Похожие презентации:

Competitive Pricing

1.

FIN 30210:Managerial Economics

Competitive Pricing

Techniques

2.

Basic pathway for a product to get to theconsumer

Distributor

Manufacturer

Retailer

Consumer

3.

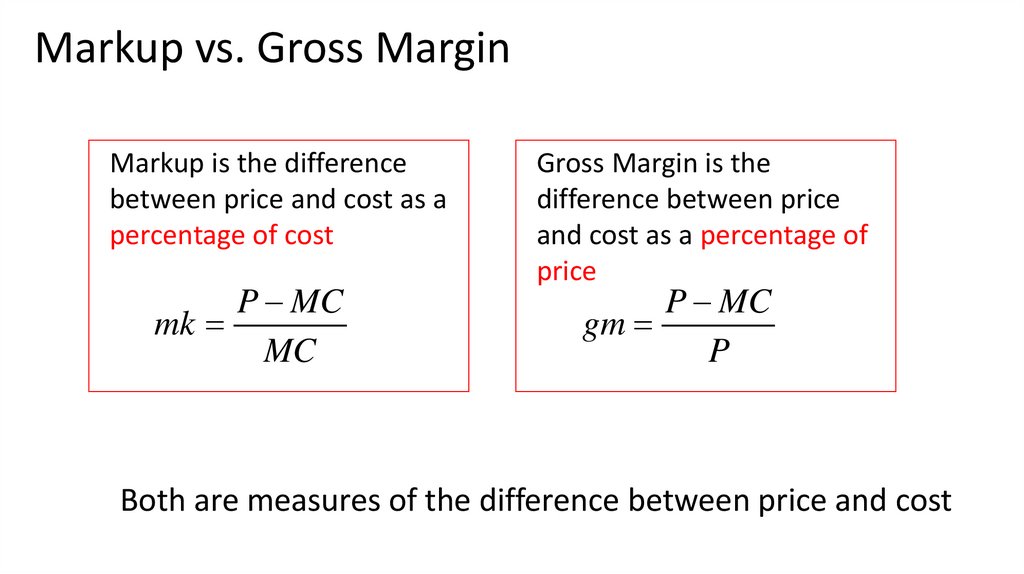

Markup vs. Gross MarginMarkup is the difference

between price and cost as a

percentage of cost

P MC

mk

MC

Gross Margin is the

difference between price

and cost as a percentage of

price

P MC

gm

P

Both are measures of the difference between price and cost

4.

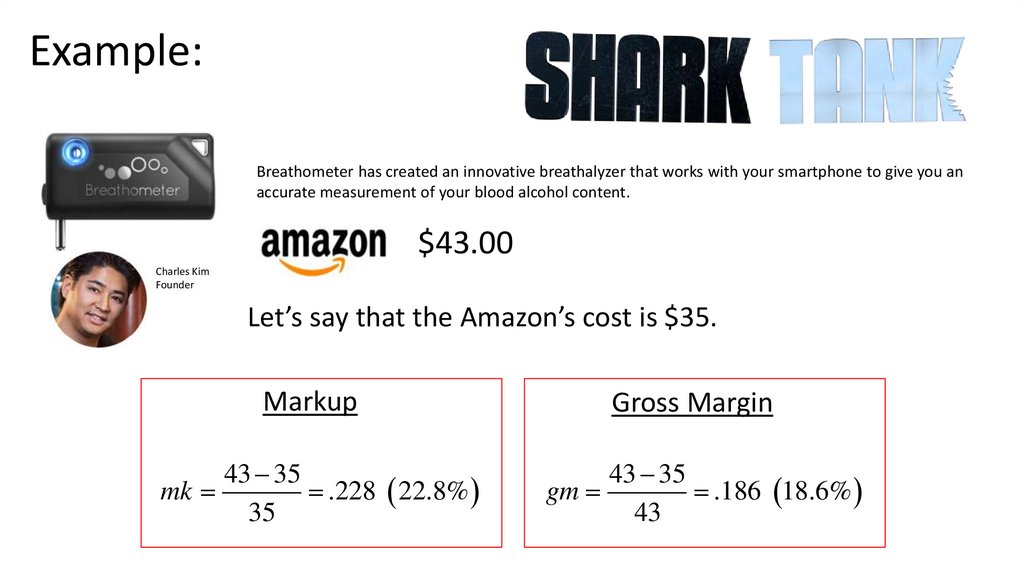

Example:Breathometer has created an innovative breathalyzer that works with your smartphone to give you an

accurate measurement of your blood alcohol content.

$43.00

Charles Kim

Founder

Let’s say that the Amazon’s cost is $35.

Markup

43 35

mk

.228 22.8%

35

Gross Margin

43 35

gm

.186 18.6%

43

5.

All 5 sharks invested inCharles’ idea - $1,000,000

for 30% of the company.

With $3,000,000 what price does Charles need to set to make a “reasonable”

rate of return?

Markup

Marginal Cost: $15

Fixed Cost: $50,000

25 15

mk

.66

p $25

Projected Annual Sales: 20,000

15

Gross Margin

Projected Annual Profits

profit 25 15 20, 000 50, 000 $150, 000

Projected Return on Investment

$150, 000

$3, 000, 000 100 5%

Is this a reasonable rate of return?

gm

25 15

.40

25

6.

All 5 sharks invested inCharles’ idea - $1,000,000

for 30% of the company.

With $3,000,000 investment, Charles needs to earn $300,000 a year to get a

10% return

$300, 000

Marginal Cost: $15

$3, 000, 000 100 10%

Fixed Cost: $50,000

Projected Annual Sales: 20,000

profit P 15 20, 000 50, 000 $300, 000

P $32.50

Gross Margin

Markup

mk

32.50 15

1.17

15

(117%)

gm

32.50 15

.54

32.50

(54%)

7.

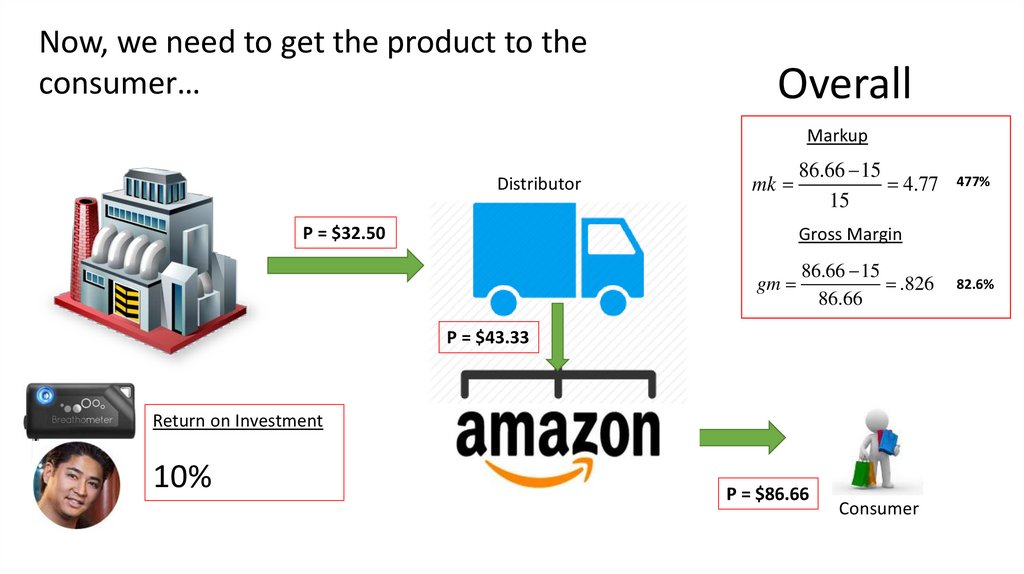

Now, we need to get the product to theconsumer…

Distributor

P = $32.50

Distributors will generally get

20-30% gross margin

P 32.5

.25

P

P $43.33

The “Keystone Margin” of

50% gross margin is the

standard for retailers

P = $43.33

P 43.33

.50

P

P $86.66

P = $86.66

Consumer

8.

Now, we need to get the product to theconsumer…

Overall

Markup

Distributor

mk

P = $32.50

86.66 15

4.77

15

Gross Margin

gm

86.66 15

.826

86.66

P = $43.33

Return on Investment

10%

477%

P = $86.66

Consumer

82.6%

9.

Retail markup data obtained from dealhack – anonline marketplace that brings together coupon

codes, promo codes and sales for hundreds of

online stores.

“The mysteries surrounding pricing have largely been eroded by the

increased access to information consumers have via the internet.

Yet, we still pay WAY TOO MUCH for certain products.”

10.

Services6,300%

5,900%

3,900%

300%

Valet Parking

490%

Lawn Services

Snow Removal

House Cleaning

Interior Painting

11.

Health Care4,500%

2,000%

1,400%

300%

MRI

500%

Overnight Hospital Stay Coronary Bypass Surgery

Brand Name Drugs

Prozac

12.

3,000%900%

1,300%

1,300%

Class Ring

Eyeglass Frames

1,000%

160%

Textbook

TI-83 Calculator

Cap and Gown

SAT Prep Class

13.

350%Life Events

330%

290%

250%

230%

200%

Greeting Cards Valentines's Day Roses

Diamonds

Wedding Dress

Childbirth

Funeral Casket

14.

6,000%Technology

4,900%

1,900%

1,000%

672%

300%

103%

64GB Ipad

Printer Ink

Phone Charger

Ethernet Cable

HDMI Cable

Cable Internet

Text Messages

15.

1,500%1,250%

1,200%

400%

300%

200%

Movie Tickets

Coffee to Go

Restaurant Wine

Restaurant Soda

Movie Popcorn

Yankees Tickets

16.

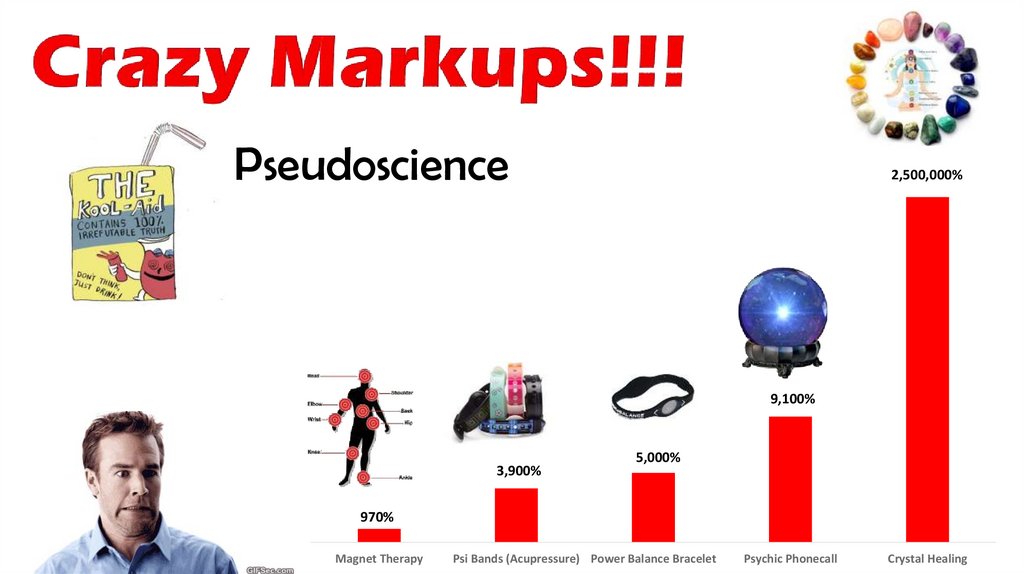

Pseudoscience2,500,000%

9,100%

3,900%

5,000%

970%

Magnet Therapy

Psi Bands (Acupressure) Power Balance Bracelet

Psychic Phonecall

Crystal Healing

17.

The Bottled Water ScamDid you ever notice what you get when you spell Evian

backwards?

Evian = Naïve

Coincidence?

Evian is owned by the

French multinational

Danone (Dannon - US)

18.

Coca-ColaPepsiCo

Danone

Nestle

Voss

Perrier was the pioneer in this industry. It introduced its sparkling water in

1976. It wasn’t until the 1990s when bottled water become an everyday

sight and a symbol of our health conscience culture. That’s when the big

boys of the beverage industry got into the game

19.

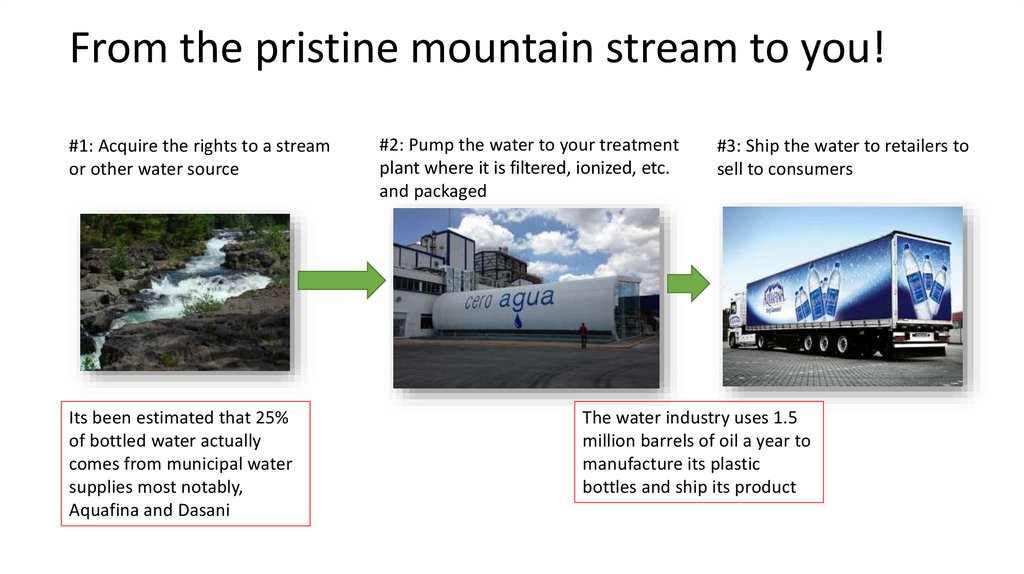

From the pristine mountain stream to you!#1: Acquire the rights to a stream

or other water source

Its been estimated that 25%

of bottled water actually

comes from municipal water

supplies most notably,

Aquafina and Dasani

#2: Pump the water to your treatment

plant where it is filtered, ionized, etc.

and packaged

#3: Ship the water to retailers to

sell to consumers

The water industry uses 1.5

million barrels of oil a year to

manufacture its plastic

bottles and ship its product

20.

Marketing WaterBottled H2O is being directly or indirectly sold as: healthy, smart, pure, sexy,

clean and simple, it is "the stuff of life."

"Treat yourself

well. Everyday."

"Fills you with

volcanicity."

"So pure, we

promise nothing."

“Drink Better, Live

Better."

"Approved by your

body as a source of

youth."

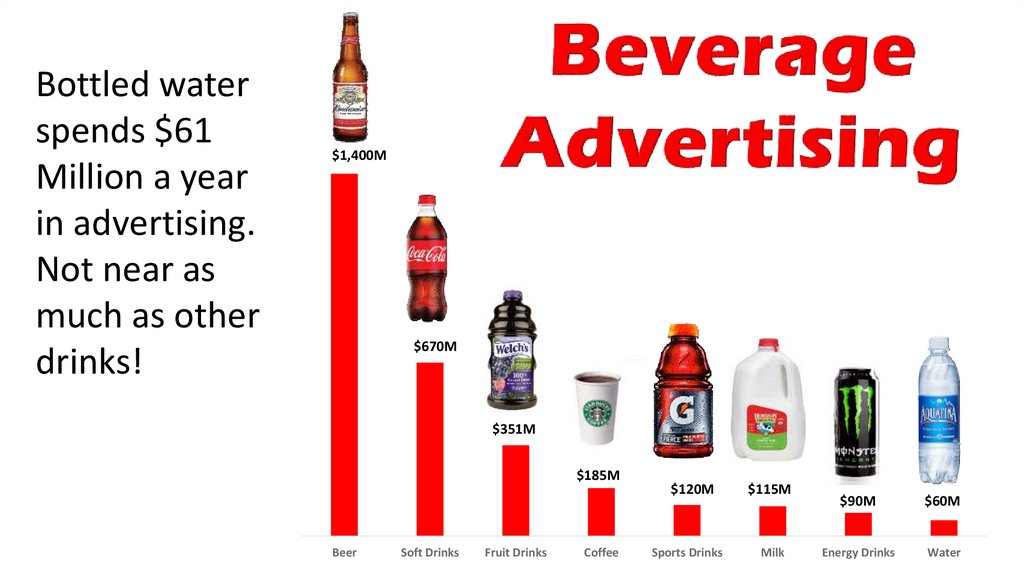

Bottled water spends $61 Million a year in advertising

21.

Bottled waterspends $61

Million a year

in advertising.

Not near as

much as other

drinks!

$1,400M

$670M

$351M

$185M

Beer

Soft Drinks

Fruit Drinks

Coffee

$120M

Sports Drinks

$115M

Milk

$90M

$60M

Energy Drinks

Water

22.

Bottom line…bottles water has a 8,500% markup!Cost

Price

• Tap water

$1.50 for 1,000 Gal

($0.0002 for 20oz.)

• Bottle/Label: $0.02

Markup

Markup

mk

1.75 .0202

85.63

.0202

Gross Margin

gm

1.75 .0202

.988

1.75

20 Oz: $1.75

128 oz. in a

gallon

Total MC: $0.0202

$11.20/Gal.

*Bought in bulk at Costco,

we can get that markup

down to about 3500%

23.

So, what conditions are necessary for super high markups?#1: A Market structure

that allows you to

control the price that

you can charge

#2: A very inelastic

demand

#3: Clever pricing

techniques

24.

Market StructureSpectrum

Monopoly

One firm

Significant artificial or legal

barriers to entry

Market power

Economic profits

High Market Concentration

Monopolistic

Oligopoly

Competition

Very few large firms

Standardized or differentiated

products

Significant barriers to entry

Market power

Interdependent pricing strategies

Many firms

differentiated products

low barriers to entry

Market power

Non-price competition

Lots of advertising

Perfect

Competition

Many very small firms

Standardized products

No barriers to entry

No market power (price takers)

Zero economic profit (reasonable

rate of return)

Low Market Concentration

25.

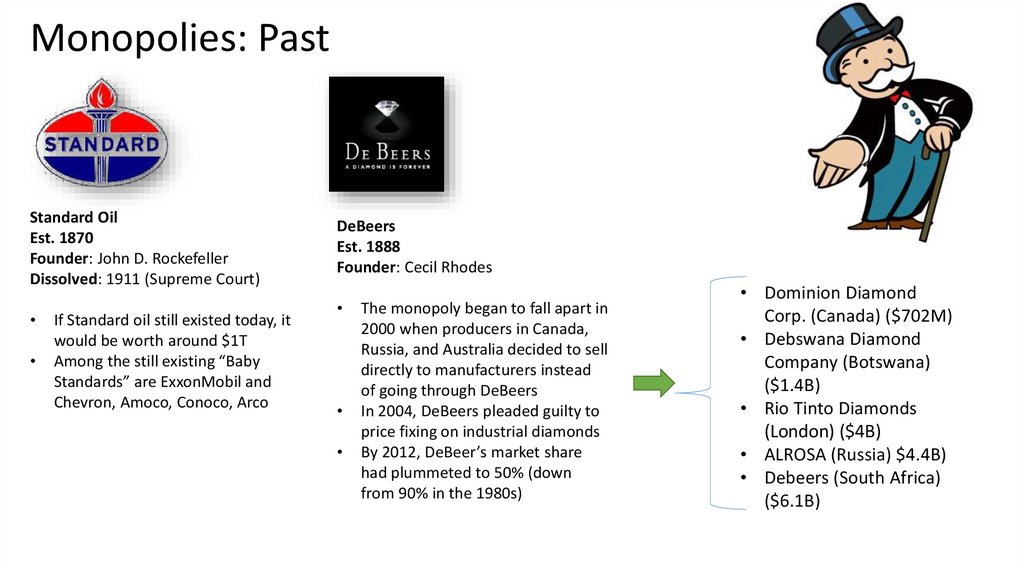

Monopolies: PastStandard Oil

Est. 1870

Founder: John D. Rockefeller

Dissolved: 1911 (Supreme Court)

If Standard oil still existed today, it

would be worth around $1T

Among the still existing “Baby

Standards” are ExxonMobil and

Chevron, Amoco, Conoco, Arco

DeBeers

Est. 1888

Founder: Cecil Rhodes

The monopoly began to fall apart in

2000 when producers in Canada,

Russia, and Australia decided to sell

directly to manufacturers instead

of going through DeBeers

In 2004, DeBeers pleaded guilty to

price fixing on industrial diamonds

By 2012, DeBeer’s market share

had plummeted to 50% (down

from 90% in the 1980s)

• Dominion Diamond

Corp. (Canada) ($702M)

• Debswana Diamond

Company (Botswana)

($1.4B)

• Rio Tinto Diamonds

(London) ($4B)

• ALROSA (Russia) $4.4B)

• Debeers (South Africa)

($6.1B)

26.

