Похожие презентации:

Week 1 L 1-3

1. Economics

GRADE: 122. Term 2

Economic stability and macroeconomic indicators(SAU1 Week 3)

International trade and foreign exchange markets

(SAU2 Week 5/6)

3. Lesson objectives

Understand main macroeconomics indicatorsDistinguish real and nominal GDP

Understand how to calculate nominal and real GDP and GDP deflator

4. Macroeconomic indicators

o key statistical data that reflect the economiccircumstances of a particular country, region or sector

o used by analysts and governments to assess the current

and future health of the economy and financial markets.

5. Key macroeconomic indicators

• GDP (gross domestic product)• Inflation Rate

• Unemployment Rate

• Real Estate Market

• Interest Rates

• Balance of Payments

6.

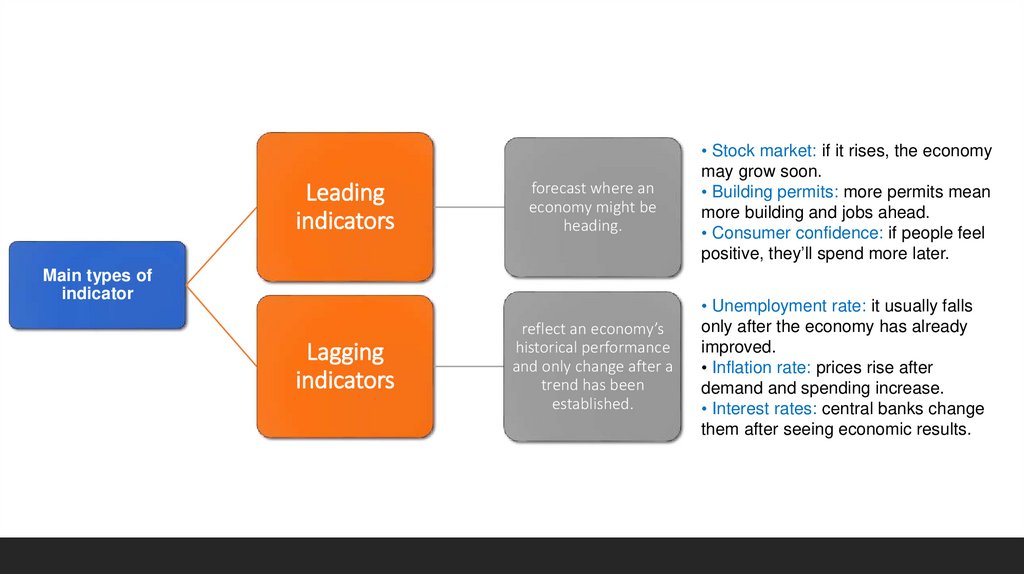

Leadingindicators

forecast where an

economy might be

heading.

• Stock market: if it rises, the economy

may grow soon.

• Building permits: more permits mean

more building and jobs ahead.

• Consumer confidence: if people feel

positive, they’ll spend more later.

reflect an economy’s

historical performance

and only change after a

trend has been

established.

• Unemployment rate: it usually falls

only after the economy has already

improved.

• Inflation rate: prices rise after

demand and spending increase.

• Interest rates: central banks change

them after seeing economic results.

