Похожие презентации:

Financial Theory Microstructure of Financial Markets

1. Financial Theory Microstructure of Financial Markets (part 2) Topic: Market Microstructure Models International College for

Economics and Finance (ICEF)Moscow

Seminar Lead: Alexei Boulatov

Fall 2023

2. Introduction

1.Basic facts and terminology on financial marketstructure

2.General models of trading strategies and pricing

3.Dynamic strategies

4. Applied topics:

Liquidity provision

High frequency and Algorithmic trading

3. 1. Basic Facts and Terminology

• Auction, dealers’ and hybrid markets, orderdriven and quote-driven, call and continuousauctions; Types of strategies

• Liquidity; bid-ask spread and its components;

price impact and its components; cost of

trading and transaction cost (t-cost). Notion of

informational efficiency

• High-frequency trading (HFT) and

collocation; typical frequencies of trading in

question; algorithmic trading

4. Types of Markets

• Auction markets– Buyers and sellers submit bids and offers at the same time. The price is

determined by the highest bid (buyers) and the lowest offer (sellers)

– Example: NYSE

• Dealers markets

– Dealers are assigned for specific securities. The dealers trade into their

own accounts – improve liquidity

– Example: NASDAQ

• Hybrid Markets

– Choice between a fully automated electronic exchange, or the auction

(specialist)

– Example: NYSE (since 2007)

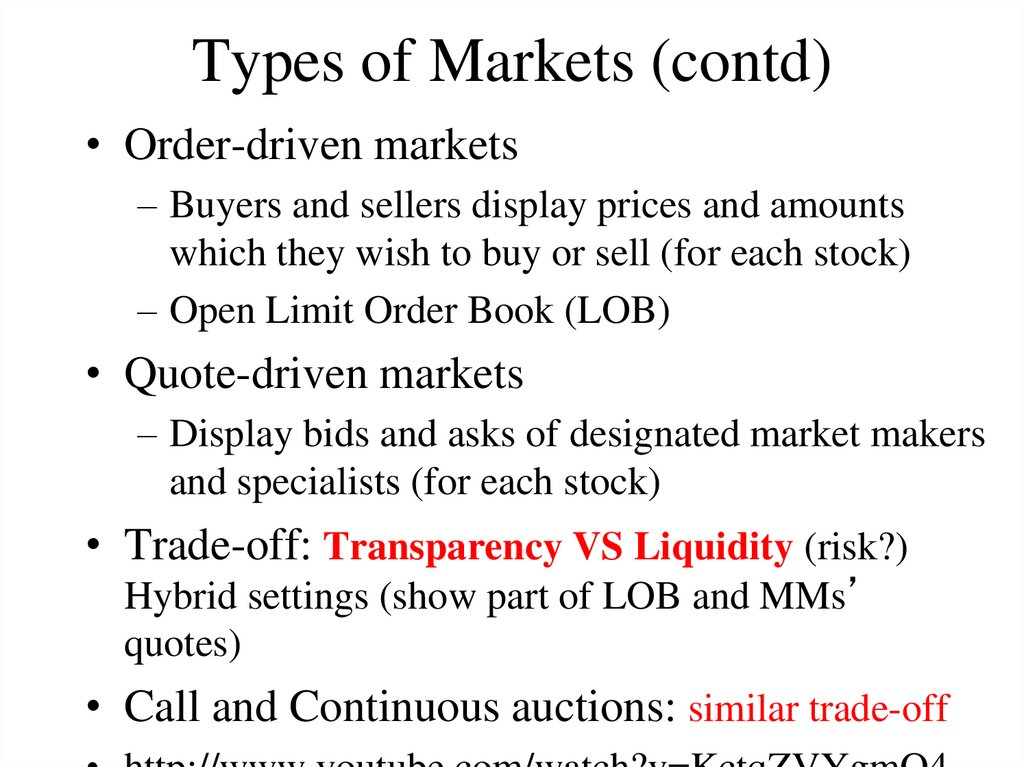

5. Types of Markets (contd)

• Order-driven markets– Buyers and sellers display prices and amounts

which they wish to buy or sell (for each stock)

– Open Limit Order Book (LOB)

• Quote-driven markets

– Display bids and asks of designated market makers

and specialists (for each stock)

• Trade-off: Transparency VS Liquidity (risk?)

Hybrid settings (show part of LOB and MMs’

quotes)

• Call and Continuous auctions: similar trade-off

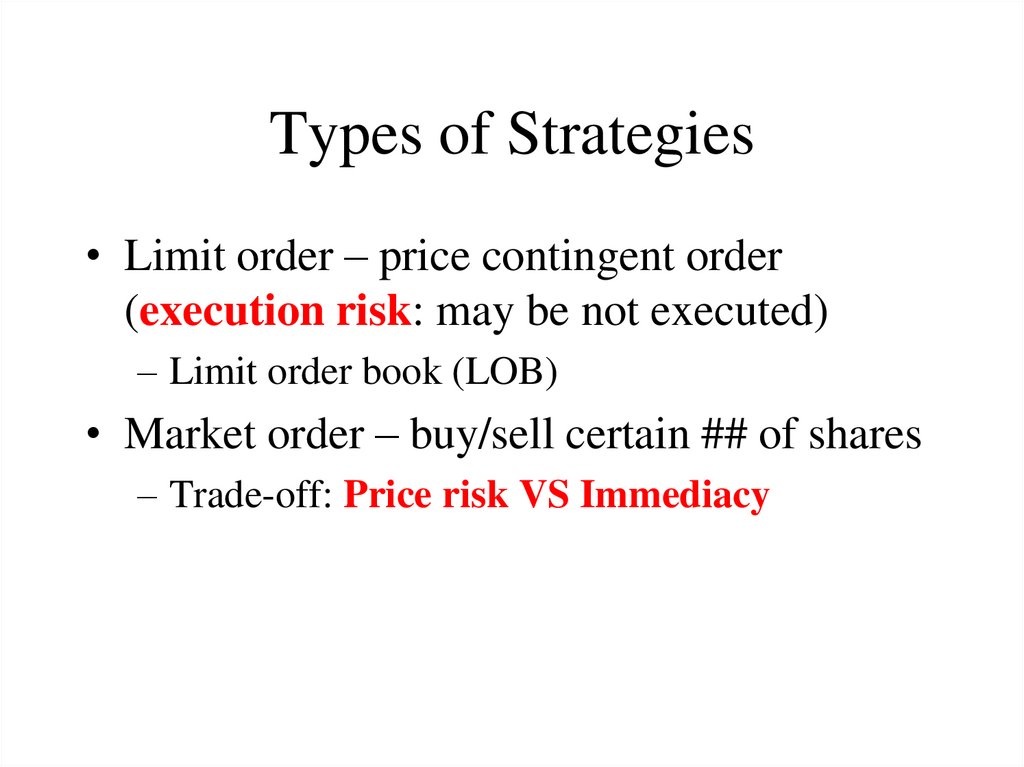

6. Types of Strategies

• Limit order – price contingent order(execution risk: may be not executed)

– Limit order book (LOB)

• Market order – buy/sell certain ## of shares

– Trade-off: Price risk VS Immediacy

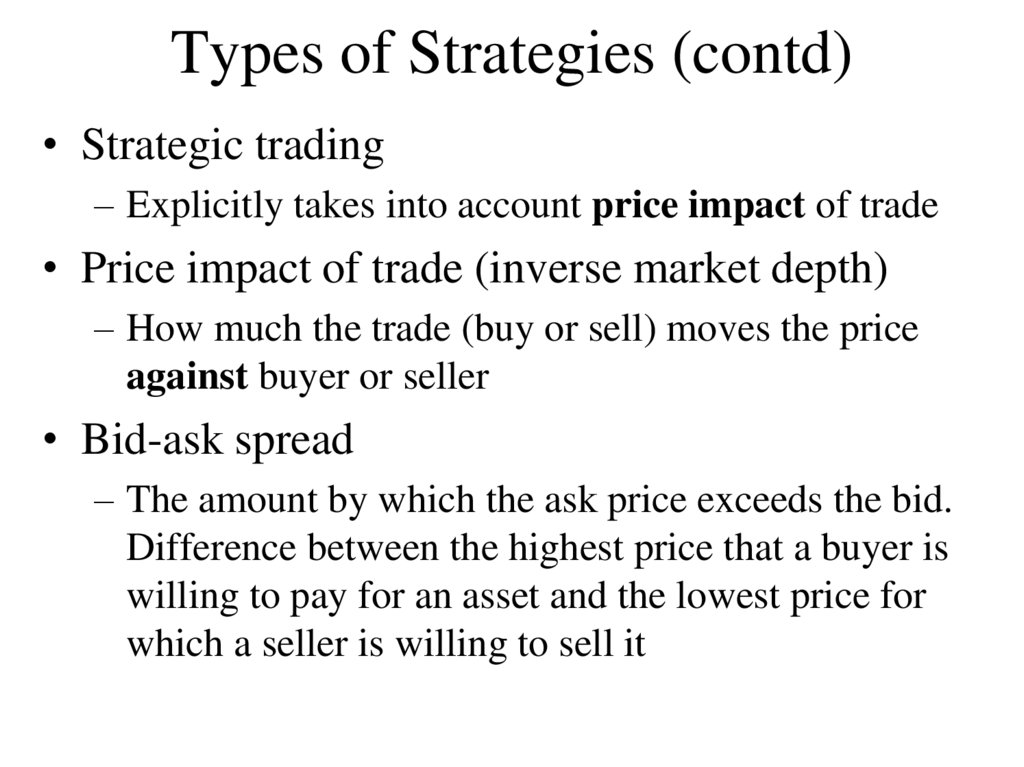

7. Types of Strategies (contd)

• Strategic trading– Explicitly takes into account price impact of trade

• Price impact of trade (inverse market depth)

– How much the trade (buy or sell) moves the price

against buyer or seller

• Bid-ask spread

– The amount by which the ask price exceeds the bid.

Difference between the highest price that a buyer is

willing to pay for an asset and the lowest price for

which a seller is willing to sell it

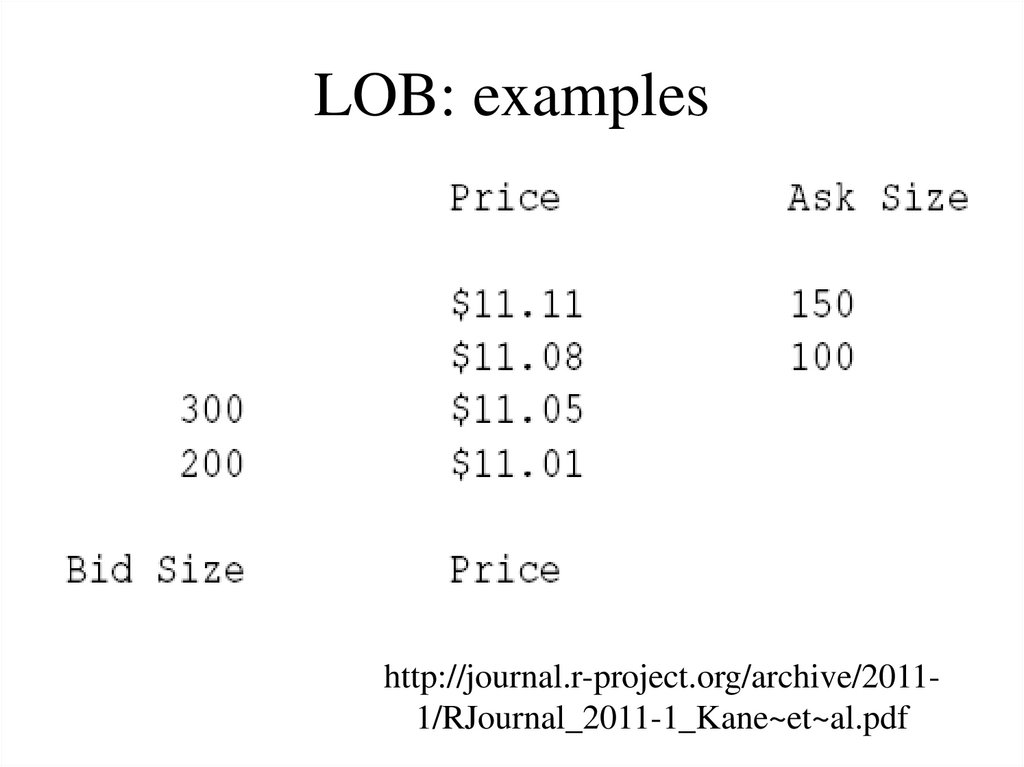

8. LOB: examples

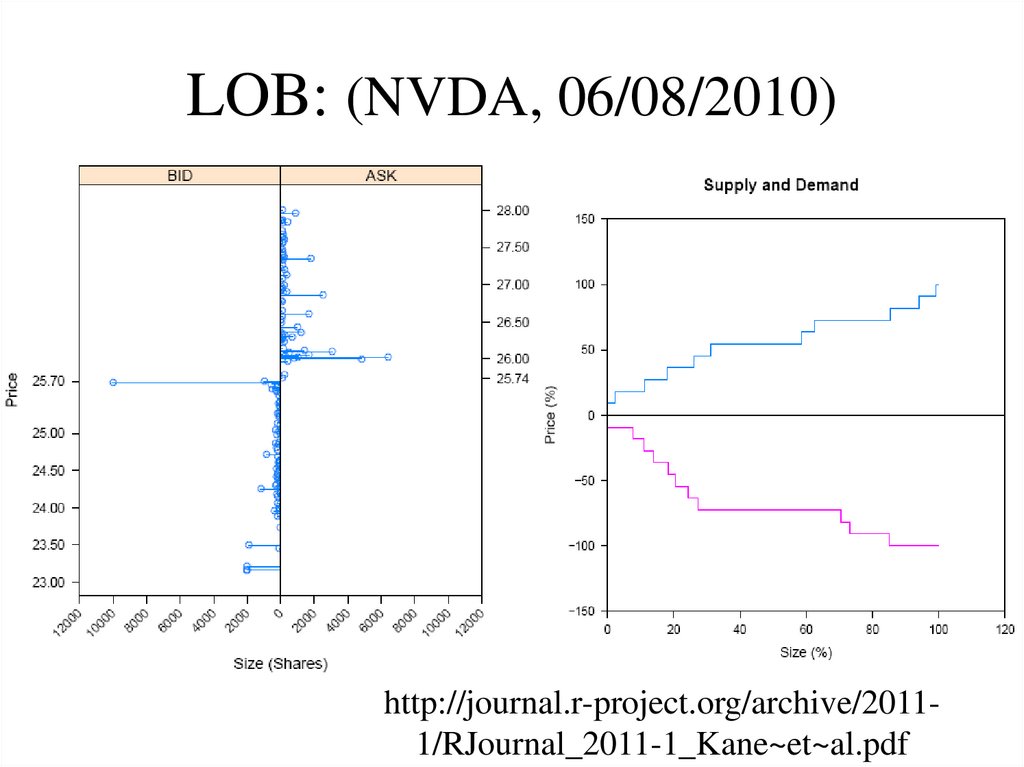

http://journal.r-project.org/archive/20111/RJournal_2011-1_Kane~et~al.pdf9. LOB: (NVDA, 06/08/2010)

http://journal.r-project.org/archive/20111/RJournal_2011-1_Kane~et~al.pdf10. Market Liquidity and Efficiency: Multiple Dimension

• Bid-ask spread– Permanent (information-related) and temporary

(inventory) components

• Price impact

– Static and temporary components

• Cost of trading and transaction cost (t-cost)

– Price impact and fixed cost

• Informational efficiency

– Information content of price

11. Algorithmic and High Frequency Trading

• Algorithmic Trading and Optimal Execution– Does not imply HF

– Objective: trade certain amount, minimize t-cost, risk

– Mean-variance approach (Almgren, Chriss)

– VWAP strategies (Volume Weighted Average Price)

Brokers try to buy below and then track VWAP

• High-frequency trading (HFT) and collocation

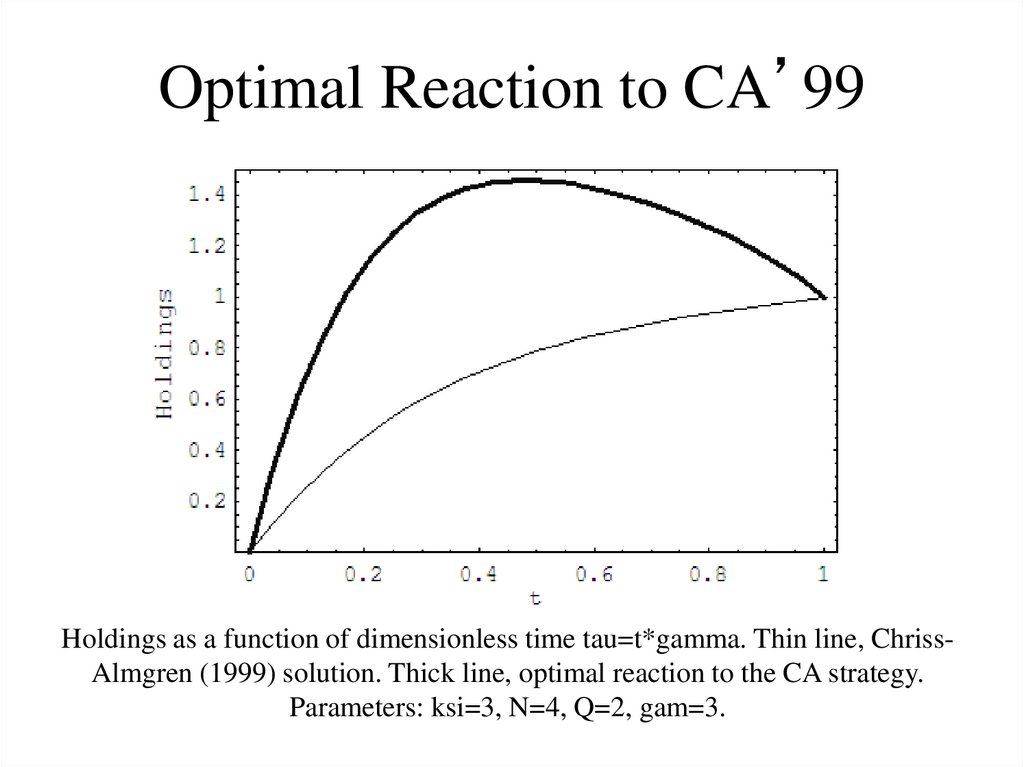

• Typical frequencies of trading in question

– Milliseconds (10^-3 s) (routing); microseconds (10^-6)

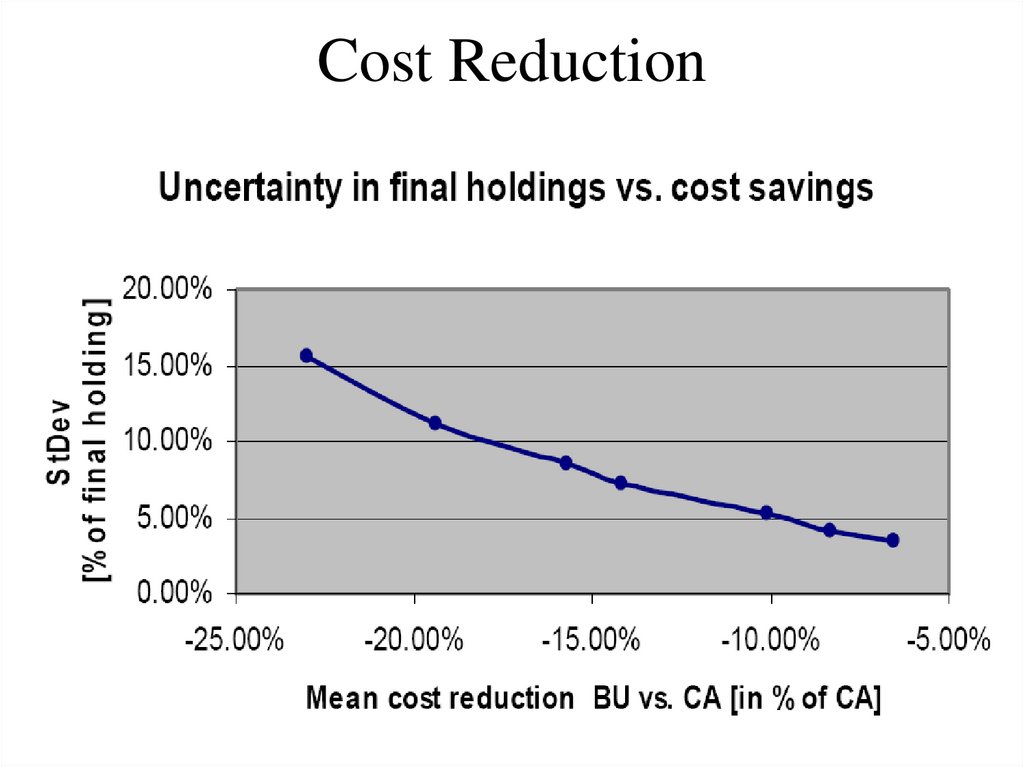

(waveguides, essentially compete with light speed)

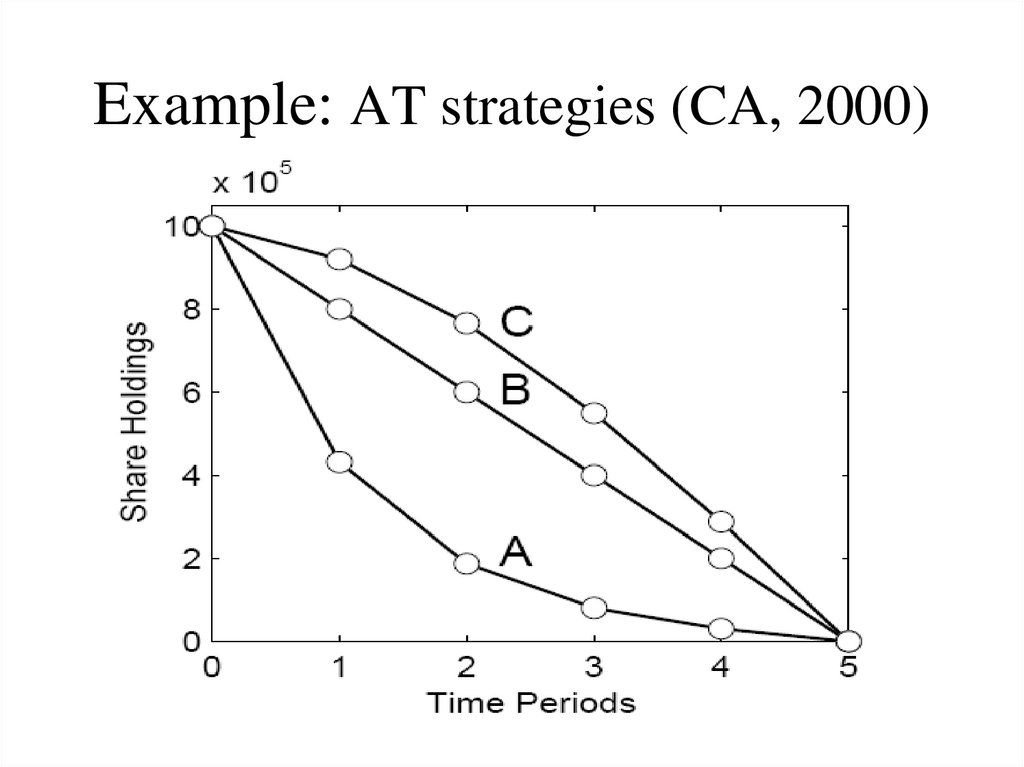

12. Example: AT strategies (CA, 2000)

13. 2. General models of trading strategies and pricing

• Price taking and Rational Expectations• Information and pricing; Rational

Expectations Equilibrium (REE)

• Models of strategic trading

14. Walrasian Equilibrium

• Agents are price takers• Agents do not take into account info content of

prices

• Price plays the role of “constraint” (through the

budget constraint)

• Problem: The price does reflect info in

equilibrium

• Rational agents should take this into account

15. Rational Expectations Equilibrium Grossman and Stieglitz, 1980

• Agents are price takers• But: they do take into account info content of

equilibrium prices

• How do they know the equilibrium price?

