Похожие презентации:

Supply, Demand, the Equilibrium, and Government Policies (lecture 2)

1.

MicroeconomicsDr. Shahab Sharfaei, PhD.

UNYP

2.

Lecture 2Supply, Demand, the

Equilibrium, and Government

Policies

3.

Market mechanism‘s elements• Demand

• Supply

• Price

• Competition

3

4.

Demand (D)4

Demand - Quantity of goods (products and services)

that consumers are willing to buy at various prices

Quantity Demanded - the amount of goods that

households would buy in a given time period if they

could buy all they wanted at the current market price.

5.

Demand (D)• The law of demand states that there is a negative, or

inverse relationship between the price and the

quantity of goods demanded

5

6.

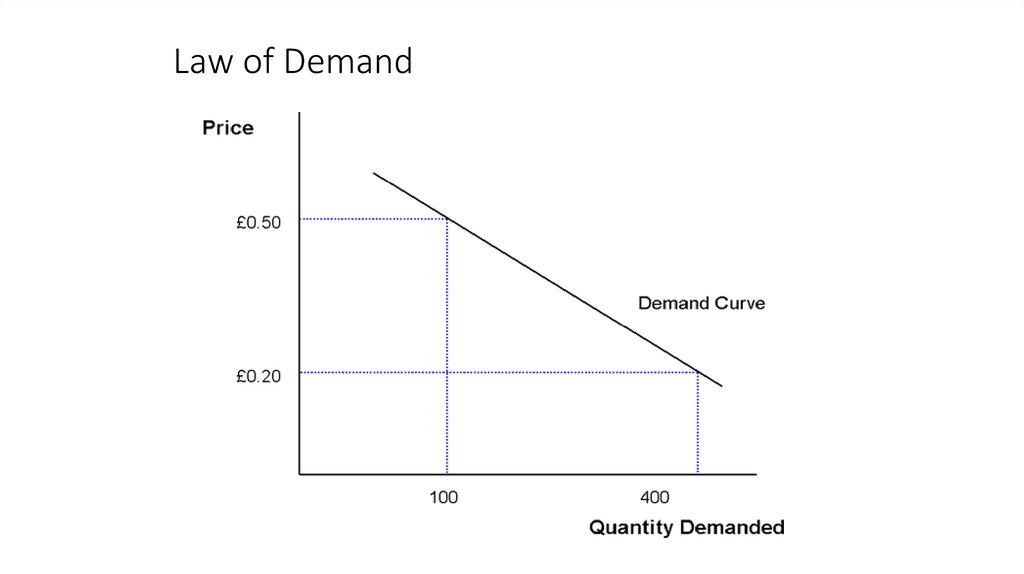

Law of Demand7.

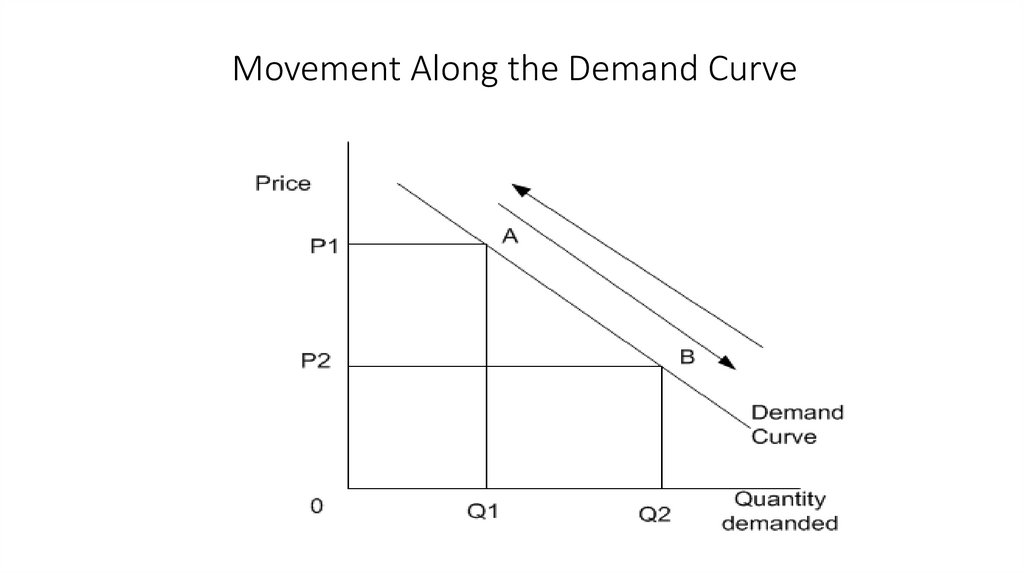

Movement Along the Demand Curve8.

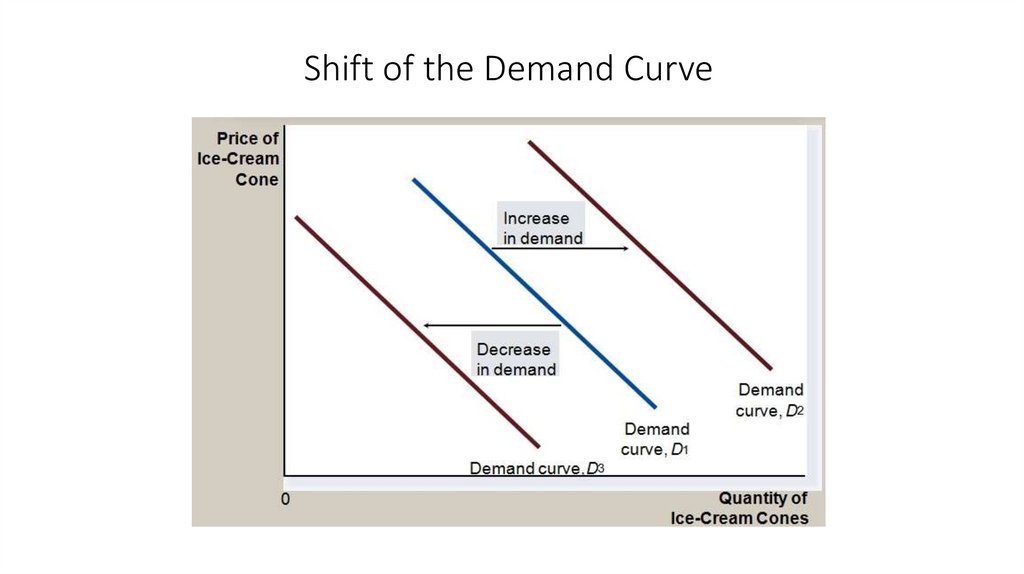

Shift of the Demand Curve9.

Changes in Market EquilibriumExercise

1.Why does the demand curve shift?

• To the right

• To the left

10.

Key terms• Income effect

• Substitutes-in-consumption

• Substitution effect

• Inferior goods

• Normal goods

• Independent goods

11.

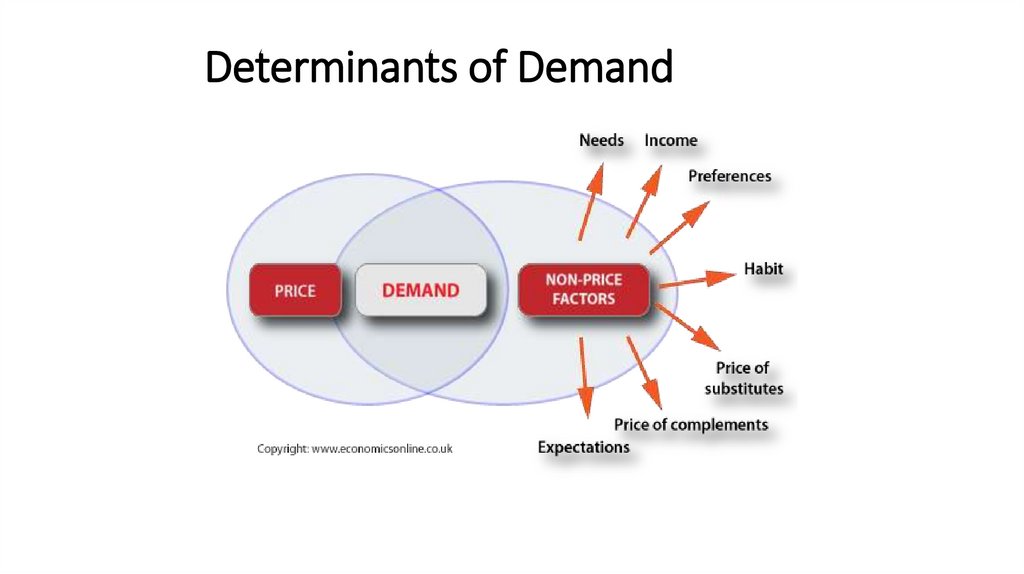

Determinants of Demand12.