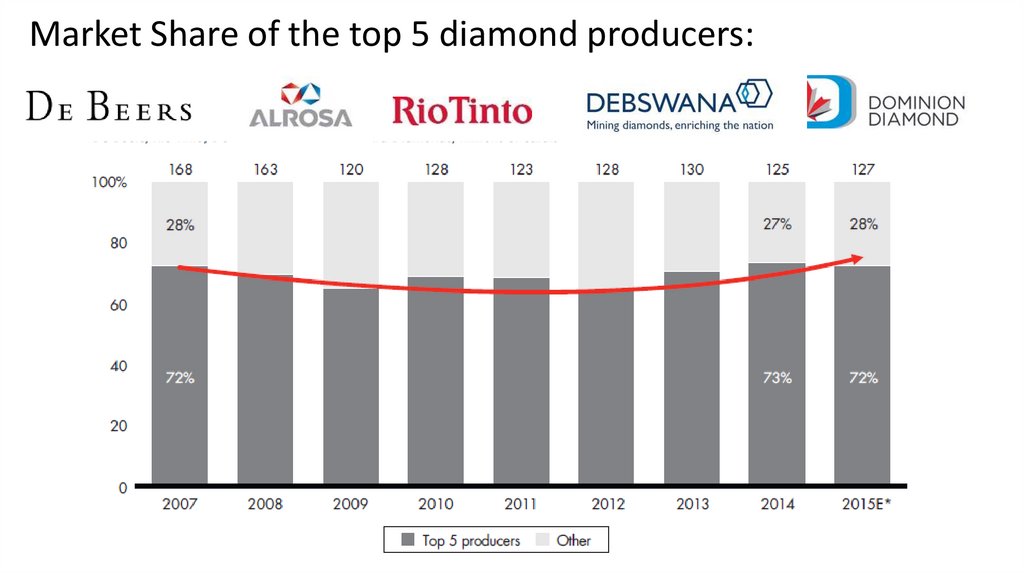

Market Share of the top 5 diamond producers:27.

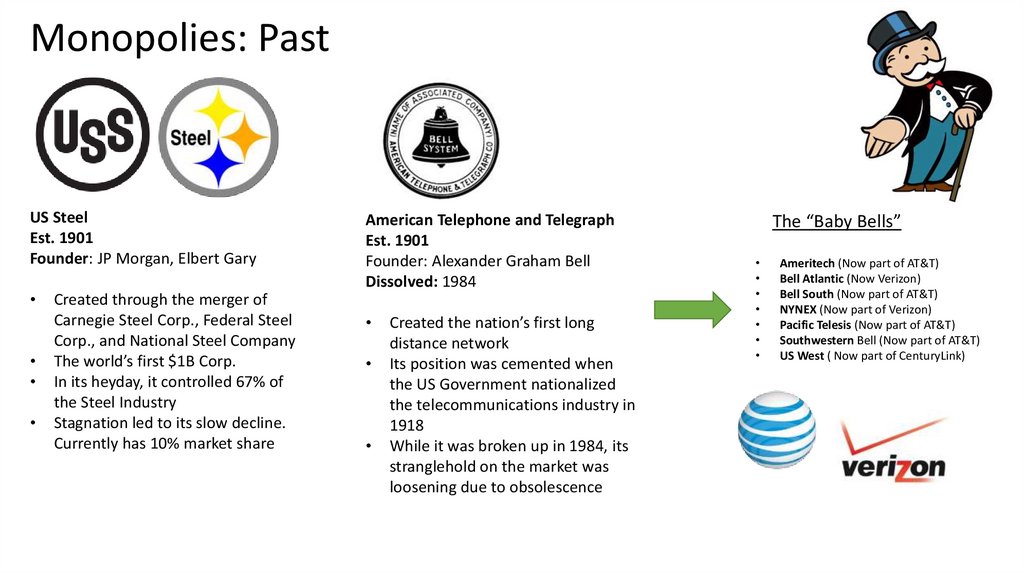

Monopolies: PastUS Steel

Est. 1901

Founder: JP Morgan, Elbert Gary

Created through the merger of

Carnegie Steel Corp., Federal Steel

Corp., and National Steel Company

The world’s first $1B Corp.

In its heyday, it controlled 67% of

the Steel Industry

Stagnation led to its slow decline.

Currently has 10% market share

American Telephone and Telegraph

Est. 1901

Founder: Alexander Graham Bell

Dissolved: 1984

Created the nation’s first long

distance network

Its position was cemented when

the US Government nationalized

the telecommunications industry in

1918

While it was broken up in 1984, its

stranglehold on the market was

loosening due to obsolescence

The “Baby Bells”

Ameritech (Now part of AT&T)

Bell Atlantic (Now Verizon)

Bell South (Now part of AT&T)

NYNEX (Now part of Verizon)

Pacific Telesis (Now part of AT&T)

Southwestern Bell (Now part of AT&T)

US West ( Now part of CenturyLink)

28.

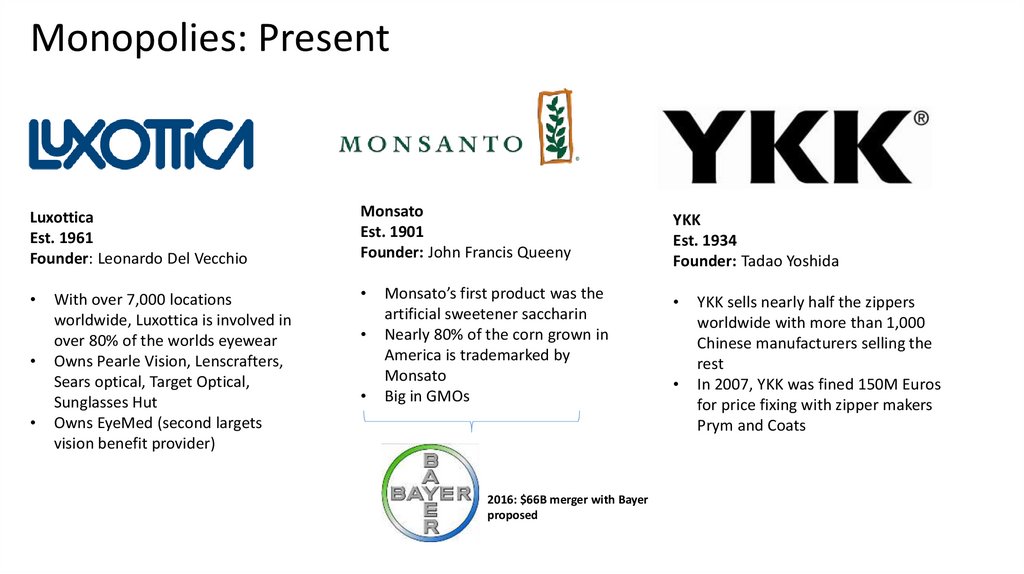

Monopolies: PresentLuxottica

Est. 1961

Founder: Leonardo Del Vecchio

Monsato

Est. 1901

Founder: John Francis Queeny

With over 7,000 locations

worldwide, Luxottica is involved in

over 80% of the worlds eyewear

Owns Pearle Vision, Lenscrafters,

Sears optical, Target Optical,

Sunglasses Hut

Owns EyeMed (second largets

vision benefit provider)

Monsato’s first product was the

artificial sweetener saccharin

Nearly 80% of the corn grown in

America is trademarked by

Monsato

Big in GMOs

2016: $66B merger with Bayer

proposed

YKK

Est. 1934

Founder: Tadao Yoshida

YKK sells nearly half the zippers

worldwide with more than 1,000

Chinese manufacturers selling the

rest

In 2007, YKK was fined 150M Euros

for price fixing with zipper makers

Prym and Coats

29.

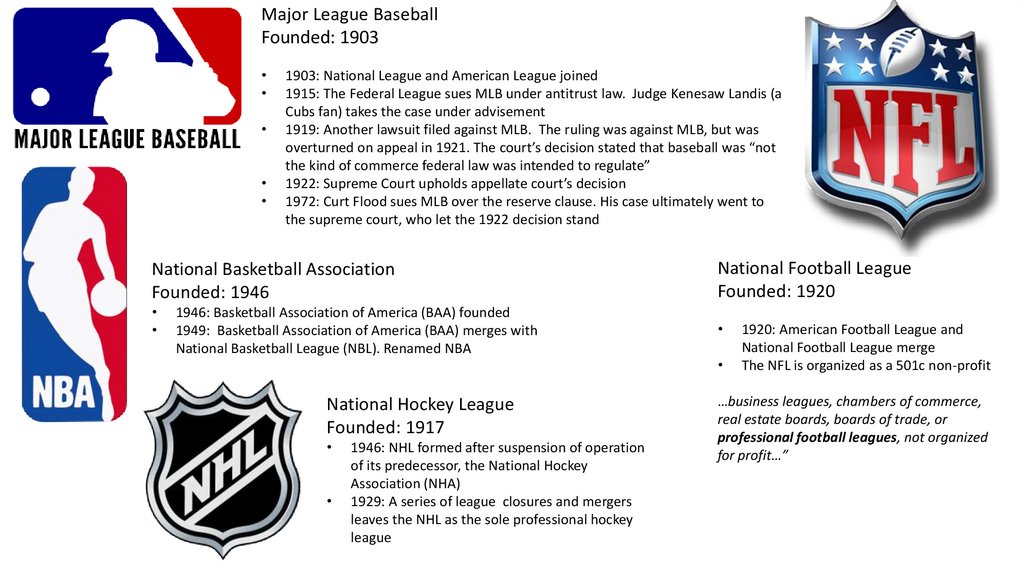

Major League BaseballFounded: 1903

1903: National League and American League joined

1915: The Federal League sues MLB under antitrust law. Judge Kenesaw Landis (a

Cubs fan) takes the case under advisement

1919: Another lawsuit filed against MLB. The ruling was against MLB, but was

overturned on appeal in 1921. The court’s decision stated that baseball was “not

the kind of commerce federal law was intended to regulate”

1922: Supreme Court upholds appellate court’s decision

1972: Curt Flood sues MLB over the reserve clause. His case ultimately went to

the supreme court, who let the 1922 decision stand

National Basketball Association

Founded: 1946

National Football League

Founded: 1920

1946: Basketball Association of America (BAA) founded

1949: Basketball Association of America (BAA) merges with

National Basketball League (NBL). Renamed NBA

National Hockey League

Founded: 1917

1946: NHL formed after suspension of operation

of its predecessor, the National Hockey

Association (NHA)

1929: A series of league closures and mergers

leaves the NHL as the sole professional hockey

league

1920: American Football League and

National Football League merge

The NFL is organized as a 501c non-profit

…business leagues, chambers of commerce,

real estate boards, boards of trade, or

professional football leagues, not organized

for profit…”

30.

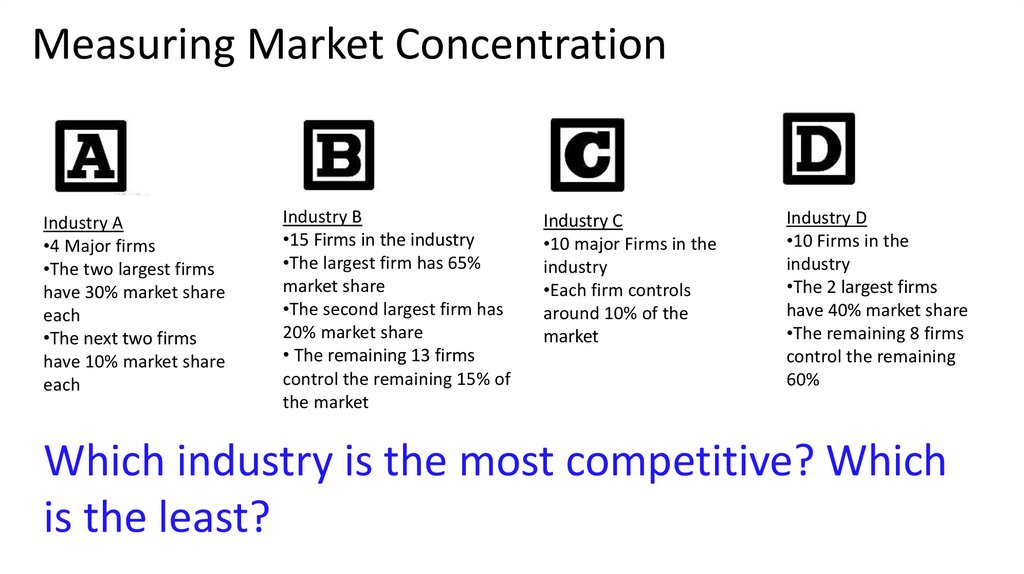

Measuring Market ConcentrationIndustry A

•4 Major firms

•The two largest firms

have 30% market share

each

•The next two firms

have 10% market share

each

Industry B

•15 Firms in the industry

•The largest firm has 65%

market share

•The second largest firm has

20% market share

• The remaining 13 firms

control the remaining 15% of

the market

Industry C

•10 major Firms in the

industry

•Each firm controls

around 10% of the

market

Industry D

•10 Firms in the

industry

•The 2 largest firms

have 40% market share

•The remaining 8 firms

control the remaining

60%

Which industry is the most competitive? Which

is the least?

31.

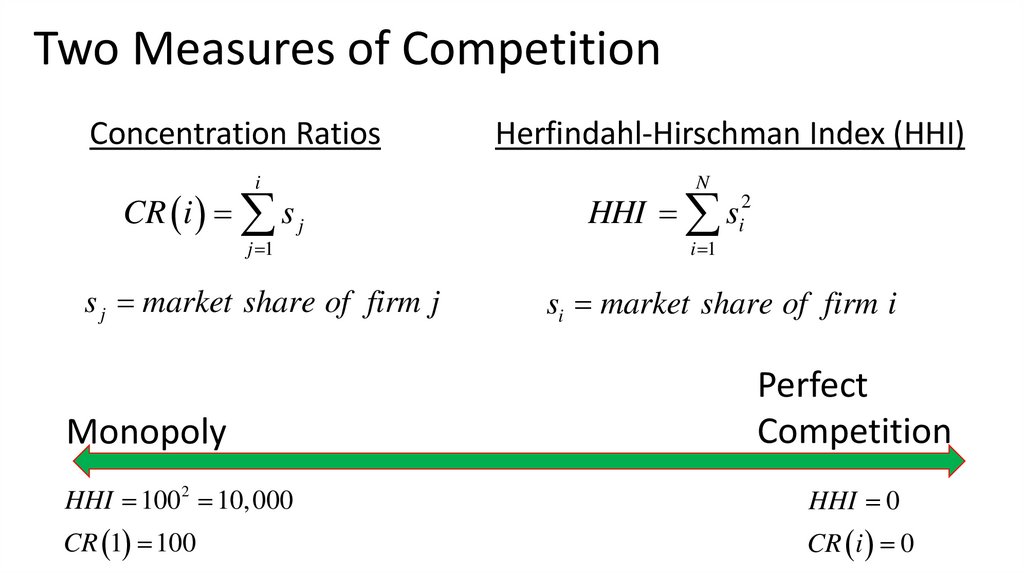

Two Measures of CompetitionConcentration Ratios

i

CR i s j

j 1

s j market share of firm j

Monopoly

Herfindahl-Hirschman Index (HHI)

N

HHI s

i 1

2

i

si market share of firm i

Perfect

Competition

HHI 1002 10, 000

HHI 0

CR 1 100

CR i 0

32.

Herfindahl-Hirschman Index (HHI)N

HHI si2

i 1

si market share of firm i

“The agencies generally consider markets in which the HHI is between 1,500 and 2,500 points to be

moderately concentrated, and consider markets in which the HHI is in excess of 2,500 points to be highly

concentrated. Transactions that increase the HHI by more than 200 points in highly concentrated markets

are presumed likely to enhance market power under the Horizontal Merger Guidelines issued by the

Department of Justice and the Federal Trade Commission.

33.

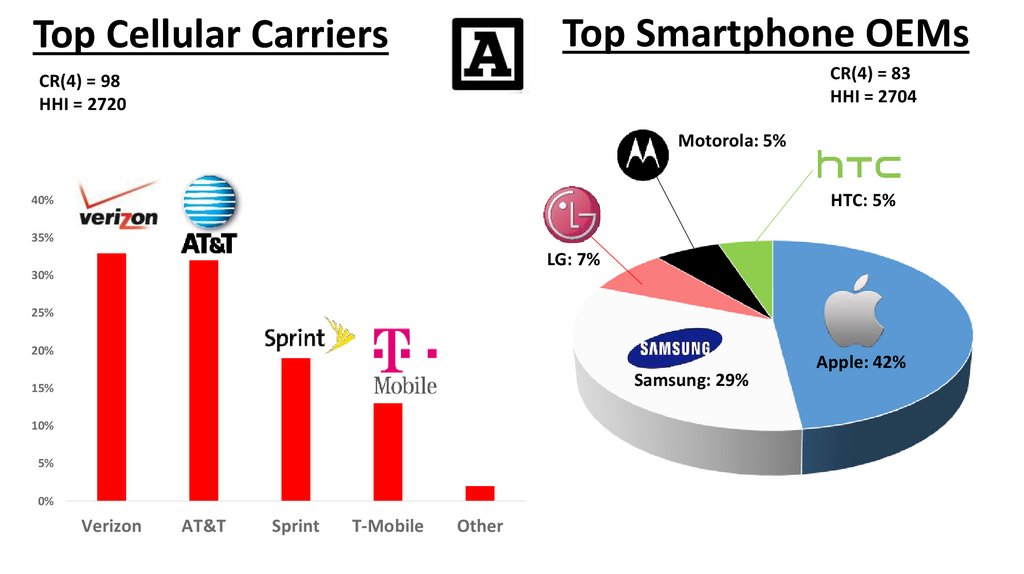

Top Smartphone OEMsTop Cellular Carriers

CR(4) = 83

HHI = 2704

CR(4) = 98

HHI = 2720

Motorola: 5%

HTC: 5%

40%

35%

LG: 7%

30%

25%

20%

Samsung: 29%

15%

10%

5%

0%

Verizon

AT&T

Sprint

T-Mobile

Other

Apple: 42%

34.

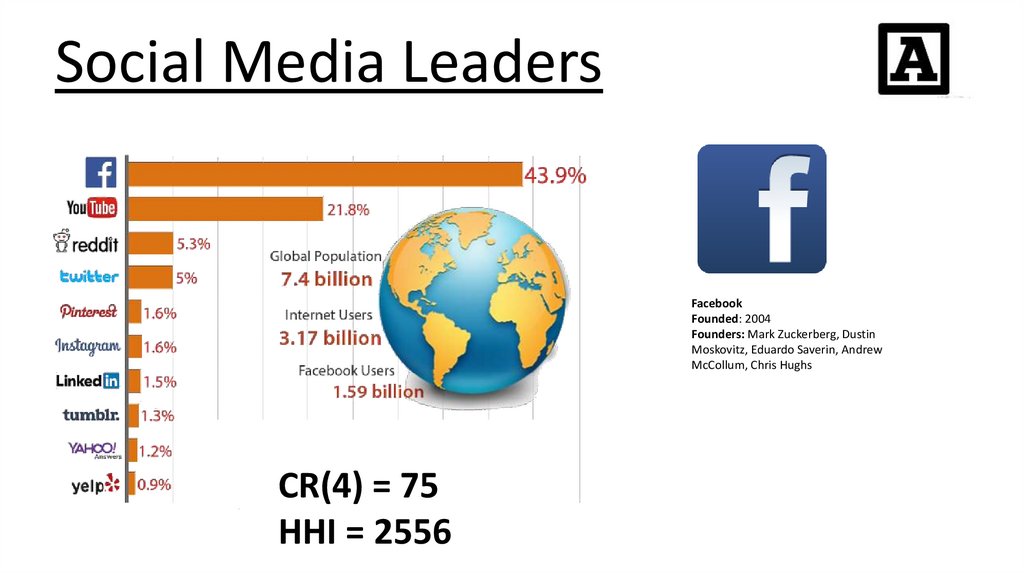

Social Media LeadersFounded: 2004

Founders: Mark Zuckerberg, Dustin

Moskovitz, Eduardo Saverin, Andrew

McCollum, Chris Hughs

CR(4) = 75

HHI = 2556

35.

Digital Movie ServicesNetflix

Founded: 1997

Founders: Reed Hastings

CR(4) = 77

HHI = 4233

Top Search Engines

Founded: 1998

Founders: Larry Page, Sergey Brin

CR(4) = 98.7

HHI = 4975

36.

The Big 1037.

Food (21,355 Companies)HHI = 102

CR(4) = 14.8

CR(8) = 22.8

CR(20) = 37.6

CR(50) = 50.8

Quaker

(PepsiCo): 6%

Mom Brands:7%

Private Label: 9%

Other:3%

Breakfast Cereals (35 Companies)

Kellogg's: 32%

General Mills: 31%

Post: 11%

HHI = 2,425

CR(4) = 80

CR(8) = 91.9

CR(20) = 99.6

38.

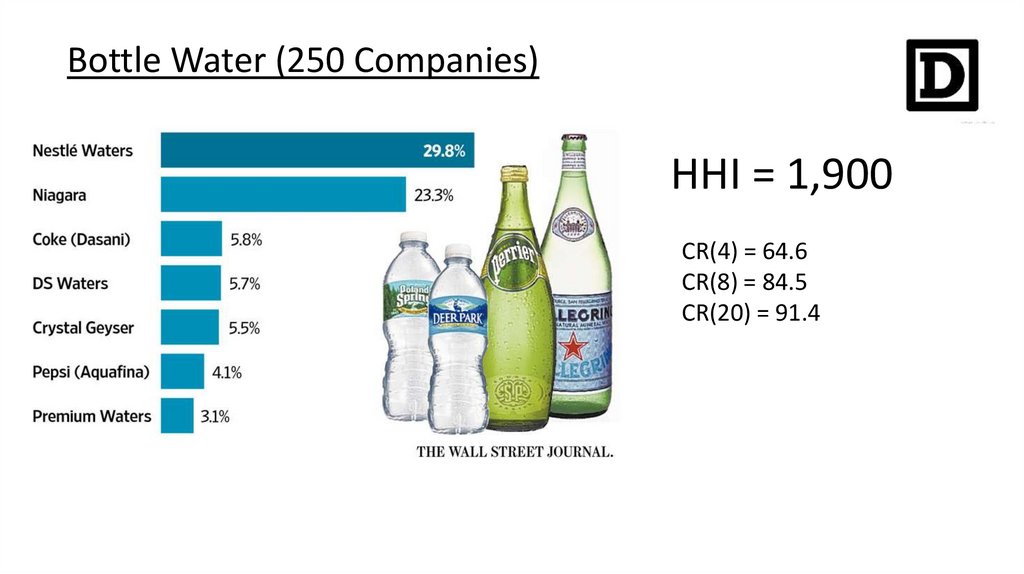

Bottle Water (250 Companies)HHI = 1,900

CR(4) = 64.6

CR(8) = 84.5

CR(20) = 91.4

39.

