Похожие презентации:

Risk Management

1.

Moscow UniversityRisk Management

Class #13 – Central Counterparty Risk

Management

Lecturer: Dmitry Antoshkin

December/2015

Notice: The concepts, ideas and opinions expressed here do not represent the views of any private institution and are solely those of the lecturers.

2.

Class #13 – CCP Risk Management1

Clearinghouses and Central Counterparties

2

Central Counterparty Risk Management Framework

3

Calculating CCP Risk

4

Annex

2

3.

Class #13 – CCP Risk Management1

Clearinghouses and Central Counterparties

2

Central Counterparty Risk Management Framework

3

Calculating CCP Risk

4

Annex

3

4.

Clearinghouses and Central Counterparties“Post-trade clearing and settlement are sometimes referred to

as the plumbing of the financial system. This term may suggest

that clearing and settlement systems are of secondary

importance. In fact, however, they are more like the central

nervous system of the financial system.”

Michael Moskow, Chicago Federal Reserve

“We allow the City to sleep at night.”

Chris Tupker, LCH.Clearnet

“I’m Winston Wolfe. I solve problems.”

The Wolf, Pulp Fiction

4

5.

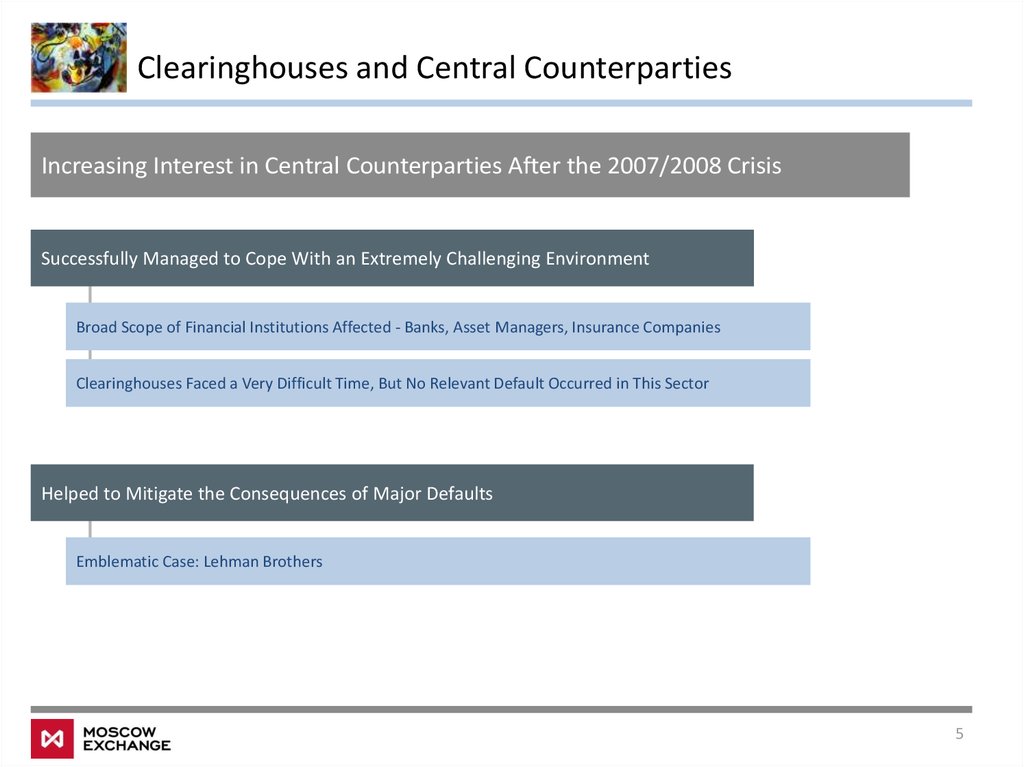

Clearinghouses and Central CounterpartiesIncreasing Interest in Central Counterparties After the 2007/2008 Crisis

Successfully Managed to Cope With an Extremely Challenging Environment

Broad Scope of Financial Institutions Affected - Banks, Asset Managers, Insurance Companies

Clearinghouses Faced a Very Difficult Time, But No Relevant Default Occurred in This Sector

Helped to Mitigate the Consequences of Major Defaults

Emblematic Case: Lehman Brothers

5

6.

Clearinghouses and Central CounterpartiesClearing, Settlement and Central Counterparty Services

Exchanges, OTC Markets

Trading

Post-Trading

Clearing and Central Counterparty Services

Clearing Transactions

Credit Risk Substitution

Default Management

CSDs, Banks

6

7.

