Похожие презентации:

This course is concerned with making good economic decisions in engineering

1.

AMERICAN UNIVERSITY OF ARMENIAIE340-ENGINEERING ECONOMICS

SPRING SEMESTER, 2017

Cost Classification and Design Economics

Lecture 2; Chapter 2

1

2. Introduction

This course is concerned with makinggood economic decisions in engineering

These decisions often involve nonengineers

◦ Managers

◦ Accountants

◦ Etc.

You need to be able to communicate with

these people, so you need a common

language

2

3. Introduction (cont.)

One of the important parts of economicdecision is identification of costs

Several cost situations occur frequently

◦ People have developed terms to

describe these

You need to know these terms to

◦ Understand what others are saying to

you

◦ Be able to persuade others that you

know what you’re doing and therefore

should be listened to

3

4. What Do Organizations Produce?

Physical output (products)Monetary income (profits)

4

5. What Inputs Do They Use?

People’s services (labor)Materials and supplies

◦ Raw materials used to make their final

products

◦ Indirect materials (lubrication oil, etc.)

◦ Electric power and other energy inputs

Capital (money), which is used to pay for:

◦ Land and buildings

◦ Producer goods (e.g., tools, equipment)

◦ Taxes

5

6. Cost classification (direct and overhead)

Most operating organizations’ costs can besummarized under two headings

Direct costs

Overhead (indirect) costs

Of these, overhead costs are often the most

complicated and troublesome

6

7. Direct costs

Most common direct costs: material &labor

These are costs that:

Examples:

◦ Can be easily measured

◦ Can be conveniently allocated to a particular

category (e.g. a product or service)

◦ Cost of steel used for making bolts

◦ Salary of a nurse on cardiac surgery ward

7

8. Overhead (indirect) costs

Costs that cannot be traced directly to aparticular product/service, because they

help support multiple products or services

Examples:

◦ Depreciation, taxes, insurance, maintenance;

electricity; general repairs; common tools

◦ Supervisors, engineers, and other

administrative/clerical personnel

◦ Can also include materials and labor for

inspection, testing, etc.

8

9. Standard Costs

Representative costs per unit of output establishedbefore the good or service is produced or delivered

◦ They are developed from anticipated direct labor

hours, materials, and overhead categories

Play an important role in cost control and other

management functions

◦ Comparing the actual cost with the standard cost

◦ Estimating future manufacturing costs

◦ Preparing bids on products or services requested

by customers

9

10. Operating expenses

The costs of doing business (typically notincluding depreciation)

Includes both direct and indirect costs,

but not capital

Examples

◦ Materials and supplies,

◦ wages and salaries,

◦ fuel, water, electric power,

◦ taxes, insurance

10

11. First Cost

The cost or total amount of investmentrequired for getting an activity started:

◦ Occurs only once for any given activity

◦ Typically assumed to be paid in year 0

◦ Typically used for capital (land, buildings,

tools, equipment), not operating expenses

11

12. Fixed Costs

Costs that remain constant:◦ Don’t vary with level of production

Examples:

◦ Depreciation, maintenance, taxes, insurance,

lease rentals, interest, sales programs,

administrative expenses, research, heat, light,

janitorial (doorkeeper) services

Fixed costs are only relatively fixed, they

may change when:

◦ Large changes in usage of resources occur

◦ When plant expansion or shutdown is involved

12

13. Variable Costs

Costs that vary with activity level:◦ E.g., with number of units produced

◦ Typically only direct costs

◦ May (or may not) remain constant per

unit of product

Examples:

◦ Materials costs, direct labor, direct

electric power

13

14. Average cost

This is simply total cost divided byvolume

◦ Often called “unit cost”

◦ Example 1: cost is $250 N, where N is

number of units of product made

Here cost is purely variable (no fixed cost)

Average cost is (250 N)/N = $250

◦ Example 2: cost is $6000 + $100 N

Average cost is $100 + 6000/N (decreases

with larger N; economy of scale)

14

15. Marginal (Incremental) cost

This is the cost change for making onemore or one fewer of the product

For Example 2 (cost = $6000 + 100 N):

◦ N = 100: cost is $16,000

◦ N = 101: cost is $16,100

◦ Here marginal cost is $100, but average

cost (at N = 100) is $160

So average and marginal cost may differ!

15

16. Marginal (incremental cost): an example

Let’s say:◦ Fixed cost is $50, variable cost is $1 per unit

◦ (Cost equation = $50 + $1 N)

If we make 10 units:

◦ Total cost is $60

◦ Average cost is total cost/number of units:

