Похожие презентации:

Ga.Ma workshop FY18

1.

Market Overview FY20182.

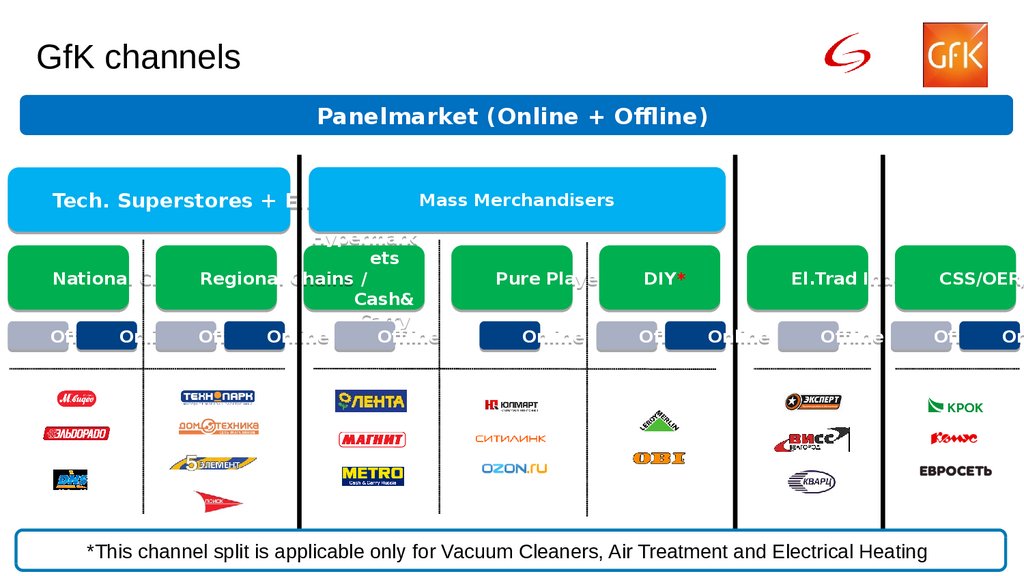

GfK channelsPanelmarket (Online + Ofine)

Tech. Superstores + El. Chains

Mass Merchandisers

Hypermark

ets

National ChainsRegional Chains /

Cash&

Carry

Ofine Online Ofine Online

Ofine

Pure Players

Online

DIY*

Ofine Online

El.Trad Indep. CSS/OER/

Ofine

*This channel split is applicable only for Vacuum Cleaners, Air Treatment and Electrical Heating

Ofine On

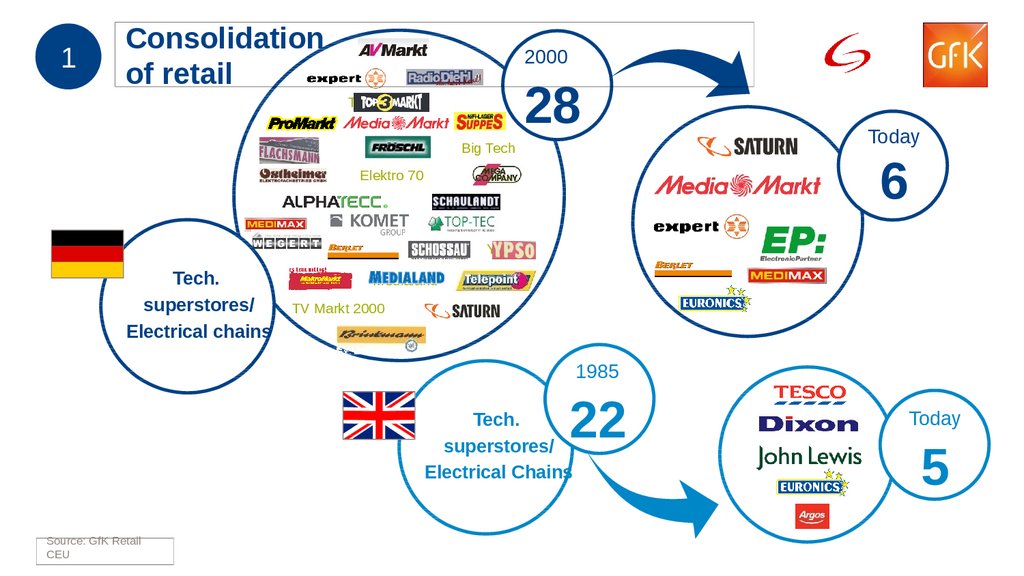

3.

1Consolidation

of retail

2000

AV Markt

28

Top 3 Markt

Big Tech

Today

6

Elektro 70

Ypso

Tech.

superstores/

Electrical chains

Medialand

TV Markt 2000

1985

22

Tech.

superstores/

Electrical Chains

Source: GfK Retail

GfK Retail Panel

CEU

Today

5

4. Consolidation of retail

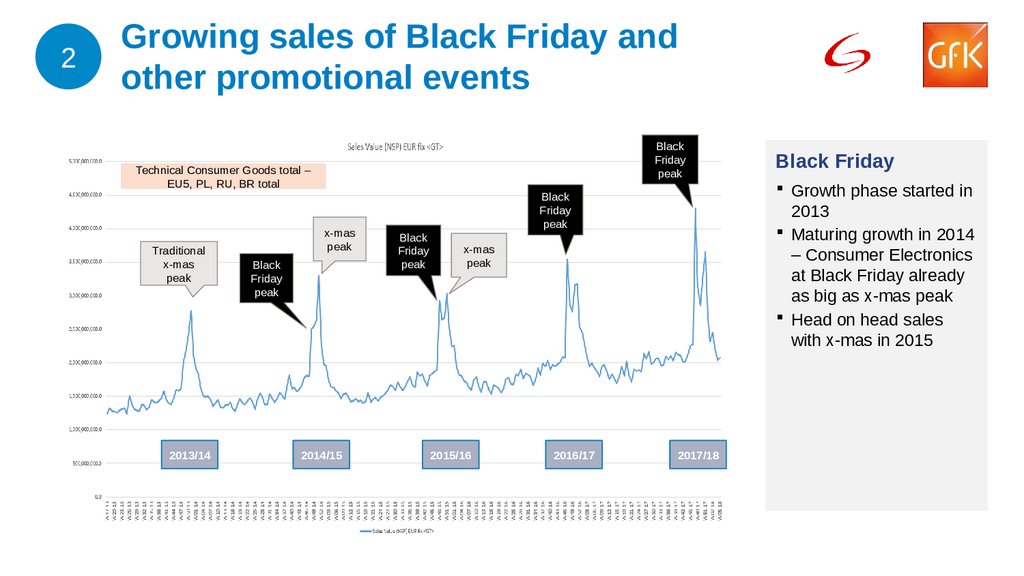

2Growing sales of Black Friday and

other promotional events

Black

Friday

peak

Technical Consumer Goods total –

EU5, PL, RU, BR total

Traditional

x-mas

peak

2013/14

x-mas

peak

Black

Friday

peak

2014/15

Growth phase started in

2013

Maturing growth in 2014

– Consumer Electronics

at Black Friday already

as big as x-mas peak

Head on head sales

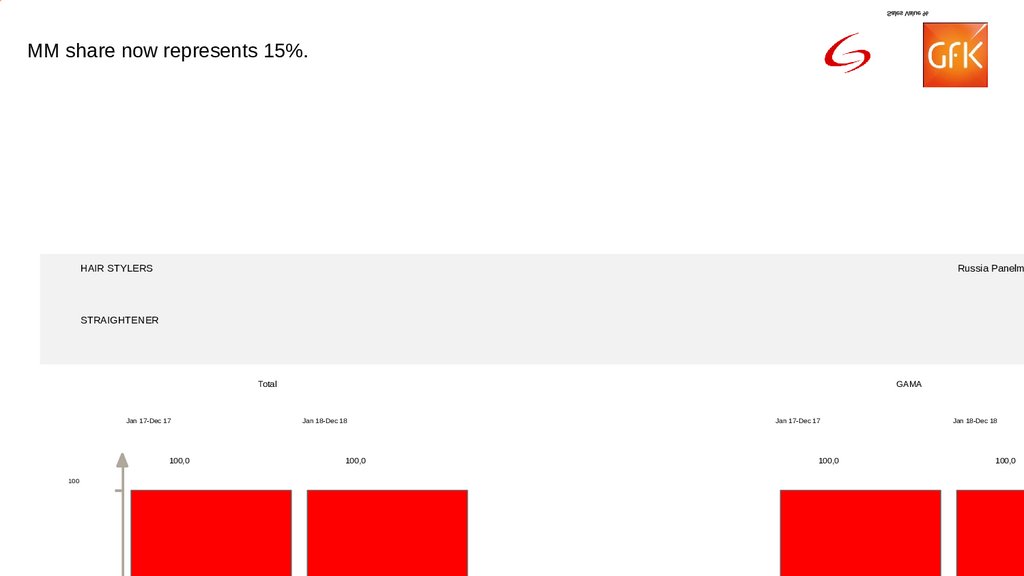

with x-mas in 2015

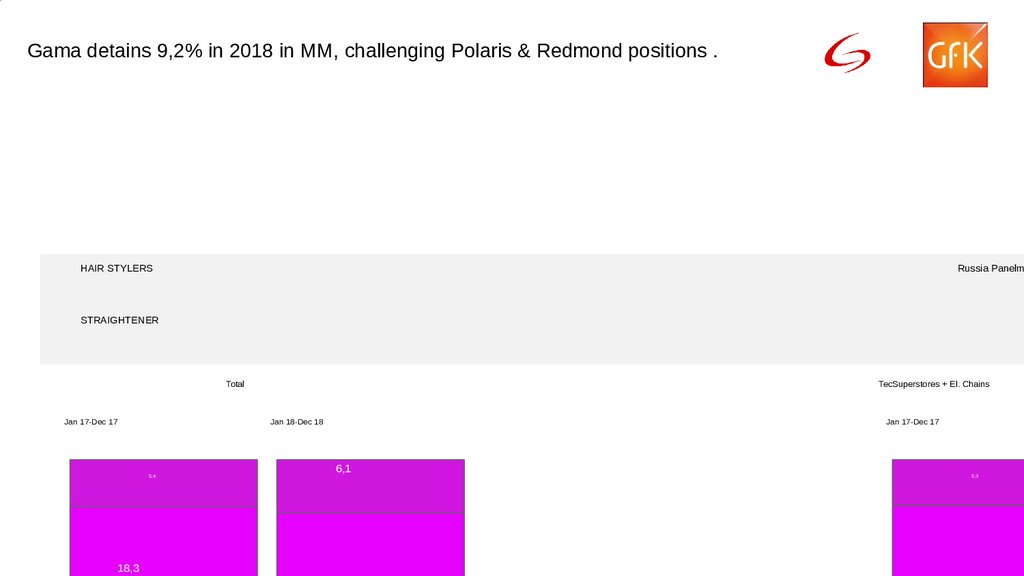

Black

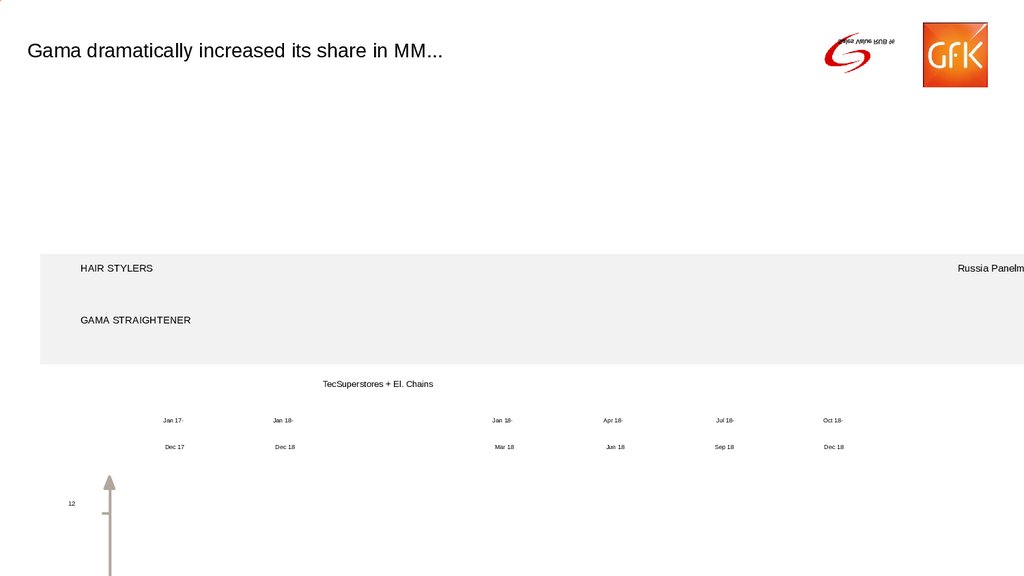

Friday

peak

Black

Friday

peak

x-mas

peak

2015/16

2016/17

Black Friday

2017/18

5.

2In Russia

Black Friday generates bigger boost in sales every

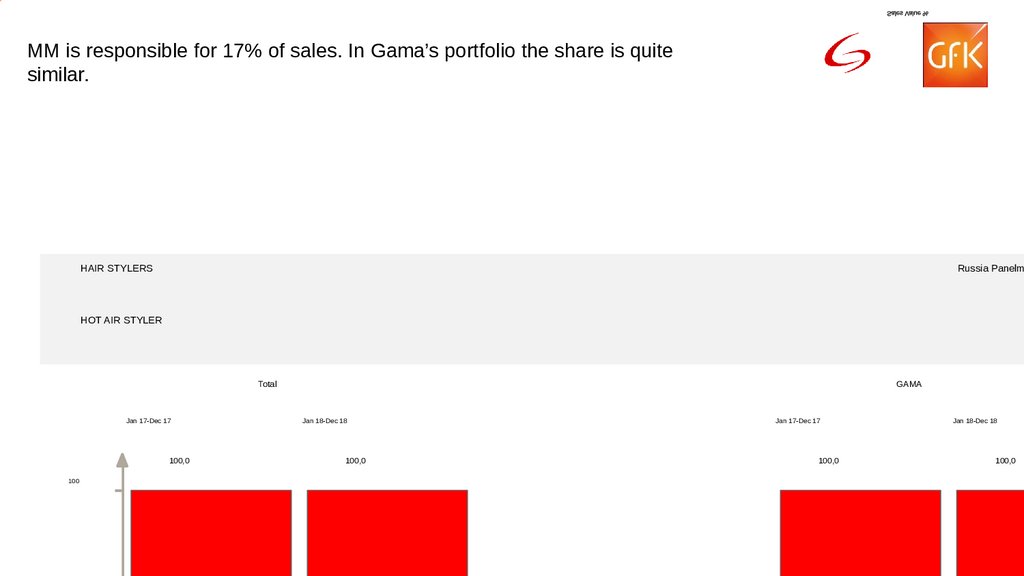

year

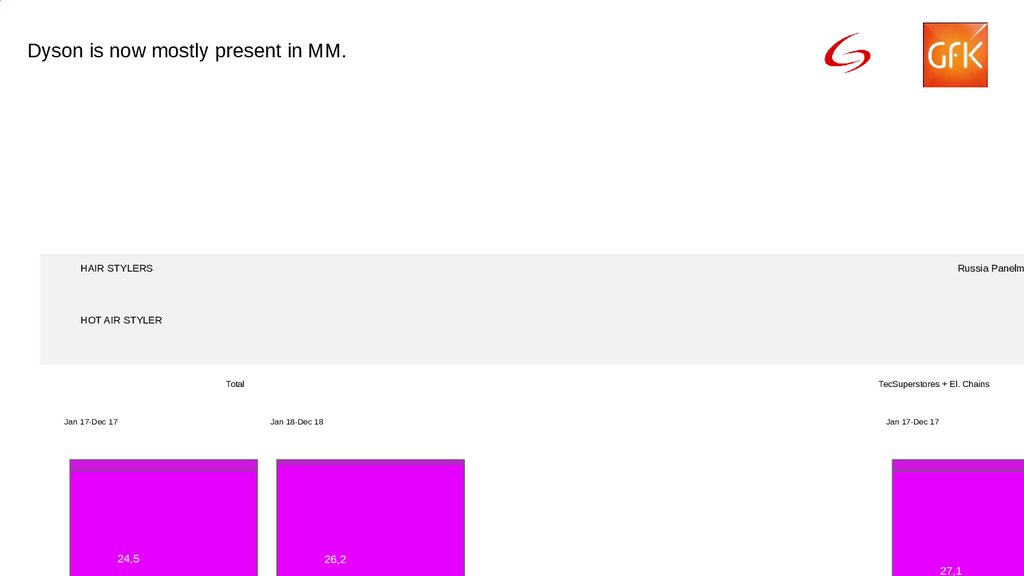

2016

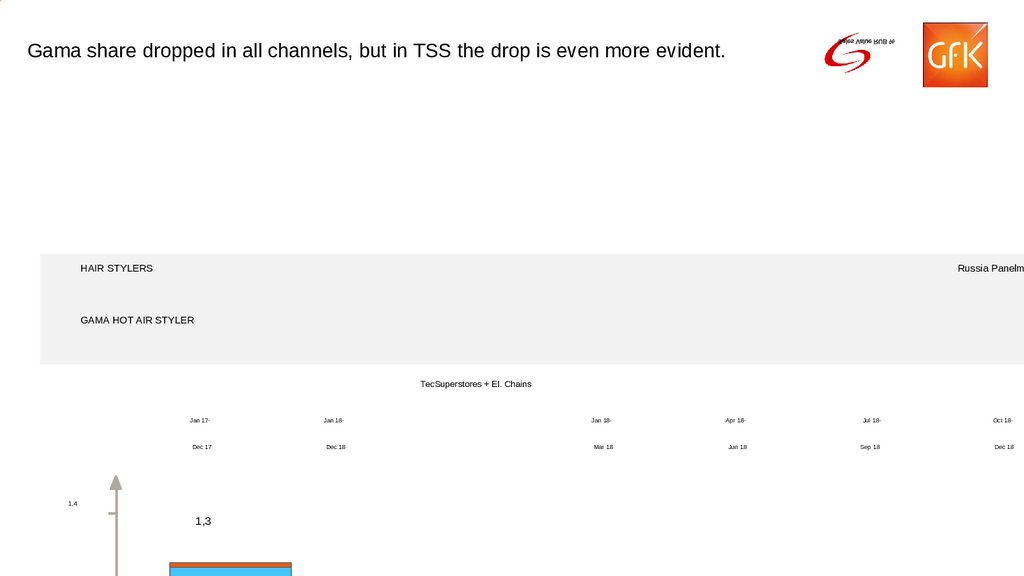

2017

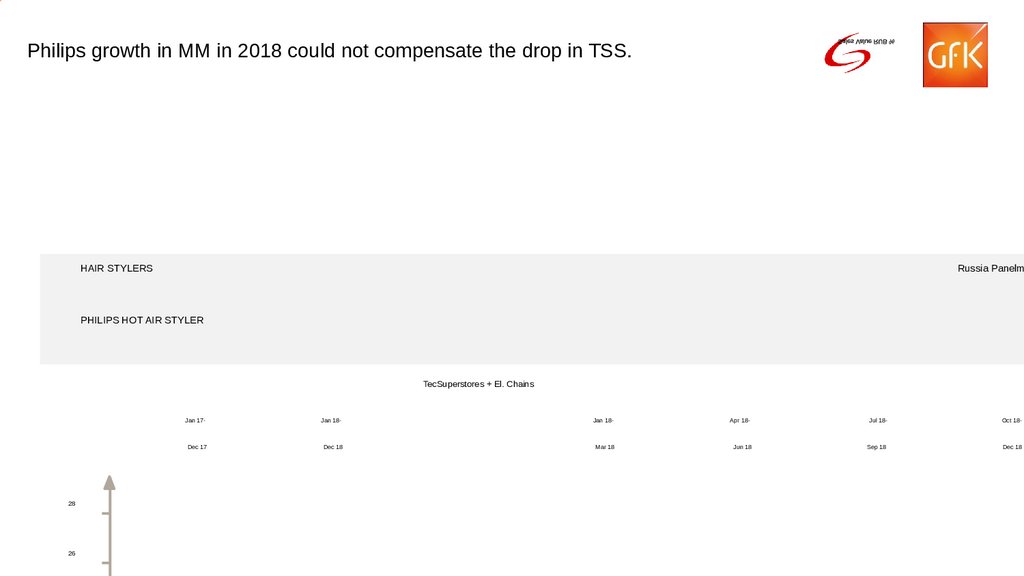

2018

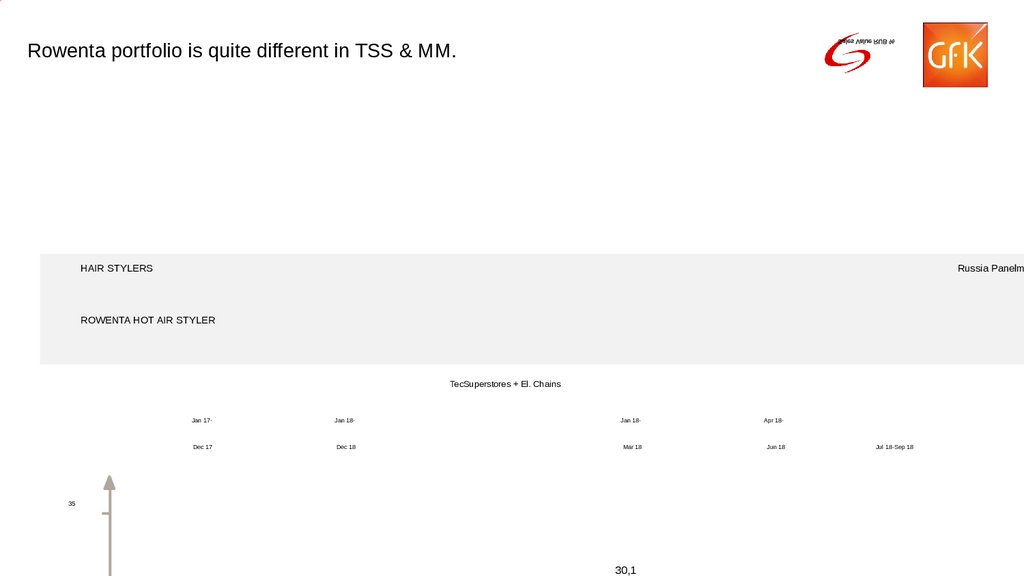

+9.3%

+19.6%

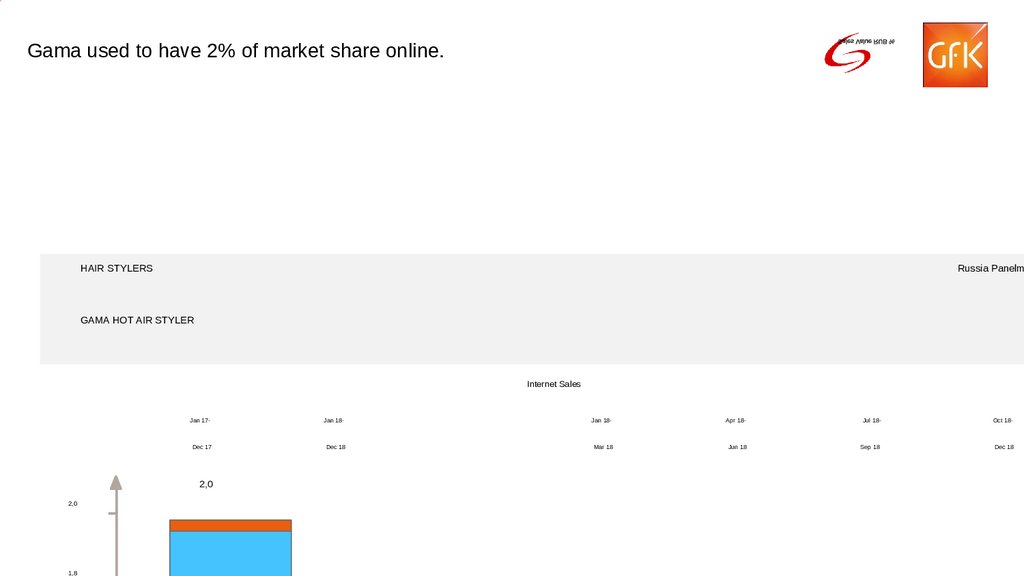

+30.3%

All figures refer to Value Growth of Black Friday week compared to previous week

6.

