Похожие презентации:

Financial Statement Analysis

1. Chapter 6

Financial StatementAnalysis

6-1

2. Financial Statement Analysis

FinancialA

Statements

Possible Framework for Analysis

Ratio

Trend

Analysis

Analysis

Common-Size

6-2

and Index Analysis

3. Examples of External Uses of Statement Analysis

TradeCreditors -- Focus on the

liquidity of the firm.

Bondholders

-- Focus on the

long-term cash flow of the firm.

Shareholders

-- Focus on the

profitability and long-term health of

the firm.

6-3

4. Examples of Internal Uses of Statement Analysis

Plan-- Focus on assessing the current

financial position and evaluating

potential firm opportunities.

Control

-- Focus on return on investment

for various assets and asset efficiency.

Understand

-- Focus on understanding

how suppliers of funds analyze the firm.

6-4

5. Primary Types of Financial Statements

Balance SheetA summary of a firm’s financial position on

a given date that shows total assets = total

liabilities + owners’ equity.

Income Statement

6-5

A summary of a firm’s revenues and

expenses over a specified period, ending

with net income or loss for the period.

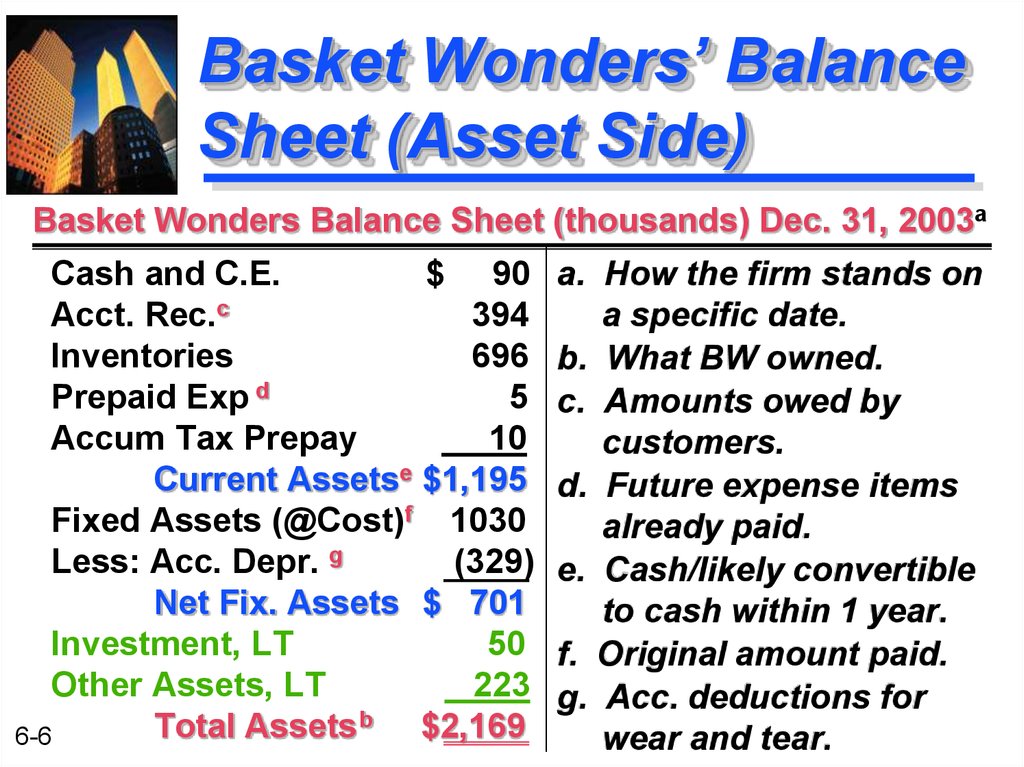

6. Basket Wonders’ Balance Sheet (Asset Side)

Basket Wonders Balance Sheet (thousands) Dec. 31, 2003aCash and C.E.

$ 90

Acct. Rec.c

394

Inventories

696

Prepaid Exp d

5

Accum Tax Prepay

10

Current Assetse $1,195

Fixed Assets (@Cost)f 1030

Less: Acc. Depr. g

(329)

Net Fix. Assets $ 701

Investment, LT

50

Other Assets, LT

223

Total Assets b $2,169

6-6

a. How the firm stands on

a specific date.

b. What BW owned.

c. Amounts owed by

customers.

d. Future expense items

already paid.

e. Cash/likely convertible

to cash within 1 year.

f. Original amount paid.

g. Acc. deductions for

wear and tear.

7. Basket Wonders’ Balance Sheet (Liability Side)

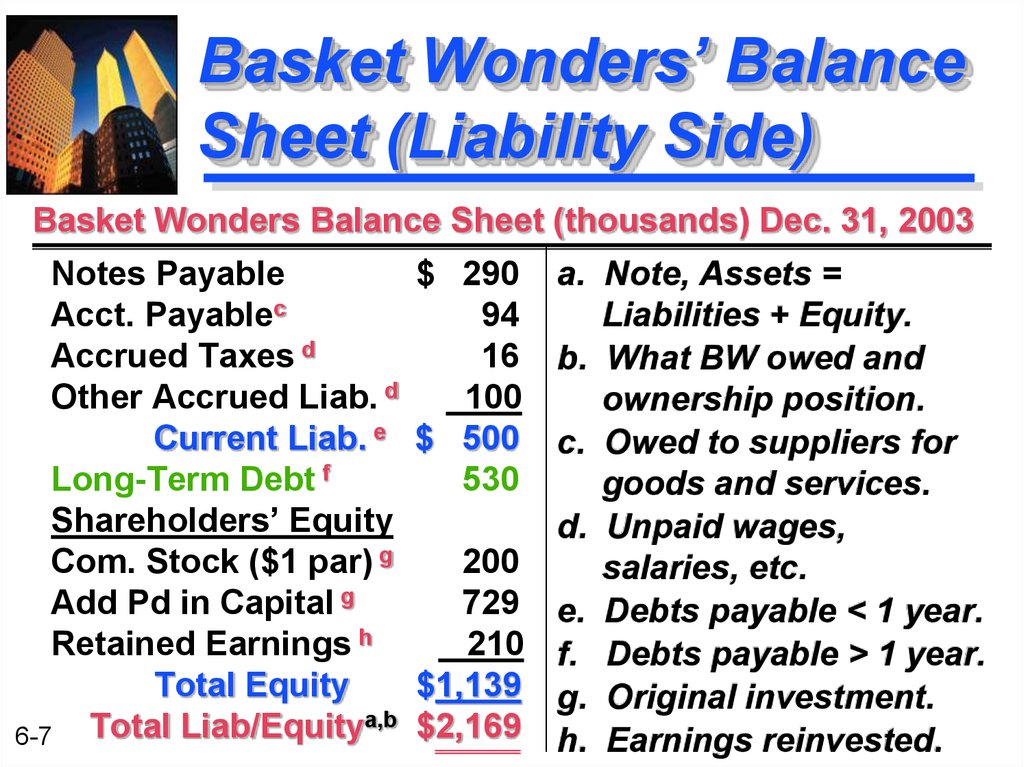

Basket Wonders Balance Sheet (thousands) Dec. 31, 2003Notes Payable

Acct. Payablec

Accrued Taxes d

Other Accrued Liab. d

Current Liab. e

Long-Term Debt f

Shareholders’ Equity

Com. Stock ($1 par) g

Add Pd in Capital g

Retained Earnings h

Total Equity

a,b

6-7 Total Liab/Equity

$ 290

94

16

100

$ 500

530

a. Note, Assets =

Liabilities + Equity.

b. What BW owed and

ownership position.

c. Owed to suppliers for

goods and services.

d. Unpaid wages,

200

salaries, etc.

729 e. Debts payable < 1 year.

210 f. Debts payable > 1 year.

$1,139 g. Original investment.

$2,169 h. Earnings reinvested.

8. Basket Wonders’ Income Statement

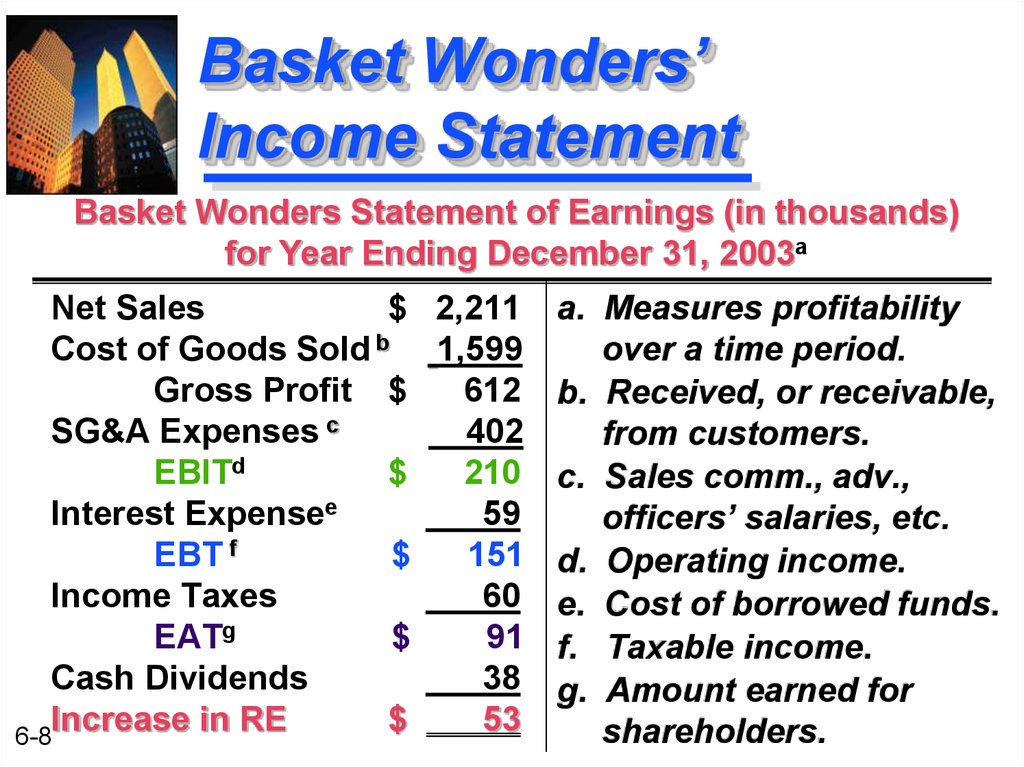

Basket Wonders Statement of Earnings (in thousands)for Year Ending December 31, 2003a

Net Sales

$ 2,211

Cost of Goods Sold b 1,599

Gross Profit $

612

SG&A Expenses c

402

EBITd

$

210

Interest Expensee

59

EBT f

$

151

Income Taxes

60

EATg

$

91

Cash Dividends

38

Increase in RE

$

53

6-8

a. Measures profitability

over a time period.

b. Received, or receivable,

from customers.

c. Sales comm., adv.,

officers’ salaries, etc.

d. Operating income.

e. Cost of borrowed funds.

f. Taxable income.

g. Amount earned for

shareholders.

9. Framework for Financial Analysis

Trend / Seasonal ComponentHow much funding will be

required in the future?

1. Analysis of the funds

needs of the firm.

Is there a seasonal

component?

Analytical Tools Used

Sources and Uses Statement

Statement of Cash Flows

Cash Budgets

6-9

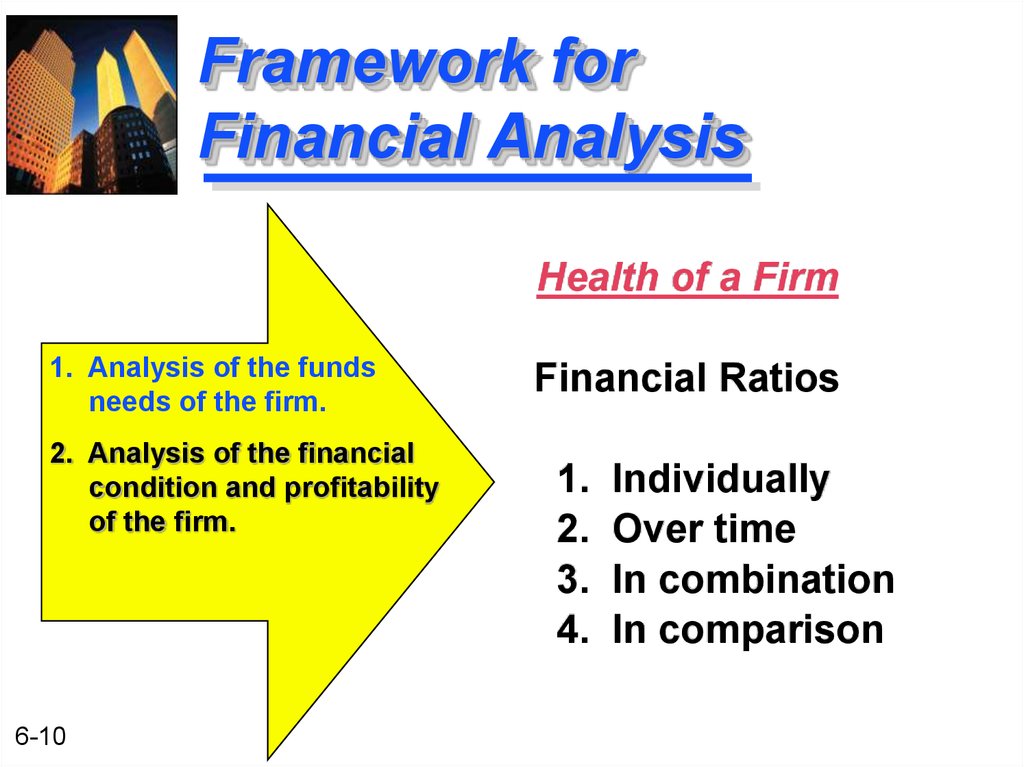

10. Framework for Financial Analysis

Health of a Firm1. Analysis of the funds

needs of the firm.