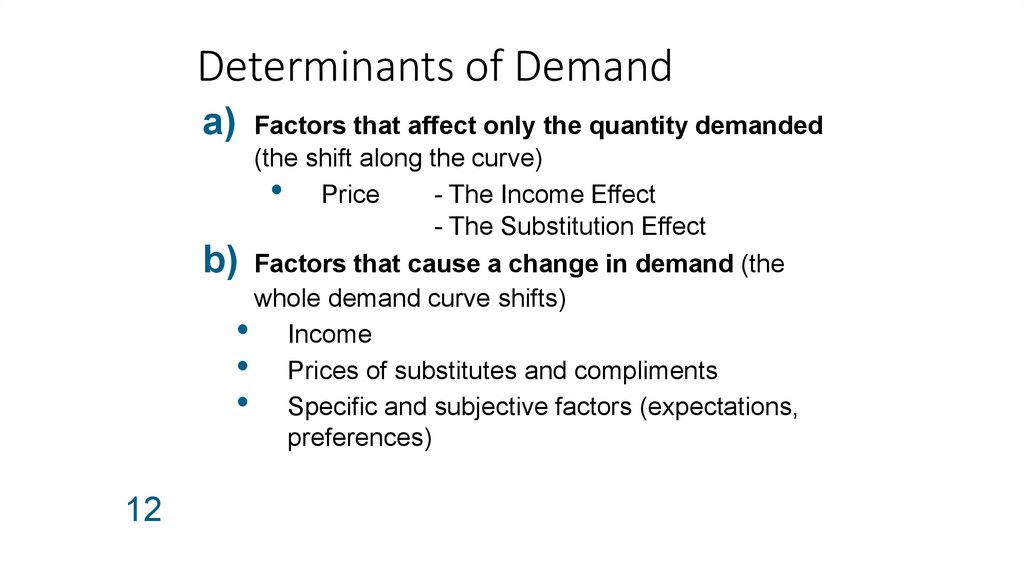

Determinants of Demanda) Factors that affect only the quantity demanded

(the shift along the curve)

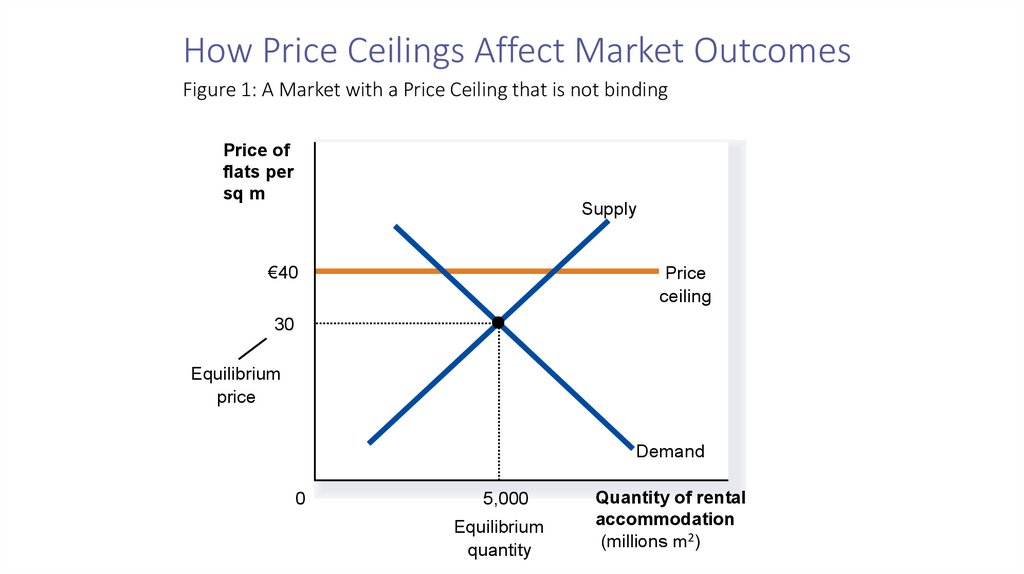

• Price - The Income Effect

- The Substitution Effect

b) Factors that cause a change in demand (the

whole demand curve shifts)

• Income

• Prices of substitutes and compliments

• Specific and subjective factors (expectations,

preferences)

12

13.

Exercise• Which of the following would not be a determinant of the

demand for a particular good?

a) prices of related goods

b) income

c) tastes

d) the prices of the inputs used to produce the good

e) fashion

14.

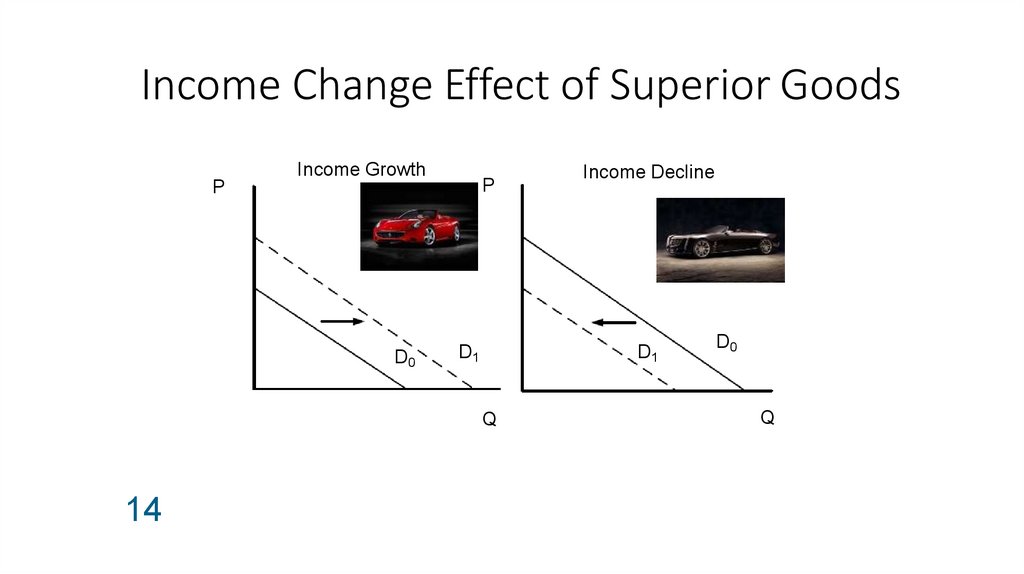

Income Change Effect of Superior GoodsP

Income Growth

D0

P

D1

D1

Q

14

Income Decline

D0

Q

15.

