Похожие презентации:

7. Evaluating the solutions effectiveness

1. 7. Evaluating the solutions effectiveness

USTSINOVICH IRINAMANAGERIAL ECONOMICS

7. EVALUATING THE SOLUTIONS

EFFECTIVENESS

2. 7. Evaluating the solutions effectiveness

7. EVALUATING THE SOLUTIONS EFFECTIVENESS1. Procedure and methodology for drawing up an investment plan

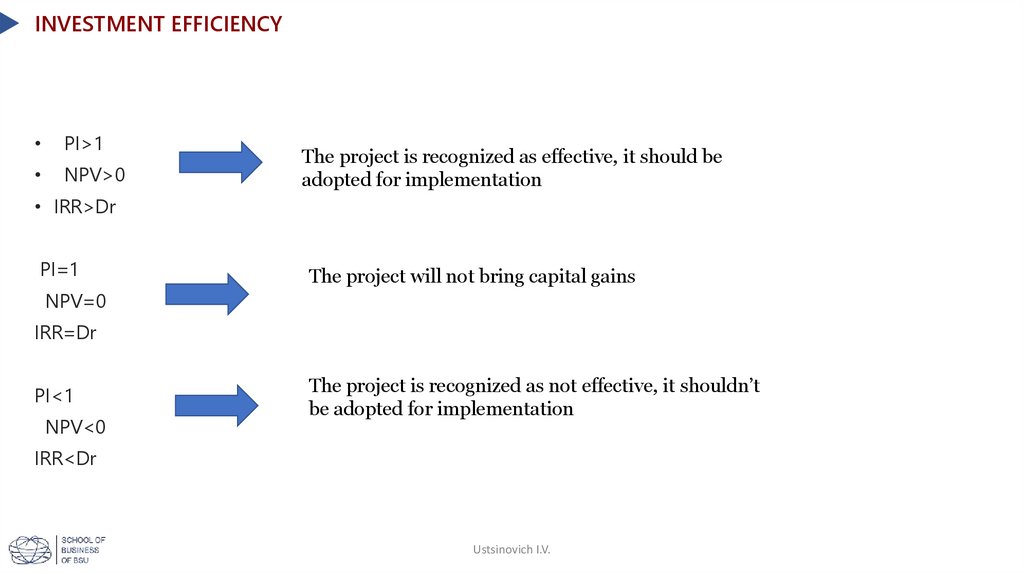

2. Methodology for evaluating investment projects

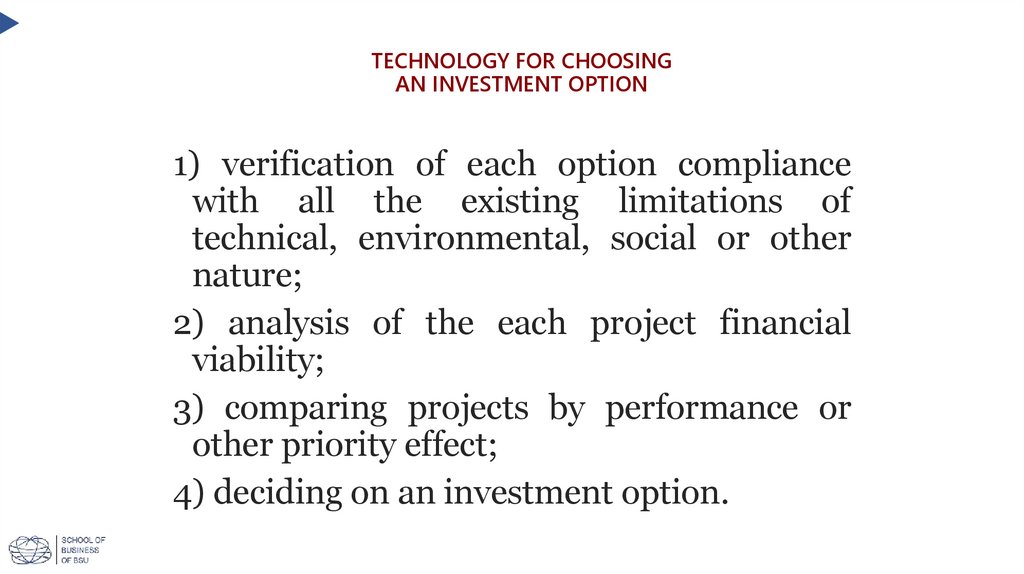

3. Alternative projects analysis

Ustsinovich I.V.

