Похожие презентации:

Complaints Training. Guide for Customer Facing

1.

Complaints TrainingGuide for Customer Facing

Departments

By Compliance Departments Group wide

2.

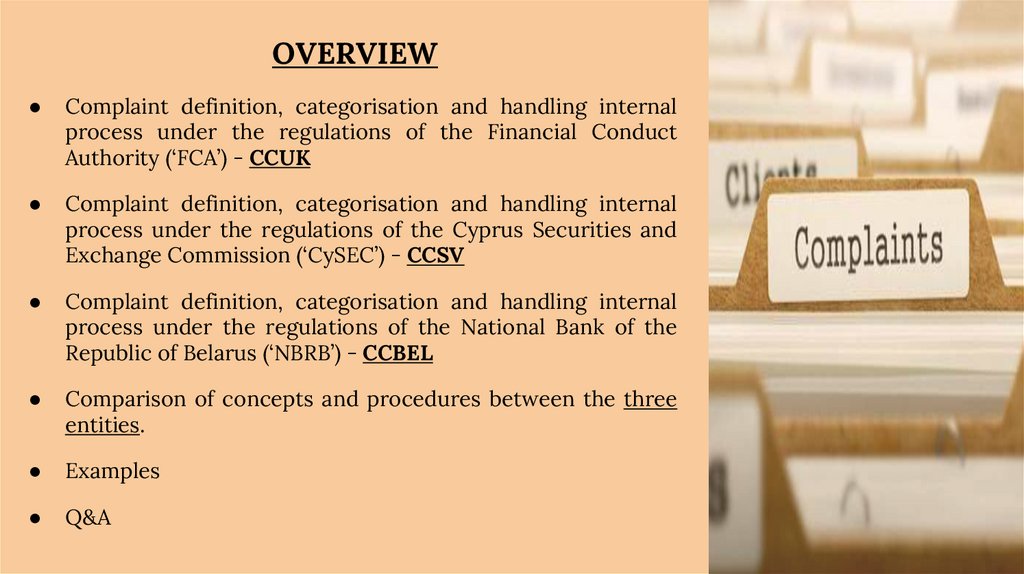

OVERVIEWComplaint definition, categorisation and handling internal

process under the regulations of the Financial Conduct

Authority (‘FCA’) - CCUK

Complaint definition, categorisation and handling internal

process under the regulations of the Cyprus Securities and

Exchange Commission (‘CySEC’) - CCSV

Complaint definition, categorisation and handling internal

process under the regulations of the National Bank of the

Republic of Belarus (‘NBRB’) - CCBEL

Comparison of concepts and procedures between the three

entities.

Examples

Q&A

3.

CCUK - Financial Conduct Authority (‘FCA’)COMPLAINT DEFINITION .-

¹ ‘any oral or written expression of dissatisfaction, whether justified or not,

from, or on behalf of a client or potential client about the provision of, or

failure to provide, a financial service, which alleges that the complainant has

suffered (or may suffer) financial loss, material distress or material

inconvenience.’

1.

FCA Handbook section DISP 1.1A.9

4.

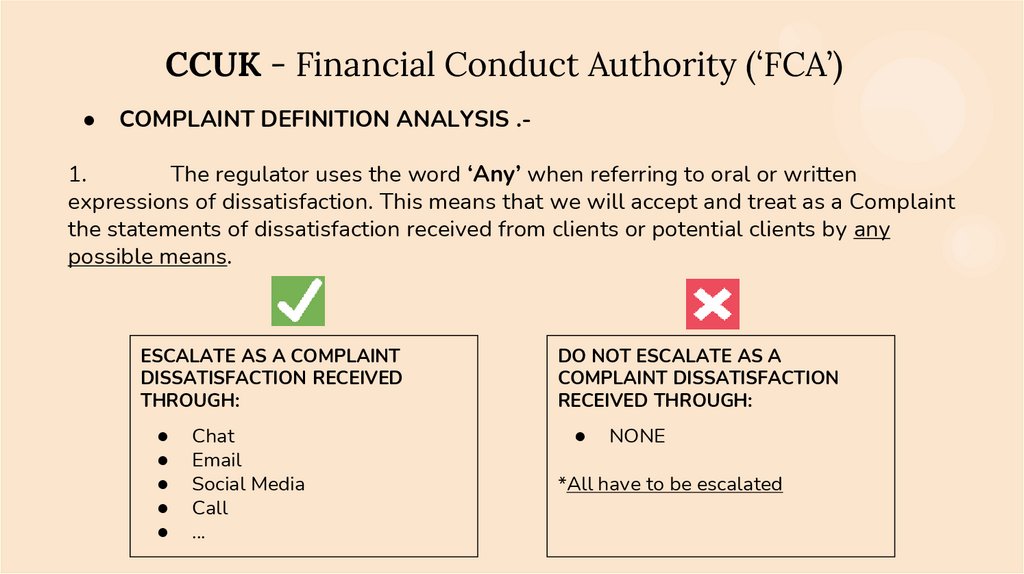

CCUK - Financial Conduct Authority (‘FCA’)COMPLAINT DEFINITION ANALYSIS .-

1.

The regulator uses the word ‘Any’ when referring to oral or written

expressions of dissatisfaction. This means that we will accept and treat as a Complaint

the statements of dissatisfaction received from clients or potential clients by any

possible means.

