Похожие презентации:

ENGLISH for your trip to English speaking countries

1.

L'ANGLAIS pour votre voyage en pays anglophonepar Natalia Ponsard,

professeur d’anglais et traductrice français - anglais - russe

2.

InnMind isan international

company

founded in

Switzerland

We are

connecting

investors with

startups in over 40

countries

Who

we

are

Our mission is

to contribute

in facilitation of

investment

activity on the

global startups

scene.

3.

The world marketof business-angel

investments

4.

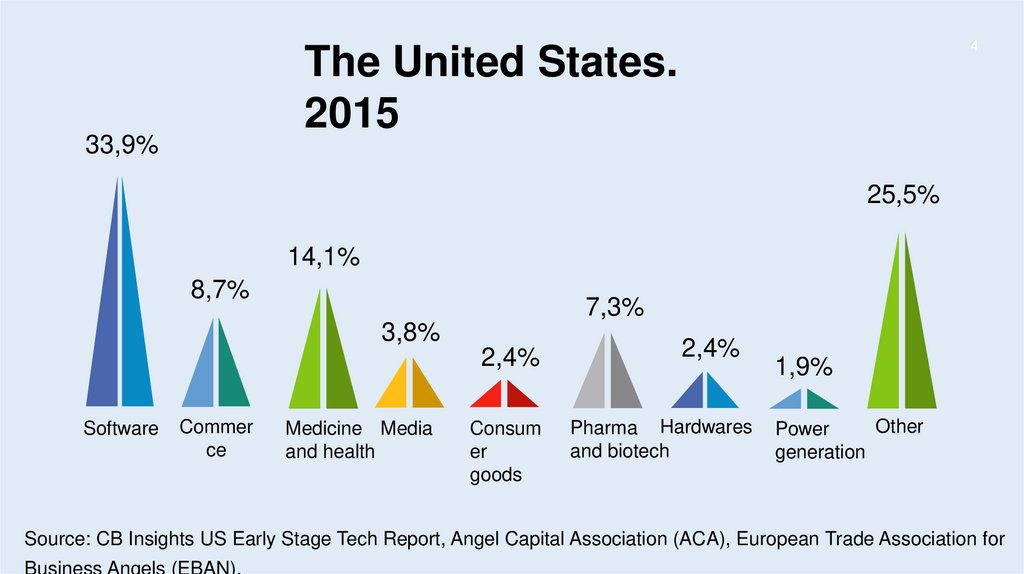

4The United States.

2015

33,9%

25,5%

14,1%

8,7%

7,3%

3,8%

2,4%

Software

Commer

ce

Medicine Media

and health

Consum

er

goods

2,4%

Pharma Hardwares

and biotech

1,9%

Other

Power

generation

Source: CB Insights US Early Stage Tech Report, Angel Capital Association (ACA), European Trade Association for

Business Angels (EBAN).

5.

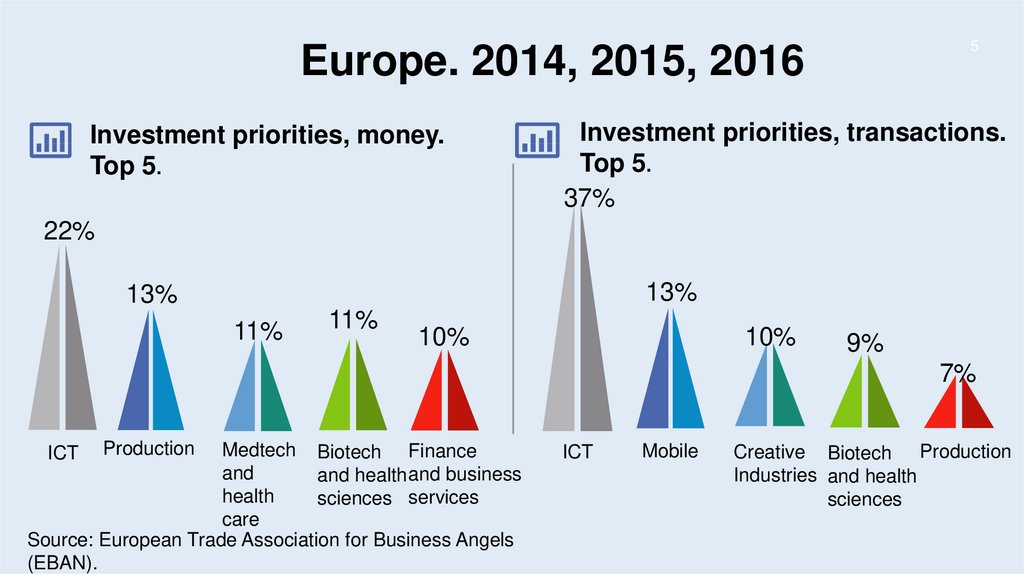

5Europe. 2014, 2015, 2016

Investment priorities, money.