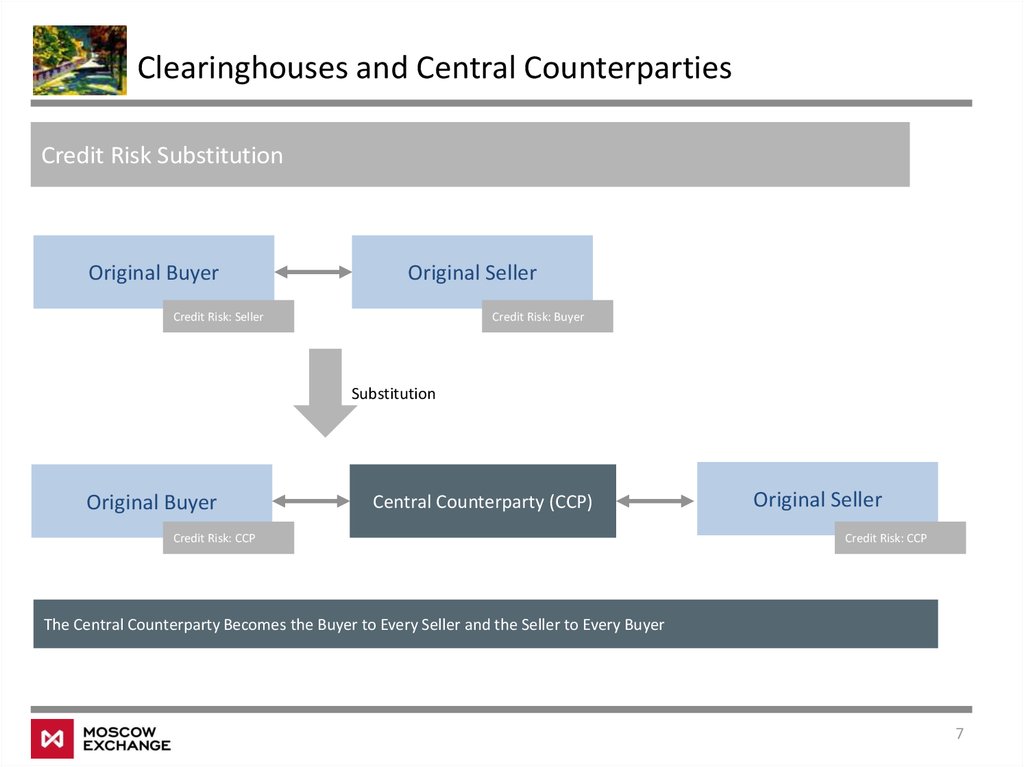

Clearinghouses and Central CounterpartiesCredit Risk Substitution

Original Buyer

Original Seller

Credit Risk: Seller

Credit Risk: Buyer

Substitution

Original Buyer

Central Counterparty (CCP)

Credit Risk: CCP

Original Seller

Credit Risk: CCP

The Central Counterparty Becomes the Buyer to Every Seller and the Seller to Every Buyer

7

8.

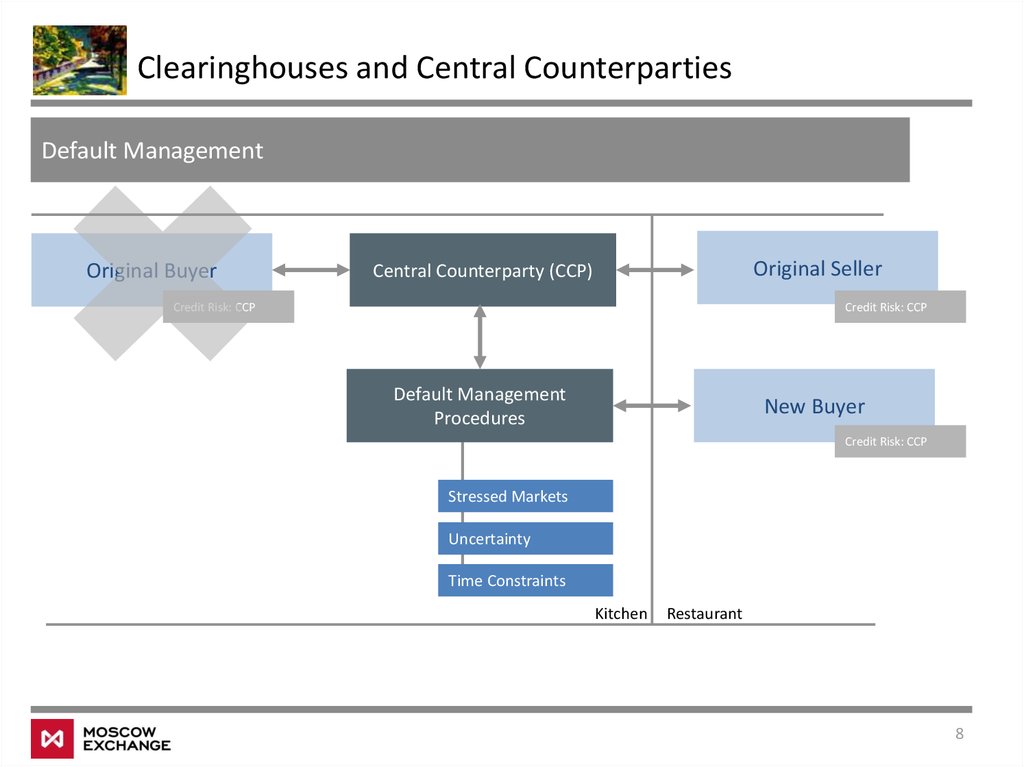

Clearinghouses and Central CounterpartiesDefault Management

Original Buyer

Original Seller

Central Counterparty (CCP)

Credit Risk: CCP

Credit Risk: CCP

Default Management

Procedures

New Buyer

Credit Risk: CCP

Stressed Markets

Uncertainty

Time Constraints

Kitchen

Restaurant

8

9.

