Похожие презентации:

Financial Reports

1. Financial Reports

Bibigul Zhakupova2.

Financial Reports consist of:Financial Statements (main):

• Balance Sheet;

• Income Statement;

• Statement of Retained

Earnings;

• Cash Flow Statement.

Disclosure Notes.

3.

Financial Reports are prepared inaccordance with accounting standards,

e.g. IFRS or GAAP

4.

Main Financial Statements:• Balance Sheet;

• Income Statement;

• Statement of Retained Earnings;

• Cash Flow Statement.

5.

Disclosure NotesMainly provide:

1.

Description of the main Accounting Policies;

2.

Explanation to some items/figures shown in

Financial Statements;

3.

Some additional information which is not in

Financial Statements, because do not belong

to the reporting period, however crucial for

investors to make decisions.

6.

Financial Statements6

The objective of financial statements is to provide

faithful information about the company’s:

•Financial position - Balance Sheet;

•Financial performance – Income Statement;

•Cash flows – Cash Flow Statement.

Financial statements also show the results of the

management's stewardship of the resources entrusted

to it.

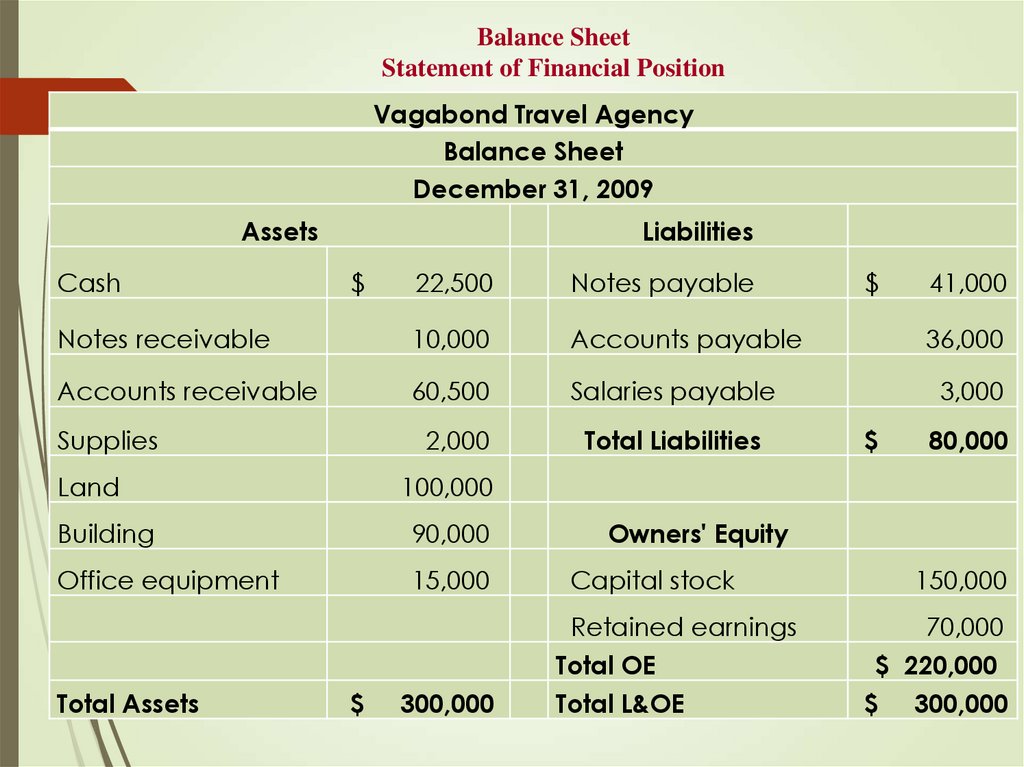

7. Balance Sheet

Balance Sheet shows a financial position atthe specific date and has three parts:

1. Assets

2. Liabilities

3. Owners/Stockholders Equity

8. Balance Sheet Statement of Financial Position

Vagabond Travel AgencyBalance Sheet

December 31, 2009

Assets

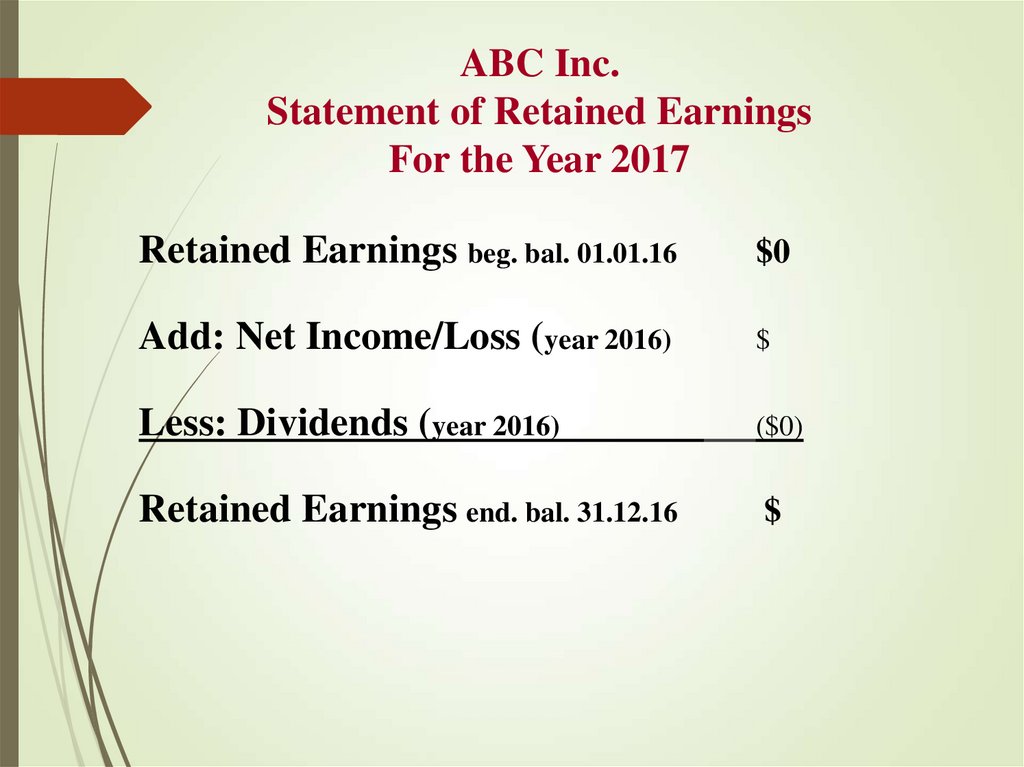

Cash

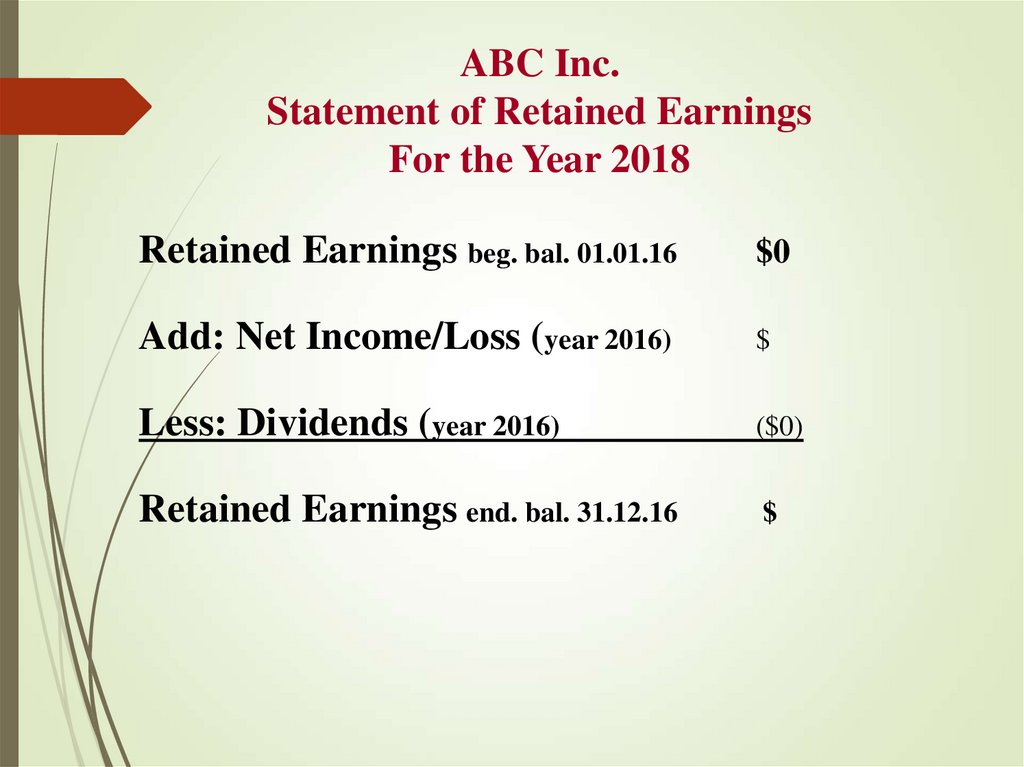

Liabilities

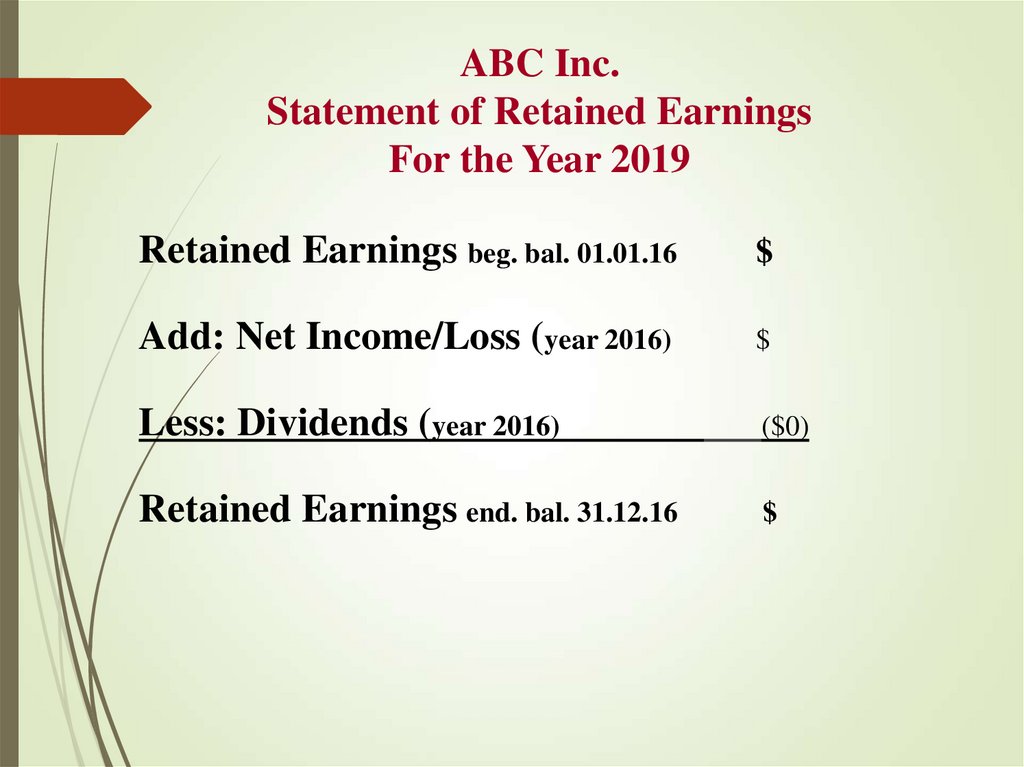

$

22,500

Notes payable

Notes receivable

10,000

Accounts payable

36,000

Accounts receivable

60,500

Salaries payable

3,000

Supplies

2,000

Total Liabilities

Land

100,000

Building

90,000

Office equipment

15,000

Capital stock

300,000

Retained earnings

Total OE

Total L&OE

Total Assets

$

$

$

41,000

80,000

Owners' Equity

150,000

70,000

$ 220,000

$ 300,000

9. Assets

Assets are the resources controlled bythe entity which are expected to bring

economic benefits to the entity in the

future.

10. Balance Sheet

Assets are listed by liquidity:Short-term assets;

Long-term assets;

11. Assets

Current / Short-Term AssetsWill be converted to cash or

consumed within one year or

the operating cycle, whichever

is longer.

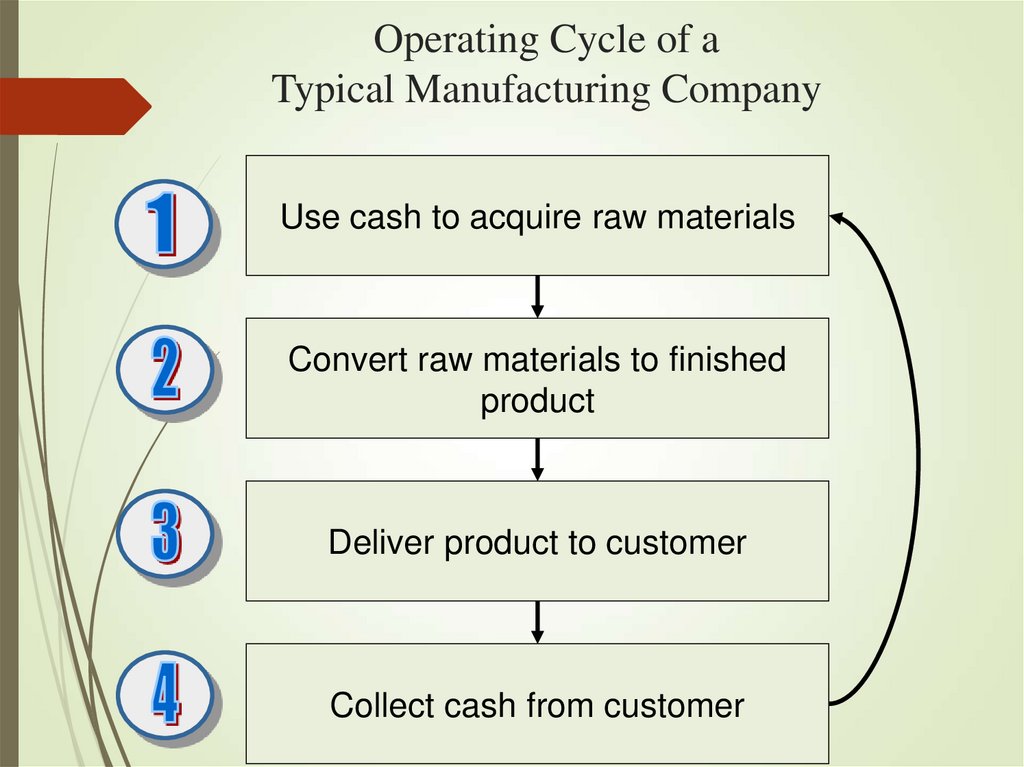

12. Operating Cycle of a Typical Manufacturing Company

Use cash to acquire raw materialsConvert raw materials to finished

product

Deliver product to customer

Collect cash from customer

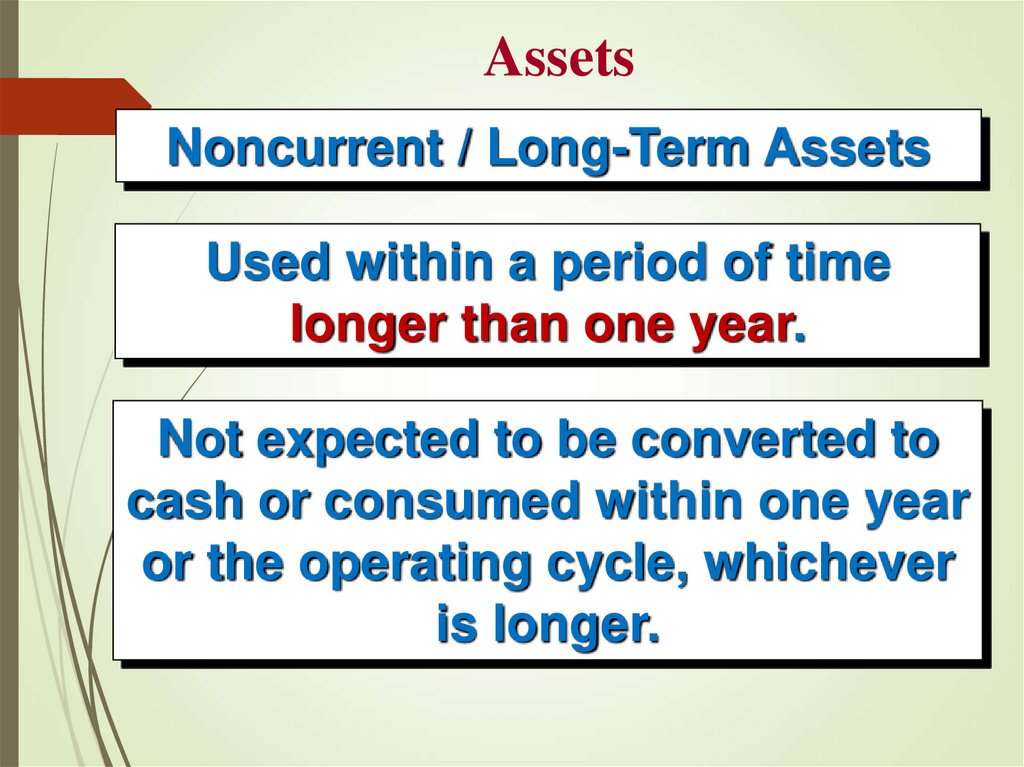

13. Assets

Noncurrent / Long-Term AssetsUsed within a period of time

longer than one year.

