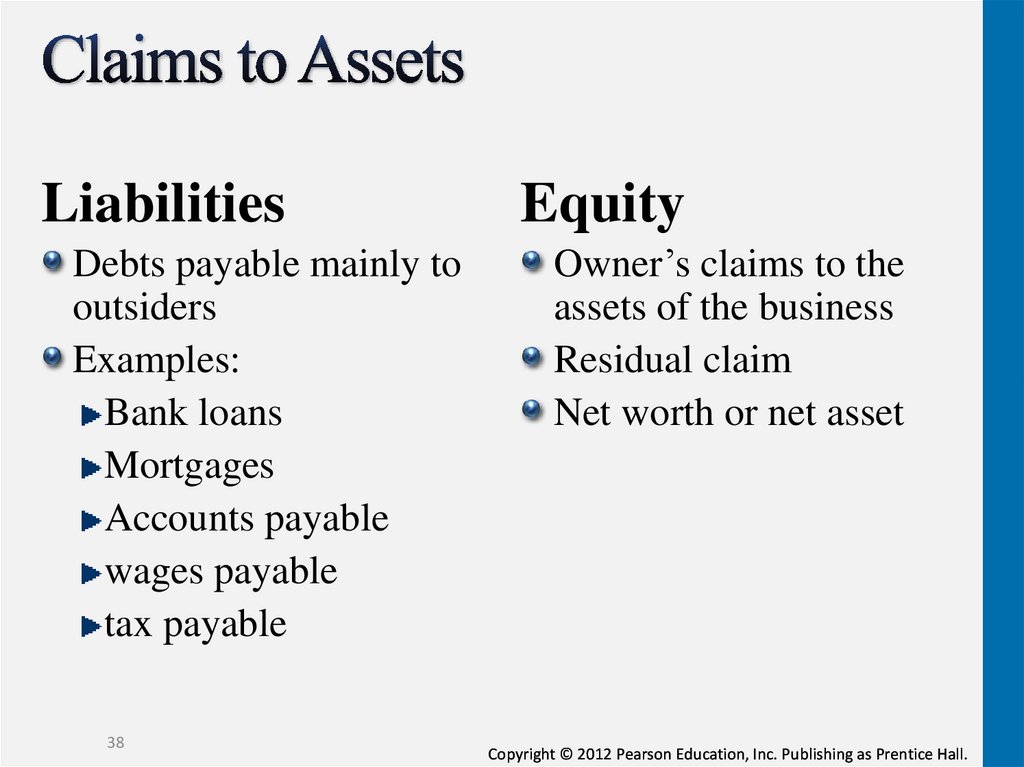

LiabilitiesDebts payable mainly to

outsiders

Examples:

Bank loans

Mortgages

Accounts payable

wages payable

tax payable

38

Equity

Owner’s claims to the

assets of the business

Residual claim

Net worth or net asset

Copyright © 2012 Pearson Education, Inc. Publishing as Prentice Hall.

39.

Assets=

Liabilities

+

Equity

The owner’s capital refers to the

owner contribution

Owner’s Capital

profit

+Revenue

-Expense

©2014Pearson

Education,Inc.Publishing

asPrenticeHall

-Owner’s

Withdrawals 1-39

Copyright © 2012 Pearson Education, Inc. Publishing as Prentice Hall.

40.

Amounts earned in business operation bydelivering goods, services to customers, rental of

property, lending of money or investment.

Sales revenue

Service revenue

Interest revenue

Dividend revenue

40

Copyright © 2012 Pearson Education, Inc. Publishing as Prentice Hall.

41.

Outflows of assets or increasing liabilities inoperating business (delivering goods or services

to customers)

Occurred in the process of earning revenue

Store or rent expense

Salary expense

Advertising expense

Utilities expense

Interest expense

Property tax expense

41

Copyright © 2012 Pearson Education, Inc. Publishing as Prentice Hall.

42.

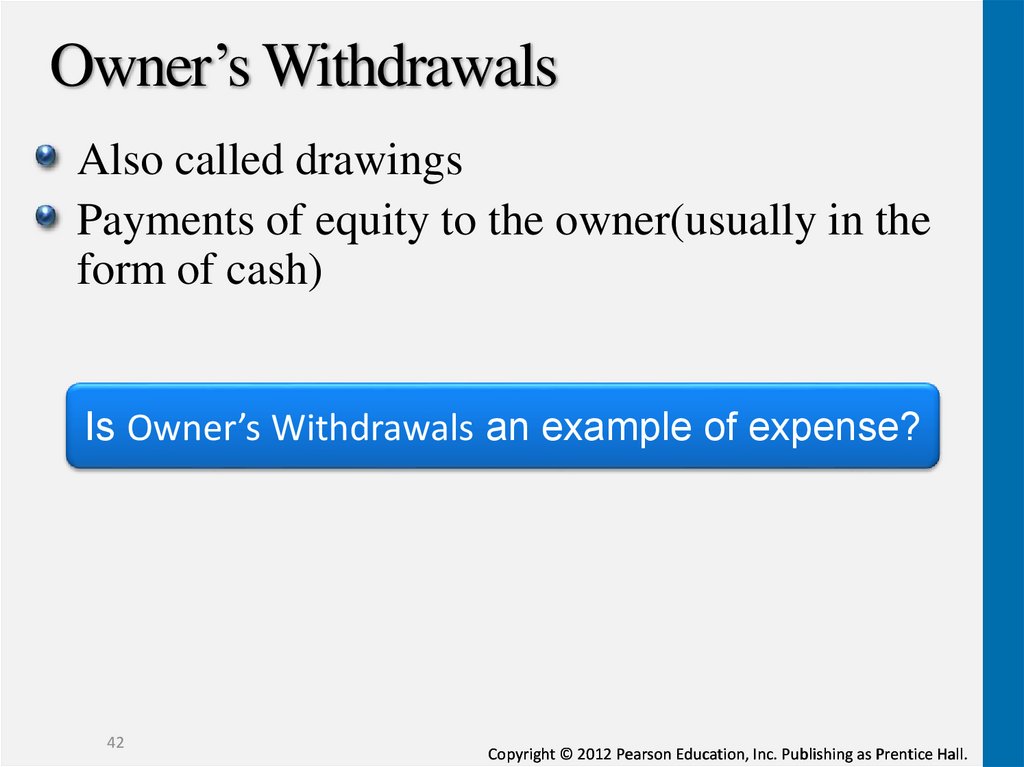

Owner’s WithdrawalsAlso called drawings

Payments of equity to the owner(usually in the

form of cash)

Is Owner’s Withdrawals an example of expense?

42

Copyright © 2012 Pearson Education, Inc. Publishing as Prentice Hall.

43.

Equity (for a corporation)For a corporation, equity is called Stockholders’ equity:

Stockholders’ equity= Paid-in capital + Retained earnings

Paid in Capital represents the total amount invested

by stockholders in a corporation.

43

Retained earnings represents

cumulative profits (or losses) retained

in the business over time.

=beginning retained earning +revenueexpense-dividend

Dividend is like owner’s withdrawals

for proprietorship.

Copyright © 2012 Pearson Education, Inc. Publishing as Prentice Hall.

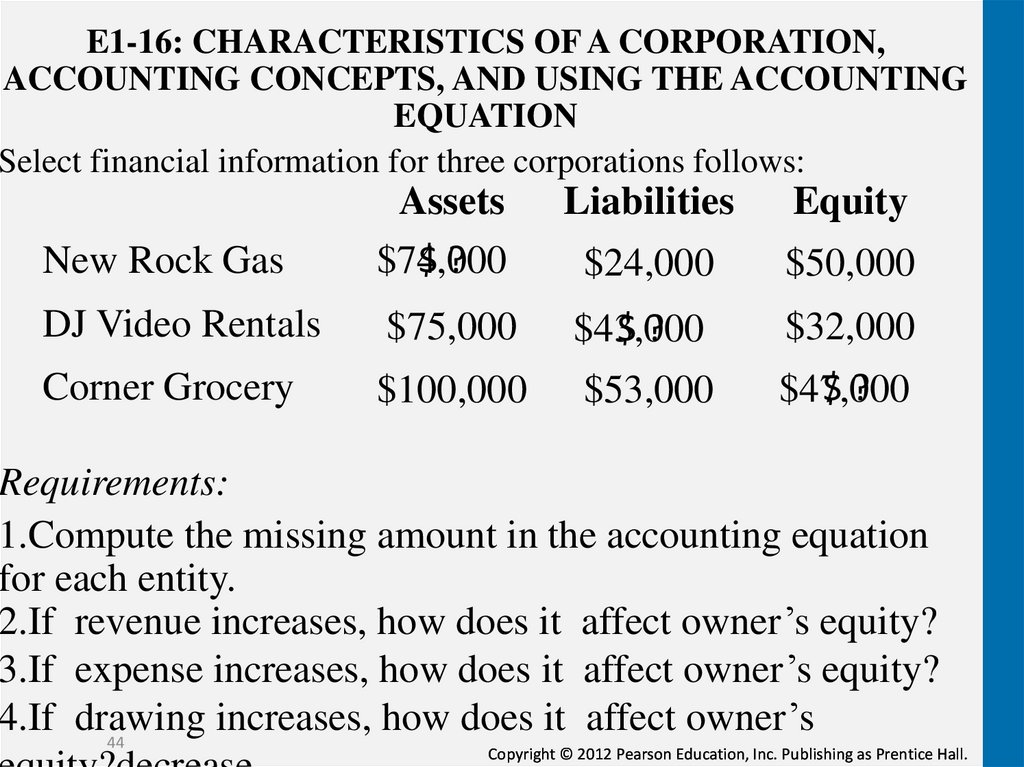

44.

