Похожие презентации:

Price offer for the provision of audit services by Independent Audit Company «Concord» LLP

1. Price offer for the provision of audit services by Independent Audit Company «Concord» LLP

2. Для внимания руководства Kazakhstan branch of the foreign company «Tek Know Holding ApS» Ex. No. 9 dated January 25, 2023

Для внимания руководстваKazakhstan branch of the foreign company «Tek Know Holding ApS»

Ex. No. 9 dated January 25, 2023

Dear sirs

Here is our price offer for verification of the accounting and tax accounting of the Kazakhstan branch of the foreign

company "Tech No Holding ApS" for 2022, compiled in accordance with IFRS and the requirements of the legislation

of the Republic of Kazakhstan.

The choice of «IAC «Concord» LLP will provide you::

reasonableness and balanced of decisions with a team with extensive experience in working with insurance companies;

a proactive approach to identifying and solving a problem, allowing you to find the right solutions to your problems in the

shortest possible time;

provision of services providing that ensures not only effective receipt of a reliable conclusion, but also useful comments

and recommendations for management;

rational value for money, not only due to the reasonable cost of services, but also due to the timely execution of the provision of

services providing within the established deadlines with the most efficient use of management time.

We hope that our proposed pricing policy will meet your expectations, as well as hope for further mutually beneficial cooperation

and will be happy to discuss with you our price proposal, as well as consider any questions at a convenient time for you.

Regards,

General Director of «IAC «Concord» LLP

Slambekova R.Zh.

2

3. Content

Regulation of auditing activitiesGovernment license

Services provided by «IAC «Concord» LLP

Membership in a Professional Auditing Organization

«IAC «Concord» LLP today

Advantages of choosing «IAC «Concord» LLP as an auditor

Our clients

Our professional team 14-17

Audit methodology of «IAC «Concord» LLP

Audit stages

Quality control and business reputation of «IAC «Concord» LLP

Compliance with ethical standards

By ordering an audit of financial statements, you get

Cost of the service terms of completion of the audit

Our office in Almaty

Conclusion

4

5

6

7-8

9

10-11

12-13

18

19

20

21

22

23-24

25

26

3

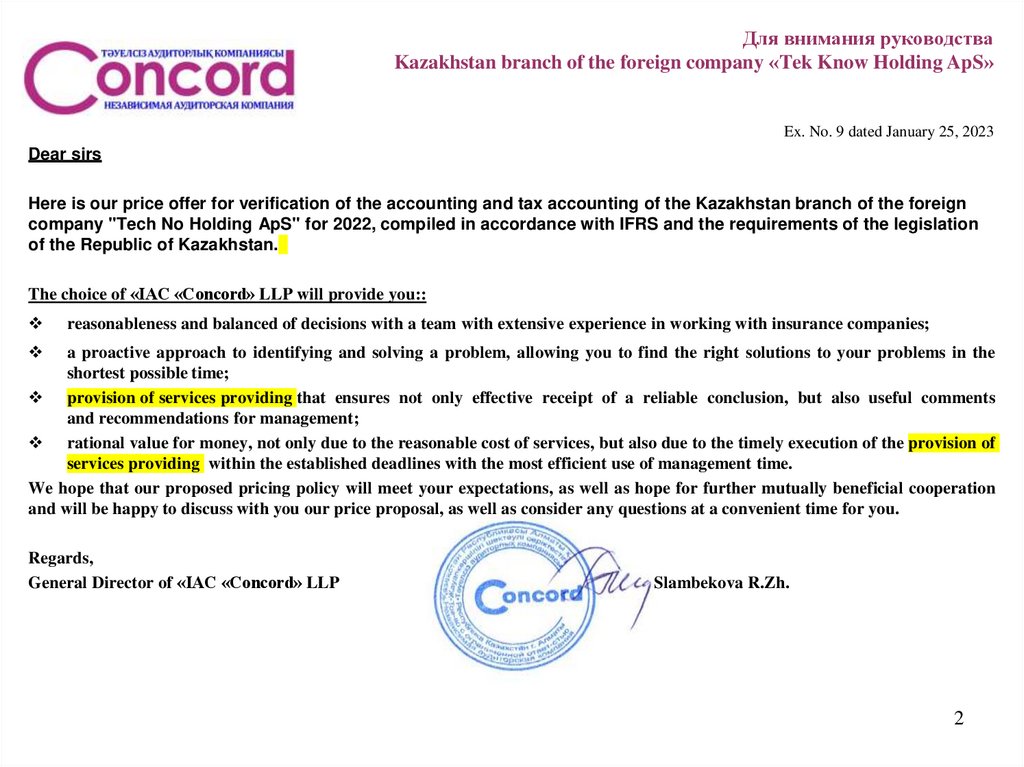

4. Regulation of auditing activities

The main regulatory legal act regulating auditing activities is the Law of the Republic ofKazakhstan "On Auditing Activities" No. 304-I dated 20.11.1998.

