Похожие презентации:

1st-2nd Lessons_Types of business entities

1.

WELCOME BACKTO TERM 2

WHERE LEARNING

LEVELS UP!

2. BUSINESS ENTITIES and FIRMS in KAZAKHSTAN

Teacher: Yerlan Iskanderov3. Lesson Objectives

• To distinguish legal forms of businessorganisation;

• To define and understand the key

characteristics

of

business

entities,

including

sole

proprietorships,

partnerships, limited liability companies

(LLCs), and corporations.

4. Think of a business you would want to have in the future….

5. BRAINSTORM

• What is a business?• What are the forms of business entities?

• What are the two main categories of persons

recognized by law of the RK in terms of legal

rights and responsibilities?

• How do financial liabilities differ for an

individual running a business versus a legal

entity?

6. What is a BUSINESS?

Business is an economicactivity that involves the

exchange, purchase, sale or

production of goods and

services with a motive to

earn profits and satisfy the

needs of customers.

Businesses can be both

profit or non-profit

organizations that function

to gain profits or achieve a

social cause respectively.

6

7. FORMS OF BUSINESS ENTITIES

There are four forms ofbusiness organizations available

to aspiring businessmen – Sole

Proprietorships, Partnerships,

Limited Liability Companies

(LLC), and Corporations.

Each form has its own

advantages and disadvantages.

Aspiring businessmen take this

into consideration before

deciding what form their

businesses will take.

FR

7

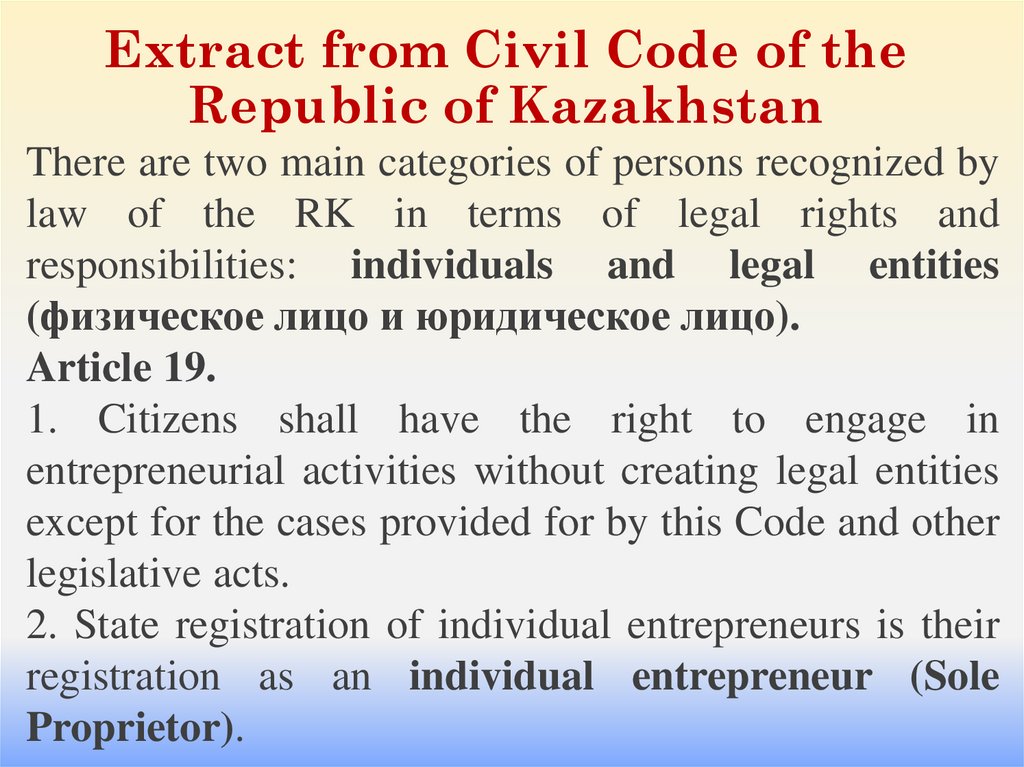

8. Extract from Civil Code of the Republic of Kazakhstan

There are two main categories of persons recognized bylaw of the RK in terms of legal rights and

responsibilities: individuals and legal entities

(физическое лицо и юридическое лицо).

Article 19.

1. Citizens shall have the right to engage in

entrepreneurial activities without creating legal entities

except for the cases provided for by this Code and other

legislative acts.

2. State registration of individual entrepreneurs is their

registration as an individual entrepreneur (Sole

Proprietor).