Main types of

indicator

Lagging

indicators

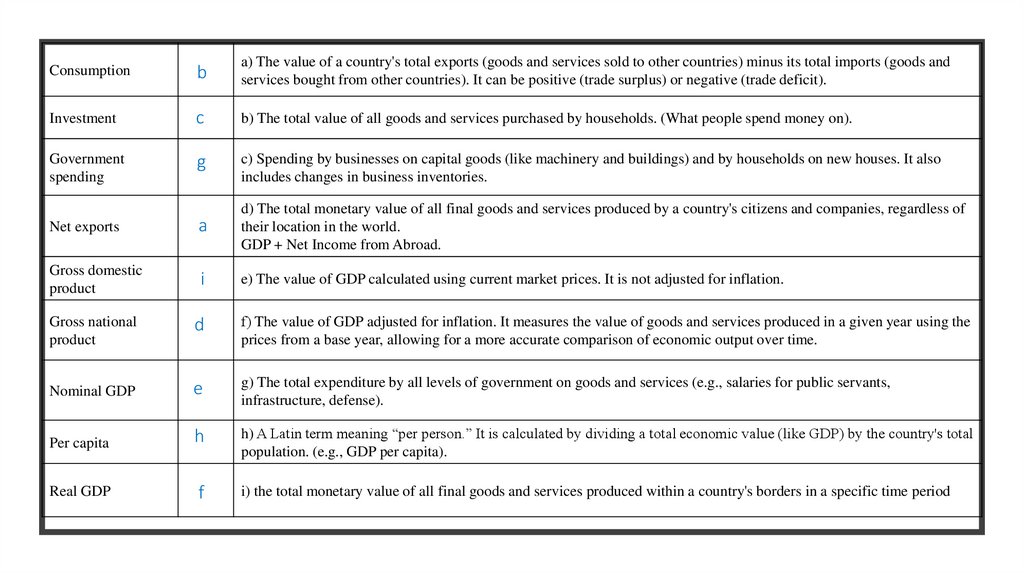

7. Vocabulary

Match the words/phrases with their definitions.Pair check

8.

Consumptionb

a) The value of a country's total exports (goods and services sold to other countries) minus its total imports (goods and

services bought from other countries). It can be positive (trade surplus) or negative (trade deficit).

Investment

c

b) The total value of all goods and services purchased by households. (What people spend money on).

Government

spending

g

c) Spending by businesses on capital goods (like machinery and buildings) and by households on new houses. It also

includes changes in business inventories.

Net exports

a

d) The total monetary value of all final goods and services produced by a country's citizens and companies, regardless of

their location in the world.

GDP + Net Income from Abroad.

Gross domestic

product

i

e) The value of GDP calculated using current market prices. It is not adjusted for inflation.

Gross national

product

d

f) The value of GDP adjusted for inflation. It measures the value of goods and services produced in a given year using the

prices from a base year, allowing for a more accurate comparison of economic output over time.

Nominal GDP

e

g) The total expenditure by all levels of government on goods and services (e.g., salaries for public servants,

infrastructure, defense).

Per capita

h

h) A Latin term meaning “per person.” It is calculated by dividing a total economic value (like GDP) by the country's total

population. (e.g., GDP per capita).

Real GDP

f

i) the total monetary value of all final goods and services produced within a country's borders in a specific time period

9. Calculate nominal and real GDP and GDP deflator

Group work (max 3 people in a group)o Read the given material.

o Identify the definition of nominal GDP, real GDP or GDP deflator.

o Identify how to calculate each of them.

o Discuss with your group members.