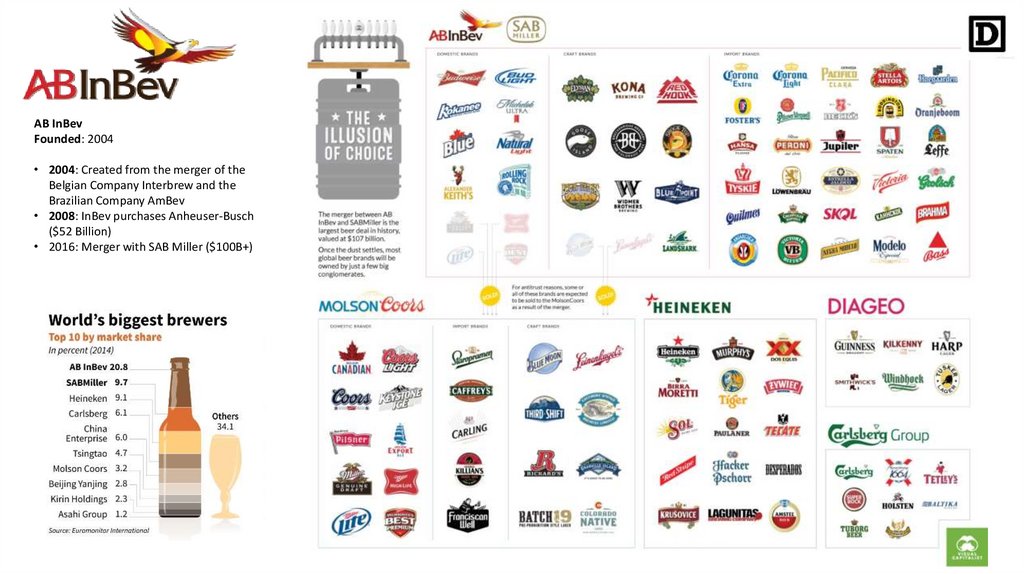

AB InBevFounded: 2004

• 2004: Created from the merger of the

Belgian Company Interbrew and the

Brazilian Company AmBev

• 2008: InBev purchases Anheuser-Busch

($52 Billion)

• 2016: Merger with SAB Miller ($100B+)

40.

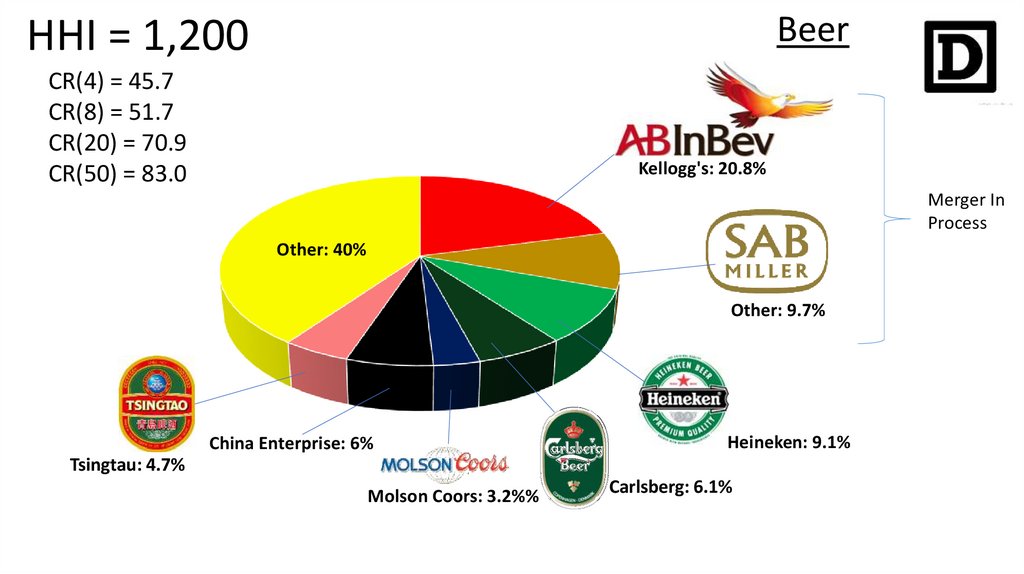

BeerHHI = 1,200

CR(4) = 45.7

CR(8) = 51.7

CR(20) = 70.9

CR(50) = 83.0

Kellogg's: 20.8%

Merger In

Process

Other: 40%

Other: 9.7%

China Enterprise: 6%

Heineken: 9.1%

Tsingtau: 4.7%

Molson Coors: 3.2%%

Carlsberg: 6.1%

41.

Note that competition depends onhow you define the market!!

Microsoft

Founded: 1975

Founders: Bill Gates, Paul Allen

CR(4) = 97

HHI = 7806

42.

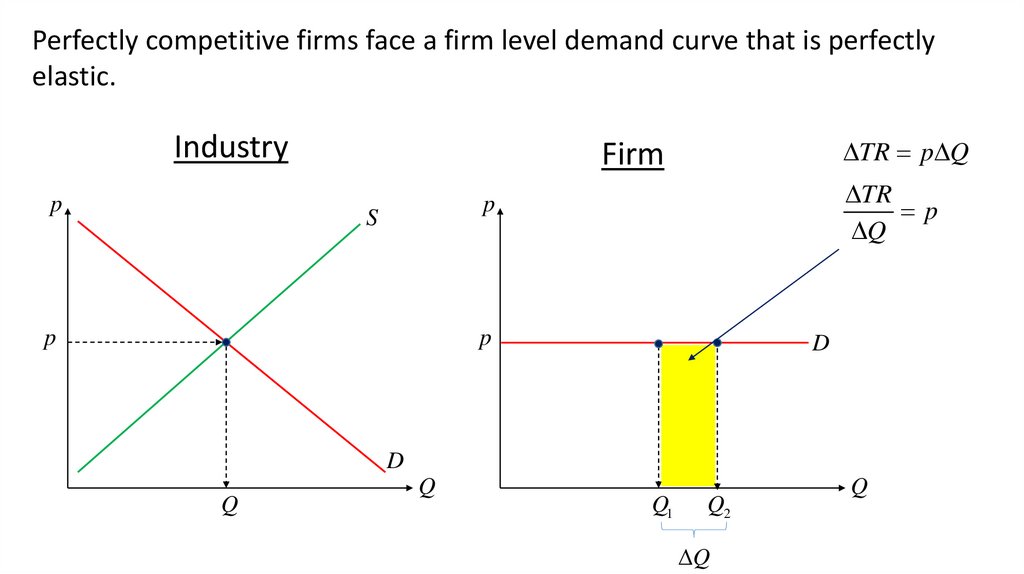

Perfectly competitive firms face a firm level demand curve that is perfectlyelastic.

Industry

p

TR p Q

Firm

TR

p

Q

p

S

p

p

D

D

Q

Q

Q1

Q2

Q

Q

43.

This leads to profit maximizing behavior with price equaling marginal cost(zero markup)

Market

p

Firm

p

S

MC

p MC

p MR

p

D

Total Revenues= P*Q

D

Q

Q

Q1

Q

44.

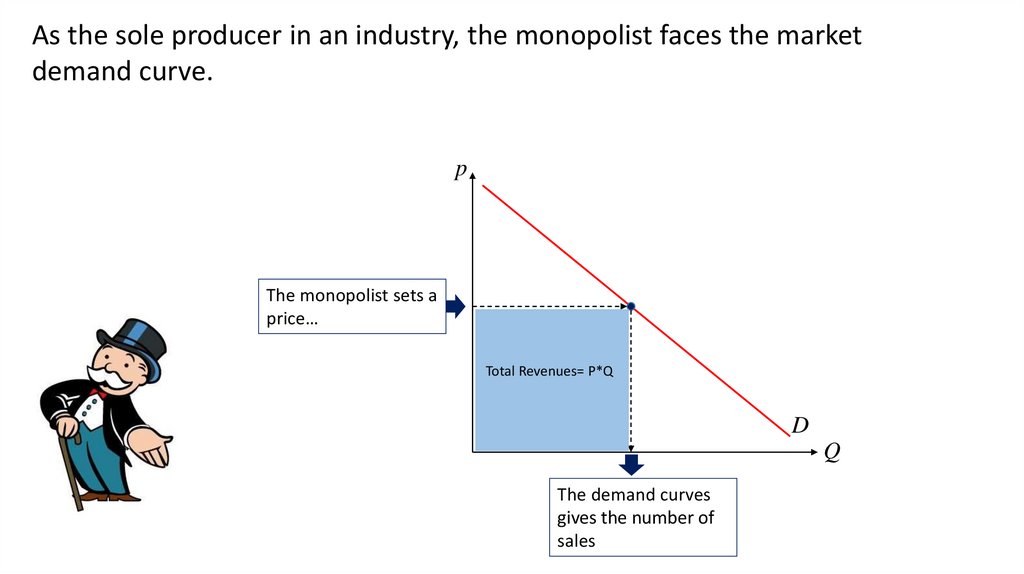

As the sole producer in an industry, the monopolist faces the marketdemand curve.

p

The monopolist sets a

price…

Total Revenues= P*Q

D

Q

The demand curves

gives the number of

sales

45.

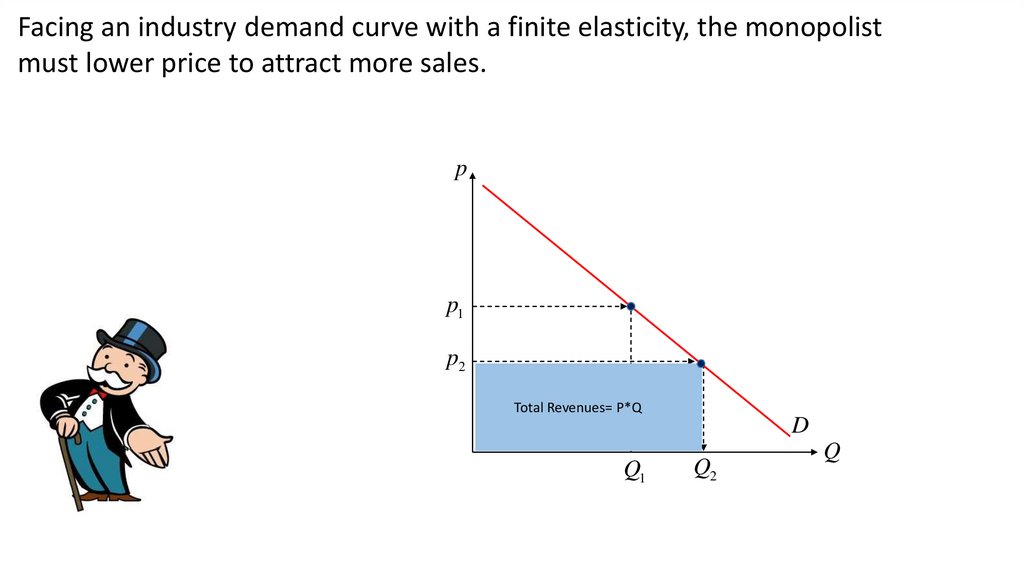

Facing an industry demand curve with a finite elasticity, the monopolistmust lower price to attract more sales.

p

p1

p2

Total Revenues= P*Q

D

Q1

Q2

Q

46.

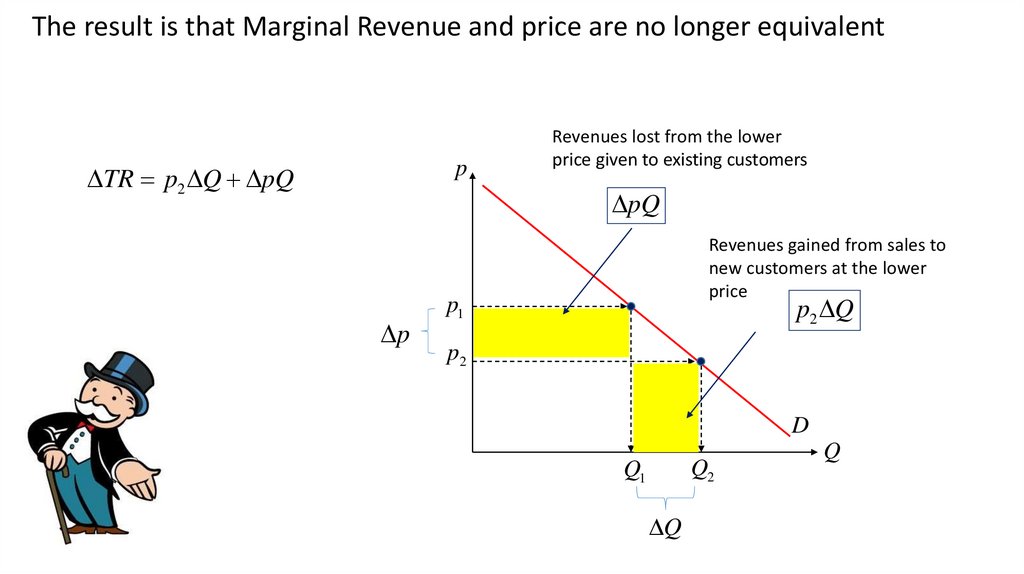

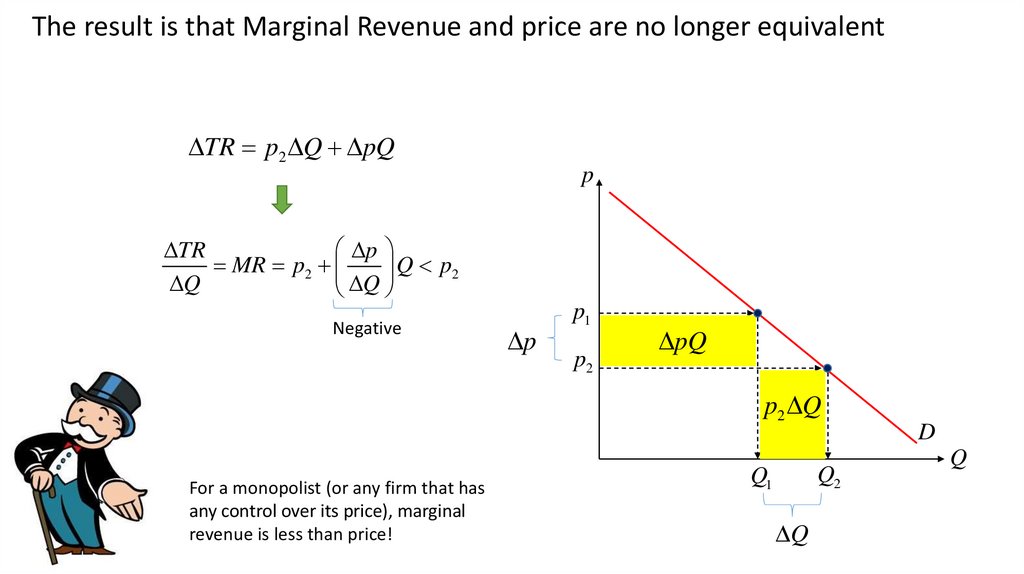

The result is that Marginal Revenue and price are no longer equivalentp

TR p2 Q pQ

Revenues lost from the lower

price given to existing customers

pQ

p

Revenues gained from sales to

new customers at the lower

price

p2 Q

p1

p2

D

Q2

Q1

Q

Q

47.

The result is that Marginal Revenue and price are no longer equivalentTR p2 Q pQ

p

p

TR

MR p2

Q p2

Q

Q

Negative

p

p1

p2

pQ

p2 Q

For a monopolist (or any firm that has

any control over its price), marginal

revenue is less than price!

Q2

Q1

Q

D

Q

48.

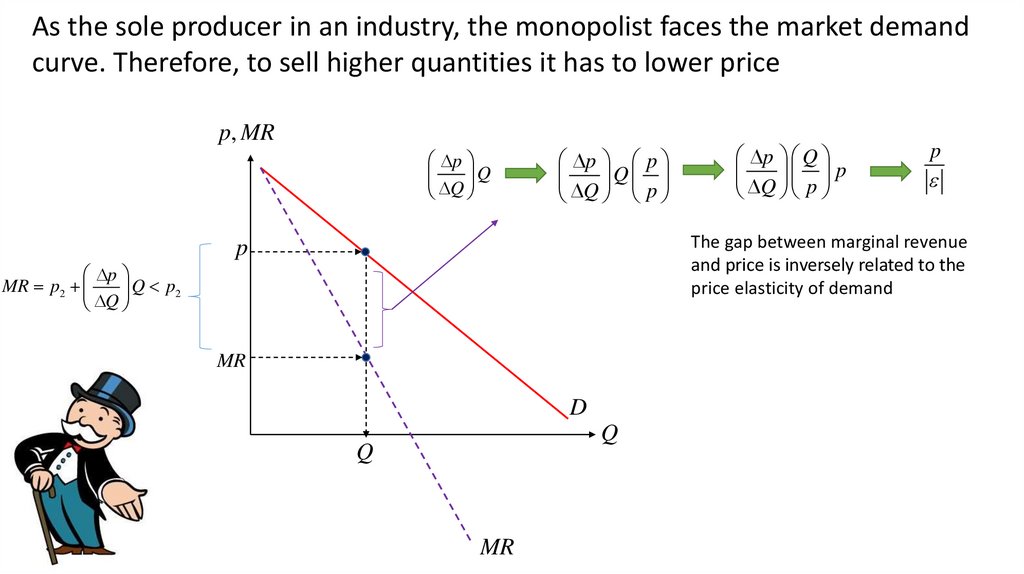

As the sole producer in an industry, the monopolist faces the market demandcurve. Therefore, to sell higher quantities it has to lower price

p, MR

p

Q

Q

p p

Q

Q p

p Q

p

Q p

p

The gap between marginal revenue

and price is inversely related to the

price elasticity of demand

p

p

MR p2

Q p2

Q

MR

D

Q

Q

MR

49.

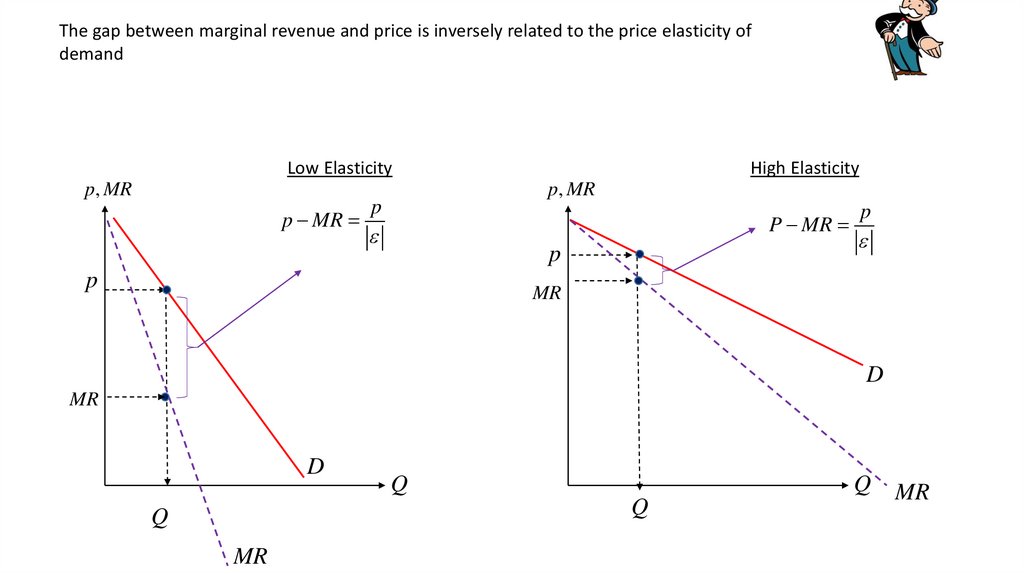

The gap between marginal revenue and price is inversely related to the price elasticity ofdemand

Low Elasticity

p, MR

p MR

High Elasticity

p, MR

p

P MR

p

p

p

MR

D

MR

D

Q

Q

Q

Q

MR

MR

50.

As the sole producer in an industry, the monopolist faces the market demandcurve. Therefore, to sell higher quantities it has to lower price

p, MR

p MR

MC

p

MR MC

p*

p MC

p

MR

D

Q

Q

*

MR

p MC 1

p

The lerner index

(gross margin %)

is inversely

related to the

elasticity of

demand

Abba Lerner

1903 – 1982

51.

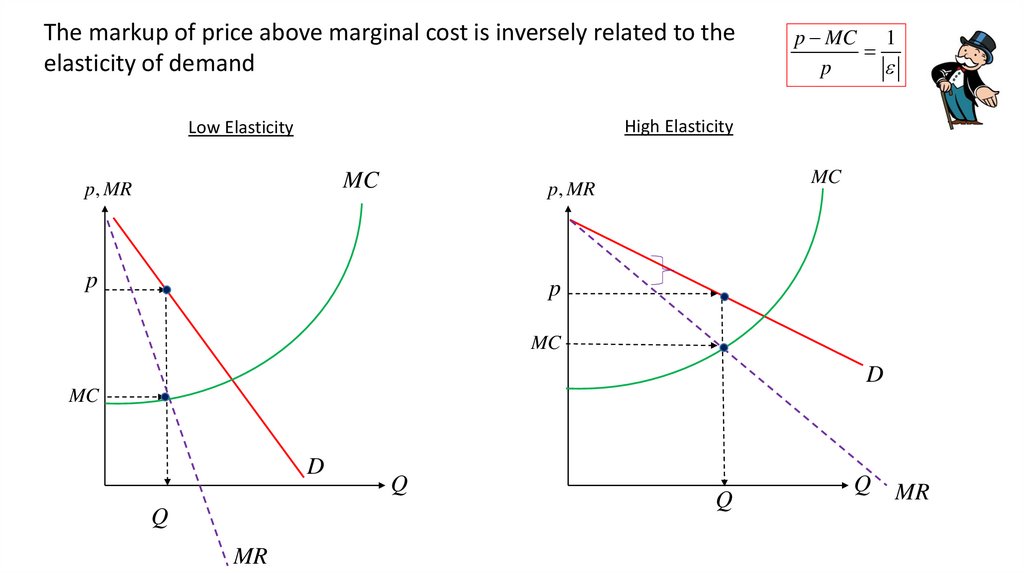

The markup of price above marginal cost is inversely related to theelasticity of demand

p MC 1

p

High Elasticity

Low Elasticity

MC

p, MR

MC

p, MR

p

p

MC

D

MC

D

Q

MR

Q

Q

Q

MR

52.

