Похожие презентации:

International business management

1. International Business Management

INTERNATIONALBUSINESS

MANAGEMENT

Economic Risk – Economic Risk for

Developing and Emerging

Economies

Dr Michael Wynn-Williams

wm82@gre.ac.uk

2. Economic risk analysis

ECONOMIC RISK ANALYSISQuestion : Is my money safe in that country?

Answer : Evaluate the Macro economic health of

the country

Some factors to consider :

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

Exchange rates

Growth of domestic credit

bank rates

prices, WPI and CPI

industrial production

unemployment

trade , exports imports invisibles, CAD

government consumption

GDP, current and constant prices

population

3. Economic Risk Analysis (ERA)

ECONOMIC RISK ANALYSIS (ERA)IMF uses quantitative analysis for evaluating

economies

Economic risk is present in all countries, but most

significant in developing and emerging economies

Guidelines devised at Greenwich evaluate the security

of doing business in the country

Developing and emerging countries tend to trade in a

narrow range of products and depend on cash flow

The three main measures of a country’s financial

standing:

GDP – how much is it producing?

Inflation – how well controlled?

Current Account – are the imports affordable?

The first part of compulsory Exam Question 1 uses

simple IMF-style quantitative formulas to measure

economic performance against a standard

The second part of the question identifies and

evaluates the main economic factors in order to make

a qualitative investment decision in the country

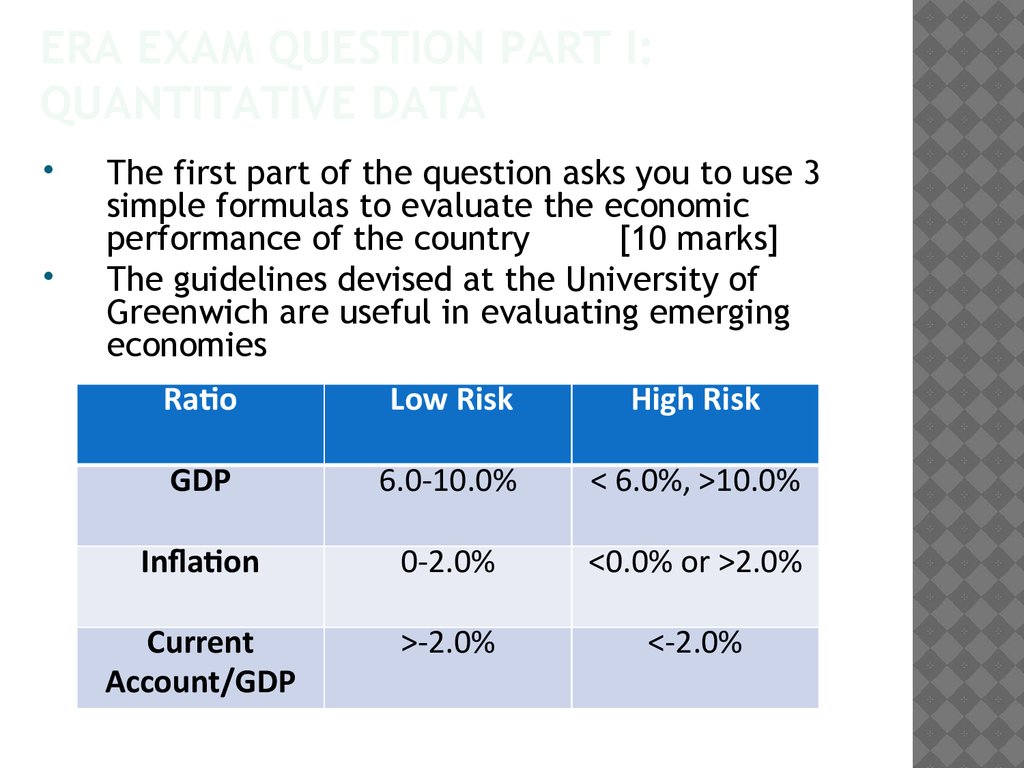

4. ERA Exam question Part I: Quantitative data

ERA EXAM QUESTION PART I:QUANTITATIVE DATA

The first part of the question asks you to use 3

simple formulas to evaluate the economic

performance of the country

[10 marks]

