Похожие презентации:

planning of managerial activity Management of Kaspi.kz

1.

planning of managerial activityManagement of

Kaspi.kz

Presented by:

Madina Dauletkyzy

Azhgaliyeva Zhanel

Ykhsan Inzhu

Zhumabek Kamilla

Asyp Aisha

Zhetkergen Nurdana

Bakytbai Nazerke

2024-2025

academic year

2.

Management of Kaspi.kzTable Of Content

01

Introduction

02

Literature review

05

Methodology

06

Findings &

Analysis

03

Company

background

07

Conclusion &

Recommendations

04

Task environment

08

References

3.

Management of Kaspi.kzIntroduction

Kaspi is one of the illustrative examples of how planning can become an

integral element of corporate strategy, ensuring the success of a company in the

long term. The fundamental purpose of planning in this company is to establish

a systematic approach to solving problems that allows you to optimize all

business processes, encompassing financial flow management, innovative

product development, and customer service. Our research aimed to understand the

intricacies of Kaspi.kz’s planning strategies that contribute to sustained market

leadership. We adopted a qualitative research approach, conducting detailed

interviews with Kaspi.kz’s team members.

4.

Litterature reviewHow to take over half of online sales in just eight years

because of planning (Kaspi case )

Kaspi.kz’s success is deeply rooted in effective planning, which enables the

company to adapt to market dynamics, manage risks, and drive

innovation. As a leading financial technology and e-commerce provider in

Kazakhstan, Kaspi.kz integrates its key services—fintech, marketplace,

payments, and government services—into a seamless ecosystem. This

approach not only positions Kaspi.kz as a market leader but also

enhances customer convenience, making it a vital part of everyday life for

millions of Kazakhstani users.

KEY

SERVICES

OF

fintech

marketplace

payments

Kaspi

government

services

5.

literature reviewPlanning Approach

STRATEGIC PLANNING

is a process in which an organization's leaders define their vision for the future and

identify their organization's goals and objectives, , supported by tools like SWOT

analysis to identify strengths, weaknesses, opportunities, and threats

OPERATIONAL PLANNING

Operational planning is the process of creating actionable steps that your team

can take to meet the goals in your strategic plan.

FINANCIAL PLANNING

Financial planning is the process of assessing the current financial situation of a

business to identify future financial goals and how to achieve them.

KEY ASPECTS OF KASPI

Is approach is the incorporation of customer feedback, using

proprietary data analytics to refine strategies and maintain its

competitive edge.

6.

Management of Kaspi.kzChallenges and

Solutions in Planning

Despite its achievements, Kaspi.kz encounters challenges in its

planning processes, including the risk of unclear goals and the need

to remain adaptable to external factors such as economic shifts or

regulatory changes. The company addresses these challenges

through a proactive approach, which includes conducting monthly

NPS surveys to gather customer feedback and making necessary

adjustments to strategies. By fostering collaboration across

departments and ensuring flexibility in its plans, Kaspi.kz remains

agile and responsive in an ever-changing market environment

7.