2. Analysis of the financial

condition and profitability

of the firm.

6-10

Financial Ratios

1.

2.

3.

4.

Individually

Over time

In combination

In comparison

11. Framework for Financial Analysis

1. Analysis of the fundsneeds of the firm.

2. Analysis of the financial

condition and profitability

of the firm.

3. Analysis of the business

risk of the firm.

Business risk relates to

the risk inherent in the

operations of the firm.

Examples:

Volatility in sales

Volatility in costs

Proximity to break-even

point

6-11

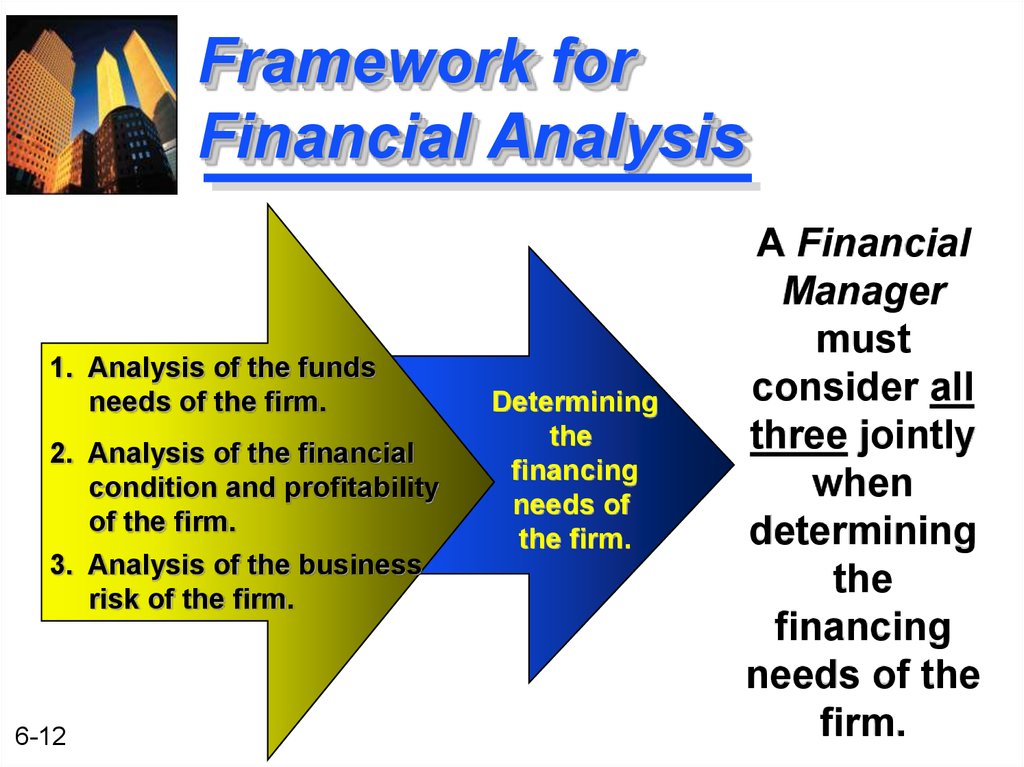

12. Framework for Financial Analysis

1. Analysis of the fundsneeds of the firm.

2. Analysis of the financial

condition and profitability

of the firm.

3. Analysis of the business

risk of the firm.

6-12

Determining

the

financing

needs of

the firm.

A Financial

Manager

must

consider all

three jointly

when

determining

the

financing

needs of the

firm.

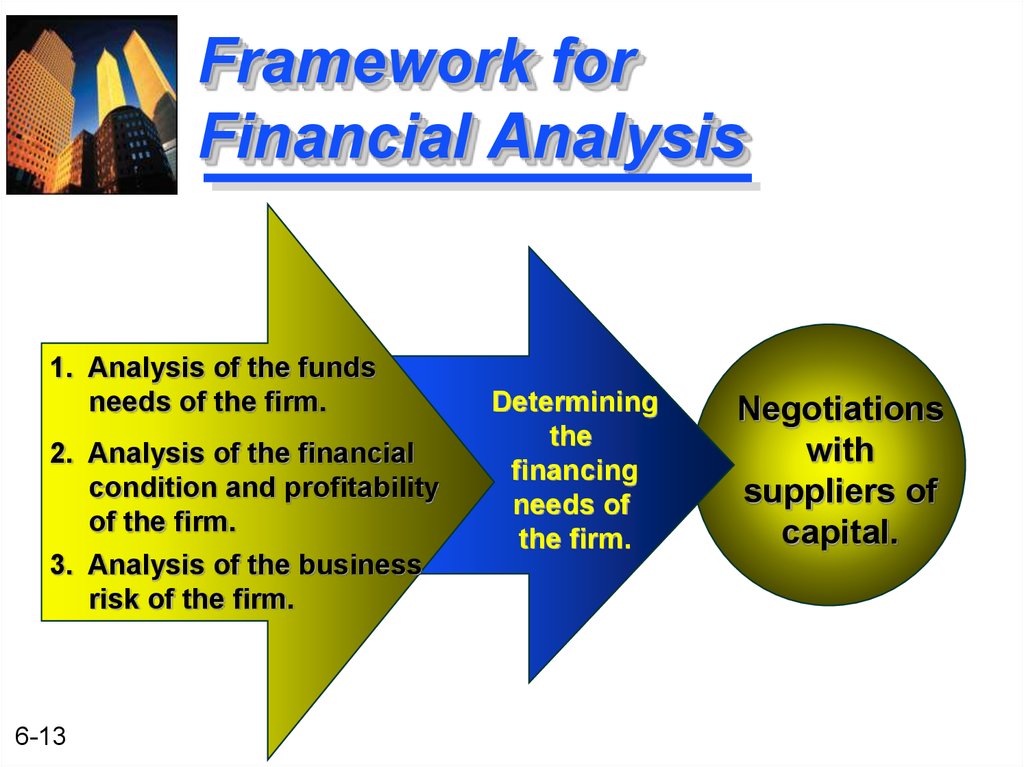

13. Framework for Financial Analysis

1. Analysis of the fundsneeds of the firm.

2. Analysis of the financial

condition and profitability

of the firm.

3. Analysis of the business

risk of the firm.

6-13

Determining

the

financing

needs of

the firm.

Negotiations

with

suppliers of

capital.

14. Use of Financial Ratios

A Financial Ratio isan index that relates

two accounting

numbers and is

obtained by dividing

one number by the

other.

6-14

Types of

Comparisons

Internal

Comparisons

External

Comparisons

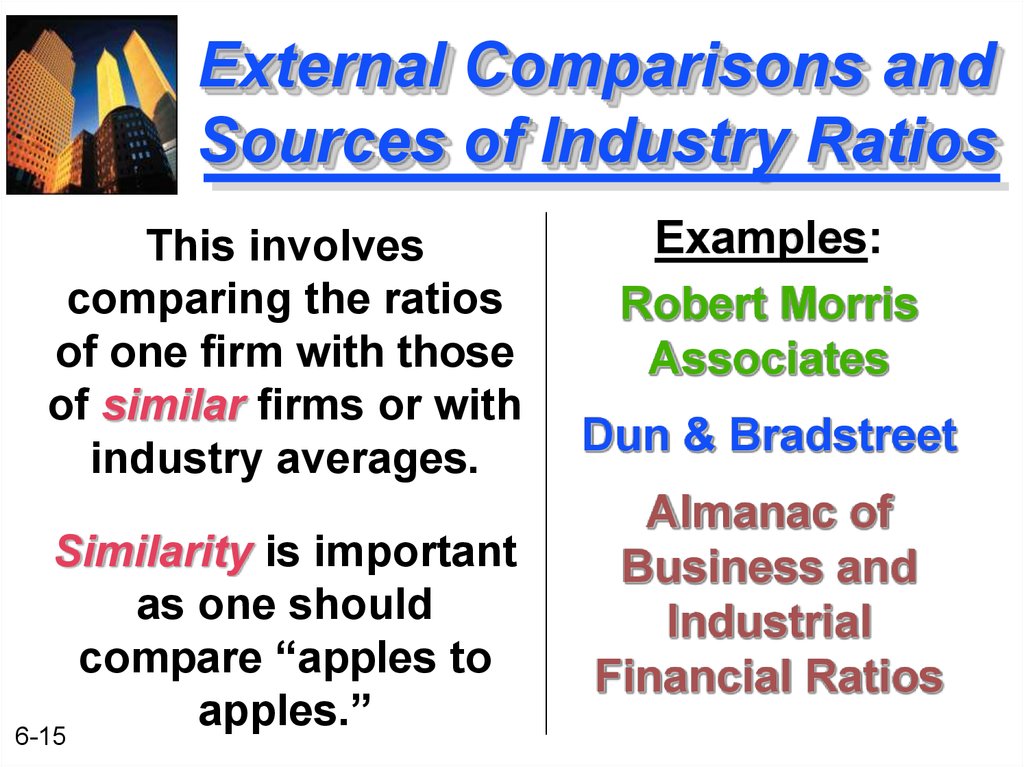

15. External Comparisons and Sources of Industry Ratios

This involvescomparing the ratios

of one firm with those

of similar firms or with

industry averages.

Similarity is important

as one should

compare “apples to

apples.”

6-15

Examples:

Robert Morris

Associates

Dun & Bradstreet

Almanac of

Business and

Industrial

Financial Ratios

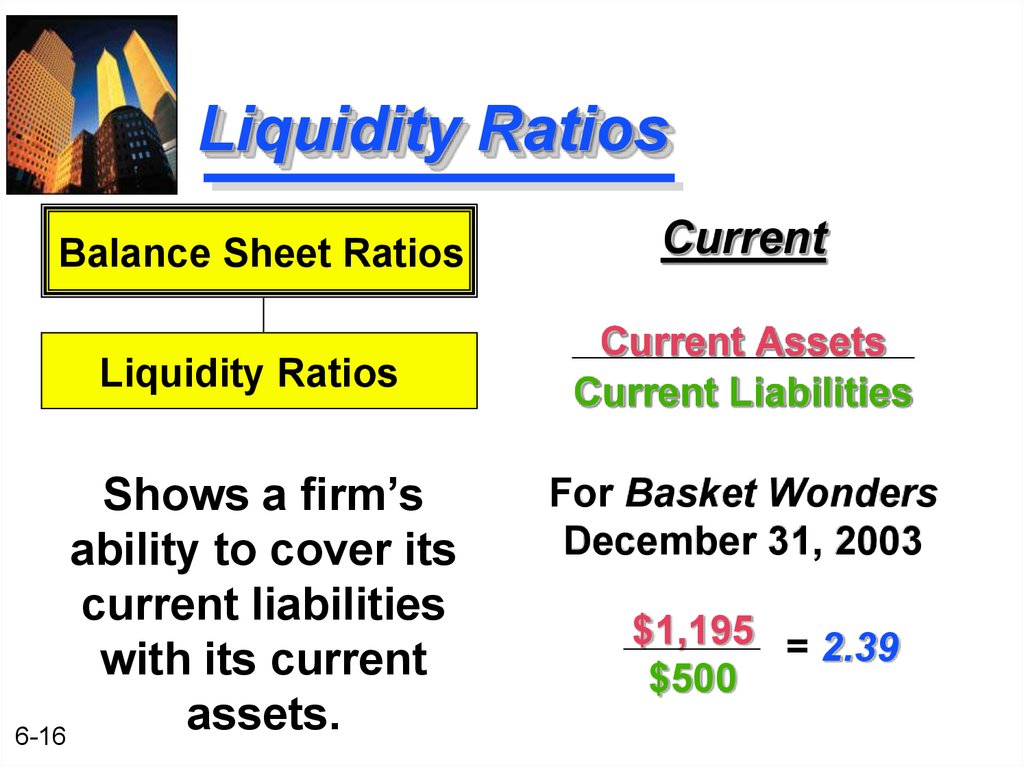

16. Liquidity Ratios

Balance Sheet RatiosLiquidity Ratios

Shows a firm’s

ability to cover its

current liabilities

with its current

assets.