ESCALATE AS A COMPLAINT

DISSATISFACTION RECEIVED

THROUGH:

Chat

Social Media

Call

...

DO NOT ESCALATE AS A

COMPLAINT DISSATISFACTION

RECEIVED THROUGH:

NONE

*All have to be escalated

5.

CCUK - Financial Conduct Authority (‘FCA’)2.

COMPLAINT DEFINITION ANALYSIS .‘Provision of, or failure to provide, a financial service.’

Every action we take or situation we face within the scope of a business relationship

with one of our clients / potential clients will be considered related to the provision of a

financial service, regardless of the situation not being directly related with a

financial/money matter.

Examples of complaint causes not being directly related with a financial/money

situation but being considered as ‘related to the provision of a financial service’:

Due Diligence (Identity Documents, Source of Funds Wealth...)

Technical Issues of the platform. (some of these issues do not have financial

consequences but need to be considered nonetheless.)

Application of Terms & Conditions and/or other Policies.

...

6.

CCUK - Financial Conduct Authority (‘FCA’)3.

COMPLAINT DEFINITION ANALYSIS .Definitions of financial loss, material distress or material inconvenience.’

Note that Compliance will decide if any of these 3 concepts apply to the case and rule it

in or out of scope, accordingly. This decision will not have be made by the person receiving

the Complaint (Customer Facing Staff).

Financial Loss: Action has resulted in a monetary loss.

Material Distress: Action has affected the emotional state of the client (stress, anxiety,

embarrassment...)

Material Inconvenience: Action has caused a difficulty and disruption on the customer’s

life.

The above does not necessarily have to be true. If the client claims it to be true then it will

fall within the definition.

7.

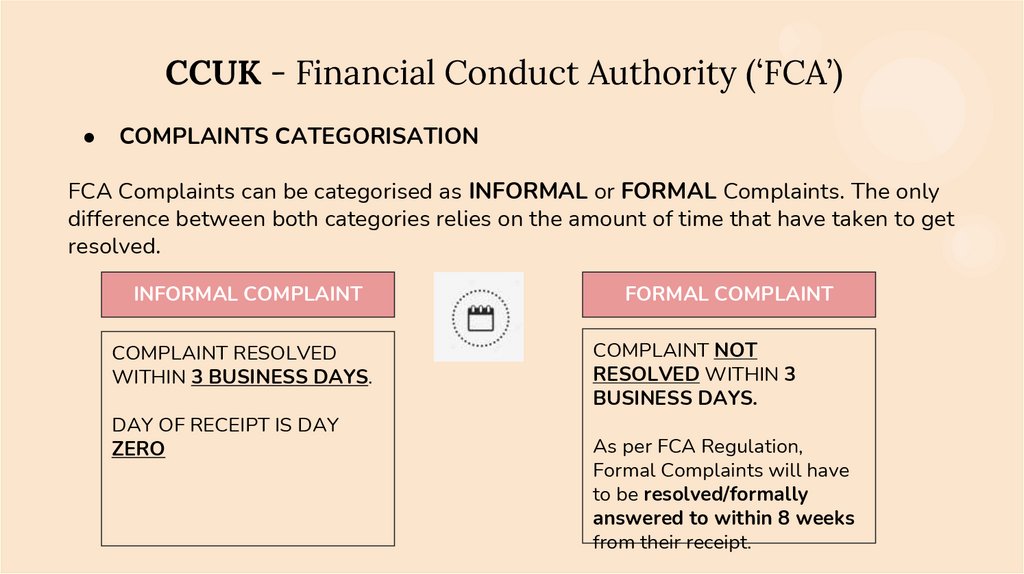

CCUK - Financial Conduct Authority (‘FCA’)COMPLAINTS CATEGORISATION

FCA Complaints can be categorised as INFORMAL or FORMAL Complaints. The only

difference between both categories relies on the amount of time that have taken to get

resolved.

INFORMAL COMPLAINT

COMPLAINT RESOLVED

WITHIN 3 BUSINESS DAYS.

DAY OF RECEIPT IS DAY

ZERO

FORMAL COMPLAINT

COMPLAINT NOT

RESOLVED WITHIN 3

BUSINESS DAYS.

As per FCA Regulation,

Formal Complaints will have

to be resolved/formally

answered to within 8 weeks

from their receipt.

8.

