Похожие презентации:

Modeling non-stationary variables

1.

Modeling Non-stationary VariablesJoint Vienna Institute/ IMF ICD

Macro-econometric Forecasting and Analysis,

JV16.12, L02, Vienna, Austria, May 17, 2016

Presenter

Mikhail Pranovich

This training material is the property of the International Monetary Fund (IMF) and is intended for use in

IMF’s Institute for Capacity development (ICD) courses. Any reuse requires the permission of ICD.

2.

Lecture Objectives• Revisit the concept of non-stationary (unit root) process and

its implications for analysis and forecasting

• Understand key tests for unit root

• Revisit the concept of cointegration

• … and testing for cointegration

2

3. Outline

Stationary and non-stationary variablesTesting for unit roots

Cointegration

Testing for cointegration

3

4. Introduction

Many economic (macro/financial) variables exhibit trendingbehavior

e.g., real GDP, real consumption, assets prices, dividends…

Key issue for estimation/forecasting:

the nature of this trend….

… is it deterministic (e.g., linear trend) or stochastic (e.g., random

walk)

The nature of the trend has important implications for the

model’s parameters and their distributions…

… and thus for the statistical procedures used to conduct

inference and forecasting

4

Macro-econometric Forecasting and

Analysis

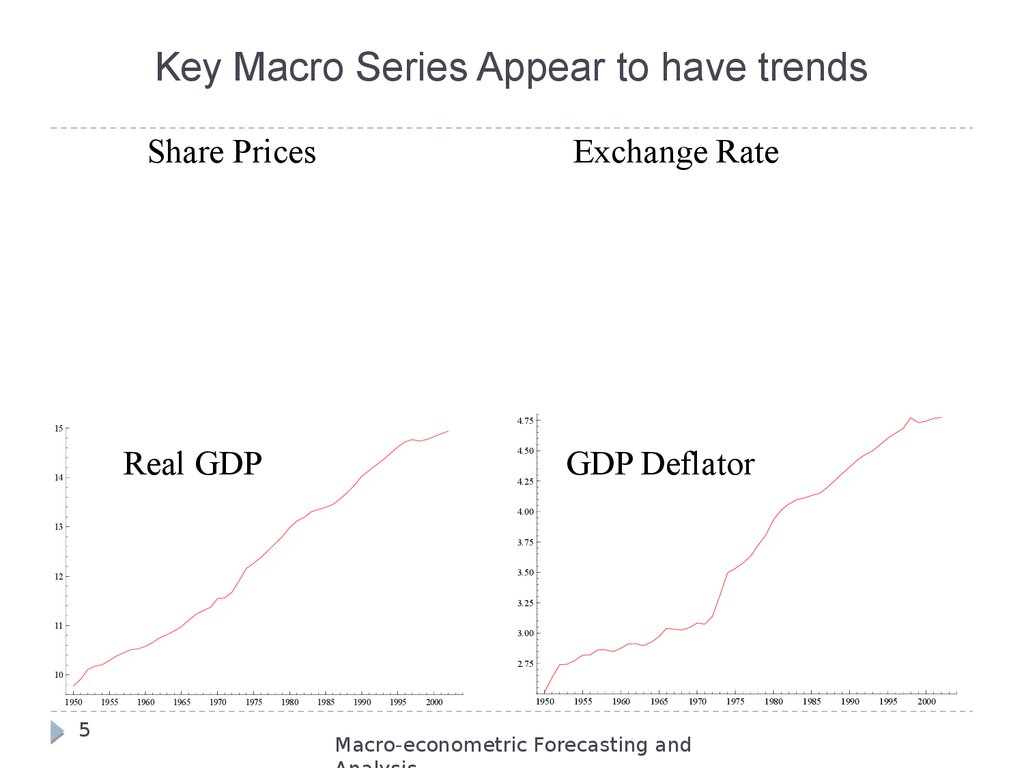

5. Key Macro Series Appear to have trends

Share PricesExchange Rate

4.75

15

Real GDP

14

GDP Deflator

4.50

4.25

4.00

13

3.75

3.50

12

3.25

11

3.00

2.75

10

1950

5

1955

1960

1965

1970

1975

1980

1985

1990

1995

2000

1950

1955

1960

1965

1970

Macro-econometric Forecasting and

1975

1980

1985

1990

1995

2000

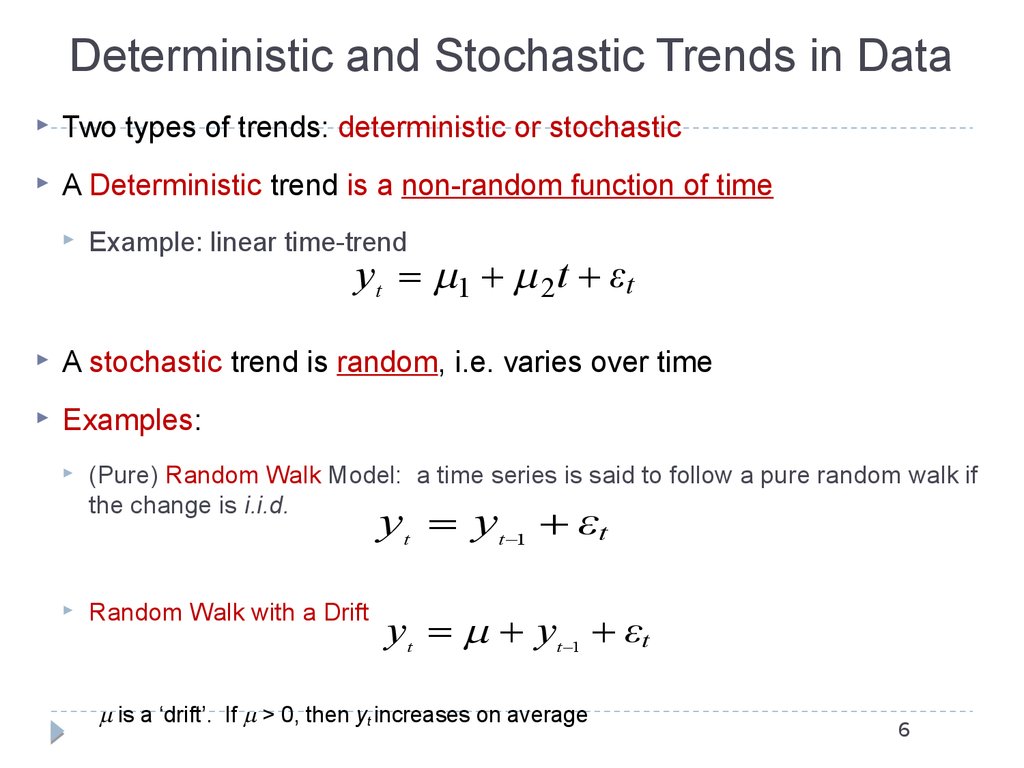

6. Deterministic and Stochastic Trends in Data

Two types of trends: deterministic or stochasticA Deterministic trend is a non-random function of time

Example: linear time-trend

y t 1 2 t εt

A stochastic trend is random, i.e. varies over time

Examples:

(Pure) Random Walk Model: a time series is said to follow a pure random walk if

the change is i.i.d.

yt yt 1 εt

Random Walk with a Drift

yt yt 1 εt

is a ‘drift’. If > 0, then yt increases on average

6

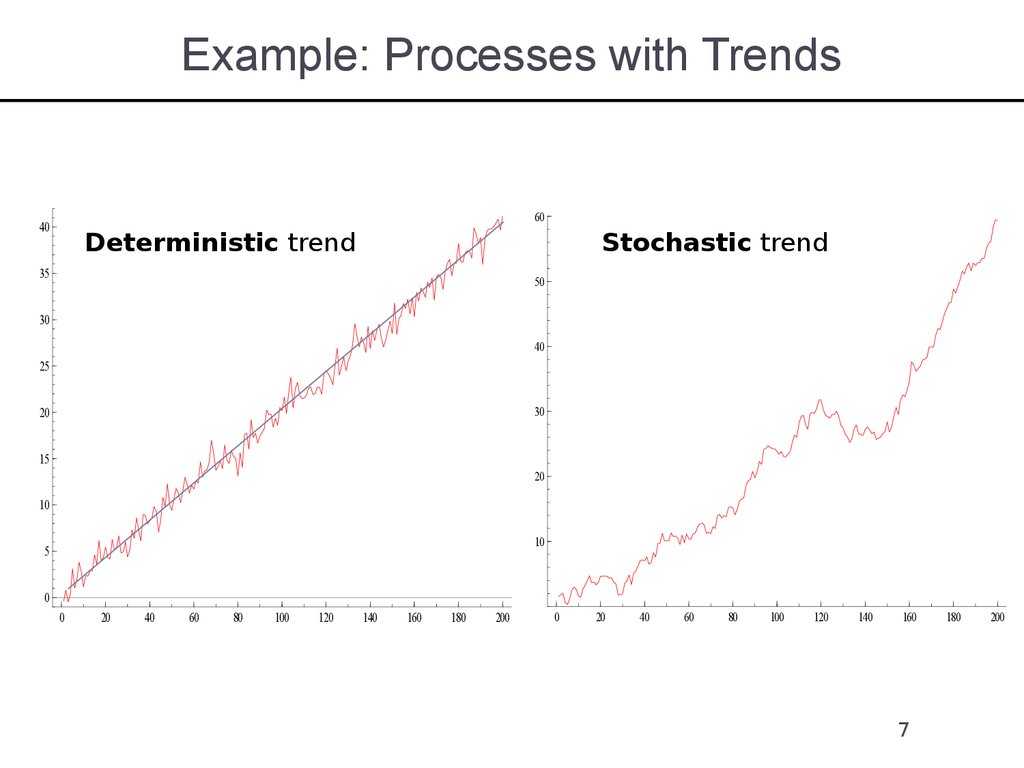

7. Example: Processes with Trends

6040

Deterministic trend

Stochastic trend

35

50

30

40

25

30

20

15

20

10

10

5

0

0

20

40

60

80

100

120

140

160

180

200

0

20

40

60

80

100

120

140

160

7

180

200

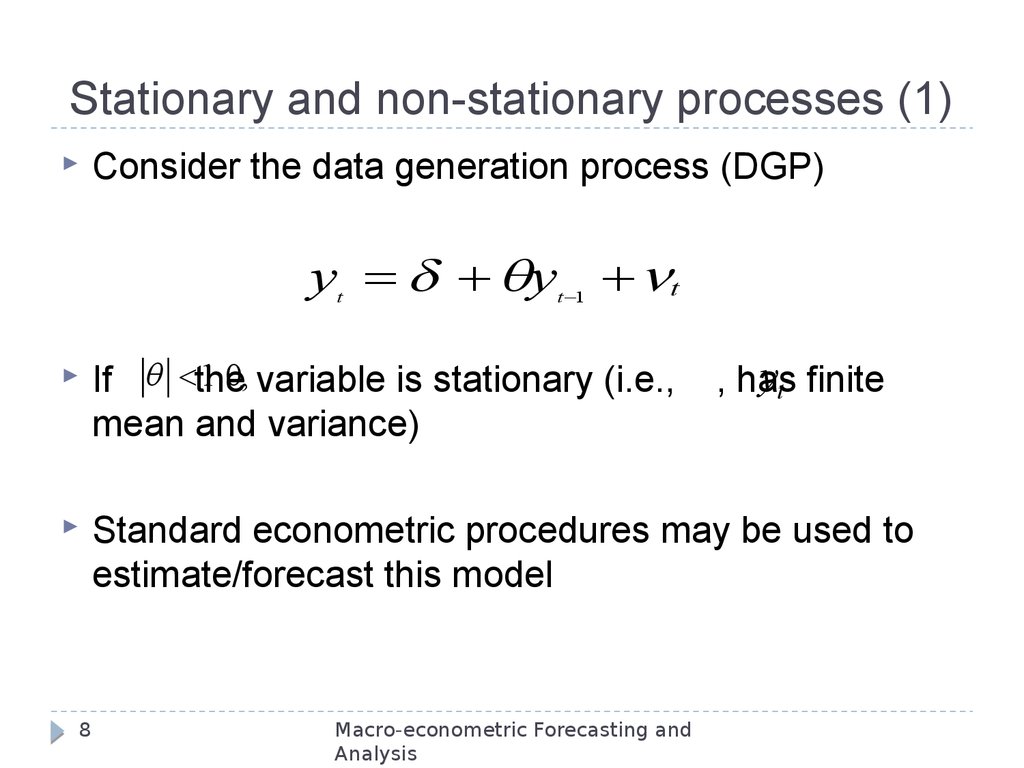

8. Stationary and non-stationary processes (1)

Consider the data generation process (DGP)y qy t

t

t 1

1.0, variable is stationary (i.e.,

If q <the

mean and variance)

Standard econometric procedures may be used to

estimate/forecast this model

8

Macro-econometric Forecasting and

Analysis

yt finite

, has

9.

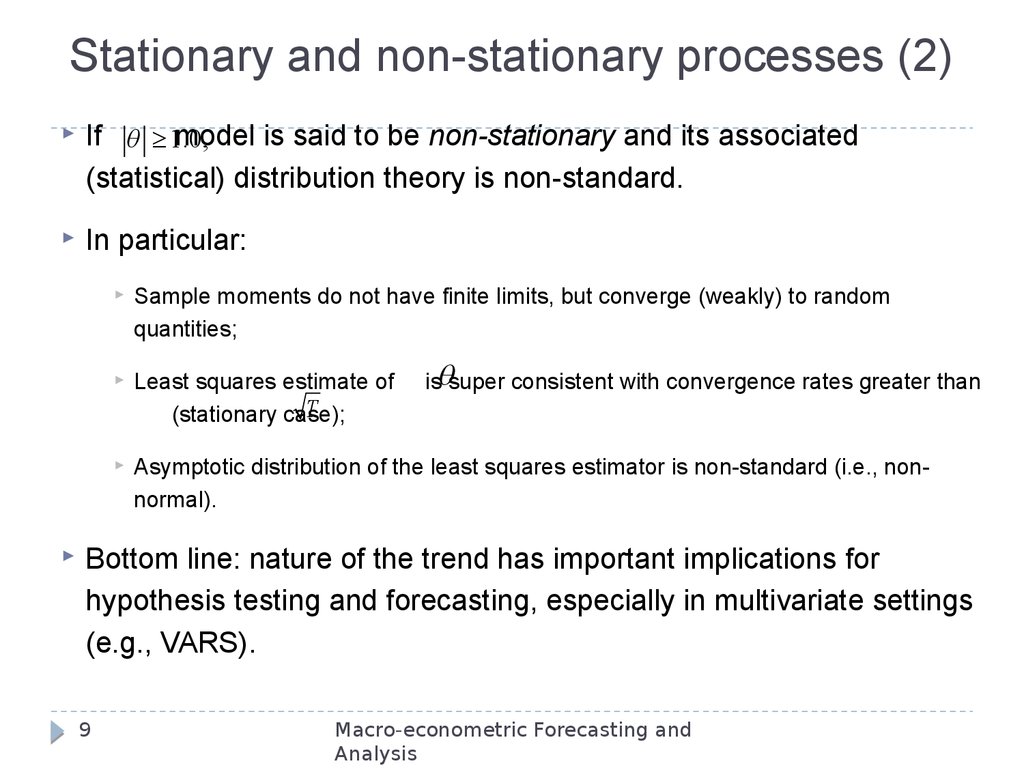

Stationary and non-stationary processes (2)If q ³ 1.0,

model is said to be non-stationary and its associated

(statistical) distribution theory is non-standard.

In particular:

Sample moments do not have finite limits, but converge (weakly) to random

quantities;

Least squares estimate of

T

(stationary case);

Asymptotic distribution of the least squares estimator is non-standard (i.e., nonnormal).

isqsuper consistent with convergence rates greater than

Bottom line: nature of the trend has important implications for

hypothesis testing and forecasting, especially in multivariate settings

(e.g., VARS).

9

Macro-econometric Forecasting and

Analysis

10. Reminder: Autoregressive AR(p) Process

We shall check how shocks affect stationary and non-stationary variables, but first recall what is an AR(p) process

An AR(p) autoregressive process (AR-process of order p):

y t q1 y t 1 q 2 y t 2 ... q p y t p εt

The error εt, is assumed to be independently and identically

distributed (i.i.d.), with a zero mean and a constant variance

10

11. Stochastic trends, autoregressive models and a unit root

The condition for stationarity in an AR(p) model: roots z of thecharacteristic equation

1- θ1z - θ2z2 - θ3z3 - ... - θpzp =0

must all be greater than one in absolute value: |z| >1

If an AR(p) process has z=1 => variable has a unit root

Example: AR(1) process yt =

+ θyt-1 + vt

A special case is θ =1 => z =1 => yt has unit root (stochastic trend)

Stationarity requires that |θ| <1 for |z|>1

11

12. The Impact of Shocks on Stationary and Non-stationary variables

Consider a simple AR(1):yt = θyt-1 + νt,

where θ takes any value for now

We can write:

yt-1= θyt-2 + νt-1

yt-2= θyt-3 + νt-2

Substituting yields:

yt = θ(θyt-2 + νt-1) + εt = θ2yt-2 + θνt-1 + νt

Successive substituting for yt-2, yt-3,... gives an representation in terms of

initial value y-1 and past errors νt-1, νt-2,...,ν0

yt = θt+1y-1 + θνt-1 + θ2νt-2 + θ3νt-3 + ...+ θtν0 + νt

12

13. The Impact of Shocks for Stationary and Non-stationary Series (2)

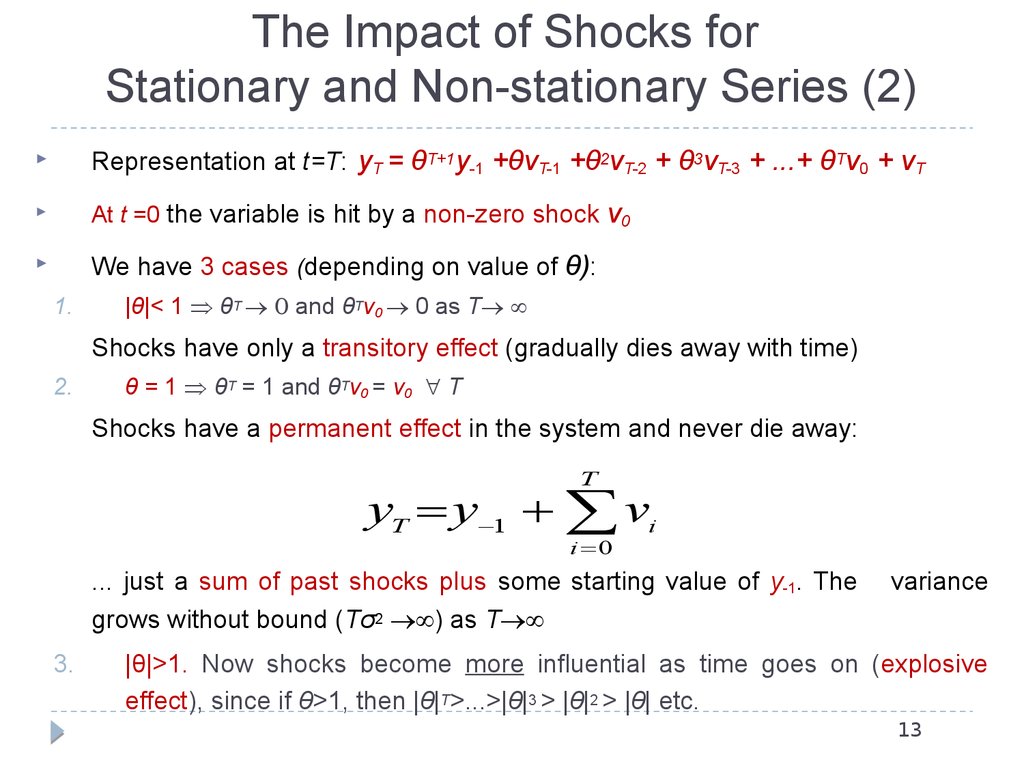

Representation at t=T: yT = θT+1y-1 +θvT-1 +θ2vT-2 + θ3vT-3 + ...+ θTv0 + vTAt t =0 the variable is hit by a non-zero shock

We have 3 cases (depending on value of θ):

1.

v0

|θ|< 1 θT 0 and θTv0 0 as T

Shocks have only a transitory effect (gradually dies away with time)

2.

