Похожие презентации:

8.Risks in the business administration system

1. 8. Risks in the business administration system

USTSINOVICH IRINAMANAGERIAL ECONOMICS

8. RISKS IN THE BUSINESS

ADMINISTRATION SYSTEM

2. 8.Risks in the business administration system

8.RISKS IN THE BUSINESS ADMINISTRATION SYSTEM1. Economic risk: essence, place and role in planning. Types of loss

and risk

2. Entrepreneurial planning risks assessment

3. Risk reduction methods

Ustsinovich I.V.

2

3. 1. Economic risk: essence, place and role in planning. Types of loss and risk

1. ECONOMIC RISK: ESSENCE, PLACE AND ROLE IN PLANNING. TYPESOF LOSS AND RISK

Ustsinovich I.V.

3

4.

• The source of the risk is uncertainty, which refersto the lack of complete and reliable information

used in the preparation and implementation of the

plan.

Ustsinovich I.V.

4

5. Risk planning includes:

RISK PLANNING INCLUDES:• determining (identifying) all risks;

• risk assessment in terms of the their occurrence and possible losses

probability;

• risk selection requiring attention;

• develop an action plan to address (reduce) the negative effects of the

occurrence of;

• Assessing the cost of risk minimization activities and analyzing their

feasibility.

Ustsinovich I.V.

5

6. Losses types:

LOSSES TYPES:• material;

• labor;

• financial;

• timing;

• image;

• other.

Ustsinovich I.V.

6

7. 2. Entrepreneurial planning risks assessment

2. ENTREPRENEURIAL PLANNING RISKS ASSESSMENTUstsinovich I.V.

7

8.

• The risks and causes of the project are assessedin accordance with the specifics and conditions

of the project.

• When identifying risks, it is common to use the

method of PEST analysis, which is often used to

assess key market trends in the industry, and its

results can in turn be used to determine the list

of threats and opportunities when compiling a

company's SWOT analysis.

Ustsinovich I.V.

8

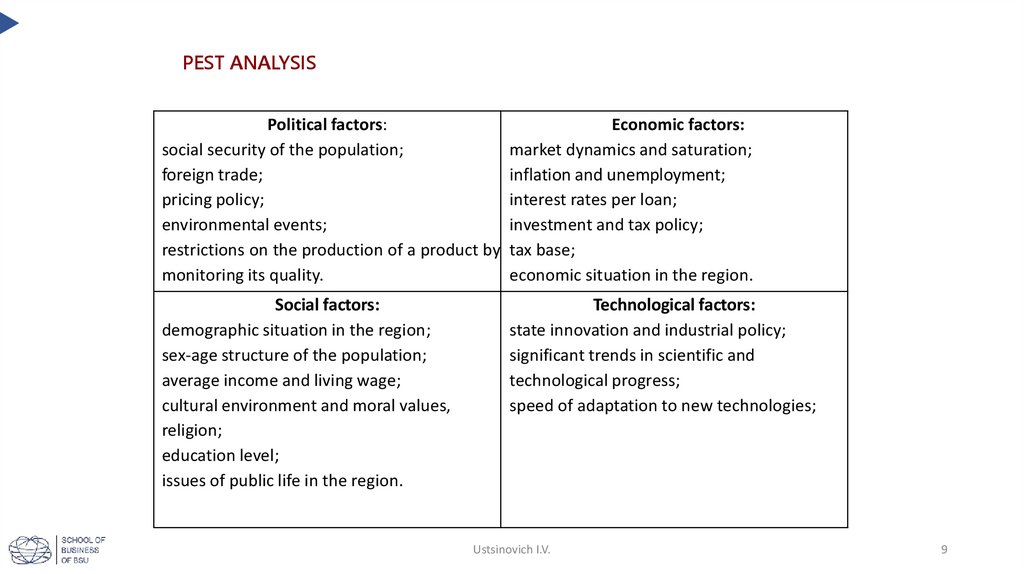

9. PEST analysis

PEST ANALYSISPolitical factors:

Economic factors:

social security of the population;

market dynamics and saturation;

foreign trade;

inflation and unemployment;

pricing policy;

interest rates per loan;

environmental events;

investment and tax policy;

restrictions on the production of a product by tax base;

monitoring its quality.

economic situation in the region.