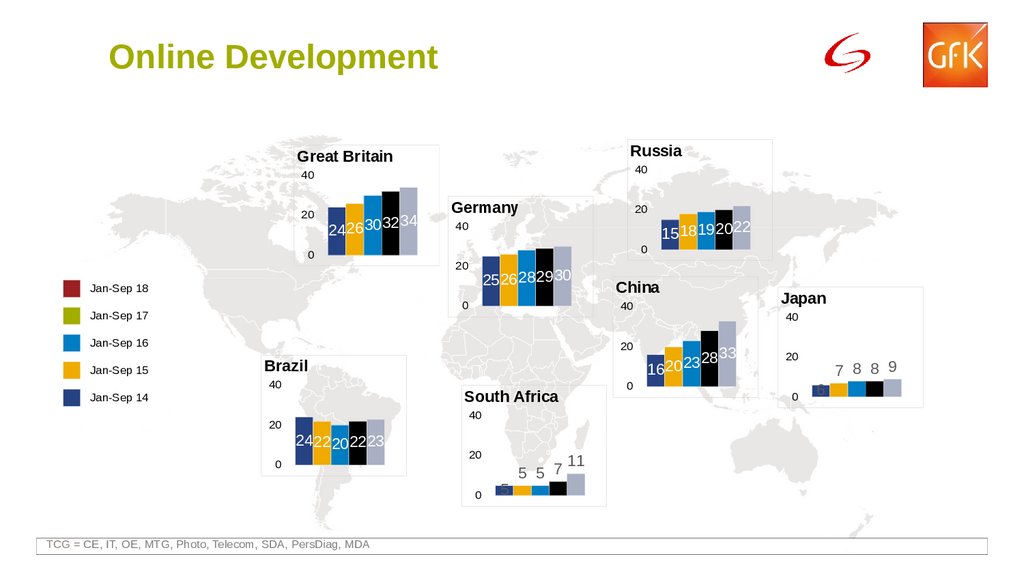

3Online Development

Russia

Great Britain

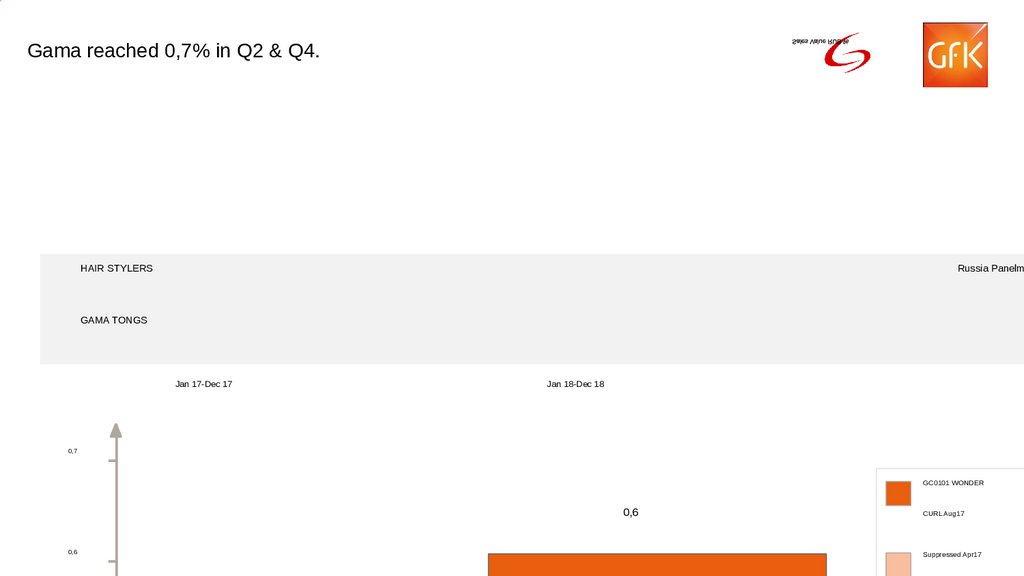

40

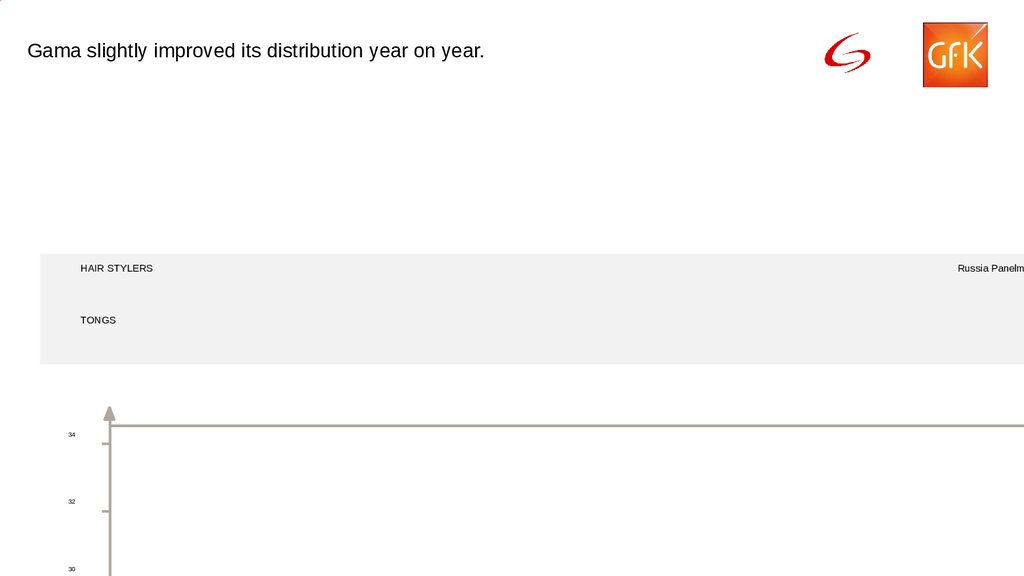

40

20

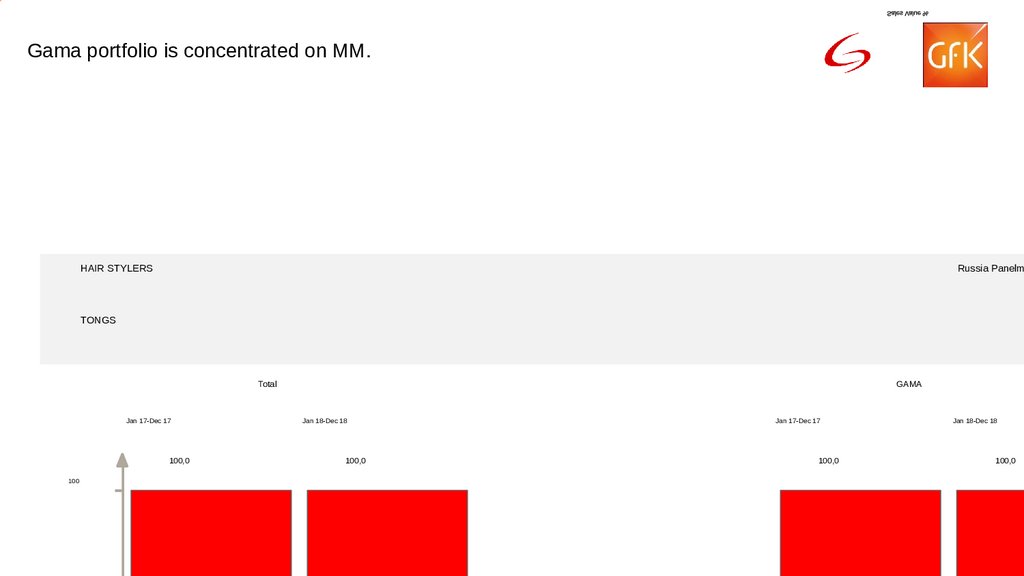

32 34

24 26 30

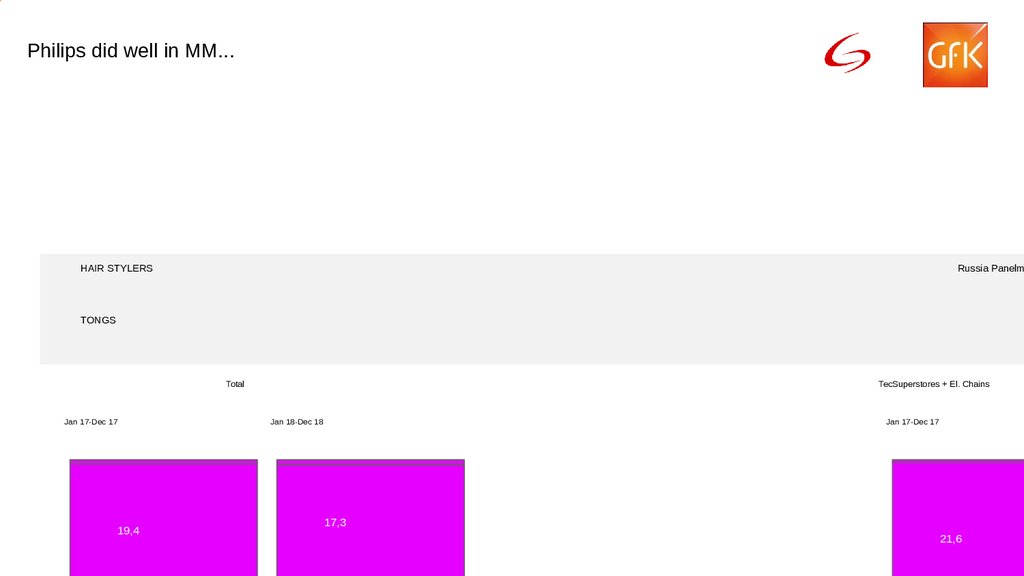

0

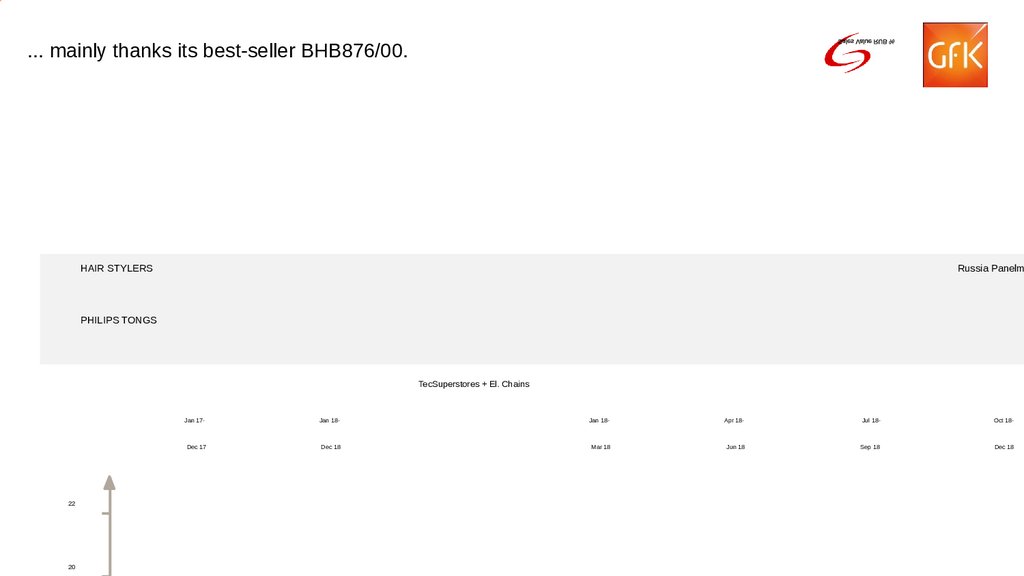

Germany

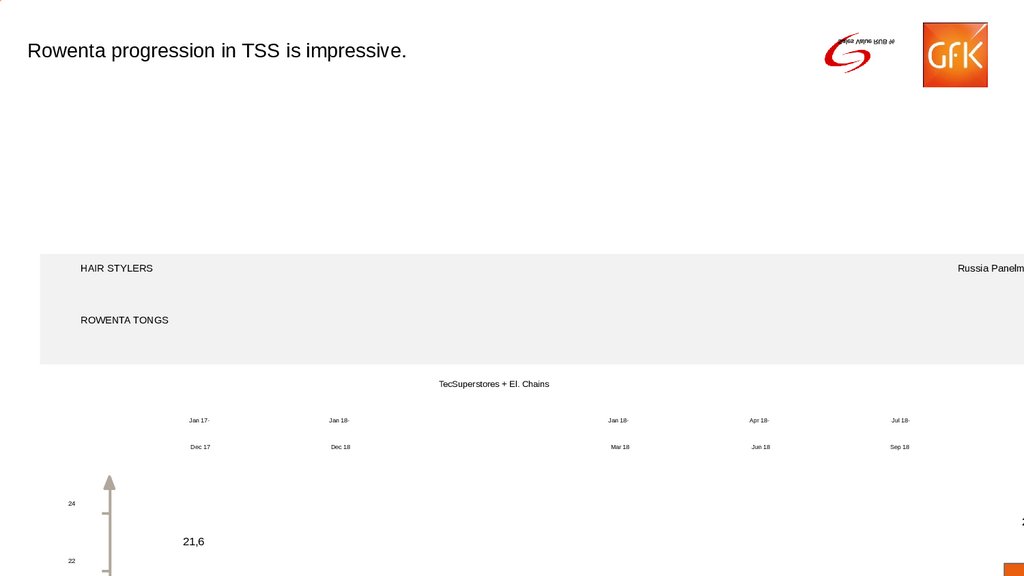

20

15 18 19 20 22

40

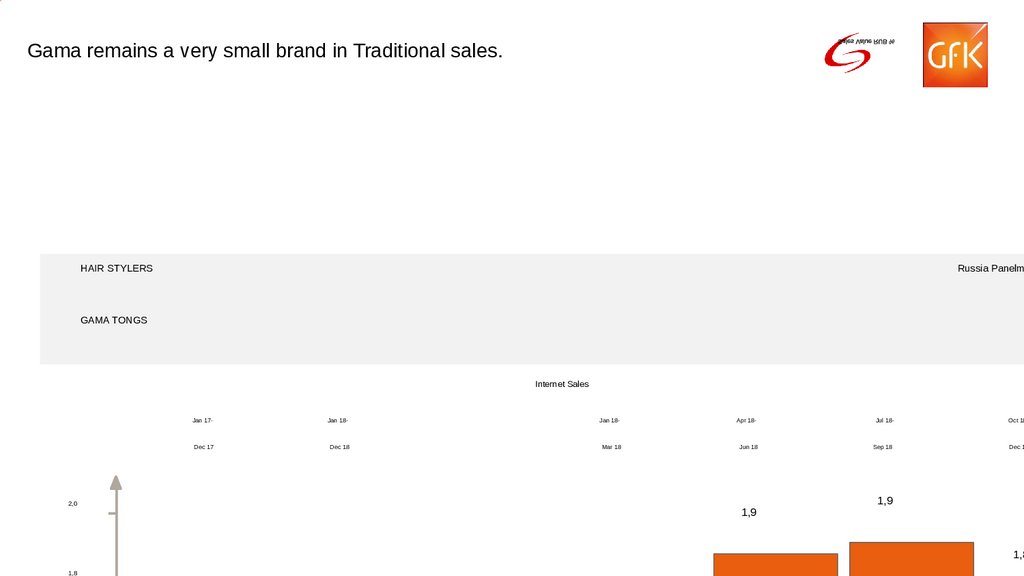

0

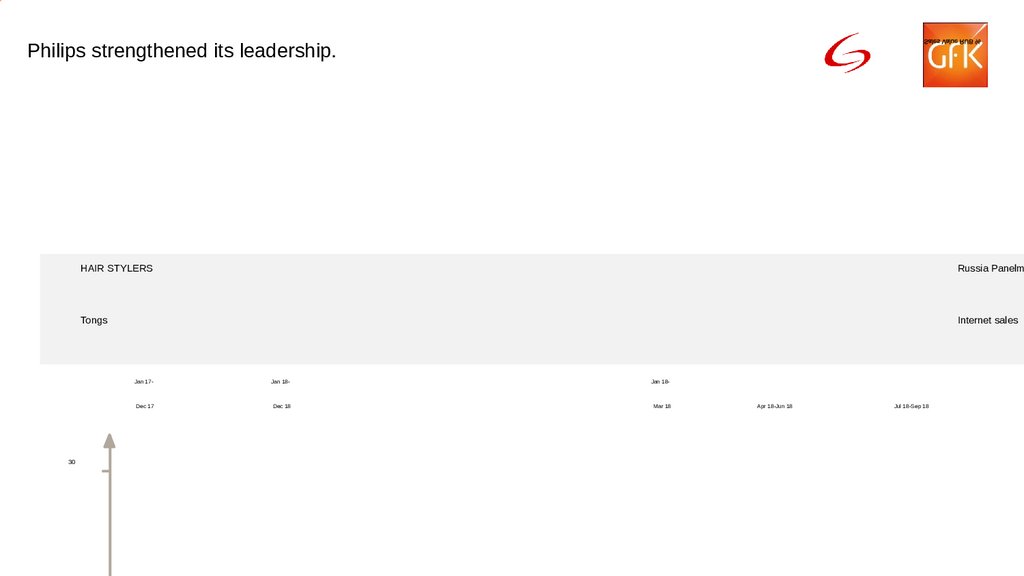

20

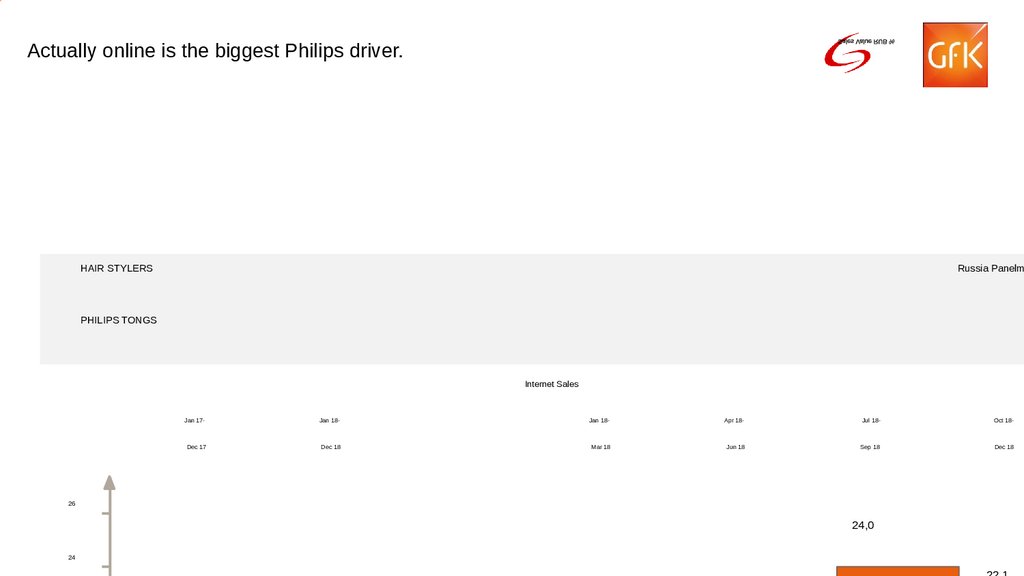

25 26 28 29 30

Jan-Sep 18

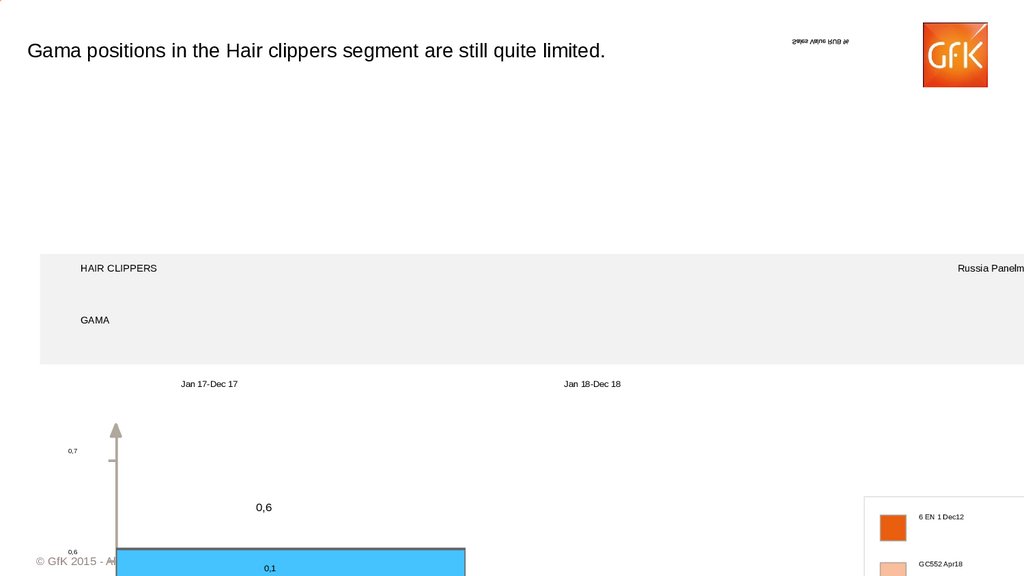

0

Jan-Sep 17

Jan-Sep 14

40

20

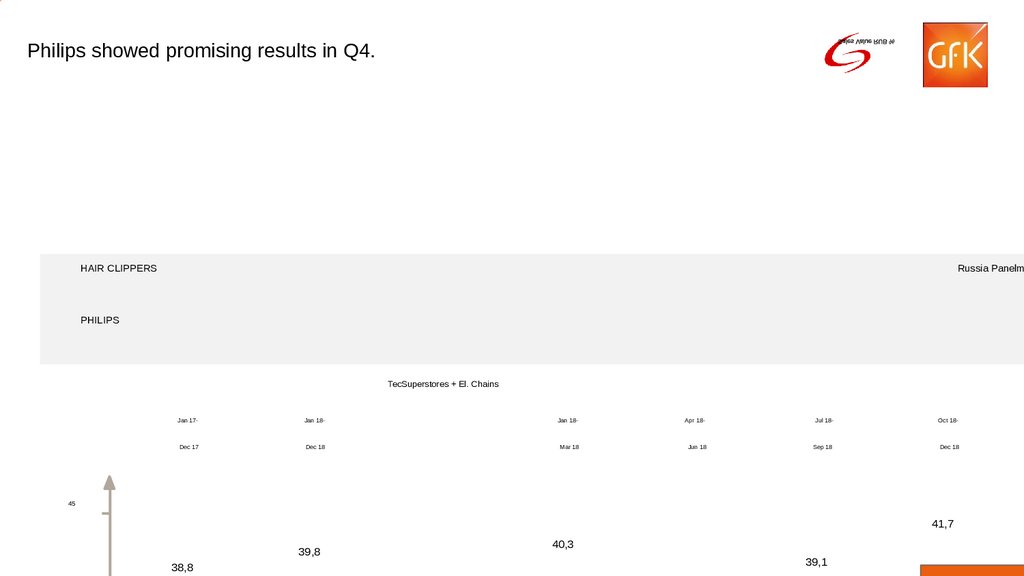

16 20 23

Brazil

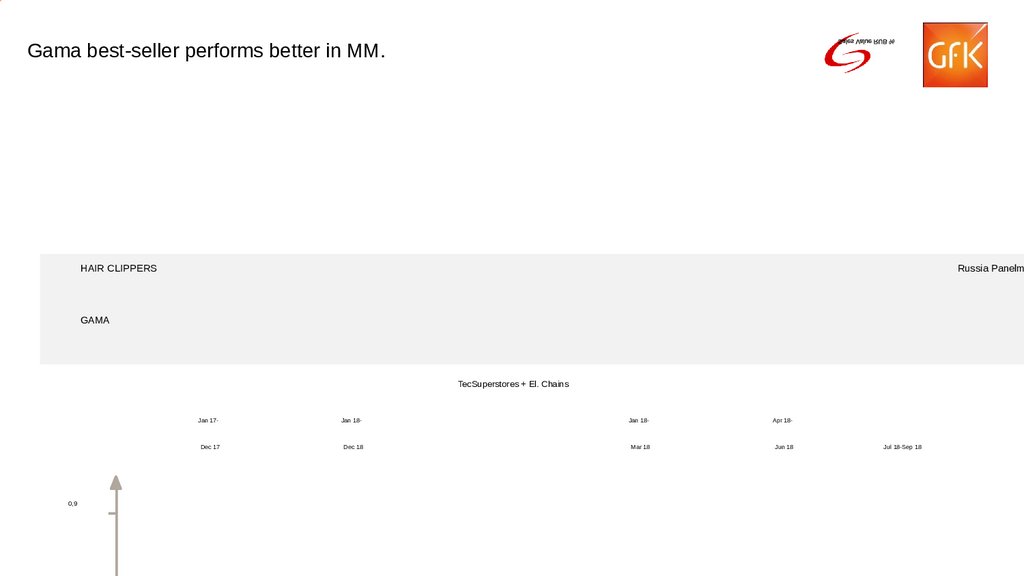