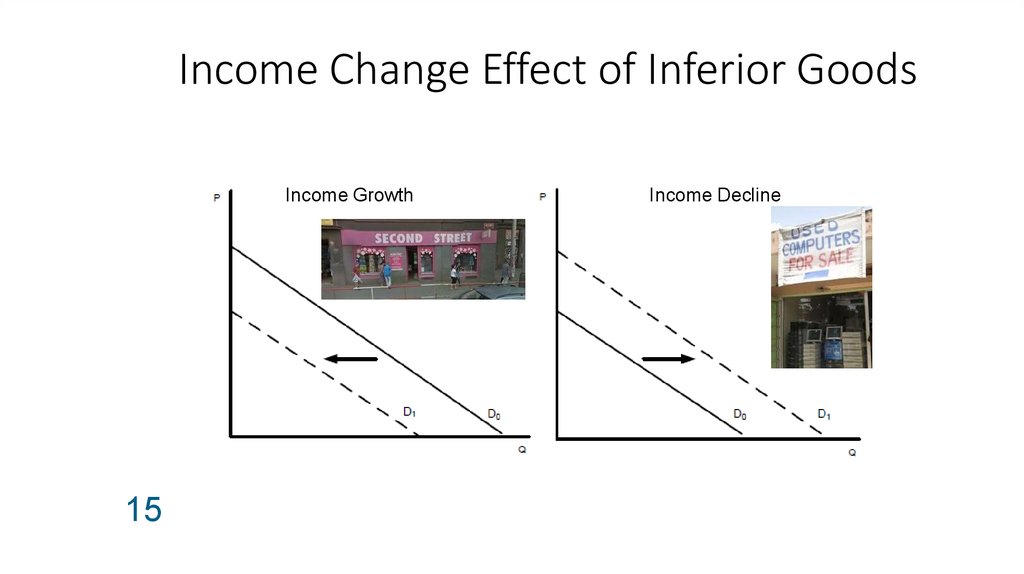

Income Change Effect of Inferior GoodsIncome Growth

15

Income Decline

16.

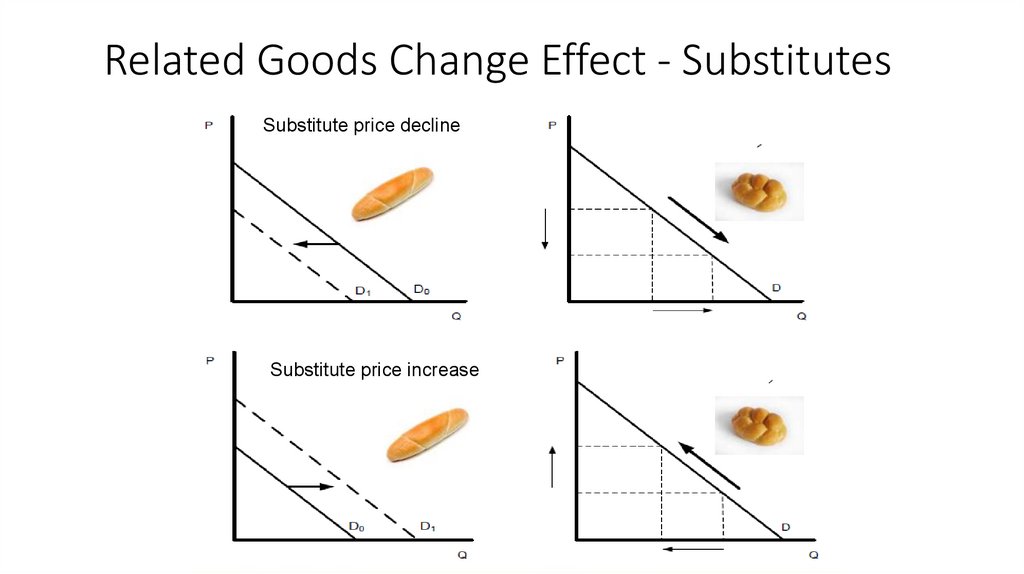

Related Goods Change Effect - SubstitutesSubstitute price decline

Substitute price increase

15

17.

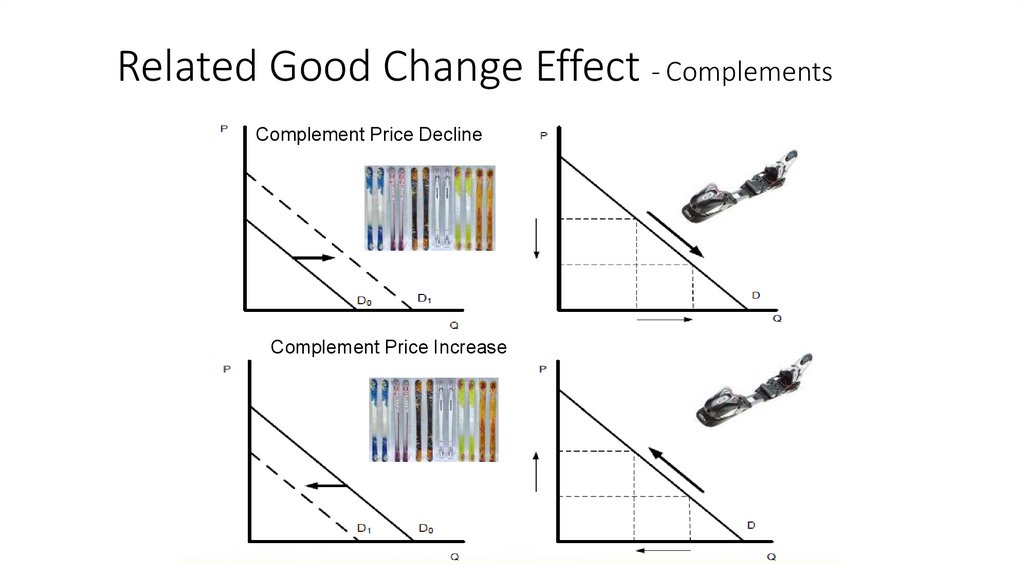

Related Good Change Effect - ComplementsComplement Price Decline

Complement Price Increase

16

18.

Self-test• What type of relationship do apps and smartphones have? If price of

smartphones increases, what do you expect to happen to the

demand of apps?

19.

Supply (S)• Supply - Quantity of goods that firms are willing

to sell at various prices

• Quantity supplied – the amount of a good that firms

want to sell at a given price (holding constant other

factors that influence firms‘ supply decisions, such

as costs and government actions)

• Supply curve – the quantity supplied at each

possible price (holding constant other factors that

can influence it)

19

20.

The Law of Supply• states that there is a positive (directly proportional)

relationship between the price and the quantity of

goods supplied

20

21.

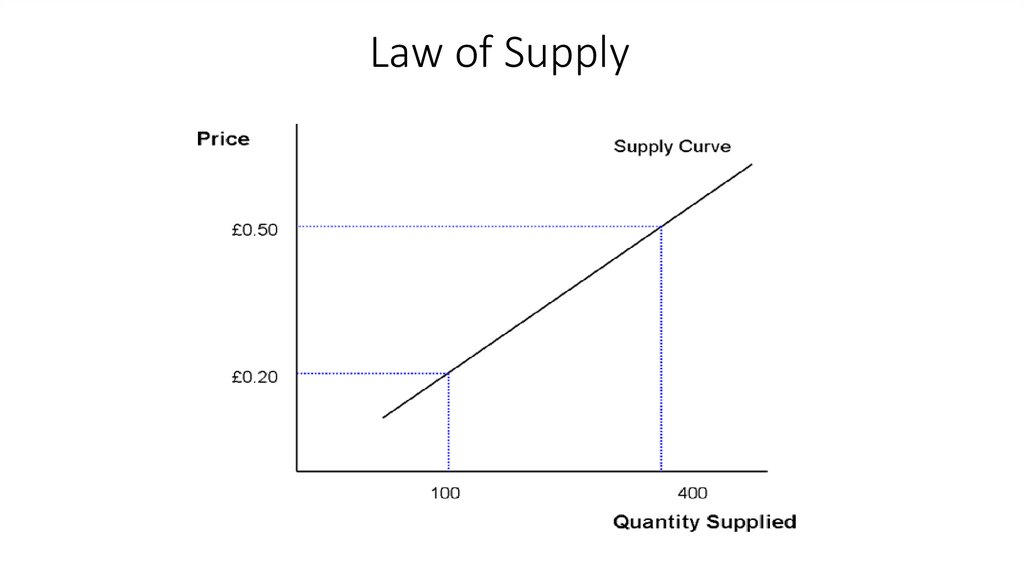

Law of Supply22.

Movement Along the Supply Curve23.