$60/10=$6 per unit

◦ Marginal cost is the extra cost (additional cost) if

we increase our production by 1 unit: $1 per unit

16

17. Marginal (incremental cost)

Marginal cost:◦ It is the correct value to look at in deciding

whether to increase production or not

◦ We need to compare marginal costs to

marginal benefits

In our example, marginal cost<<average cost

◦ High fixed cost creates economies of scale

Marginal cost can also be > average cost

17

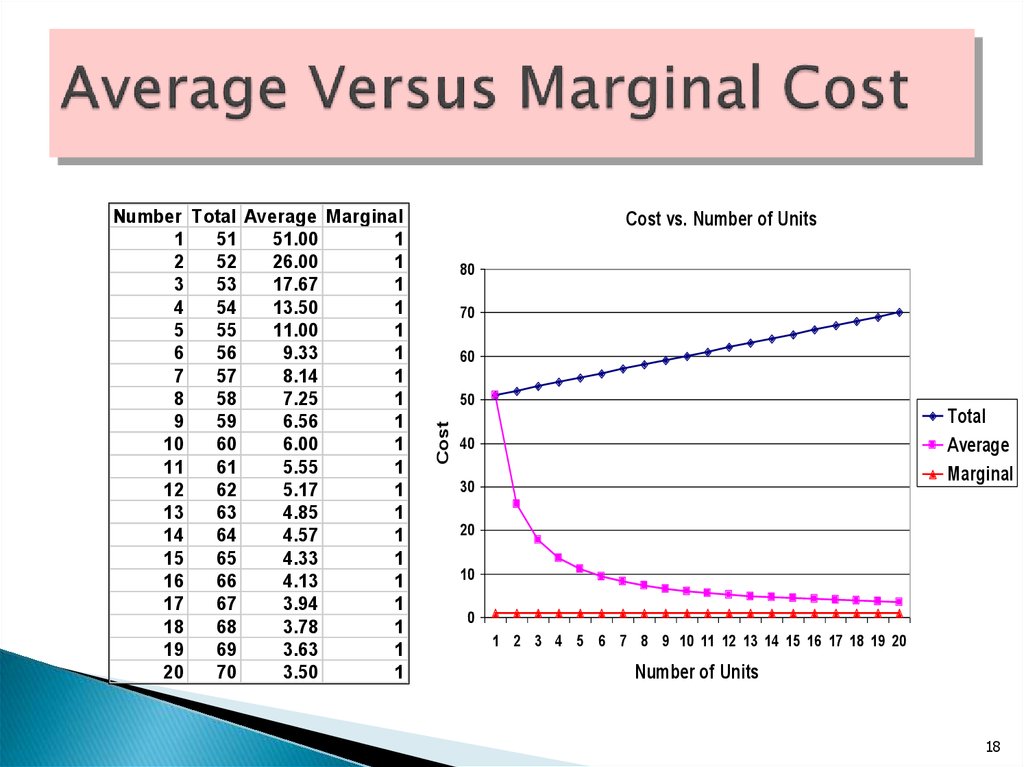

18. Average Versus Marginal Cost

Cost vs. Number of Units80

70

60

50

Cost

Number Total Average Marginal

1

51

51.00

1

2

52

26.00

1

3

53

17.67

1

4

54

13.50

1

5

55

11.00

1

6

56

9.33

1

7

57

8.14

1

8

58

7.25

1

9

59

6.56

1

10

60

6.00

1

11

61

5.55

1

12

62

5.17

1

13

63

4.85

1

14

64

4.57

1

15

65

4.33

1

16

66

4.13

1

17

67

3.94

1

18

68

3.78

1

19

69

3.63

1

20

70

3.50

1

Total

Average

Marginal

40

30

20

10

0

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20

Number of Units

18

19. Marginal (incremental cost)

Becauseis the change in quantity

of labor that affects a one unit change

in output, this implies that this equals

1/MPL (marginal product of labor)

So, when marginal cost is increasing (decreasing) the

marginal product of labor is decreasing (increasing)

19

20. Recurring and Nonrecurring Costs

Recurring are the costs that are repetitiveAll variable costs are recurring, but not all

recurring costs have to be variable

A fixed cost can be recurring cost, e.g. Office space

rental for architectural and engineering service

An example of a nonrecurring cost can be the cost

of constructing a plant or purchasing a piece of

land

20

21. Opportunity cost

is what you have to give up toget something

◦ Often expressed in dollar terms; but not always:

Opportunity cost of this lecture is 1 hour’s sleep, or

more

21

22. Sunk Costs

Sunk costs are costs that can’t berecovered

◦ Not the same as past costs

◦ Sunk costs are generally irrelevant to decision

Example:

◦ If a firm sinks $1 million on an enterprise

software installation, that cost is "sunk" because

it was a one-time thing and cannot be recovered

once expended.

◦ Room painting

22

23. Life-cycle cost

This is the total cost for a system, machine,project, etc. during its service life

Major subdivisions:

◦ Acquisition cost

◦ Operation cost

◦ Maintenance cost

23

24. Cost-Estimating Methods

Accounting MethodEngineering Method

Statistical Method

24

25. Accounting Method

Based on historical dataCosts are classified into fixed, variable and

semivariable

Advantages:

◦ simplicity

◦ low cost

Disadvantages:

◦ future might not be like the past

25

26. Engineering Method

Depends upon the knowledge of physicalrelationships (labor-hours, kw of energy,

pounds of material)

Conjecture about the future is made on the

basis of the knowledge on the capacity of

equipment, capabilities of people…

Useful when historical data is unavailable

26

27. Statistical Method

Uses statistical tools (from simple graphs tocomplex regressions)