The audit activity of «IAC Concord» LLP and its employees is regulated by:

•State license to engage in auditing activities No. 0000084, issued by the Ministry of

Finance of the Republic of Kazakhstan on 05.03.2012;

•The legislation of the Republic of Kazakhstan on auditing activities;

•International Standards on Auditing (IAS);

•The Code of Ethics of Professional Accountants;

•Company-wide standards and Methodology of the Company.

4

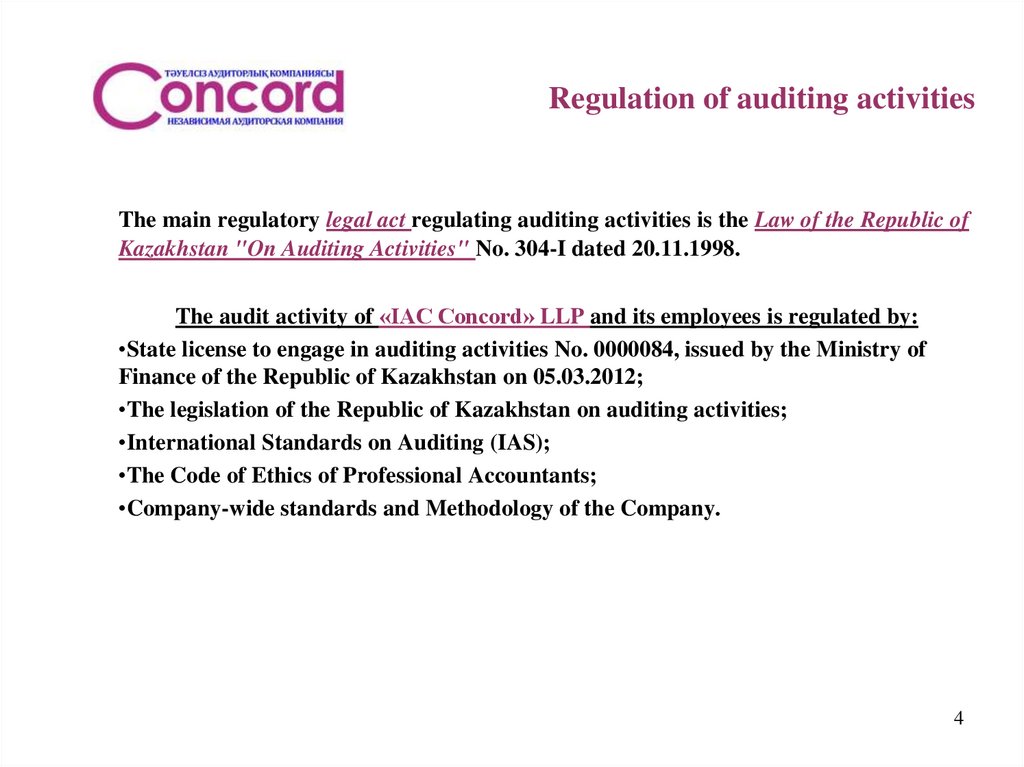

5. Government license

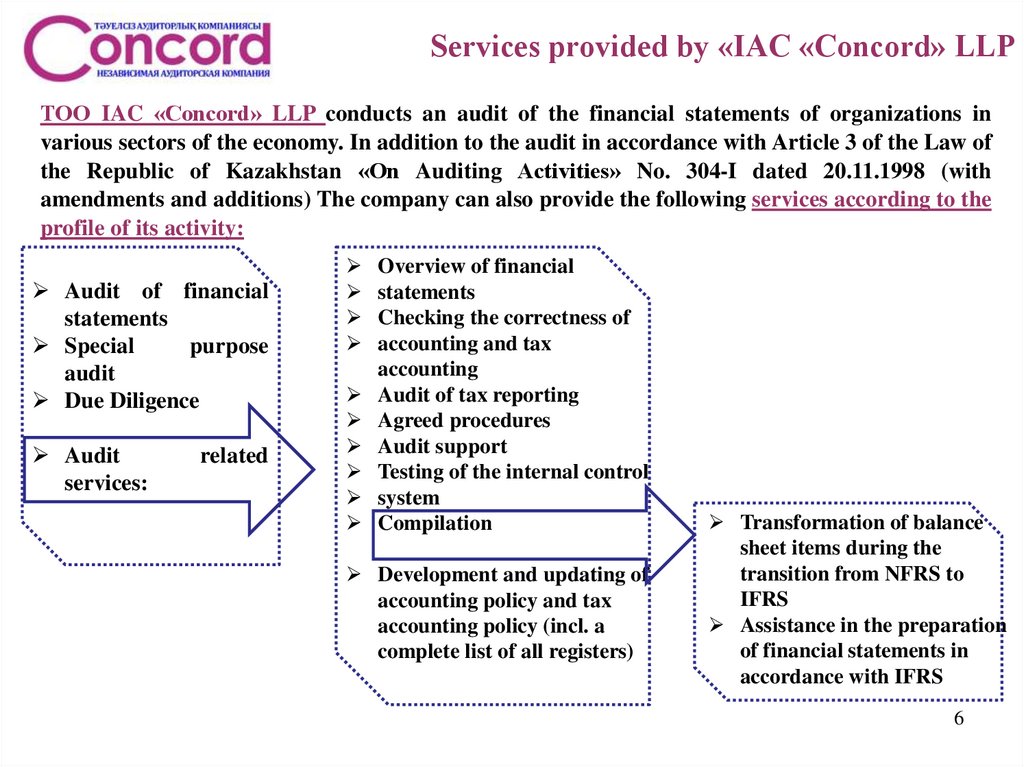

56. Services provided by «IAC «Concord» LLP

ТОО IAC «Concord» LLP conducts an audit of the financial statements of organizations invarious sectors of the economy. In addition to the audit in accordance with Article 3 of the Law of

the Republic of Kazakhstan «On Auditing Activities» No. 304-I dated 20.11.1998 (with

amendments and additions) The company can also provide the following services according to the

profile of its activity:

Audit of financial

statements

Special

purpose

audit

Due Diligence

Audit

services:

related

Overview of financial

statements

Checking the correctness of

accounting and tax

accounting

Audit of tax reporting

Agreed procedures

Audit support

Testing of the internal control

system

Compilation

Development and updating of

accounting policy and tax

accounting policy (incl. a

complete list of all registers)

Transformation of balance

sheet items during the

transition from NFRS to

IFRS

Assistance in the preparation

of financial statements in

accordance with IFRS

6

7. Membership in a Professional Auditing Organization

Thenon-governmental regulatory body is the Professional Auditin Organization

«Chamber of Auditors of the Republic of Kazakhstan».

IAC Concord LLP is a member of the Professional Auditing Organization «Chamber of

Auditors of the Republic of Kazakhstan», accredited by the Ministry of Finance of the

Republic of Kazakhstan, and has a certificate of recognition of a legal entity as a member

of a Professional Auditing Organization with the rights, duties and responsibilities

