Похожие презентации:

Quantitave Methods. Part 1. Time value of money (TVM)

1.

CFA Level 1Quantitave Methods

Study Session 2 –3

Part 1

Exam weight –8-12%

1

2.

Time value of money (TVM)LOS #6

2

3.

Time value of money (TVM)The candidate should be able to:

a.

b.

c.

d.

e.

3

Interpret interest rates

Calculate and interpret the effective annual rate

Calculate and interpret the future value (FV) and

present value (PV)

Solve time value of money problems for different

frequencies of compounding

Solve time value of money problems for different

types of cash flow

4.

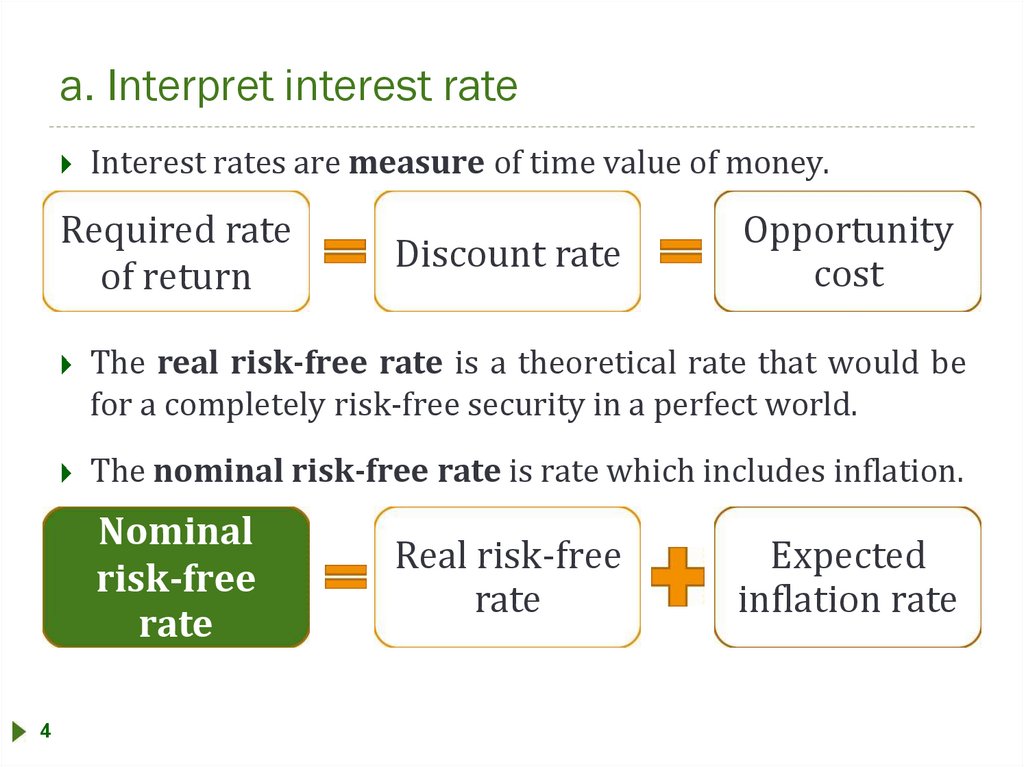

a. Interpret interest rateInterest rates are measure of time value of money.

Required rate

of return

Discount rate

Opportunity

cost

The real risk-free rate is a theoretical rate that would be

for a completely risk-free security in a perfect world.

The nominal risk-free rate is rate which includes inflation.

Nominal

risk-free

rate

4

Real risk-free

rate

Expected

inflation rate

5.

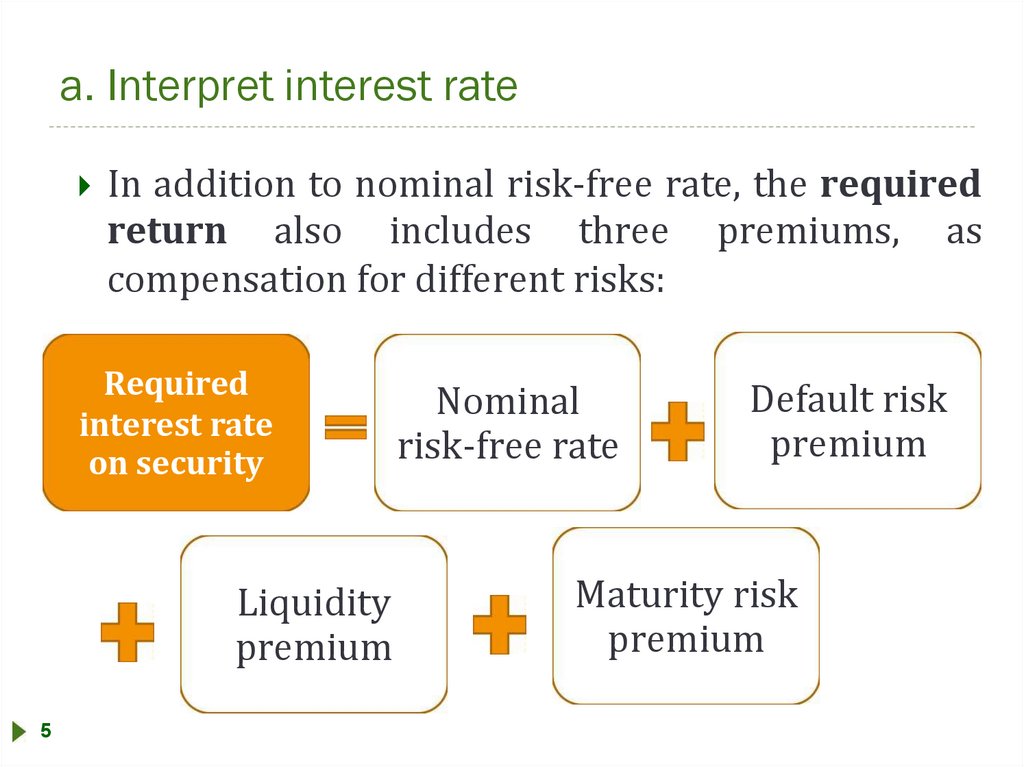

a. Interpret interest rateIn addition to nominal risk-free rate, the required

return also includes three premiums, as

compensation for different risks:

Required

interest rate

on security

Liquidity

premium

5

Nominal

risk-free rate

Default risk

premium

Maturity risk

premium

6.

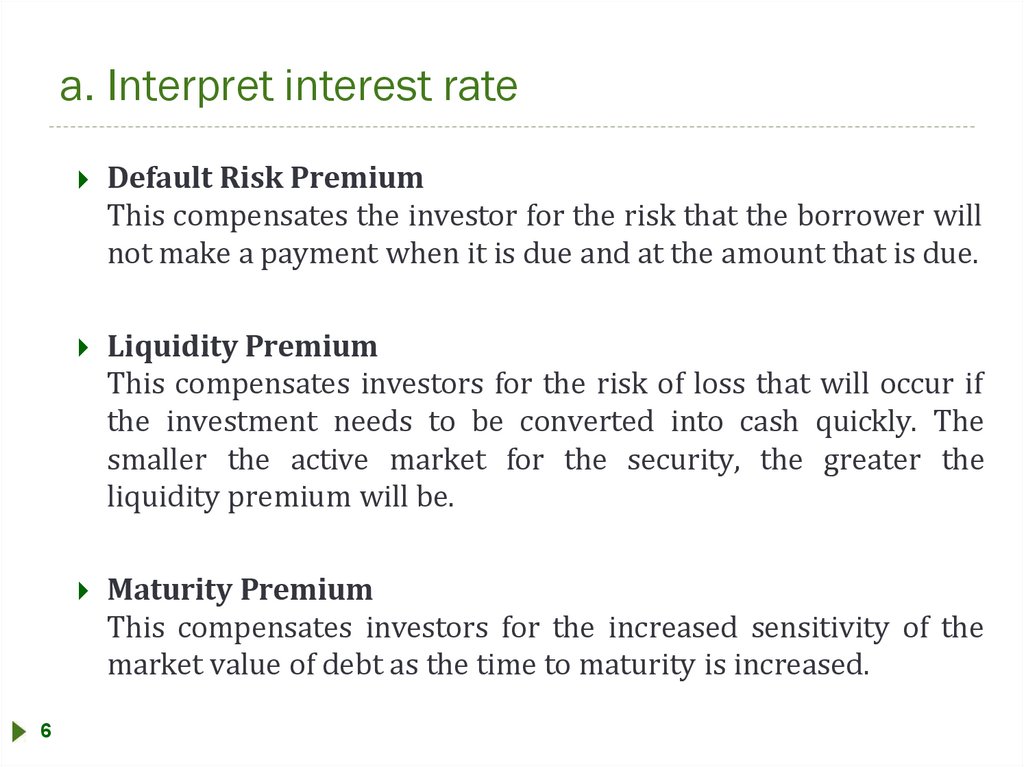

a. Interpret interest rateDefault Risk Premium

This compensates the investor for the risk that the borrower will

not make a payment when it is due and at the amount that is due.

Liquidity Premium

This compensates investors for the risk of loss that will occur if

the investment needs to be converted into cash quickly. The

smaller the active market for the security, the greater the

liquidity premium will be.

Maturity Premium

This compensates investors for the increased sensitivity of the

market value of debt as the time to maturity is increased.

6

7.

b. Effective annual rateEffective annual rate (EAR) – rate that investors actually

realize as a result of compounding in annual terms.

stated rate m

EAR (1

) 1

m

Example 1: Computing EAR

Using a stated rate of 6%, compute EARs for semiannual, quarterly,

monthly and daily compounding.

For continuous compounding (e - "Euler's number" 2,7182818284590452353602874713527…..):

7

EAR e

stated rate

1

8.

c. Calculate and interpret FV and PVFuture value is the amount to which a current deposit will grow

over time when it is placed in an account paying compound interest.

Present value of a single sum is today’s value of a cash flow that is to

be received at some point in the future.

PV

FV

(1 r)n

where

r = rate of return per compounding period

n = total number of compounding periods

Example 2: PV of a single sum

Given a discount rate of 9%, calculate the PV of a $1,000 cash flow that will be

received in five years.

8

9.

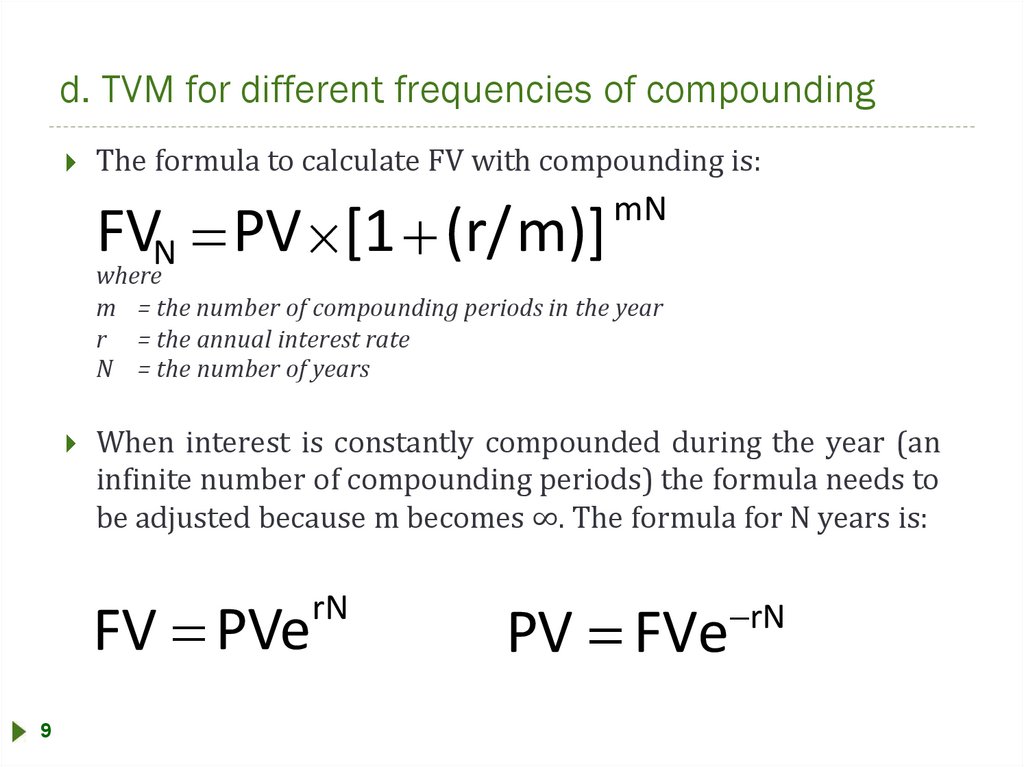

d. TVM for different frequencies of compoundingThe formula to calculate FV with compounding is:

FVN PV [1 (r/ m)]

mN

where

m = the number of compounding periods in the year

r = the annual interest rate

N = the number of years

When interest is constantly compounded during the year (an

infinite number of compounding periods) the formula needs to

be adjusted because m becomes ∞. The formula for N years is:

FV PVe

9

rN

PV FVe

rN

10.

d. TVM for different frequencies of compoundingExample 3: Growth with quarterly compounding

John plans to invest $2,500 in an account that will earn 8% per year with

quarterly compounding. How much will be in the account at the end of two years?

Example 4: Present value with monthly compounding

Alice would like to have $5,000 saved in account at the end of three years. If the

return on the account is 9% per year with monthly compounding, how much

must Alice deposit today in order to reach her saving goal in three years?

10

11.

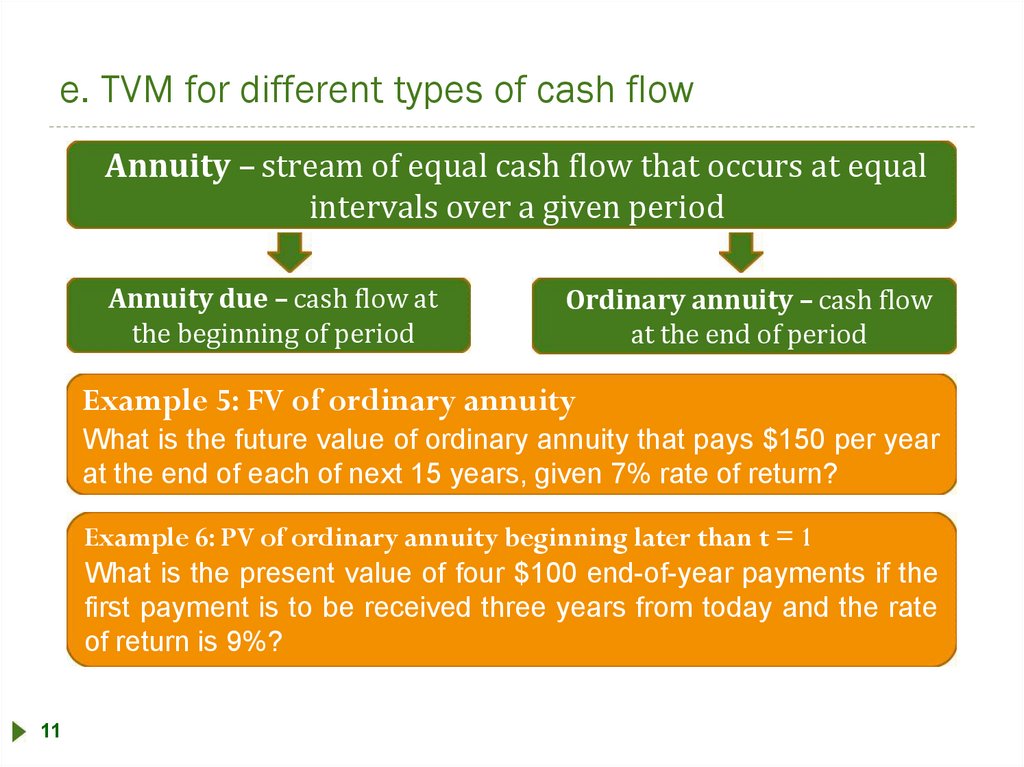

e. TVM for different types of cash flowAnnuity – stream of equal cash flow that occurs at equal

intervals over a given period

Annuity due – cash flow at

the beginning of period

Ordinary annuity – cash flow

at the end of period

Example 5: FV of ordinary annuity

What is the future value of ordinary annuity that pays $150 per year

at the end of each of next 15 years, given 7% rate of return?

Example 6: PV of ordinary annuity beginning later than t = 1

What is the present value of four $100 end-of-year payments if the

first payment is to be received three years from today and the rate

of return is 9%?

11

12.

e. TVM for different types of cash flowPerpetuity is a financial instrument that pays fixed amount

of money (PMT) at set intervals over an infinite period of

time.

PVperpetuity

PMT

r

Example 7: PV of perpetuity

Kodon Corporation issues preferred stock that will pay $4.50 per

year in annual dividends every year. Given 8% rate of return, what

is the value of Kodon’s preferred stock today?

12

13.