Objective is to find a functional relationship

between changes in costs and factors like

output rate

The most reliable method when data is

available

27

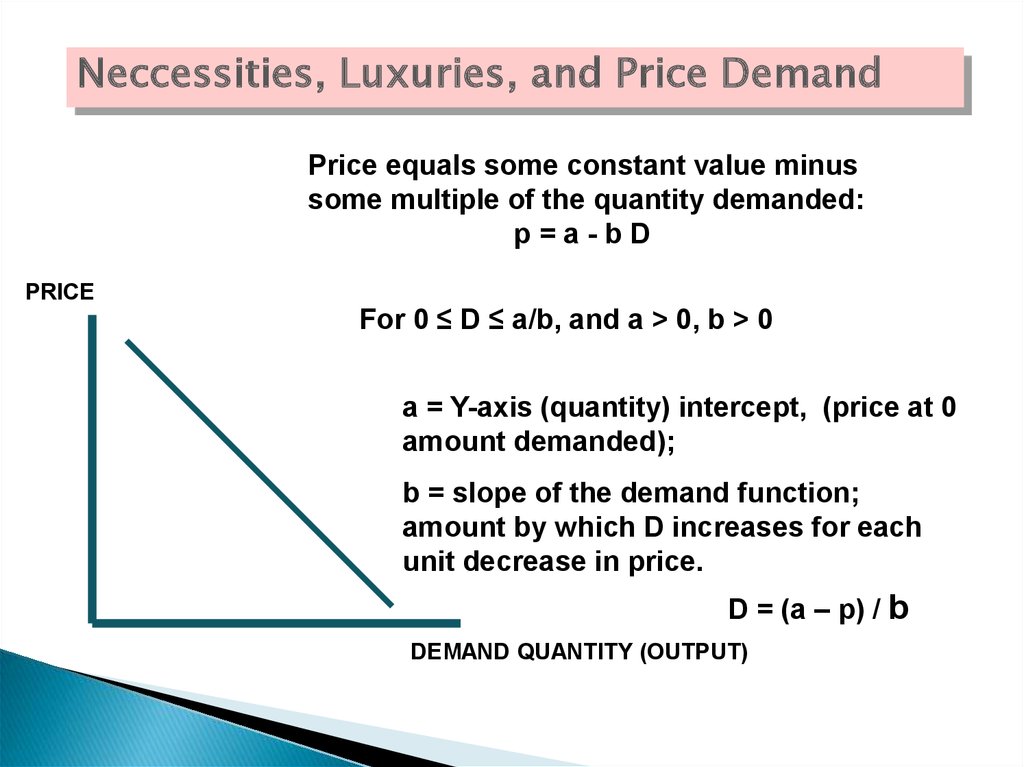

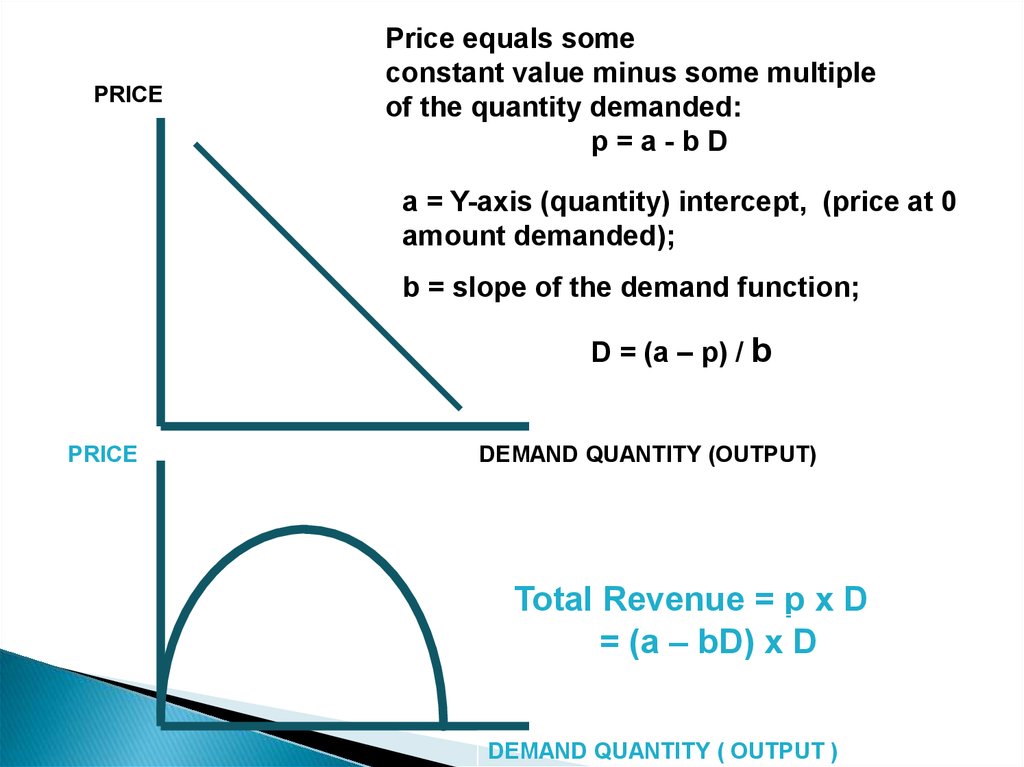

28.

Neccessities, Luxuries, and Price DemandPrice equals some constant value minus

some multiple of the quantity demanded:

p=a-bD

PRICE

For 0 ≤ D ≤ a/b, and a > 0, b > 0

a = Y-axis (quantity) intercept, (price at 0

amount demanded);

b = slope of the demand function;

amount by which D increases for each

unit decrease in price.