Not expected to be converted to

cash or consumed within one year

or the operating cycle, whichever

is longer.

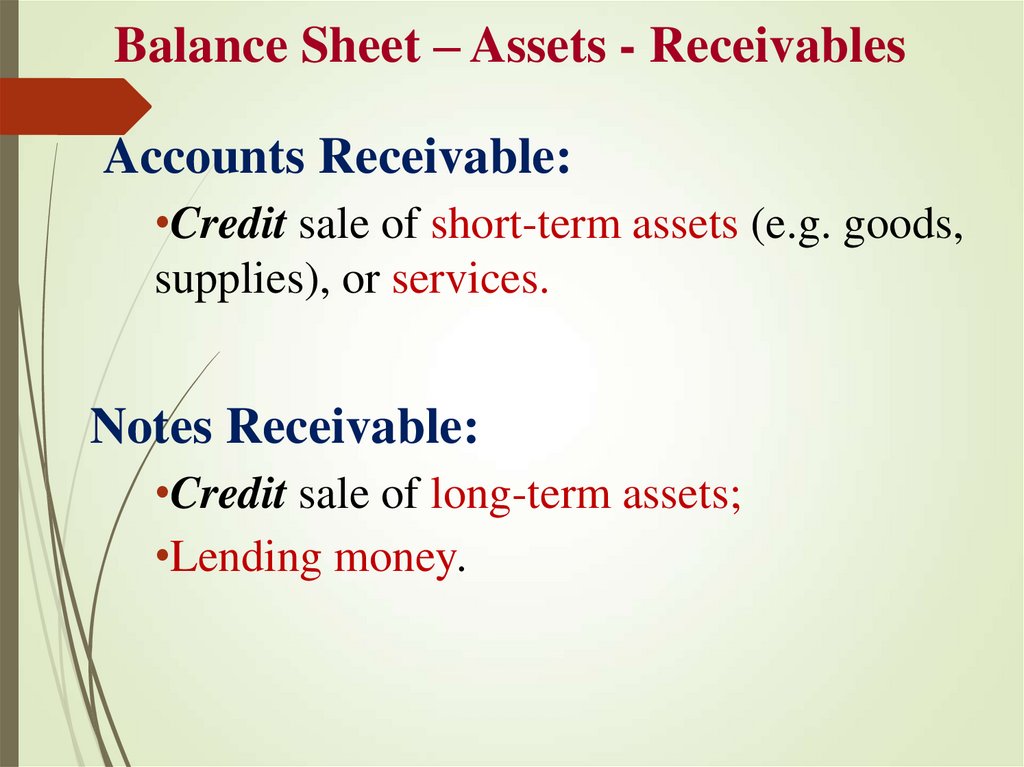

14. Balance Sheet – Assets - Receivables

Accounts Receivable:•Credit sale of short-term assets (e.g. goods,

supplies), or services.

Notes Receivable:

•Credit sale of long-term assets;

•Lending money.

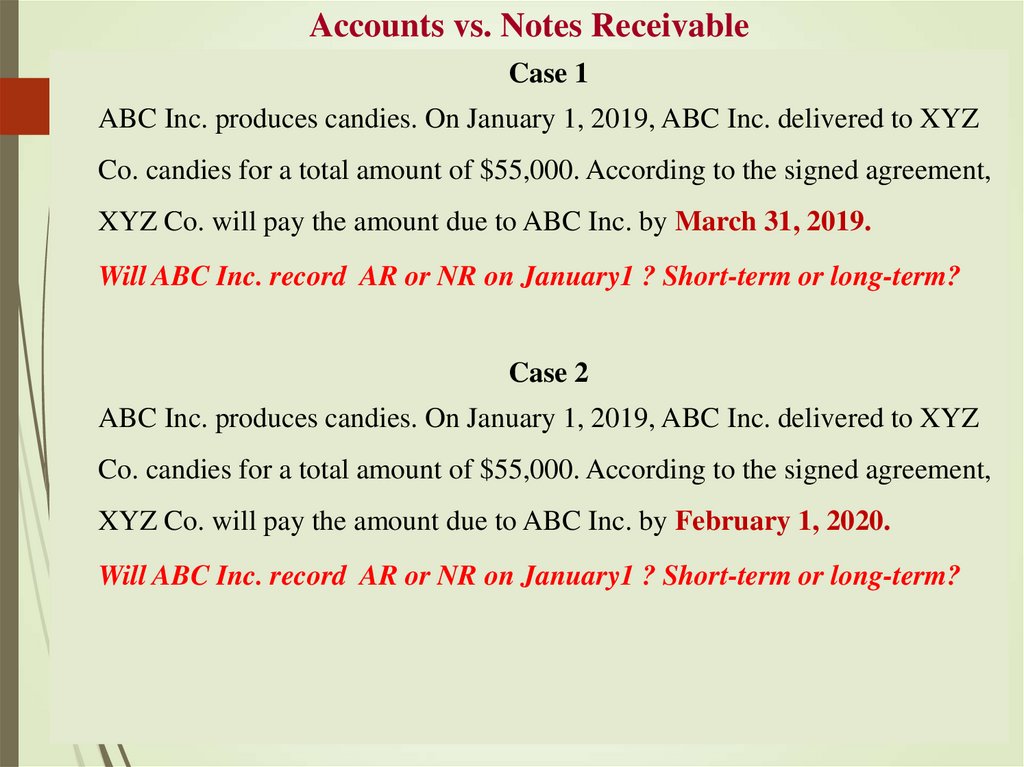

15. Accounts vs. Notes Receivable

Case 1ABC Inc. produces candies. On January 1, 2019, ABC Inc. delivered to XYZ

Co. candies for a total amount of $55,000. According to the signed agreement,

XYZ Co. will pay the amount due to ABC Inc. by March 31, 2019.

Will ABC Inc. record AR or NR on January1 ? Short-term or long-term?

Case 2

ABC Inc. produces candies. On January 1, 2019, ABC Inc. delivered to XYZ

Co. candies for a total amount of $55,000. According to the signed agreement,

XYZ Co. will pay the amount due to ABC Inc. by February 1, 2020.

Will ABC Inc. record AR or NR on January1 ? Short-term or long-term?

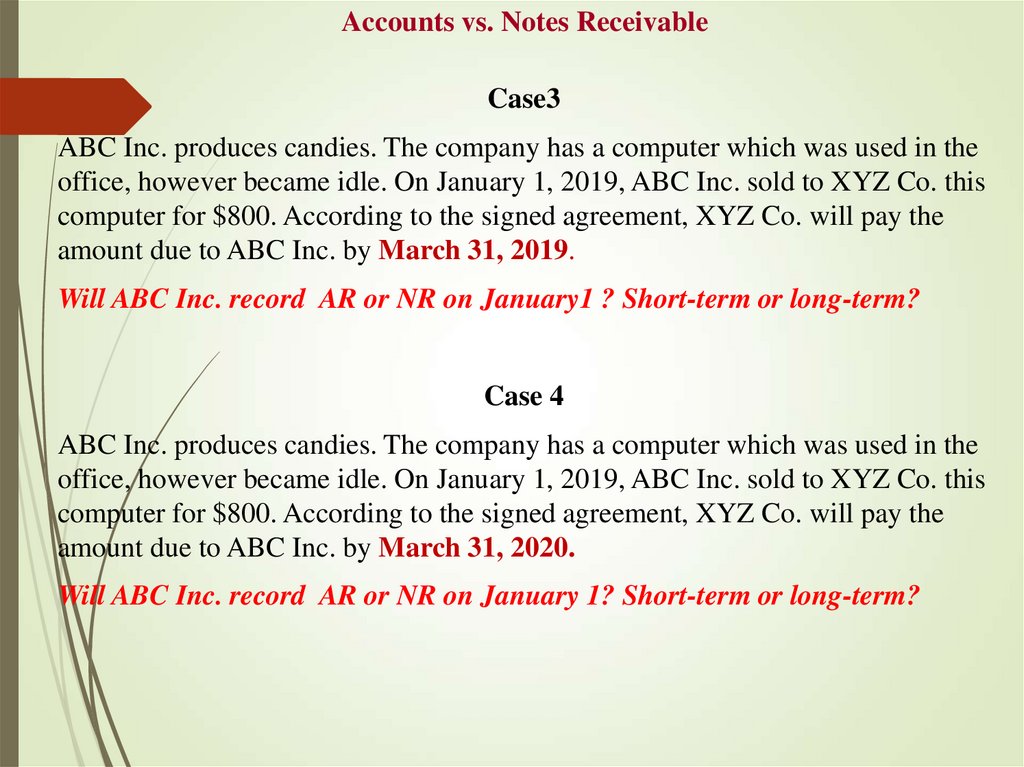

16. Accounts vs. Notes Receivable

Case3ABC Inc. produces candies. The company has a computer which was used in the

office, however became idle. On January 1, 2019, ABC Inc. sold to XYZ Co. this

computer for $800. According to the signed agreement, XYZ Co. will pay the

amount due to ABC Inc. by March 31, 2019.

Will ABC Inc. record AR or NR on January1 ? Short-term or long-term?

Case 4

ABC Inc. produces candies. The company has a computer which was used in the

office, however became idle. On January 1, 2019, ABC Inc. sold to XYZ Co. this

computer for $800. According to the signed agreement, XYZ Co. will pay the

amount due to ABC Inc. by March 31, 2020.

Will ABC Inc. record AR or NR on January 1? Short-term or long-term?

17. Liabilities

Liabilities are the present obligations/debts of the entity arising from the

past events, the settlement of which is

expected to result in an outflow of

resources

18. Balance Sheet

Liabilities are listed by time of payment:Short-term liabilities (to be paid

within 1 year);

Long-term liabilities (to be paid

within a period longer than 1 year);

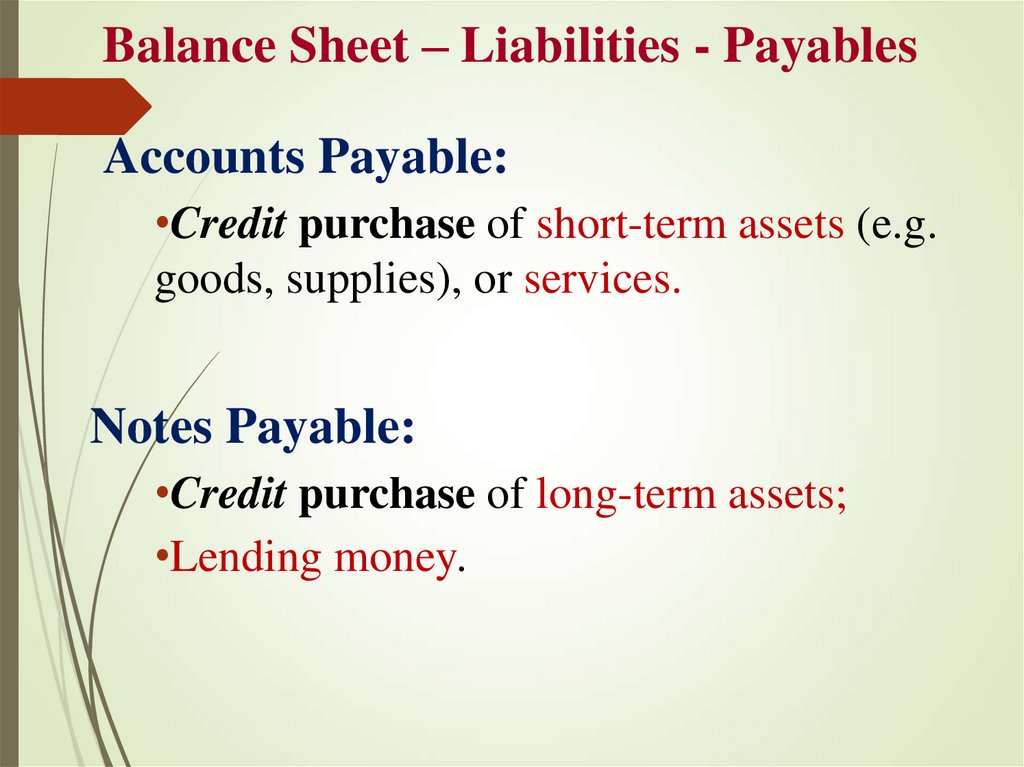

19. Balance Sheet – Liabilities - Payables

Accounts Payable:•Credit purchase of short-term assets (e.g.

goods, supplies), or services.

Notes Payable:

•Credit purchase of long-term assets;

•Lending money.

20.

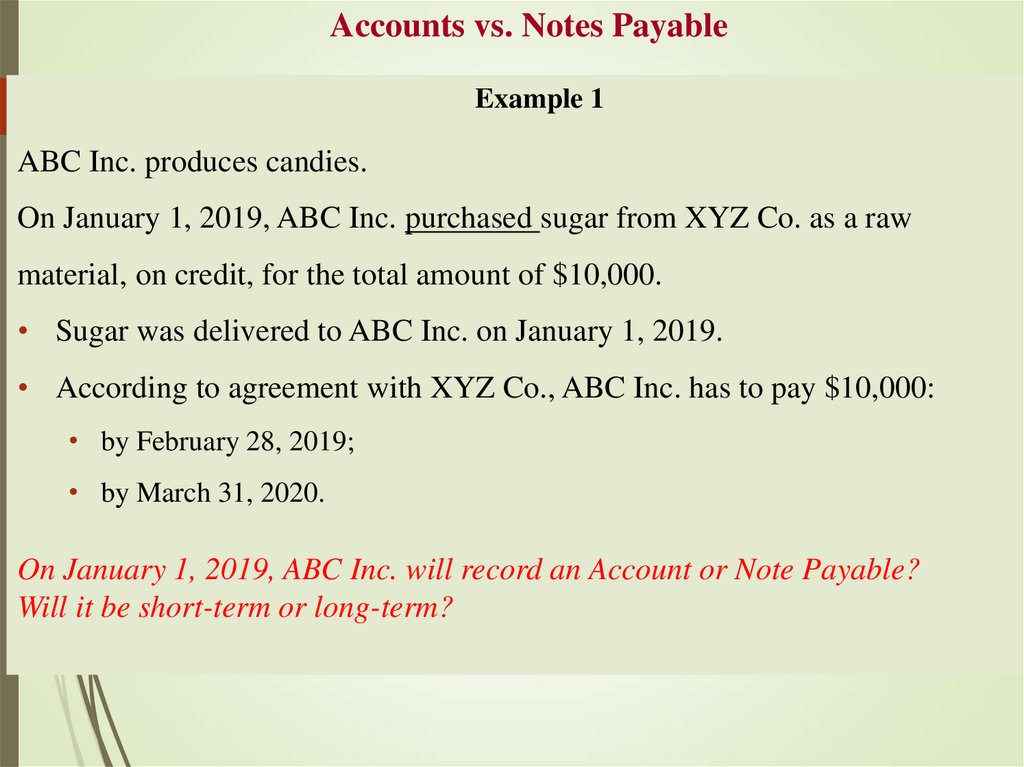

Accounts vs. Notes PayableExample 1

ABC Inc. produces candies.