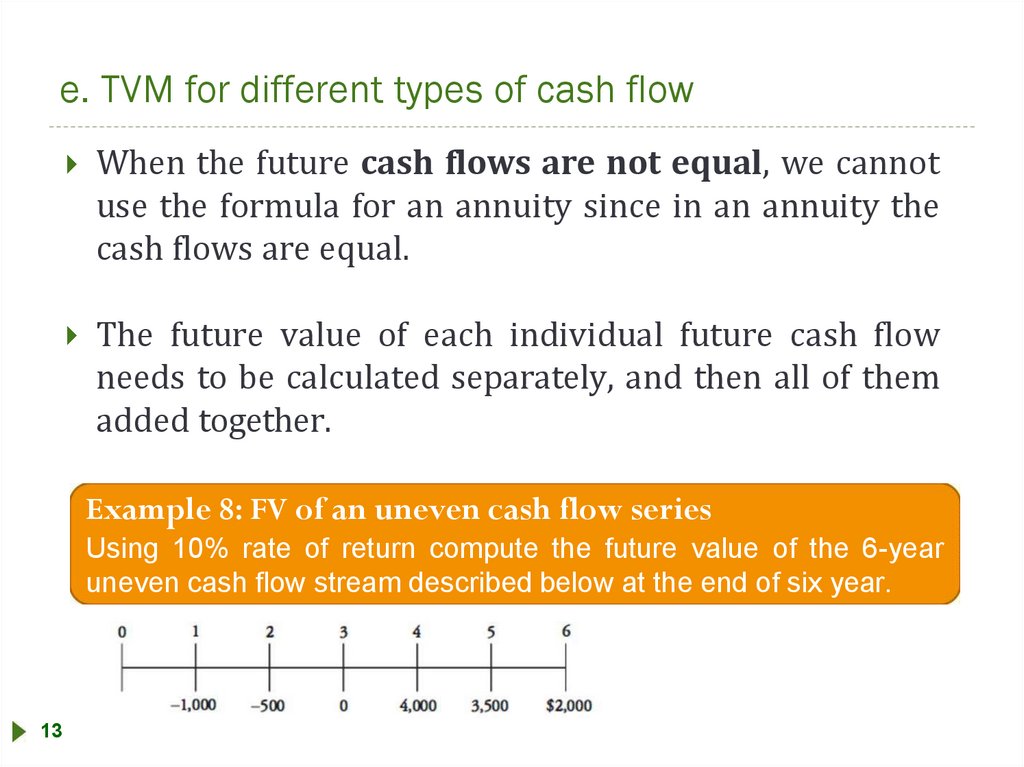

e. TVM for different types of cash flowWhen the future cash flows are not equal, we cannot

use the formula for an annuity since in an annuity the

cash flows are equal.

The future value of each individual future cash flow

needs to be calculated separately, and then all of them

added together.

Example 8: FV of an uneven cash flow series

Using 10% rate of return compute the future value of the 6-year

uneven cash flow stream described below at the end of six year.

13

14.

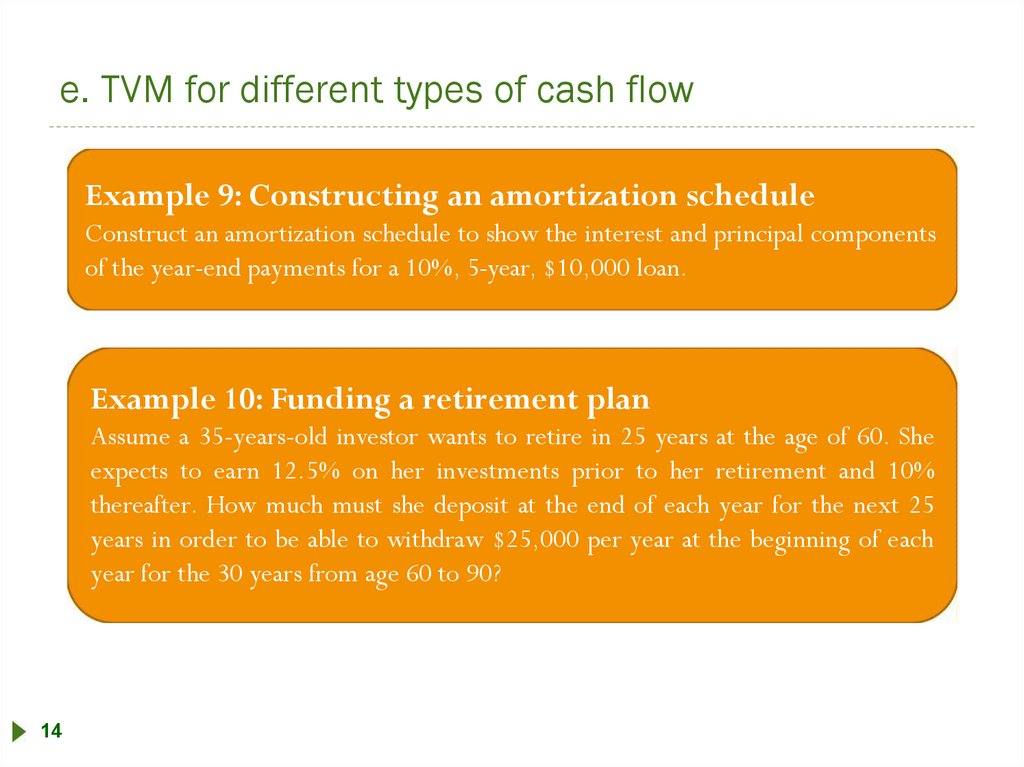

e. TVM for different types of cash flowExample 9: Constructing an amortization schedule

Construct an amortization schedule to show the interest and principal components

of the year-end payments for a 10%, 5-year, $10,000 loan.

Example 10: Funding a retirement plan

Assume a 35-years-old investor wants to retire in 25 years at the age of 60. She

expects to earn 12.5% on her investments prior to her retirement and 10%

thereafter. How much must she deposit at the end of each year for the next 25

years in order to be able to withdraw $25,000 per year at the beginning of each

year for the 30 years from age 60 to 90?

14

15.

LOS #6 HomeworkQuestion 1

John Pelker plans to retire in six years and will require $950,000. Today, Pelker will deposit

$100,000 into an interest bearing account and will set aside an additional $100,000 at the

end of each of the next six years. What percentage return must Pelker earn to achieve his

goal of $950,000 for his retirement? If Pelker were to invest his money at the beginning of

each of the next six years, would his investments require a higher or lower return to meet

his goal than investing at the end of the period?

Percentage return

Beginning period

A) 8%

higher

B) 10%

lower

C) 8%

lower

D) 10%

higher

Question 2

Arc Manufacturing borrowed $100 million over a ten year period. If Arc makes annual

payment of $15 million, calculate the approximate stated annual interest rate. Indicate

whether the effective annual interest rate would be the same of higher.

Stated rate

Effective rate

A) 8%

Same

B) 10%

Same

C) 8%

Higher

Higher

15 D) 10%

16.

LOS #6 HomeworkQuestion 3

Optimal Insurance is offering a deferred annuity that promises to pay 10 percent per annum

with equal annual payments beginning at the end of 10 years and continuing for a total of 10

annual payments. For an initial investment of $100,000, what will be the amount of the

annual payments?

A) $25,937

B) $42,212

C) $39,416

D) $38,375

Question 4

Marc Schmitz borrows $20,000 to be paid back in four equal annual payments at an interest

rate of 8 percent. The interest amount in the second year’s payment would be:

A)

B)

C)

D)

16

$1 116.90

$1 600.00

$6 038.40

$1 244.90

17.

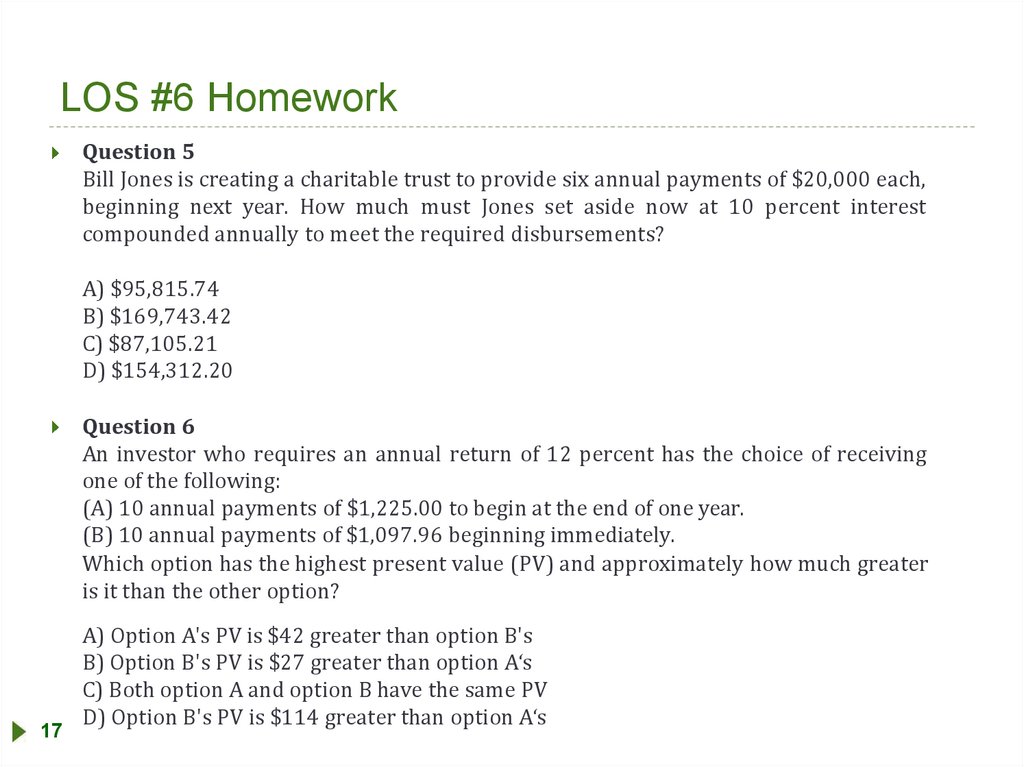

LOS #6 HomeworkQuestion 5

Bill Jones is creating a charitable trust to provide six annual payments of $20,000 each,

beginning next year. How much must Jones set aside now at 10 percent interest

compounded annually to meet the required disbursements?

A) $95,815.74

B) $169,743.42

C) $87,105.21

D) $154,312.20

Question 6

An investor who requires an annual return of 12 percent has the choice of receiving

one of the following:

(A) 10 annual payments of $1,225.00 to begin at the end of one year.

(B) 10 annual payments of $1,097.96 beginning immediately.

Which option has the highest present value (PV) and approximately how much greater

is it than the other option?

17

A) Option A's PV is $42 greater than option B's

B) Option B's PV is $27 greater than option A‘s

C) Both option A and option B have the same PV

D) Option B's PV is $114 greater than option A‘s

18.

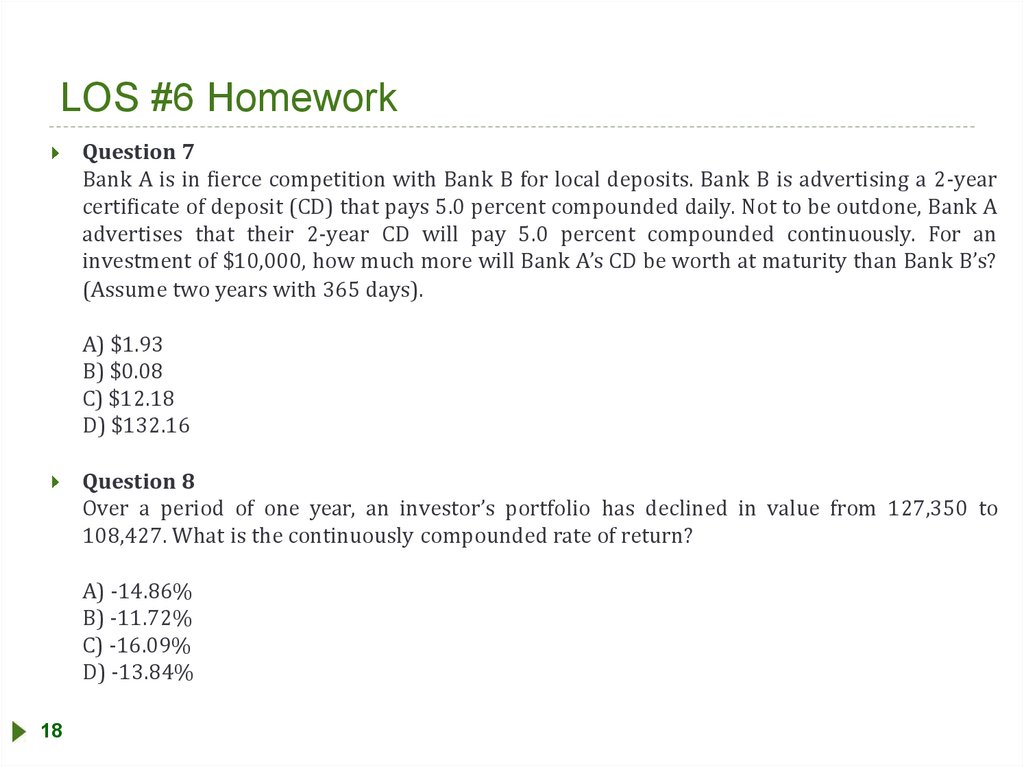

LOS #6 HomeworkQuestion 7

Bank A is in fierce competition with Bank B for local deposits. Bank B is advertising a 2-year

certificate of deposit (CD) that pays 5.0 percent compounded daily. Not to be outdone, Bank A

advertises that their 2-year CD will pay 5.0 percent compounded continuously. For an

investment of $10,000, how much more will Bank A’s CD be worth at maturity than Bank B’s?

(Assume two years with 365 days).

A) $1.93

B) $0.08

C) $12.18

D) $132.16

Question 8

Over a period of one year, an investor’s portfolio has declined in value from 127,350 to

108,427. What is the continuously compounded rate of return?

A) -14.86%

B) -11.72%

C) -16.09%

D) -13.84%

18

19.

LOS #6 HomeworkQuestion 9

A local loan shark offers 4 for 5 on payday. What it involves is that you borrow $4 from

him and repay $5 on the next payday (one week later). What is the annual interest rate on

this loan? What is the effective interest rate on this loan? Assume 52 weeks in one year,

and select the answer closest to your numbers.

Annual Interest Rate

Effective Interest Rate

A) 1,300%

10,947,544%

B) 25%

300%

C) 25%

1,300%

D) 260%

1,312%

Question 10

Janet Jacobson intends to start saving for retirement today in an IRA. Is she invests $3000

each year, starting at the end of year 1, how much will she accumulate after 40 years is she

expects to earn 12 or 13 percent over the period?

A)

B)

C)

D)

19

12%

$2,301,274

$2,577,427

$2,301,274

$2,577,427

13%

$3,041,113

$3,534,436

$3,534,436

$3,041,113

20.

LOS #6 HomeworkQuestion 11

Find the present value of the following uneven cash flow stream. Assume end of the year

payments. The discount rate is 12 percent.

Yr 1 -2,000

Yr 2

-3,000

Yr 3 6,000

Yr 4

25,000

Yr 5 30,000

A) $33,004.15

B) $58,164.58

C) $36,964.65

D) $65,144.33

Question 12

What's the maximum an investor should be willing to pay for an annuity that will pay out

$10,000 at the beginning of each of the next 10 years, given the investor wants to earn 12.5

percent, compounded annually?

A) $55,364

B) $52,285

C) $62,285

D) $69,620

20

21.

LOS #6 HomeworkQuestion 13

John is getting a $25,000 loan, with an 8% annual interest

rate to be paid in 48 equal monthly installments. If the first

payment is due at the end of the first month, what are the

principal and interest values for the first payment?

Principal

A) $443.65

B) $410.32

C) $443.65

D) $410.32

21

Interest

$200.00

$200.00

$166.67

$166.67

22.

Statistical concepts and marketreturn

LOS #7

22

23.

Statistical concepts and market returnThe candidate should be able to:

a.

Distinguish between descriptive and inferential statistics, population

and a sample, and among the types of measurement scales

b.

Define a parameter, a sample statistic, and a frequency distribution.

c.

Calculate and interpret relative frequencies and cumulative relative

frequencies, given a frequency distribution.

d.

Describe the properties of a data set presented as a histogram or a

frequency polygon

e.

Calculate and interpret measures of central tendency, including

population mean, sample mean, arithmetic mean, weighted average

mean, geometric and harmonic mean, median, and mode.

f.

Calculate and interpret quartiles, quintiles, deciles, and percentiles.

g.

Calculate and interpret 1) a range and a mean absolute deviation and

2) the variance and standard deviation of a population and of a

sample

23

24.

Statistical concepts and market returnThe candidate should be able to:

h.

Calculate and interpret the proportion of observations falling within a

specified number of standard deviations of the mean using

Chebyshev's inequality

i.

Calculate and interpret the coefficient of variation and the Sharpe

ratio

j.

Explain skewness and the meaning of a positively or negatively

skewed return distribution

k.

Describe the relative locations of the mean, median and mode for a

unimodal, nonsymmetrical distribution

l.

Explain measures of sample skewness and kurtosis

m.

Compare the use of arithmetic and geometric means when analyzing

investment returns

24

25.

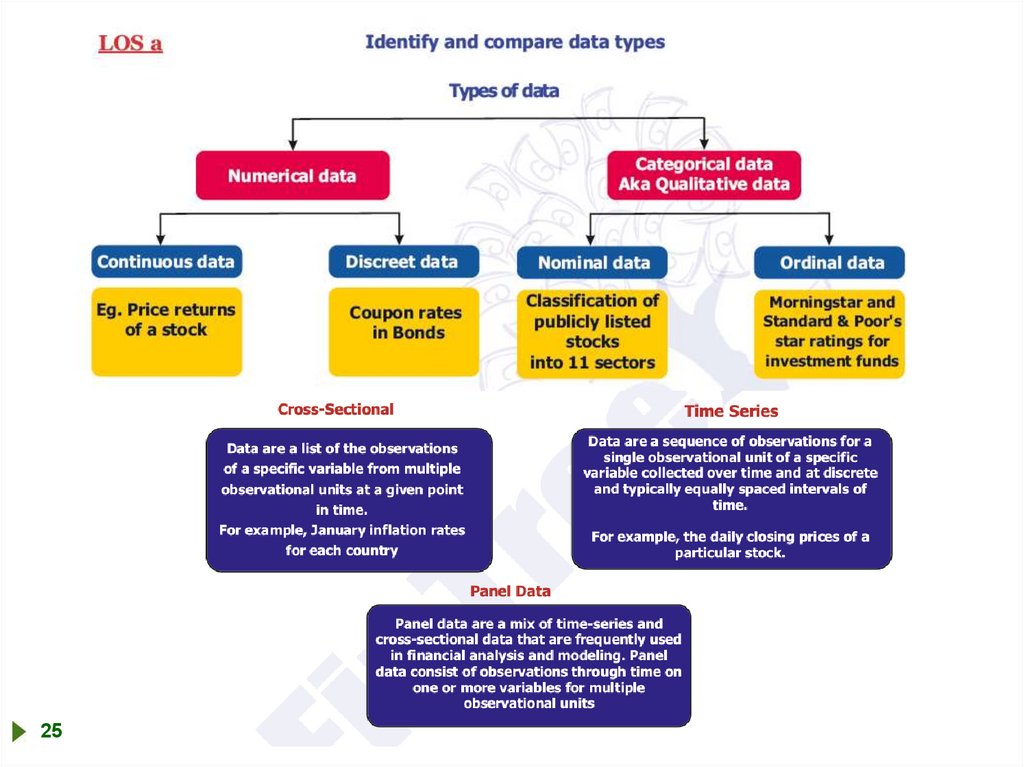

a. Descriptive and inferential statisticsThe term statistics refers to data and the methods used to analyze the data.

