Похожие презентации:

Decision-making processes and evaluation

1.

LVIV POLYTECHNIC NATIONAL UNIVERSITYCourse: Evaluation of assets by different techniques, using IT

DECISION-MAKING PROCESSES AND EVALUATION

Prof. Francesca Nocca

University of Naples Federico II, Italy

francesca.nocca@unina.it

2.

DECISION MAKING PROCESSES AND EVALUATIONSECTIONS OF THE LECTURE

SECTION I

• Decision-making processes and evaluation: an overview

• Focus on multicriteria evaluation methods

SECTION II

• Case study: Real Estate Market Dynamics in the City of Naples (Italy)

SECTION III

• Conclusions

3.

DECISION-MAKING PROCESSES AND EVALUATION: AN OVERVIEW4.

WHAT DOES IT MEAN TO EVALUATE?Whenever the individual is called upon to make a decision, he or she is faced with a problem of

choosing among several alternative options, including the option of non-intervention, that is, he/she

is forced to carry out a process of evaluation among several possibilities in order to identify the

PREFERABLE ONE. It is not possible, therefore, to separate the issue of choice from that of

evaluation (Costanza et al., 1997).

Evaluation is the set of activities oriented

toward the appropriate organization of the

information necessary for choice, such that

each actor in the decision-making process is

able to make the most balanced decision

possible (Nijkamp et al., 1990).

Evaluation in design consists of comparing

design alternatives to deduce the overall most

desirable design hypothesis, that is, the one

that comes closest to the ''ideal project''

(Zeleny, 1982).

DECISION-MAKING PROCESSES AND EVALUATION |

5.

WHAT DOES IT MEAN TO EVALUATE?Evaluation is a strategic activity at different levels and a fundamental tool for:

⮚ scientific support for decision-making processes to make appropriate choices and rationalize

programs and actions;

⮚ ex-ante, on-going and ex-post verification of the actual achievement of planned objectives in

terms of quantity, costs, efficiency, effectiveness, quality of processes and products, and impacts

aimed at continuous improvement;

⮚ guarantee with respect to users, investments and society as a whole.

DECISION-MAKING PROCESSES AND EVALUATION |

6.

THE INTERNATIONAL FRAMEWORKDECISION-MAKING PROCESSES AND EVALUATION |

7.

WHEN TO EVALUATE?T- 1

T1

T2

T3

Planning

Implementation

Managment

Ex ante

Evaluation

On going

Evaluation

Ex post

evaluation

POSITIONING IN THE DECISION-MAKING PROCESS

EX ANTE

ON GOING

EX POST

Before the action (project, plan, etc.) is outlined and

implemented; to verify whether it is appropriate

and/or feasible.

After the action (project, plan, etc.) has been

outlined and while it is being implemented; to check

whether the progress corresponds to what was

planned.

After the action (project, plan, etc.) has been

implemented and has produced results; to check

whether it has produced the expected results or even

unexpected results.

OBJECTIVE

Planning

Monitoring

Monitoring and

feedback

8.

MULTICRITERIA EVALUATION METHODS9.

MULTIDIMENSIONAL EVALUATIONSEvaluation methods help to choose "which" project or plan or strategy is PREFERRED over others, "to what extent“,

and "for whom“, making policymakers, public and private actors, and interested social groups more aware of the

various types of consequential effects of individual actions.

MONETARY APPROACHES

ECONOMIC

DIMENSION

FINANCIAL ANALYSIS

COST-BENEFIT ANALYSIS

CULTURAL

DIMENSION

SOCIAL

DIMENSION

COST-EFFECTIVENESS ANALYSIS

NON-MONETARY APPROACHES

ENVIRONMENTAL

DIMENSION

MULTICRITERIA ANALYSIS

DECISION-MAKING PROCESSES AND EVALUATION |

10.

MULTICRITERIA EVALUATION METHODSMCDA

Multi-Criteria Analysis (MCDA) is a branch of Operations Research (OR) that is used to evaluate

multiple criteria and conflicting opinions in decision making. MCDA uses mathematical approaches

to formalize problems and uses operational steps to solve them. Its main strength is inherent in its

ability to aggregate diverse data, information, criteria and conflicting views into synthetic results.