E1-16: CHARACTERISTICS OF A CORPORATION,ACCOUNTING CONCEPTS, AND USING THE ACCOUNTING

EQUATION

Select financial information for three corporations follows:

Liabilities

Equity

New Rock Gas

Assets

$?

$74,000

$24,000

$50,000

DJ Video Rentals

$75,000

$?

$43,000

$32,000

Corner Grocery

$100,000

$53,000

$?

$47,000

Requirements:

1.Compute the missing amount in the accounting equation

for each entity.

2.If revenue increases, how does it affect owner’s equity?

3.If expense increases, how does it affect owner’s equity?

4.If drawing

increases, how does it affect owner’s

44

Copyright © 2012 Pearson Education, Inc. Publishing as Prentice Hall.

45.

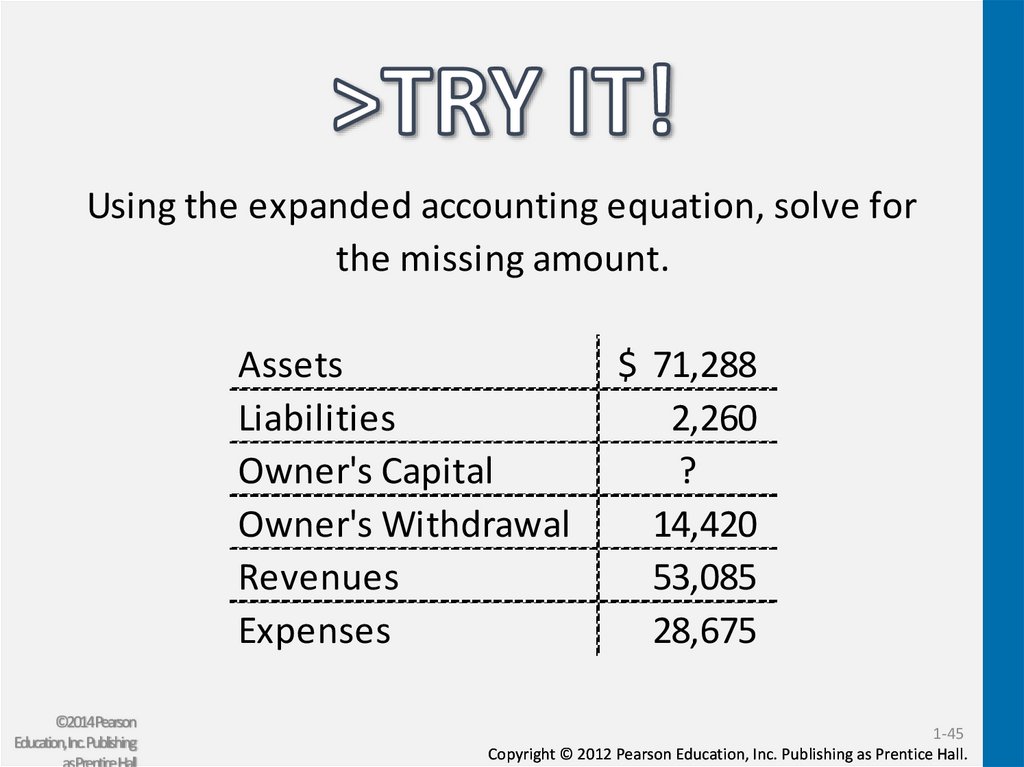

Using the expanded accounting equation, solve forthe missing amount.

Assets

Liabilities

Owner's Capital

Owner's Withdrawal

Revenues

Expenses

©2014Pearson

Education,Inc.Publishing

asPrenticeHall

$ 71,288

2,260

?

14,420

53,085

28,675

1-45

Copyright © 2012 Pearson Education, Inc. Publishing as Prentice Hall.

46.

8Use the accounting equation to

analyze transactions

46

Copyright © 2012 Pearson Education, Inc. Publishing as Prentice Hall.

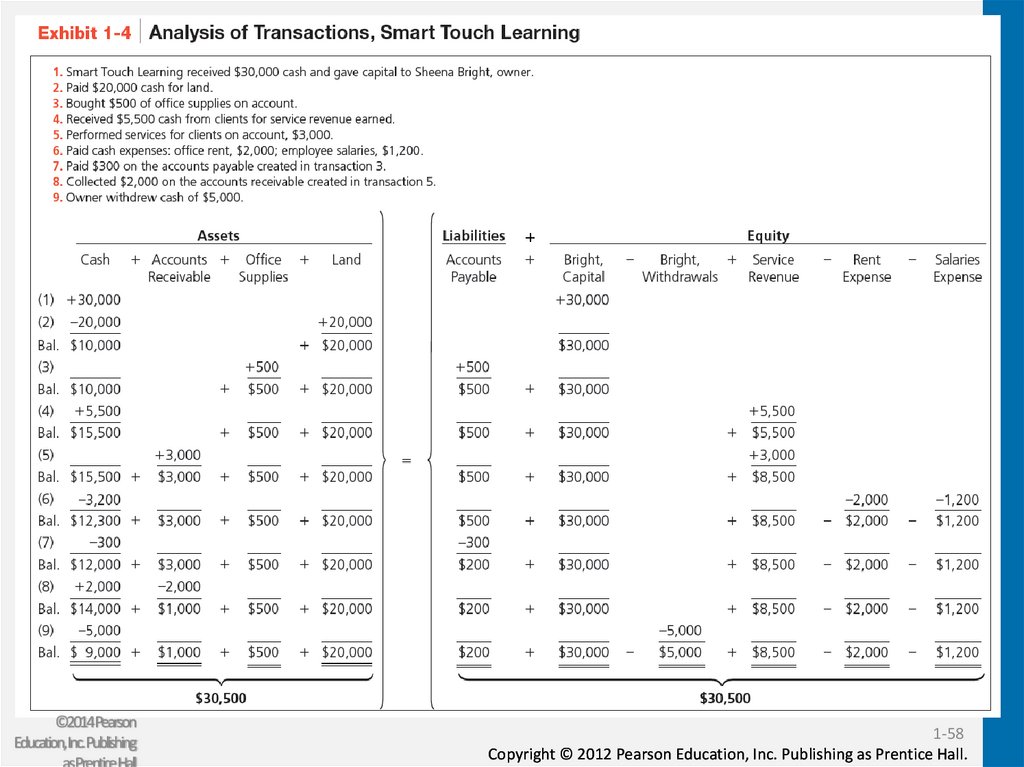

47.

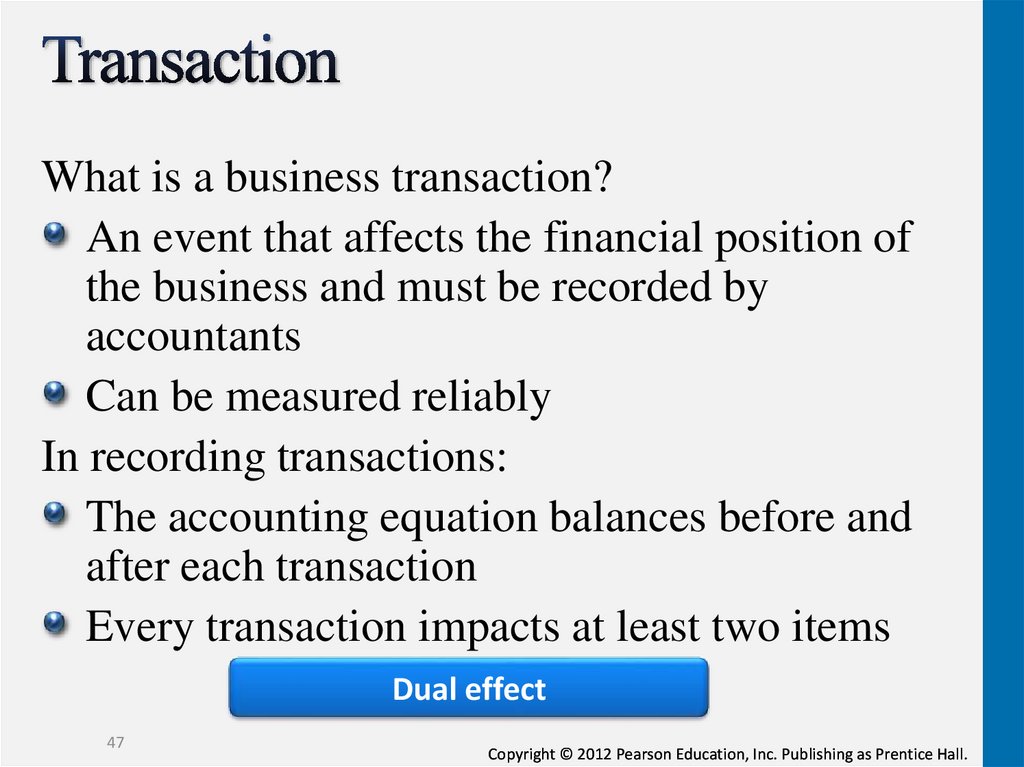

What is a business transaction?An event that affects the financial position of

the business and must be recorded by

accountants

Can be measured reliably

In recording transactions:

The accounting equation balances before and

after each transaction

Every transaction impacts at least two items

Dual effect

47

Copyright © 2012 Pearson Education, Inc. Publishing as Prentice Hall.