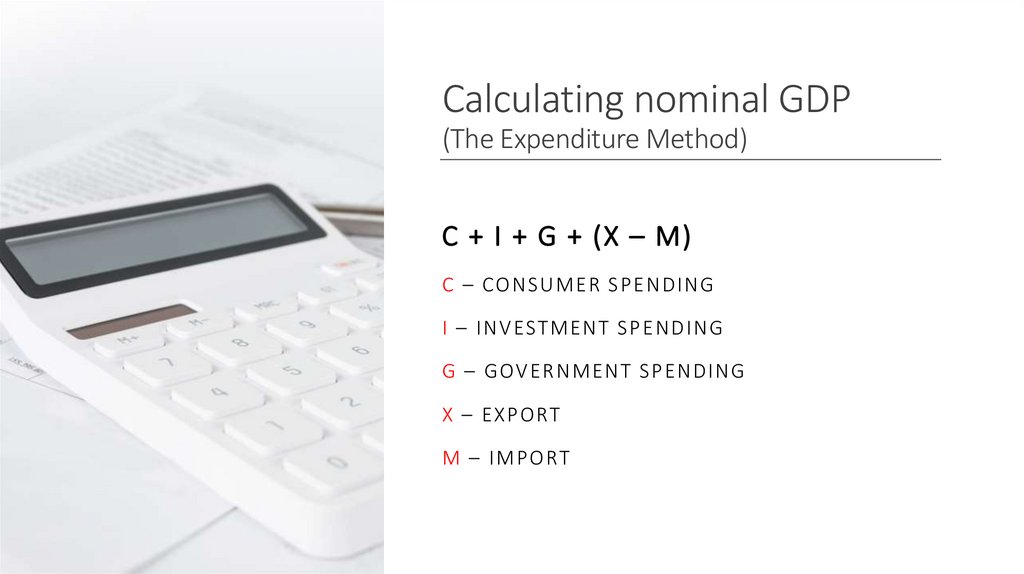

10. Calculating nominal GDP (The Expenditure Method)

C + I + G + (X – M)C – CON S UMER S P E NDING

I – I N V ESTMENT S P E NDING

G – G OV E R NMENT S P E NDING

X – E X P ORT

M – I M P ORT

11. Calculating nominal GDP The Output (Production) Method

MULTIPLY THE CURRENT YEAR QUANTITY OUTPUTBY THE CURRENT MARKET PRICE.

12. Calculating real GDP

USE BASE YEAR PRICES AND MULTIPLYTHEM BY CURRENT YEAR QUANTITIES

FOR ALL THE GOODS AND SERVICES

PRODUCED IN AN ECONOMY

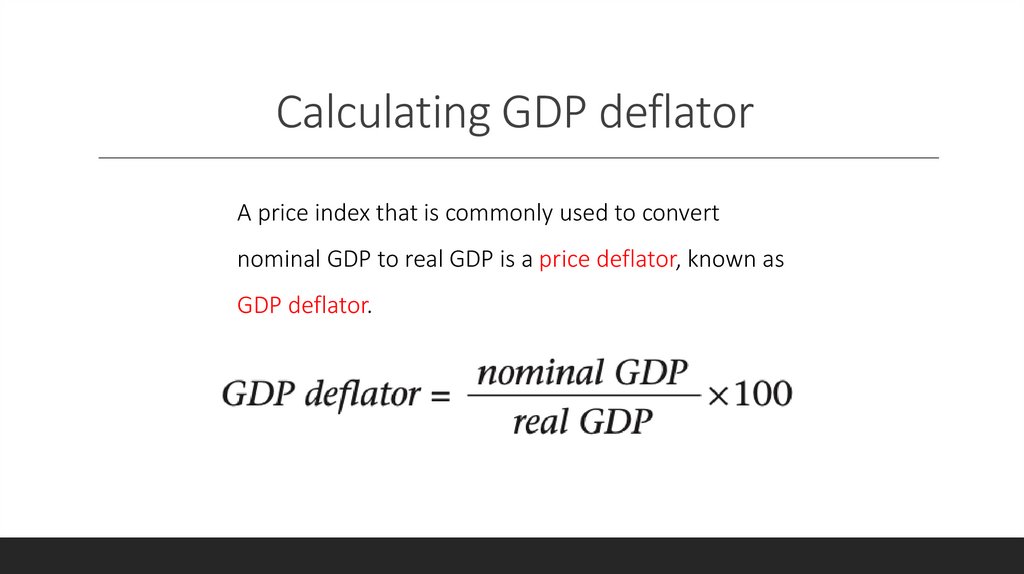

13. Calculating GDP deflator

A price index that is commonly used to convertnominal GDP to real GDP is a price deflator, known as

GDP deflator.

14. Formative assessment

Calculation nominal GDP, real GDP and GDP deflator(individual work).

Assessment criteria

o nominal GDP, real GDP, and the GDP deflator are accurately

calculated using appropriate formulas.

o calculations and explanations are presented clearly and

logically

15. Discussion

• If Real GDP increases, what might that tell us about jobs and production in thecountry?

