Похожие презентации:

Economic nature of taxes

1. Learning objectives

Economic nature of taxes.The basis of structure of taxes and taxation.

The tax system of RK: stages of

development and contemporary conditions.

2. Basic terminology

tax agent — a person who in accordancewith this Code is entrusted with the duty of

assessment, withholding and transfer of

taxes withheld at source of payment;

taxes — obligatory monetary payments to

the budget as established by the state

through legislation in a unilateral procedure,

except for the cases specified in this Code,

which are paid in certain amounts, which

are irrevocable and non-refundable

3. Basic terminology

Atax can be defined as a payment to support the cost

of government. A tax differs from a fine or penalty

imposed by a government because a tax is not intended

to deter or punish unacceptable behavior. On the other

hand, taxes are compulsory rather than voluntary on the

part of the payer.

A

tax differs from a user's fee because the payment of a

tax does not entitle the payer to a specific good or

service in return. In the abstract, citizens receive any

number of government benefits for their tax dollars.

Nevertheless, the value of government benefits received

by any particular person is not correlated to the tax that

person must pay.

4. Basic terminology

Ataxpayer is any person or organization required by law to

pay a tax to a governmental authority. In our country, the term

person refers to both natural persons (individuals) and

corporations. Corporations are entities organized under the

laws. These corporate entities generally enjoy the same legal

rights, privileges, and protections as individuals.

The

incidence of a tax refers to the ultimate economic

burden represented by the tax. Most people jump to the

conclusion that the person or organization who makes a direct

tax payment to the government bears the incidence of such tax.

But in some cases, the payer can shift the incidence to a third

party. Consider the following examples.

5. Income tax incidence

Government G imposes a new tax on corporatebusiness profits. A manufacturing corporation with

monopoly on a product in great demand by the

public responds to the new tax by increasing the

retail price at which it sells the product. In this case,

the corporation is nominally the taxpayer and must

remit the new tax to the government. The economic

burden of the tax falls on the corporation's

customers who are indirectly paying the tax in the

form of a higher price for the same product.

6. The Relationship between Base, Rate, and Revenue

Taxes are usually characterized by reference to theirbase. A tax base is an item, occurrence, transaction,

or activity with respect to which a tax is levied. Tax

bases are usually expressed in monetary terms. For

instance, real property taxes are levied on the

ownership of land and buildings, and the dollar value

of the property is the tax base. When designing a tax,

governments try to identify tax bases that taxpayers

cannot easily avoid or conceal. In this respect, real

property is an excellent tax base because it cannot

be moved or hidden, and its ownership is a matter of

public record.

7. The Relationship between Base, Rate, and Revenue

The amount of a tax is calculated by multiplying thebase by a tax rate, which is usually expressed as a

percentage. This relationship is expressed by the

following formula.

Tax (T) = Rate (r) X Base (B)

A single percentage that applies to the entire tax

base is described as a flat rate. Many types of taxes

use a graduated rate structure consisting of

multiple percentages that apply to specified portions

or brackets of the tax base.

8. Standards for good taxes

Theorists maintain that every tax can and shouldbe evaluated on certain basic standards. These

standards can be summarized as follows:

A good tax should be sufficient to raise the

necessary government revenues.

A good tax should be convenient for the

government to administer and for people to pay.

A good tax should be efficient in economic

terms.

A good tax should be fair.

9. Sufficiency

The first standard by which to evaluate a tax is itssufficiency as a revenue raiser. A tax is sufficient

if it generates enough funds to pay for the public

goods and services provided by the government.

After all, the reason that governments tax their

citizens in the first place is to raise revenues

needed for specific purposes. If a tax (or

combination of taxes) is sufficient, a government

can balance its budget. Tax revenues equal

government spending, and the government has no

need to raise additional funds.

10. Sufficiency

What is the consequence of an insufficient taxsystem? The government must make up its

revenue shortfall (the excess of current

spending over tax receipts) from some other

source. We know that state governments now

depend heavily on legalized gambling as an

alternative source of funds. Governments may

own assets or property rights that they can

lease or sell to raise money.