Social factors:

demographic situation in the region;

sex-age structure of the population;

average income and living wage;

cultural environment and moral values,

religion;

education level;

issues of public life in the region.

Technological factors:

state innovation and industrial policy;

significant trends in scientific and

technological progress;

speed of adaptation to new technologies;

Ustsinovich I.V.

9

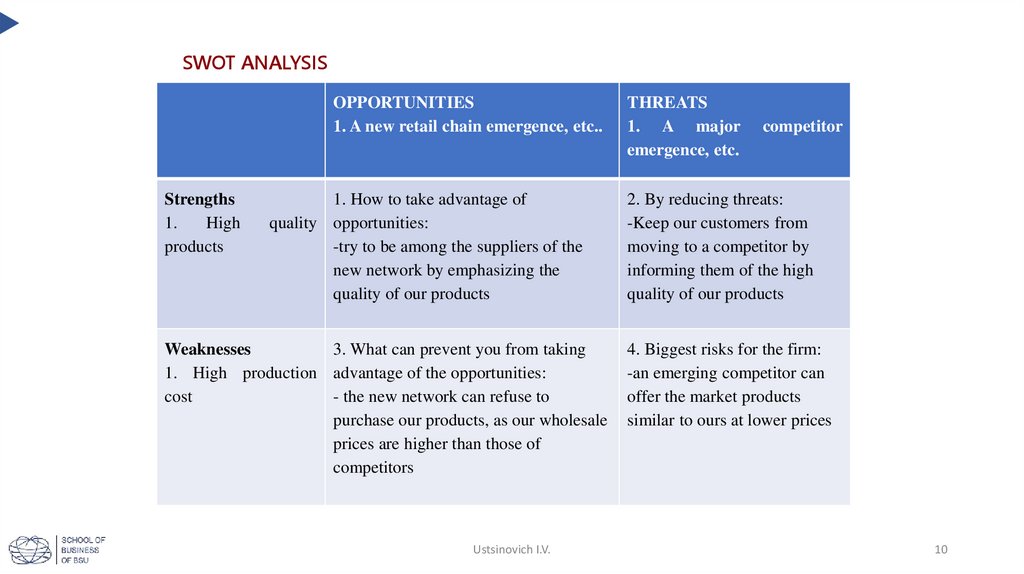

10. SWOT analysis

SWOT ANALYSISOPPORTUNITIES

1. A new retail chain emergence, etc..

Strengths

1.

High

products

1. How to take advantage of

quality opportunities:

-try to be among the suppliers of the

new network by emphasizing the

quality of our products

Weaknesses

3. What can prevent you from taking

1. High production advantage of the opportunities:

cost

- the new network can refuse to

purchase our products, as our wholesale

prices are higher than those of

competitors

Ustsinovich I.V.

THREATS

1. A major

emergence, etc.

competitor

2. By reducing threats:

-Keep our customers from

moving to a competitor by

informing them of the high

quality of our products

4. Biggest risks for the firm:

-an emerging competitor can

offer the market products

similar to ours at lower prices

10

11. Risk assessment methods

RISK ASSESSMENT METHODS• statistical

• expert

• settlement-analytical

Ustsinovich I.V.

11

12.

• In order to identify the impact of risks on the effectiveness ofan investment project in the Rules for the Development of

Business Plans of Investment Projects, it is recommended to

conduct a multi-factor analysis of the sensitivity of the project

Ustsinovich I.V.