Descriptive statistics are used to summarize large data sets.

Inferential statistics are used to make forecasts, estimates and judgments about a

larger set of data (the population) based on a smaller set of data (a sample).

A population is the set of all possible members of a stated group.

A sample is a subset of the population that is being analyzed.

There are a number of scales that may be used for measurement:

Nominal scales classify or count the items in no specific order. Each item is given a number.

This is the least accurate way of measuring something. An example would be assigning the

number 1 to a municipal bond fund, the number 2 to a corporate bond fund, and so on for

each fund style.

Ordinal scales rank items from first to last based on size, return, amount or some other

measure. It does not indicate the difference between each ranking, though. For example, the

ranking of 1,000 small cap growth stocks by performance may be done by assigning the

number 1 to the 100 best performing stocks, the number 2 to the next 100 best performing

stocks, and so on.

Interval scales provide a set measurement between rankings (like temperature – in degrees).

Ratio scales present both a ranking measure and an interval measure (a currency unit).

!!! Remember the French word “NOIR” (black)

25

26.

2527.

2528.

2529.

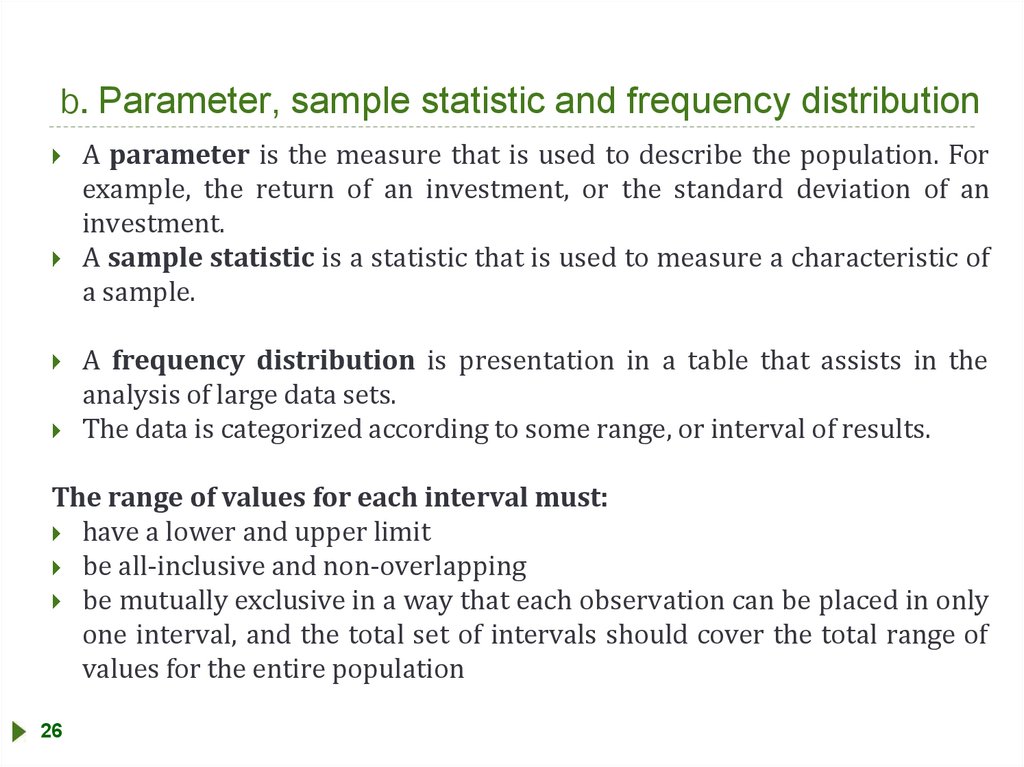

b. Parameter, sample statistic and frequency distributionA parameter is the measure that is used to describe the population. For

example, the return of an investment, or the standard deviation of an

investment.

A sample statistic is a statistic that is used to measure a characteristic of

a sample.

A frequency distribution is presentation in a table that assists in the

analysis of large data sets.

The data is categorized according to some range, or interval of results.

The range of values for each interval must:

have a lower and upper limit

be all-inclusive and non-overlapping

be mutually exclusive in a way that each observation can be placed in only

one interval, and the total set of intervals should cover the total range of

values for the entire population

26

30.

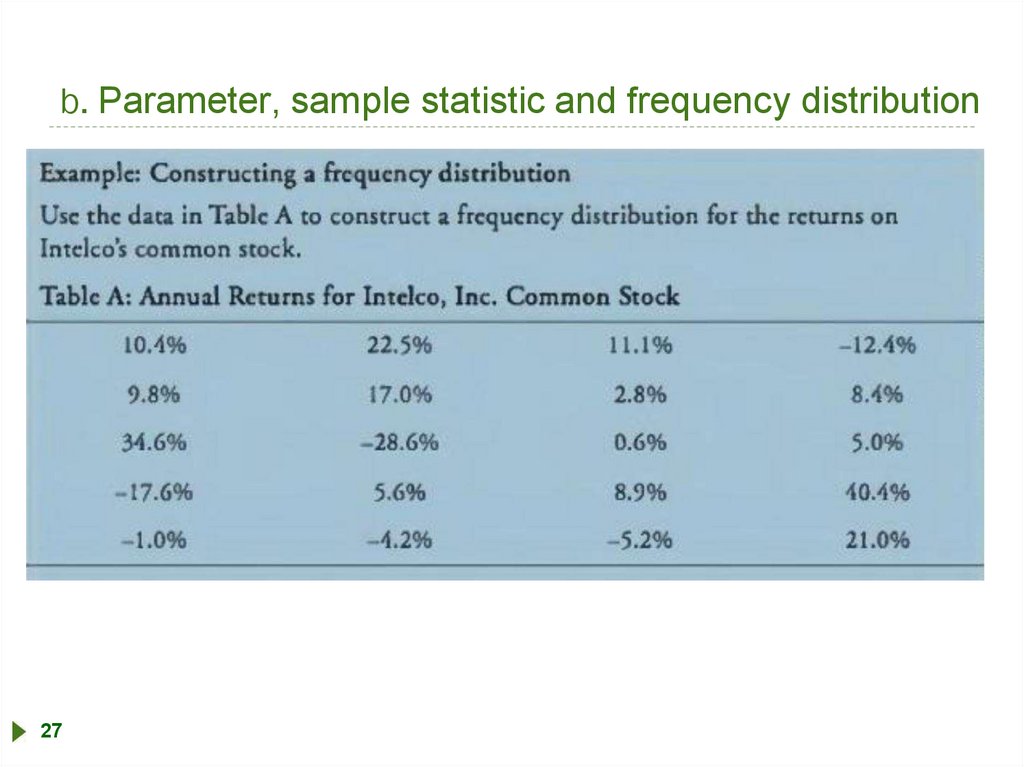

b. Parameter, sample statistic and frequency distribution27

31.

c. Relative frequencies and cumulative relative frequenciesThe relative frequency is a measure of what percentage of

the total results were in a specific range. Or, in other words,

relative frequency is the percentage of total observations

falling within each interval.

The cumulative relative frequency is what % of the

population has accumulated as the results move through

the range.

Example 1: Relative frequency

Calculate relative frequencies and cumulative relative frequencies

from the previous example

28

32.

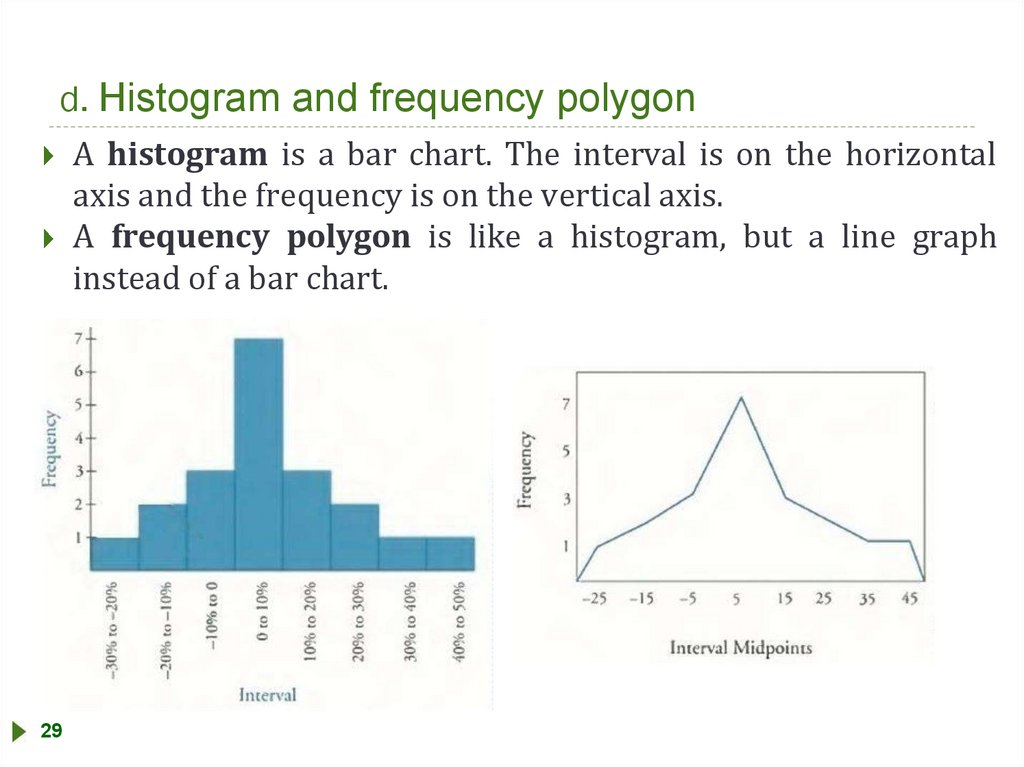

d. Histogram and frequency polygonA histogram is a bar chart. The interval is on the horizontal

axis and the frequency is on the vertical axis.

A frequency polygon is like a histogram, but a line graph

instead of a bar chart.

29

33.

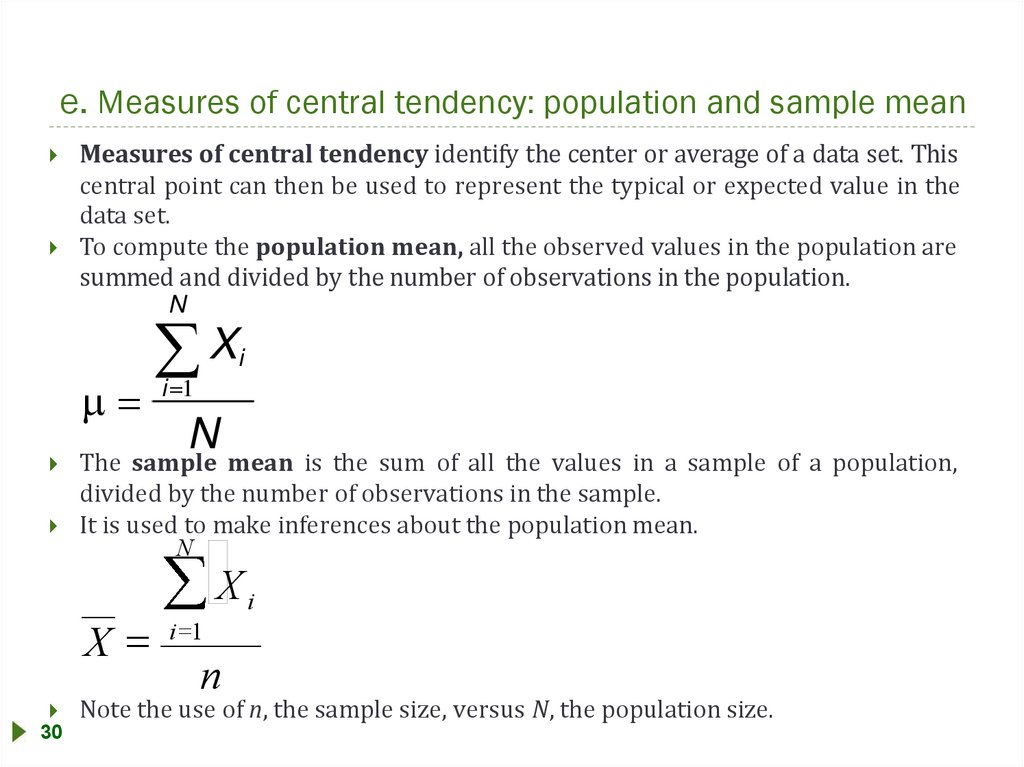

e. Measures of central tendency: population and sample meanMeasures of central tendency identify the center or average of a data set. This

central point can then be used to represent the typical or expected value in the

data set.

To compute the population mean, all the observed values in the population are

summed and divided by the number of observations in the population.

N

X

i

i 1

N

The sample mean is the sum of all the values in a sample of a population,

divided by the number of observations in the sample.

It is used to make inferences about the population mean.

N

Xi

X

30

i 1

n

Note the use of n, the sample size, versus N, the population size.

34.

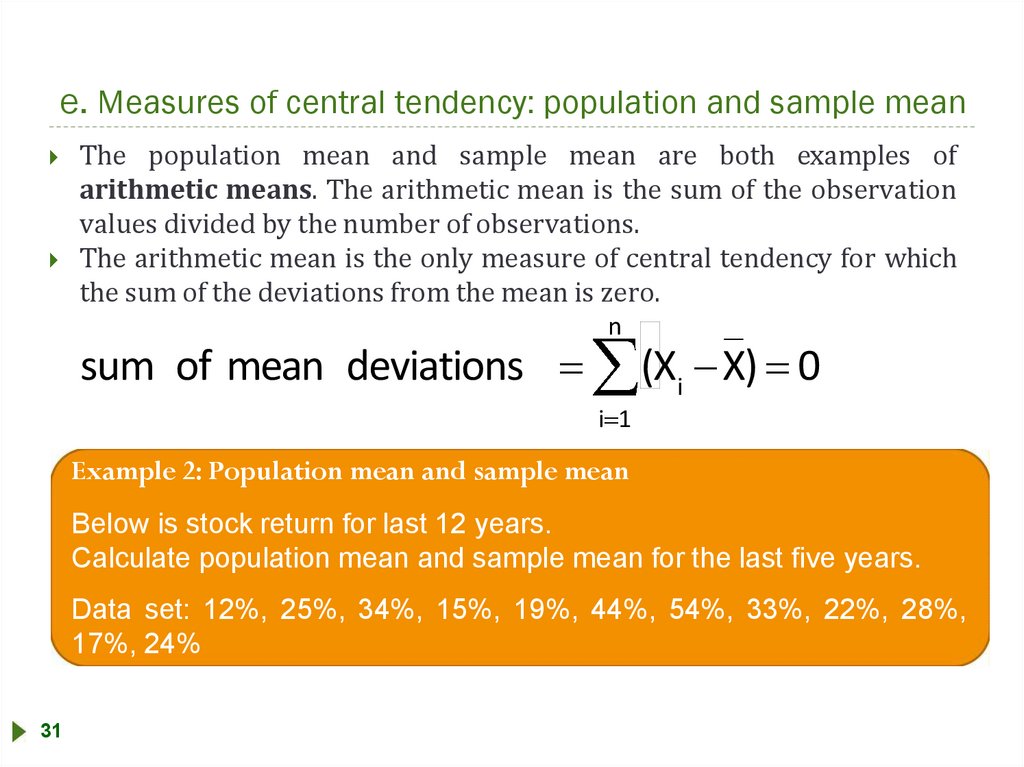

e. Measures of central tendency: population and sample meanThe population mean and sample mean are both examples of

arithmetic means. The arithmetic mean is the sum of the observation

values divided by the number of observations.

The arithmetic mean is the only measure of central tendency for which

the sum of the deviations from the mean is zero.

n

sum of mean deviations

(Xi X) 0

i 1

Example 2: Population mean and sample mean

Below is stock return for last 12 years.

Calculate population mean and sample mean for the last five years.

Data set: 12%, 25%, 34%, 15%, 19%, 44%, 54%, 33%, 22%, 28%,

17%, 24%

31

35.