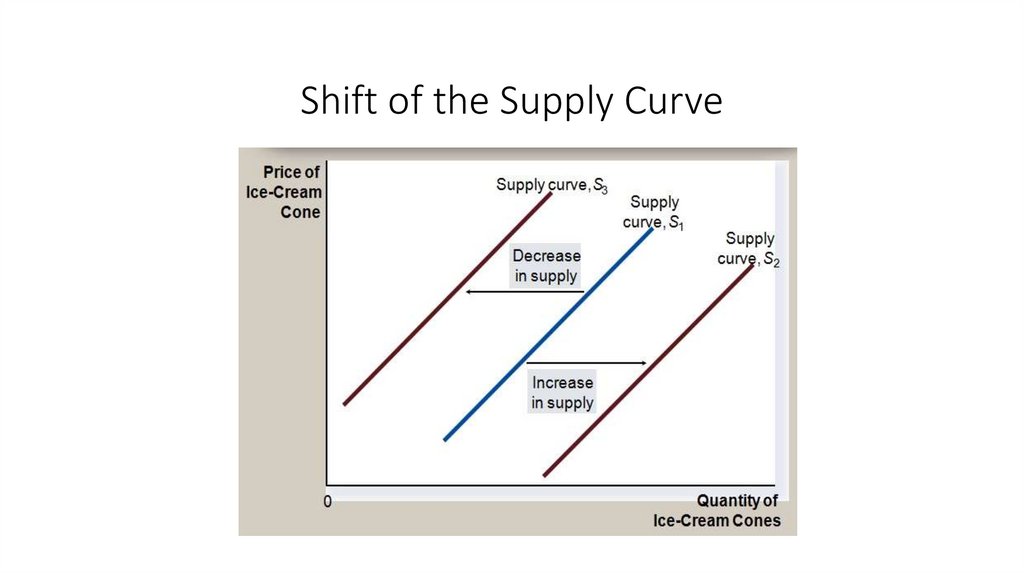

Shift of the Supply Curve24.

Changes in Market EquilibriumExercise

1.Why does the supply curve shift?

• To the right

• To the left

2. Why do supply curves slope upwards?

25.

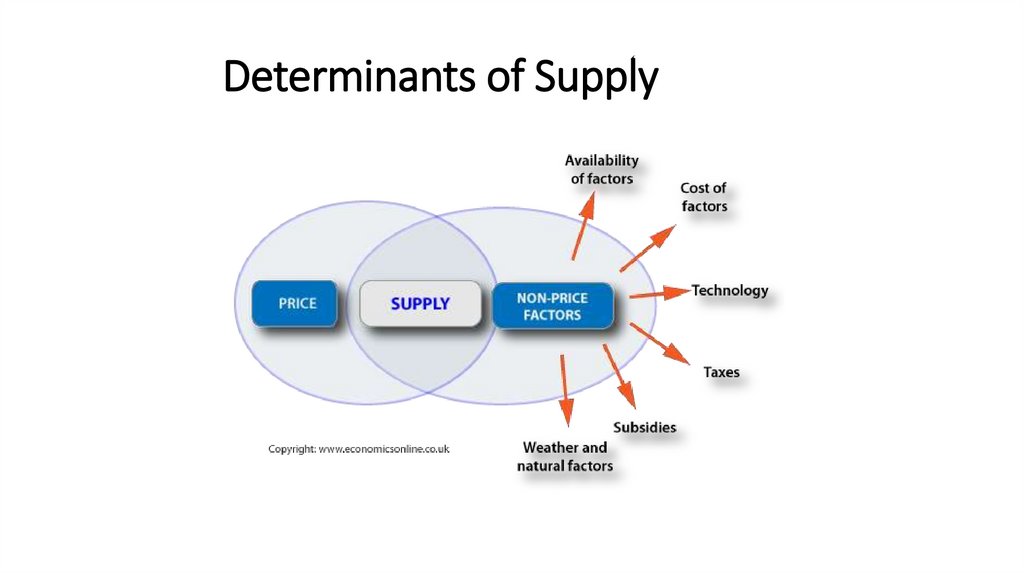

Determinants of Supply26.

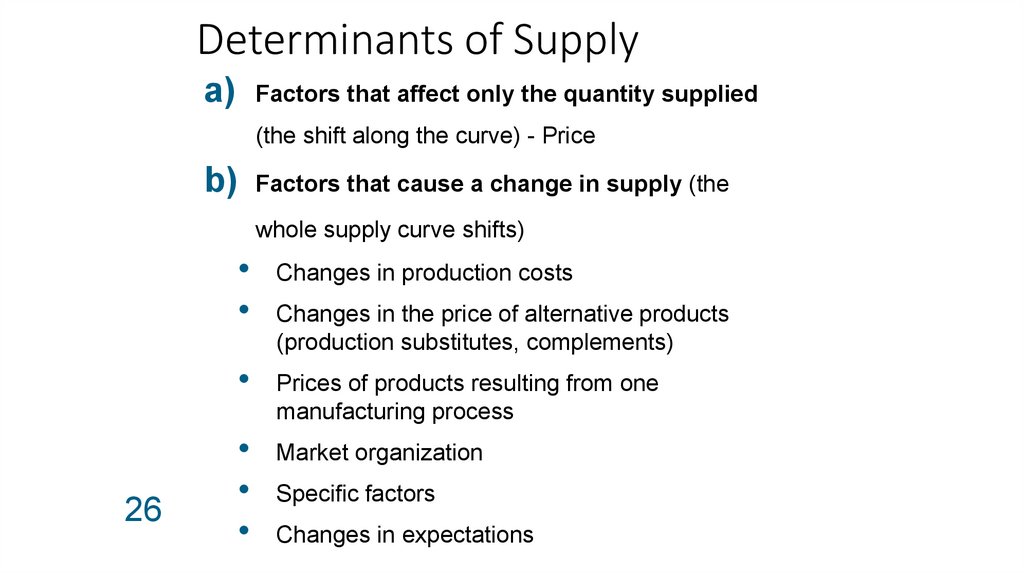

Determinants of Supplya) Factors that affect only the quantity supplied

(the shift along the curve) - Price

b) Factors that cause a change in supply (the

whole supply curve shifts)

26

Changes in production costs

Changes in the price of alternative products

(production substitutes, complements)

Prices of products resulting from one

manufacturing process

Market organization

Specific factors

Changes in expectations

27.

Determinants of Supply• Substitutes-in-production

• Complements-in-production

28.

How Will Future Supply and/or Quantity SuppliedChange?

(under the ceteris paribus assumption)

a) Boston Consulting predicts that Chinese companies

will use robots to reduce labor costs by 18%.

b) Jonathan, an executive automotive analyst for the

American Automobile Dealers Association's used car

guide, predict that prices of used cars will drop

between 2 and 2.5 percent in 2022.

c) Across the nation, there is talk of an increase in

minimum wage.

29.

How Will Supply and/or Quantity Supplied Change?(under the ceteris paribus assumption)

d) The median price of an existing single-family home

rose from a year earlier in 86% of the 175

metropolitan areas measured, the National

Association of Realtors said in an expert report.

How will this news influence behavior of building

contractors who construct multi-family apartment

buildings and single-family houses?

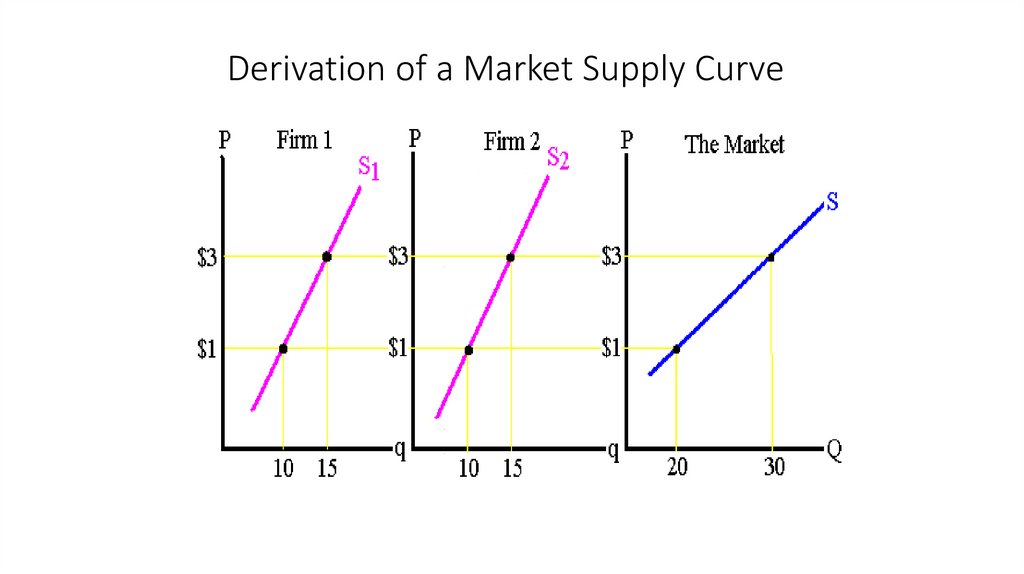

30.