• Price contingent claims “limit orders”

• Problem: The price does reflect all private info

in equilibrium (too much info!!)

– Rational agents disregard private info!!-problem!

• Solution: Noisy REE (price is not fully revealing)

16. Strategic trading models

• Strategic liquidity demanders (Kyle’85)– Standard Kyle’85 model

– Kyle’83 model (imperfect competition of liquidity

providers)

• Strategic liquidity suppliers (Kyle’89)

– Kyle’89 model

• Both liquidity suppliers and demanders are

informed and strategic

– George-Boulatov’2012

• Limiting cases

17. Kyle’85 type models

• Models of Insider Trading (info-based)– Review: Kyle’85, Kyle’83

• Formulation of the problem

– Oligopolistic MMs and competitive limit

– Game-theoretic settings: Nash and Stackelberg

18. References

• Albert S. Kyle, 1985, “Continuous Auctions and Informed TraderTrading”, Econometrica 53, 1315-1335.

• Jean-Charles Rochet, and Jean-Luc Vila, 1994, “Insider Trading

without Normality”, Review of Economic Studies 61, 131-152.

• Alex Boulatov and Thomas J. George, 2012, “Hidden and

Displayed Liquidity in Securities Markets with Informed Liquidity

Providers”, Review of Financial Studies, forthcoming.

Continuous time models:

• Kerry Back, 1992, “Insider Trading in Continuous Time”, The

Review of Financial Studies 5, 387-409.

Other related papers:

• Kyung-Ha Cho, and Nicole Karoui, 2000, “Insider Trading and

Nonlinear Equilibria: Single Auction Case”, Annales D’Economie

et de Statistique 60, 21-41.

19. Info-based models of insider trading

• Strategic nature of trading• Motivation:

– Asset pricing models, (Back’92)

20. Kyle’85 model (2-period case)

• Single Strategic insider:– Selects the linear trading strategy X(v) = βv

– Observes fundamental v; then submits market order

• Noise traders (trades are not info-motivated)

– Demand = u;

• Market makers (risk-neutral = competitive)

– Observe aggregate demand y = X(v) + u

– Regret-free pricing: P(y) = E[ v | X(v)+u = y]

• Result: linear equilibrium (Q: any stories?)

P(y) = λy

X(v) = βv

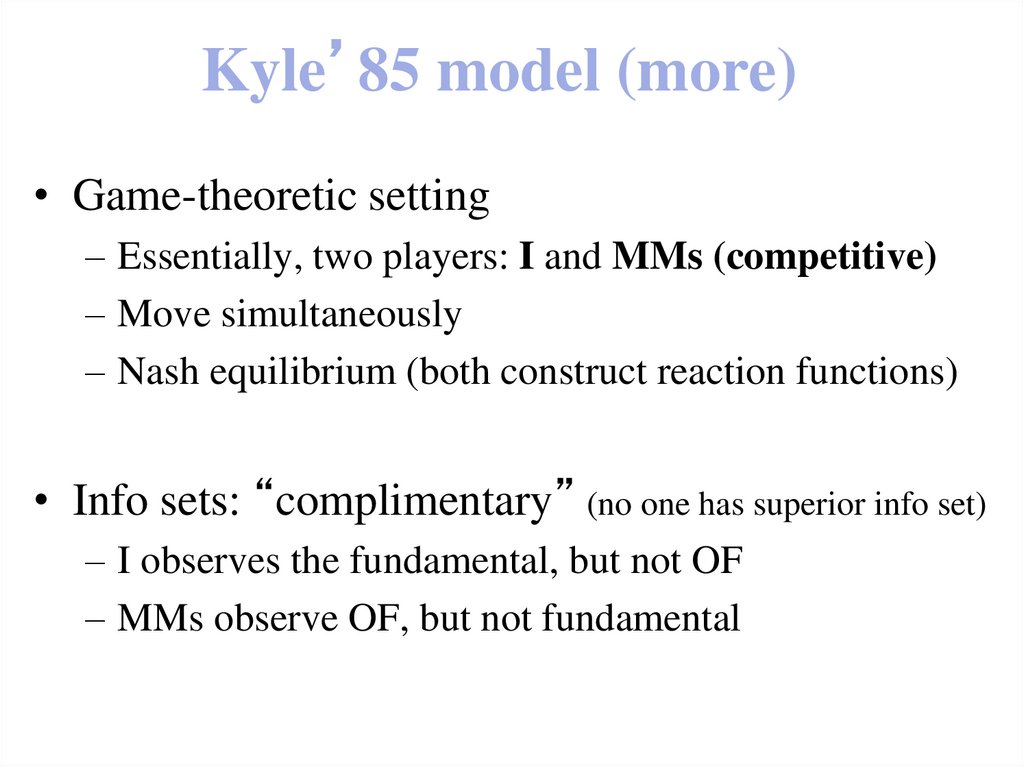

21. Kyle’85 model (more)

• Game-theoretic setting– Essentially, two players: I and MMs (competitive)

– Move simultaneously

– Nash equilibrium (both construct reaction functions)

• Info sets: “complimentary” (no one has superior info set)

– I observes the fundamental, but not OF

– MMs observe OF, but not fundamental

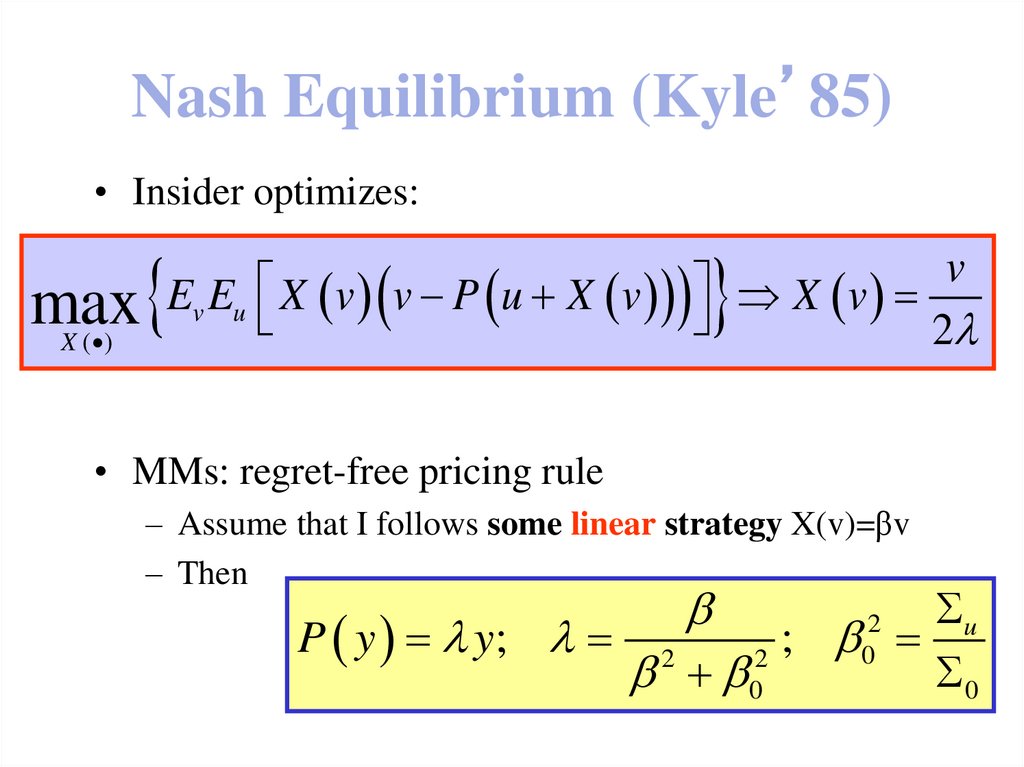

22. Nash Equilibrium (Kyle’85)

• Insider optimizes:v

Ev Eu X v v P u X v X v

max

2

X ( )

• MMs: regret-free pricing rule

– Assume that I follows some linear strategy X(v)=βv

– Then

u

P y y; 2

;

2

0

0

2

0

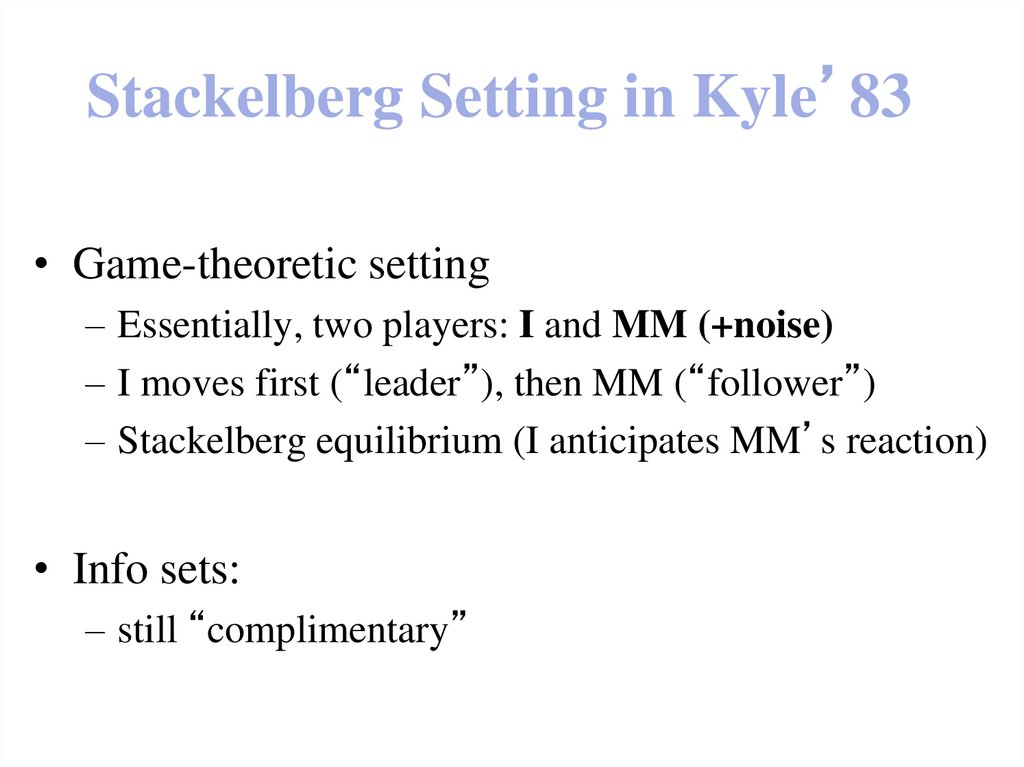

23. Stackelberg Setting in Kyle’83

• Game-theoretic setting– Essentially, two players: I and MM (+noise)

– I moves first (“leader”), then MM (“follower”)

– Stackelberg equilibrium (I anticipates MM’s reaction)

• Info sets:

– still “complimentary”

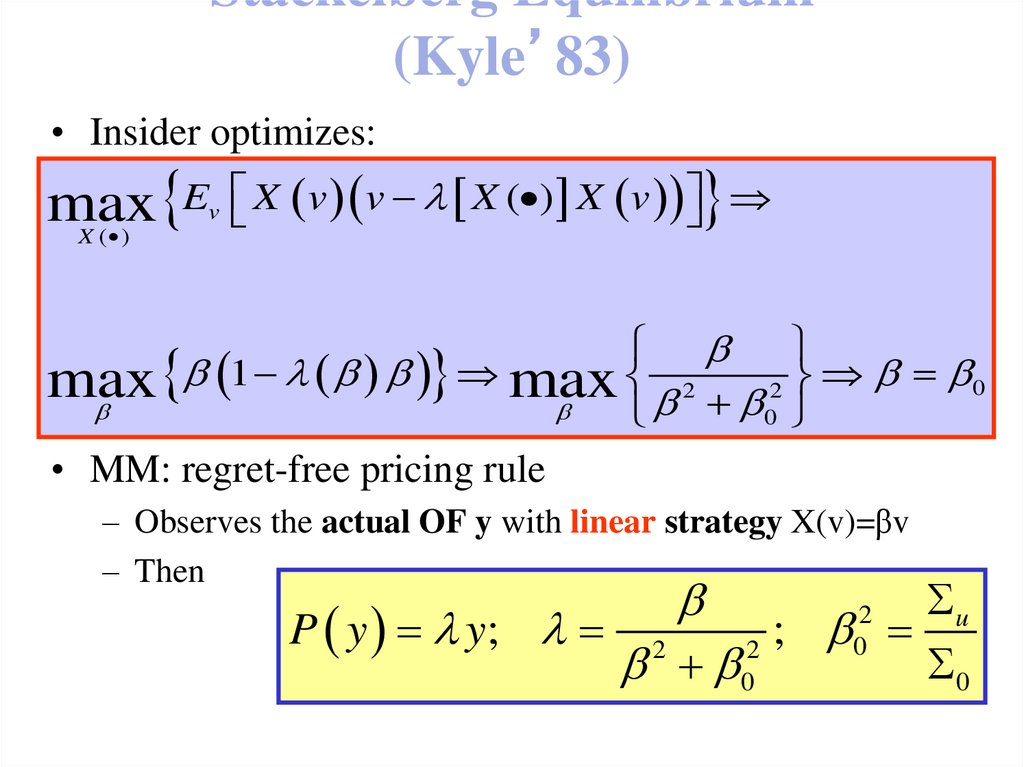

24. Stackelberg Equilibrium (Kyle’83)

• Insider optimizes:max E X v v X ( ) X v

v

X ( )

1 max 2

0

max

2

0

• MM: regret-free pricing rule

– Observes the actual OF y with linear strategy X(v)=βv

– Then

u

P y y; 2

;

2

0

0

2

0

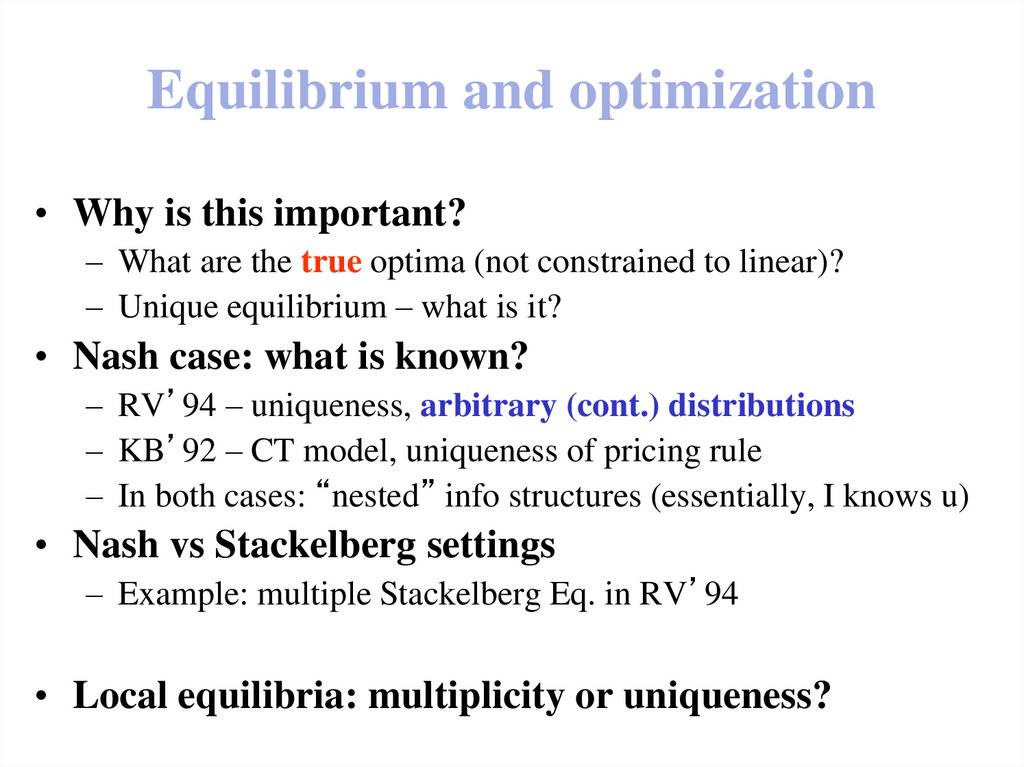

25. Equilibrium and optimization

• Why is this important?– What are the true optima (not constrained to linear)?

– Unique equilibrium – what is it?

• Nash case: what is known?

– RV’94 – uniqueness, arbitrary (cont.) distributions

– KB’92 – CT model, uniqueness of pricing rule

– In both cases: “nested” info structures (essentially, I knows u)

• Nash vs Stackelberg settings

– Example: multiple Stackelberg Eq. in RV’94

• Local equilibria: multiplicity or uniqueness?

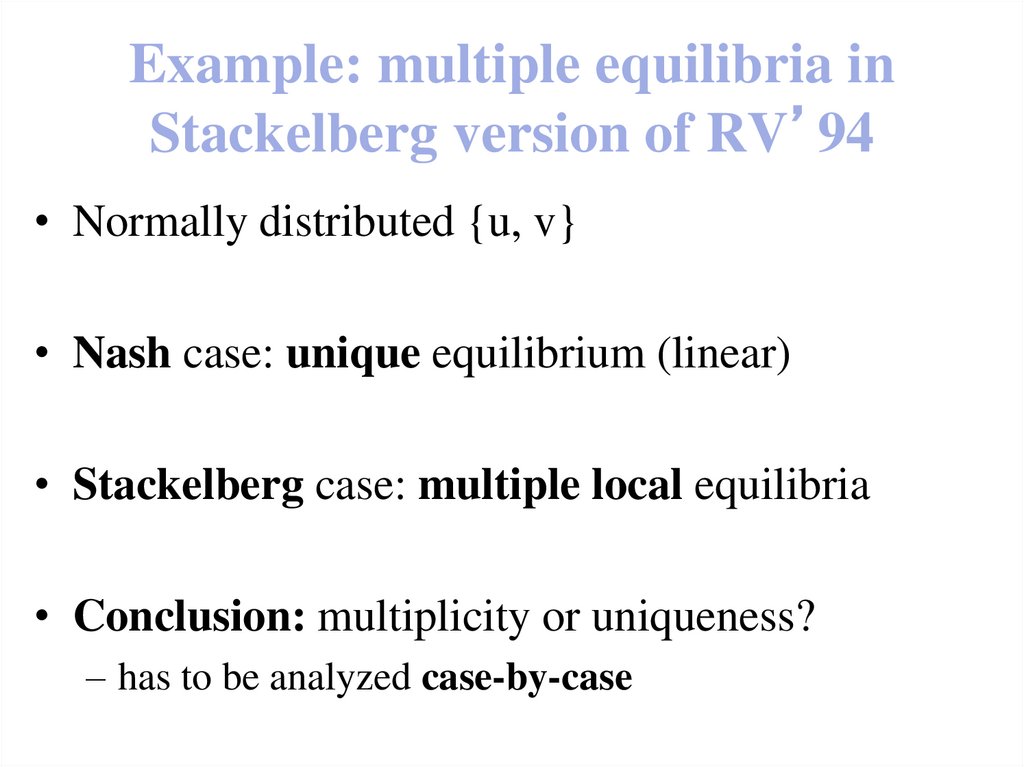

26. Example: multiple equilibria in Stackelberg version of RV’94

• Normally distributed {u, v}• Nash case: unique equilibrium (linear)

• Stackelberg case: multiple local equilibria

• Conclusion: multiplicity or uniqueness?