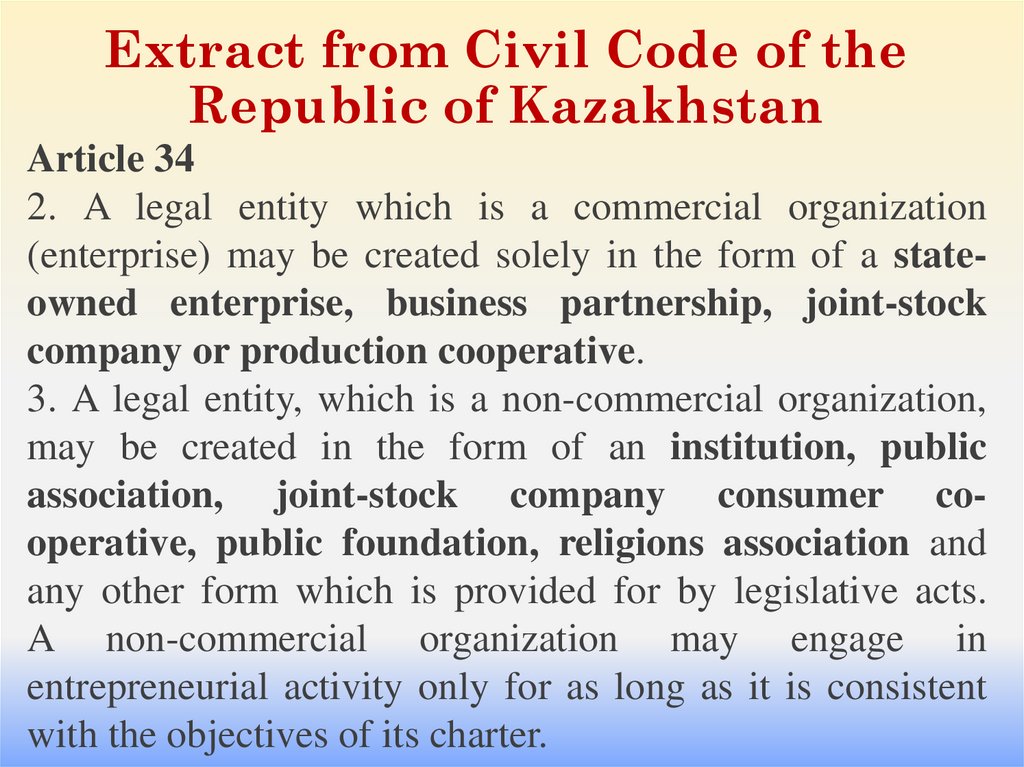

9. Extract from Civil Code of the Republic of Kazakhstan

Article 342. A legal entity which is a commercial organization

(enterprise) may be created solely in the form of a stateowned enterprise, business partnership, joint-stock

company or production cooperative.

3. A legal entity, which is a non-commercial organization,

may be created in the form of an institution, public

association, joint-stock company consumer cooperative, public foundation, religions association and

any other form which is provided for by legislative acts.

A non-commercial organization may engage in

entrepreneurial activity only for as long as it is consistent

with the objectives of its charter.