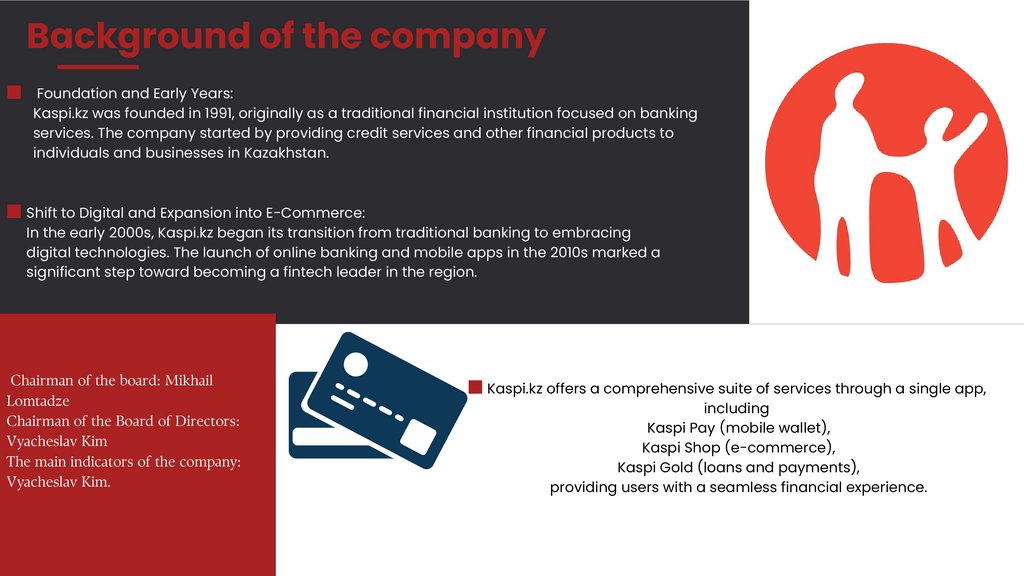

Background of the companyFoundation and Early Years:

Kaspi.kz was founded in 1991, originally as a traditional financial institution focused on banking

services. The company started by providing credit services and other financial products to

individuals and businesses in Kazakhstan.

Shift to Digital and Expansion into E-Commerce:

In the early 2000s, Kaspi.kz began its transition from traditional banking to embracing

digital technologies. The launch of online banking and mobile apps in the 2010s marked a

significant step toward becoming a fintech leader in the region.

Chairman of the board: Mikhail

Lomtadze

Chairman of the Board of Directors:

Vyacheslav Kim

The main indicators of the company:

Vyacheslav Kim.

Kaspi.kz offers a comprehensive suite of services through a single app,

including

Kaspi Pay (mobile wallet),

Kaspi Shop (e-commerce),

Kaspi Gold (loans and payments),

providing users with a seamless financial experience.

8.

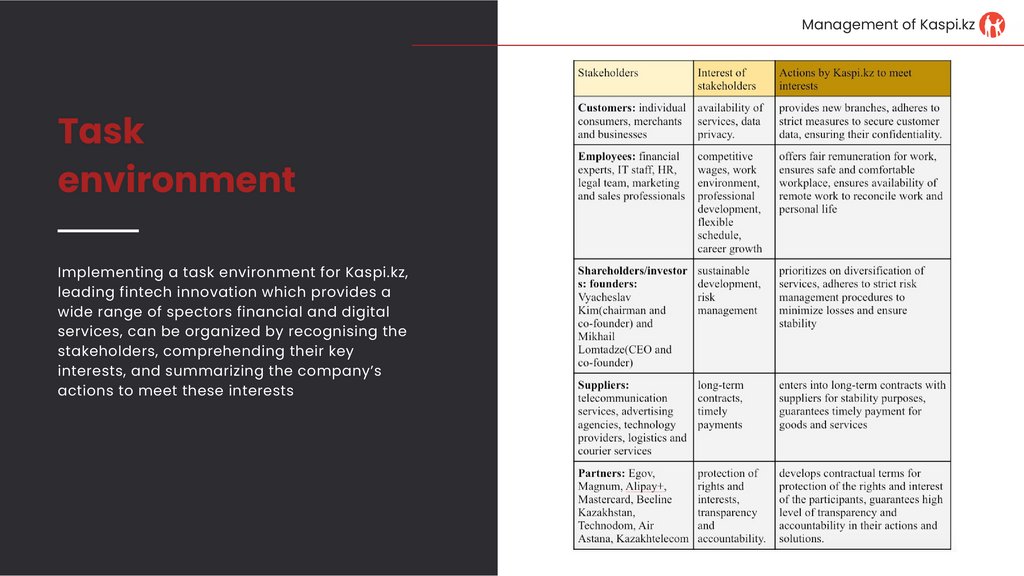

Management of Kaspi.kzTask

environment

Implementing a task environment for Kaspi.kz,

leading fintech innovation which provides a

wide range of spectors financial and digital

services, can be organized by recognising the

stakeholders, comprehending their key

interests, and summarizing the company’s

actions to meet these interests

9.