48.

TRANSACTION 1November 2, 2014, Sheena Bright decide to start elearning agency company as a proprietorship named

Smart Touch Learning, Inc.

She invests $30,000 cash in exchange for $30,000 of

capital.

Assets

=

Liabilities

Bright, capital

Cash

(1) +30,000

+ Owner’s Equity

=

+30,000

1 accounts? types?

2 change?

3 balanced?

There is an increase in the asset Cash, $30,000, and an

equal increase in the owner’ equity, Bright ,capital,

$30,000.

Copyright © 2012 Pearson Education, Inc. Publishing as Prentice Hall.

49.

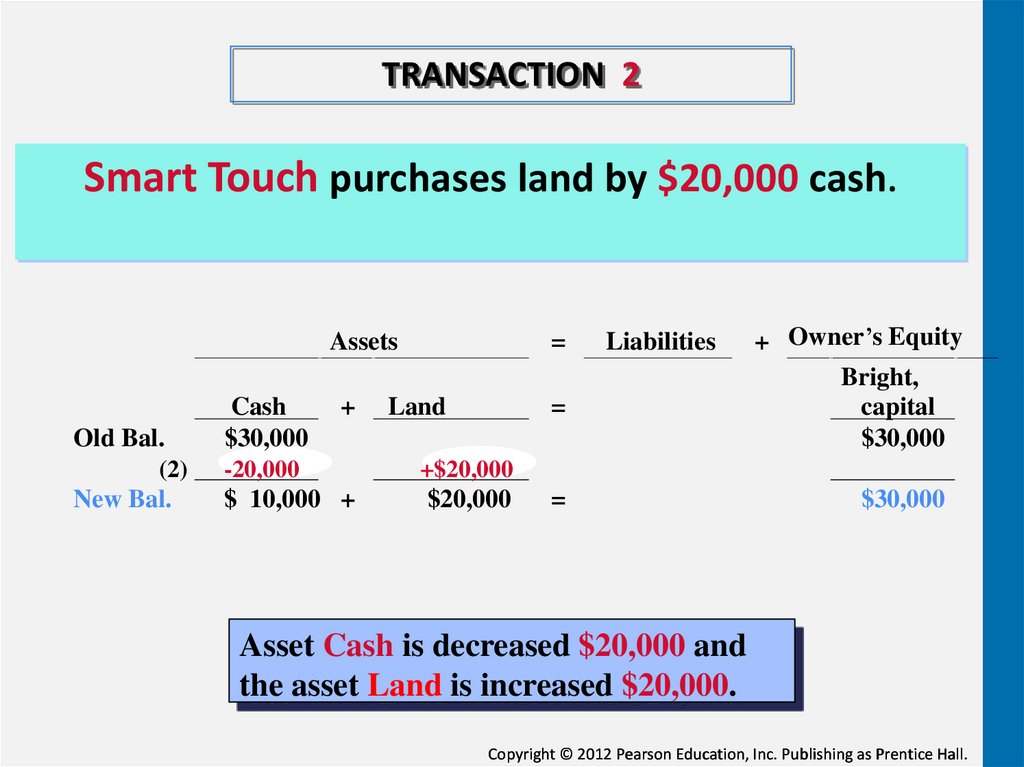

TRANSACTION 2Smart Touch purchases land by $20,000 cash.

Old Bal.

(2)

New Bal.

Cash

$30,000

Assets

=

+

=

Land

-20,000

+$20,000

$ 10,000 +

$20,000

Liabilities

=

+ Owner’s Equity

Bright,

capital

$30,000

$30,000

Asset Cash is decreased $20,000 and

the asset Land is increased $20,000.

Copyright © 2012 Pearson Education, Inc. Publishing as Prentice Hall.

50.

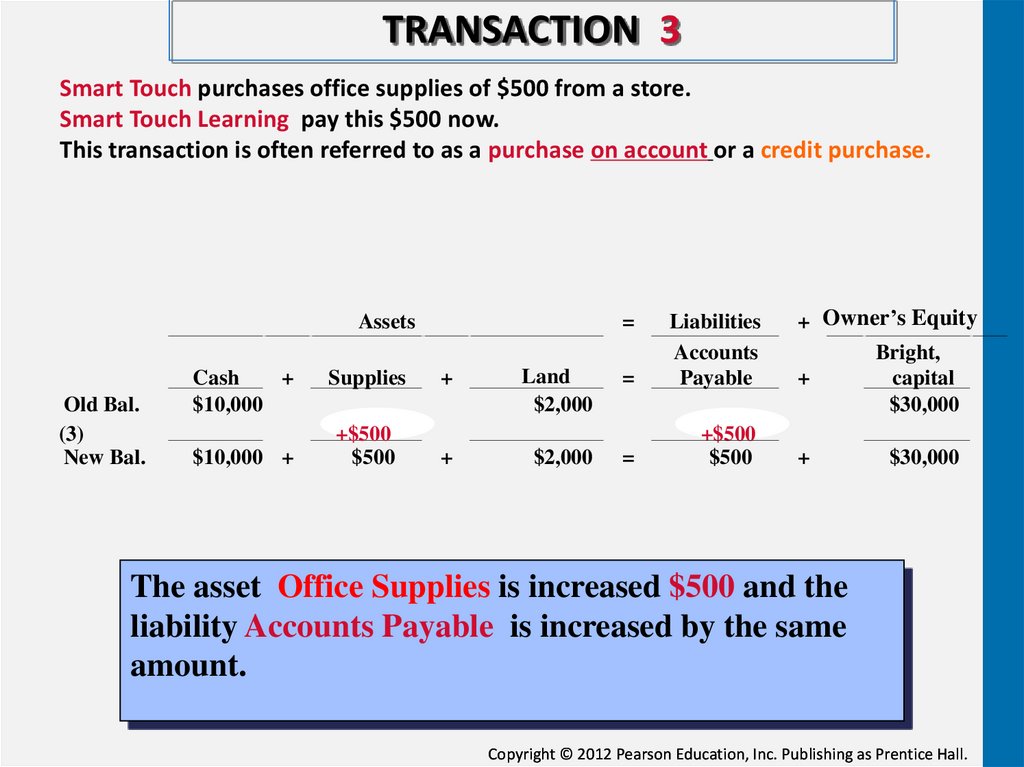

TRANSACTION 3Smart Touch purchases office supplies of $500 from a store.

Smart Touch Learning pay this $500 now.

This transaction is often referred to as a purchase on account or a credit purchase.

Assets

Old Bal.

(3)

New Bal.

Cash

+

$10,000

$10,000 +

Supplies

+$500

$500

=

+

+

Land

$2,000

$2,000

=

Liabilities

Accounts

Payable

=

+$500

$500

+ Owner’s Equity

Bright,

+

capital

$30,000

+

$30,000

The asset Office Supplies is increased $500 and the

liability Accounts Payable is increased by the same

amount.

Copyright © 2012 Pearson Education, Inc. Publishing as Prentice Hall.

51.

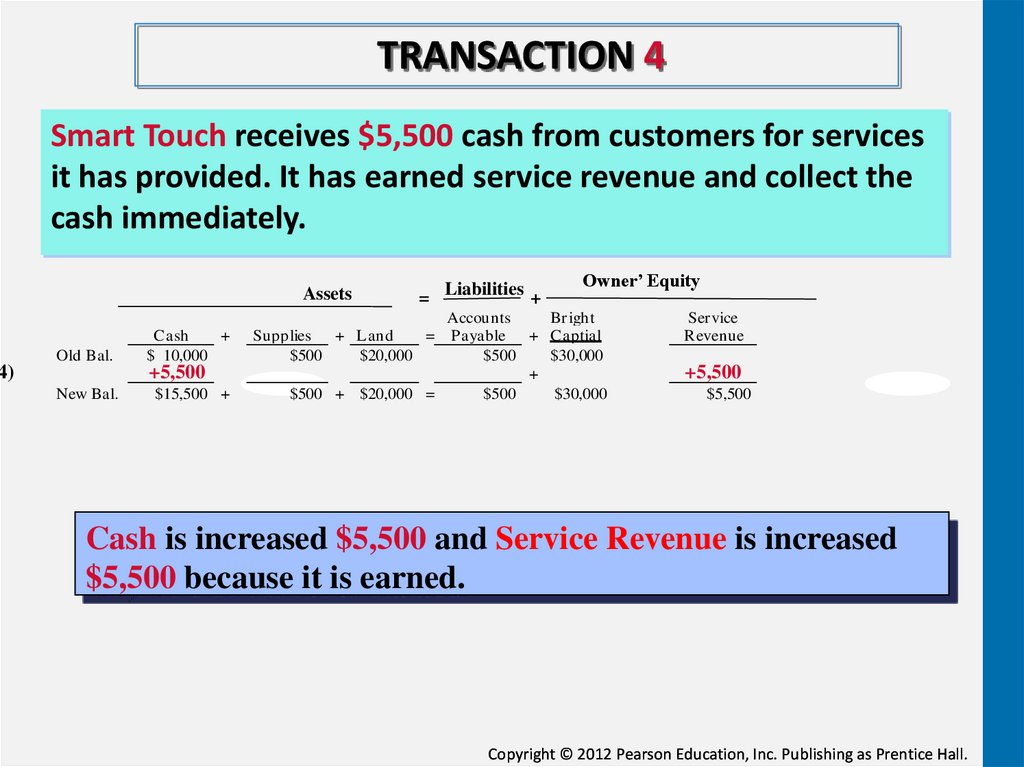

TRANSACTION 4Smart Touch receives $5,500 cash from customers for services

it has provided. It has earned service revenue and collect the

cash immediately.