D = (a – p) / b

DEMAND QUANTITY (OUTPUT)

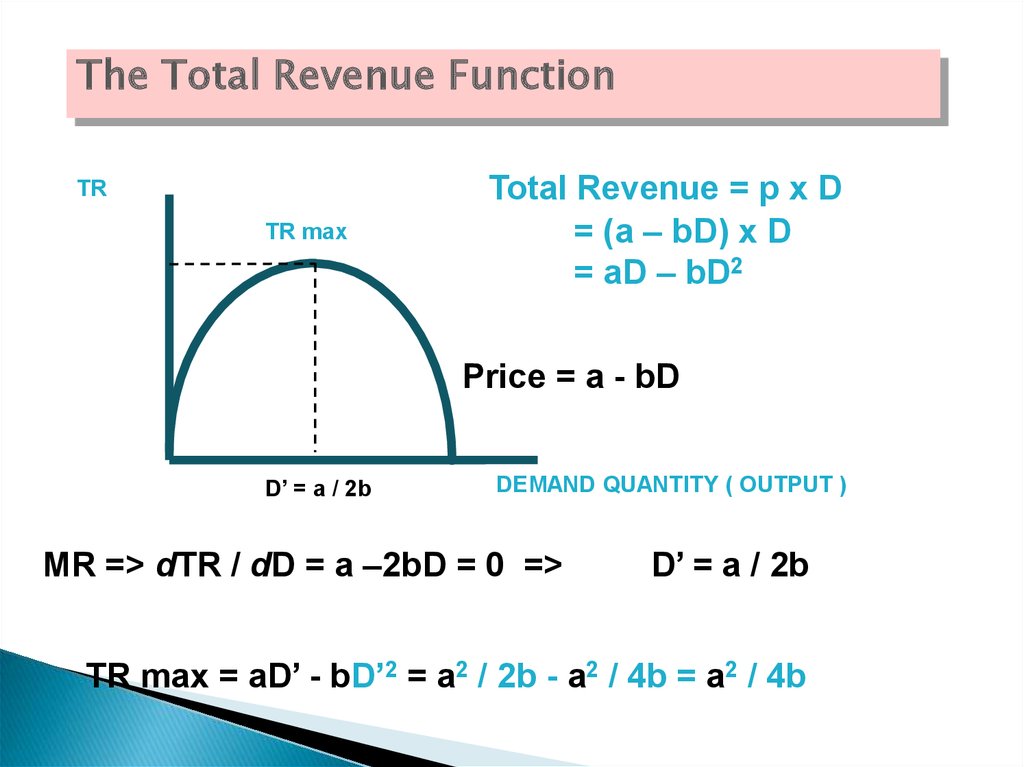

29.

The Total Revenue FunctionTR

TR max

Total Revenue = p x D

= (a – bD) x D

= aD – bD2

Price = a - bD

D’ = a / 2b

DEMAND QUANTITY ( OUTPUT )

MR => dTR / dD = a –2bD = 0 =>

D’ = a / 2b

TR max = aD’ - bD’2 = a2 / 2b - a2 / 4b = a2 / 4b

30. Cost, Volume, and Breakeven point Relationship

Profit = (aD - bD2) – (CF + CvD) = - bD2 + (a-Cv)D-CFMax Profit => d(profit)/dD = 0 =>

a – Cv - 2bD = 0

D* = a – Cv / - 2b

30

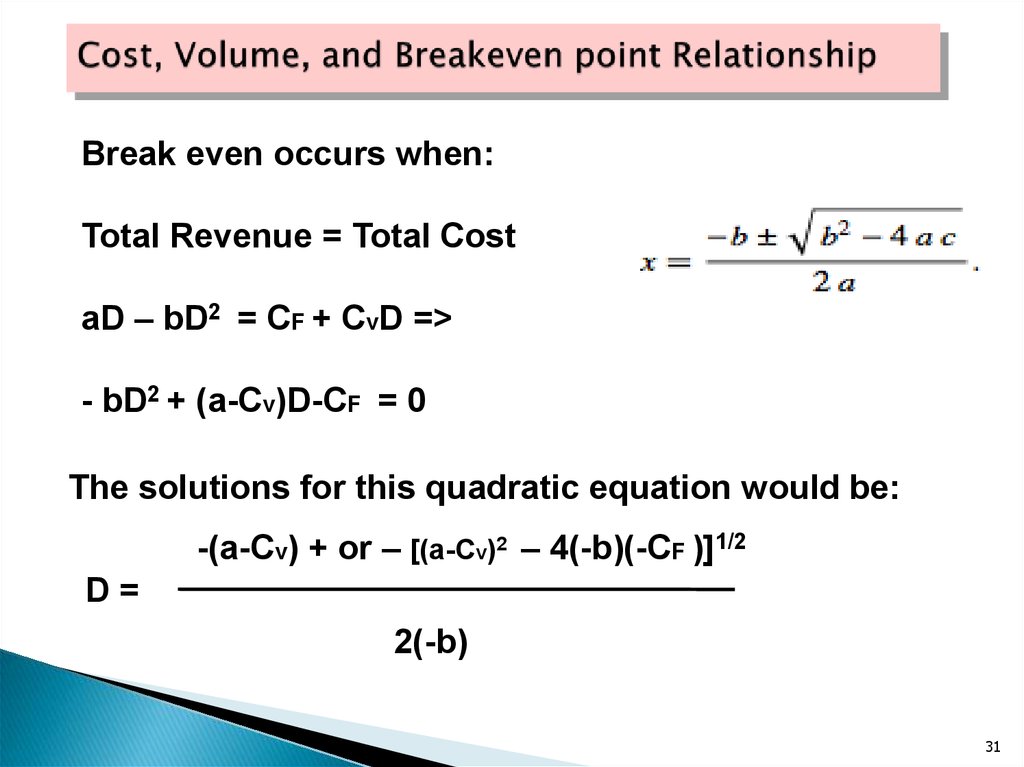

31. Cost, Volume, and Breakeven point Relationship

Break even occurs when:Total Revenue = Total Cost

aD – bD2 = CF + CvD =>

- bD2 + (a-Cv)D-CF = 0

The solutions for this quadratic equation would be:

