Похожие презентации:

Tous. Research report

1.

TOUSRESEARCH REPORT

MARCH 2018 | Brand Vision

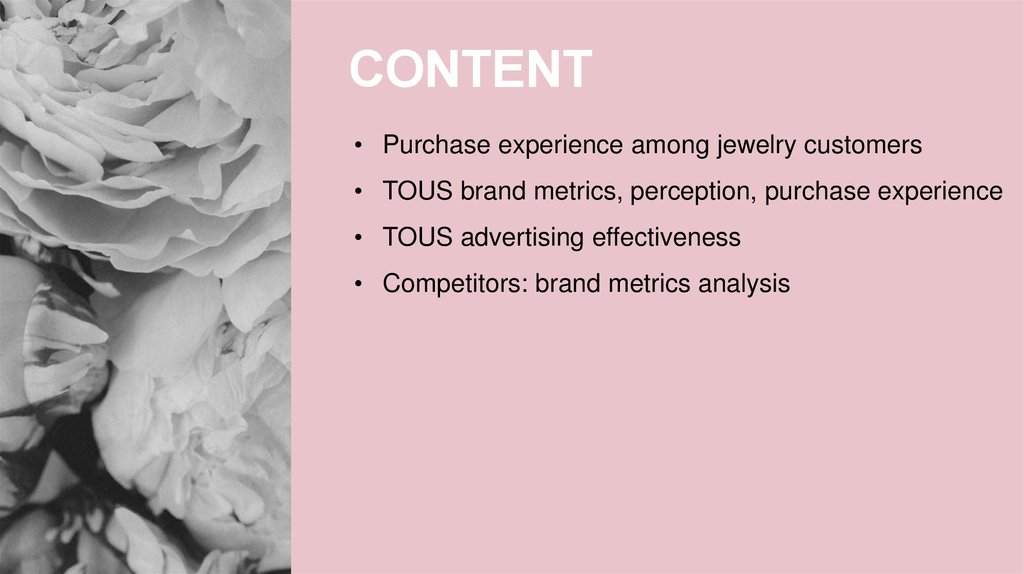

2. CONTENT

• Purchase experience among jewelry customers• TOUS brand metrics, perception, purchase experience

• TOUS advertising effectiveness

• Competitors: brand metrics analysis

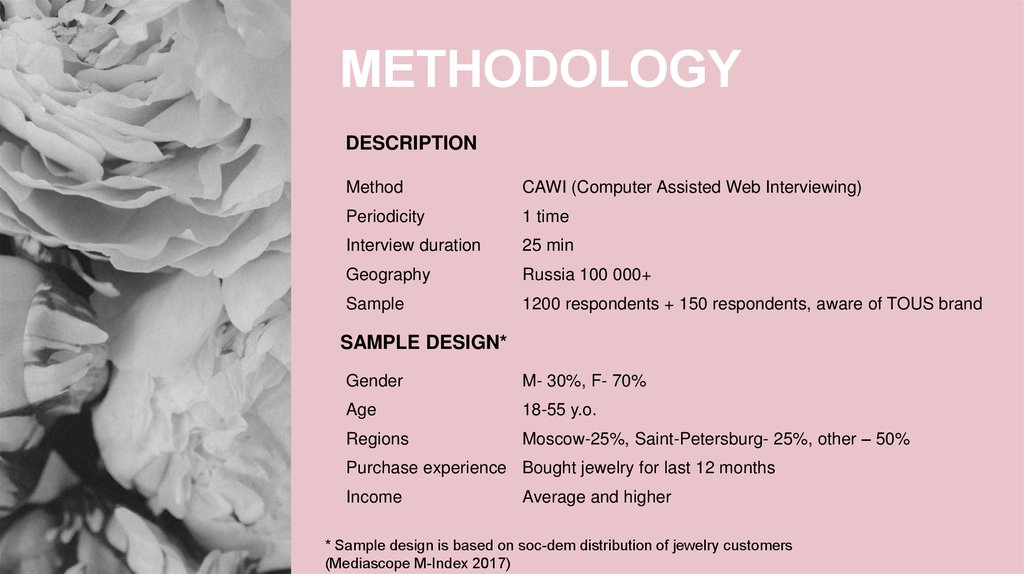

3. METHODOLOGY

DESCRIPTIONMethod

CAWI (Computer Assisted Web Interviewing)

Periodicity

1 time

Interview duration

25 min

Geography

Russia 100 000+

Sample

1200 respondents + 150 respondents, aware of TOUS brand

SAMPLE DESIGN*

Gender

M- 30%, F- 70%

Age

18-55 y.o.

Regions

Moscow-25%, Saint-Petersburg- 25%, other – 50%

Purchase experience Bought jewelry for last 12 months

Income

Average and higher

* Sample design is based on soc-dem distribution of jewelry customers

(Mediascope M-Index 2017)

4. MAIN OBJECTIVES

Evaluation of the brand's position on keybrand metrics, including awareness,

purchase, loyalty

Description of Target Audience in terms of

consumption habits and attitude towards the

brand

Identification of brand strengths and

weaknesses

5.

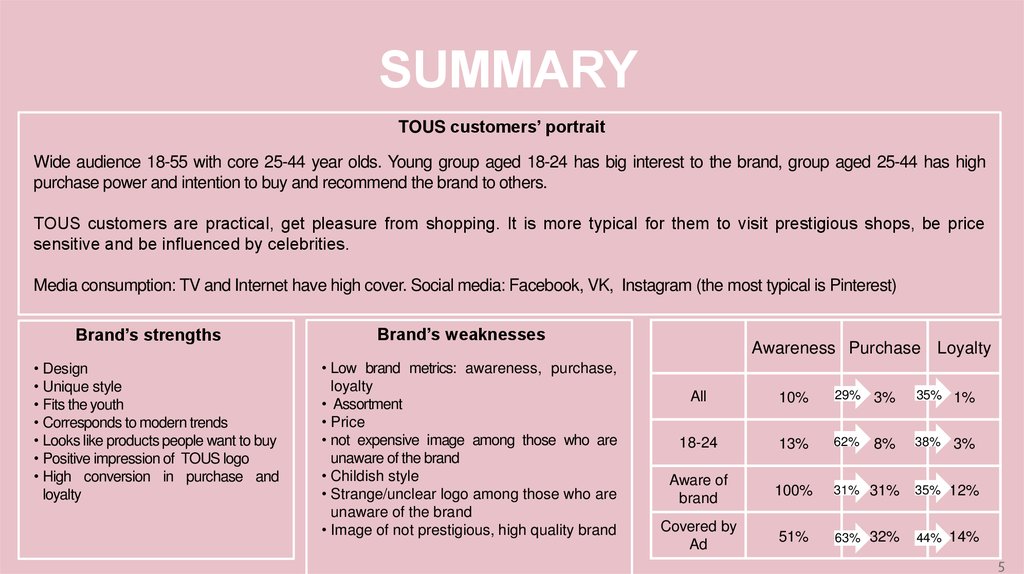

SUMMARYTOUS customers’ portrait

Wide audience 18-55 with core 25-44 year olds. Young group aged 18-24 has big interest to the brand, group aged 25-44 has high

purchase power and intention to buy and recommend the brand to others.

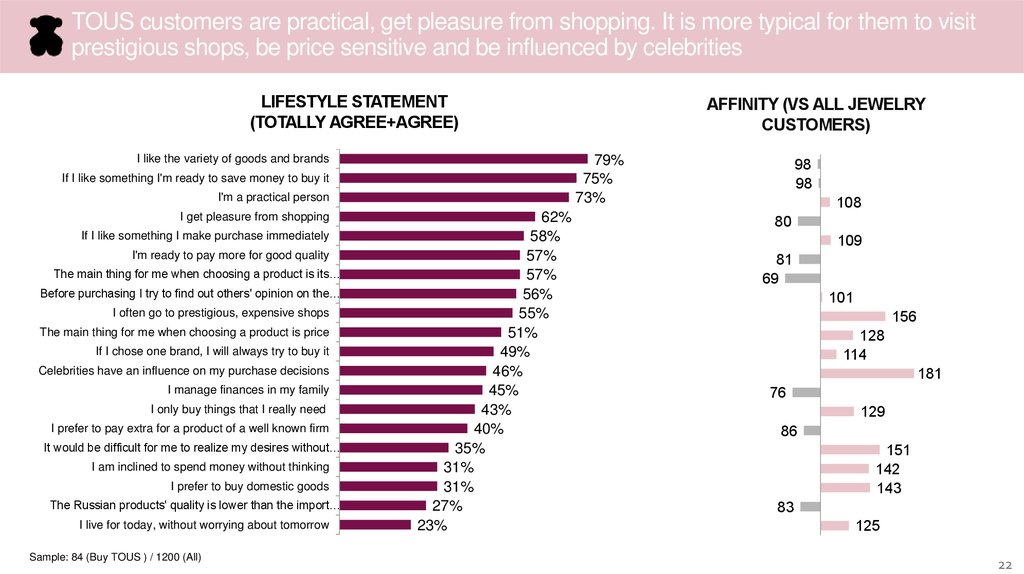

TOUS customers are practical, get pleasure from shopping. It is more typical for them to visit prestigious shops, be price

sensitive and be influenced by celebrities.

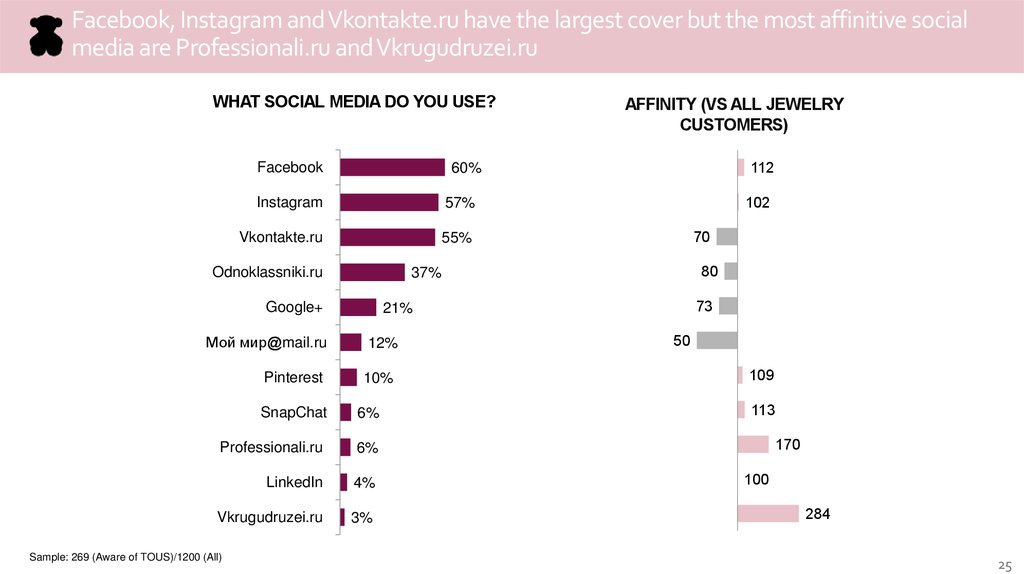

Media consumption: TV and Internet have high cover. Social media: Facebook, VK, Instagram (the most typical is Pinterest)

Brand’s strengths

• Design

• Unique style

• Fits the youth

• Corresponds to modern trends

• Looks like products people want to buy

• Positive impression of TOUS logo

• High conversion in purchase and

loyalty

Brand’s weaknesses

• Low brand metrics: awareness, purchase,

loyalty

• Assortment

• Price

• not expensive image among those who are

unaware of the brand

• Childish style

• Strange/unclear logo among those who are

unaware of the brand

• Image of not prestigious, high quality brand

Awareness Purchase Loyalty

All

10%

29%

3%

35% 1%

18-24

13%

62%

8%

38% 3%

Aware of

brand

100%

31% 31%

35% 12%

Covered by

Ad

51%

63% 32%

44% 14%

5

6. PURCHASE EXPERIENCE AMONG JEWELRY CUSTOMERS

7.

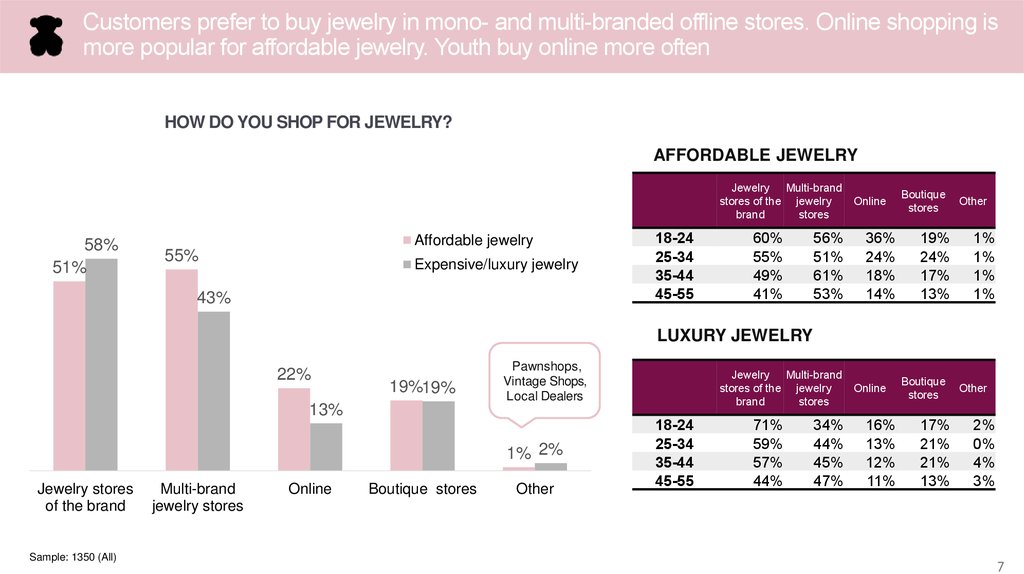

Customers prefer to buy jewelry in mono- and multi-branded offline stores. Online shopping ismore popular for affordable jewelry. Youth buy online more often

HOW DO YOU SHOP FOR JEWELRY?