On January 1, 2019, ABC Inc. purchased sugar from XYZ Co. as a raw

material, on credit, for the total amount of $10,000.

• Sugar was delivered to ABC Inc. on January 1, 2019.

• According to agreement with XYZ Co., ABC Inc. has to pay $10,000:

• by February 28, 2019;

• by March 31, 2020.

On January 1, 2019, ABC Inc. will record an Account or Note Payable?

Will it be short-term or long-term?

21.

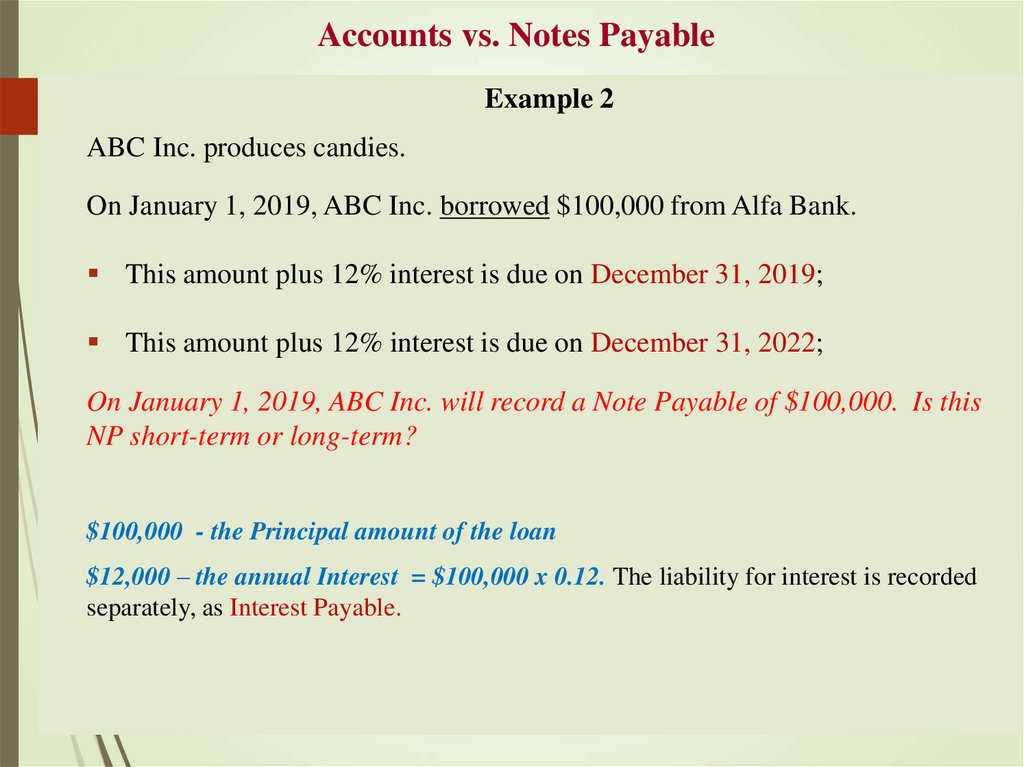

Accounts vs. Notes PayableExample 2

ABC Inc. produces candies.

On January 1, 2019, ABC Inc. borrowed $100,000 from Alfa Bank.

This amount plus 12% interest is due on December 31, 2019;

This amount plus 12% interest is due on December 31, 2022;

On January 1, 2019, ABC Inc. will record a Note Payable of $100,000. Is this

NP short-term or long-term?

$100,000 - the Principal amount of the loan

$12,000 – the annual Interest = $100,000 x 0.12. The liability for interest is recorded

separately, as Interest Payable.

22. Liabilities

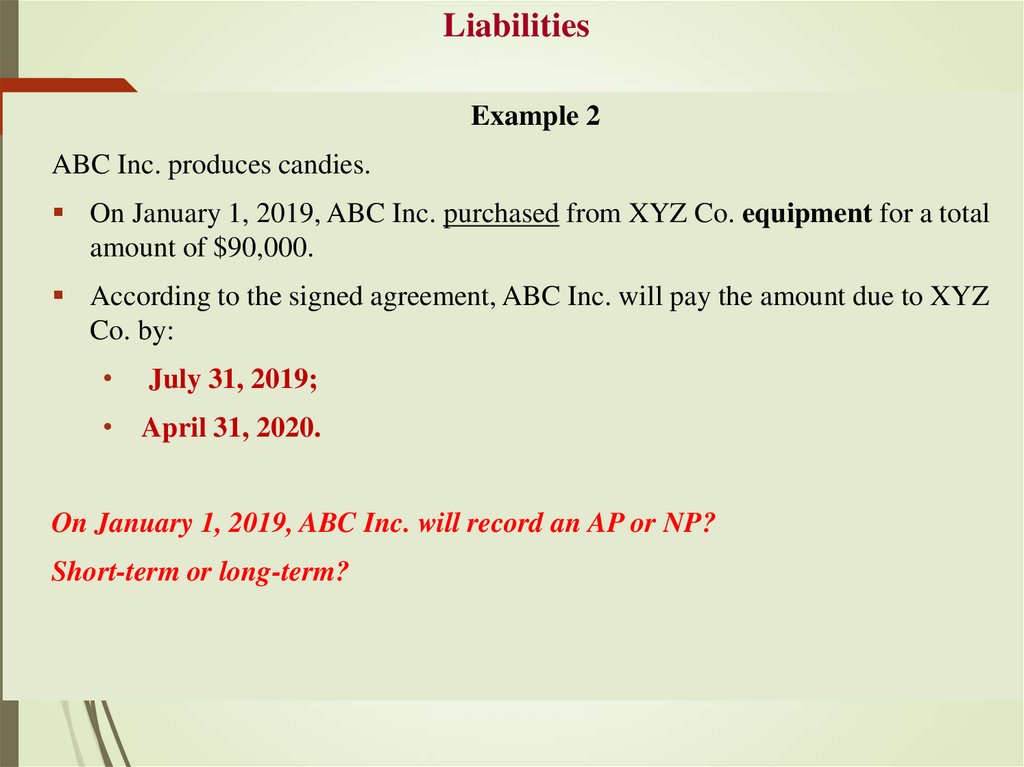

Example 2ABC Inc. produces candies.

On January 1, 2019, ABC Inc. purchased from XYZ Co. equipment for a total

amount of $90,000.

According to the signed agreement, ABC Inc. will pay the amount due to XYZ

Co. by:

July 31, 2019;

• April 31, 2020.

On January 1, 2019, ABC Inc. will record an AP or NP?

Short-term or long-term?

23. Equity

Equity is the residual interest ofowners in the assets of the entity after

deducting all its liabilities.

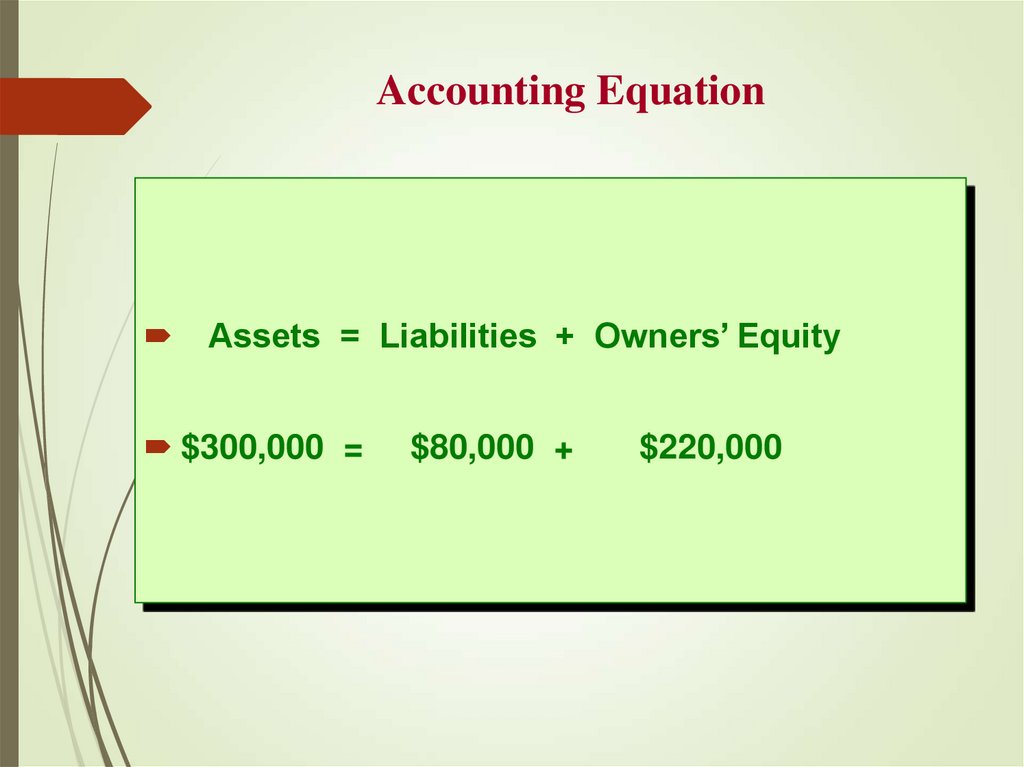

24. Accounting Equation

Assets = Liabilities + Owners’ Equity$300,000 =

$80,000 +

$220,000

25. Underlying Concepts

Business entity concept;Going concern assumption;

Historical cost principle;

Objectivity principle;

Conservatism principle;

Materiality principle;

Efficiency of the accounting system.

26. Income Statement

ABC Inc.Income Statement

for the year 2017

Revenues

(Costs)

(Expenses)

Net Income (Profit)/ Net Loss

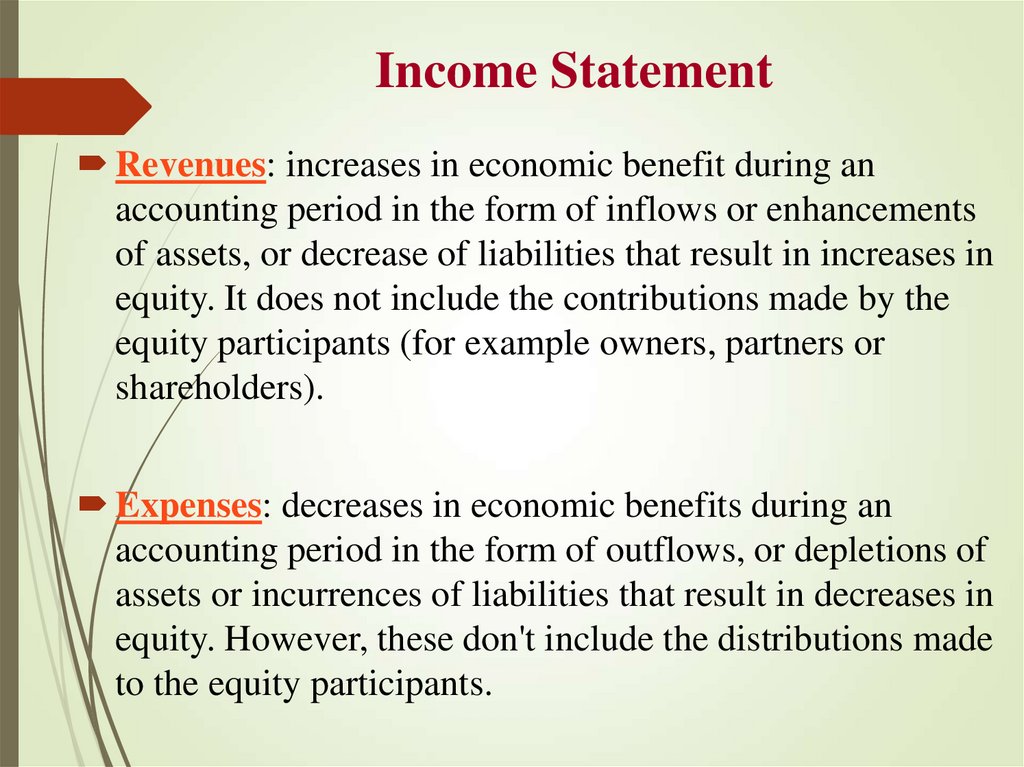

27. Income Statement

Revenues: increases in economic benefit during anaccounting period in the form of inflows or enhancements

of assets, or decrease of liabilities that result in increases in

equity. It does not include the contributions made by the

equity participants (for example owners, partners or

shareholders).

Expenses: decreases in economic benefits during an

accounting period in the form of outflows, or depletions of

assets or incurrences of liabilities that result in decreases in

equity. However, these don't include the distributions made

to the equity participants.

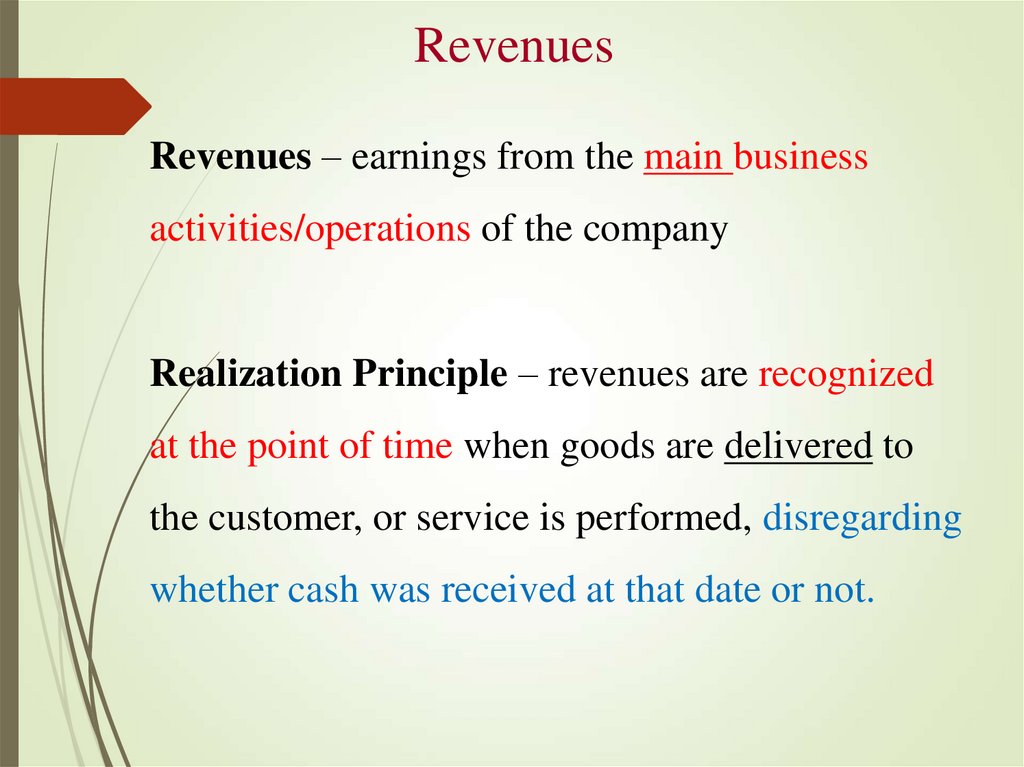

28. Revenues

Revenues – earnings from the main businessactivities/operations of the company

Realization Principle – revenues are recognized

at the point of time when goods are delivered to

the customer, or service is performed, disregarding

whether cash was received at that date or not.