12

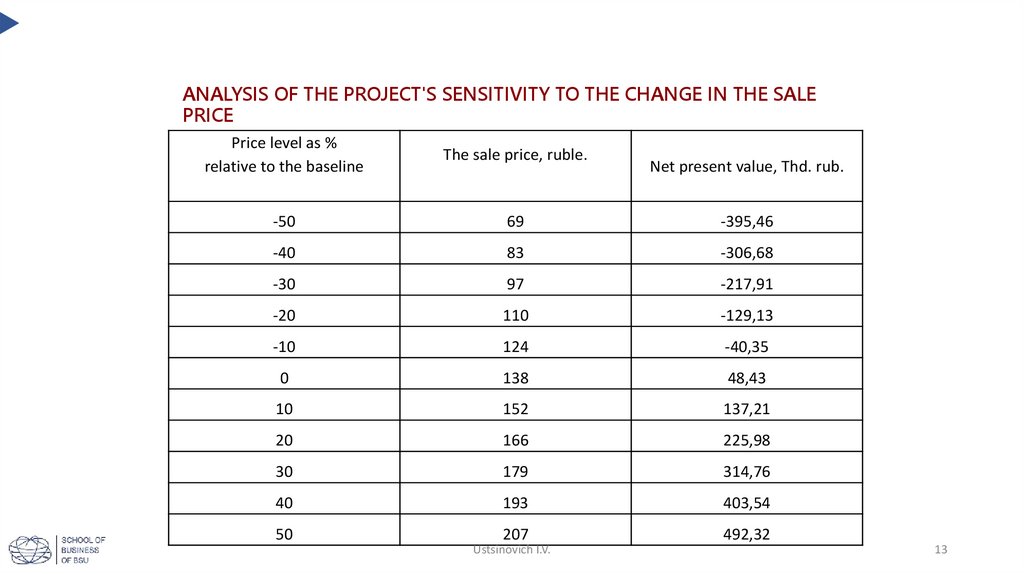

13. Analysis of the project's sensitivity to the change in the sale price

ANALYSIS OF THE PROJECT'S SENSITIVITY TO THE CHANGE IN THE SALEPRICE

Price level as %

relative to the baseline

The sale price, ruble.

-50

69

-395,46

-40

83

-306,68

-30

97

-217,91

-20

110

-129,13

-10

124

-40,35

0

138

48,43

10

152

137,21

20

166

225,98

30

179

314,76

40

193

403,54

207

492,32

50

Ustsinovich I.V.

Net present value, Thd. rub.

13

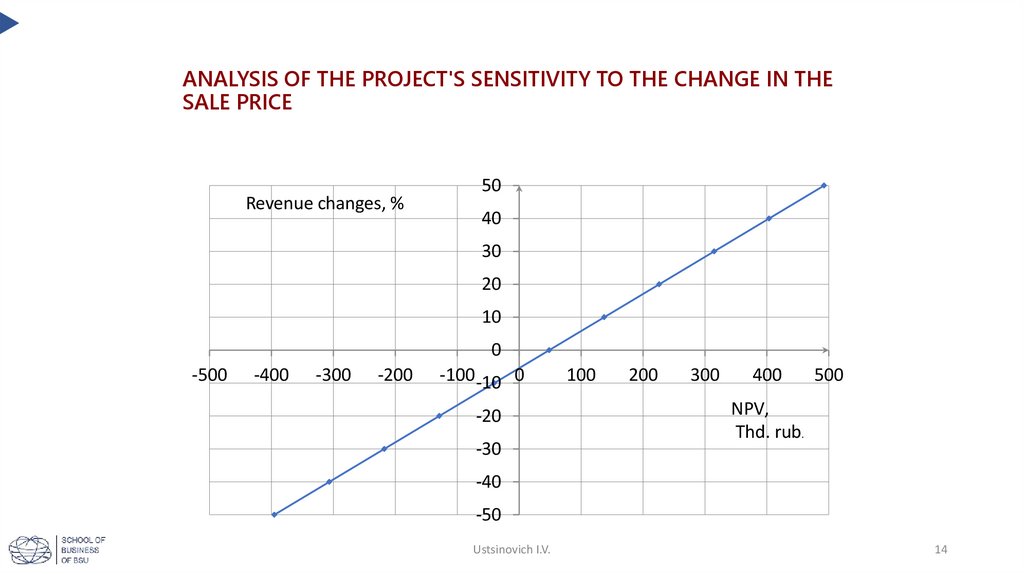

14. Analysis of the project's sensitivity to the change in the sale price

ANALYSIS OF THE PROJECT'S SENSITIVITY TO THE CHANGE IN THESALE PRICE

Revenue changes, %

50

40

30

20

10

0

-500

-400

-300

-200

-100 -10 0

-20

-30

100

200

300

400

500

NPV,

Thd. rub.