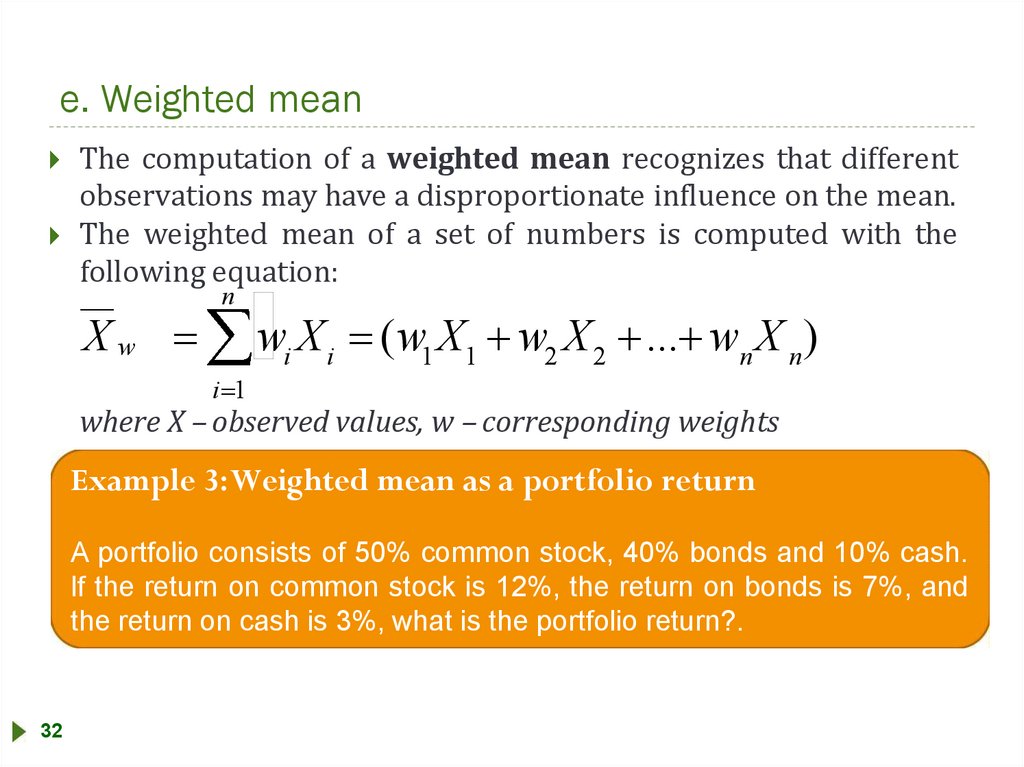

e. Weighted meanThe computation of a weighted mean recognizes that different

observations may have a disproportionate influence on the mean.

The weighted mean of a set of numbers is computed with the

following equation:

n

Xw

wi X i

(w1 X1 w2 X 2 ... wnX n)

i 1

where X – observed values, w – corresponding weights

Example 3:Weighted mean as a portfolio return

A portfolio consists of 50% common stock, 40% bonds and 10% cash.

lf the return on common stock is 12%, the return on bonds is 7%, and

the return on cash is 3%, what is the portfolio return?.

32

36.

e. MedianThe median is the midpoint of a data set when the data is arranged in ascending

or descending order. Half the observations lie above the median and half are

below.

The median is important because the arithmetic mean can be affected by

extremely large or small values (outliers). When this occurs, the median is a better

measure of central tendency than the mean because it is not affected by extreme

values that may actually be the result of errors in the data.

Example 4:The median using an odd number of observations

What is the median return for five portfolio managers with 10-year annualized total returns

record of 30%, 15%, 25%, 21% and 23%?

Example 5:The median using an even number of observations

Suppose we add a sixth manager to the previous example with a return of 28%.What is the

median return?

33

37.

e. ModeThe mode is the value that occurs most frequently in a data

set. A data set may have more than one mode or no mode.

When a distribution has one value that appears most

frequently it is said to be unimodal.

When a set of data has two or three values that occur most

frequently it is said to be bimodal or trimodal,

respectively.

Example 6:The mode

What is the mode of the following data set?

Data Set: 30%, 28%, 25%, 23%, 28%, 15%, 5%

34

38.

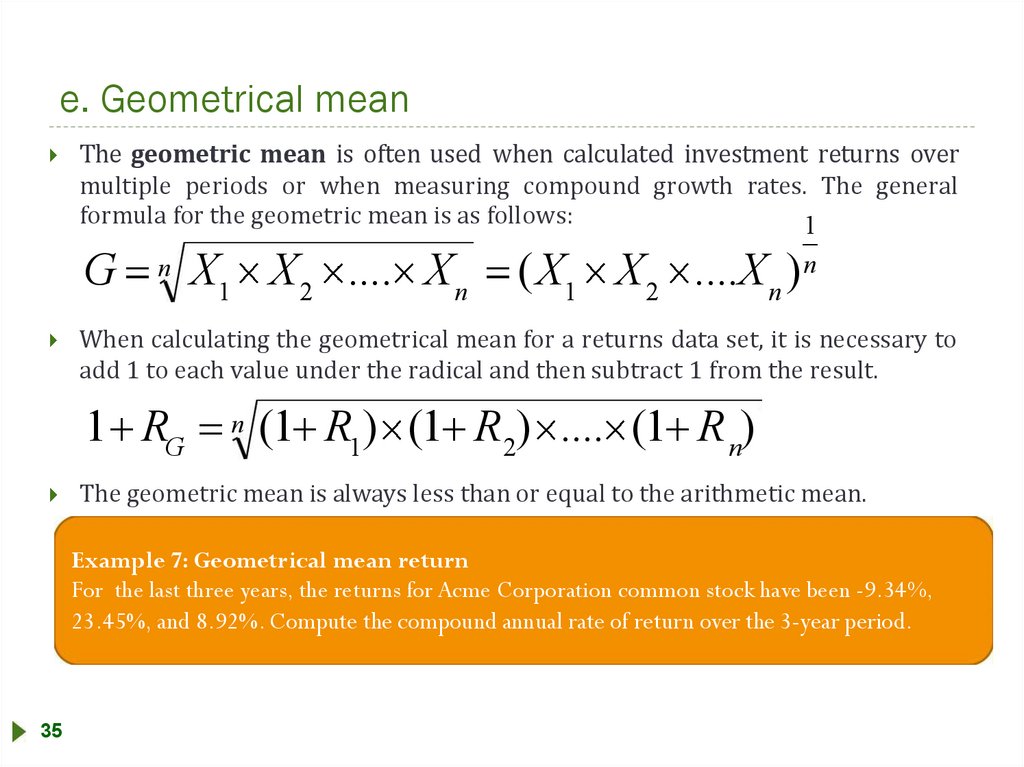

e. Geometrical meanThe geometric mean is often used when calculated investment returns over

multiple periods or when measuring compound growth rates. The general

formula for the geometric mean is as follows:

1

G

n

X1 X 2 .... X n

(X1 X 2 ....X n ) n

When calculating the geometrical mean for a returns data set, it is necessary to

add 1 to each value under the radical and then subtract 1 from the result.

1 RG

n

(1 R1) (1 R 2) .... (1 R n)

The geometric mean is always less than or equal to the arithmetic mean.

Example 7: Geometrical mean return

For the last three years, the returns for Acme Corporation common stock have been -9.34%,

23.45%, and 8.92%. Compute the compound annual rate of return over the 3-year period.

35

39.

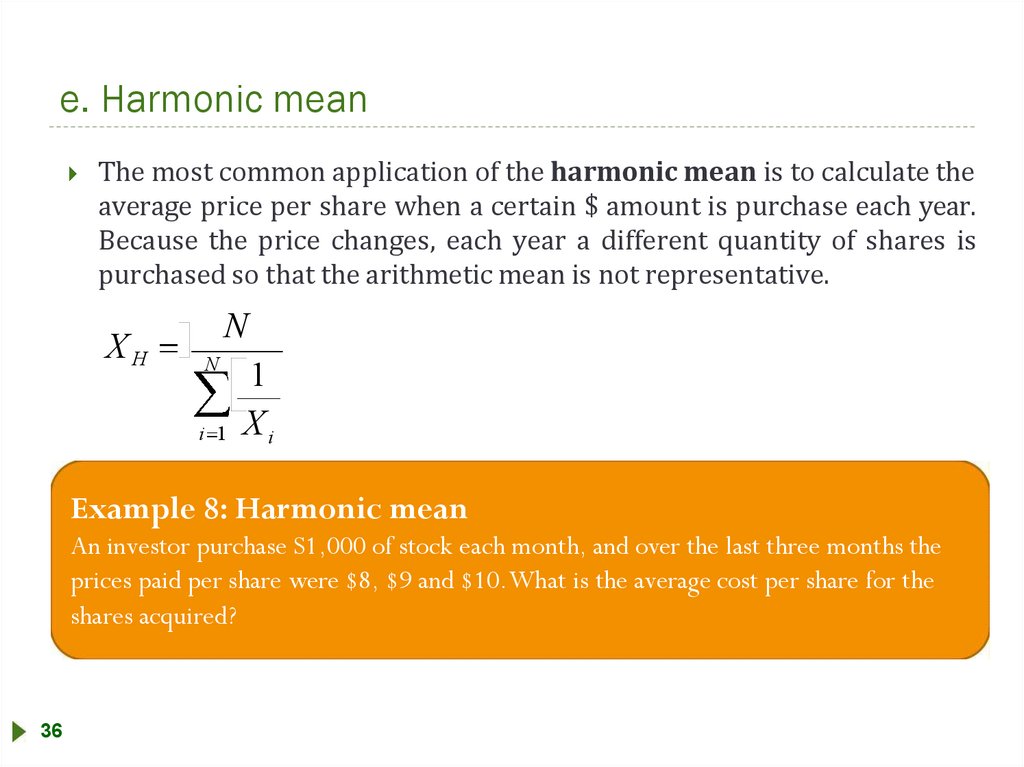

e. Harmonic meanThe most common application of the harmonic mean is to calculate the

average price per share when a certain $ amount is purchase each year.

Because the price changes, each year a different quantity of shares is

purchased so that the arithmetic mean is not representative.

XH

N

N

1

i 1 Xi

Example 8: Harmonic mean

An investor purchase S1,000 of stock each month, and over the last three months the

prices paid per share were $8, $9 and $10.What is the average cost per share for the

shares acquired?

36

40.

2541.

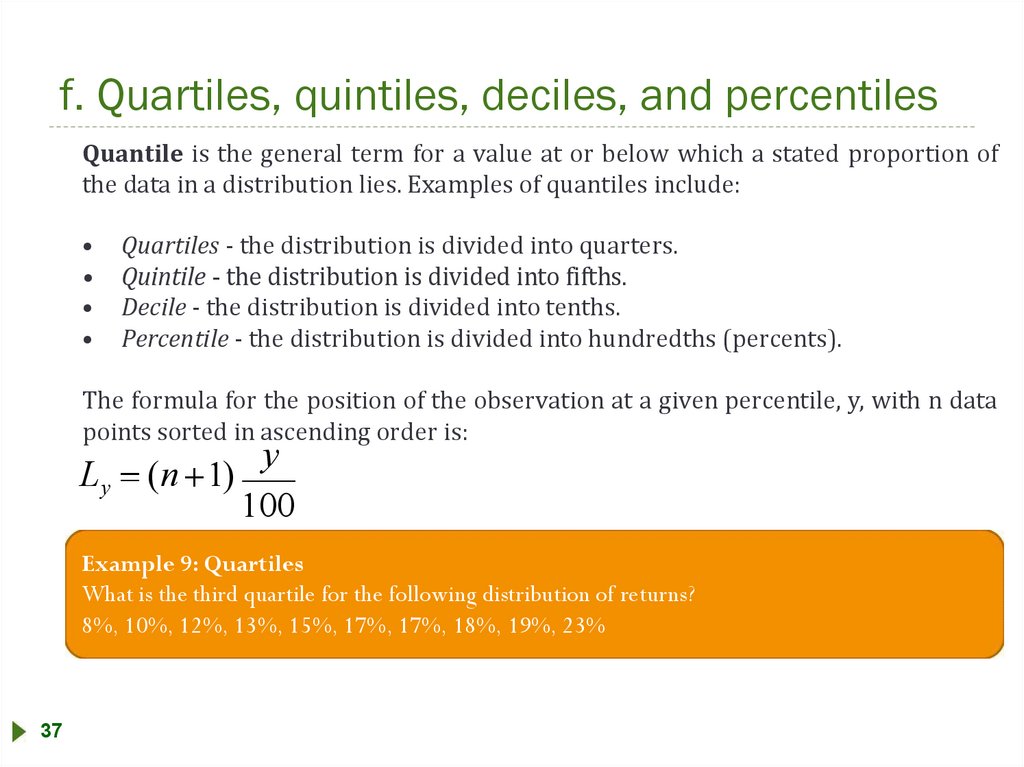

f. Quartiles, quintiles, deciles, and percentilesQuantile is the general term for a value at or below which a stated proportion of

the data in a distribution lies. Examples of quantiles include:

Quartiles - the distribution is divided into quarters.

Quintile - the distribution is divided into fifths.

Decile - the distribution is divided into tenths.

Percentile - the distribution is divided into hundredths (percents).

The formula for the position of the observation at a given percentile, y, with n data

points sorted in ascending order is:

Ly

y

(n 1)

100

Example 9: Quartiles

What is the third quartile for the following distribution of returns?

8%, 10%, 12%, 13%, 15%, 17%, 17%, 18%, 19%, 23%

37

42.

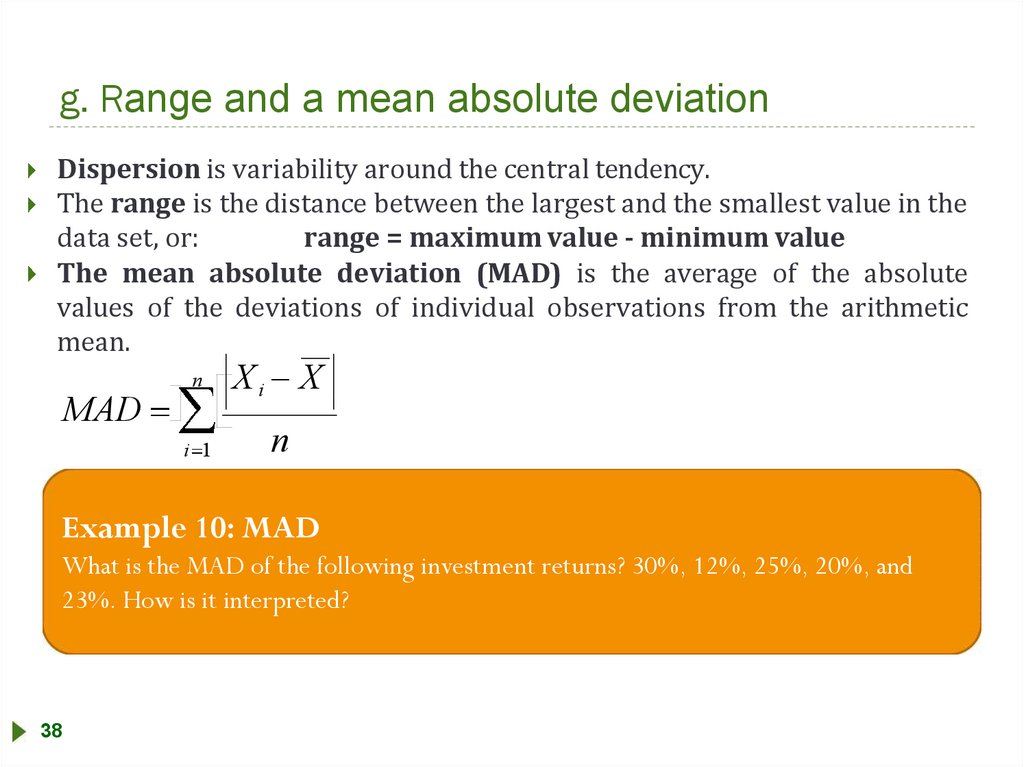

g. Range and a mean absolute deviationDispersion is variability around the central tendency.

The range is the distance between the largest and the smallest value in the

data set, or:

range = maximum value - minimum value

The mean absolute deviation (MAD) is the average of the absolute

values of the deviations of individual observations from the arithmetic

mean.

MAD

n

i 1

Xi

X

n

Example 10: MAD

What is the MAD of the following investment returns? 30%, 12%, 25%, 20%, and

23%. How is it interpreted?

38

43.

g. Population variance and standard deviationThe population variance is defined as the average of the squared deviations from

the mean. The population variance uses the values for all members of a population

and is calculated using the following formula:

N

2

(Xi

)2

i 1

N

The population standard deviation is the square root of the population variance

and is calculated as follows:

N

(Xi

i 1

N

39

)2

44.

g. Population variance and standard deviationExample 11: Population variance

Assume the 5-year annualized total returns for the five investment managers used in the

earlier example represent all of the managers at a small investment firm.What is the

population variance of returns?

Example 12: Population standard deviation

Using the data from the preceding examples, compute the population standard

deviation.

40

45.