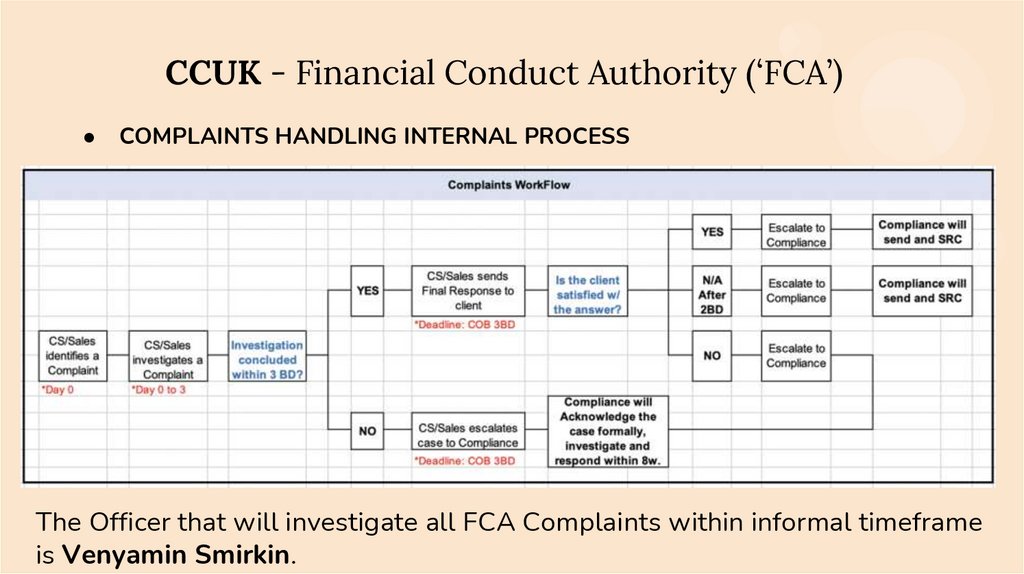

CCUK - Financial Conduct Authority (‘FCA’)COMPLAINTS HANDLING INTERNAL PROCESS

The Officer that will investigate all FCA Complaints within informal timeframe

is Venyamin Smirkin.

9.

CCSV - Cyprus Securities and ExchangeCommission (‘CySEC’)

10.

CCSV - Cyprus Securities and ExchangeCommission (‘CySEC’)

COMPLAINT DEFINITION .“A statement of dissatisfaction addressed to a firm by a natural or legal person relating

to the provision of an investment service provided under MiFID II, the UCITS Directive or

the AIFMD”.

According to Article 26 (1) of Directive (EU) 2017/565

“Investment firms shall establish, implement and

maintain effective and transparent complaints

management policies and procedures for the prompt

handling of clients’ or potential clients’ complaints.

Investment firms shall keep a record of the complaints

received and the measures taken for their resolution”

11.

CCSV - Cyprus Securities and ExchangeCommission (‘CySEC’)

COMPLAINT’S NATURE .-

According to CySEC, complaints could be related either with a financial product or with a

financial service provided by a CIF (Cyprus Investment Firm).

Examples:

● Due Diligence (Identity Documents, Source of Funds/Wealth...)

● Technical Issues of the web or mobile platform. (some of these issues do not have financial

consequences but need to be considered nonetheless.)

● Application of Terms & Conditions and/or other Policies.

12.

CCSV - Cyprus Securities and ExchangeCommission (‘CySEC’)

COMPLAINT’S NATURE .-

The compliance department should be informed of any client’s expression of dissatisfaction that meets

the following criteria:

1. received via Email through complaint@capital.com or complaints online Website Form;

1. queries/questions received by Customer Support or account managers (via Email, Call…) with

regards to some issue and request for resolution, and, if/when the resolution is offered, the client

remains dissatisfied (keywords): complaint, authorities/regulators, legal actions, lawyers etc;

1. queries/questions received by Customer Support or account managers with regards to some issue

with a request for resolution, nevertheless the query/question is complicated and cannot be

resolved within 72 hrs;

1. recurring questions/queries about the same/identical issue and/or affecting a number of clients;

1. when the content of the complaint text implies that the complaint should be treated as a formal

complaint, i.e. requests for complaint reference number (URN).

13.

CCSV - Cyprus Securities and ExchangeCommission (‘CySEC’)

COMPLAINTS CATEGORISATION

The regulator does not differentiate on the type of complaint, formal or informal.

The company differentiates between a formal complaint and a query (an informal complaint).

Formal complaints will be treated as such only if the client provides details of the causes of the

complaint.

14.

CCSV - Cyprus Securities and ExchangeCommission (‘CySEC’)

COMPLAINTS PROCEDURE - QUERIES (INFORMAL COMPLAINTS)

CC CY has implemented the following procedure for queries/informal complaints handling:

1. When an enquiry/question cannot be resolved immediately by the customer support/sales

agents it should be forwarded through slack to the relevant department.

1. The relevant department will provide the customer support with a proper reply for the

client or if further investigation is required, a task will be opened in Asana for the enquiry.

1. When the investigation is complete a reply will be sent to the client either through

customer support or through the compliance department.

P.S. If the client remains unsatisfied then he needs to be informed that he has a right to

submit a formal complaint via complaint@capital.com

15.

CCSV - Cyprus Securities and ExchangeCommission (‘CySEC’)

Queries/Informal Complaints are (but not limited to):

1. Inquiries/questions

2. Requests to investigate

3. Request to receive a reply from the compliance department

Generally, informal complaints are the

complaints which are easy to be handled

internally and the client is satisfied with the

information provided or the offer for

settlement provided by the company’s

representatives..

16.

CCSV - Cyprus Securities and ExchangeCommission (‘CySEC’)

COMPLAINTS PROCEDURE - FORMAL COMPLAINTS

CC CY has implemented the following procedure for formal complaints handling:

1. Upon reception of a formal complaint it is registered in an internal register with a unique

reference number (URN).

2. The URN is communicated to the complainant within 5 days upon reception of the complaint.

3. The CIF informs the complainant that he should use the URN for any future communication

with the CIF, the Financial Ombudsman/ CySEC.

4. Investigation and final conclusion letter needs to be communicated to the complaint within

two months from the date the initial complaint was received.