AFFORDABLE JEWELRY

Jewelry Multi-brand

stores of the jewelry

brand

stores

58%

51%

Affordable jewelry

55%

Expensive/luxury jewelry

43%

18-24

25-34

35-44

45-55

60%

55%

49%

41%

56%

51%

61%

53%

Online

36%

24%

18%

14%

Boutique

stores

19%

24%

17%

13%

Other

1%

1%

1%

1%

LUXURY JEWELRY

22%

19%19%

13%

Pawnshops,

Vintage Shops,

Local Dealers

1% 2%

Jewelry stores

of the brand

Sample: 1350 (All)

Multi-brand

jewelry stores

Online

Boutique stores

Other

Jewelry Multi-brand

stores of the jewelry

brand

stores

18-24

25-34

35-44

45-55

71%

59%

57%

44%

34%

44%

45%

47%

Online

16%

13%

12%

11%

Boutique

stores

17%

21%

21%

13%

Other

2%

0%

4%

3%

7

8.

Style and price are the main influencers for making decision during jewelry purchasingOVERALL, WHAT HAS AN INFLUENCE ON YOUR

DECISION TO BUY JEWELRY?

75%

Style of jewelry

63%

Pricing

45%

Promotions

29%

Brand

The shopping environment

18%

Recommendation

17%

Influencer/Celebrities

Other

Sample: 1350 (All)

Style of

Pricing Promotions Brand

jewelry

5%

2%

M

F

The

Recomm Influencer/

Other

shopping

endation Celebrities

environment

72% 65%

76% 62%

37%

48%

31%

27%

16%

19%

24%

13%

4%

5%

3%

2%

18-24

82%

74%

54%

31%

23%

25%

4%

0%

25-34

76%

64%

43%

28%

16%

17%

5%

2%

35-44

76%

58%

41%

34%

21%

15%

7%

1%

45-55

66%

58%

48%

21%

14%

10%

1%

5%

Moscow 71%

62%

46%

25%

18%

15%

6%

2%

Saint-P. 76%

65%

49%

32%

19%

14%

3%

1%

Regions 77%

63%

42%

29%

18%

19%

4%

3%

8

9.

Merchandising influences customers’ intention to buy thingsWHEN YOU ARE SHOPPING IN A STORE, HOW INFLUENTIAL

IS VISUAL MERCHANDISING IN MOTIVATING YOU

TO MAKE A PURCHASE?

3%

13%

Extremely

influential

27%

15%

42%

Somewhat

influential

Neither

Somewhat

Not influential

influential nor

not influential at all

not influential

18-24

27%

40%

17%

14%

2%

25-34

29%

42%

14%

12%

3%

35-44

27%

44%

13%

12%

4%

45-55

25%

43%

14%

16%

2%

Extremely influential

Somewhat influential

Neither influential, nor not influential

Somewhat not influential

Not at all influential

Sample: 1350 (All)

9

10.

The majority would be motivated by a loyalty programWOULD A LOYALTY PROGRAM OF A JEWELRY BRAND

MOTIVATE YOU TO PURCHASE THAT

JEWELRY MORE OFTEN?

23%

77%

Yes

Sample: 1350 (All)

Yes

No

M

76%

24%

F

77%

23%

18-24

25-34

35-44

45-55

77%

79%

75%

76%

23%

21%

25%

24%

Moscow

80%

20%

Saint-P.

81%

19%

Regions

74%

26%

No

10

11.

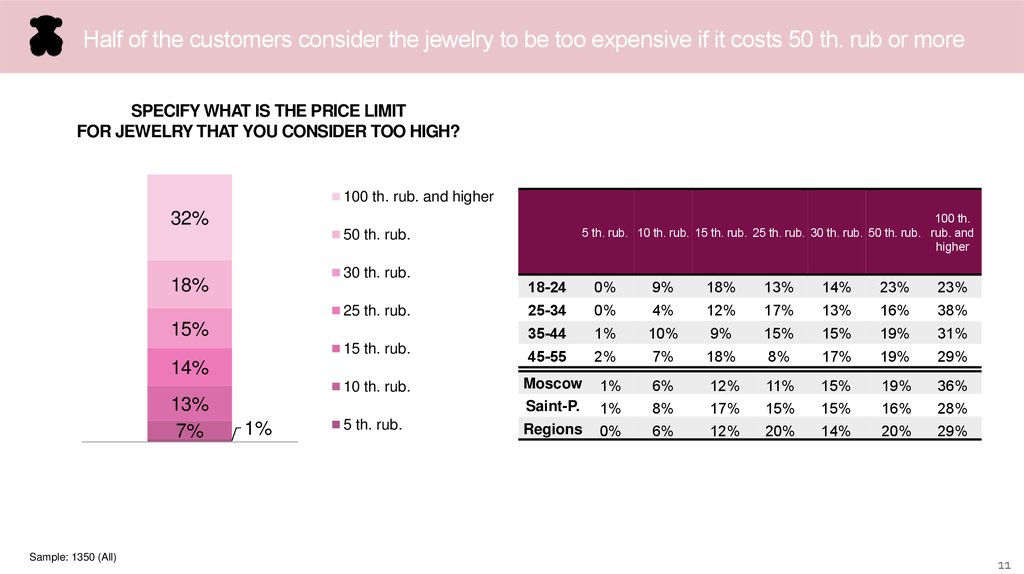

Half of the customers consider the jewelry to be too expensive if it costs 50 th. rub or moreSPECIFY WHAT IS THE PRICE LIMIT

FOR JEWELRY THAT YOU CONSIDER TOO HIGH?

100 th. rub. and higher

32%

100 th.

5 th. rub. 10 th. rub. 15 th. rub. 25 th. rub. 30 th. rub. 50 th. rub. rub. and

higher

50 th. rub.

30 th. rub.

18%

25 th. rub.

15%

15 th. rub.

14%

10 th. rub.

13%

7%

Sample: 1350 (All)

1%

5 th. rub.

18-24

0%

9%

18%

13%

14%

23%

23%

25-34

0%

4%

12%

17%

13%

16%

38%

35-44

1%

10%

9%

15%

15%

19%

31%

45-55

2%

7%

18%

8%

17%

19%

29%

Moscow

1%

6%

12%

11%

15%

19%

36%

Saint-P.

1%

8%

17%

15%

15%

16%

28%

Regions

0%

6%

12%

20%

14%

20%

29%

11

12.

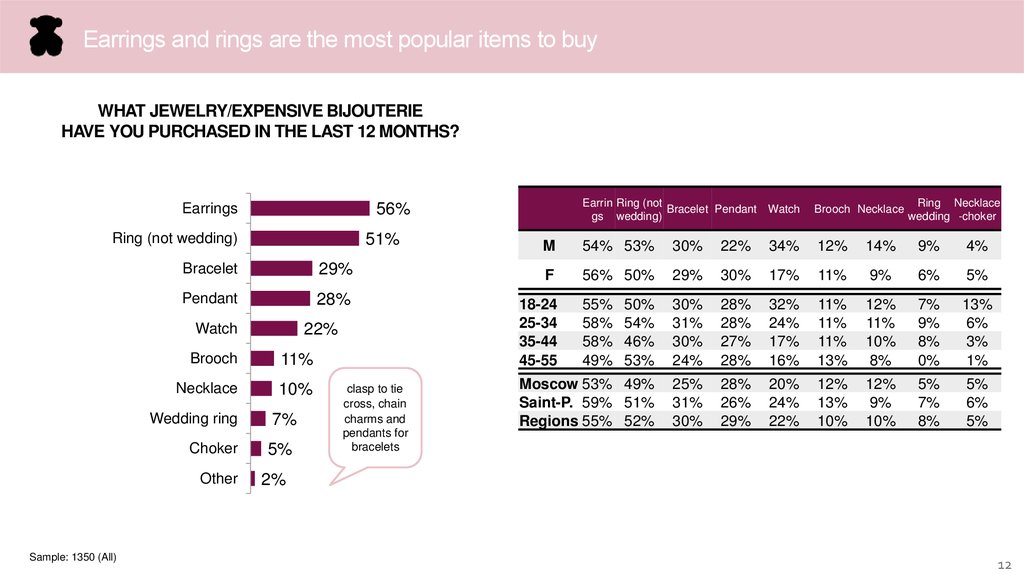

Earrings and rings are the most popular items to buyWHAT JEWELRY/EXPENSIVE BIJOUTERIE

HAVE YOU PURCHASED IN THE LAST 12 MONTHS?

51%

Ring (not wedding)

Brooch Necklace

M

54% 53%

30%

22%

34%

12%

14%

9%

4%

56% 50%

29%

30%

17%

11%

9%

6%

5%

55%

58%

58%

49%

50%

54%

46%

53%

30%

31%

30%

24%

28%

28%

27%

28%

32%

24%

17%

16%

11%

11%

11%

13%

12%

11%

10%

8%

7%

9%

8%

0%

13%

6%

3%

1%

Moscow 53% 49%

Saint-P. 59% 51%

Regions 55% 52%

25%

31%

30%

28%

26%

29%

20%

24%

22%

12%

13%

10%

12%

9%

10%

5%

7%

8%

5%

6%

5%

Bracelet

29%

F

Pendant

28%

18-24

25-34

35-44

45-55

22%

Watch

Brooch

11%

Necklace

10%

Wedding ring

7%

Choker

5%

Other

Sample: 1350 (All)

Earrin Ring (not

Bracelet Pendant Watch

gs wedding)

56%

Earrings

clasp to tie

cross, chain

charms and

pendants for

bracelets

Ring Necklace

wedding -choker

2%

12

13.

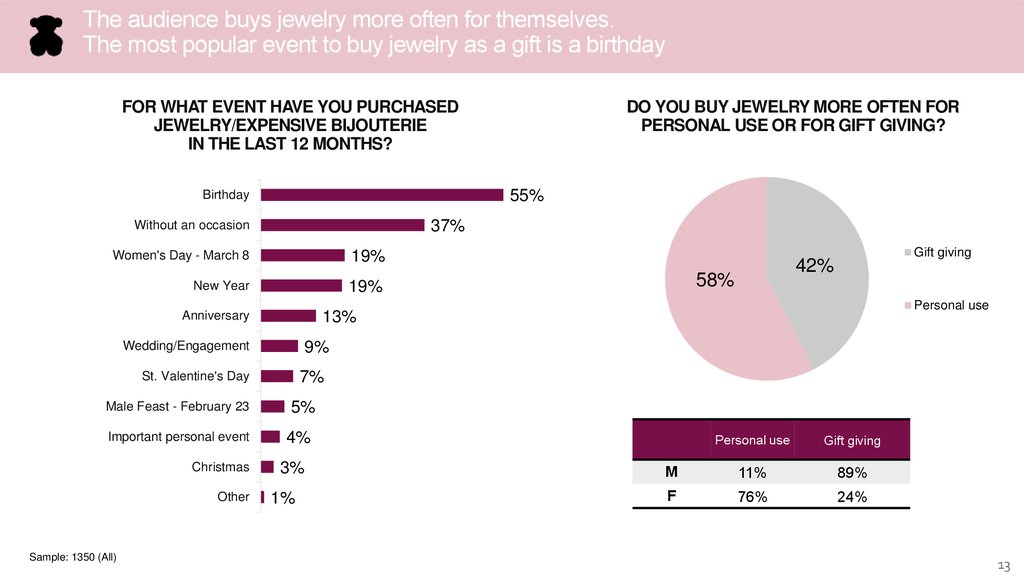

The audience buys jewelry more often for themselves.The most popular event to buy jewelry as a gift is a birthday

DO YOU BUY JEWELRY MORE OFTEN FOR

PERSONAL USE OR FOR GIFT GIVING?

FOR WHAT EVENT HAVE YOU PURCHASED

JEWELRY/EXPENSIVE BIJOUTERIE

IN THE LAST 12 MONTHS?

55%

Birthday

37%

Without an occasion

Women's Day - March 8

19%

New Year

19%

7%

St. Valentine's Day

Christmas

Other

Sample: 1350 (All)

Personal use

9%

Wedding/Engagement

Important personal event

58%

13%

Anniversary

Male Feast - February 23

Gift giving

42%

5%

4%

3%

1%

Personal use

Gift giving

M

11%

89%

F

76%

24%

13

14.

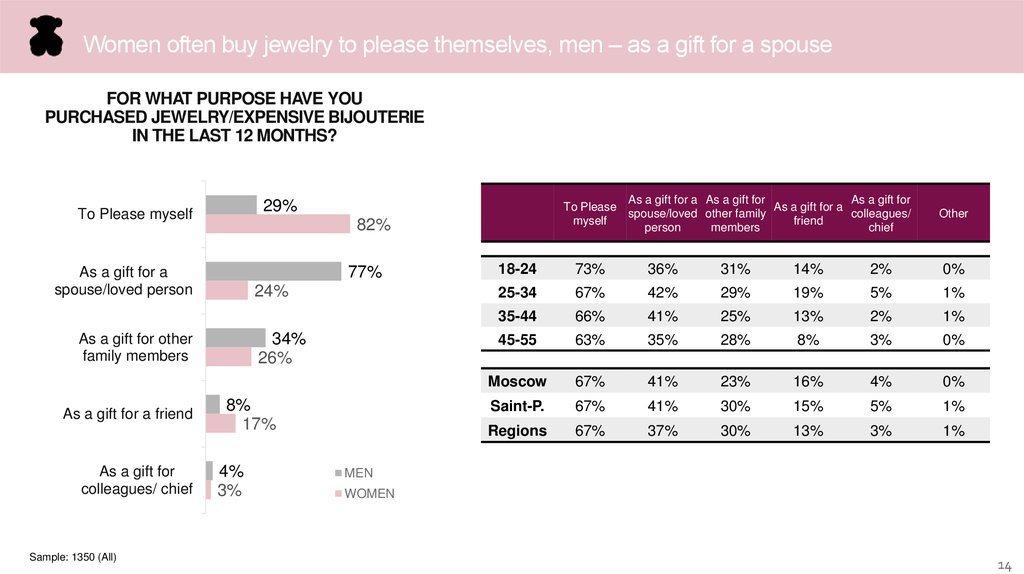

Women often buy jewelry to please themselves, men – as a gift for a spouseFOR WHAT PURPOSE HAVE YOU

PURCHASED JEWELRY/EXPENSIVE BIJOUTERIE

IN THE LAST 12 MONTHS?