Derivation of a Market Supply Curve31.

Exercise• If bread is an inferior good, then what will happen in the

market for bread as the consumer income increases?

a) the quantity will increase.

b) the quantity will decrease.

c) the price will fall.

d) both a) and c) are correct.

e) both b) and c) are correct.

32.

Exercise• Two goods are substitutes if a decrease in the price of one

good

a) decreases the demand for the other good.

b) decreases the quantity demanded of the other good.

c) increases the demand for the other good.

d) increases the quantity demanded of the other good.

e) doesn't influence the other good

f) increases the price of other good

33.

How Will Future Demand and/or Quantity Demanded Change?(under the ceteris paribus assumption)

a) With just a handful of exceptions, the latest round of

publication paper price negotiations ended with

manufacturers forced to make more concessions in

France (i.e. substantially cut their prices). How will

newspaper buyers react?

b) Chinese vintners are pinning their hopes on the 2022

Olympic Games. Why?

c) Apple will improve iPhone cameras with use of mirrors.

d) Gov. Sam Brownback has proposed large increases in

tobacco taxes from 10% of an item's wholesale price to

25% of that price.

34.

How Will Demand and/or Quantity Demanded Change?(under the ceteris paribus assumption)

e) In 2015 Canon reduced the price of their 4K

video DSLR, the Canon EOS 1DC, by $4,000.

How will this news affect Nikon D4S?

35.

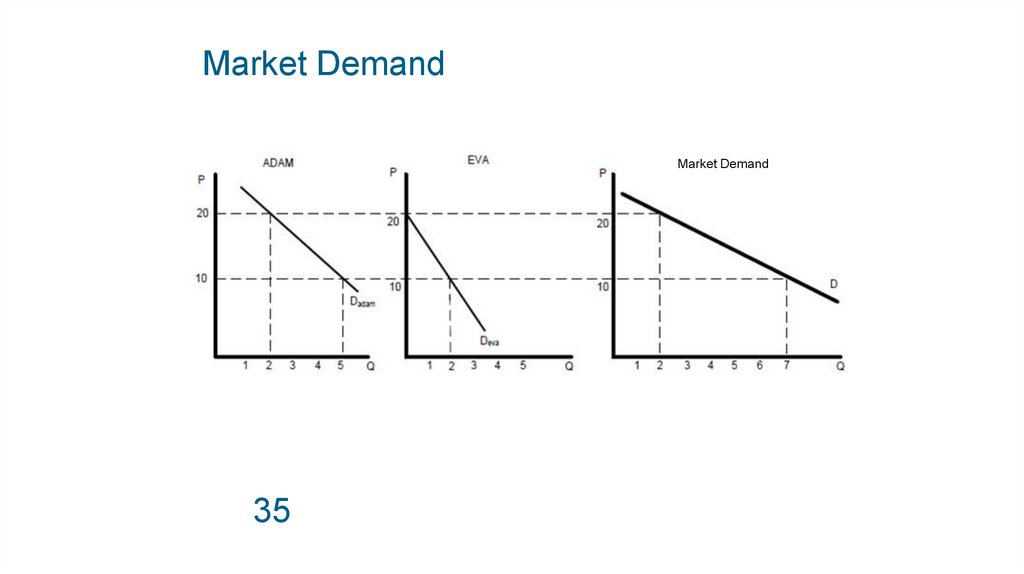

Market DemandMarket Demand

35

36.

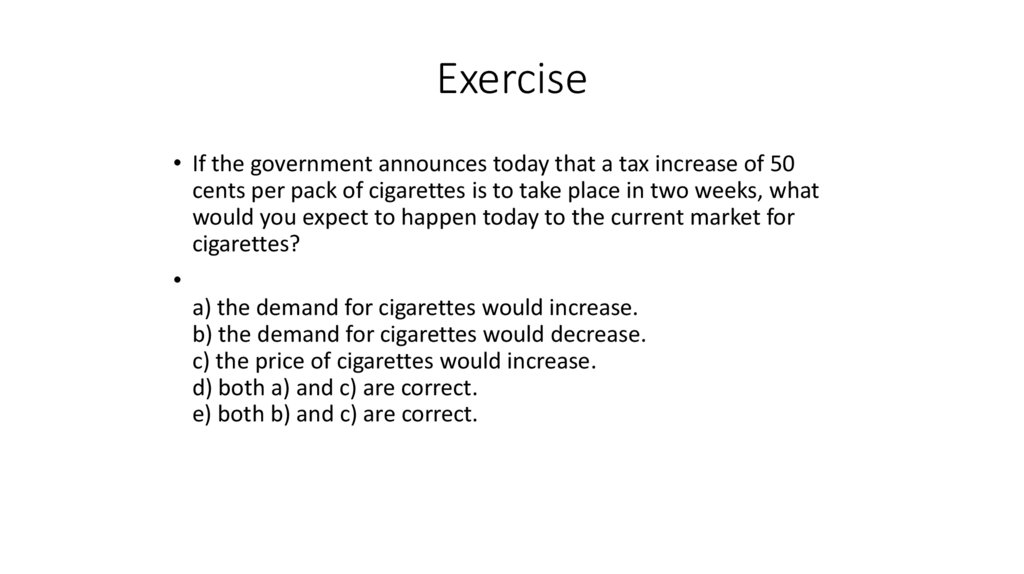

Exercise• If the government announces today that a tax increase of 50

cents per pack of cigarettes is to take place in two weeks, what

would you expect to happen today to the current market for

cigarettes?

a) the demand for cigarettes would increase.

b) the demand for cigarettes would decrease.

c) the price of cigarettes would increase.

d) both a) and c) are correct.

e) both b) and c) are correct.

37.

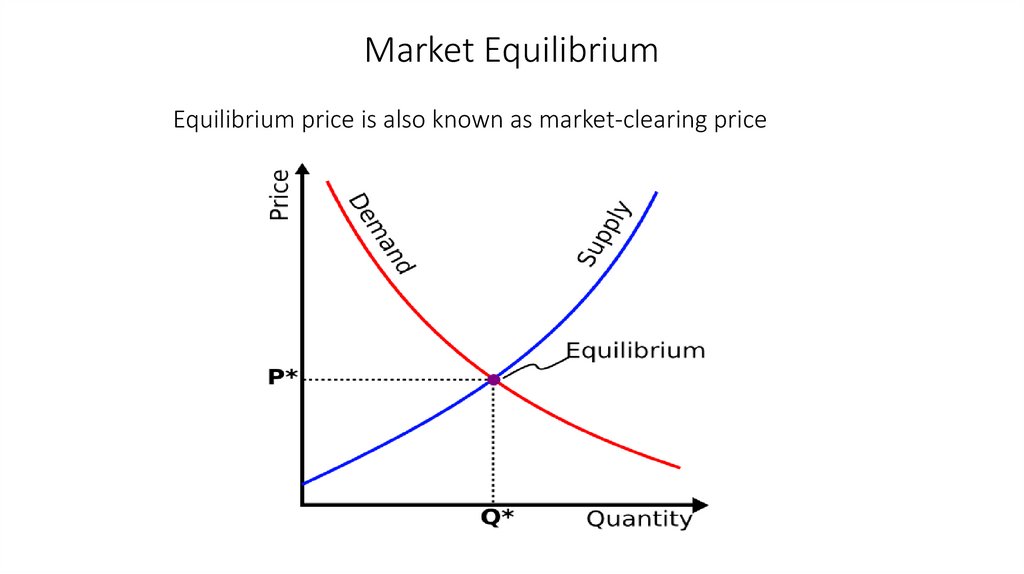

Market EquilibriumEquilibrium price is also known as market-clearing price

38.