Multi-criteria analyses are a decision support tool. They allow dealing with complex problems

characterized by uncertainty and monetary and nonmonetary, quantitative and qualitative

information.

GIS and Regional Science

Sustainability

Medicine

Statistics

Medical Technology

Figure source: Poli, 2022

DECISION-MAKING PROCESSES AND EVALUATION |

11.

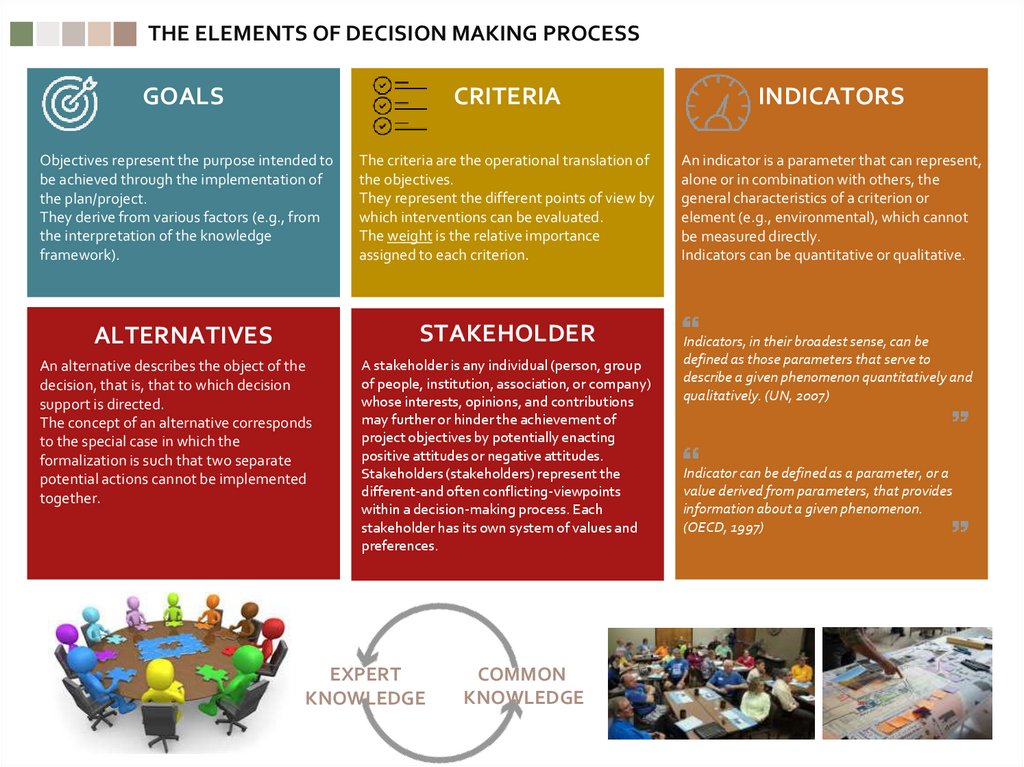

THE ELEMENTS OF DECISION MAKING PROCESSGOALS

CRITERIA

INDICATORS

Objectives represent the purpose intended to

be achieved through the implementation of

the plan/project.

They derive from various factors (e.g., from

the interpretation of the knowledge

framework).

The criteria are the operational translation of

the objectives.

They represent the different points of view by

which interventions can be evaluated.

The weight is the relative importance

assigned to each criterion.

An indicator is a parameter that can represent,

alone or in combination with others, the

general characteristics of a criterion or

element (e.g., environmental), which cannot

be measured directly.

Indicators can be quantitative or qualitative.

ALTERNATIVES

STAKEHOLDER

An alternative describes the object of the

decision, that is, that to which decision

support is directed.

The concept of an alternative corresponds

to the special case in which the

formalization is such that two separate

potential actions cannot be implemented

together.

A stakeholder is any individual (person, group

of people, institution, association, or company)

whose interests, opinions, and contributions

may further or hinder the achievement of

project objectives by potentially enacting

positive attitudes or negative attitudes.