Assets

Old Bal.

4)

Cash

+

$ 10,000

+5,500

New Bal.

$15,500 +

= Liabilities +

Owner’ Equity

Accounts

Br ight

Supplies

+ Land

= Payable + Captial

$500

$20,000

$500

$30,000

+

$500 + $20,000 =

$500

$30,000

Ser vice

Revenue

+5,500

$5,500

Cash is increased $5,500 and Service Revenue is increased

$5,500 because it is earned.

Copyright © 2012 Pearson Education, Inc. Publishing as Prentice Hall.

52.

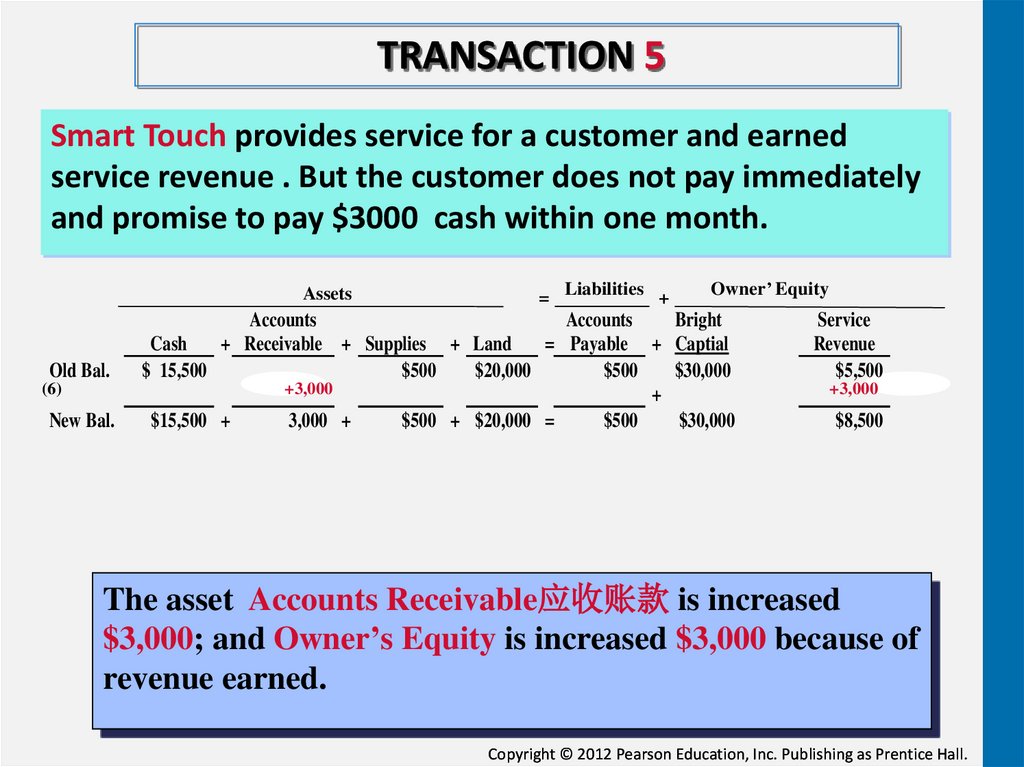

TRANSACTION 5Smart Touch provides service for a customer and earned

service revenue . But the customer does not pay immediately

and promise to pay $3000 cash within one month.

Assets

Old Bal.

(6)

New Bal.

= Liabilities +

Owner’ Equity

Accounts

Accounts

Bright

Cash

+ Receivable + Supplies + Land

= Payable + Captial

$ 15,500

$500

$20,000

$500

$30,000

+3,000

+

$15,500 +

3,000 +

$500 + $20,000 =

$500

$30,000

Service

Revenue

$5,500

+3,000

$8,500

The asset Accounts Receivable应收账款 is increased

$3,000; and Owner’s Equity is increased $3,000 because of

revenue earned.

Copyright © 2012 Pearson Education, Inc. Publishing as Prentice Hall.

53.

TRANSACTION 6Smart Touch pays $3,200 cash for expenses:

$2,000 for office rent and $1,200 for employee salaries.

$35,700

Cash is decreased $3,200 and Owner’s equity is

decreased by $3,200 because of expense occurred.

.

Copyright © 2012 Pearson Education, Inc. Publishing as Prentice Hall.

54.

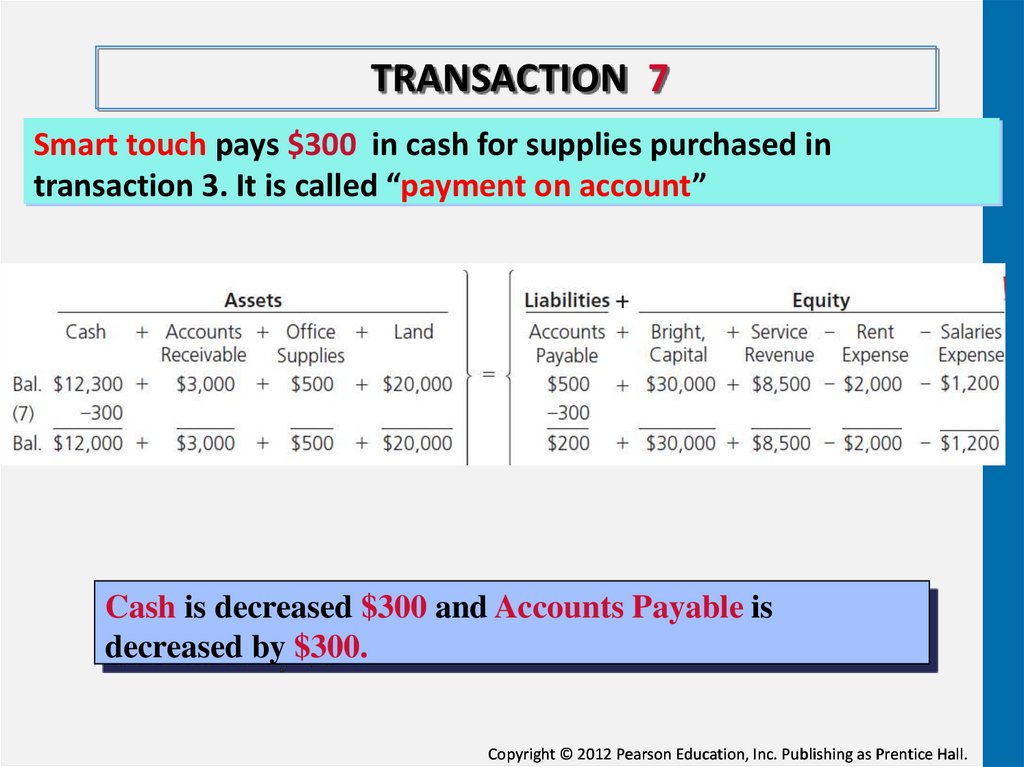

TRANSACTION 7Smart touch pays $300 in cash for supplies purchased in

transaction 3. It is called “payment on account”

Cash is decreased $300 and Accounts Payable is

decreased by $300.

Copyright © 2012 Pearson Education, Inc. Publishing as Prentice Hall.

55.