5. In case more time is needed and a delay is expected the CIF needs to notify the complainant

for the reasons of the delay and the expected time of completion. Maximum time of

investigation is 3 months from reception of complaint.

6. Monthly report to CySEC of all complaints received and how they are being handled.

17.

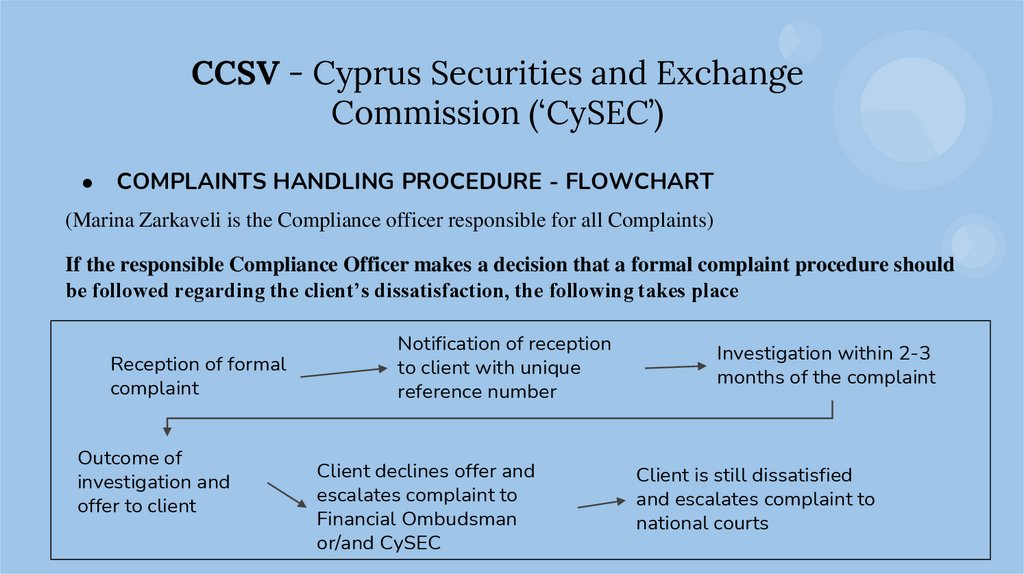

CCSV - Cyprus Securities and ExchangeCommission (‘CySEC’)

COMPLAINTS HANDLING PROCEDURE - FLOWCHART

(Marina Zarkaveli is the Compliance officer responsible for all Complaints)

If the responsible Compliance Officer makes a decision that a formal complaint procedure should

be followed regarding the client’s dissatisfaction, the following takes place

Reception of formal

complaint

Outcome of

investigation and

offer to client

Notification of reception

to client with unique

reference number

Client declines offer and

escalates complaint to

Financial Ombudsman

or/and CySEC

Investigation within 2-3

months of the complaint

Client is still dissatisfied

and escalates complaint to

national courts

18.

CCSV - Cyprus Securities and ExchangeCommission (‘CySEC’)

References

*Guidelines on Complaints-handling for the securities and banking sectors, JC 2018 35

19.

CCBEL - National Bank of the Republic of Belarus (‘NBRB’)COMPLAINT DEFINITION .-

*Clause 1 of Belarusian law ‘On the complaints (appeals) of citizens and legal entities’ defines the

term Complaint as “a demand to restore the rights, freedoms and/or legitimate interests from a

complainant, that have been violated by the actions or omissions of organizations and citizens,

including individual entrepreneurs (hereinafter, unless otherwise specified, - a citizen)”

*There is no dedicated complaint handling procedure specified by the National Bank of the Republic of

Belarus (‘NBRB’). Instead, all complaints other queries/inquiries are handled in accordance with Belarusian

legislation.

20.

CCBEL - National Bank of the Republic of Belarus (‘NBRB’)Complaints definition and categorisation in the context of Belarusian legislation.-

According to Belarusian legislation there is no such as thing an “informal” complaint. At the same

time, very specific conditions must be met for a complaint to be considered as “formal” or official.

From legal perspective, all communications containing clear expressions of dissatisfaction or

mentions of potential legal actions that we receive from Customers are to be considered as

queries/enqyres and can’t be recognised as a formal complaints.

These can be received via our standard means such as Chat, Email, Social Media or Call.

Nonetheless, according to our Company’s internal policies and in order to provide and maintain

the highest possible level of Customer satisfaction, such cases are treated and referred to

internally as informal complaints.

All unresolved potential complaints must be escalated to the Compliance department and dealt

with accordingly.

21.

CCBEL - National Bank of the Republic of Belarus (‘NBRB’)Complaints definition and categorisation in the context of Belarusian legislation.-

According to the current Belarusian regulations, only the following can be acknowledged as formal:

Complaints submitted in a printed/written form and delivered to Company’s legal address by post services

or the applicant (his legal representative) himself.

● Complaints submitted by the applicant (his legal representative) leaving a handwritten record in a “Book of

complaints and suggestions” stored in the office at the Company’s legal address.

In addition to Complaints, the Customers can also submit their claims:

● Claims submitted directly to our regulator (no limitations for them to be in a printed/written form in this case).

● Legal claims submitted through Belarusian and International legal system (courts).

It must be noted, that there are no third party organisations conducting Alternative Dispute Resolution under NBRB

regulations and therefore complaints recognised as formal tend to have much more serious repercussions for the

Company in comparison to CCUK and CCSV jurisdictions and must be avoided at all costs.