Stakeholders (stakeholders) represent the

different-and often conflicting-viewpoints

within a decision-making process. Each

stakeholder has its own system of values and

preferences.

EXPERT

KNOWLEDGE

COMMON

KNOWLEDGE

Indicators, in their broadest sense, can be

defined as those parameters that serve to

describe a given phenomenon quantitatively and

qualitatively. (UN, 2007)

Indicator can be defined as a parameter, or a

value derived from parameters, that provides

information about a given phenomenon.

(OECD, 1997)

12.

CASE STUDY: THE CITY OF NAPLES, ITALY13.

REAL ESTATE MARKET DYNAMICS AND URBAN REGENERATION IN THE CITY OF NAPLES, ITALYTERRITORIAL FRAMEWORK: ITALY, CAMPANIA REGION, CITY OF NAPLES

The city of Naples is a municipality of almost one

million inhabitants, part of the Metropolitan City

of Naples.

It is rich in valuable cultural and nature heritage,

and its historic centre was on the UNESCO World

Heritage List since 1995.

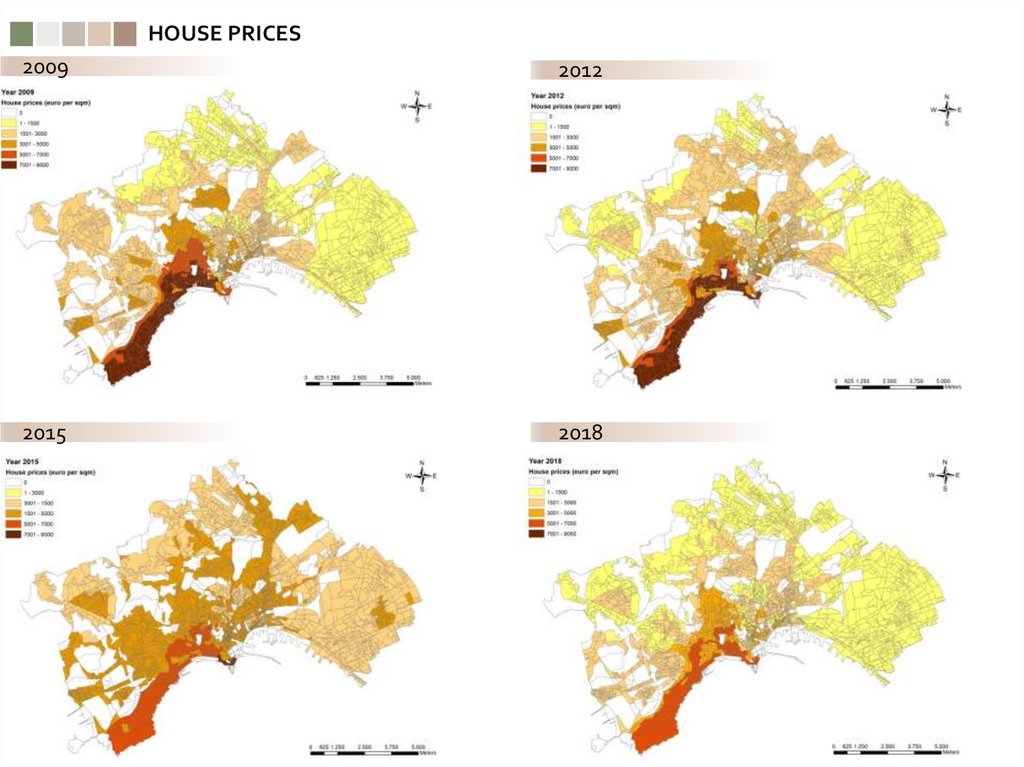

Focusing attention on the city of Naples (Italy), the purpose of this research work to analyse in detail the real estate

dynamics in this city through the integration of a Multi-Criteria Decision Analysis (MCDA) method and

Geographical Information System (GIS). This integration allowed us to map and analyse the territory, linking a

specific issue (the real estate dynamics) to the territory itself, and to analyse it according to specific criteria. This aims

for a better understanding and interpretation of real estate dynamics, representing a useful tool for orienting and

supporting urban planning strategies.