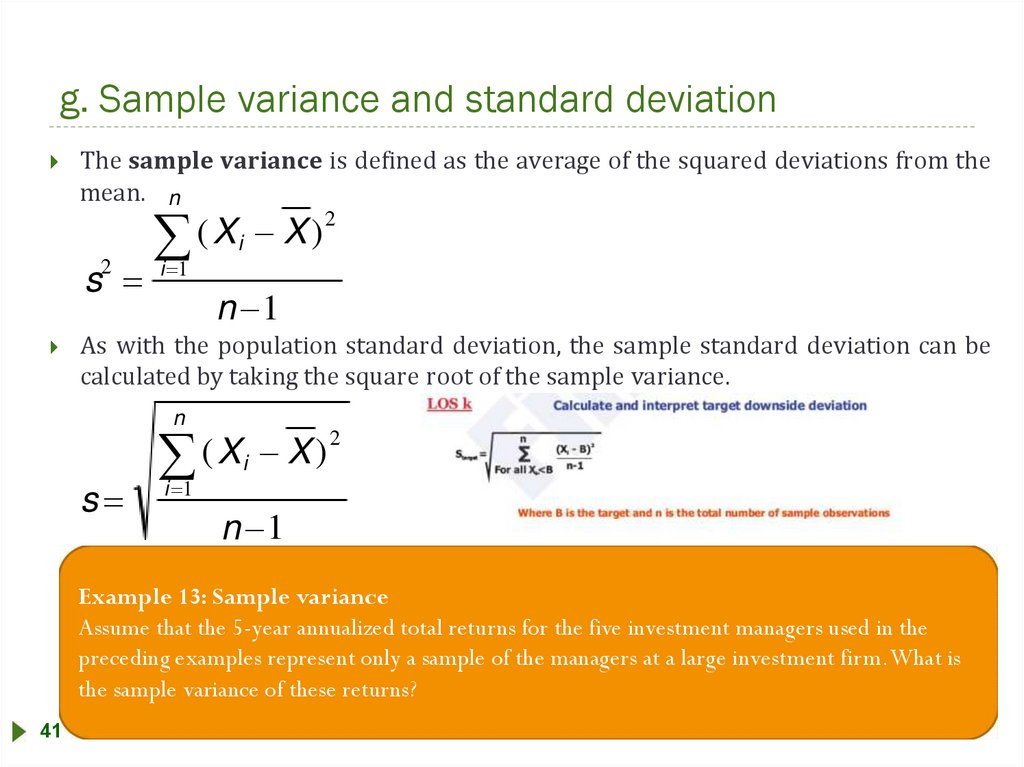

g. Sample variance and standard deviationThe sample variance is defined as the average of the squared deviations from the

mean. n

2

(

)

X

X

i

s i 1

2

n 1

As with the population standard deviation, the sample standard deviation can be

calculated by taking the square root of the sample variance.

n

s

2

(

)

X

X

i

i 1

n 1

Example 13: Sample variance

Assume that the 5-year annualized total returns for the five investment managers used in the

preceding examples represent only a sample of the managers at a large investment firm.What is

the sample variance of these returns?

41

46.

h. Chebyshev's inequalityChebyshev's inequality states for any set of observations

that:

Nk

2

1 1/ k

N

where N – total number observations in population

Nk – number observations that lie within k standard deviations

or, in other words, the percentage of the observations that lie

within k standard deviations of the mean is at least 1 - 1/k^2

Example 14: Chebyshev's inequality

What is the minimum percentage of any distribution that will lie within

±1,25; 1,50; 2; 3; 4 standard deviations of the mean?

42

47.

i. The coefficient of variationRelative dispersion is the amount of variability in a

distribution relative to a reference point or benchmark.

Relative dispersion is commonly measured with the

coefficient of variation which is computed as:

CV is used to measure the risk (variability) per unit of

expected return (mean).

43

48.

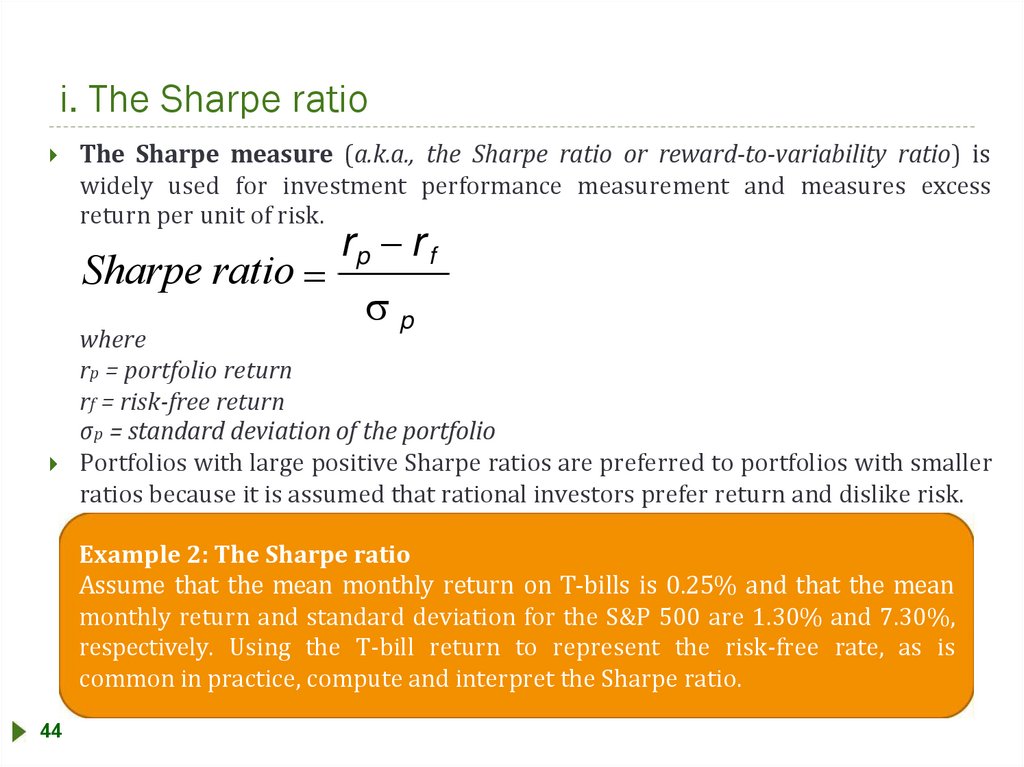

i. The Sharpe ratioThe Sharpe measure (a.k.a., the Sharpe ratio or reward-to-variability ratio) is

widely used for investment performance measurement and measures excess

return per unit of risk.

Sharpe ratio

rp r f

p

where

rp = portfolio return

rf = risk-free return

σp = standard deviation of the portfolio

Portfolios with large positive Sharpe ratios are preferred to portfolios with smaller

ratios because it is assumed that rational investors prefer return and dislike risk.

Example 2: The Sharpe ratio

Assume that the mean monthly return on T-bills is 0.25% and that the mean

monthly return and standard deviation for the S&P 500 are 1.30% and 7.30%,

respectively. Using the T-bill return to represent the risk-free rate, as is

common in practice, compute and interpret the Sharpe ratio.

44

49.

j. Skewness and the meaning of a positively or negativelyskewed return distribution

A distribution is symmetrical if it is shaped identically on

both sides of its mean.

Distributional symmetry implies that intervals of losses and

gains will exhibit the same frequency.

Skewness, or skew, refers to the extent to which a

distribution is not symmetrical.

A positively skewed distribution is characterized by many outliers in the

upper region, or right tail. A positively skewed distribution is said to be

skewed right because of its relatively long upper (right) tail.

A negatively skewed distribution has a disproportionately large amount of

outliers that fall within its lower (left) tail. A negatively skewed

distribution is said to be skewed left because of its long lower tail.

45

50.

k. Relative locations of the mean, median, and mode for aunimodal, nonsymmetrical distribution

46

51.

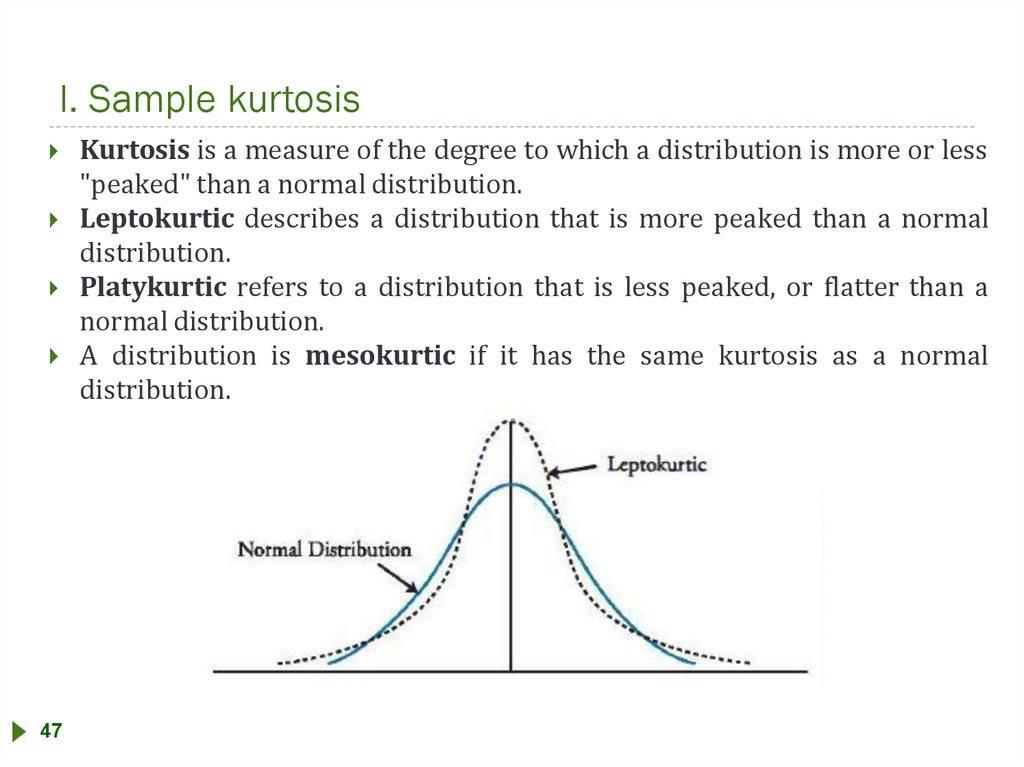

l. Sample kurtosisKurtosis is a measure of the degree to which a distribution is more or less

"peaked" than a normal distribution.

Leptokurtic describes a distribution that is more peaked than a normal

distribution.

Platykurtic refers to a distribution that is less peaked, or flatter than a

normal distribution.

A distribution is mesokurtic if it has the same kurtosis as a normal

distribution.

47

52.

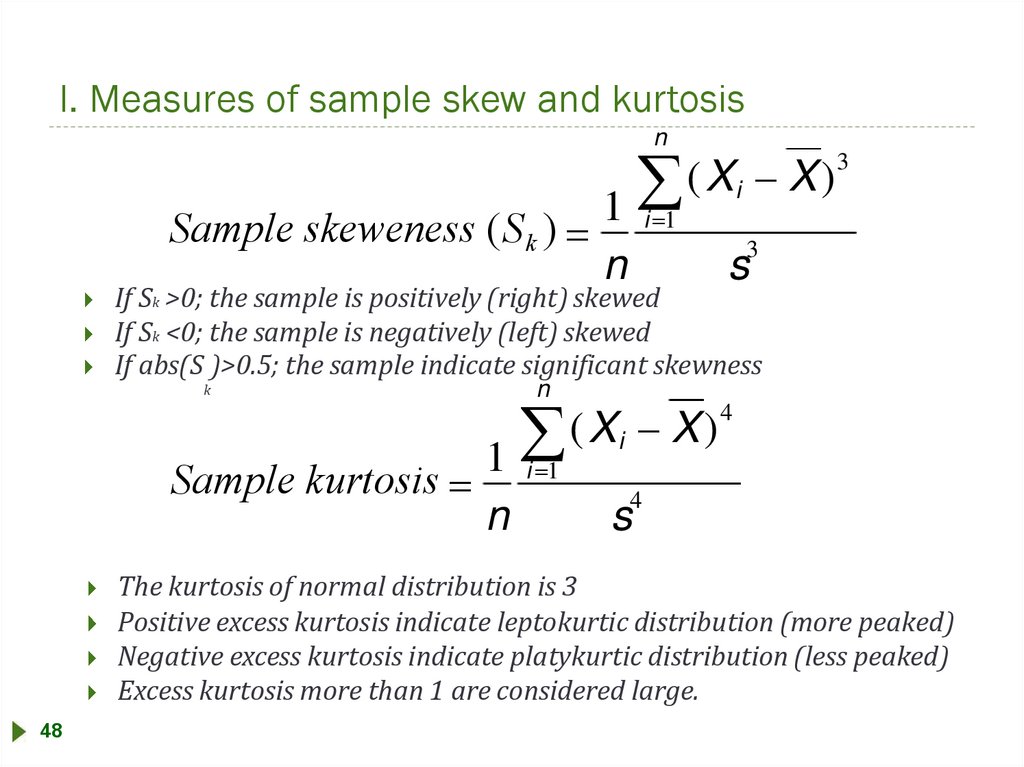

l. Measures of sample skew and kurtosisn

Sample skeweness (S k )

(X X)

1

3

i

i 1

3

n

s

If Sk >0; the sample is positively (right) skewed

If Sk <0; the sample is negatively (left) skewed

If abs(S )>0.5; the sample indicate significant skewness

k

Sample kurtosis

n

(X X)

1

i 1

n

4

i

4

s

The kurtosis of normal distribution is 3

Positive excess kurtosis indicate leptokurtic distribution (more peaked)

Negative excess kurtosis indicate platykurtic distribution (less peaked)

Excess kurtosis more than 1 are considered large.

48

53.

m. Explain the use of arithmetic and geometric meanswhen analyzing investment returns

The geometric mean of past annual returns is the appropriate

measure of past performance. It gives average annual compound

return.

The arithmetic mean is statistically best estimator of the next

year's return given only the three years of return outcomes.

Example 3: Geometric vs arithmetic means

With annual returns of 5%, 12% and 9% over three years, calculate and

interpret geometric and arithmetic means?

49

54.

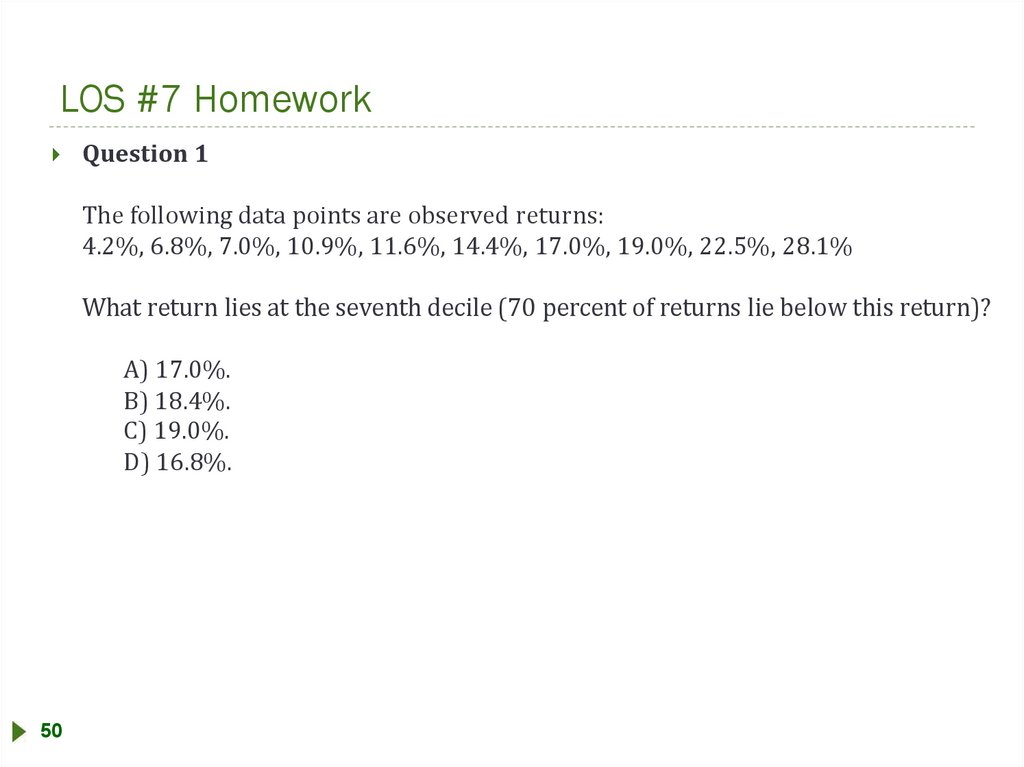

LOS #7 HomeworkQuestion 1

The following data points are observed returns:

4.2%, 6.8%, 7.0%, 10.9%, 11.6%, 14.4%, 17.0%, 19.0%, 22.5%, 28.1%

What return lies at the seventh decile (70 percent of returns lie below this return)?

A) 17.0%.

B) 18.4%.

C) 19.0%.

D) 16.8%.

50

55.

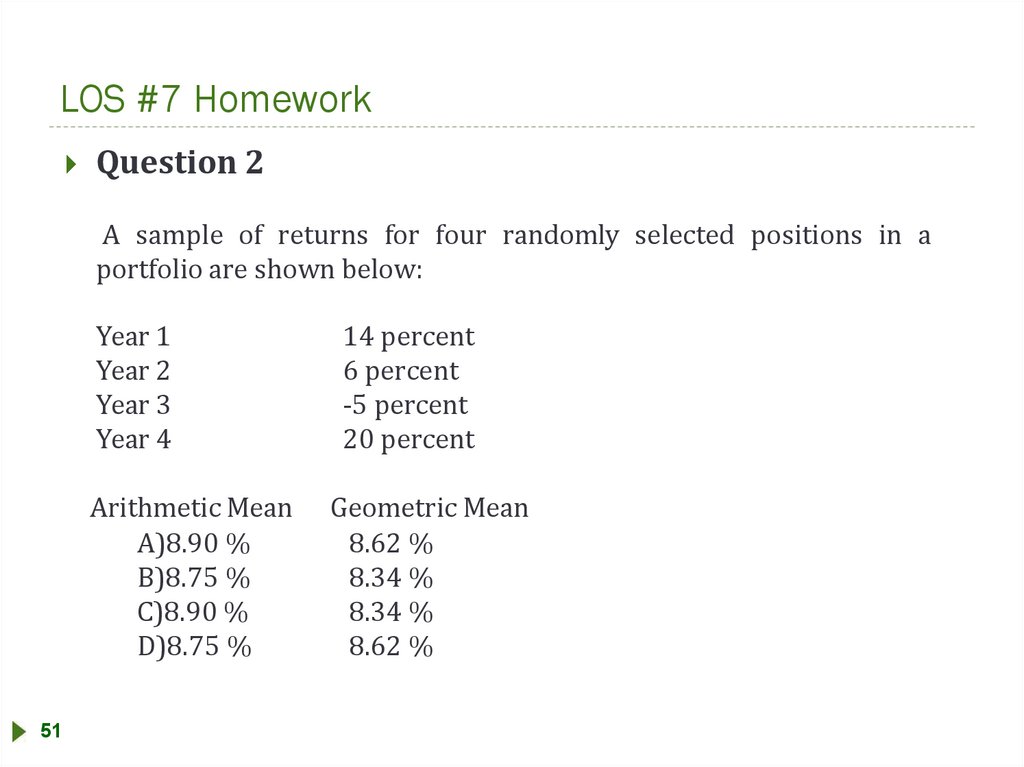

LOS #7 HomeworkQuestion 2

A sample of returns for four randomly selected positions in a

portfolio are shown below:

51

Year 1

Year 2

Year 3

Year 4

14 percent

6 percent

-5 percent

20 percent

Arithmetic Mean

A)8.90 %

B)8.75 %

C)8.90 %

D)8.75 %

Geometric Mean

8.62 %

8.34 %

8.34 %

8.62 %

56.