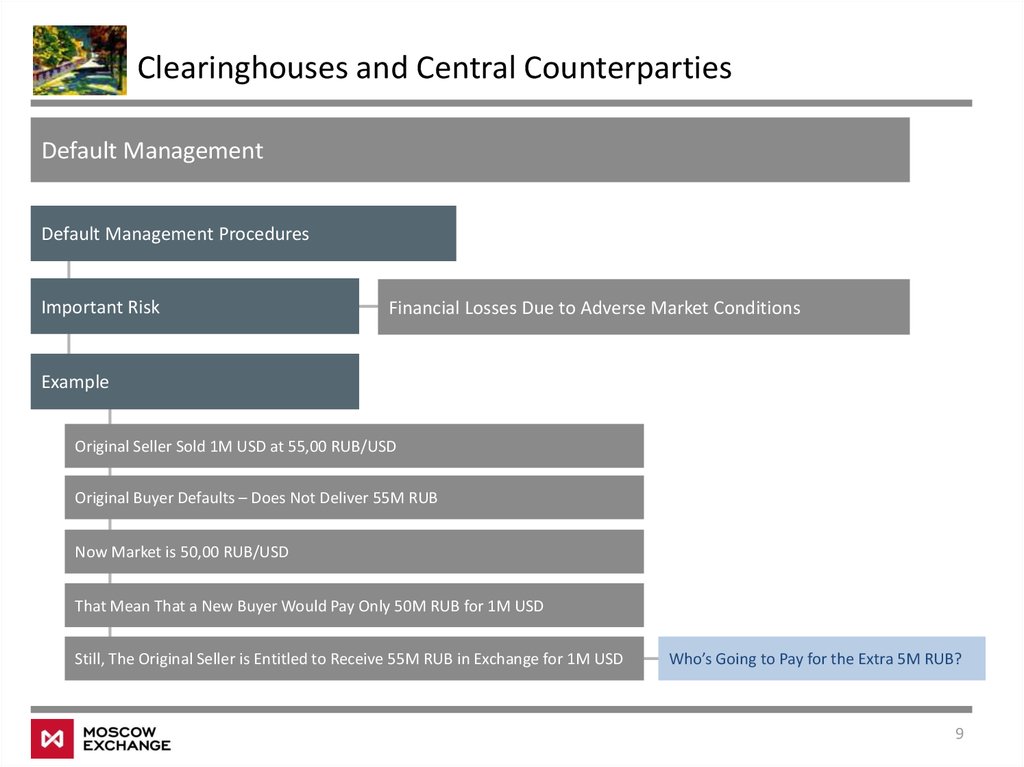

Clearinghouses and Central CounterpartiesDefault Management

Default Management Procedures

Important Risk

Financial Losses Due to Adverse Market Conditions

Example

Original Seller Sold 1M USD at 55,00 RUB/USD

Original Buyer Defaults – Does Not Deliver 55M RUB

Now Market is 50,00 RUB/USD

That Mean That a New Buyer Would Pay Only 50M RUB for 1M USD

Still, The Original Seller is Entitled to Receive 55M RUB in Exchange for 1M USD

Who’s Going to Pay for the Extra 5M RUB?

9

10.

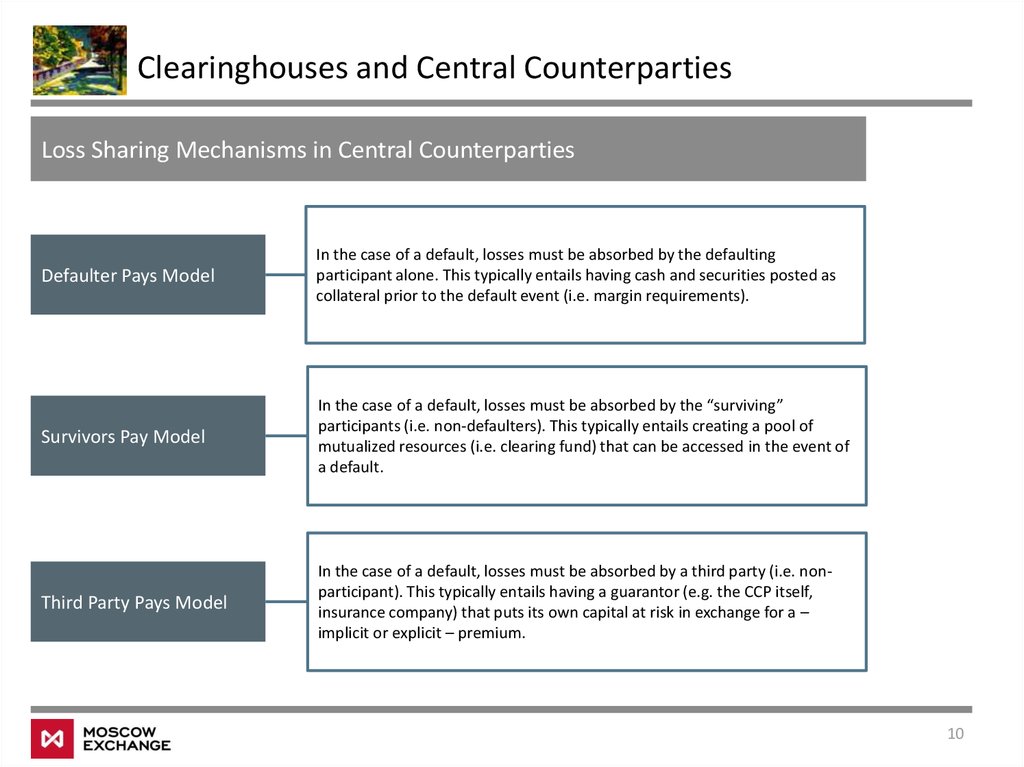

Clearinghouses and Central CounterpartiesLoss Sharing Mechanisms in Central Counterparties

Defaulter Pays Model

In the case of a default, losses must be absorbed by the defaulting

participant alone. This typically entails having cash and securities posted as

collateral prior to the default event (i.e. margin requirements).

Survivors Pay Model

In the case of a default, losses must be absorbed by the “surviving”

participants (i.e. non-defaulters). This typically entails creating a pool of

mutualized resources (i.e. clearing fund) that can be accessed in the event of

a default.