provided for by the Charter and the Code of Ethics of Auditors (registration No. 125-A

dated 03.05.2012).

7

8. Membership in a Professional Auditing Organization

89. «IAC «Concord» LLP today

«IAC «Concord» LLP - one of the largest audit companies in Kazakhstan, flexibly responding

to all external changes, dynamic, competent and experienced team.

«IAC «Concord» LLP It is one of the leading Kazakhstani audit companies that successfully

compete with international audit companies that are part of the Big FOUR.

«IAC «Concord» LLP was included in the list of audit organizations recognized by the

Exchange that meet the qualification requirements for audit organizations for admission of

financial instruments to the special trading platform of the regional financial center of Almaty

by the decision of the Committee of the Board of Directors on Financial Reporting and Audit

of Issuers of Kazakhstan Stock Exchange JSC (KASE).

Besides, «IAC «Concord» LLP - has a certificate of «Quality Management Systems» ISO 90012016.

We have passed external quality control of the audit services provided, as a result of which we

received a high rating of 5, which means that the activity of the audit organization is sufficient

to ensure the quality of the audit at the proper level and is aimed at compliance with the

requirements of the ISA and the Code of Ethics of Professional Accountants (IFAC).

9

10. Advantages of choosing «IAC «Concord» LLP as an auditor

❖ Personal responsibility of Management «IAC «Concord» LLP :Compliance with the established deadlines;

Timely resolution of key issues;

Business reputation and stability of «IAC «Concord» LLP ;

A team of highly qualified professionals.

❖ Global approach – individual solutions:

Priority in the work of the management of «IAC «Concord» LLP with global clients as a decisionmaking center;

The use of an integrated approach to audit, the distinctive feature of which is flexibility, allowing to take into

account the individual needs of the client and provide services taking into account all the features of his

business.