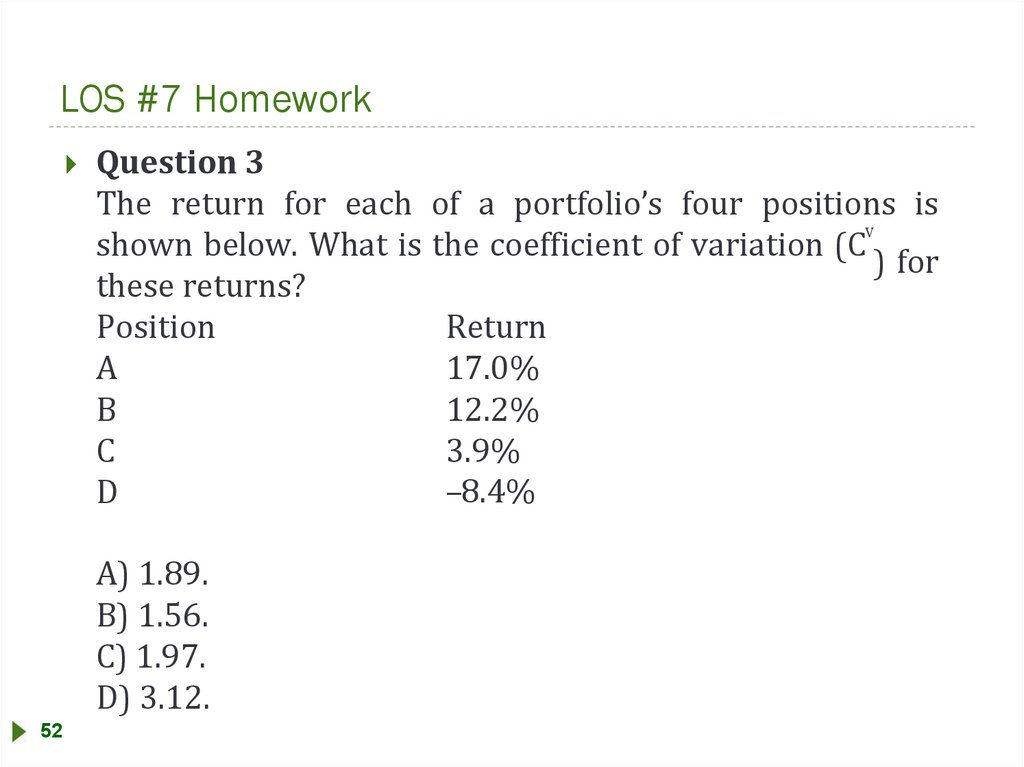

LOS #7 HomeworkQuestion 3

The return for each of a portfolio’s four positions is

V

shown below. What is the coefficient of variation (C ) for

these returns?

Position

Return

A

17.0%

B

12.2%

C

3.9%

–8.4%

D

A) 1.89.

B) 1.56.

C) 1.97.

D) 3.12.

52

57.

LOS #7 HomeworkQuestion 4

The returns for individual positions in a portfolio are shown below:

Position

Return (%)

A

4.8

B

3.7

C

6.2

D

3.4

E

1.7

If the risk-free rate of return is 3.5 percent, what is the Sharpe

measure for this portfolio?

A) 1.037

B) 0.307

C) 0.870

D) 1.292

53

58.

LOS #7 HomeworkQuestion 5

The mean monthly return on U.S. Treasury bills (T-bills)

is 0.42 percent with a standard deviation of 0.25 percent.

The mean monthly return for an index of small stocks is

4.56 percent, with a standard deviation of 3.56 percent.

What is the Sharpe measure for the index of small stocks?

A) 10.60

B) 16.56

C) 1.16

D) 3.48

54

59.

Probability ConceptsLOS #8

55

60.

Probability ConceptsThe candidate should be able to:

a.

define a random variable, an outcome, an event, mutually exclusive

events, and exhaustive events

b.

state the two defining properties of probability and distinguish

among empirical, subjective and a priori probabilities

c.

state the probability of an event in terms of odds

d. distinguish between unconditional and conditional probabilities

e.

explain the multiplication, addition, and total probability rules

f.

calculate and interpret 1) the joint probability of two events 2) the

probability that at least one of two events will occur, given the

probability of each and the joint probability of the two events, and 3)

a joint probability of any number of independent events

g.

distinguish between dependent and independent events

h.

calculate and interpret an unconditional probability using the total

probability rule

56

61.

Probability ConceptsThe candidate should be able to:

i.

explain the use of conditional expectation in investment

applications

j.

explain the use of a tree diagram to represent an investment

problem

k.

calculate and interpret covariance and correlation

l.

calculate and interpret the expected value, variance, and standard

deviation of a random variable and of returns on a portfolio

m.

calculate and interpret covariance given a joint probability function

n.

calculate and interpret an updated probability using Bayes' formula

o.

identify the most appropriate method to solve a particular counting

problem, and solve counting problems using factorial, combination,

and permutation concepts

57

62.

a. Random variable, an outcome, an event, mutuallyexclusive events, and exhaustive events

A random variable is an uncertain quantity/number.

An outcome is an observed value of a random variable.

An event is a single outcome or a set of outcomes.

Mutually exclusive events are events that cannot both

happen at the same time.

Exhaustive events are those that include all possible

outcomes.

58

63.

b. Properties of probabilityThere are two defining properties of probability:

The probability of occurrence of any event is between 0 and 1;

If a set of events is mutually exclusive and exhaustive, the probabilities

of those events sum to 1.

An empirical probability is established by analyzing past

data.

An a priori probability is determined using a formal

reasoning and inspection process.

Empirical and a priori probabilities are objective

probabilities.

A subjective probability involves the use of personal

judgment.

59

64.

c. Probability of an event in terms of odds.Stating the odds that an event will or will not occur is an

alternative way of expressing probabilities.

Consider an event that has a probability of occurrence of

0.125, which is one-eighth.

The odds that the event will occur are 0.125/(10.125)=1/7 which we state "the odds for the event

occurring are one-to-seven”.

60

65.

d. Unconditional and conditional probabilitiesUnconditional probability (a.k.a. marginal probability)

refers to the probability of an event regardless of the past

or future occurrence of other events.

A conditional probability is one where the occurrence of

one event affects the probability of the occurrence of

another event.

Example: we might be concerned with the probability of a recession

given that the monetary authority increases interest rates. The key word

to watch for here is "given.“

Using probability notation "the probability of A given the

occurrence of B“ is expressed as P(A|B), where the vertical

bar ( | ) indicates "given”.

61

66.

e. Multiplication, addition, and total probability rulesThe multiplication rule of probability is used to

determine the joint probability of two events:

P( AB)

P( A B) P(B)

The addition rule of probability is used to determine the

probability that at least one of two events will occur:

P( A or B)

P( A) P(B) P( AB)

The total probability rule is used to determine the

unconditional probability of an event, given conditional

probabilities:

P( A)

62

P( A B1 ) P(B1 ) .... P( A B n) P(B n )

67.

f. The joint probability of two eventsThe joint probability of two events is the probability that they will both occur.

The calculation is sometimes referred to as the multiplication rule of

probability:

P( AB)

P( A B) P(B)

This relationship can be rearranged to define the conditional probability of A

given B as follows:

P( A B)

P( AB)

P(B)

Example 1: Multiplication rule of probability

Consider the following information:

• P(ӏ) = 0.4, the probability of the monetary authority increasing interest rates (I) is

40%.

• P(R I ӏ) = 0.7, the probability of a recession (R) given an increase in interest rates.

What is P(R ӏ ), the joint probability of a recession and an increase in interest rates?

63

68.

f. The Probability that at least one of two events will occurP( A or B)

P( A) P(B) P( AB)

For mutually exclusive events, where the joint probability,

P(AB) is zero, the probability that either A or B will occur

is simply the sum of the unconditional probabilities for

each event, P(A or B) = P(A) + P(B).

Venn diagram

64

69.

f. The Probability that at least one of two events will occurExample 2: Addition rule of probability

Using the information in our previous interest rate and recession

example and the fact that the unconditional probability of a recession,

P(R) is 34%, determine the probability that either interest rates will

increase or a recession will occur.

When dealing with independent events, the word and indicates

multiplication, and the word or indicates addition.

Example 3: Joint probability for more than two independent events

Using empirical probabilities, suppose we observe that me DJIA has closed

higher on two-thirds of all days in the past few decades. Furthermore, it has

been determined that up and down days are independent. Based on this

information, compute the probability of the DJIA closing higher for five

consequent years.

65

70.

g. Dependent and independent eventsIndependent events refer to events for which the

occurrence of one has no influence on the occurrence of

the others.

Events A and B are independent if and only if:

P( A B)

P( A)

If this condition is not satisfied, the events are dependent.

66

71.

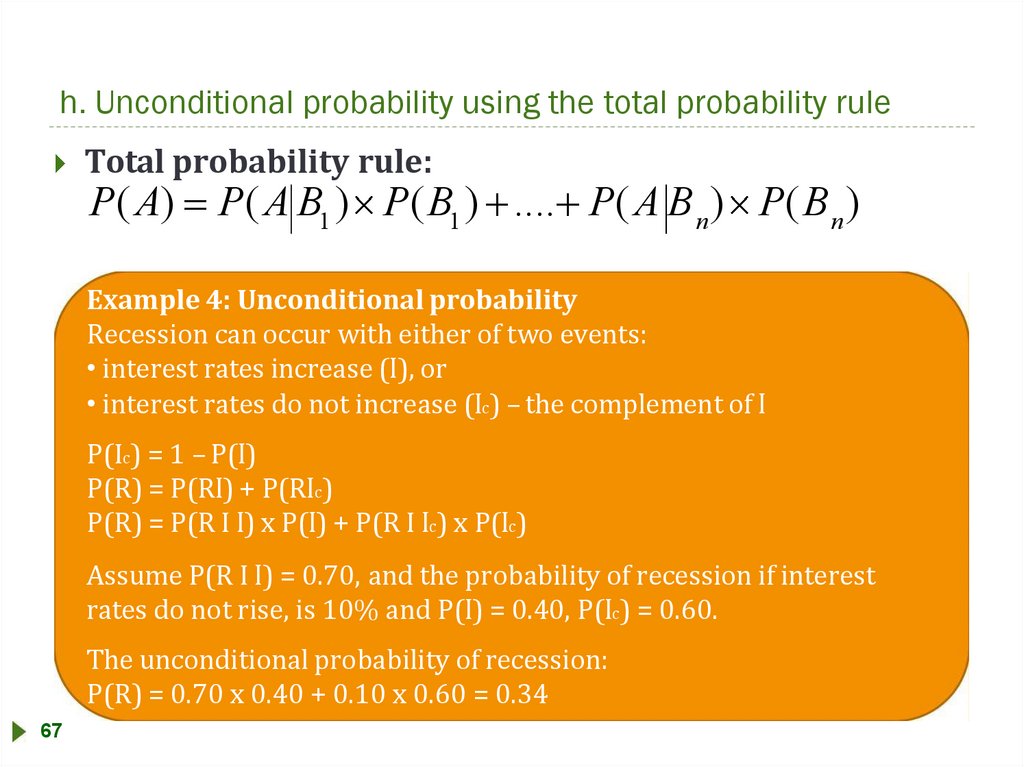

h. Unconditional probability using the total probability ruleTotal probability rule:

P( A)

P( A B1 ) P(B1 ) .... P( A B n) P(B n )

Example 4: Unconditional probability

Recession can occur with either of two events:

• interest rates increase (ӏ), or

• interest rates do not increase (ӏc) – the complement of ӏ

P(Ic) = 1 – P(ӏ)

P(R) = P(Rӏ) + P(Rӏc)

P(R) = P(R I ӏ) x P(ӏ) + P(R I ӏc) x P(ӏc)

Assume P(R I ӏ) = 0.70, and the probability of recession if interest

rates do not rise, is 10% and P(ӏ) = 0.40, P(ӏc) = 0.60.

The unconditional probability of recession:

P(R) = 0.70 x 0.40 + 0.10 x 0.60 = 0.34

67

72.

h. Unconditional probabilityConditional

Unconditional probability

probability

68

Joint

probability

73.

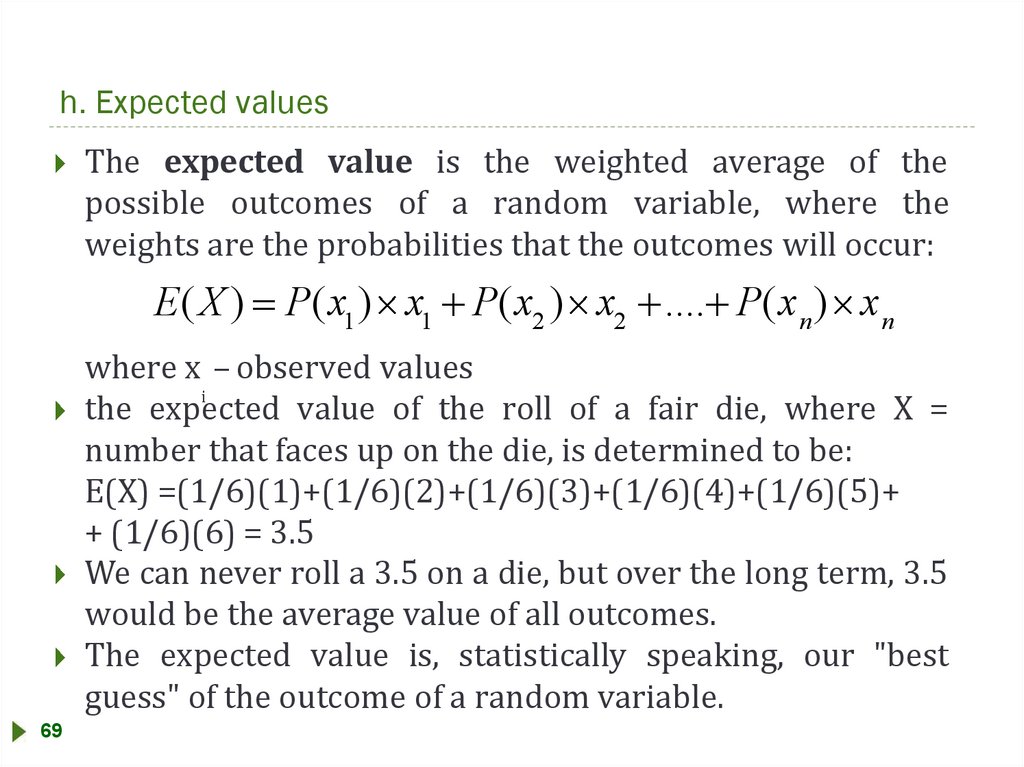

h. Expected valuesThe expected value is the weighted average of the

possible outcomes of a random variable, where the

weights are the probabilities that the outcomes will occur:

E(X ) P(x1 ) x1 P(x2 ) x2 .... P(x n ) x n

where x – observed values

i

the expected value of the roll of a fair die, where X =

number that faces up on the die, is determined to be:

E(X) =(1/6)(1)+(1/6)(2)+(1/6)(3)+(1/6)(4)+(1/6)(5)+

+ (1/6)(6) = 3.5

We can never roll a 3.5 on a die, but over the long term, 3.5

would be the average value of all outcomes.

The expected value is, statistically speaking, our "best

guess" of the outcome of a random variable.

69

74.

h. Expected valuesExample 5: Expected earnings per share

The probability distribution of EPS for Ron's Stores is

given in the figure below. Calculate the expected earnings

per share.

Probability

10%

20%

40%

30%

70

Earnings per share

£1.80

£1.60

£1.20

£1.00

75.