-(a-Cv) + or – [(a-Cv)2 – 4(-b)(-CF )]1/2

D=

2(-b)

31

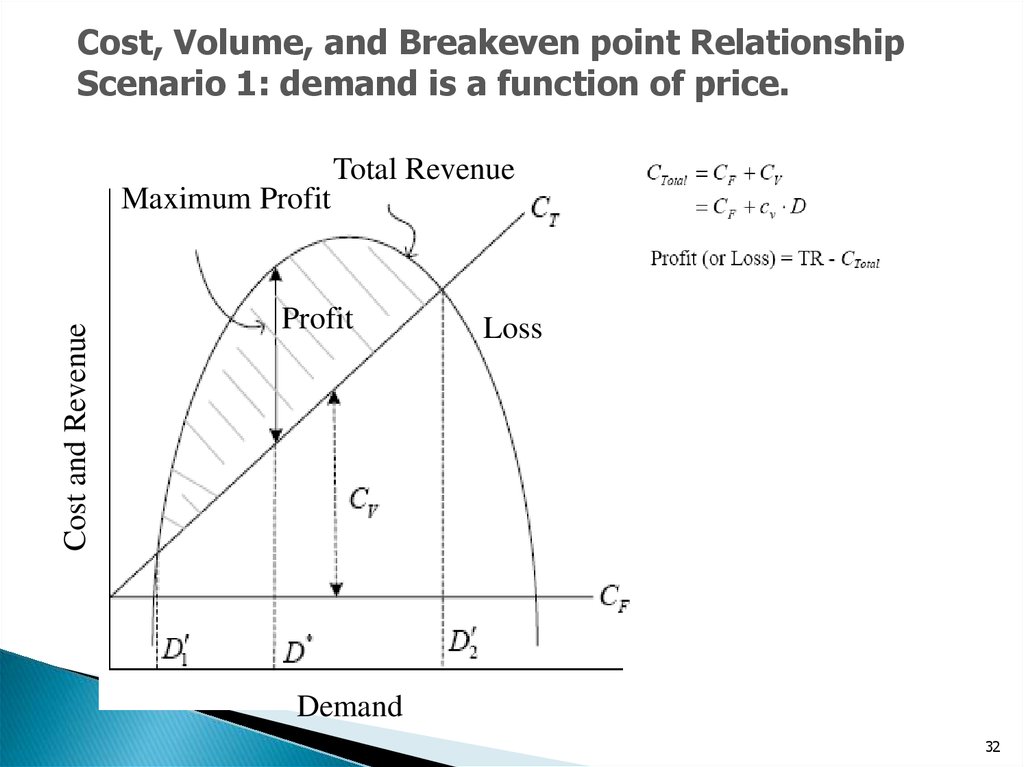

32.

Cost, Volume, and Breakeven point RelationshipScenario 1: demand is a function of price.

Total Revenue

Cost and Revenue

Maximum Profit

Profit

Loss

Demand

32

33.

PRICEPrice equals some

constant value minus some multiple

of the quantity demanded:

p=a-bD

a = Y-axis (quantity) intercept, (price at 0

amount demanded);

b = slope of the demand function;

D = (a – p) / b

PRICE

DEMAND QUANTITY (OUTPUT)

Total Revenue = p x D

= (a – bD) x D

DEMAND QUANTITY ( OUTPUT )

34.

MaximumProfit

Cost / Revenue

Marginal

( Incremental) Cost

Profit is maximum where

Total Revenue exceeds

Total Cost by greatest amount

Marginal

Revenue

Quantity ( Output )

Demand

Cost / Revenue

Ct

Profit

Total Revenue

Cf

D’1

D*

D’2

D’1 and D’2 are breakeven points

Quantity ( Output )