Third Party Pays Model

In the case of a default, losses must be absorbed by a third party (i.e. nonparticipant). This typically entails having a guarantor (e.g. the CCP itself,

insurance company) that puts its own capital at risk in exchange for a –

implicit or explicit – premium.

10

11.

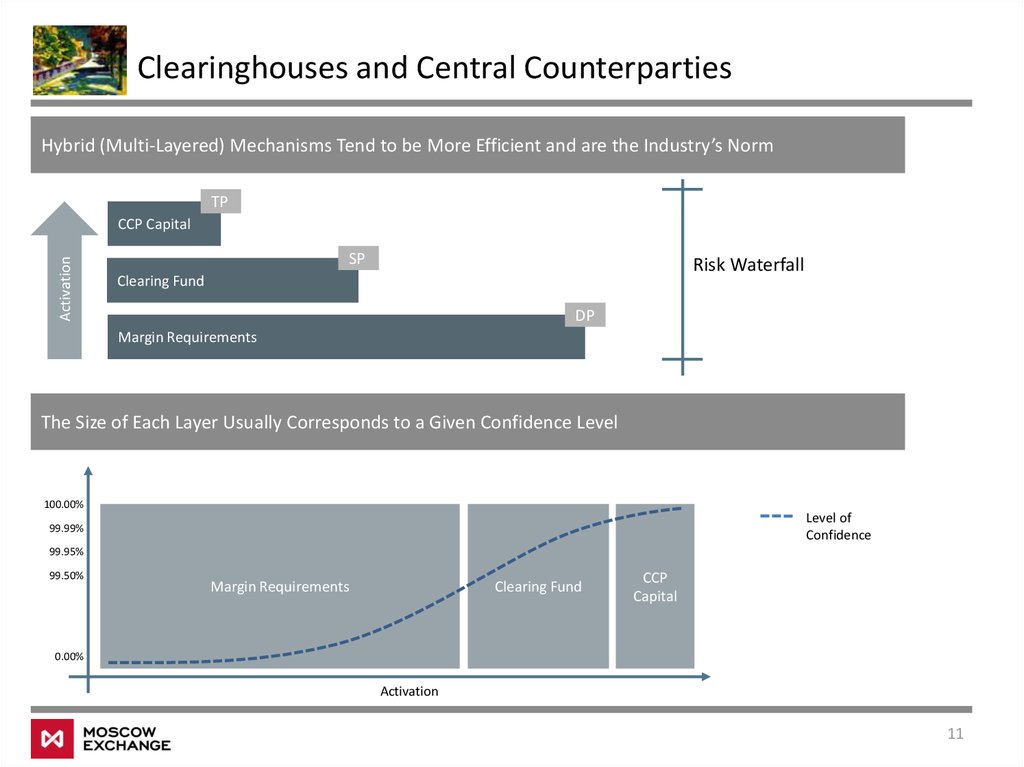

Clearinghouses and Central CounterpartiesHybrid (Multi-Layered) Mechanisms Tend to be More Efficient and are the Industry’s Norm

TP

Activation

CCP Capital

SP

Risk Waterfall

Clearing Fund

DP

Margin Requirements

The Size of Each Layer Usually Corresponds to a Given Confidence Level

100.00%

Level of

Confidence

99.99%

99.95%

99.50%

Margin Requirements

Clearing Fund

CCP

Capital

0.00%

Activation

11

12.

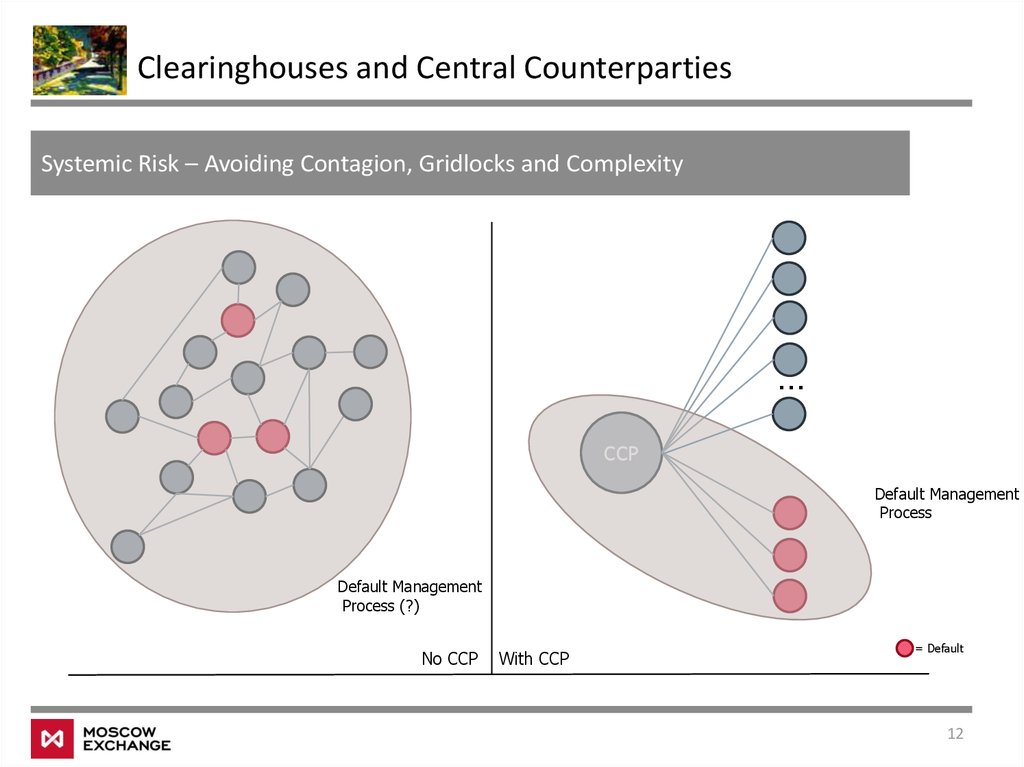

Clearinghouses and Central CounterpartiesSystemic Risk – Avoiding Contagion, Gridlocks and Complexity

…

CCP

Default Management

Process

Default Management

Process (?)