22.

CCBEL - National Bank of the Republic of Belarus (‘NBRB’)Complaints handling internal process

1. When a potential complaint is received from a Customer via Email, Webchat, Social media, during a

phone call, etc. it is mandatory for the employee who handled the initial communication to conduct

preliminary investigation and attempt resolving the case immediately.

2. In situations, when immediate resolution is impossible, the case must be forwarded to the relevant

department and the Customer needs to be notified accordingly. The relevant department will provide

Customer Support department with instructions for a proper reply.

3. If further investigation is required or a decision regarding potential resolution must be made, then such

a case needs to escalate to Compliance department via #possible_complaints Slack channel. The

responsible Compliance Officers (currently Venyamin Smirkin and Tatiana Borisenko) must be tagged.

4. If the case/enquiry is directly related to legal matters, then such a case must be escalated to

Compliance department immediately.

5. Once the case is escalated to Compliance department, the decision will be made whether to treat the

case as another enquiry or an informal Complaint. If it is decided to treat the case as informal Complaint,

a dedicated Asana task will be created by responsible Compliance Officer.

23.

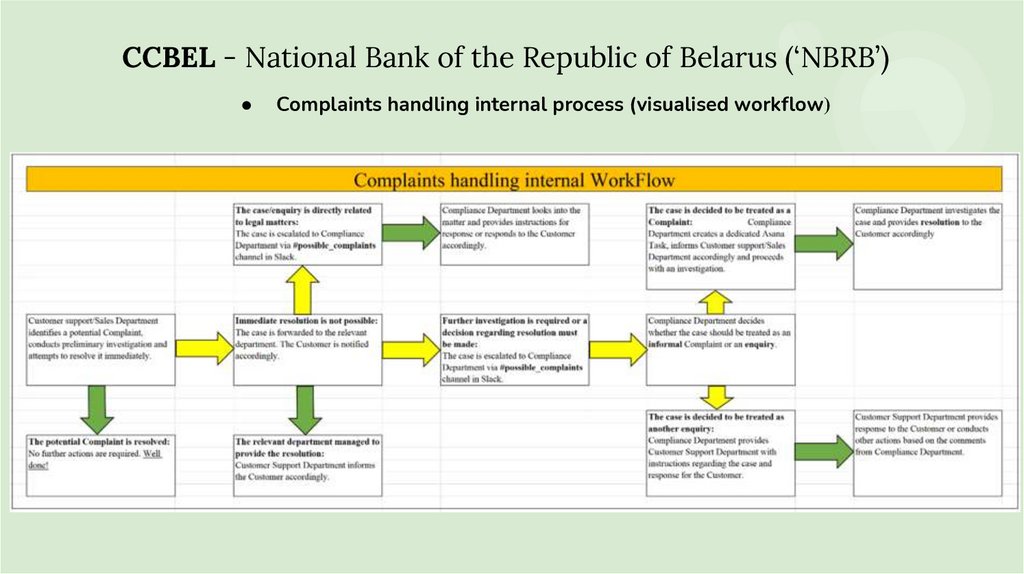

CCBEL - National Bank of the Republic of Belarus (‘NBRB’)Complaints handling internal process (visualised workflow)

24.

COMPARISON OF CONCEPTS & PROCEDURESCCUK

CCSV

CCBEL

> Regulation - Complaints are

highly regulated by the FCA.

> Regulation - CySEC adheres

to the established in the EU

Reg. regarding Complaints.

> Regulation - In NBRB there is a

lack of strict and formal

regulations on Complaints Pr.

Process highly relies on decisions

made by Compliance/Customer

Facing employees.

> Definition

i) Expression of dissatisfaction

ii) From Client/Potential Client natural or legal person

iii) re. Financial Service (provision

or failure to provide)

iv) Alleged financial loss,

material distress / inconvenience.

> Definition

i) Expression of dissatisfaction

ii) From Client/Potential Client natural or legal person

iii) re. Financial Service or

Product

> Definition

i) Demand to restore the rights,

freedoms and/or legitimate

interests.

ii) From any ‘Complainant’

25.