Demand

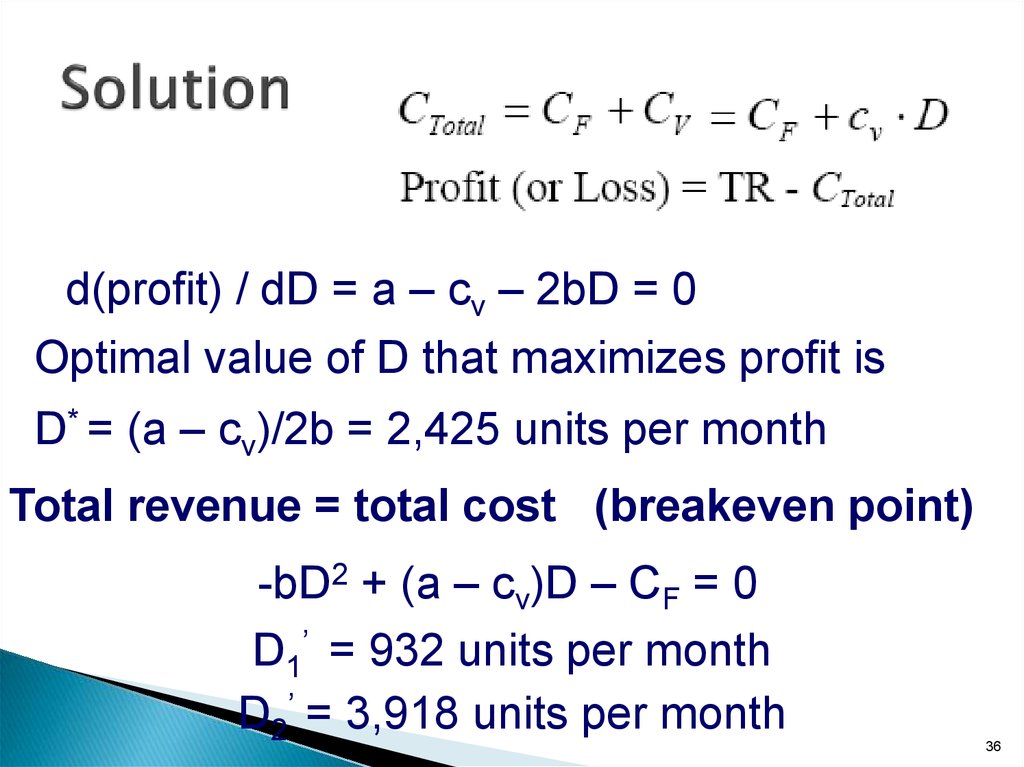

35. Example 2.6

A Company produces an electronic timing switchthat is used in consumer and commercial products

made by several other manufacturing firms. The

fixed cost (CF) is $73,000 per month, and the variable

cost (cv) is $83 per unit. The selling price per unit is

p = $180 – 0.02(D)

a) Determine the optimal volume for this product, and

b) Find the volumes at which breakeven occurs; that

is, what is the domain of profitable demand?

35

36. Solution

d(profit) / dD = a – cv – 2bD = 0Optimal value of D that maximizes profit is

D* = (a – cv)/2b = 2,425 units per month

Total revenue = total cost (breakeven point)