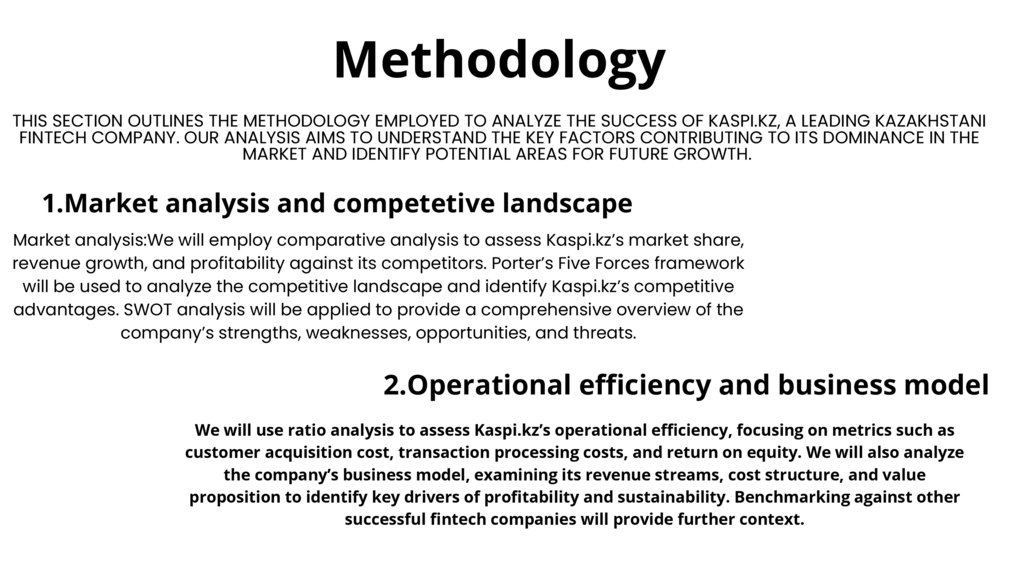

MethodologyTHIS SECTION OUTLINES THE METHODOLOGY EMPLOYED TO ANALYZE THE SUCCESS OF KASPI.KZ, A LEADING KAZAKHSTANI

FINTECH COMPANY. OUR ANALYSIS AIMS TO UNDERSTAND THE KEY FACTORS CONTRIBUTING TO ITS DOMINANCE IN THE

MARKET AND IDENTIFY POTENTIAL AREAS FOR FUTURE GROWTH.

1.Market analysis and competetive landscape

Market analysis:We will employ comparative analysis to assess Kaspi.kz’s market share,

revenue growth, and profitability against its competitors. Porter’s Five Forces framework

will be used to analyze the competitive landscape and identify Kaspi.kz’s competitive

advantages. SWOT analysis will be applied to provide a comprehensive overview of the

company’s strengths, weaknesses, opportunities, and threats.

2.Operational efficiency and business model

We will use ratio analysis to assess Kaspi.kz’s operational efficiency, focusing on metrics such as

customer acquisition cost, transaction processing costs, and return on equity. We will also analyze

the company’s business model, examining its revenue streams, cost structure, and value

proposition to identify key drivers of profitability and sustainability. Benchmarking against other

successful fintech companies will provide further context.

10.

3. Customer experience and BrandPerception

1.DATA SOURCES: WHILE DIRECT ACCESS TO KASPI.KZ’S INTERNAL CUSTOMER DATA IS

UNAVAILABLE, THIS SECTION WILL UTILIZE PUBLICLY AVAILABLE INFORMATION SUCH

AS CUSTOMER REVIEWS AND RATINGS FROM ONLINE PLATFORMS (E.G., APP STORE,

OPENAI PLAY), SOCIAL MEDIA SENTIMENT ANALYSIS (MONITORING MENTIONS ON

TWITTER, FACEBOOK, ETC.), AND NEWS ARTICLES DISCUSSING CUSTOMER

EXPERIENCES.

2.ANALYTICAL TECHNIQUES: THIS ANALYSIS WILL EMPLOY SENTIMENT

ANALYSIS TO GAUGE OVERALL CUSTOMER SATISFACTION. WE WILL ANALYZE

THE FREQUENCY AND NATURE OF POSITIVE AND NEGATIVE CUSTOMER

FEEDBACK, LOOKING FOR TRENDS AND PATTERNS. THIS WILL BE

COMPLEMENTED BY A QUALITATIVE ANALYSIS OF ONLINE REVIEWS TO

UNDERSTAND SPECIFIC ASPECTS OF THE CUSTOMER EXPERIENCE VALUED OR

CRITICIZED BY USERS.