To Please myself

82%

77%

As a gift for a

spouse/loved person

24%

34%

26%

As a gift for other

family members

As a gift for a friend

As a gift for

colleagues/ chief

Sample: 1350 (All)

As a gift for a As a gift for

As a gift for

To Please

As a gift for a

spouse/loved other family

colleagues/

myself

friend

person

members

chief

29%

8%

17%

4%

3%

Other

18-24

73%

36%

31%

14%

2%

0%

25-34

67%

42%

29%

19%

5%

1%

35-44

66%

41%

25%

13%

2%

1%

45-55

63%

35%

28%

8%

3%

0%

Moscow

67%

41%

23%

16%

4%

0%

Saint-P.

67%

41%

30%

15%

5%

1%

Regions

67%

37%

30%

13%

3%

1%

MEN

WOMEN

14

15.

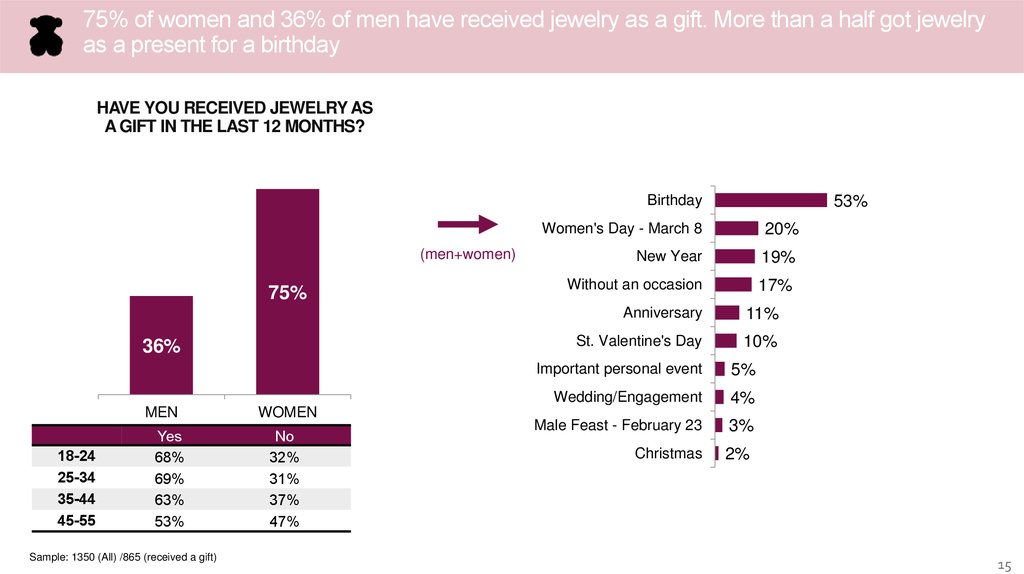

75% of women and 36% of men have received jewelry as a gift. More than a half got jewelryas a present for a birthday

HAVE YOU RECEIVED JEWELRY AS

A GIFT IN THE LAST 12 MONTHS?

53%

Birthday

(men+women)

75%

36%

MEN

18-24

25-34

35-44

45-55

Yes

68%

69%

63%

53%

Sample: 1350 (All) /865 (received a gift)

WOMEN

No

32%

31%

37%

47%

Women's Day - March 8

20%

New Year

19%

Without an occasion

17%

Anniversary

11%

St. Valentine's Day

10%

Important personal event

5%

Wedding/Engagement

4%

Male Feast - February 23

3%

Christmas

2%

15

16.

SUMMARY: PURCHASE EXPERIENCE• Customers buy jewelry more often for themselves. Women purchase jewelry to please

themselves, men buy it as a gift.

• Birthday is the most popular event to buy jewelry.

• Earrings and rings are the most popular types of purchased jewelry.

• Customers prefer to buy jewelry in mono- and multi-branded offline stores. Online shopping

is more popular for affordable jewelry. Youth buy online more often.

• Style and price are the main influencers for making decision during jewelry purchasing.

• Loyalty program is a good motivator to buy things more often.

.

16

17. TOUS BRAND METRICS, PERCEPTION AND PURCHASE EXPERIENCE

18.

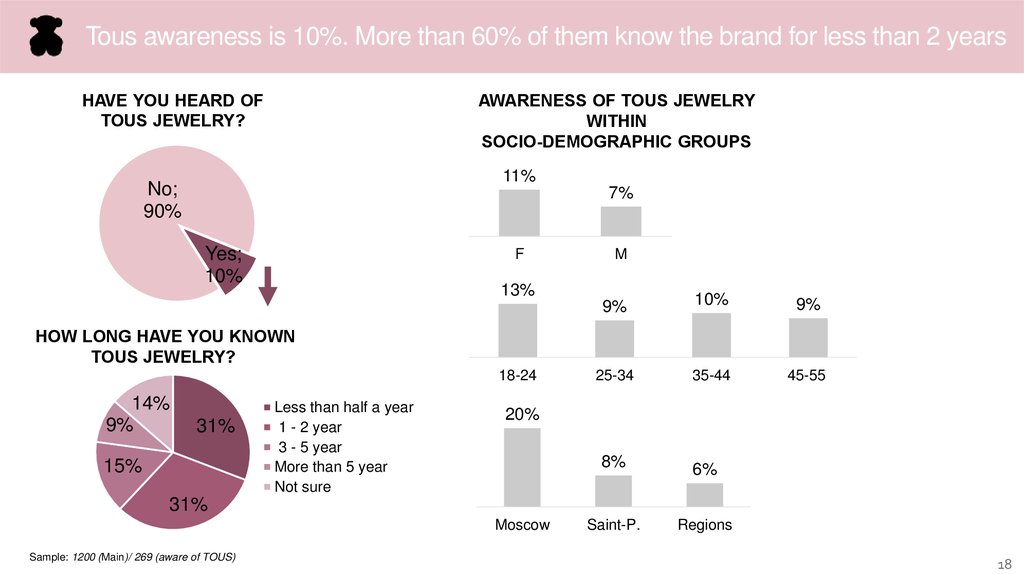

Tous awareness is 10%. More than 60% of them know the brand for less than 2 yearsAWARENESS OF TOUS JEWELRY

WITHIN

SOCIO-DEMOGRAPHIC GROUPS

HAVE YOU HEARD OF

TOUS JEWELRY?

11%

No;

90%

7%

Yes;

10%

F

M

13%

9%

10%

9%

25-34

35-44

45-55

HOW LONG HAVE YOU KNOWN

TOUS JEWELRY?

18-24

14%

9%

31%

15%

Less than half a year

1 - 2 year

3 - 5 year

More than 5 year

Not sure

20%

8%

6%

31%

Moscow

Sample: 1200 (Main)/ 269 (aware of TOUS)

Saint-P.

Regions

18

19.

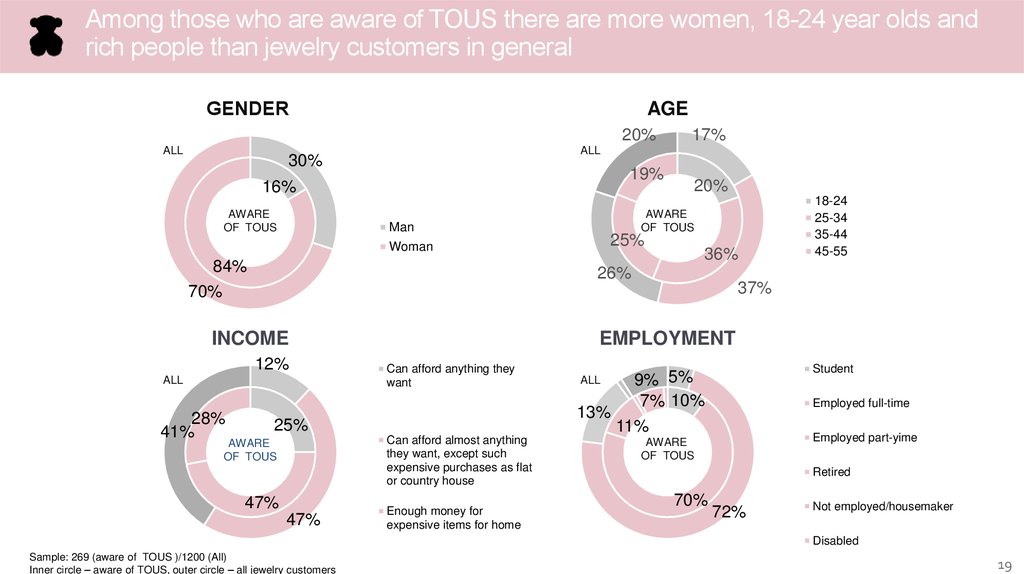

Among those who are aware of TOUS there are more women, 18-24 year olds andrich people than jewelry customers in general

GENDER

AGE

20%

ALL

30%

19%

16%

AWARE

OF TOUS

Man

84%

70%

20%

AWARE

OF TOUS

25%

Woman

36%

26%

INCOME

12%

ALL

28%

41%

17%

ALL

Can afford anything they

want

Can afford almost anything

they want, except such

expensive purchases as flat

or country house

47%

47%

37%

EMPLOYMENT

25%

AWARE

OF TOUS

18-24

25-34

35-44

45-55

Enough money for

expensive items for home

Student

9% 5%

7% 10%

13%

11%

ALL

Employed full-time

Employed part-yime

AWARE

OF TOUS

Retired

70%

72%

Not employed/housemaker

Disabled

Sample: 269 (aware of TOUS )/1200 (All)

Inner circle – aware of TOUS, outer circle – all jewelry customers

19

20.

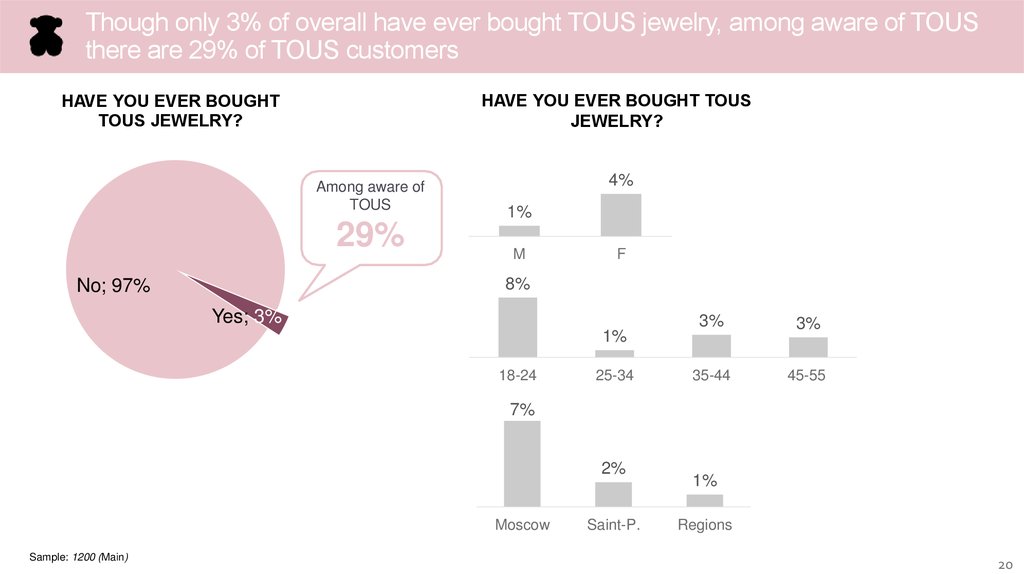

Though only 3% of overall have ever bought TOUS jewelry, among aware of TOUSthere are 29% of TOUS customers

HAVE YOU EVER BOUGHT TOUS

JEWELRY?

HAVE YOU EVER BOUGHT

TOUS JEWELRY?

Among aware of

TOUS

29%

4%

1%

M

F

8%

No; 97%

Yes; 3%

1%

18-24

25-34

3%

3%

35-44

45-55

7%

2%

Moscow

Sample: 1200 (Main)

Saint-P.

1%

Regions

20

21.

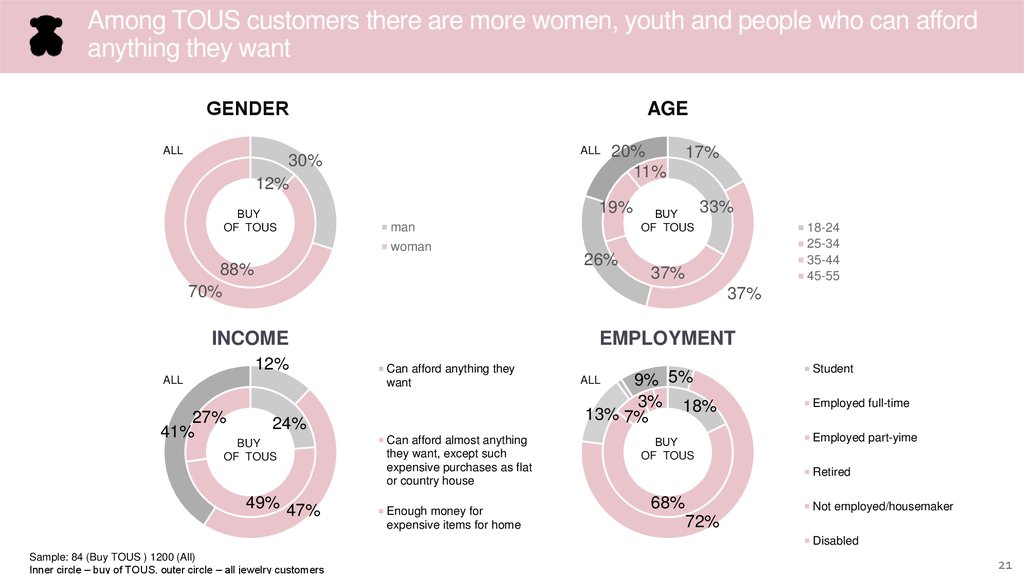

Among TOUS customers there are more women, youth and people who can affordanything they want

GENDER

ALL

AGE

ALL

30%

12%

BUY

OF TOUS

19%

man

woman

88%

70%

26%

17%

BUY

OF TOUS

33%

18-24

25-34

35-44

45-55

37%

37%

INCOME

12%

ALL

27%

41%

20%

11%

EMPLOYMENT

Can afford anything they

want

24%

BUY

OF TOUS

49% 47%

Can afford almost anything

they want, except such

expensive purchases as flat

or country house

Enough money for

expensive items for home

9% 5%

3% 18%

13% 7%

Student

ALL

BUY

OF TOUS

Employed full-time

Employed part-yime

Retired

68%

Not employed/housemaker

72%

Disabled

Sample: 84 (Buy TOUS ) 1200 (All)

Inner circle – buy of TOUS, outer circle – all jewelry customers

21

22.