θ = 1 θT = 1 and θTv0 = v0 T

Shocks have a permanent effect in the system and never die away:

T

yT y 1 vi

i 0

... just a sum of past shocks plus some starting value of y-1. The

grows without bound (Tσ2 ) as T

3.

variance

|θ|>1. Now shocks become more influential as time goes on (explosive

effect), since if θ>1, then |θ|T>...>|θ|3 > |θ|2 > |θ| etc.

13

14. Integration

Another way to write the stochastic trend model is:y y

t

t

y

t 1

t

Thus the first difference of yt is stationary provided vt is

stationary (“difference stationary” process). Also

referred to as an I(1) variable.

Similarly, in the case of the deterministic trend model, yt

is interpreted as trend stationary

14

because removal of the deterministic trend from yt renders it

a stationary random variable

Macro-econometric Forecasting and

Analysis

15. Order of Integration: I(d)

In general, if yt is I(d) then:d y (1 L) d y t

t

t

If d=0, then the series is already stationary

15

Macro-econometric Forecasting and

Analysis

16. Problems due to Stochastic Trends (from a statistical perspective)

Non-standard distribution of test statisticsSpurious regression:

in a simple linear regression, two (or more) non-stationary time series

may appear to be related even though they are not

Need to use special modeling techniques when dealing with

non-stationary data (VARs in differences or VECMs)

Need to distinguish btw. stochastic and deterministic trends as

it may affect estimates of policy-relevant variables

e.g. estimate of an output gap or of a structural budget deficit

… for that we need unit root tests…

16

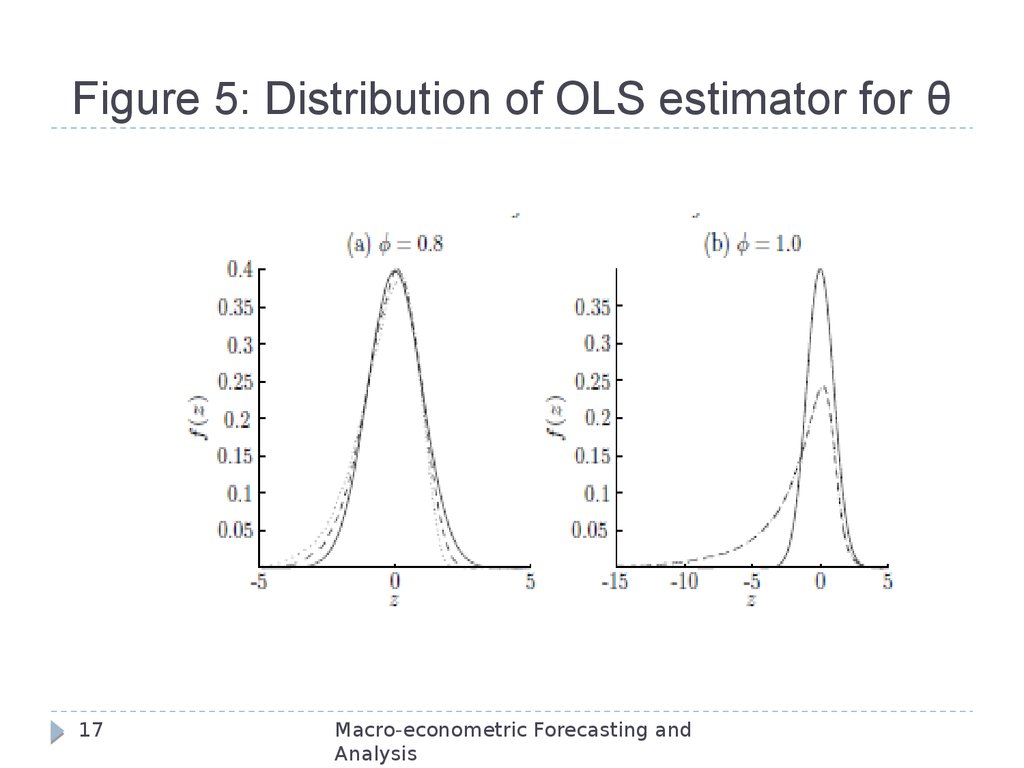

17. Figure 5: Distribution of OLS estimator for θ

17Macro-econometric Forecasting and

Analysis

18. Testing For Unit Roots

Previous section suggests that I(1) variables needspecial handling

So how do we identify I(1) processes, i.e., test for

unit roots?

Natural test is to consider the t-statistic for the nullhypothesis of a unit root, i.e., qˆ 1

Given the previous graph, it is not surprising that the

t-distribution for qˆ 1 is non-normal

18

Macro-econometric Forecasting and

Analysis

19. Testing for Unit Roots: Procedures

Dickey FullerAugmented Dickey Fuller

Phillips Perron

Kwiatkowski, Phillips, Schmidt and Shin (KPSS)

19

Macro-econometric Forecasting and

Analysis

20. Dickey Fuller Test

Fuller (1976), Dickey and Fuller (1979)Example:

consider a particular case of an AR(1) model:

yt = θyt-1 + εt

We test a hypothesis

H0: θ =1 → the series contains a unit root/stochastic trend (is a random

walk)

against

H1: |θ| <1 → the series is a zero-mean stationary AR(1)

20

21. Dickey-Fuller Test (2)

For the purpose of testing we reformulate the regression:yt = yt – yt-1 =θyt-1 -yt-1 + vt = (θ-1)yt-1 + vt =

= yt-1 + vt

so that the test of H0: θ = 1 H0: = 0

The test is based on the t-ratio for

this t-ratio does not have the usual t-distribution under the H0

critical values are derived from Monte Carlo experiments, and are tabulated

(known): see appendix A

The test is not invariant to the addition of deterministic

components (more general formulation: intercept + time-trend)

21

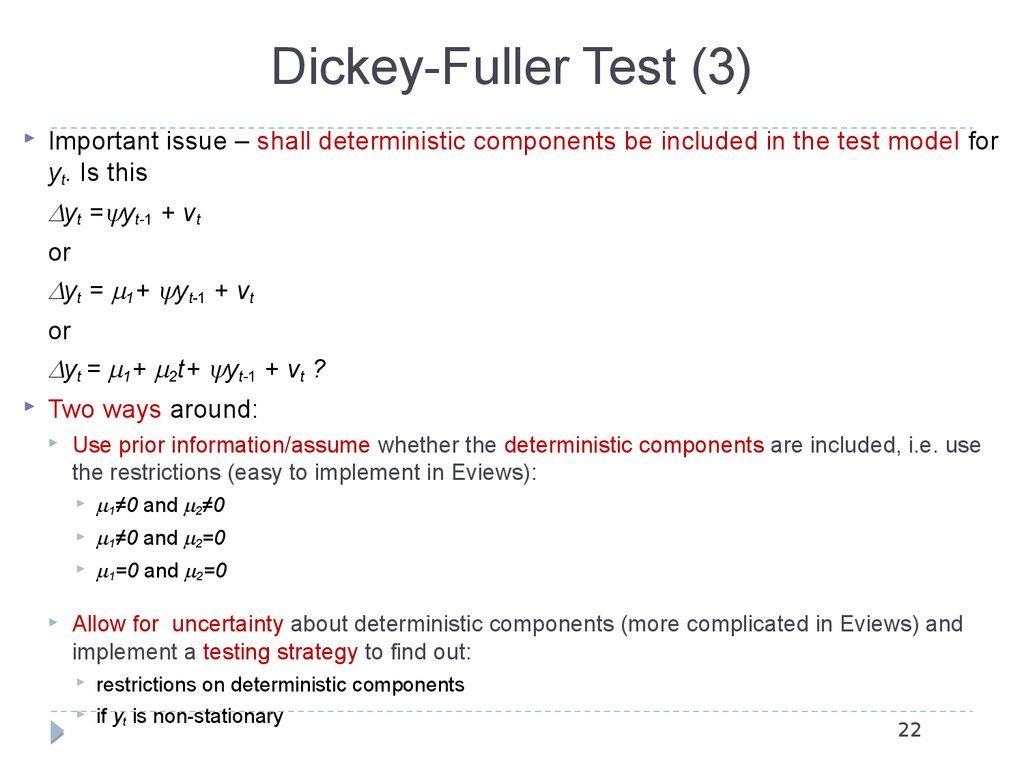

22. Dickey-Fuller Test (3)

Important issue – shall deterministic components be included in the test model foryt. Is this

yt = yt-1 + vt

or

yt = 1+ yt-1 + vt

or

yt = 1+ 2t+ yt-1 + vt ?

Two ways around:

Use prior information/assume whether the deterministic components are included, i.e. use

the restrictions (easy to implement in Eviews):

1≠0 and 2≠0

1≠0 and 2=0

1=0 and 2=0

Allow for uncertainty about deterministic components (more complicated in Eviews) and

implement a testing strategy to find out:

restrictions on deterministic components

if yt is non-stationary

22

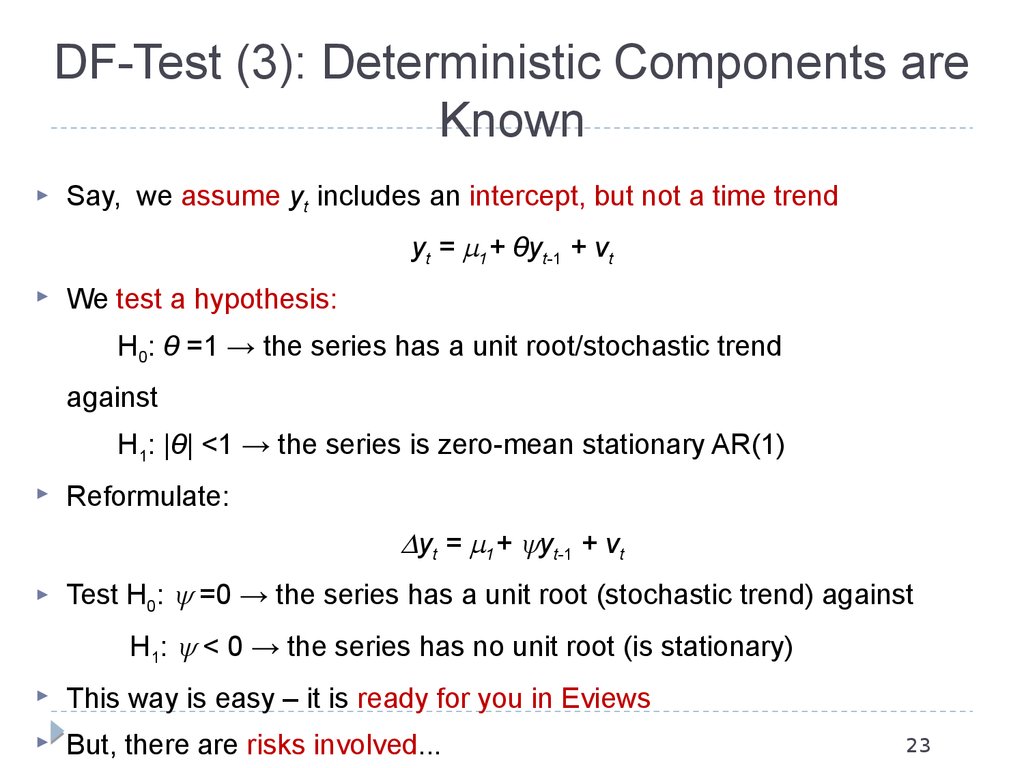

23. DF-Test (3): Deterministic Components are Known

Say, we assume yt includes an intercept, but not a time trendyt = 1+ θyt-1 + vt

We test a hypothesis:

H0: θ =1 → the series has a unit root/stochastic trend

against

H1: |θ| <1 → the series is zero-mean stationary AR(1)

Reformulate:

yt = 1+ yt-1 + vt

Test H0: =0 → the series has a unit root (stochastic trend) against

H1: < 0 → the series has no unit root (is stationary)

This way is easy – it is ready for you in Eviews

But, there are risks involved...

23

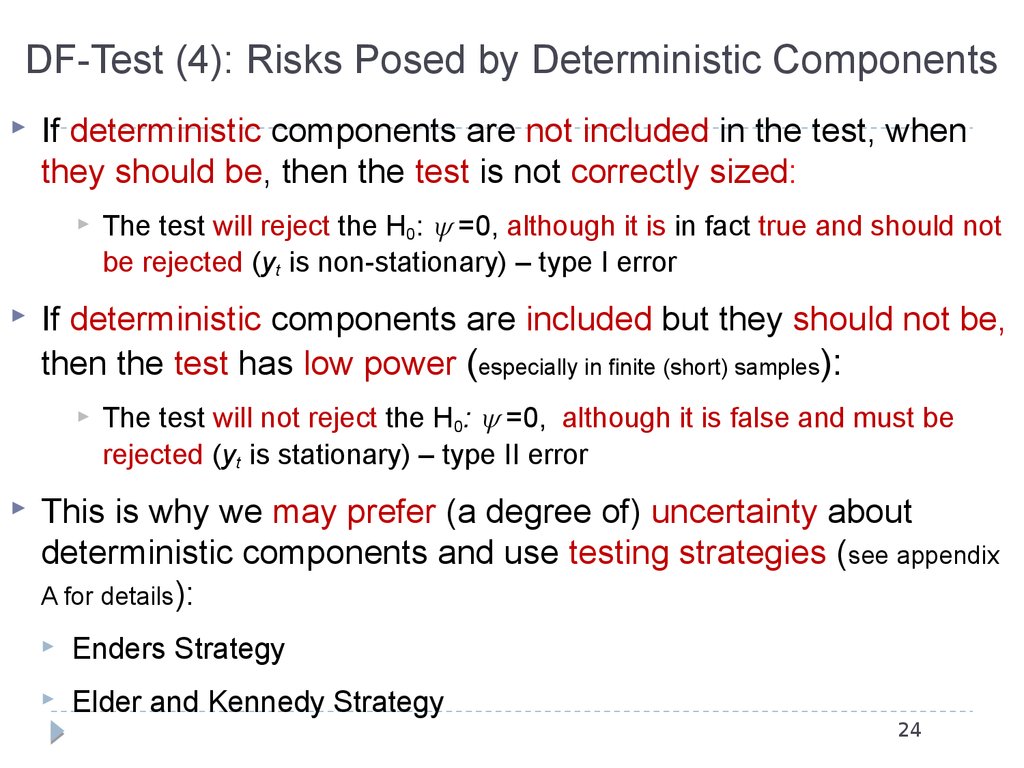

24. DF-Test (4): Risks Posed by Deterministic Components

If deterministic components are not included in the test, whenthey should be, then the test is not correctly sized:

If deterministic components are included but they should not be,

then the test has low power (especially in finite (short) samples):

The test will reject the H0: =0, although it is in fact true and should not

be rejected (yt is non-stationary) – type I error

The test will not reject the H0: =0, although it is false and must be

rejected (yt is stationary) – type II error

This is why we may prefer (a degree of) uncertainty about

deterministic components and use testing strategies (see appendix

A for details):

Enders Strategy

Elder and Kennedy Strategy

24

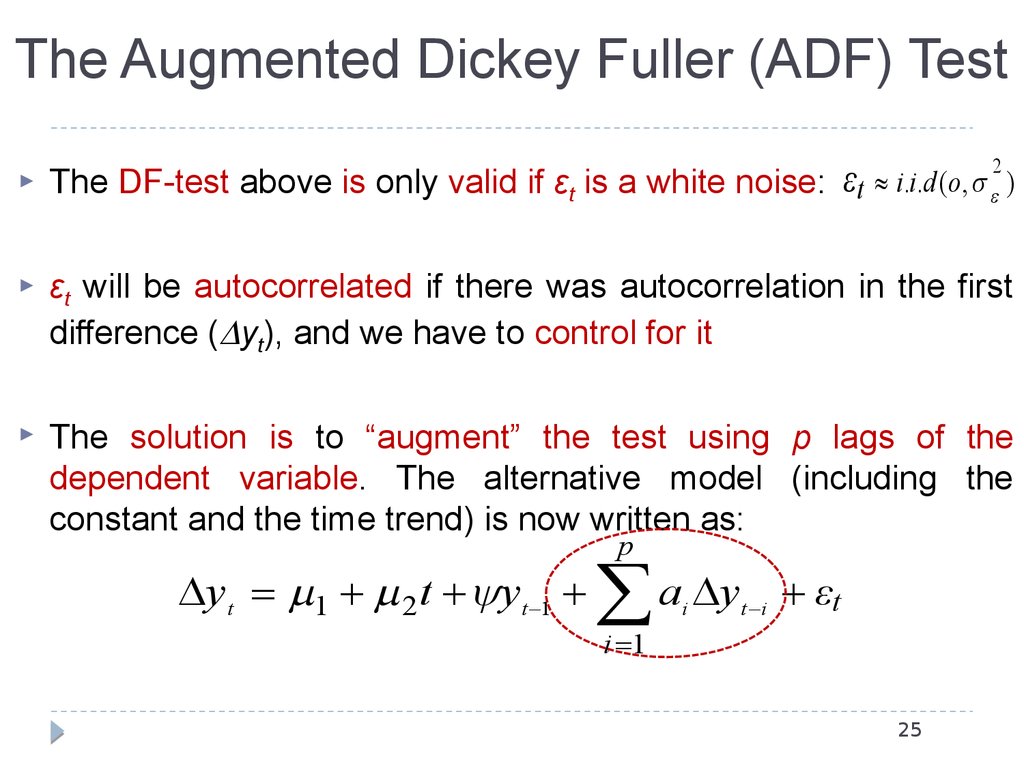

25. The Augmented Dickey Fuller (ADF) Test

2The DF-test above is only valid if εt is a white noise: εt i.i.d (o, )