❖ Our experience and understanding of the business:

Deep understanding of the industry as well as the inherent risks;

A fresh look and ideas that bring additional benefits to the business of the audited company, as part of

the audit;

We do not recruit customers by quantity. We are looking for reliable partners, so the order is carried

out for each partner individually with a focus on results and is never formal.

❖ Our guarantees:

All services are provided by us at the level of high professional regulations and standards of our

company's Methodology with the use of a multi-level quality control system;

The civil liability of «IAC «Concord» LLP is insured in a reliable insurance company.

10

11.

High potential ofour personnel

Our guarantees

for the customer

Your advantage

Complexity of the

approach

Service support

after the audit

We will help solve problems

related to control systems,

financial reporting and other

issues affecting the success of

our clients' business!!!

11

12. Our clients

The clients of «IAC «Concord» LLP are enterprises operating in the field of construction,production, trade, information systems, pharmaceuticals, education, subsoil use, finance and

others.

12

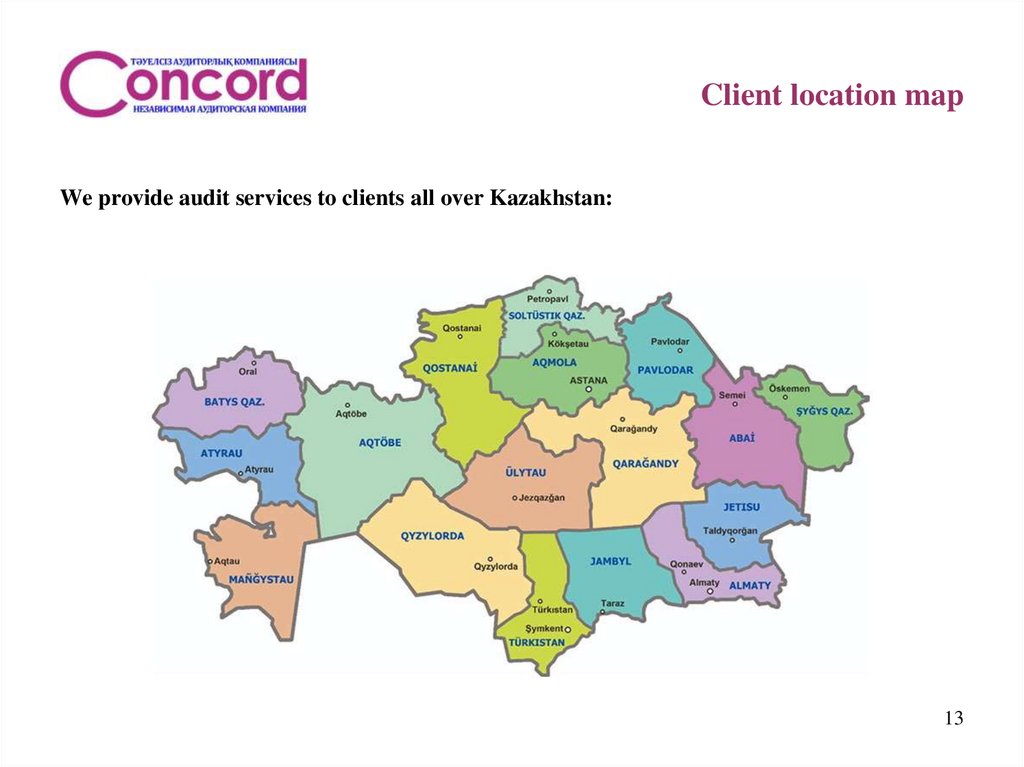

13. Client location map

We provide audit services to clients all over Kazakhstan:13

14. Our professional team

The team consists of successful, responsible professionals who have repeatedlyproven their qualifications: auditors, accountants, economists, lawyers,

management specialists with many years of experience working with enterprises of

various forms of ownership and activities, as well as deep knowledge of

international financial reporting standards, understanding the specifics of your

Company's industry. Each of the employees of «IAC «Concord» LLP is an

important link in our common professional work.

The specialists of «IAC «Concord» LLP have knowledge confirmed by

international and national certification in the field of accounting and auditing

(Auditor of the Republic of Kazakhstan, ACCA, CPA, DipIFR ACCA, CAP,

Professional Accountant of the Republic of Kazakhstan, tax consultant), as well as

sufficient professional experience to perform the work efficiently.

The staff of «IAC «Concord» LLP employs 10 auditors who have a qualification

certificate Auditor of the Republic of Kazakhstan.

The company attaches great importance to continuous professional training of

employees. Seminars and trainings organized by the Company for its employees

and clients are regularly held on amendments to IFRS, topical issues of financial

and economic activities of enterprises, taxation and other issues that interest the

client.