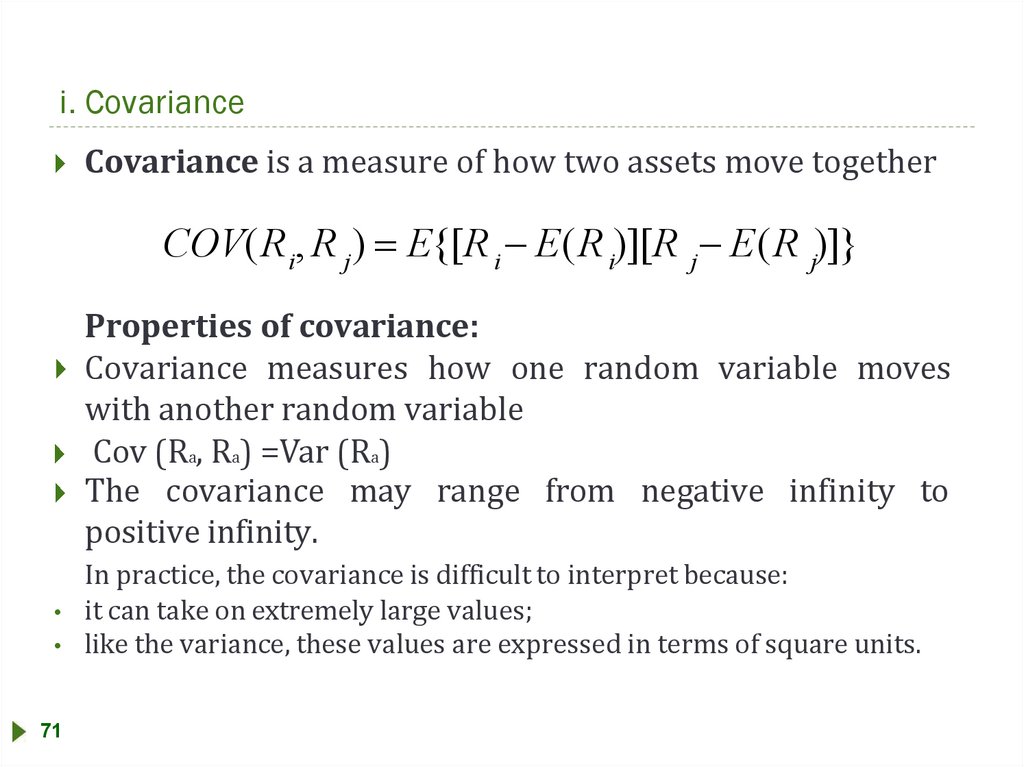

i. CovarianceCovariance is a measure of how two assets move together

COV(R i, R j)

E{[R i E(R i)][R j E(R j)]}

Properties of covariance:

Covariance measures how one random variable moves

with another random variable

Cov (Ra, Ra) =Var (Ra)

The covariance may range from negative infinity to

positive infinity.

71

In practice, the covariance is difficult to interpret because:

it can take on extremely large values;

like the variance, these values are expressed in terms of square units.

76.

i. Covariance72

77.

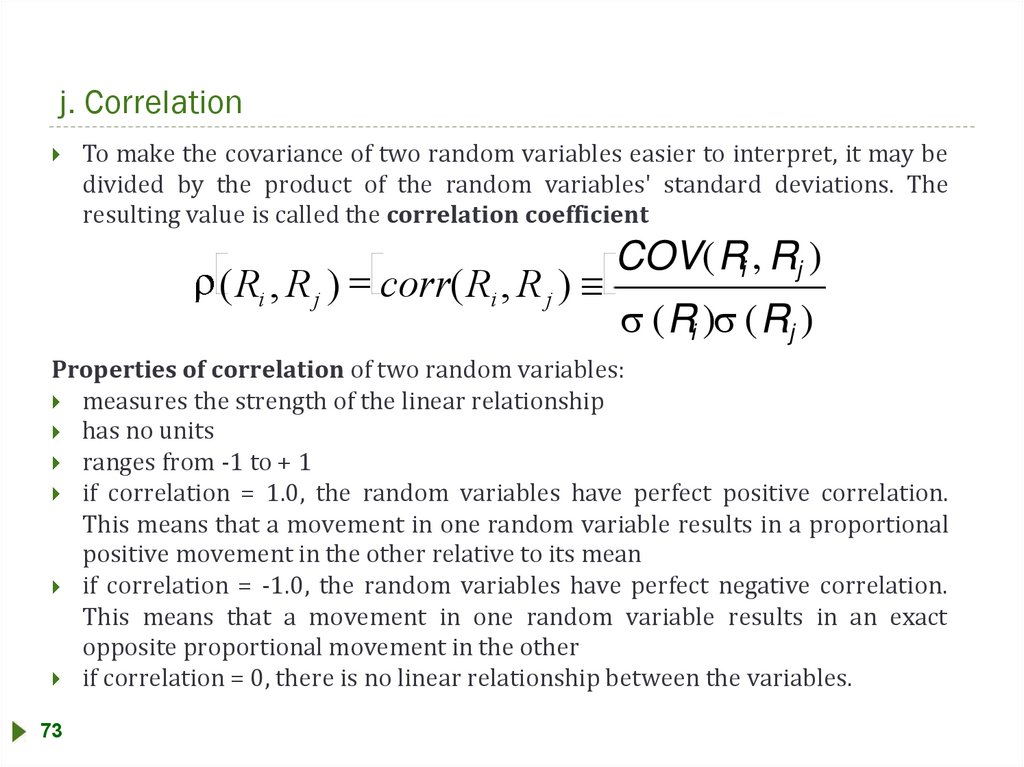

j. CorrelationTo make the covariance of two random variables easier to interpret, it may be

divided by the product of the random variables' standard deviations. The

resulting value is called the correlation coefficient

(Ri , R j ) corr(Ri , R j )

COV( Ri , Rj )

( Ri ) ( Rj )

Properties of correlation of two random variables:

measures the strength of the linear relationship

has no units

ranges from -1 to + 1

if correlation = 1.0, the random variables have perfect positive correlation.

This means that a movement in one random variable results in a proportional

positive movement in the other relative to its mean

if correlation = -1.0, the random variables have perfect negative correlation.

This means that a movement in one random variable results in an exact

opposite proportional movement in the other

if correlation = 0, there is no linear relationship between the variables.

73

78.

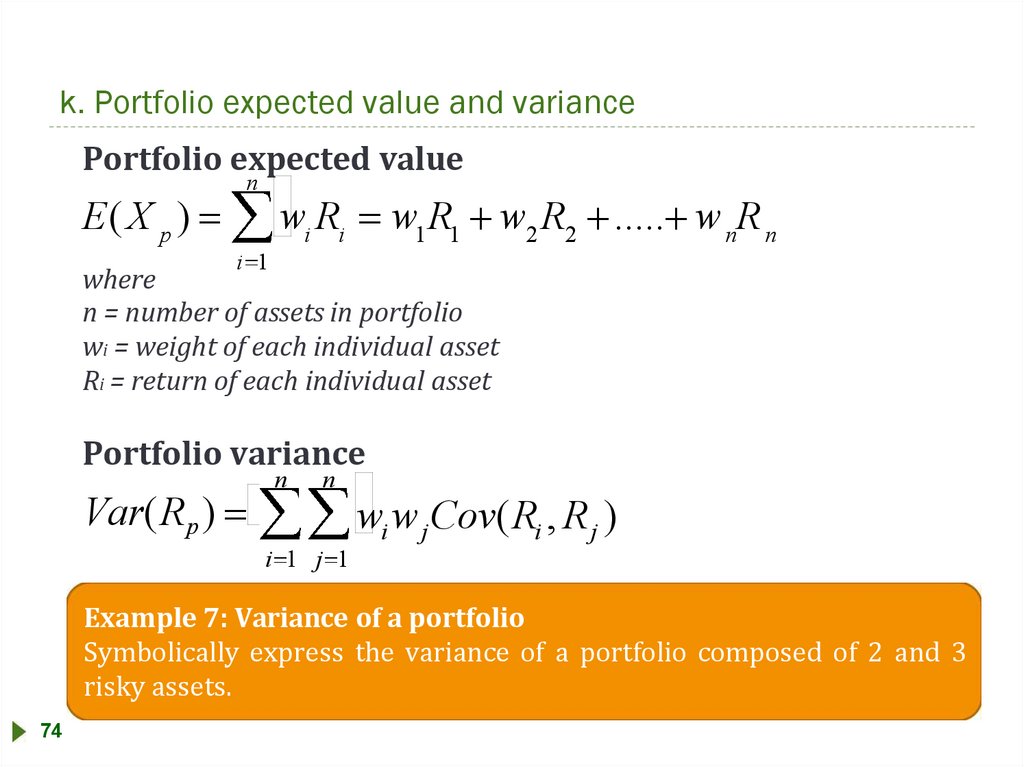

k. Portfolio expected value and variancePortfolio expected value

E(X p )

n

wi Ri

w1 R1 w2 R2 ..... w nR n

i 1

where

n = number of assets in portfolio

wi = weight of each individual asset

Ri = return of each individual asset

Portfolio variance

Var(R p )

n

n

wi w j Cov(Ri , R j )

i 1 j 1

Example 7: Variance of a portfolio

Symbolically express the variance of a portfolio composed of 2 and 3

risky assets.

74

79.

l. Calculate covariance given a joint probability75

80.

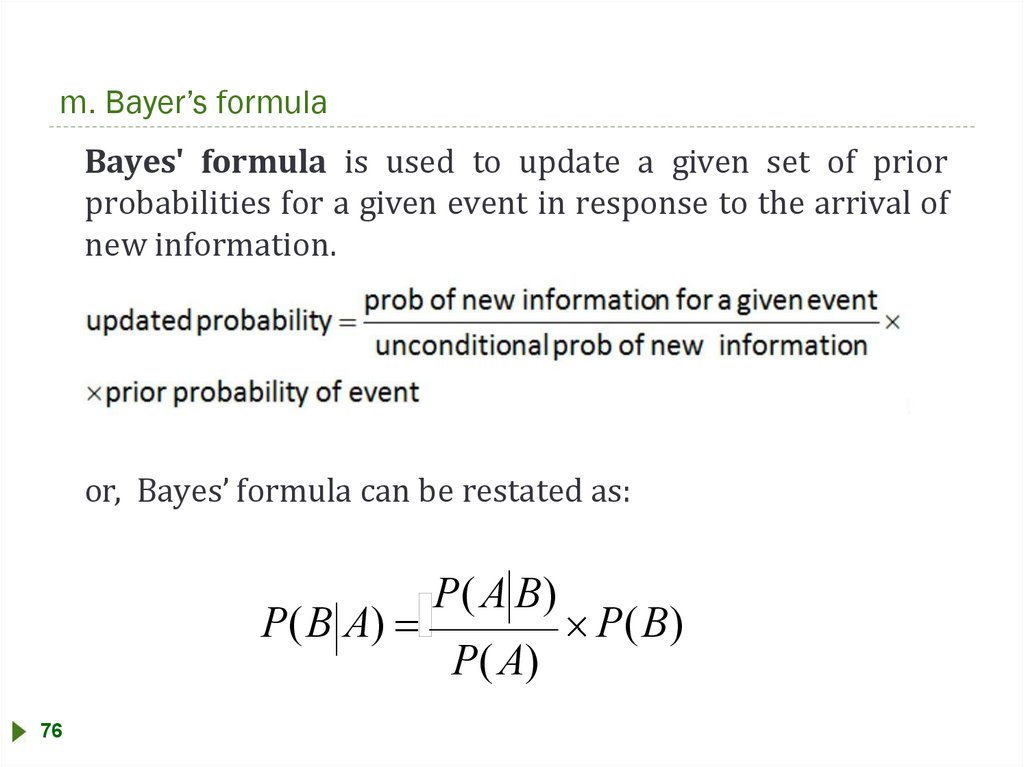

m. Bayer’s formulaBayes' formula is used to update a given set of prior

probabilities for a given event in response to the arrival of

new information.

or, Bayes’ formula can be restated as:

P(B A)

76

P(A B)

P(A)

P(B)

81.

m. Bayer’s formulaExample 9: Bayes’ formula

Electcomp Corporation manufactures electronic components for

computers and other devices. There is speculation that Electcomp is

about to announce a major expansion into overseas markets. The

expansion will occur, however, only if Electcomp's managers estimate

overseas demand to be sufficient to support the necessary sales.

Furthermore, if demand is sufficient and overseas expansion occurs,

Electcomp is likely to raise its prices. Using O to represent the event

of overseas expansion, ӏ to represent a price increase, and ӏc to

represent no price increase, an industry analyst has estimated the

unconditional and conditional probabilities shown as follows:

P(ӏ) = 0.3; P(ӏc)=0.7; P(O I ӏ)=0.6; P(O I ӏc)=0.4

What is the probability of increase in prices given that company will

expand overseas?

77

82.

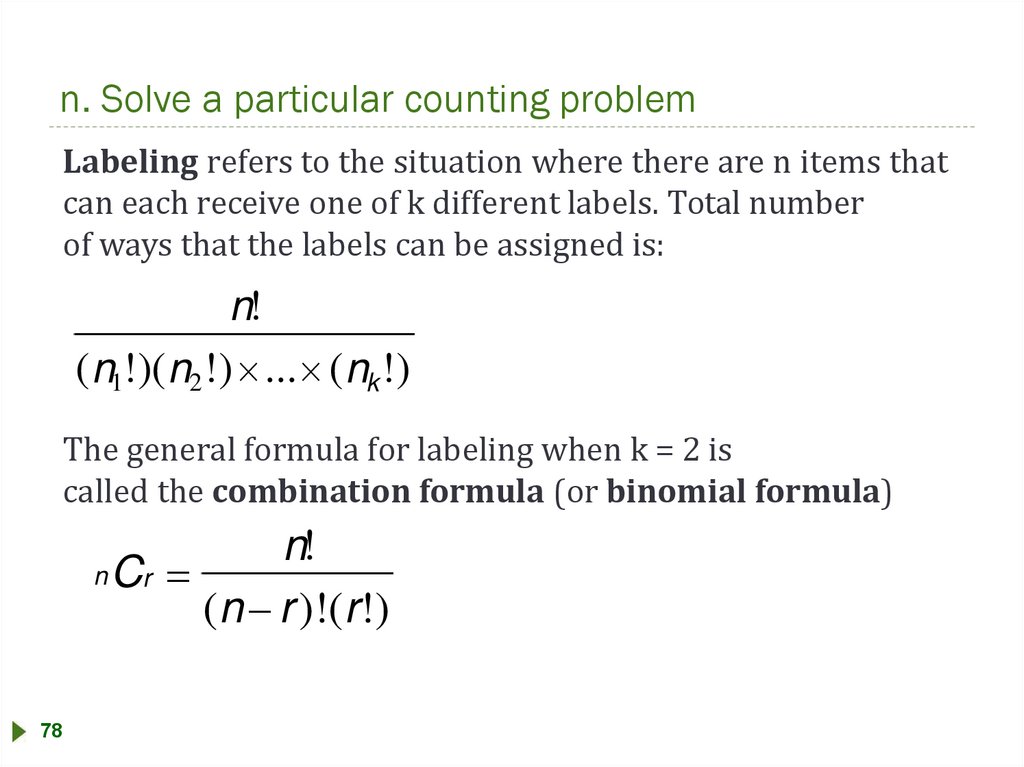

n. Solve a particular counting problemLabeling refers to the situation where there are n items that

can each receive one of k different labels. Total number

of ways that the labels can be assigned is:

n!

( n1!)( n2 !) ... ( nk !)

The general formula for labeling when k = 2 is

called the combination formula (or binomial formula)

n!

n Cr

(n r )!(r !)

78

83.

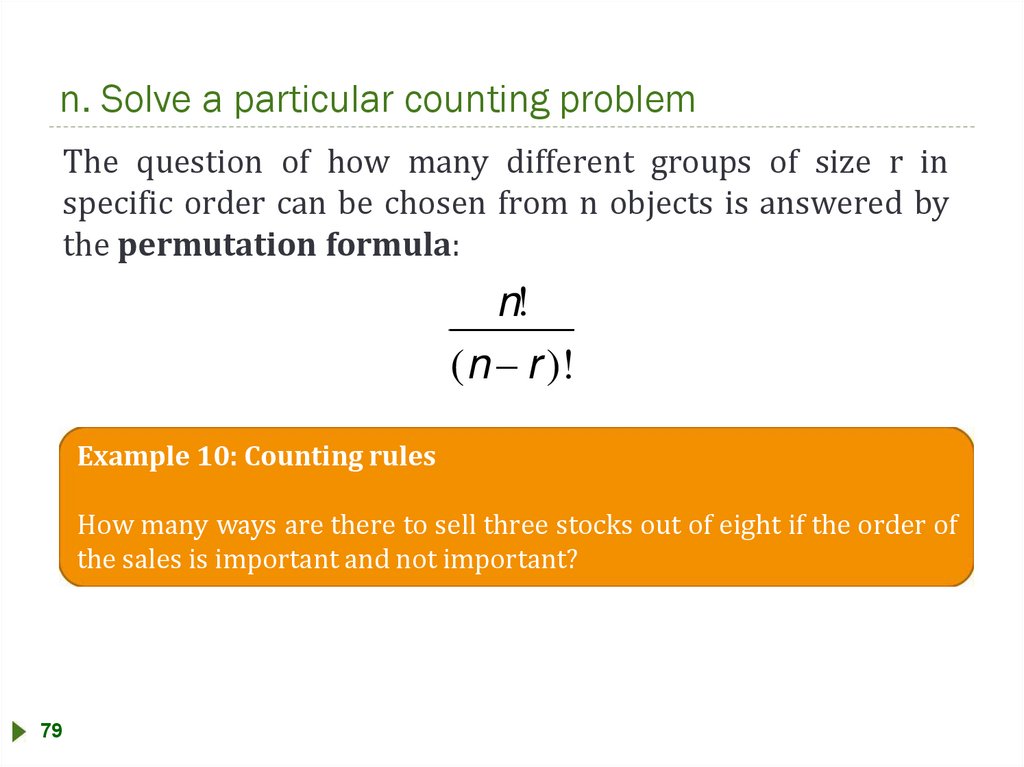

n. Solve a particular counting problemThe question of how many different groups of size r in

specific order can be chosen from n objects is answered by

the permutation formula:

n!

( n r )!

Example 10: Counting rules

How many ways are there to sell three stocks out of eight if the order of

the sales is important and not important?

79

84.