TOUS customers are practical, get pleasure from shopping. It is more typical for them to visitprestigious shops, be price sensitive and be influenced by celebrities

LIFESTYLE STATEMENT

(TOTALLY AGREE+AGREE)

79%

75%

73%

I like the variety of goods and brands

If I like something I'm ready to save money to buy it

I'm a practical person

I get pleasure from shopping

If I like something I make purchase immediately

I'm ready to pay more for good quality

The main thing for me when choosing a product is its…

Before purchasing I try to find out others' opinion on the…

I often go to prestigious, expensive shops

The main thing for me when choosing a product is price

If I chose one brand, I will always try to buy it

Celebrities have an influence on my purchase decisions

I manage finances in my family

I only buy things that I really need

I prefer to pay extra for a product of a well known firm

It would be difficult for me to realize my desires without…

I am inclined to spend money without thinking

I prefer to buy domestic goods

The Russian products' quality is lower than the import…

I live for today, without worrying about tomorrow

Sample: 84 (Buy TOUS ) / 1200 (All)

AFFINITY (VS ALL JEWELRY

CUSTOMERS)

62%

58%

57%

57%

56%

55%

51%

49%

46%

45%

43%

40%

35%

31%

31%

27%

23%

98

98

108

80

109

81

69

101

156

128

114

181

76

129

86

151

142

143

83

125

22

23.

Usage of media among those who are aware of TOUS does not show significantdifference from target audience in general

HOW OFTEN DO YOU…?

(Aware of TOUS)

120

100

140%

92

96

120%

95

87

88

88

100%

80

Usage among aware of

TOUS (Every day +

Several times a week)

80%

Affinity to All

60

60%

94%

40

40%

72%

48%

20

59%

79%

20%

35%

0

0%

TV

Internet

Sample: 269 (Aware of TOUS) /1200 (All)

Press

Social network

Going to Malls

Radio

23

24.

Those who are aware of TOUS use the Internet to the same extent as jewelrycustomers, average TV viewing is less for 0.5 hour per day

HOW MANY HOURS PER DAY

DO YOU SPEND ON…?

AWARE OF TOUS

Average

ALL

2.5 h

3.9 h

8%

8%

4%

2%

16%

9%

15%

3.0 h

3.9 h

7%

3%

7%

8%

12%

15%

16%

23%

From 15 min. till half an hour

13%

46%

Sample: 269 (Aware of TOUS)/1200 (All)

Less than 15 min.

24%

14%

TV VIEWING

From 1 till 2 hours

From half an hour till 1 hour

10%

36%

From 3 till 4 hours

From 2 till 3 hours

15%

13%

17%

5 hours and more

From 4 till 5 hours

17%

17%

16%

2%

INTERNET USAGE

TV VIEWING

INTERNET USAGE

24

25.

Facebook, Instagram and Vkontakte.ru have the largest cover but the most affinitive socialmedia are Professionali.ru and Vkrugudruzei.ru

WHAT SOCIAL MEDIA DO YOU USE?

60%

57%

Vkontakte.ru

55%

Odnoklassniki.ru

102

70

80

73

21%

12%

10%

SnapChat

6%

Professionali.ru

6%

4%

Vkrugudruzei.ru

3%

Sample: 269 (Aware of TOUS)/1200 (All)

112

37%

Google+

Мой мир@mail.ru

AFFINITY (VS ALL JEWELRY

CUSTOMERS)

50

109

113

170

100

284

25

26.

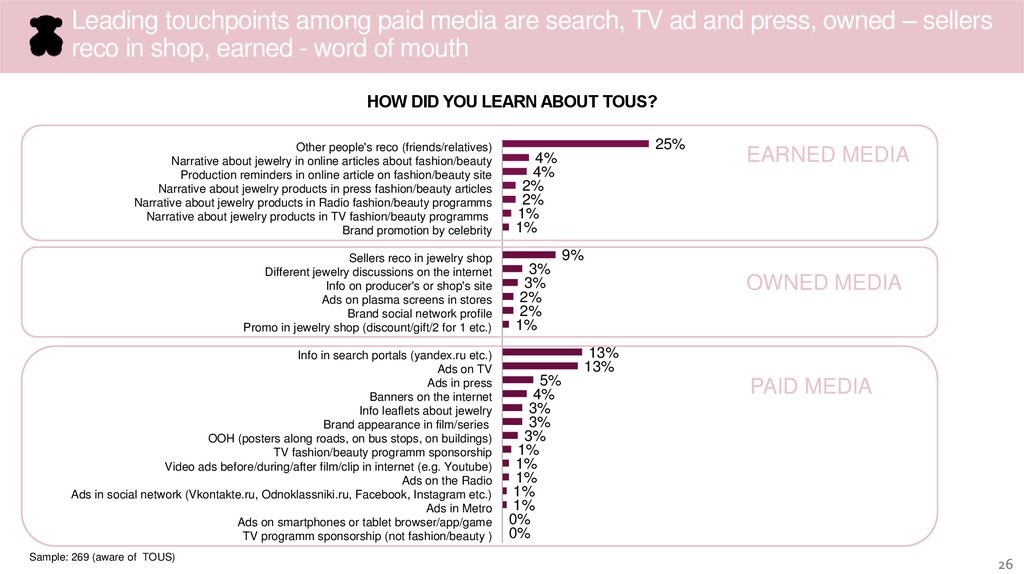

Leading touchpoints among paid media are search, TV ad and press, owned – sellersreco in shop, earned - word of mouth

HOW DID YOU LEARN ABOUT TOUS?

Other people's reco (friends/relatives)

Narrative about jewelry in online articles about fashion/beauty

Production reminders in online article on fashion/beauty site

Narrative about jewelry products in press fashion/beauty articles

Narrative about jewelry products in Radio fashion/beauty programms

Narrative about jewelry products in TV fashion/beauty programms

Brand promotion by celebrity

Sellers reco in jewelry shop

Different jewelry discussions on the internet

Info on producer's or shop's site

Ads on plasma screens in stores

Brand social network profile

Promo in jewelry shop (discount/gift/2 for 1 etc.)

Info in search portals (yandex.ru etc.)

Ads on TV

Ads in press

Banners on the internet

Info leaflets about jewelry

Brand appearance in film/series

OOH (posters along roads, on bus stops, on buildings)

TV fashion/beauty programm sponsorship

Video ads before/during/after film/clip in internet (e.g. Youtube)

Ads on the Radio

Ads in social network (Vkontakte.ru, Odnoklassniki.ru, Facebook, Instagram etc.)

Ads in Metro

Ads on smartphones or tablet browser/app/game

TV programm sponsorship (not fashion/beauty )

Sample: 269 (aware of TOUS)

25%

4%

4%

2%

2%

1%

1%

3%

3%

2%

2%

1%

5%

4%

3%

3%

3%

1%

1%

1%

1%

1%

0%

0%

EARNED MEDIA

9%

OWNED MEDIA

13%

13%

PAID MEDIA

26

27.

The youngest group aged 18-24 has a leading position by brand metrics andconversion to purchase and loyalty

ALL

18-24

25-44

45-55

Brand awareness

Brand awareness

Brand awareness

Brand awareness

10%

13%

10%

9%

29%

62%

19%

28%

Purchase

Purchase

Purchase

Purchase

3%

8%

2%

3%

35%

38%

30%

10%

Loyalty

Loyalty

Loyalty

Loyalty

1%

3%

1%

1%

Sample: 1200 (main)

27

28.

TOUS jewelry is perceived as youthful, tenderness and funWHAT IS YOUR OVERALL IMPRESSION

OF THE BRAND TOUS?

51%

Fun

Fashion

able

Trendy

Youthful

spirit

Elegant

Classic

Tender

ness

None of

the

above

M

F

39%

38%

27%

29%

41%

28%

43%

53%

25%

18%

14%

10%

36%

43%

11%

6%

18-24

25-34

35-44

45-55

36%

45%

37%

27%

25%

38%

25%

22%

38%

34%

25%

22%

60%

51%

51%

43%

23%

20%

19%

14%

11%

10%

16%

4%

32%

41%

52%

39%

6%

5%

4%

14%

Moscow 31%

31%

37%

49%

27%

11%

39%

8%

Saint-P. 49%

29%

31%

59%

18%

10%

39%

10%

Regions 40%

27%

22%

50%

11%

10%

46%

4%

42%

38%

30%

29%

19%

11%

Youthful

spirit

Tenderness

Sample: 269 (aware of TOUS)

Fun

Trendy

Fashionable

Elegant

Classic

28

29.

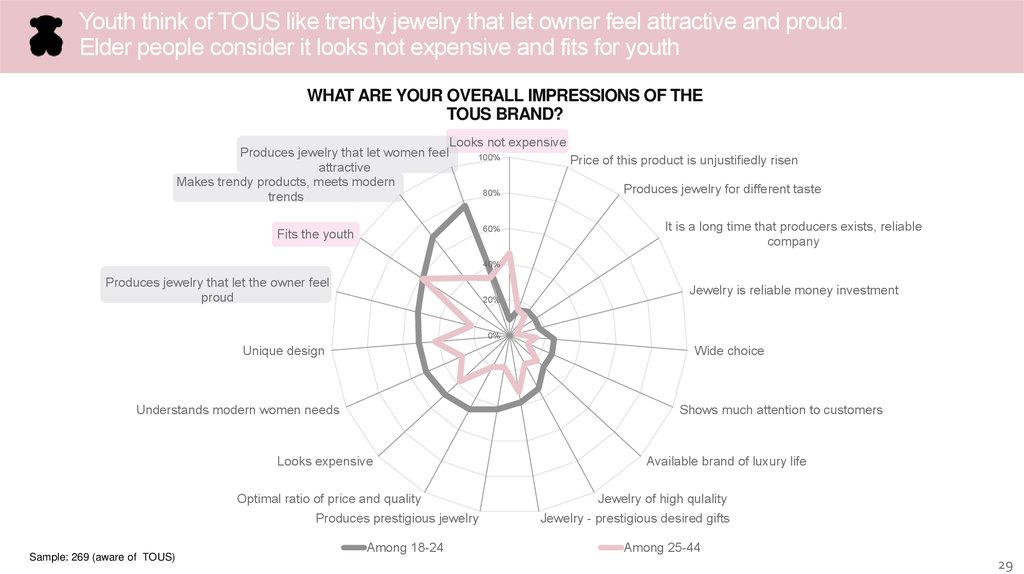

Youth think of TOUS like trendy jewelry that let owner feel attractive and proud.Elder people consider it looks not expensive and fits for youth

WHAT ARE YOUR OVERALL IMPRESSIONS OF THE

TOUS BRAND?

Produces jewelry that let women feel

attractive

Makes trendy products, meets modern

trends

Looks not expensive

100%

80%

60%

Fits the youth

Price of this product is unjustifiedly risen

Produces jewelry for different taste

It is a long time that producers exists, reliable

company

40%

Produces jewelry that let the owner feel

proud

20%

Jewelry is reliable money investment

0%

Unique design

Wide choice

Understands modern women needs

Shows much attention to customers

Looks expensive

Optimal ratio of price and quality

Produces prestigious jewelry

Sample: 269 (aware of TOUS)

Among 18-24

Available brand of luxury life

Jewelry of high qulality

Jewelry - prestigious desired gifts

Among 25-44

29

30.

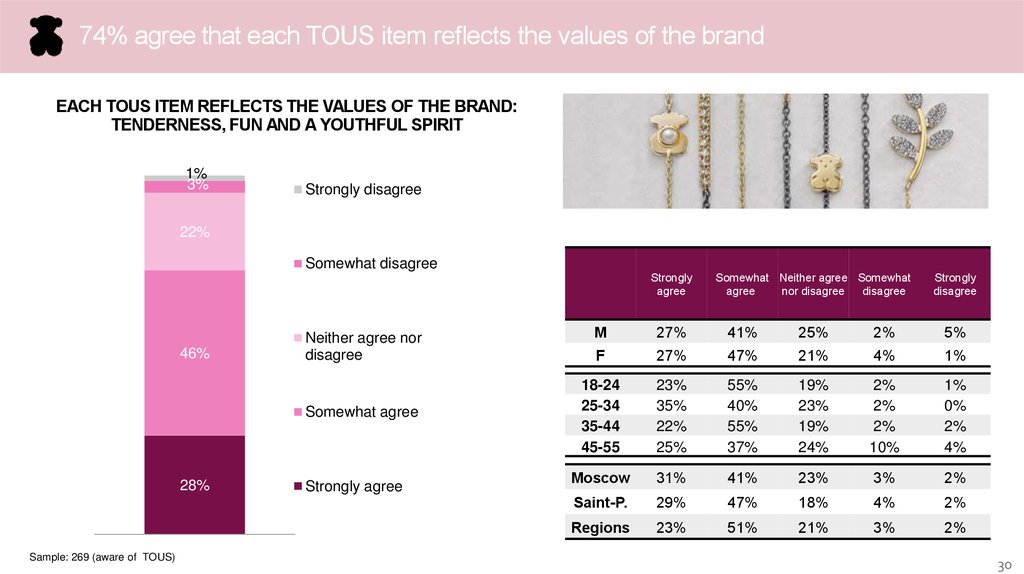

74% agree that each TOUS item reflects the values of the brandEACH TOUS ITEM REFLECTS THE VALUES OF THE BRAND:

TENDERNESS, FUN AND A YOUTHFUL SPIRIT

1%

3%

Strongly disagree

22%

Somewhat disagree

Strongly

agree

46%

Neither agree nor

disagree

Somewhat agree

28%

Sample: 269 (aware of TOUS)

Strongly agree

Somewhat Neither agree Somewhat

agree

nor disagree

disagree

Strongly

disagree

M

27%

41%

25%

2%

5%

F

27%

47%

21%

4%

1%

18-24

25-34

35-44

45-55

23%

35%

22%

25%

55%

40%

55%

37%

19%

23%

19%

24%

2%

2%

2%

10%

1%

0%

2%

4%

Moscow

31%

41%

23%

3%

2%

Saint-P.