εt will be autocorrelated if there was autocorrelation in the first

difference ( yt), and we have to control for it

The solution is to “augment” the test using p lags of the

dependent variable. The alternative model (including the

constant and the time trend) is now written as:

p

y t 1 2 t y t 1

a y

i

t i

εt

i 1

25

26. The ADF-Test (2)

Again, we have three choices:(1) include neither a constant nor a time trend

(2) include a constant

(3) include a constant and a time trend

Again, we either:

use prior information and impose a model from the beginning, or

remain uncertain about deterministic components and follow one of the

Strategies

Useful result: Critical values for the ADF-test are the same as for

DF-test

Note, however, that the test statistics are sensitive to the lag length p

26

27. The ADF-Test: Lag Length Selection

Three approaches are commonly used:Akaike Information Criterion (AIC)

Schwarz-Bayesian Criterion (SBC)

General-to-Specific successive t-tests on lag coefficients

AIC and BIC are statistics that favour fit (smaller residuals) but penalize for every

additional parameter that needs to be estimated:

So, we prefer a model with a smaller value of a criterion statistic

General-to-Specific: begin with a general model where p is fairly large, and

successively re-estimate with one less lag each time (keeping the sample fixed)

It is advised to use AIC

Tendency of SBC to select too parsimonious of a model

The ADF-test is biased when any autocorrelation remains in the residuals

27length

Note: the test critical values do not depend on the method used to select the lag

28. Dickey-Fuller (and ADF) Test: Criticism

The power of the tests is low if the process is stationary butwith a root “close” to 1 (so called “near unit root” process)

e.g. the test is poor at rejecting θ = 1 (ψ=0), when the true

data generating process is

yt = 0.95yt-1 + εt

This problem is particularly pronounced in small samples

28

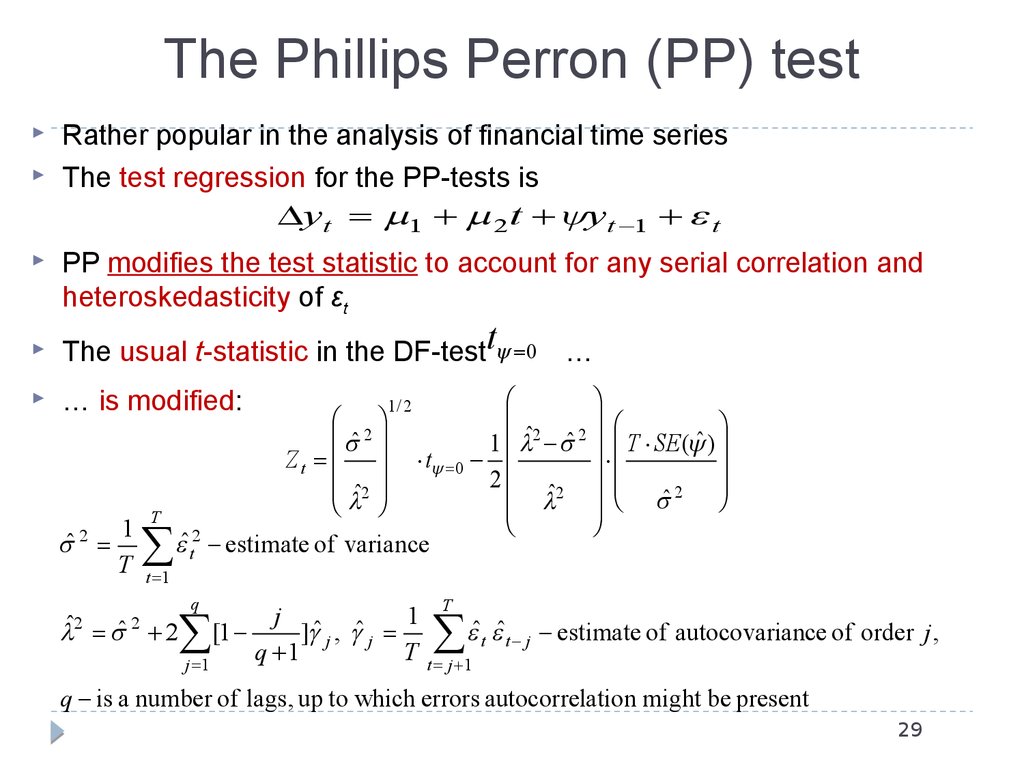

29. The Phillips Perron (PP) test

Rather popular in the analysis of financial time seriesThe test regression for the PP-tests is

yt 1 2 t yt 1 t

PP modifies the test statistic to account for any serial correlation and

heteroskedasticity of εt

The usual t-statistic in the DF-testt 0

… is modified:

1

ˆ 2

T

T

…

2

2

2

ˆ

1 ˆ ˆ T SE ( ˆ )

Zt

t 0

2

ˆ2

ˆ2

2

ˆ

ˆt2 estimate of variance

1/ 2

t 1

q

T

j

1

ˆ 2 [1

] ˆ j , ˆ j

ˆt ˆt j estimate of autocovariance of order j ,

q 1

T t j 1

j 1

ˆ2

2

q is a number of lags, up to which errors autocorrelation might be present

29

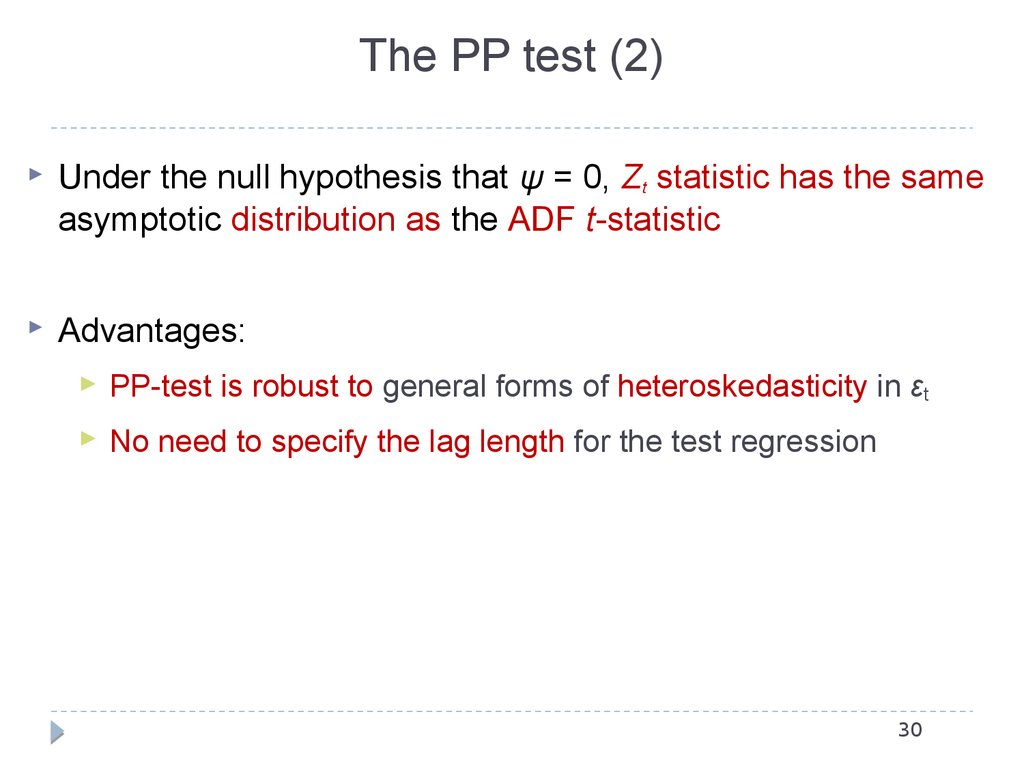

30. The PP test (2)

Under the null hypothesis that ψ = 0, Zt statistic has the sameasymptotic distribution as the ADF t-statistic

Advantages:

PP-test is robust to general forms of heteroskedasticity in εt

No need to specify the lag length for the test regression

30

31. The Kwiatkowski-Phillips-Schmidt-Shin (KPSS) test

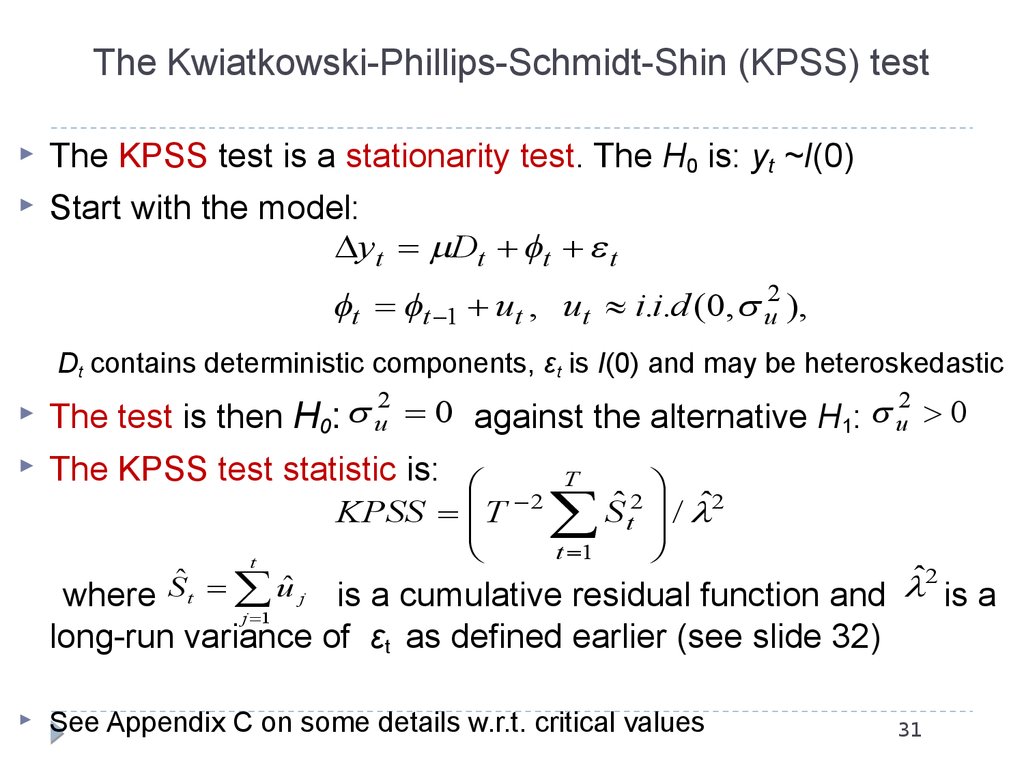

The KPSS test is a stationarity test. The H0 is: yt ~I(0)Start with the model:

yt Dt t t

t t 1 ut , ut i.i.d (0, u2 ),

Dt contains deterministic components, εt is I(0) and may be heteroskedastic

2

2

0

The test is then H0: u

against the alternative H1: u 0

The KPSS test statistic is:

T

t

KPSS T 2

t 1

Sˆt2 / ˆ2

ˆ2

where

is a cumulative residual function and

is a

j 1

long-run variance of εt as defined earlier (see slide 32)

Sˆt uˆ j

See Appendix C on some details w.r.t. critical values

31

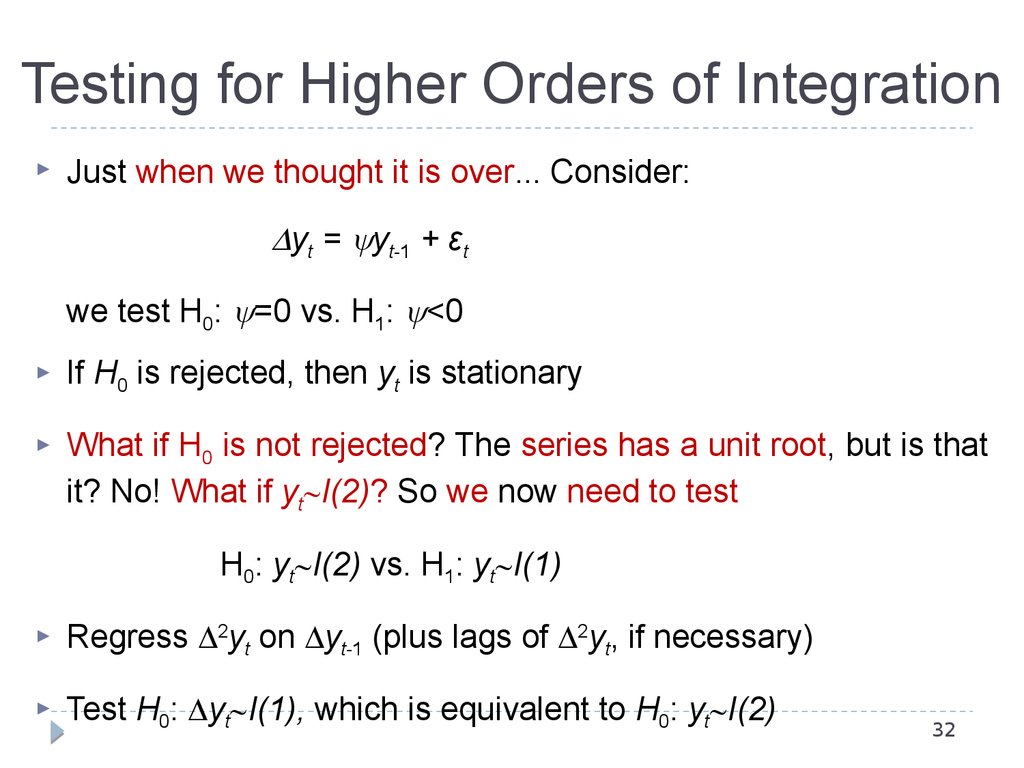

32. Testing for Higher Orders of Integration

Just when we thought it is over... Consider:yt = yt-1 + εt

we test H0: =0 vs. H1: <0

If H0 is rejected, then yt is stationary

What if H0 is not rejected? The series has a unit root, but is that

it? No! What if yt I(2)? So we now need to test

H0: yt I(2) vs. H1: yt I(1)

Regress 2yt on yt-1 (plus lags of 2yt, if necessary)

Test H0: yt I(1), which is equivalent to H0: yt I(2)

32

33. Working with Non-Stationary Variables

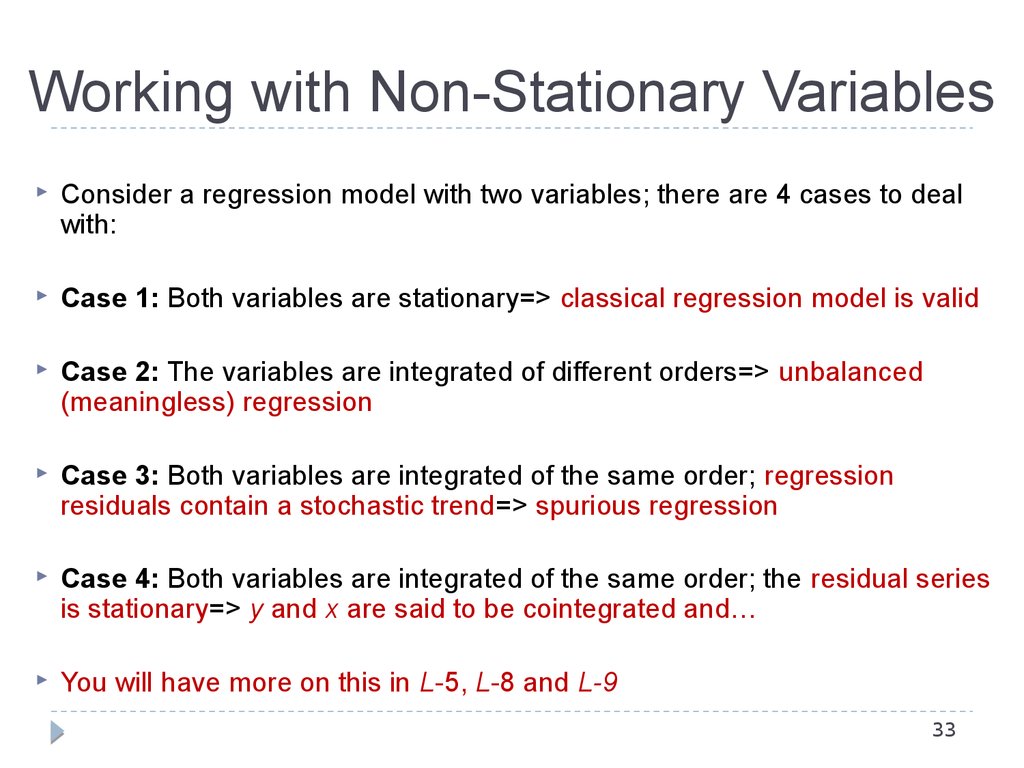

Consider a regression model with two variables; there are 4 cases to dealwith:

Case 1: Both variables are stationary=> classical regression model is valid

Case 2: The variables are integrated of different orders=> unbalanced

(meaningless) regression

Case 3: Both variables are integrated of the same order; regression

residuals contain a stochastic trend=> spurious regression

Case 4: Both variables are integrated of the same order; the residual series

is stationary=> y and x are said to be cointegrated and…

You will have more on this in L-5, L-8 and L-9

33

34. Cointegration

Important implication is that non-stationary timeseries can be rendered stationary by differencing

Now we turn to the case of N>1 (i.e., multiple

variables)

An alternative approach to achieving stationarity is to

form linear combinations of the I(1) series – this is

the essence of “cointegration” [Engle and Granger

(1987)]

34

Macro-econometric Forecasting and

Analysis

35. Cointegration

Three main implications of cointegration:35

Existence of cointegration implies a set of dynamic long-run

equilibria where the weights used to achieve stationarity are the

parameters of the long-run (or equilibrium) relationship.

The OLS estimates of the weights converge to their population

values at a super-consistent rate of “T” compared to the usual

T

rate of convergence,

Modeling a system of cointegrated variables allows for

specification of both the long-run and short-run dynamics. The

end result is called a “Vector Error Correction Model (VECM)”.

Macro-econometric Forecasting and

Analysis

36. Cointegration

We will see that cointegrated systems (VECMs) arespecial VARS.

Specifically, cointegration implies a set of non-linear

cross-equation restrictions on the VAR.

Easiest/most flexible way to estimate VECM’s is by

full-information maximum likelihood.

36

Macro-econometric Forecasting and

Analysis

37. Long-Run Equilibrium Relationships: Examples

Permanent Income Hypothesis (PIH)Postulates a long-run relationship between log real

consumption and log real income:

log(rct ) b c b y log( ryt ) ut

37

Assuming real consumption and income are nonstationary (I(1)) variables, then the PIH is postulating that

real consumption and income move together over time

and that ut is a stationary series.