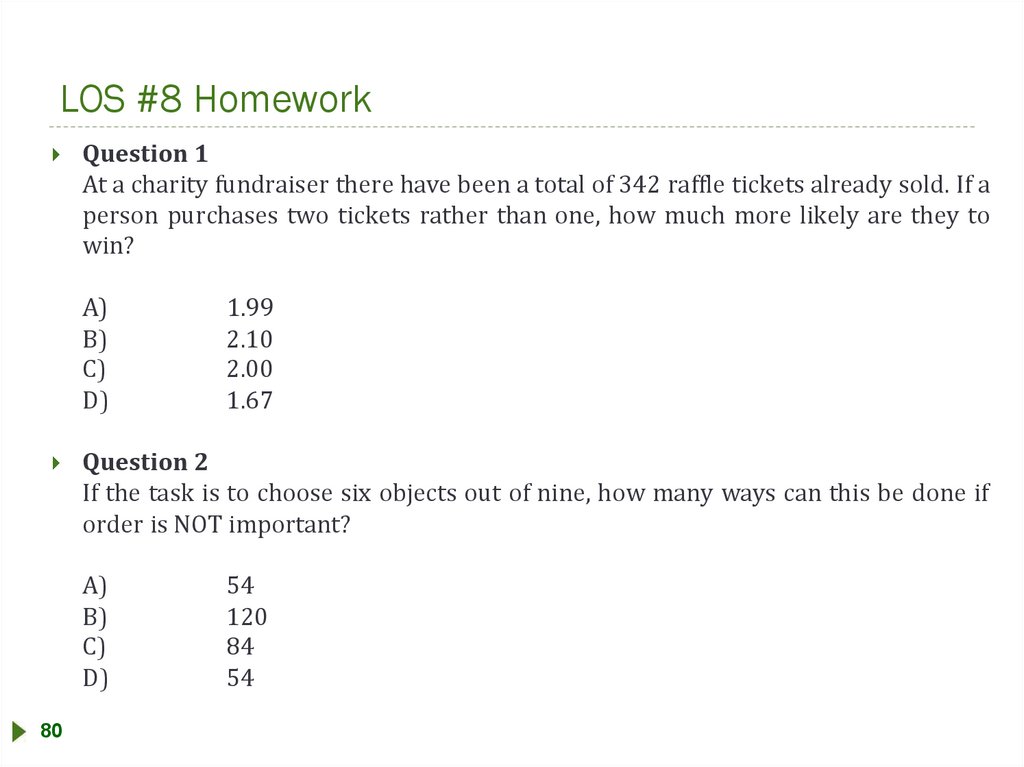

LOS #8 HomeworkQuestion 1

At a charity fundraiser there have been a total of 342 raffle tickets already sold. If a

person purchases two tickets rather than one, how much more likely are they to

win?

A)

B)

C)

D)

1.99

2.10

2.00

1.67

Question 2

If the task is to choose six objects out of nine, how many ways can this be done if

order is NOT important?

A)

B)

C)

D)

80

54

120

84

54

85.

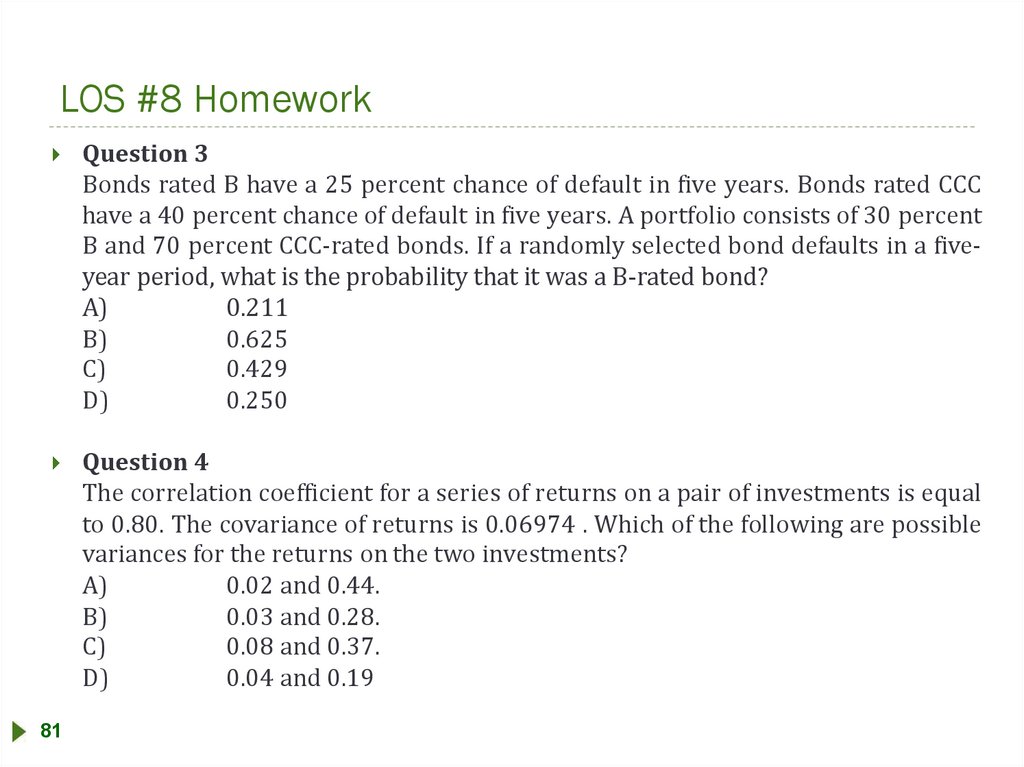

LOS #8 HomeworkQuestion 3

Bonds rated B have a 25 percent chance of default in five years. Bonds rated CCC

have a 40 percent chance of default in five years. A portfolio consists of 30 percent

B and 70 percent CCC-rated bonds. If a randomly selected bond defaults in a fiveyear period, what is the probability that it was a B-rated bond?

A)

0.211

B)

0.625

C)

0.429

D)

0.250

Question 4

The correlation coefficient for a series of returns on a pair of investments is equal

to 0.80. The covariance of returns is 0.06974 . Which of the following are possible

variances for the returns on the two investments?

A)

0.02 and 0.44.

B)

0.03 and 0.28.

C)

0.08 and 0.37.

D)

0.04 and 0.19

81

86.

LOS #8 HomeworkQuestion 5

For assets A and B we know the following: E(Ra)=0.10, E(Ra)=0.20, V(Ra)=0.25,

V(Ra)=0.36 and the correlation of the returns is 0.6. What is the variance of the

return of a portfolio that is equally invested in the two assets?

A) 0.3050.

B) 0.1500.

C) 0.2425.

D) 0.2275.

Question 6

The probability of A is 0.4. The probability of Ac is 0.6. The probability of (B|A) is

0.5, and the probability of (B|Ac) is 0.2. Using Bayes’ formula, what is the

probability of (A|B)?

82

A) 0.875

B) 0.125

C) 0.625

D) 0.375

87.

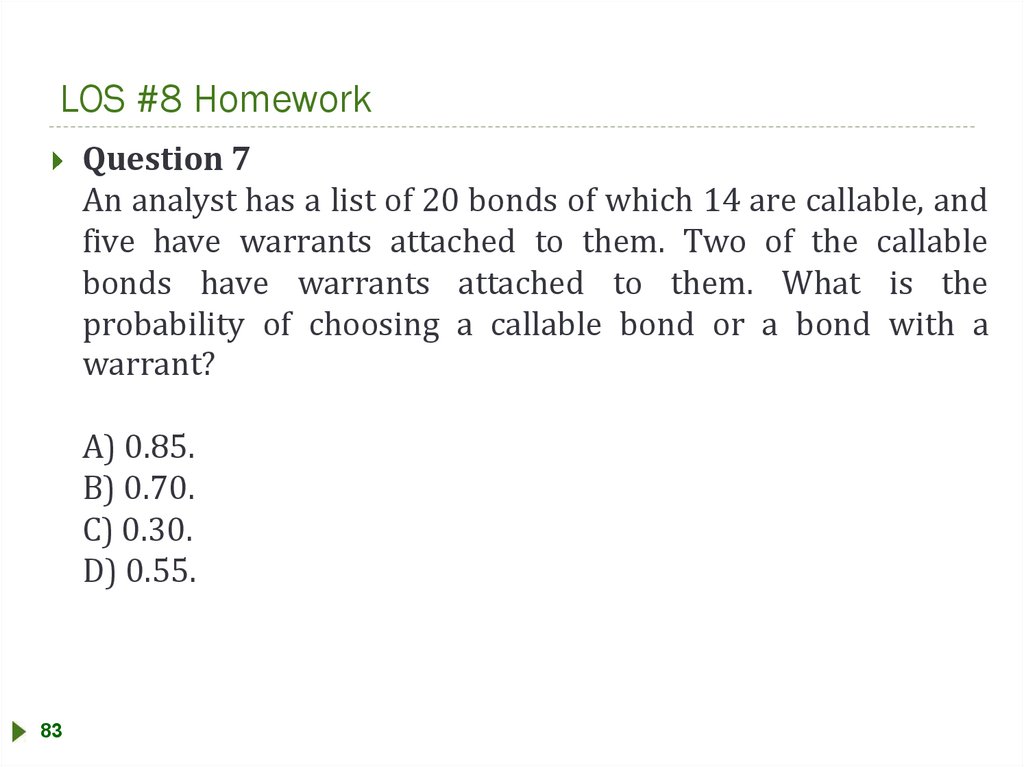

LOS #8 HomeworkQuestion 7

An analyst has a list of 20 bonds of which 14 are callable, and

five have warrants attached to them. Two of the callable

bonds have warrants attached to them. What is the

probability of choosing a callable bond or a bond with a

warrant?

A) 0.85.

B) 0.70.

C) 0.30.

D) 0.55.

83

88.

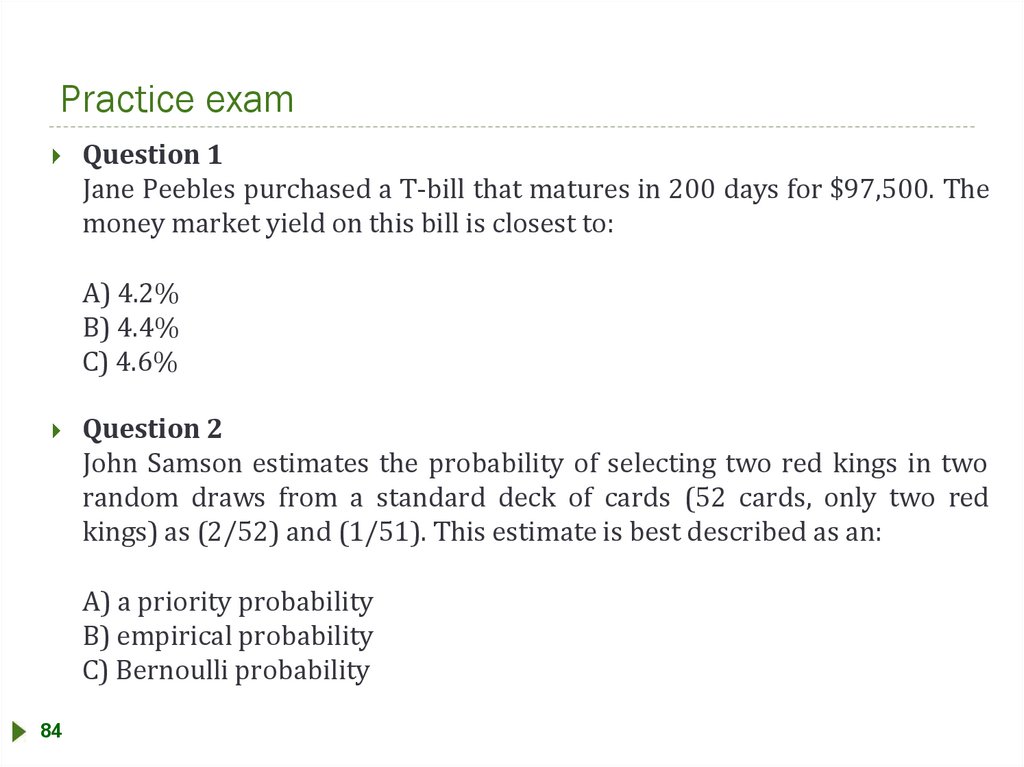

Practice examQuestion 1

Jane Peebles purchased a T-bill that matures in 200 days for $97,500. The

money market yield on this bill is closest to:

A) 4.2%

B) 4.4%

C) 4.6%

Question 2

John Samson estimates the probability of selecting two red kings in two

random draws from a standard deck of cards (52 cards, only two red

kings) as (2/52) and (1/51). This estimate is best described as an:

A) a priority probability

B) empirical probability

C) Bernoulli probability

84

89.

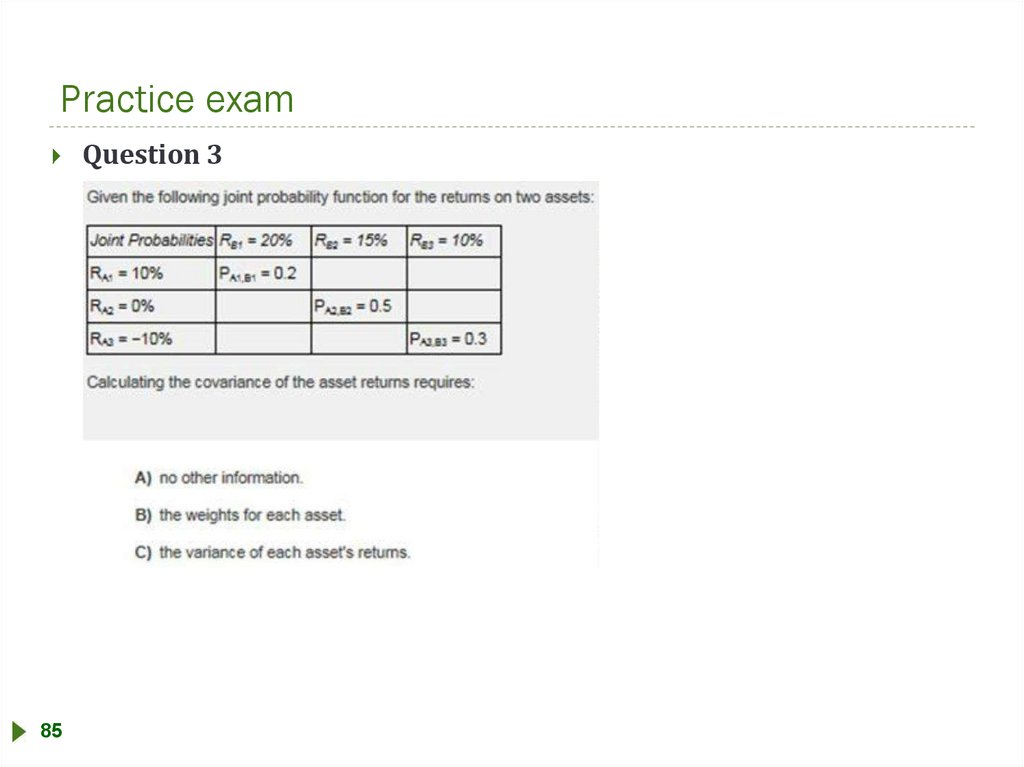

Practice examQuestion 3

85

90.

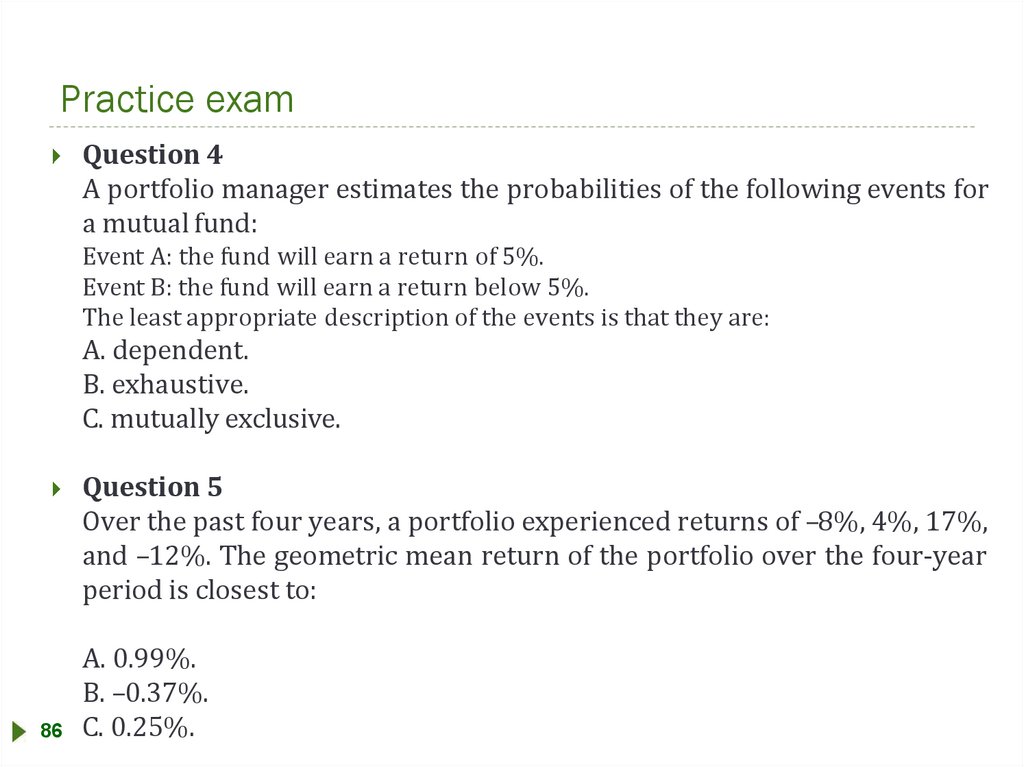

Practice examQuestion 4

A portfolio manager estimates the probabilities of the following events for

a mutual fund:

Event A: the fund will earn a return of 5%.

Event B: the fund will earn a return below 5%.

The least appropriate description of the events is that they are:

A. dependent.

B. exhaustive.

C. mutually exclusive.

Question 5

Over the past four years, a portfolio experienced returns of –8%, 4%, 17%,

and –12%. The geometric mean return of the portfolio over the four-year

period is closest to:

A. 0.99%.

B. –0.37%.

86 C. 0.25%.

91.

Practice examQuestion 6

The following ten observations are a sample drawn from an approximately

normal population:

The sample standard deviation is closest to:

A. 17.56.

B. 18.58.

C. 19.59.

87

Финансы

Финансы