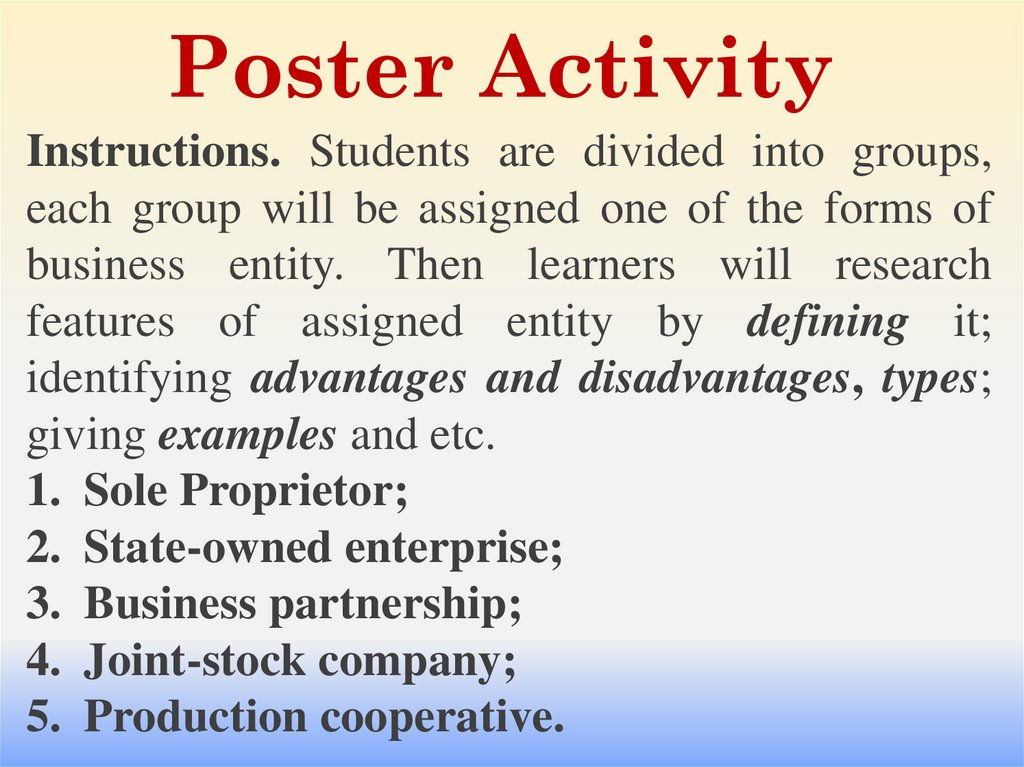

10. Poster Activity

Instructions. Students are divided into groups,each group will be assigned one of the forms of

business entity. Then learners will research

features of assigned entity by defining it;

identifying advantages and disadvantages, types;

giving examples and etc.