The guidelines devised at the University of

Greenwich are useful in evaluating emerging

economies

Ratio

Low Risk

High Risk

GDP

6.0-10.0%

< 6.0%, >10.0%

Inflation

0-2.0%

<0.0% or >2.0%

Current

Account/GDP

>-2.0%

<-2.0%

5. Finding the data

FINDING THE DATAMost of the data is available from the

World Bank

The

data is for all countries, not just developing

economy clients of The Bank

One piece of data, for the current

account/GDP, comes from the IMF World

Economic Outlook (WEO)

In the exam the data will comprise the World

Bank figures + CAD/GDP

The data sheet will be a Word file

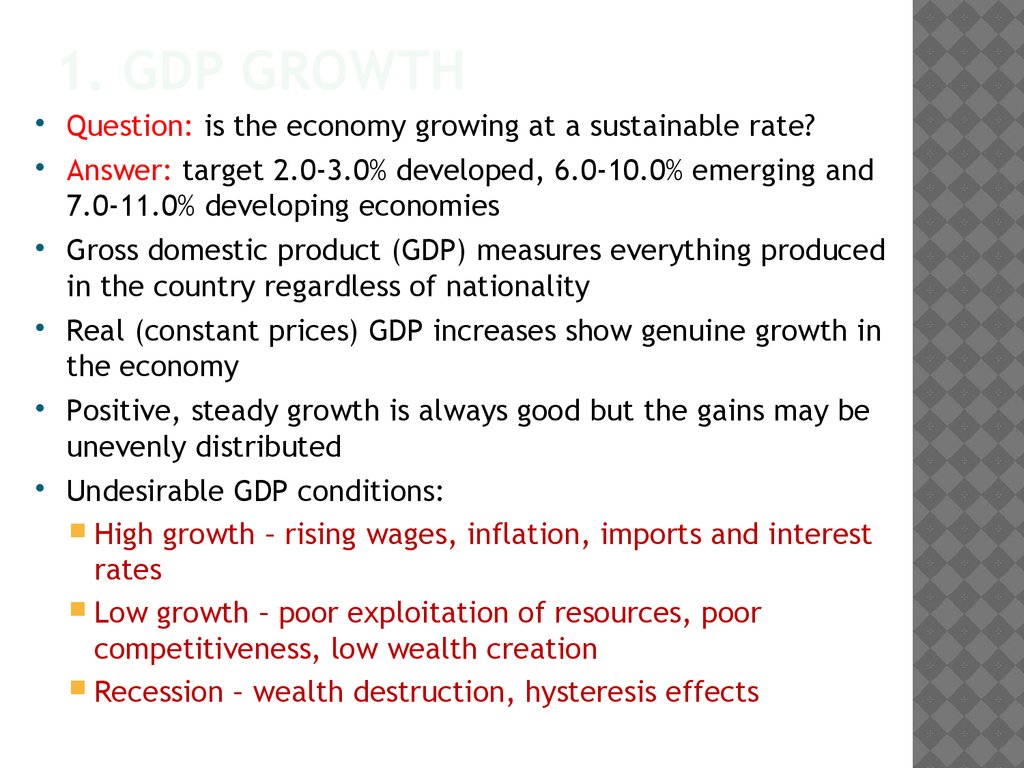

6. 1. GDP Growth

1. GDP GROWTHQuestion: is the economy growing at a sustainable rate?

Answer: target 2.0-3.0% developed, 6.0-10.0% emerging and

7.0-11.0% developing economies

Gross domestic product (GDP) measures everything produced

in the country regardless of nationality

Real (constant prices) GDP increases show genuine growth in

the economy

Positive, steady growth is always good but the gains may be

unevenly distributed

Undesirable GDP conditions:

High growth – rising wages, inflation, imports and interest

rates

Low growth – poor exploitation of resources, poor

competitiveness, low wealth creation

Recession – wealth destruction, hysteresis effects

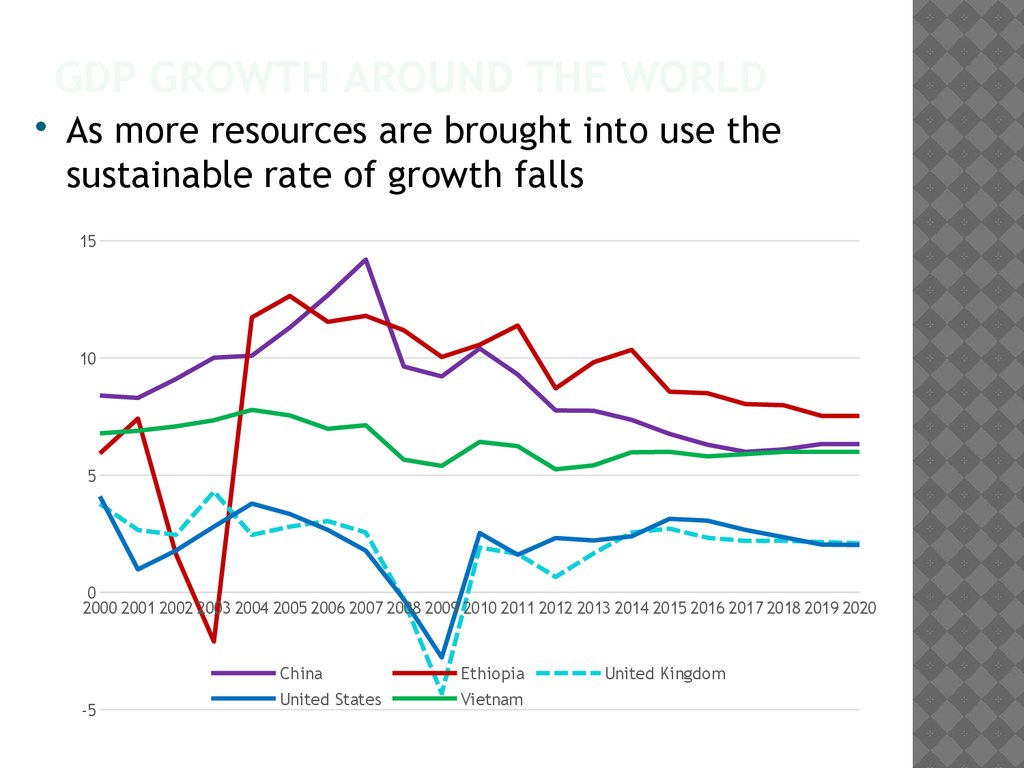

7. GDP Growth around the world

GDP GROWTH AROUND THE WORLDAs more resources are brought into use the

sustainable rate of growth falls

15

10

5

0

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020

-5

China

United States

Ethiopia

Vietnam

United Kingdom

8. GDP Growth targets

GDP GROWTH TARGETSNeed to find a balance between a booming

economy and recession

An

overheating economy with high inflation is usually

treated with high interest rates

A recessionary economy with low inflation is usually

treated with low interest rates

Stagflation (low growth, high inflation) is a

challenging paradox!