14

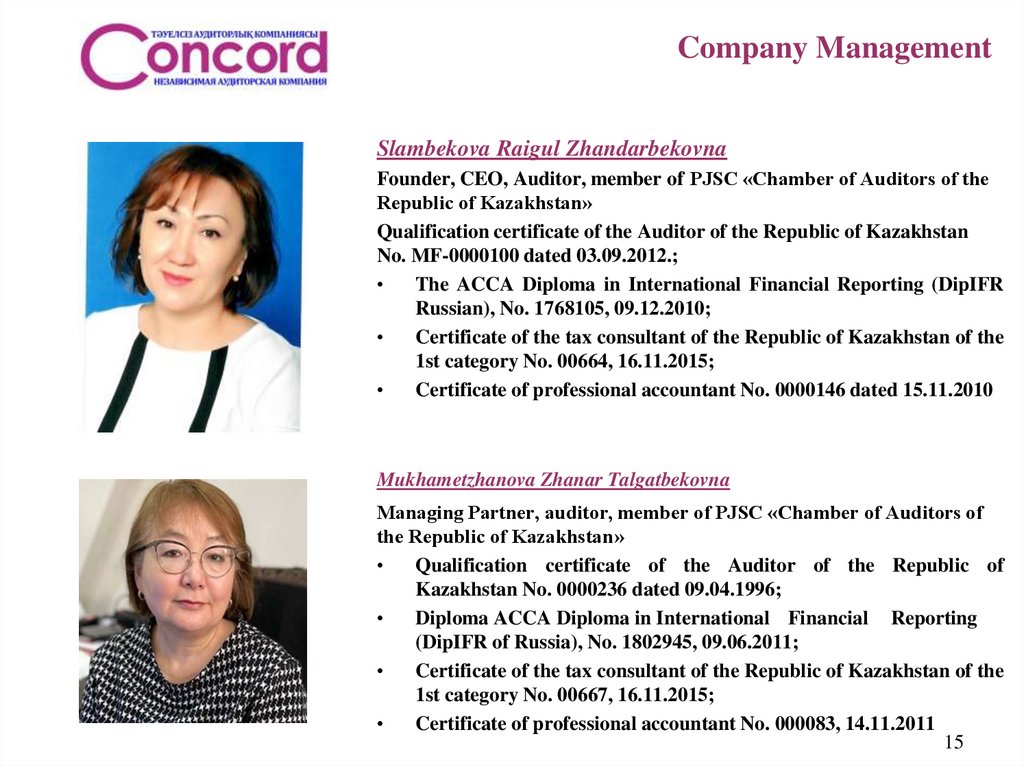

15. Company Management

Slambekova Raigul ZhandarbekovnaFounder, CEO, Auditor, member of PJSC «Chamber of Auditors of the

Republic of Kazakhstan»

Qualification certificate of the Auditor of the Republic of Kazakhstan

No. MF-0000100 dated 03.09.2012.;

The ACCA Diploma in International Financial Reporting (DipIFR

Russian), No. 1768105, 09.12.2010;

Certificate of the tax consultant of the Republic of Kazakhstan of the

1st category No. 00664, 16.11.2015;

Certificate of professional accountant No. 0000146 dated 15.11.2010

Mukhametzhanova Zhanar Talgatbekovna

Managing Partner, auditor, member of PJSC «Chamber of Auditors of

the Republic of Kazakhstan»

Qualification certificate of the Auditor of the Republic of

Kazakhstan No. 0000236 dated 09.04.1996;

Diploma ACCA Diploma in International Financial Reporting

(DipIFR of Russia), No. 1802945, 09.06.2011;

Certificate of the tax consultant of the Republic of Kazakhstan of the

1st category No. 00667, 16.11.2015;

Certificate of professional accountant No. 000083, 14.11.2011

15

16. Composition of the audit team

Sarbasov Sauran BaglanovichMailybayeva Gulnara Sapargalievna

Auditor, member of PJSC «Chamber of Auditors of

the Republic of Kazakhstan»

Qualification Certificate of the Auditor of the

Republic of Kazakhstan No. MF-0000194, dated

06.08.2014;

International Certificate Member

of

the

Association of Chartered Certified Accountants

(ACCA), No. 00906797, 28.04.2011;

International Certificate Certified Professional

Accountant of British Columbia (CPA), No. 31,

01.01.2018.

Auditor, member of PJSC «Chamber of Auditors of the

Republic of Kazakhstan»

Qualification certificate of the Auditor of the

Republic of Kazakhstan No. MF-0001150 dated

18.08.2020;

International

Certificate

Member of the

Association Association of Chartered Certified

Accountants (ACCA), No. 2080614, 09.19.2013;

International Certificate Certified Professional

Accountant of British Columbia(CPA), No. XX,

01.12.2015.