29. Expenses

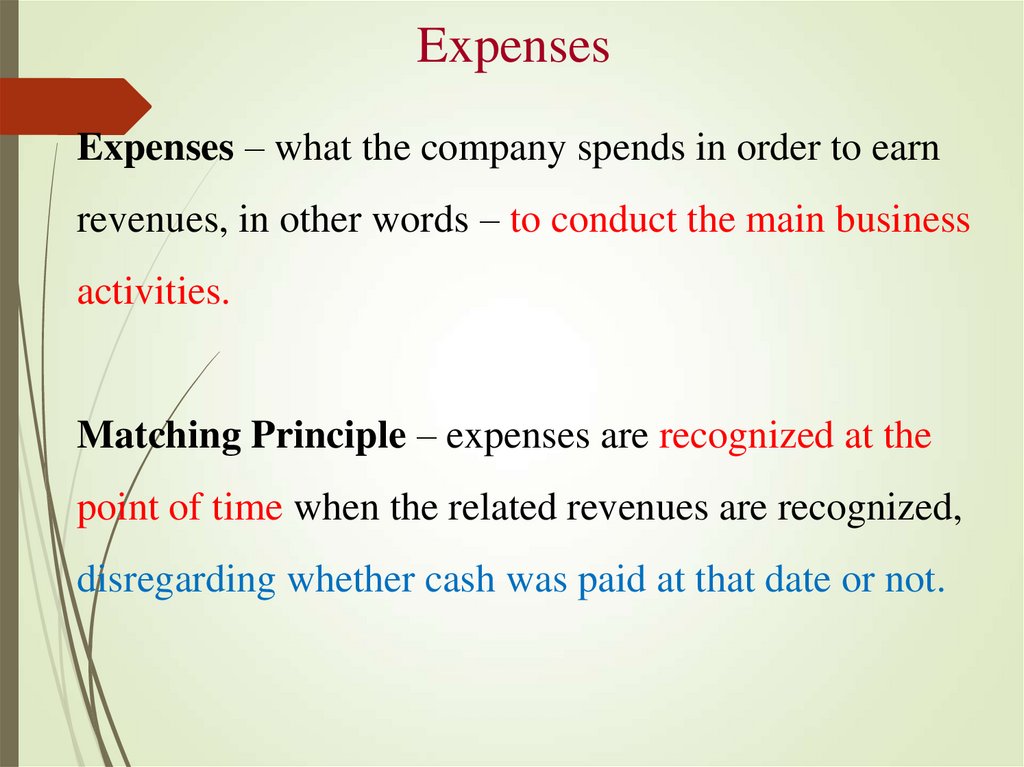

Expenses – what the company spends in order to earnrevenues, in other words – to conduct the main business

activities.

Matching Principle – expenses are recognized at the

point of time when the related revenues are recognized,

disregarding whether cash was paid at that date or not.

30. Income Statement

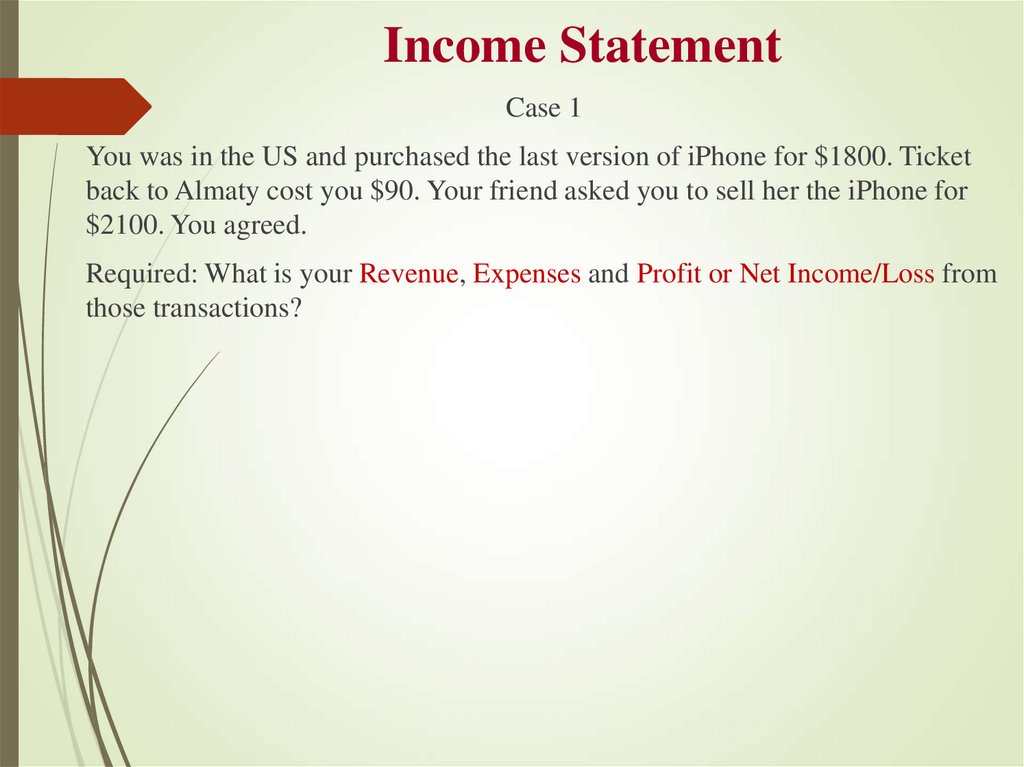

Case 1You was in the US and purchased the last version of iPhone for $1800. Ticket

back to Almaty cost you $90. Your friend asked you to sell her the iPhone for

$2100. You agreed.

Required: What is your Revenue, Expenses and Profit or Net Income/Loss from

those transactions?

31. Income Statement

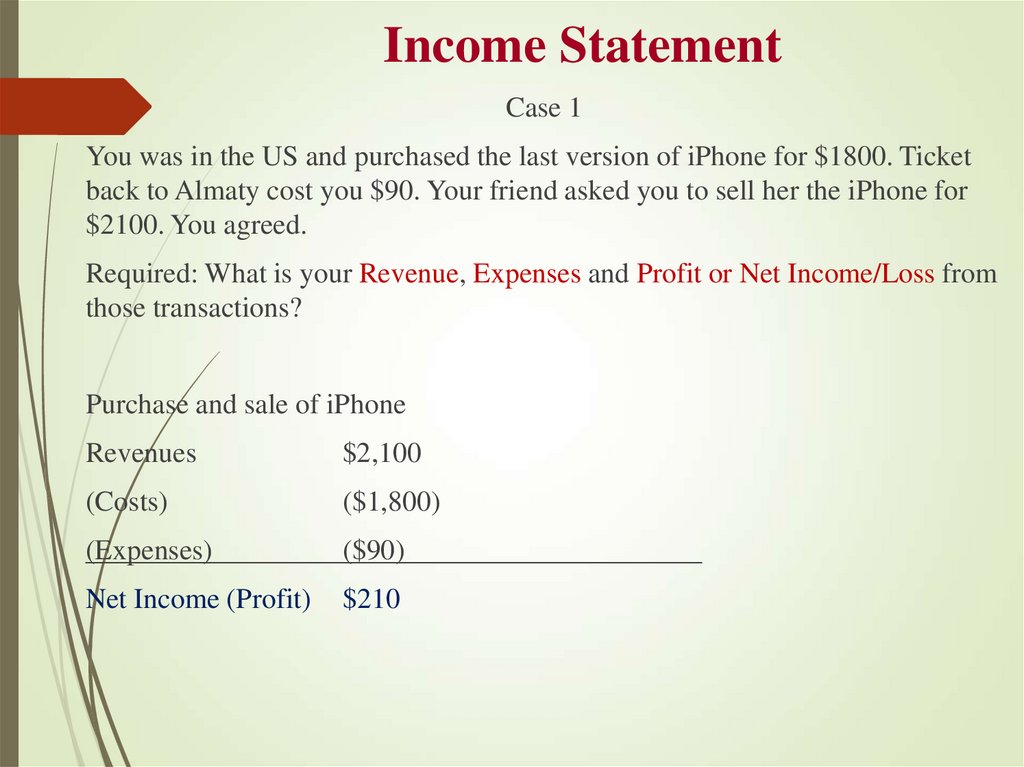

Case 1You was in the US and purchased the last version of iPhone for $1800. Ticket

back to Almaty cost you $90. Your friend asked you to sell her the iPhone for

$2100. You agreed.

Required: What is your Revenue, Expenses and Profit or Net Income/Loss from

those transactions?

Purchase and sale of iPhone

Revenues

$2,100

(Costs)

($1,800)

(Expenses)

($90)

Net Income (Profit)

$210

32. Income Statement

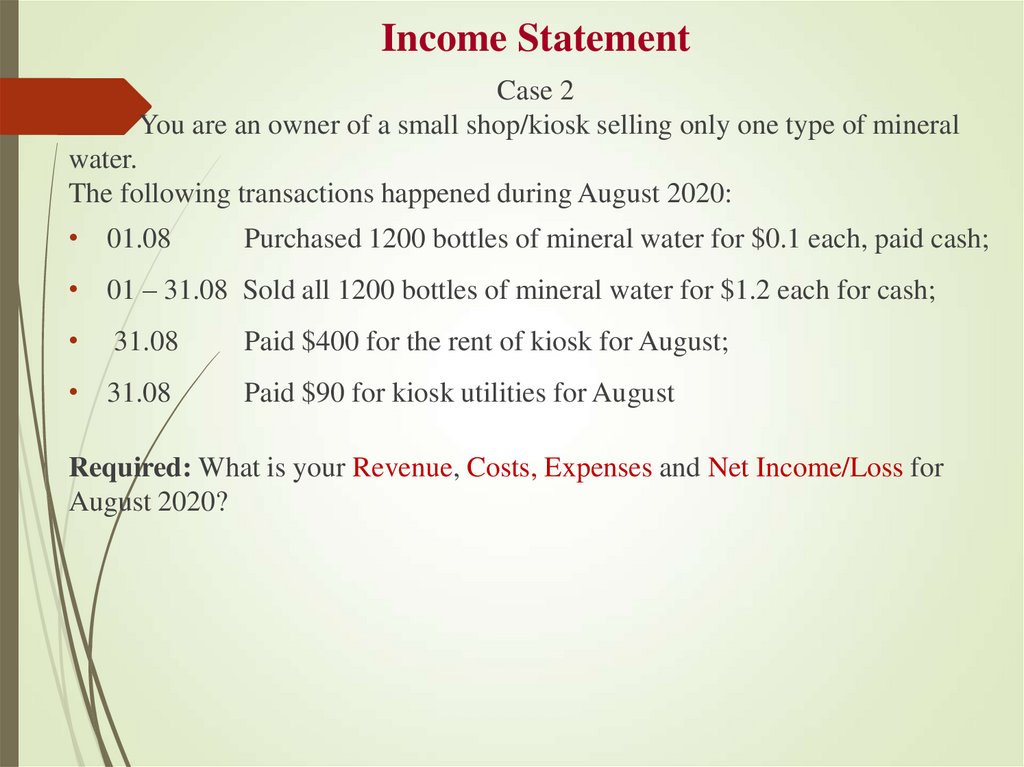

Case 2You are an owner of a small shop/kiosk selling only one type of mineral

water.

The following transactions happened during August 2020:

• 01.08

Purchased 1200 bottles of mineral water for $0.1 each, paid cash;

• 01 – 31.08 Sold all 1200 bottles of mineral water for $1.2 each for cash;

31.08

• 31.08

Paid $400 for the rent of kiosk for August;

Paid $90 for kiosk utilities for August

Required: What is your Revenue, Costs, Expenses and Net Income/Loss for

August 2020?

33. Income Statement

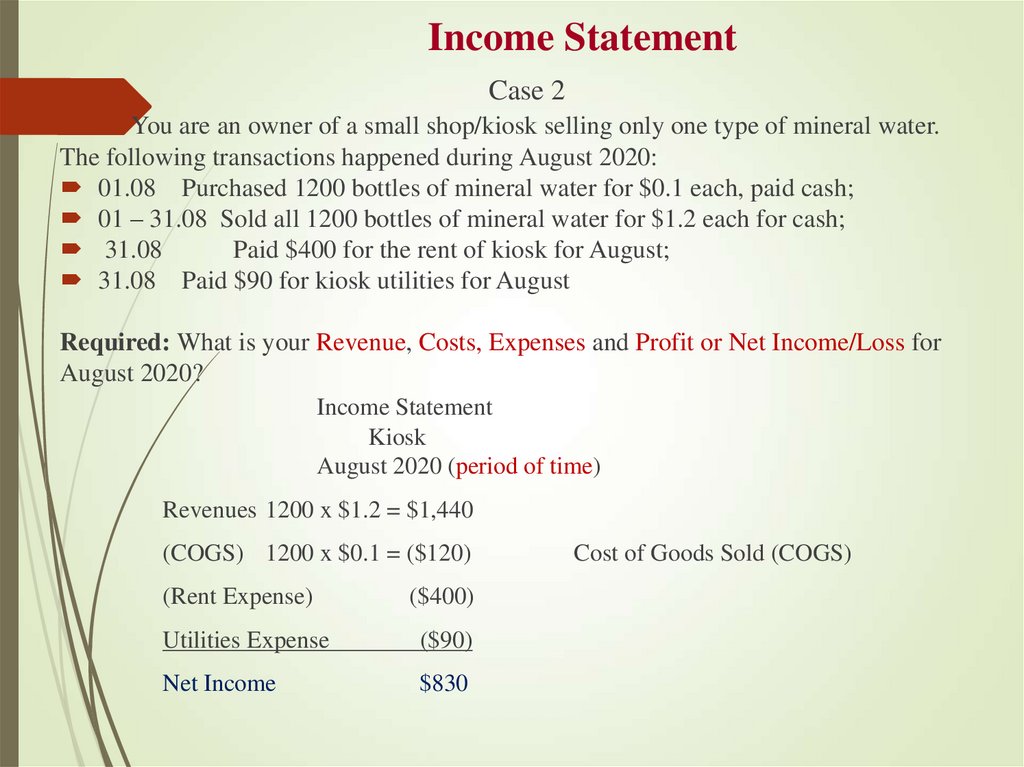

Case 2You are an owner of a small shop/kiosk selling only one type of mineral water.

The following transactions happened during August 2020:

01.08 Purchased 1200 bottles of mineral water for $0.1 each, paid cash;

01 – 31.08 Sold all 1200 bottles of mineral water for $1.2 each for cash;

31.08

Paid $400 for the rent of kiosk for August;

31.08 Paid $90 for kiosk utilities for August

Required: What is your Revenue, Costs, Expenses and Profit or Net Income/Loss for

August 2020?

Income Statement

Kiosk

August 2020 (period of time)

Revenues 1200 x $1.2 = $1,440

(COGS) 1200 x $0.1 = ($120)

(Rent Expense)

($400)

Utilities Expense

($90)

Net Income

$830

Cost of Goods Sold (COGS)

34. Income Statement

Case 2You are an owner of a small shop/kiosk selling only one type of mineral

water.

The following transactions happened during August 2020:

• 01.08

Purchased 1200 bottles of mineral water for $0.1 each, paid cash;

• 02.08

Purchased a cashier machine for $648, with useful life is 3 years;

• 02 – 31.08 Sold 900 bottles of mineral water for $1.2 each for cash;

31.08

• 31.08

Paid $400 for the rent of kiosk for August;

Paid $90 for kiosk utilities for August

Required: What is your Revenue, Costs, Expenses and Net Income/Loss for

August 2020?