3. 1. Procedure and methodology for drawing up an investment plan

1. PROCEDURE AND METHODOLOGY FOR DRAWING UP ANINVESTMENT PLAN

Ustsinovich I.V.

4. Concept

CONCEPTInvestments are any property and other civil rights assets held by the investor on the

right of ownership invested by the investor in order to generate profit (income) and/or

achieve other meaningful results or for other purposes not related to personal, family,

home and other such uses.

Investment activity is a set of practical actions of legal entities, citizens and the state to

implement investments.

Ustsinovich I.V.

5.

THE INVESTMENT PLANThe investment plan includes the calculation and

justification of:

• fixed-asset investment;

• cost increase in net working capital;

• financial costs.

6.

TOTAL INVESTMENT COSTSTotal investment costs are defined as the amount:

• а) investment in fixed assets (capital expenditures) including value added tax

• b) cost increase in net working capital

In the business plan, the total investment costs and their sources of financing are shown in a table:

• Table of total investment costs and sources of financing

7. Total investment costs

TOTAL INVESTMENT COSTSTotal investment costs:

Capital expenditures (VAT-free)

Pre-investment costs

Acquisition and installation of fixed assets objects

Pre-production costs

Other investment costs

Vat (tax)

Increase in net working capital (difference

between working capital by year)

8. Net working capital calculating

NET WORKING CAPITAL CALCULATING• Net working capital is the difference between short-term

assets and short-term liabilities.

• Short-term assets are assets that the company is going to

turn into cash in the near future.

• Short-term liabilities are liabilities that it intends to pay off in

the near future.

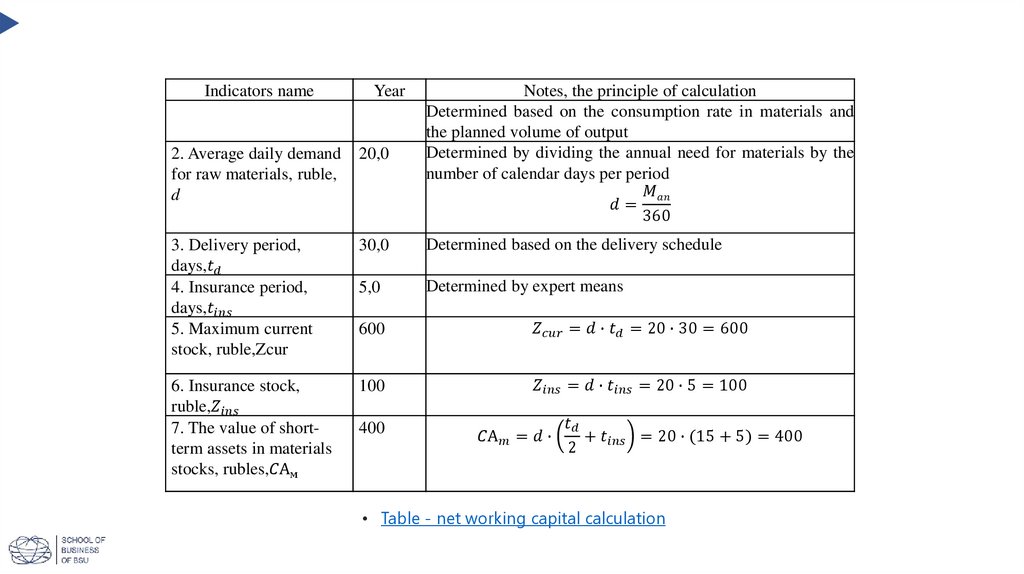

9.

2. Average daily demandfor raw materials, ruble,

d

20,0

Notes, the principle of calculation

Determined based on the consumption rate in materials and

the planned volume of output

Determined by dividing the annual need for materials by the

number of calendar days per period

Финансы

Финансы