11.

Management of Kaspi.kzMain

findings

The company's planning process:

Standing plan

MBO strategy(management by objectives)

Top-Down Communication

Main indicators

~KPI(key performance indicator)

~NPS survey (index of determining the efficiency of

the company)

12.

Management of Kaspi.kzTypes of departmentalization

Functional deparmentalization

Product departmentalization

Costumer departmentalization

Special analytical department

Analyze big data related to the company and

participate in the planning process

Decision-making based on costumer

needs

By analyzing state of costumer satisfaction level

13.

Management of Kaspi.kzCompensation:

Direct

(monetary compensation)

Indirect

(private compensation)

involving employees in the planning process

Interview individually with employees

and get their opinions, as well as suggestions for improving the work and goals of the

companies.

Positive feedback loop

Satisfyed team =Satisfyed costumer

14.

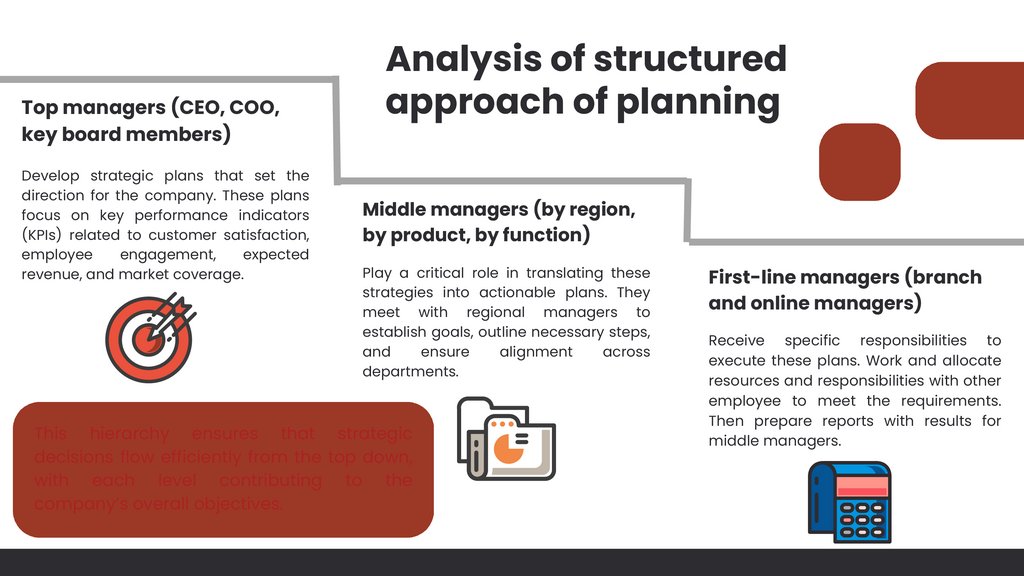

Top managers (CEO, COO,key board members)

Develop strategic plans that set the

direction for the company. These plans

focus on key performance indicators

(KPIs) related to customer satisfaction,

employee

engagement,

expected

revenue, and market coverage.

Analysis of structured

approach of planning

Middle managers (by region,

by product, by function)

Play a critical role in translating these

strategies into actionable plans. They

meet with regional managers to

establish goals, outline necessary steps,

and

ensure

alignment

across

departments.

This hierarchy ensures that strategic

decisions flow efficiently from the top down,

with each level contributing to the

company’s overall objectives.

First-line managers (branch

and online managers)

Receive specific responsibilities to

execute these plans. Work and allocate

resources and responsibilities with other

employee to meet the requirements.

Then prepare reports with results for

middle managers.

15.