40

0

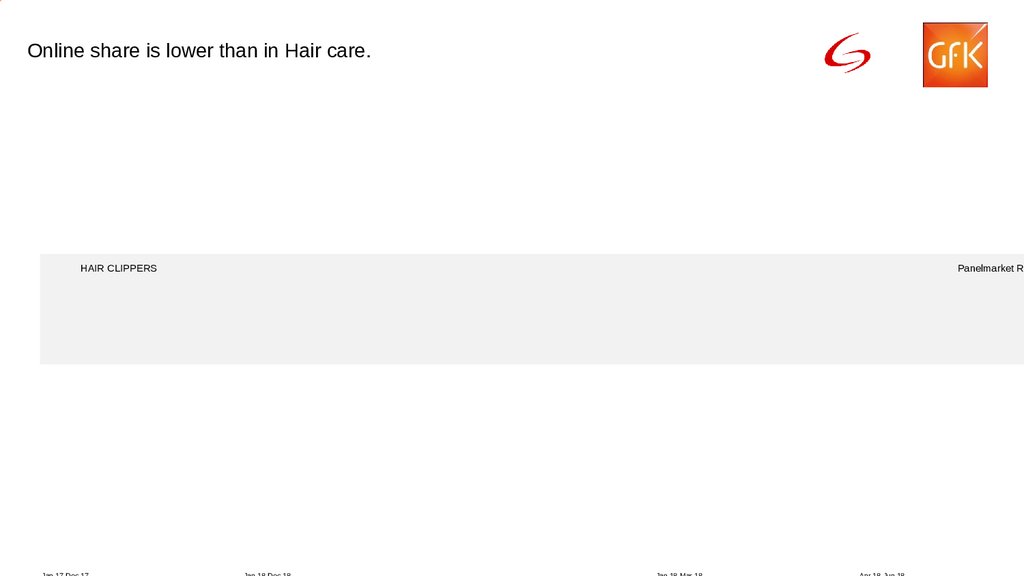

South Africa

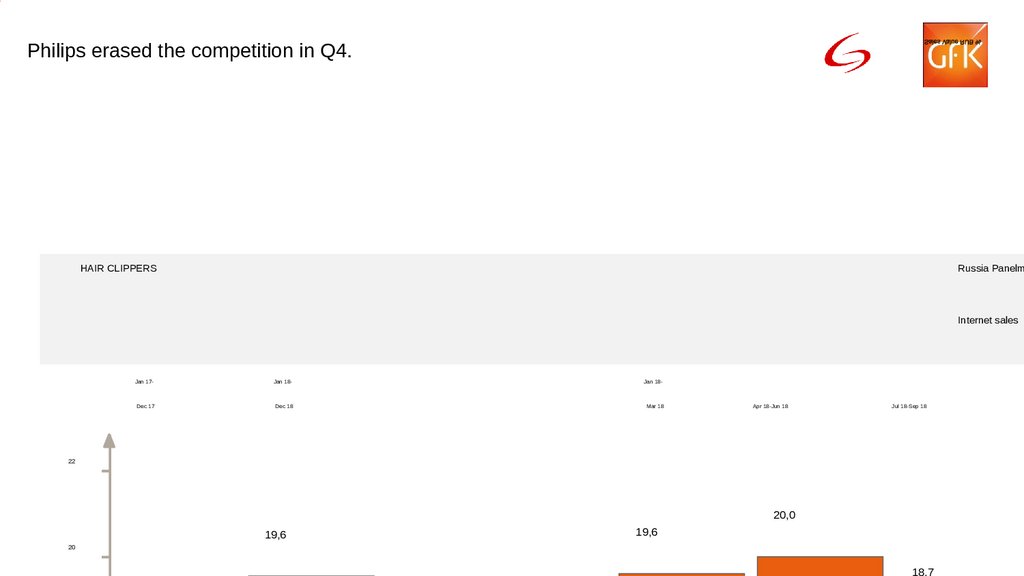

40

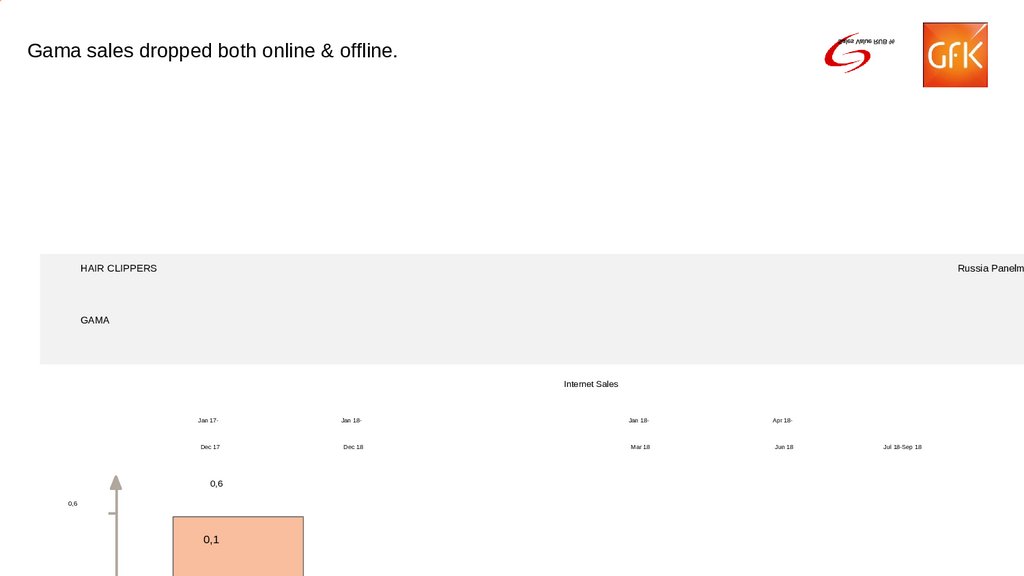

20

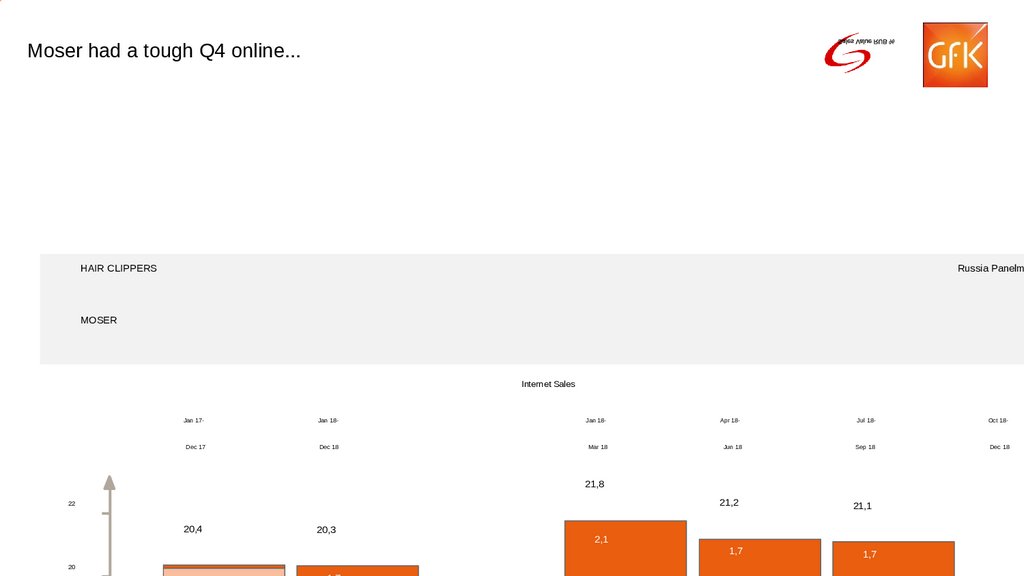

24 22 20 22 23

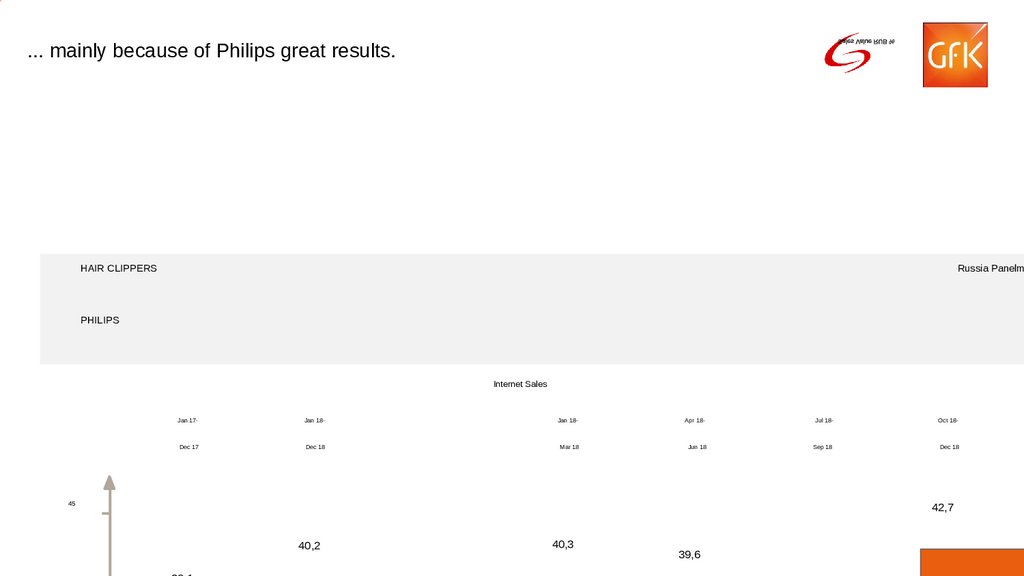

0

20

0

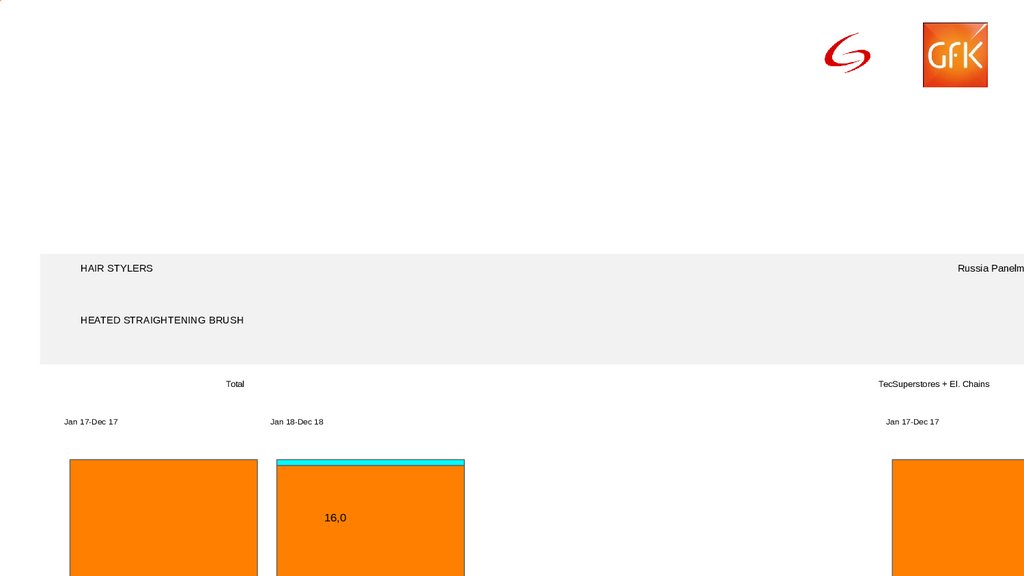

TCG = CE, IT, OE, MTG, Photo, Telecom, SDA, PersDiag, MDA

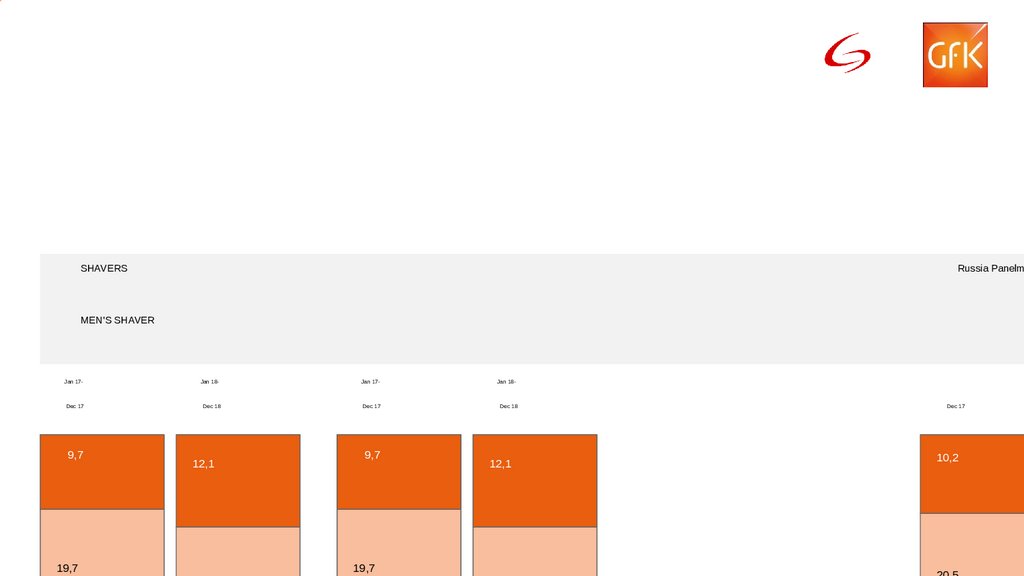

Japan

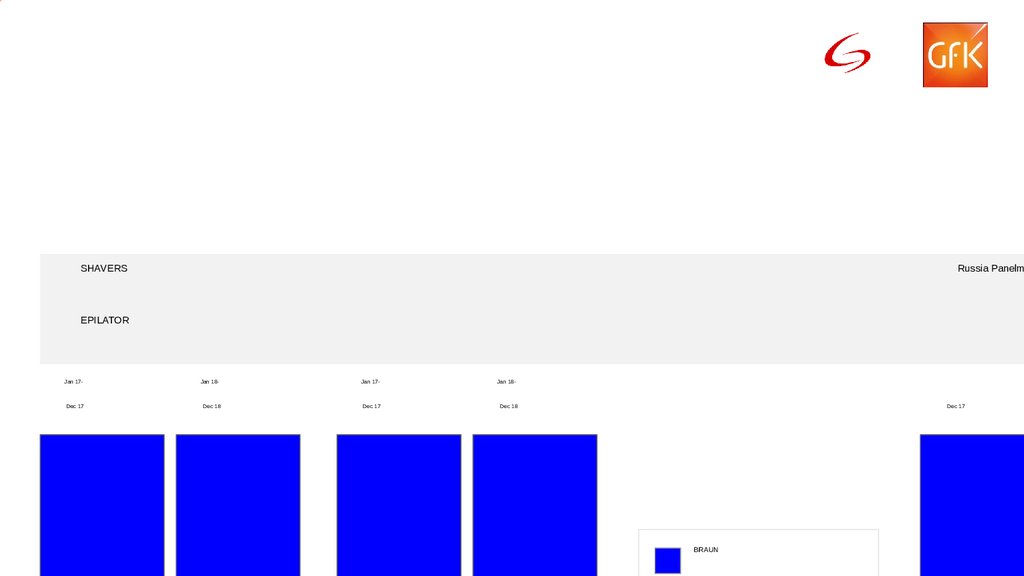

40

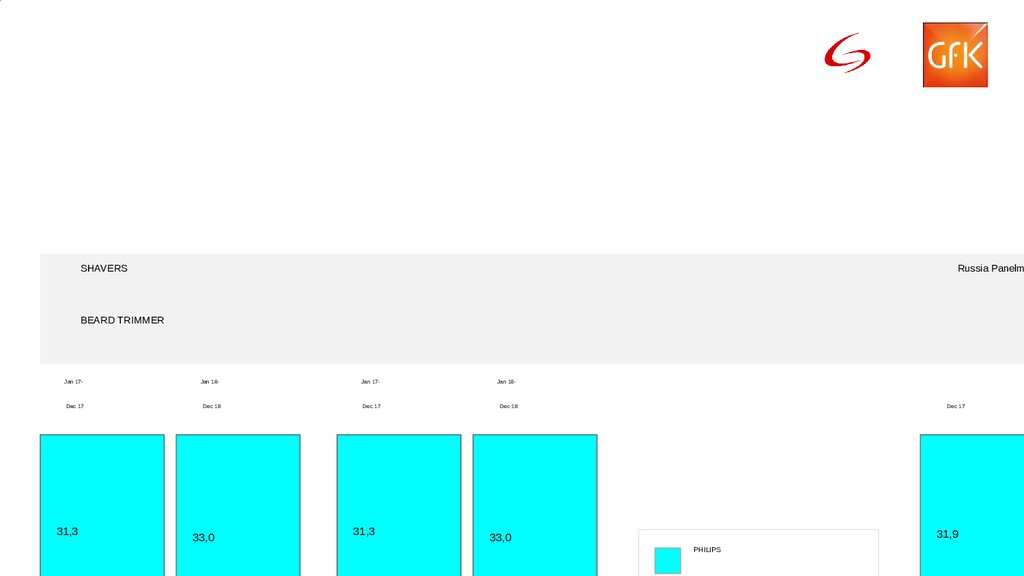

Jan-Sep 16

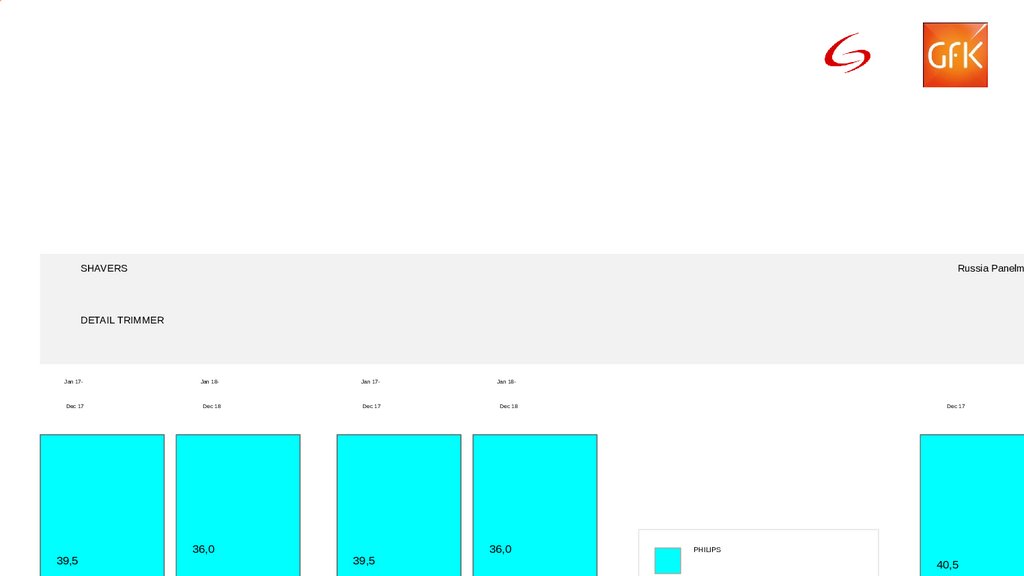

Jan-Sep 15

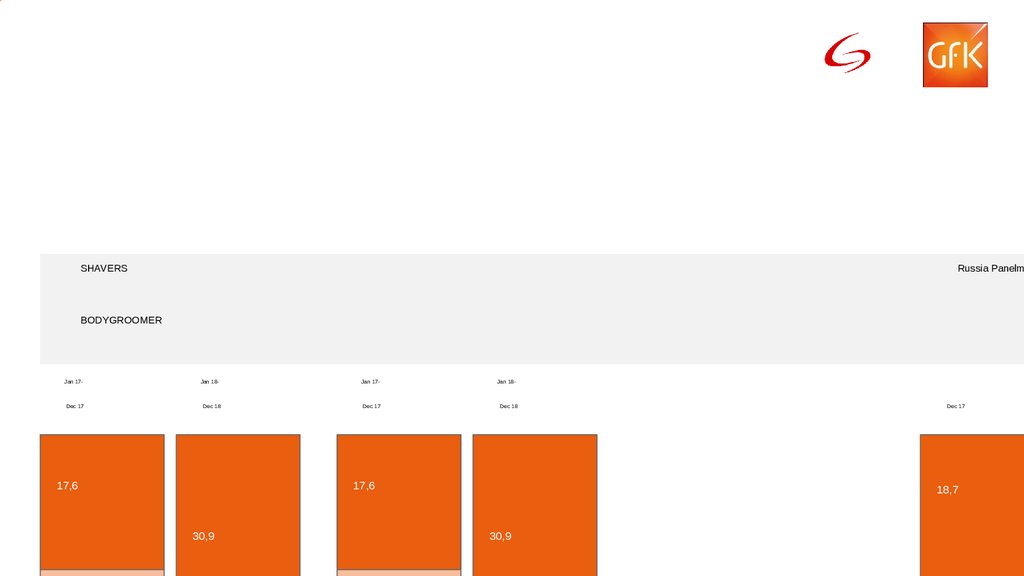

China

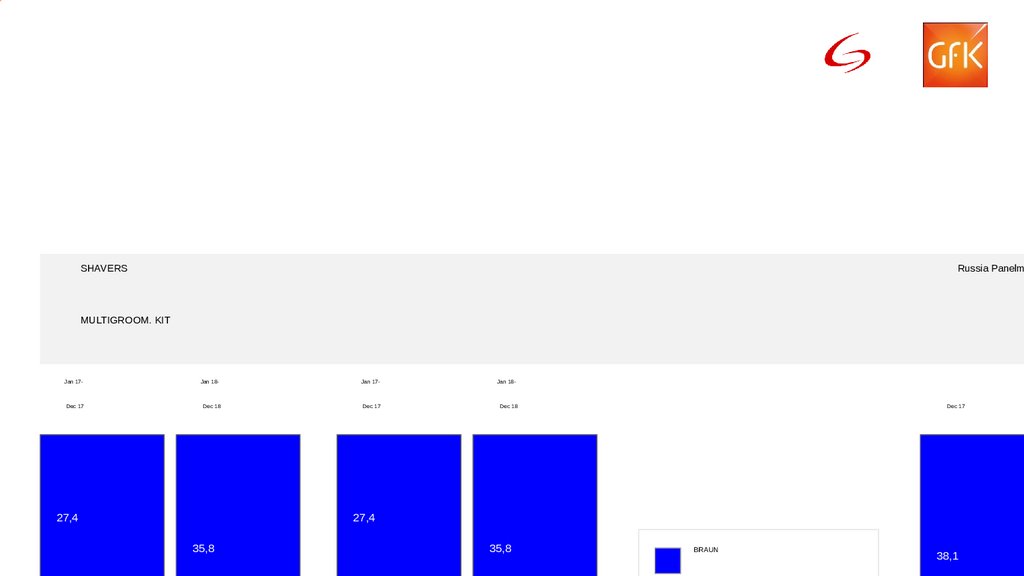

5

5 5 7

11

28 33

20

0

7 8 8 9

6

7.