1. Sole Proprietor;

2. State-owned enterprise;

3. Business partnership;

4. Joint-stock company;

5. Production cooperative.

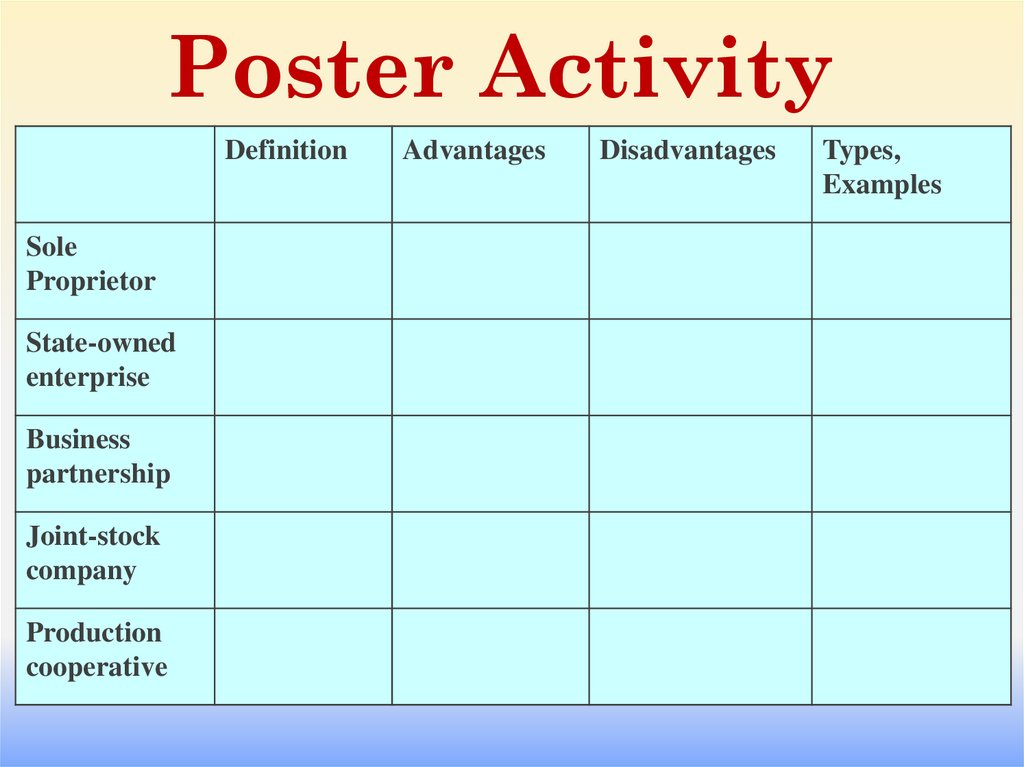

11. Poster Activity

DefinitionSole

Proprietor

State-owned

enterprise

Business

partnership

Joint-stock

company

Production

cooperative

Advantages

Disadvantages

Types,

Examples

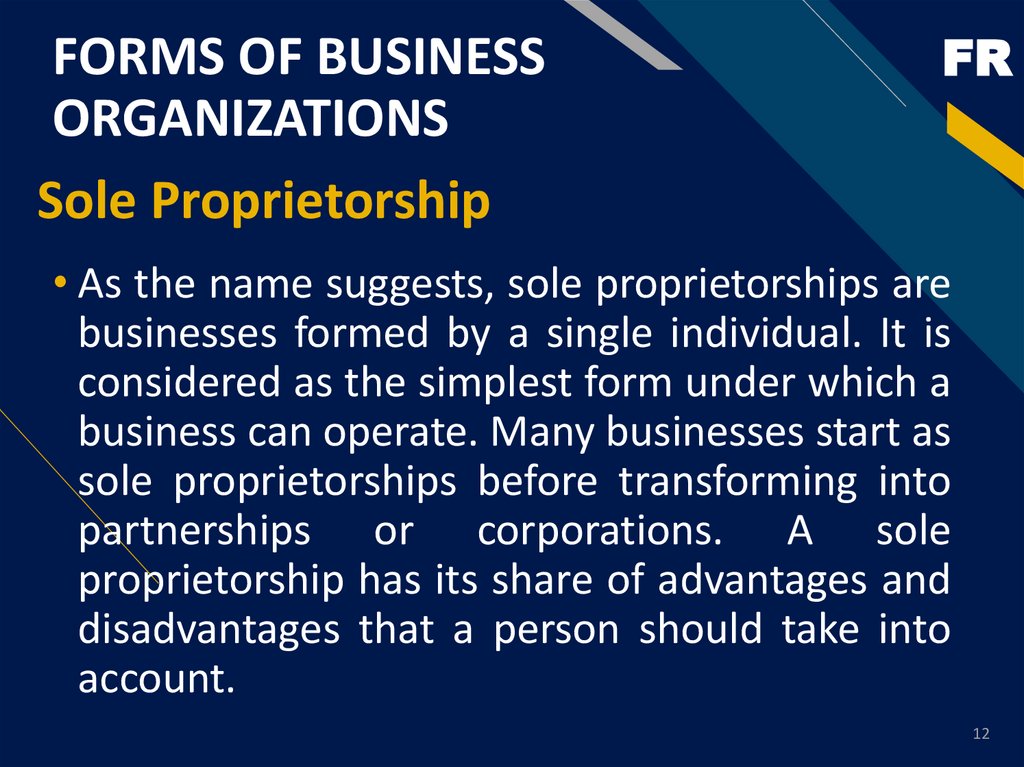

12. FORMS OF BUSINESS ORGANIZATIONS

Sole ProprietorshipFR

• As the name suggests, sole proprietorships are

businesses formed by a single individual. It is

considered as the simplest form under which a

business can operate. Many businesses start as

sole proprietorships before transforming into

partnerships or corporations. A sole

proprietorship has its share of advantages and

disadvantages that a person should take into

account.