Top 5.

Investment priorities, transactions.

Top 5.

37%

22%

13%

13%

11%

11%

10%

10%

9%

7%

Production

Medtech Biotech Finance

and

and health and business

health

sciences services

care

Source: European Trade Association for Business Angels

(EBAN).

ICT

ICT

Mobile

Creative Biotech Production

Industries and health

sciences

6.

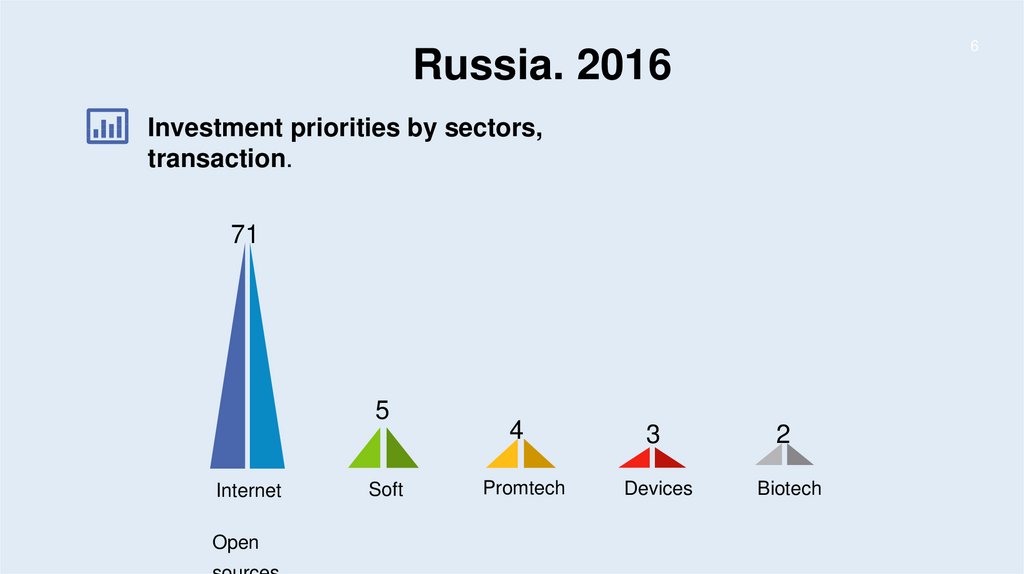

6Russia. 2016

Investment priorities by sectors,

transaction.

71

5

Internet

Open

Soft

4

Promtech

3

Devices

2

Biotech

7.

«In general, the situationconfirms the obvious trend - IT

remains an indisputable leader

in all parameters.» Russian

Angels Monitor 2016

At the same time, European business

angels are not afraid to invest in quite

complex and technically, investment

projects in such areas as

manufacturing or biotech and life

sciences. In this sense, they differ from

their Russian counterparts, who often

choose relatively "light technologies".

8.

Some questions for you…Who can reduce your

investment risks by deep

evaluation and further

support in startup

development?

Who can help you to

find co-investors to

share risks and make

joint investments?

Do you want to be sure

that founders will take

right decisions and will

manage business

effectively?

9.