29%

47%

18%

4%

2%

Regions

23%

51%

21%

3%

2%

30

31.

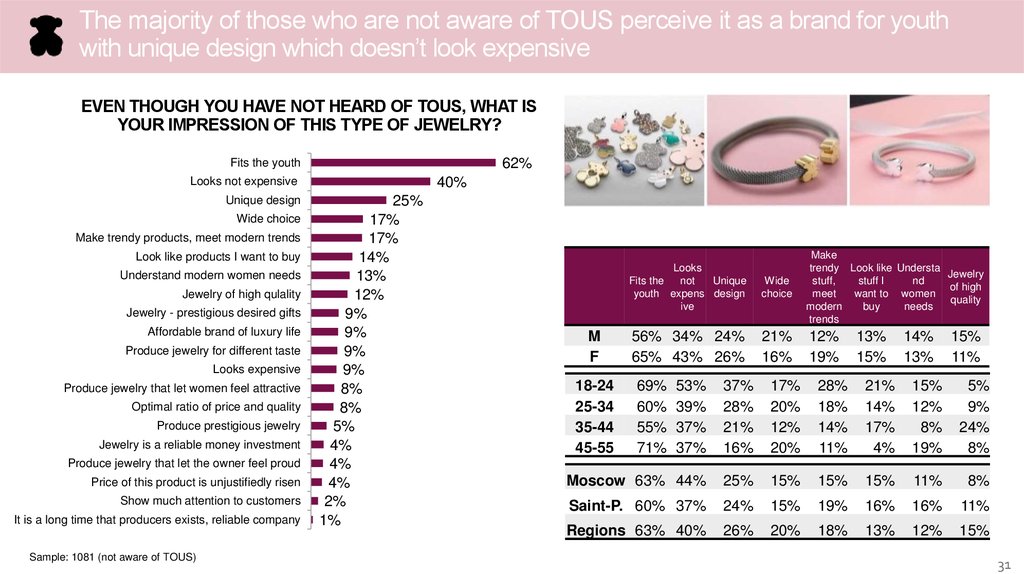

The majority of those who are not aware of TOUS perceive it as a brand for youthwith unique design which doesn’t look expensive

EVEN THOUGH YOU HAVE NOT HEARD OF TOUS, WHAT IS

YOUR IMPRESSION OF THIS TYPE OF JEWELRY?

62%

Fits the youth

40%

Looks not expensive

Unique design

Wide choice

Make trendy products, meet modern trends

Look like products I want to buy

Understand modern women needs

Jewelry of high qulality

Jewelry - prestigious desired gifts

Affordable brand of luxury life

Produce jewelry for different taste

Looks expensive

Produce jewelry that let women feel attractive

Optimal ratio of price and quality

Produce prestigious jewelry

Jewelry is a reliable money investment

Produce jewelry that let the owner feel proud

Price of this product is unjustifiedly risen

Show much attention to customers

It is a long time that producers exists, reliable company

Sample: 1081 (not aware of TOUS)

25%

17%

17%

14%

13%

12%

9%

9%

9%

9%

8%

8%

5%

4%

4%

4%

2%

1%

M

F

18-24

25-34

35-44

45-55

Looks

Fits the

not

Unique

youth expens design

ive

Wide

choice

Make

trendy Look like Understa

Jewelry

stuff,

stuff I

nd

of high

meet

want to women

quality

modern

buy

needs

trends

56% 34% 24%

65% 43% 26%

21%

16%

12%

19%

69%

60%

55%

71%

13%

15%

14%

13%

15%

11%

53%

39%

37%

37%

37%

28%

21%

16%

17%

20%

12%

20%

28%

18%

14%

11%

21%

14%

17%

4%

15%

12%

8%

19%

5%

9%

24%

8%

Moscow 63% 44%

25%

15%

15%

15%

11%

8%

Saint-P. 60% 37%

24%

15%

19%

16%

16%

11%

Regions 63% 40%

26%

20%

18%

13%

12%

15%

31

32.

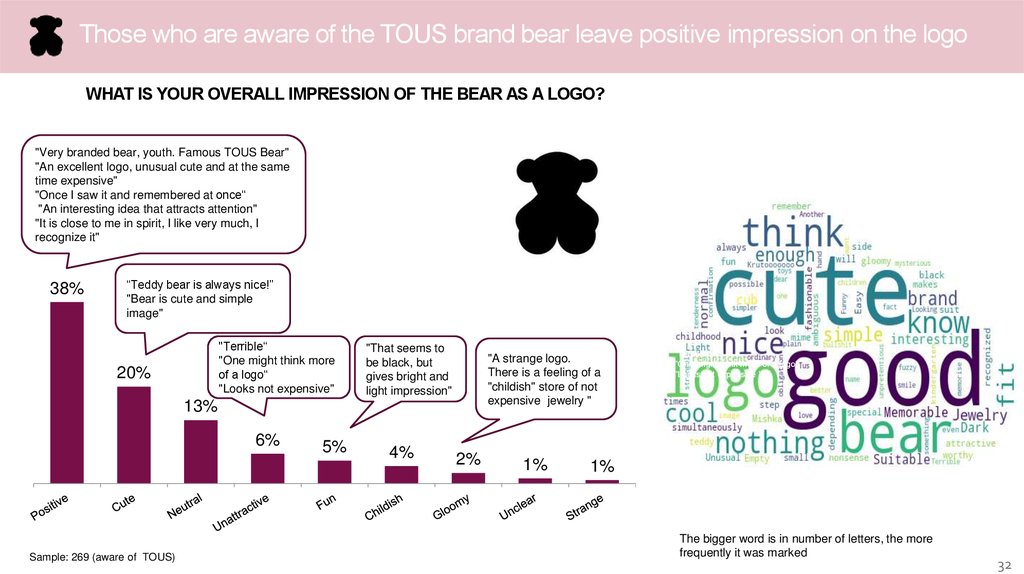

Those who are aware of the TOUS brand bear leave positive impression on the logoWHAT IS YOUR OVERALL IMPRESSION OF THE BEAR AS A LOGO?

"Very branded bear, youth. Famous TOUS Bear"

"An excellent logo, unusual cute and at the same

time expensive"

"Once I saw it and remembered at once“

"An interesting idea that attracts attention"

"It is close to me in spirit, I like very much, I

recognize it"

38%

“Teddy bear is always nice!”

"Bear is cute and simple

image"

"Terrible“

"One might think more

of a logo“

"Looks not expensive"

20%

"That seems to

be black, but

gives bright and

light impression"

"A strange logo.

There is a feeling of a

"childish" store of not

expensive jewelry "

13%

6%

Sample: 269 (aware of TOUS)

5%

4%

2%

1%

"Terrible“

"One might think more of a logo“

"Looks not expensive "

1%

The bigger word is in number of letters, the more

frequently it was marked

32

33.

Among those who are unfamiliar with brand, the TOUS bear is perceived to be lesspositive and more childish/strange

WHAT IS YOUR OVERALL IMPRESSION OF THE BEAR AS A LOGO?

"It looks interesting, original and easy to remember"

"It looks original. I've never heard of TOUS before, but look of

the logo itself, in my opinion, is able to arouse interest to it"

"An interesting approach, quite creative in comparison to other

jewelry companies"

19%

"Unattractive. At first glance it

looks like a blot "

"It looks not expensive and

not very attractive"

"The logo is not for jewelry"

12%

10%

10%

"Its form is somewhat weird, especially

the lower part, I do not really like it“

“Are you sure that this is a bear indeed?“

"If they had not written that it was a

bear, I would not have guessed"

"Its form is somewhat weird,

especially the lower part, I do not

really like it“

“Are you sure that this is a bear

indeed?“

"If they had not written that it was a

bear, I would not have guessed"

9%

9%

7%

Sample: 1081 (not aware of TOUS)

6%

5%

The bigger word is in number of letters, the more

frequently it was marked

33

34.

21% are likely to wear jewelry with the Bear on it, the readiness is much higheramong those who are aware of the brand and the youngest group 18-24 y.o.

* Large share of “No” may be related with this

exact jewelry, not with the Bear

WOULD YOU WEAR JEWELRY WITH

THE TOUS BEAR? *

14%

21%

Yes

No

Not sure

64%

72%

64%

59%

63%

68%

50%

34%

21%

7%

18-24

Sample: 1200 (Main)

15%

25-34

20%

34%

17%

35-45

13%

15%

45-55

16%

18%

Aware TOUS

Sample: 269 (aware of TOUS)/1081 (Not aware of TOUS)

14%

Not aware TOUS

34

35.

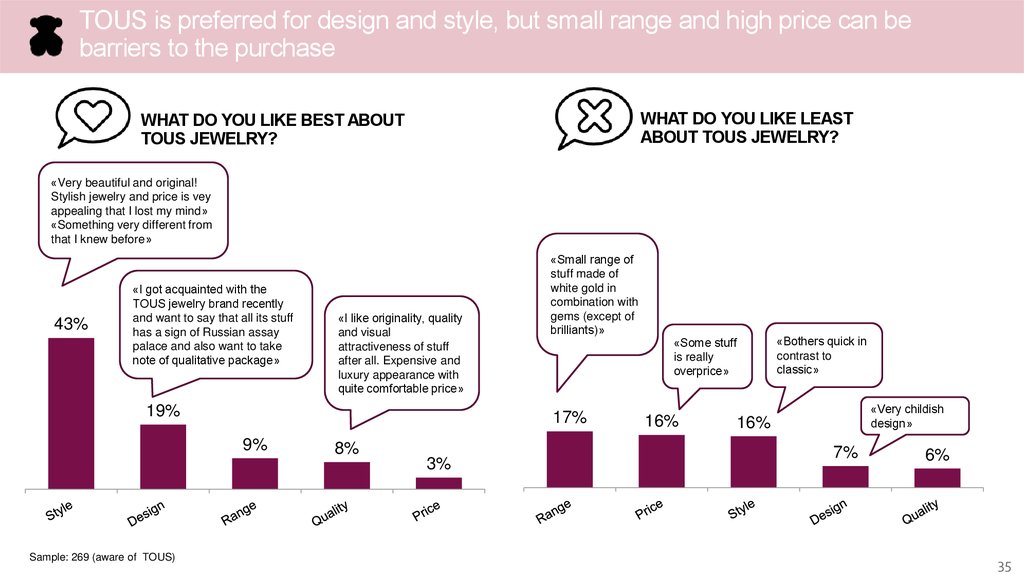

TOUS is preferred for design and style, but small range and high price can bebarriers to the purchase

WHAT DO YOU LIKE LEAST

ABOUT TOUS JEWELRY?

WHAT DO YOU LIKE BEST ABOUT

TOUS JEWELRY?

«Very beautiful and original!

Stylish jewelry and price is vey

appealing that I lost my mind»

«Something very different from

that I knew before»

43%

«I got acquainted with the

ТОUS jewelry brand recently

and want to say that all its stuff

has a sign of Russian assay

palace and also want to take

note of qualitative package»

«I like originality, quality

and visual

attractiveness of stuff

after all. Expensive and

luxury appearance with

quite comfortable price»

19%

17%

9%

Sample: 269 (aware of TOUS)

«Small range of

stuff made of

white gold in

combination with

gems (except of

brilliants)»

8%

3%

«Some stuff

is really

overprice»

16%

«Bothers quick in

contrast to

classic»

«Very childish

design»

16%

7%

6%

35

36.

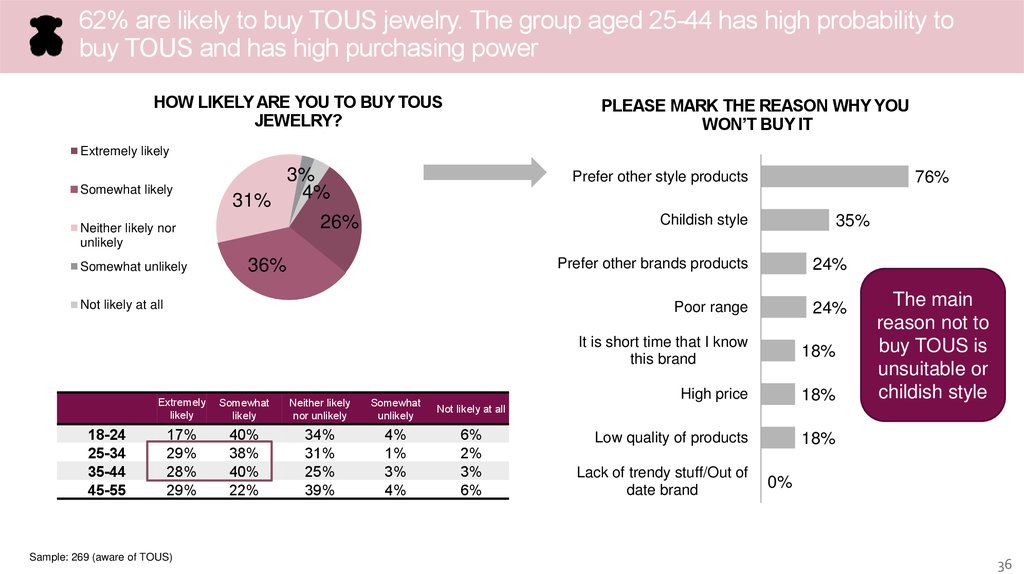

62% are likely to buy TOUS jewelry. The group aged 25-44 has high probability tobuy TOUS and has high purchasing power

HOW LIKELY ARE YOU TO BUY TOUS

JEWELRY?

PLEASE MARK THE REASON WHY YOU

WON’T BUY IT

Extremely likely

Somewhat likely

Neither likely nor

unlikely

Somewhat unlikely

3%

4%

31%

26%

36%

Extremely

likely

Somewhat

likely

Neither likely

nor unlikely

Somewhat

unlikely

Not likely at all

17%

29%

28%

29%

40%

38%

40%

22%

34%

31%

25%

39%

4%

1%

3%

4%

6%

2%

3%

6%

Sample: 269 (aware of TOUS)

35%

Childish style

Not likely at all

18-24

25-34

35-44

45-55

76%

Prefer other style products

Prefer other brands products

24%

Poor range

24%

It is short time that I know

this brand

18%

High price

18%

Low quality of products

18%

Lack of trendy stuff/Out of

date brand

The main

reason not to

buy TOUS is

unsuitable or

childish style

0%

36

37.