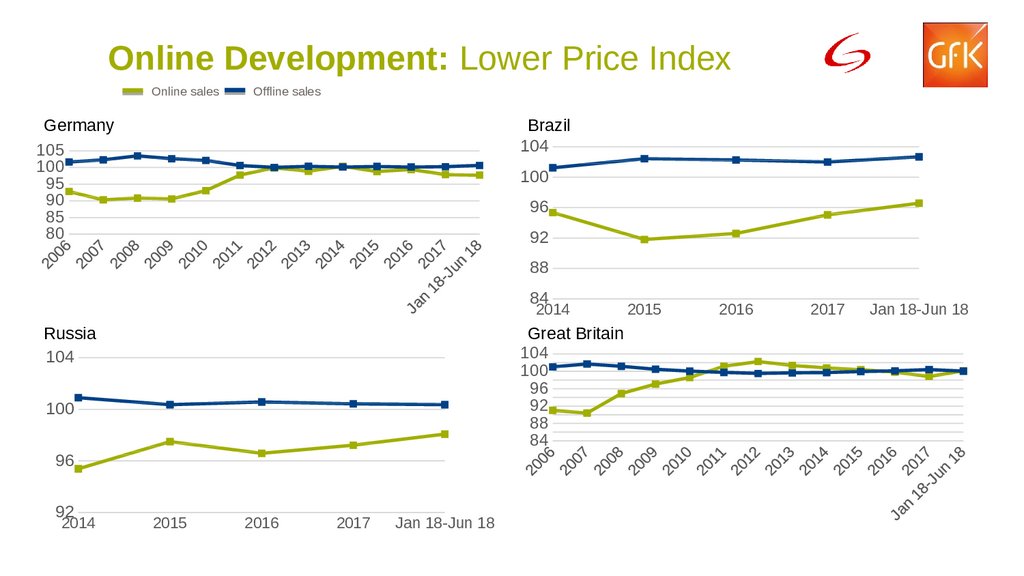

3Online Development: Lower Price Index

Online sales

Offline sales

Germany

105

100

95

90

85

80

Brazil

104

100

96

92

88

84

2014

Russia

104

Great Britain

104

100

96

92

88

84

100

96

92

2014

2015

2016

2017

Jan 18-Jun 18

2015

2016

2017

Jan 18-Jun 18

8.

3Online in Russia: Big Investments

Retail

Vendors

launching new projects

developing monobrand chains

9.

10.

Macro & Consumer11.

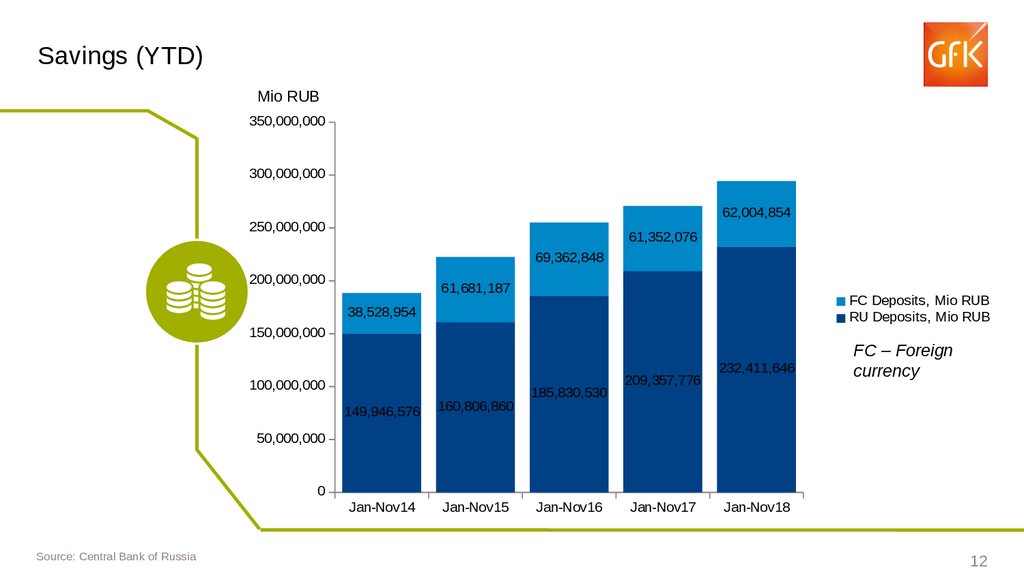

Savings (YTD)Mio RUB

350,000,000

300,000,000

+15%

+18%

250,000,000

200,000,000

19%

38,528,954

19

26%

23

29

29%

69,362,848

81%

22%

21

62,004,854

61,352,076

61,681,187

27

24%

150,000,000

100,000,000

+6%

+9%

71%

76%

149,946,576

81

160,806,860

73

Jan-Nov14

Jan-Nov15

185,830,530

74%

77

209,357,776

78%

79

232,411,646

FC Deposits, Mio RUB

RU Deposits, Mio RUB

FС – Foreign

currency

71

50,000,000

0

Source: Central Bank of Russia

Jan-Nov16

Jan-Nov17

Jan-Nov18

12

12. Savings (YTD)

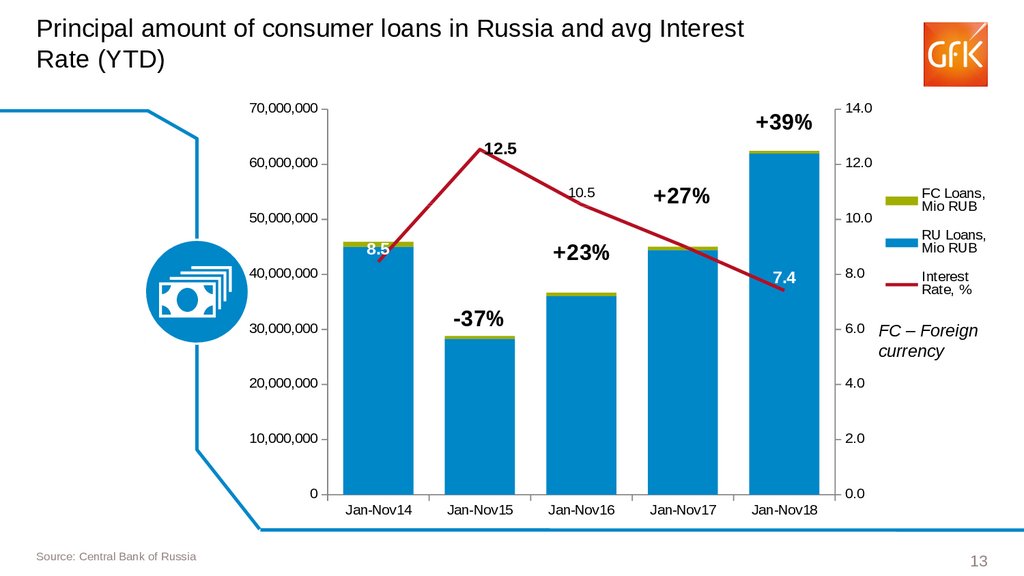

Principal amount of consumer loans in Russia and avg InterestRate (YTD)

70,000,000

+39%

12.5

60,000,000

12.0

10.5

50,000,000

+23%

8.5

+27%

10.0

9.0

40,000,000

-37%

8.0

6.0

20,000,000

4.0

10,000,000

2.0

0

Interest

Rate, %

FС – Foreign

currency

0.0

Jan-Nov14

Source: Central Bank of Russia

FC Loans,

Mio RUB

RU Loans,

Mio RUB

7.4

30,000,000

14.0

Jan-Nov15

Jan-Nov16

Jan-Nov17

Jan-Nov18

13

13. Principal amount of consumer loans in Russia and avg Interest Rate (YTD)

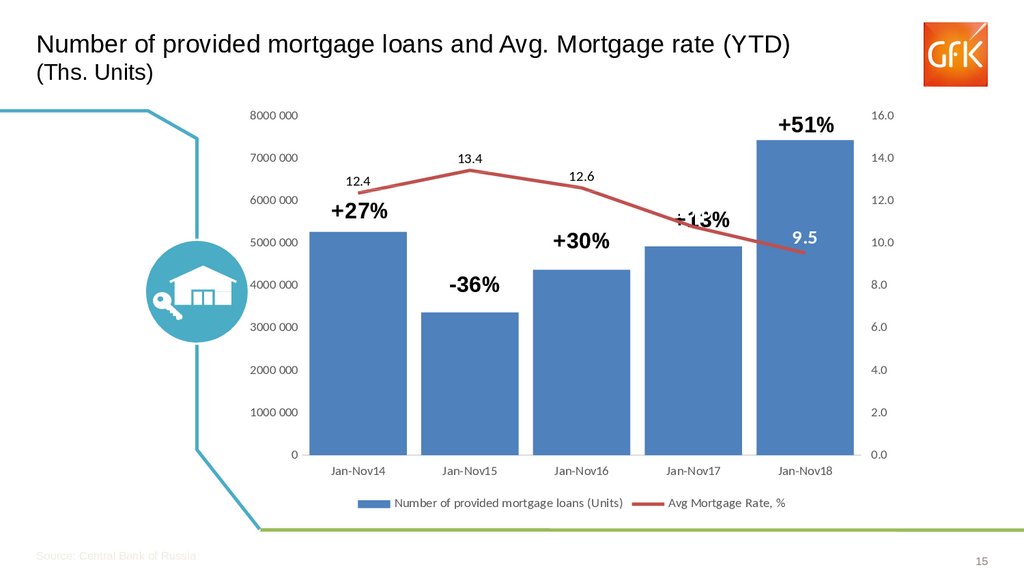

Number of provided mortgage loans and Avg. Mortgage rate (YTD)(Ths. Units)

8000 000

+51%

7000 000

14.0

13.4

12.6

12.4

6000 000

+27%

+30%

5000 000

12.0

10.8

+13%

9.5

-36%

4000 000

10.0

8.0

3000 000

6.0

2000 000

4.0

1000 000

2.0

0

0.0

Jan-Nov14

Jan-Nov15

Jan-Nov16

Number of provided mortgage loans (Units)

Source: Central Bank of Russia

16.0

Jan-Nov17

Jan-Nov18

Avg Mortgage Rate, %

15

14. Mortgage volume in Russia and Avg Mortgage rate(YTD) (changes to previous year, %)

General MarketTrends

15. Number of provided mortgage loans and Avg. Mortgage rate (YTD) (Ths. Units)

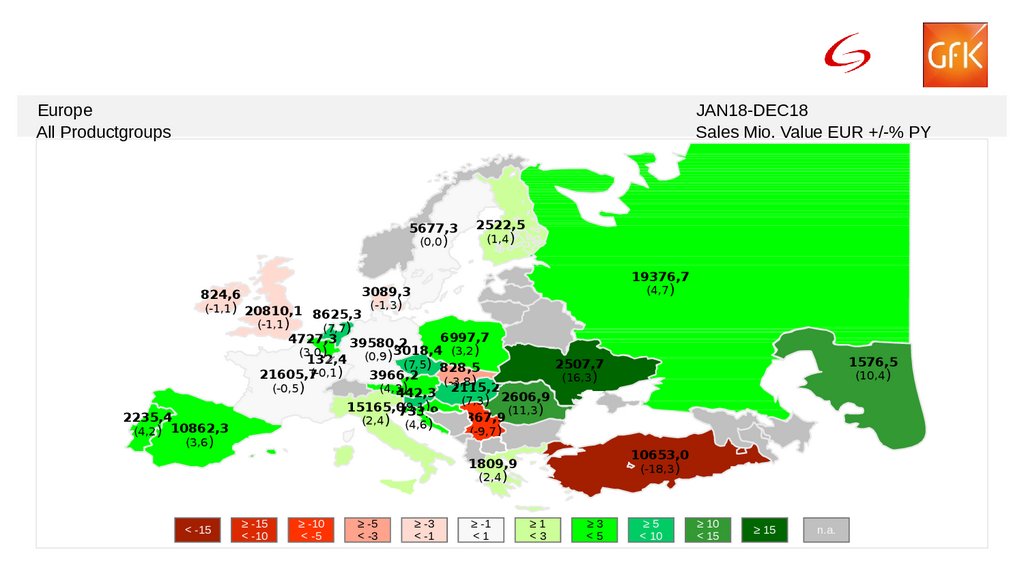

EuropeAll Productgroups

JAN18-DEC18

Sales Mio. Value EUR +/-% PY

5677,3

(0,0)

2522,5

(1,4)

19376,7

(4,7)

3089,3

824,6

(-1,3)

(-1,1) 20810,1

8625,3

(-1,1)

(7,7)

2235,4

(4,2) 10862,3

6997,7

4727,3 39580,2

3018,4 (3,2)

(3,0)

132,4 (0,9) (7,5)

2507,7

828,5

(-0,1)

21605,7

3966,2

(16,3)

(-3,8)

2115,2

(-0,5)

(4,3

)

442,3

2606,9

(7,3)

(9,1)

15165,0733,9

(11,3)

367,9

(2,4)

(4,6)

(3,6)

10653,0

(-18,3)

(2,4)

≥ -15

< -10

≥ -10

< -5

≥ -5

< -3

≥ -3

< -1

(10,4)

(-9,7)

1809,9

< -15

1576,5

≥ -1

<1

≥1

<3

≥3

<5

≥5

< 10

≥ 10

< 15

≥ 15

n.a.

16.

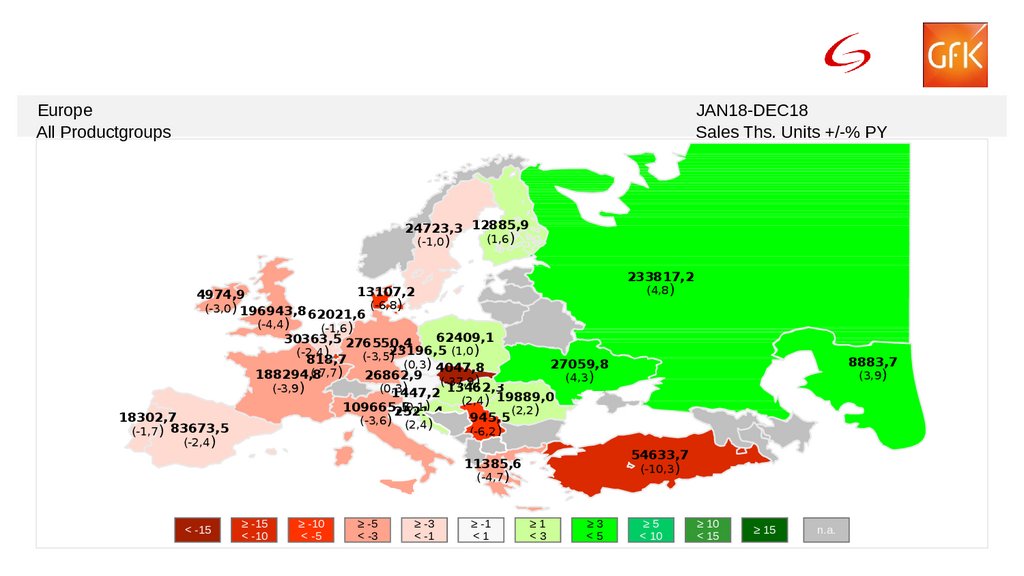

EuropeAll Productgroups

JAN18-DEC18

Sales Ths. Units +/-% PY

24723,3 12885,9

(-1,0)

(1,6)

233817,2

(4,8)

13107,2

4974,9

(-6,8)

(-3,0) 196943,8

62021,6

(-4,4)

18302,7

(-1,7) 83673,5

(-1,6)

62409,1

30363,5 276550,4

23196,5 (1,0)

(-2,4)

818,7 (-3,5) (0,3)

27059,8

4047,8

(-7,7)

188294,8

26862,9 (-37,9)

(4,3)

13462,3

(-3,9)

(0,3

)

1447,2

19889,0

(2,4)

(0,1)

109665,5

(2,2)

2521,4

1945,5

(-3,6)

(2,4)

(-2,4)

54633,7

(-10,3)

(-4,7)

≥ -15

< -10

≥ -10

< -5

≥ -5

< -3

≥ -3

< -1

(3,9)

(-6,2)

11385,6

< -15

8883,7

≥ -1

<1

≥1

<3

≥3

<5

≥5

< 10

≥ 10

< 15

≥ 15

n.a.

17.

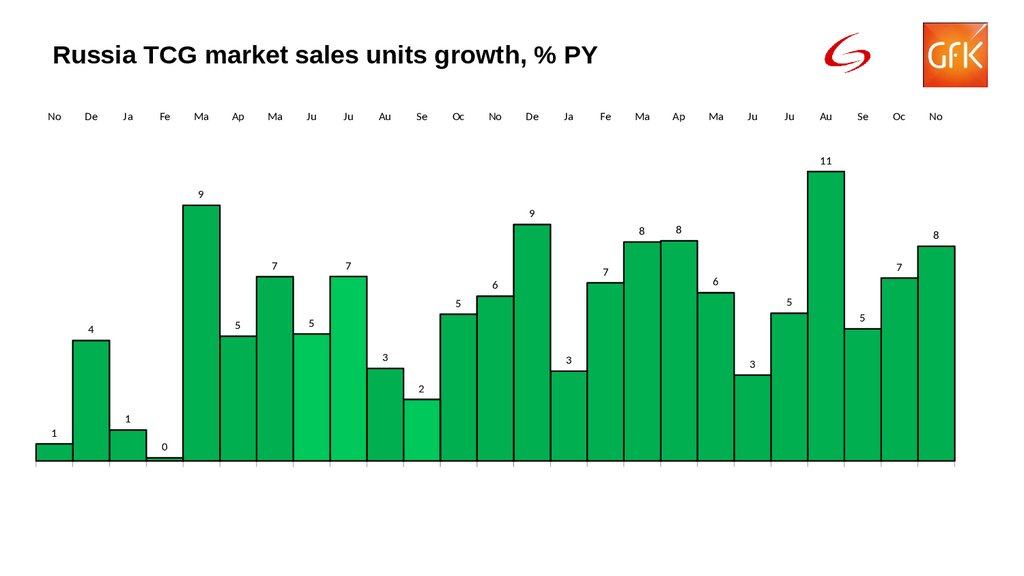

Russia TCG market sales units growth, % PYNo

De

Ja

Fe

Ma

Ap

Ma

Ju

Ju

Au

Se

Oc

No

De

Ja

Fe

Ma

Ap

Ma

Ju

Ju

Au

Se

Oc

No

11

9

9

8

7

7

7

6

8

8

7

6

5

5

5

4

5

5

3

3

2

1

1

0

3

18.