Sustainable GDP growth target depends on the

economy

Developed

– slow and steady at 2.0-3.0%

Emerging – relatively high rate 6.0-10%

Developing – relatively very high growth 7.0-11.0%

Rate of return should match the risk

9. GDP Risk and Return for Emerging economies

GDP RISK AND RETURN FOREMERGING ECONOMIES

Sustainable high rates of growth as

unemployed resources are brought into the

economy – e.g. migration from countryside to

cities

GDP

Risk/Return

Recession

<3.9%

High

Low growth

4.0-5.9%

Medium

Sustainable

6.0-10.0%

Low

Boom/overheating

10.1%+

High

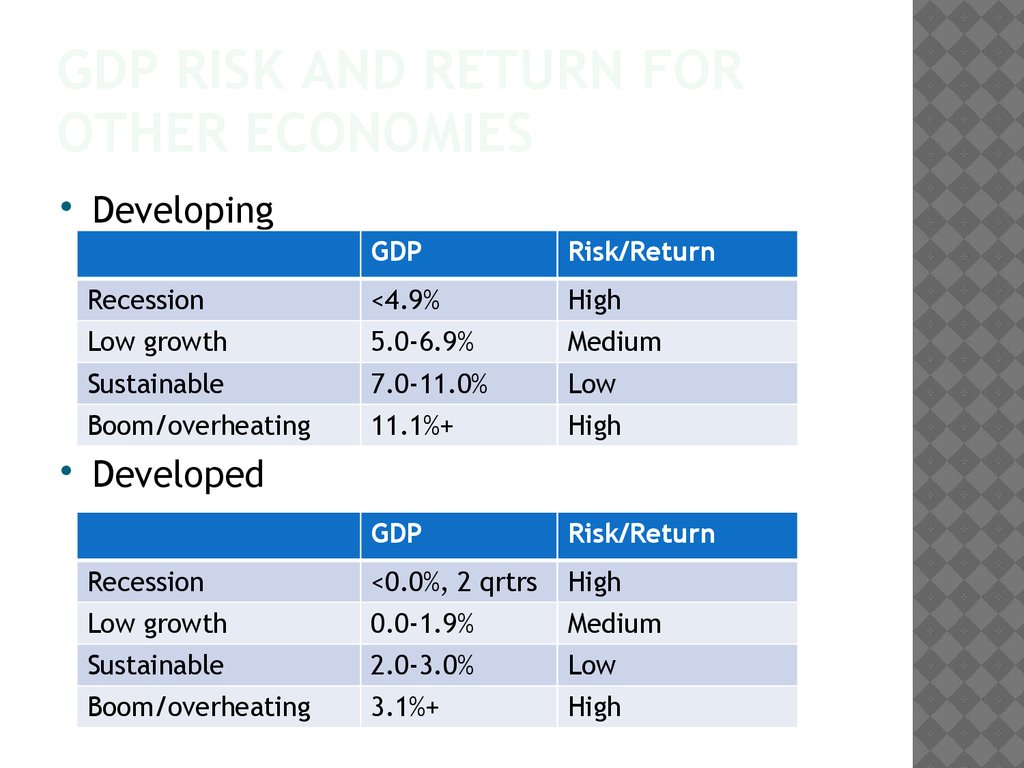

10. GDP Risk and Return for Other economies

GDP RISK AND RETURN FOROTHER ECONOMIES

Developing

GDP

Risk/Return

Recession

<4.9%

High

Low growth

5.0-6.9%

Medium

Sustainable

7.0-11.0%

Low

Boom/overheating

11.1%+

High

GDP

Risk/Return

Recession

<0.0%, 2 qrtrs

High

Low growth

0.0-1.9%

Medium

Sustainable

2.0-3.0%

Low

Boom/overheating

3.1%+

High

Developed

11. 2: Inflation – % Consumer Prices

2: INFLATION – % CONSUMER PRICES50

40

30

20

10

0

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020

-10

China

United States

Ethiopia

Vietnam

United Kingdom

12. inflation

INFLATIONQuestion: Are prices under control?

Answer: compare the inflation with the 2.0% target

Various measures of inflation (RPI, CPI). World Bank use

GDP deflator accounting for the nominal change in GDP

i.e. reveals real GDP change

The GDP deflator is inflation for all output, not a basket

of goods

High inflation

High inflation means constant adjustment to prices

Usually necessitates high interest rates.

Debt values are eroded over time

Low inflation/Deflation

Low inflation is too narrow a target, can slip into

deflation

Deflation may require negative interest rates – tricky!