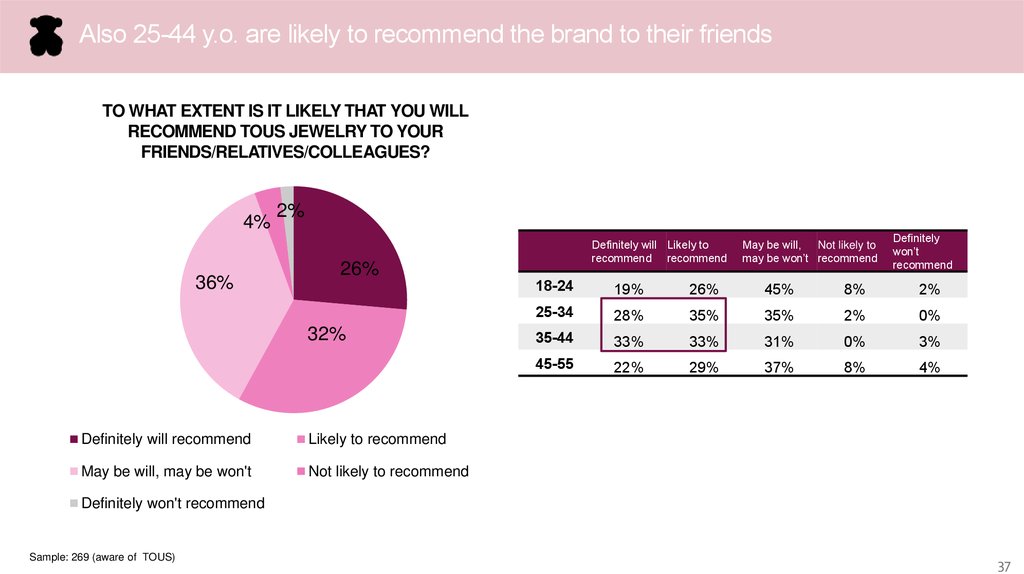

Also 25-44 y.o. are likely to recommend the brand to their friendsTO WHAT EXTENT IS IT LIKELY THAT YOU WILL

RECOMMEND TOUS JEWELRY TO YOUR

FRIENDS/RELATIVES/COLLEAGUES?

4%

36%

2%

Definitely will Likely to

recommend recommend

26%

32%

Definitely will recommend

Likely to recommend

May be will, may be won't

Not likely to recommend

May be will, Not likely to

may be won’t recommend

Definitely

won’t

recommend

18-24

19%

26%

45%

8%

2%

25-34

28%

35%

35%

2%

0%

35-44

33%

33%

31%

0%

3%

45-55

22%

29%

37%

8%

4%

Definitely won't recommend

Sample: 269 (aware of TOUS)

37

38. TOUS ADVERTISING EFFECTIVENESS

39.

Clip recognition is 13%. Brand attribution is 44%.Effective coverage of advertising campaign is 6% in total

Clip recognition

13%

o Aided recognition - % of respondents

who saw the advertising message at

least once

o Correct attribution with brand - % of

Brand attribution

Aided recognition

Sample: 1200 (main)

M

F

10%

15%

18-24

25-34

35-44

45-55

22%

11%

15%

6%

Moscow

Saint-P.

Regions

19%

11%

12%

44%

correctly named the brand among

those who saw the advertising

message

o Effective coverage - % of the

Effective coverage

6%

respondents who saw the advertising

and at the same time correctly

attributed to the brand

39

40.

56% confuse the brand of the TV ad. However there is wide range of the competitors,there is no brand-leader with strong association with the clip

WHERE DID YOU SEE THIS

ADVERTISING MESSAGE?

TV

51%

Internet

35%

Social media

Store

25%

9%

ATTRIBUTION WITH BRAND

Sample: 158 (saw ad)

TOUS

Pandora

44%

9%

Tiffany&Co Sunlight Adamas Valtera MUZ Swarovski

7%

5%

5%

4%

3% 2%

40

41.

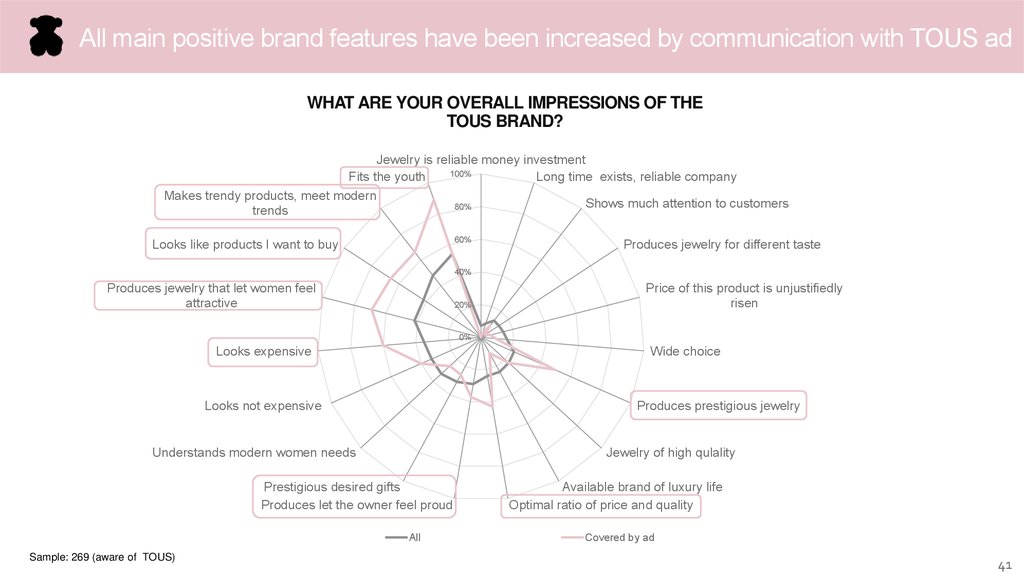

All main positive brand features have been increased by communication with TOUS adWHAT ARE YOUR OVERALL IMPRESSIONS OF THE

TOUS BRAND?

Jewelry is reliable money investment

100%

Fits the youth

Long time exists, reliable company

Makes trendy products, meet modern

Shows much attention to customers

80%

trends

60%

Looks like products I want to buy

Produces jewelry for different taste

40%

Produces jewelry that let women feel

attractive

20%

Price of this product is unjustifiedly

risen

0%

Looks expensive

Wide choice

Looks not expensive

Produces prestigious jewelry

Understands modern women needs

Jewelry of high qulality

Prestigious desired gifts

Produces let the owner feel proud

All

Sample: 269 (aware of TOUS)

Available brand of luxury life

Optimal ratio of price and quality

Covered by ad

41

42.

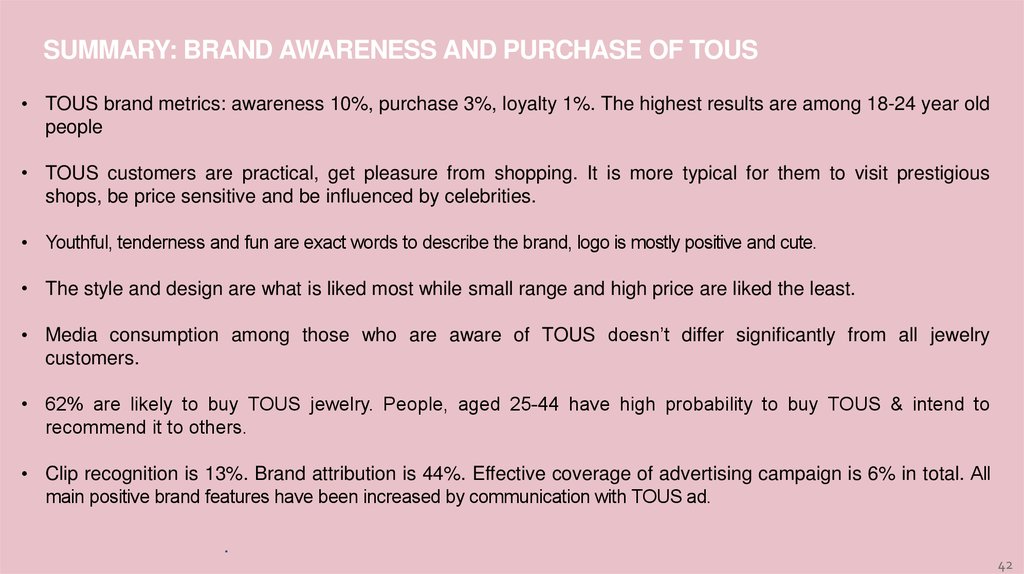

SUMMARY: BRAND AWARENESS AND PURCHASE OF TOUS• TOUS brand metrics: awareness 10%, purchase 3%, loyalty 1%. The highest results are among 18-24 year old

people

• TOUS customers are practical, get pleasure from shopping. It is more typical for them to visit prestigious

shops, be price sensitive and be influenced by celebrities.

• Youthful, tenderness and fun are exact words to describe the brand, logo is mostly positive and cute.

• The style and design are what is liked most while small range and high price are liked the least.

• Media consumption among those who are aware of TOUS doesn’t differ significantly from all jewelry

customers.

• 62% are likely to buy TOUS jewelry. People, aged 25-44 have high probability to buy TOUS & intend to

recommend it to others.

• Clip recognition is 13%. Brand attribution is 44%. Effective coverage of advertising campaign is 6% in total. All

main positive brand features have been increased by communication with TOUS ad.

.

42

43. COMPETITORS: BRAND METRICS OVERVIEW

44.

Brand awareness: TOUS shows rather low results, but among covered by TOUS ad it ismuch higher

WHAT BRANDS OF JEWELRY DO YOU KNOW OR HAVE HEARD OF?

Aided brand awareness

Spontaneous brand awareness

83%

80%

76%

75%

72%

67%

Among covered by

TOUS ad

61%

Among covered by

TOUS ad

51%

42%

54%

9%

29%

19% 18% 17%

16% 15% 13% 13%

11%

Sunlight

Tiffany

Pandora Sokolov Adamas Swarovski

MUZ

10%

7%

7%

585Gold Cartier Bvlgari

6%

6%

4%

3%

1%

Yakutskie Yashma Bronitskij

Valtera

brillianty

zoloto

Yuvelir

TOUS

Other

Swarovski

Sunlight

Pandora

Adamas

Tiffany&Co

MUZ

Sokolov

Valtera

TOUS

18-24 31% 23% 20% 17%

6%

14%

9%

26%

6% 12%

2%

11%

3%

6%

3%

57%

18-24

93%

90%

90%

80%

79%

64%

68%

51%

13%

25-34 31%

20%

20%

22%

21%

12%

13%

13%

8%

6%

5%

5%

8%

6%

2%

57%

25-34

84%

81%

84%

77%

78%

67%

67%

44%

9%

35-44 25%

16%

19%

12%

16%

14%

11%

6%

15% 9%

7%

6%

6%

4%

0%

51%

35-44

77%

74%

63%

74%

64%

63%

54%

41%

10%

45-55 26%

18%

9%

14%

13%

21%

21%

12% 15% 4%

14%

4%

4%

1%

1%

47%

45-55

80%

77%

66%

65%

68%

74%

51%

31%

9%

Sample: 1200 (Main)

44

45.

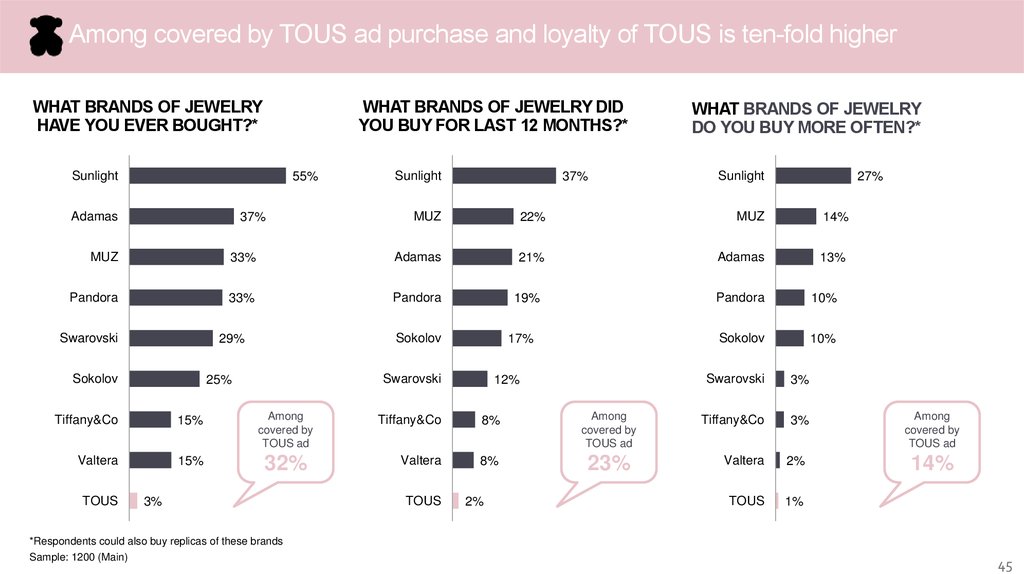

Among covered by TOUS ad purchase and loyalty of TOUS is ten-fold higherWHAT BRANDS OF JEWELRY

HAVE YOU EVER BOUGHT?*

WHAT BRANDS OF JEWELRY DID

YOU BUY FOR LAST 12 MONTHS?*

Sunlight

55%

Adamas

37%

Sunlight

MUZ

14%

21%

Adamas

13%

Adamas

Pandora

33%

Pandora

Sokolov

17%

Swarovski

Tiffany&Co

15%

Among

covered by

TOUS ad

Valtera

15%

32%

TOUS

19%

Sokolov

25%

3%

*Respondents could also buy replicas of these brands

Sample: 1200 (Main)

27%

22%

33%

29%

Sunlight

MUZ

MUZ

Swarovski

37%

WHAT BRANDS OF JEWELRY

DO YOU BUY MORE OFTEN?*

12%

Tiffany&Co

8%

Among

covered by

TOUS ad

Valtera

8%

23%

TOUS

2%

Pandora

10%

Sokolov

10%

Swarovski

3%

Tiffany&Co

3%

Valtera

2%

TOUS

1%

Among

covered by

TOUS ad

14%

45

46.