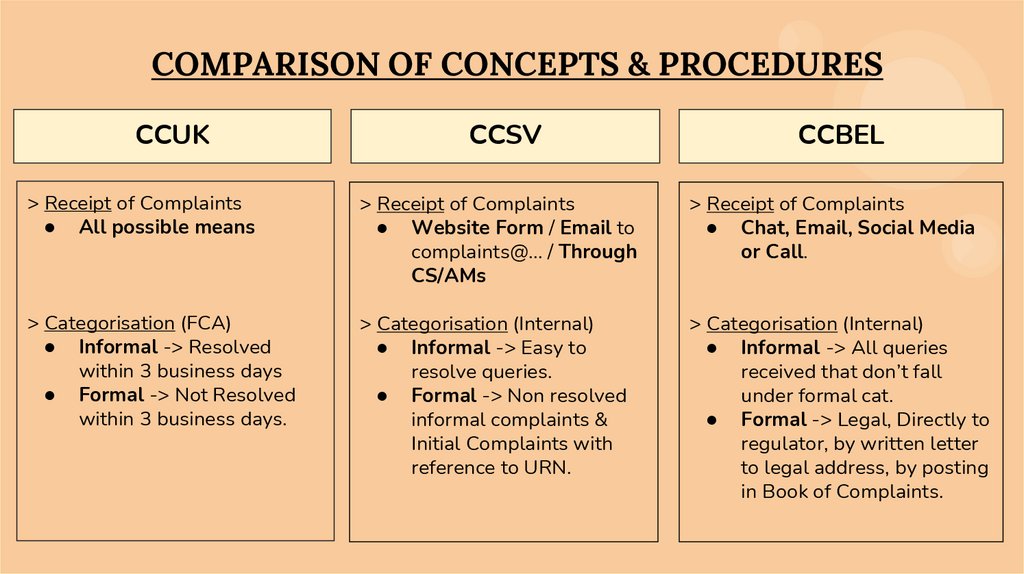

COMPARISON OF CONCEPTS & PROCEDURESCCUK

CCSV

CCBEL

> Receipt of Complaints

● All possible means

> Receipt of Complaints

● Website Form / Email to

complaints@... / Through

CS/AMs

> Receipt of Complaints

● Chat, Email, Social Media

or Call.

> Categorisation (FCA)

● Informal -> Resolved

within 3 business days

● Formal -> Not Resolved

within 3 business days.

> Categorisation (Internal)

● Informal -> Easy to

resolve queries.

● Formal -> Non resolved

informal complaints &

Initial Complaints with

reference to URN.

> Categorisation (Internal)

● Informal -> All queries

received that don’t fall

under formal cat.

● Formal -> Legal, Directly to

regulator, by written letter

to legal address, by posting

in Book of Complaints.

26.

COMPARISON OF CONCEPTS & PROCEDURESCCUK

> Process

Informal ->

CCSV

> Process

i) CS/AM publishes case in

Slack Channel

#uk_informal_complaints

ii) Venyamin investigates

and either resolves within

3 business days or the

case is taken as formal by

Compliance UK.

Formal -> Investigation &

Final response generally

given within 8 weeks.

Informal ->

i) CS/AM publishes case

in Slack Channel

#possible_complaints

ii) Compliance or CS will

investigate and provide a

response. If the client is

not satisfied has to

escalate case to formal.

Formal -> Investigation &

Final response generally

given within 8 weeks.

CCBEL

> Process

Informal ->

i) CS/AM publishes case in

Slack Channel

#possible_complaints

ii) Venyamin & Tatsiana will

decide if treat it as query or

informal complaint, and will

investigate and respond.

Formal -> Rare cases.

Investigation and Final

response generally given

within 2 weeks.

27.

COMPARISON OF CONCEPTS & PROCEDURESCCUK

> Alternative Dispute Resolution

(‘ADR’)

Financial Ombudsman

Service (‘FOS’)

If a client is not satisfied with our

final response, can escalate the

case to the FOS free of cost.

CCSV

> Alternative Dispute

Resolution (‘ADR’)

Financial Ombudsman of

the Republic of Cyprus

(‘FO’)

If a client is not satisfied with

our final response, can escalate

the case to the FO paying a fee

of 20 Euros.

CCBEL

> Alternative Dispute Resolution

(‘ADR’)

None

28.

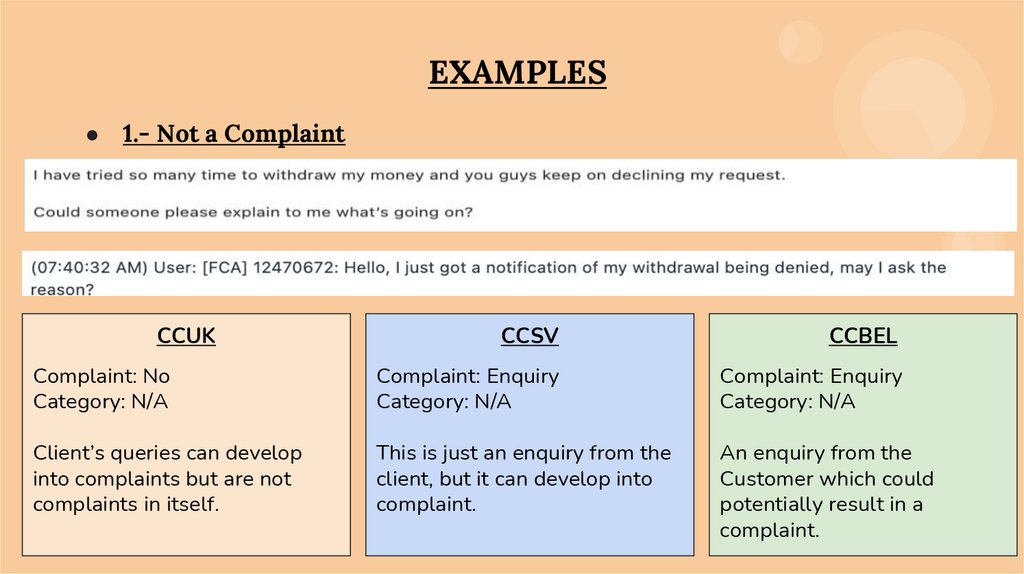

EXAMPLES● 1.- Not a Complaint

CCUK

CCSV

CCBEL

Complaint: No

Category: N/A

Complaint: Enquiry

Category: N/A

Complaint: Enquiry

Category: N/A

Client’s queries can develop

into complaints but are not

complaints in itself.