35. Income Statement

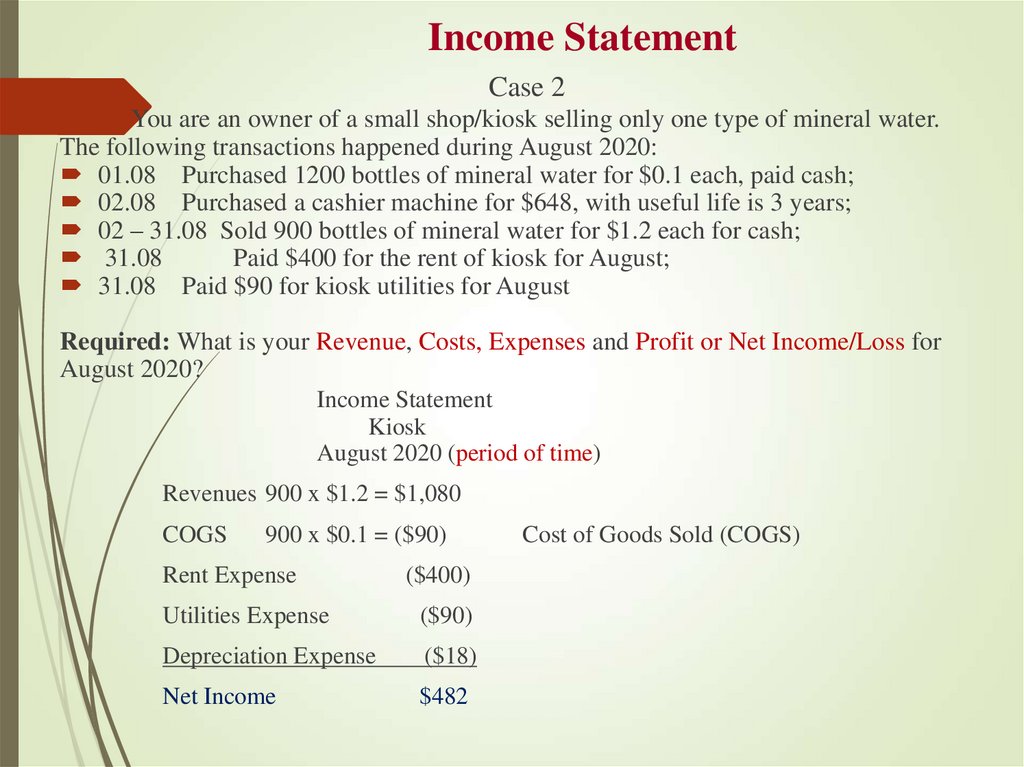

Case 2You are an owner of a small shop/kiosk selling only one type of mineral water.

The following transactions happened during August 2020:

01.08 Purchased 1200 bottles of mineral water for $0.1 each, paid cash;

02.08 Purchased a cashier machine for $648, with useful life is 3 years;

02 – 31.08 Sold 900 bottles of mineral water for $1.2 each for cash;

31.08

Paid $400 for the rent of kiosk for August;

31.08 Paid $90 for kiosk utilities for August

Required: What is your Revenue, Costs, Expenses and Profit or Net Income/Loss for

August 2020?

Income Statement

Kiosk

August 2020 (period of time)

Revenues 900 x $1.2 = $1,080

COGS

900 x $0.1 = ($90)

Rent Expense

($400)

Utilities Expense

($90)

Depreciation Expense

($18)

Net Income

$482

Cost of Goods Sold (COGS)

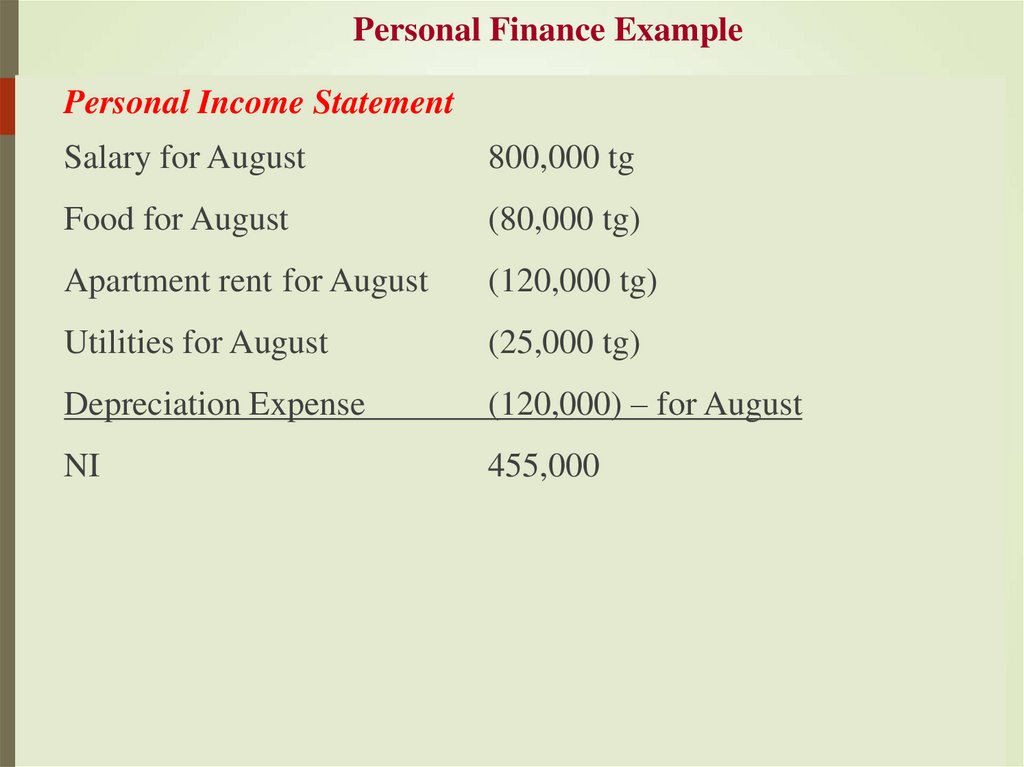

36. Personal Finance Example

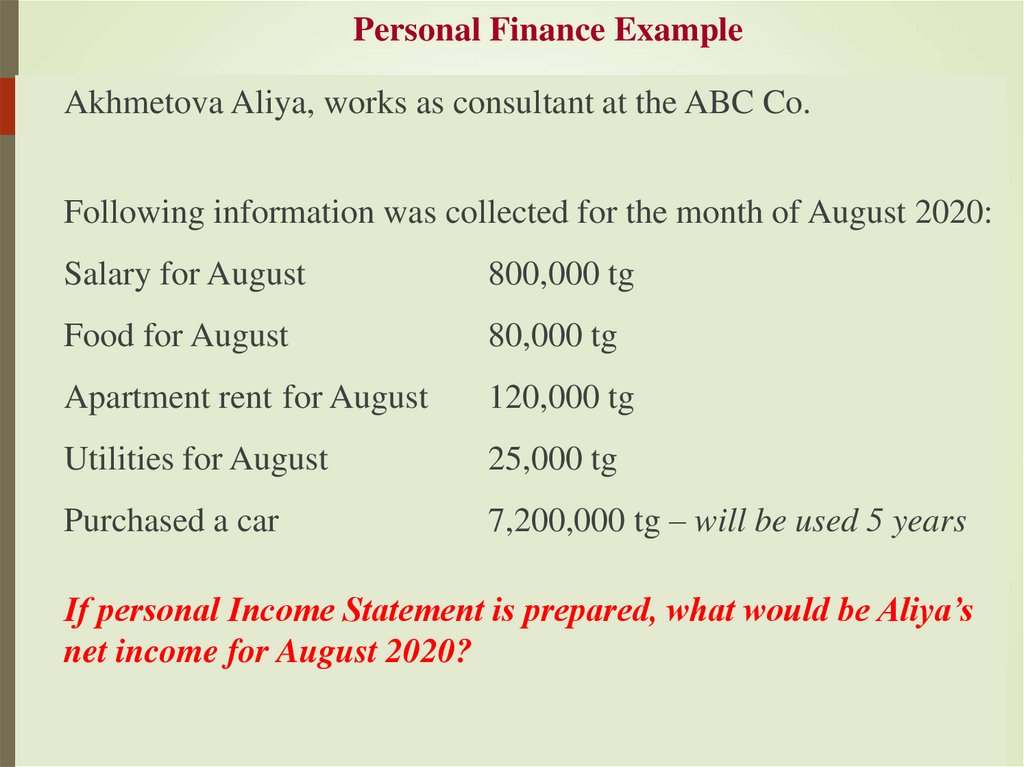

Akhmetova Aliya, works as consultant at the ABC Co.Following information was collected for the month of August 2020:

Salary for August

800,000 tg

Food for August

80,000 tg

Apartment rent for August

120,000 tg

Utilities for August

25,000 tg

Purchased a car

7,200,000 tg – will be used 5 years

If personal Income Statement is prepared, what would be Aliya’s

net income for August 2020?

37. Personal Finance Example

Personal Income StatementSalary for August

800,000 tg

Food for August

(80,000 tg)

Apartment rent for August

(120,000 tg)

Utilities for August

(25,000 tg)

Depreciation Expense

(120,000) – for August

NI

455,000

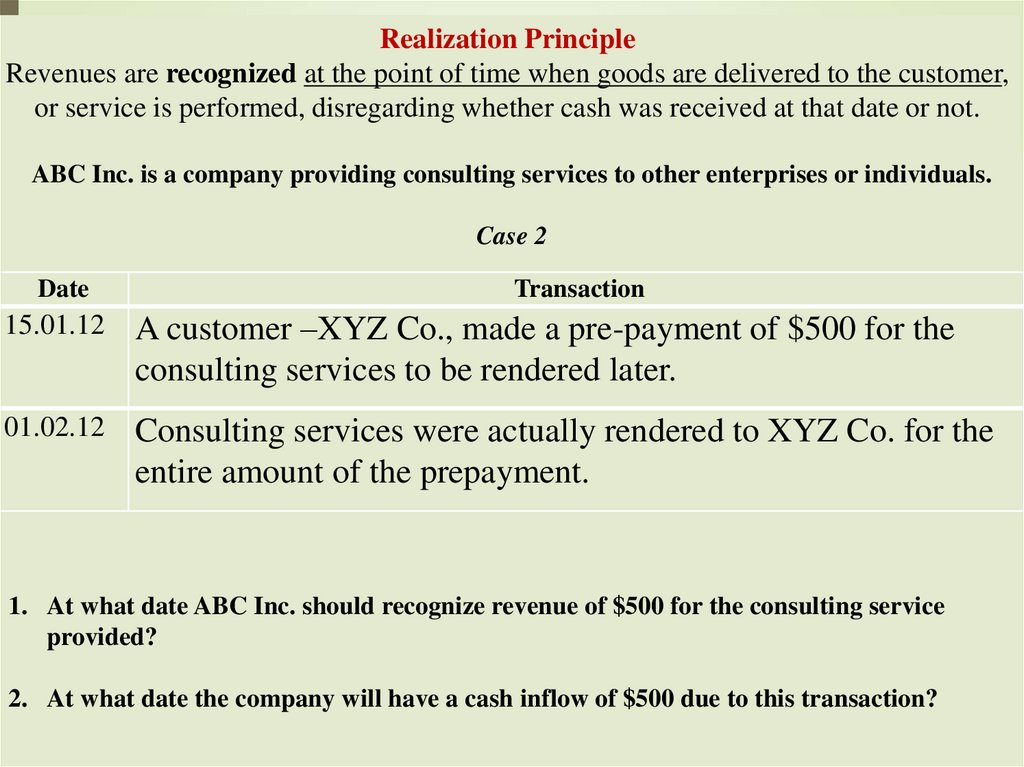

38. Realization Principle Revenues are recognized at the point of time when goods are delivered to the customer, or service is

performed, disregarding whether cash was received at that date or not.ABC Inc. is a company providing consulting services to other enterprises or individuals.

Case 2

Date

Transaction

15.01.12

A customer –XYZ Co., made a pre-payment of $500 for the

consulting services to be rendered later.

01.02.12

Consulting services were actually rendered to XYZ Co. for the

entire amount of the prepayment.

1. At what date ABC Inc. should recognize revenue of $500 for the consulting service

provided?

2. At what date the company will have a cash inflow of $500 due to this transaction?

39. Realization Principle Revenues are recognized at the point of time when goods are delivered to the customer, or service is

performed, disregarding whether cash was received at that date or not.ABC Inc. is a company providing consulting services to other enterprises or individuals.

Case 1

Date

Transaction

20.01.12

Consulting service was provided to XYZ Co. Price of the

service is $500. According to the signed agreement, XYZ Co.

should pay this amount by March 31, 2012.

25.03.12

XYZ Co. paid for the consulting service.

1. At what date ABC Inc. should recognize revenue of $500 for the consulting service

provided?

2. At what date the company will have a cash inflow of $500 due to this transaction?

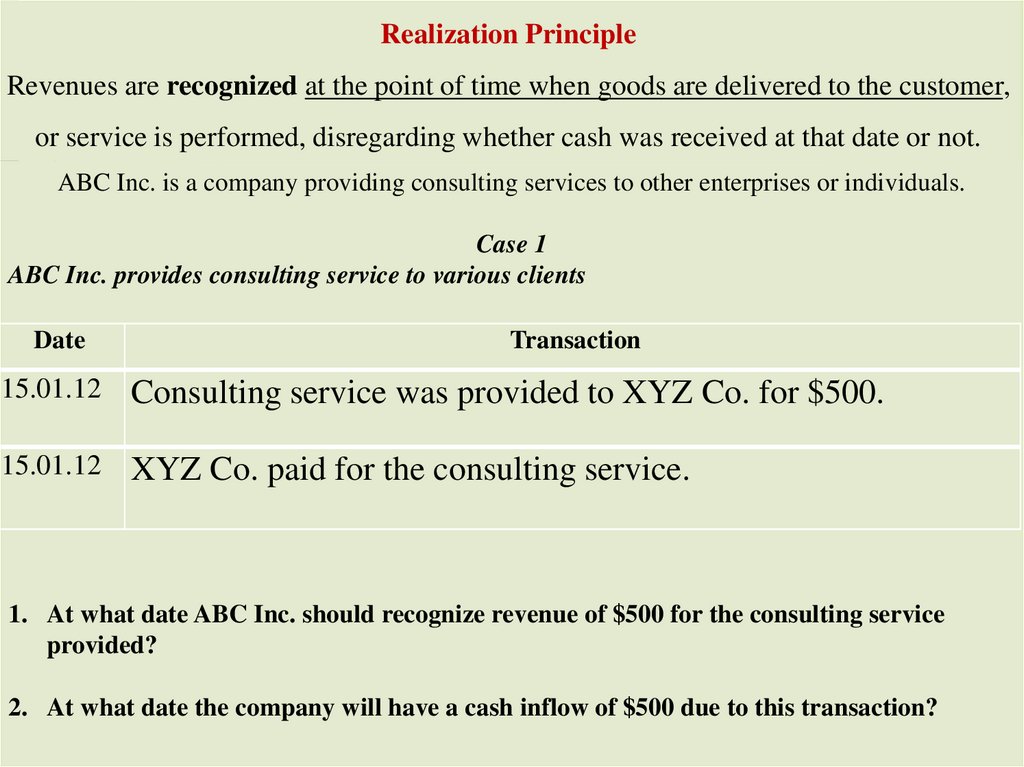

40. Realization Principle Revenues are recognized at the point of time when goods are delivered to the customer, or service is

performed, disregarding whether cash was received at that date or not.ABC Inc. is a company providing consulting services to other enterprises or individuals.