– has to be analyzed case-by-case

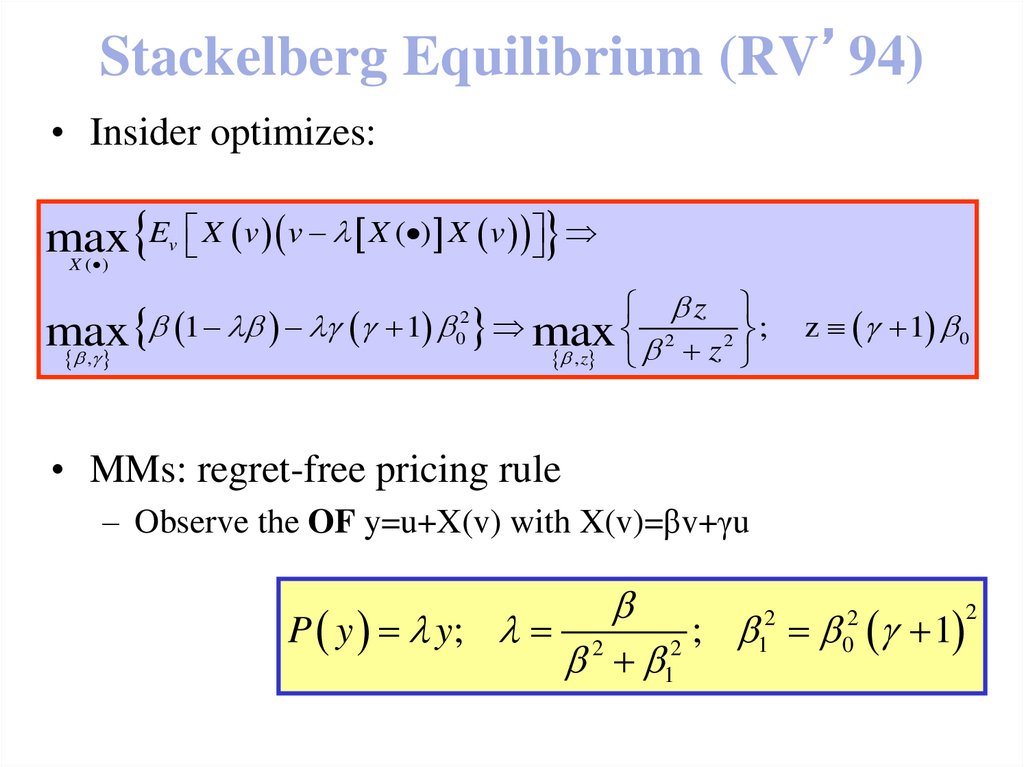

27. Stackelberg Equilibrium (RV’94)

• Insider optimizes:max E X v v X ( ) X v

X ( )

v

z

1 1 max 2

;

max

2

,

, z z

2

0

z 1 0

• MMs: regret-free pricing rule

– Observe the OF y=u+X(v) with X(v)=βv+γu

P y y;

2

2

1

; 1

2

1

2

0

2

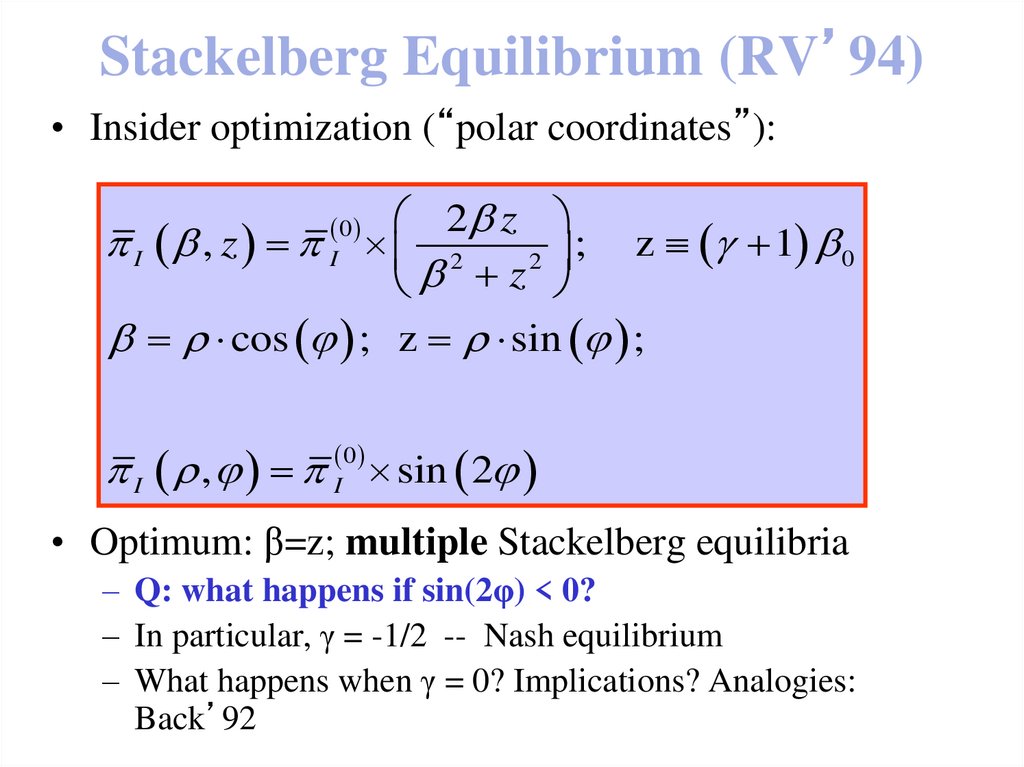

28. Stackelberg Equilibrium (RV’94)

• Insider optimization (“polar coordinates”):2 z

I , z I 2

; z 1 0

2

z

cos ; z sin ;

0

I , I 0 sin 2

• Optimum: β=z; multiple Stackelberg equilibria

– Q: what happens if sin(2φ) < 0?

– In particular, γ = -1/2 -- Nash equilibrium

– What happens when γ = 0? Implications? Analogies:

Back’92

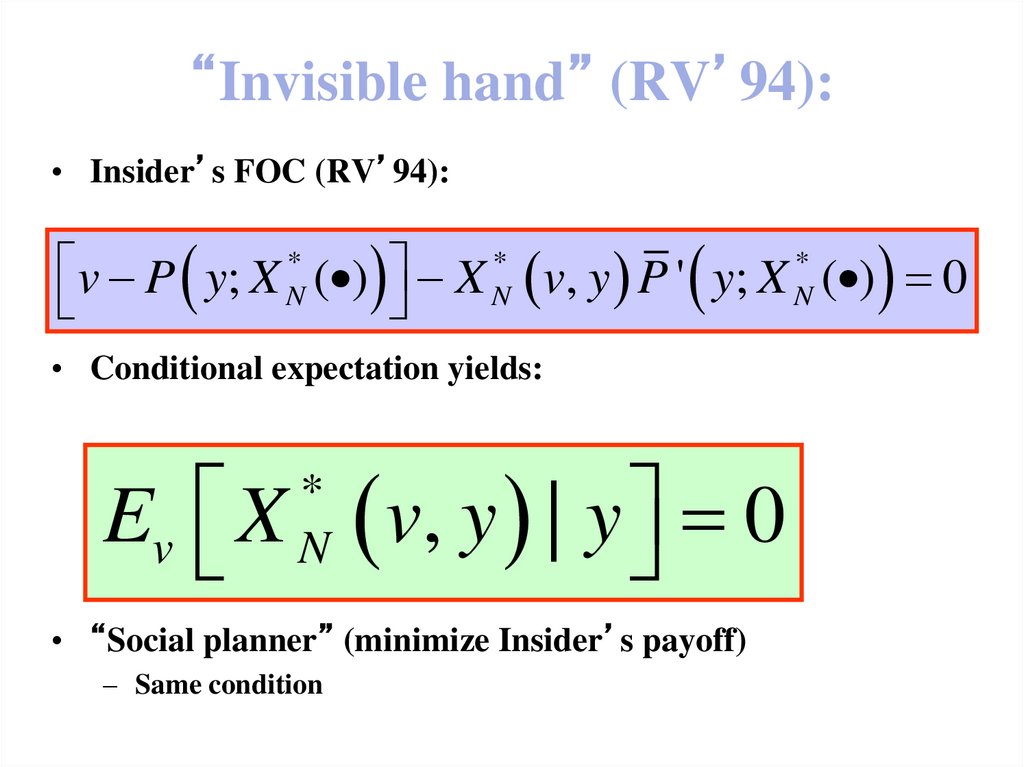

29. “Invisible hand” (RV’94):

• Insider’s FOC (RV’94):v P y; X N* ( ) X N* v, y P ' y; X N* ( ) 0

• Conditional expectation yields:

Ev X

*

N

v, y | y 0

• “Social planner” (minimize Insider’s payoff)

– Same condition

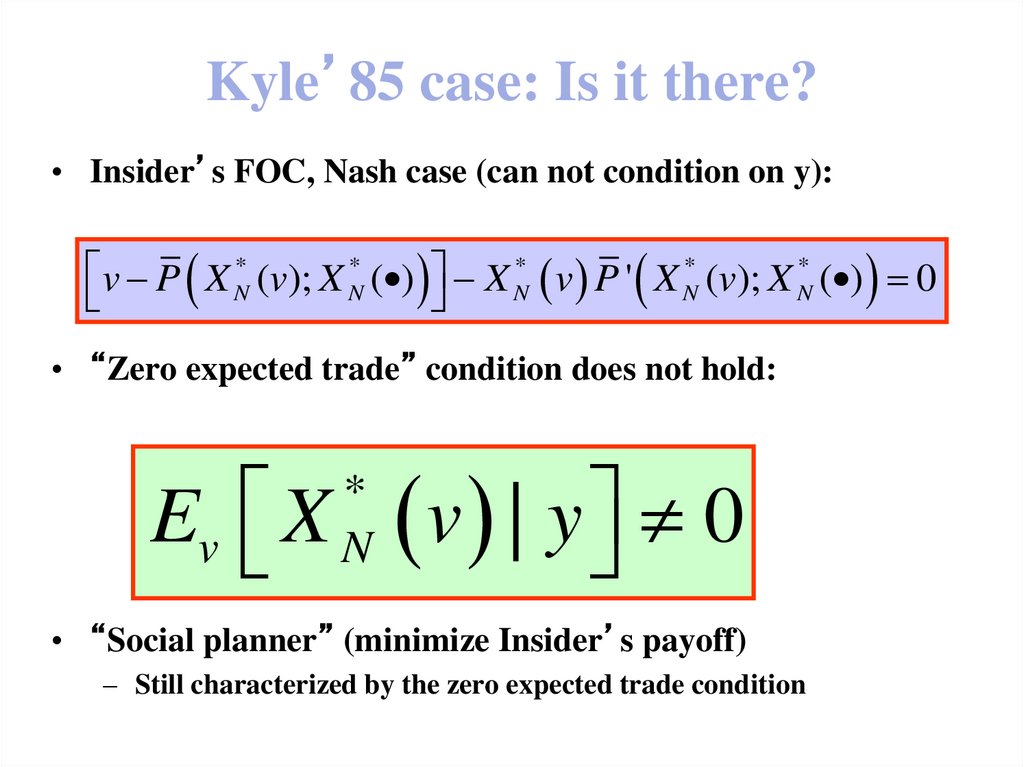

30. Kyle’85 case: Is it there?

• Insider’s FOC, Nash case (can not condition on y):v P X N* (v); X N* ( ) X N* v P ' X N* (v); X N* ( ) 0

• “Zero expected trade” condition does not hold:

Ev X

*

N

v | y 0

• “Social planner” (minimize Insider’s payoff)

– Still characterized by the zero expected trade condition

31. Why Is it not there?

• Info sets of the insider and market maker:– Are not nested

32. Can we solve the RV’94 model?

• Point:– The info sets are nested; apply the zero

expected trade condition explicitly

– Obtain: characterization (ODE) for the

optimal pricing rule P(y)

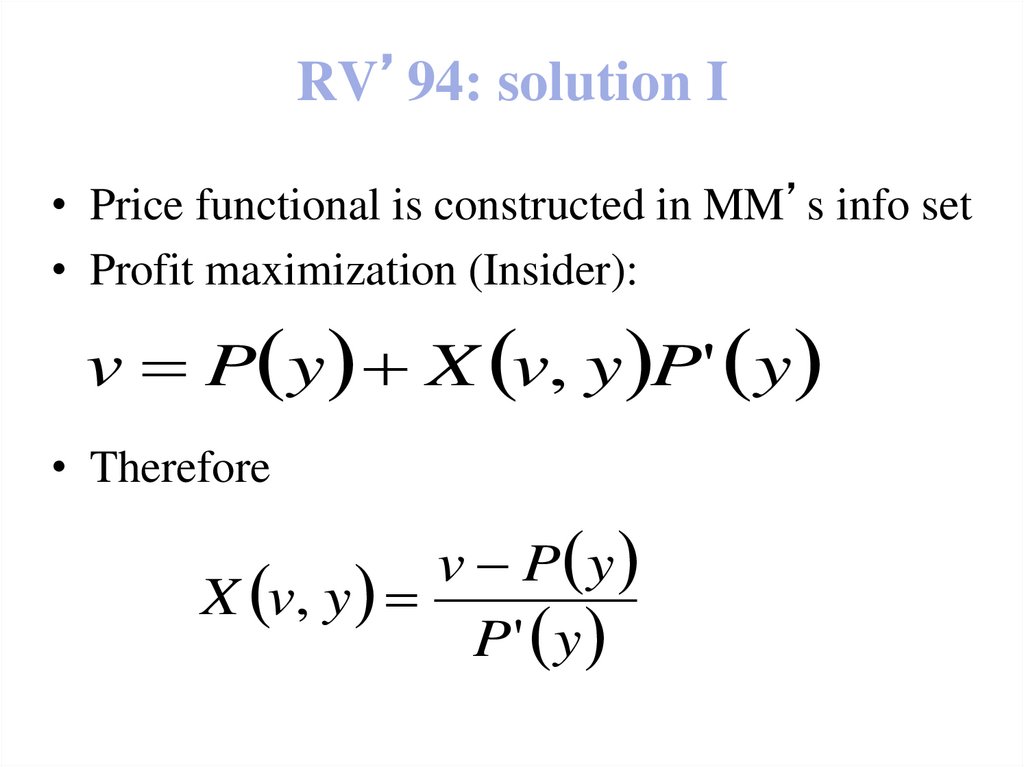

33. RV’94: solution I

• Price functional is constructed in MM’s info set• Profit maximization (Insider):

v P y X v, y P' y

• Therefore

v P y

X v, y

P' y

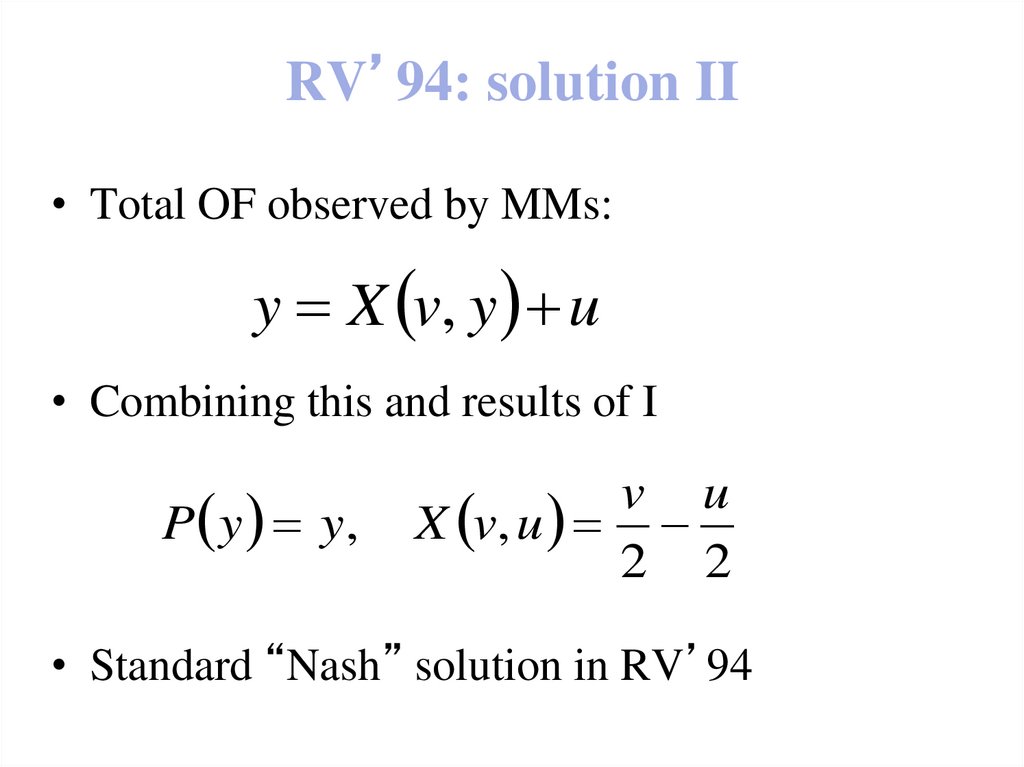

34. RV’94: solution II

• Total OF observed by MMs:y X v, y u

• Combining this and results of I

P y y,

v u

X v, u

2 2

• Standard “Nash” solution in RV’94

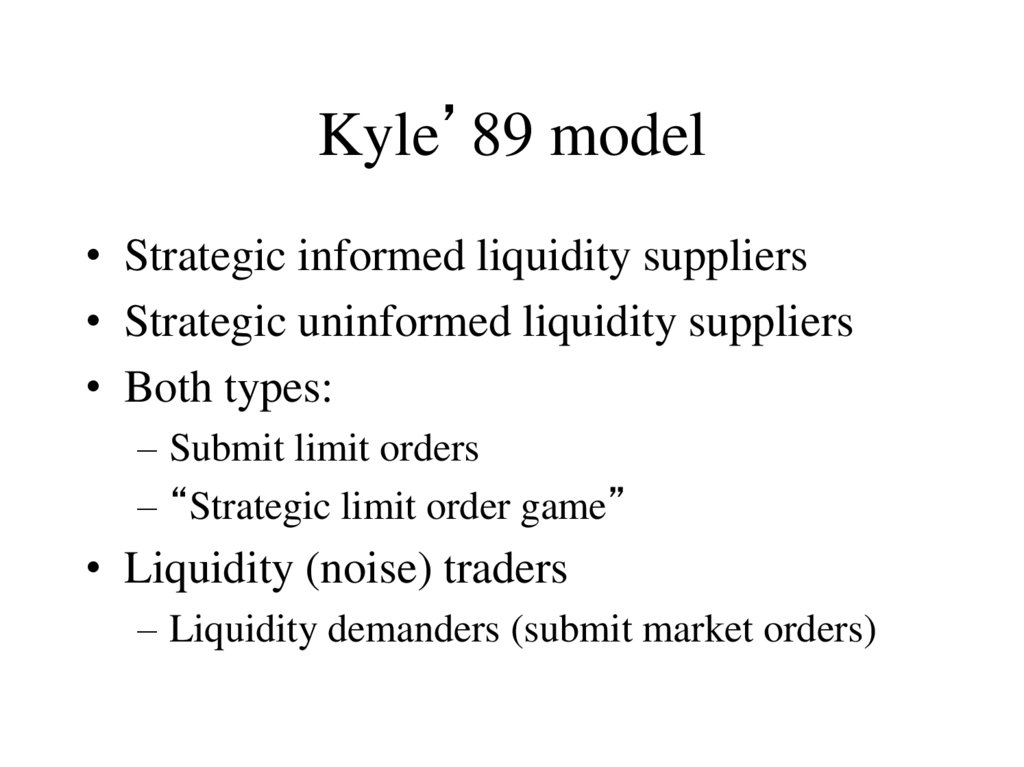

35. Kyle’89 model

• Strategic informed liquidity suppliers• Strategic uninformed liquidity suppliers

• Both types:

– Submit limit orders

– “Strategic limit order game”

• Liquidity (noise) traders

– Liquidity demanders (submit market orders)

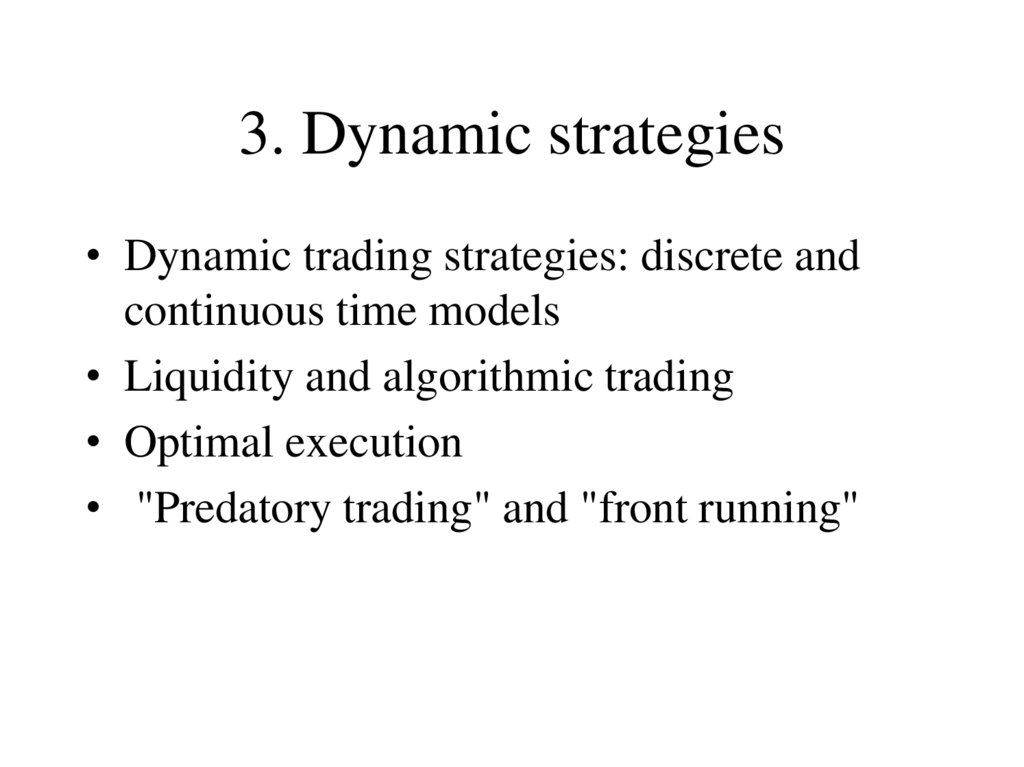

36. 3. Dynamic strategies

• Dynamic trading strategies: discrete andcontinuous time models

• Liquidity and algorithmic trading

• Optimal execution

• "Predatory trading" and "front running"

37. References

• Albert S. Kyle, 1985, “Continuous Auctions and InformedTrader Trading”, Econometrica 53, 1315-1335.

• Kerry Back, 1992, “Insider Trading in Continuous Time”, The

Review of Financial Studies 5, 387-409.

Other related papers:

• Oleg Bondarenko, 2001, “Competing market makers, liquidity

provisions, and bid-ask spreads”, Journal of Financial Markets

4, 269-308.

• Jürgen Dennert, 1993, “Price Competition between Market

Makers”, Review of Economic Studies 60, 735-751.

• Dan Bernhardt and Eric Hughson, 1997, “Splitting Orders”,

The Review of Financial Studies, 10, 69-101.