METHODOLOGY

HOUSING MARKET

COMMERCIAL PROPERTY MARKET

The change in market prices of housing

and commercial properties has been

analysed in relation to the 2009–2018

period (after the 2008 crisis).

We are carrying out this work to update it to

date!

14.

HOUSE PRICES2009

2012

2015

2018

15.

COMMERCIAL PROPERTY PRICES2009

2012

2015

2018

16.

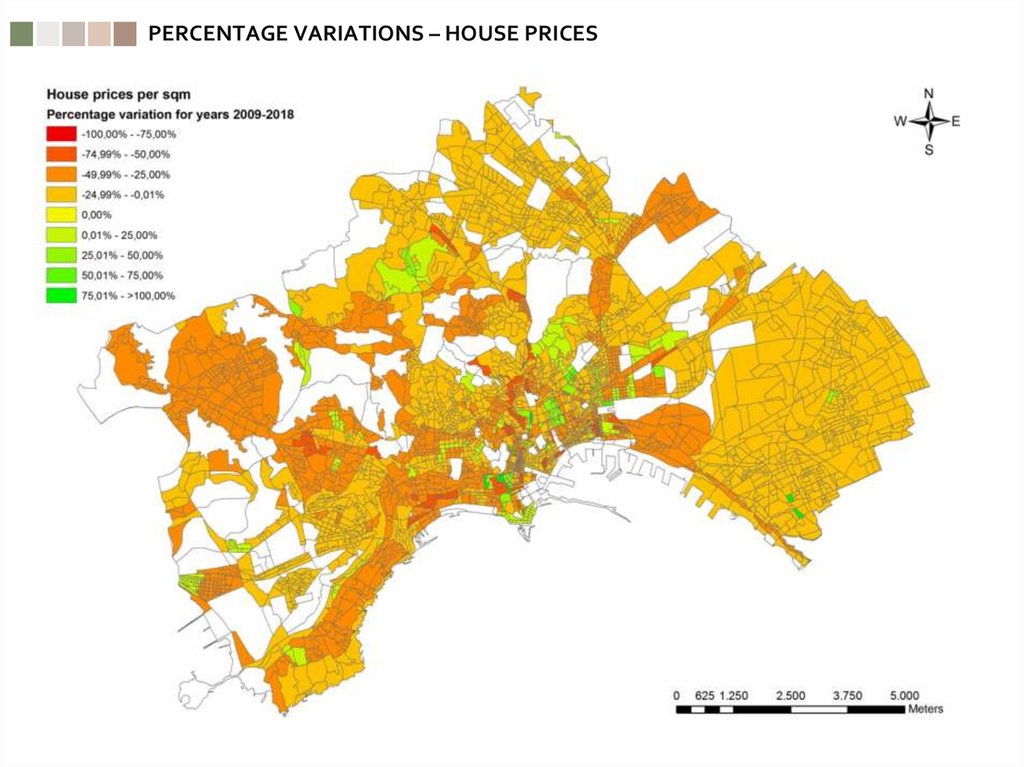

PERCENTAGE VARIATIONS – HOUSE PRICES17.

PERCENTAGE VARIATIONS – COMMERCIAL PROPERTY PRICES18.

TERRITORIAL STATISTICAL ANALYSES19.