No CCP

With CCP

= Default

12

13.

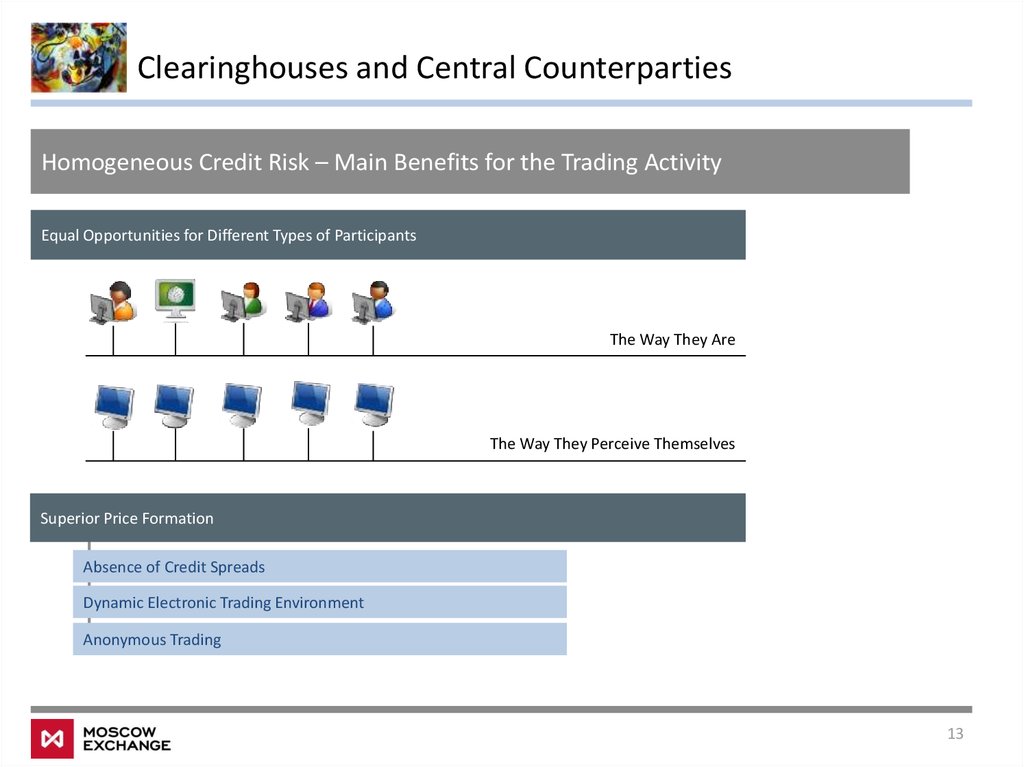

Clearinghouses and Central CounterpartiesHomogeneous Credit Risk – Main Benefits for the Trading Activity

Equal Opportunities for Different Types of Participants

The Way They Are

The Way They Perceive Themselves

Superior Price Formation

Absence of Credit Spreads

Dynamic Electronic Trading Environment

Anonymous Trading

13

14.

Class #13 – CCP Risk Management1

Clearinghouses and Central Counterparties

2

Central Counterparty Risk Management Framework

3

Calculating CCP Risk

4

Annex

14

15.