-40

-50

Ustsinovich I.V.

14

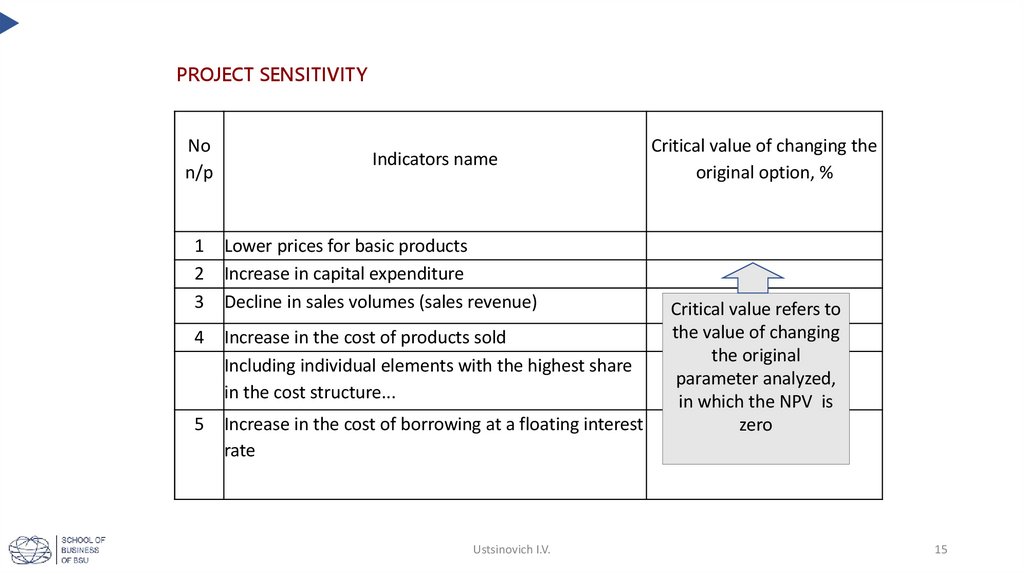

15. Project sensitivity

PROJECT SENSITIVITYNo

n/p

Indicators name

1

2

3

Lower prices for basic products

Increase in capital expenditure

Decline in sales volumes (sales revenue)

4

Increase in the cost of products sold

Including individual elements with the highest share

in the cost structure...

5

Increase in the cost of borrowing at a floating interest

rate

Ustsinovich I.V.

Critical value of changing the

original option, %

Critical value refers to

the value of changing

the original

parameter analyzed,

in which the NPV is

zero

15

16. Script analysis sequence:

SCRIPT ANALYSIS SEQUENCE:• identify critical parameters (e.g. through sensitivity analysis);

• scenarios develop and determine the likelihood of their

implementation (see example);

• calculating performance in the implementation of relevant

development scenarios by substitution into the financial model;

• assessing expected performance values based on risk and approving an

action plan.

Ustsinovich I.V.