6-16

Current

Current Assets

Current Liabilities

For Basket Wonders

December 31, 2003

$1,195 = 2.39

$500

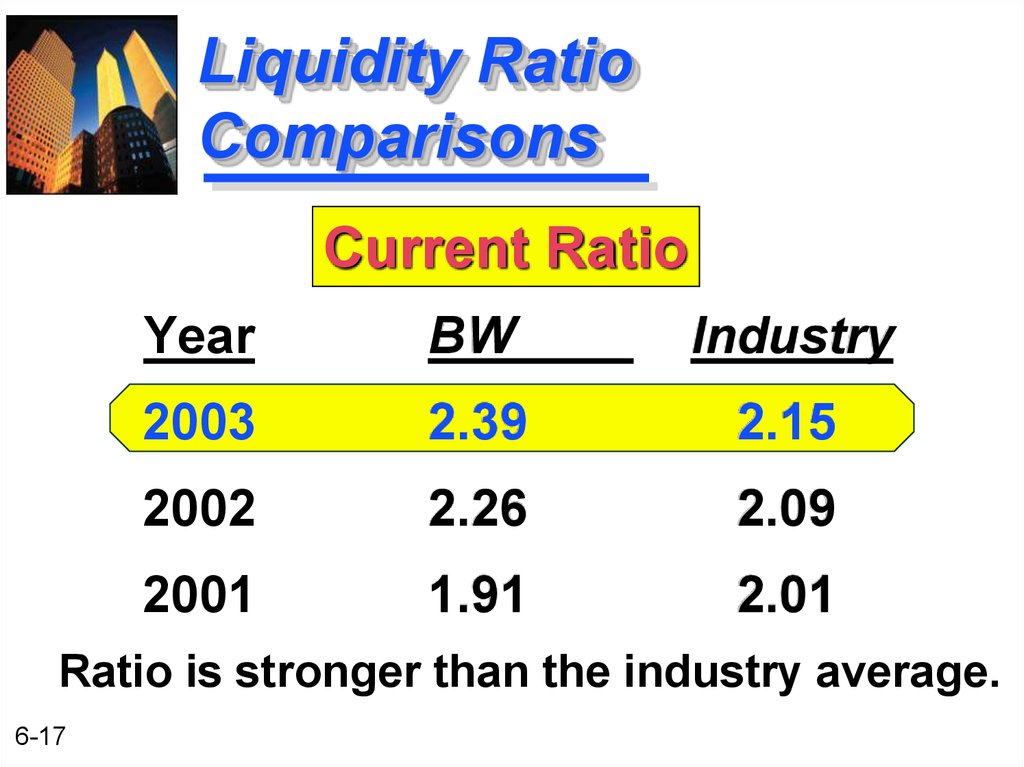

17. Liquidity Ratio Comparisons

Current RatioYear

BW

Industry

2003

2.39

2.15

2002

2.26

2.09

2001

1.91

2.01

Ratio is stronger than the industry average.

6-17

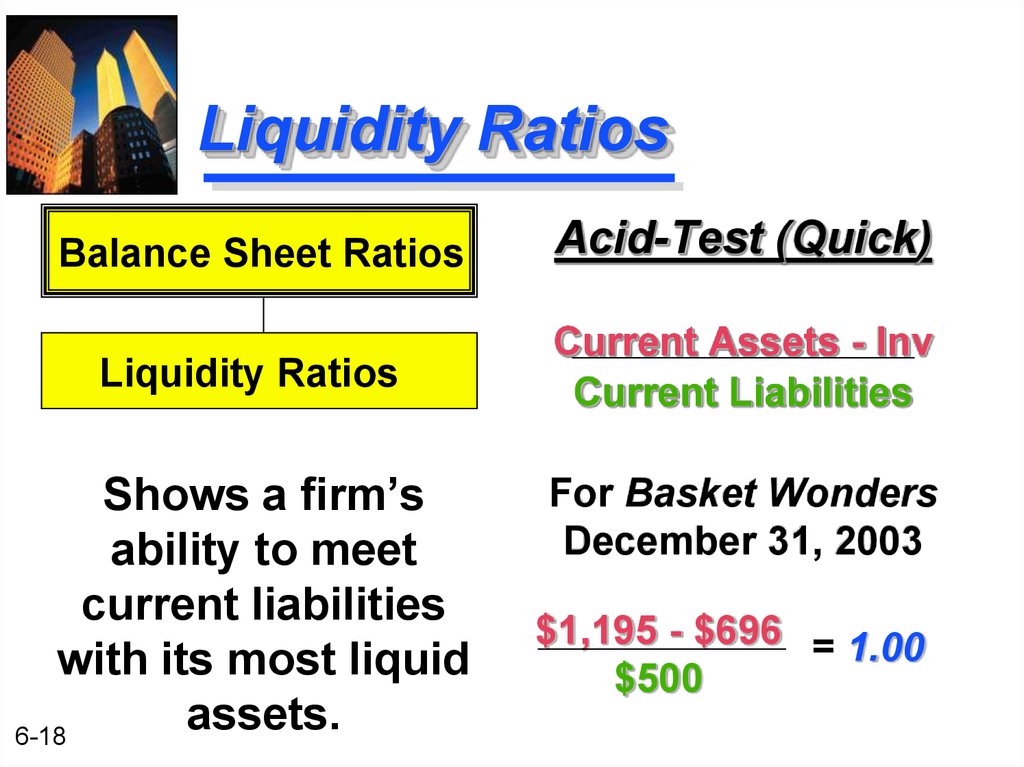

18. Liquidity Ratios

Balance Sheet RatiosLiquidity Ratios

Shows a firm’s

ability to meet

current liabilities

with its most liquid

assets.

6-18

Acid-Test (Quick)

Current Assets - Inv

Current Liabilities

For Basket Wonders

December 31, 2003

$1,195 - $696 = 1.00

$500

19. Liquidity Ratio Comparisons

Acid-Test RatioYear

BW

Industry

2003

1.00

1.25

2002

1.04

1.23

2001

1.11

1.25

Ratio is weaker than the industry average.

6-19

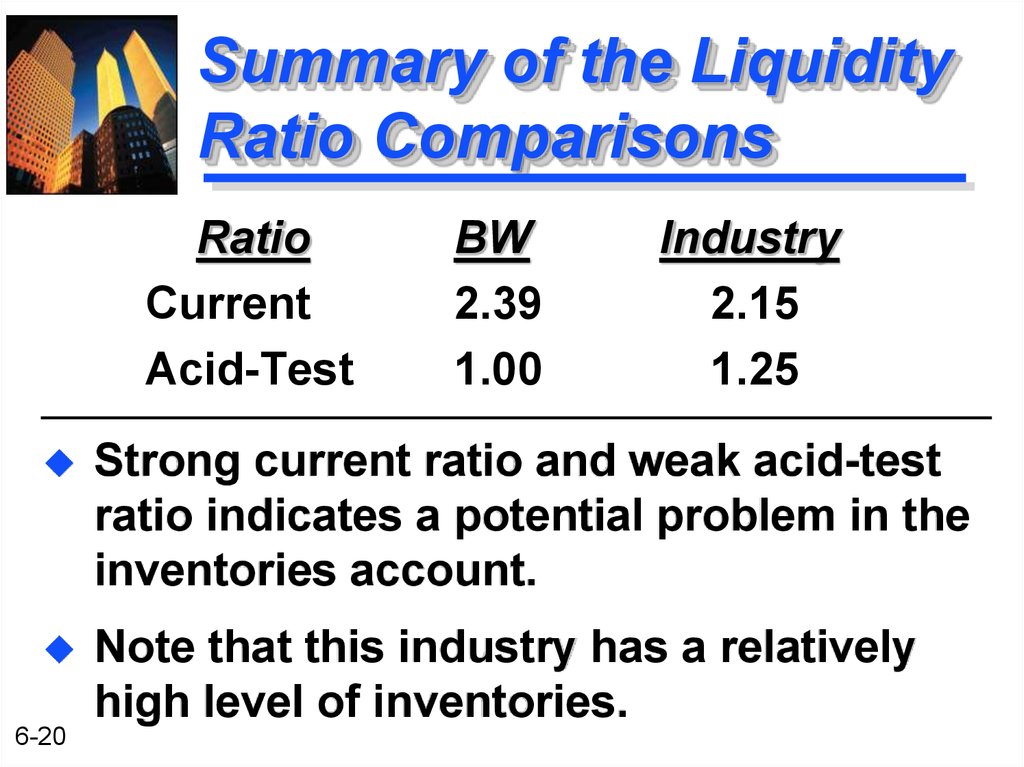

20. Summary of the Liquidity Ratio Comparisons

RatioCurrent

Acid-Test

BW

2.39

1.00

Industry

2.15

1.25

Strong current ratio and weak acid-test

ratio indicates a potential problem in the

inventories account.

Note that this industry has a relatively

high level of inventories.