Macro-econometric Forecasting and

Analysis

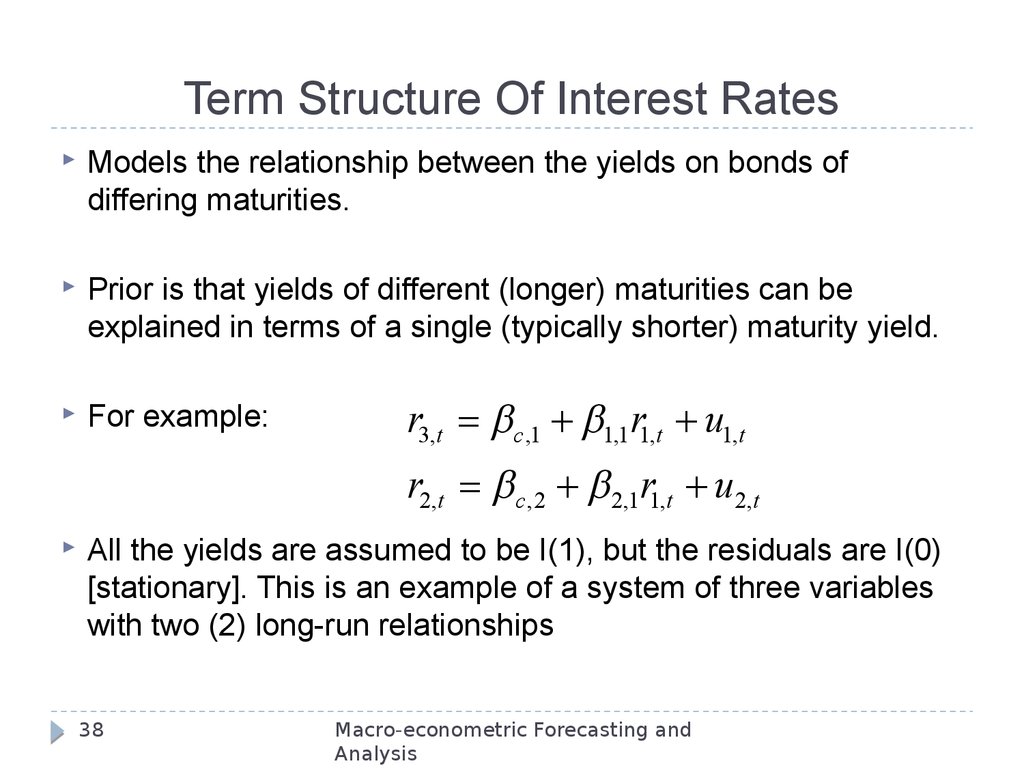

38. Term Structure Of Interest Rates

Models the relationship between the yields on bonds ofdiffering maturities.

Prior is that yields of different (longer) maturities can be

explained in terms of a single (typically shorter) maturity yield.

For example:

r3,t b c ,1 b1,1r1,t u1,t

r2,t b c ,2 b 2,1r1,t u2,t

All the yields are assumed to be I(1), but the residuals are I(0)

[stationary]. This is an example of a system of three variables

with two (2) long-run relationships

38

Macro-econometric Forecasting and

Analysis

39. VECM

Cointegration postulates the existence of long-runequilibrium relationships between non-stationary

variables where short-run deviations from equilibrium

are stationary.

What is the underlying economic model?

How do we estimate such a model?

39

Macro-econometric Forecasting and

Analysis

40. Bivariate VECMs

Consider a bivariate model containing two I(1)variables, say y1,t and y 2,t .

Assume the long-run relationship is given by

y1,t b c b y y2,t ut

Here b c b y y2,t represents the long-run equilibrium,

and ut represents the short-run deviations from the

long-run equilibrium (see next slide).

40

Macro-econometric Forecasting and

Analysis

41. Phase Diagram: VECM

y1B

C

D

A

y2

41

Macro-econometric Forecasting and

Analysis

42. Adjusting Back To Equilibrium

Suppose there is a positive shock in the previousperiod, raising y1,t to point B while leaving y2,t-1

unchanged.

How can the system converge back to its long-run

equilibrium?

There are three possible trajectories…

42

Macro-econometric Forecasting and

Analysis

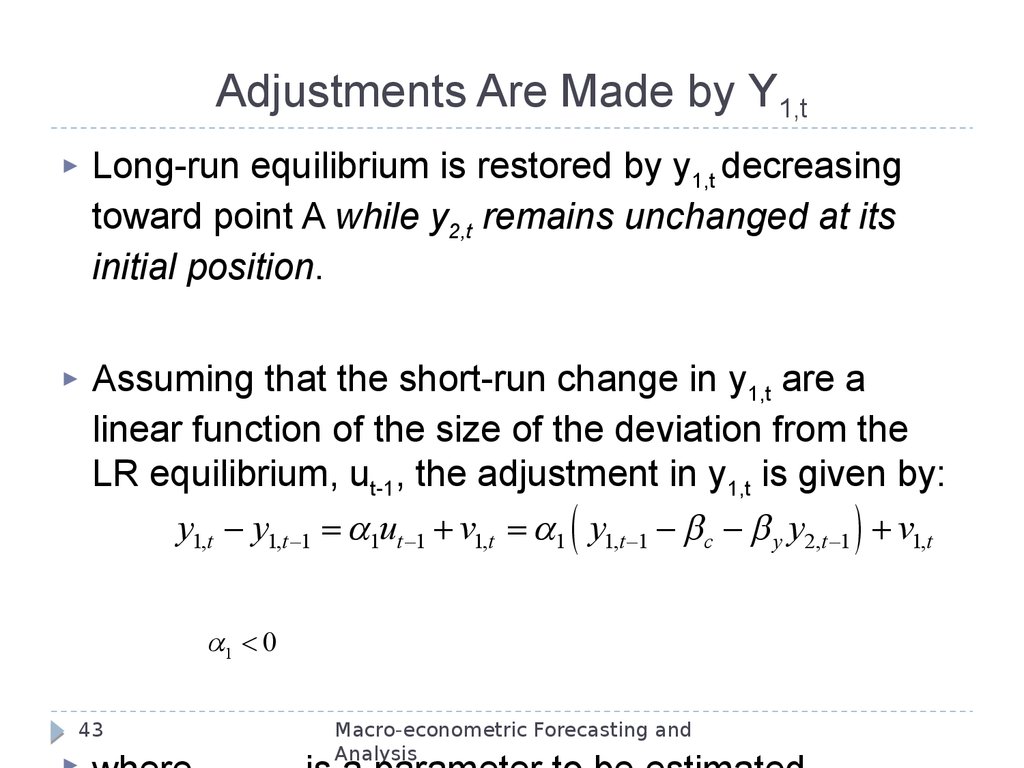

43. Adjustments Are Made by Y1,t

Long-run equilibrium is restored by y1,t decreasingtoward point A while y2,t remains unchanged at its

initial position.

Assuming that the short-run change in y1,t are a

linear function of the size of the deviation from the

LR equilibrium, ut-1, the adjustment in y1,t is given by:

y1,t y1,t 1 a1ut 1 v1,t a1 ( y1,t 1 b c b y y2,t 1 ) v1,t

a1 < 0

43

Macro-econometric Forecasting and

Analysis

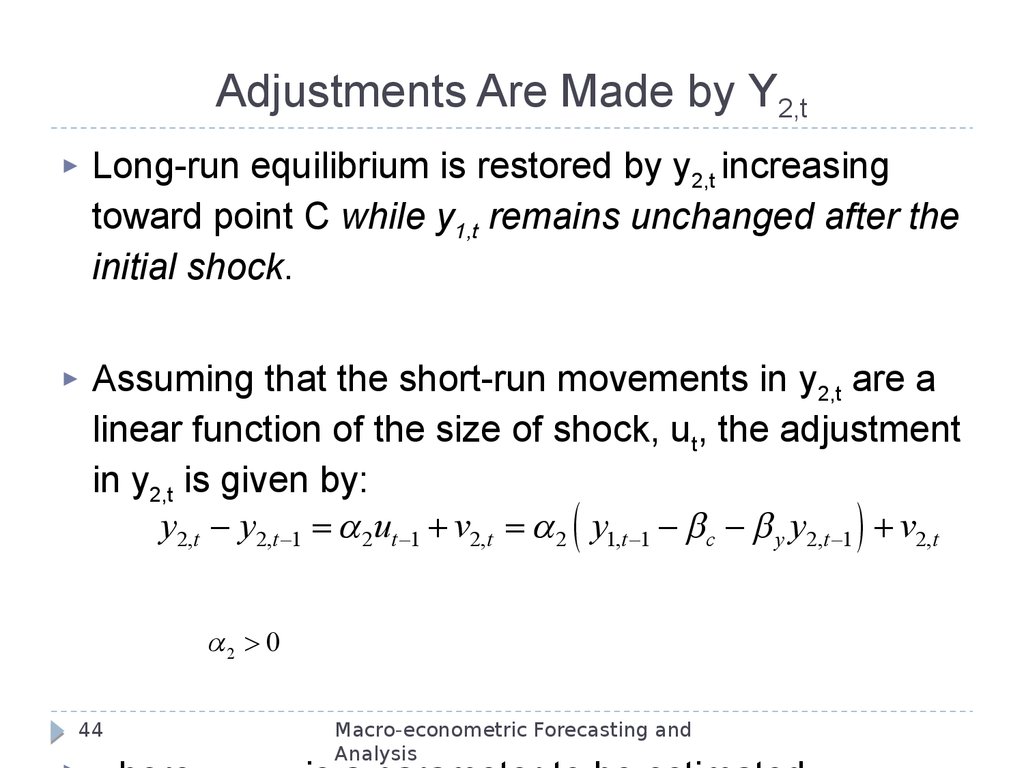

44. Adjustments Are Made by Y2,t

Long-run equilibrium is restored by y2,t increasingtoward point C while y1,t remains unchanged after the

initial shock.

Assuming that the short-run movements in y2,t are a

linear function of the size of shock, ut, the adjustment

in y2,t is given by:

y2,t y2,t 1 a 2ut 1 v2,t a 2 ( y1,t 1 b c b y y2,t 1 ) v2,t

a2 0

44

Macro-econometric Forecasting and

Analysis

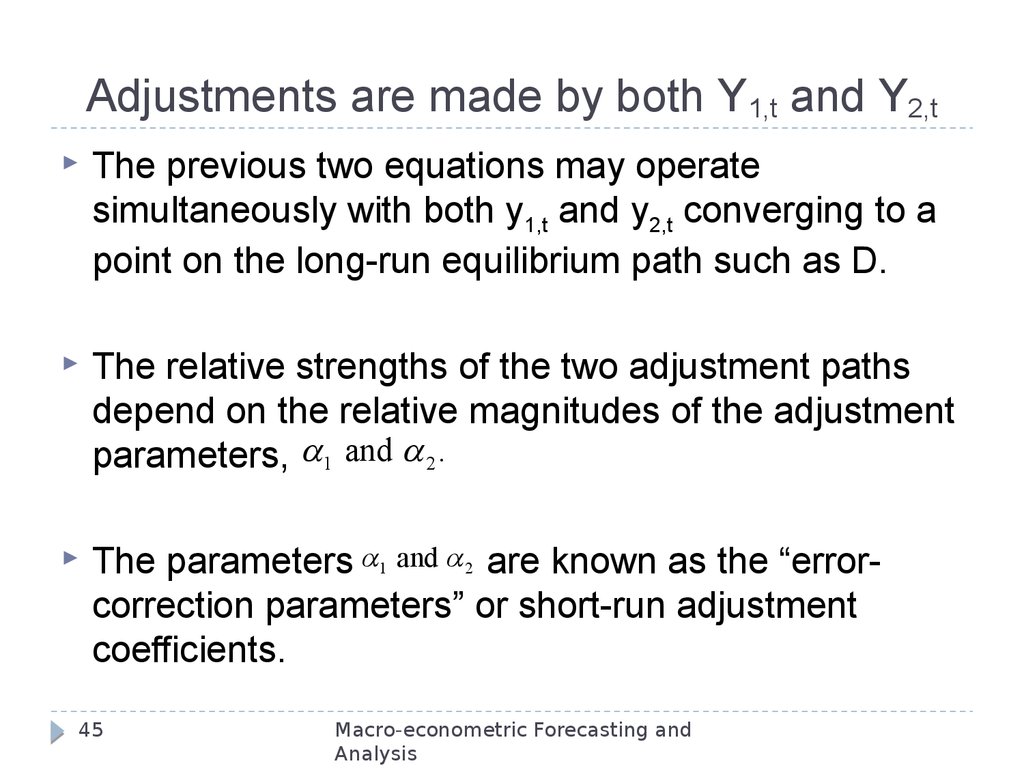

45. Adjustments are made by both Y1,t and Y2,t

The previous two equations may operatesimultaneously with both y1,t and y2,t converging to a

point on the long-run equilibrium path such as D.

The relative strengths of the two adjustment paths

depend on the relative magnitudes of the adjustment

parameters, a1 and a 2 .

The parameters a1 and a 2 are known as the “errorcorrection parameters” or short-run adjustment

coefficients.

45

Macro-econometric Forecasting and

Analysis

46. VECM = Special VAR

A VECM is actually a special case of a VAR wherethe parameters are subject to a set of cross-equation

restrictions because all the variables are governed

by the same long-run equations. Consider what we

have when we put the two equations together:

é y1,t ù é a1b c ù éa1 ù éë1 b y ùû é y1,t 1 ù é v1,t ù

ê ú

ê y ú ê

ê y ú êv ú

ú

ë 2,t û ë a 2 b c û ëa 2 û

ë 2,t 1 û ë 2,t û

or in terms of a VAR…

46

Macro-econometric Forecasting and

Analysis

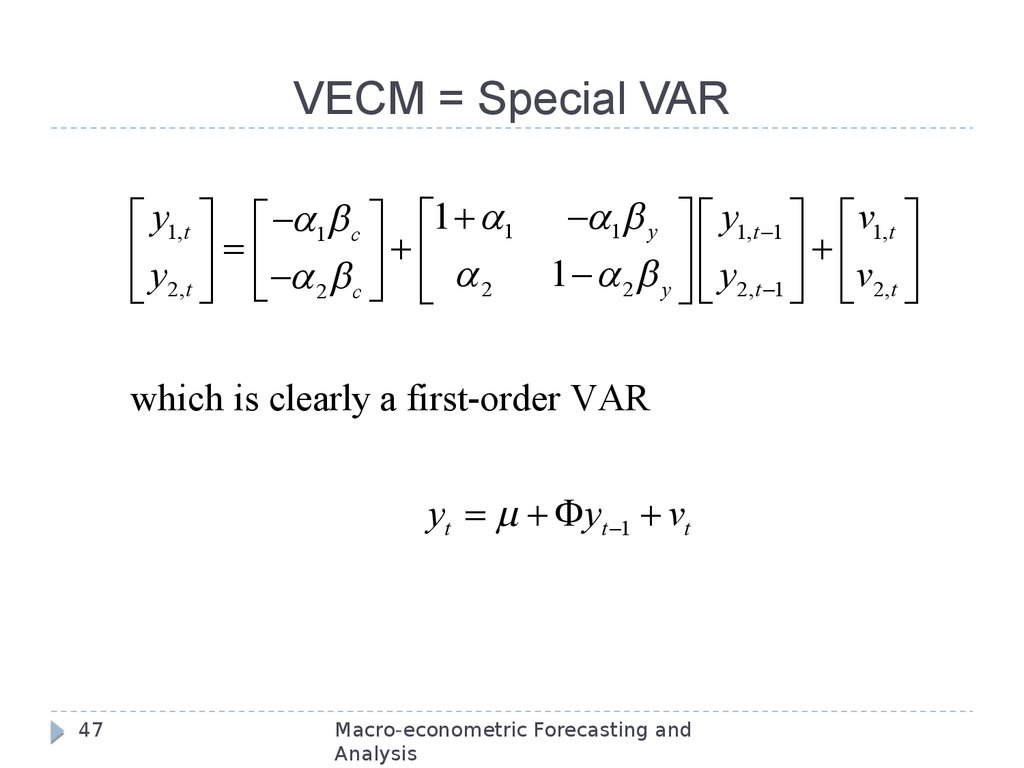

47. VECM = Special VAR

é y1,t ù é a1b c ù é1 a1 a1b y ù é y1,t 1 ù é v1,t ùê

ê ú

ú

êy ú ê

ê

ú

ú

ë 2,t û ë a 2 b c û ë a 2 1 a 2 b y û ë y2,t 1 û ëv2,t û

which is clearly a first-order VAR

yt Fyt 1 vt

47

Macro-econometric Forecasting and

Analysis

48. VECM = Special VAR

Obviously, we have a first order VAR with tworestrictions on the parameters.

In an unconstrained VAR of order one, no crossequation restrictions are imposed, implying 6

unknown parameters.

However, a VECM – owing to the cross-equation

restrictions – has only four unknown parameters.

Less restrictions are needed to identify the model.

48

Macro-econometric Forecasting and

Analysis

49. Multivariate Methods: N > 2

Multivariate Methods: N > 2Can easily generalize the relationship between a

VAR and a VECM to N variables and p lags.

Assume first that p = 1:

Subtracting yt-1 from both sides:

yt yt 1 ( I N F1 ) yt 1 vt

yt F1 yt 1 vt

yt F (1) yt 1 vt , where F (1)= ( I N F1 )

or

This is a VECM, but with p = 0 lags.

49

Macro-econometric Forecasting and

Analysis

50. VAR with p lags > 1

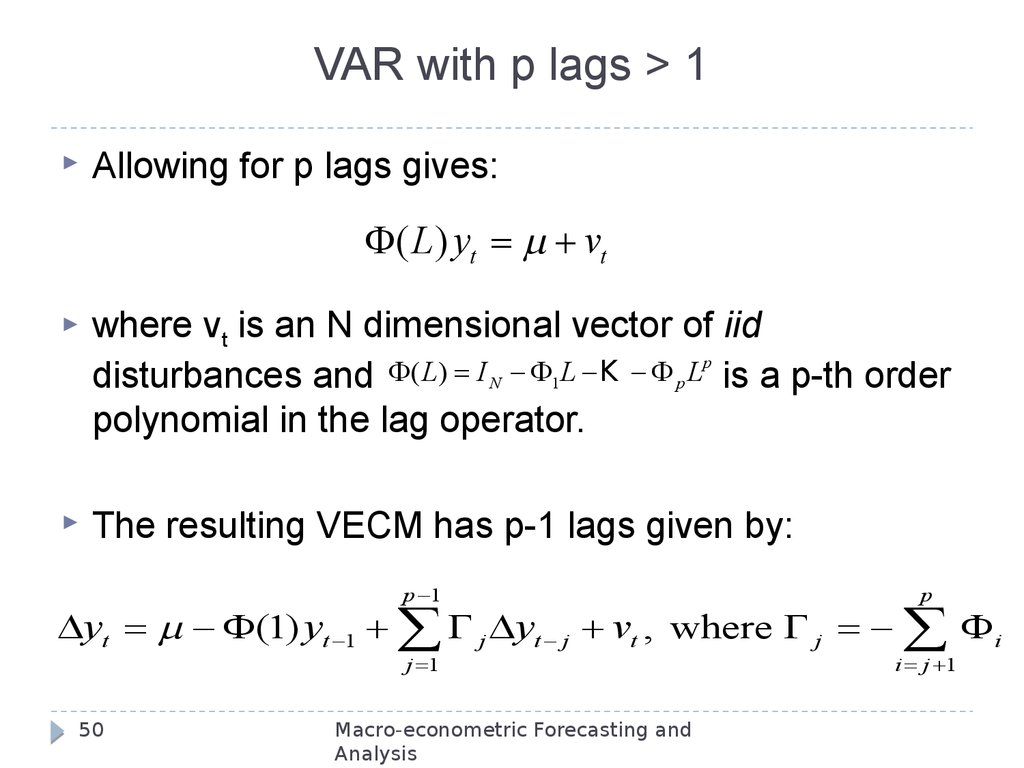

VAR with p lags > 1Allowing for p lags gives:

F ( L) yt vt

where vt is an N dimensional vector of iid

p

F

(

L

)

I

F

L

K

F

L

disturbances and

is a p-th order

N

1

p

polynomial in the lag operator.