38. Outline

• Dynamic Models of Informed Trading– Review: Kyle’85

• Dynamic Bayesian Equilibria: typical features

– Review: Kyle’85, Back’92, Bondarenko’ 2001

• Formulation of the problem

– Game-theoretic settings: Dynamic Bayesian Nash

– Reduction to one- or two-sided optimization

• Solutions: an overview

39. Dynamic Informed Trading

• Why is this important?– One of the fundamental issues of the MS theory

– Kyle [1985]: an example of CT insider trading

• Features:

– Constant market depth over time

– Private info is totally reflected in price at t = T

• Extensions:

– Relax the ME assumption: Dealers make money

– Inter-dealer competition: Informed dealers

40. Insider trading and liquidity provision

• Strategic nature of insider trading• Lifting the market efficiency condition:

– Dealers are making profits (imperfect

competition)

• two-sided strategic trading (Dennert’93)

41. Kyle’85 model: CT setting

• Game-theoretic setting– Essentially, two types players: I and MMs (+noise)

• Info sets:

– still “complimentary”

• Multiple auctions

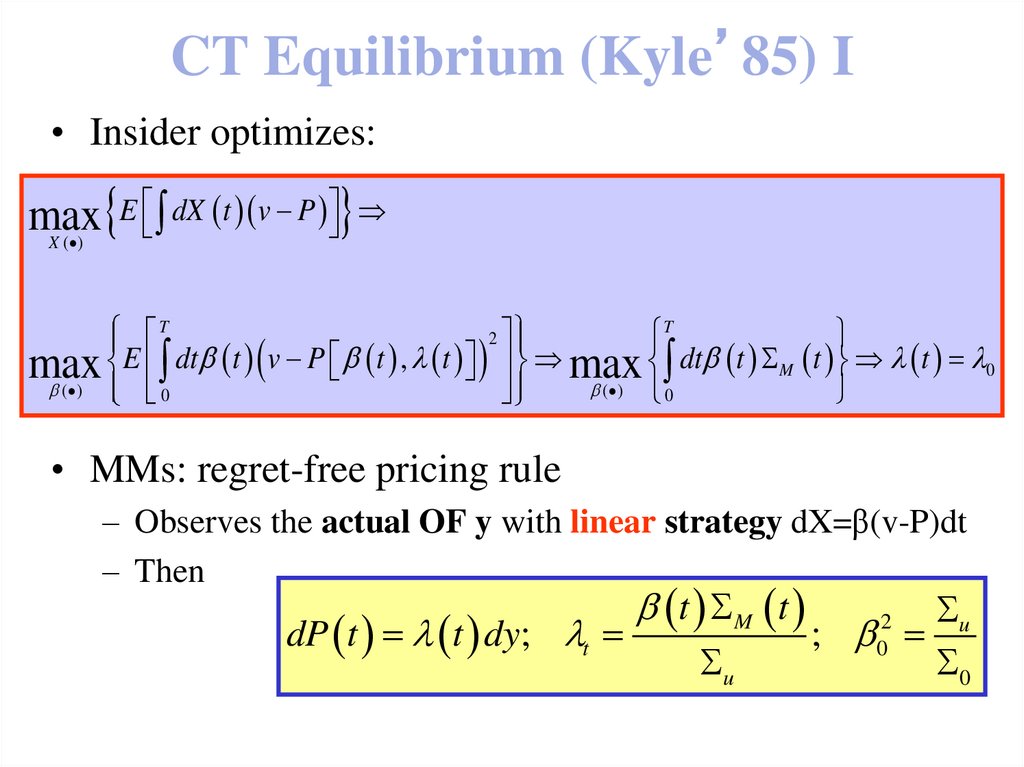

42. CT Equilibrium (Kyle’85) I

• Insider optimizes:max E dX t v P

X ( )

T

2

T

E dt t v P t , t max dt t M t t 0

max

( )

( ) 0

0

• MMs: regret-free pricing rule

– Observes the actual OF y with linear strategy dX=β(v-P)dt

– Then

dP t t dy; t

t M t

u

u

;

0

2

0

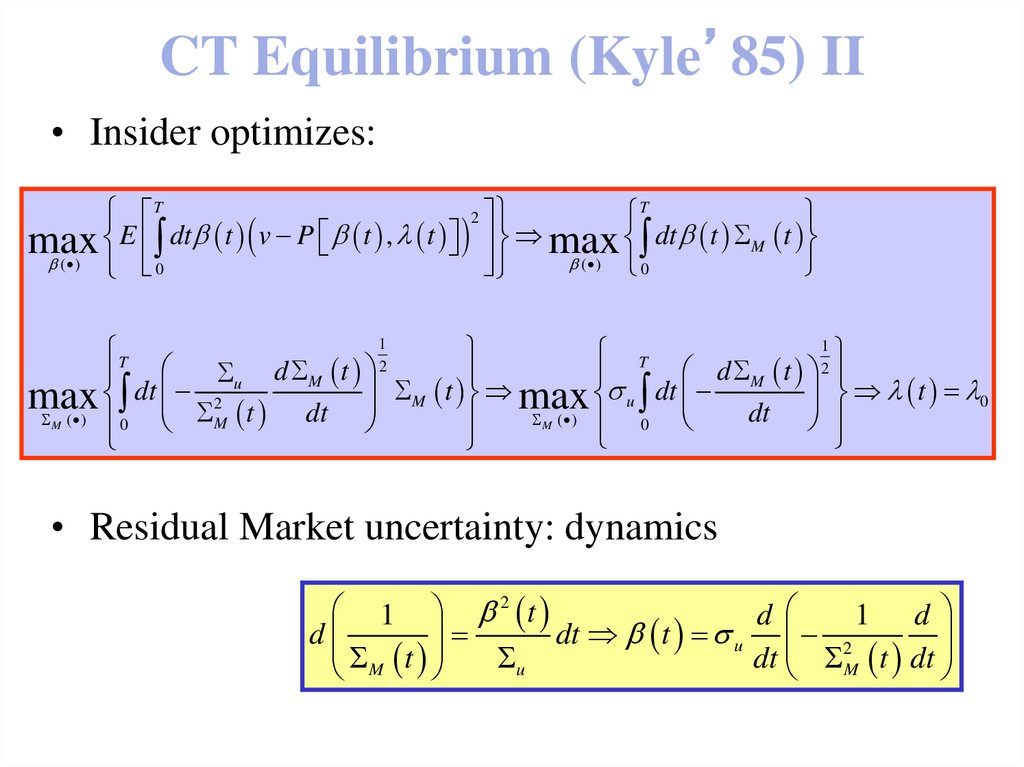

43. CT Equilibrium (Kyle’85) II

• Insider optimizes:T

2

T

E dt t v P t , t max dt t M t

max

( )

( ) 0

0

1

1

T

T

2

2

d

t

d

t

u

M

M

dt

t

dt

max u

t 0

M

max

2

dt

M ( ) 0

M ( )

0

M t dt

• Residual Market uncertainty: dynamics

1 2 t

d

1 d

d

dt t u 2

u

dt M t dt

M t

44. Resulting equilibrium

• Why is this important?– Dynamic trading strategies – more realistic

– Global optimization (insider’s problem)

• Stackelberg case: is it different?

– In both cases: same answer (different methodology)

• Other equilibria: Nash vs Stackelberg cases

– Example: multiple static Stackelberg Eq. in RV’94

• Dynamic equilibria: multiplicity or uniqueness?

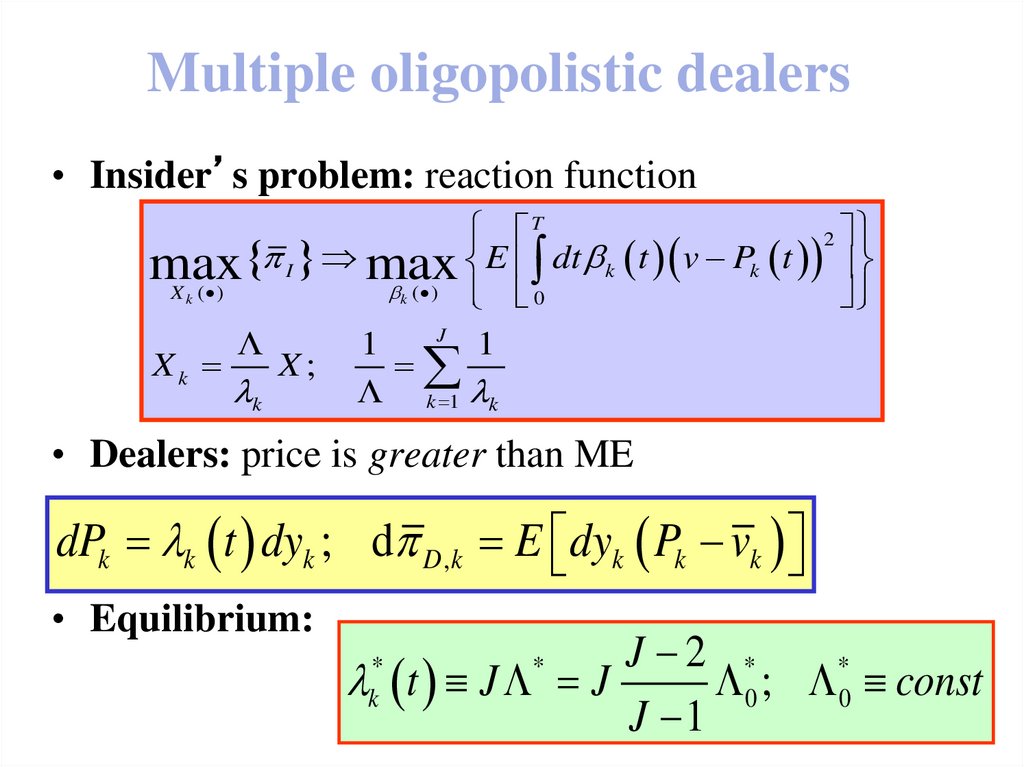

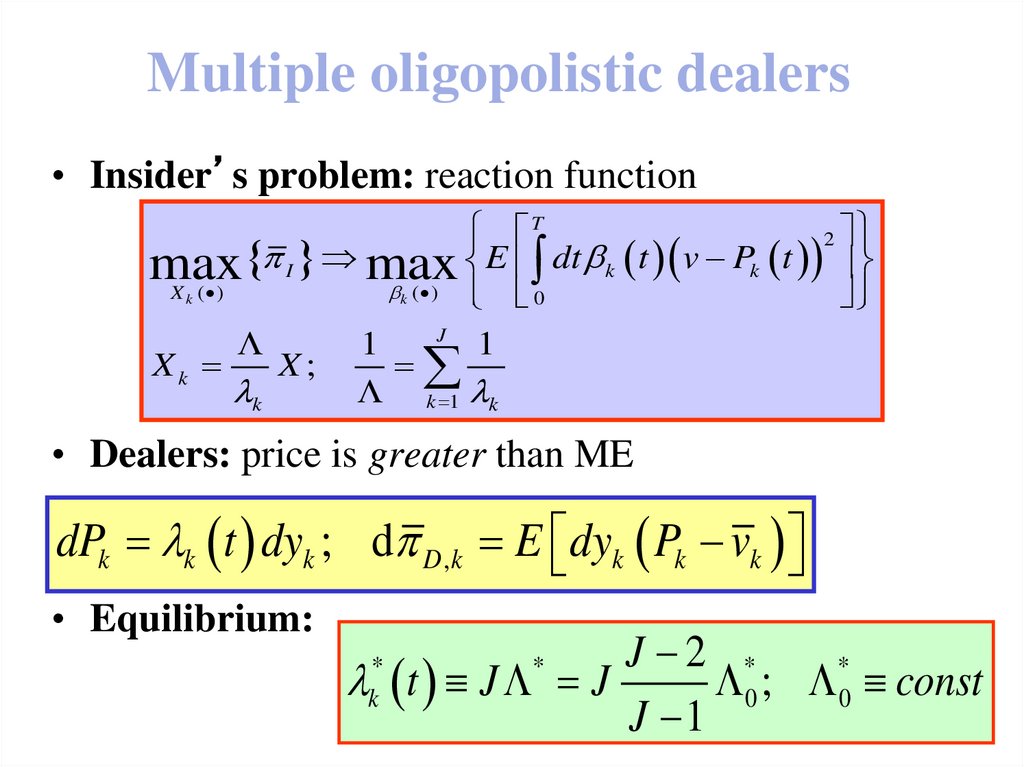

45. Multiple oligopolistic dealers

• Insider’s problem: reaction functionT

2

I max E dt k t v Pk t

max

X k ( )

k ( )

0

J

1

1

Xk

X;

k

k 1 k

• Dealers: price is greater than ME

dPk k t dyk ; d D ,k E dyk Pk vk

• Equilibrium:

J 2 *

*

t J J

0 ; 0 const

J 1

*

k

*

46. Conclusions

• Dynamic CT linear equilibrium from Kyle’85– Same in Nash and Stackelberg cases

• The CT version of Bondarenko’01

47. Dynamic Private Information: Multiple Signals

Boulatov and Livdan, 201148. Strategic trading: long VS short-lived private info

• Monopolist insider– “One-shot” info inflow; long-lived private info (screening

effects) – Kyle (1985)

– Continuous info inflow – Foster and Wiswanathan (1990),

Back & Pedersen (1998)

• Multiple insiders – competition effects

– Homogeneous signals; “one-shot” inflow -- short-lived

private info (“rat race”) – Holden and Subrahmanyam (1992)

– Heterogeneous signals, one-shot inflow – long-lived private

info – Foster and Wiswanathan (1996), BCW (2000)

49. This case

• Dynamic info inflow (multiple signals, prespecified time moments)• Multiple agents (competition effects)

• The problem is difficult:

– How do the agents update their info sets in case

of multiple private signals (dynamic info

acquisition)?

50. Our approach

• Focus on the dynamic info acquisition problem• Use the existing dynamic “one-shot info” model

(BCW, 2000) as a “benchmark” -- analyze the

specific effect of dynamic info acquisition

• Discrete (private) info inflow

• Timing of new info arrival is public knowledge –

traders receive private signals when market is closed

– Motivation: info asymmetry increases when the market is

closed – French and Roll (1986), Ito, Lyons and Melvin

(1998)

– Empirical implications: U-shaped trading volume, nonperiodic structure

51. Long-horizon effects of MM: Info Story

• How is the arriving (dynamic) private infoincorporated in the market?

– multiple agents (Oligopoly)

– asymmetric information (heterogeneous signals)

– Information inflow (periodic)

52. Setting

• Oligopoly:– agents have “complimentary” pieces of info,

i.e. aggregate signal is superior to any

individual one

• Therefore:

– agents learn both from Price (set by the MM

based on aggregate signal), and from private

signals

53. Static VS Dynamic Info

• Static Info– Info distribution across agents:

• Perfectly correlated signals – “rat race”, no long-lived private

info

• Less than perfect correlation – “waiting phase” (screening),

private info is long-lived

• Dynamic Info

– Timing of Info (new “dimension”):

• Generally leads to more trading if the new info arrival is

anticipated (less incentive to screen the “old” info)

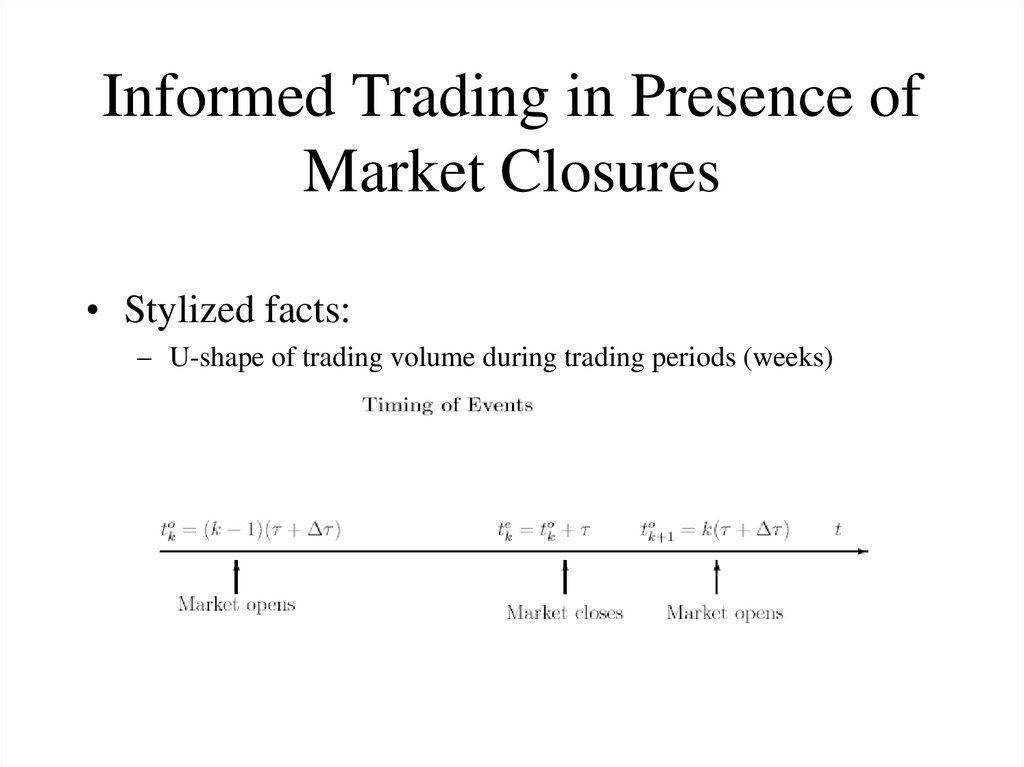

54. Informed Trading in Presence of Market Closures

• Stylized facts:– U-shape of trading volume during trading periods (weeks)

– A-periodic temporal structure on larger time scales (months)

55. Comparison to the Existing Literature

• Holden & Subrahmanyam [1992]– Perfectly correlated signals

– short-lived private info (as opposed to our case)

• Foster & Wishwanathan [1990, 1996]

– monopolist economy - additional assumptions to generate

trading patterns (announcements each period)

– non-strategic between different periods

• Hong & Wang [2000]

– periodic closures - symmetric equilibrium (periodic trading

patterns) - counterfactual

56. The Model I

• Agents:The Model I

– N Insiders (I-informed traders): receive

noisy (heterogeneous) private signals; Learn

(price & signals)

– Market Maker (MM): observes aggregate

demand, sets regret-free price; Learns

(aggregate demand)

– Liquidity (noise) traders: sufficient #

• Market Closure periods: MM does not

learn, I keeps learning

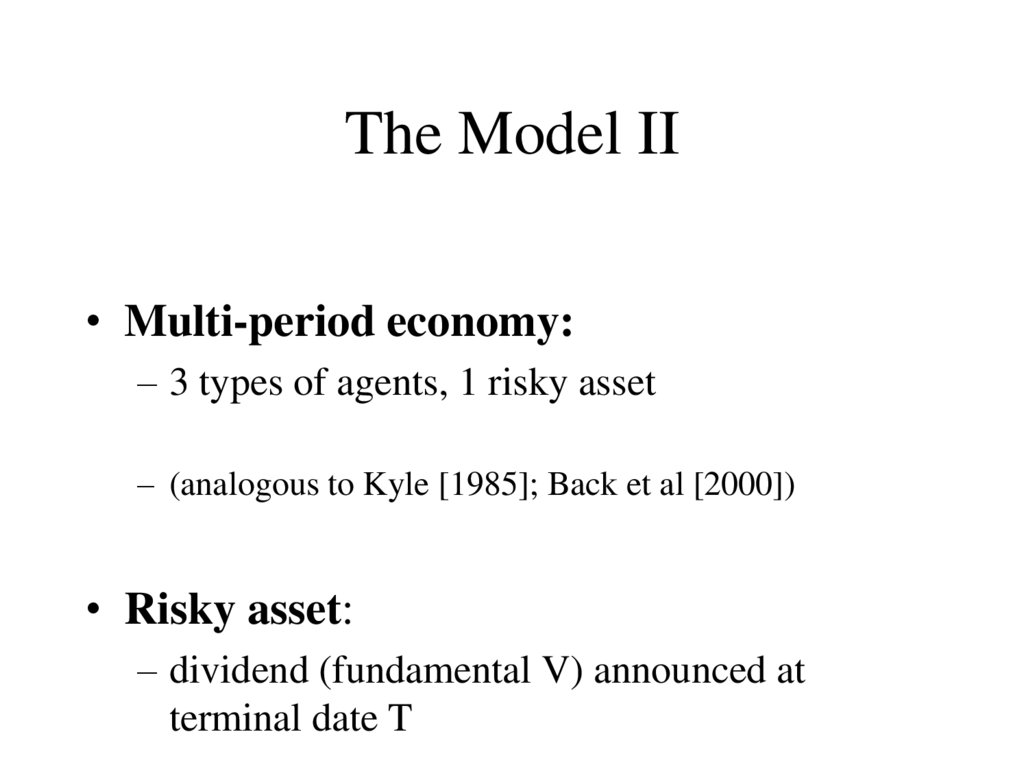

57. The Model II

• Multi-period economy:– 3 types of agents, 1 risky asset

– (analogous to Kyle [1985]; Back et al [2000])

• Risky asset:

– dividend (fundamental V) announced at

terminal date T

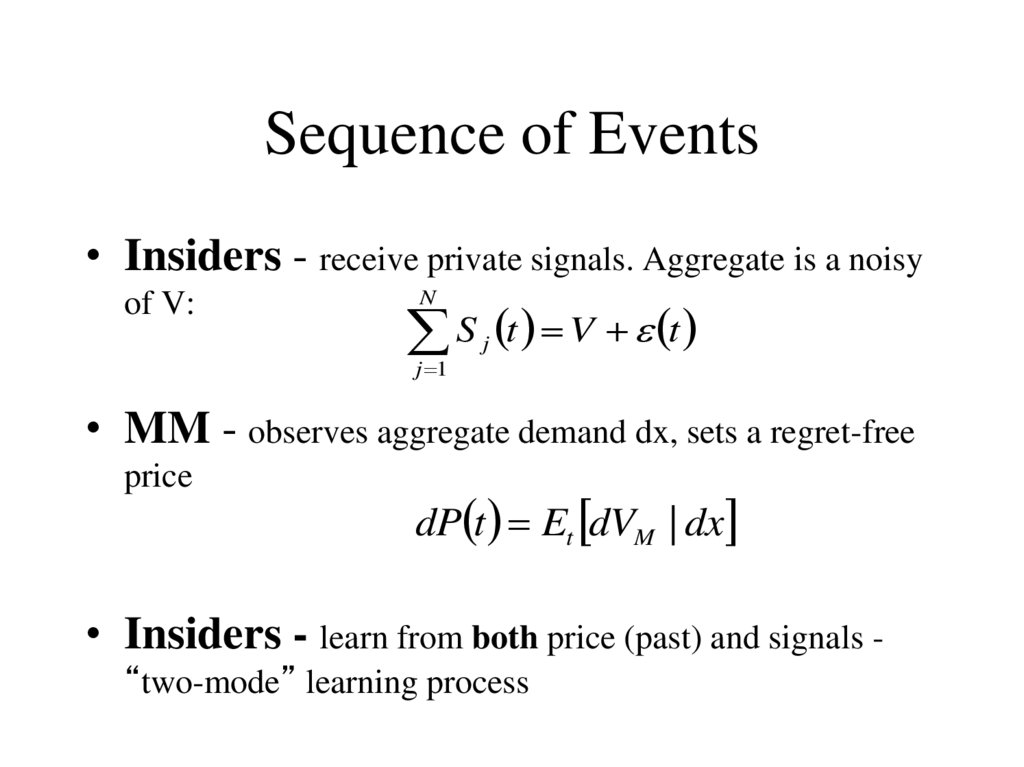

58. Sequence of Events

• Insiders - receive private signals. Aggregate is a noisyof V:

N

S t V t

j 1

j

• MM - observes aggregate demand dx, sets a regret-free

price

dP t Et dVM | dx

• Insiders - learn from both price (past) and signals “two-mode” learning process