11. Sufficiency

Another option is for governments to borrowmoney to finance their operating deficits

Debt financing is not a permanent solution to an

insufficient tax system. Like other debtors,

governments must pay interest on borrowed funds.

As the public debt increases, so does the annual

interest burden. At some point, a government may

find itself in the untenable position of borrowing

new money not to provide more public goods and

services but merely to pay the interest on existing

debt.

12. TAXES SHOULD BE CONVENIENT

Our second standard for evaluating a tax is convenience.From the government's viewpoint, a good tax should be

convenient to administer. Specifically, the government

should have a method for collecting the tax that most

taxpayers understand and with which they routinely

cooperate. The collection method should not overly intrude

on taxpayers' privacy but should offer minimal opportunity

for noncompliance.

A good tax should be economical for the government. The

administrative cost of collecting and enforcing the tax

should be reasonable in comparison with the total revenue

generated.

13. TAXES SHOULD BE CONVENIENT

From the taxpayer's viewpoint, a good taxshould be convenient to pay. The

convenience standard suggests that people

can compute their tax with reasonable

certainty. Moreover, they do not have to

devote undue time or incur undue costs in

complying with the tax law. A retail sales tax

receives high marks when judged by these

criteria. People can easily compute the sales

tax on a purchase and can pay the tax as part

of the purchase price with no effort

whatsoever!

14. TAXES SHOULD BE EFFICIENT

Our third standard for a good tax is economicefficiency. Tax policymakers use the term :

efficiency in two different ways. Sometimes the

term describes a tax that does not interfere with

or influence taxpayers' economic behavior. At

other times, policymakers describe a tax as

efficient when individuals or organizations react

to the tax by deliberately changing their

economic behavior.

15. The Classical Standard of Efficiency

The classical economist Adam Smith believedthat taxes should have as little effect as possible

on the economy. In his 1776 masterwork, The

Wealth of Nations, Smith concluded the

following:

A tax ... may obstruct the industry of the people,

and discourage them from applying to certain

branches of business which might give

maintenance and employment to great

multitudes. While it obliges the people to pay, it

may thus diminish, or perhaps destroy, some of

the funds which might enable them more easily

to do so.

16. The Classical Standard of Efficiency

The laissez-faire system favored by Adam Smiththeoretically creates a level playing field on which

individuals and organizations, operating in their own

self-interest, freely compete. When governments

interfere with the system by taxing certain economic

activities, the playing field tilts against the competitors

engaging in those activities. The capitalistic game is

disrupted, and the outcome may no longer be the best

for society.

Of course, every modern economy has a tax system,

and firms functioning within the economy must adapt

to that system. Business managers become familiar

with the existing tax laws and make decisions based on

those laws. To return to the sports metaphor, these

managers have adjusted their game plan to suit the

present contours of the economic playing field.

17. Taxes as an Instrument of Fiscal Policy

TheBritish economist John Maynard Keynes

disagreed with the classical notion that a good tax

should be neutral. Keynes believed that free markets

are effective in organizing production and allocating

scarce resources but lack adequate self-regulating

mechanisms for maintaining economic stability.

According to Keynes, governments should protect

their citizens and institutions against the inherent

instability of capitalism.

18. Taxes as an Instrument of Fiscal Policy

Historically, this instability caused cycles ofhigh unemployment, severe fluctuations in

prices (inflation or deflation), and uneven

economic growth. Lord Keynes believed

that governments could counteract these

problems through fiscal policies to promote

full employment, price-level stability, and a

steady rate of economic growth.

19. Taxes as an Instrument of Fiscal Policy

In the Keynesian schema, tax systems area primary tool of fiscal policy. Rather than

trying to design a neutral tax system,

governments should deliberately use taxes

to move the economy in the desired

direction. If an economy is suffering from

sluggish growth and high unemployment,

the government could reduce taxes to

transfer funds from the public to the

private sector

20. Taxes as an Instrument of Fiscal Policy

The tax cut should both stimulate demand forconsumer goods and services and increase

private investment. As a result, the economy

should expand and new jobs should be created.