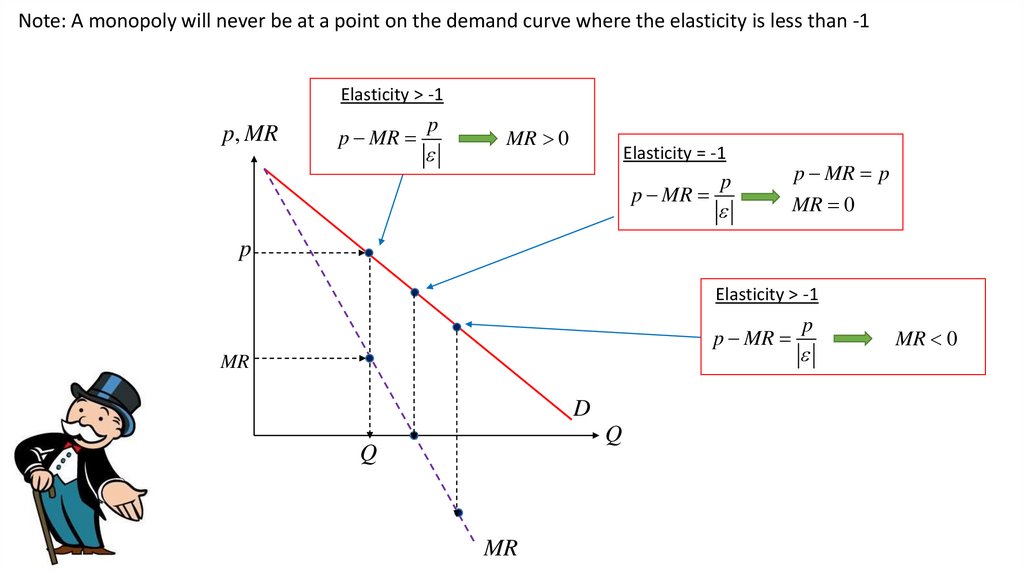

Note: A monopoly will never be at a point on the demand curve where the elasticity is less than -1Elasticity > -1

p, MR

p MR

p

MR 0

Elasticity = -1

p MR

p

p MR p

MR 0

p

Elasticity > -1

p MR

MR

D

Q

Q

MR

p

MR 0

53.

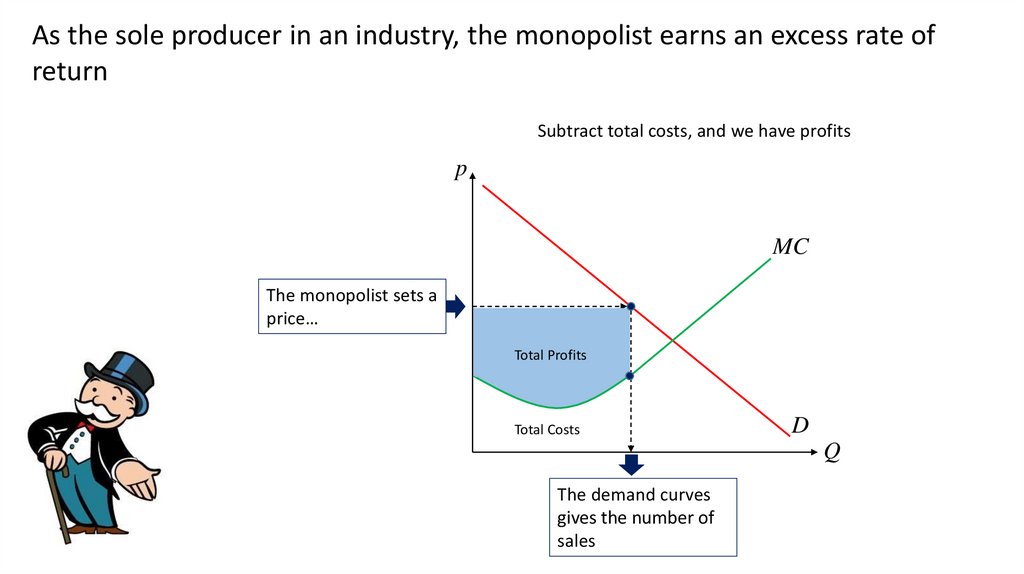

As the sole producer in an industry, the monopolist earns an excess rate ofreturn

Subtract total costs, and we have profits

p

MC

The monopolist sets a

price…

Total Profits

Total Costs

D

Q

The demand curves

gives the number of

sales

54.

Suppose that you face the followingdemand curve….

Q 100 2 p

p 50 .5Q

(Demand)

( Inverse Demand)

p

You have a constant marginal cost of $10

$50

10

.25

80

2

Perfectly competitive

outcome

MC

$10

80

D

Q

What price would you charge to maximize

profits?

55.

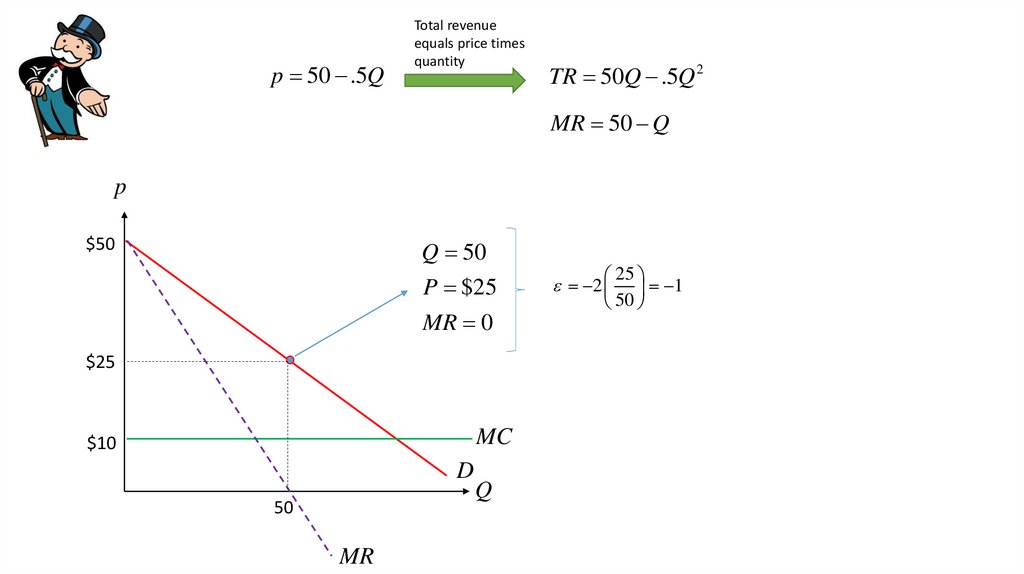

p 50 .5QTotal revenue

equals price times

quantity

TR 50Q .5Q 2

MR 50 Q

p

$50

Q 50

P $25

MR 0

$25

MC

$10

D

50

MR

Q

25

1

50

2

56.

p 50 .5QTotal revenue

equals price times

quantity

TR 50Q .5Q

Set marginal

revenue equal to

marginal cost

2

MR 50 Q

50 Q 10

Q 40

P $30

p

Q 40

$50

P $30

$30

30

1.5

40

2

Markup

Profit = $800

MC

$10

TC = $400

D

40

MR

p MC 30 10

2

MC

10

Gross Margin

Q

p MC 30 10

1

.67 =

p

30

1.5

57.

Perfect Competition vs. MonopolyMonopoly

p

p

Total Gain = $1,200

$50

$50

Perfect Competition

Total Gain = $1,600

Q 100 2 p

MC $10

CS =$400

$30

CS = (1/2)(80)(40) =$1600

Profit = $800

DWL =$400

MC

$10

TC = $400

D

40

MR

MC

$10

D

TC = $800

Q

80

Q

58.

In House BrandsUnder License

Brands

Industry: Eyewear Manufacturing

Founded: 1961

Headquarters: Milan, Italy

While the eyeglass

frame industry is pretty

competitive, Luxottica

owns around 80% of

the “Luxury frame”

market

For Eyeglass Manufacturing:

• CR(4) = 42

• CR(8) = 60

• CR(20) = 80

• CR(50) = 90

• HHI = 702

And 6 others…

And 11 others…

And 15 others…

59.

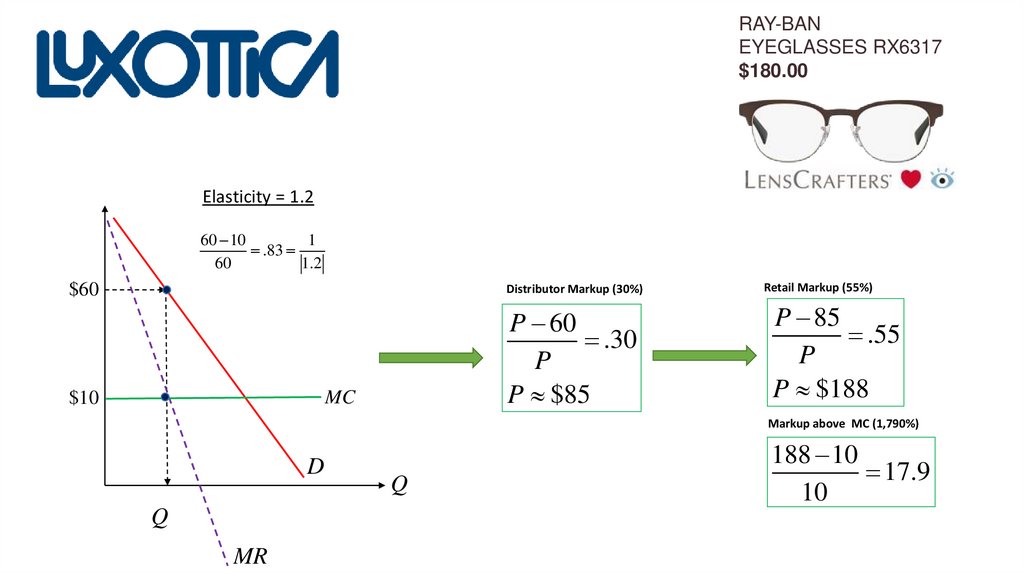

RAY-BANEYEGLASSES RX6317

$180.00

Elasticity = 1.2

60 10

1

.83

60

1.2

$60

Distributor Markup (30%)

$10

P 60

.30

P

P $85

MC

Retail Markup (55%)

P 85

.55

P

P $188

Markup above MC (1,790%)

D

Q

MR

Q

188 10

17.9

10

60.

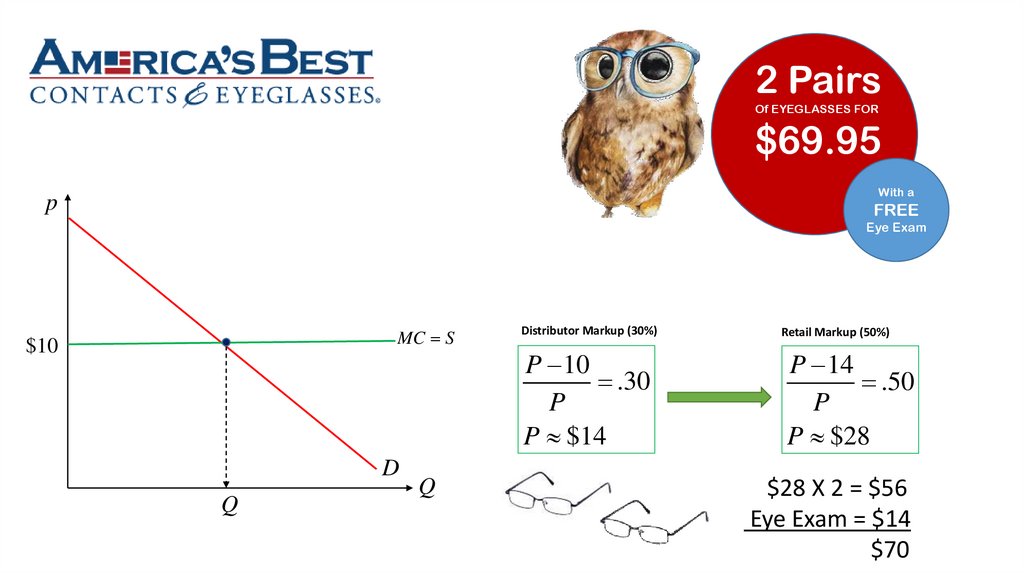

2 PairsOf EYEGLASSES FOR

$69.95

With a

p

FREE

Eye Exam

MC S

$10

D

Q

Q

Distributor Markup (30%)

P 10

.30

P

P $14

Retail Markup (50%)

P 14

.50

P

P $28

$28 X 2 = $56

Eye Exam = $14

$70

61.

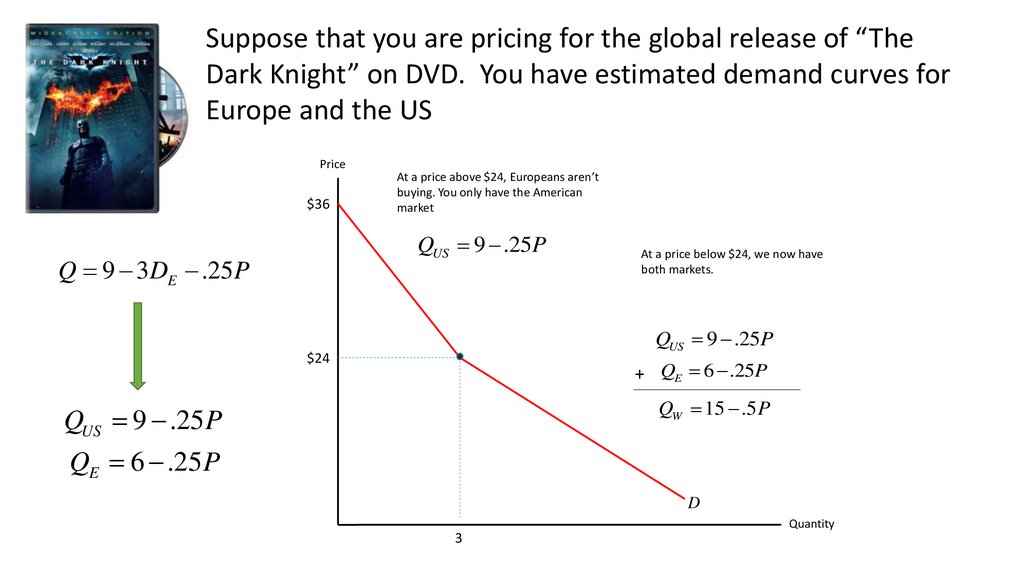

Suppose that you are pricing for the global release of “TheDark Knight” on DVD. You have estimated demand curves for

Europe and the US

Price

$36

At a price above $24, Europeans aren’t

buying. You only have the American

market

QUS 9 .25P

Q 9 3DE .25 P

At a price below $24, we now have

both markets.

QUS 9 .25P

$24

+ QE 6 .25P

QW 15 .5 P

QUS 9 .25 P

QE 6 .25 P

D

Quantity

3

62.

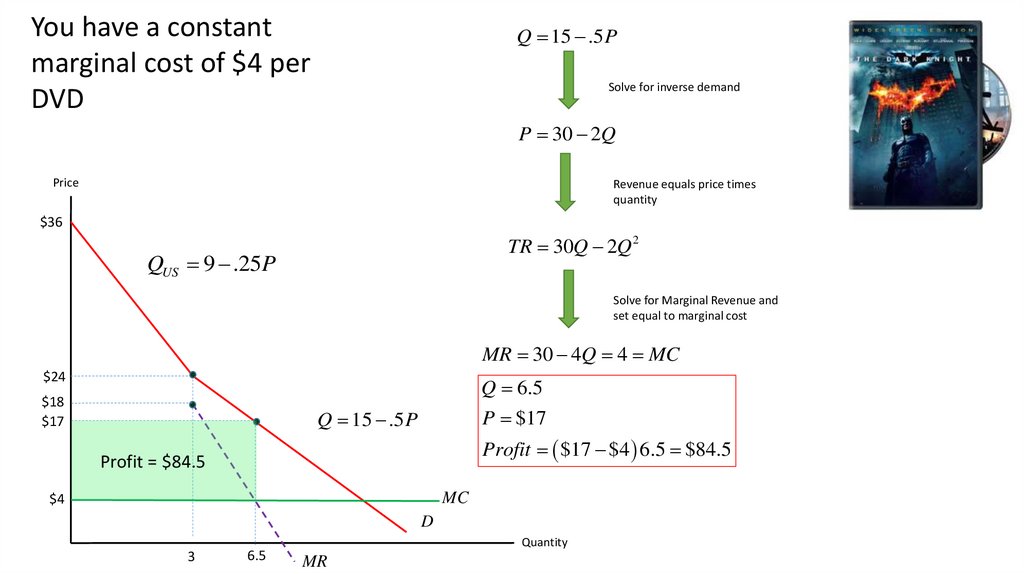

You have a constantmarginal cost of $4 per

DVD

Q 15 .5 P

Solve for inverse demand

P 30 2Q

Price

Revenue equals price times

quantity

$36

TR 30Q 2Q 2

QUS 9 .25P

Solve for Marginal Revenue and

set equal to marginal cost

MR 30 4Q 4 MC

$24

Q 6.5

$18

$17

P $17

Q 15 .5 P

Profit $17 $4 6.5 $84.5

Profit = $84.5

MC

$4

D

3

6.5

Quantity

MR

63.

DVD region codes are a digital rights management technique designed to allow film distributors andtelevision companies to control aspects of a release, including content, release date, and price,

according to the region

64.

To Price discriminate, you need• To identify different buyers

• Prevent resale

Europe

United States

QE 6 .25 PE

QUS 9 .25PUS

PE 24 4QE

PUS 36 4QUS

TR 24Q 4Q 2

TR 36Q 4Q 2

Price

Price

MR 36 8Q 4

Q 2 .5

Q 4

$36

MR 24 8Q 4

P $14

P $20

$24

Profit $64 $25 $89

$20

$14

$64

$4

$25

MC

$4

MC

D

D

Quantity

4

2.5

MR

MR

Quantity

65.

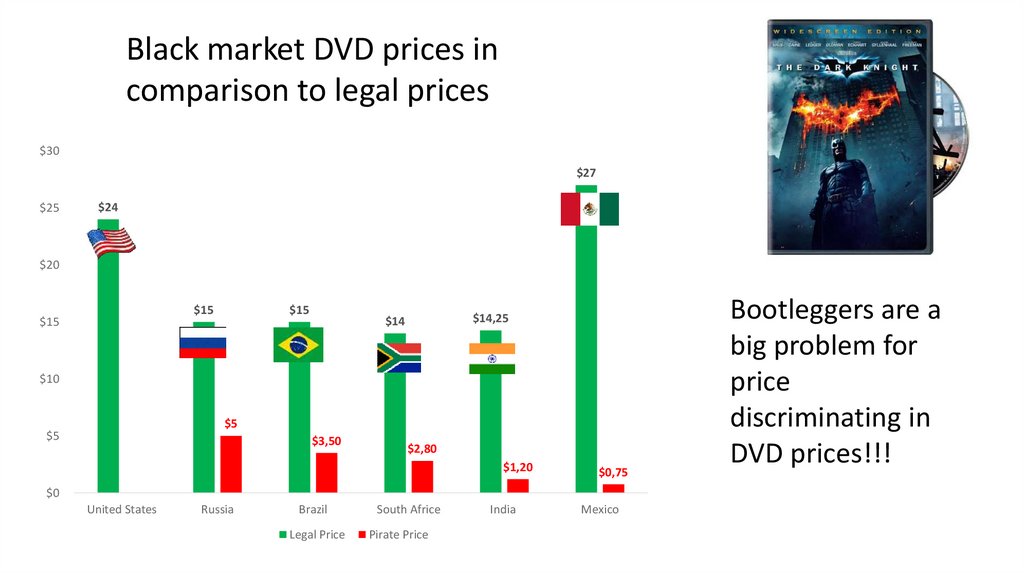

Black market DVD prices incomparison to legal prices

$30

$27

$25

$24

$20

$15

$15

$15

$14,25

$14

$10

$5

$5

$3,50

$2,80

$1,20

$0,75

$0

United States

Russia

Brazil

Legal Price

South Africe

Pirate Price

India

Mexico

Bootleggers are a

big problem for

price

discriminating in

DVD prices!!!

66.

Average Netflix Monthly Revenue per customer by countryDenmark

Norway

Sweden

Austria

France

Germany

Luxambourg

Belgium

Netherlands

Finland

UK

Switzerland

United States

Japan

Brazil

Colombia

Canada

Mexico

Chile

Argentina

15,11

13,44

12,36

11,88

11,88

11,88

11,88

11,88

11,38

11,38

10,89

9,8

8,16

8,01

7,98

7,82

7,78

7,6

Netflix CEO Reed Hastings has long said that his company isn’t primarily

competing with cable TV or other paid services in Latin America, but

with piracy instead. The region is a piracy hotbed, according to the U.S.

Trade Representative (USTR), which has been keeping Argentina, Chile

and Venezuela on its priority watch list of piracy worst offenders.

6,61

4,75

0

2

4

6

8

10

12

14

16

67.