Some consumers may wait for further price reductions

Debts values increase over time

13. Inflation and Risk/return

INFLATION AND RISK/RETURNMost central banks are targeting 2.0% CPI

inflation

Some central banks will accept overshoots

and undershoots for short periods, others

(e.g. ECB) will accept only an undershoot

On balance, 0.0-2.0% inflation is probably

considered low risk

World Bank data shows inflation as GDP

deflator

Inflation Measure

GDP deflator, annual

% change

Low Risk

0.0-2.0%

High Risk

<0.0%

>2.0%

14. 3. Current Account Deficit – CAD

3. CURRENT ACCOUNT DEFICIT – CADDeveloping countries are often dominated by one or two

industries

It can become highly volatile as trade fluctuates

20

15

10

5

0

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020

-5

-10

China

United Kingdom

United States

Venezuela

15. Current Account Deficit – CAD

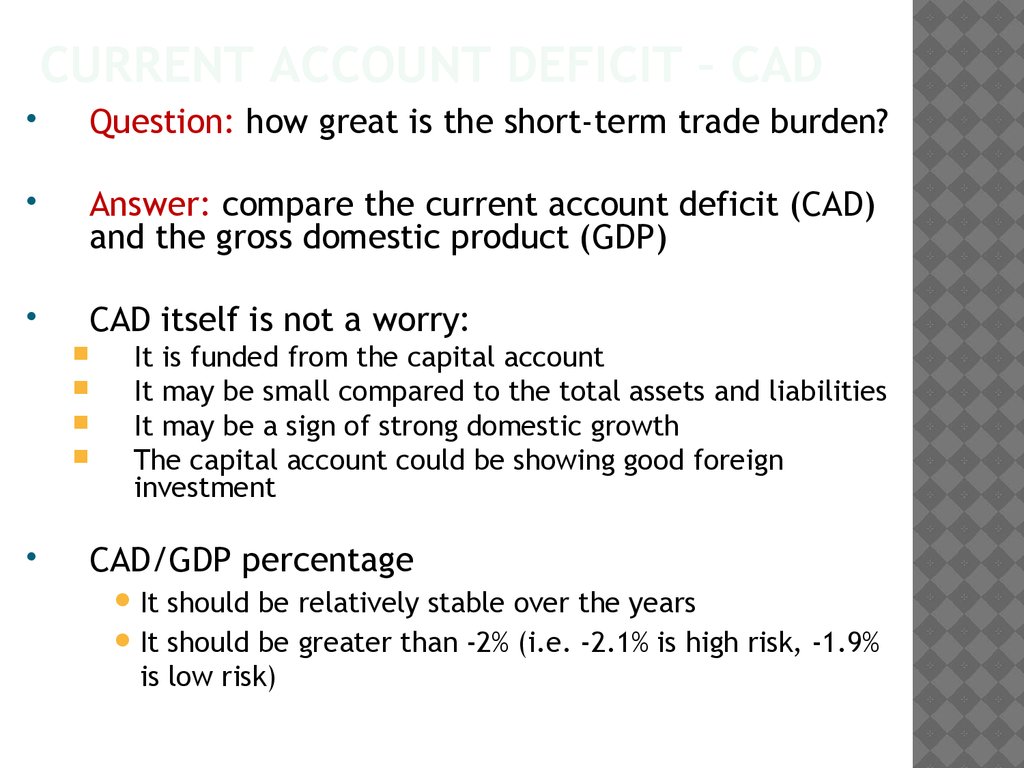

CURRENT ACCOUNT DEFICIT – CADQuestion: how great is the short-term trade burden?

Answer: compare the current account deficit (CAD)

and the gross domestic product (GDP)

CAD itself is not a worry:

It is funded from the capital account

It may be small compared to the total assets and liabilities

It may be a sign of strong domestic growth

The capital account could be showing good foreign

investment

CAD/GDP percentage

It

should be relatively stable over the years

It should be greater than -2% (i.e. -2.1% is high risk, -1.9%

is low risk)