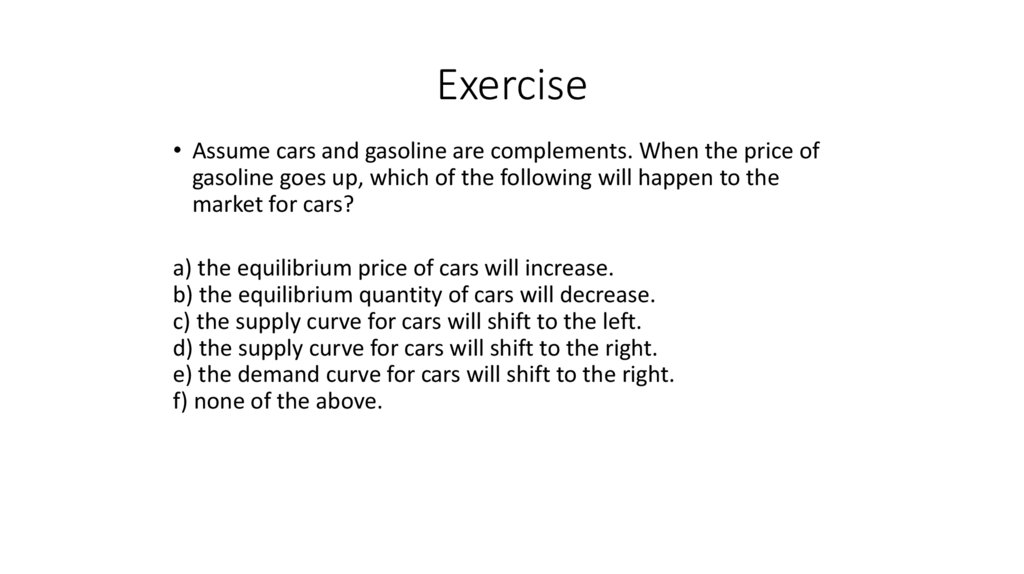

Exercise• Assume cars and gasoline are complements. When the price of

gasoline goes up, which of the following will happen to the

market for cars?

a) the equilibrium price of cars will increase.

b) the equilibrium quantity of cars will decrease.

c) the supply curve for cars will shift to the left.

d) the supply curve for cars will shift to the right.

e) the demand curve for cars will shift to the right.

f) none of the above.

39.

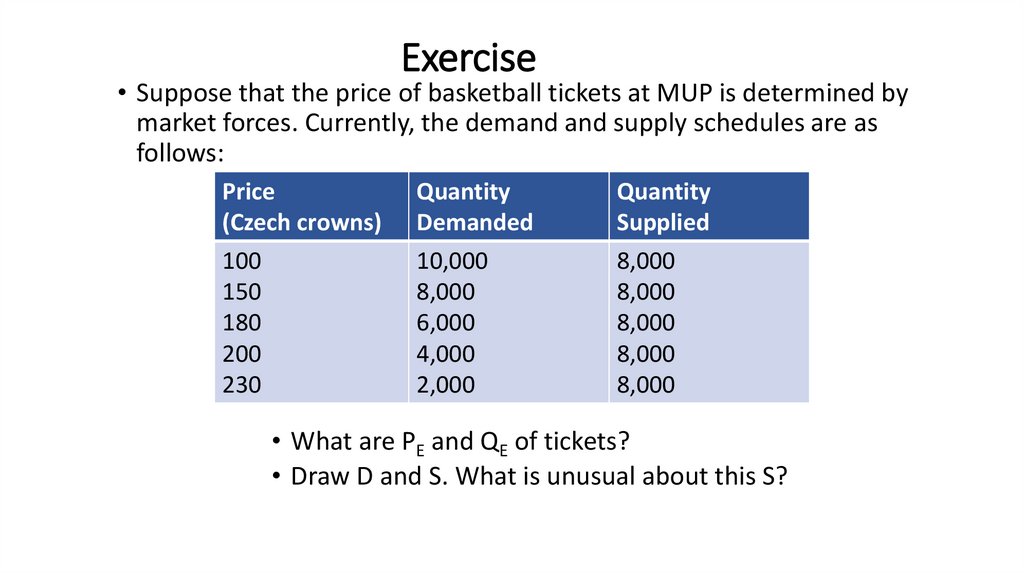

Exercise• Suppose that the price of basketball tickets at MUP is determined by

market forces. Currently, the demand and supply schedules are as

follows:

Price

(Czech crowns)

Quantity

Demanded

Quantity

Supplied

100

150

180

200

230

10,000

8,000

6,000

4,000

2,000

8,000

8,000

8,000

8,000

8,000

• What are PE and QE of tickets?

• Draw D and S. What is unusual about this S?

40.

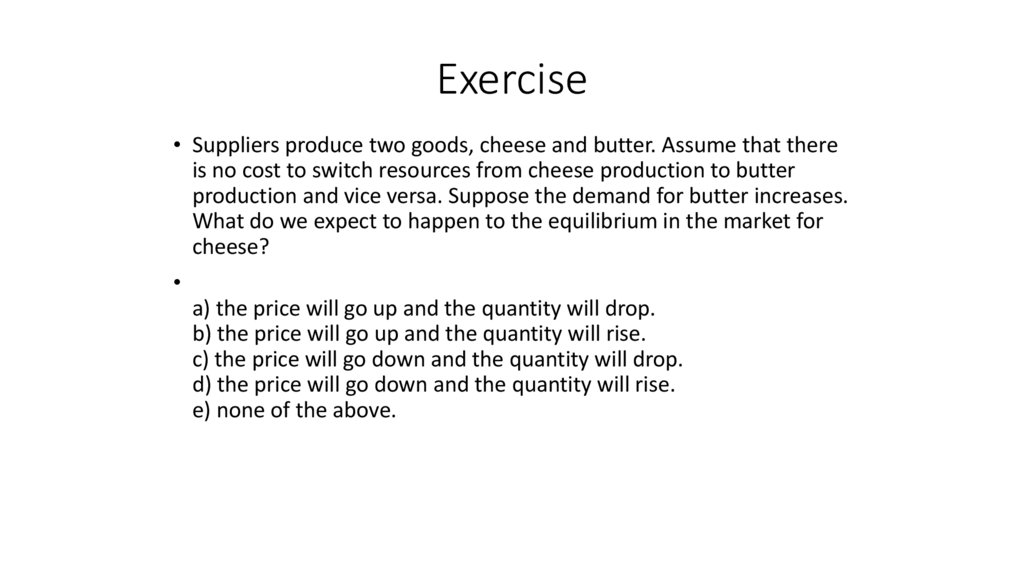

Exercise• Suppliers produce two goods, cheese and butter. Assume that there

is no cost to switch resources from cheese production to butter

production and vice versa. Suppose the demand for butter increases.

What do we expect to happen to the equilibrium in the market for

cheese?

a) the price will go up and the quantity will drop.

b) the price will go up and the quantity will rise.

c) the price will go down and the quantity will drop.

d) the price will go down and the quantity will rise.

e) none of the above.

41.

Relevant Literature• Mankiw „Principles of Microeconomics“: Chapter 4

(„The Market Forces of Supply and Demand“)

42.

I. Controls on Prices43.

Market Outcomes• In a free, unregulated market system, market forces establish equilibrium

prices and exchange quantities.

• While equilibrium conditions may be efficient, they may not always be fair.

• Governments seek to influence unfair markets.

44.

Price Ceiling and FloorPrice controls are usually enacted when policymakers believe the market

price is unfair to buyers or sellers.

•Result in government-created price ceilings and floors.

• Price Ceiling: A legal maximum on the price at which a good can be sold.

• Price Floor: A legal minimum on the price at which a good can be sold.

45.