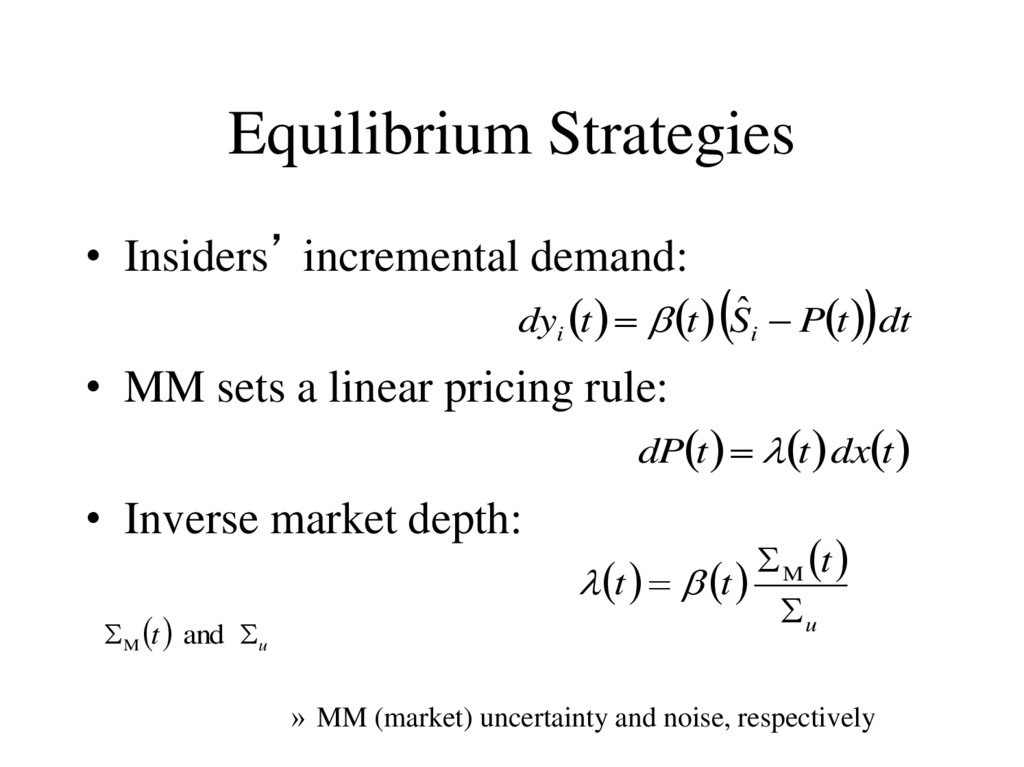

59. Equilibrium Strategies

• Insiders’ incremental demand:dyi t t Sˆi P t dt

• MM sets a linear pricing rule:

dP t t dx t

• Inverse market depth:

M t and u

M t

t t

u

» MM (market) uncertainty and noise, respectively

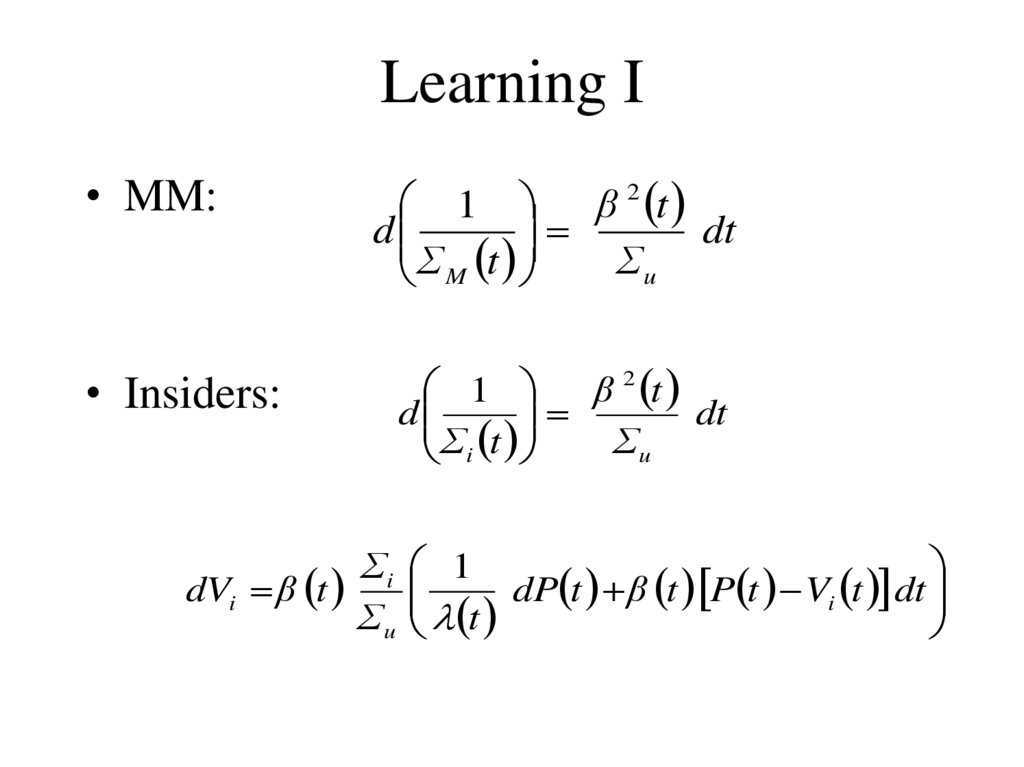

60. Learning I

• MM:1 β 2 t

d

dt

Σu

Σ M t

• Insiders:

1

β 2 t

d

dt

Σu

Σi t

Σi 1

dVi β t

dP t β t P t Vi t dt

Σ u t

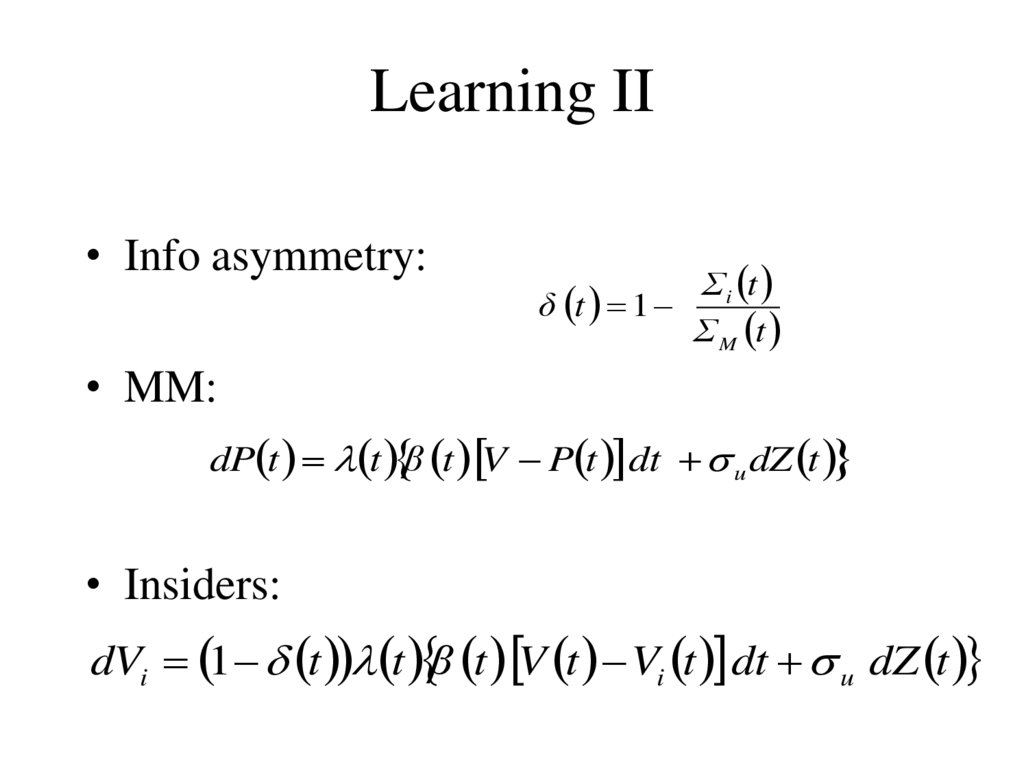

61. Learning II

• Info asymmetry:Σ i t

δ t 1

Σ M t

• MM:

dP t t β t V P t dt u dZ t

• Insiders:

dVi 1 t t β t V t Vi t dt u dZ t

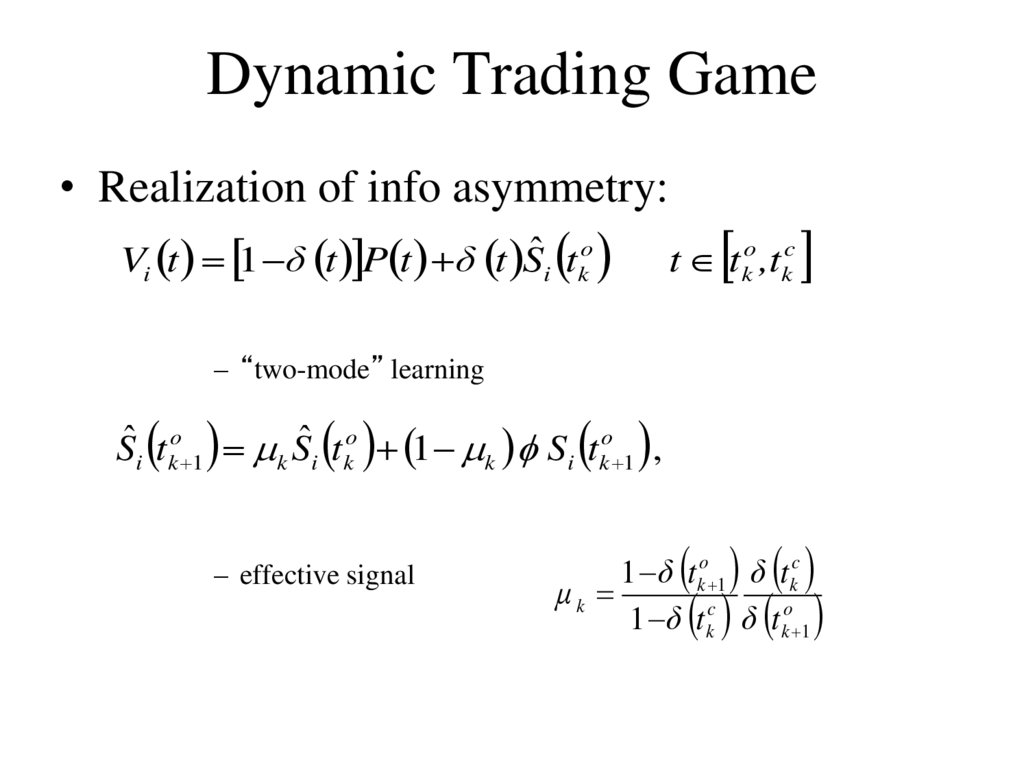

62. Dynamic Trading Game

• Realization of info asymmetry:Vi t 1 δ t P t δ t Sˆi tko

t tko ,tkc

– “two-mode” learning

Sˆi tko 1 k Sˆi tko 1 k Si tko 1 ,

– effective signal

1 δ t ko 1 δ t kc

μk

1 δ t kc δ t ko 1

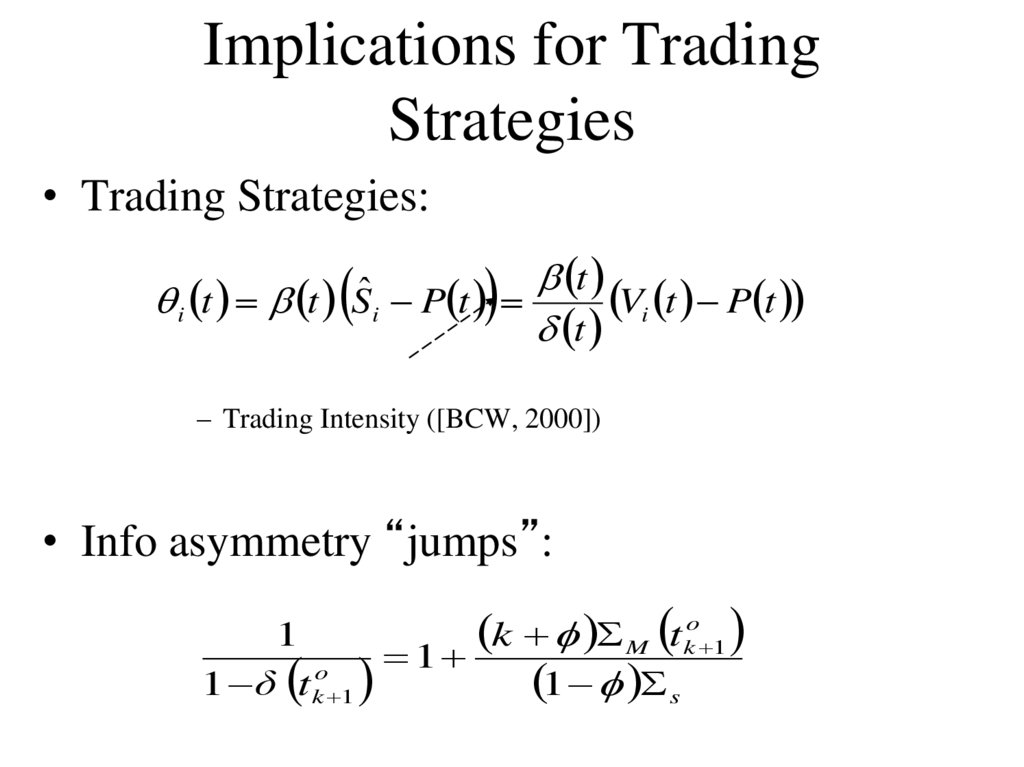

63. Implications for Trading Strategies

• Trading Strategies:t

ˆ

Vi t P t

i t t Si P t

t

– Trading Intensity ([BCW, 2000])

• Info asymmetry “jumps”:

k M t ko 1

1

1

o

1 s

1 δ t k 1

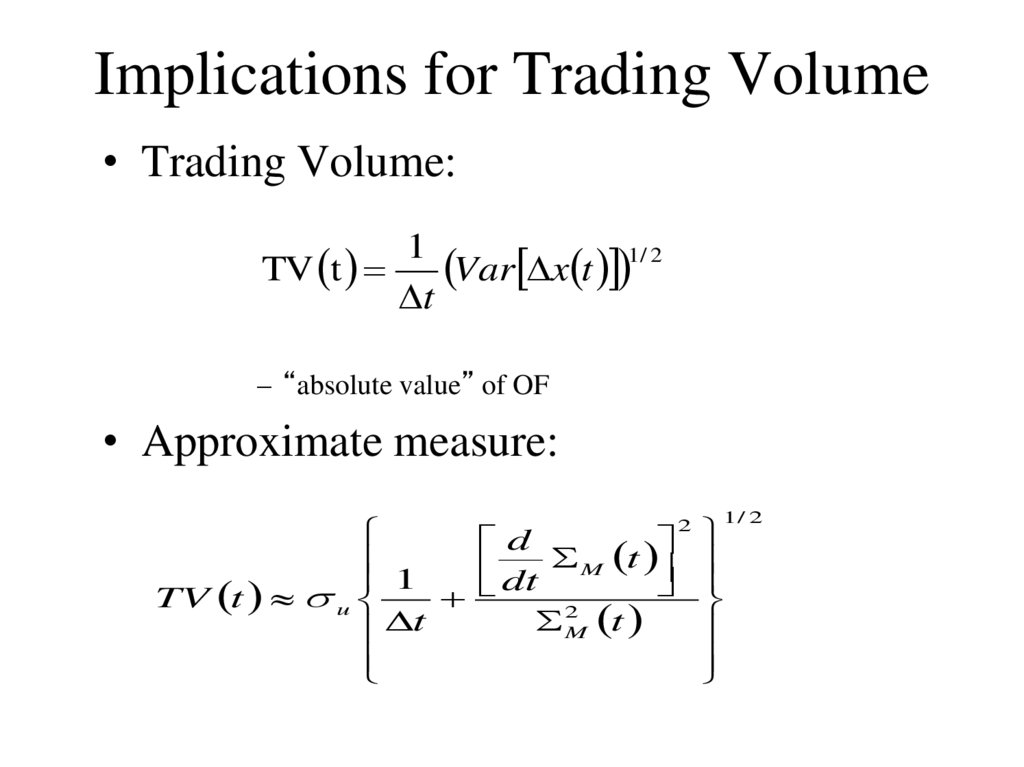

64. Implications for Trading Volume

• Trading Volume:1

Var x t 1/ 2

TV t

t

– “absolute value” of OF

• Approximate measure:

d

t

M

1

dt

TV t u

2

t

M t

2

1/ 2

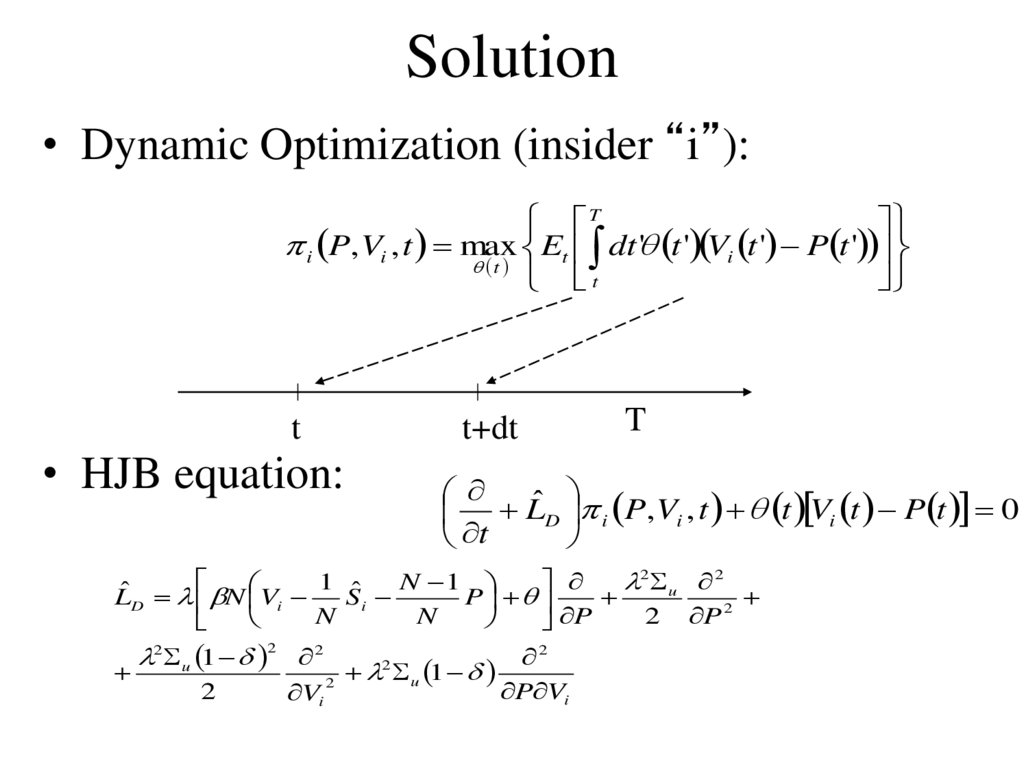

65. Solution

• Dynamic Optimization (insider “i”):T

i P, Vi , t max Et dt

' t ' Vi t ' P t '

t

t

t

t+dt

• HJB equation:

T

Lˆ D i P, Vi , t t Vi t P t 0

t

2

2

1

N

1

u

Lˆ D N Vi

Sˆi

P

2

N

N

P

2

P

2 u 1 2 2

2

2

u 1

2

P Vi

Vi

2

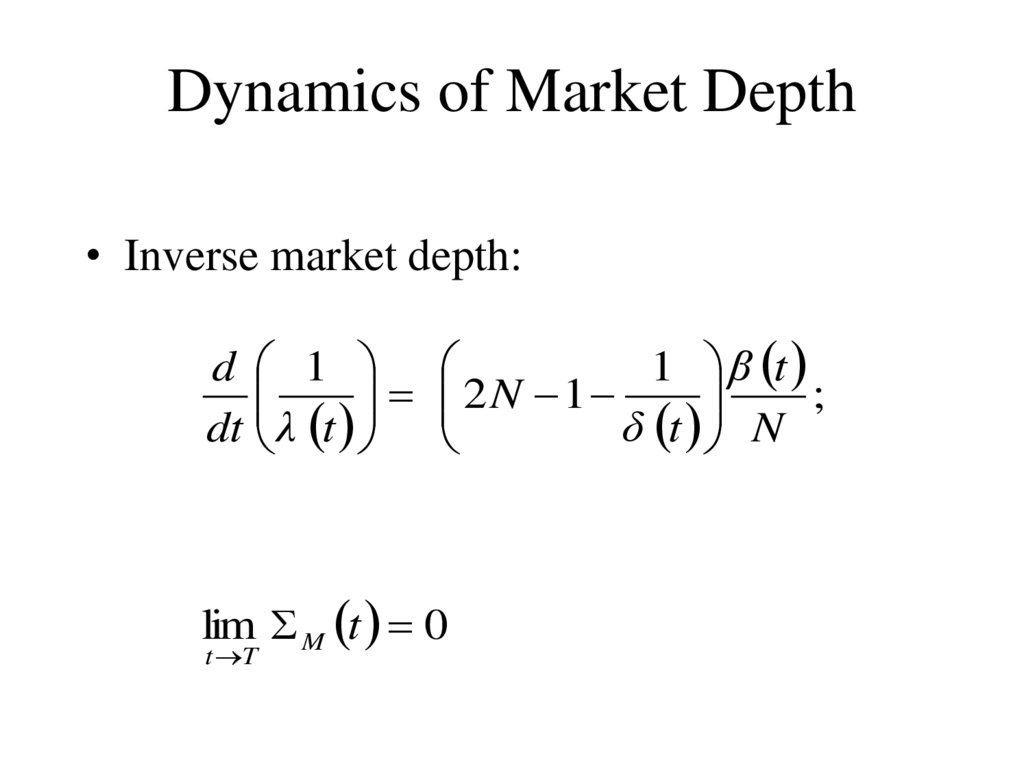

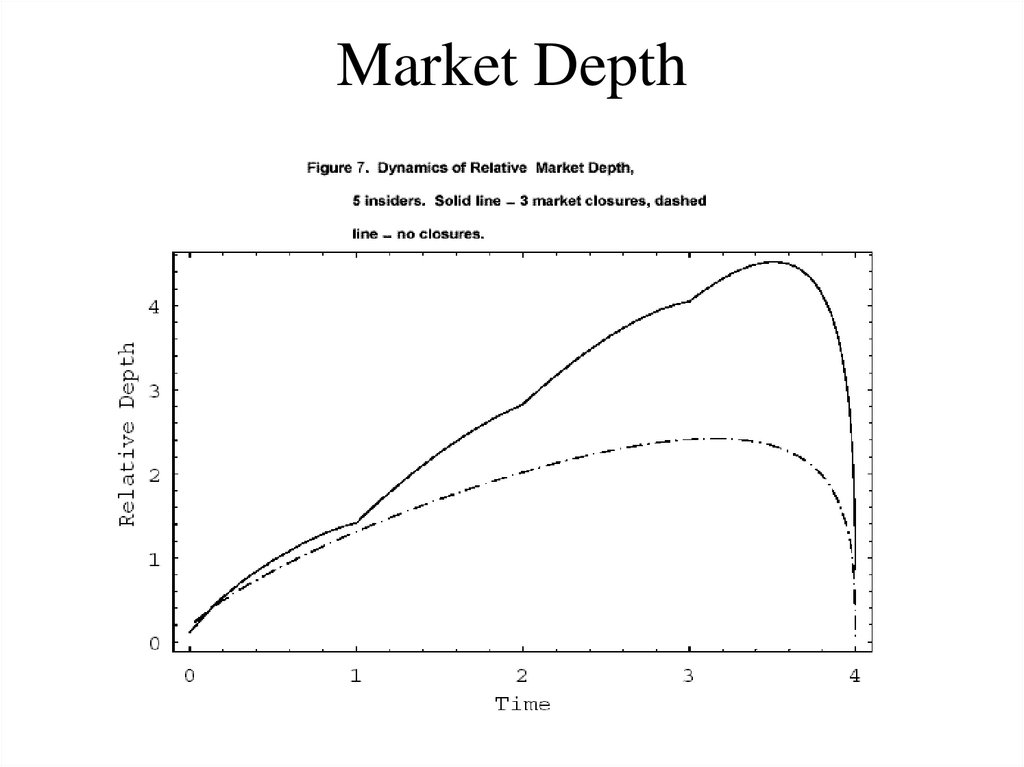

66. Dynamics of Market Depth

• Inverse market depth:d 1

1 β t

2 N 1

;