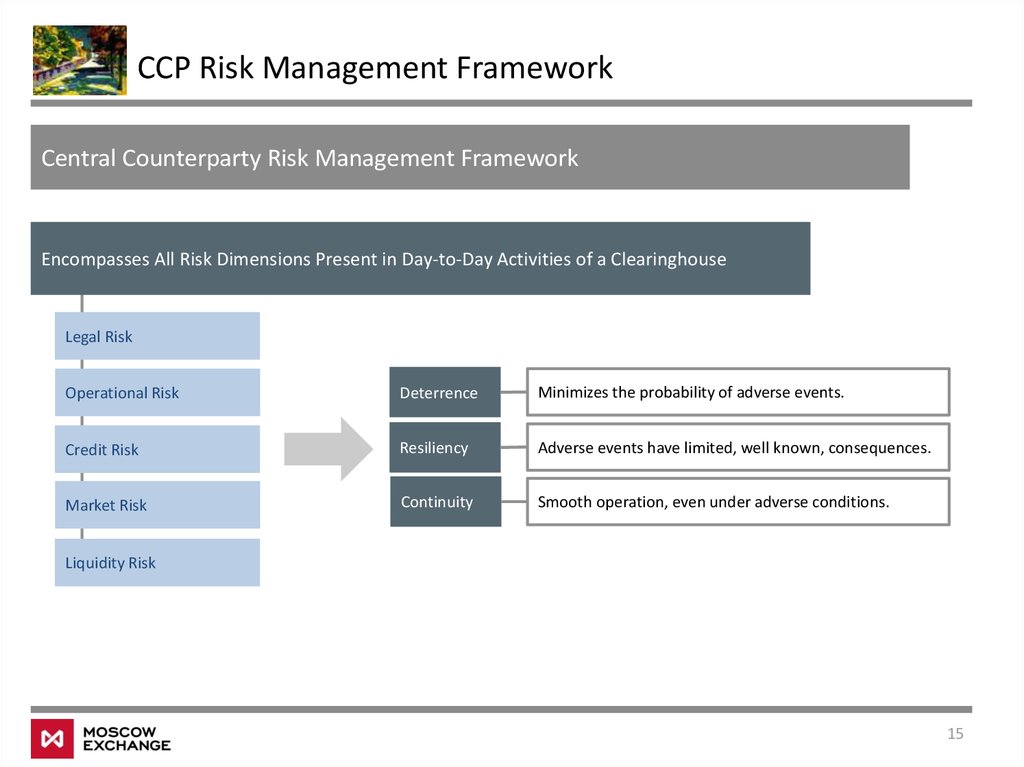

CCP Risk Management FrameworkCentral Counterparty Risk Management Framework

Encompasses All Risk Dimensions Present in Day-to-Day Activities of a Clearinghouse

Legal Risk

Operational Risk

Deterrence

Minimizes the probability of adverse events.

Credit Risk

Resiliency

Adverse events have limited, well known, consequences.

Market Risk

Continuity

Smooth operation, even under adverse conditions.

Liquidity Risk

15

16.

CCP Risk Management FrameworkLegal Risk

Main Dangers

Disputes Concerning Services and Procedures

Basic Toolkit

Sound Legal Framework

Settlement Unwind

Netting

Litigation re Default Procedures

Certainty and Finality

Collateral Seizure

Collateral Protection

Adherence to Clearinghouse Rules and Procedures

Well Structured Contracts

Clarity re Responsibilities and/or Potential Liabilities

16

17.

CCP Risk Management FrameworkOperational Risk

Main Dangers

Basic Toolkit

IT Disruptions

High Availability IT Architecture

Human Error, Fraud

Internal Audits

Unavailability of Service Providers

Adequate Staffing

Natural Catastrophes

Business Continuity Plans

17

18.

CCP Risk Management FrameworkCredit Risk

Main Dangers

Basic Toolkit

Default of a Participant

Well Structured Default Procedures

Default of a Financial Services Provider

Admission Criteria

Declining Credit Quality/Default of an Issuer of

Collateral

Conservative Investment Policy

Declining Credit Quality/Default of an Issuer of

Investment Assets (Investment Portfolio)

Continuous, Thorough Credit Assessment

Participants

Financial Services Providers

Issuers – Collateral and Investments

18

19.

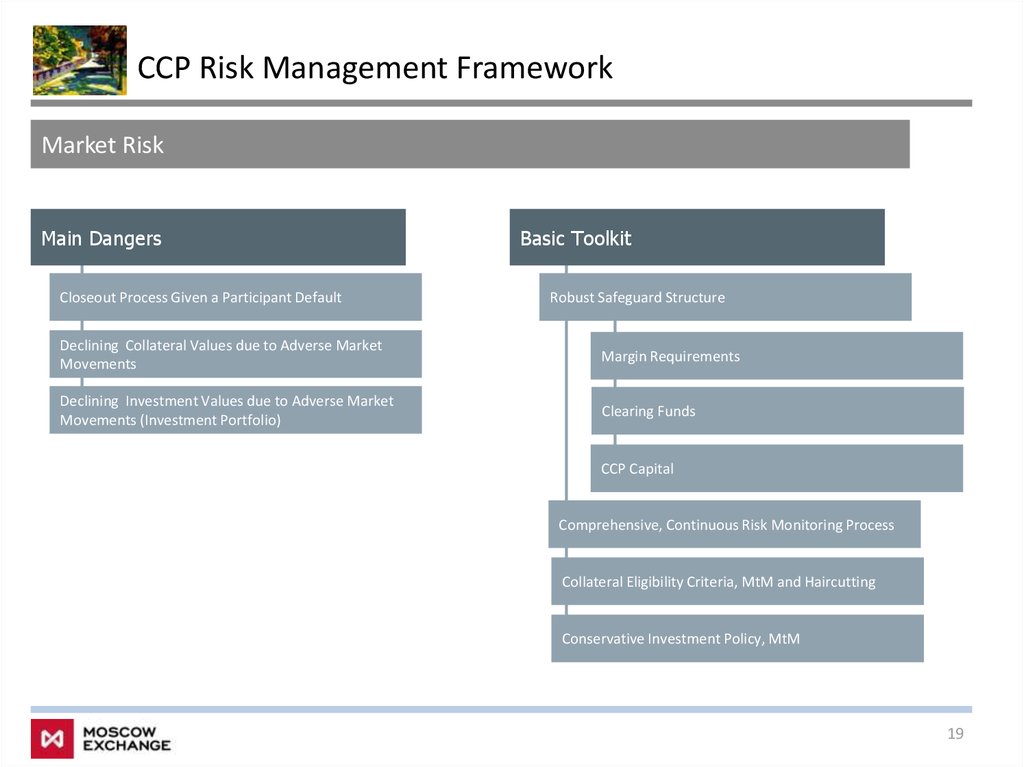

CCP Risk Management FrameworkMarket Risk

Main Dangers

Closeout Process Given a Participant Default

Basic Toolkit

Robust Safeguard Structure

Declining Collateral Values due to Adverse Market

Movements

Margin Requirements

Declining Investment Values due to Adverse Market

Movements (Investment Portfolio)

Clearing Funds

CCP Capital

Comprehensive, Continuous Risk Monitoring Process

Collateral Eligibility Criteria, MtM and Haircutting

Conservative Investment Policy, MtM

19

20.