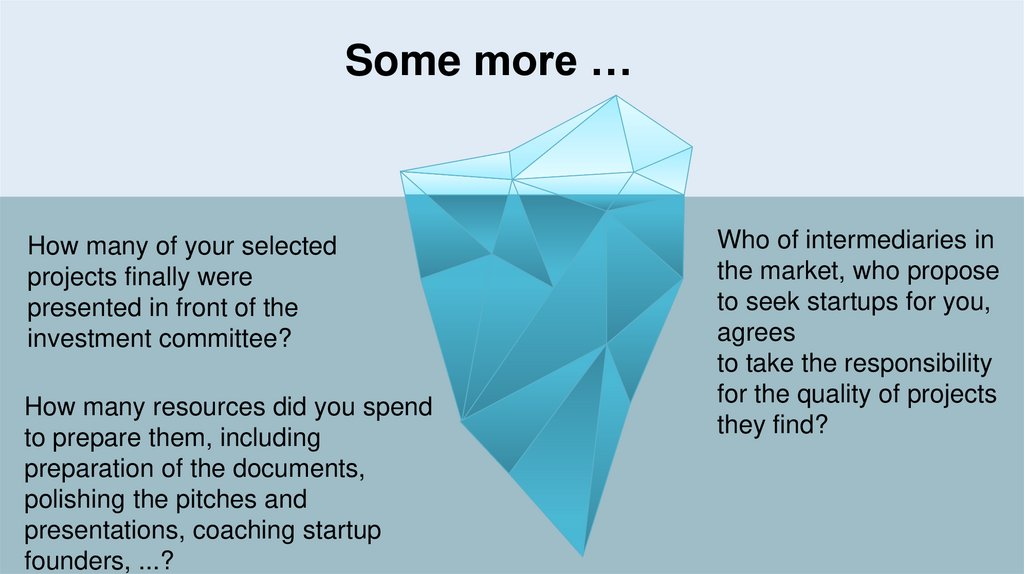

Some more …How many of your selected

projects finally were

presented in front of the

investment committee?

How many resources did you spend

to prepare them, including

preparation of the documents,

polishing the pitches and

presentations, coaching startup

founders, ...?

Who of intermediaries in

the market, who propose

to seek startups for you,

agrees

to take the responsibility

for the quality of projects

they find?

10.

«We believe thatinvestment activities

should be fuelled not by

increase in quantity of

deals, but by increase in

quality of innovative

startups who are

fundraising and, thus, by

reduction of investment

11.

Why you should choose usSelection of startups

thousands of startups

40+ regions

collaboration with startup

hubs and accelerators

Deep assessment

investment analysis

detailed due diligence

support to the startup teams

in their further development

after fundraising

Economy of

resources

help you

to save your

resources while solving the

variety of your investment

tasks

12.

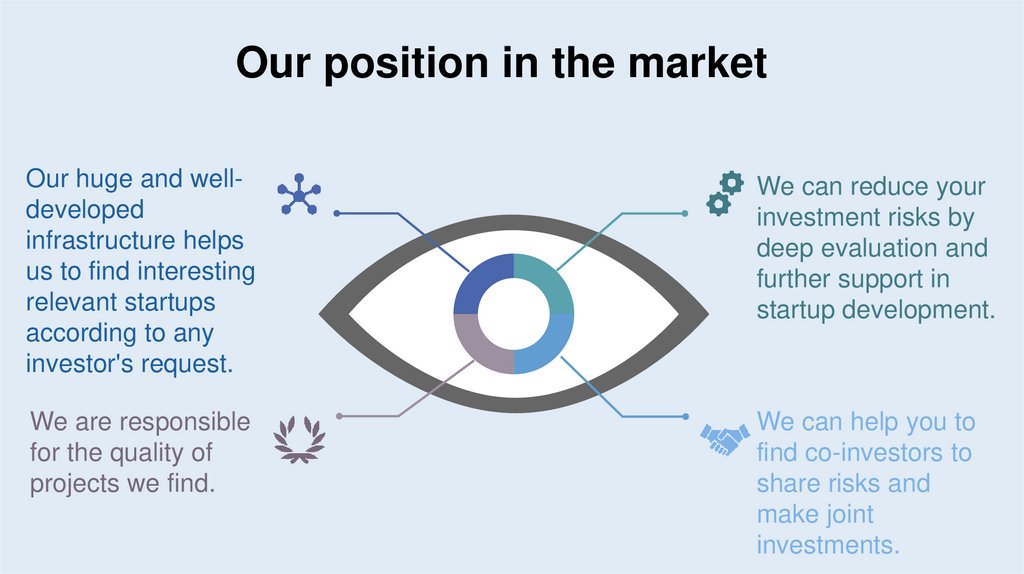

Our position in the marketOur huge and welldeveloped

infrastructure helps

us to find interesting

relevant startups

according to any

investor's request.

We can reduce your

investment risks by

deep evaluation and

further support in

startup development.

We are responsible

for the quality of

projects we find.

We can help you to

find co-investors to

share risks and

make joint

investments.

13.