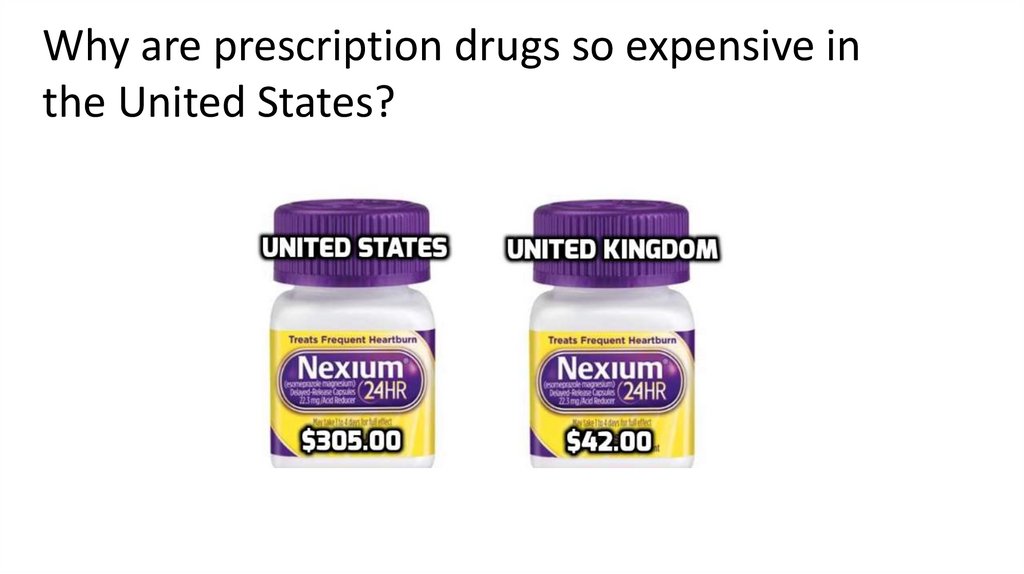

Why are prescription drugs so expensive inthe United States?

68.

Americans Spend Way More than most other countries on Prescription drugs*Source: OECD Health Statistics

69.

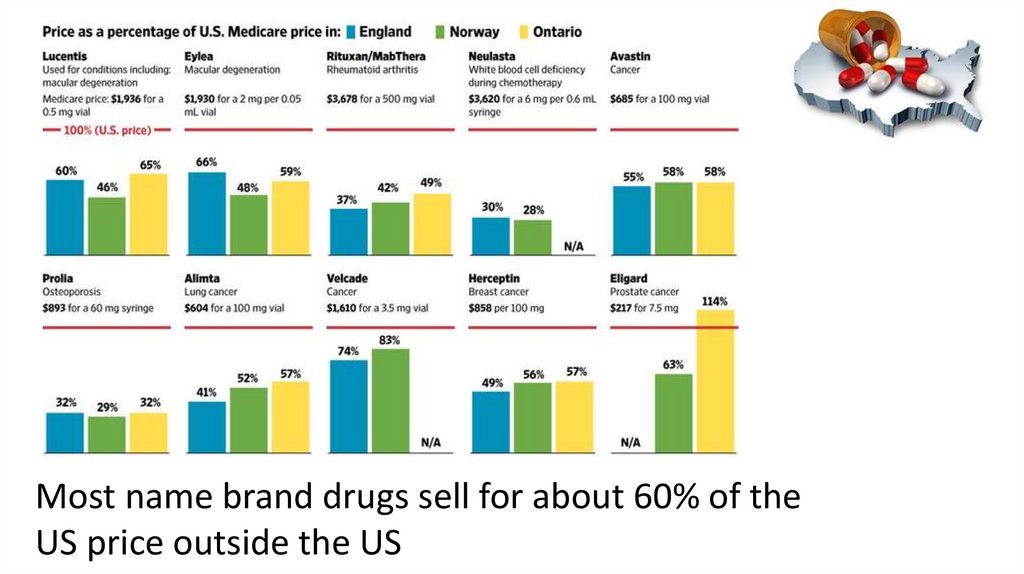

Most name brand drugs sell for about 60% of theUS price outside the US

70.

This hasresulted in

Americans

relying much

more on

generics than

the rest of the

world

71.

Issue #1:Developing

Prescription

Drugs is

VERY

Expensive

Compound Success

Rates by Stage

Years

0

Discovery

(2–10 Years)

Phase I

20–80 Healthy Volunteers Used to

Determine Safety and Dosage

2

4

6

8

Phase III

10

1,000–5,000 Patient Volunteers

Used to Monitor Adverse

Reactions to Long-Term Use

12

Additional PostMarketing Testing

Preclinical Testing

Laboratory and

Animal Testing

14

16

Phase II

100–300 Patient Volunteers

Used to Look for Efficacy

and Side Effects

FDA Review Approval

5,000–10,000

Screened

250

Enter Preclinical

Testing

5

Enter

Clinical

Testing

1

Approved

by the FDA

Net Cost: $1 Billion Invested Over 12-15 Years

*Source: PhRMA Pharmaceutical Industry Profile 2003, Chapter 1: Increased Length and Complexity of the Research and

Development Process. And DiMasi, JA, Hansen, RW, Grabowski, HG. “The Price of Innovation: new estimates of drug

development costs.” J of Health Economics. 2003:22:151-185.

72.

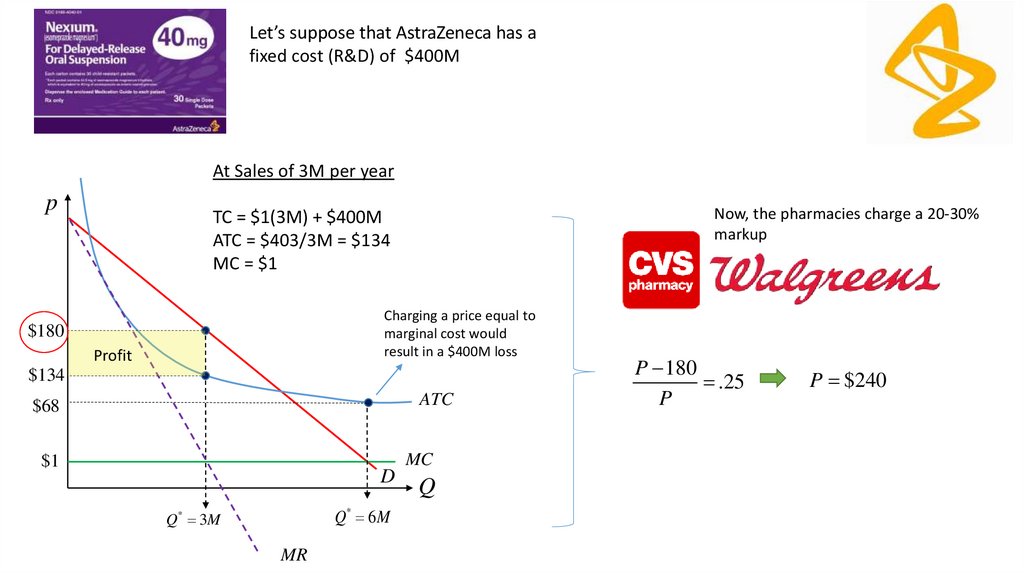

Let’s suppose that AstraZeneca has afixed cost (R&D) of $400M

At Sales of 3M per year

p

Now, the pharmacies charge a 20-30%

markup

TC = $1(3M) + $400M

ATC = $403/3M = $134

MC = $1

Charging a price equal to

marginal cost would

result in a $400M loss

$180

Profit

$134

ATC

$68

$1

D

Q* 6 M

Q* 3M

MR

MC

Q

P 180

.25

P

P $240

73.

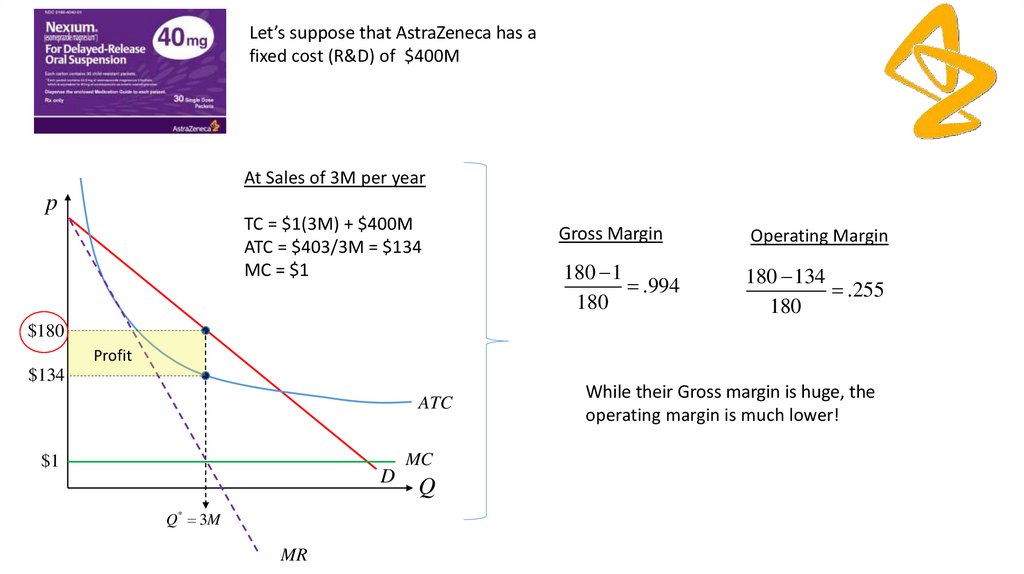

Let’s suppose that AstraZeneca has afixed cost (R&D) of $400M

At Sales of 3M per year

p

TC = $1(3M) + $400M

ATC = $403/3M = $134

MC = $1

Gross Margin

Operating Margin

180 1

.994

180

180 134

.255

180

$180

Profit

$134

ATC

$1

D

Q* 3M

MR

MC

Q

While their Gross margin is huge, the

operating margin is much lower!

74.

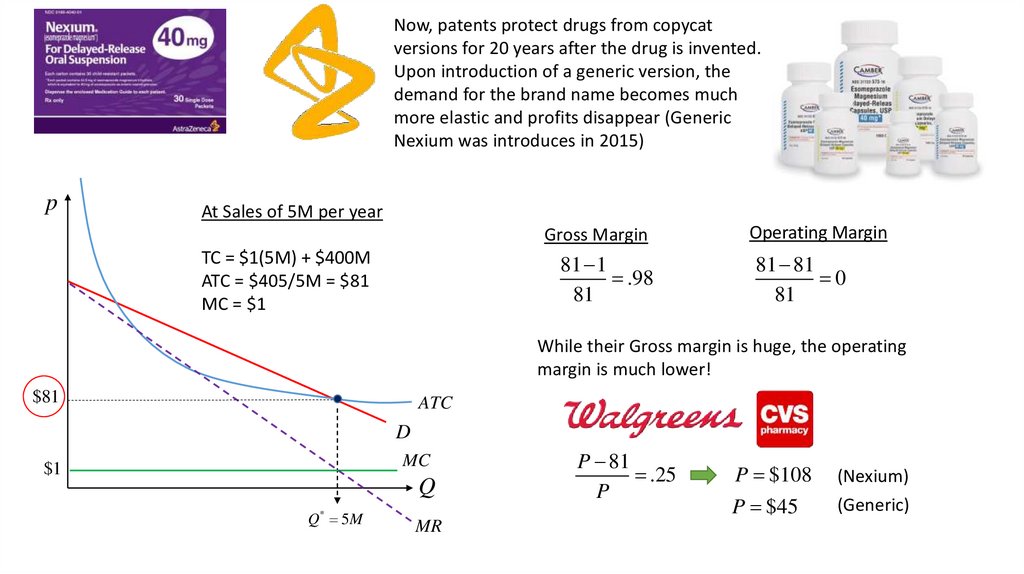

Now, patents protect drugs from copycatversions for 20 years after the drug is invented.

Upon introduction of a generic version, the

demand for the brand name becomes much

more elastic and profits disappear (Generic

Nexium was introduces in 2015)

p

At Sales of 5M per year

Gross Margin

TC = $1(5M) + $400M

ATC = $405/5M = $81

MC = $1

81 1

.98

81

Operating Margin

81 81

0

81

While their Gross margin is huge, the operating

margin is much lower!

$81

ATC

D

MC

$1

Q

Q* 5M

MR

P 81

.25

P

P $108

P $45

(Nexium)

(Generic)

75.

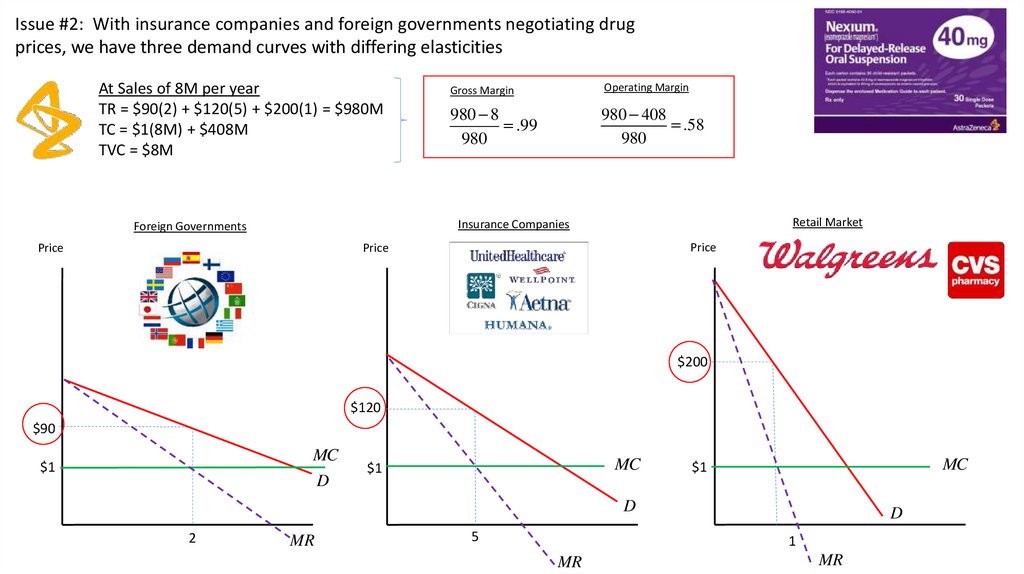

Issue #2: With insurance companies and foreign governments negotiating drugprices, we have three demand curves with differing elasticities

At Sales of 8M per year

TR = $90(2) + $120(5) + $200(1) = $980M

TC = $1(8M) + $408M

TVC = $8M

Gross Margin

Operating Margin

980 8

.99

980

980 408

.58

980

Retail Market

Insurance Companies

Foreign Governments

Price

Price

Price

$200

$120

$90

MC

D

$1

MC

$1

MC

$1

D

2

MR

5

D

1

MR

MR

76.

Why is movie popcorn so expensive?Dollars

$15

Avid

Moviegoer

Occasional

Moviegoer

$8

0

200

Ticket Price

Popcorn Price

Total

Option #1

$14

$1

$15

Option #2

$8

$7

$15

Option #3

$2

$13

$15

300

As long as the total

price (popcorn +

ticket) is $15 or less,

avid moviegoers will

still go

77.

Two Part PricingIn some situations, producers have

more than one price they can charge

customers…this opens up many new

pricing strategies

Shoppers Club Cards

Cover Charges

Notre Dame Ticket Rights Fee

Credit Cards with Annual

Fees

Land Line “Rental Fee”

Amusement Park Entry Fees

78.

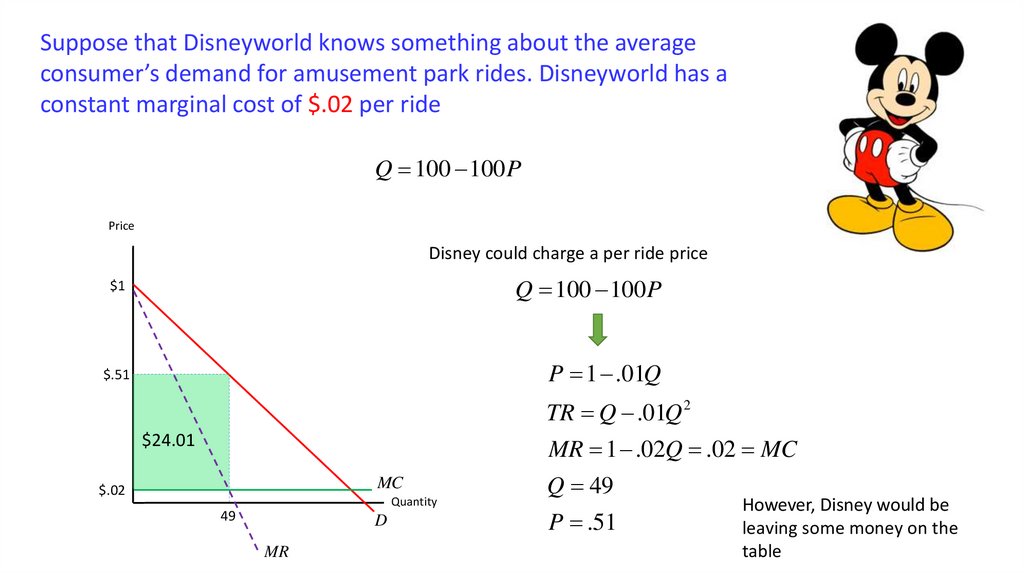

Suppose that Disneyworld knows something about the averageconsumer’s demand for amusement park rides. Disneyworld has a

constant marginal cost of $.02 per ride

Q 100 100 P

Price

Disney could charge a per ride price

$1

Q 100 100 P

$.51

P 1 .01Q

TR Q .01Q 2

$24.01

MR 1 .02Q .02 MC

MC

$.02

Quantity

49

D

MR

Q 49

P .51

However, Disney would be

leaving some money on the

table

79.

Suppose that Disneyworld knows something about the averageconsumer’s demand for amusement park rides. Disneyworld has a

constant marginal cost of $.02 per ride

Q 100 100 P

Price

$1

CS = (1/2)($1-.51)*49 = $12.00

$.51

Disney could charge an entry fee to

the park equal to the consumer

surplus. This is known as two part

pricing

$24.01

MC

$.02

Quantity

49

D

MR

Profit = $24.01 + $12.00 = $36.01

80.

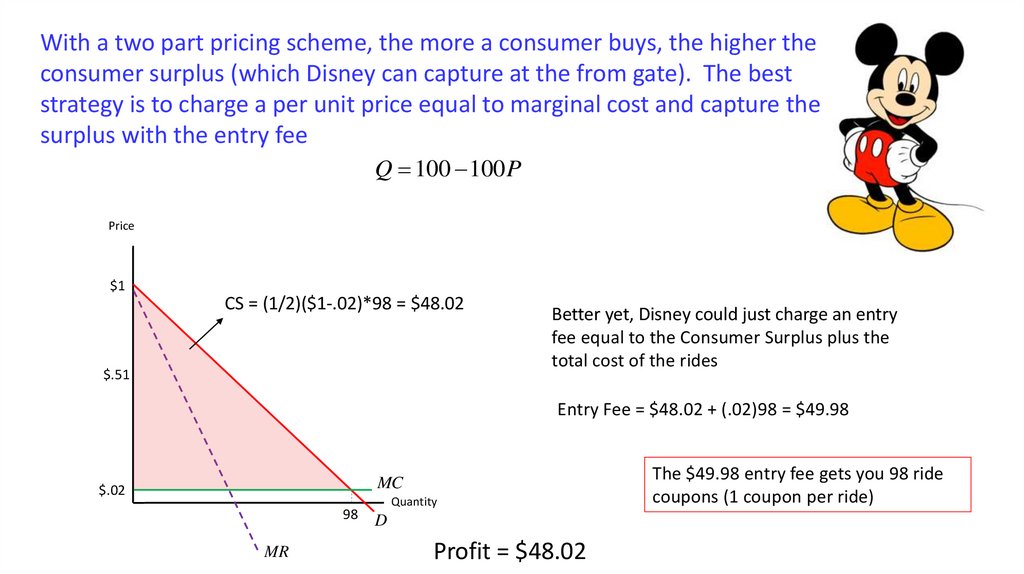

With a two part pricing scheme, the more a consumer buys, the higher theconsumer surplus (which Disney can capture at the from gate). The best

strategy is to charge a per unit price equal to marginal cost and capture the

surplus with the entry fee

Q 100 100 P

Price

$1

CS = (1/2)($1-.02)*98 = $48.02

$.51

Better yet, Disney could just charge an entry

fee equal to the Consumer Surplus plus the

total cost of the rides

Entry Fee = $48.02 + (.02)98 = $49.98

MC

$.02

98

MR

Quantity

D

Profit = $48.02

The $49.98 entry fee gets you 98 ride

coupons (1 coupon per ride)

81.

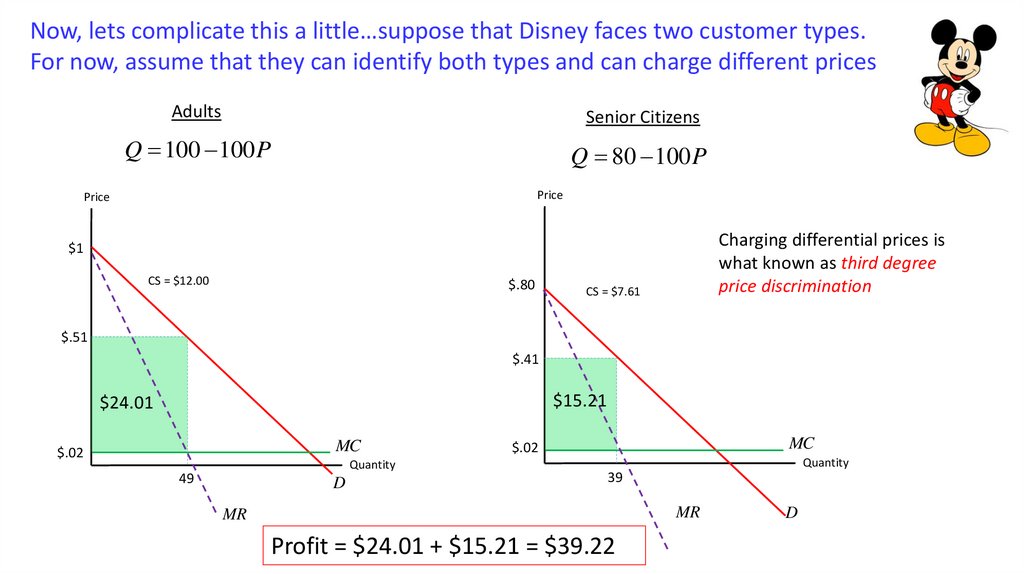

Now, lets complicate this a little…suppose that Disney faces two customer types.For now, assume that they can identify both types and can charge different prices

Adults

Senior Citizens

Q 100 100 P

Q 80 100 P

Price

Price

Charging differential prices is

what known as third degree

price discrimination

$1

CS = $12.00

$.80

CS = $7.61

$.51

$.41

$15.21

$24.01

MC

$.02

Quantity

49

D

MC

$.02

Quantity

39

MR

MR

Profit = $24.01 + $15.21 = $39.22

D

82.