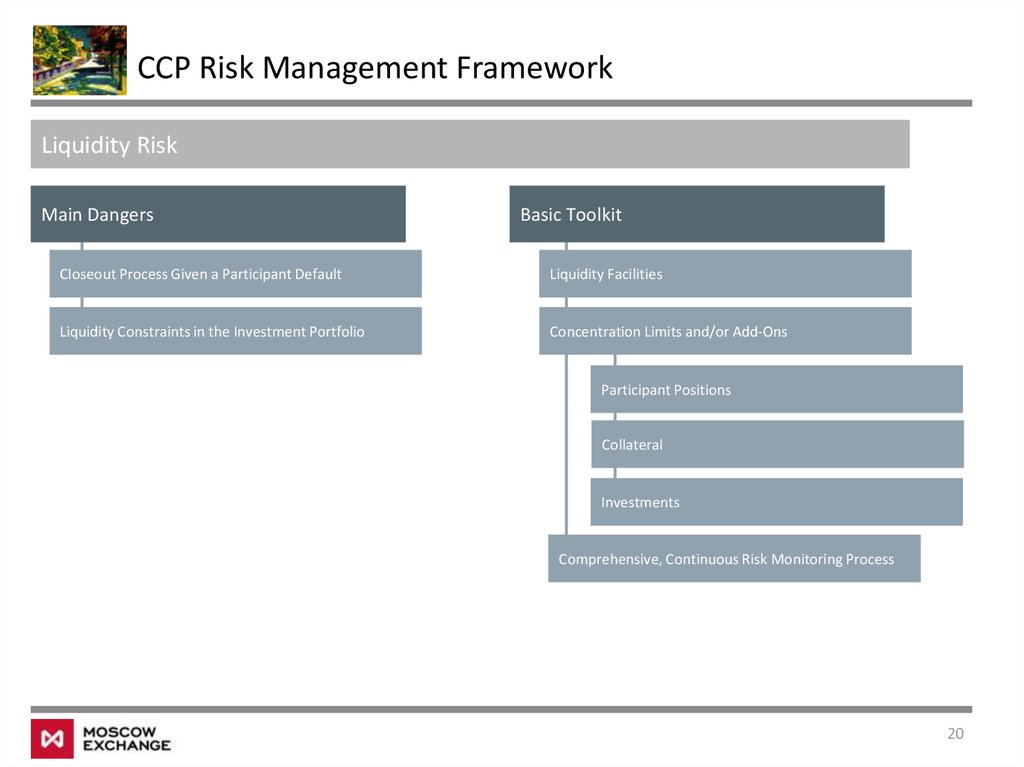

CCP Risk Management FrameworkLiquidity Risk

Main Dangers

Basic Toolkit

Closeout Process Given a Participant Default

Liquidity Facilities

Liquidity Constraints in the Investment Portfolio

Concentration Limits and/or Add-Ons

Participant Positions

Collateral

Investments

Comprehensive, Continuous Risk Monitoring Process

20

21.

Class #13 – CCP Risk Management1

Clearinghouses and Central Counterparties

2

Central Counterparty Risk Management Framework

3

Calculating CCP Risk

4

Annex

21

22.

Calculating CCP RiskThe Risk Management Problem of a Central Counterparty

In The Absence of a Default, The CCP is Not Exposed to Market Risk

Zero Net Position

Buyer to Every Seller, Seller to Every Buyer

In The Case of a Default

Closeout Procedures

Adverse Market Environment

Financial Losses

22

23.