TOUS brand’s KPI is not very high. But conversion is rather good.MUZ has the best conversion from awareness to purchase and loyalty

TOUS

MUZ

PANDORA

SWAROVSKI

Brand awareness

(spontaneous brand

awareness)

Brand awareness

(spontaneous brand

awareness)

Brand awareness

(spontaneous brand

awareness)

Brand awareness

(spontaneous brand

awareness)

10%

67%

76%

83%

(1%)

(13%)

(18%)

(15%)

29%

50%

43%

36%

Purchase

Purchase

Purchase

Purchase

3%

33%

33%

29%

35%

43%

30%

10%

Loyalty

Loyalty

Loyalty

Loyalty

1%

14%

10%

3%

Sample: 1200 (main)

46

47.

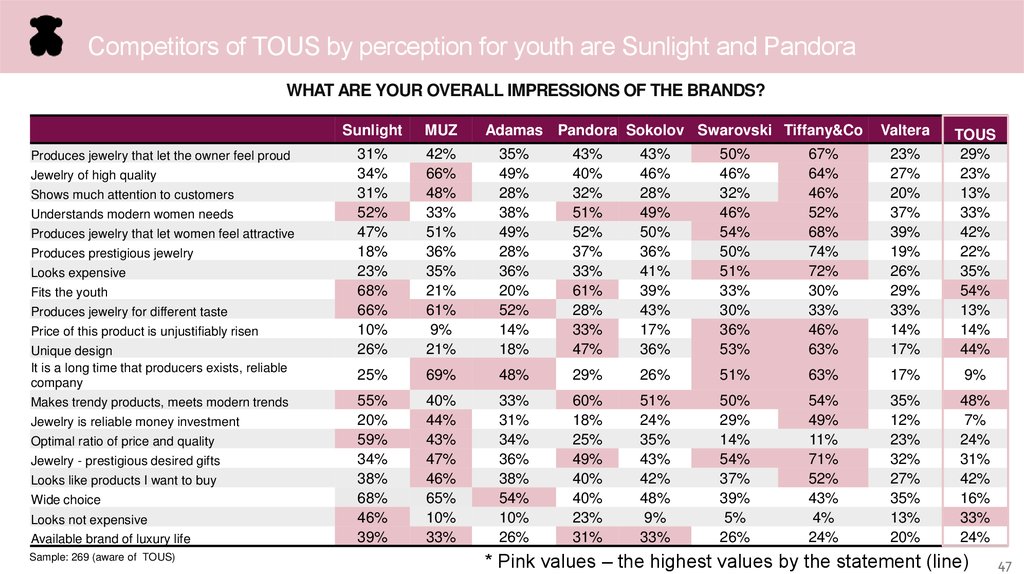

Competitors of TOUS by perception for youth are Sunlight and PandoraWHAT ARE YOUR OVERALL IMPRESSIONS OF THE BRANDS?

Produces jewelry that let the owner feel proud

Jewelry of high quality

Shows much attention to customers

Understands modern women needs

Produces jewelry that let women feel attractive

Produces prestigious jewelry

Looks expensive

Fits the youth

Produces jewelry for different taste

Price of this product is unjustifiably risen

Unique design

It is a long time that producers exists, reliable

company

Makes trendy products, meets modern trends

Jewelry is reliable money investment

Optimal ratio of price and quality

Jewelry - prestigious desired gifts

Looks like products I want to buy

Wide choice

Looks not expensive

Available brand of luxury life

Sample: 269 (aware of TOUS)

Sunlight

MUZ

Adamas Pandora Sokolov Swarovski Tiffany&Co

Valtera

31%

34%

31%

52%

47%

18%

23%

68%

66%

10%

26%

42%

66%

48%

33%

51%

36%

35%

21%

61%

9%

21%

35%

49%

28%

38%

49%

28%

36%

20%

52%

14%

18%

43%

40%

32%

51%

52%

37%

33%

61%

28%

33%

47%

43%

46%

28%

49%

50%

36%

41%

39%

43%

17%

36%

50%

46%

32%

46%

54%

50%

51%

33%

30%

36%

53%

67%

64%

46%

52%

68%

74%

72%

30%

33%

46%

63%

23%

27%

20%

37%

39%

19%

26%

29%

33%

14%

17%

TOUS

29%

23%

13%

33%

42%

22%

35%

54%

13%

14%

44%

25%

69%

48%

29%

26%

51%

63%

17%

9%

55%

20%

59%

34%

38%

68%

46%

39%

40%

44%

43%

47%

46%

65%

10%

33%

33%

31%

34%

36%

38%

54%

10%

26%

60%

18%

25%

49%

40%

40%

23%

31%

51%

24%

35%

43%

42%

48%

9%

33%

50%

29%

14%

54%

37%

39%

5%

26%

54%

49%

11%

71%

52%

43%

4%

24%

35%

12%

23%

32%

27%

35%

13%

20%

48%

7%

24%

31%

42%

16%

33%

24%

* Pink values – the highest values by the statement (line)

47

48.

SUMMARY: COMPETITORS. BRAND METRICS OVERVIEW• Brand awareness: TOUS shows rather low results, but among covered by TOUS ad it

is much higher

• Among covered by TOUS ad purchase and loyalty of TOUS are ten-fold higher

• TOUS brand’s KPI is not very high. But conversion is rather good.

• Competitors of TOUS by perception for youth are Sunlight and Pandora

.

56

49.

DISCOVERED INSIGHTS: WHAT THIS MEANS FOR USINSIGHTS

ACTIONS

TOUS consumers are most of all W18-34 y.o. But the customers of jewelry are W2544 y.o., they also most likely to intend to buy and to recommend TOUS jewelry.

Focus on two different audiences: W18-24 and W25-44 years old.

TOUS awareness is not very high, but among people who are aware of TOUS,

purchase and loyalty are much higher. Communication with TOUS ads

increases it by a factor of 2. Actual ad has good brand attribution, but low aided recognition.

Increase volume of market presence.

The highest awareness and purchase of TOUS are in Moscow region, but there is

much room to grow.

Focus on Moscow region, but if there is a possibility consider allocating more ad

spending in regions.

Customers are most likely to learn about new jewelry from TV and internet, their main

media channels.

Ensure TOUS is clearly communicated on TV and internet.

Design and unique style are what is liked best about TOUS, while assortment and

price are liked the least.

Promote unique style and design, broad assortment.

77% of shoppers are motivated by a loyalty program for a brand of jewelry .

Develop usage of loyalty program for TOUS.

18-24 y.o. are most likely to wear jewelry with the Bear.

Use advertising with the Bear primarily in communication with youth.

Tous has image of not luxurious, prestigious, high quality brand. Especially among

25-44 y.o.

Focus on high quality and luxury of brand in ad message targeting on 25-44.

The most popular event to buy jewelry as a gift is a birthday

Earrings and rings are the most popular jewelry.

Focus on theme of birthday in ad message.

Focus on earrings and rings in ad message.

57

50.

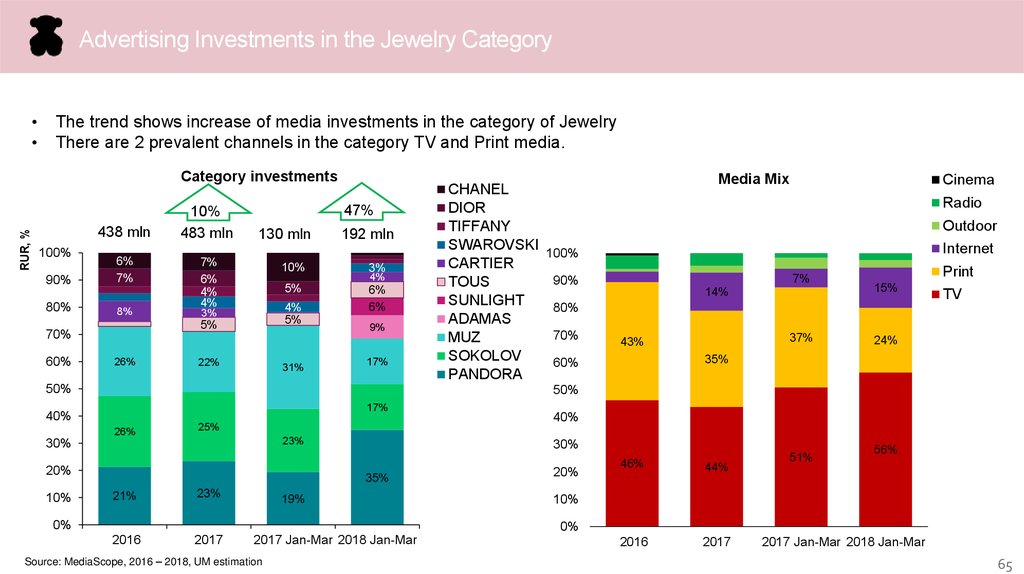

Advertising Investments in the Jewelry CategoryThe trend shows increase of media investments in the category of Jewelry

There are 2 prevalent channels in the category TV and Print media.

RUR, %

Category investments

438 mln

100%

90%

80%

6%

7%

8%

47%

130 mln

7%

6%

4%

4%

10%

5%

4%

5%

3%

5%

70%

60%

10%

483 mln

26%

22%

31%

192 mln

3%

4%

6%

6%

9%

17%

50%

Media Mix

Cinema

Radio

Outdoor

Internet

100%

7%

90%

14%

15%

TV

80%

70%

37%

43%

24%

35%

60%

50%

17%

40%

26%

25%

23%

30%

20%

10%

CHANEL

DIOR

TIFFANY

SWAROVSKI

CARTIER

TOUS

SUNLIGHT

ADAMAS

MUZ

SOKOLOV

PANDORA

30%

35%

21%

23%

2016

2017

40%

19%

0%

20%

46%

44%

2016

2017

51%

56%

10%

0%

2017 Jan-Mar 2018 Jan-Mar

Source: MediaScope, 2016 – 2018, UM estimation

2017 Jan-Mar 2018 Jan-Mar

65

51.

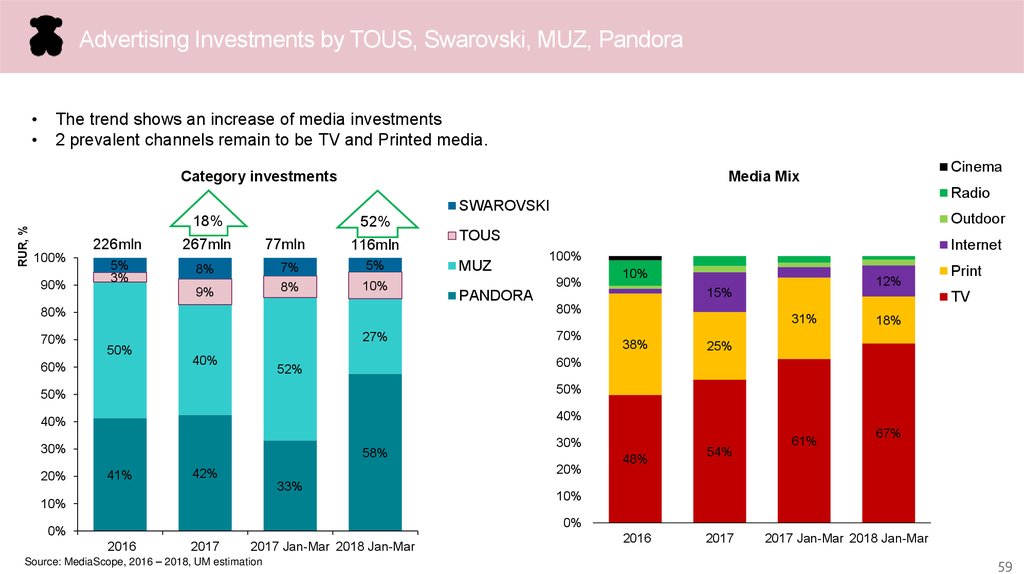

Advertising Investments by TOUS, Swarovski, MUZ, PandoraThe trend shows an increase of media investments

2 prevalent channels remain to be TV and Printed media.

Category investments

Cinema

Media Mix

Radio

RUR, %

SWAROVSKI

18%

100%

90%

226mln

267mln

5%

3%

8%

Outdoor

52%

77mln

7%

8%

9%

116mln

5%

10%

TOUS

MUZ

90%

80%

70%

70%

27%

60%

40%

50%

40%

40%

30%

30%

58%

41%

12%

15%

TV

31%

38%

18%

25%

60%

52%

50%

20%

10%

PANDORA

80%

50%

Internet

100%

20%

42%

33%

10%

48%

54%

61%

67%

10%

0%

0%

2016

2017

2017 Jan-Mar 2018 Jan-Mar

Source: MediaScope, 2016 – 2018, UM estimation

2016

2017

2017 Jan-Mar 2018 Jan-Mar

59

52.