Case 1

ABC Inc. provides consulting service to various clients

Date

Transaction

15.01.12

Consulting service was provided to XYZ Co. for $500.

15.01.12

XYZ Co. paid for the consulting service.

1. At what date ABC Inc. should recognize revenue of $500 for the consulting service

provided?

2. At what date the company will have a cash inflow of $500 due to this transaction?

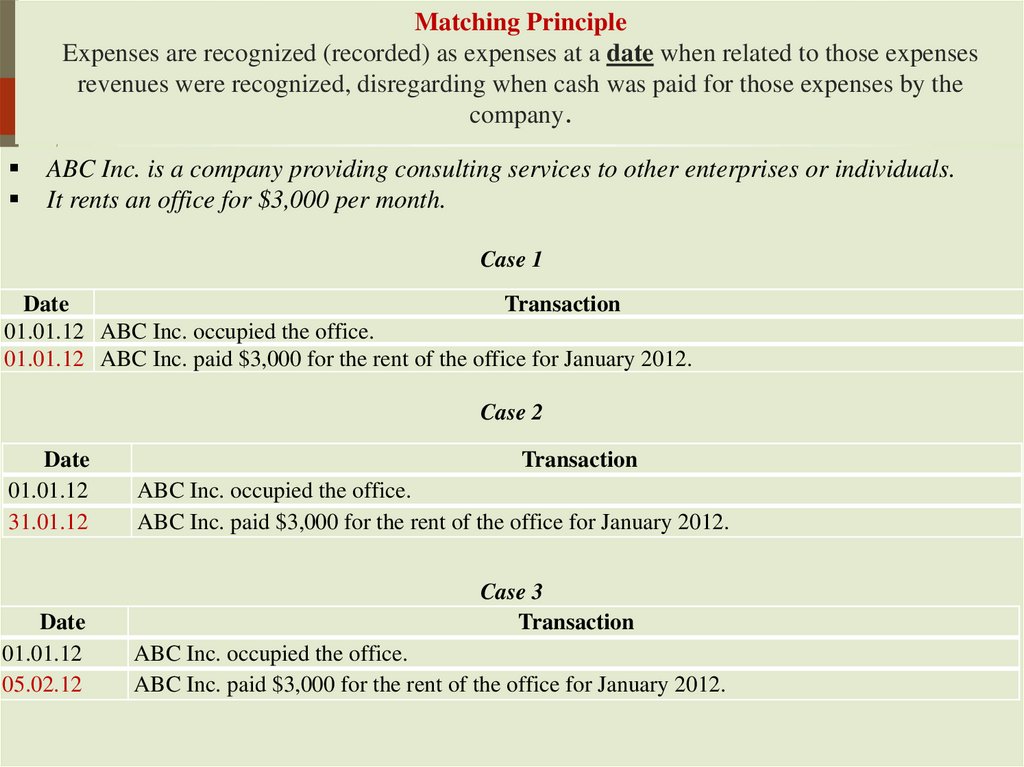

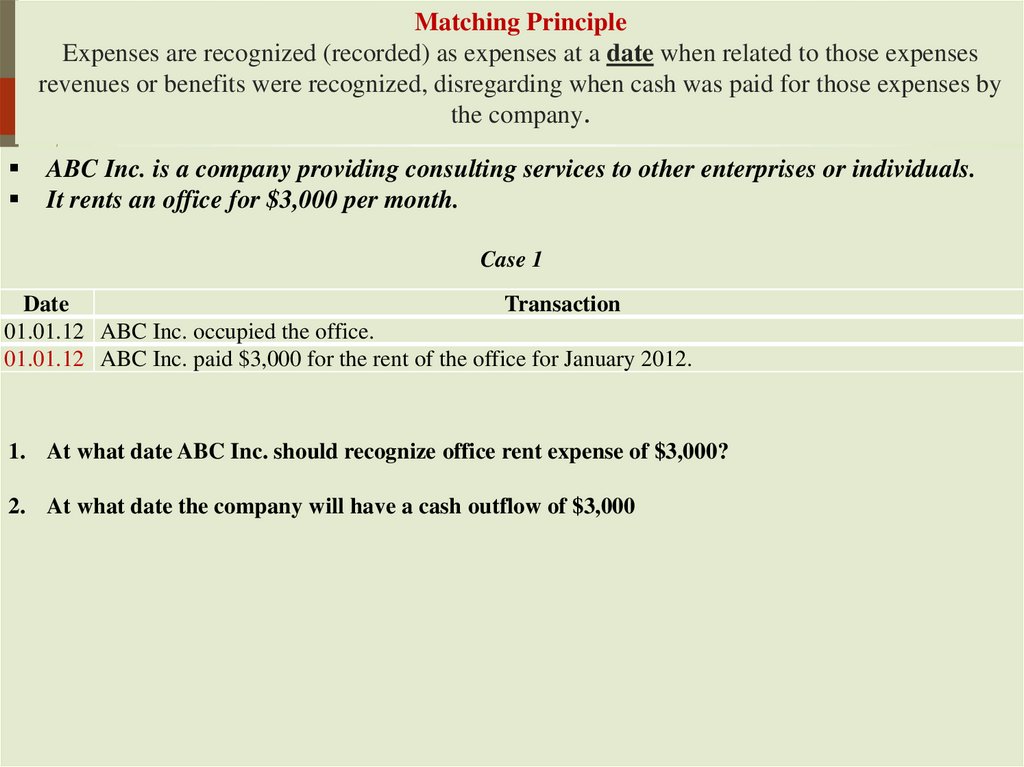

41. Matching Principle Expenses are recognized (recorded) as expenses at a date when related to those expenses revenues were

recognized, disregarding when cash was paid for those expenses by thecompany.

ABC Inc. is a company providing consulting services to other enterprises or individuals.

It rents an office for $3,000 per month.

Case 1

Date

Transaction

01.01.12 ABC Inc. occupied the office.

01.01.12 ABC Inc. paid $3,000 for the rent of the office for January 2012.

Case 2

Date

01.01.12

31.01.12

Date

01.01.12

05.02.12

Transaction

ABC Inc. occupied the office.

ABC Inc. paid $3,000 for the rent of the office for January 2012.

Case 3

Transaction

ABC Inc. occupied the office.

ABC Inc. paid $3,000 for the rent of the office for January 2012.

42. Matching Principle Expenses are recognized (recorded) as expenses at a date when related to those expenses revenues or benefits

were recognized, disregarding when cash was paid for those expenses bythe company.

ABC Inc. is a company providing consulting services to other enterprises or individuals.

It rents an office for $3,000 per month.

Case 1

Date

Transaction

01.01.12 ABC Inc. occupied the office.

01.01.12 ABC Inc. paid $3,000 for the rent of the office for January 2012.

1. At what date ABC Inc. should recognize office rent expense of $3,000?

2. At what date the company will have a cash outflow of $3,000

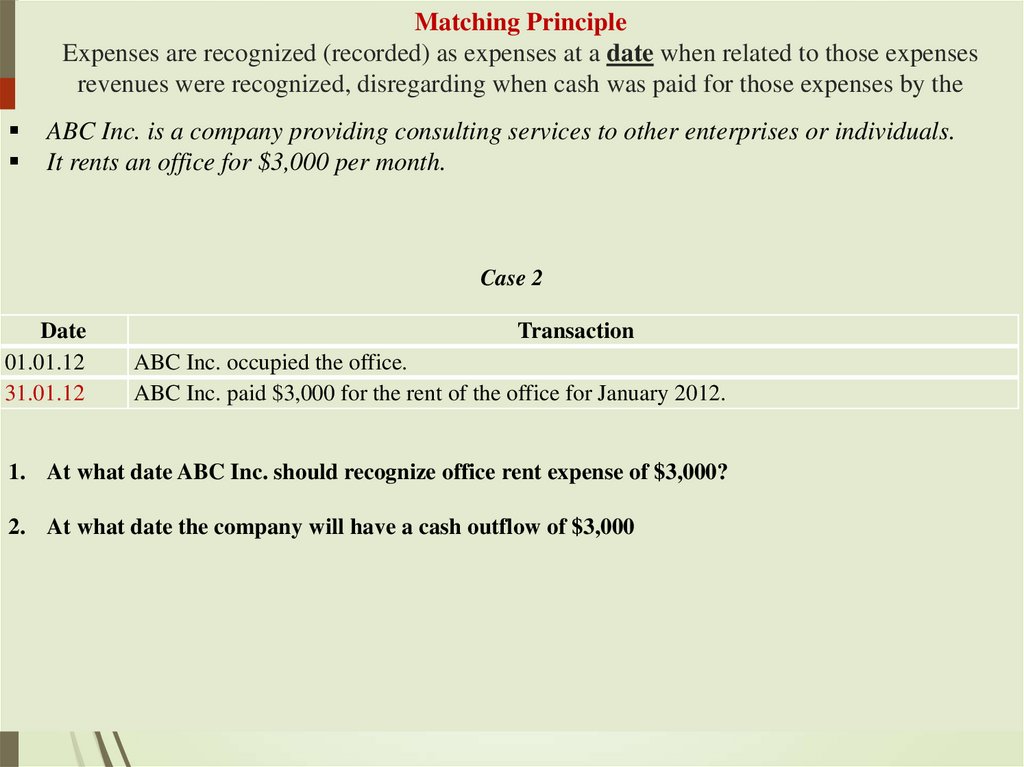

43. Matching Principle Expenses are recognized (recorded) as expenses at a date when related to those expenses revenues were

recognized, disregarding when cash was paid for those expenses by thecompany.

ABC Inc. is a company providing consulting services to other enterprises or individuals.

It rents an office for $3,000 per month.

Case 2

Date

01.01.12

31.01.12

Transaction

ABC Inc. occupied the office.

ABC Inc. paid $3,000 for the rent of the office for January 2012.

1. At what date ABC Inc. should recognize office rent expense of $3,000?

2. At what date the company will have a cash outflow of $3,000

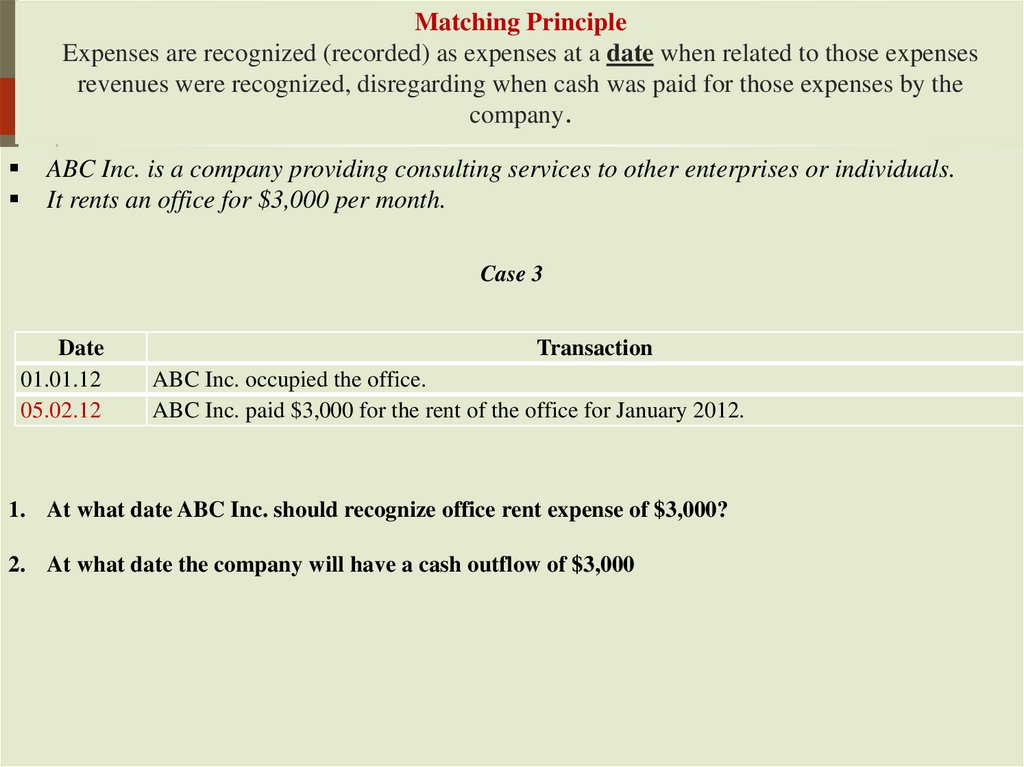

44. Matching Principle Expenses are recognized (recorded) as expenses at a date when related to those expenses revenues were

recognized, disregarding when cash was paid for those expenses by thecompany.

ABC Inc. is a company providing consulting services to other enterprises or individuals.

It rents an office for $3,000 per month.

Case 3

Date

01.01.12

05.02.12

Transaction

ABC Inc. occupied the office.

ABC Inc. paid $3,000 for the rent of the office for January 2012.

1. At what date ABC Inc. should recognize office rent expense of $3,000?

2. At what date the company will have a cash outflow of $3,000

45. Statement of Comprehensive Income

Statement of Comprehensive Income consists ofthe Income Statement (Statement of Profit/Loss)

and Other Comprehensive Income items

46. Statement of Retained Earnings

Retained Earnings/Deficit – accumulatedamount of net income/loss for the period of

time the company was operating, less all

the dividends paid during this period of time.

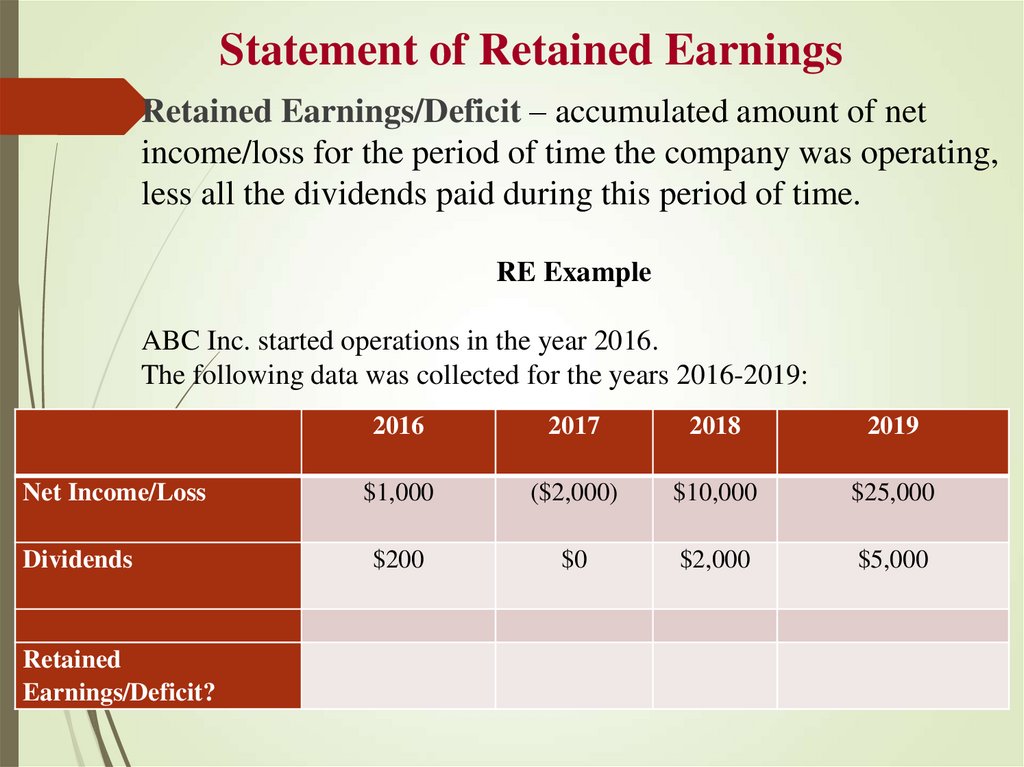

47. Statement of Retained Earnings

Retained Earnings/Deficit – accumulated amount of netincome/loss for the period of time the company was operating,

less all the dividends paid during this period of time.