Kairanova Tolkyn Muhametkalievna

Shevernitskaya Tamara Yurievna

Auditor, member of PJSC «Chamber of Auditors of

the Republic of Kazakhstan»

Qualification Certificate of the Auditor of the

Republic of Kazakhstan No. MF-0000525 dated

16.01.2018 г.;

International Certificate Member of the

Association Association of Chartered Certified

Accountants (ACCA) No. 0962263, 20.06.2015;

Certificate of professional accountant, No.

000709, 03.01.2019.

Auditor, member of PJSC «Chamber of Auditors of the

Republic of Kazakhstan»

Qualification certificate of the Auditor of the

Republic of Kazakhstan No. 0000585 dated

18.08.2006;

The ACCA Diploma in International Financial

Reporting (DipIFR Russian) dated 10.12.2009;

CIPA Certificate, No. 0000124 dated 12.16.2006;

Certificate of professional accountant, No.

000556, 02.15.2013.

16

17. Composition of the audit team

Rakhimberlinova Zhanar ZhandarbekovnaSlambekov Azamat Sanatayuly

Auditor, member of PJSC «Chamber of Auditors of

the Republic of Kazakhstan»

Qualification certificate of the Auditor of the

Republic of Kazakhstan No. MF-0000112 dated

03.09.2012;

The ACCA Diploma in International Financial

Reporting (DipIFR Russian), № 1767985 dated

09.12.2010 ;

Certificate of the tax consultant of the Republic

of Kazakhstan of the 1st category No. 00665

dated 16.11.2015;

Certificate of professional accountant No.

0000142 dated 15.11.2010

Auditor, member of PJSC «Chamber of Auditors of

the Republic of Kazakhstan»

Qualification certificate of the auditor of the

Republic of Kazakhstan No. MF 0001037 dated

20.02.2020;

Certificate of professional accountant No. 001705

dated 28.10.2016;

Certificate of the tax consultant of the Republic of

Kazakhstan of the 1st category No. 001411 dated

27.03.2019.

Rudina Alina Andreevna

Супиева Наргиза Хамраевна

Auditor, member of PJSC «Chamber of Auditors of

the Republic of Kazakhstan»

Qualification certificate of the Auditor of the

Republic of Kazakhstan No. MF 0001361 dated

21.01.2021;

Certificate of professional accountant No.

0001714 dated 27.01.2017;

Certificate of the tax consultant of the Republic

of Kazakhstan of the 1st category No. 001409

dated 27.03.2019.

Auditor, member of PJSC «Chamber of Auditors of

the Republic of Kazakhstan»

Qualification certificate of the Auditor of the

Republic of Kazakhstan No. MF 0001484 dated

17.03.2021 г.;

Certificate of professional accountant No. BSB 00736 dated 02.08.2019 г.;

Certificate of the tax consultant of the Republic

17

of Kazakhstan of the 1st category No. 001415

dated 27.03.2019 г.

18. Audit methodology of «IAC «Concord» LLP

General overview of the Audit MethodologyThe provision of high-quality audit services, in accordance with current

professional standards, is the guiding principle of the Audit Methodology

of «IAC «Concord» LLP . Our Methodology serves as a means of

controlling the services we provide and acts as a guarantor of a highquality, independent audit.

The approach of our Audit Methodology ensures a holistic audit of your

Company « without surprises» , which:

Максимизирует знания отраслевых вопросов, стратегических рисков,

бизнес-процессов и требований к представлению отчетности;

Maximizes knowledge of industry issues, strategic risks, business

processes and reporting requirements;

Focuses on the most significant risks in your financial statements;

Understands the importance of the control system, including the

information technology control system, in the functioning of your

Company as a whole.

We have considerable experience in providing audit services, the purpose

of which is to use our knowledge and experience for the benefit of our

clients.

18

19. Audit stages

1.Planning

Implementation of risk assessment procedures, identification of specific risks;

Development of audit strategy, identification of critical accounting objects;

Development of an audit approach.

2. Evaluation of the internal control system

Study of the accounting system and preparation of financial statements;

Assessment of the organization and functioning of the selected controls;

Testing the effectiveness of selected controls;

Assessment of the risk of non-detection of errors and distortions by applying

control procedures.

3.

Detailed verification procedures

Planning and selection of detailed procedures;

Performing detailed procedures;

Assessment of whether audit evidence is sufficient and credible;

Formulation of conclusions on critical accounting objects.

4.