6-20

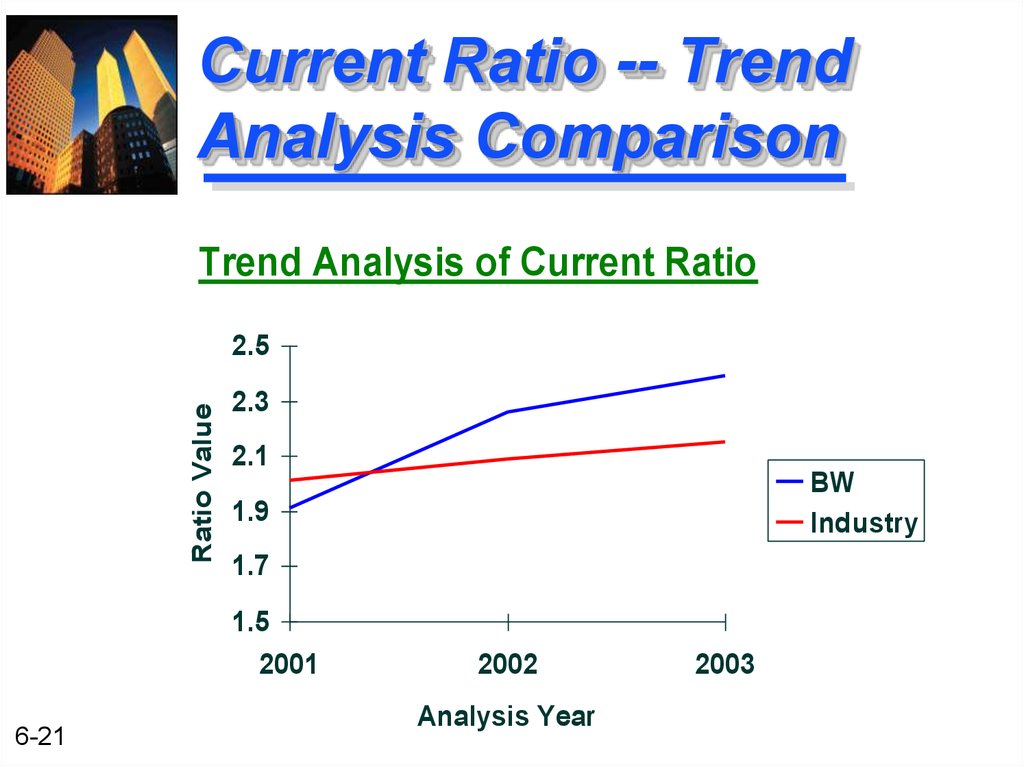

21. Current Ratio -- Trend Analysis Comparison

Trend Analysis of Current RatioRatio Value

2.5

2.3

2.1

1.9

1.7

1.5

2001

6-21

BW

Industry

2002

Analysis Year

2003

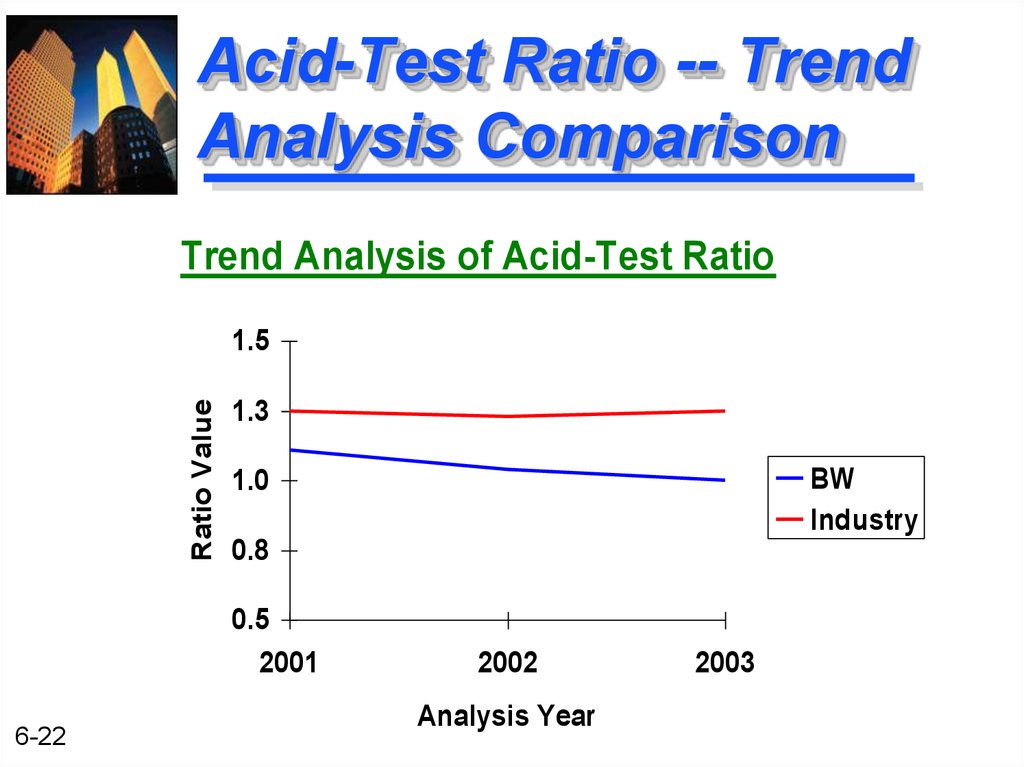

22. Acid-Test Ratio -- Trend Analysis Comparison

Trend Analysis of Acid-Test RatioRatio Value

1.5

1.3

0.8

0.5

2001

6-22

BW

Industry

1.0

2002

Analysis Year

2003

23. Summary of the Liquidity Trend Analyses

The current ratio for BW has been risingat the same time the acid-test ratio has

been declining.

The current ratio for the industry has

been rising slowly at the same time the

acid-test ratio has been relatively stable.

This indicates that inventories are a

significant problem for BW.

6-23

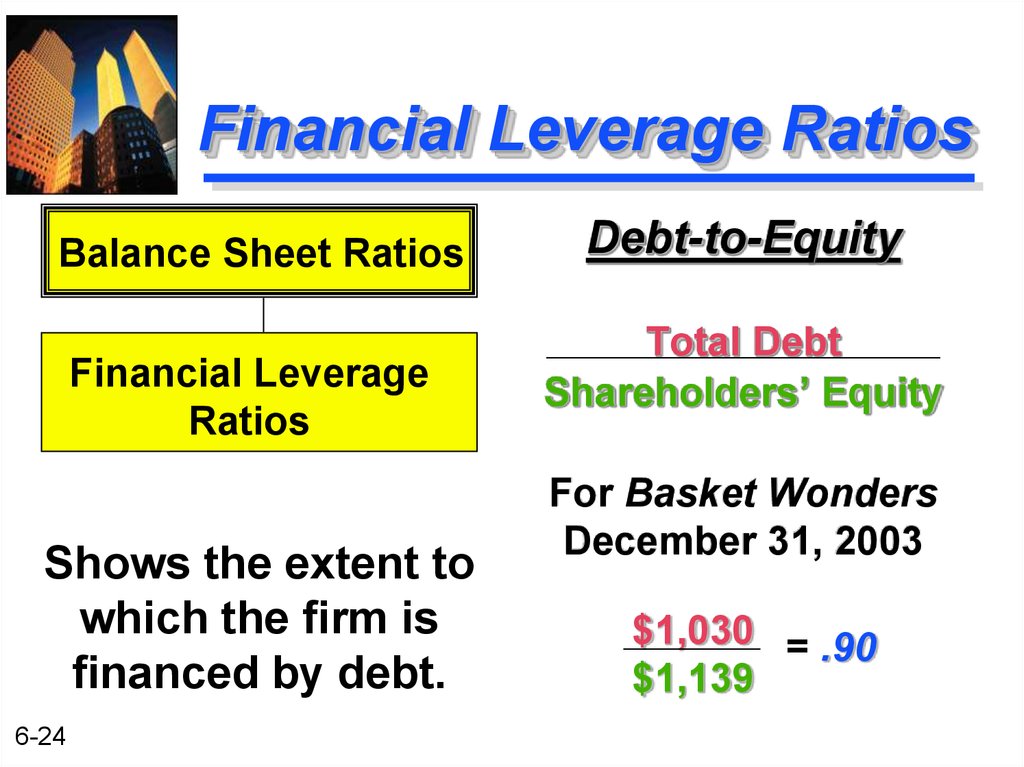

24. Financial Leverage Ratios

Balance Sheet RatiosFinancial Leverage

Ratios

Shows the extent to

which the firm is

financed by debt.

6-24

Debt-to-Equity

Total Debt

Shareholders’ Equity

For Basket Wonders

December 31, 2003

$1,030 = .90

$1,139

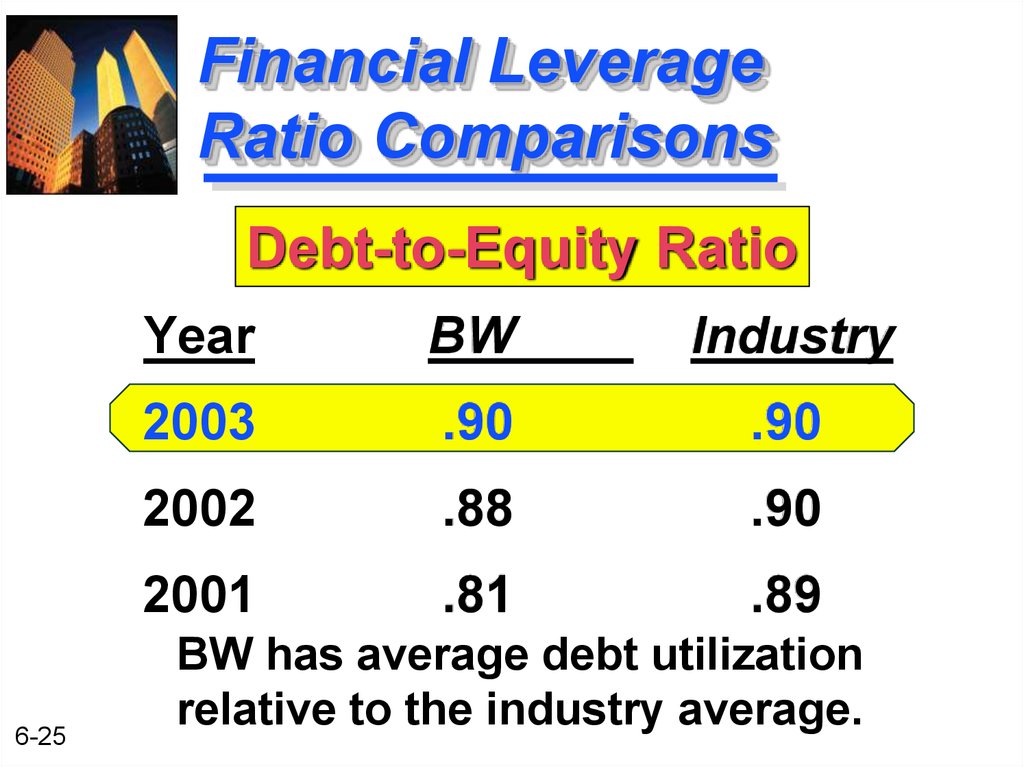

25. Financial Leverage Ratio Comparisons

Debt-to-Equity Ratio6-25

Year

BW

Industry

2003

.90

.90

2002

.88

.90

2001

.81

.89

BW has average debt utilization

relative to the industry average.

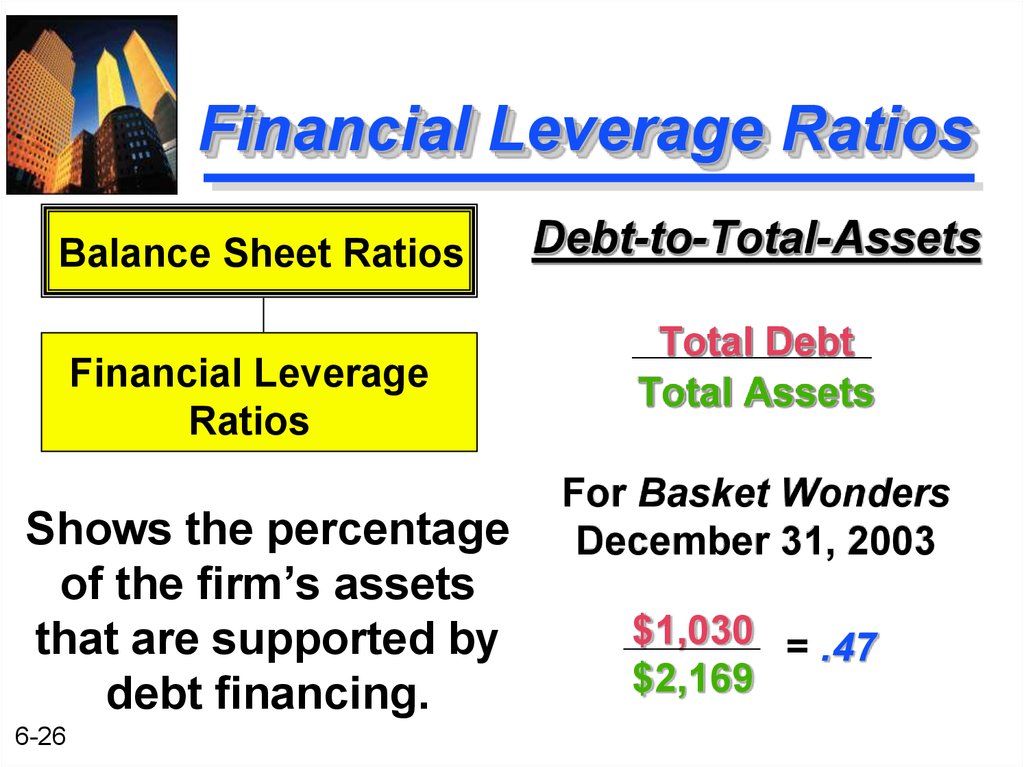

26. Financial Leverage Ratios

Balance Sheet RatiosFinancial Leverage

Ratios

Shows the percentage

of the firm’s assets

that are supported by

debt financing.

6-26

Debt-to-Total-Assets

Total Debt

Total Assets

For Basket Wonders

December 31, 2003

$1,030 = .47

$2,169

27. Financial Leverage Ratio Comparisons

Debt-to-Total-Asset Ratio6-27

Year

BW

Industry

2003

.47

.47

2002

.47

.47

2001

.45

.47

BW has average debt utilization

relative to the industry average.

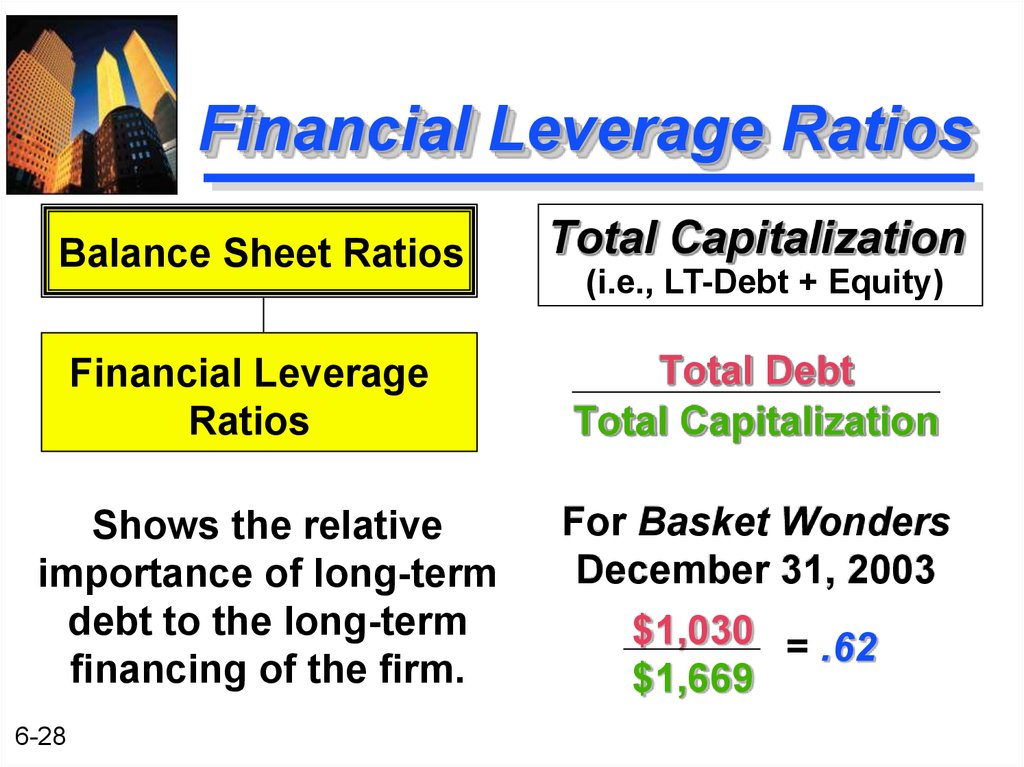

28. Financial Leverage Ratios

Balance Sheet RatiosFinancial Leverage

Ratios

Shows the relative

importance of long-term

debt to the long-term

financing of the firm.