RE Example

ABC Inc. started operations in the year 2016.

The following data was collected for the years 2016-2019:

2016

2017

2018

2019

Net Income/Loss

$1,000

($2,000)

$10,000

$25,000

Dividends

$200

$0

$2,000

$5,000

Retained

Earnings/Deficit?

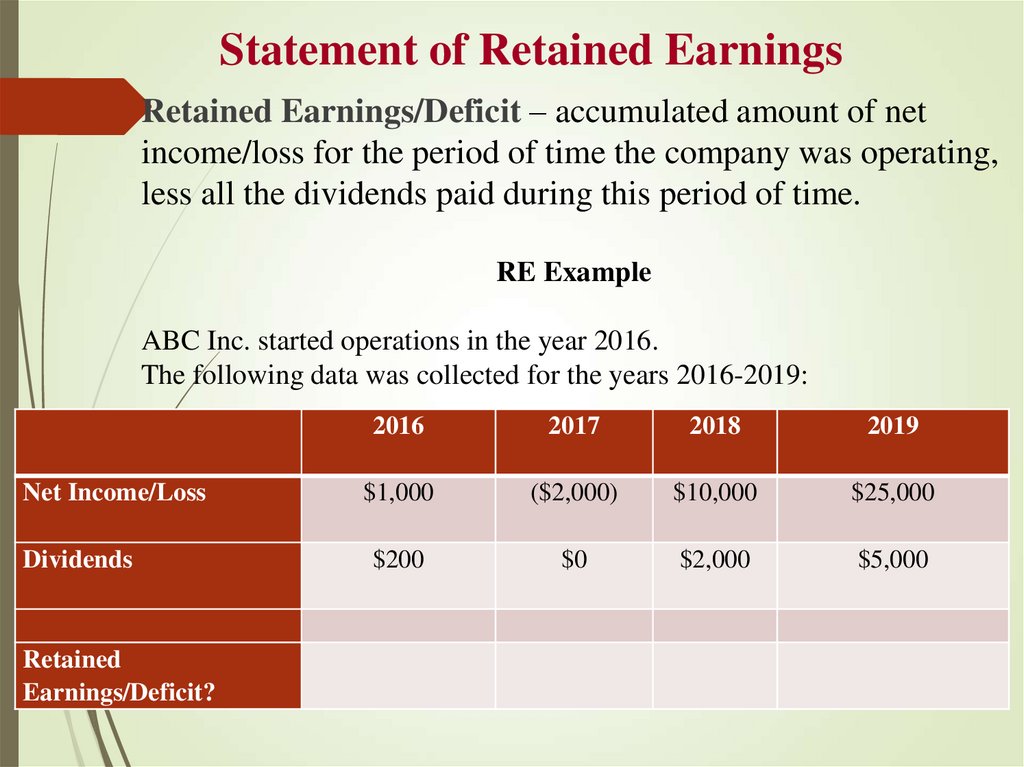

48. Statement of Retained Earnings

Retained Earnings/Deficit – accumulated amount of netincome/loss for the period of time the company was operating,

less all the dividends paid during this period of time.

RE Example

ABC Inc. started operations in the year 2016.

The following data was collected for the years 2016-2019:

2016

2017

2018

2019

Net Income/Loss

$1,000

($2,000)

$10,000

$25,000

Dividends

$200

$0

$2,000

$5,000

Retained

Earnings/Deficit?

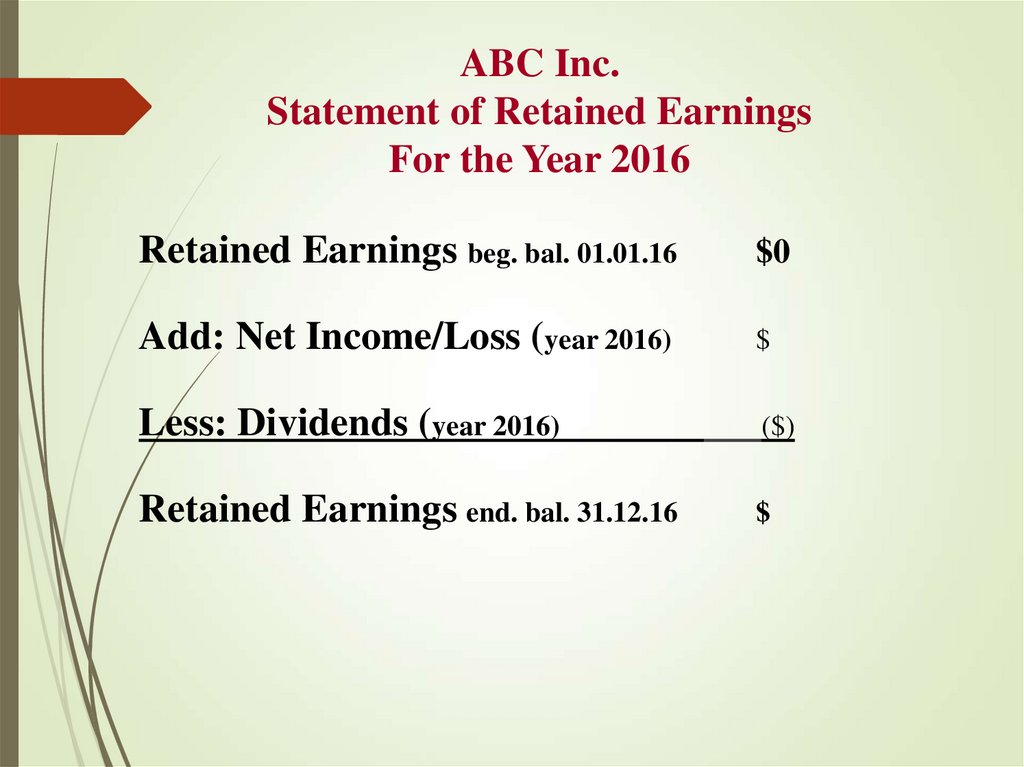

49. ABC Inc. Statement of Retained Earnings For the Year 2016

Retained Earnings beg. bal. 01.01.16$0

Add: Net Income/Loss (year 2016)

$

Less: Dividends (year 2016)

($)

Retained Earnings end. bal. 31.12.16

$

50. ABC Inc. Statement of Retained Earnings For the Year 2017

Retained Earnings beg. bal. 01.01.16$0

Add: Net Income/Loss (year 2016)

$

Less: Dividends (year 2016)

($0)

Retained Earnings end. bal. 31.12.16

$

51. ABC Inc. Statement of Retained Earnings For the Year 2018

Retained Earnings beg. bal. 01.01.16$0

Add: Net Income/Loss (year 2016)

$

Less: Dividends (year 2016)

($0)

Retained Earnings end. bal. 31.12.16

$

52. ABC Inc. Statement of Retained Earnings For the Year 2019

Retained Earnings beg. bal. 01.01.16$

Add: Net Income/Loss (year 2016)

$

Less: Dividends (year 2016)

($0)

Retained Earnings end. bal. 31.12.16

$

53. Cash Flow Statement

Cash inflows and outflows from:1. Operating Activities;

2. Investing Activities;

3. Financing Activities.

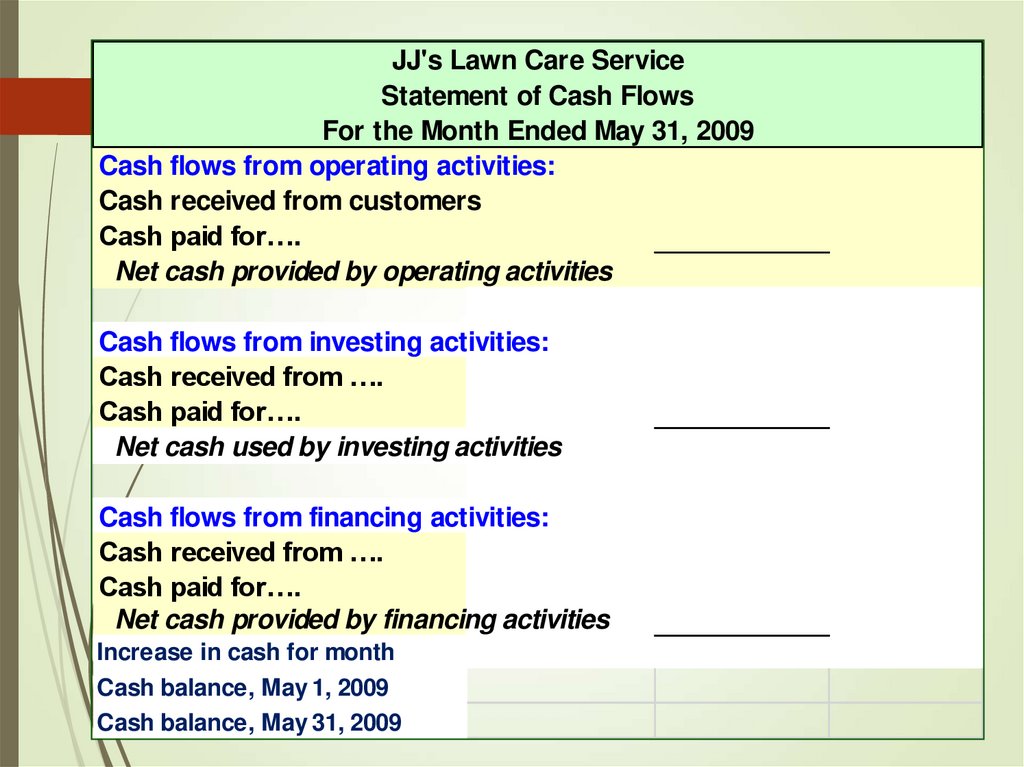

54.

JJ's Lawn Care ServiceStatement of Cash Flows

For the Month Ended May 31, 2009

Cash flows from operating activities:

Cash received from customers

Cash paid for….

Net cash provided by operating activities

Cash flows from investing activities:

Cash received from ….

Cash paid for….

Net cash used by investing activities

Cash flows from financing activities:

Cash received from ….

Cash paid for….

Net cash provided by financing activities

Increase in cash for month

Cash balance, May 1, 2009

Cash balance, May 31, 2009

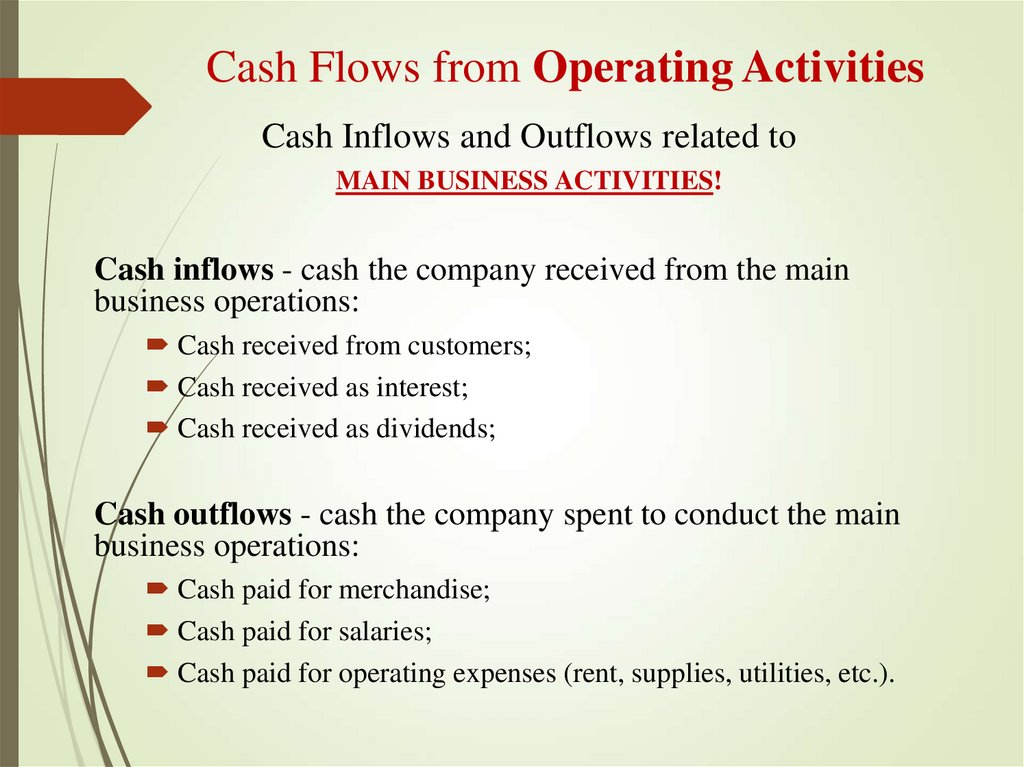

55. Cash Flows from Operating Activities

Cash Inflows and Outflows related toMAIN BUSINESS ACTIVITIES!

Cash inflows - cash the company received from the main

business operations:

Cash received from customers;

Cash received as interest;

Cash received as dividends;

Cash outflows - cash the company spent to conduct the main

business operations:

Cash paid for merchandise;

Cash paid for salaries;

Cash paid for operating expenses (rent, supplies, utilities, etc.).

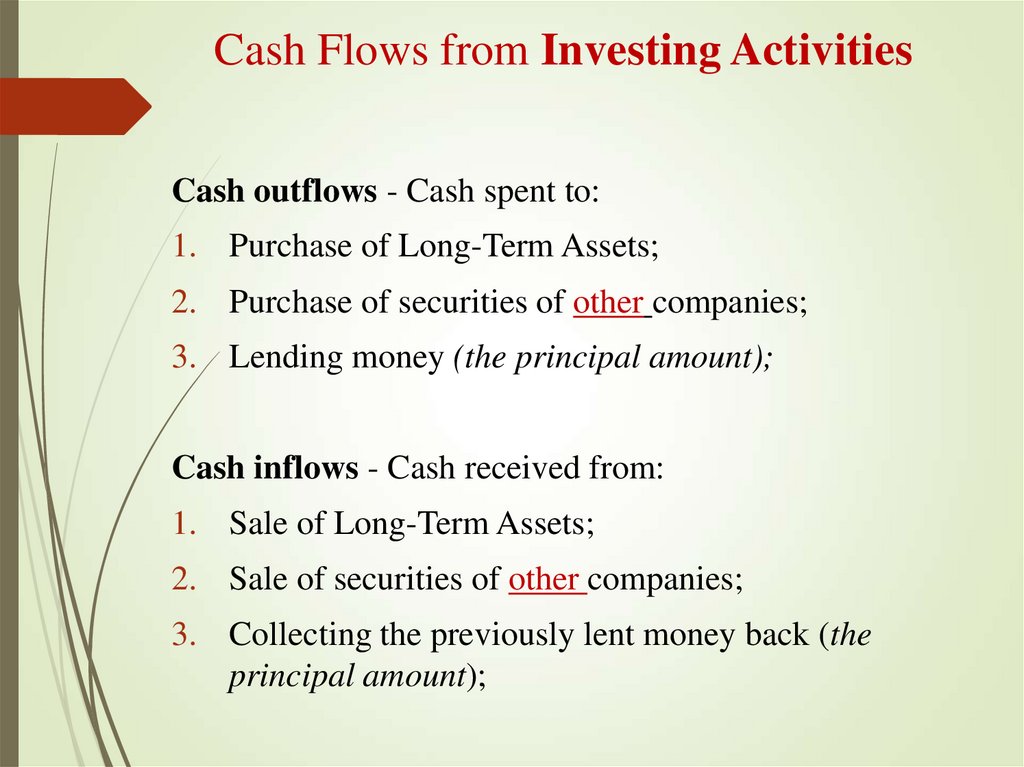

56. Cash Flows from Investing Activities

Cash outflows - Cash spent to:1. Purchase of Long-Term Assets;