This is just an enquiry from the

client, but it can develop into

complaint.

An enquiry from the

Customer which could

potentially result in a

complaint.

29.

EXAMPLES● 2.- Complaints - Tone and expressions

CCSV

CCBEL

Complaint: Yes

Category: Formal/Informal

Complaint: Yes

Category: Informal

Complaint: Yes

Category: Informal

Statement of dissatisfaction

identifiable through tone and

expressions and implying

material distress.

Informal complaint that could

be escalated as an official

complaint if the answer

provided doesn’t satisfy the

client.

Considered informal complaint.

However, depending on the

circumstances and information in

UAA there is a chance that it

could have been treated as

simple query.

CCUK

30.

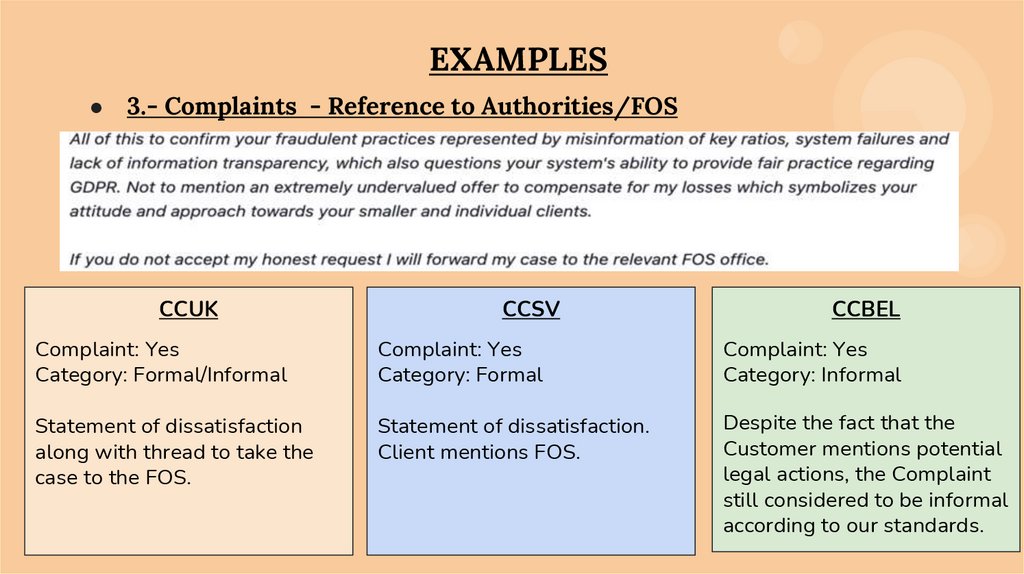

EXAMPLES● 3.- Complaints - Reference to Authorities/FOS

CCUK

CCSV

CCBEL

Complaint: Yes

Category: Formal/Informal

Complaint: Yes

Category: Formal

Complaint: Yes

Category: Informal

Statement of dissatisfaction

along with thread to take the

case to the FOS.

Statement of dissatisfaction.

Client mentions FOS.

Despite the fact that the

Customer mentions potential

legal actions, the Complaint

still considered to be informal

according to our standards.

31.

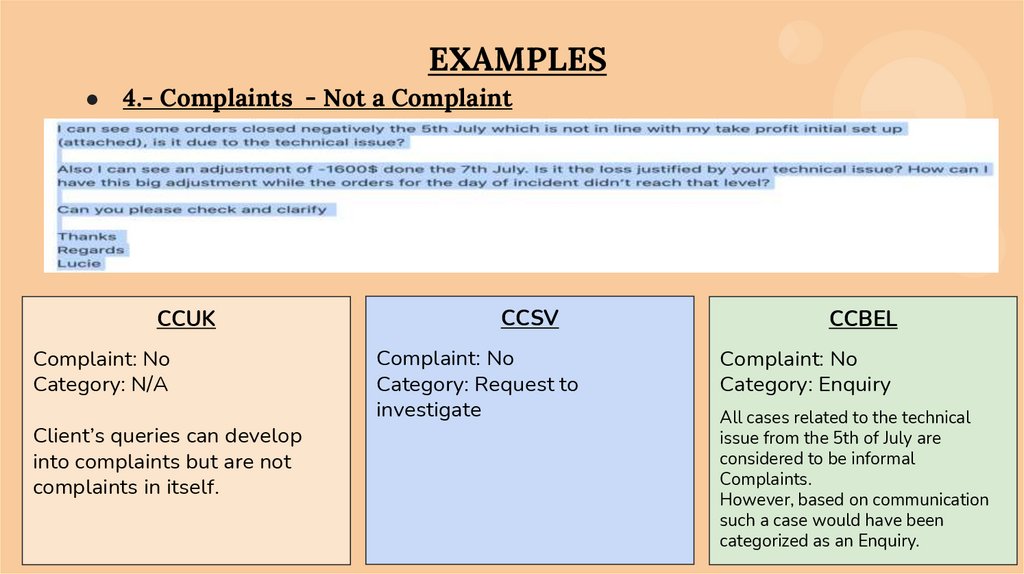

EXAMPLES● 4.- Complaints - Not a Complaint

CCUK

Complaint: No

Category: N/A

Client’s queries can develop

into complaints but are not

complaints in itself.