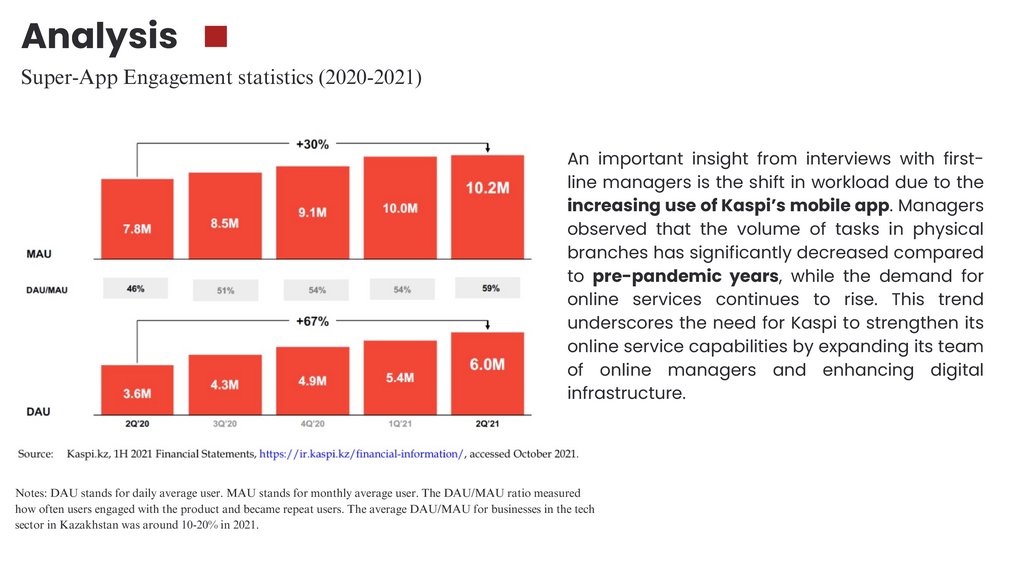

AnalysisSuper-App Engagement statistics (2020-2021)

An important insight from interviews with firstline managers is the shift in workload due to the

increasing use of Kaspi’s mobile app. Managers

observed that the volume of tasks in physical

branches has significantly decreased compared

to pre-pandemic years, while the demand for

online services continues to rise. This trend

underscores the need for Kaspi to strengthen its

online service capabilities by expanding its team

of online managers and enhancing digital

infrastructure.

Notes: DAU stands for daily average user. MAU stands for monthly average user. The DAU/MAU ratio measured

how often users engaged with the product and became repeat users. The average DAU/MAU for businesses in the tech

sector in Kazakhstan was around 10-20% in 2021.

16.

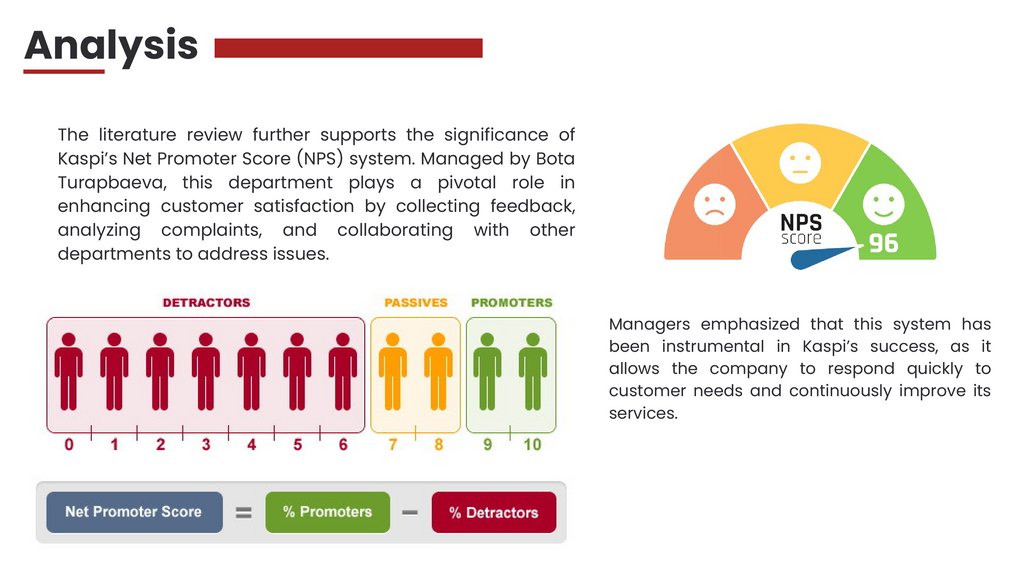

AnalysisThe literature review further supports the significance of

Kaspi’s Net Promoter Score (NPS) system. Managed by Bota

Turapbaeva, this department plays a pivotal role in

enhancing customer satisfaction by collecting feedback,

analyzing complaints, and collaborating with other

departments to address issues.