The resulting VECM has p-1 lags given by:

p 1

p

j 1

i j 1

yt F (1) yt 1 G j yt j vt , where G j F i

50

Macro-econometric Forecasting and

Analysis

51. Cointegration

If the vector time series yt is assumed to be I(1), then yt iscointegrated if there exists an N x r full column rank

matrix, b, such that the r linear combinations:

b ¢ yt ut

are I(0).

The dimension

b “r” is called the cointegrating rank and the

columns of

are called the co-integrating vectors.

This implies that (N – r) common trends exist that are I(1).

51

Macro-econometric Forecasting and

Analysis

52.

Granger Representation TheoremSuppose yt, which can be I(1) or I(0), is generated by

p 1

yt F (1) yt 1 G j yt j vt

j 1

Three important cases:

(a) If F (1) has full rank, i.e., r = N, then yt is I(0)

(b) If F (1) has reduced rank 0 < r < N,

F (1) ab ¢ where a and b are each ( N x r ) matrices with full column rank.

b ¢ yt

52

then yt is I(1) and

is I(0)

b with cointegrating vectors

given by

the columns of

F (1)

F (1) 0

(c) if

has zero rank, r = 0,

and yt is I(1) and not

cointegrated.

Macro-econometric Forecasting and

Analysis

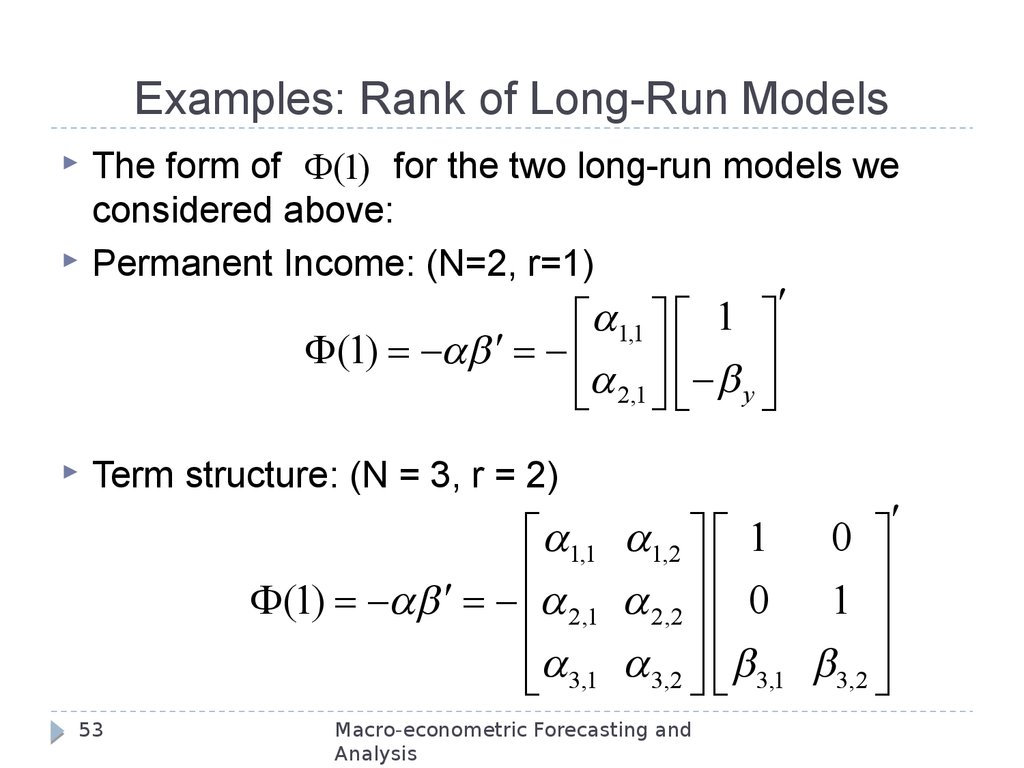

53. Examples: Rank of Long-Run Models

The form of F (1) for the two long-run models weconsidered above:

Permanent Income: (N=2, r=1)

Term structure: (N = 3, r = 2)

éa1,1 ù é 1 ù¢

F (1) ab ¢ ê ú ê

ú

b

a

ë 2,1 û ë y û

éa1,1 a1,2 ù é 1 0 ù¢

ê

ú

ê

ú

F (1) ab ¢ êa 2,1 a 2,2 ú ê 0 1 ú

êëa 3,1 a 3,2 úû êë b 3,1 b3,2 úû

53

Macro-econometric Forecasting and

Analysis

54.

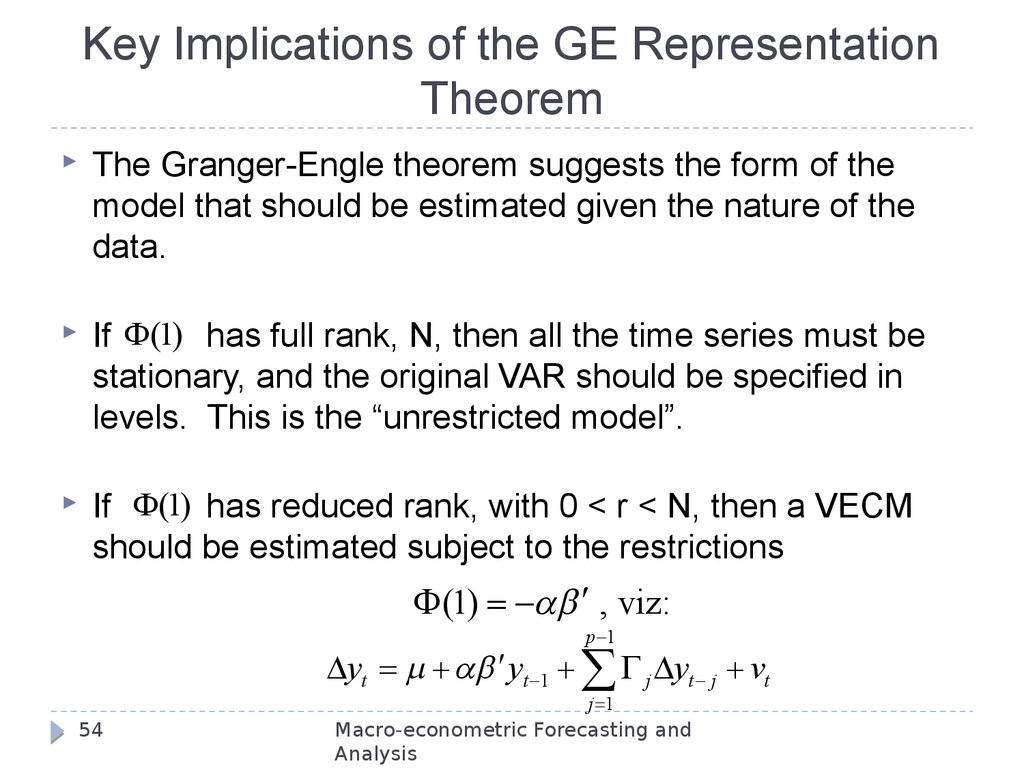

Key Implications of the GE RepresentationTheorem

The Granger-Engle theorem suggests the form of the

model that should be estimated given the nature of the

data.

If F (1) has full rank, N, then all the time series must be

stationary, and the original VAR should be specified in

levels. This is the “unrestricted model”.

If F (1) has reduced rank, with 0 < r < N, then a VECM

should be estimated subject to the restrictions

F (1) ab ¢ , viz:

p 1

yt ab ¢ yt 1 G j yt j vt

54

j 1

Macro-econometric Forecasting and

Analysis

55.

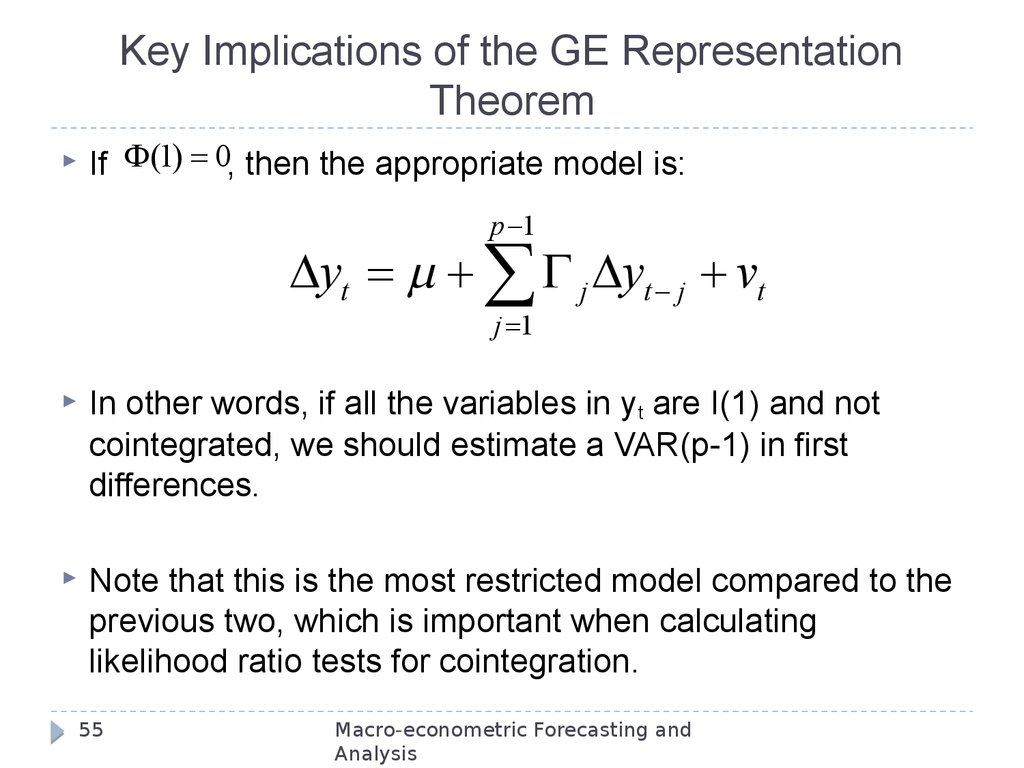

Key Implications of the GE RepresentationTheorem

If F (1) 0, then the appropriate model is:

p 1

yt G j yt j vt

j 1

In other words, if all the variables in yt are I(1) and not

cointegrated, we should estimate a VAR(p-1) in first

differences.

Note that this is the most restricted model compared to the

previous two, which is important when calculating

likelihood ratio tests for cointegration.

55

Macro-econometric Forecasting and

Analysis

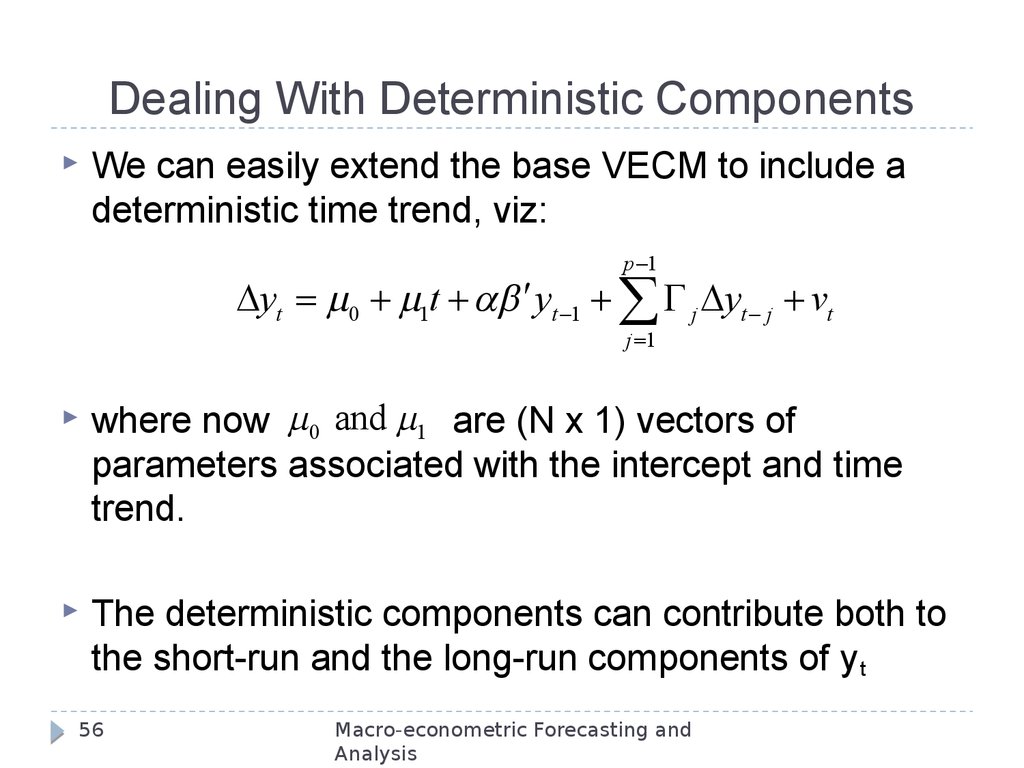

56. Dealing With Deterministic Components

We can easily extend the base VECM to include adeterministic time trend, viz:

p 1

yt 0 1t ab ¢ yt 1 G j yt j vt

j 1

where now 0 and 1 are (N x 1) vectors of

parameters associated with the intercept and time

trend.

The deterministic components can contribute both to

the short-run and the long-run components of y t

56

Macro-econometric Forecasting and

Analysis

57. Deterministic Components

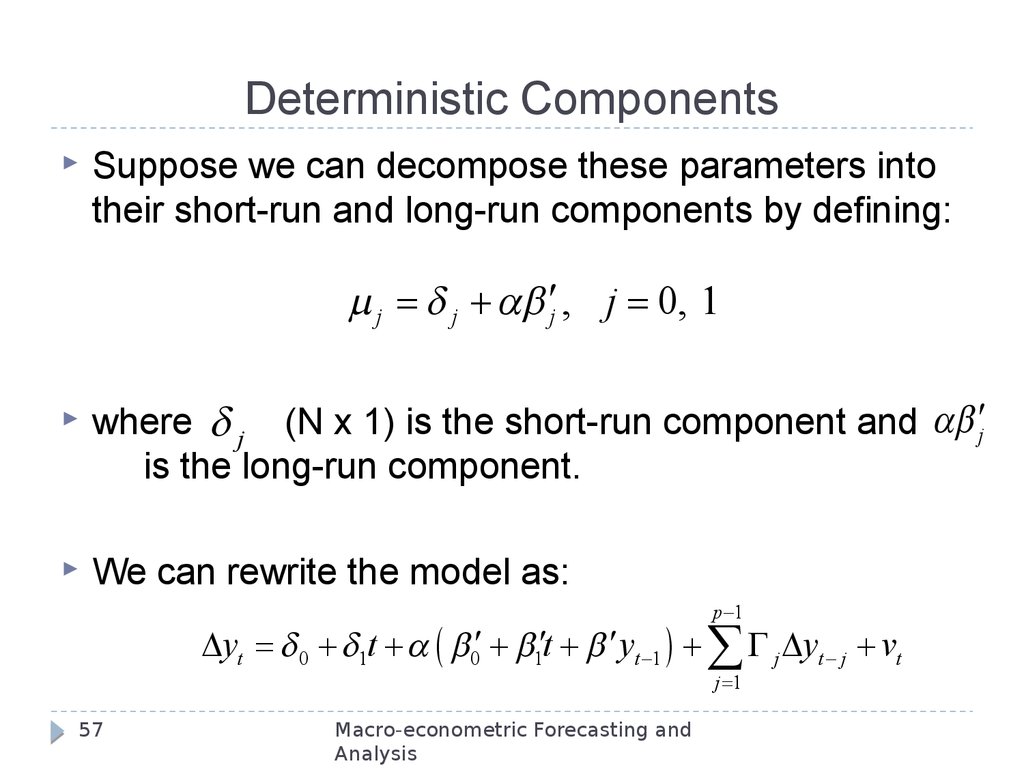

Suppose we can decompose these parameters intotheir short-run and long-run components by defining:

j j ab ¢j , j 0, 1

where j (N x 1) is the short-run component and ab ¢j

is the long-run component.

We can rewrite the model as:

p 1

yt 0 1t a ( b 0¢ b1¢t b ¢ yt 1 ) G j yt j vt

j 1

57

Macro-econometric Forecasting and

Analysis

58. Deterministic Components

The term ( b 0¢ b1¢t b ¢ yt 1 ) represents the long-runrelationship among the variables.

The parameter 0 provides a drift component in the

equation of yt , so it contributes a trend to yt

Similarly 1t allows for linear time trend in yt and a

quadratic trend to yt

By contrast, b 0 contributes a constant to the EC-Eq

b1¢t

and

contributes a linear time trend to EC-Eq

58

Macro-econometric Forecasting and

Analysis

59. Deterministic Components

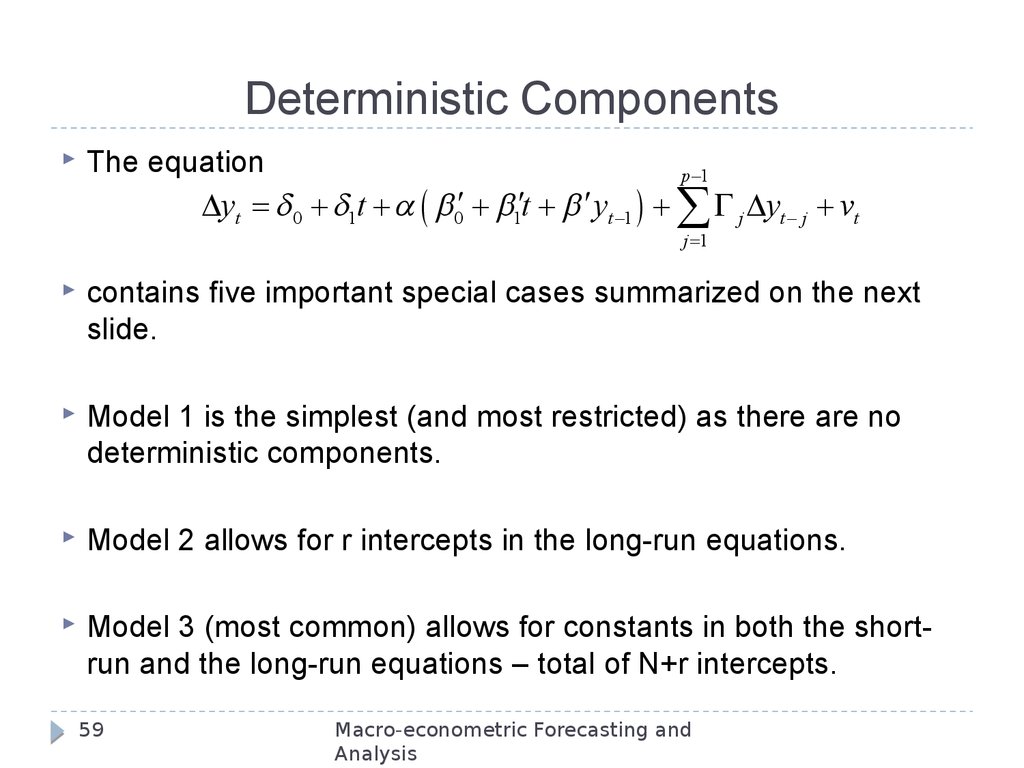

The equationp 1

yt 0 1t a ( b 0¢ b1¢t b ¢ yt 1 ) G j yt j vt

j 1

contains five important special cases summarized on the next

slide.