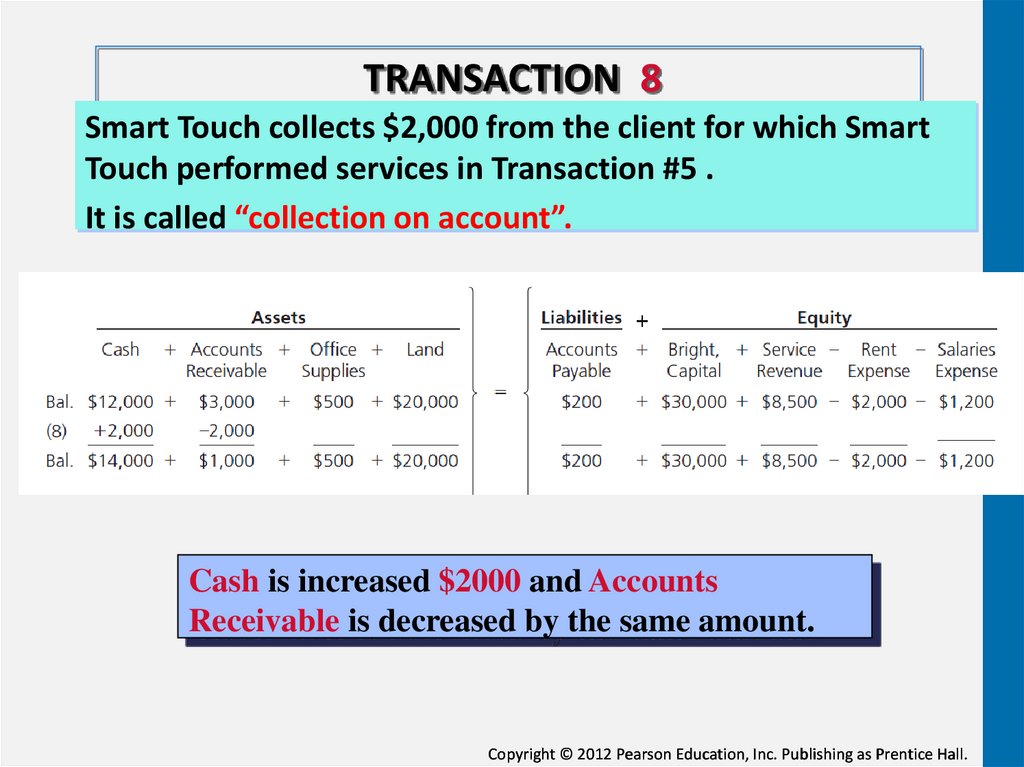

TRANSACTION 8Smart Touch collects $2,000 from the client for which Smart

Touch performed services in Transaction #5 .

It is called “collection on account”.

Cash is increased $2000 and Accounts

Receivable is decreased by the same amount.

Copyright © 2012 Pearson Education, Inc. Publishing as Prentice Hall.

56.

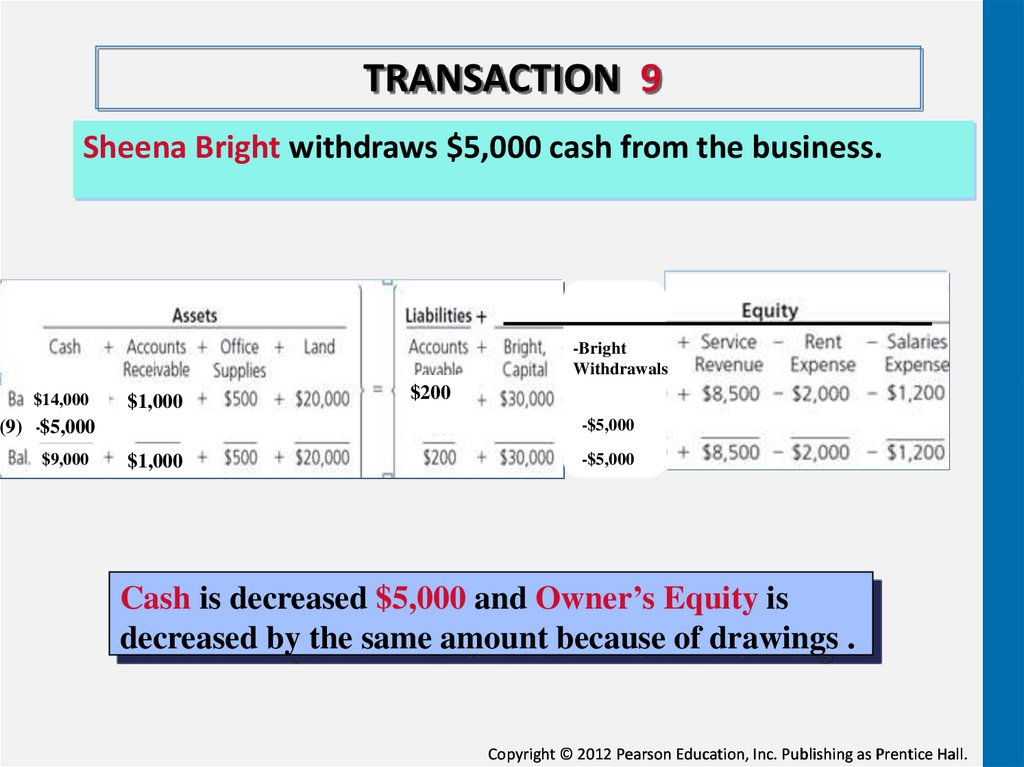

TRANSACTION 9Sheena Bright withdraws $5,000 cash from the business.

-Bright

Withdrawals

$14,000

$1,000

-$5,000

(9) -$5,000

$9,000

$200

$1,000

-$5,000

Cash is decreased $5,000 and Owner’s Equity is

decreased by the same amount because of drawings .

Copyright © 2012 Pearson Education, Inc. Publishing as Prentice Hall.

57.

What happens now?Sheena Bright pays $200 to buy groceries at a cost of $200,

paying cash from her personal account.

Copyright © 2012 Pearson Education, Inc. Publishing as Prentice Hall.

58.

©2014PearsonEducation,Inc.Publishing

asPrenticeHall

1-58

Copyright © 2012 Pearson Education, Inc. Publishing as Prentice Hall.

59.

Remember: the two sides ofthe accounting equation

must always be equal!!

会计 当而已矣

Copyright © 2012 Pearson Education, Inc. Publishing as Prentice Hall.

60.

On Mar.1, Ray and Barbara Neal invest $15,000 cash in Softbyte in exchangefor $15,000 of capital.

On Mar.5, Softbyte receives a utility bill for $1000 from the Daily Utilities

Company for utilities expense but postpones payment of

the bill until a later date.

On Mar.10, Softbyte pays its Daily Utilities bill of $1000 in cash.

On Mar.15, Softbyte provides services of $4,000 for customers.

A bill of $4,000 is sent to customers on account.

On Mar 22, the amount of $500 in cash is received from customers

who have previously been billed for services provided on Mar. 15.

.

60

Copyright © 2012 Pearson Education, Inc. Publishing as Prentice Hall.

61.

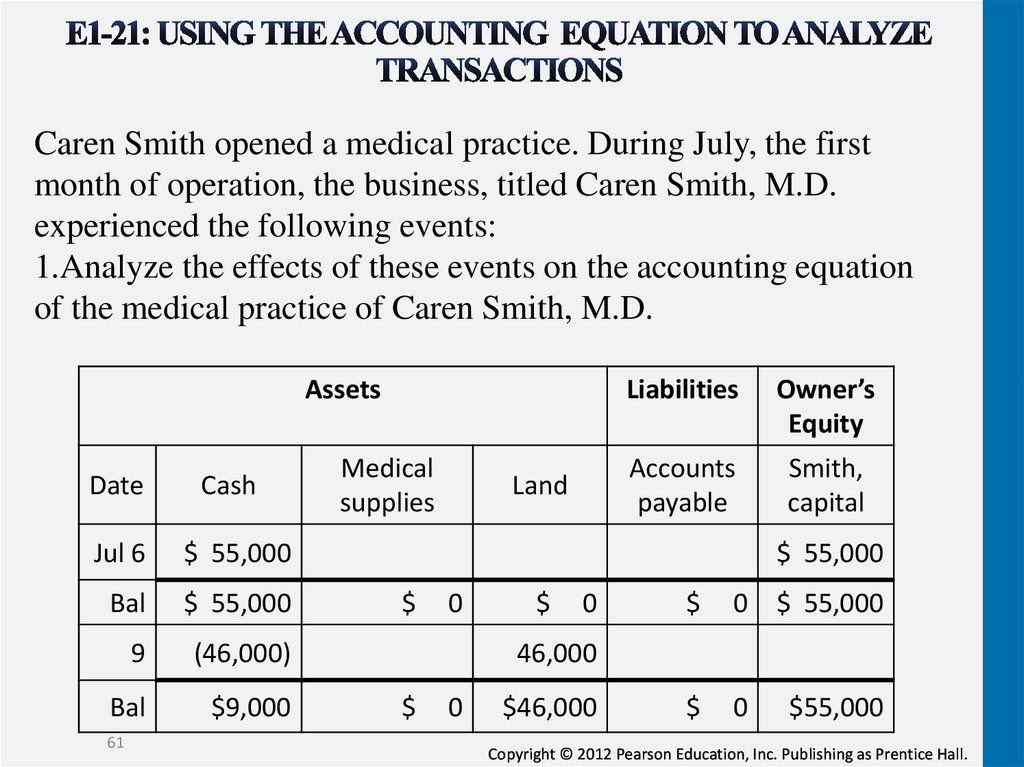

Caren Smith opened a medical practice. During July, the firstmonth of operation, the business, titled Caren Smith, M.D.

experienced the following events:

1.Analyze the effects of these events on the accounting equation

of the medical practice of Caren Smith, M.D.