16

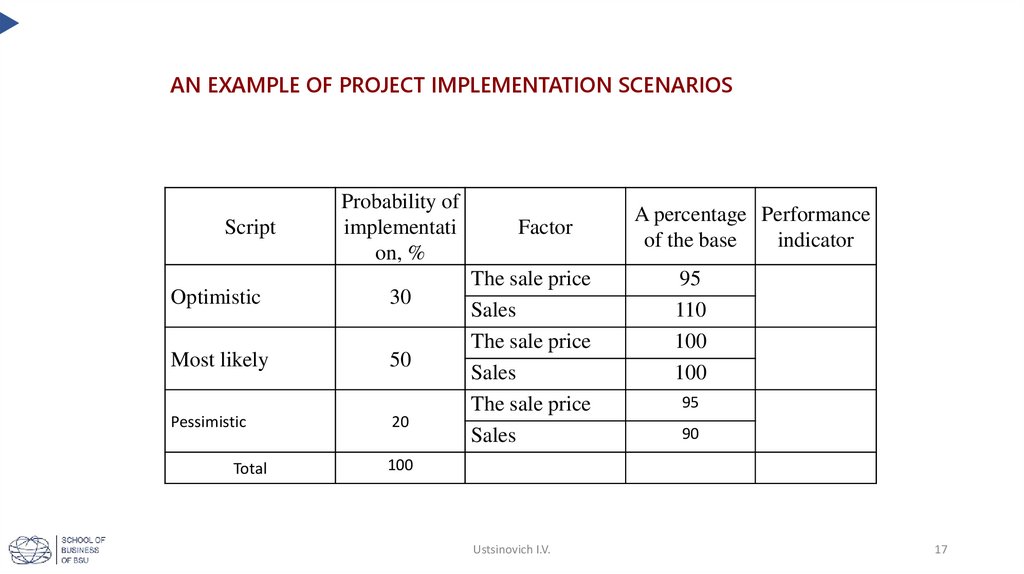

17. An example of project implementation scenarios

AN EXAMPLE OF PROJECT IMPLEMENTATION SCENARIOSScript

Probability of

implementati

on, %

Optimistic

30

Most likely

50

Pessimistic

Total

20

Factor

The sale price

Sales

The sale price

Sales

The sale price

Sales

A percentage Performance

of the base

indicator

95

110

100

100

95

90

100

Ustsinovich I.V.

17

18.

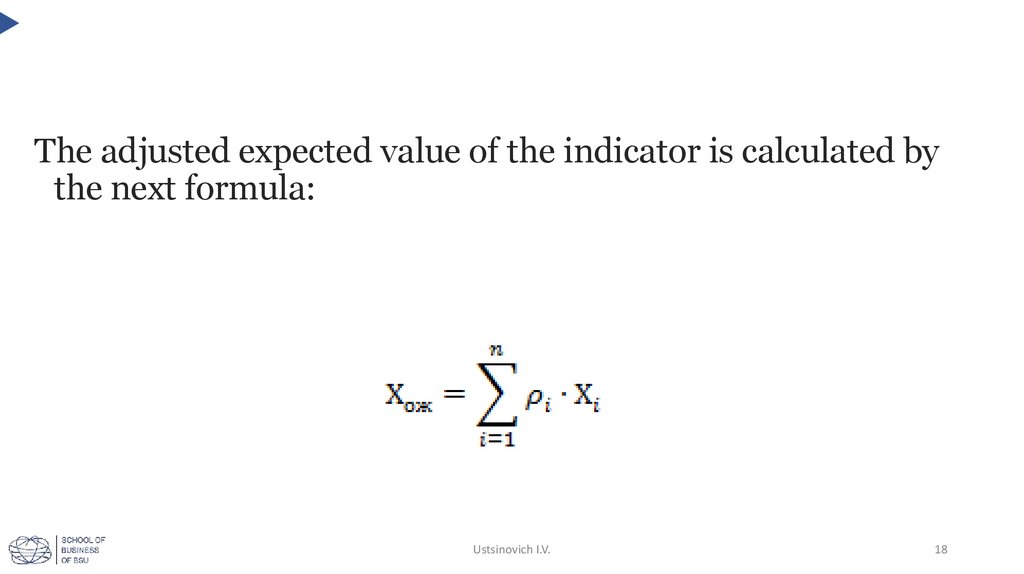

The adjusted expected value of the indicator is calculated bythe next formula:

Ustsinovich I.V.

18

19. 3. Risk reduction methods

3. RISK REDUCTION METHODSUstsinovich I.V.

19

20. Risk reduction methods

RISK REDUCTION METHODS• risk evasion;

• localization;

• taking hold of risk;

• diversification.

Ustsinovich I.V.

20

21. Thank you for your attention!

THANK YOU FOR YOUR ATTENTION!Irina Valeryevna Ustsinovitch, Ph.D. in Economics, Associate Professor

+375 (29) 7785456

i.ustinovich@yandex.ru

Ustsinovich I.V.

21

Бизнес

Бизнес