16. Current Account Deficit – CAD

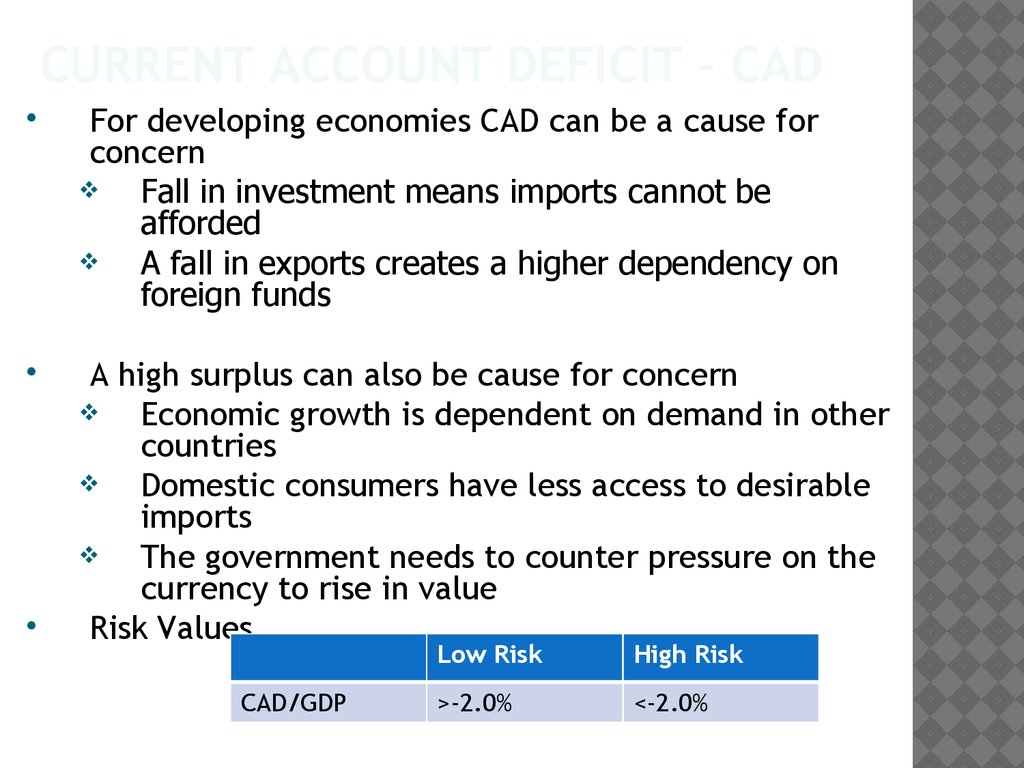

CURRENT ACCOUNT DEFICIT – CADFor developing economies CAD can be a cause for

concern

Fall in investment means imports cannot be

afforded

A fall in exports creates a higher dependency on

foreign funds

A high surplus can also be cause for concern

Economic growth is dependent on demand in other

countries

Domestic consumers have less access to desirable

imports

The government needs to counter pressure on the

currency to rise in value

Risk Values

CAD/GDP

Low Risk

High Risk

>-2.0%

<-2.0%

17. Developed Country Comparison: Usa