Conversely, if an economy is overheated so that

wages and prices are in

an inflationary spiral, the government could

raise taxes. People will have less money to

spend, the demand for consumer and investment

goods should soften, and the upward pressure on

wages and prices should be relieved.

21. Taxes and Behavior Modification

Modern governments use their tax systemsto address not only macroeconomic

concerns but also social problems. Many

such problems could be alleviated if people

or institutions could be persuaded to alter

their behavior. Governments can promote

behavioral change by writing tax laws to

penalize undesirable behavior or reward

desirable behavior. The penalty takes the

form of a higher tax burden, while the

reward is some type of tax relief.

22. Taxes and Behavior Modification

Some of the social problems that the federal incometax system tries to remedy are byproducts of the free

enterprise system, which economists refer to as

negative externalities. One of the most widely

recognized is environmental pollution. The tax system

contains provisions that either pressure or entice

companies to clean up their act, so to speak.

23. Income Tax Preferences

Provisions in the federal income tax system designed asincentives for certain behaviors or as subsidies for

targeted activities are described as tax preferences.

These provisions do not contribute to the accurate

measurement of the tax base or the correct calculation

of the tax. Tax preferences do not support the primary

function of the law, which is to raise revenues. In fact,

tax preferences do just the opposite. Because they allow

certain persons or organizations to pay less tax,

preferences lose money for the Treasury. In this respect,

preferences are indirect government expenditures.

24. Taxes should be fair

Ability to payA useful was to begin our discussion of equity

is with the proposition that each person’s

contribution to the support of the government

should reflect that person’s ability to pay.

In the tax policy literature, ability to pay refers

to the economic resources under person’s

control. Each of the major taxes is based on

some dimension of ability to pay.

25. Taxes should be fair

For instance, income taxes are based on theperson’s inflow of economic resources during

the year;

Sales and excise taxes are based on a different

dimension of ability to pay: a person’s

consumption of resources represented by

purchase of goods and services

Real and personal property taxes complement

income and sale taxes by focusing on the third

dimension of ability to pay: a person’s

accumulation of resources in the form of

property

26. Horizontal equity

If a tax is designed so that persons with thesame ability to pay (as measured by the tax

base) owe the same amount of tax, that

system can be described as horizontally

equitable. The structure of certain taxes

guarantees their horizontal equity.

27. Vertical Equity

A tax system is vertically equitable ifpersons with a greater ability to pay owe

more tax than persons with a lesser ability to

pay. While horizontal equity is concerned

with a rational and impartial measurement of

the tax base, vertical equity is concerned

with a fair rate structure by which to

calculate the tax.

28. The classification of taxes

Mainly the taxes can be classified based on differentconditions:

1. Depending on the burden of the tax payer;

2. Depending on the type of a tax ;

3. Depending on subject of tax;

4. Depending on jurisdictions;

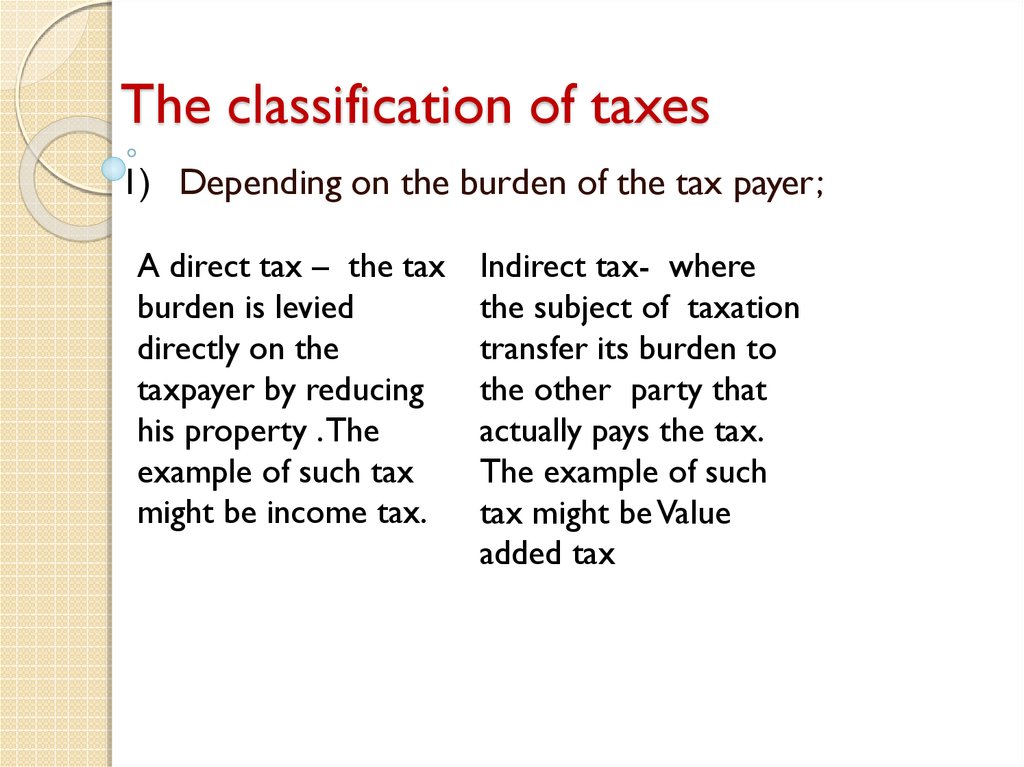

29. The classification of taxes

1) Depending on the burden of the tax payer;A direct tax – the tax

burden is levied

directly on the

taxpayer by reducing

his property . The

example of such tax

might be income tax.

Indirect tax- where

the subject of taxation

transfer its burden to

the other party that

actually pays the tax.