Model 1 is the simplest (and most restricted) as there are no

deterministic components.

Model 2 allows for r intercepts in the long-run equations.

Model 3 (most common) allows for constants in both the shortrun and the long-run equations – total of N+r intercepts.

59

Macro-econometric Forecasting and

Analysis

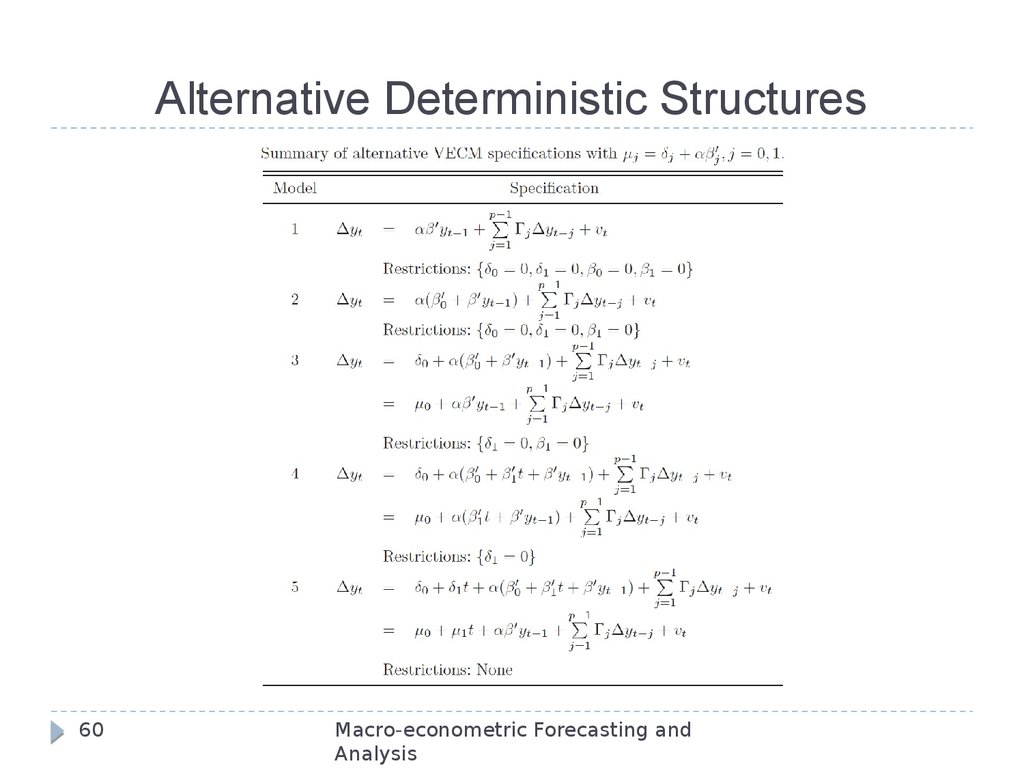

60. Alternative Deterministic Structures

60Macro-econometric Forecasting and

Analysis

61. Estimating VECM Models

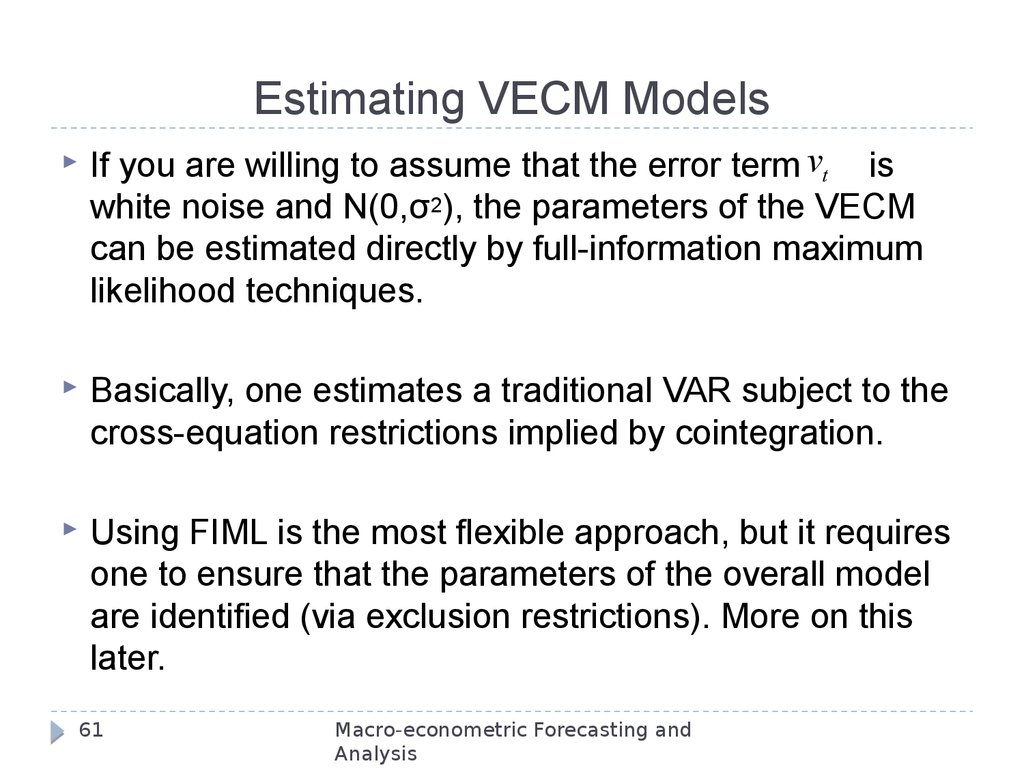

If you are willing to assume that the error term vt iswhite noise and N(0,σ2), the parameters of the VECM

can be estimated directly by full-information maximum

likelihood techniques.

Basically, one estimates a traditional VAR subject to the

cross-equation restrictions implied by cointegration.

Using FIML is the most flexible approach, but it requires

one to ensure that the parameters of the overall model

are identified (via exclusion restrictions). More on this

later.

61

Macro-econometric Forecasting and

Analysis

62. Three Cases:

F (1) can be inverted.VECM is equivalent to the unconstrained VAR. No

restrictions are imposed on the VAR.

Maximum likelihood estimator is obtained by

applying OLS to each equation separately.

The estimator is applied to the levels of the data,

since they are (must be) stationary.

62

Macro-econometric Forecasting and

Analysis

63. Reduced Rank (Cointegration) Case: FIML

If F (1) cannot be inverted (i.e., reduced rank case, orwe are dealing with a cointegrated system), we

impose the cross-equation restrictions coming from

the lagged ECM term(s), and then estimate the

system using full-information maximum likelihood

methods.

The VECM is a restricted model compared to the

unconstrained VAR.

63

Macro-econometric Forecasting and

Analysis

64. Reduced Rank Case: Johansen Estimator

We can also use the Johansen (1988) estimator.This differs from FIML in that the cross-equation

identifying restrictions are NOT imposed on the

model before estimation.

The Johansen approach estimates a basis for the

vector space spanned by the cointegrating vectors,

and THEN imposes identification on the coefficients.

64

Macro-econometric Forecasting and

Analysis

65. Zero-Rank Case for

F(1)When F (1) 0, the VECM reduces to a VAR in

first differences.

As with the full-rank model, the maximum

likelihood estimator is the ordinary least squares

estimator applied to each equation separately.

This is the most constrained model compared to

a VECM/unconstrained VAR in levels.

65

Macro-econometric Forecasting and

Analysis

66. Identification

The Johansen procedure requires one to normalizethe cointegrating vectors so that one of the variables

in the equation is regarded as the dependent

variable of the long-run relationship.

In the bi-variate term structure and the permanent

income example, the normalization takes the form of

designating one of variables in the system as the

dependent variable.

66

Macro-econometric Forecasting and

Analysis

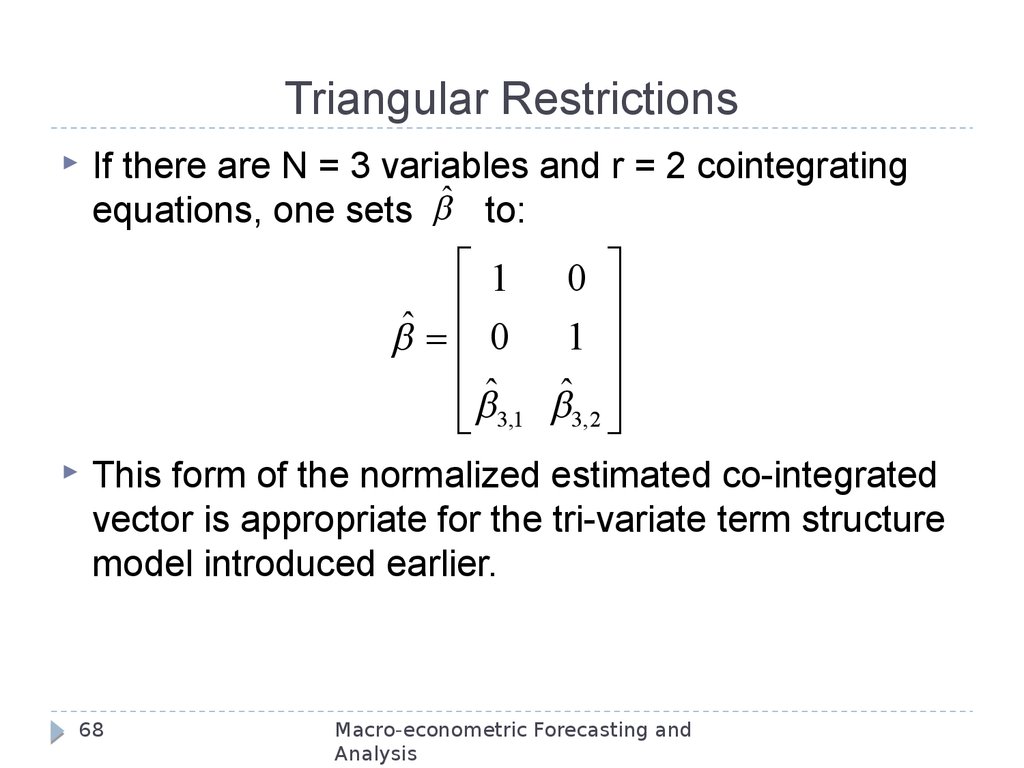

67. Identification: Triangular Restrictions

Suppose there are r long-run relationships.Identification can be achieved by transforming the

top (r x r) block of bˆ (the long-run parameters) to

the identity matrix.

If r = 1, this corresponds to normalizing one the

coefficients to unity.

67

Macro-econometric Forecasting and

Analysis

68. Triangular Restrictions

If there are N = 3 variables and r = 2 cointegratingequations, one sets bˆ to:

é 1 0 ù

ê

ú

ˆ

b ê 0 1 ú

êˆ

ú

ˆ

ë b 3,1 b3,2 û

This form of the normalized estimated co-integrated

vector is appropriate for the tri-variate term structure

model introduced earlier.

68

Macro-econometric Forecasting and

Analysis

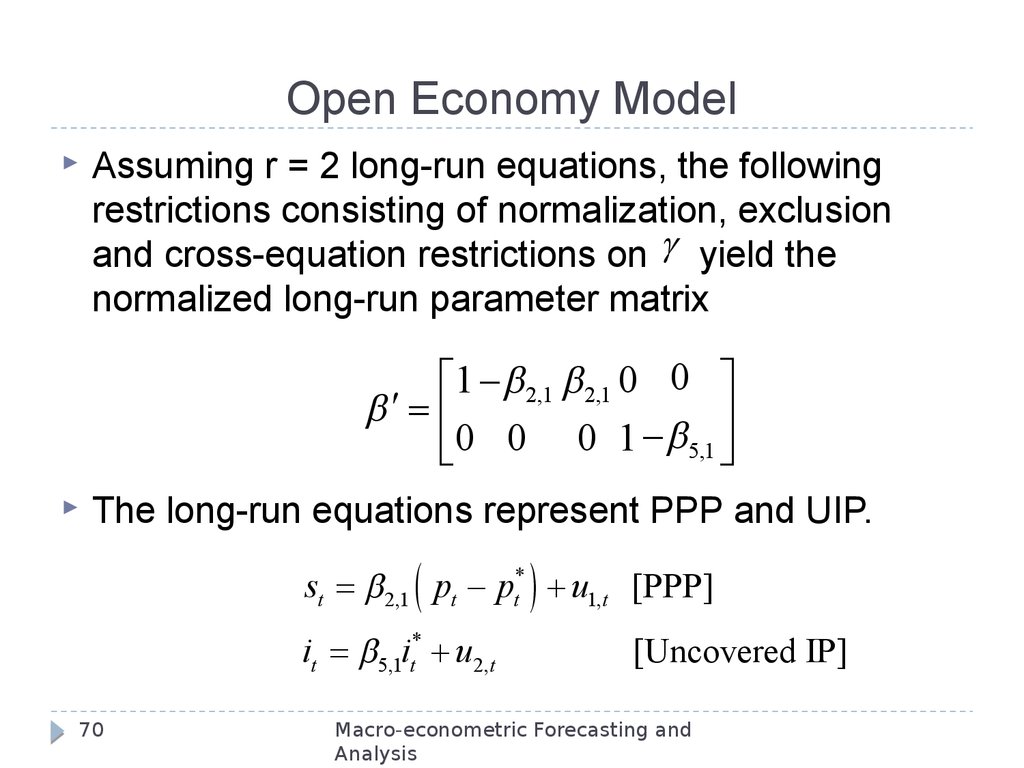

69. Structural Restrictions

Traditional identification methods can also be usedwith VECM’s, including exclusion restrictions, crossequation restrictions, and restrictions on the

disturbance covariance matrix.

Example: Johansen and Juselius(1992) propose an

open economy model in which yt { st , pt , pt* , it , it*}

represents, respectively, the spot exchange rate, the

domestic price level, the foreign price, the domestic

interest rate and the foreign interest rate.

Thus, N = 5.

69

Macro-econometric Forecasting and

Analysis

70. Open Economy Model

Assuming r = 2 long-run equations, the followingrestrictions consisting of normalization, exclusion

and cross-equation restrictions on yield the

normalized long-run parameter matrix

é1 b 2,1 b 2,1 0 0 ù

b¢ ê

ú

b

ë0 0 0 1 5,1 û

The long-run equations represent PPP and UIP.

st b 2,1 ( pt pt* ) u1,t [PPP]

it b 5,1it* u2,t

70

[Uncovered IP]

Macro-econometric Forecasting and

Analysis

71. Cointegration Rank

So far we have taken the rank of the system as given. Buthow do we decide how many co-integrating vectors are in

the vector of N variables?

Simple approach is to estimate models of different rank and

then do a formal likelihood ratio test to decide whether

restricted model (i.e., the model with rank r less than N) is

appropriate.

Specifically, one would estimate the most restricted model (r

= 0), a model that assumes (r=1), then a model that

assumes r = 2, etc. The process ends when we cannot

reject the null (r = r0).

71

Macro-econometric Forecasting and

Analysis

72. Cointegration Rank: Likelihood Ratio Test

Suppose we estimate the model assuming nocointegration. Let the parameters involved in that

model be denoted byqˆr N .

Let the value of the likelihood of this model be

denoted by LT qˆr N

Now estimate the model assuming r ≥ 1. Obviously,

this is an restricted model compared to the r = N

case. Let the value of the likelihood in this case be

denoted by LT qˆr r

(

)

(

72

0

)

Macro-econometric Forecasting and

Analysis

73. Cointegration Rank: Likelihood Ratio Test

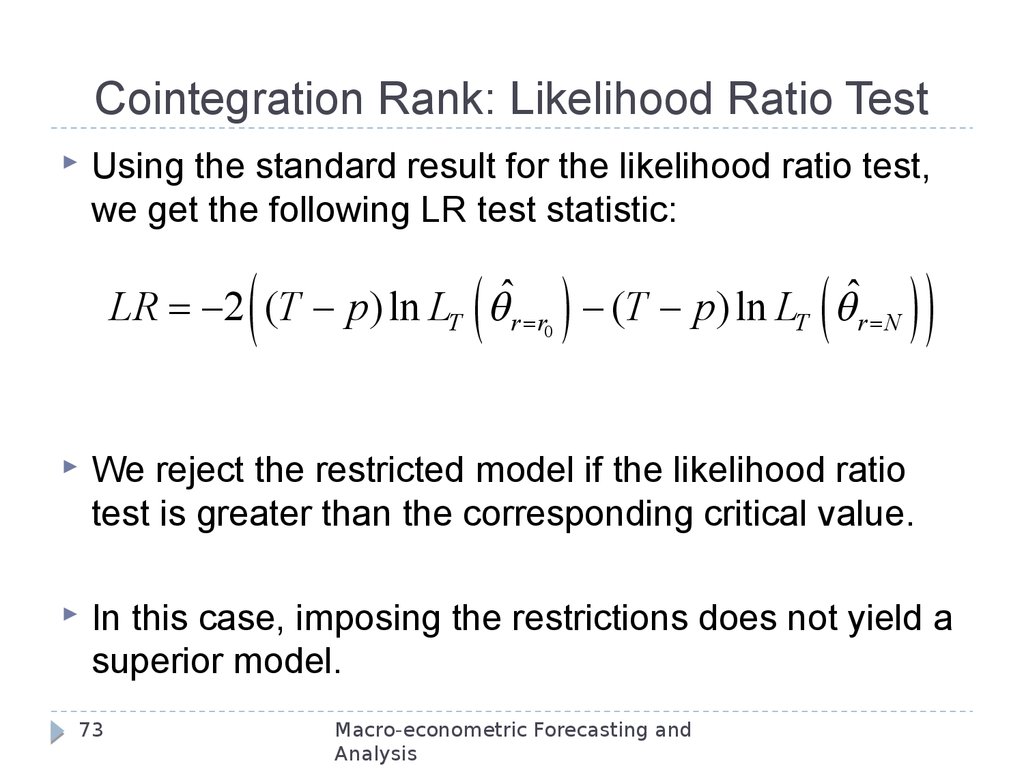

Using the standard result for the likelihood ratio test,we get the following LR test statistic:

(

(

)

(

LR 2 (T p) ln LT qˆr r0 (T p ) ln LT qˆr N

))

We reject the restricted model if the likelihood ratio

test is greater than the corresponding critical value.

In this case, imposing the restrictions does not yield a

superior model.

73

Macro-econometric Forecasting and

Analysis

74. Cointegration Rank: Johansen Approach

A numerically equivalent approach was proposed byJohansen (1988).

He expressed the problem in terms of the eigen values

of the likelihood function – an approach that is

numerically equivalent to the likelihood ratio test. He

termed it the “trace statistic”.