Assets

Date

Cash

Jul 6

$ 55,000

Bal

$ 55,000

9

(46,000)

Bal

$9,000

61

Medical

supplies

Land

Liabilities

Owner’s

Equity

Accounts

payable

Smith,

capital

$ 55,000

$

0

$

0

$

0

$ 55,000

$

0

$55,000

46,000

$

0

$46,000

Copyright © 2012 Pearson Education, Inc. Publishing as Prentice Hall.

62.

AssetsDate

Cash

Jul 12

Bal

Medical

supplies

Land

$1,800

Liabilities

Owner’s

Equity

Accounts

payable

Smith,

capital

$1,800

$9,000

$1,800

$46,000

$1,800

$55,000

Bal

$9,000

$1,800

$46,000

$1,800

$55,000

15-31

8,000

Bal

$17,000

29

(1,600)

(900)

(100)

15

62

8,000

$1,800

$46,000

$1,800

$63,000

(1,600)

(900)

(100)

Copyright © 2012 Pearson Education, Inc. Publishing as Prentice Hall.

63.

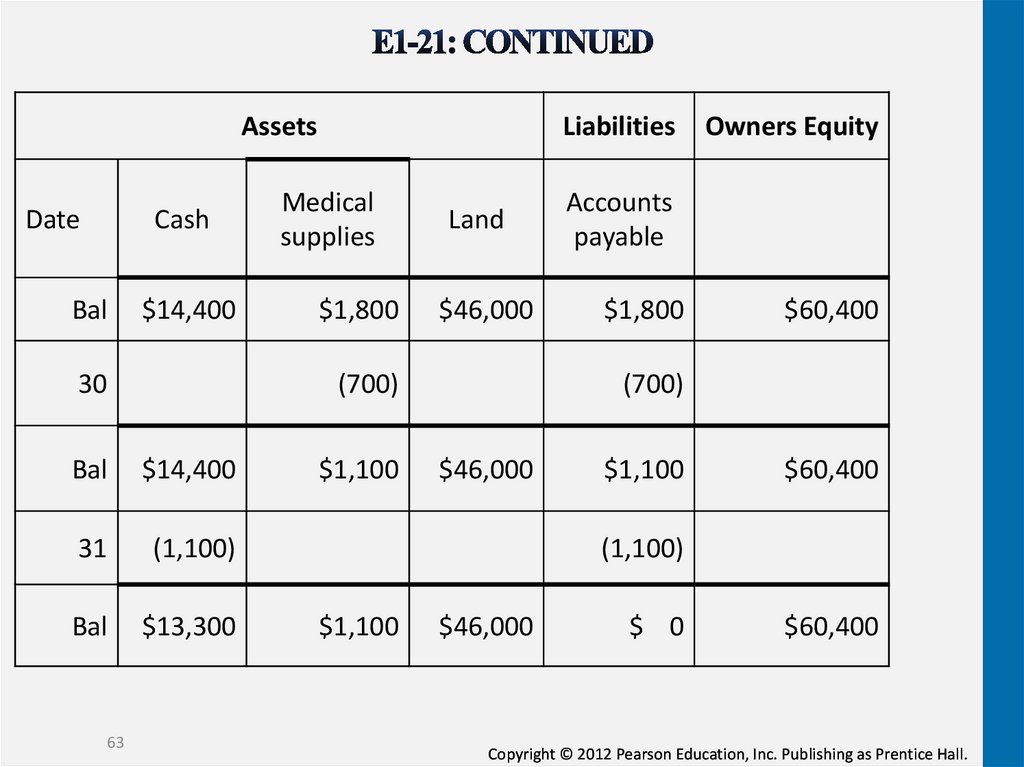

AssetsDate

Cash

Bal

$14,400

30

Medical

supplies

$1,800

Land

$46,000

(700)

Bal

$14,400

31

(1,100)

Bal

$13,300

63

Liabilities

$1,100

Owners Equity

Accounts

payable

$1,800

$60,400

(700)

$46,000

$1,100

$60,400

(1,100)

$1,100

$46,000

$ 0

$60,400

Copyright © 2012 Pearson Education, Inc. Publishing as Prentice Hall.

64.

9Prepare financial statements

64

Copyright © 2012 Pearson Education, Inc. Publishing as Prentice Hall.

65.

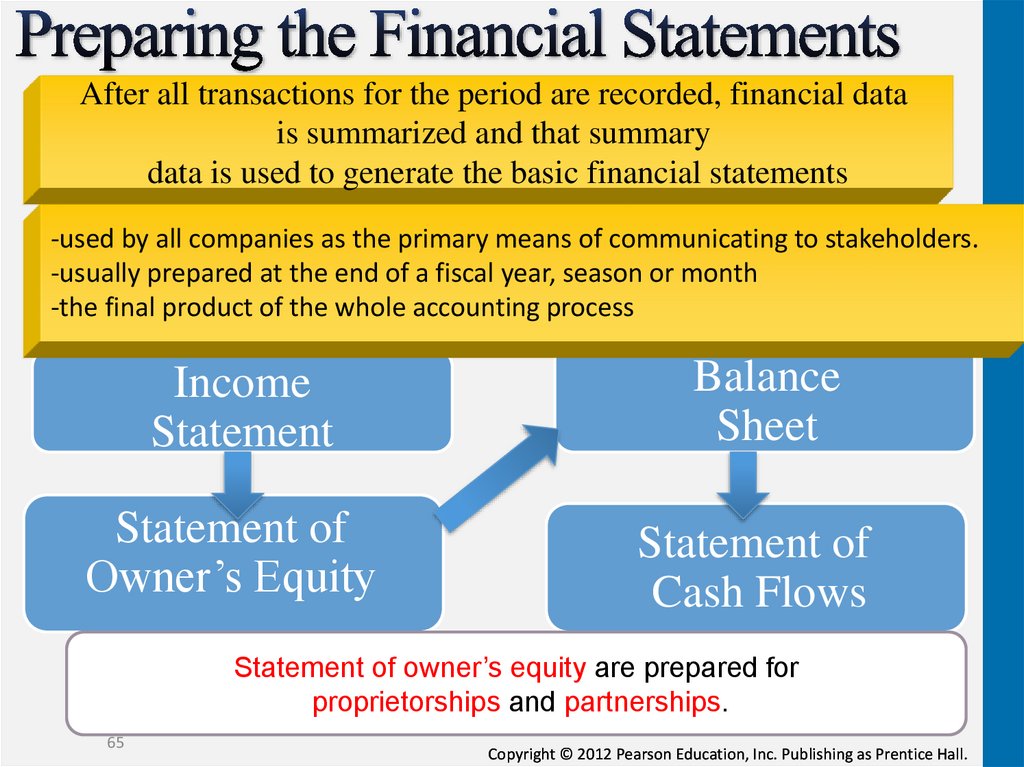

After all transactions for the period are recorded, financial datais summarized and that summary

data is used to generate the basic financial statements

-used by all companies as the primary means of communicating to stakeholders.

-usually prepared at the end of a fiscal year, season or month

-the final product of the whole accounting process

Income

Statement

Balance

Sheet

Statement of

Owner’s Equity

Statement of

Cash Flows

Statement of owner’s equity are prepared for

proprietorships and partnerships.

65

Copyright © 2012 Pearson Education, Inc. Publishing as Prentice Hall.

66.

Income STATEMENTSMART TOUCH LEARNING, INC.

Income Statement

For the Month Ended November 30, 2013

Revenues

Service revenue

Expenses

Rent expense

Salaries expense

Total expenses

Net income

$ 8,500

2,000

1,200

Reports the

success or failure

of the company’s

operations for a

period of time.

3,200

5,300

Net income of $5,300 will be added to Equity.

Copyright © 2012 Pearson Education, Inc. Publishing as Prentice Hall.

67.