Managers emphasized that this system has

been instrumental in Kaspi’s success, as it

allows the company to respond quickly to

customer needs and continuously improve its

services.

17.

Analysis of areas for improvementCustomer Service Response times

Managers acknowledged that during peak

periods, the response time for customer

inquiries, both in the app and on the hotline,

could be slow.

Improving the efficiency of customer support

through better training and resource allocation

could significantly enhance customer

satisfaction.

Financial education for customers

Managers suggested that Kaspi could develop

educational initiatives to improve financial

literacy, helping customers better manage loans

and credit products.

This would not only benefit customers but also

reduce the risk of loan defaults, positively

impacting Kaspi’s financial performance.

18.

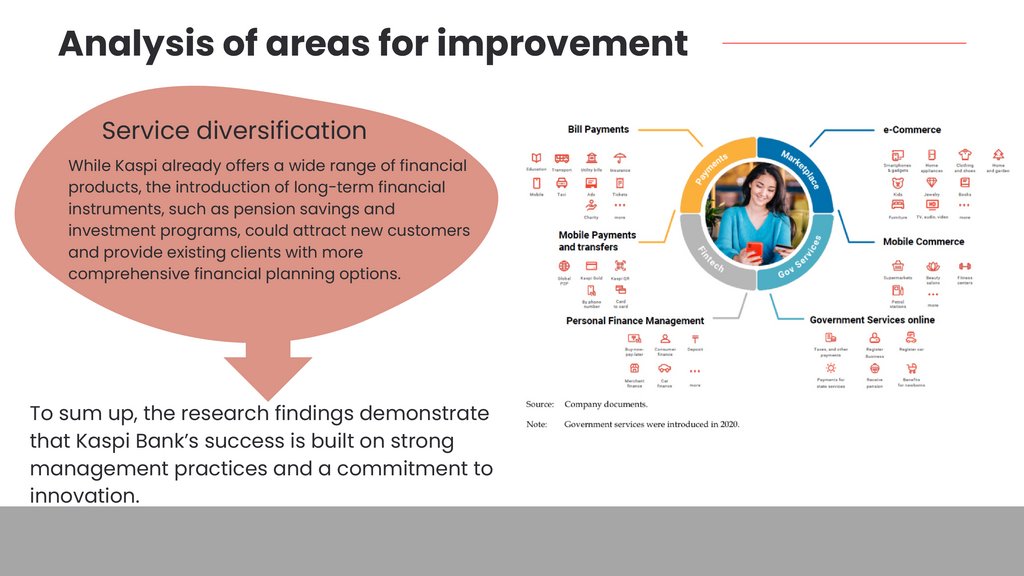

Analysis of areas for improvementService diversification

While Kaspi already offers a wide range of financial

products, the introduction of long-term financial

instruments, such as pension savings and

investment programs, could attract new customers

and provide existing clients with more

comprehensive financial planning options.

To sum up, the research findings demonstrate

that Kaspi Bank’s success is built on strong

management practices and a commitment to

innovation.

19.

Management of Kaspi.kzConclusion

Our primary goal was to understand how planning can evolve into a critical component

of Kaspi.kz’s corporate strategy, ensuring the company’s long-term success. Through

our research, we aimed to analyze and identify the mechanisms and strategies that

contribute to sustained leadership within the organization.

As a result, we successfully achieved our objective by uncovering insights into

Kaspi.kz’s systematic approach to solving problems. The company excels in optimizing

financial flows, fostering innovation, and delivering exceptional customer service. This

outcome demonstrates that the planning strategies of Kaspi.kz not only align with its

strategic vision but also enable its continued growth and success.

20.