dt λ t

δ t N

lim M t 0

t T

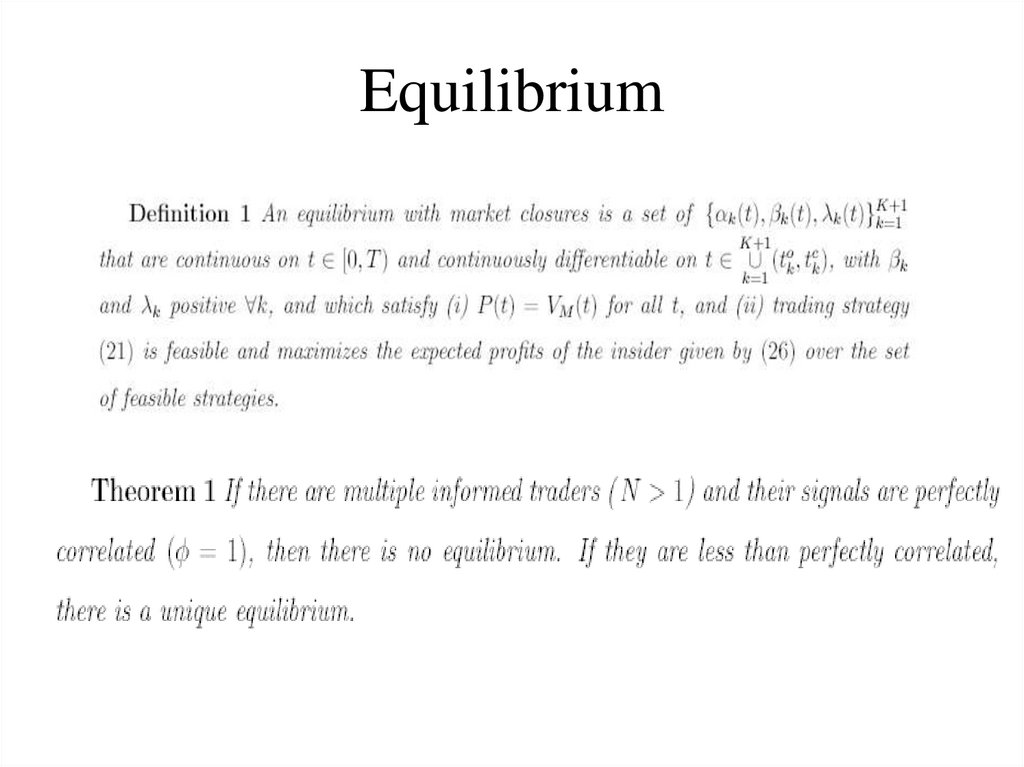

67. Equilibrium

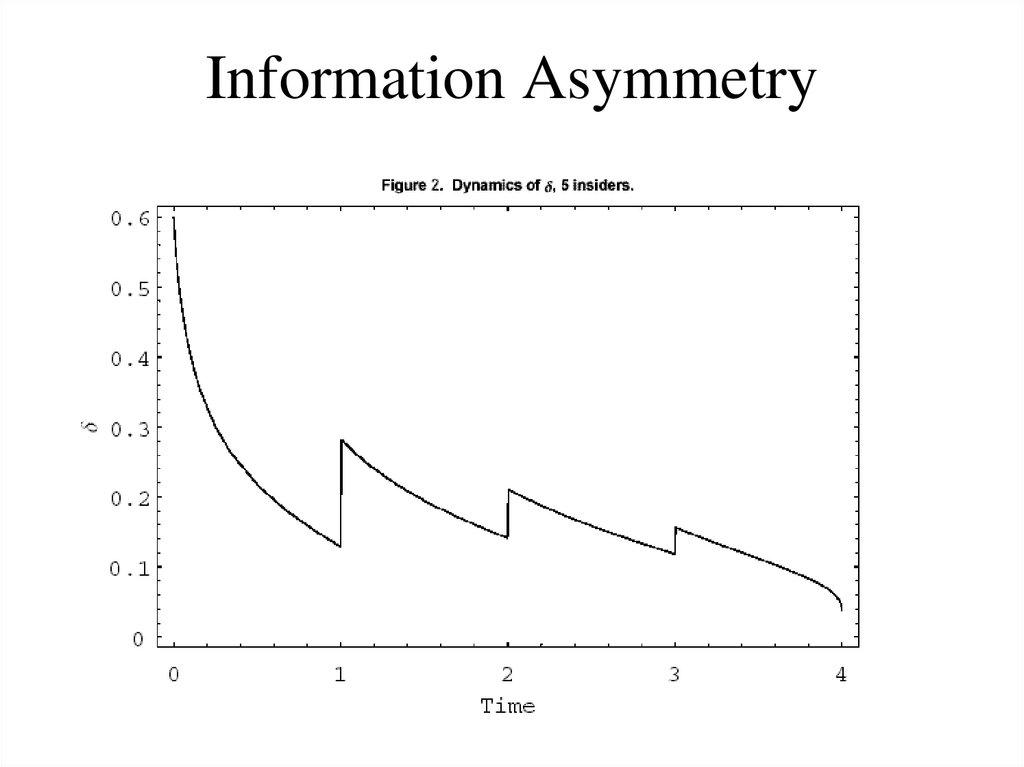

68. Information Asymmetry

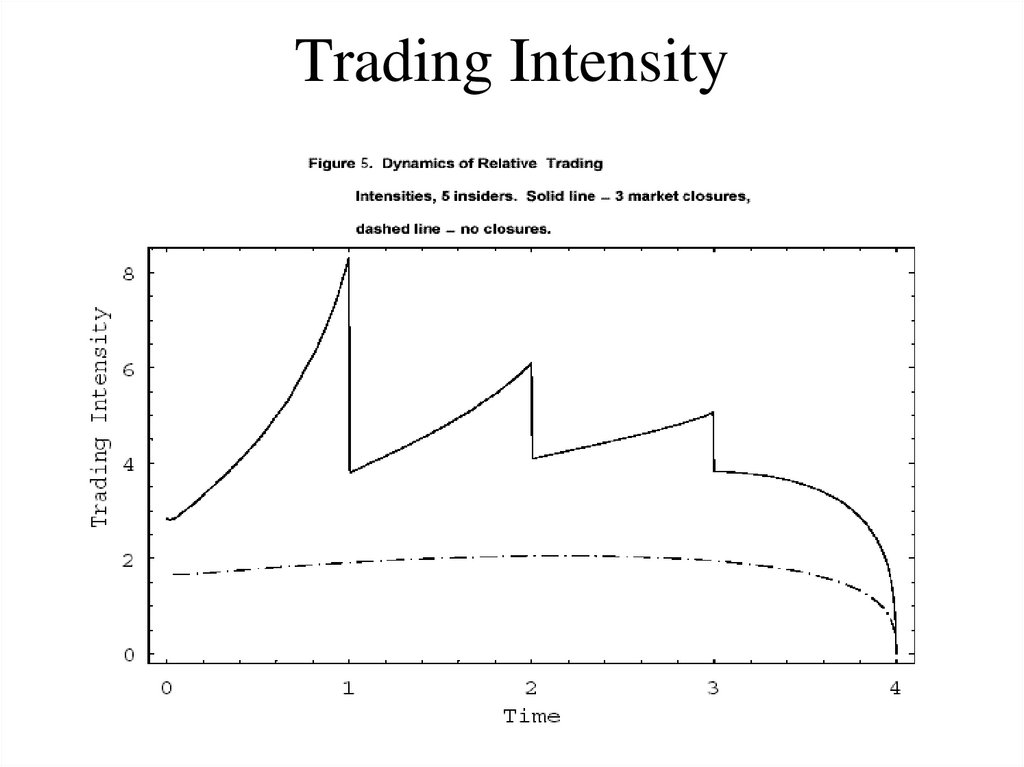

69. Trading Intensity

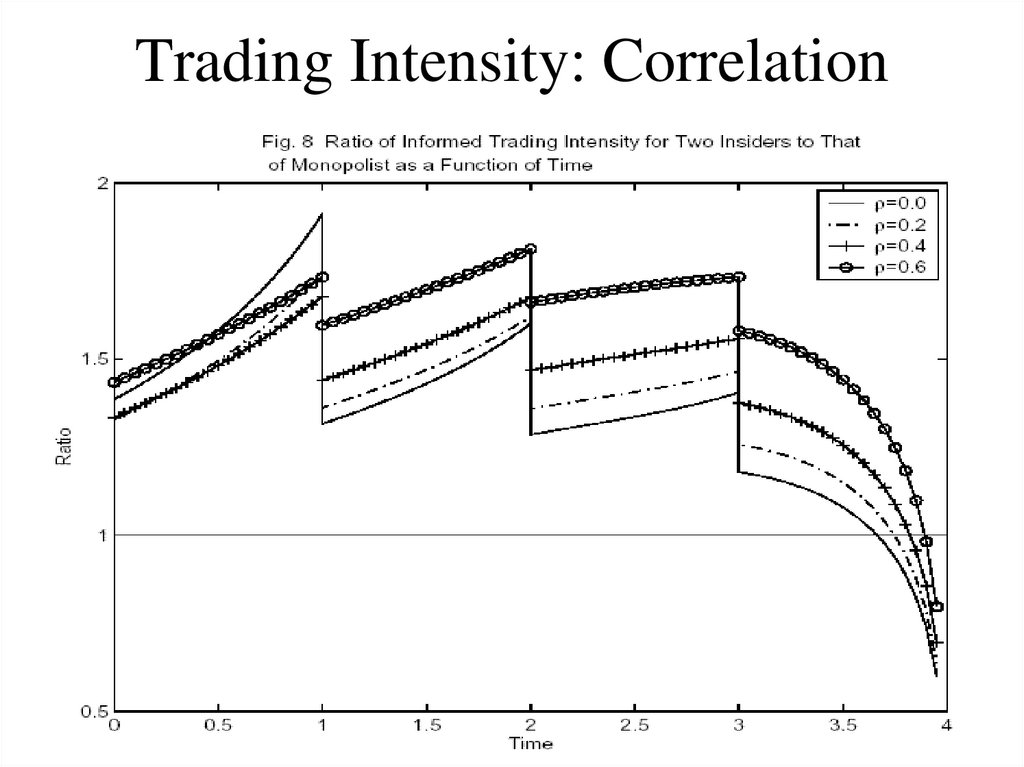

70. Trading Intensity: Correlation

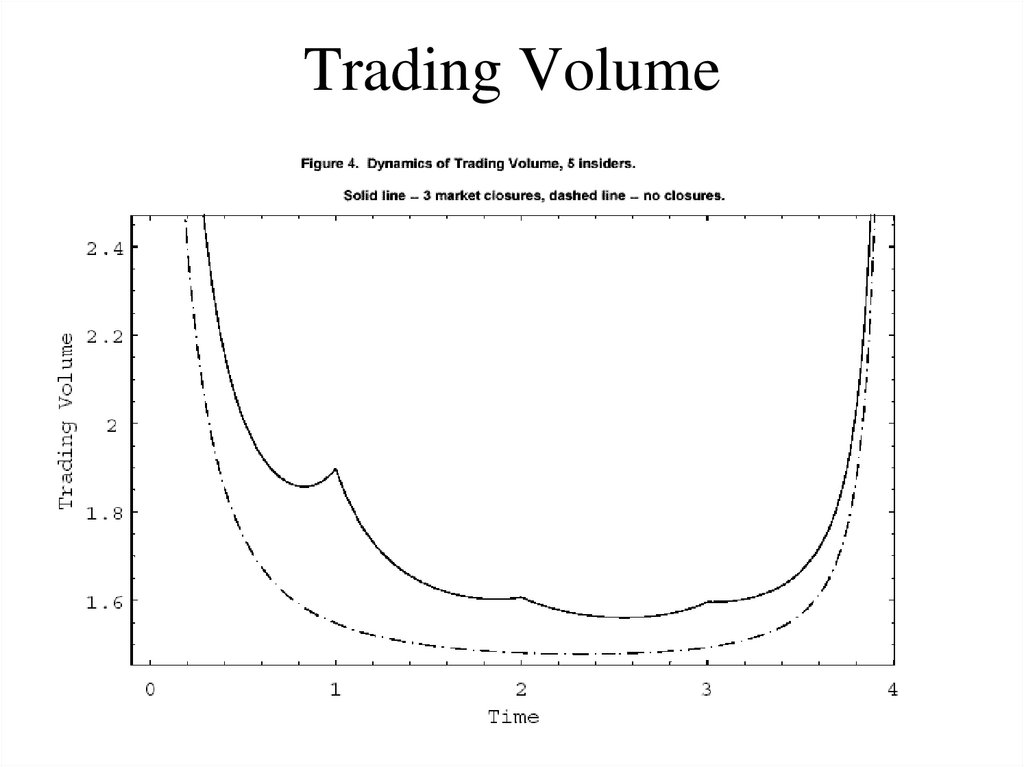

71. Trading Volume

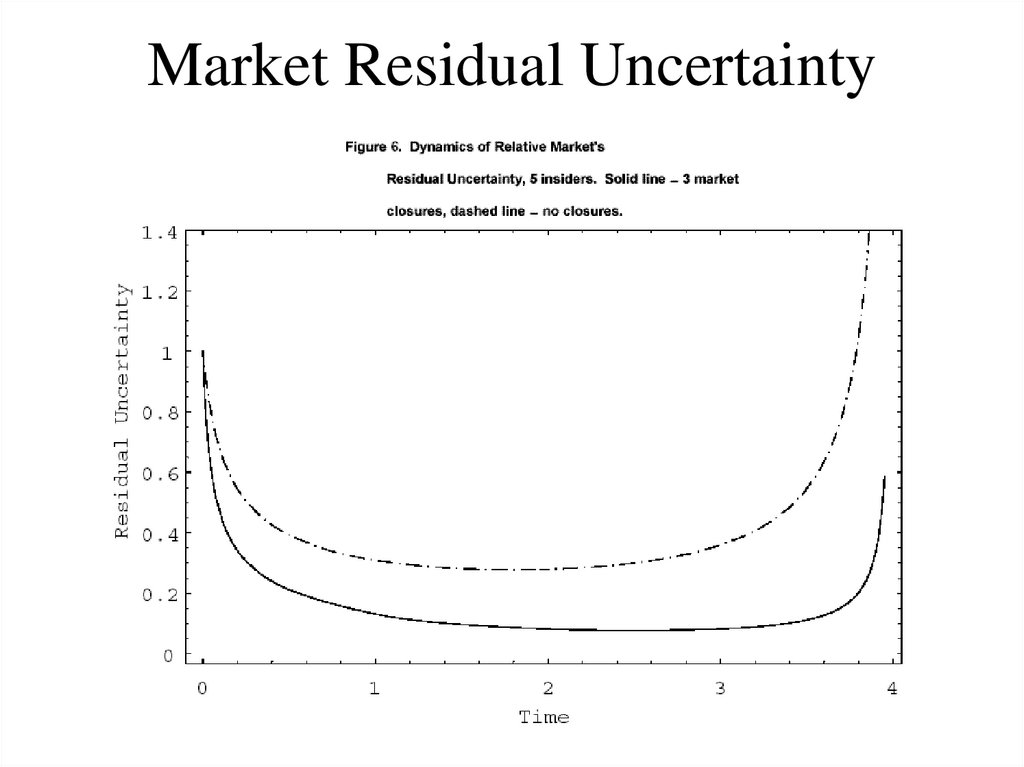

72. Market Residual Uncertainty

73. Market Depth

74. Conclusions

• Rational Strategic Insiders (oligopoly)• Long-lived info

– Assumption: periodic market closures

• Results:

– non-periodic time patterns of trading intensities

– reversing the results of BCW [2000] on info

inefficiency of oligopoly (monopoly)

75. 4. Applied topics

• High-frequency and algorithmic trading• Quality of markets and informed liquidity

provision

• Optimization of limited information resources

(limited attention).

76. Optimal Execution (oligopoly)

• Liquidity trading: large firms (Black Rock)– Portfolio Rebalancing

– Transition (new managers)

– Low-freq trading strategies

• Options

– Block trading (lack of anonymity)

– Slice and submit as a set of market orders

• What is the optimal “slicing” procedure?

• Issues: Front running (HF); Other large traders

77. Chriss and Almgren (1999)

• Monopolist liquidity trader• Optimal execution over a fixed time interval T

• Ex: supposed we need to buy/sell X shares of

MSFT over a 1 week period of time; how do we

“slice” it over time?

• Take into account a “temporary” price impact

• Mean-variance optimization problem

78. Optimal Reaction to CA’99

Holdings as a function of dimensionless time tau=t*gamma. Thin line, ChrissAlmgren (1999) solution. Thick line, optimal reaction to the CA strategy.Parameters: ksi=3, N=4, Q=2, gam=3.

79. Summary

• Relax the assumption of monopolist liquiditytrader

• Optimal reaction functions to CA’99

– in general quite different from standard strategies

• Dynamic Nash Equilibrium strategy

– analytically obtained and

– quite different from the standard CA’99 strategies

• NE is useful as a “benchmark”

80. Cost Reduction

81. Modifications of Chriss-Almgren

• Adaptive dynamic strategies• Boulatov, Ulitsky, 2011

• Idea: put a “slack” on the constraint at

terminal date t = T

• Results: surprisingly good!

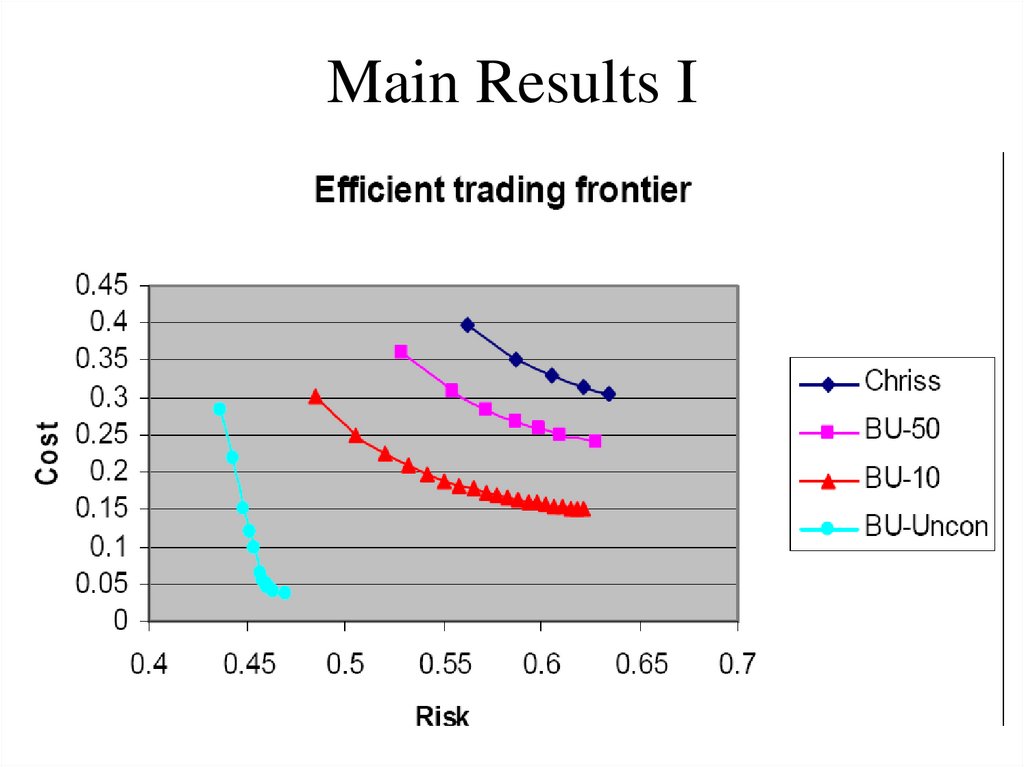

82. Main Results I

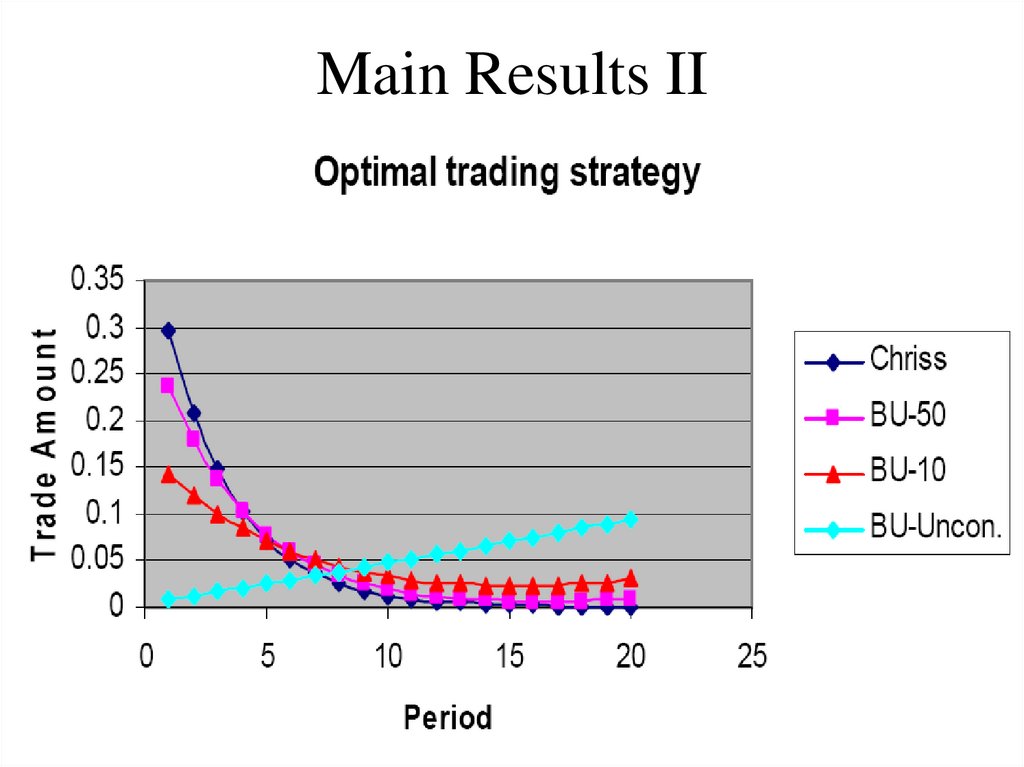

83. Main Results II

84. Securities Trading when Liquidity Providers are Informed

Boulatov, George, 201184

85. Motivation

• What happens when LPs are informed?• Canonical models: uninformed LP

• No such constraint exists in real markets

• In this model LPs can be informed

– simple model that has Kyle (1985) as an appropriate limit

– analyzes opacity in dealing and public liquidity provision

– identifies potentially important bias in existing empirical

work

– provides a prediction that has not been tested

85

86. This Model

• Based on Kyle ~ continuous price grid, traders competedirectly, order quantity unrestricted

• We consider two settings

– designated informed dealers

– informed traders choose to supply or demand liquidity

• Competition is more intense when the informed compete

as liquidity providers than liquidity demanders

86

87. Assumptions

• Single asset that pays off v~N(0, v2)• J risk-neutral strategic liquidity providers who each

– observes a signal, sj, about the security’s payoff

– submits supply schedule yj(sj,p), where y>0 means sell, to a

consolidated “book” of orders

• N risk-neutral strategic liquidity demanders who each

– observes a signal, si, about the security’s payoff

– submits market order xi(si), where x>0 means buy, that is

executed against the consolidated “book” at a uniform price.