12

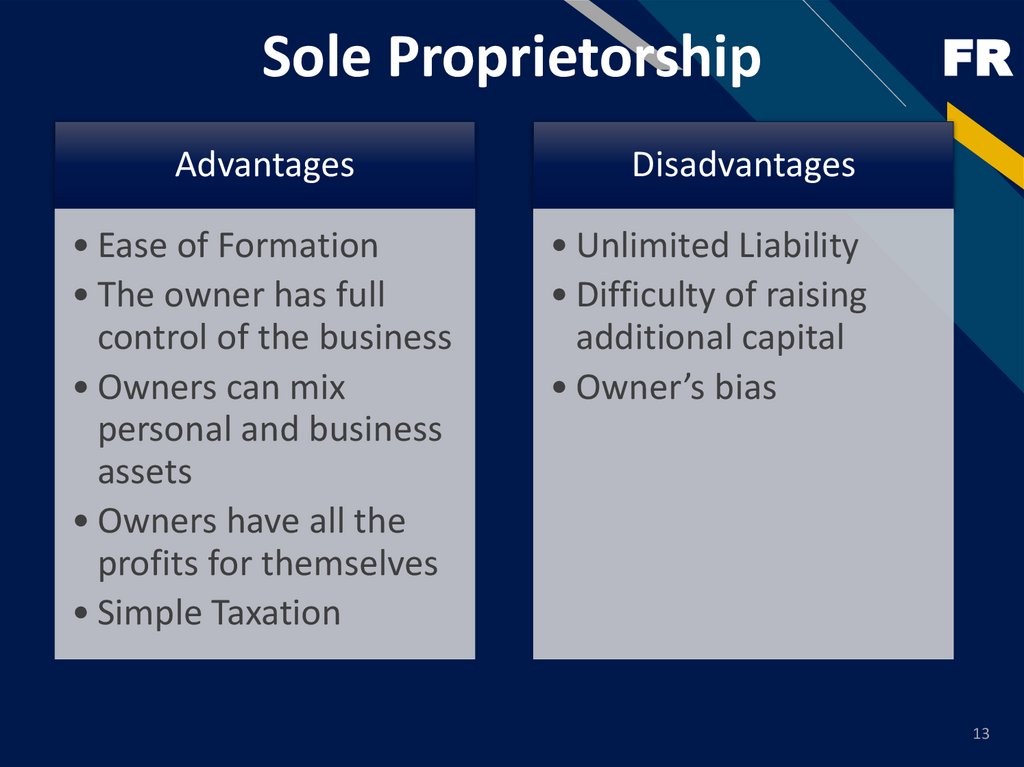

13. Sole Proprietorship

Advantages• Ease of Formation

• The owner has full

control of the business

• Owners can mix

personal and business

assets

• Owners have all the

profits for themselves

• Simple Taxation

FR

Disadvantages

• Unlimited Liability

• Difficulty of raising

additional capital

• Owner’s bias

Template Editing

Instructions and

Feedback

13

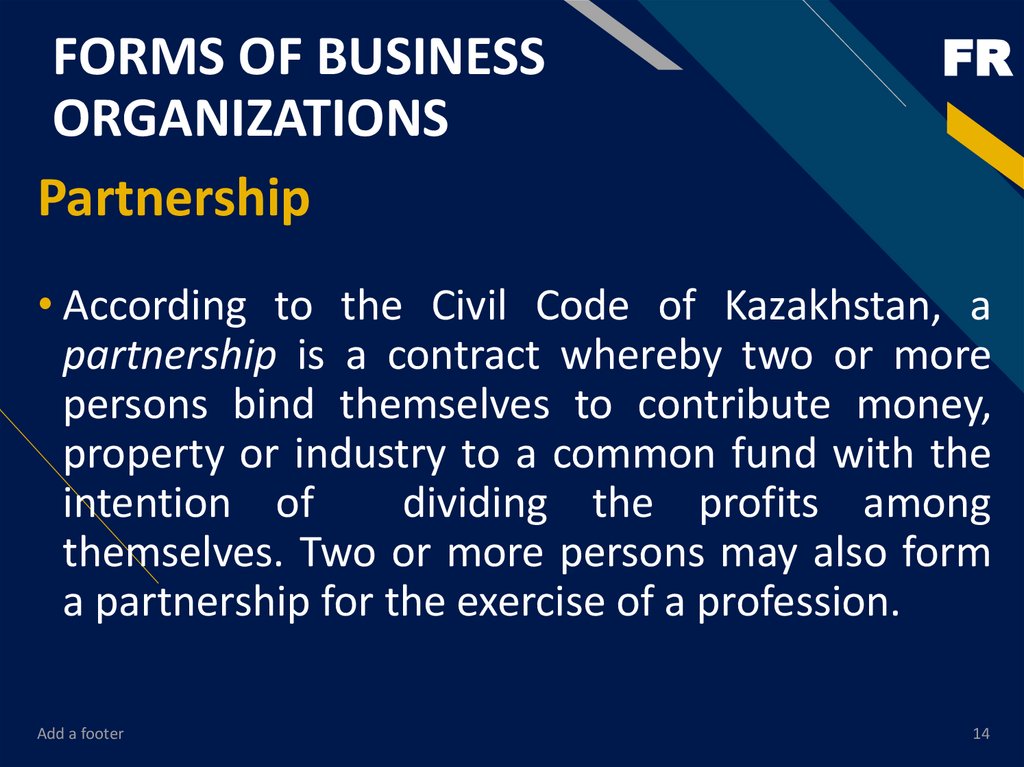

14. FORMS OF BUSINESS ORGANIZATIONS

PartnershipFR

• According to the Civil Code of Kazakhstan, a

partnership is a contract whereby two or more

persons bind themselves to contribute money,

property or industry to a common fund with the

intention of

dividing the profits among

themselves. Two or more persons may also form

a partnership for the exercise of a profession.