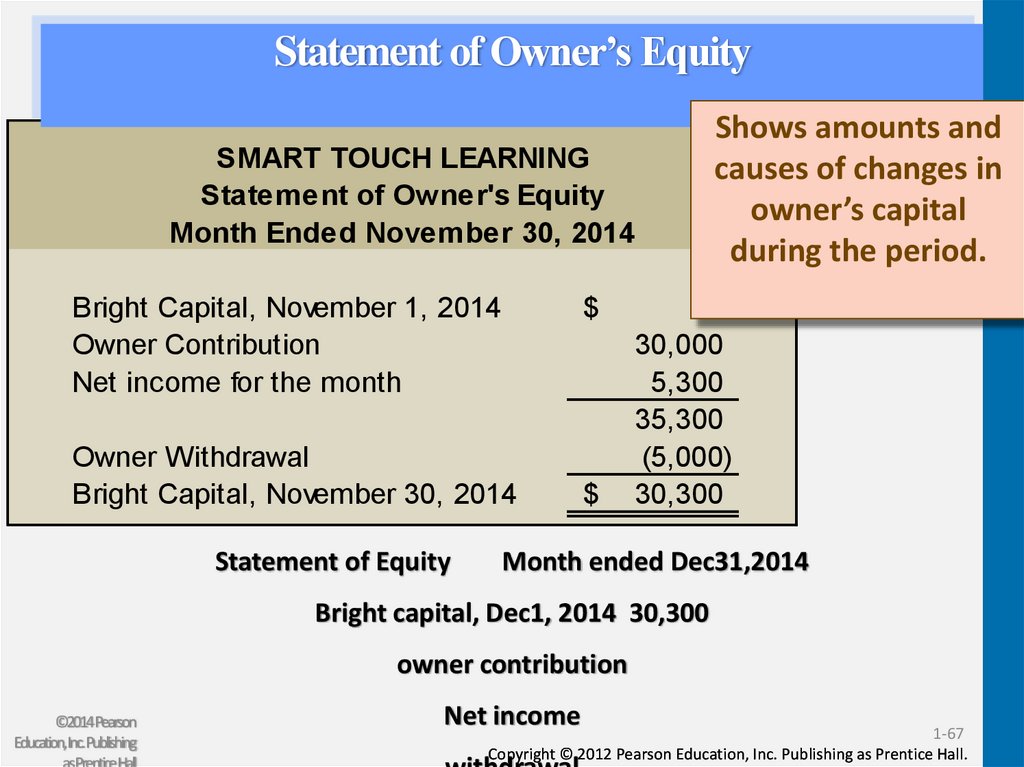

Statement of Owner’s EquitySMART TOUCH LEARNING

Statement of Owner's Equity

Month Ended November 30, 2014

Bright Capital, November 1, 2014

Owner Contribution

Net income for the month

$

Owner Withdrawal

Bright Capital, November 30, 2014

Statement of Equity

$

Shows amounts and

causes of changes in

owner’s capital

during the period.

30,000

5,300

35,300

(5,000)

30,300

Month ended Dec31,2014

Bright capital, Dec1, 2014 30,300

owner contribution

©2014Pearson

Education,Inc.Publishing

asPrenticeHall

Net income

1-67

Copyright © 2012 Pearson Education, Inc. Publishing as Prentice Hall.

68.

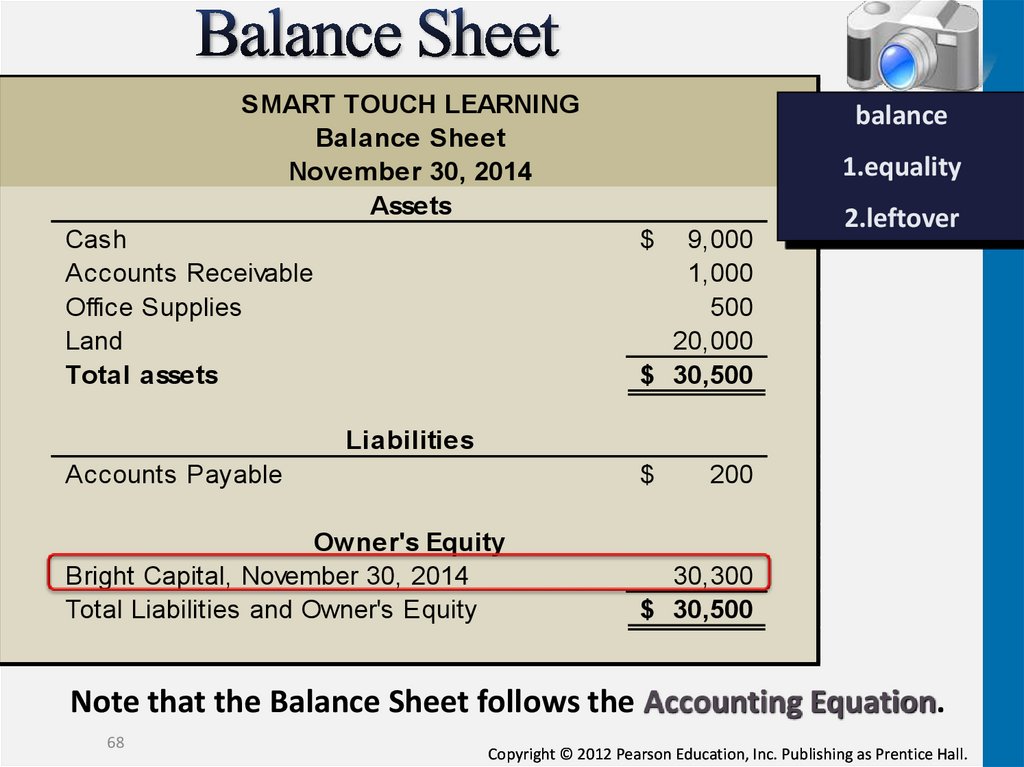

SMART TOUCH LEARNINGBalance Sheet

November 30, 2014

Assets

Cash

Accounts Receivable

Office Supplies

Land

Total assets

balance

1.equality

$

9,000

1,000

500

20,000

$ 30,500

2.leftover

Liabilities

Accounts Payable

$

200

Owner's Equity

Bright Capital, November 30, 2014

Total Liabilities and Owner's Equity

30,300

$ 30,500

Note that the Balance Sheet follows the Accounting Equation.

68

Copyright © 2012 Pearson Education, Inc. Publishing as Prentice Hall.

69.

Answers the question of whether the businessgenerates enough cash to pay its bills.

The statement of cash flows reports the cash

receipts (positive amounts) and the cash

payments out (negative amounts) during a

period.

69

Copyright © 2012 Pearson Education, Inc. Publishing as Prentice Hall.

70.

SMART TOUCH LEARNINGStatement of Cash Flows

Month Ended November 30, 2014

Cash Flows from Operating Activities:

Receipts:

Collections from customers

Payments:

For rent

$ (2,000)

For salaries

(1,200)

For office supplies

(300)

Net cash provided by operating activities

Cash Flows from Investing Activities:

Acquisition of land

$

(3,500)

4,000

(20,000)

Net cash used by investing activities

Cash Flows from Financing Activities:

Owner contribution

Owner withdrawals

(20,000)

30,000

(5,000)

Net cash provided by financing activities

Net increase in cash

Cash balance, November 1, 2014

Cash balance, November 30, 2014

7,500

25,000

$

9,000

9,000

Copyright © 2012 Pearson Education, Inc. Publishing as Prentice Hall.

71.

Studio Photography is a priortership . The balance of Ansel, capital was$45,000 at November 31, 2012. At December 31, 2012, the business’s

accounting records show these balances:

Insurance expense

$ 8,000 Accounts receivable

$ 8,000

Cash

37,000 Note payable

12,000

Accounts payable

7,000 Ansel, capital, Dec 31, 2012

Advertising expense

3,000 Salary expense

25,000

Service revenue

80,000 Equipment

50,000

Ansel, drawing

13,000

?

Prepare the following financial statements for Studio Photography, Inc. (a

proprietorship)for the month ended December 31, 2012:

a. Income statement

b. Statement of owner’s equity

c. Balance sheet

71

Copyright © 2012 Pearson Education, Inc. Publishing as Prentice Hall.

72.

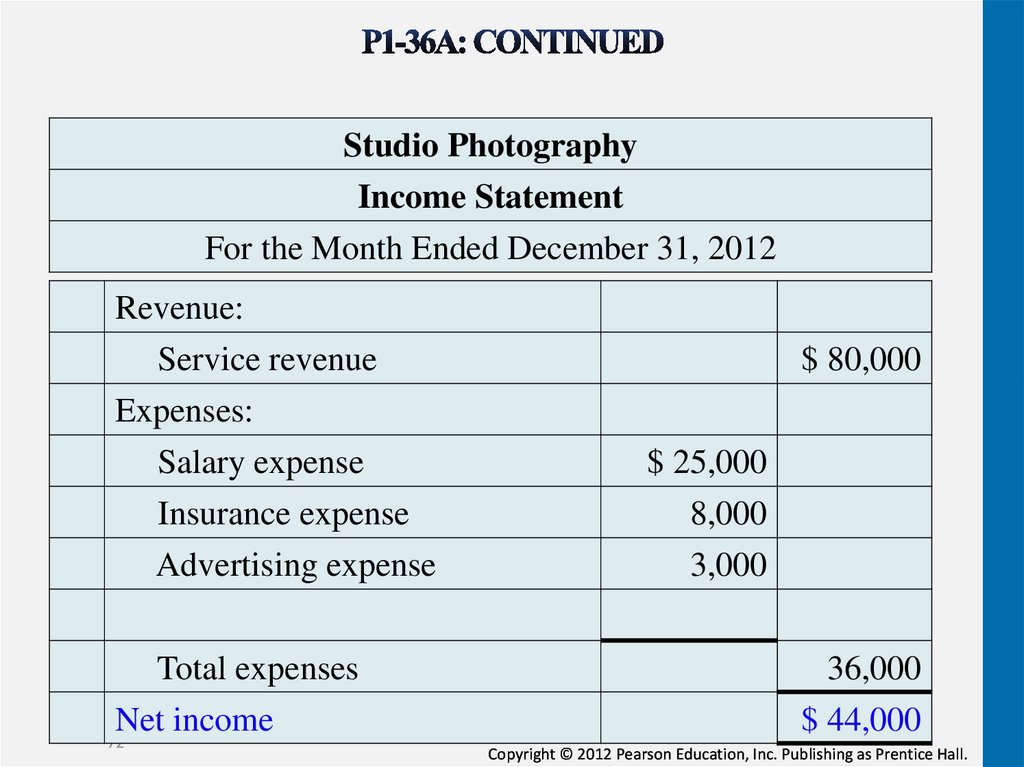

Studio PhotographyIncome Statement

For the Month Ended December 31, 2012

Revenue:

Service revenue

Expenses:

Salary expense

Insurance expense

Advertising expense

Total expenses

Net income

72

$ 80,000

$ 25,000

8,000

3,000

36,000

$ 44,000

Copyright © 2012 Pearson Education, Inc. Publishing as Prentice Hall.