6-28

Total Capitalization

(i.e., LT-Debt + Equity)

Total Debt

Total Capitalization

For Basket Wonders

December 31, 2003

$1,030 = .62

$1,669

29. Financial Leverage Ratio Comparisons

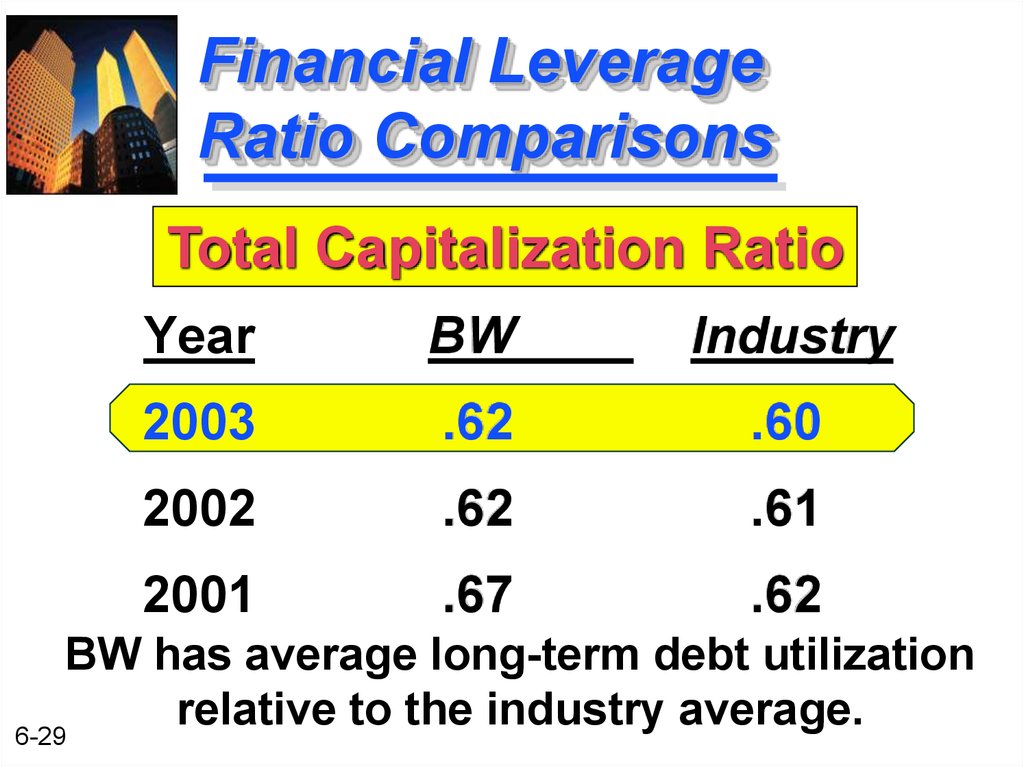

Total Capitalization RatioYear

BW

Industry

2003

.62

.60

2002

.62

.61

2001

.67

.62

BW has average long-term debt utilization

relative to the industry average.

6-29

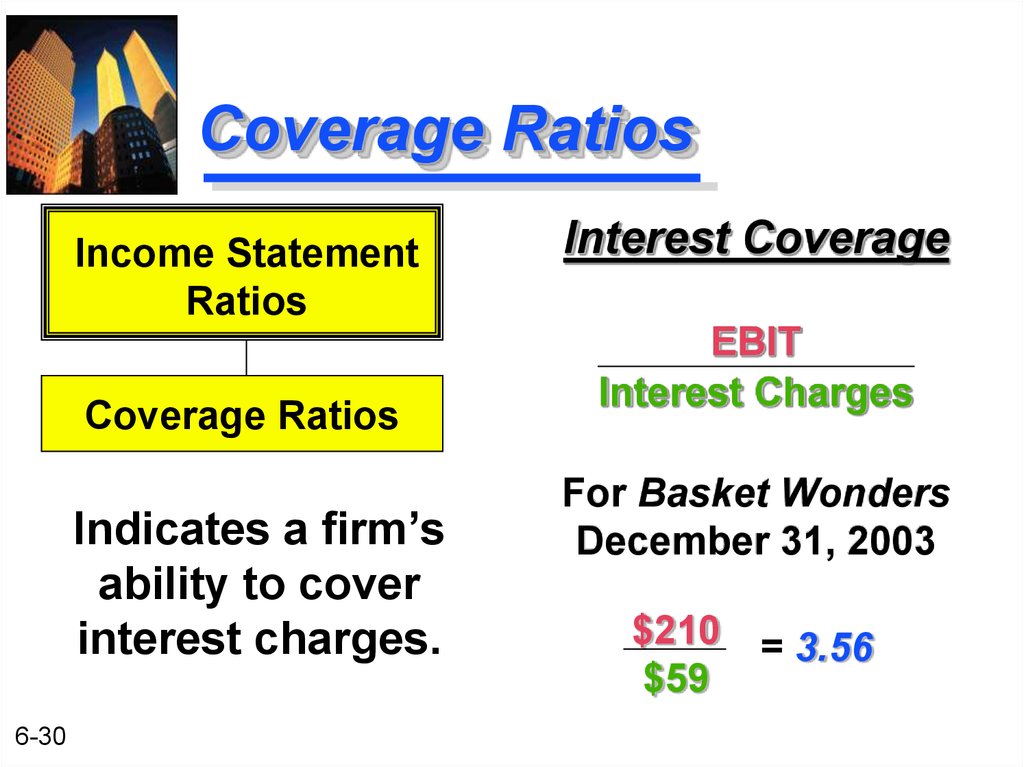

30. Coverage Ratios

Income StatementRatios

Coverage Ratios

Indicates a firm’s

ability to cover

interest charges.

6-30

Interest Coverage

EBIT

Interest Charges

For Basket Wonders

December 31, 2003

$210 = 3.56

$59

31. Coverage Ratio Comparisons

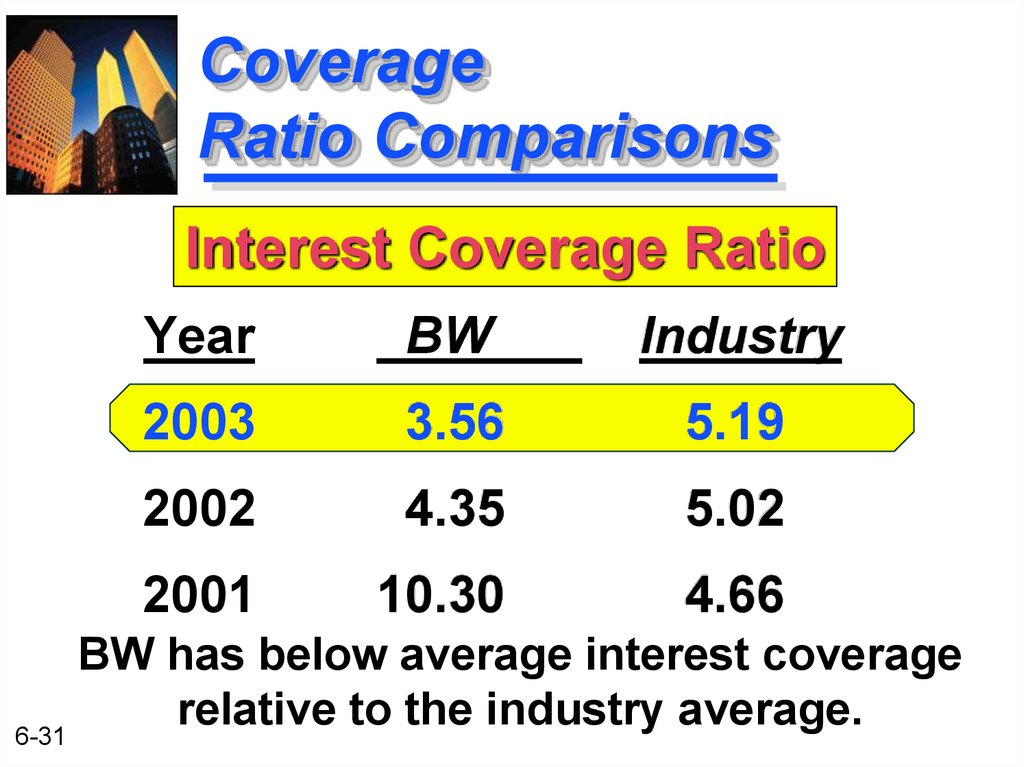

Interest Coverage RatioYear

BW

Industry

2003

3.56

5.19

2002

4.35

5.02

2001

10.30

4.66

BW has below average interest coverage

relative to the industry average.

6-31

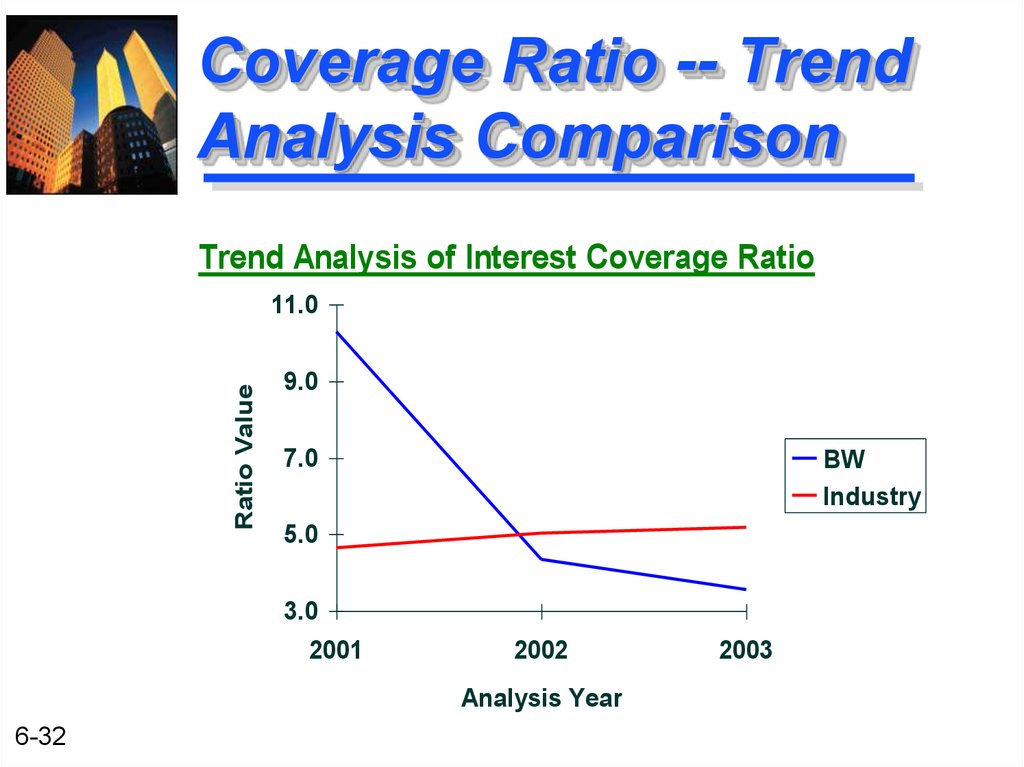

32. Coverage Ratio -- Trend Analysis Comparison

Trend Analysis of Interest Coverage RatioRatio Value

11.0

9.0

7.0

BW

Industry

5.0

3.0

2001

2002

Analysis Year

6-32

2003

33. Summary of the Coverage Trend Analysis

The interest coverage ratio for BW hasbeen falling since 2001. It has been

below industry averages for the past

two years.

This indicates that low earnings (EBIT)

may be a potential problem for BW.