Add a footer

14

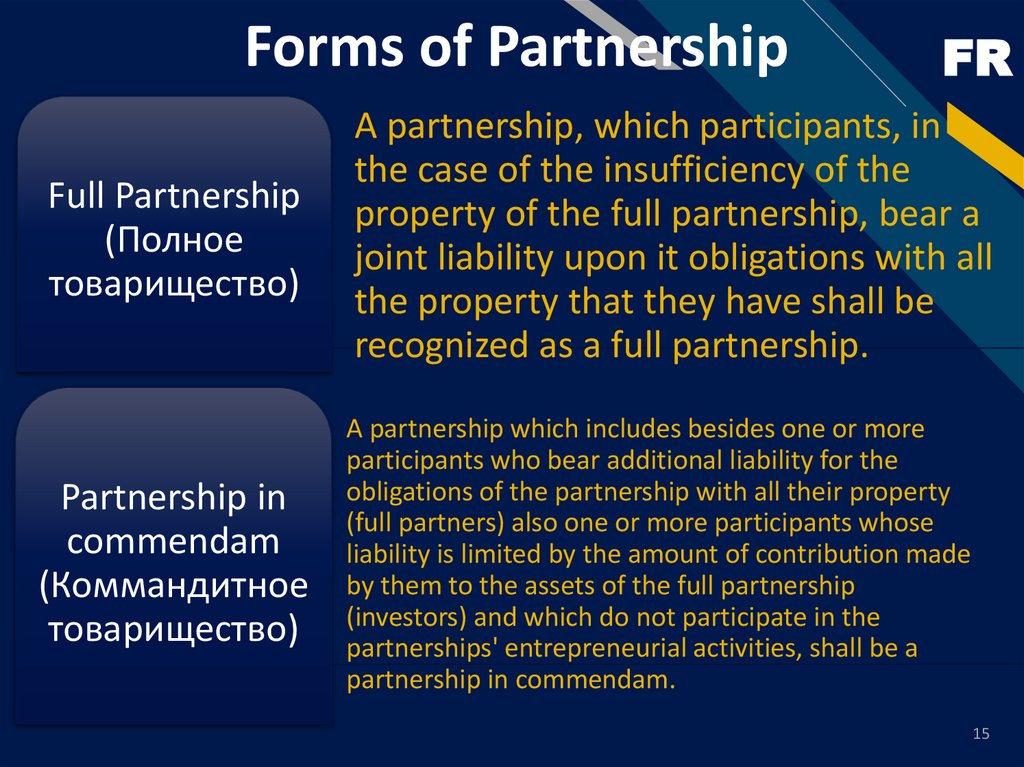

15. Forms of Partnership

Full Partnership(Полное

товарищество)

FR

A partnership, which participants, in

the case of the insufficiency of the

property of the full partnership, bear a

joint liability upon it obligations with all

the property that they have shall be

recognized as a full partnership.

Template Editing

Instructions and

Feedback

Partnership in

commendam

(Коммандитное

товарищество)

A partnership which includes besides one or more

participants who bear additional liability for the

obligations of the partnership with all their property

(full partners) also one or more participants whose

liability is limited by the amount of contribution made

by them to the assets of the full partnership

(investors) and which do not participate in the

partnerships' entrepreneurial activities, shall be a

partnership in commendam.

15

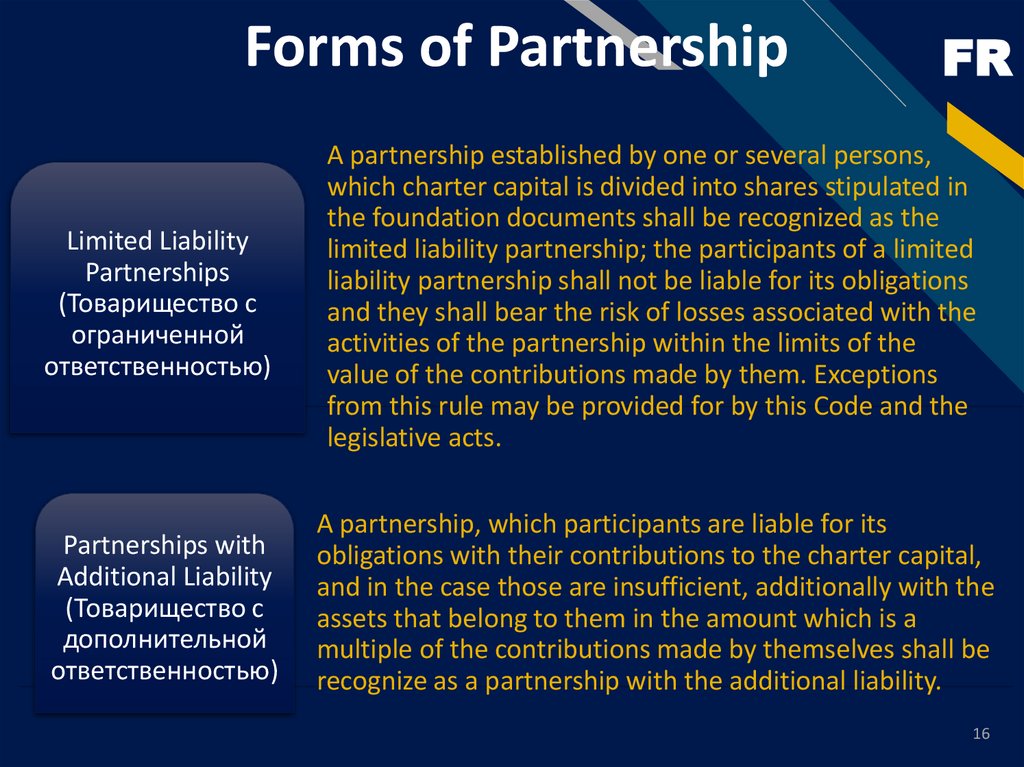

16. Forms of Partnership

FRLimited Liability

Partnerships

(Товарищество с

ограниченной

ответственностью)

A partnership established by one or several persons,

which charter capital is divided into shares stipulated in

the foundation documents shall be recognized as the

limited liability partnership; the participants of a limited

liability partnership shall not be liable for its obligations

and they shall bear the risk of losses associated with the

activities of the partnership within the limits of the

value of the contributions made by them. Exceptions

from this rule may be provided for by this Code and the

legislative acts.