Completion of the audit

Implementation of procedures for the completion of the audit;

Conducting a general assessment of the financial statements and the

information disclosed therein;

Preparation of the auditor's report.

19

20. Quality control and business reputation of «IAC «Concord» LLP

The business reputation of «IAC «Concord» LLP is basedon the principles of activity, a system of values and a code

of professional conduct. During the work in the market of

the Republic of Kazakhstan, our company has confirmed

and strengthened its business reputation, as it has always

attached the most important importance to the issues of

business integrity and independence of the auditor. One of

the main aspects of our business strategy was to gain an

impeccable reputation, which performs the functions of an

auditor with all care and at the proper level. In all

situations when we faced the need for choice, we chose the

path of business decency and independence.

«IAC «Concord» LLP pays close attention to the

implementation of audit quality control, which provides

for a wide range of measures aimed at ensuring the

integrity and objectivity of employees when performing

work to achieve high quality audit.

20

21. Compliance with ethical standards

IndependenceConfidentiality

«IAC «Concord» LLP has

the opportunity to perform the

above works at the level of high

professional and ethical

standards.

Compliance with these

standards ensures:

Disclosure of

significant

factors

Objectivity

21

22. By ordering an audit of financial statements, you get

For participants• An audit report on the reliability of financial

statements, which allows the reporting user to draw

correct conclusions about the financial position of

the company based on the data of the report.

For guidance

• An internal report containing the main problems

negatively affecting the internal control system of the

organization, as well as affecting financial stability

or entailing tax and other risks.

For the financial

service

• Information on the full list of deviations identified

during the audit in the accounting methodology and

taxation of the organization from the norms of

legislation and recommendations for the elimination

of these inconsistencies.

22

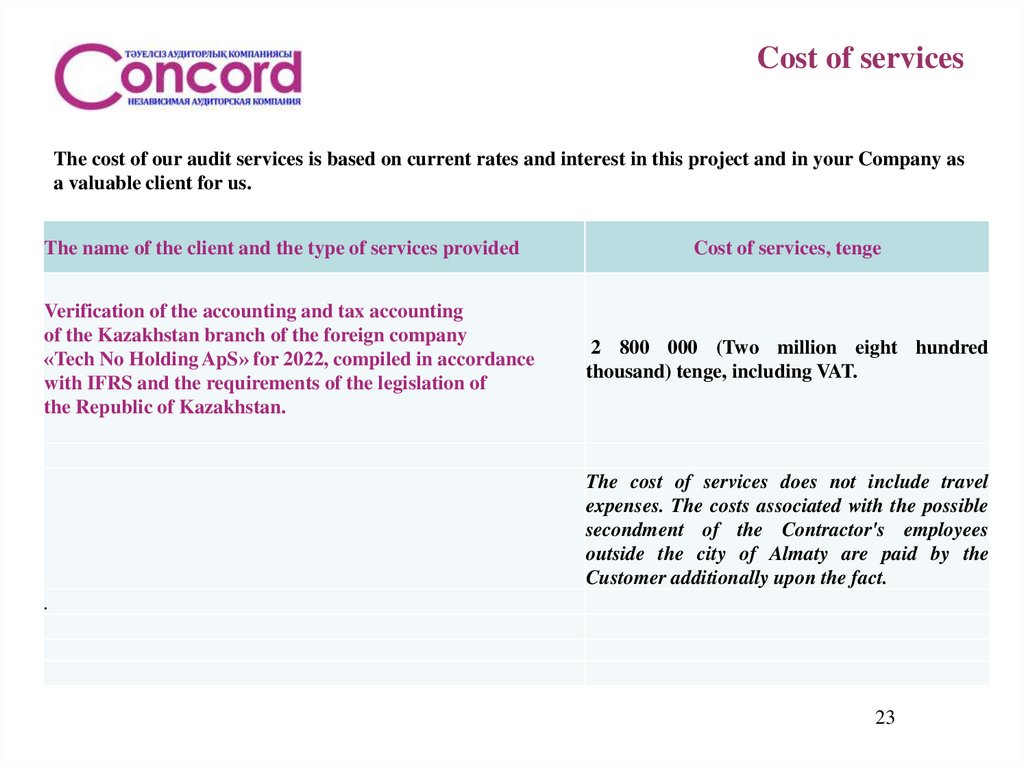

23. Cost of services

The cost of our audit services is based on current rates and interest in this project and in your Company asa valuable client for us.

The name of the client and the type of services provided

Cost of services, tenge

Verification of the accounting and tax accounting

of the Kazakhstan branch of the foreign company

«Tech No Holding ApS» for 2022, compiled in accordance

with IFRS and the requirements of the legislation of

the Republic of Kazakhstan.