• Do you think GDP always shows how well people are living? Why or why not?

• Why do governments pay attention to GDP data every year?

16. Additional

17. Inflation

18. Discuss

1. What does inflation mean?2. Is it a good or a bad thing?

3. In what countries has inflation been particularly

prevalent?

4. What evidence of inflation have you seen?

19. Inflation: What It Is, Where It Comes From and How It Can Bite You

Make notes on the following questions:• What are the causes of inflation?

• What can a government do to help restrain the negative e ects of inflation?

• How does inflation a ect everyday people?

20. Degrees of inflation

• Creeping Inflation - the price level increase at a very slow rate over a period of time. The inflation rate islow and steady.

• Hyperinflation - is the worst kind of inflation; it is a situation where inflation is increasing at a rate of

several hundred % per year.

• Accelerating inflation - the general price level is increasing at a more rapid rate.

• Walking inflation - refers to the rise in the price level at a higher rate than the creeping inflation. Price

level will increase by 5% per annum. Unless this is controlled, it will lead to running inflation.

• Running inflation - The rate at which the price level increases in this period is very high, may be even

above 10%.

• Stagflation - an economic situation with a prolonged period of little or no growth and inflation and

unemployment occur at the same time. (stagnation).

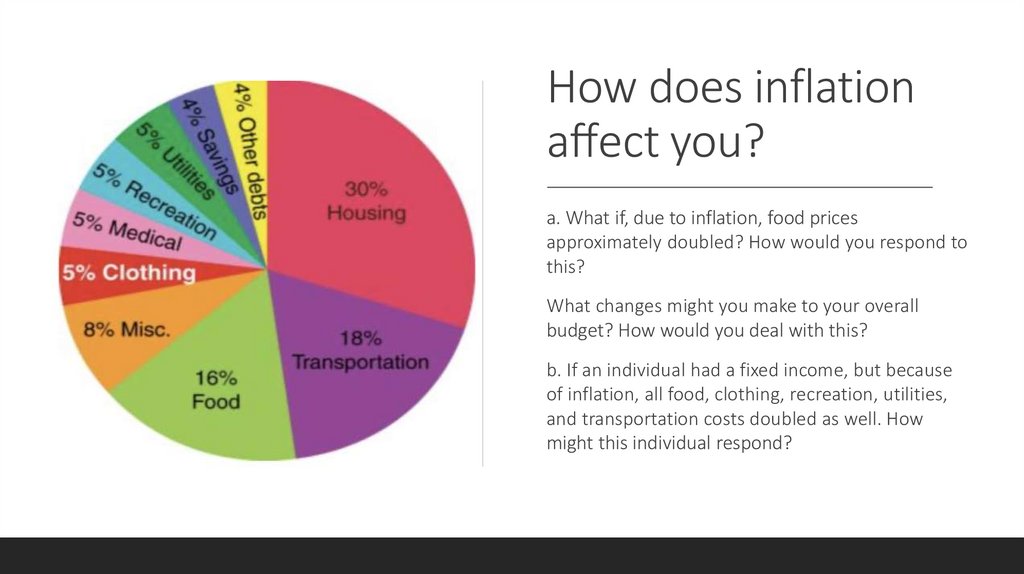

21. How does inflation affect you?

How does inflationa ect you?

a. What if, due to inflation, food prices

approximately doubled? How would you respond to

this?

What changes might you make to your overall

budget? How would you deal with this?

b. If an individual had a fixed income, but because

of inflation, all food, clothing, recreation, utilities,

and transportation costs doubled as well. How

might this individual respond?

22. Group work

Choose one cause and prepare a short presentation focusing on the following key points:Describe the cause.

Give at least one example.

How would this particular event a ect everyday citizens and consumers?

What could governments do to respond to this?

What could individuals do to respond to this?

Экономика

Экономика