CCSV

Complaint: No

Category: Request to

investigate

CCBEL

Complaint: No

Category: Enquiry

All cases related to the technical

issue from the 5th of July are

considered to be informal

Complaints.

However, based on communication

such a case would have been

categorized as an Enquiry.

32.

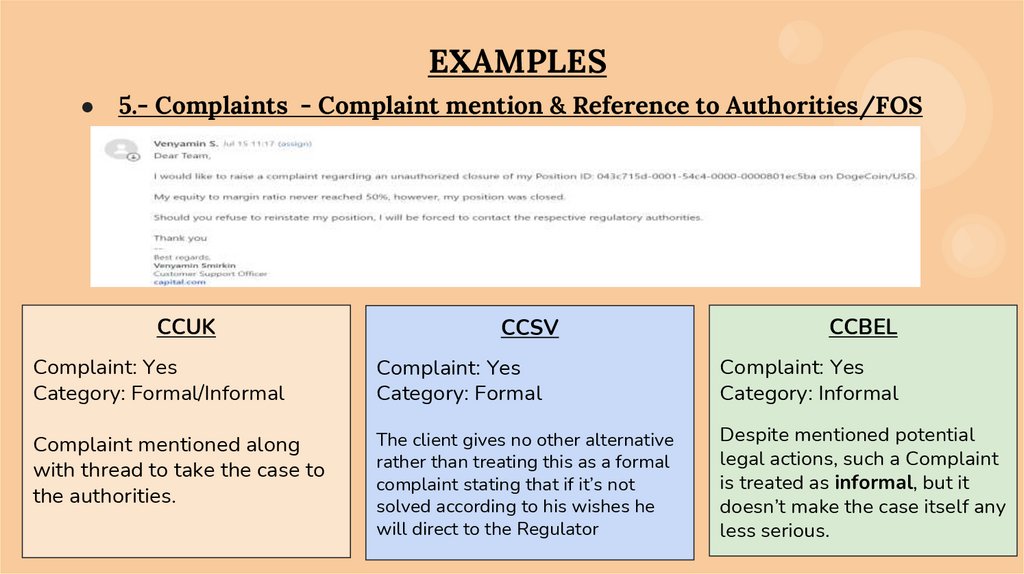

EXAMPLES● 5.- Complaints - Complaint mention & Reference to Authorities/FOS

CCUK

CCSV

CCBEL

Complaint: Yes

Category: Formal/Informal

Complaint: Yes

Category: Formal

Complaint: Yes

Category: Informal

Complaint mentioned along

with thread to take the case to

the authorities.

The client gives no other alternative

rather than treating this as a formal

complaint stating that if it’s not

solved according to his wishes he

will direct to the Regulator

Despite mentioned potential

legal actions, such a Complaint

is treated as informal, but it

doesn’t make the case itself any

less serious.

33.

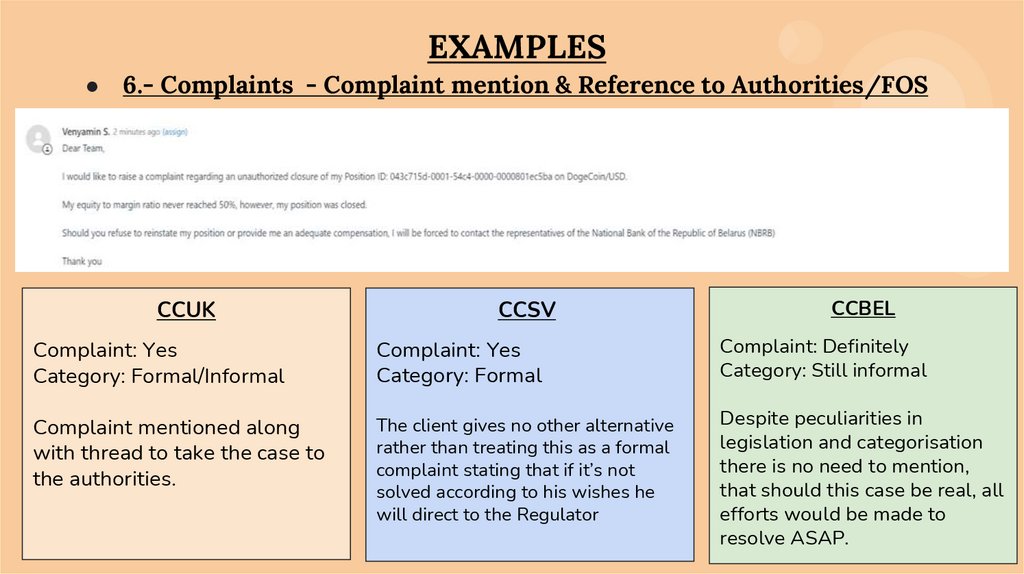

EXAMPLES● 6.- Complaints - Complaint mention & Reference to Authorities/FOS

CCUK

CCSV

CCBEL

Complaint: Yes

Category: Formal/Informal

Complaint: Yes

Category: Formal

Complaint: Definitely

Category: Still informal

Complaint mentioned along

with thread to take the case to

the authorities.

The client gives no other alternative

rather than treating this as a formal

complaint stating that if it’s not

solved according to his wishes he

will direct to the Regulator

Despite peculiarities in

legislation and categorisation

there is no need to mention,

that should this case be real, all

efforts would be made to

resolve ASAP.

Английский язык

Английский язык