2 800 000 (Two million eight hundred

thousand) tenge, including VAT.

The cost of services does not include travel

expenses. The costs associated with the possible

secondment of the Contractor's employees

outside the city of Almaty are paid by the

Customer additionally upon the fact.

.

23

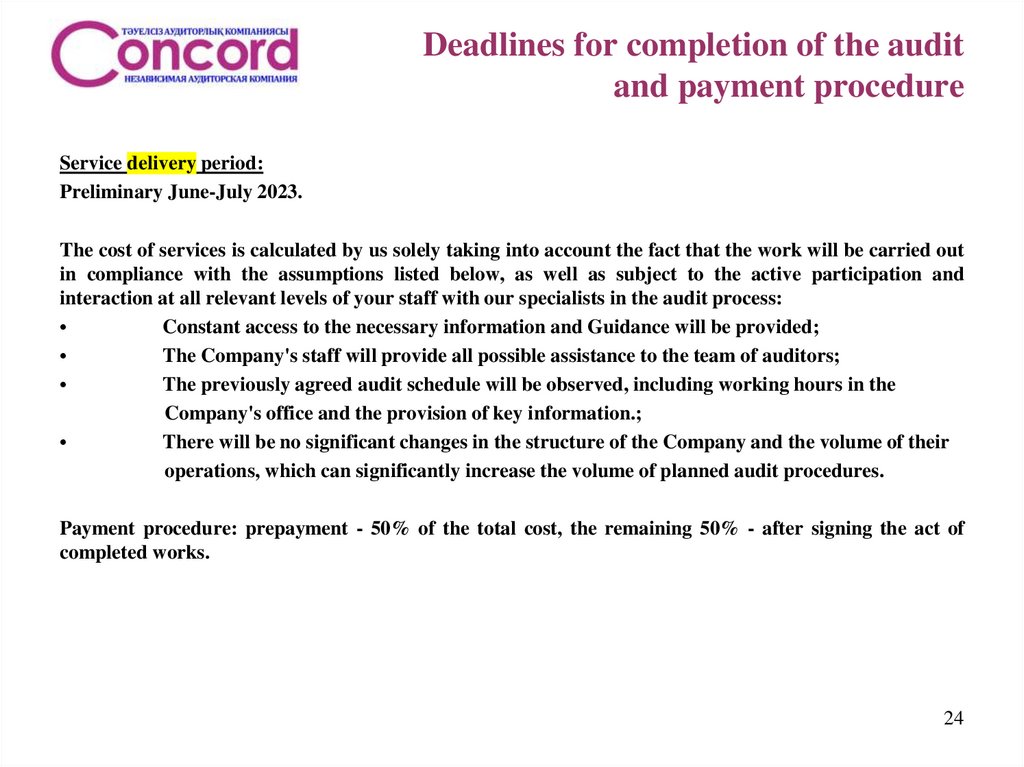

24. Deadlines for completion of the audit and payment procedure

Service delivery period:Preliminary June-July 2023.

The cost of services is calculated by us solely taking into account the fact that the work will be carried out

in compliance with the assumptions listed below, as well as subject to the active participation and

interaction at all relevant levels of your staff with our specialists in the audit process:

Constant access to the necessary information and Guidance will be provided;

The Company's staff will provide all possible assistance to the team of auditors;

The previously agreed audit schedule will be observed, including working hours in the

Company's office and the provision of key information.;

There will be no significant changes in the structure of the Company and the volume of their

operations, which can significantly increase the volume of planned audit procedures.

Payment procedure: prepayment - 50% of the total cost, the remaining 50% - after signing the act of

completed works.

24

25. Our office in Almaty

Our office in Almaty:, 140 Aimanova str., room 8a

Phone number: (727) 225 81 25, 225 81 35

cellular phone: +7 (707) 910 71 44

25

26. Conclusion

Consideration of the client's interests and requirementsThe Company's management will have a full opportunity to openly express their opinion about the work of

our specialists and the quality of their services. All the comments and suggestions made will be taken into

account in the planning process and the distribution of responsibilities in the future. «IAC « Concord» LLP

attaches great importance to establishing constructive business relationships with customers, considering it as

an integral part of our business.

Conclusion

We understand that the appointment of an auditor is a very difficult issue, and we are fully aware of the

importance of such a step. By sending you our offer of cooperation, we hope that we were able to highlight all

the main issues, took into account all the requirements and tasks facing the Company, and also clearly

demonstrated our responsible approach to audit and self-confidence as professionals in their field. Our

business philosophy is based on people and ideas.

26

Финансы

Финансы Бизнес

Бизнес