-bD2 + (a – cv)D – CF = 0

D1’ = 932 units per month

D2’ = 3,918 units per month

36

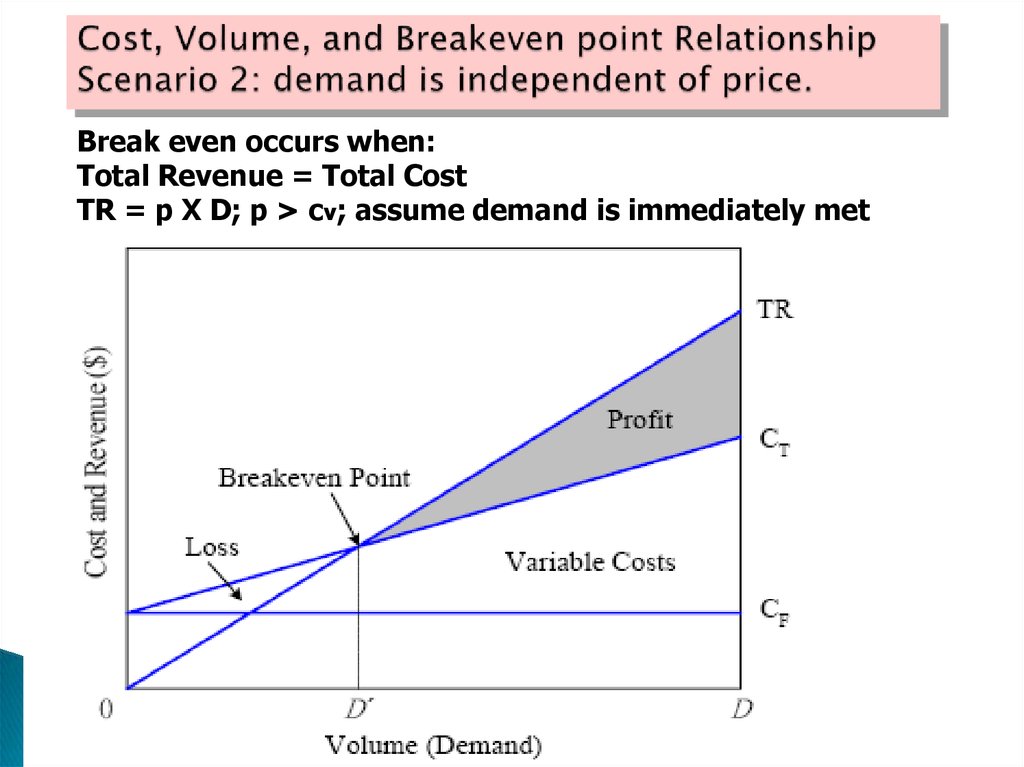

37. Cost, Volume, and Breakeven point Relationship Scenario 2: demand is independent of price.

Break even occurs when:Total Revenue = Total Cost

TR = p X D; p > cv; assume demand is immediately met

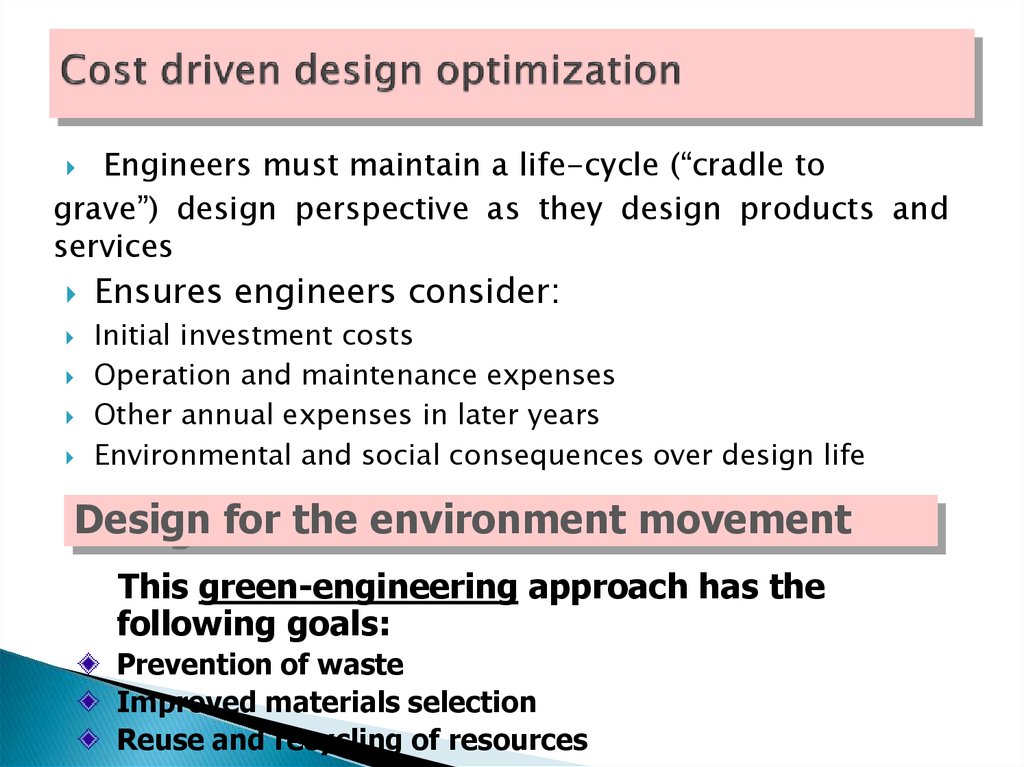

38. Cost driven design optimization

Engineers must maintain a life-cycle (“cradle tograve”) design perspective as they design products and

services

Ensures engineers consider:

Initial investment costs

Operation and maintenance expenses

Other annual expenses in later years

Environmental and social consequences over design life

Design for the environment movement

This green-engineering approach has the

following goals:

Prevention of waste

Improved materials selection

Reuse and recycling of resources

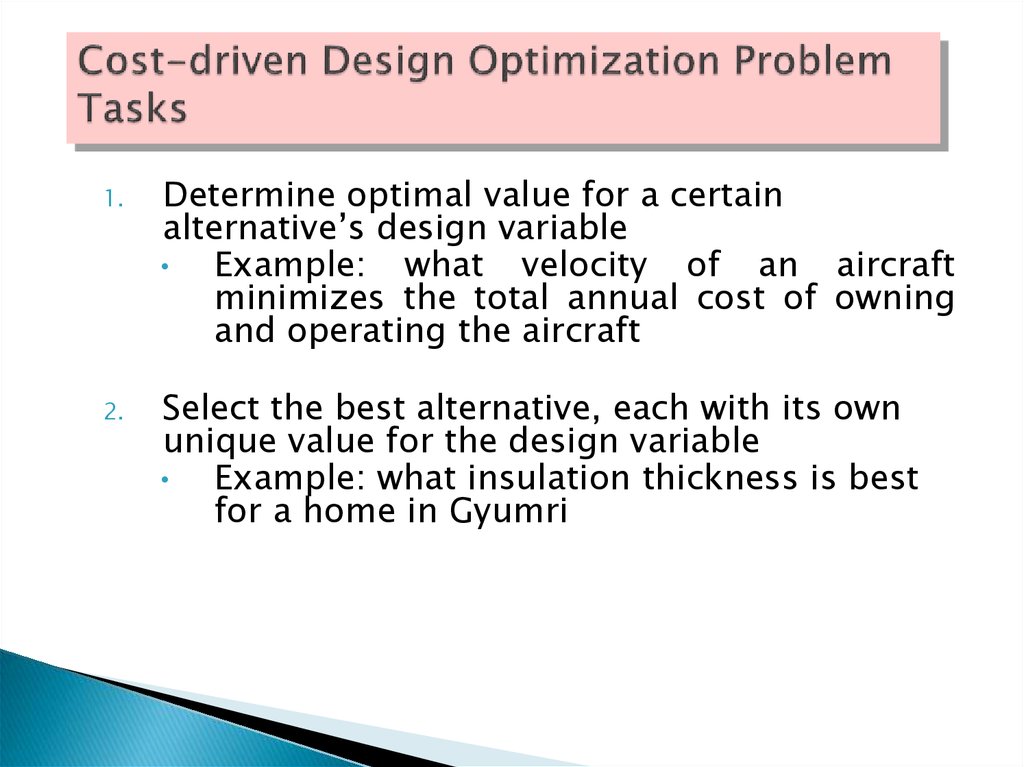

39. Cost-driven Design Optimization Problem Tasks

1.2.