• What sj and si are, and whether N and J are exogenous or endogenous

varies across the settings we analyze.

• Uninformed liquidity traders submit market orders of u~N(0, u2)

87

88. Symmetric Nash Equilibrium

• Equilibrium: pair of strategies {y(.), x(.)} thatmaximizes expected profit of dealer j and

trader i, respectively, given that

– other dealers and traders follow them

– markets clear

• Simultaneous moves (NE)

• Pure strategy equilibria with linear strategies

exist in all settings we analyze; i.e.,

y(sj,p) = sj + p

and x(si) = si

88

89. Setting 1: Designated Dealers

• J dealers are designated by the market• v = v1 + v2, components are indep. normal

• Dealers observe sj = v1 for all j

• If transparent, non-dealers are fully informed

and observe si = v

• If opaque, non-dealers are “blocked” from

observing v1 and observe only si = v2.

89

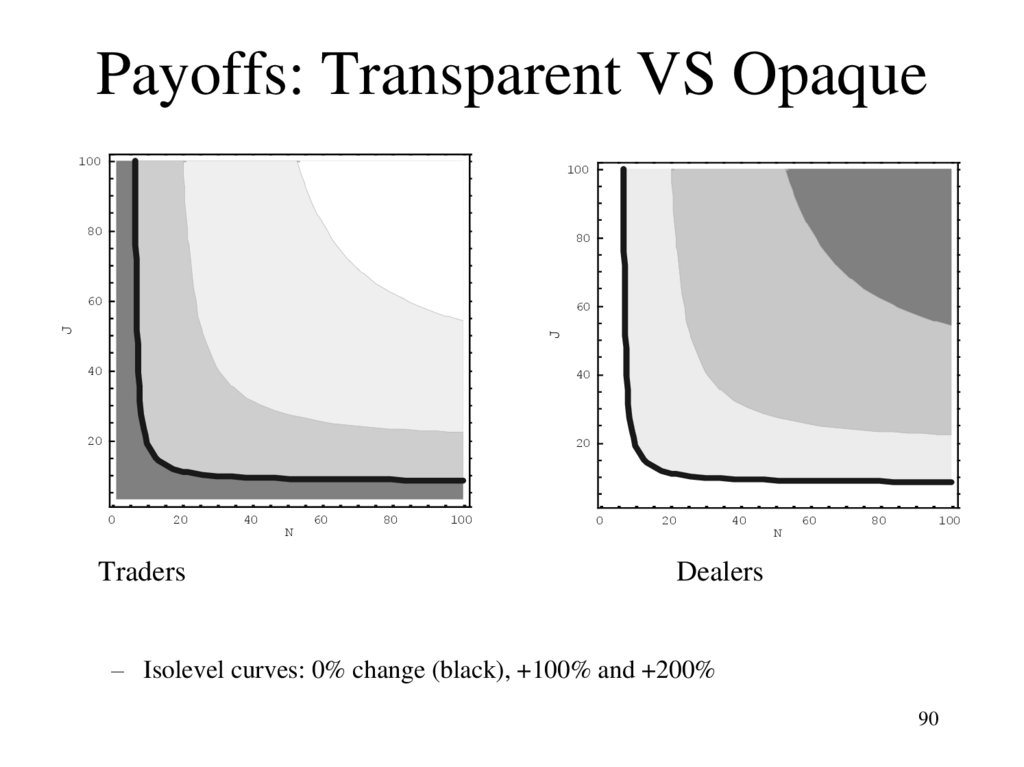

90. Payoffs: Transparent VS Opaque

100100

80

80

60

J

J

60

40

40

20

20

0

20

Traders

40

N

60

80

100

0

20

40

N

60

80

100

Dealers

– Isolevel curves: 0% change (black), +100% and +200%

90

91. Opaque Market

Unsurprising things:

– Dealers benefit from competition among non-dealers and are harmed by competition

among themselves; vice-versa for non-dealers

– The scale of dealer and informed non-dealer profit is greater with greater liquidity trading

Surprising things:

– Dealers do not profit from their informational advantage. Competition among even a few

of them leads the price schedule to be anchored by v1 as if it were the unconditional

expectation of v

– Dealer profits behave like a tax on non-dealer informed trader profits—they are increasing

in u v2, and tend to zero as N > 0

– How much dealers extract from the informed depends only on their relative numbers and

not on informational asymmetries or the quantity of liquidity trading:

N i / J j = (J-2) / (N+1)

Despite having an informational advantage, competition among dealers leaves them

profiting only from widening spreads in accordance with how aggressively they

expect the informed to trade

91

92. Transparent Market

• Transparency produces overlap in dealers’ and traders’information

– This enables dealers to better forecast how the informed will

trade, and to price discriminate more effectively

• The informed know this and reduce the intensity of their

trading vis-a-vis the opaque market

– This reduces the intensity of competition among the informed

and increases the total profits extracted from liquidity traders

– If either J or N are small to begin with, then one or the other has

a lot of monopoly power and there is not much competition to

reduce, and the result is opposite

92

93. Results

• All informed choose to supply liquidity (J*=M) and• Liquidity traders’ expected losses are minimized

– Competition is more intense when informed trade as LPs

than LDs

• Similar to Glosten’s (1994) conclusion on public

provision of liquidity except here

– Competition is imperfect

– Traders choose their order types

– In equilibrium the informed supply liqudity

94. Implications

• With the informed providing liquidity, the priceschedule reflects the security’s true value even

before crossing market orders

• Empirical Implication: More private

information “arrives” with limit rather than

market orders

– Consistent with evidence in Kaniel & Liu (2006)

and Rourke (2007)

– Existing measures of info content of trades are

biased downward

95. Empirical Evidence

• Hendershott, Jones & Menkveld (2008) comparemeasures of market quality before and after Autoquote on

the NYSE

– Autoquote improved timeliness of information about trading

disseminated off the floor

• Quote midpoints move less in response to order arrivals

after Autoquote; i.e., price schedule better anticipates

order flow after Autoquote

• Dealers profit more after Autoquote

95

96. Setting 2: Endogenous Choice of Order Type

• M informed agents, each observes si = vi• v = v1 + ... + vM

where vi ~ iid Normal

• M = J + N, where J is the number who

choose to submit supply schedules, N

choose market orders

• J* is such that no trader benefits by

switching order types

96

97. Results

• All informed choose to supply liquidity (J*=M) and• Liquidity traders’ expected losses are minimized

– Competition is more intense when informed trade as LPs than

LDs

• Similar to Glosten’s (1994) conclusion on public provision

of liquidity except here

– Competition is imperfect

– Traders choose their order types

– In equilibrium the informed supply liqudity

97

98. Implications

• With the informed providing liquidity, the priceschedule reflects the security’s true value even

before crossing market orders

• Empirical Implication: More private

information “arrives” with limit rather than

market orders

– Consistent with evidence in Kaniel & Liu (2006)

and Rourke (2007)

– Existing measures of info content of trades are

98

biased downward

99. Adding friction to Liq. Provision

• Frictions drive informed away from liquidityprovision and toward demanding liquidity

• Breaching anonymity: partial loss of LPs’ info.

advantage (similar to Foucault, et.al. ’07)

• Other frictions would have a similar effect

– Direct costs of monitoring limit orders (Seppi, ’97)

– Delay in cancellation of previous orders features

prominently in dynamic model of Goettler, et.al. ’07

100. Results

• Greater anonymity breach -- more migration fromliquidity provision to liquidity demand

– Greater friction causes more migration

• The more informed there are, the smaller is the

anonymity breach necessary to cause migration

– Frictions have bigger impacts, the greater the intensity of

potential competition

• Anonymity promotes competition

• New Empirical Prediction: More info “arrives” with

limit than market orders in markets that are more

protective of LPs anonymity

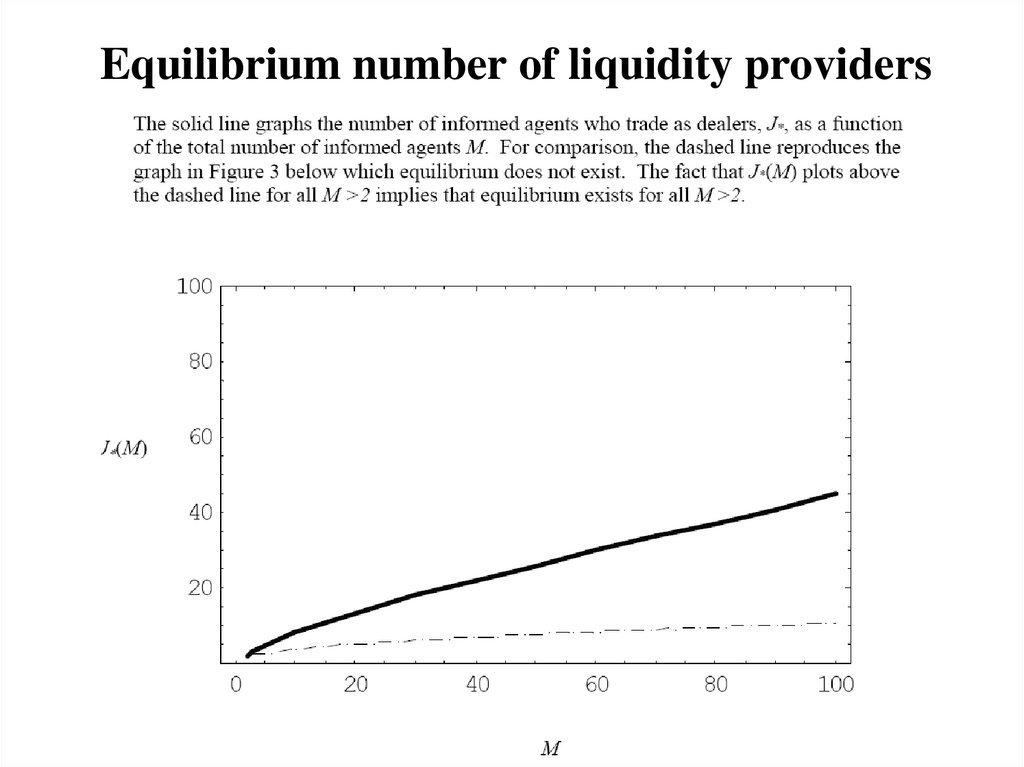

101. Equilibrium number of liquidity providers

102. Useful Benchmark Models

• Dennert (1993) based on Kyle (1985)– Strategic, risk-neutral market makers post separate price schedules to

attract a single informed and uninformed market order traders

– Captures imperfect competition among liquidity providers, but they are

uninformed. Price schedules convey no information

– Our model has imperfect competition among informed liquidity

providers who post supply schedules to a consolidated book;

consolidated price schedule aggregates information

• Glosten (1994)

– Competitive risk-neutral liquidity providers submit regret-free limit

orders. Informed and uninformed submit market orders

– Liquidity provision is perfectly competitive among uninformed liquidity

providers. This determines the intensity of competition by assumption.

– In our model, traders choose to provide or demand liquidity, so the

intensity of competition among liquidity providers arises endogenously.

102

103. Other Interesting Papers

Kumar & Seppi (1993)

Chakravarty & Holden (1995)

Kaniel & Liu (2006)

Foucault, Moinas & Theissen (2007)

Goettler, Parlour & Rajan (2007)

– Dynamic model with sequential trader draws and quantity

constraints. Numerical simulations produce comparative statics.

– Stale limit orders cannot be updated until the trader is drawn again

from the urn. This implicit cost deters liquidity provision in volatile

markets

Glosten-Milgrom settings: discrete price grids, sequential random

arrival of individual traders, fixed quantities

103

104. Summary

• Relax the constraint that informed must trade asdemanders of liquidity

• Equilibrium intensity of competition is greater when

informed compete as liquidity providers than as liquidity

demanders

• Transparency tends to impede competition in the settings

we analyze

Lack of anonymity leads to a similar effect

• Nice existing work, but a great deal of potential still

exists

104

105. Limited Dealer Attention and Quote Adjustments

Boulatov, Hatch, Johnson, Lei (BHJL), 2007106. Outline

• Limited attention: overview (mostly theory)• Dynamic strategic trading with multiple dealers

– Modeling: typical issues/problems

– Review: Kyle’85, Dennert’93, Bondarenko’ 2001

• BHJL model

– Game-theoretic setting: dynamic Nash

– How to model limited attention?

– Optimization problem

• Solution: an overview

107. Limited Attention

• Why is it important?– One of the fundamental issues (decision making)

– MS theory: need for general models/approaches

• Investment decisions (corporate)

– Peng (2005) – info processing capacity constraints

– Peng and Xiong (2006) – categorizing (simplified

decisions in presence of info processing constraints)

• Financial markets

– Corwin and Coughenour (2006) – empirical

– BHJL (2009) – MS model with LA

108. References I

• Alex Boulatov, Brian C. Hatch, Shane A. Johnson, Adam Y.C.Lei, 2009, “Dealer Attention, the Speed of Quote Adjustment

to Information, and Net Dealer Revenue”, Journal of Banking

and Finance, forthcoming.

• Lin Peng, 2005, “Learning with Information Capacity

Constraints”, Journal of Financial and Quantitative Analysis,

40, 307-329.

• Shane Corwin and Jay Coughenour, 2008, “Limited Attention

and the Allocation of Effort in Securities Trading", Journal of

Finance, forthcoming.

• Lin Peng and Wei Xiong, 2006, “Investor Attention,

Overconfidence and Category Learning”, Journal of Financial

Economics, 80, 563-602.

109. References II

• Albert S. Kyle, 1985, “Continuous Auctions and InformedTrader Trading”, Econometrica 53, 1315-1335.

• Oleg Bondarenko, 2001, “Competing market makers, liquidity

provisions, and bid-ask spreads”, Journal of Financial Markets

4, 269-308.

• Jürgen Dennert, 1993, “Price Competition between Market

Makers”, Review of Economic Studies 60, 735-751.

110. Investment with capacity constraints I

• Lin Peng (2005) – theory• Two sources of info on the fundamentals

– Dividend process (no constraints)

– “private” information production – constrained

• Endogenous capacity allocation

– Rate of information entropy reduction is bounded

– Same effect as costly information production

• There may be a conceptual problem

– Conditional or unconditional factor dynamics?

– Ex: observation of a constant factor

111. Investment with capacity constraints II

• Endogenous capacity allocation: results• Allocate more capacity to

– Large stocks

– Stocks with higher uncertainty

• Note: both are perfectly consistent with BHJL

• Results (cross-section)

– Higher rate of adjustment to fundamental shocks

– Lower residual uncertainty

112. Implications for financial markets I

• Corwin and Coughenour (2008) – Empirical• Evidence on NYSE specialists (market-makers)

– Why limited attention? Time & processing constraints

• Allocate more attention to

– More “active” stocks (higher trading activity)

• Results

– Lower transaction costs

– Higher liquidity

• Note: all the above is consistent with BHJL

113. Implications for financial markets II

• Why NYSE? Specialists: well-defined portfolios• Limited Attention Hypothesis

“If limited attention forces a specialist to allocate

efforts across stocks, we expect their ability to

provide liquidity for a given stock to be

negatively related to the attention requirements of

other stocks in their portfolio…”

• Testing LAH

– intraday TAQ + trading floor location data

– Results: BA spreads decrease, rate and magnitude of

price improvements increase in attention

114. Strategic trading and liquidity provision

• Strategic nature of insider trading• Lifting the market efficiency condition:

– Dealers are making profits (imperfect

competition)

• two-sided strategic trading (Dennert’93)

115. BHJL: Limited Dealers’ Attention

• Limited attention – slow reaction to new info• Focus on dynamics of quote adjustment process

• “A dealer who is slow to detect and incorporate new

information into quoted prices faces the risk that on

subsequent trades he buys from (sells to) informed

traders or even liquidity traders at prices that are too

high (low).”

• Therefore, dealer with higher attention rate should

(ceteris paribus) make higher expected profits.

• Note: competition with other dealers and insiders

116. Model Ingredients

• 3 types of agents: 1 insider, J dealers, lq. Traders• 2 stocks

• Dealers:

– do not know fundamentals until the announcement

date T

vi ~ N 0, 0,i

– Before trading, regard

Informed trader:

– learns the fundamentals at t = 0.

– continuously submits market orders to each of the

dealers for both stocks.

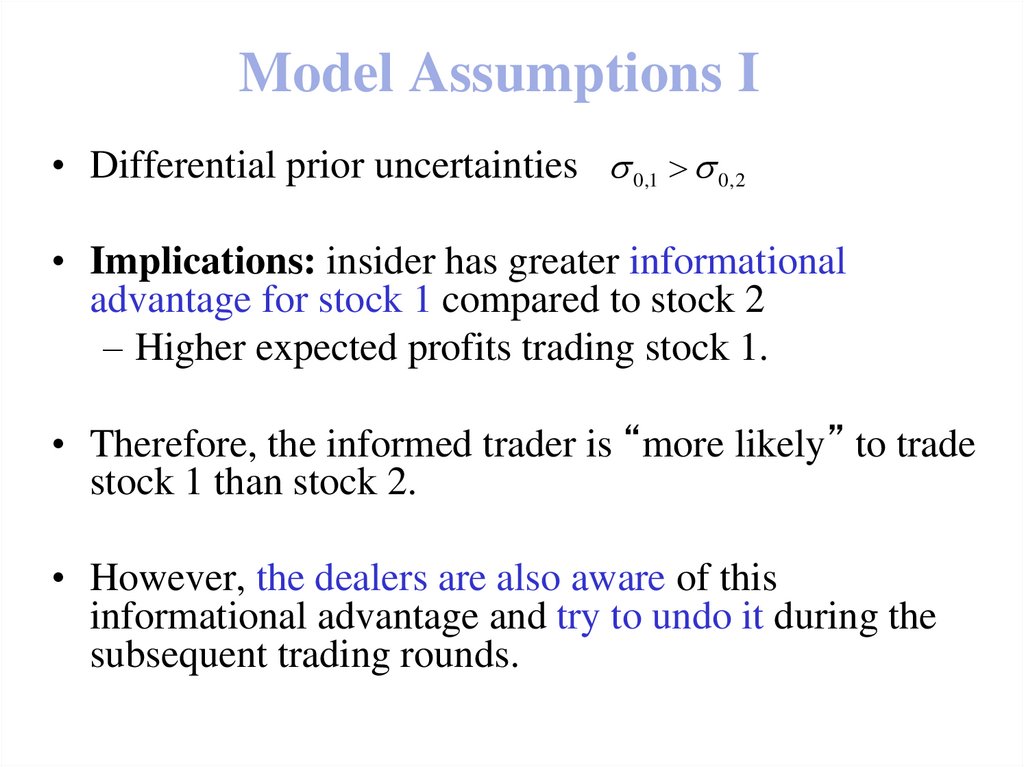

117. Model Assumptions I

• Differential prior uncertainties 0,1 > 0,2• Implications: insider has greater informational

advantage for stock 1 compared to stock 2

– Higher expected profits trading stock 1.

• Therefore, the informed trader is “more likely” to trade

stock 1 than stock 2.

• However, the dealers are also aware of this

informational advantage and try to undo it during the

subsequent trading rounds.