Alternatively, they could use the two part pricing scheme to extra every dollar ofconsumer surplus from both groups

Senior Citizens

Adults

Q 80 100 P

Q 100 100 P

Price

Price

Senior Package (78 Ride Coupons)

Adult Package (98 Ride Coupons)

$1

$30.42 + (.02)(78) = $31.98

$48.02 + (.02)(98) = $49.98

$.80

$48.02

$.02

Charging differential prices is

what known as first degree

price discrimination

$30.42

MC

MC

$.02

Quantity

98 D

Quantity

78

D

Profit = $48.02 + $30.42 = $78.44

83.

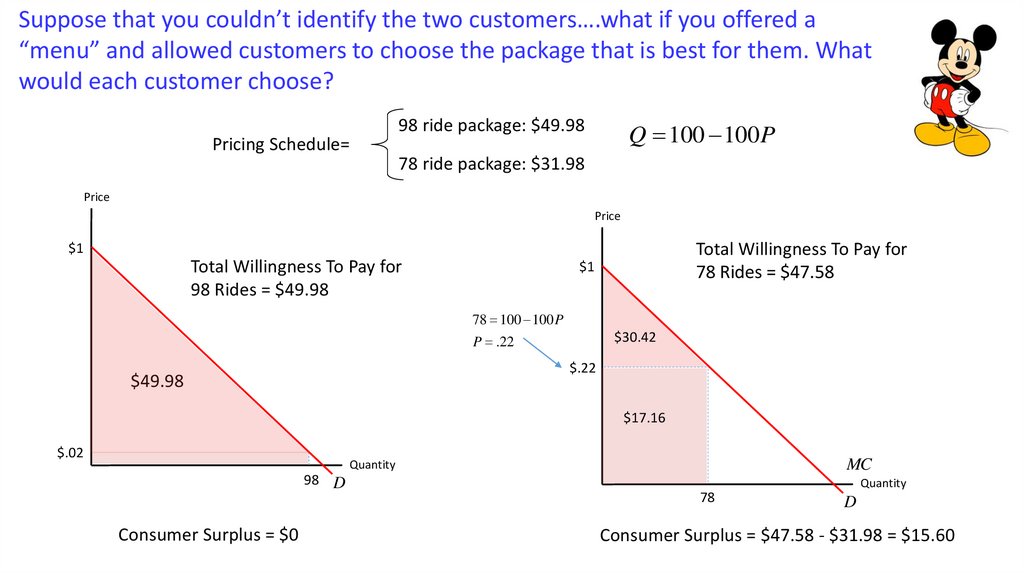

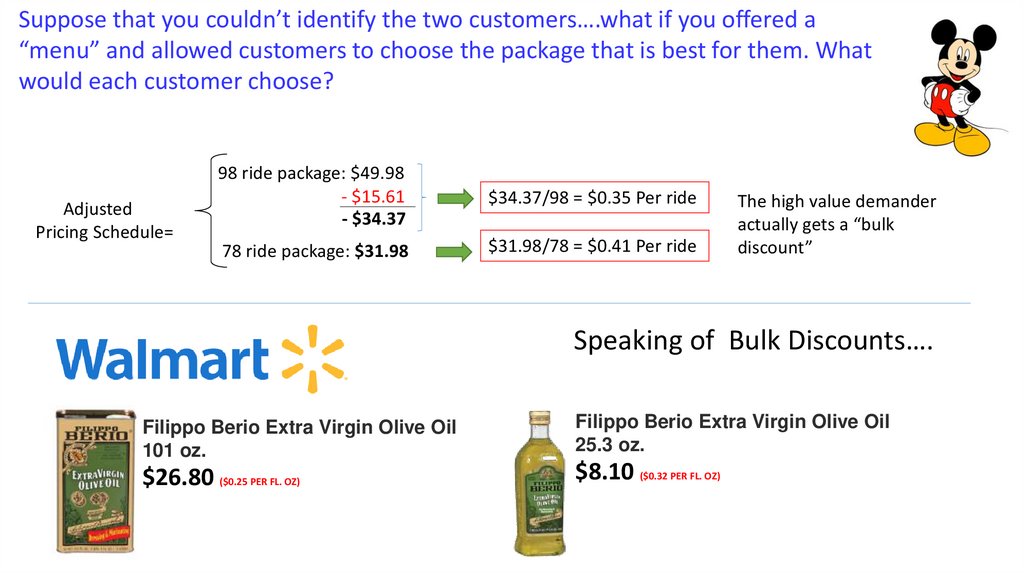

Suppose that you couldn’t identify the two customers….what if you offered a“menu” and allowed customers to choose the package that is best for them. What

would each customer choose?

Pricing Schedule=

98 ride package: $49.98

Q 100 100 P

78 ride package: $31.98

Price

Price

Total Willingness To Pay for

78 Rides = $47.58

$1

Total Willingness To Pay for

98 Rides = $49.98

$1

78 100 100 P

$30.42

P .22

$.22

$49.98

$17.16

$.02

MC

Quantity

98 D

Consumer Surplus = $0

Quantity

78

D

Consumer Surplus = $47.58 - $31.98 = $15.60

84.

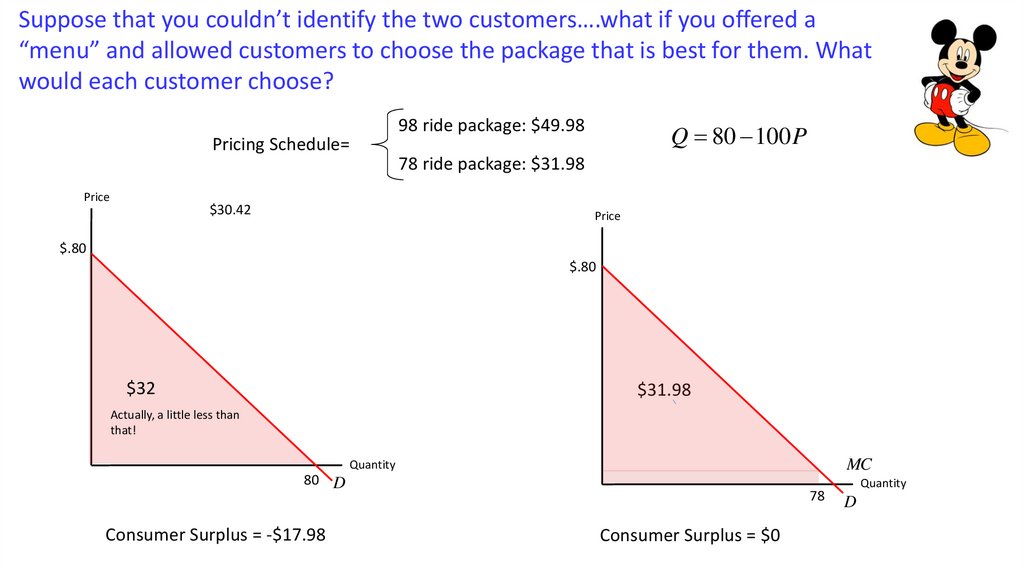

Suppose that you couldn’t identify the two customers….what if you offered a“menu” and allowed customers to choose the package that is best for them. What

would each customer choose?

Pricing Schedule=

Price

$30.42

98 ride package: $49.98

Q 80 100 P

78 ride package: $31.98

Price

$.80

$.80

$32

$31.98

Actually, a little less than

that!

MC

Quantity

80 D

Consumer Surplus = -$17.98

78

Consumer Surplus = $0

Quantity

D

85.

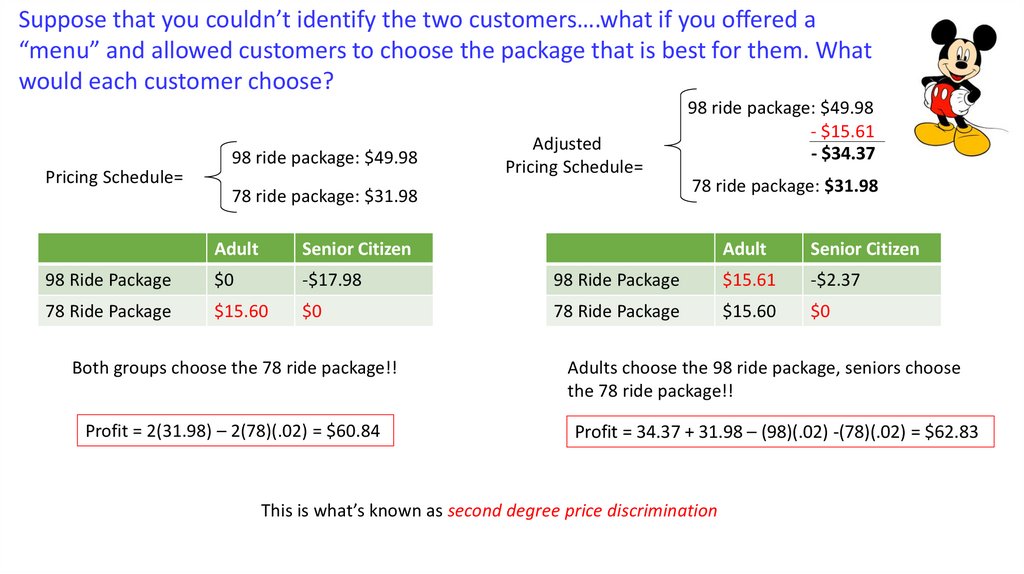

Suppose that you couldn’t identify the two customers….what if you offered a“menu” and allowed customers to choose the package that is best for them. What

would each customer choose?

Pricing Schedule=

98 ride package: $49.98

Adjusted

Pricing Schedule=

78 ride package: $31.98

Adult

Senior Citizen

98 Ride Package

$0

-$17.98

78 Ride Package

$15.60

$0

Both groups choose the 78 ride package!!

Profit = 2(31.98) – 2(78)(.02) = $60.84

98 ride package: $49.98

- $15.61

- $34.37

78 ride package: $31.98

Adult

Senior Citizen

98 Ride Package

$15.61

-$2.37

78 Ride Package

$15.60

$0

Adults choose the 98 ride package, seniors choose

the 78 ride package!!

Profit = 34.37 + 31.98 – (98)(.02) -(78)(.02) = $62.83

This is what’s known as second degree price discrimination

86.

Suppose that you couldn’t identify the two customers….what if you offered a“menu” and allowed customers to choose the package that is best for them. What

would each customer choose?

Adjusted

Pricing Schedule=

98 ride package: $49.98

- $15.61

- $34.37

$34.37/98 = $0.35 Per ride

78 ride package: $31.98

$31.98/78 = $0.41 Per ride

The high value demander

actually gets a “bulk

discount”

Speaking of Bulk Discounts….

Filippo Berio Extra Virgin Olive Oil

101 oz.

$26.80 ($0.25 PER FL. OZ)

Filippo Berio Extra Virgin Olive Oil

25.3 oz.

$8.10 ($0.32 PER FL. OZ)

87.

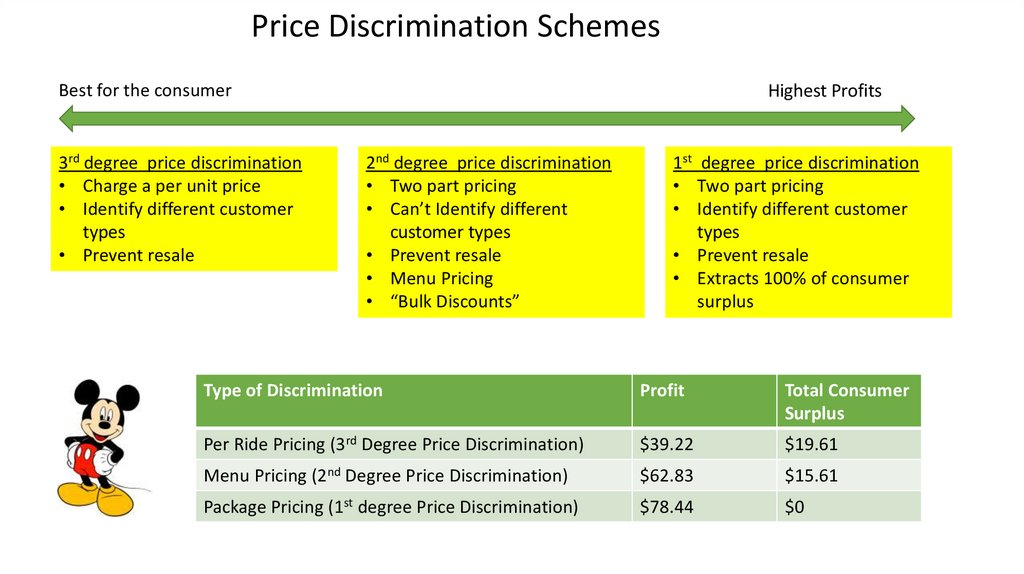

Price Discrimination SchemesBest for the consumer

3rd degree price discrimination

• Charge a per unit price

• Identify different customer

types

• Prevent resale

Highest Profits

2nd degree price discrimination

• Two part pricing

• Can’t Identify different

customer types

• Prevent resale

• Menu Pricing

• “Bulk Discounts”

1st degree price discrimination

• Two part pricing

• Identify different customer

types

• Prevent resale

• Extracts 100% of consumer

surplus

Type of Discrimination

Profit

Total Consumer

Surplus

Per Ride Pricing (3rd Degree Price Discrimination)

$39.22

$19.61

Menu Pricing (2nd Degree Price Discrimination)

$62.83

$15.61

Package Pricing (1st degree Price Discrimination)

$78.44

$0

88.

BundlingMicrosoft PowerPoint 2016

$79.99

Microsoft OneNote 2016

$70

Microsoft Outlook 2016

$109.00

Microsoft Excel 2016

Microsoft Word 2016

$79.99

Office Home and Business 2016

$79.99

$229.99

Source: Microsoft Store

89.

Bundle$229.99

Separate

$79.99

$79.99

Audio CD: $11.55

MP3:

$9.49

$79.99

$109.00

$70.00

Bundle

Track

Price

Most Wonderful Girl

$0.99

Fingerlicking Good

$0.99

Sole Sucker

$0.99

Rover Take Over

$0.99

Nasty Love

$0.99

Voodoo U

$0.99

Hot Magma

$0.99

Stripper

$0.99

Sexbomb

$0.99

Drowning in Ecstasy

$0.99

Lover

$0.99

She and Mr. Jones

$0.99

Total:

$418.97

$11.88

Separate

90.

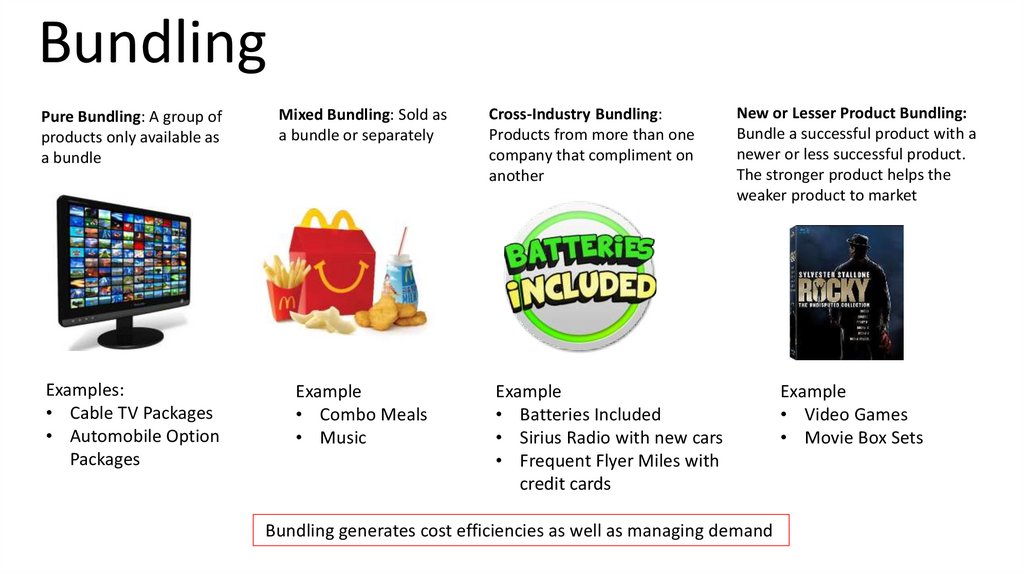

BundlingPure Bundling: A group of

products only available as

a bundle

Mixed Bundling: Sold as

a bundle or separately

Examples:

• Cable TV Packages

• Automobile Option

Packages

Example

• Combo Meals

• Music

Cross-Industry Bundling:

Products from more than one

company that compliment on

another

New or Lesser Product Bundling:

Bundle a successful product with a

newer or less successful product.

The stronger product helps the

weaker product to market

Example

• Batteries Included

• Sirius Radio with new cars

• Frequent Flyer Miles with

credit cards

Bundling generates cost efficiencies as well as managing demand

Example

• Video Games

• Movie Box Sets

91.

Suppose that you are selling two products. Marginal costs for these products are $100(Product 1) and $150 (Product 2). You have 4 potential consumers that will either buy one

unit or none of each product (they buy if the price is below their reservation value)

Consumer

Sum

A

$50

$450

$500

B

$250

$275

$525

C

$300

$220

$520

D

$450

$50

$500

92.

Separate PricingMicrosoft Excel

Microsoft Word

MC = $150

MC = $100

P

Q

TR

TC

Profit

P

Q

TR

TC

Profit

$450

1

$450

$100

$350

$450

1

$450

$150

$300

$300

2

$600

$200

$400

$275

2

$550

$300

$250

$250

3

$750

$300

$450

$220

3

$660

$450

$210

$50

4

$200

$400

-$200

$50

4

$200

$600

-$400

Profits = $450 + $300 = $750

93.

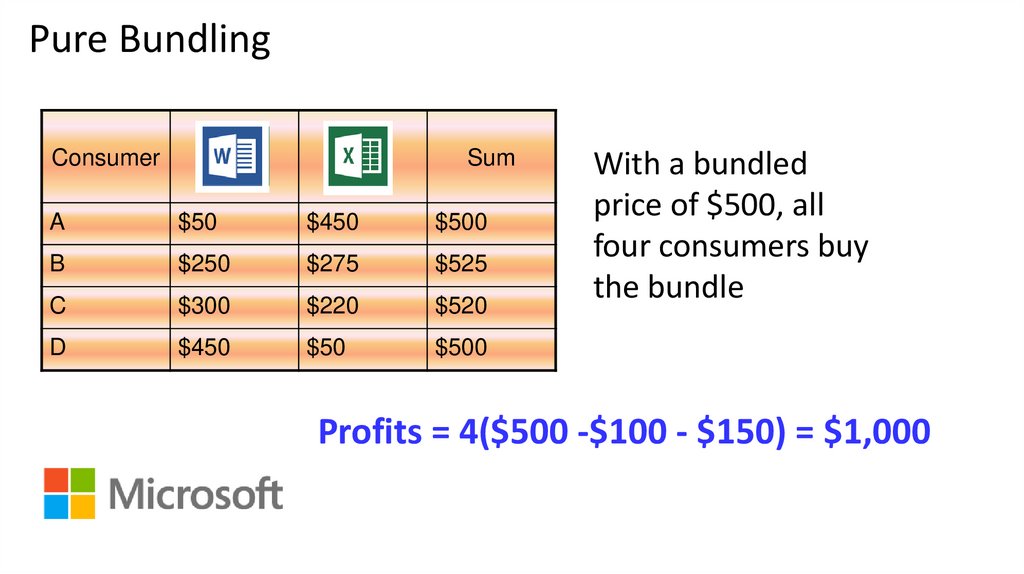

Pure BundlingConsumer

Sum

A

$50

$450

$500

B

$250

$275

$525

C

$300

$220

$520

D

$450

$50

$500

With a bundled

price of $500, all

four consumers buy

the bundle

Profits = 4($500 -$100 - $150) = $1,000

94.

Mixed BundlingConsumer

Sum

A

$50

$450

$500

B

$250

$275

$525

C

$300

$220

$520

D

$450

$50

$500

Price = $250

Price = $450

Price = $500

With mixed bundling,

consumers have the option

of buying the individual

titles or the bundle. Utility

maximizing consumers make

the choice that provides the

greatest consumer surplus

Consumer A: Buys Excel (Profit = $300) or Bundle

(Profit = $250)

Consumer B: Buys Bundle (Profit = $250)

Consumer C: Buys Word (Profit = $150)

Consumer D: Buys Only Word (Profit = $150)

Profit = $850 or $800

95.

Mixed BundlingConsumer

Sum

A

$50

$450

$500

B

$250

$275

$525

C

$300

$220

$520

D

$450

$50

$500

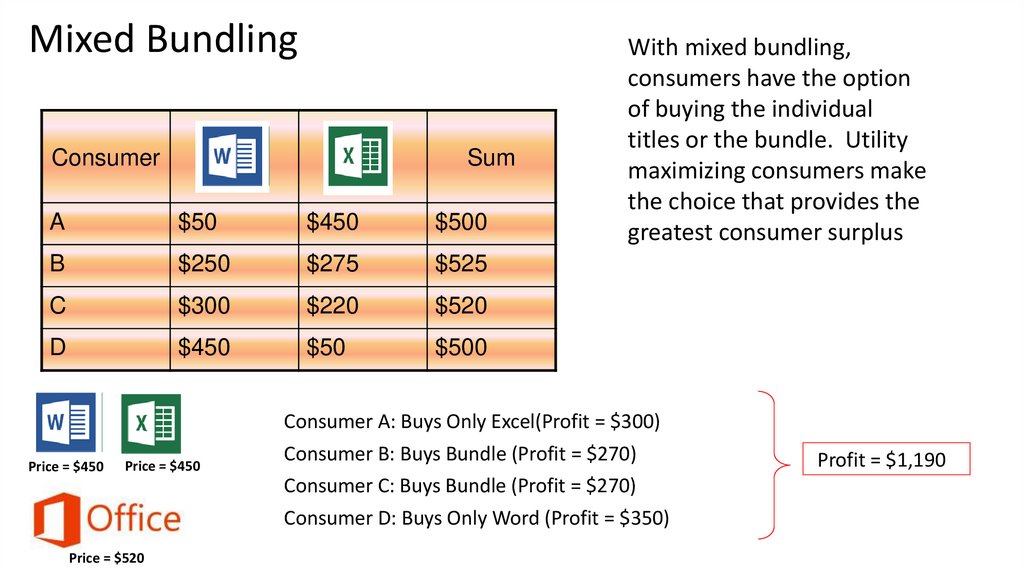

Price = $450

Price = $450

Price = $520

With mixed bundling,

consumers have the option

of buying the individual

titles or the bundle. Utility

maximizing consumers make

the choice that provides the

greatest consumer surplus

Consumer A: Buys Only Excel(Profit = $300)

Consumer B: Buys Bundle (Profit = $270)

Consumer C: Buys Bundle (Profit = $270)

Consumer D: Buys Only Word (Profit = $350)

Profit = $1,190

96.