The example of such

tax might be Value

added tax

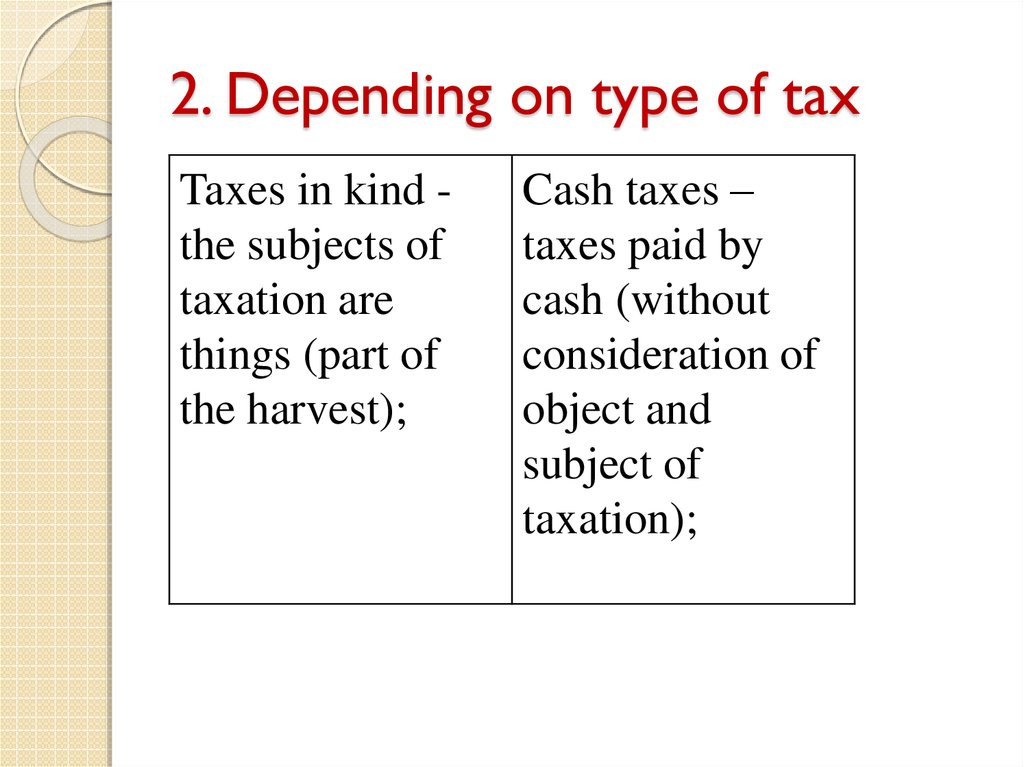

30. 2. Depending on type of tax

Taxes in kind the subjects oftaxation are

things (part of

the harvest);

Cash taxes –

taxes paid by

cash (without

consideration of

object and

subject of

taxation);

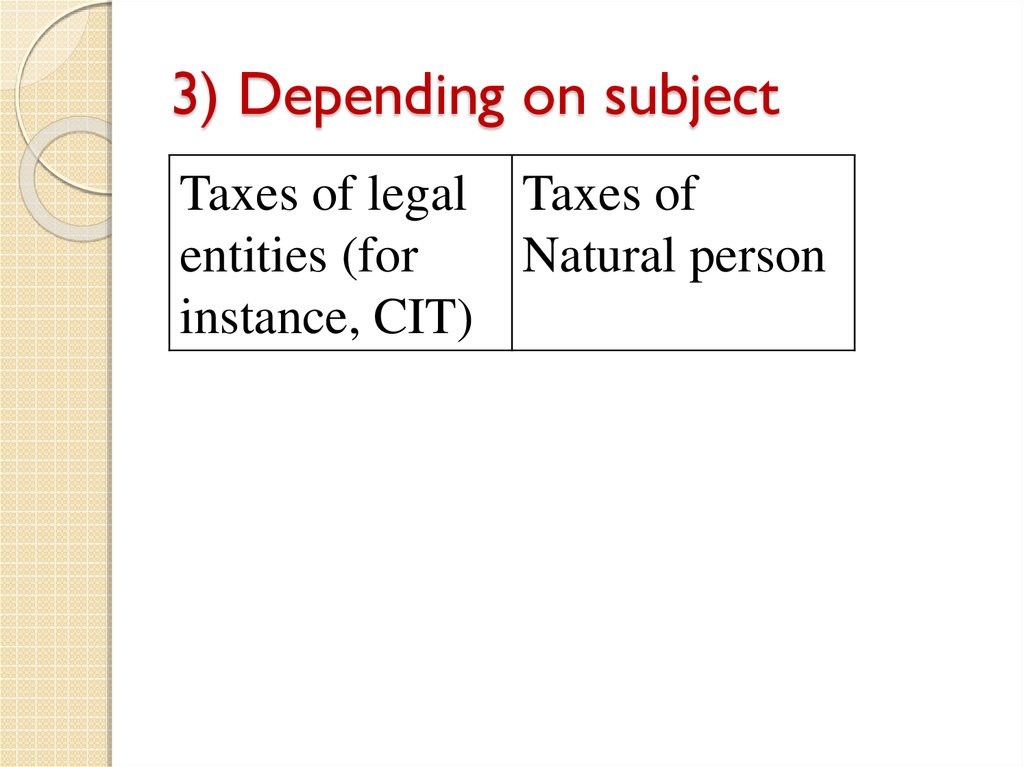

31. 3) Depending on subject

Taxes of legal Taxes ofentities (for

Natural person

instance, CIT)