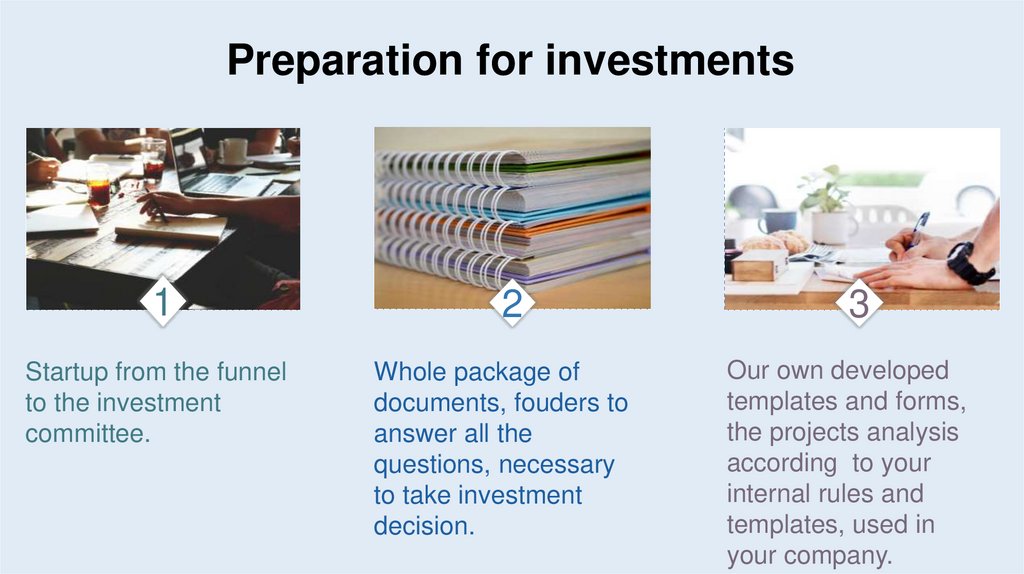

Preparation for investments1

Startup from the funnel

to the investment

committee.

2

Whole package of

documents, fouders to

answer all the

questions, necessary

to take investment

decision.

3

Our own developed

templates and forms,

the projects analysis

according to your

internal rules and

templates, used in

your company.

14.

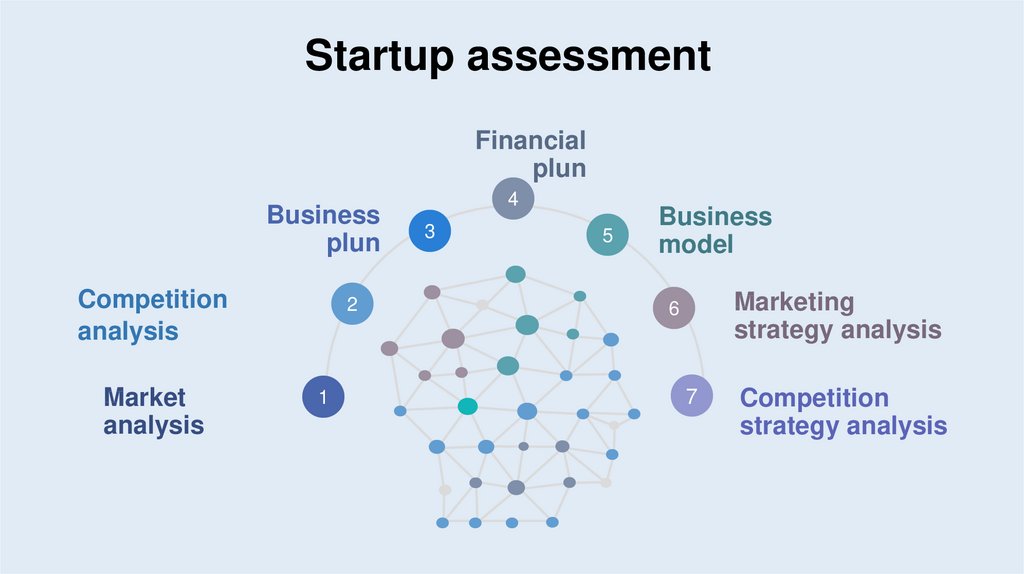

Startup assessmentFinancial

plun

Business

plun

Competition

analysis

Market

analysis

2

1

4

3

5

Business

model

Marketing

strategy analysis

6

7

Competition

strategy analysis

15.