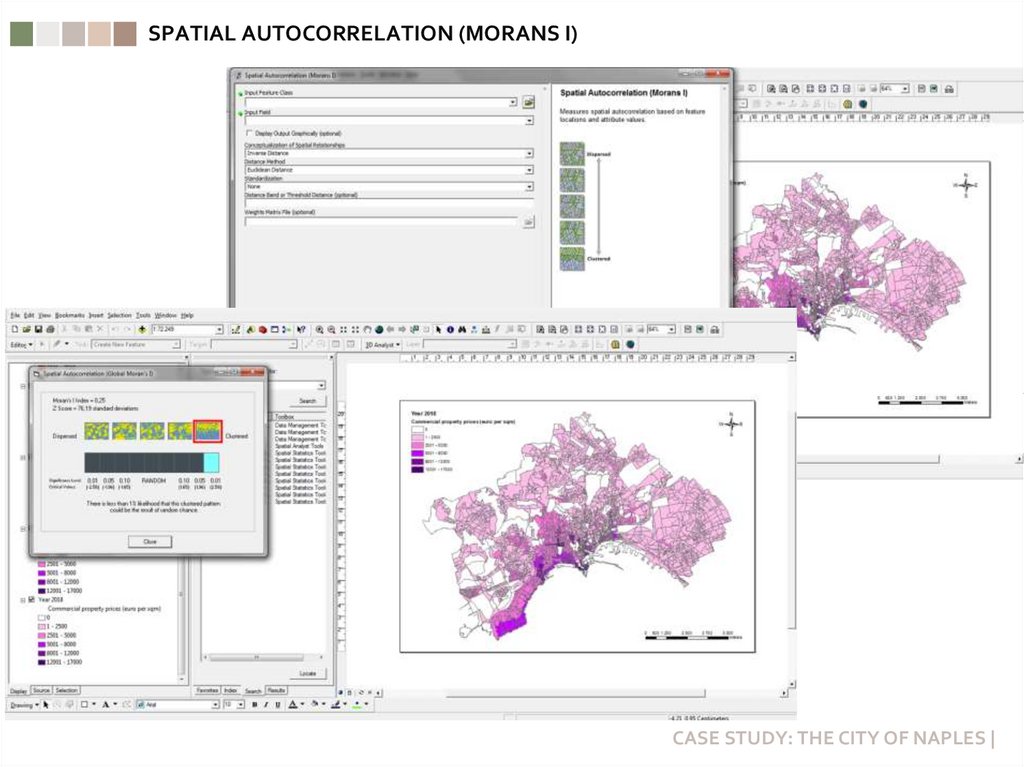

SPATIAL AUTOCORRELATION (MORANS I)CASE STUDY: THE CITY OF NAPLES |

20.

CLUSTER AND OUTLIER ANALYSIS (ANSELIN LOCAL MORANS I)Cluster and Outlier Analysis (COA) in the ArcGIS framework has been elaborated for identifying

concentrations of values and spatial outliers. It has been conducted in order to identify similarities of

behavior between data spatially close to each other.

CASE STUDY: THE CITY OF NAPLES |

21.

CLUSTER AND OUTLIER ANALYSIS – HOUSE PRICES2009

2012

2015

2018

22.

CLUSTER AND OUTLIER ANALYSIS – COMMERCIAL PROPERTY PRICES2009

2012

2015

2018

23.

HIGH/LOW CLUSTERING (GETIS-ORD GENERAL G)CASE STUDY: THE CITY OF NAPLES |

24.

HOT SPOT ANALYSIS (GETIS-ORD Gi*)The Hot Spot Analysis (HSA) has been conducted (by means of ArcGIS software) using the Getis–Ord Gi*

statistic for determining if spatial clusters are referring to high values (hot spots) or low values (cold

spots).

A hotspot is “an area that has higher concentration of events compared to the expected number given a

random distribution of events”.

CASE STUDY: THE CITY OF NAPLES |

25.

HOTSPOT ANALYSIS – HOUSE PRICES2009

2012

2015

2018

26.

HOTSPOT ANALYSIS – COMMERCIAL PROPERTY PRICES2009

2012

2015

2018

27.