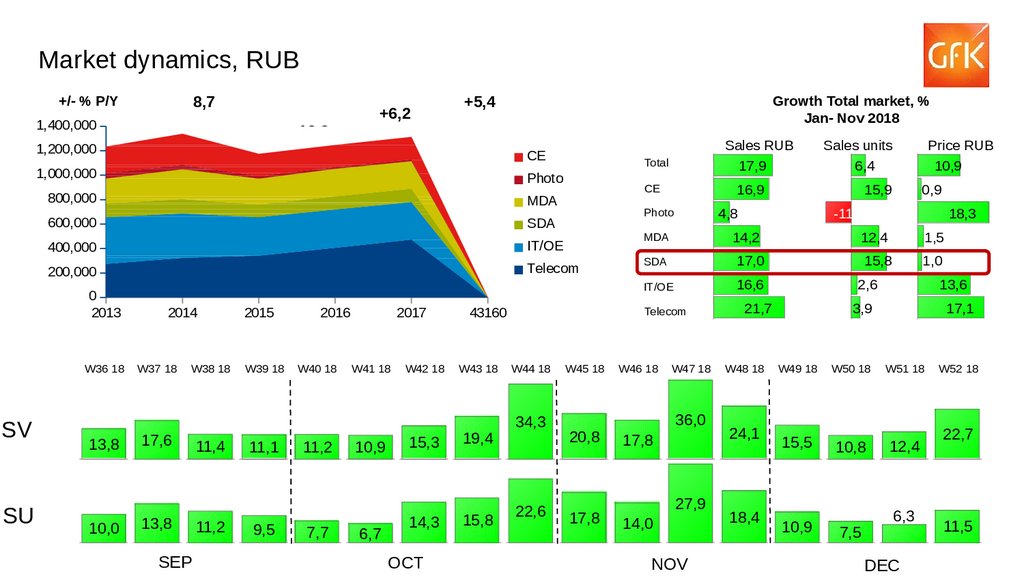

Market dynamics, RUB8,7

+/- % P/Y

+6,2

1,400,000

-12,3

CE

1,000,000

Photo

600,000

SDA

400,000

IT/OE

200,000

Telecom

W37 18

13,8

17,6

10,0

13,8

W38 18

SEP

11,4

11,2

2015

W39 18

11,1

9,5

2016

W40 18

11,2

7,7

2017

W41 18

10,9

6,7

W42 18

W43 18

15,3

19,4

14,3

15,8

OCT

34,3

22,6

W45 18

0,9

-11,4

18,3

14,2

12,4

1,5

SDA

17,0

15,8

1,0

IT/OE

16,6

MDA

Telecom

W44 18

Price RUB

10,9

15,9

4,8

Photo

43160

Sales units

6,4

16,9

CE

MDA

2014

Sales RUB

17,9

Total

800,000

W36 18

SU

Growth Total market, %

Jan- Nov 2018

1,200,000

0

2013

SV

+5,4

W46 18

W47 18

36,0

20,8

17,8

17,8

14,0

27,9

NOV

2,6

21,7

W48 18

24,1

18,4

13,6

3,9

17,1

W49 18

W50 18

W51 18

15,5

10,8

12,4

10,9

7,5

6,3

DEC

W52 18

22,7

11,5

19.

Small Domestic Appliances20.

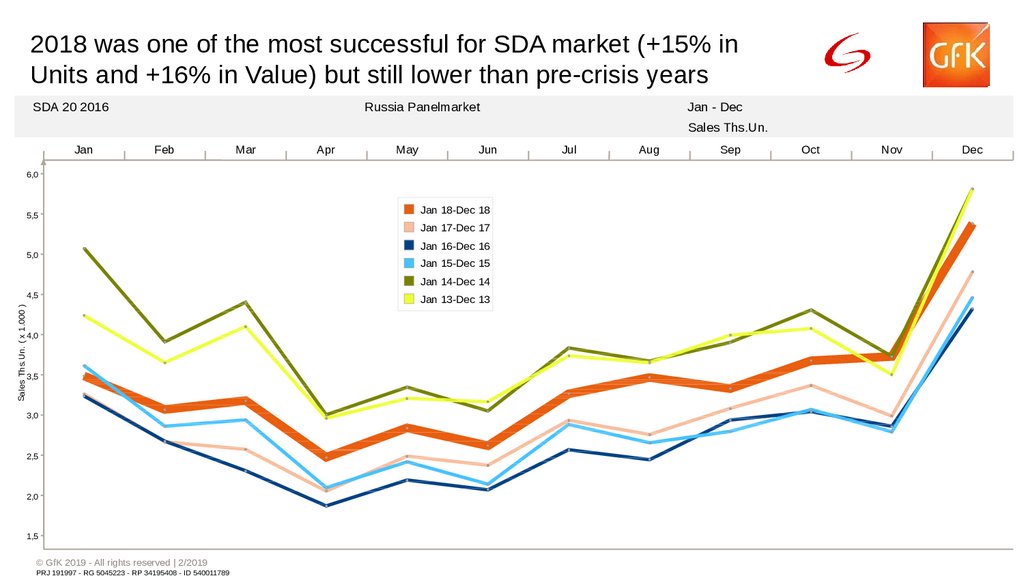

2018 was one of the most successful for SDA market (+15% inUnits and +16% in Value) but still lower than pre-crisis years

SDA 20 2016

Russia Panelmarket

Jan - Dec

Sales Ths.Un.

Jan

Feb

Mar

Apr

May

Jun

6,0

5,5

Jan 18-Dec 18

Jan 17-Dec 17

5,0

Jan 16-Dec 16

Jan 15-Dec 15

Jan 14-Dec 14

Sales Ths.Un. ( x 1.000 )

4,5

4,0

3,5

3,0

2,5

2,0

1,5

© GfK 2019 - All rights reserved | 2/2019

PRJ 191997 - RG 5045223 - RP 34195408 - ID 540011789

Jan 13-Dec 13

Jul

Aug

Sep

Oct

Nov

Dec

21. Market dynamics, RUB

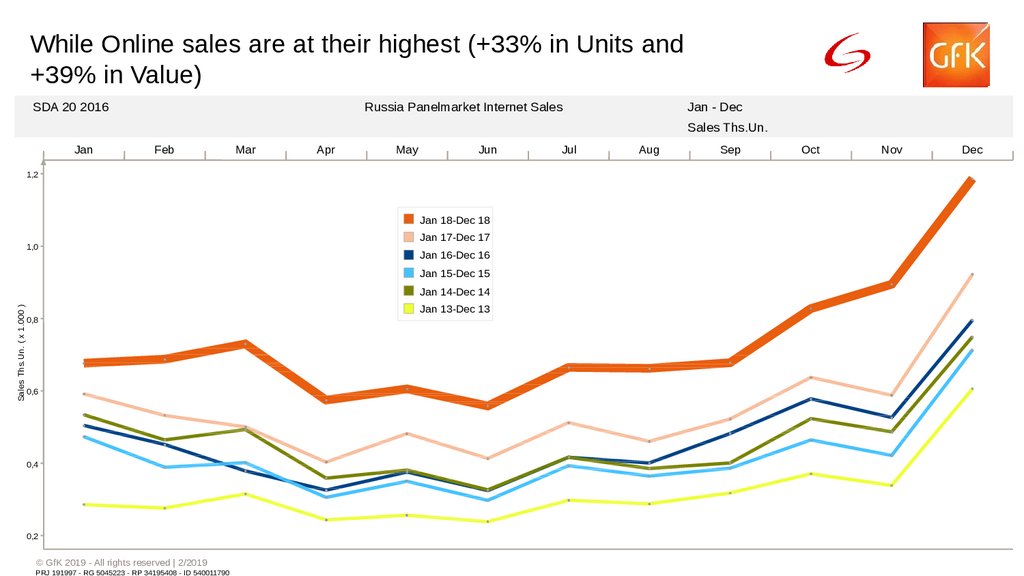

While Online sales are at their highest (+33% in Units and+39% in Value)

SDA 20 2016

Russia Panelmarket Internet Sales

Jan - Dec

Sales Ths.Un.

Jan

Feb

Mar

Apr

May

Jun

1,2

Jan 18-Dec 18

1,0

Jan 17-Dec 17

Jan 16-Dec 16

Jan 15-Dec 15

Sales Ths.Un. ( x 1.000 )

Jan 14-Dec 14

0,8

0,6

0,4

0,2

© GfK 2019 - All rights reserved | 2/2019

PRJ 191997 - RG 5045223 - RP 34195408 - ID 540011790

Jan 13-Dec 13

Jul

Aug

Sep

Oct

Nov

Dec

22.

Pure Players is the most skyrocketing channel in SDASDA 20

Jan 17-Dec 17

Russia Panelm

Jan 18-Dec 18

Mar 18-Apr 18

May 18-Jun 18

23.

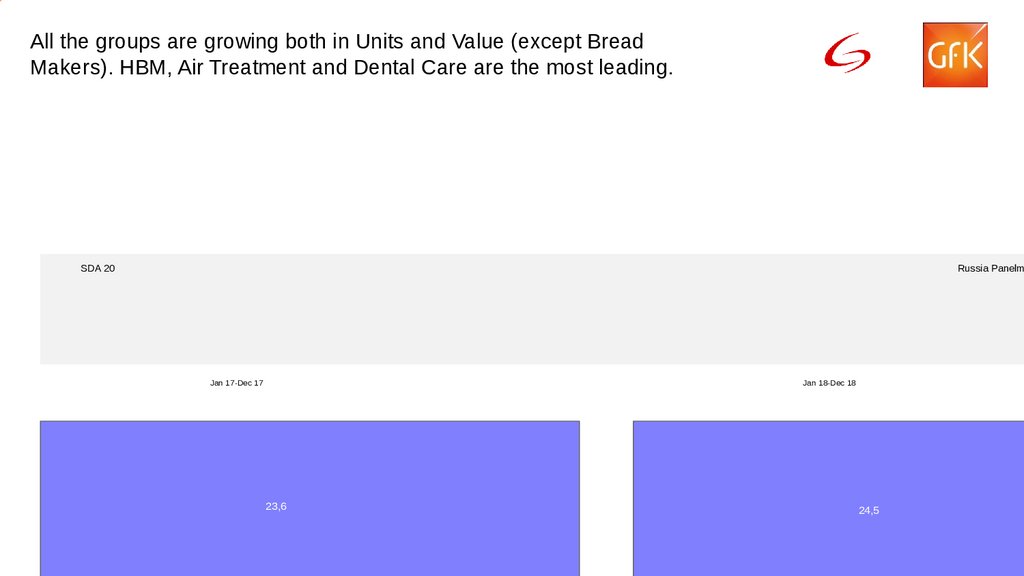

All the groups are growing both in Units and Value (except BreadMakers). HBM, Air Treatment and Dental Care are the most leading.

SDA 20

Russia Panelm

Jan 17-Dec 17

Jan 18-Dec 18

23,6

24,5

24.

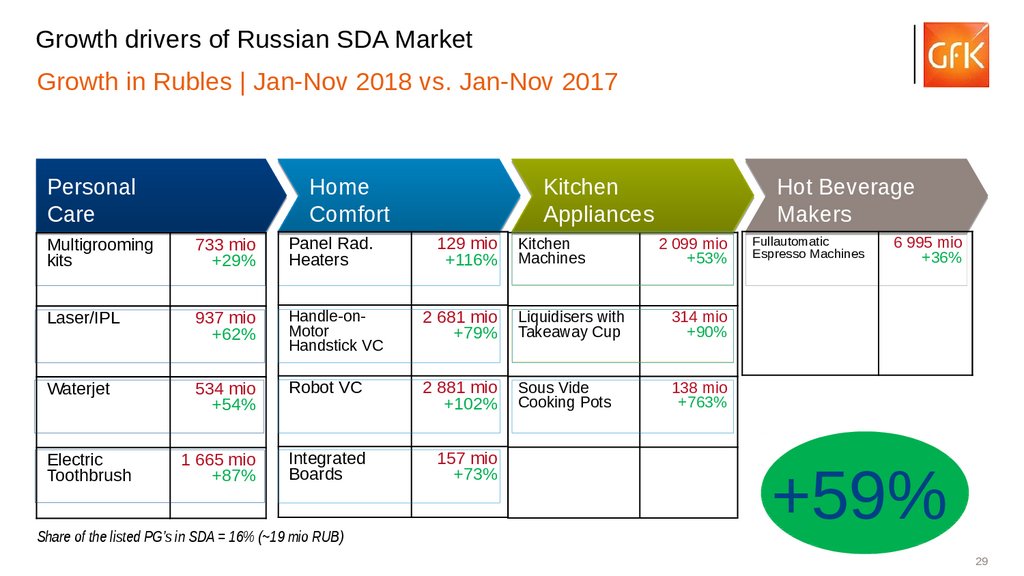

Growth drivers of Russian SDA MarketGrowth in Rubles | Jan-Nov 2018 vs. Jan-Nov 2017

Personal

Care

Home

Comfort

Kitchen

Appliances

Multigrooming

kits

733 mio

+29%

Panel Rad.

Heaters

Laser/IPL

937 mio

+62%

Handle-onMotor

Handstick VC

2 681 mio

+79%

Liquidisers with

Takeaway Cup

314 mio

+90%

Waterjet

534 mio

+54%

Robot VC

2 881 mio

+102%

Sous Vide

Cooking Pots

138 mio

+763%

1 665 mio

+87%

Integrated

Boards

157 mio

+73%

Electric

Toothbrush

Share of the listed PG’s in SDA = 16% (~19 mio RUB)

129 mio

+116%

Hot Beverage

Makers

Kitchen

Machines

2 099 mio

+53%

Fullautomatic

Espresso Machines

6 995 mio

+36%

+59%

29

25.

SDA 20Russia Panelm

2013

Dec 13

28

26,4

26

2014

Dec 14

26. GfK Sample # of Outlets Traditional Panel

SDA 20Russia Panelm

2013

Dec 13

28

26,4

GROUP PHILIPS

26

2014

Dec 14

27.

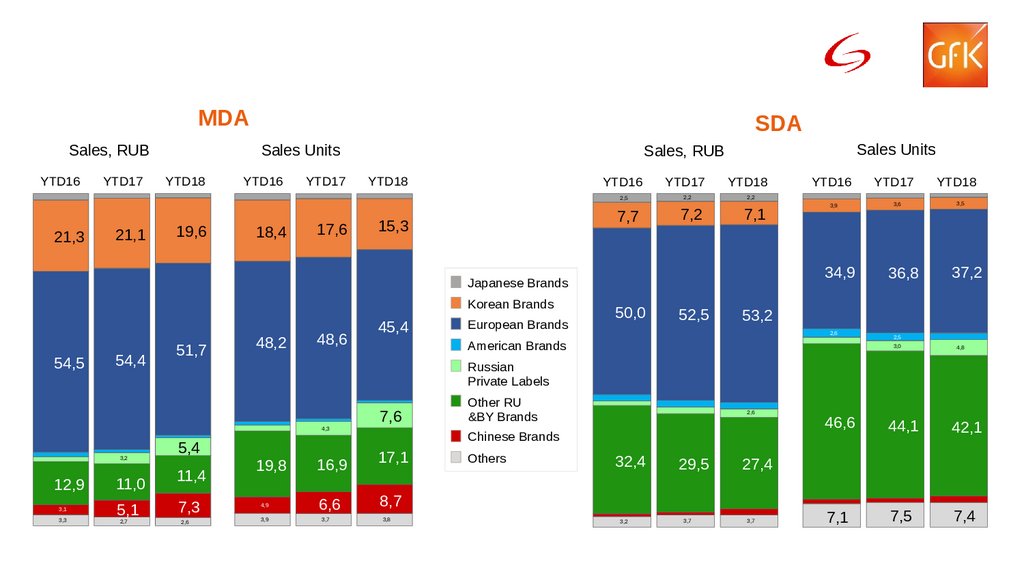

MDASales, RUB

YTD16

YTD17

SDA

Sales Units

YTD18

YTD16

YTD17

YTD18

YTD16

2,5

21,3

21,1

19,6

18,4

17,6

Sales Units

Sales, RUB

7,7

15,3

YTD17

2,2

7,2

YTD18

7,1

54,5

54,4

51,7

48,2

48,6

45,4

12,9

3,1

3,3

5,1

2,7

52,5

YTD17

YTD18

3,6

36,8

3,5

37,2

53,2

2,6

2,5

3,0

4,8

Russian

Private Labels

4,3

11,0

50,0

American Brands

7,6

3,2

European Brands

3,9

34,9

Japanese Brands

Korean Brands

YTD16

2,2

5,4

11,4

7,3

2,6

19,8

4,9

3,9

2,6

Chinese Brands

16,9

17,1

6,6

8,7

3,7

Other RU

&BY Brands

3,8

Others

32,4

3,2

29,5

3,7

46,6

44,1

42,1

7,1

7,5

7,4

27,4

3,7

28.

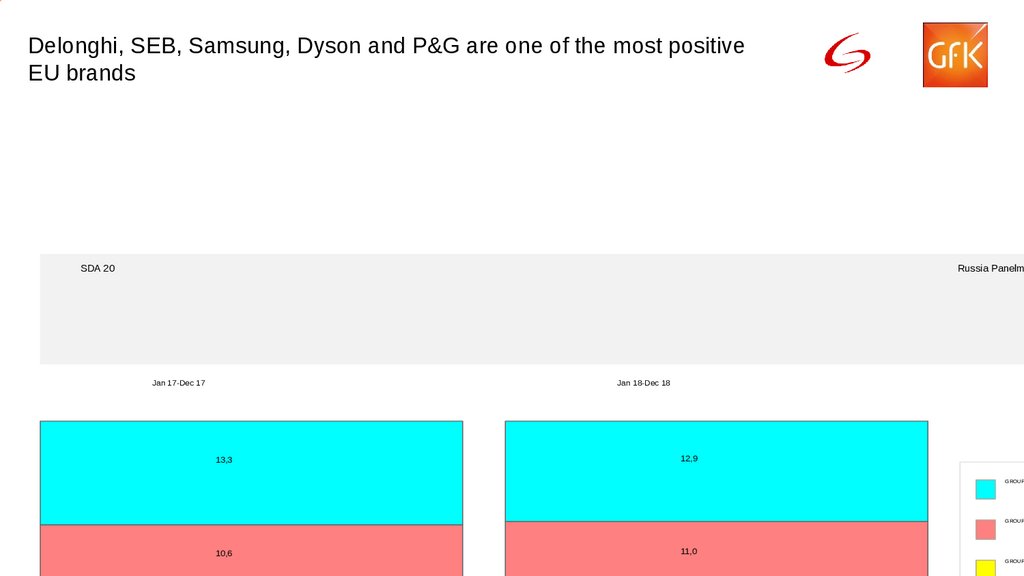

Delonghi, SEB, Samsung, Dyson and P&G are one of the most positiveEU brands

SDA 20

Russia Panelm

Jan 17-Dec 17

Jan 18-Dec 18

13,3

12,9

GROUP

GROUP

10,6

11,0

GROUP

29. Growth drivers of Russian SDA Market

30.

Hair Care categoriesHAIR CARE

Hair Dryers

Hair Stylers

31.

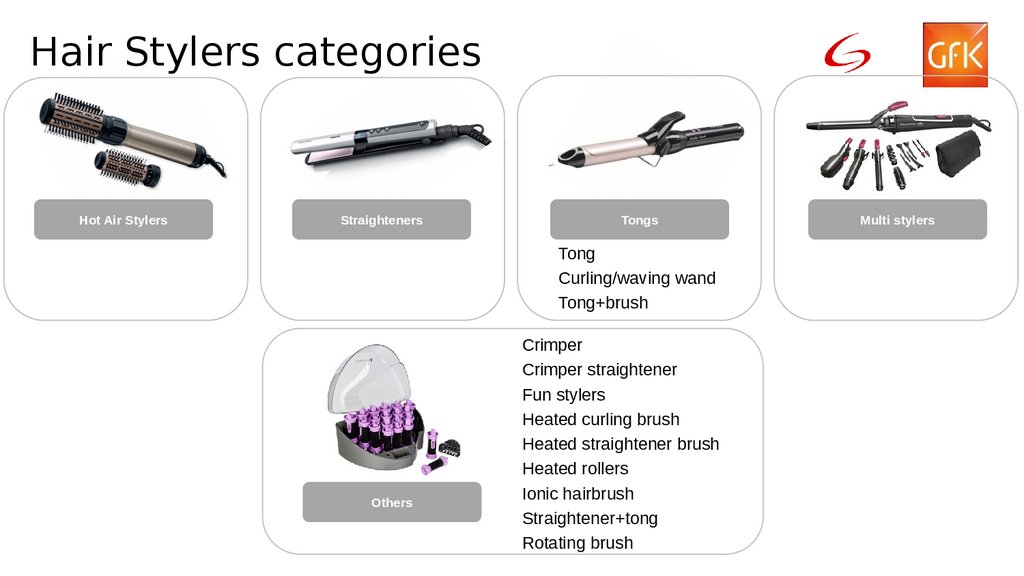

Hair Stylers categoriesHot Air Stylers

Straighteners

Tongs

Tong

Curling/waving wand

Tong+brush

Others

Crimper

Crimper straightener

Fun stylers

Heated curling brush

Heated straightener brush

Heated rollers

Ionic hairbrush

Straightener+tong

Rotating brush

Multi stylers

32. MDA & SDA manufacturers, Jan-Nov 2018

Total Haircare market showed better results in 2018 comparing to the previousyear.

HAIRCARE

Russia Panelm

Sales Units

Jan 17-Dec 17

Jan 18-Dec 18

14

12

33.

Total Gama share in 2018 is 1,6% of the market.HAIRCARE

Russia Panelm

Total

Jan 17-Dec 17

Jan 18-Dec 18

34.

Rowenta & Philips strengthened their leaderships in Q4.HAIRCARE

Russia Panelm

35.

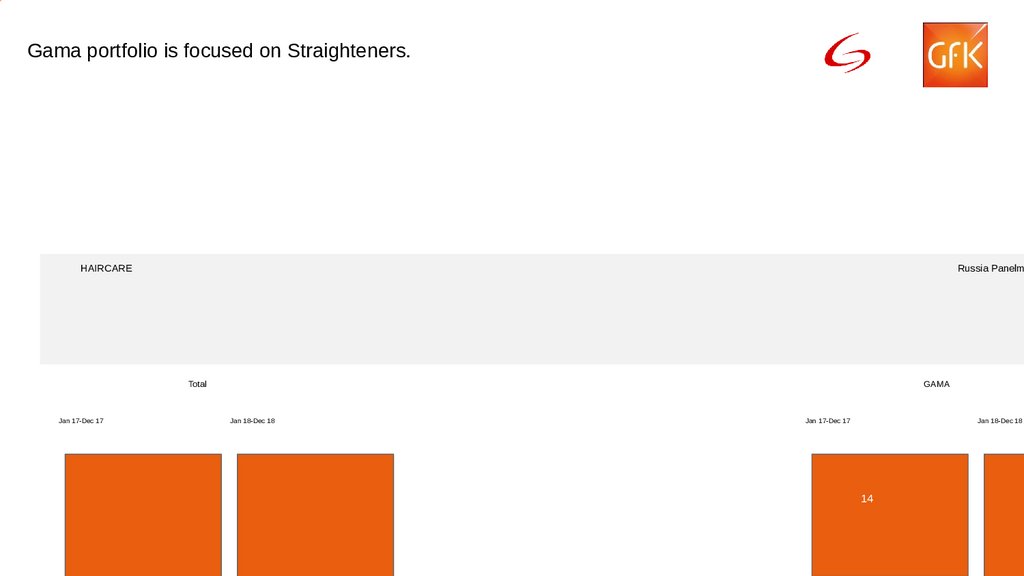

Gama portfolio is focused on Straighteners.HAIRCARE

Russia Panelm

Total

Jan 17-Dec 17

GAMA

Jan 18-Dec 18

Jan 17-Dec 17

Jan 18-Dec 18

14

36.