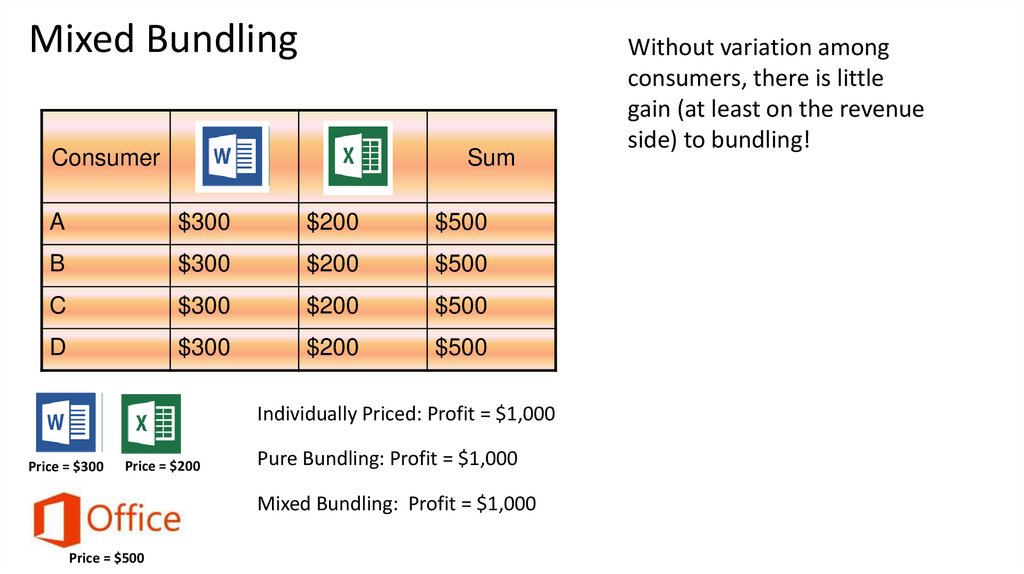

Mixed BundlingConsumer

Sum

A

$300

$200

$500

B

$300

$200

$500

C

$300

$200

$500

D

$300

$200

$500

Individually Priced: Profit = $1,000

Price = $300

Price = $200

Pure Bundling: Profit = $1,000

Mixed Bundling: Profit = $1,000

Price = $500

Without variation among

consumers, there is little

gain (at least on the revenue

side) to bundling!

97.

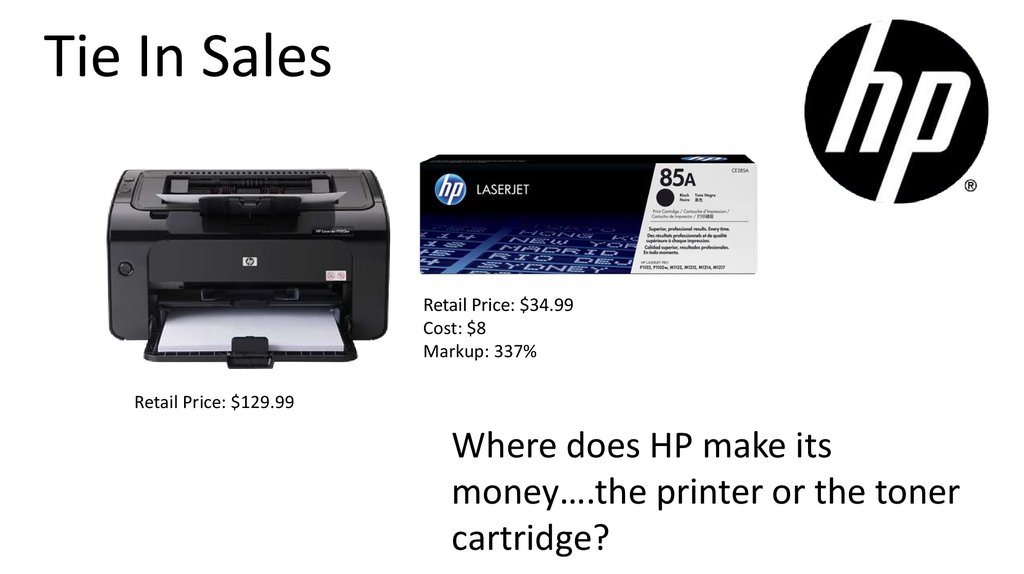

Tie In SalesRetail Price: $34.99

Cost: $8

Markup: 337%

Retail Price: $129.99

Where does HP make its

money….the printer or the toner

cartridge?

98.

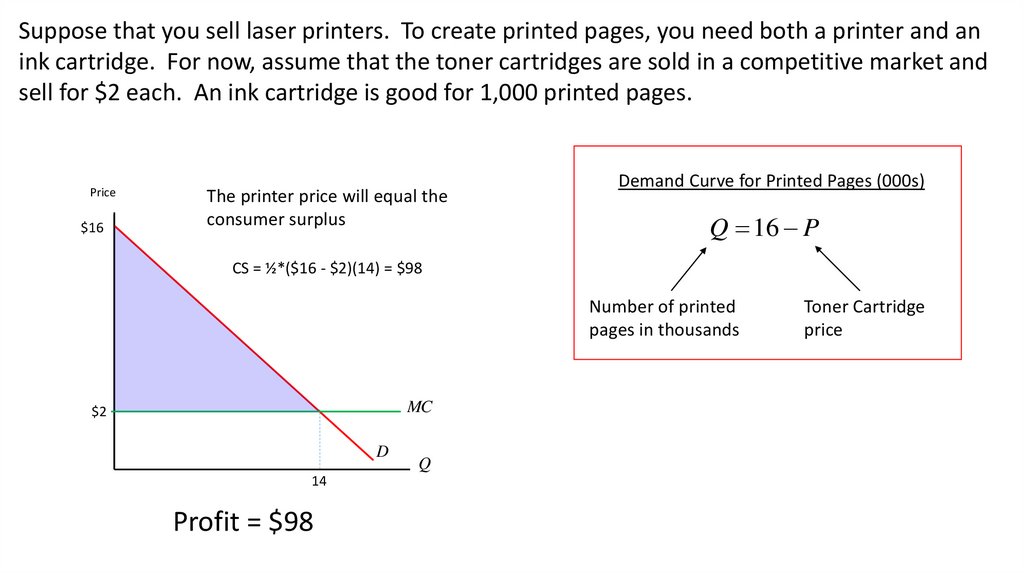

Suppose that you sell laser printers. To create printed pages, you need both a printer and anink cartridge. For now, assume that the toner cartridges are sold in a competitive market and

sell for $2 each. An ink cartridge is good for 1,000 printed pages.

Price

$16

The printer price will equal the

consumer surplus

Demand Curve for Printed Pages (000s)

Q 16 P

CS = ½*($16 - $2)(14) = $98

Number of printed

pages in thousands

MC

$2

D

14

Profit = $98

Q

Toner Cartridge

price

99.

Now, suppose that you design the printer to take a special cartridge that only you produce.Q 16 P

Price

$16

CS = ½*($16 - $9)(7) = $24.50

$9

P 16 Q

This area becomes

deadweight loss…nobody

gets it!

$49

MC

$2

D

MR 16 2Q 2 MC

Q

14

$7

TR PQ 16Q Q 2

Q 7

P $9

MR

Profit = $49 + $24.50 = $73.50

What we make on the cartridges, we are losing on the printers…we would be

better off giving away the cartridges, wouldn’t we?

100.

Suppose that you face two different consumers…assume one of each type$16

Q 16 P

$16

D

High Value Demander

Q 12 P

D

Q

Q

Low Value Demander

Assume that you can identify both types and can charge different

prices

101.

Suppose that you face two different consumers…assume one of each typePrice

$16

Price

Q 16 P

$12

CS = ½*($16 - $2)(14) = $98

$2

MC

D

14

Q 12 P

CS = ½*($10 - $2)(10) = $50

MC

$2

Q

High Value Demander

D

Q

10

Low Value Demander

Profit = $98 + $50 = $148

If you can identify these two customers types and price discriminate against them, your best move is to

sell both types the cartridges at cost and discriminate on the printer price

102.

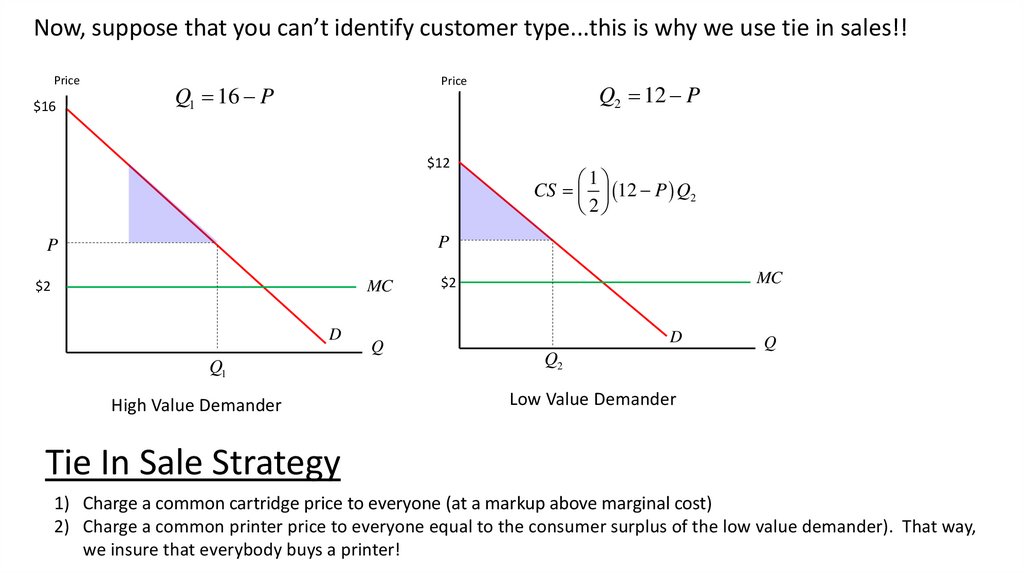

Now, suppose that you can’t identify customer type...this is why we use tie in sales!!Price

$16

Price

Q1 16 P

$12

Q2 12 P

1

CS 12 P Q2

2

P

P

$2

MC

D

Q1

High Value Demander

Q

MC

$2

D

Q

Q2

Low Value Demander

Tie In Sale Strategy

1) Charge a common cartridge price to everyone (at a markup above marginal cost)

2) Charge a common printer price to everyone equal to the consumer surplus of the low value demander). That way,

we insure that everybody buys a printer!

103.

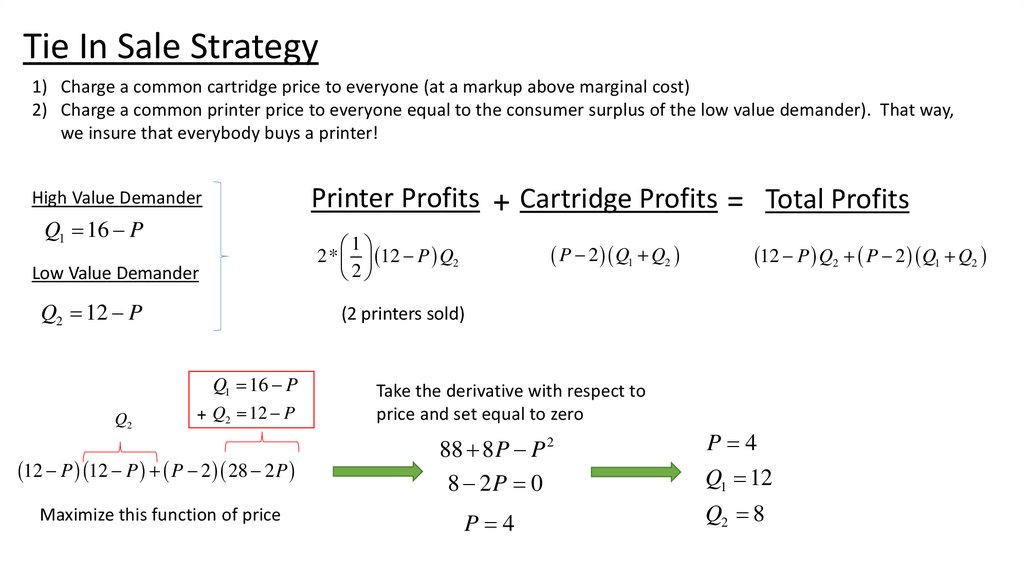

Tie In Sale Strategy1) Charge a common cartridge price to everyone (at a markup above marginal cost)

2) Charge a common printer price to everyone equal to the consumer surplus of the low value demander). That way,

we insure that everybody buys a printer!

Printer Profits + Cartridge Profits = Total Profits

High Value Demander

Q1 16 P

1

2* 12 P Q2

2

Low Value Demander

Q2 12 P

12 P Q2 P 2 Q1 Q2

(2 printers sold)

Q1 16 P

Q2

P 2 Q1 Q2

+ Q2 12 P

12 P 12 P P 2 28 2 P

Maximize this function of price

Take the derivative with respect to

price and set equal to zero

88 8P P 2

8 2P 0

P 4

P 4

Q1 12

Q2 8

104.

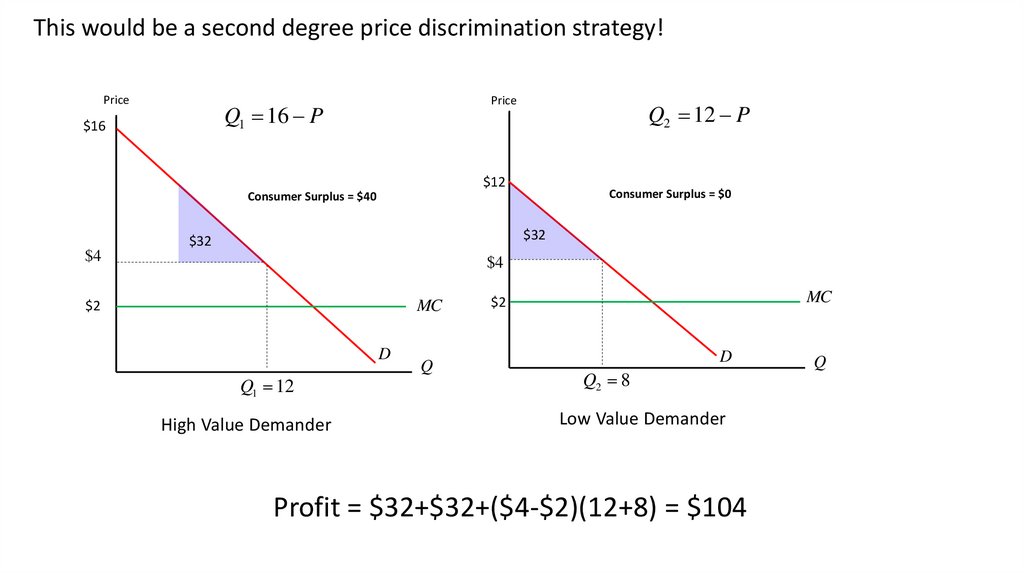

This would be a second degree price discrimination strategy!Price

Price

Q1 16 P

$16

Q2 12 P

$12

Consumer Surplus = $0

Consumer Surplus = $40

$32

$32

$4

$4

$2

MC

D

Q1 12

High Value Demander

Q

MC

$2

D

Q2 8

Low Value Demander

Profit = $32+$32+($4-$2)(12+8) = $104

Q

105.

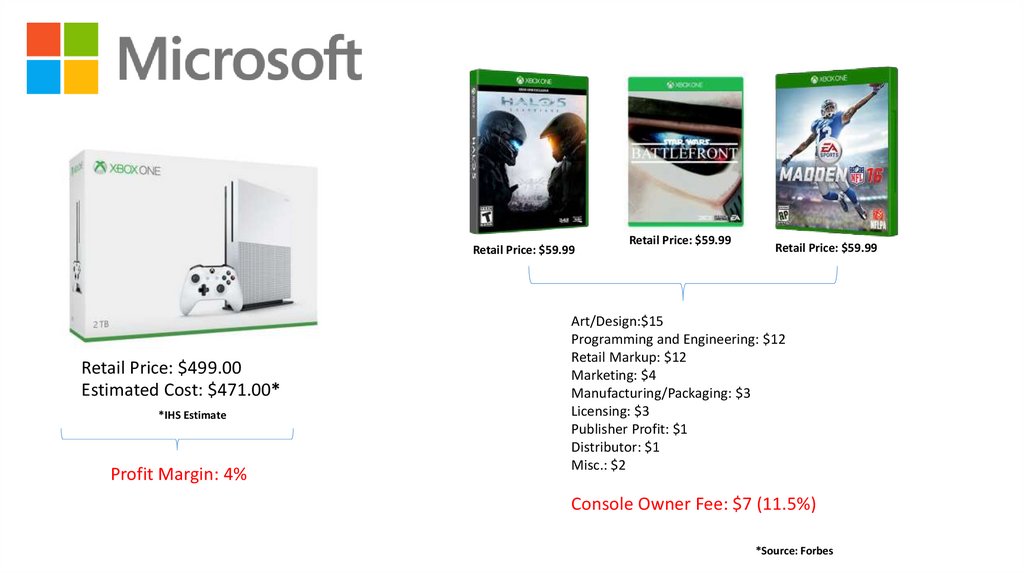

Retail Price: $59.99Retail Price: $499.00

Estimated Cost: $471.00*

*IHS Estimate

Profit Margin: 4%

Retail Price: $59.99

Retail Price: $59.99

Art/Design:$15

Programming and Engineering: $12

Retail Markup: $12

Marketing: $4

Manufacturing/Packaging: $3

Licensing: $3

Publisher Profit: $1

Distributor: $1

Misc.: $2

Console Owner Fee: $7 (11.5%)

*Source: Forbes

106.

Retail Price: $35.99Price Per Blade: $2.99

Retail Price: $24.38

Price Per Blade: $3.05

Retail Price: $7.49

Cost: $.08 per blade

Markup: 3,500%

Retail Price: $48.98

Price Per Blade: $3.06

107.

Complimentary Goods PricingQ 12 PH PB

Price of a Hot Dog

Price of a Hot Dog Bun

Hot Dogs and Buns are made by separate companies – each has a

monopoly in its own industry. For simplicity, assume that the

marginal cost of production for each equals zero.

108.

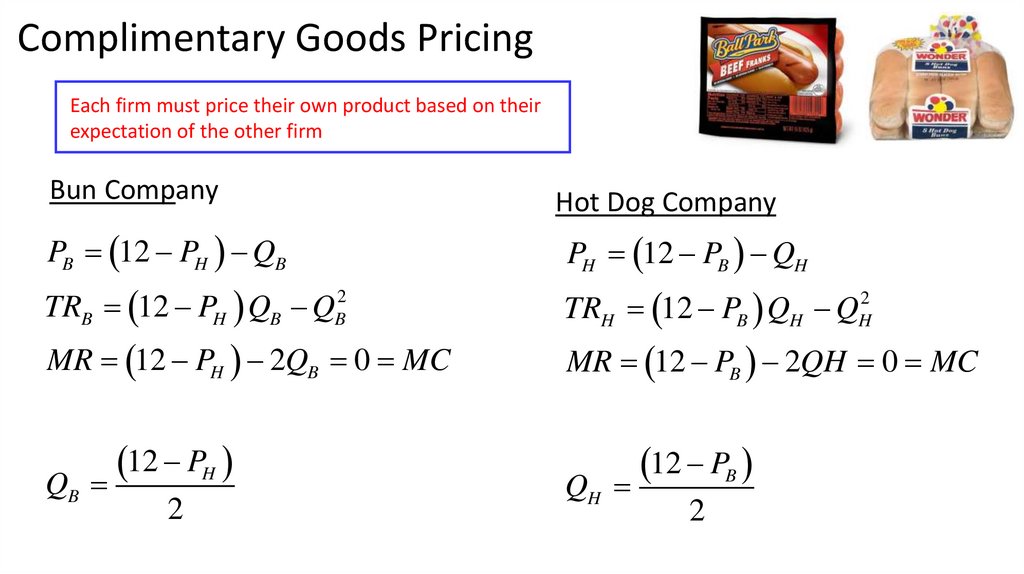

Complimentary Goods PricingEach firm must price their own product based on their

expectation of the other firm

Bun Company

Hot Dog Company

PB 12 PH QB

PH 12 PB QH

TRB 12 PH QB QB2

TRH 12 PB QH QH2

MR 12 PH 2QB 0 MC

MR 12 PB 2QH 0 MC

QB

12 PH

2

QH

12 PB

2

109.