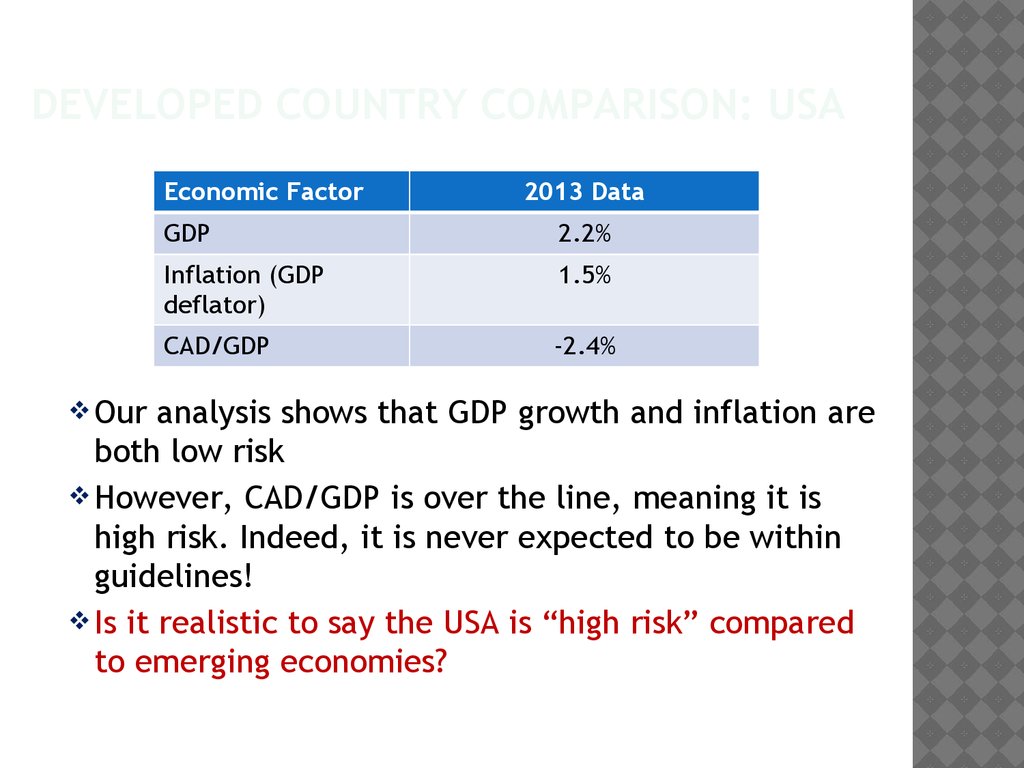

DEVELOPED COUNTRY COMPARISON: USAEconomic Factor

Our

2013 Data

GDP

2.2%

Inflation (GDP

deflator)

1.5%

CAD/GDP

-2.4%

analysis shows that GDP growth and inflation are

both low risk

However, CAD/GDP is over the line, meaning it is

high risk. Indeed, it is never expected to be within

guidelines!

Is it realistic to say the USA is “high risk” compared

to emerging economies?

18. Criticism of the IMF Quantitative approach

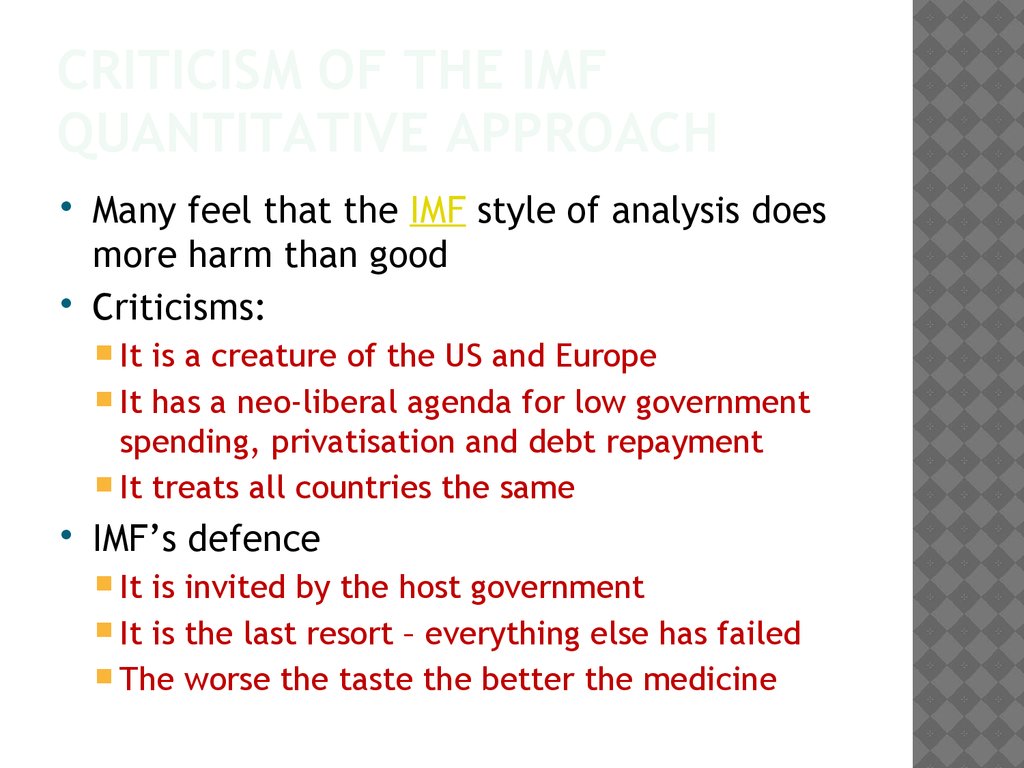

CRITICISM OF THE IMFQUANTITATIVE APPROACH

Many feel that the IMF style of analysis does

more harm than good

Criticisms:

It

is a creature of the US and Europe

It has a neo-liberal agenda for low government

spending, privatisation and debt repayment

It treats all countries the same

IMF’s defence

It

is invited by the host government

It is the last resort – everything else has failed

The worse the taste the better the medicine

19. ERA exam question Part ii: FDI investment decision

ERA EXAM QUESTION PART II:FDI INVESTMENT DECISION

The second half of Exam Question 1 concerns

the best target for foreign direct investment

(FDI)

[15 marks]

The decision of which sector of the economy

to invest in can only be based on the

information in the datasheet.

There are three sectors to choose from:

Agriculture

Industry

Services

The FDI decision should identify and analyse

the most appropriate economic factors

20. Factors influencing FDI

FACTORS INFLUENCING FDIThe economic factors that are appropriate to

the FDI decision depend upon the nature of the

investment – it is therefore an opportunity for

creative thinking by entrepreneurs

FDI entrepreneurs need to analyse trends in the

data to uncover any new opportunities

It is also important to identify specific data that

indicates new opportunities

To help you remember the most important

factors, we have a Greenwich mnemonic:

GLIFTS

21. Greenwich mnemonic - GLIFTS

GREENWICH MNEMONIC - GLIFTSGLIFTS is only there to help you remember – it

should not be referenced!

It will point you towards the most basic

information, but you can use any factor you

think is important

GLIFTS will give you up to 6 economic factors –

at least 5 are needed for the exam

22. Using GLIFTS

USING GLIFTSG – GDP per capita growth rate (the trend). May

indicate a growing productivity, higher spending.

L - Life expectancy. Gives you an idea of the general

well being of the population and the degree to which

the government is looking after everyone

I – Inflation (GDP deflator): is the trend steady or out

of control? Indicates the economic competency of the

government

F – FDI, measure of how well the country is attracting

foreign investors, particularly the trend

T – Technology

S – School

23. Other interesting data…

OTHER INTERESTING DATA…An entrepreneur will browse data looking for

items of interest

This is when your creativity reaches its peak!

Some data that might catch your eye and

deserve further consideration:

Poverty Headcount

Malnutrition

Immunisation

Boy/girl ratio in

education

Water access

Agriculture, industry,

services added value

Gross capital formation

Time to start a business

Net migration

Total debt service

24. Seminar task

SEMINAR TASKCome prepared with your calculators.

We will be doing two sets of exercises

Working

out the ERA for an emerging country – data

sheets available in the tutorial folder

Considering the country as a candidate for investment

25. sources

SOURCESWorld Bank

<http://databank.worldbank.org/data/views/reports/ReportWidgetCustom.aspx?

Report_Name=CountryProfile&Id=b450fd57>

IMF (for CAD/GDP) – latest World Economic Outlook report

<http://www.imf.org/external/ns/cs.aspx?id=28>

Australia CAD/GDP – Mr Wood.com.au

<http://economics.mrwood.com.au/statistics/goal/goalcadgdp.asp>

US Debt Service – Creditflowinvestor.com

<http://www.creditflowinvestor.com/FederalDebtService.htm>

IMF paper on MRR – Boorman, J. and S. Ingves (2001), Issues in Reserves

Adequacy and Management

<http://www.imf.org/external/np/pdr/resad/2001/101501.pdf>

Bank of England current account information sheet

<http://www.bankofengland.co.uk/publications/speeches/2006/speech271.pdf>

IMF guide to financial terminology

<http://www.imf.org/external/pubs/ft/eds/Eng/Guide/file6.pdf>

UN debt service ratio definition

<http://esl.jrc.it/envind/un_meths/UN_ME069.htm>

Экономика

Экономика Менеджмент

Менеджмент Бизнес

Бизнес