Note, we know that debt levels are in

line with the industry averages.

6-33

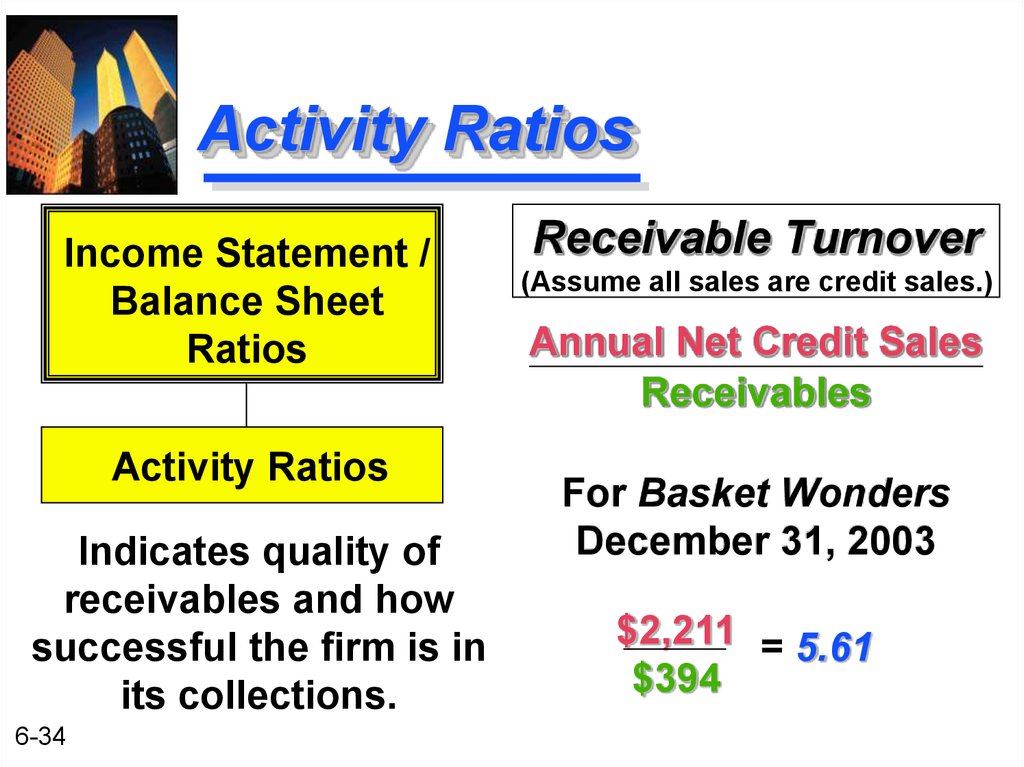

34. Activity Ratios

Income Statement /Balance Sheet

Ratios

Activity Ratios

Indicates quality of

receivables and how

successful the firm is in

its collections.

6-34

Receivable Turnover

(Assume all sales are credit sales.)

Annual Net Credit Sales

Receivables

For Basket Wonders

December 31, 2003

$2,211 = 5.61

$394

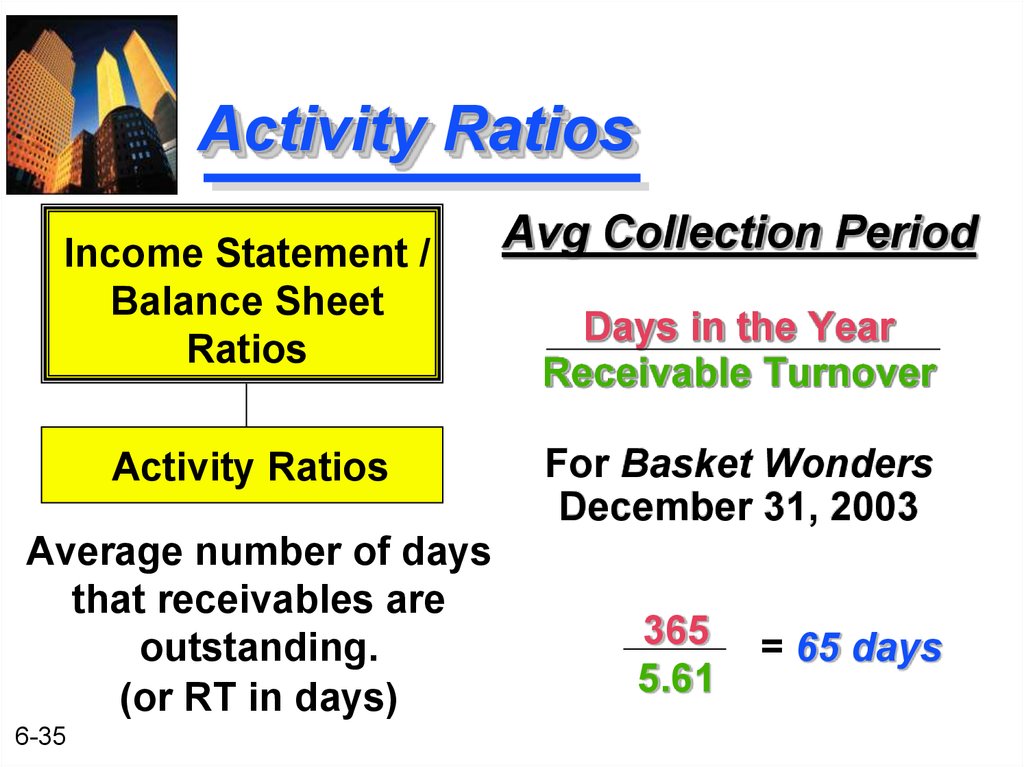

35. Activity Ratios

Income Statement /Balance Sheet

Ratios

Activity Ratios

Average number of days

that receivables are

outstanding.

(or RT in days)

6-35

Avg Collection Period

Days in the Year

Receivable Turnover

For Basket Wonders

December 31, 2003

365

5.61

= 65 days

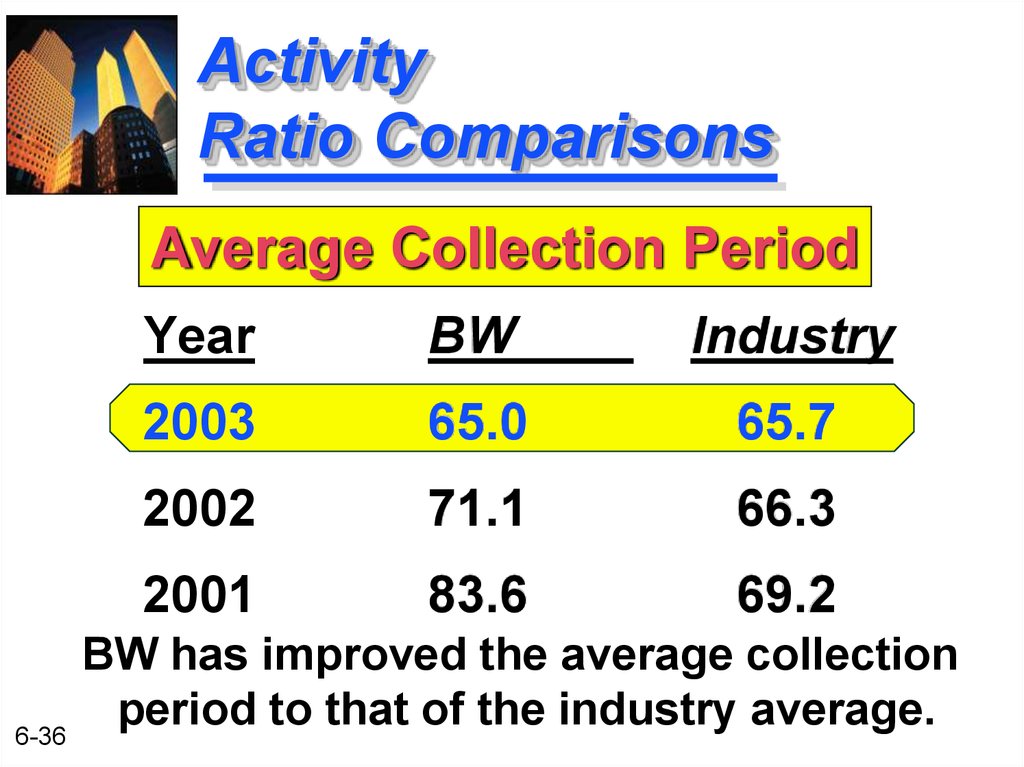

36. Activity Ratio Comparisons

Average Collection Period6-36

Year

BW

Industry

2003

65.0

65.7

2002

71.1

66.3

2001

83.6

69.2

BW has improved the average collection

period to that of the industry average.

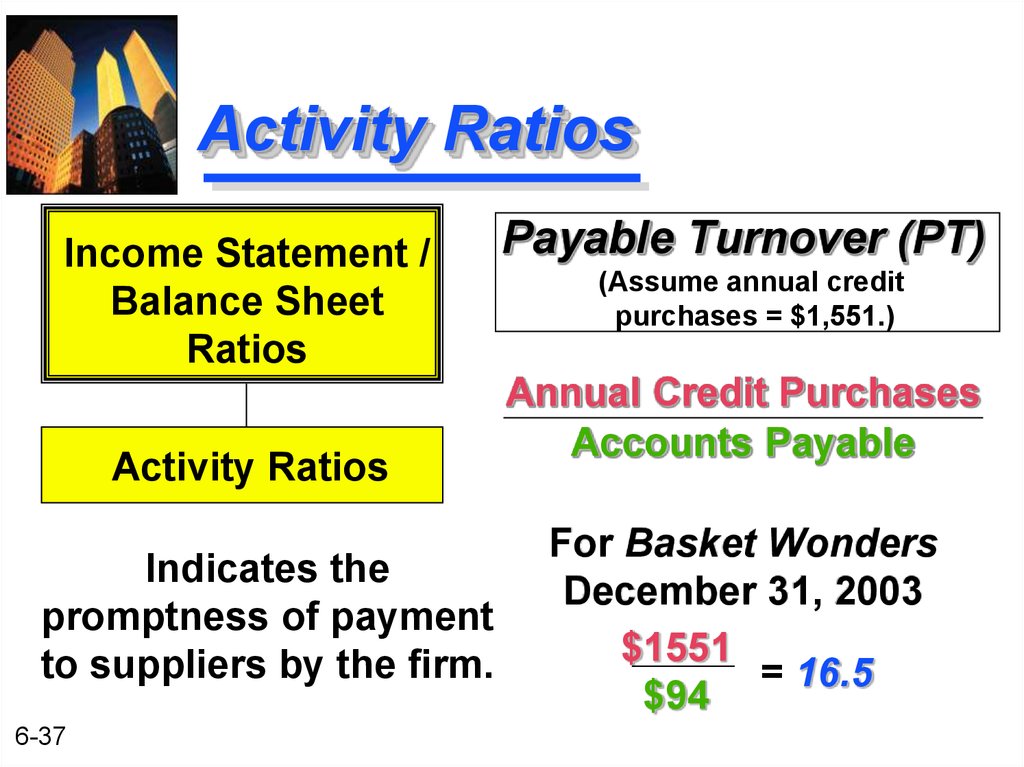

37. Activity Ratios

Income Statement /Balance Sheet

Ratios

Activity Ratios

Indicates the

promptness of payment

to suppliers by the firm.

6-37

Payable Turnover (PT)

(Assume annual credit

purchases = $1,551.)