73.

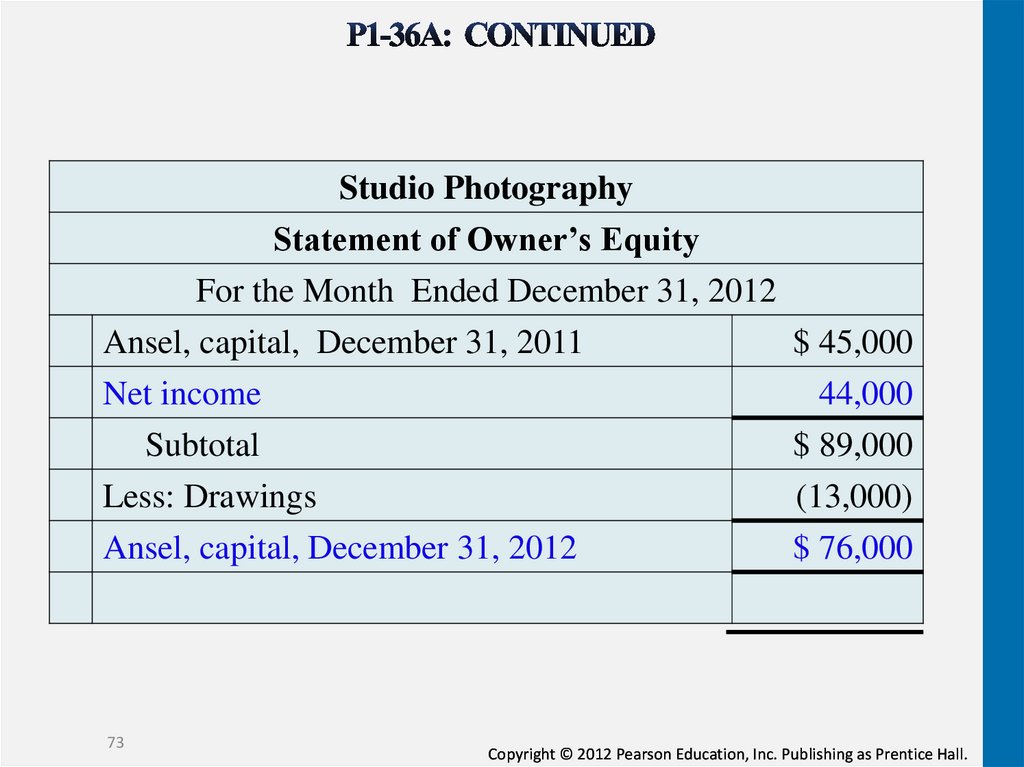

Studio PhotographyStatement of Owner’s Equity

For the Month Ended December 31, 2012

Ansel, capital, December 31, 2011

$ 45,000

Net income

44,000

Subtotal

$ 89,000

Less: Drawings

(13,000)

Ansel, capital, December 31, 2012

$ 76,000

73

Copyright © 2012 Pearson Education, Inc. Publishing as Prentice Hall.

74.

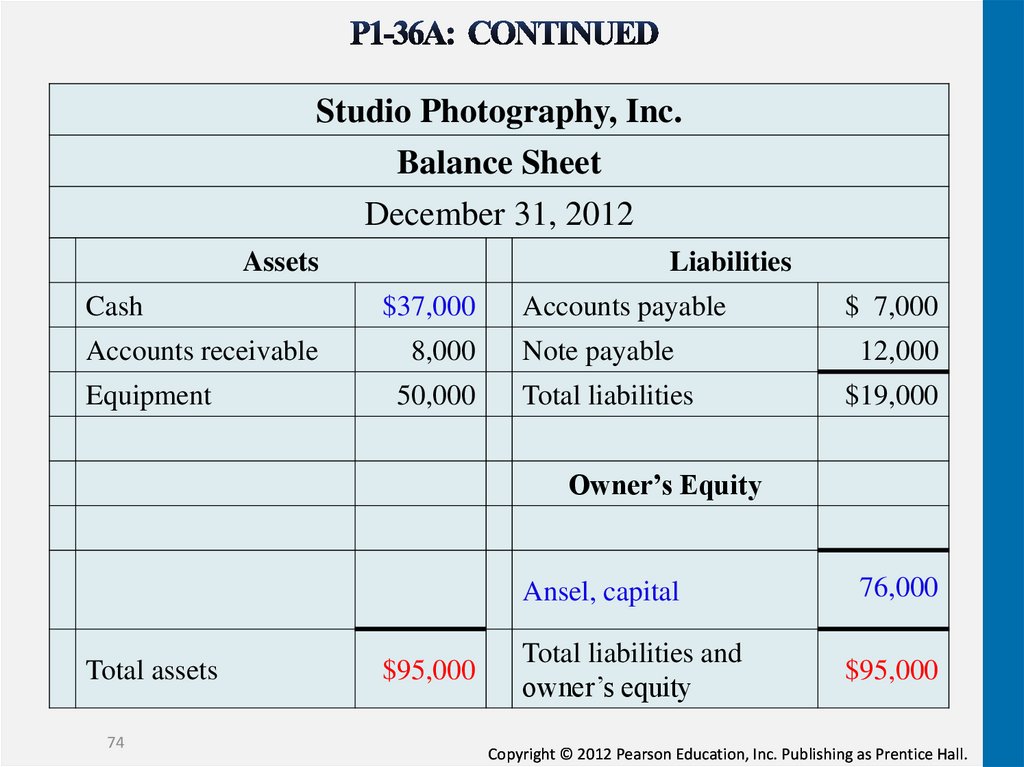

Studio Photography, Inc.Balance Sheet

December 31, 2012

Assets

Cash

Liabilities

$37,000

Accounts payable

$ 7,000

Accounts receivable

8,000

Note payable

12,000

Equipment

50,000

Total liabilities

$19,000

Owner’s Equity

Total assets

74

$95,000

Ansel, capital

76,000

Total liabilities and

owner’s equity

$95,000

Copyright © 2012 Pearson Education, Inc. Publishing as Prentice Hall.

75.

Accounting is the language of business. Financialstatements report a company’s activities in monetary

terms.

Different users—including individuals, business

owners, managers, investors, creditors, and tax

authorities—review a company’s financial statements

for different reasons. Each user’s goal will determine

which pieces of the financial statements he or she will

find most useful.

75

Copyright © 2012 Pearson Education, Inc. Publishing as Prentice Hall.

76.

Most U.S. businesses follow generally acceptedaccounting principles (GAAP). If the company is

publicly traded, then it must also follow SEC

guidelines. If the company operates internationally,

then international financial reporting standards (IFRS)

will apply. The goal is that, eventually, all public U.S.

companies will report using IFRS rules.

There are five main forms of business organizations:

proprietorships, partnerships, corporations,

LLPs/LLCs, and not-for-profits. Each is unique in its

formation, ownership, life, and liability exposure.

76

Copyright © 2012 Pearson Education, Inc. Publishing as Prentice Hall.

77.

Proprietorships are formed when one person creates abusiness. One person owns the proprietorship.

Although the proprietorship is a separate entity, it has

no continuous life, and the owner has unlimited

liability for the business’s debts. Proprietorships have

a more difficult time raising capital, but have the

advantage of reduced regulation and less taxes than

the corporate form of business.

The accounting concepts are the underlying

assumptions used when recording financial

information for a business. Think of the concepts like

rules of a game. You have to play by the rules.

77

Copyright © 2012 Pearson Education, Inc. Publishing as Prentice Hall.

78.

The accounting equation must always equal. That is,Assets (what you own) must equal Liabilities (what

you owe) + Equity (net worth).

The accounting equation is Assets = Liabilities +

Equity. Every business transaction affects various

parts of the equation, but after each transaction is

recorded, the equation must ALWAYS balance

(equal).

Financial statements are prepared from the ending

balances of each account. Each financial statement

shows a different view of the company’s overall

results

78

Copyright © 2012 Pearson Education, Inc. Publishing as Prentice Hall.

79.

Financial statements are prepared from thetransaction analyses (summary of events) reported

in each account (Exhibit 1-6) in the order shown in

Exhibit 1-7. No one financial statement shows

everything about a company. It is the financial

statements AND the relationships the statements

show that give users the overall picture for a

specific company.

79

Copyright © 2012 Pearson Education, Inc. Publishing as Prentice Hall.

80.

80Copyright © 2012 Pearson Education, Inc. Publishing as Prentice Hall.

Финансы

Финансы