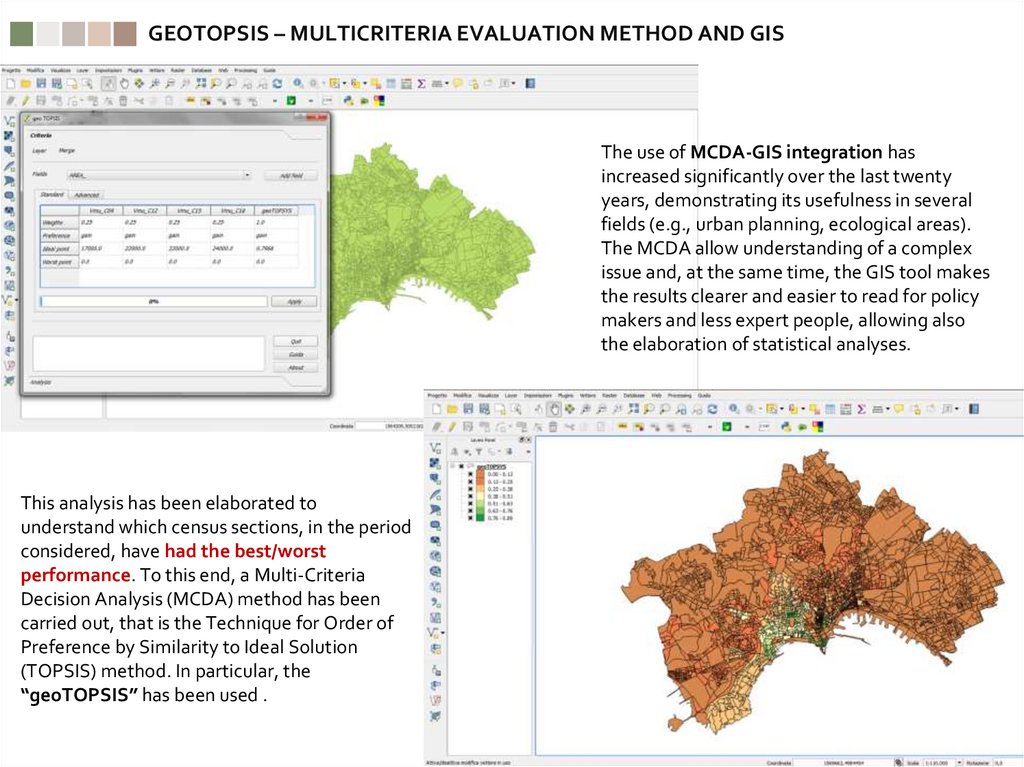

GEOTOPSIS – MULTICRITERIA EVALUATION METHOD AND GISThe use of MCDA-GIS integration has

increased significantly over the last twenty

years, demonstrating its usefulness in several

fields (e.g., urban planning, ecological areas).

The MCDA allow understanding of a complex

issue and, at the same time, the GIS tool makes

the results clearer and easier to read for policy

makers and less expert people, allowing also

the elaboration of statistical analyses.

This analysis has been elaborated to

understand which census sections, in the period

considered, have had the best/worst

performance. To this end, a Multi-Criteria

Decision Analysis (MCDA) method has been

carried out, that is the Technique for Order of

Preference by Similarity to Ideal Solution

(TOPSIS) method. In particular, the

“geoTOPSIS” has been used .

28.