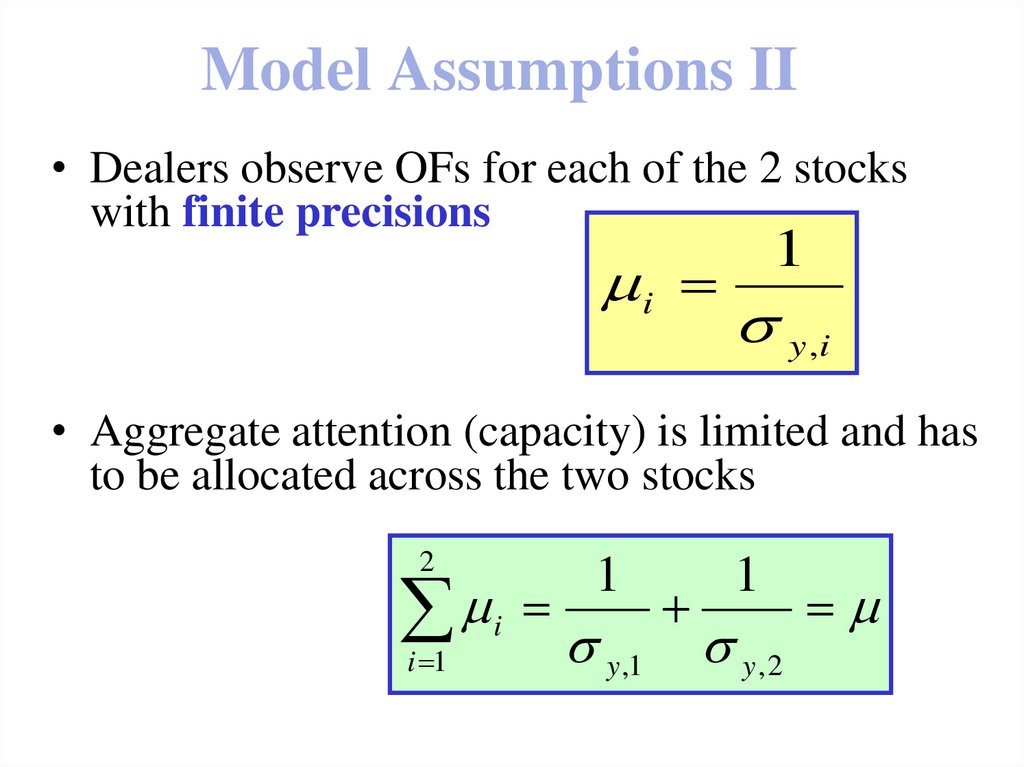

118. Model Assumptions II

• Dealers observe OFs for each of the 2 stockswith finite precisions

i

1

y ,i

• Aggregate attention (capacity) is limited and has

to be allocated across the two stocks

2

1

i 1

i

y ,1

1

y,2

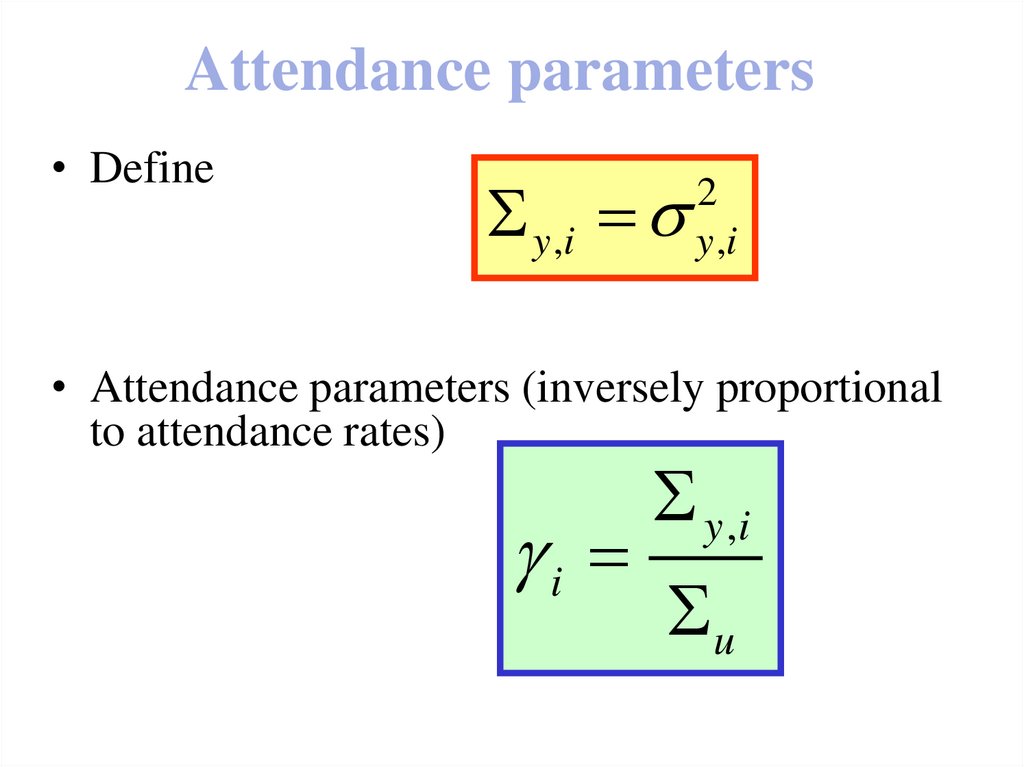

119. Attendance parameters

• Definey ,i

2

y ,i

• Attendance parameters (inversely proportional

to attendance rates)

i

y ,i

u

120. Optimal Attention Allocation

• Stock 1: higher attendance than 2• Dealers’ and informed trader’s payoffs:

– Higher for trading stock 1 than 2

121. Multiple oligopolistic dealers

• Insider’s problem: reaction functionT

2

I max E dt k t v Pk t

max

X k ( )

k ( )

0

J

1

1

Xk

X;

k

k 1 k

• Dealers: price is greater than ME

dPk k t dyk ; d D ,k E dyk Pk vk

• Equilibrium:

J 2 *

*

t J J

0 ; 0 const

J 1

*

k

*

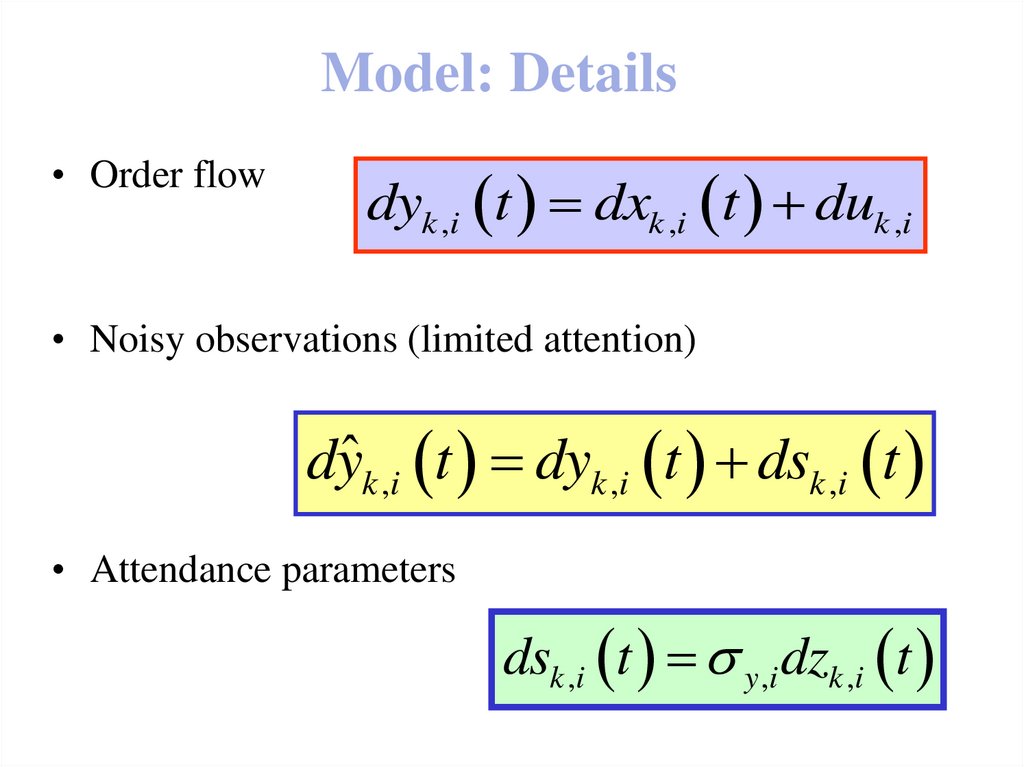

122. Model: Details

• Order flowdyk ,i t dxk ,i t duk ,i

• Noisy observations (limited attention)

dyˆk ,i t dyk ,i t dsk ,i t

• Attendance parameters

dsk ,i t y ,i dzk ,i t

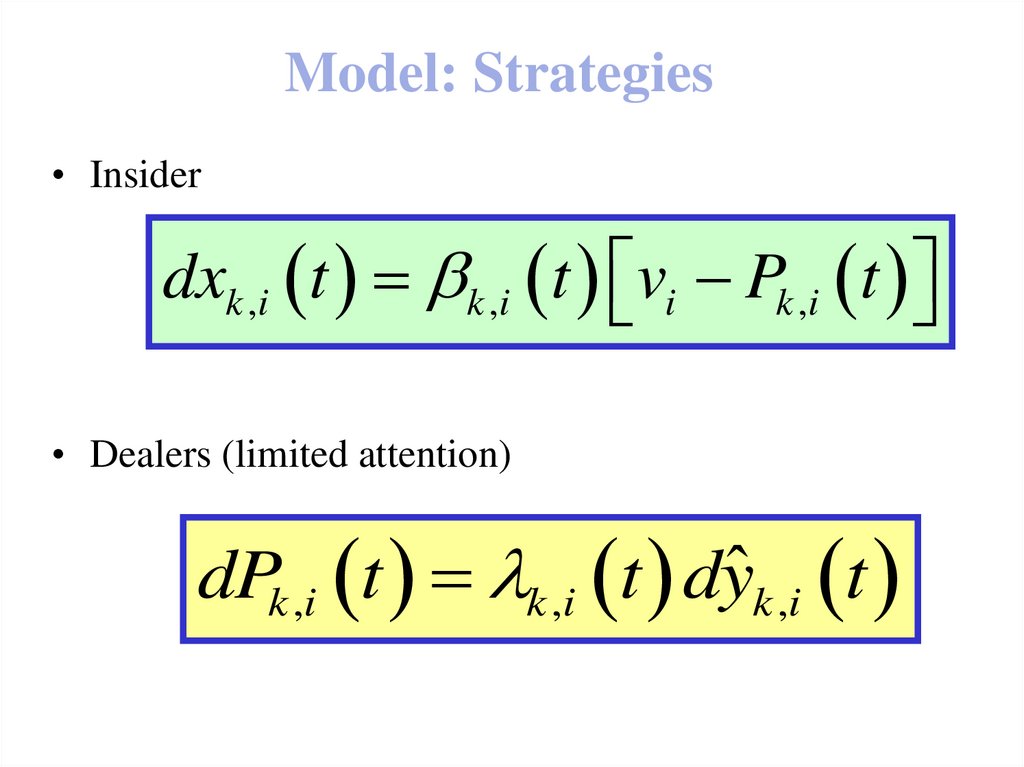

123. Model: Strategies

• Insiderdxk ,i t k ,i t vi Pk ,i t

• Dealers (limited attention)

dPk ,i t k ,i t dyˆk ,i t

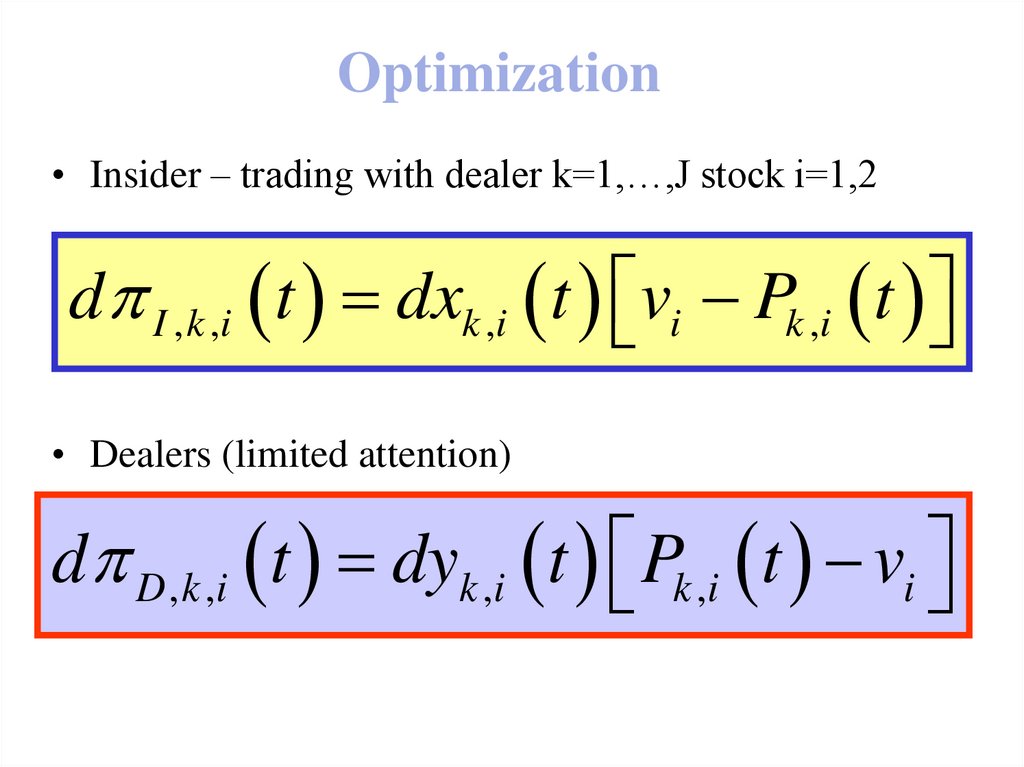

124. Optimization

• Insider – trading with dealer k=1,…,J stock i=1,2d I , k ,i t dxk ,i t vi Pk ,i t

• Dealers (limited attention)

d D , k ,i t dyk ,i t Pk ,i t vi

125. Equilibrium I

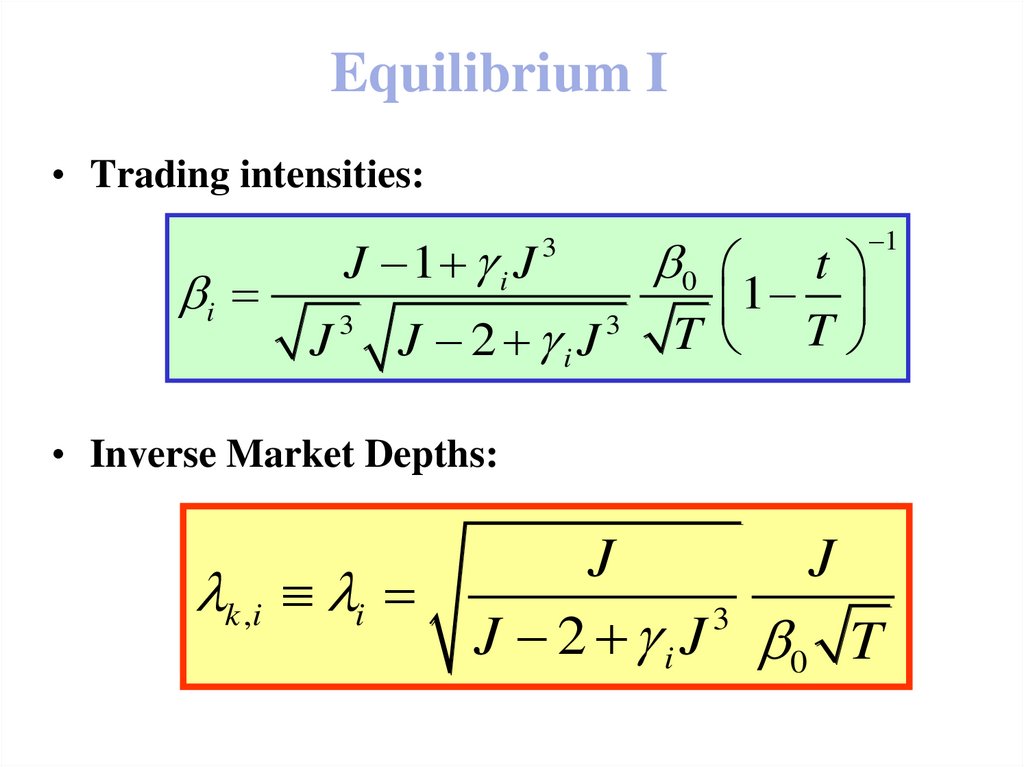

• Trading intensities:i

J 1 i J

J

3

0

3

J 2 iJ

3

t

1

T T

1

• Inverse Market Depths:

k ,i i

J

J

3

J 2 i J 0 T

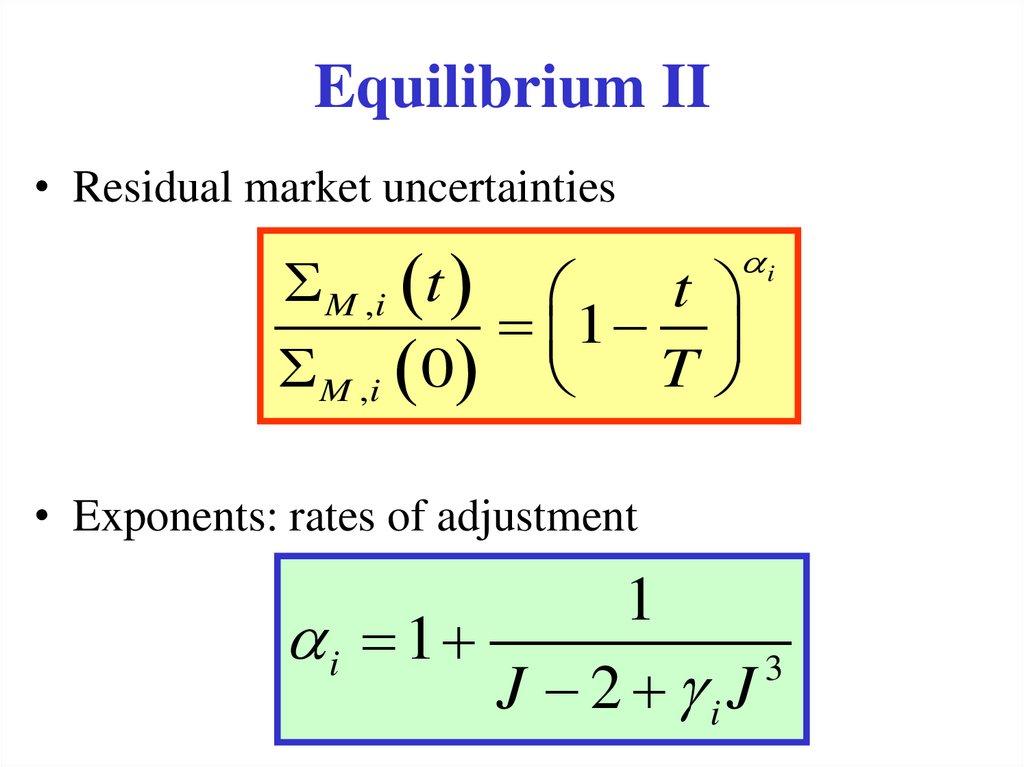

126. Equilibrium II

• Residual market uncertaintiesM ,i t

i

t

1

M ,i 0

T

• Exponents: rates of adjustment

1

i 1

3

J 2 iJ

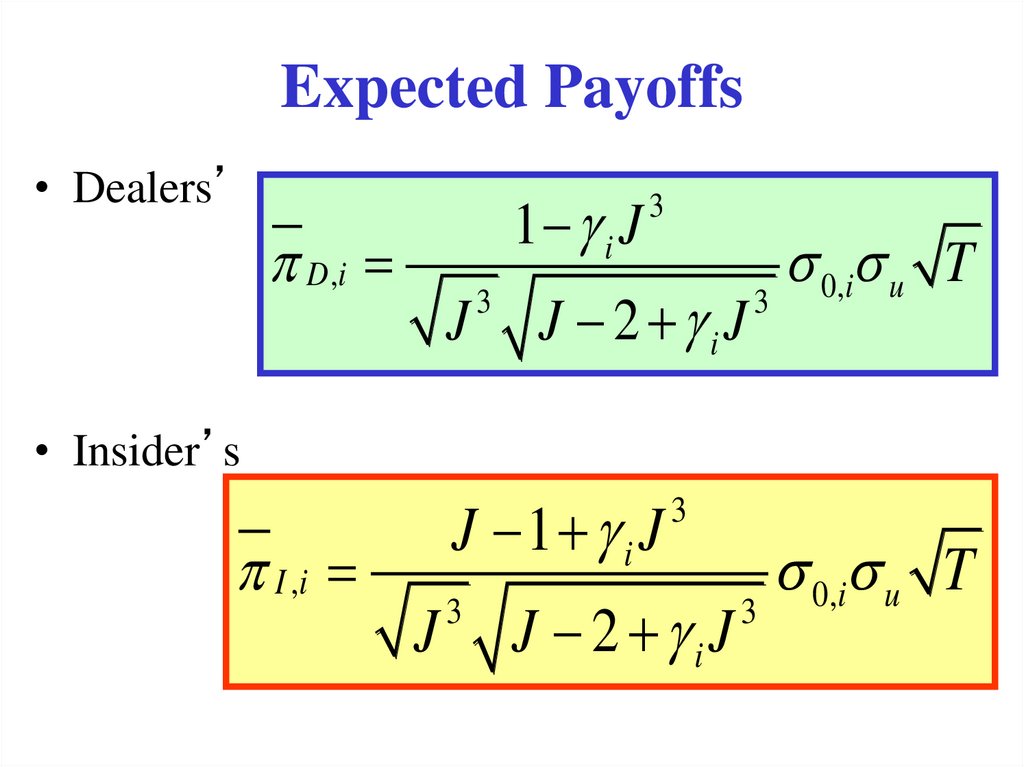

127. Expected Payoffs

• Dealers’1 i J

D ,i

J

3

3

J 2 iJ

3

0,i u T

• Insider’s

J 1 i J

I ,i

J

3

3

J 2 iJ

3

0,i u T

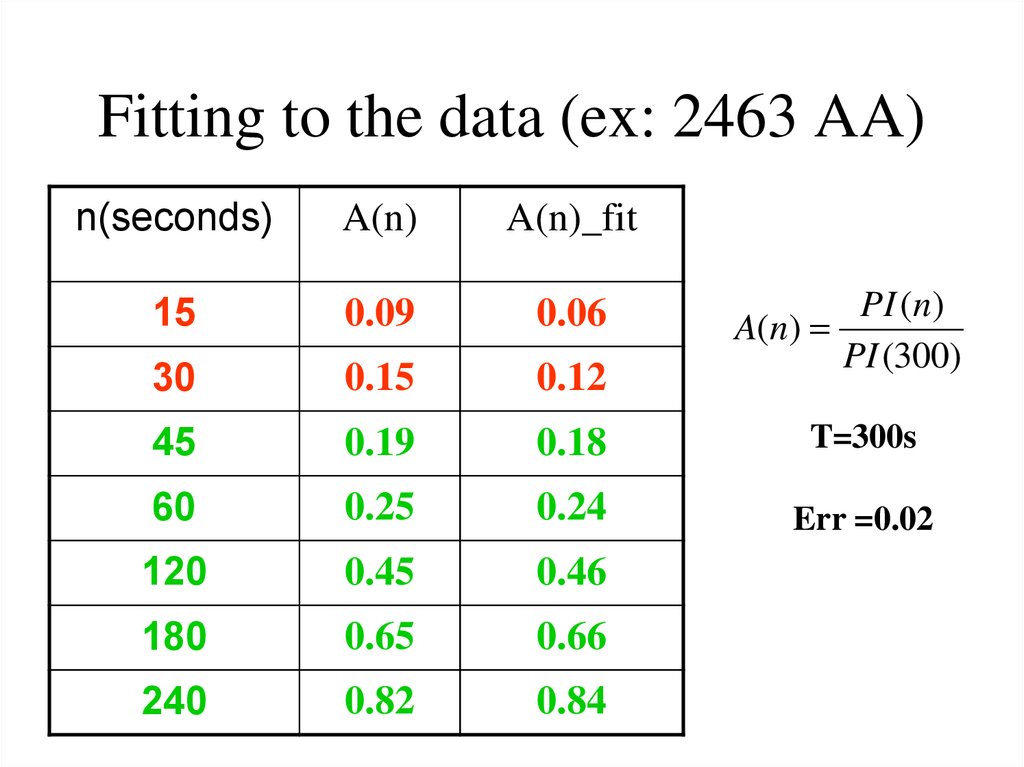

128. Fitting to the data (ex: 2463 AA)

n(seconds)A(n)

A(n)_fit

15

0.09

0.06

30

0.15

0.12

45

0.19

0.18

T=300s

60

0.25

0.24

Err =0.02

120

0.45

0.46

180

0.65

0.66

240

0.82

0.84

PI (n)

A(n)

PI (300)

129. Conclusions

• Dynamic Bayesian Nash CT linear equilibrium– Same in Nash and Stackelberg cases

• Fitting to the data: fits reasonably well

Маркетинг

Маркетинг