Determine optimal value for a certain

alternative’s design variable

• Example: what velocity of an aircraft

minimizes the total annual cost of owning

and operating the aircraft

Select the best alternative, each with its own

unique value for the design variable

• Example: what insulation thickness is best

for a home in Gyumri

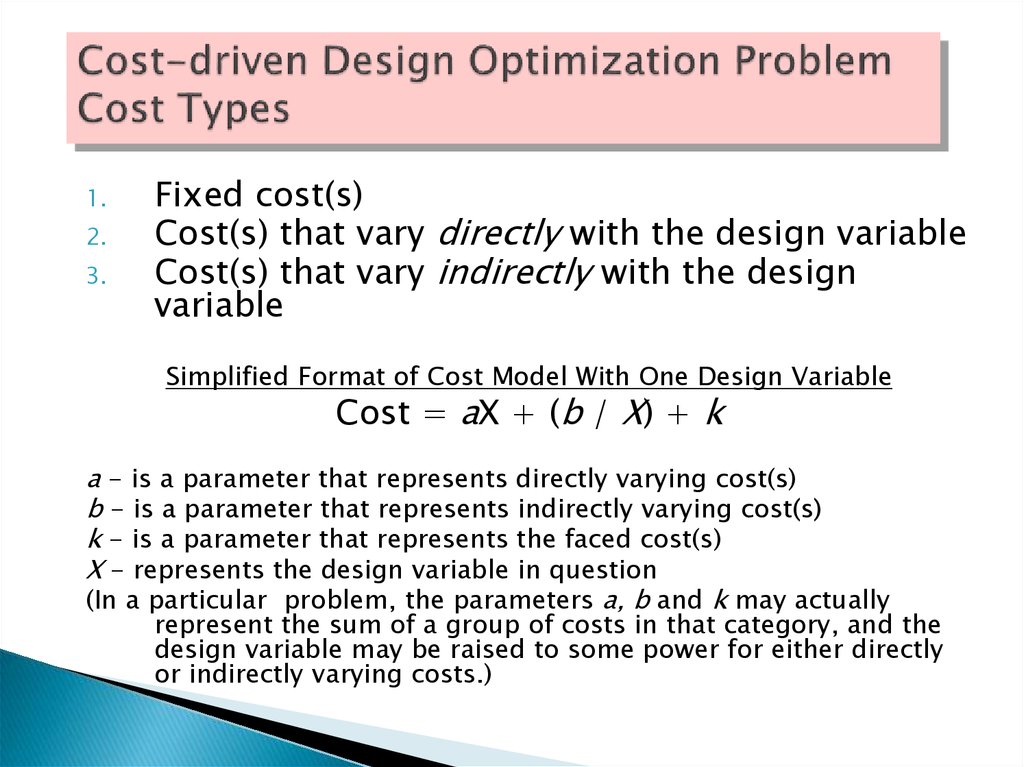

40. Cost-driven Design Optimization Problem Cost Types

1.2.

3.

Fixed cost(s)

Cost(s) that vary directly with the design variable

Cost(s) that vary indirectly with the design

variable

Simplified Format of Cost Model With One Design Variable

Cost = aX + (b / X) + k

a - is a parameter that represents directly varying cost(s)

b - is a parameter that represents indirectly varying cost(s)

k - is a parameter that represents the faced cost(s)

X - represents the design variable in question

(In a particular problem, the parameters a, b and k may actually

represent the sum of a group of costs in that category, and the

design variable may be raised to some power for either directly

or indirectly varying costs.)

41. General Approach for Optimizing a Design With Respect to Cost

1.Identify primary cost-driving design variable

2.

Write an expression for the cost model in terms of the

design variable

3.

4.

5.

Set first derivative of cost model with respect to

continuous design variable equal to 0. (For discrete design

variables, compute cost model for each discrete value over

selected range).

Solve equation in step 3 for optimum value of continuous

design variables

For continuous design variables, use the second derivative

of the cost model with respect to the design variable to

determine whether optimum corresponds to global

maximum or minimum.

42. Present Economy Studies

When alternatives for accomplishing a task are comparedfor one year or less (I.e., influence of time on money is

irrelevant)

Rules for Selecting Preferred Alternative

Rule 1 – When revenues and other economic benefits are

present and vary among alternatives, choose alternative

that maximizes overall profitability based on the number

of defect-free units of output

Rule 2 – When revenues and economic benefits are not

present or are constant among alternatives, consider only

costs and select alternative that minimizes total cost per

defect-free output

43. Present Economy Studies

Total Cost in Material SelectionIn many cases, selection of among materials cannot be based

solely on costs of materials. Frequently, change in materials

affect design, processing, and shipping costs.

Alternative Machine Speeds

Machines can frequently be operated at different speeds,

resulting in different rates of product output. However, this

usually results in different frequencies of machine downtime.

Such situations lead to present economy studies to determine

preferred operating speed.

44. Present Economy Studies

Make Versus Purchase (Outsourcing) StudiesA company may choose to produce an item in house, rather than

purchase from a supplier at a price lower than production costs

if:

direct, indirect or overhead costs are incurred regardless of whether

the item is purchased from an outside supplier, and

• The incremental cost of producing the item in the short run is less

than the supplier’s price.

The relevant short-run costs of the make versus purchase

decisions are the incremental costs incurred and the opportunity

costs of resources

45. Present Economy Studies

Make Versus Purchase (Outsourcing) StudiesOpportunity costs may become significant when

in-house manufacture of an item causes other

production opportunities to be foregone (E.G.,

insufficient capacity)

In the long run, capital investments in additional

manufacturing plant and capacity are often feasible

alternatives to outsourcing.

Экономика

Экономика