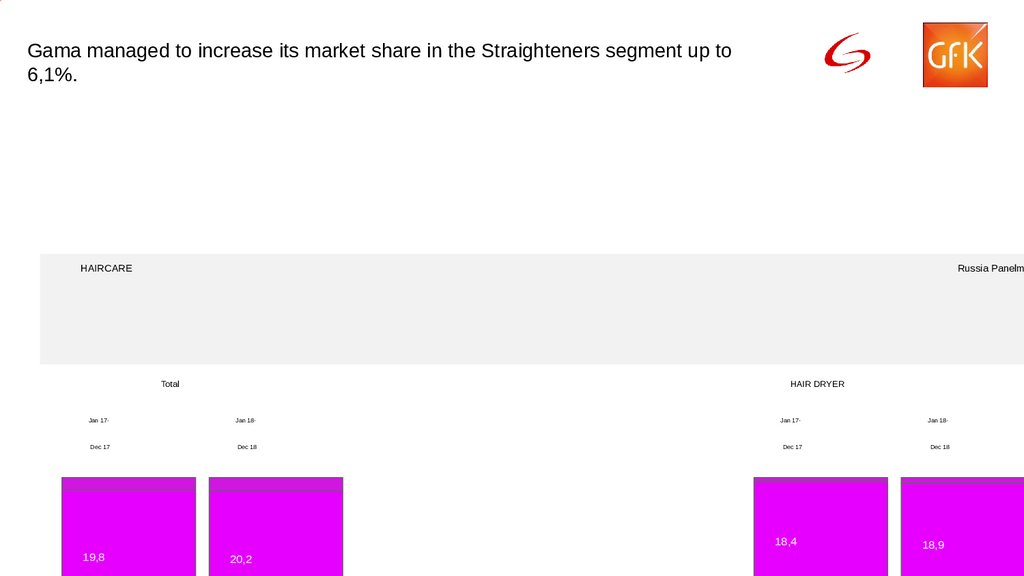

Gama managed to increase its market share in the Straighteners segment up to6,1%.

HAIRCARE

Russia Panelm

Total

HAIR DRYER

Jan 17-

Jan 18-

Jan 17-

Jan 18-

Dec 17

Dec 18

Dec 17

Dec 18

18,4

19,8

20,2

18,9

37.

In Q4 Internet sales reached 24% in value.HAIRCARE

Panelmarket R

38.

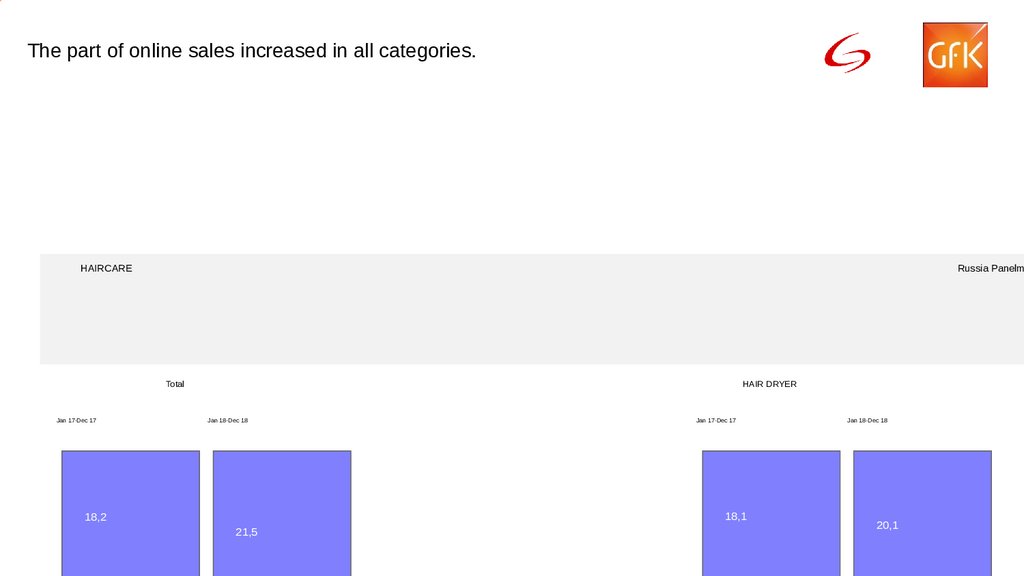

The part of online sales increased in all categories.HAIRCARE

Russia Panelm

Total

Jan 17-Dec 17

HAIR DRYER

Jan 18-Dec 18

Jan 17-Dec 17

18,1

18,2

21,5

Jan 18-Dec 18

20,1

39.

40.

Gama share reached its highest level in Q3.HAIR DRYERS

Russia Panelm

GAMA

Jan 17-Dec 17

Jan 18-Dec 18

0,8

GH0302 DIAMOND

ION CERAMIC Jun17

0,7

0,6

GH0302 May17

41.

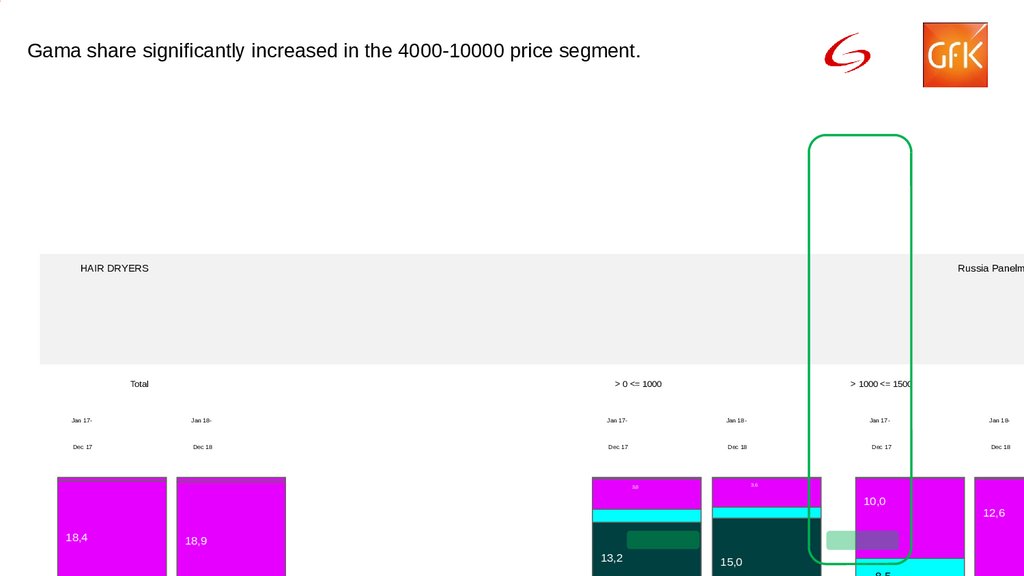

Gama share significantly increased in the 4000-10000 price segment.HAIR DRYERS

Russia Panelm

Total

> 0 <= 1000

> 1000 <= 1500

Jan 17-

Jan 18-

Jan 17-

Jan 18-

Jan 17-

Jan 18-

Dec 17

Dec 18

Dec 17

Dec 18

Dec 17

Dec 18

3,6

3,8

10,0

18,4

18,9

13,2

15,0

12,6

42.

Gama managed to improve its distribution year on year. However the leadingbrands have better KPIs.

HAIR DRYERS

24

22

Russia Panelm

43.

Dyson is now the brand number 3...HAIR DRYERS

Russia Panelm

44.

Technical characteristics© GfK 2015 - All rights reserved

52

45.

... which is influencing the BLDC motor share…HAIR DRYERS

Russia Panelm

Jan 17-Dec 17

Jan 18-Dec 18

25,3

22,9

46.

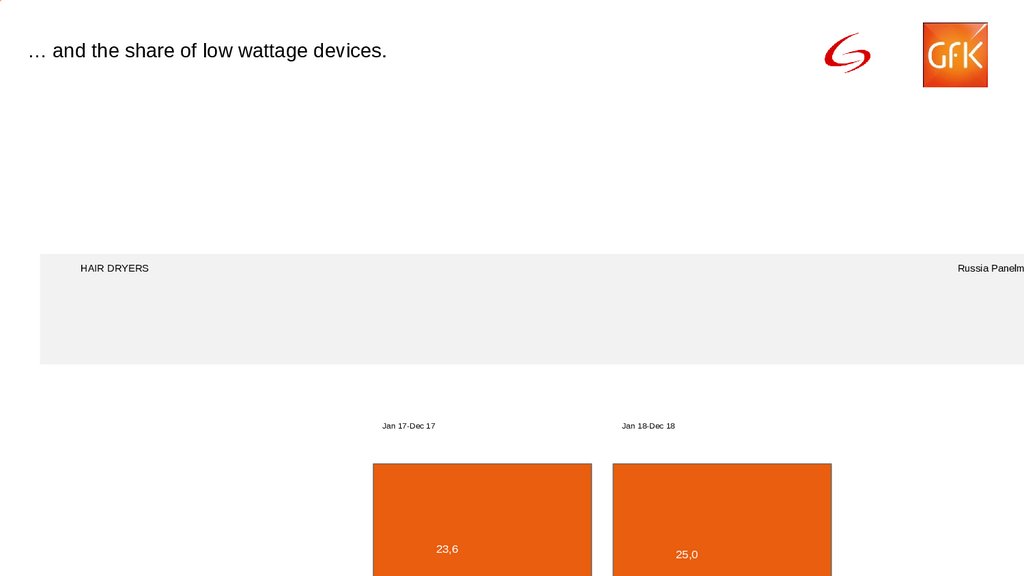

… and the share of low wattage devices.HAIR DRYERS

Russia Panelm

Jan 17-Dec 17

Jan 18-Dec 18

23,6

25,0

47.

Channels© GfK 2015 - All rights reserved

55

48.

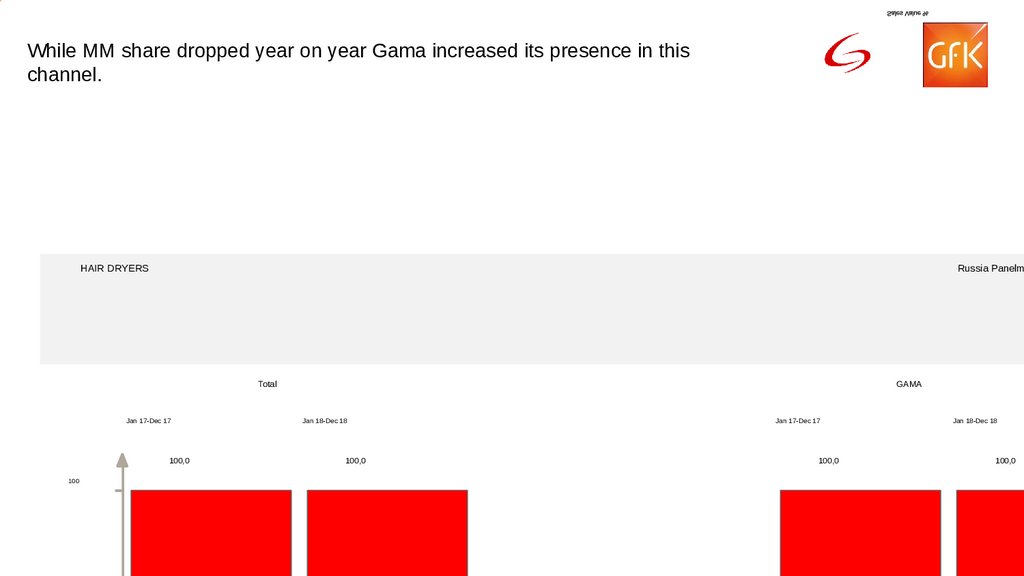

While MM share dropped year on year Gama increased its presence in thischannel.

HAIR DRYERS

Russia Panelm

Total

Jan 17-Dec 17

100,0

100

GAMA

Jan 18-Dec 18

100,0

Jan 17-Dec 17

100,0

Jan 18-Dec 18

100,0

49.

In MM Gama managed to hold more than 1% of market share.HAIR DRYERS

Russia Panelm

GAMA

TecSuperstores + El. Chains

1,4

Jan 17-

Jan 18-

Jan 18-

Apr 18-

Jul 18-

Oct 18-

Dec 17

Dec 18

Mar 18

Jun 18

Sep 18

Dec 18

50.

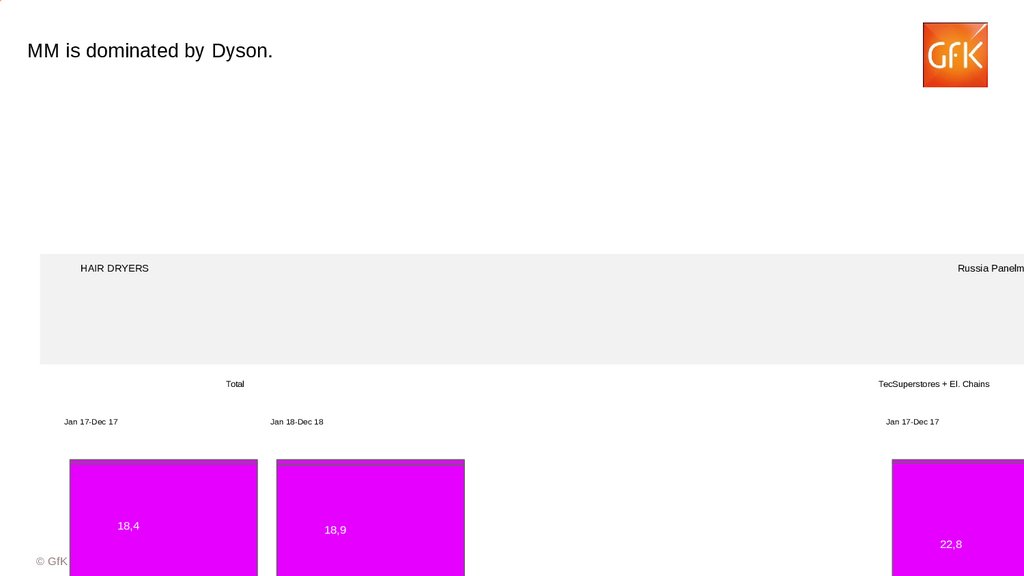

MM is dominated by Dyson.HAIR DRYERS

Russia Panelm

Total

Jan 17-Dec 17

18,4

TecSuperstores + El. Chains

Jan 18-Dec 18

Jan 17-Dec 17

18,9

22,8

© GfK 2015 - All rights reserved

58

51.

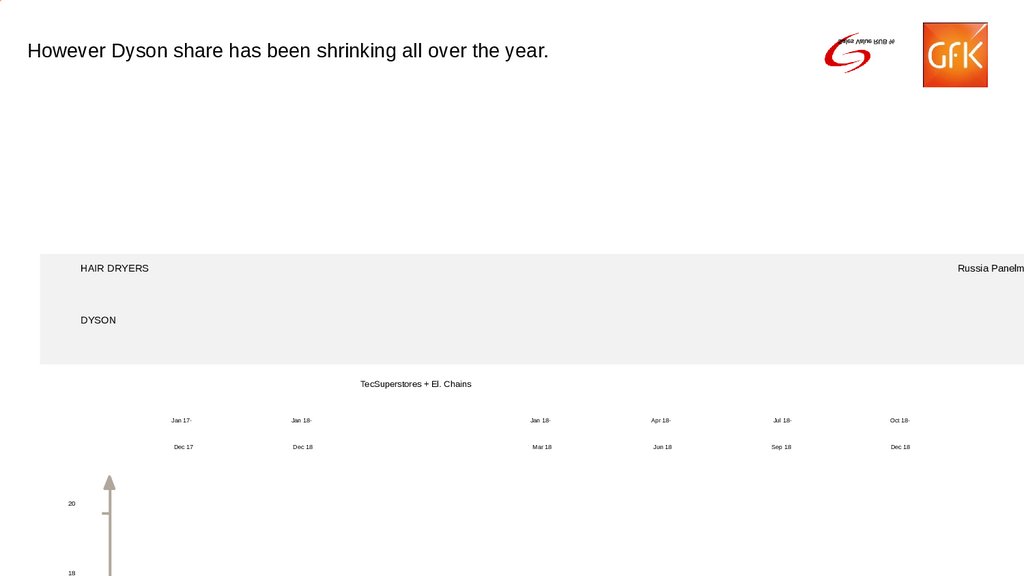

However Dyson share has been shrinking all over the year.HAIR DRYERS

Russia Panelm

DYSON

TecSuperstores + El. Chains

20

18

Jan 17-

Jan 18-

Jan 18-

Apr 18-

Jul 18-

Oct 18-

Dec 17

Dec 18

Mar 18

Jun 18

Sep 18

Dec 18

52. Technical characteristics

Philips increase year on year is more impressive in MM.HAIR DRYERS

Russia Panelm

PHILIPS

TecSuperstores + El. Chains

18

Jan 17-

Jan 18-

Jan 18-

Apr 18-

Jul 18-

Dec 17

Dec 18

Mar 18

Jun 18

Sep 18

53.

Rowenta remains a small player in MM…HAIR DRYERS

Russia Panelm

ROWENTA

TecSuperstores + El. Chains

Jan 17-

Jan 18-

Jan 18-

Apr 18-

Jul 18-

Oct 18-

Dec 17

Dec 18

Mar 18

Jun 18

Sep 18

Dec 18

25,5

26

1,9

24

22,8

22,9

22,6

54.

… as well as Babyliss.HAIR DRYERS

Russia Panelm

BABYLISS

TecSuperstores + El. Chains

Jan 17-

Jan 18-

Jan 18-

Apr 18-

Jul 18-

Oct 18-

Dec 17

Dec 18

Mar 18

Jun 18

Sep 18

Dec 18

8,6

9

8,4

8,2

8,0

7,9

7,8

55. Channels

INTERNET SALES© GfK 2016 - All rights reserved

73

56.

HAIR DRYERSPanelmarket R

57.

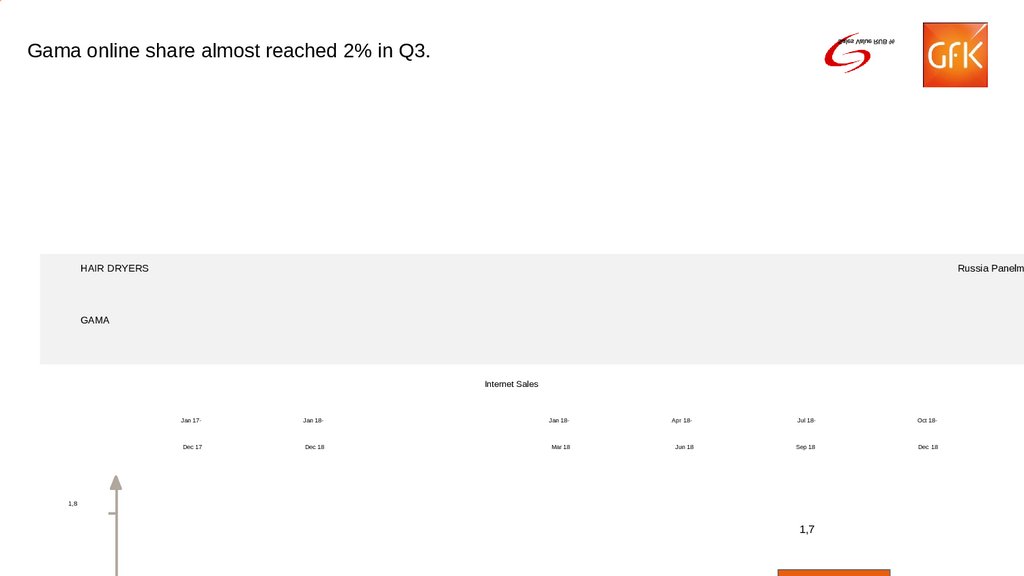

Gama online share almost reached 2% in Q3.HAIR DRYERS

Russia Panelm

GAMA

Internet Sales

Jan 17-

Jan 18-

Jan 18-

Apr 18-

Jul 18-

Oct 18-

Dec 17

Dec 18

Mar 18

Jun 18

Sep 18

Dec 18

1,8

1,7

58.

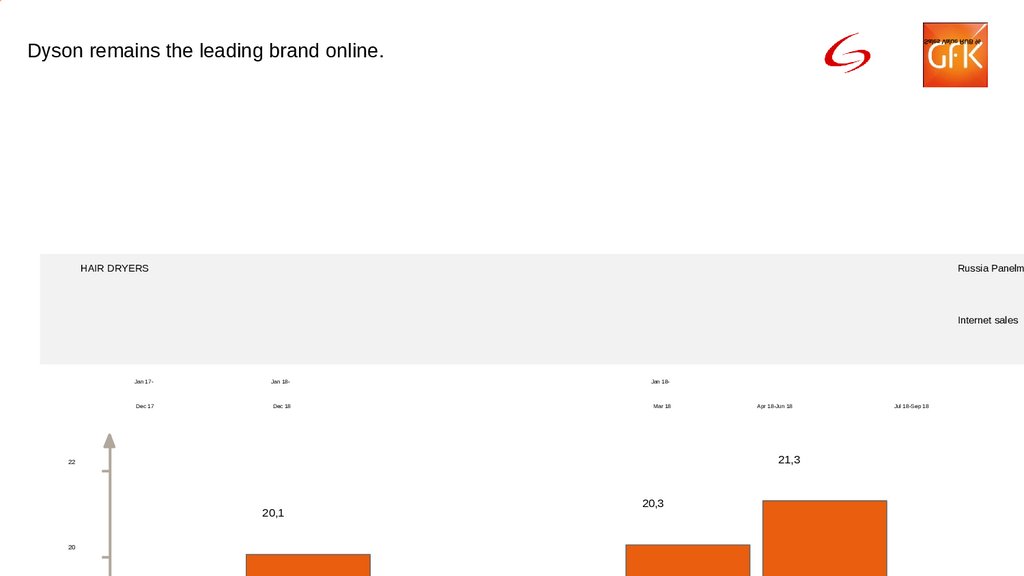

Dyson remains the leading brand online.HAIR DRYERS

Russia Panelm

Internet sales

Jan 17-

Jan 18-

Jan 18-

Dec 17

Dec 18

Mar 18

21,3

22

20,1

20

Apr 18-Jun 18

20,3

Jul 18-Sep 18

59.

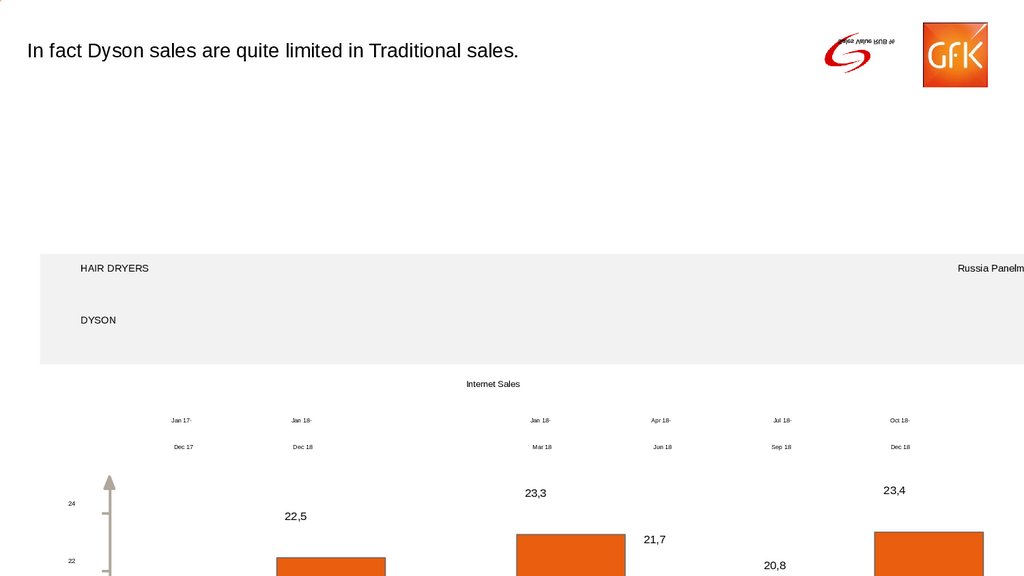

In fact Dyson sales are quite limited in Traditional sales.HAIR DRYERS

Russia Panelm

DYSON

Internet Sales

Jan 17-

Jan 18-

Jan 18-

Apr 18-

Jul 18-

Oct 18-

Dec 17

Dec 18

Mar 18

Jun 18

Sep 18

Dec 18

23,4

23,3

24

22,5

21,7

22

20,8

60.