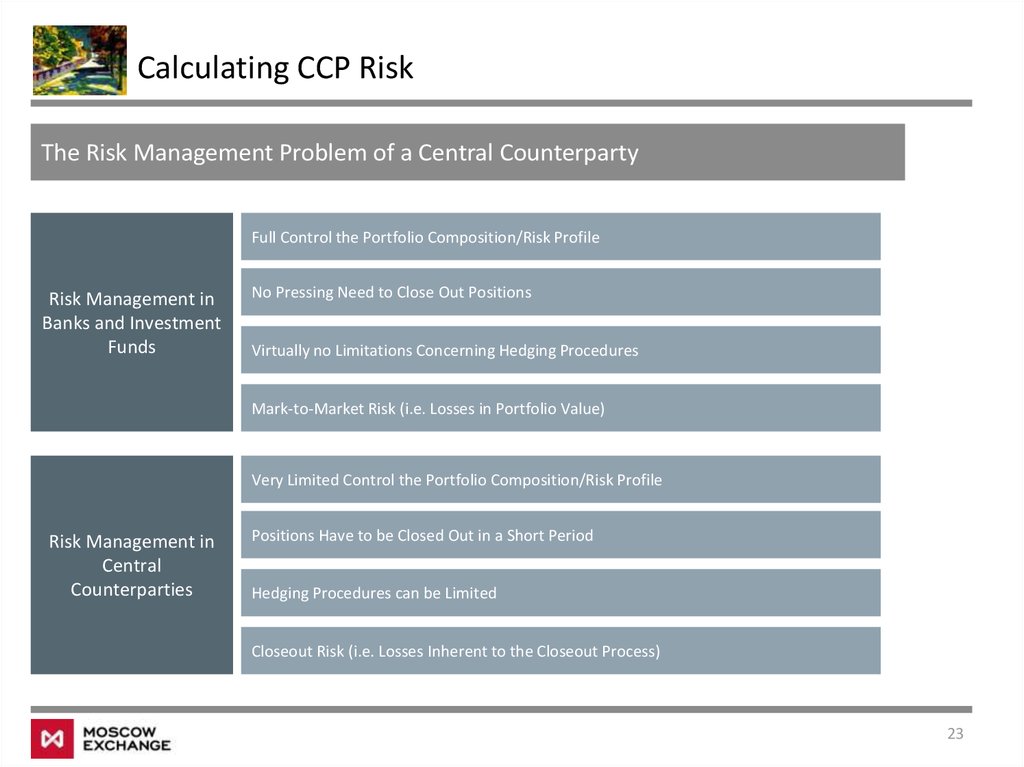

Calculating CCP RiskThe Risk Management Problem of a Central Counterparty

Full Control the Portfolio Composition/Risk Profile

Risk Management in

Banks and Investment

Funds

No Pressing Need to Close Out Positions

Virtually no Limitations Concerning Hedging Procedures

Mark-to-Market Risk (i.e. Losses in Portfolio Value)

Very Limited Control the Portfolio Composition/Risk Profile

Risk Management in

Central

Counterparties

Positions Have to be Closed Out in a Short Period

Hedging Procedures can be Limited

Closeout Risk (i.e. Losses Inherent to the Closeout Process)

23

24.

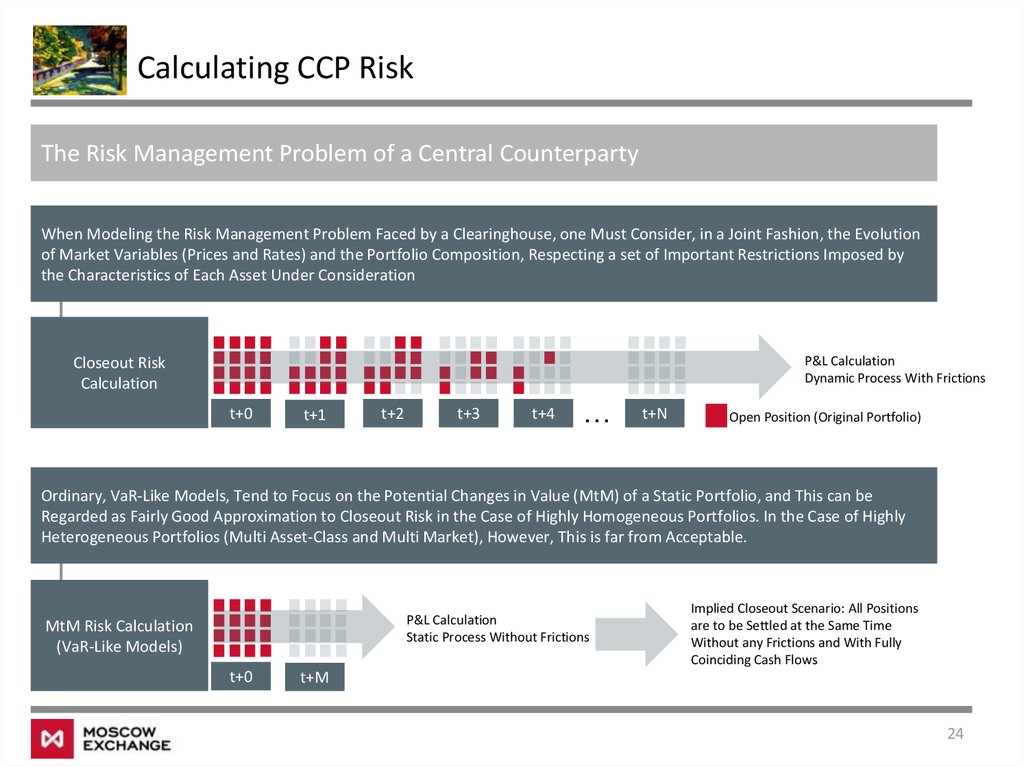

Calculating CCP RiskThe Risk Management Problem of a Central Counterparty

When Modeling the Risk Management Problem Faced by a Clearinghouse, one Must Consider, in a Joint Fashion, the Evolution

of Market Variables (Prices and Rates) and the Portfolio Composition, Respecting a set of Important Restrictions Imposed by

the Characteristics of Each Asset Under Consideration

P&L Calculation

Dynamic Process With Frictions

Closeout Risk

Calculation

t+0

t+1

t+2

t+3

t+4

...

t+N

Open Position (Original Portfolio)

Ordinary, VaR-Like Models, Tend to Focus on the Potential Changes in Value (MtM) of a Static Portfolio, and This can be

Regarded as Fairly Good Approximation to Closeout Risk in the Case of Highly Homogeneous Portfolios. In the Case of Highly

Heterogeneous Portfolios (Multi Asset-Class and Multi Market), However, This is far from Acceptable.

P&L Calculation

Static Process Without Frictions

MtM Risk Calculation

(VaR-Like Models)

t+0

Implied Closeout Scenario: All Positions

are to be Settled at the Same Time

Without any Frictions and With Fully

Coinciding Cash Flows

t+M

24

25.

Class #13 – CCP Risk Management1

Clearinghouses and Central Counterparties

2

Central Counterparty Risk Management Framework

3

Calculating CCP Risk

4

Annex

25

26.

AnnexUseful References

‒ Principles for Financial Market Infrastructures, CPMI-IOSCO, (2012);

‒ Modelling Risk in Central Counterparty Clearing Houses – A Review, Bank of England, (2002);

‒ The Economics of Central Clearing: Theory and Practice, Pirrong, C., ISDA, (2011).

26

Менеджмент

Менеджмент