Partnerships with

Additional Liability

(Товарищество с

дополнительной

ответственностью)

A partnership, which participants are liable for its

obligations with their contributions to the charter capital,

and in the case those are insufficient, additionally with the

assets that belong to them in the amount which is a

multiple of the contributions made by themselves shall be

recognize as a partnership with the additional liability.

Template Editing

Instructions and

Feedback

16

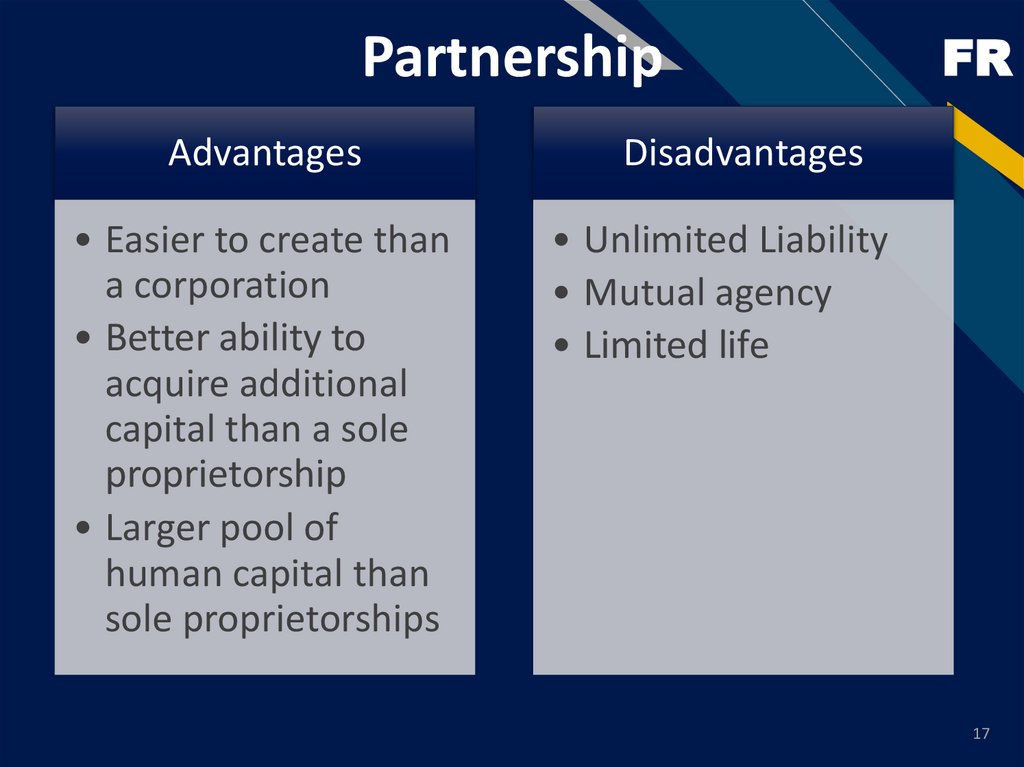

17. Partnership

AdvantagesDisadvantages

• Easier to create than

a corporation

• Better ability to

acquire additional

capital than a sole

proprietorship

• Larger pool of

human capital than

sole proprietorships

• Unlimited Liability

• Mutual agency

• Limited life