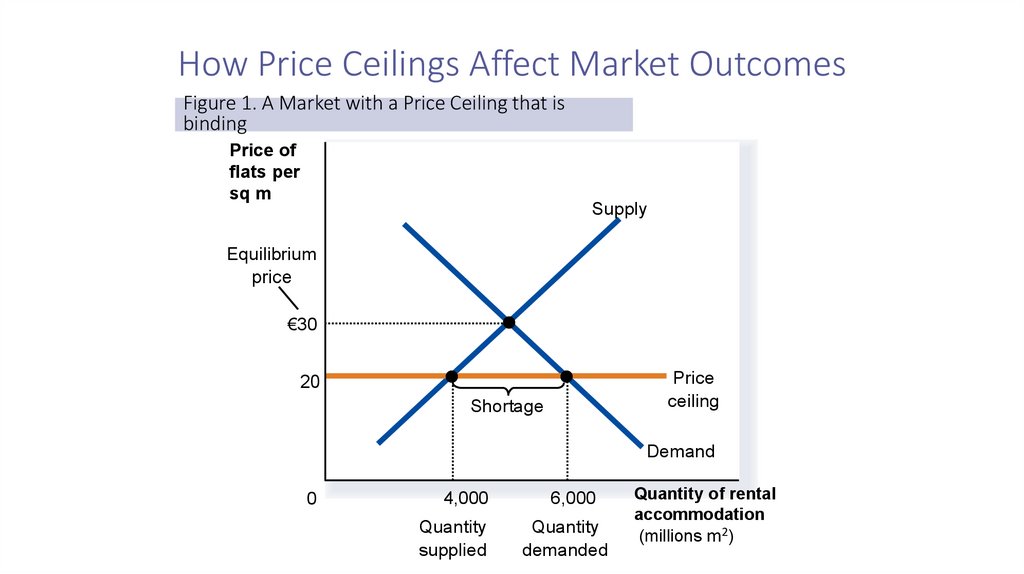

How Price Ceilings Affect MarketOutcomes

•When the government imposes a price ceiling there are two possible

outcomes:

• The price ceiling is not binding if set above the equilibrium price.

• The price ceiling is binding if set below the equilibrium price, leading to a shortage.

46.

How Price Ceilings Affect Market OutcomesFigure 1: A Market with a Price Ceiling that is not binding

Price of

flats per

sq m

Supply

€40

Price

ceiling

30

Equilibrium

price

Demand

0

5,000

Equilibrium

quantity

Quantity of rental

accommodation

(millions m2)

47.

How Price Ceilings Affect Market OutcomesFigure 1. A Market with a Price Ceiling that is

binding

Price of

flats per

sq m

Supply

Equilibrium

price

€30

Price

ceiling

20

Shortage

Demand

0

4,000

6,000

Quantity

supplied

Quantity

demanded

Quantity of rental

accommodation

(millions m2)

48.

How Price Ceilings Affect Market Outcomes• Effects of Price Ceilings

• A binding price ceiling creates

• Shortages because QD > QS. Example: Rent controls in a city may restrict new

building.

• Non-price rationing. Examples: Long queues; discrimination by sellers.

49.

50.

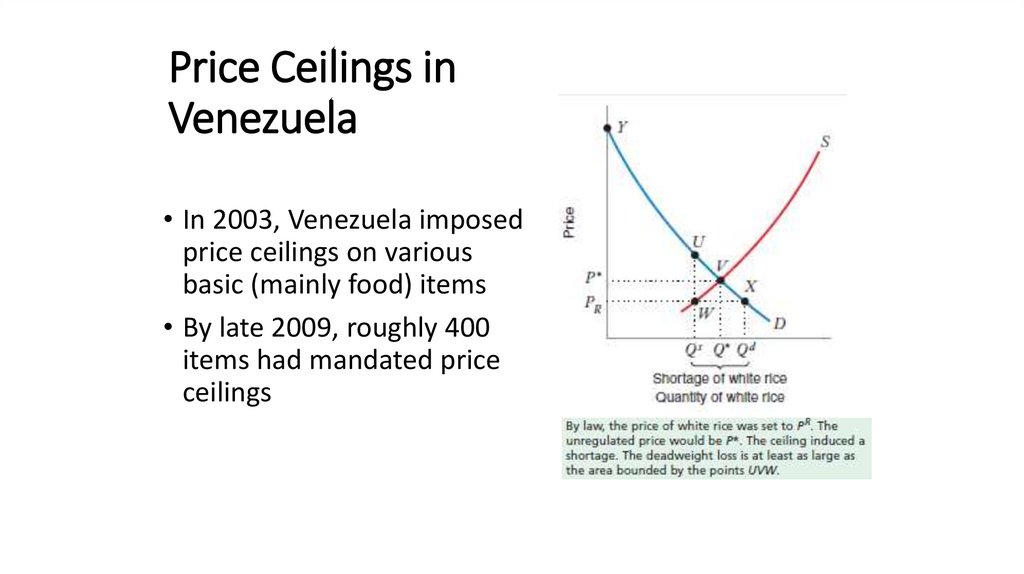

Price Ceilings inVenezuela

• In 2003, Venezuela imposed

price ceilings on various

basic (mainly food) items

• By late 2009, roughly 400

items had mandated price

ceilings

51.

Price Ceilings in Venezuela• Venezuela has been plagued by food shortages ever

since

• It has been difficult to find food at regulated prices

• Consumers had to wait in long lines

• In a 2012 survey, powdered milk could not be found

in 42 percent of grocery establishments

52.

Price Ceilings in Venezuela• Food companies have attempted to alter their

products to versions that are not regulated

• For example, the price of white rice is regulated, but

the price of flavoured rice is not

• Government imposed production quotas to force

producers to produce more of foods with price

ceilings

• Rice companies were required to have 80 percent of

their production sold as white rice

53.

Price Ceilings in Venezuela• Companies responded by limiting total production

• In 2009, the government seized control of several

food processing factories

• The government is also contending with increased

smuggling of low priced food into Columbia

54.

Price controls• In competitive markets, we do not expect to observe

shortages or surpluses (markets clear)

• Shortages or surpluses often result from government

controls of prices

55.

Price controls• Assume that a hurricane destroys roads and

buildings, and brings down power plants

• Consequently, many shops are closed and

supplies are interrupted

• Sellers take advantage of the situation and raise

prices to increase their profits

• Assume that you are a mayor of the affected

city

• Would you freeze prices in order to prevent the

increase in prices?

56.

How Price Floors Affect Market Outcomes•When the government imposes a price floor there are two possible

variations.

• The price floor is not binding if set below the equilibrium price.

• The price floor is binding if set above the equilibrium price, leading to a surplus.

57.

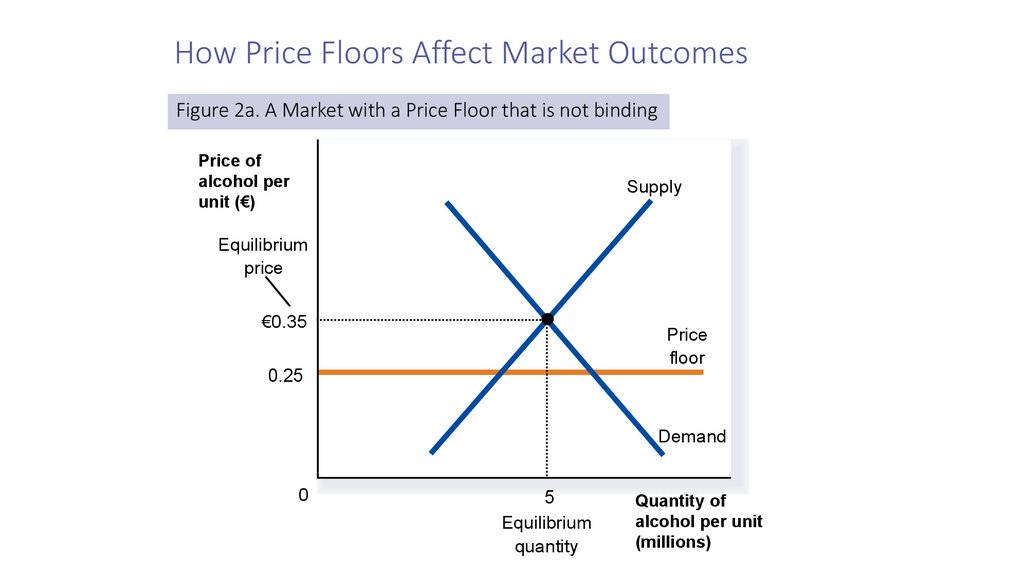

How Price Floors Affect Market OutcomesFigure 2a. A Market with a Price Floor that is not binding

Price of

alcohol per

unit (€)

Supply

Equilibrium

price

€0.35

Price

floor

0.25

Demand

0

5

Equilibrium

quantity

Quantity of

alcohol per unit

(millions)

58.