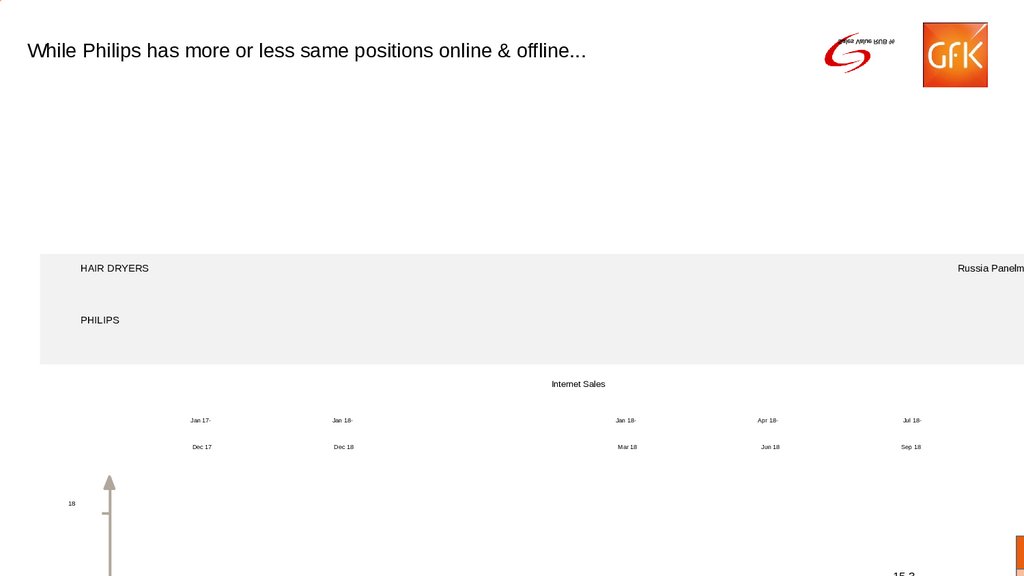

While Philips has more or less same positions online & offline...HAIR DRYERS

Russia Panelm

PHILIPS

Internet Sales

18

Jan 17-

Jan 18-

Jan 18-

Apr 18-

Jul 18-

Dec 17

Dec 18

Mar 18

Jun 18

Sep 18

61.

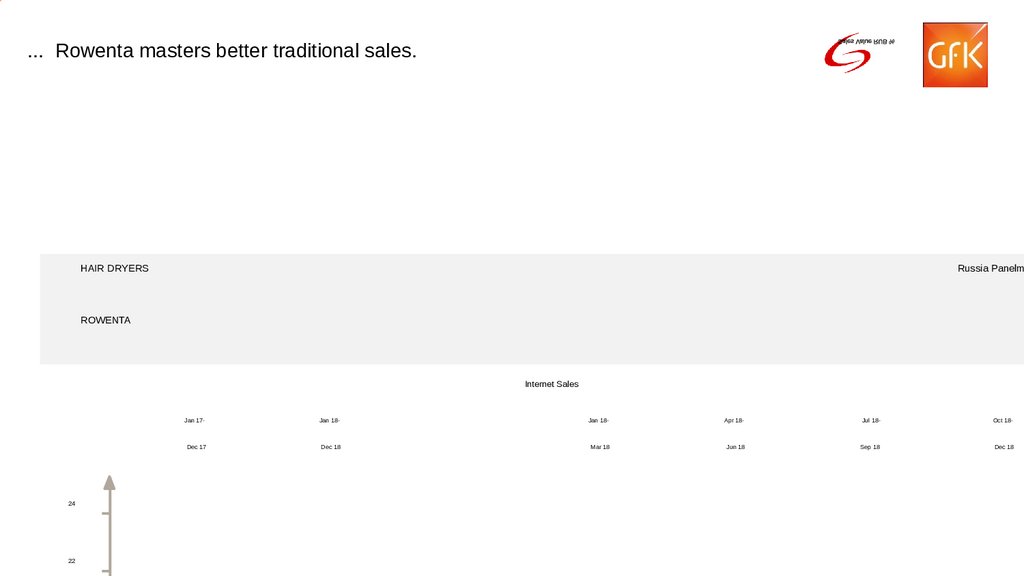

... Rowenta masters better traditional sales.HAIR DRYERS

Russia Panelm

ROWENTA

Internet Sales

24

22

Jan 17-

Jan 18-

Jan 18-

Apr 18-

Jul 18-

Oct 18-

Dec 17

Dec 18

Mar 18

Jun 18

Sep 18

Dec 18

62.

63. Cities

Gama managed to accumulate 2,5% of market share in 2018.HAIR STYLERS

Russia Panelm

64.

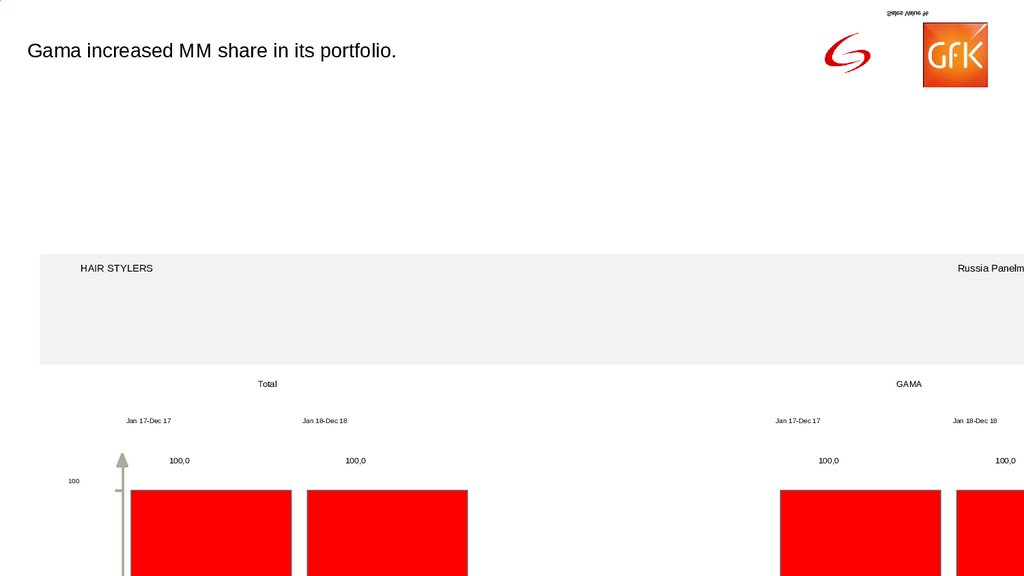

Gama increased MM share in its portfolio.HAIR STYLERS

Russia Panelm

Total

Jan 17-Dec 17

100,0

100

GAMA

Jan 18-Dec 18

100,0

Jan 17-Dec 17

100,0

Jan 18-Dec 18

100,0

65.

However Gama should pay attention to its distribution.HAIR STYLERS

26

24

Russia Panelm

66.

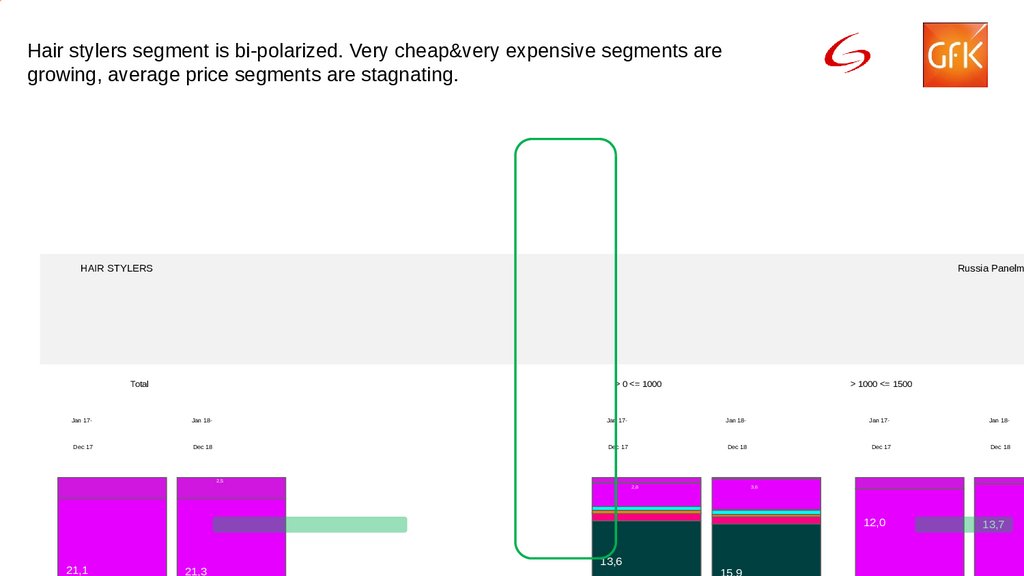

Hair stylers segment is bi-polarized. Very cheap&very expensive segments aregrowing, average price segments are stagnating.

HAIR STYLERS

Russia Panelm

Total

> 0 <= 1000

> 1000 <= 1500

Jan 17-

Jan 18-

Jan 17-

Jan 18-

Jan 17-

Jan 18-

Dec 17

Dec 18

Dec 17

Dec 18

Dec 17

Dec 18

2,5

2,8

3,6

12,0

21,1

21,3

13,6

13,7

67.

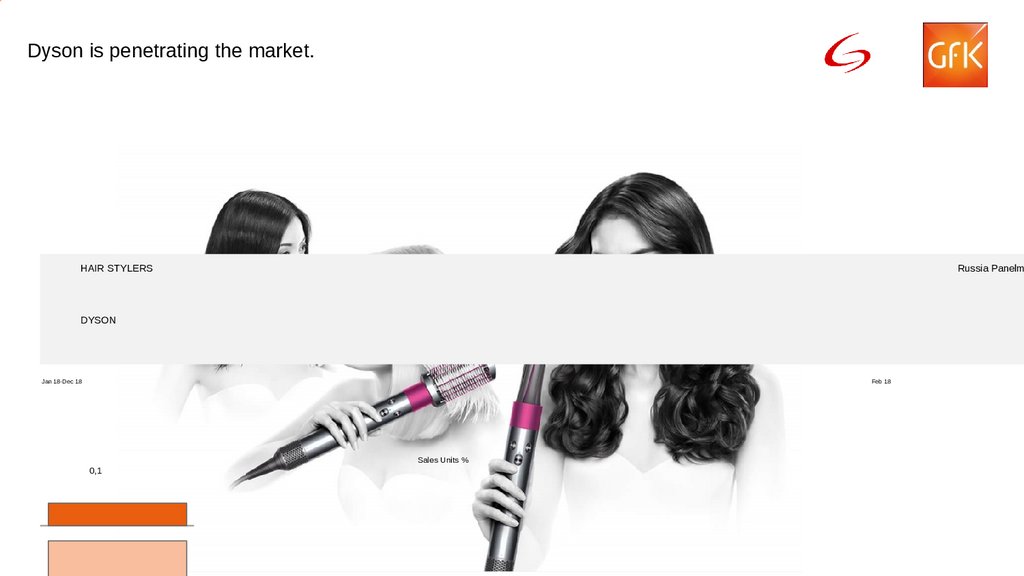

Dyson is penetrating the market.HAIR STYLERS

Russia Panelm

DYSON

Jan 18-Dec 18

Jan 18

Sales Units %

0,1

Feb 18

68.

Dyson is challenging leaders online with 12,3% of share in Q4.HAIR STYLERS

Russia Panelm

Internet sales

28

26

Jan 17-

Jan 18-

Jan 18-

Dec 17

Dec 18

Mar 18

Apr 18-Jun 18

Jul 18-Sep 18

69.

Straighteners© GfK 2015 - All rights reserved

89

70.

Gama became an important player in the Straighteners segment.HAIR STYLERS

STRAIGHTENER

Russia Panelm

71.

However lost some distribution points...HAIR STYLERS

STRAIGHTENER

28

26

Russia Panelm

72.

... that is influenced by the brand’s performance in TSS.HAIR STYLERS

STRAIGHTENER

30

28

Russia TecSup

73.

HAIR STYLERSRussia Mass M

STRAIGHTENER

32

30

Jan 18-Dec 18 (2,8)

74.

MM share now represents 15%.HAIR STYLERS

Russia Panelm

STRAIGHTENER

Total

Jan 17-Dec 17

100,0

100

GAMA

Jan 18-Dec 18

100,0

Jan 17-Dec 17

100,0

Jan 18-Dec 18

100,0

75.

Gama detains 9,2% in 2018 in MM, challenging Polaris & Redmond positions .HAIR STYLERS

Russia Panelm

STRAIGHTENER

Total

Jan 17-Dec 17

Jan 18-Dec 18

5,4

18,3

TecSuperstores + El. Chains

Jan 17-Dec 17

6,1

5,3

76.

Gama dramatically increased its share in MM...HAIR STYLERS

Russia Panelm

GAMA STRAIGHTENER

TecSuperstores + El. Chains

12

Jan 17-

Jan 18-

Jan 18-

Apr 18-

Jul 18-

Oct 18-

Dec 17

Dec 18

Mar 18

Jun 18

Sep 18

Dec 18

77.

... and so did Philips.HAIR STYLERS

Russia Panelm

PHILIPS STRAIGHTENER

TecSuperstores + El. Chains

18

Jan 17-

Jan 18-

Jan 18-

Apr 18-

Jul 18-

Oct 18-

Dec 17

Dec 18

Mar 18

Jun 18

Sep 18

Dec 18

78.

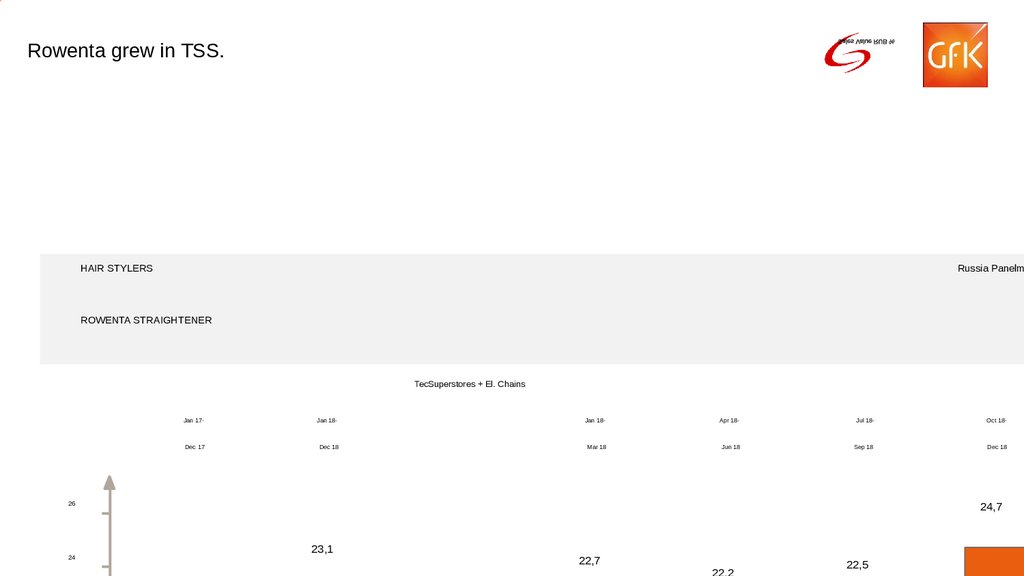

Rowenta grew in TSS.HAIR STYLERS

Russia Panelm

ROWENTA STRAIGHTENER

TecSuperstores + El. Chains

Jan 17-

Jan 18-

Jan 18-

Apr 18-

Jul 18-

Oct 18-

Dec 17

Dec 18

Mar 18

Jun 18

Sep 18

Dec 18

26

24

24,7

23,1

22,7

22,5

79.

INTERNET SALES© GfK 2016 - All rights reserved

108

80.

HAIR STYLERSSTRAIGHTENER

Panelmarket R

81.

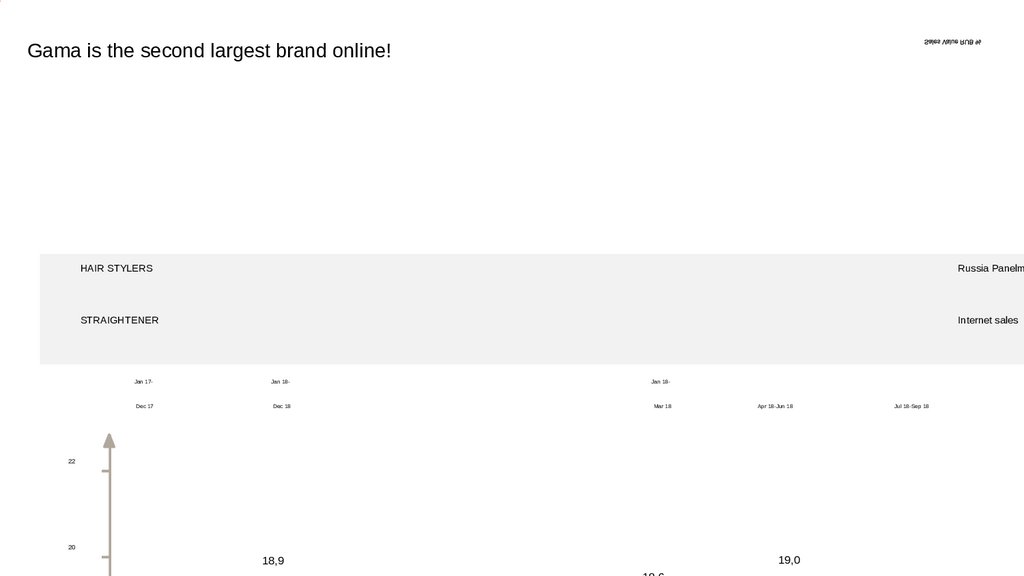

Gama is the second largest brand online!HAIR STYLERS

Russia Panelm

STRAIGHTENER

Internet sales

Jan 17-

Jan 18-

Jan 18-

Dec 17

Dec 18

Mar 18

Apr 18-Jun 18

Jul 18-Sep 18

22

20

© GfK 2016 - All rights reserved

18,9

19,0

110

82.

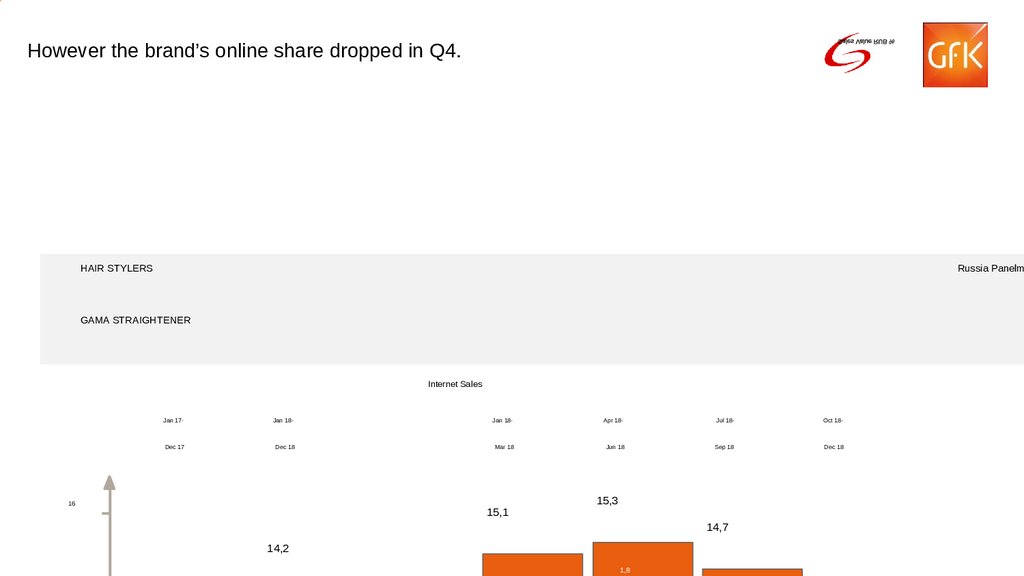

However the brand’s online share dropped in Q4.HAIR STYLERS

Russia Panelm

GAMA STRAIGHTENER

Internet Sales

Jan 17-

Jan 18-

Jan 18-

Apr 18-

Jul 18-

Oct 18-

Dec 17

Dec 18

Mar 18

Jun 18

Sep 18

Dec 18

16

15,1

15,3

14,7

14,2

1,8

83.

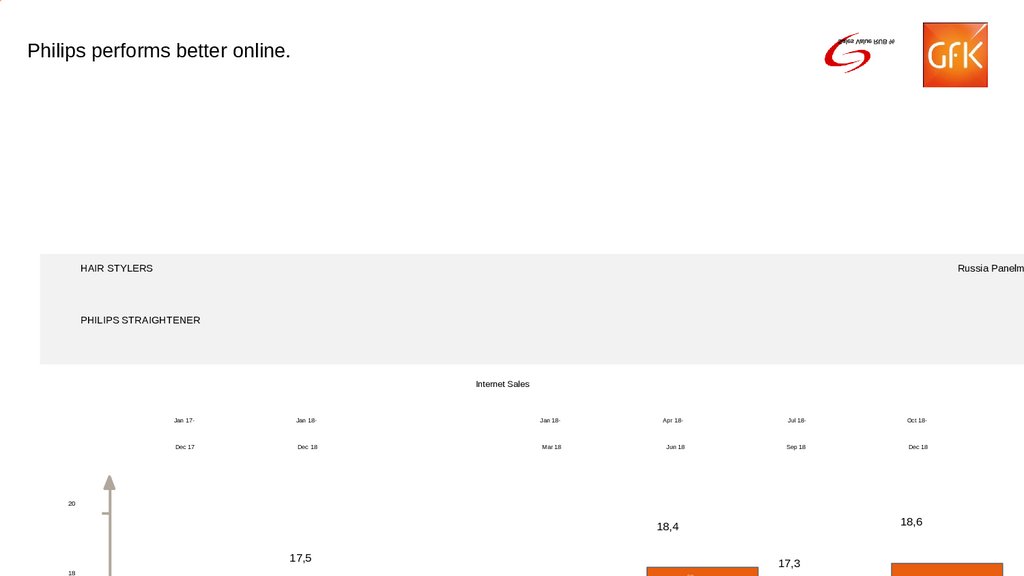

Philips performs better online.HAIR STYLERS

Russia Panelm

PHILIPS STRAIGHTENER

Internet Sales

Jan 17-

Jan 18-

Jan 18-

Apr 18-

Jul 18-

Oct 18-

Dec 17

Dec 18

Mar 18

Jun 18

Sep 18

Dec 18

20

18,6

18,4

17,5

18

17,3

84.