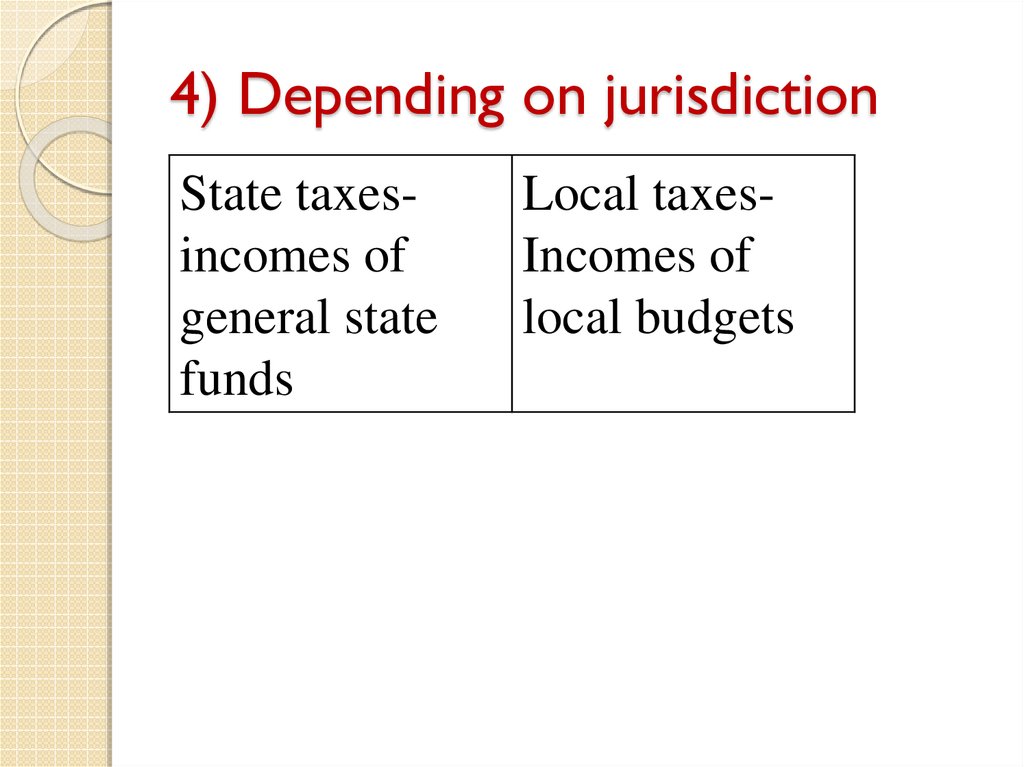

32. 4) Depending on jurisdiction

State taxesincomes ofgeneral state

funds

Local taxesIncomes of

local budgets

33. Tax system of the Republic of Kazakhstan

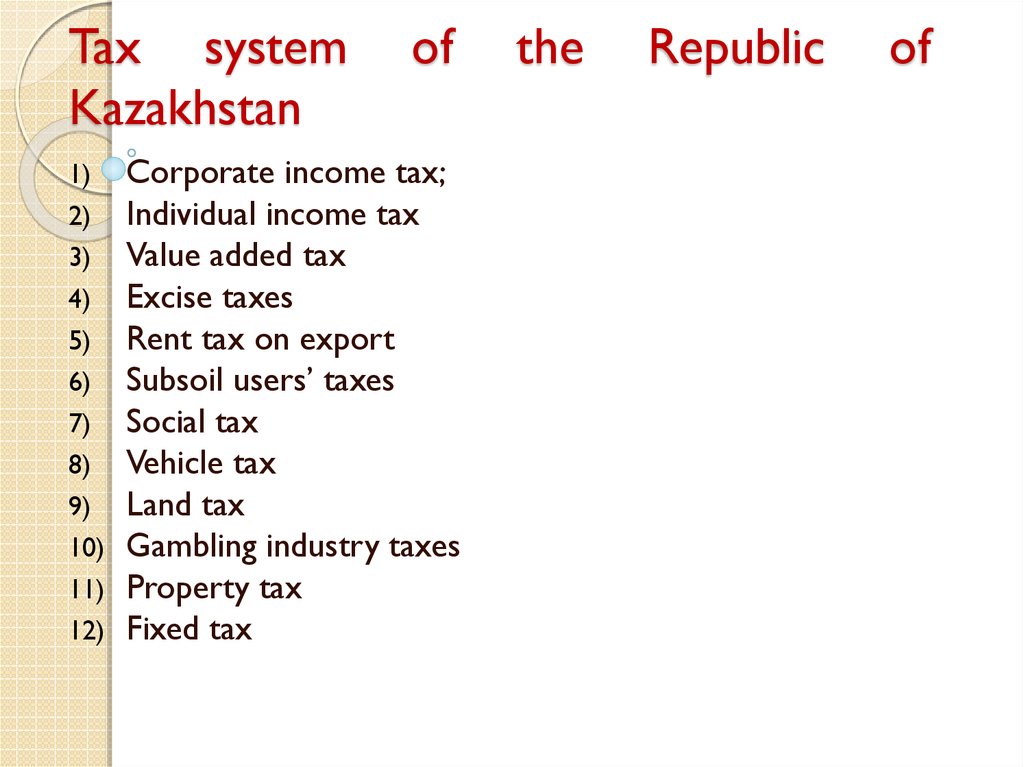

Tax systemKazakhstan

of

Corporate income tax;

2) Individual income tax

3) Value added tax

4) Excise taxes

5) Rent tax on export

6) Subsoil users’ taxes

7) Social tax

8) Vehicle tax

9) Land tax

10) Gambling industry taxes

11) Property tax

12) Fixed tax

1)

the

Republic

of

34. The Taxation Principles in the Republic of Kazakhstan

The tax legislation of the Republic of Kazakhstanshall be based upon the taxation principles. The

principles of the obligatory nature, of the certainty,

fairness of taxation, unity of the tax system and

publicity of the tax legislation of the Republic of

Kazakhstan shall be recognised as the taxation

principles.

35. The Principle of the Obligatory Nature of Taxation

The taxpayers shall be obliged to perform taxobligations, the tax agents — the obligation of the

assessment, withholding and transferring taxes in

accordance with the tax legislation of the Republic

of Kazakhstan in full volume and within

established time.

36. The Principle of Certainty of Taxation

Taxes and other obligatory payments to thebudget of the Republic of Kazakhstan must be

well-defined. The certainty of taxation shall be

understood as establishing in the tax legislation

of the Republic of Kazakhstan of all reasons

and procedure for the emergence,

implementation and termination of tax

obligations of taxpayers, duties of tax agents

with regard to the assessment, withholding and

transfer of taxes.

37. The Principle of Fairness of Taxation

1. Taxation in the Republic of Kazakhstanshall be universal and obligatory.