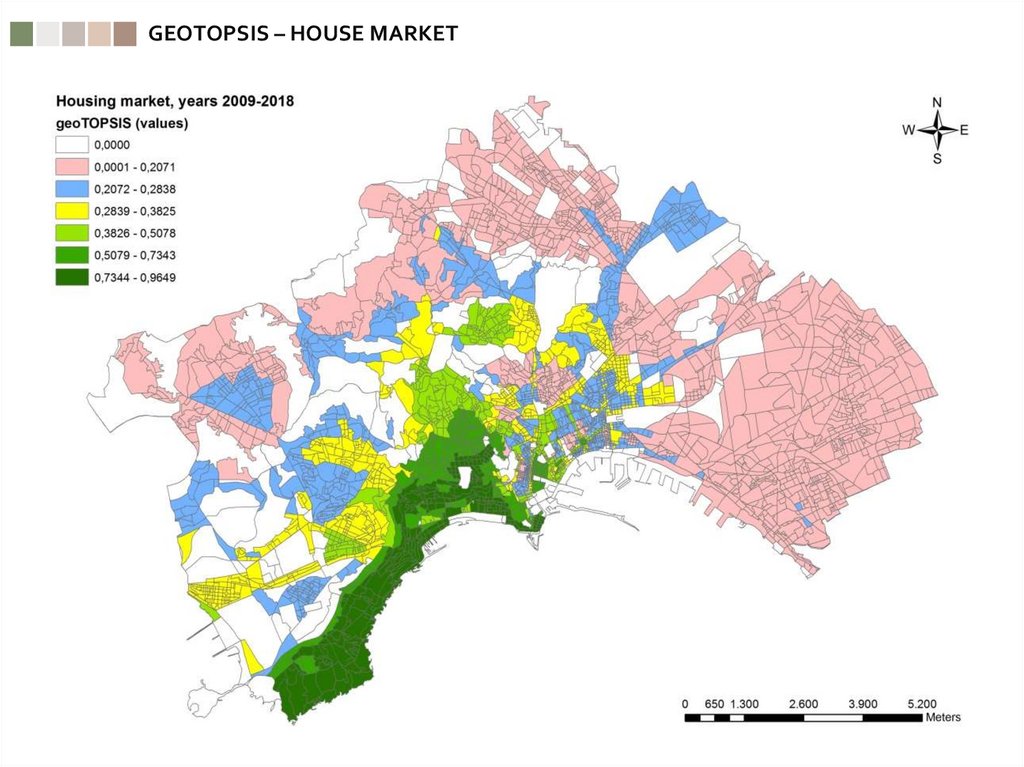

GEOTOPSIS – HOUSE MARKET29.

GEOTOPSIS – COMMERCIAL PROPERTY MARKET30.

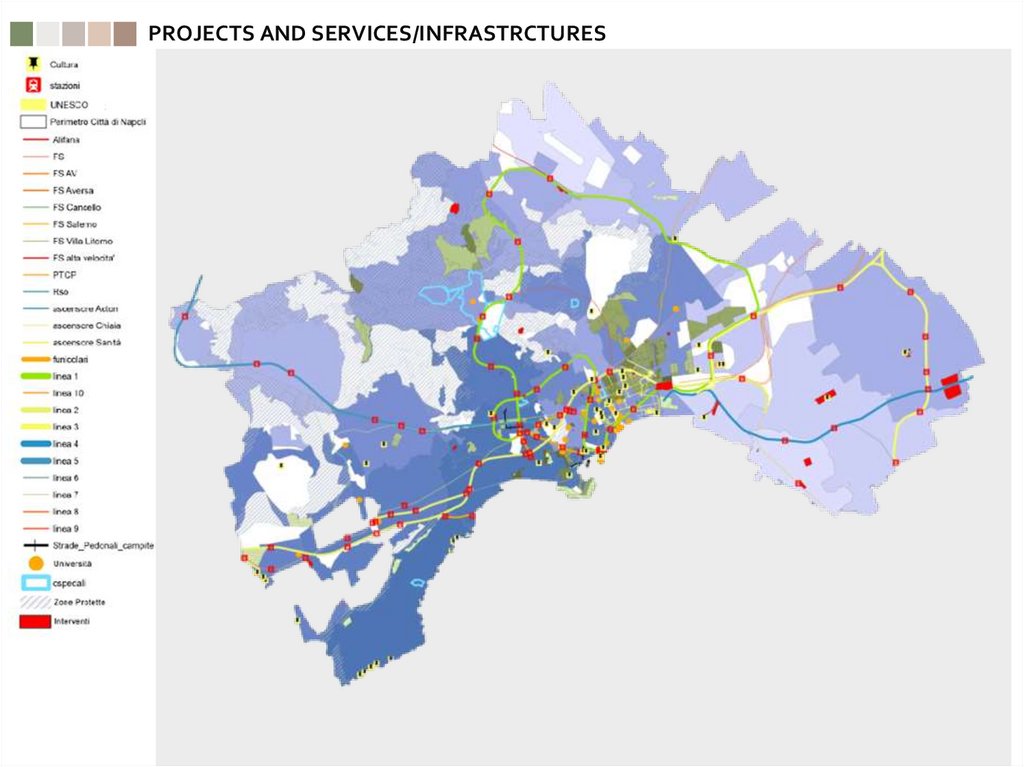

PROJECTS AND SERVICES/INFRASTRCTURES31.