2. Purchase of securities of other companies;

3. Lending money (the principal amount);

Cash inflows - Cash received from:

1. Sale of Long-Term Assets;

2. Sale of securities of other companies;

3. Collecting the previously lent money back (the

principal amount);

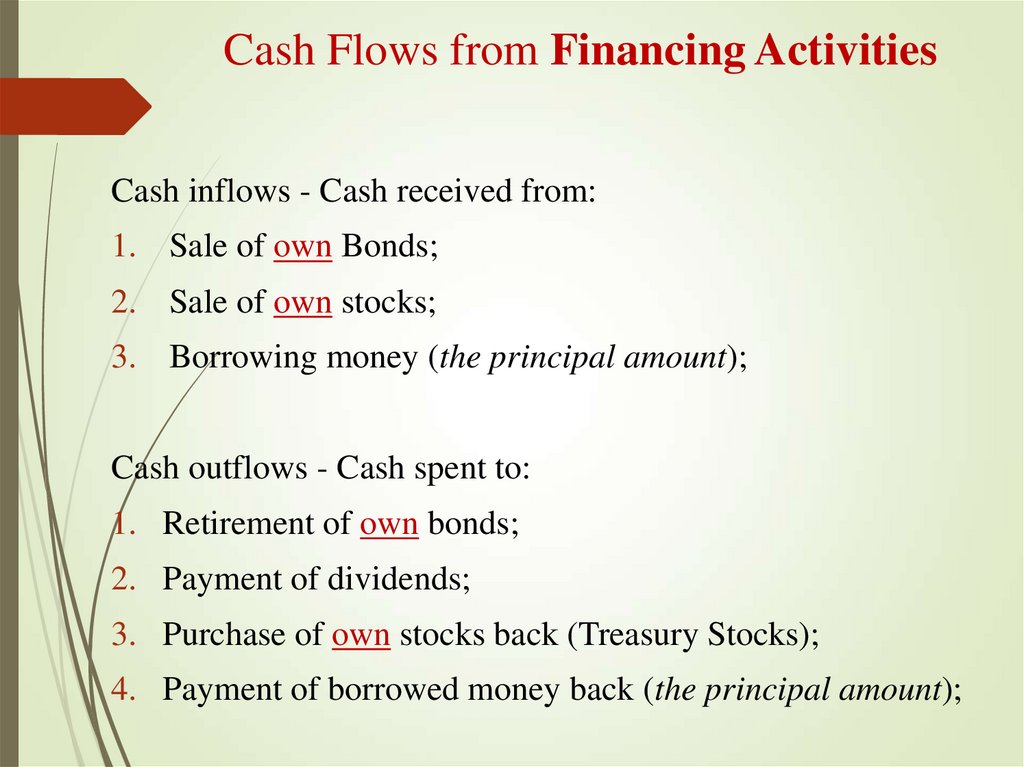

57. Cash Flows from Financing Activities

Cash inflows - Cash received from:1. Sale of own Bonds;

2. Sale of own stocks;

3. Borrowing money (the principal amount);

Cash outflows - Cash spent to:

1. Retirement of own bonds;

2. Payment of dividends;

3. Purchase of own stocks back (Treasury Stocks);

4. Payment of borrowed money back (the principal amount);

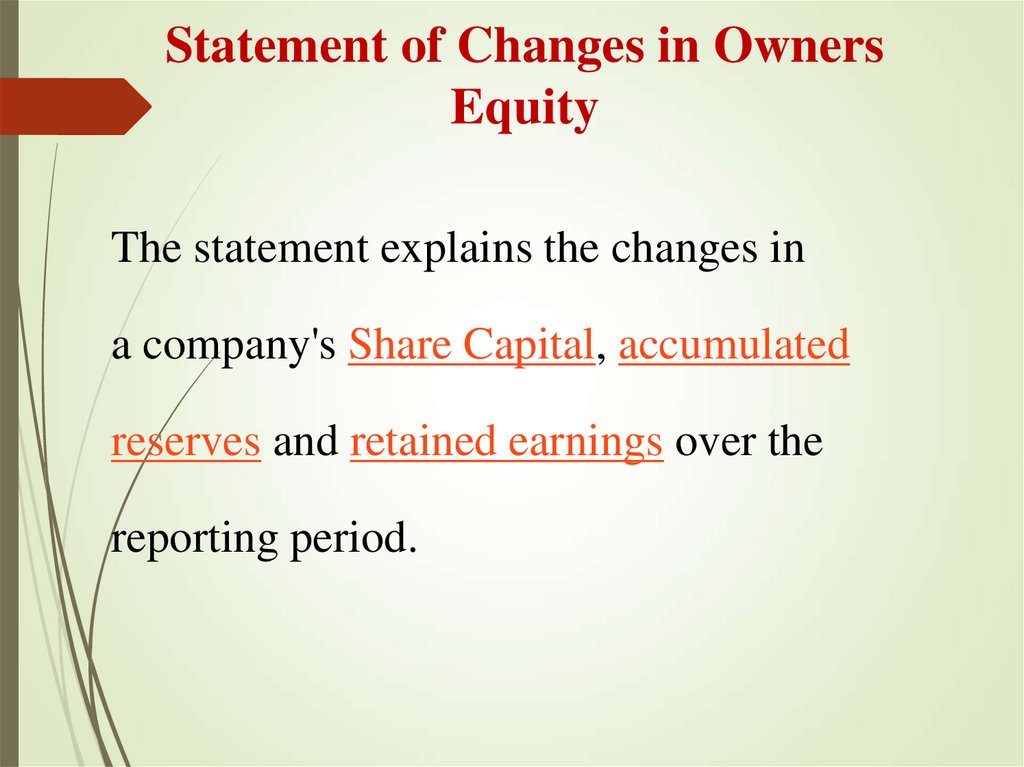

58. Statement of Changes in Owners Equity

The statement explains the changes ina company's Share Capital, accumulated

reserves and retained earnings over the

reporting period.

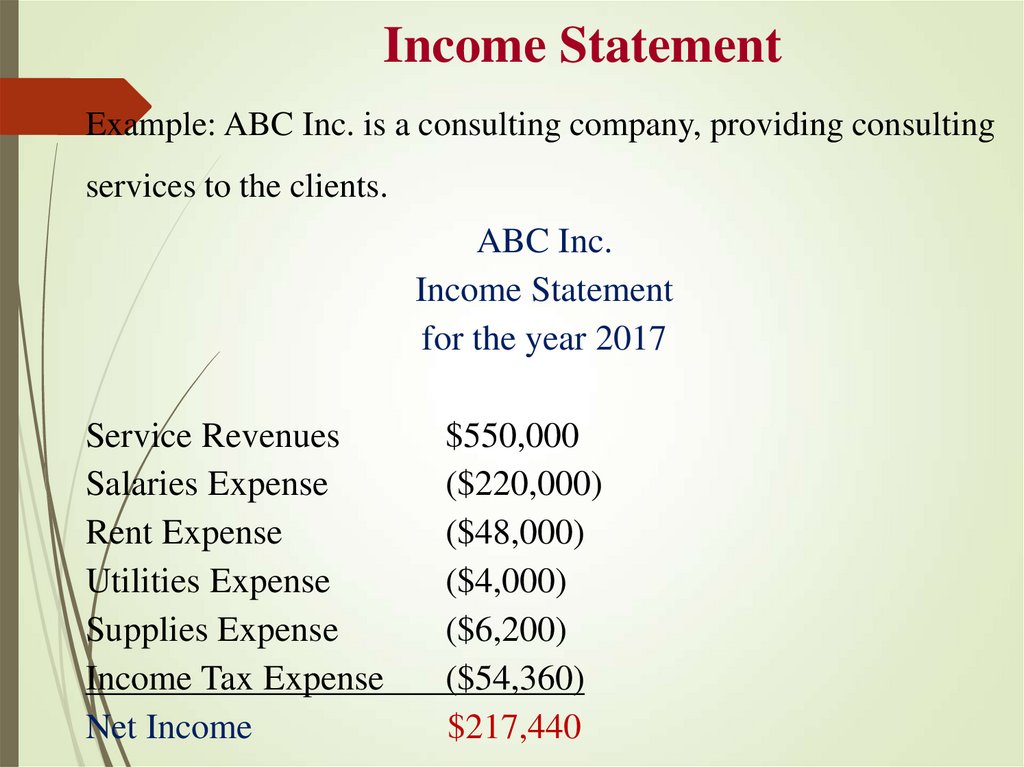

59. Income Statement

Example: ABC Inc. is a consulting company, providing consultingservices to the clients.

ABC Inc.

Income Statement

for the year 2017

Service Revenues

Salaries Expense

Rent Expense

Utilities Expense

Supplies Expense

Income Tax Expense

Net Income

$550,000

($220,000)

($48,000)

($4,000)

($6,200)

($54,360)

$217,440

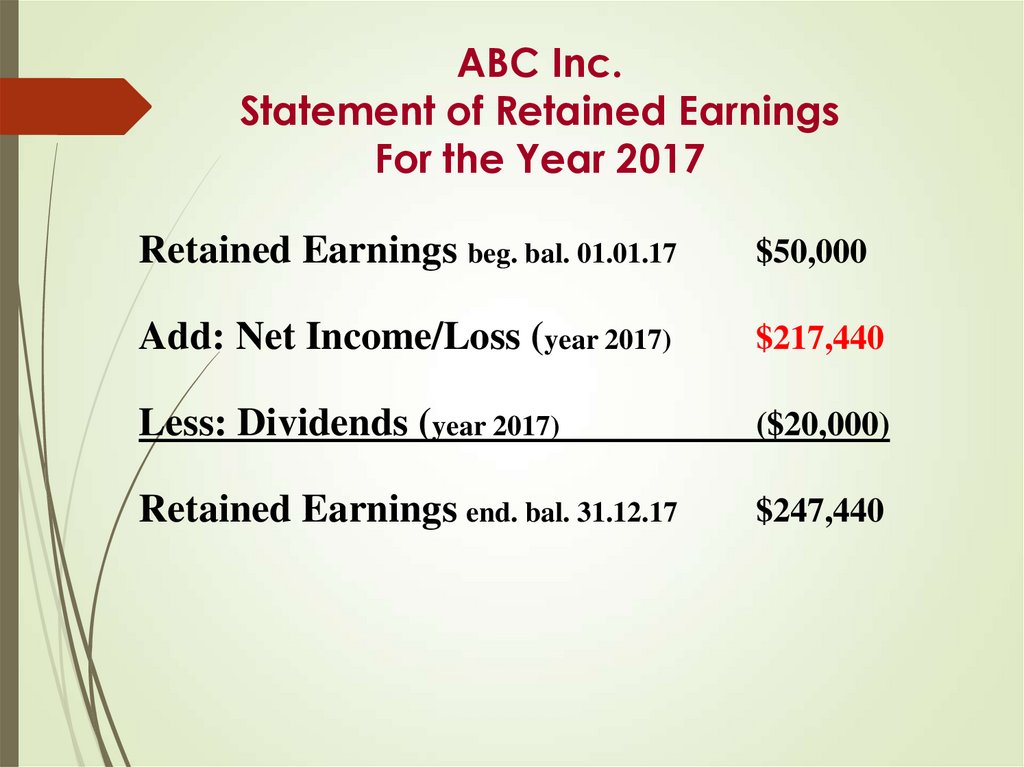

60. ABC Inc. Statement of Retained Earnings For the Year 2017

Retained Earnings beg. bal. 01.01.17$50,000

Add: Net Income/Loss (year 2017)

$217,440

Less: Dividends (year 2017)

($20,000)

Retained Earnings end. bal. 31.12.17

$247,440

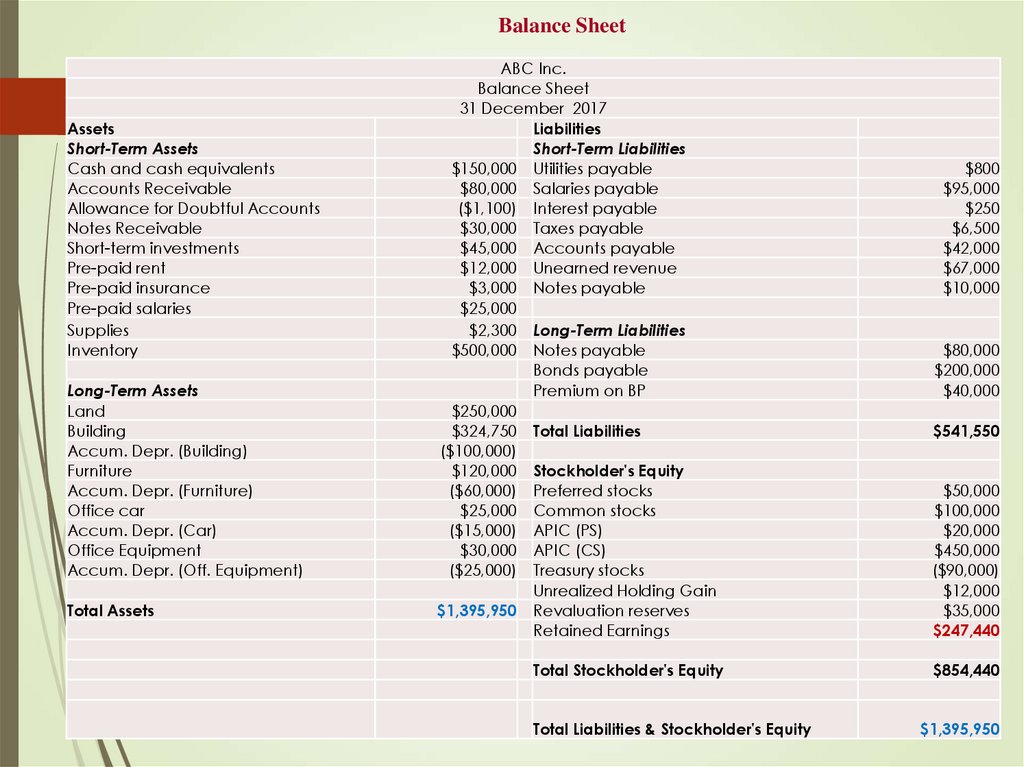

61. Balance Sheet

AssetsShort-Term Assets

Cash and cash equivalents

Accounts Receivable

Allowance for Doubtful Accounts

Notes Receivable

Short-term investments

Pre-paid rent

Pre-paid insurance

Pre-paid salaries

Supplies

Inventory

Long-Term Assets

Land

Building

Accum. Depr. (Building)

Furniture

Accum. Depr. (Furniture)

Office car

Accum. Depr. (Car)

Office Equipment

Accum. Depr. (Off. Equipment)

Total Assets

ABC Inc.

Balance Sheet

31 December 2017

Liabilities

Short-Term Liabilities

$150,000 Utilities payable

$80,000 Salaries payable

($1,100) Interest payable

$30,000 Taxes payable

$45,000 Accounts payable

$12,000 Unearned revenue

$3,000 Notes payable

$25,000

$2,300 Long-Term Liabilities

$500,000 Notes payable

Bonds payable

Premium on BP

$250,000

$324,750 Total Liabilities

($100,000)

$120,000 Stockholder's Equity

($60,000) Preferred stocks

$25,000 Common stocks

($15,000) APIC (PS)

$30,000 APIC (CS)

($25,000) Treasury stocks

Unrealized Holding Gain

$1,395,950 Revaluation reserves

Retained Earnings

$50,000

$100,000

$20,000

$450,000

($90,000)

$12,000

$35,000

$247,440

Total Stockholder's Equity

$854,440

Total Liabilities & Stockholder's Equity

$800

$95,000

$250

$6,500

$42,000

$67,000

$10,000

$80,000

$200,000

$40,000

$541,550

$1,395,950

Финансы

Финансы