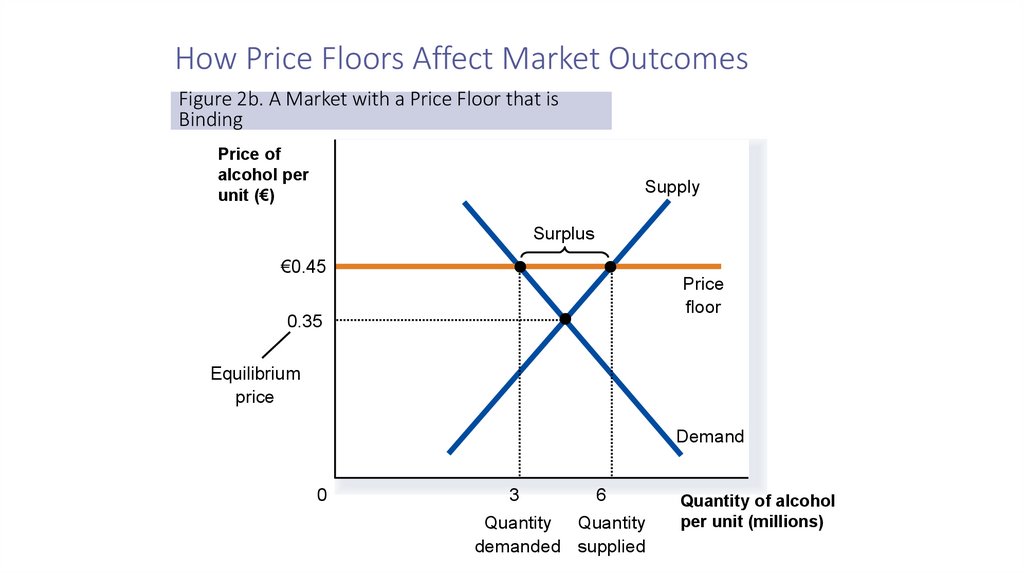

How Price Floors Affect Market OutcomesFigure 2b. A Market with a Price Floor that is

Binding

Price of

alcohol per

unit (€)

Supply

Surplus

€0.45

Price

floor

0.35

Equilibrium

price

Demand

0

3

6

Quantity Quantity

demanded supplied

Quantity of alcohol

per unit (millions)

59.

Price FloorThe minimum prices of production (price higher than the equilibrium)

QD <QS

E.g. subsidized prices of agricultural produce. There is

overproduction.

60.

How Price Floors Affect Market Outcomes• A price floor prevents supply and demand from moving toward the

equilibrium price and quantity.

• When the market price hits the floor, it can fall no further, and the market price equals

the floor price.

• A binding price floor causes a surplus because QS > QD.

61.

Price Controls• Price controls are used when governments or other agencies believe that the

market is not allocating resources equitably (even if it is allocating resources

efficiently).

• But there are other options which we will now explore.

62.

Video• https://youtu.be/dnj2WRIG11U?si=-ck8TnpEz1cilBA5

63.

II. Taxes64.

Introduction to Taxes• Governments levy taxes to raise revenue for public projects.

• However,

• Taxes discourage market activity.

• When a good is taxed, the quantity sold is smaller.

• Buyers and sellers share the tax burden.

65.

Introduction to Taxes•A direct tax is levied on income and wealth

•Indirect tax is levied on the sale of goods and

services.

66.

How Taxes on Sellers Affect Market Outcomes• A Specific Tax where the government requires the seller to pay a certain

amount for each good sold.

• Quantity sold falls.

• Even though the tax is levied on sellers, buyers and sellers will share the burden of

the tax; buyers pay more for the good and sellers receive less (because of the tax).

67.

Elasticity and Tax Incidence•Implications of tax.

• Taxes result in a change in market equilibrium. Taxes discourage market activity.

• Buyers pay more and sellers receive less, regardless of whom the tax is levied on.

Buyers and sellers share the tax burden.

Tax incidence is the manner in which the burden of a tax is shared among market

participants.

68.

IV. The Tax System69.

Taxes and Efficiency• Governments raise taxes to:

Help pay for the various services that government provides.

Influence behaviour and achieve market outcomes that are deemed

desirable.

• The Cost of Taxes to Taxpayers.

The tax payment itself.

Deadweight losses.

Administrative burdens.

70.

Taxes and EfficiencyTwo objectives when designing a tax system are efficiency

and equity.

One tax system is more efficient than another if it raises the same

amount of revenue at a smaller cost to taxpayers and the

government.

Efficient taxes have small deadweight losses and low administrative

burdens.

Taxes affect consumer and producer behaviour and produce

different market outcomes compared to free market outcomes.

71.

V. The Deadweight Loss ofTaxation

72.

An Introduction• A tax on a product means:

• The price that a buyer pays will be greater than the price the seller receives.

•Tax Revenue

• T = the size of the tax

• Q = the quantity of the good sold

T Q = the government’s tax revenue

73.

Deadweight Loss and Tax Revenue as Taxes Varyo For the small tax, tax revenue is small.

o As the size of the tax rises, tax revenue grows.

o But as the size of the tax continues to rise, tax revenue falls because the higher

tax reduces the size of the market.

o

As the tax increases, the level of tax revenue will eventually fall.

74.

VI. Administrative Burden75.

A Second Cost of Tax• Complying with tax laws creates additional deadweight losses.

• Taxpayers spend time and money documenting, computing, and filling

tax forms.

• These are additional administrative costs they incur, over and above

the actual taxes they pay.

• The administrative burden of any tax system is part of the inefficiency it

creates.

76.

VII. The Design of the Tax System77.

Adam Smith’s Four Canons of Taxation1. Equality

o Each person should pay taxes according to their

ability to pay.

2. Certainty

o

Taxpayers need to know what taxes they owe, and governments

should have some certainty in how much they are able to collect in

taxes.

3. Convenience

o

Paying taxes should be made as easy as possible

4. Economic

o

The cost of collecting and administering taxes must be less than the

amount collected.

78.

Marginal Tax Rates versus Average Tax Rates•The average tax rate is total tax paid divided by total income.

•The marginal tax rate is the extra tax paid on an additional pound of

income.

79.

Lump-Sum Taxes• A lump-sum tax is a tax that is the same amount for every person,

regardless of earnings or any actions that the person might take.

• For this type of tax, the marginal tax rate is equal to zero.

• This is the most efficient type of tax.

• It does not distort incentives

• Little administrative burden

80.

Summary1)

2)

3)

4)

5)

6)

Price controls include price ceilings and price floors.

A price ceiling is a legal maximum on the price of a good or service. An example is rent control.

A price floor is a legal minimum on the price of a good or a service. An example is the minimum

wage.

Taxes are used to raise revenue for public purposes.

The incidence of the tax depends on the price elasticities of supply and demand.

The burden tends to fall on the side of the market that is less price elastic.

81.

Summary7)

A tax on a good reduces the welfare of buyers and sellers of

the good, and the reduction in consumer and producer

surplus usually exceeds the revenues raised by the

government.

8)

The fall in total surplus—the sum of consumer surplus,

producer surplus, and tax revenue — is called the

deadweight loss of the tax.

9)

Taxes have a deadweight loss because they cause buyers to

consume less and sellers to produce less.

10) This change in behaviour shrinks the size of the market

below the level that maximizes total surplus.

Экономика

Экономика