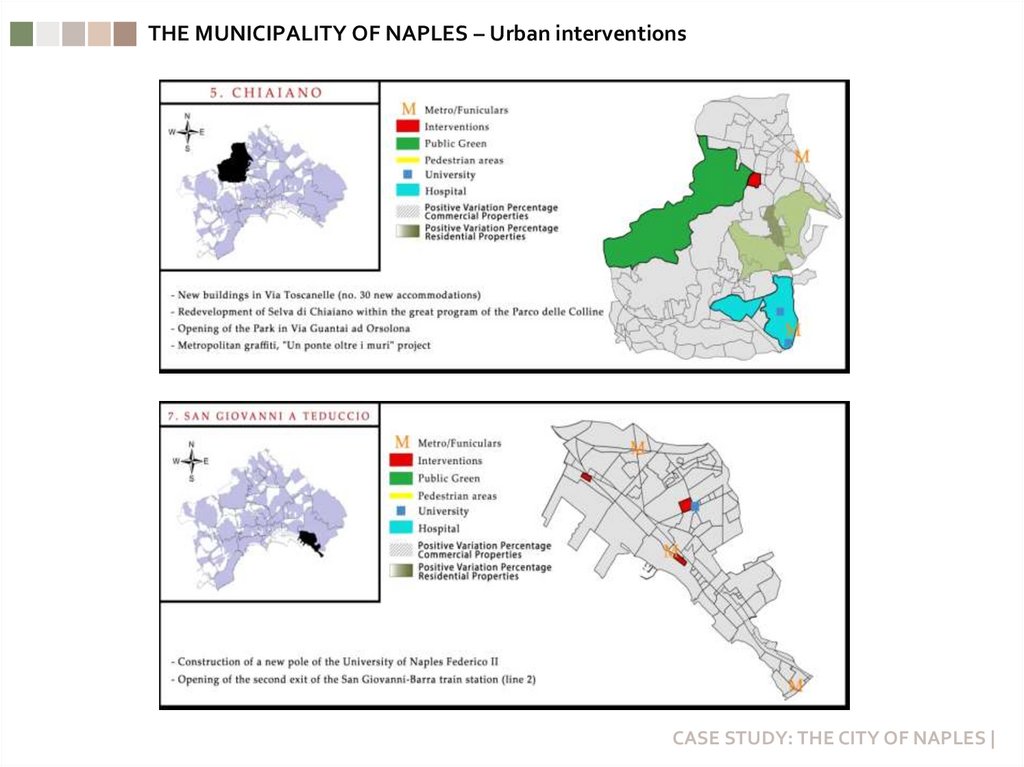

THE MUNICIPALITY OF NAPLES – Urban interventionsCASE STUDY: THE CITY OF NAPLES |

32.

THE MUNICIPALITY OF NAPLES – Urban interventionsCASE STUDY: THE CITY OF NAPLES |

33.

CONCLUSIONS34.

CONCLUSIONS⮚ The integrated evaluation approach provides an important support for a better understanding and interpretation

of urban dynamics, and to orient and activate, consequently, the appropriate planning policies, implementing

actions, and projects that are more appropriate to the “vocation” of each area.

⮚ The MCDA methods are a useful tool for evaluating alternative projects considering different criteria and

including various actors/stakeholders and points of view.

⮚ The integration of a Multi-Criteria Decision Analysis (MCDA) and Geographical Information System (GIS) allowed

us to map and analyse the territory, linking a specific issue (the real estate dynamics) to the territory itself, and to

analyse it according to specific criteria. In particular, in this work the use of geoTOPSIS allows classifying and

discretizing urban areas in order to understand which ones have maintained the best or worst performance during

the period considered. This can support decision makers in a clearer and more detailed reading of the territory in

order to identify the areas in which to plan new interventions.

⮚ The analysis at a high level of definition, such as that of census sections, can be useful for future steps of the

research, representing a base for elaborating analysis linking the real estate dynamics with other information

collected for the same sections for the census. This integrated approach can support the governance of cities and

the development of strategies for enhancing the comprehensive territorial productivity.

35.

LVIV POLYTECHNIC NATIONAL UNIVERSITYCourse: Evaluation of assets by different techniques, using IT

DECISION-MAKING PROCESSES AND EVALUATION

Prof. Francesca Nocca

University of Naples Federico II, Italy

francesca.nocca@unina.it

THANK YOU!

Менеджмент

Менеджмент