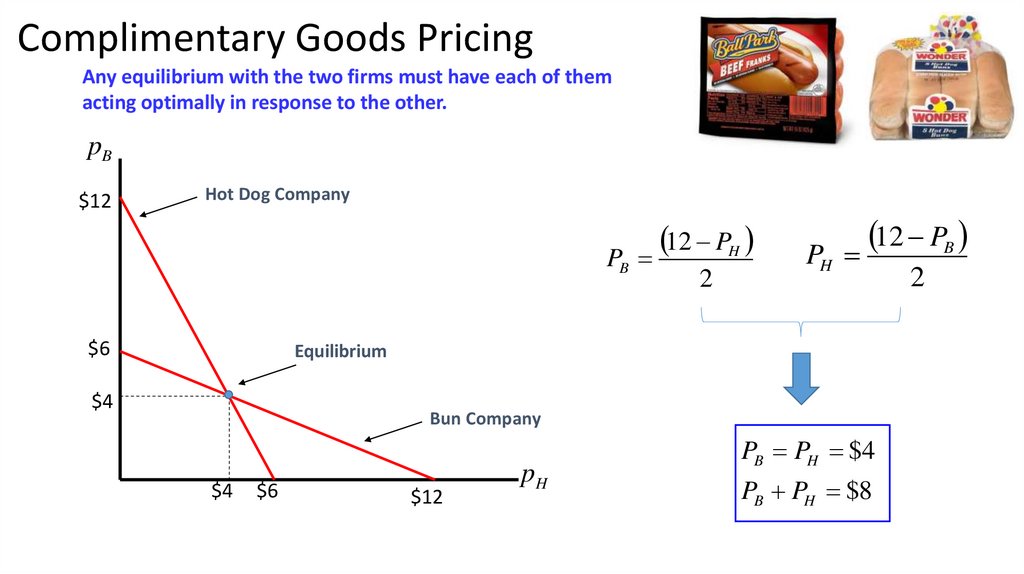

Complimentary Goods PricingEach firm must price their own product based on their

expectation of the other firm

Bun Company

Hot Dog Company

PB 12 PH QB

QB

PB

12 PH

2

PH 12 PB QH

12 PH

QH

2

PH

12 PB

12 PB

2

2

110.

Complimentary Goods PricingAny equilibrium with the two firms must have each of them

acting optimally in response to the other.

pB

$12

Hot Dog Company

PB

$6

12 PH

2

PH

12 PB

Equilibrium

$4

Bun Company

$4

$6

$12

pH

PB PH $4

PB PH $8

2

111.

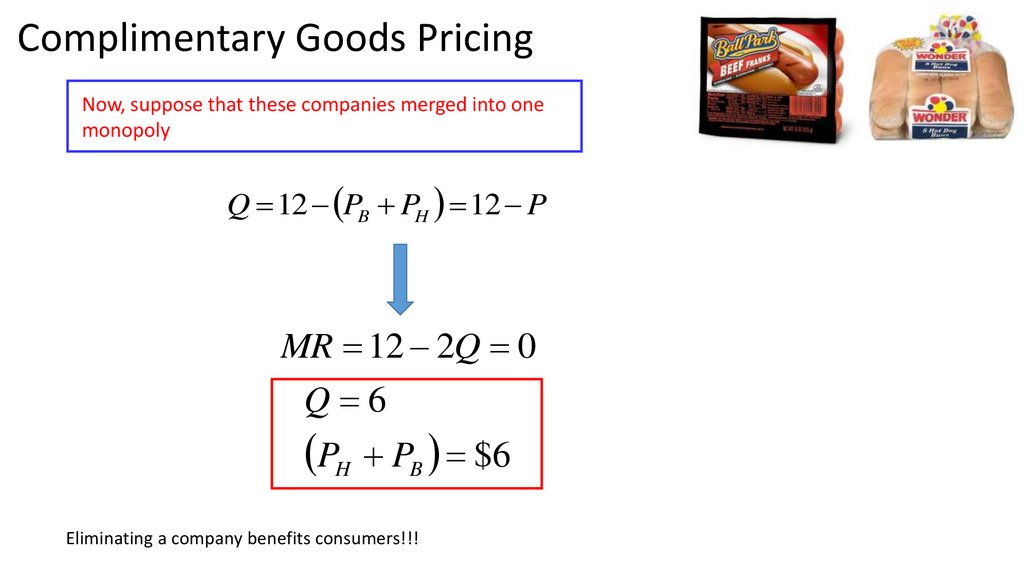

Complimentary Goods PricingNow, suppose that these companies merged into one

monopoly

Q 12 PB PH 12 P

MR 12 2Q 0

Q 6

PH PB $6

Eliminating a company benefits consumers!!!

112.

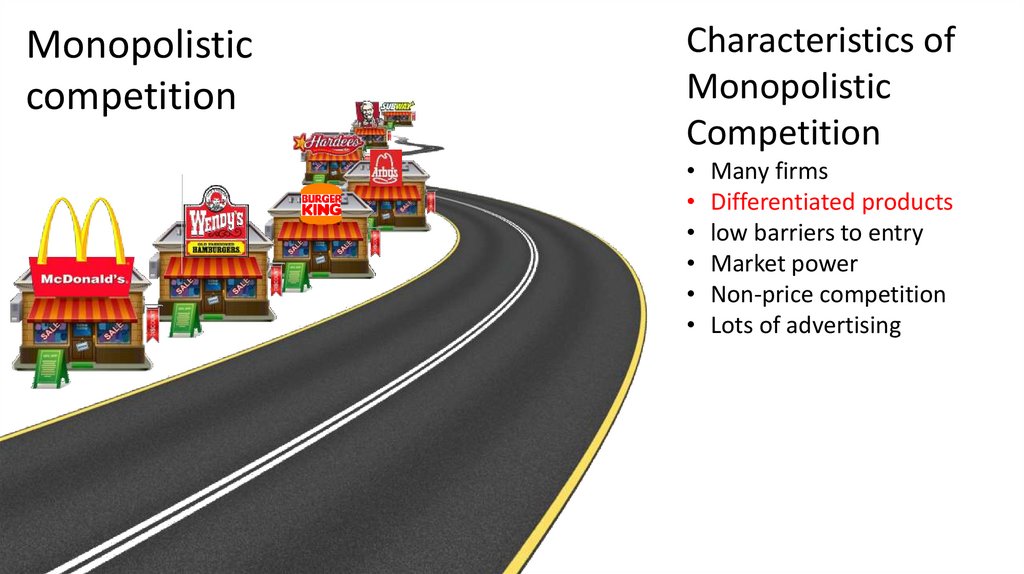

Monopolisticcompetition

Characteristics of

Monopolistic

Competition

Many firms

Differentiated products

low barriers to entry

Market power

Non-price competition

Lots of advertising

113.

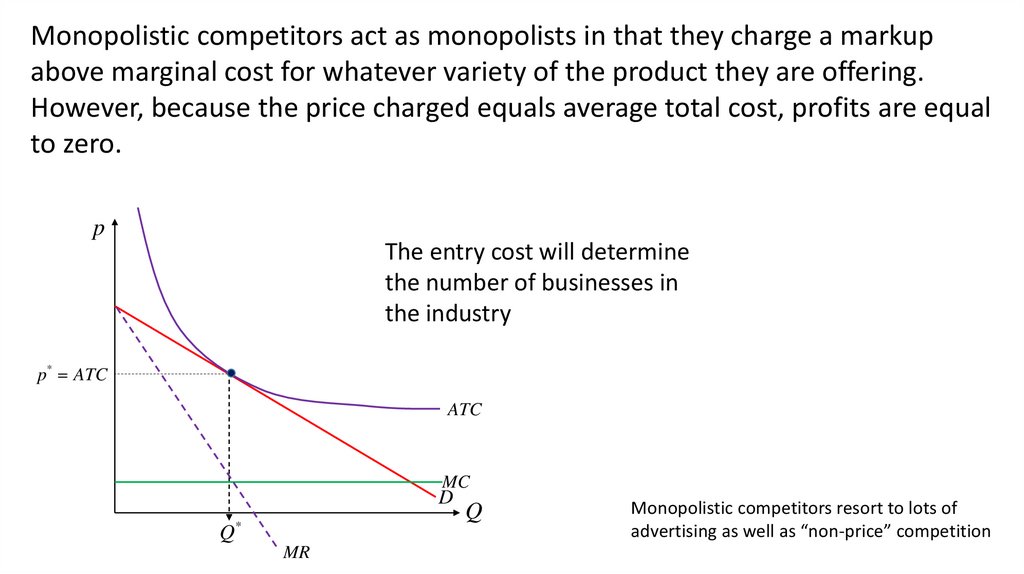

Monopolistic competitors act as monopolists in that they charge a markupabove marginal cost for whatever variety of the product they are offering.

However, because the price charged equals average total cost, profits are equal

to zero.

p

The entry cost will determine

the number of businesses in

the industry

p* ATC

ATC

MC

D

Q*

MR

Q

Monopolistic competitors resort to lots of

advertising as well as “non-price” competition

114.

Non-Price Competition example - LocationGucci currently has 31 locations in the US

Starbucks currently has 12,937 locations in the US

Why does it make sense for Starbucks to have lots of locations, but not Gucci?

115.

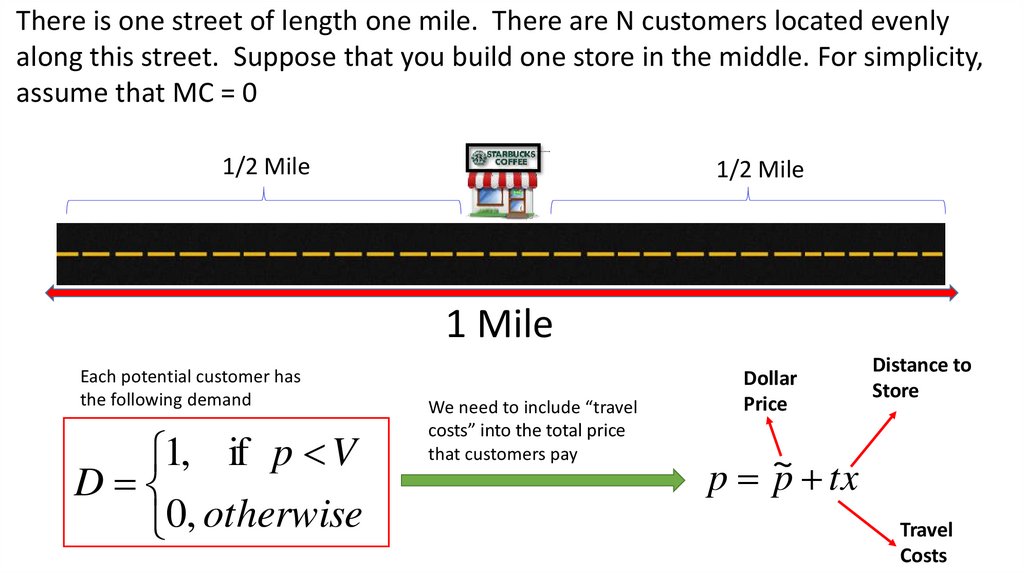

There is one street of length one mile. There are N customers located evenlyalong this street. Suppose that you build one store in the middle. For simplicity,

assume that MC = 0

1/2 Mile

1/2 Mile

1 Mile

Each potential customer has

the following demand

1, if p V

D

0, otherwise

We need to include “travel

costs” into the total price

that customers pay

Dollar

Price

Distance to

Store

p ~

p tx

Travel

Costs

116.

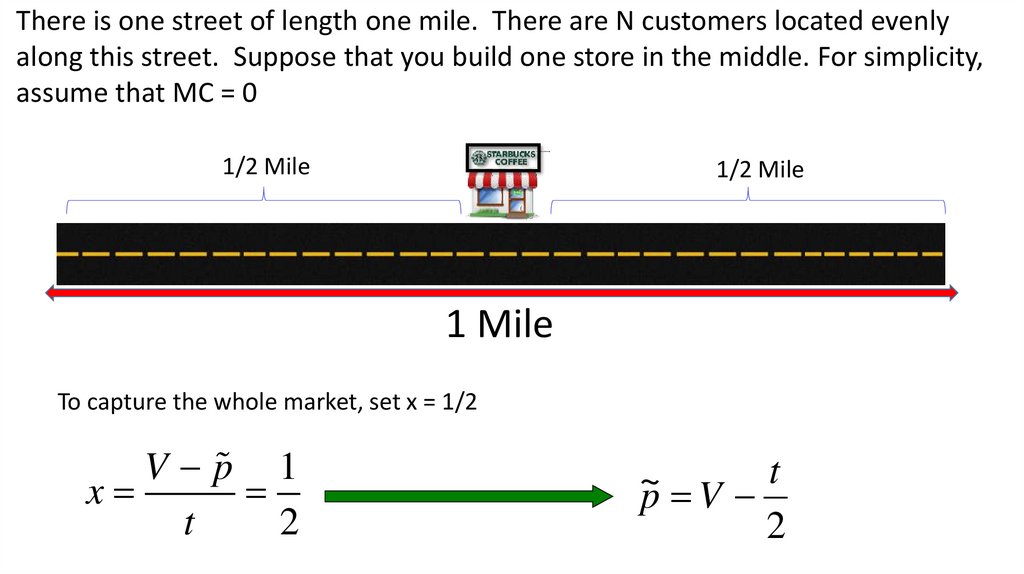

There is one street of length one mile. There are N customers located evenlyalong this street. Suppose that you build one store in the middle. For simplicity,

assume that MC = 0

1/2 Mile

1/2 Mile

1 Mile

To capture the whole market, set x = 1/2

V p 1

x

t

2

t

~

p V

2

117.

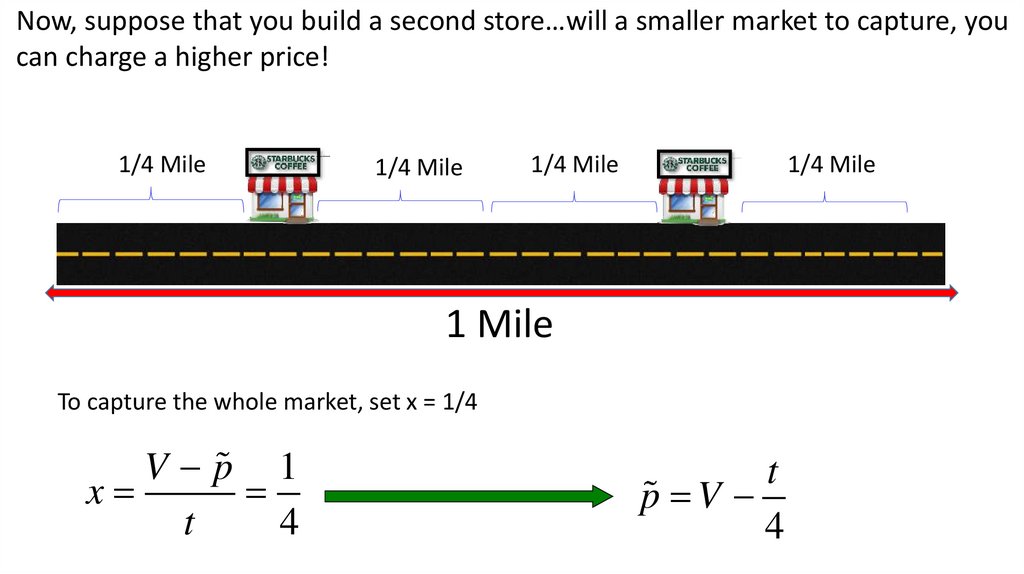

Now, suppose that you build a second store…will a smaller market to capture, youcan charge a higher price!

1/4 Mile

1/4 Mile

1/4 Mile

1/4 Mile

1 Mile

To capture the whole market, set x = 1/4

V p 1

x

t

4

t

p V

4

118.

Now, three stores!1/6 Mile

1/6 Mile

1/6 Mile

1/6 Mile

1/6 Mile

1 Mile

To capture the whole market, set x = 1/6

V p 1

x

t

6

t

p V

6

1/6 Mile

119.

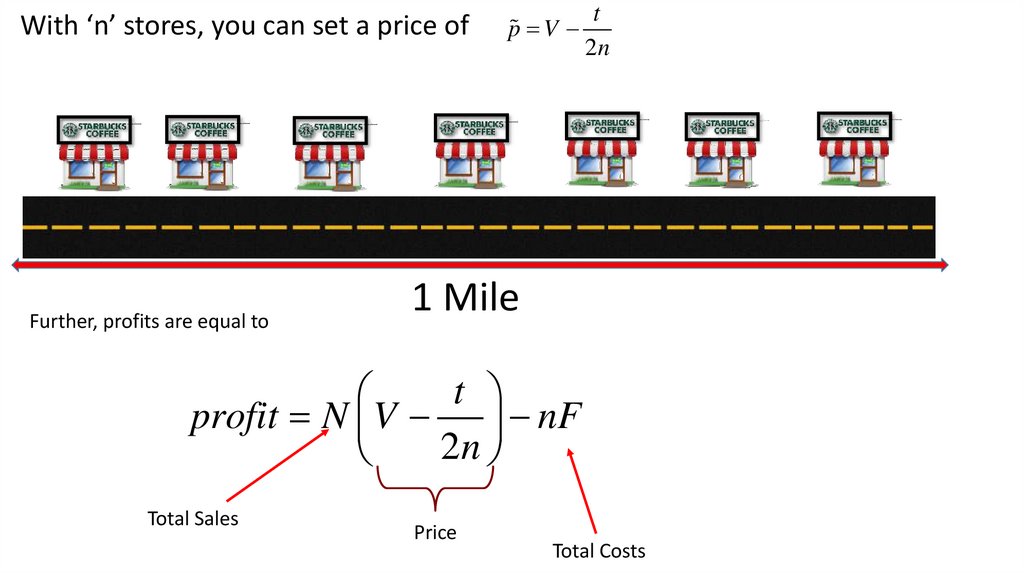

With ‘n’ stores, you can set a price ofFurther, profits are equal to

p V

t

2n

1 Mile

t

profit N V nF

2n

Total Sales

Price

Total Costs

120.

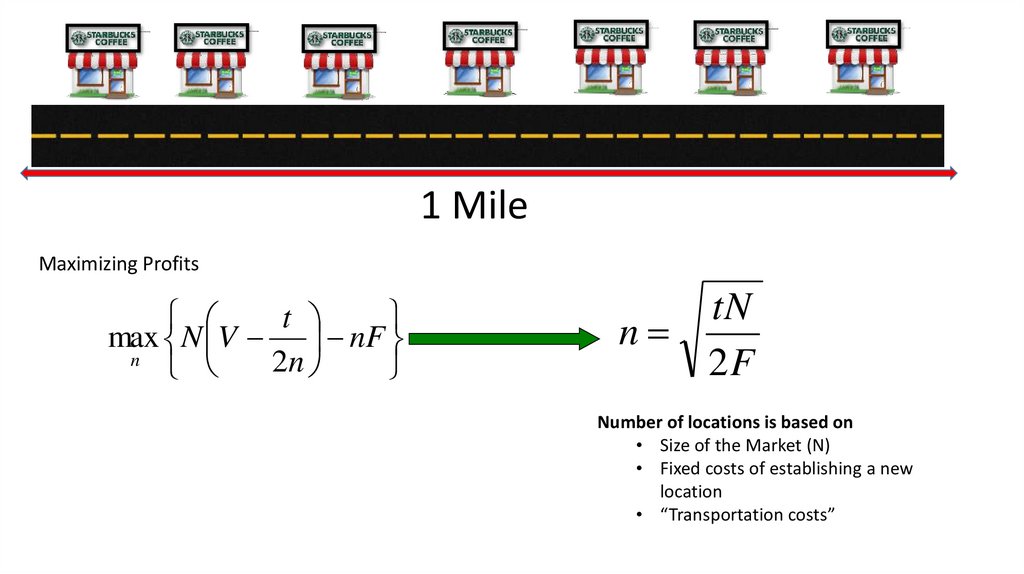

1 MileMaximizing Profits

t

max N V nF

n

2n

tN

n

2F

Number of locations is based on

• Size of the Market (N)

• Fixed costs of establishing a new

location

• “Transportation costs”

121.

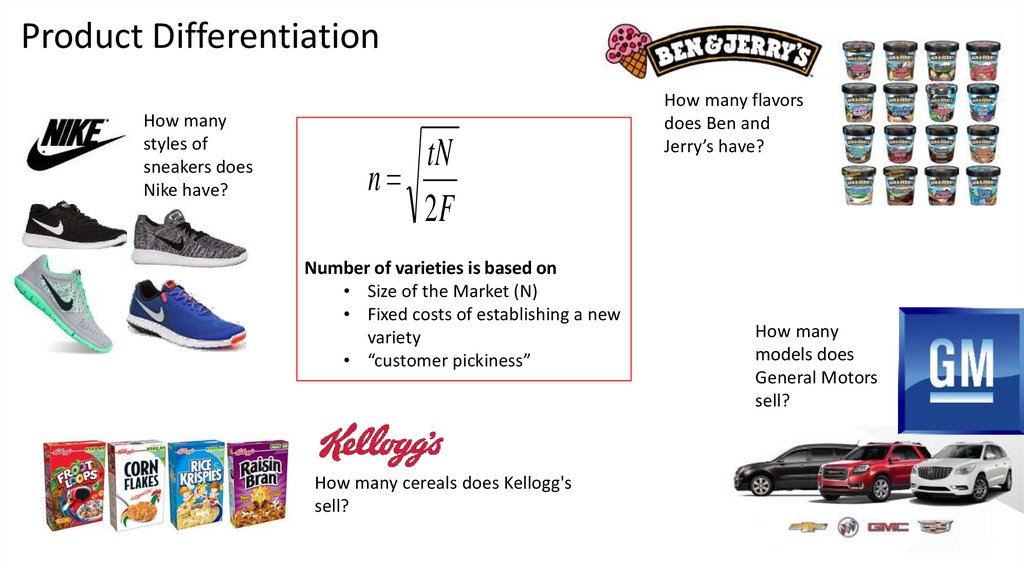

Product DifferentiationHow many

styles of

sneakers does

Nike have?

tN

n

2F

Number of varieties is based on

• Size of the Market (N)

• Fixed costs of establishing a new

variety

• “customer pickiness”

How many cereals does Kellogg's

sell?

How many flavors

does Ben and

Jerry’s have?

How many

models does

General Motors

sell?

Английский язык

Английский язык