FR

Template Editing

Instructions and

Feedback

17

18. FORMS OF BUSINESS ORGANIZATIONS

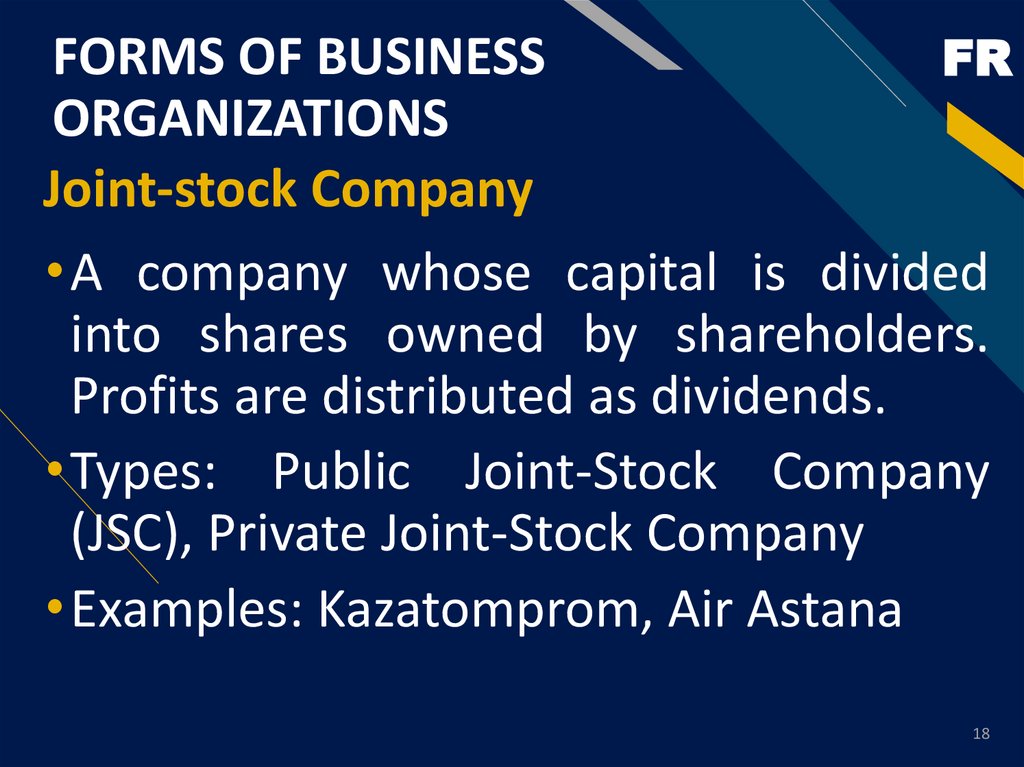

FORMS OF BUSINESSFR

ORGANIZATIONS

Joint-stock Company

• A company whose capital is divided

into shares owned by shareholders.

Profits are distributed as dividends.

• Types: Public Joint-Stock Company

(JSC), Private Joint-Stock Company

• Examples: Kazatomprom, Air Astana

18

19. Joint-stock Company

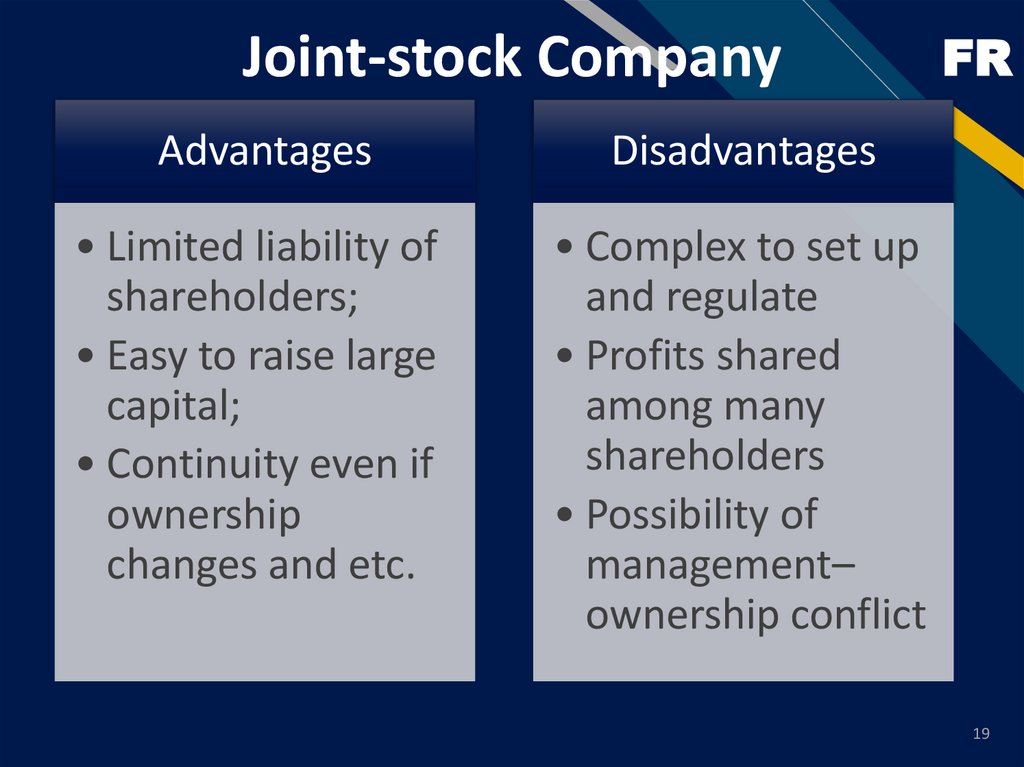

AdvantagesDisadvantages

• Limited liability of

shareholders;

• Easy to raise large

capital;

• Continuity even if

ownership

changes and etc.

• Complex to set up

and regulate

• Profits shared

among many

shareholders

• Possibility of

management–

ownership conflict

FR

Template Editing

Instructions and

Feedback

19