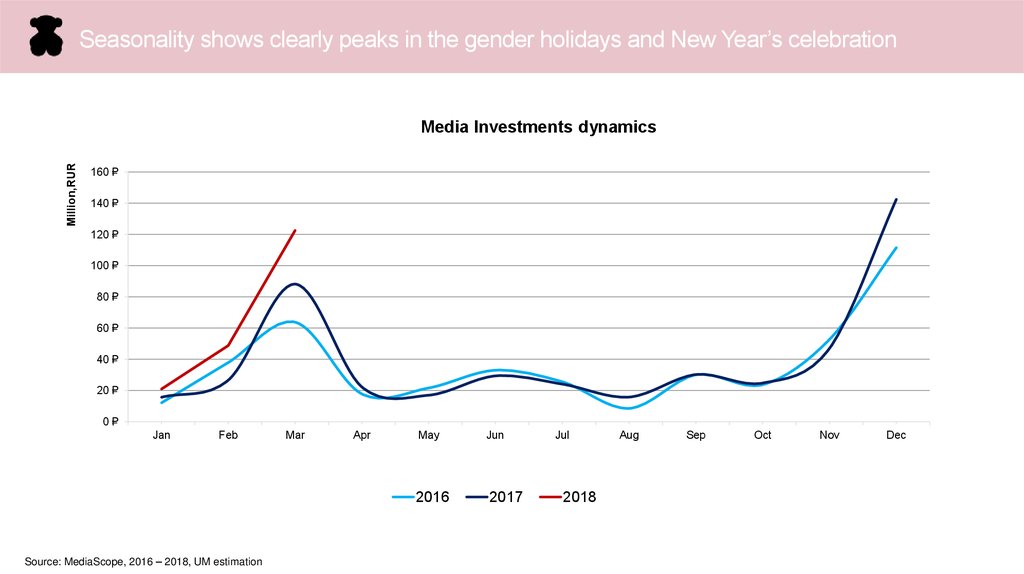

Seasonality shows clearly peaks in the gender holidays and New Year’s celebrationMillion,RUR

Media Investments dynamics

160 ₽

140 ₽

120 ₽

100 ₽

80 ₽

60 ₽

40 ₽

20 ₽

0₽

Jan

Feb

Source: MediaScope, 2016 – 2018, UM estimation

Mar

Apr

May

Jun

2016

2017

Jul

2018

Aug

Sep

Oct

Nov

Dec

53.

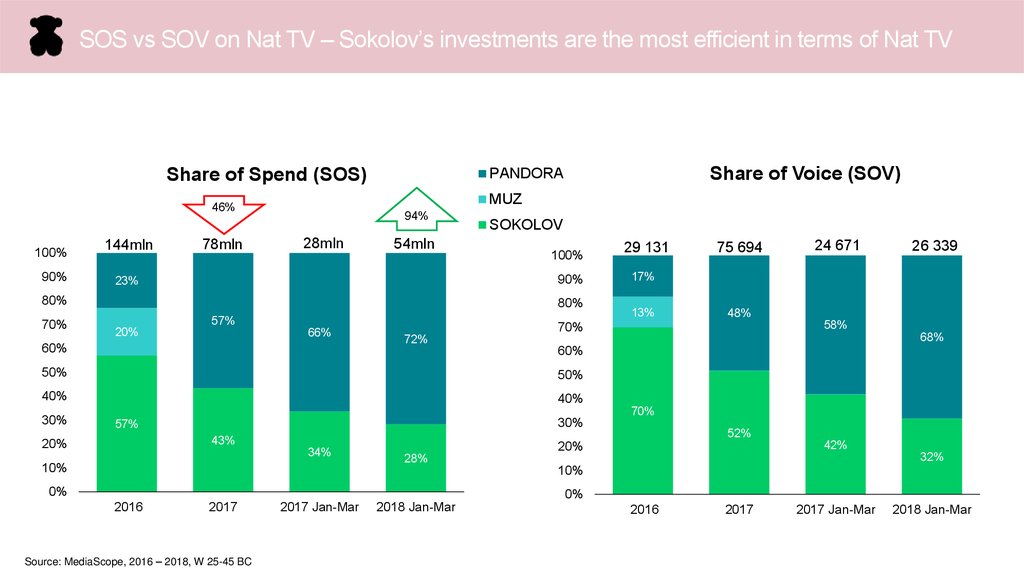

SOS vs SOV on Nat TV – Sokolov’s investments are the most efficient in terms of Nat TVShare of Spend (SOS)

MUZ

46%

100%

90%

144mln

78mln

94%

28mln

54mln

SOKOLOV

100%

90%

23%

80%

70%

Share of Voice (SOV)

PANDORA

80%

57%

20%

66%

60%

75 694

24 671

26 339

17%

13%

48%

58%

70%

68%

72%

60%

50%

50%

40%

40%

30%

29 131

30%

57%

43%

20%

34%

10%

70%

52%

42%

20%

32%

28%

10%

0%

0%

2016

2017

Source: MediaScope, 2016 – 2018, W 25-45 BC

2017 Jan-Mar

2018 Jan-Mar

2016

2017

2017 Jan-Mar

2018 Jan-Mar

54.

Regional TV – Sokolov and Moskow Jewelry Plant massively support their products invarious cities

2016

Regional TRP's

SOKOLOV

MUZ

2017

Regional TRP's

SOKOLOV

1

2

3

4

5

6

7

8

Chelyabinsk

Ekaterinburg

Irkutsk

Kazan

Khabarovsk

Krasnodar

Krasnoyarsk

Moscow

532

470

996

2921

777

636

593

2

541

9

Nizhniy Novgorod

975

459

1

2

3

4

5

6

7

8

9

10

Chelyabinsk

Ekaterinburg

Irkutsk

Izhevsk

Kazan

Kemerovo

Khabarovsk

Krasnodar

Krasnoyarsk

Moscow

781

1589

2975

336

2276

809

840

2908

1976

10

11

12

Novosibirsk

Omsk

Perm

232

515

808

11

Nizhniy Novgorod

13

Rostov-On-Don

673

12

13

14

14

Saint-Petersburg

15

16

17

18

19

20

21

22

23

24

Samara

Saratov

Stavropol

Tula

Tver

Tyumen

Ufa

Vladivostok

Volgograd

Voronezh

558

1123

2062

384

671

1319

524

1008

576

222

495

726

175

489

744

847

661

755

162

119

634

585

254

375

Source: MediaScope, 2016 – 2017, W 25-45 BC

MUZ

SWAROVSKI TOUS

2790

2782

2367

484

1

2

3

4

5

6

7

8

1833

10

11

Chelyabinsk

Ekaterinburg

Irkutsk

Izhevsk

Kazan

Khabarovsk

Krasnodar

Moscow

Nizhniy

Novgorod

Novosibirsk

Perm

12

Rostov-On-Don

1057

9

5394

423

384

2504

423

Novosibirsk

Omsk

Perm

2834

1995

1969

2193

15

Rostov-On-Don

2728

1385

501

16

Saint-Petersburg

2511

3009

843

17

18

19

20

21

22

23

24

25

26

Samara

Saratov

Stavropol

Tula

Tver

Tyumen

Ufa

Vladivostok

Voronezh

Yaroslavl

834

3128

2270

267

2360

169

2753

46

92

2298

153

844

663

1346

2868

1003

Jan-Mar

Regional TRP's SOKOLOV

2018

905

102

13

14

15

16

17

18

19

20

21

SaintPetersburg

Samara

Saratov

Stavropol

Tver

Tyumen

Vladivostok

Volgograd

Voronezh

MUZ

PANDORA ADAMAS

607

287

164

621

138

491

1054

123

444

456

492

477

118

347

97

548

463

1099

362

1380

174

1051

1113

452

1675

852

493

1550

496

1108

986

239

813

3

763

257

13

125

134

55.

Investments – Awareness correlation. Generally awareness rises with investments and mayhave accumulative effect in the following quarter after the quarter of ad running.

Spend

Awareness

60

100%

2016 – 94mln

2017 – 113mln

80%

50

40

60%

30

40%

Millions, RUR

Millions, RUR

Pandora

70

20

60

Sokolov

40

60%

30

40%

Mar'16May'16

Jun'16Aug'16

Sep'16Nov'16

Dec'16Feb'17

Mar'17May'17

Jun'17Aug'17

Sep'17Nov'17

Dec'17Feb'18

20%

10

0%

-

100%

2016 – 12mln

2017 – 21mln

80%

50

40

60%

30

40%

20

Mar'16May'16

Jun'16Aug'16

Sep'16Nov'16

Dec'16Feb'17

Mar'17May'17

Jun'17Aug'17

Sep'17Nov'17

Dec'17Feb'18

MUZ

70

60

0%

100%

2016 – 113mln

2017 – 108mln

80%

50

40

60%

30

40%

20

20%

10

-

Millions, RUR

Millions, RUR

60

80%

50

Swarovski

70

100%

2016 – 114mln

2017 – 123mln

20

20%

10

-

70

20%

10

Mar'16May'16

Jun'16Aug'16

Sep'16Nov'16

Dec'16Feb'17

Mar'17May'17

Jun'17Aug'17

Sep'17Nov'17

Dec'17Feb'18

0%

-

Source: MediaScope, M’Index, H1 2016, H2 2016, H1 2017, H2 2017, W 25-45 BC, 2016 – 2017, UM estimation

Mar'16May'16

Jun'16Aug'16

Sep'16Nov'16

Dec'16Feb'17

Mar'17May'17

Jun'17Aug'17

Sep'17Nov'17

Dec'17Feb'18

0%

63

56.

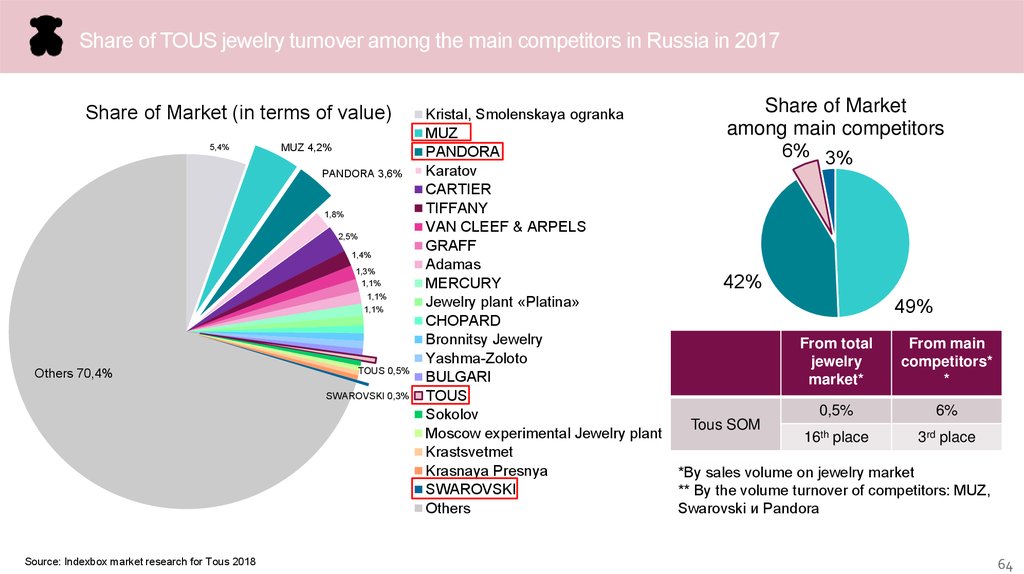

Share of TOUS jewelry turnover among the main competitors in Russia in 2017Share of Market (in terms of value)

5,4%

MUZ 4,2%

PANDORA 3,6%

1,8%

2,5%

1,4%

1,3%

1,1%

1,1%

1,1%

Others 70,4%

TOUS 0,5%

SWAROVSKI 0,3%

Source: Indexbox market research for Tous 2018

Kristal, Smolenskaya ogranka

MUZ

PANDORA

Karatov

CARTIER

TIFFANY

VAN CLEEF & ARPELS

GRAFF

Adamas

MERCURY

Jewelry plant «Platina»

CHOPARD

Bronnitsy Jewelry

Yashma-Zoloto

BULGARI

TOUS

Sokolov

Moscow experimental Jewelry plant

Krastsvetmet

Krasnaya Presnya

SWAROVSKI

Others

Share of Market

among main competitors

6% 3%

42%

49%

Tous SOM

From total

jewelry

market*

From main

competitors*

*

0,5%

6%

16th place

3rd place

*By sales volume on jewelry market

** By the volume turnover of competitors: MUZ,

Swarovski и Pandora

64

57.

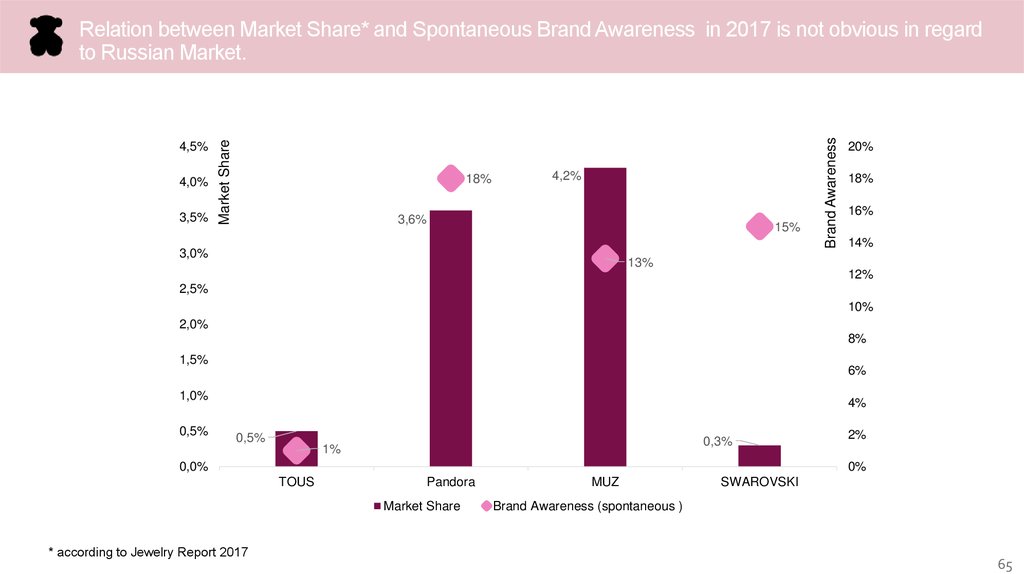

4,0%3,5%

18%

4,2%

3,6%

15%

3,0%

Brand Awareness

4,5%

Market Share

Relation between Market Share* and Spontaneous Brand Awareness in 2017 is not obvious in regard

to Russian Market.

20%

18%

16%

14%

13%

12%

2,5%

10%

2,0%

8%

1,5%

6%

1,0%

0,5%

4%

0,5%

0,3%

1%

0,0%

0%

TOUS

Pandora

Market Share

* according to Jewelry Report 2017

2%

MUZ

SWAROVSKI

Brand Awareness (spontaneous )

65

58.

MOSCOW, RUSSIA127018, POLKOVAYA STR, 3/3, OF. 302

TEL.: +7 (916) 459 27 71

TEL.: +7 (495) 177 46 54

VTKACH@VISION-AGENCY.RU

WWW.VISION-AGENCY.RU

Маркетинг

Маркетинг