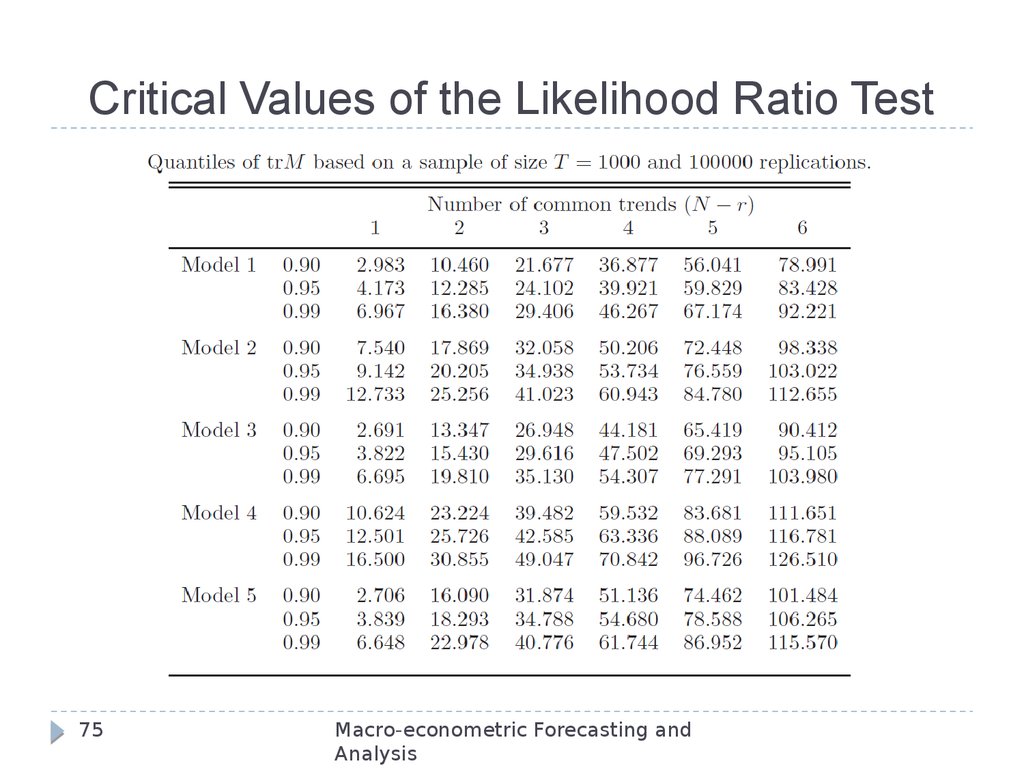

The critical values of the LR test are non-standard, and

depend on the structure of the deterministic part of the

model. Critical values are shown on the next slide.

74

Macro-econometric Forecasting and

Analysis

75. Critical Values of the Likelihood Ratio Test

75Macro-econometric Forecasting and

Analysis

76. Tests on the Cointegrating Vector (Long-Run Parameters)

bHypothesis tests on the cointegrating vector, ,

constitute tests of long-run economic theories.

In contrast to the cointegration rank tests, the

asymptotic distribution of the Wald, Likelihood Ratio

2

c

and Lagrange Multiplier tests

is under the null

hypothesis that the restrictions are valid.

76

Macro-econometric Forecasting and

Analysis

77. Exogeneity

An important feature of a VECM is that all of the variablesin the system are endogenous.

When the system is out of equilibrium, all the variables

interact with each other to move the system back into

equilibrium,

In a VECM, this process occurs (as we saw) through the

impact of lagged variables so that yi,t is affected by the

lags of the other variables either through the error

correction term, ut-1, or through the lags of y j ,t , j ¹ i

77

Macro-econometric Forecasting and

Analysis

78. Weak versus Strong Exogeneity

If the first channel does not exist, i.e., the lagged errorcorrection term does not influence the adjustment

process, the variable concerned is said to be weakly

exogenous.

If the first and second channels do not exist, then only

the lagged values of a variable can be used to explain

its changes. In this case, we say that that variable is

strongly exogenous.

Strong exogeneity testing is equivalent to Granger

causality testing.

78

Macro-econometric Forecasting and

Analysis

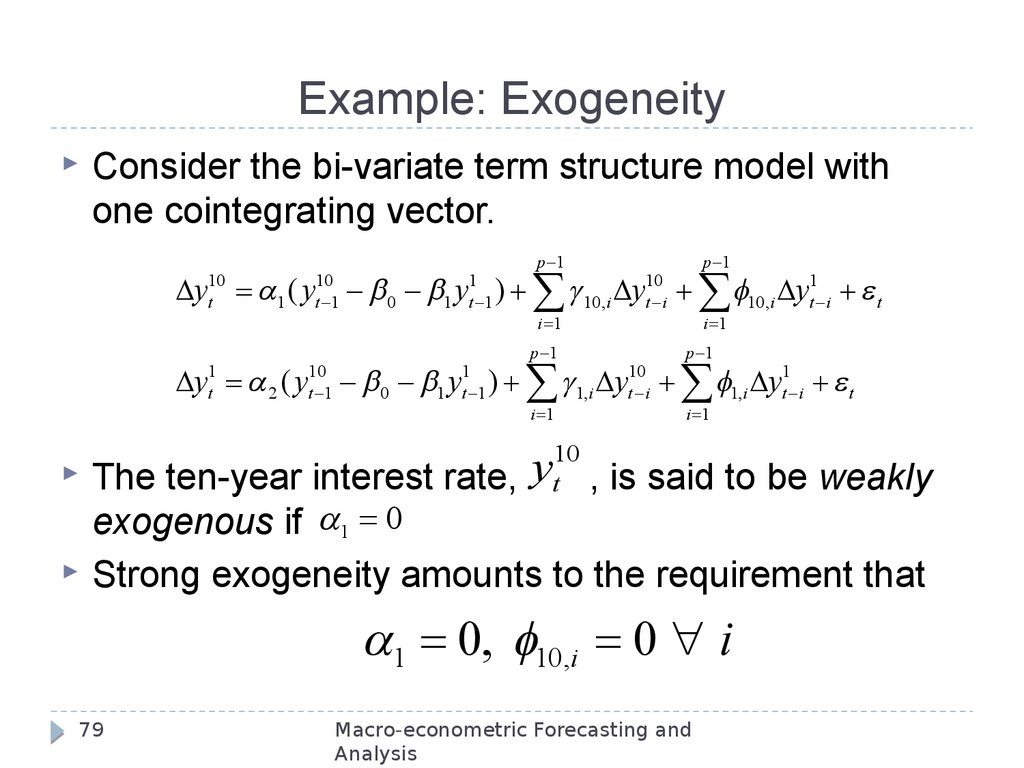

79. Example: Exogeneity

Consider the bi-variate term structure model withone cointegrating vector.

y a1 ( y

10

t

10

t 1

p 1

p 1

b 0 b y ) 10,i y 10,i yt1 i t

1

1 t 1

i 1

10

t i

i 1

p 1

p 1

i 1

i 1

yt1 a 2 ( yt10 1 b 0 b1 yt1 1 ) 1,i yt10 i 1,i yt1 i t

10

y

The ten-year interest rate, t , is said to be weakly

exogenous if a1 0

Strong exogeneity amounts to the requirement that

a1 0, 10,i 0 i

79

Macro-econometric Forecasting and

Analysis

80. Impulse Response Functions

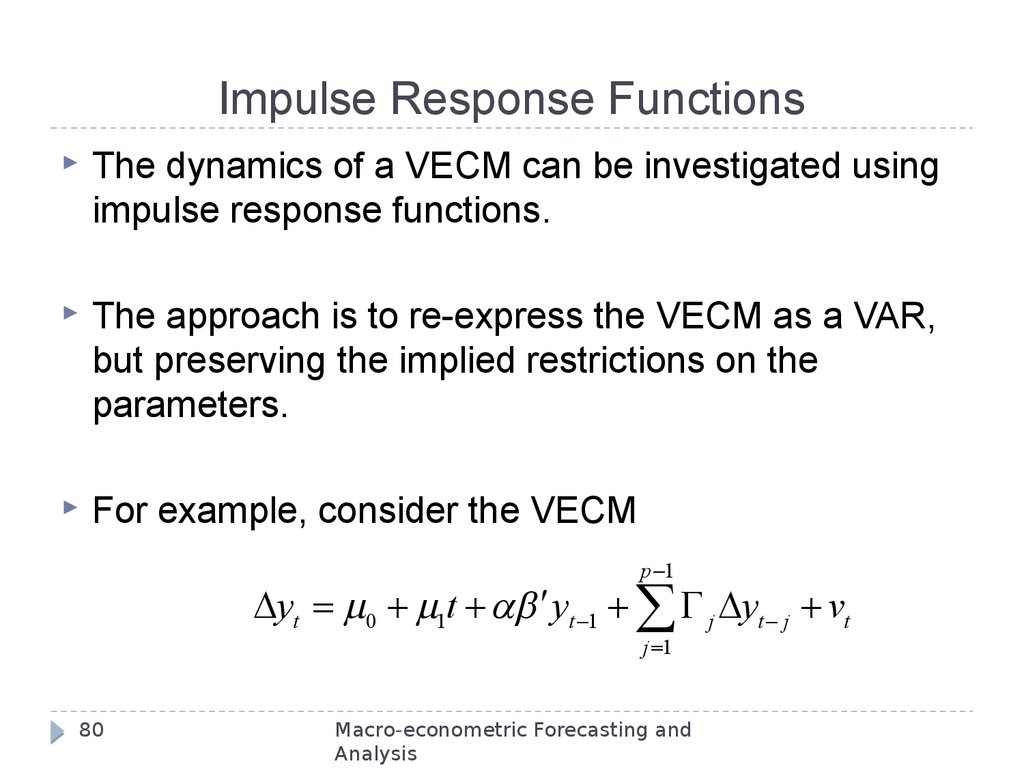

The dynamics of a VECM can be investigated usingimpulse response functions.

The approach is to re-express the VECM as a VAR,

but preserving the implied restrictions on the

parameters.

For example, consider the VECM

p 1

yt 0 1t ab ¢ yt 1 G j yt j vt

j 1

80

Macro-econometric Forecasting and

Analysis

81. Impulse Response Functions: VECM

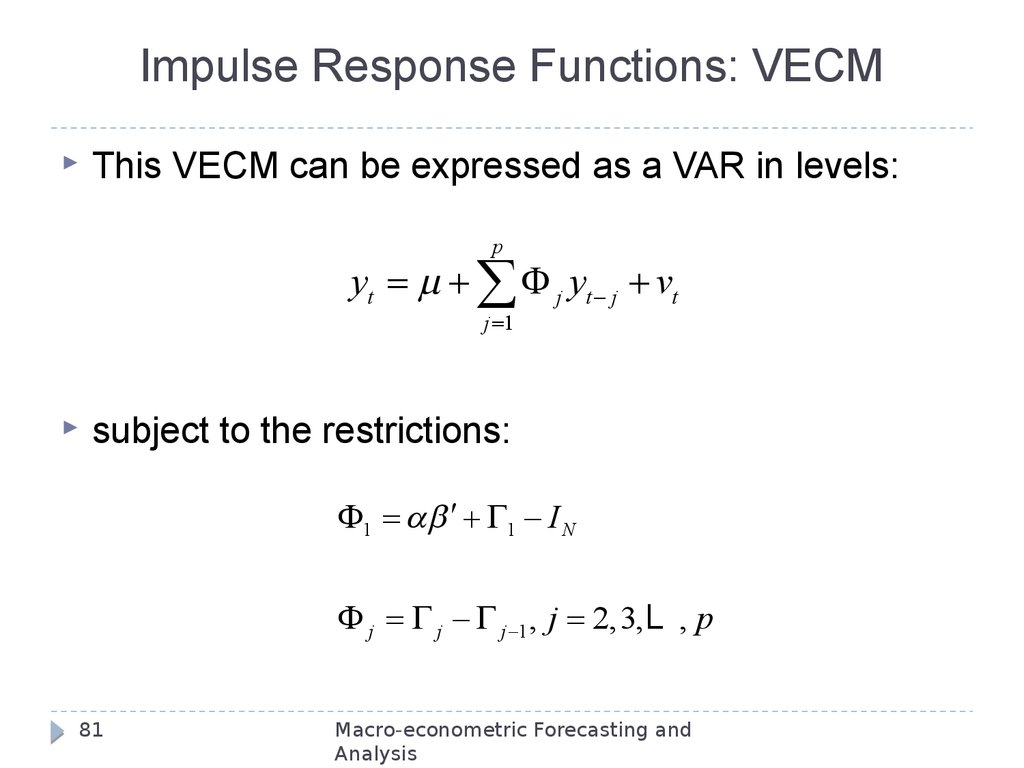

This VECM can be expressed as a VAR in levels:p

yt F j yt j vt

j 1

subject to the restrictions:

F1 ab ¢ G1 I N

F j G j G j 1 , j 2,3,L , p

81

Macro-econometric Forecasting and

Analysis

82. Appendices

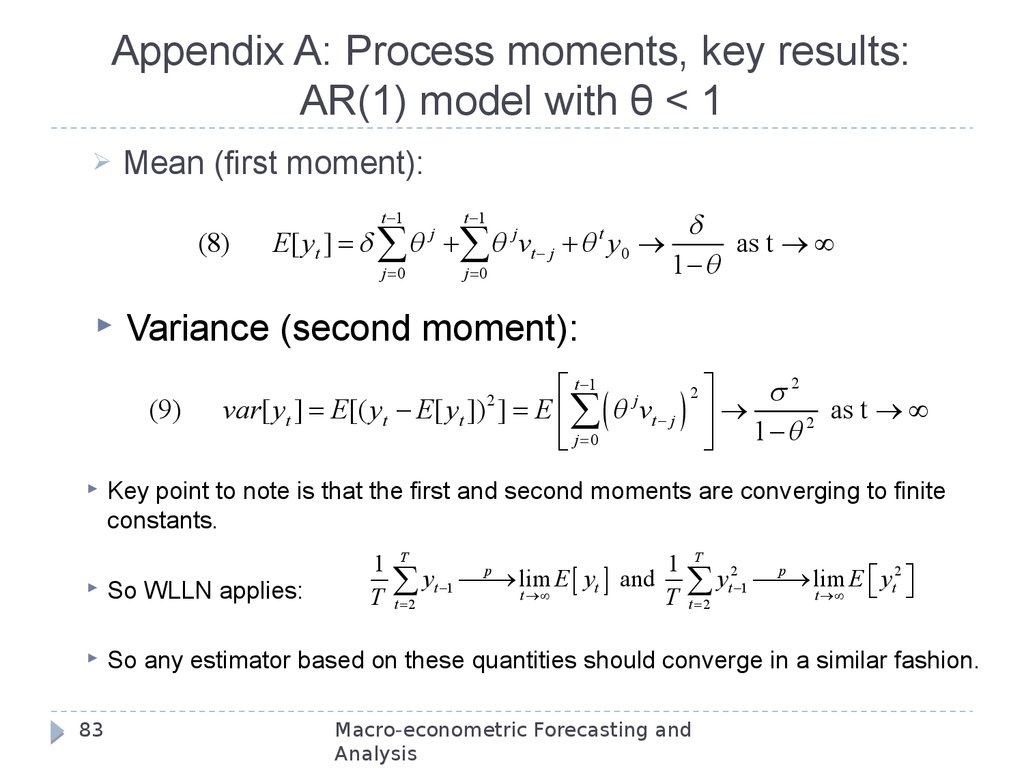

83. Appendix A: Process moments, key results: AR(1) model with θ < 1

Appendix A: Process moments, key results:AR(1) model with θ < 1

Mean (first moment):

(8)

t 1

j 0

j 0

as t

1 q

Variance (second moment):

(9)

t 1

E[ yt ] q q j vt j q t y0

j

é t 1 j

2ù

2

var[ yt ] E[( yt E[ yt ]) ] E ê ( q vt j ) ú

as t

2

ë j 0

û 1 q

2

Key point to note is that the first and second moments are converging to finite

constants.

1 T

1 T 2

p

p

yt 1 ¾¾

lim E [ yt ] and yt 1 ¾¾

lim E éë yt2 ùû

t

t

T t 2

T t 2

So WLLN applies:

So any estimator based on these quantities should converge in a similar fashion.

83

Macro-econometric Forecasting and

Analysis

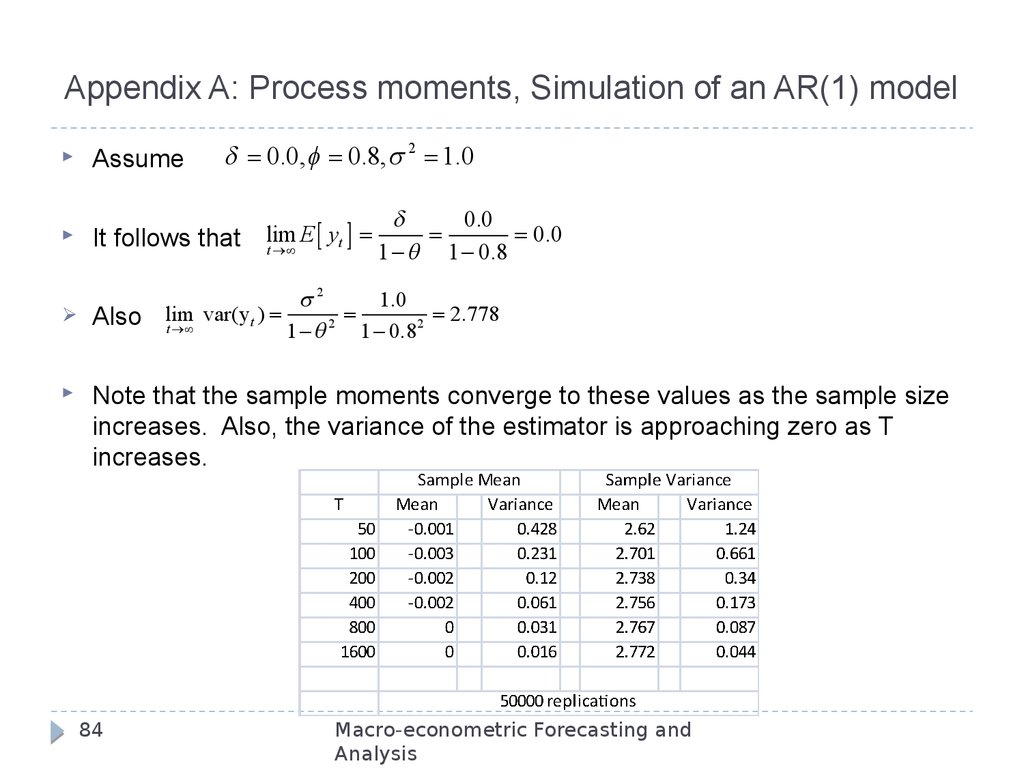

84. Appendix A: Process moments, Simulation of an AR(1) model

Assume0.0, 0.8, 2 1.0

It follows that

lim E [ yt ]

t

0.0

0.0

1 q 1 0.8

2

1.0

lim var(yt )

2.778

t

1 q 2 1 0.82

Also

Note that the sample moments converge to these values as the sample size

increases. Also, the variance of the estimator is approaching zero as T

increases.