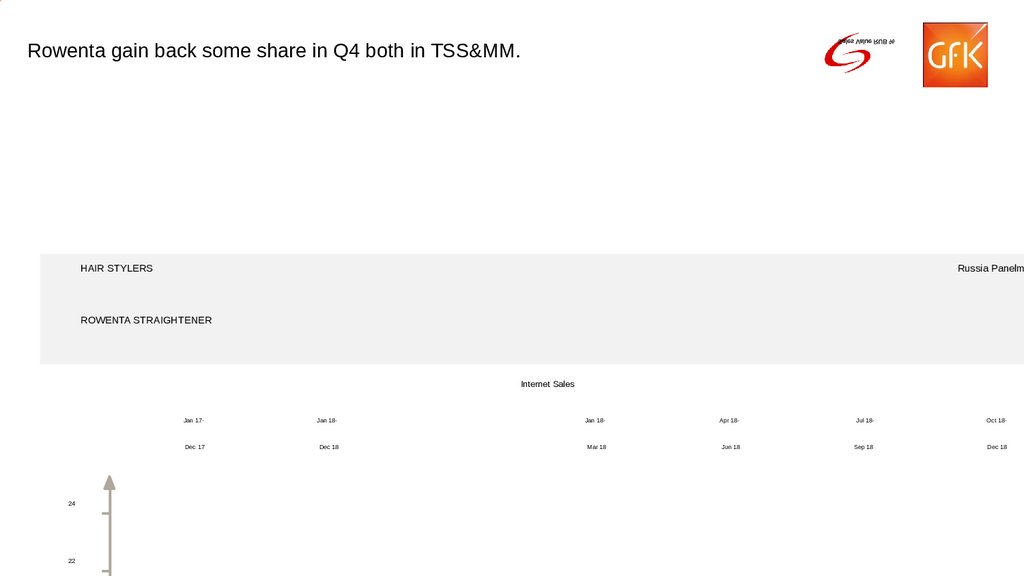

Rowenta gain back some share in Q4 both in TSS&MM.HAIR STYLERS

Russia Panelm

ROWENTA STRAIGHTENER

Internet Sales

24

22

Jan 17-

Jan 18-

Jan 18-

Apr 18-

Jul 18-

Oct 18-

Dec 17

Dec 18

Mar 18

Jun 18

Sep 18

Dec 18

85.

Hot Air Stylers© GfK 2015 - All rights reserved

115

86.

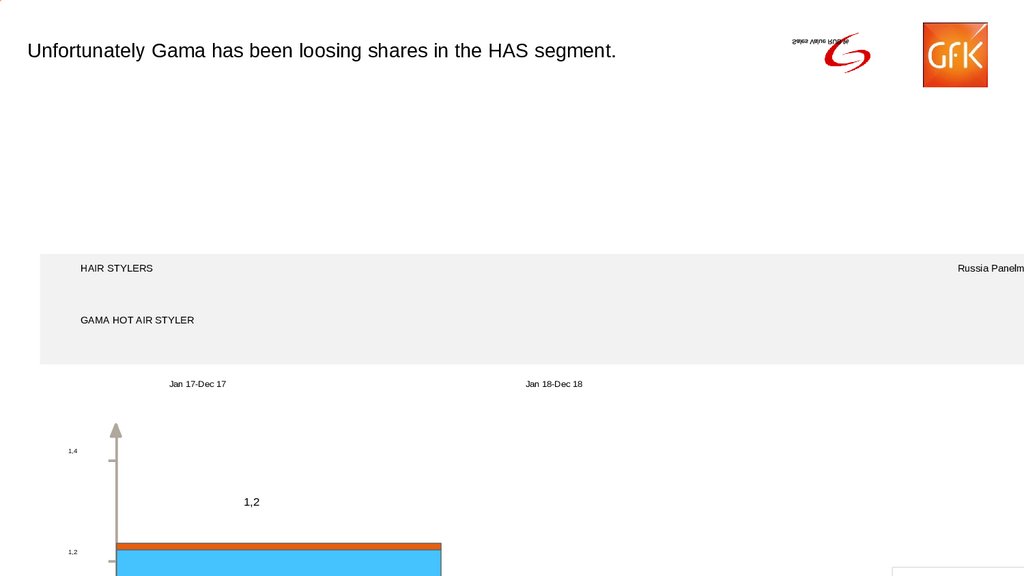

Unfortunately Gama has been loosing shares in the HAS segment.HAIR STYLERS

Russia Panelm

GAMA HOT AIR STYLER

Jan 17-Dec 17

Jan 18-Dec 18

1,4

1,2

1,2

87.

The brand’s distribution is also quite limited.HAIR STYLERS

HOT AIR STYLER

35

Russia Panelm

88.

HAIR STYLERSHOT AIR STYLER

45

40

Russia Mass M

89. Straighteners

Dyson almost reached 5% in 2018.HAIR STYLERS

HOT AIR STYLER

Russia Panelm

90.

MM is responsible for 17% of sales. In Gama’s portfolio the share is quitesimilar.

HAIR STYLERS

Russia Panelm

HOT AIR STYLER

Total

Jan 17-Dec 17

100,0

100

GAMA

Jan 18-Dec 18

100,0

Jan 17-Dec 17

100,0

Jan 18-Dec 18

100,0

91.

Dyson is now mostly present in MM.HAIR STYLERS

Russia Panelm

HOT AIR STYLER

Total

Jan 17-Dec 17

24,5

TecSuperstores + El. Chains

Jan 18-Dec 18

Jan 17-Dec 17

26,2

27,1

92.

Gama share dropped in all channels, but in TSS the drop is even more evident.HAIR STYLERS

Russia Panelm

GAMA HOT AIR STYLER

TecSuperstores + El. Chains

Jan 17-

Jan 18-

Jan 18-

Apr 18-

Jul 18-

Oct 18-

Dec 17

Dec 18

Mar 18

Jun 18

Sep 18

Dec 18

1,4

1,3

93.

Philips growth in MM in 2018 could not compensate the drop in TSS.HAIR STYLERS

Russia Panelm

PHILIPS HOT AIR STYLER

TecSuperstores + El. Chains

28

26

Jan 17-

Jan 18-

Jan 18-

Apr 18-

Jul 18-

Oct 18-

Dec 17

Dec 18

Mar 18

Jun 18

Sep 18

Dec 18

94.

Rowenta portfolio is quite different in TSS & MM.HAIR STYLERS

Russia Panelm

ROWENTA HOT AIR STYLER

TecSuperstores + El. Chains

Jan 17-

Jan 18-

Jan 18-

Apr 18-

Dec 17

Dec 18

Mar 18

Jun 18

35

30,1

Jul 18-Sep 18

95.

INTERNET SALES96.

Gama used to have 2% of market share online.HAIR STYLERS

Russia Panelm

GAMA HOT AIR STYLER

Internet Sales

Jan 17-

Jan 18-

Jan 18-

Apr 18-

Jul 18-

Oct 18-

Dec 17

Dec 18

Mar 18

Jun 18

Sep 18

Dec 18

2,0

2,0

1,8

97.

Dyson influenced online share growth in Q4.HAIR STYLERS

HOT AIR STYLER

Panelmarket R

98.

Dyson is now the absolute leader online in Q4.35

HAIR STYLERS

Russia Panelm

HOT AIR STYLER

Internet sales

Jan 17-

Jan 18-

Jan 18-

Dec 17

Dec 18

Mar 18

Apr 18-Jun 18

Jul 18-Sep 18

99.

Philips suffered a lot because of Dyson.HAIR STYLERS

Russia Panelm

PHILIPS HOT AIR STYLER

Internet Sales

30

Jan 17-

Jan 18-

Jan 18-

Apr 18-

Jul 18-

Oct 18-

Dec 17

Dec 18

Mar 18

Jun 18

Sep 18

Dec 18

28,7

28,3

100.

Rowenta dynamics online is also quite alarming.HAIR STYLERS

Russia Panelm

ROWENTA HOT AIR STYLER

Internet Sales

30

Jan 17-

Jan 18-

Jan 18-

Apr 18-

Dec 17

Dec 18

Mar 18

Jun 18

Jul 18-Sep 18

101.

Tongs© GfK 2015 - All rights reserved

144

102.

Gama reached 0,7% in Q2 & Q4.HAIR STYLERS

Russia Panelm

GAMA TONGS

Jan 17-Dec 17

Jan 18-Dec 18

0,7

GC0101 WONDER

0,6

0,6

CURL Aug17

Suppressed Apr17

103.

Gama slightly improved its distribution year on year.HAIR STYLERS

TONGS

34

32

30

Russia Panelm

104.

Tongs decreased by -1% in value in 2018.HAIR STYLERS

TONGS

Russia Panelm

105.

Gama portfolio is concentrated on MM.HAIR STYLERS

Russia Panelm

TONGS

Total

Jan 17-Dec 17

100,0

100

GAMA

Jan 18-Dec 18

100,0

Jan 17-Dec 17

100,0

Jan 18-Dec 18

100,0

106.

Gama share in TSS is stagnating.HAIR STYLERS

Russia Panelm

GAMA TONGS

TecSuperstores + El. Chains

2,0

1,8

Jan 17-

Jan 18-

Jan 18-

Apr 18-

Jul 18-

Oct 18

Dec 17

Dec 18

Mar 18

Jun 18

Sep 18

Dec 1

107.

Philips did well in MM...HAIR STYLERS

Russia Panelm

TONGS

Total

Jan 17-Dec 17

19,4

TecSuperstores + El. Chains

Jan 18-Dec 18

Jan 17-Dec 17

17,3

21,6

108.

... mainly thanks its best-seller BHB876/00.HAIR STYLERS

Russia Panelm

PHILIPS TONGS

TecSuperstores + El. Chains

22

20

Jan 17-

Jan 18-

Jan 18-

Apr 18-

Jul 18-

Oct 18-

Dec 17

Dec 18

Mar 18

Jun 18

Sep 18

Dec 18

109.

Rowenta progression in TSS is impressive.HAIR STYLERS

Russia Panelm

ROWENTA TONGS

TecSuperstores + El. Chains

Jan 17-

Jan 18-

Jan 18-

Apr 18-

Jul 18-

Dec 17

Dec 18

Mar 18

Jun 18

Sep 18

24

2

21,6

22

110.

INTERNET SALES© GfK 2016 - All rights reserved

161

111.

Online is not so positive in units.HAIR STYLERS

TONGS

Panelmarket R

112.

Gama remains a very small brand in Traditional sales.HAIR STYLERS

Russia Panelm

GAMA TONGS

Internet Sales

2,0

Jan 17-

Jan 18-

Jan 18-

Apr 18-

Jul 18-

Oct 18

Dec 17

Dec 18

Mar 18

Jun 18

Sep 18

Dec 1

1,9

1,9

1,8

1,8

113.

Philips strengthened its leadership.30

HAIR STYLERS

Russia Panelm

Tongs

Internet sales

Jan 17-

Jan 18-

Jan 18-

Dec 17

Dec 18

Mar 18

Apr 18-Jun 18

Jul 18-Sep 18

114.

Actually online is the biggest Philips driver.HAIR STYLERS

Russia Panelm

PHILIPS TONGS

Internet Sales

Jan 17-

Jan 18-

Jan 18-

Apr 18-

Jul 18-

Oct 18-

Dec 17

Dec 18

Mar 18

Jun 18

Sep 18

Dec 18

26

24,0

24

115. Hot Air Stylers

Hair clippers© GfK 2015 - All rights reserved

169

116.

Gama positions in the Hair clippers segment are still quite limited.HAIR CLIPPERS

Russia Panelm

GAMA

Jan 17-Dec 17

Jan 18-Dec 18

0,7

0,6

6 EN 1 Dec12

0,6

© GfK 2015 - All rights reserved

0,1

GC552 Apr18

170

117.

Moser became the second largest brand.HAIR CLIPPERS

Russia Panelm

118.

Moser enlarged its distribution. The brand’s KPIs are now better than Rowenta ones.HAIR CLIPPERS

45

40

Russia Panelm

119.

TSS part in Gama sales dropped to 53%.HAIR CLIPPERS

Russia Panelm

Total

Jan 17-Dec 17

100,0

100

GAMA

Jan 18-Dec 18

100,0

Jan 17-Dec 17

100,0

Jan 18-Dec 18

100,0

120.

HAIR CLIPPERSRussia Panelm

Total

Jan 17-Dec 17

TecSuperstores + El. Chains

Jan 18-Dec 18

Jan 17-Dec 17

121.

Philips showed promising results in Q4.HAIR CLIPPERS

Russia Panelm

PHILIPS

TecSuperstores + El. Chains

Jan 17-

Jan 18-

Jan 18-

Apr 18-

Jul 18-

Oct 18-

Dec 17

Dec 18

Mar 18

Jun 18

Sep 18

Dec 18

45

41,7

39,8

38,8

40,3

39,1

122.

Moser share dramatically dropped in MM.HAIR CLIPPERS

Russia Panelm

MOSER

TecSuperstores + El. Chains

16

Jan 17-

Jan 18-

Jan 18-

Apr 18-

Jul 18-

Oct 18-

Dec 17

Dec 18

Mar 18

Jun 18

Sep 18

Dec 18

123.

Gama best-seller performs better in MM.HAIR CLIPPERS

Russia Panelm

GAMA

TecSuperstores + El. Chains

0,9

Jan 17-

Jan 18-

Jan 18-

Apr 18-

Dec 17

Dec 18

Mar 18

Jun 18

Jul 18-Sep 18

124.

INTERNET SALES© GfK 2016 - All rights reserved

185

125.

Online share is lower than in Hair care.HAIR CLIPPERS

Panelmarket R

126.

Philips erased the competition in Q4.HAIR CLIPPERS

Russia Panelm

Internet sales

Jan 17-

Jan 18-

Jan 18-

Dec 17

Dec 18

Mar 18

Apr 18-Jun 18

Jul 18-Sep 18

22

20,0

19,6

19,6

20

18,7

127.

Gama sales dropped both online & offline.HAIR CLIPPERS

Russia Panelm

GAMA

Internet Sales

Jan 17-

Jan 18-

Jan 18-

Apr 18-

Dec 17

Dec 18

Mar 18

Jun 18

0,6

0,6

0,1

Jul 18-Sep 18

128.

Moser had a tough Q4 online...HAIR CLIPPERS

Russia Panelm

MOSER

Internet Sales

Jan 17-

Jan 18-

Jan 18-

Apr 18-

Jul 18-

Oct 18-

Dec 17

Dec 18

Mar 18

Jun 18

Sep 18

Dec 18

21,8

21,2

22

20,4

20,3

2,1

1,7

20

21,1

1,7

129.

... mainly because of Philips great results.HAIR CLIPPERS

Russia Panelm

PHILIPS

Internet Sales

Jan 17-

Jan 18-

Jan 18-

Apr 18-

Jul 18-

Oct 18-

Dec 17

Dec 18

Mar 18

Jun 18

Sep 18

Dec 18

45

42,7

40,2

40,3

39,6

130.

12

3

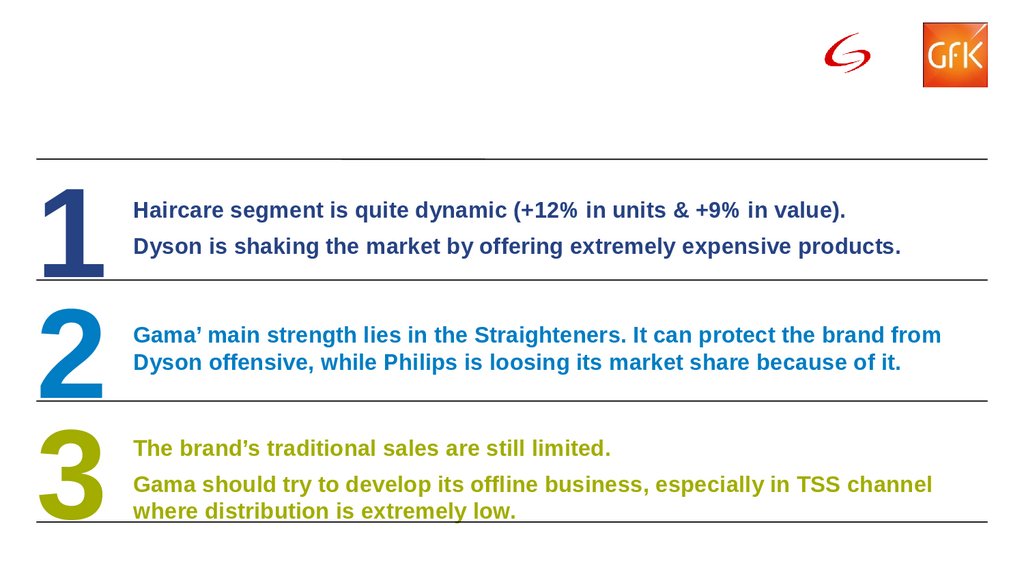

Haircare segment is quite dynamic (+12% in units & +9% in value).

Dyson is shaking the market by offering extremely expensive products.

Gama’ main strength lies in the Straighteners. It can protect the brand from

Dyson offensive, while Philips is loosing its market share because of it.

The brand’s traditional sales are still limited.

Gama should try to develop its offline business, especially in TSS channel

where distribution is extremely low.

131.

HAIR STYLERSHEATED STRAIGHTENING BRUSH

Russia Panelm

132.

HAIR STYLERSRussia Panelm

HEATED STRAIGHTENING BRUSH

Total

Jan 17-Dec 17

TecSuperstores + El. Chains

Jan 18-Dec 18

Jan 17-Dec 17

16,0

133.

SHAVERSRussia Panelm

MEN'S SHAVER

Jan 17-

Jan 18-

Jan 17-

Jan 18-

Dec 17

Dec 18

Dec 17

Dec 18

Dec 17

PHILIPS

134.

SHAVERSRussia Panelm

EPILATOR

Jan 17-

Jan 18-

Jan 17-

Jan 18-

Dec 17

Dec 18

Dec 17

Dec 18

Dec 17

BRAUN

135.

SHAVERSRussia Panelm

BEARD TRIMMER

Jan 17-

Jan 18-

Jan 17-

Jan 18-

Dec 17

Dec 18

Dec 17

Dec 18

31,3

33,0

31,3

Dec 17

31,9

33,0

PHILIPS

136.

SHAVERSRussia Panelm

DETAIL TRIMMER

Jan 17-

Jan 18-

Jan 17-

Jan 18-

Dec 17

Dec 18

Dec 17

Dec 18

39,5

36,0

39,5

36,0

Dec 17

PHILIPS

40,5

137.

SHAVERSRussia Panelm

BODYGROOMER

Jan 17-

Jan 18-

Jan 17-

Jan 18-

Dec 17

Dec 18

Dec 17

Dec 18

Dec 17

138.

SHAVERSRussia Panelm

MULTIGROOM. KIT

Jan 17-

Jan 18-

Jan 17-

Jan 18-

Dec 17

Dec 18

Dec 17

Dec 18

27,4

Dec 17

27,4

35,8

35,8

BRAUN

38,1

139.

SHAVERSRussia Panelm

MEN'S SHAVER

Jan 17-

Jan 18-

Jan 17-

Jan 18-

Dec 17

Dec 18

Dec 17

Dec 18

9,7

19,7

12,1

9,7

19,7

12,1

Dec 17

10,2

140.

SHAVERSRussia Panelm

EPILATOR

Jan 17-

Jan 18-

Jan 17-

Jan 18-

Dec 17

Dec 18

Dec 17

Dec 18

Dec 17

9,1

9,4

6,8

9,1

14,9

6,8

14,9

15,7

15,7

11,9

141.

SHAVERSRussia Panelm

BEARD TRIMMER

Jan 17-

Jan 18-

Jan 17-

Jan 18-

Dec 17

Dec 18

Dec 17

Dec 18

17,1

Dec 17

17,1

21,8

21,8

22,0

142.

SHAVERSRussia Panelm

BODYGROOMER

Jan 17-

Jan 18-

Jan 17-

Jan 18-

Dec 17

Dec 18

Dec 17

Dec 18

17,6

17,6

30,9

Dec 17

18,7

30,9

143.

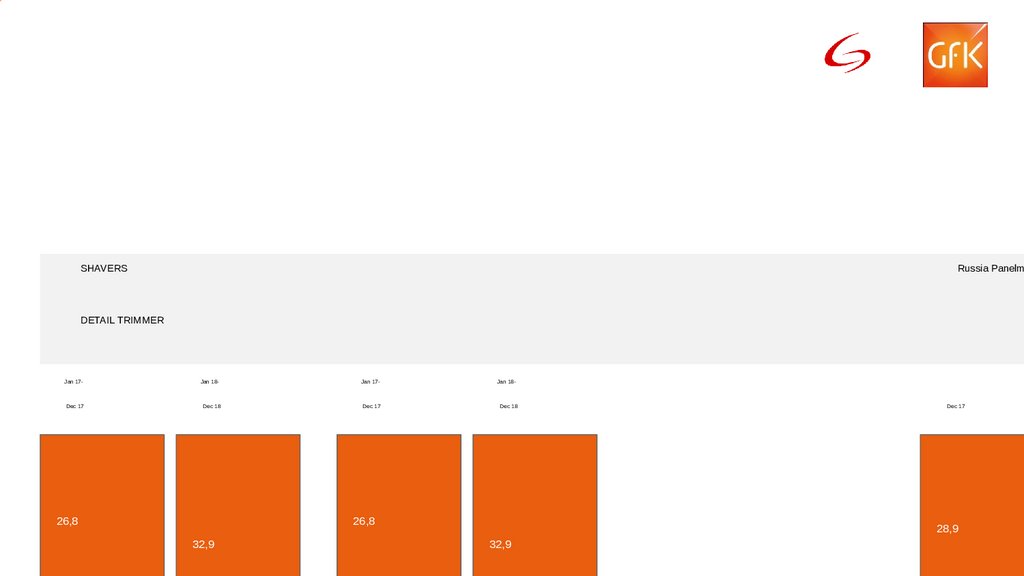

SHAVERSRussia Panelm

DETAIL TRIMMER

Jan 17-

Jan 18-

Jan 17-

Jan 18-

Dec 17

Dec 18

Dec 17

Dec 18

26,8

26,8

32,9

Dec 17

28,9

32,9

144. Tongs

SHAVERSRussia Panelm

MULTIGROOM. KIT

Jan 17-

Jan 18-

Jan 17-

Jan 18-

Dec 17

Dec 18

Dec 17

Dec 18

Dec 17

19,1

23,0

23,0

26,5

26,5

145.

MIKHAIL KUZNETSOVSECTOR MANAGER | SDA CONSUMER CHOICES

TEL.: +7 495 937-72-22*1417

E-MAIL: Mikhail.Kuznetsov@gfk.com

Менеджмент

Менеджмент