Annual Credit Purchases

Accounts Payable

For Basket Wonders

December 31, 2003

$1551

= 16.5

$94

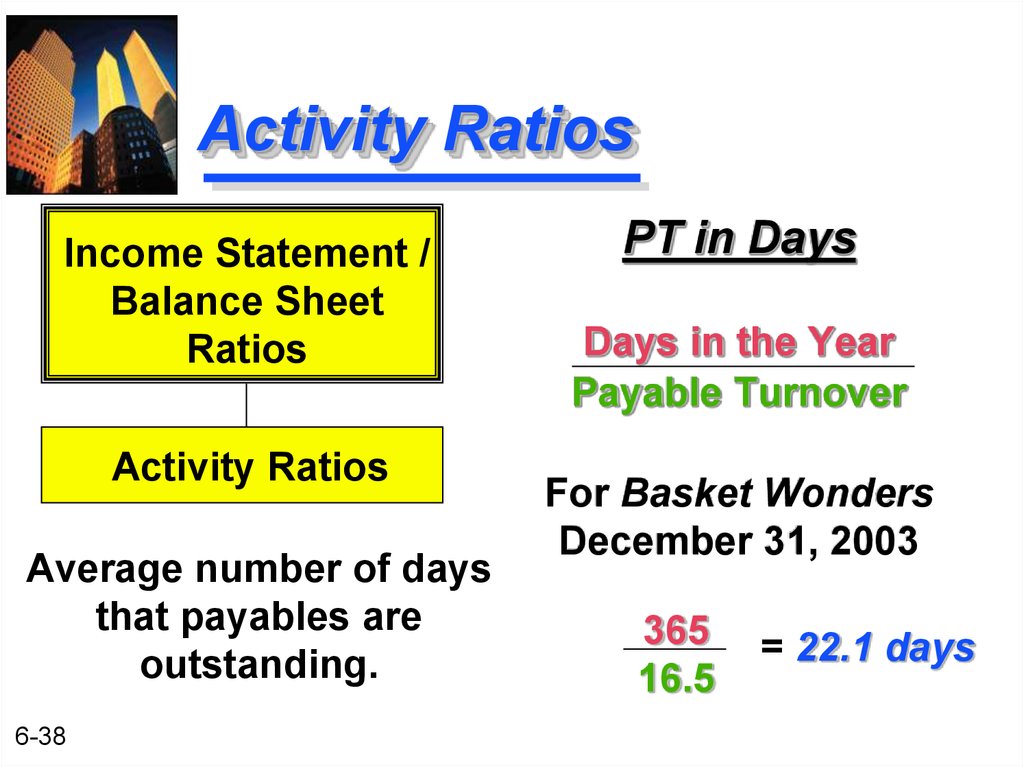

38. Activity Ratios

Income Statement /Balance Sheet

Ratios

Activity Ratios

Average number of days

that payables are

outstanding.

6-38

PT in Days

Days in the Year

Payable Turnover

For Basket Wonders

December 31, 2003

365

16.5

= 22.1 days

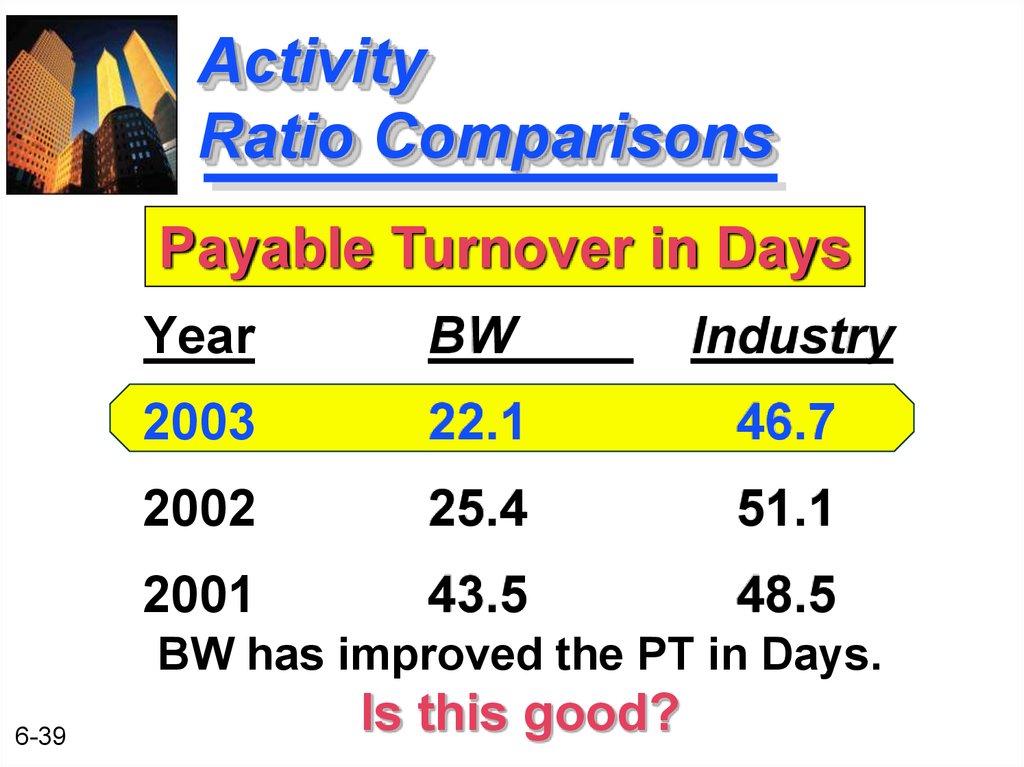

39. Activity Ratio Comparisons

Payable Turnover in DaysYear

BW

Industry

2003

22.1

46.7

2002

25.4

51.1

2001

43.5

48.5

BW has improved the PT in Days.

6-39

Is this good?

40. Activity Ratios

Income Statement /Balance Sheet

Ratios

Activity Ratios

Indicates the

effectiveness of the

inventory management

practices of the firm.

6-40

Inventory Turnover

Cost of Goods Sold

Inventory

For Basket Wonders

December 31, 2003

$1,599 = 2.30

$696

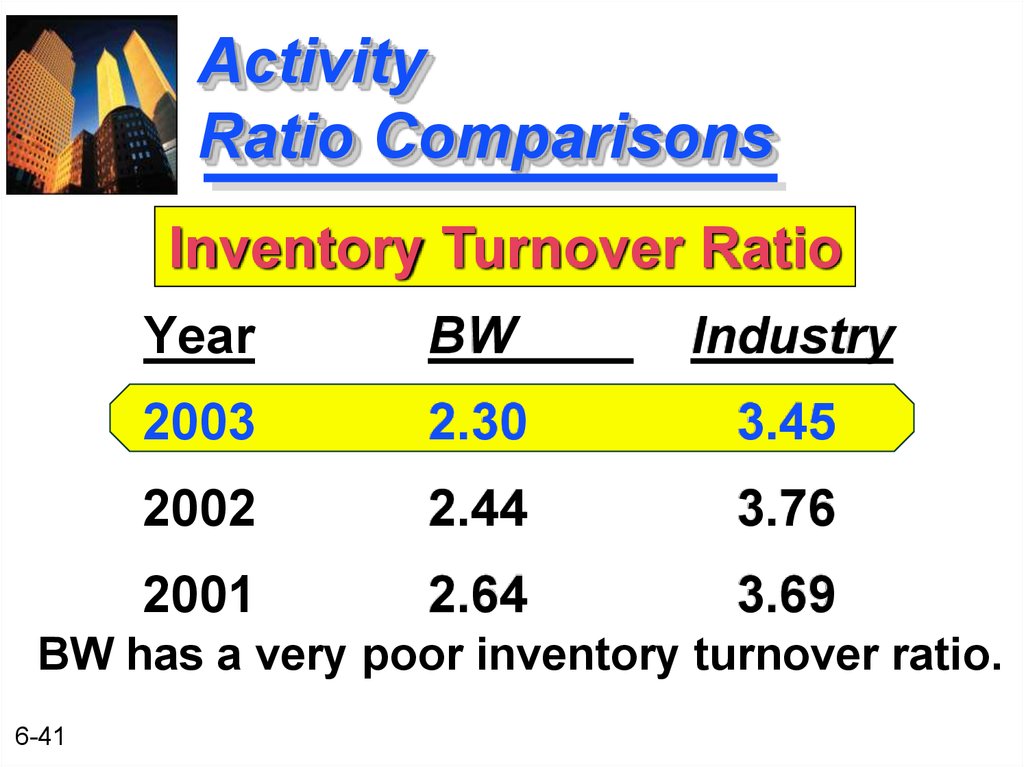

41. Activity Ratio Comparisons

Inventory Turnover RatioYear

BW

Industry

2003

2.30

3.45

2002

2.44

3.76

2001

2.64

3.69

BW has a very poor inventory turnover ratio.

6-41

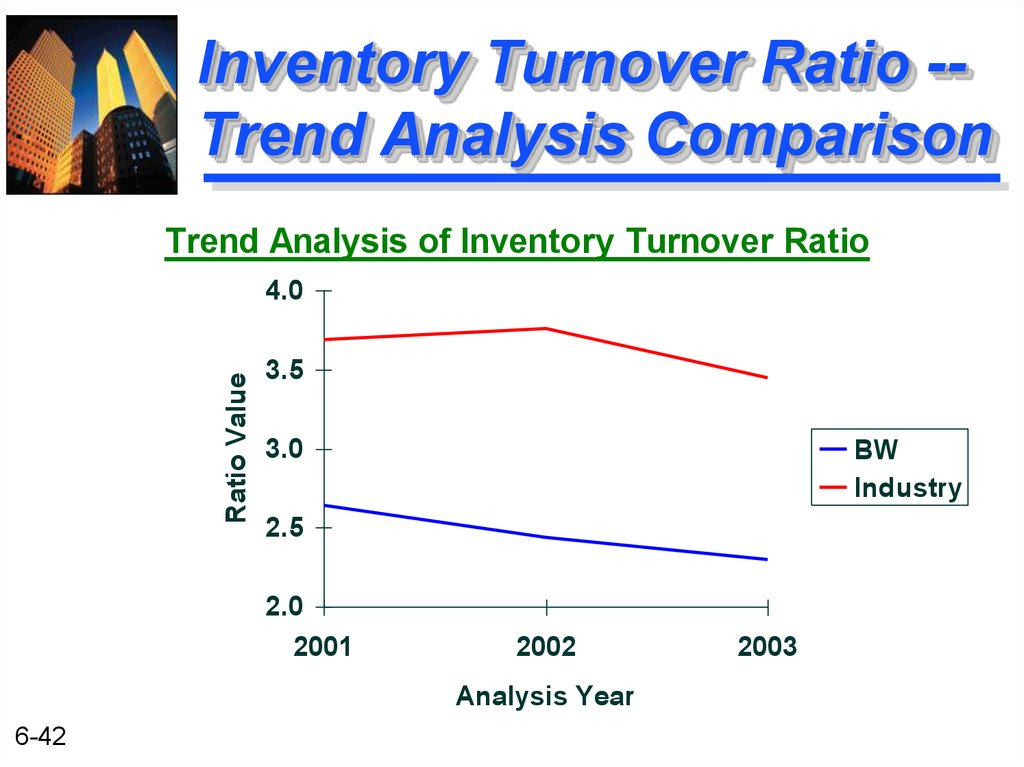

42. Inventory Turnover Ratio --Trend Analysis Comparison

Inventory Turnover Ratio -Trend Analysis ComparisonTrend Analysis of Inventory Turnover Ratio

Ratio Value

4.0

3.5

3.0

BW

Industry

2.5

2.0

2001

2002

Analysis Year

6-42

2003

43. Activity Ratios

Income Statement /Balance Sheet

Ratios

Activity Ratios

Indicates the overall

effectiveness of the firm

in utilizing its assets to

generate sales.

6-43

Total Asset Turnover

Net Sales

Total Assets

For Basket Wonders

December 31, 2003

$2,211 = 1.02

$2,169

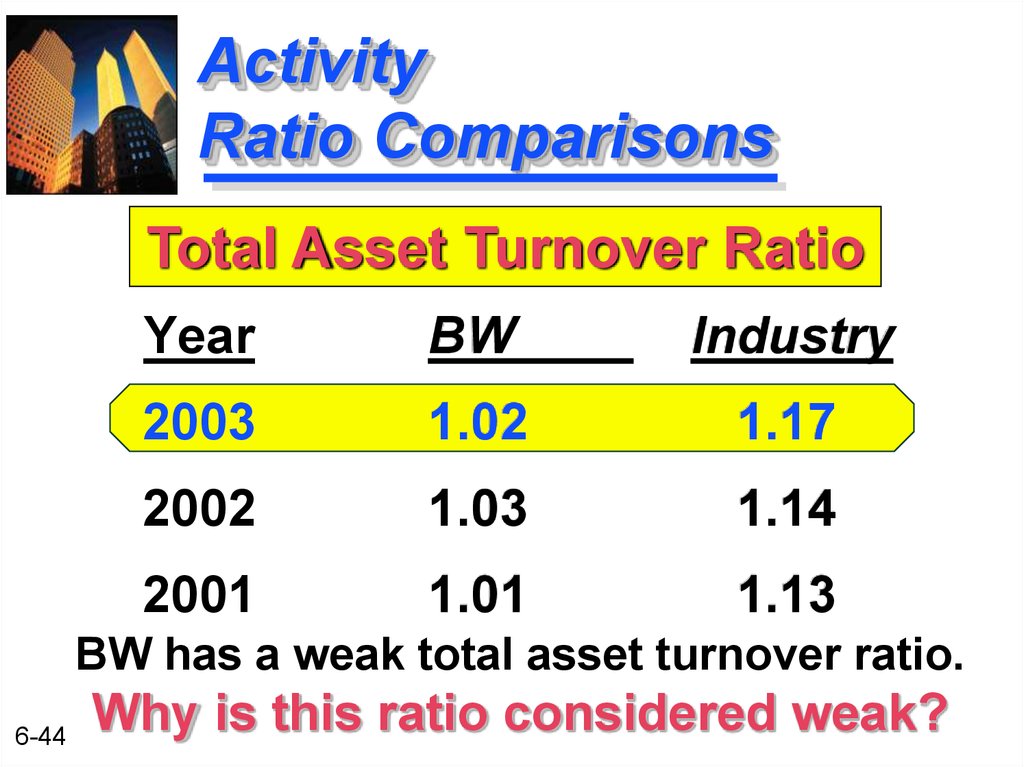

44. Activity Ratio Comparisons

Total Asset Turnover RatioYear

BW

Industry

2003

1.02

1.17

2002

1.03

1.14

2001

1.01

1.13

BW has a weak total asset turnover ratio.