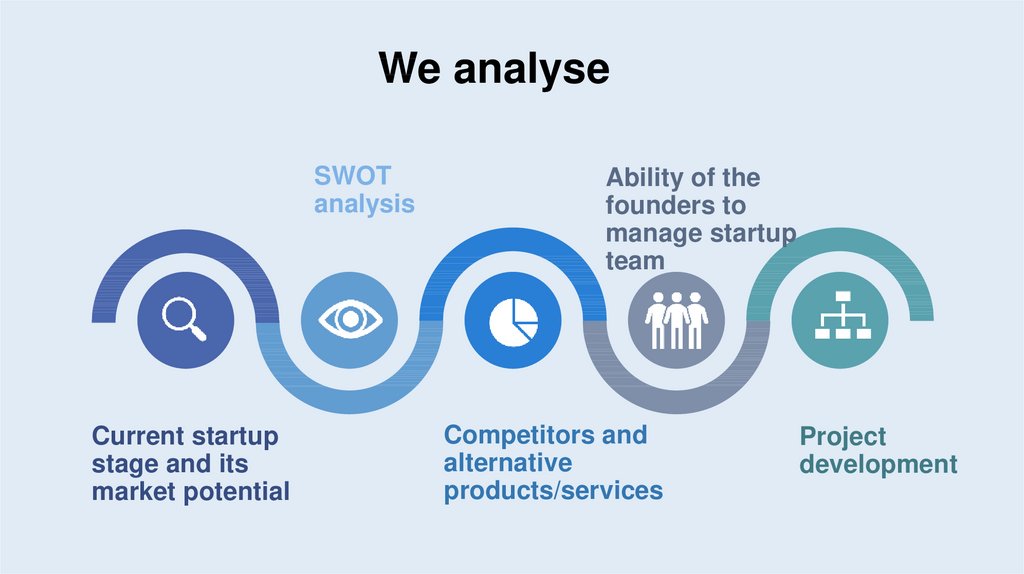

We analyseSWOT

analysis

Current startup

stage and its

market potential

Ability of the

founders to

manage startup

team

Competitors and

alternative

products/services

Project

development

16.

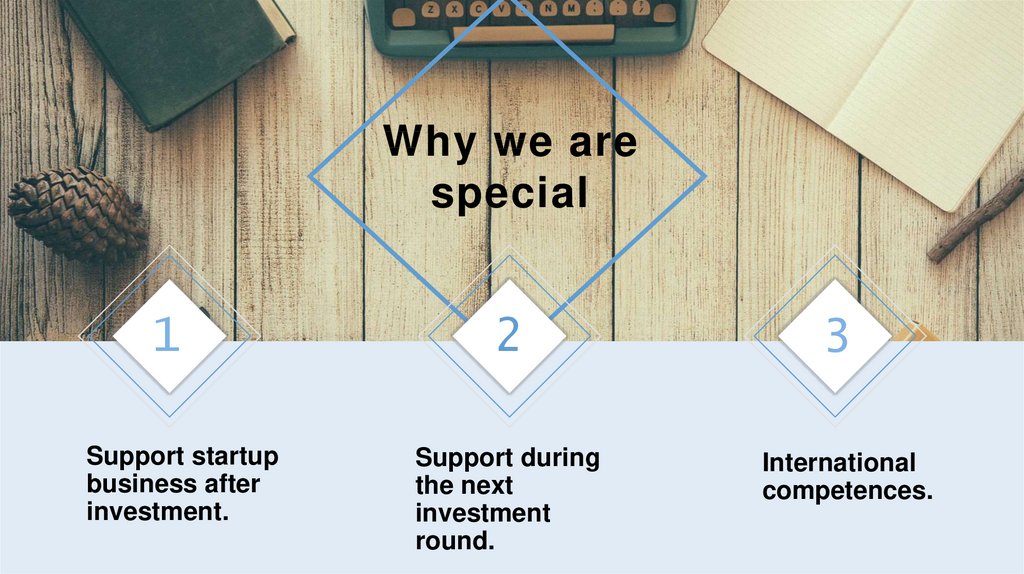

Why we arespecial

1

Support startup

business after

investment.

2

Support during

the next

investment

round.

3

International

competences.

17.

«We are proud ofour startups.»

InnMind

18.

Have anyquestions?

Contact us directly:

@someonespecial.katerin

a

k.voronova@innmind.com

Катерина Воронова

Thank you !

Английский язык

Английский язык