Management of Kaspi.kzThe planning processes at Kaspi.kz highlight how strategic foresight

and adaptability can secure market leadership. By integrating

customer feedback and prioritizing innovation, the company

consistently enhances its services and operational efficiency. To

further strengthen its position, Kaspi.kz could actively involve

employees at all levels in the planning process, launch initiatives to

improve financial literacy among its customers, and diversify its

service offerings to include long-term financial solutions like pension

plans and investment programs

21.

Recommendations1.Employee Participation in the Planning Process

Involving middle and lower-level employees in the strategic planning process, not

just top management. Holding regular meetings or introducing a system for

collecting employee suggestions will bring fresh ideas and different perspectives.

2. INTRODUCING ADDITIONAL WAYS TO MOTIVATE EMPLOYEES

Kaspi Bank can implement additional motivation systems, such as performancebased bonuses or recognizing employees for outstanding work. These initiatives

will not only boost morale but also encourage employees to take greater

ownership of their roles.

3. Focusing on Innovation and Technology Development

Investing in technology is crucial for maintaining competitiveness. Creating a

dedicated department for implementing new technologies or providing ongoing

training for employees will help Kaspi Bank stay at the forefront of innovation.

22.

Management of Kaspi.kzOutlook:

In the coming years, Kaspi.kz will be able

to strengthen its leadership position by

entering new markets, expanding its

digital capabilities, and developing hightech solutions for it. To achieve these

goals, the company will further improve

its planning system and continue to

constantly monitor external markets and

internal processes.

23.

Thank you for your attention!24.

ReferencesAlavi, M., & Leidner, D. E. (2001). Review: Knowledge Management and Knowledge

Management Systems: Conceptual Foundations and research issues. MIS Quarterly,

25(1), 107. https://doi.org/10.2307/3250961

Burns, T. E., & Stalker, G. (1961). The management of innovation. SSRN Electronic Journal.

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1496187

Cokins, G. (2009). Performance Management: integrating strategy execution, methodologies,

risk, and analytics. http://ci.nii.ac.jp/ncid/BB00926196

Dechow, P. M., Sloan, R. G., & Hutton, A. P. (1994). Detecting earnings management. SSRN

Electronic Journal. https://autopapers.ssrn.com/sol3/papers.cfm?abstract_id=5520

Edition, N. (2023, October 31). The Secret of Success. How Kaspi.kz launches innovative

products. Bluescreen. https://bluescreen.kz/siekriet-uspiekha-kak-kaspikzzapuskaiet-innovatsionnyie-produkty/

Fink, S. (1989). Crisis Management: planning for the inevitable.

http://ci.nii.ac.jp/ncid/BB04567812

Freeman, R. E. (2010). Strategic Management. https://doi.org/10.1017/cbo9781139192675

Griffin, R. W. (2002). Management. Houghton Mifflin.

Hiatt, J. M. (2003). Change management.

https://openlibrary.org/books/OL8800988M/Change_Management

Kaplan, R. S., & Norton, D. P. (1997). The balanced scorecard: Translating strategy into

action. Long Range Planning, 30(3), 467. https://doi.org/10.1016/s00246301(97)80925-9

McKeown, G. (2014). Essentialism: the disciplined pursuit of less.

http://ci.nii.ac.jp/ncid/BB1812321

25.

ReferencesMcLeay, M., Radia, A., & Thomas, R. (2014). Money in the Modern Economy: An

Introduction. SSRN Electronic Journal.

https://papers.ssrn.com/sol3/Delivery.cfm/SSRN_ID2416229_code459244.pdf?abst

ractid=2416229&mirid=1

Northouse, P. G. (2015). Leadership : Theory and practice. http://cds.cern.ch/record/1630817

Shakenova, S., Slamgazhy, A., & Kaldybekova, A. (2023). Crisis communication: the case

study of Kaspi bank of Kazakhstan. Herald of Journalism, 67(1).

https://doi.org/10.26577/hj.2023.v67.i1.04

Sucher, S. J., Khrais, F., & Westner, M. M. (2024, June 28). Kaspi.kz: Building Trust through

Innovation. Harvard Business School.

Маркетинг

Маркетинг