84

Macro-econometric Forecasting and

Analysis

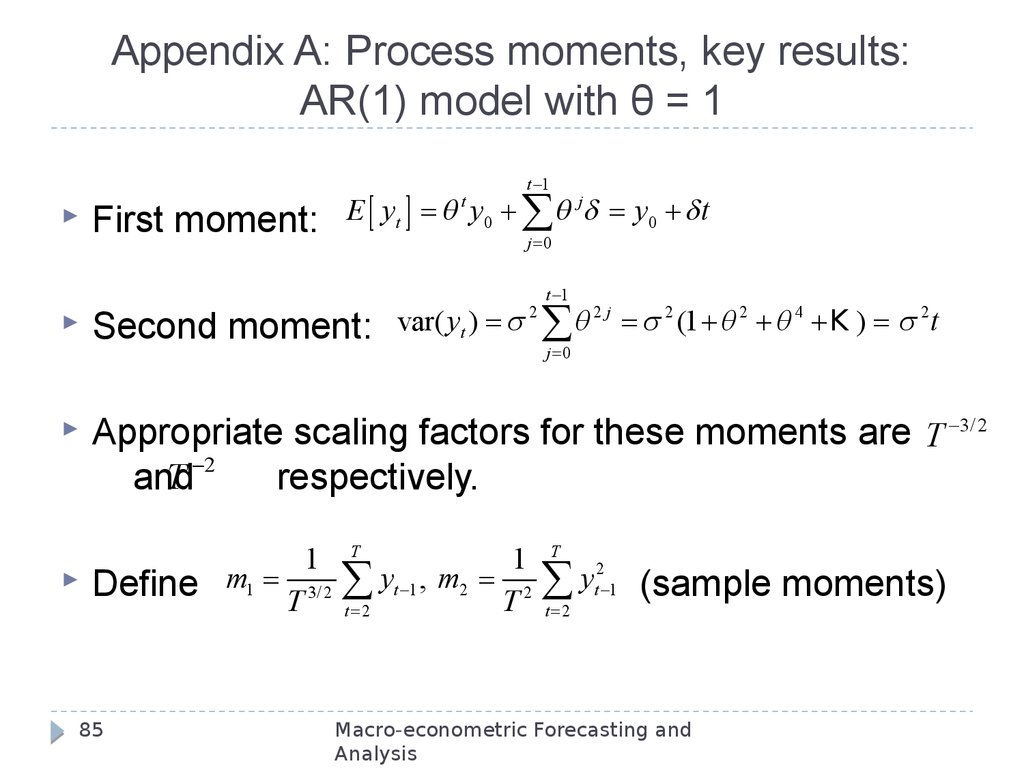

85. Appendix A: Process moments, key results: AR(1) model with θ = 1

First moment:t 1

E [ yt ] q y0 q j y0 t

t

j 0

Second moment:

var( yt )

2

t 1

2j

2

2

4

2

q

(1

q

q

K

)

t

j 0

Appropriate scaling factors for these moments are T 3/2

2

T

and

respectively.

Define

85

m1

1

T 3/2

T

1

yt 1 , m2 2

T

t 2

T

2

y

t 1

t 2

(sample moments)

Macro-econometric Forecasting and

Analysis

86. Appendix A: Process moments, simulation of an I(1) Process

Notice that the variances of the first two sample moments do not fallas the sample size is increased (Columns 2 and 4).

The variances converge to 1/3, so m1 and m2 converge to random

variables in the limit.

86

Macro-econometric Forecasting and

Analysis

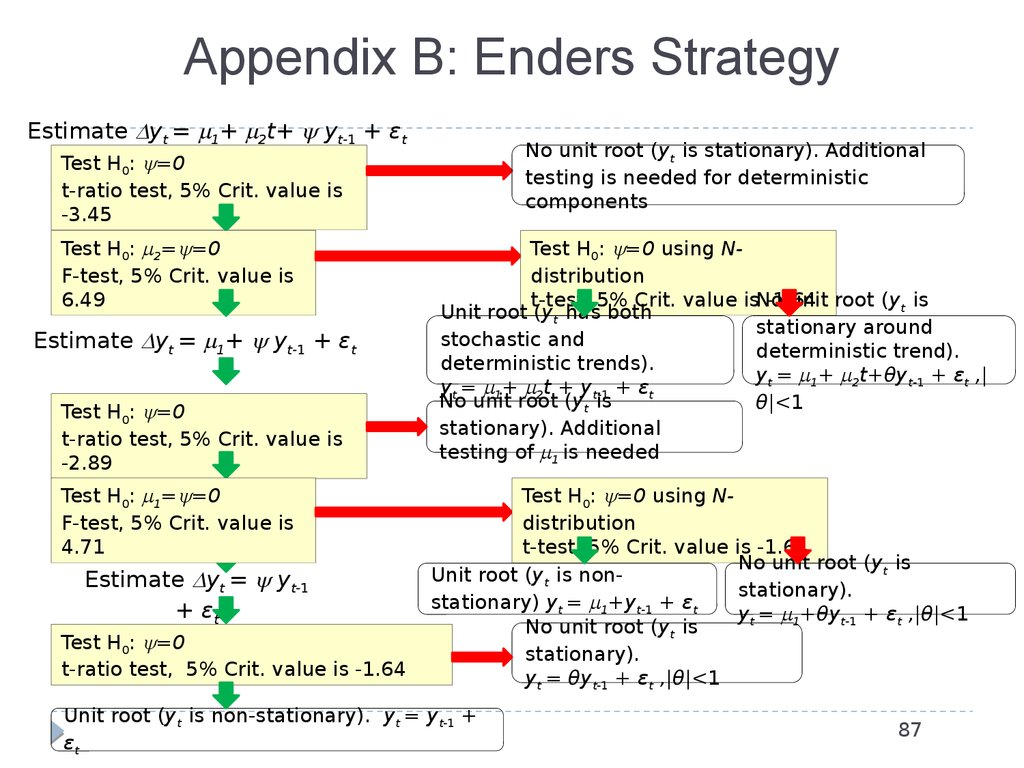

87. Appendix B: Enders Strategy

Estimate yt = 1+ 2t+ yt-1 + εtNo unit root (yt is stationary). Additional

testing is needed for deterministic

components

Test H0: =0

t-ratio test, 5% Crit. value is

-3.45

Test H0: 2= =0

F-test, 5% Crit. value is

6.49

Estimate yt = 1+ yt-1 + εt

Test H0: =0

t-ratio test, 5% Crit. value is

-2.89

Test H0: 1= =0

F-test, 5% Crit. value is

4.71

Estimate yt = yt-1

+ εt

Test H0: =0

t-ratio test, 5% Crit. value is -1.64

Test H0: =0 using Ndistribution

t-test, 5% Crit. value isNo

-1.64

unit root (yt is

Unit root (yt has both

stationary around

stochastic and

deterministic trend).

deterministic trends).

yt = 1+ 2t+θyt-1 + εt ,|

yt = 1+ 2t + yt-1 + εt

No unit root (yt is

θ|<1

stationary). Additional

testing of 1 is needed

Test H0: =0 using Ndistribution

t-test, 5% Crit. value is -1.64

No unit root (yt is

Unit root (yt is nonstationary).

stationary) yt = 1+yt-1 + εt

yt = 1+θyt-1 + εt ,|θ|<1

No unit root (yt is

stationary).

yt = θyt-1 + εt ,|θ|<1

Unit root (yt is non-stationary). yt = yt-1 +

εt

87

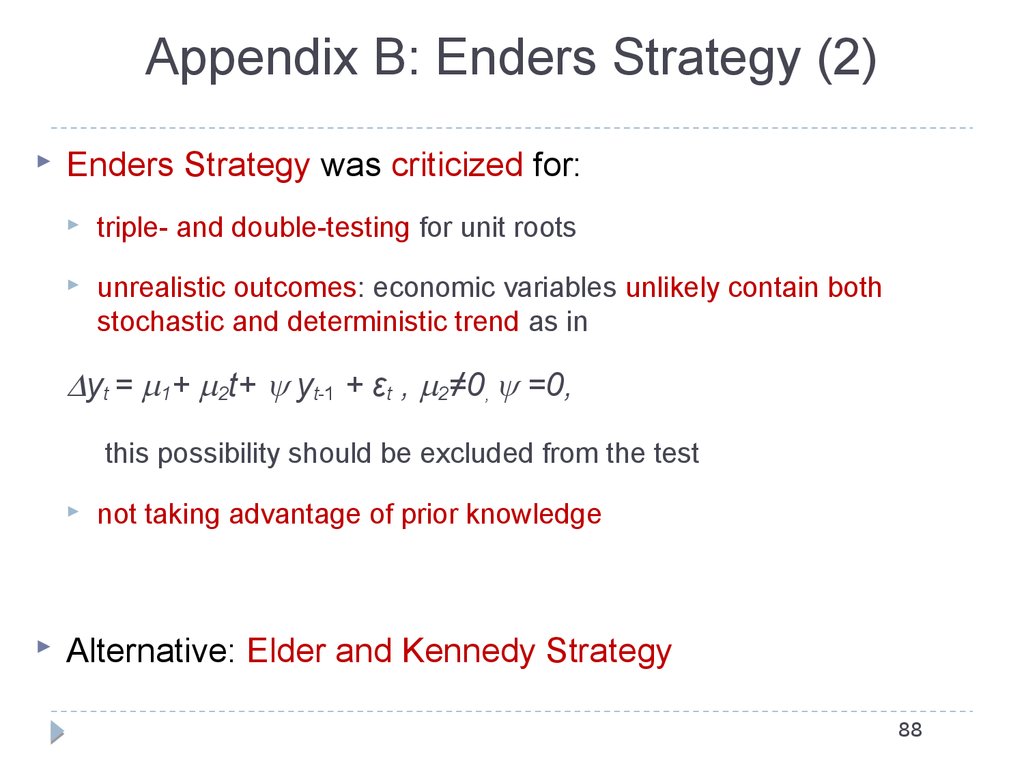

88. Appendix B: Enders Strategy (2)

Enders Strategy was criticized for:triple- and double-testing for unit roots

unrealistic outcomes: economic variables unlikely contain both

stochastic and deterministic trend as in

yt = 1+ 2t+ yt-1 + εt , 2≠0, =0,

this possibility should be excluded from the test

not taking advantage of prior knowledge

Alternative: Elder and Kennedy Strategy

88

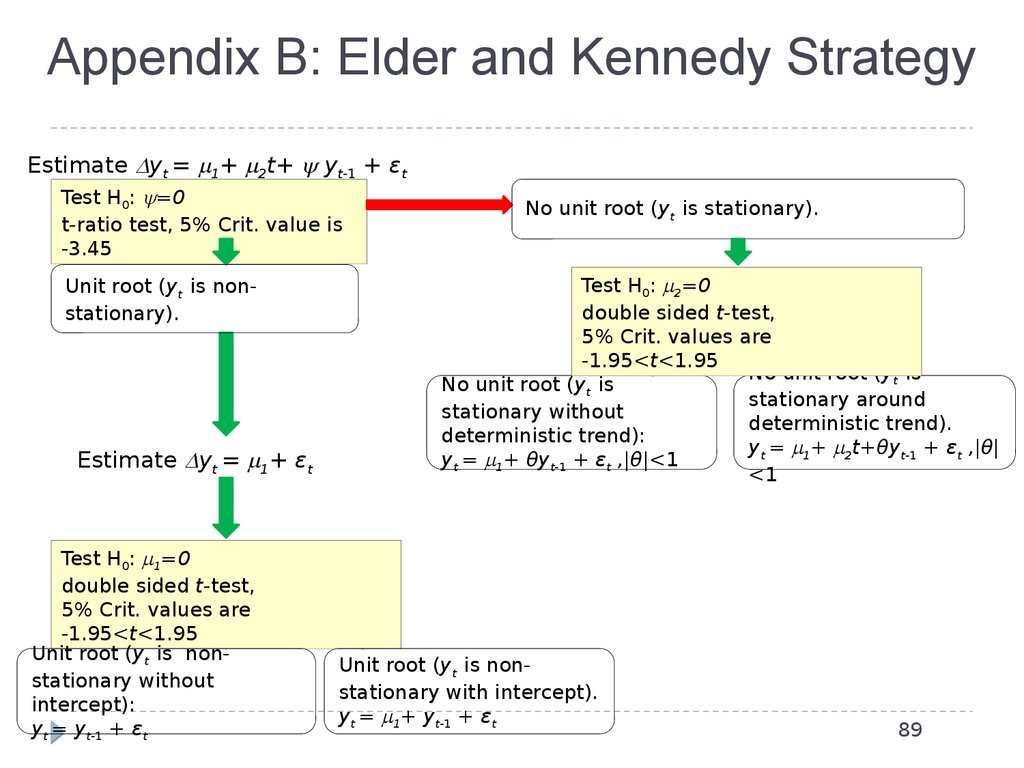

89. Appendix B: Elder and Kennedy Strategy

Estimate yt = 1+ 2t+ yt-1 + εtTest H0: =0

t-ratio test, 5% Crit. value is

-3.45

Unit root (yt is nonstationary).

Estimate yt = 1+ εt

Test H0: 1=0

double sided t-test,

5% Crit. values are

-1.95<t<1.95

Unit root (yt is nonstationary without

intercept):

yt = yt-1 + εt

No unit root (yt is stationary).

Test H0: 2=0

double sided t-test,

5% Crit. values are

-1.95<t<1.95

No unit root (yt is

No unit root (yt is

stationary around

stationary without

deterministic trend).

deterministic trend):

yt = 1+ 2t+θyt-1 + εt ,|θ|

yt = 1+ θyt-1 + εt ,|θ|<1

<1

Unit root (yt is nonstationary with intercept).

yt = 1+ yt-1 + εt

89

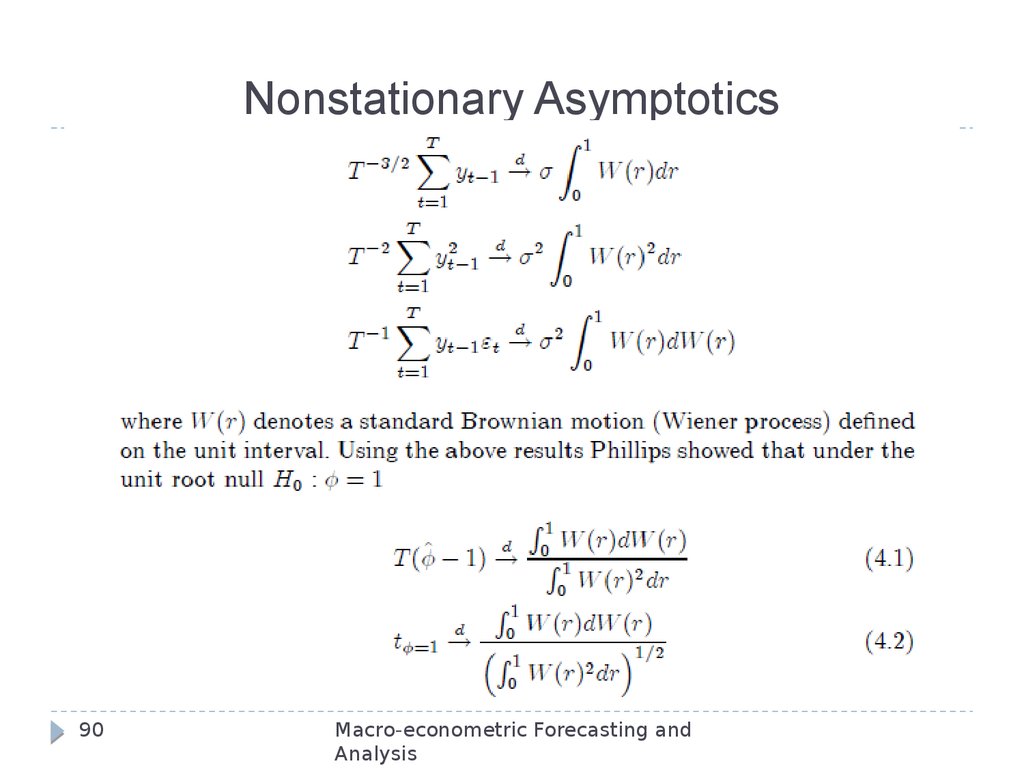

90. Nonstationary Asymptotics

90Macro-econometric Forecasting and

Analysis

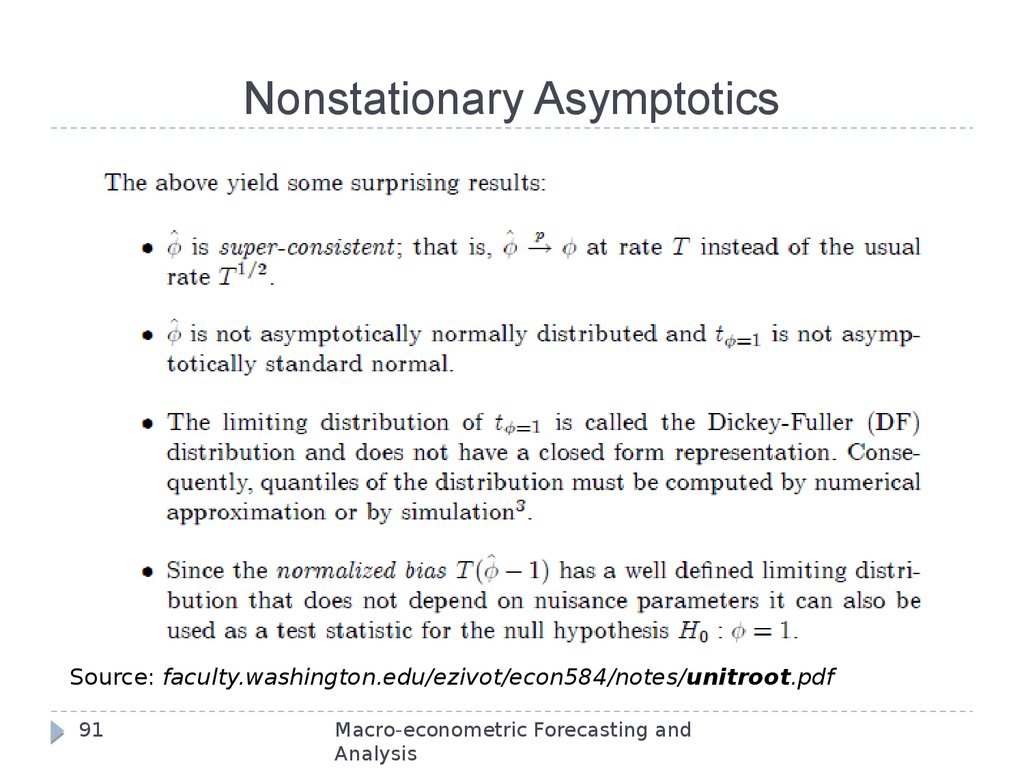

91. Nonstationary Asymptotics

Source: faculty.washington.edu/ezivot/econ584/notes/unitroot.pdf91

Macro-econometric Forecasting and

Analysis

Математика

Математика Экономика

Экономика