2. It shall be prohibited to grant tax privileges

of individual nature.

38. The Principle of Unity of the Tax System

The tax system of the Republic ofKazakhstan shall be uniform in the entire

territory of the Republic of Kazakhstan with

regard to all taxpayers (tax agents).

39. The Principle of Publicity of Tax Legislation of the Republic of Kazakhstan

Regulatory legal acts which regulate issuesof taxation shall be subject to obligatory

publication in official publications.

40. Contemporary conditions

At February 6, 2008, the President ofKazakhstan assigned to the government of

the Republic of Kazakhstan to establish

new tax code. In his speech to the nation, the

President outlined such main objective as to

update tax system in accordance with new

stage of development of Kazakhstan,

facilitate diversification and modernization

of the economy and reduce tax pressure on

non-industrial sectors of the economy.

41. Contemporary conditions

As a result of the outlined objectives, theworking group was established by the

decree of the Prime Minister to create new

tax code.

At August 2008, the draft of the new tax

code was presented to the Mazhylis of the

Republic of Kazakhstan. It was signed by

the President of Kazakhstan at December

10, 2008.

42. Contemporary conditions

Inthe light of these changes, it is planned to

reduce gradually the rate of Corporate income

tax; from January 2009 up to 20%, from 2010

up to 17,5%, and in 2011 up to 15%.

The new tax code excludes payments in

advance for small and medium businesses

The rate of Value added tax was established at

the rate of 12 %. This is one of the lowest VAT

rates in the world.

The tax reform also considered the

simplification of the methods of tax

computation.

Экономика

Экономика