6-44

Why is this ratio considered weak?

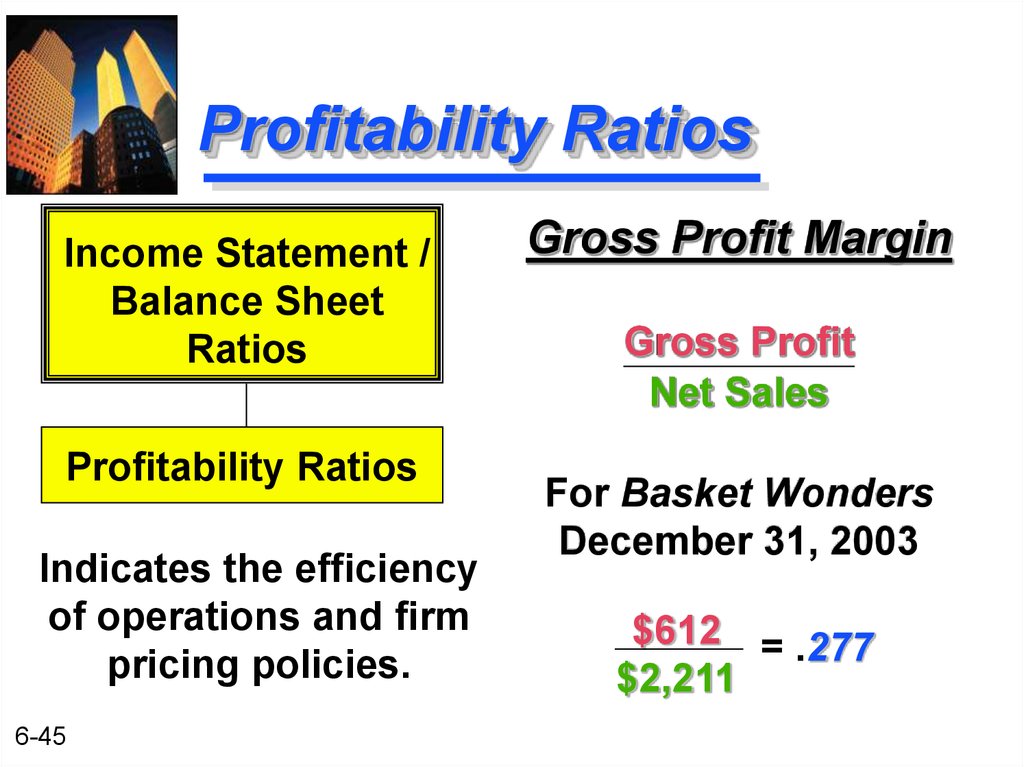

45. Profitability Ratios

Income Statement /Balance Sheet

Ratios

Profitability Ratios

Indicates the efficiency

of operations and firm

pricing policies.

6-45

Gross Profit Margin

Gross Profit

Net Sales

For Basket Wonders

December 31, 2003

$612 = .277

$2,211

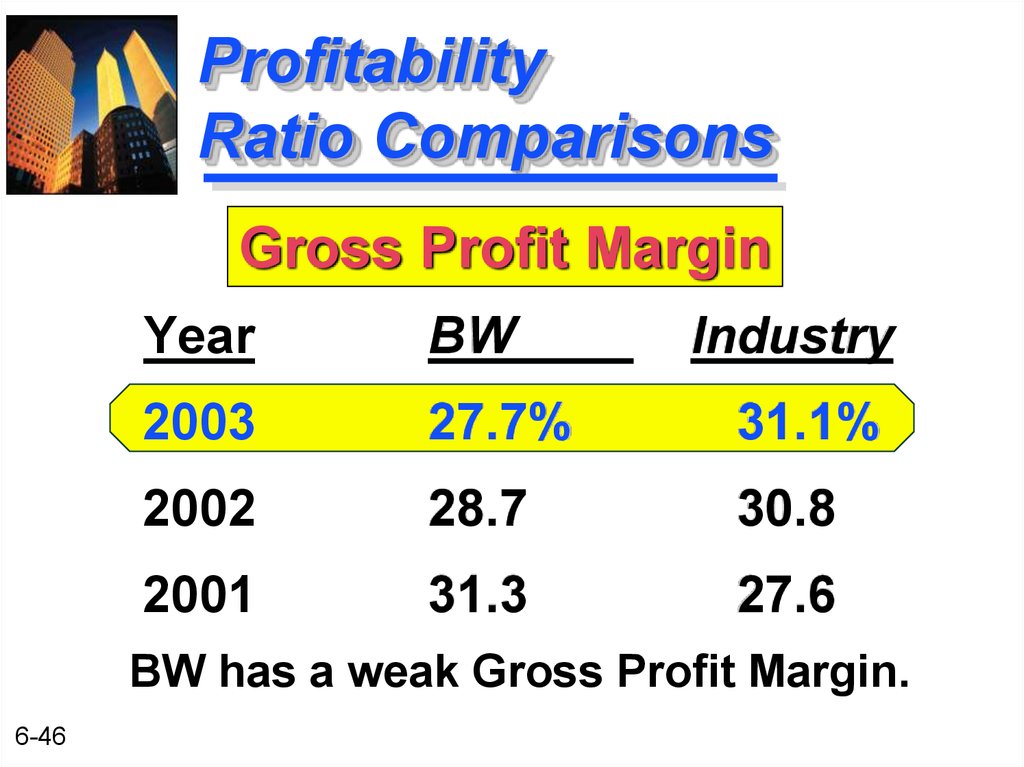

46. Profitability Ratio Comparisons

Gross Profit MarginYear

BW

Industry

2003

27.7%

31.1%

2002

28.7

30.8

2001

31.3

27.6

BW has a weak Gross Profit Margin.

6-46

47. Gross Profit Margin -- Trend Analysis Comparison

Gross Profit Margin -Trend Analysis ComparisonTrend Analysis of Gross Profit Margin

Ratio Value (%)

35.0

32.5

30.0

BW

Industry

27.5

25.0

2001

2002

Analysis Year

6-47

2003

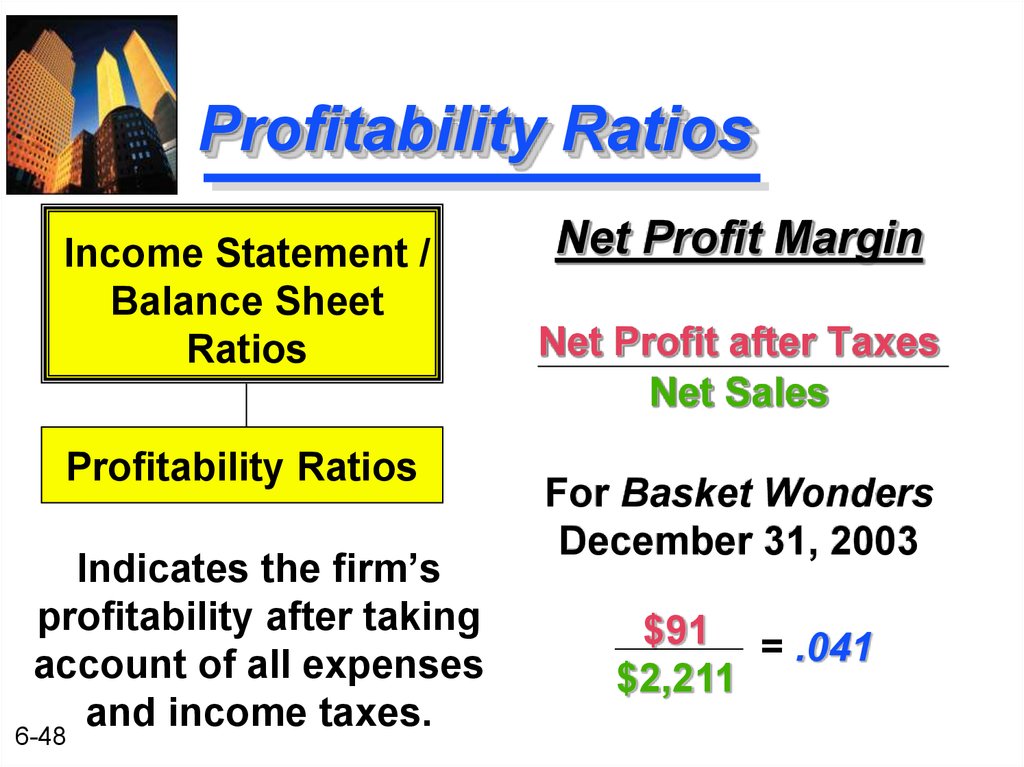

48. Profitability Ratios

Income Statement /Balance Sheet

Ratios

Profitability Ratios

Indicates the firm’s

profitability after taking

account of all expenses

and income taxes.

6-48

Net Profit Margin

Net Profit after Taxes

Net Sales

For Basket Wonders

December 31, 2003

$91 = .041

$2,211

49. Profitability Ratio Comparisons

Net Profit MarginYear

BW

Industry

2003

4.1%

8.2%

2002

4.9

8.1

2001

9.0

7.6

BW has a poor Net Profit Margin.

6-49

50. Net Profit Margin -- Trend Analysis Comparison

Net Profit Margin -Trend Analysis ComparisonTrend Analysis of Net Profit Margin

Ratio Value (%)

10

9

8

7

BW

Industry

6

5

4

2001

2002

Analysis Year

6-50

2003

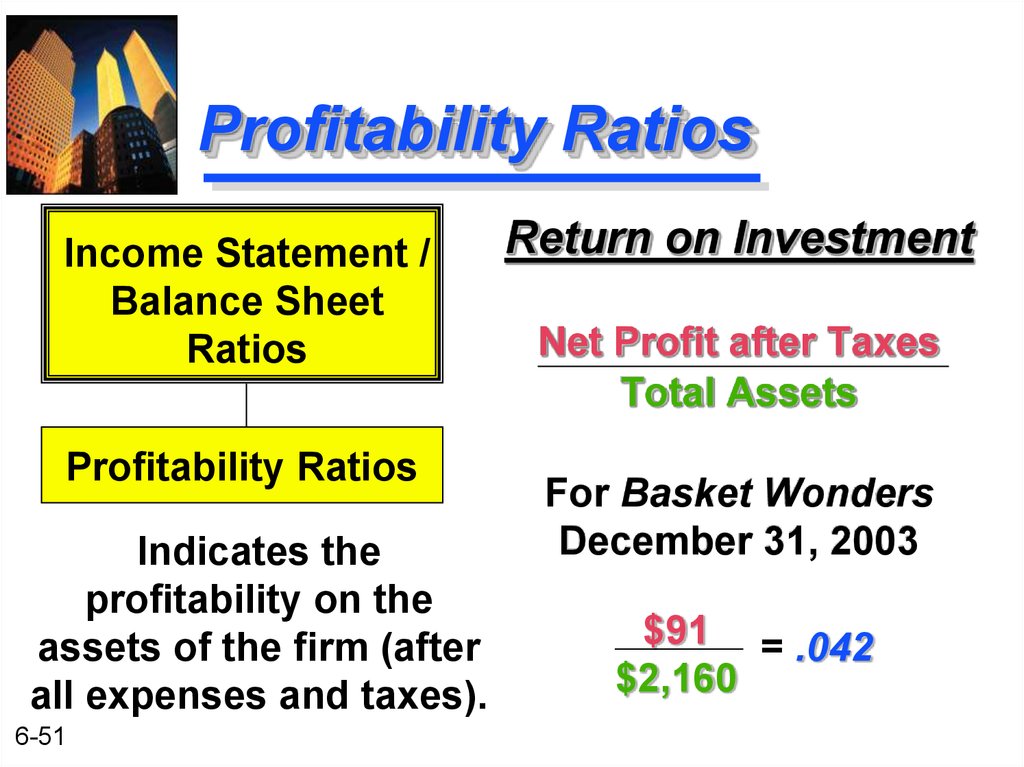

51. Profitability Ratios

Income Statement /Balance Sheet

Ratios

Profitability Ratios

Indicates the

profitability on the

assets of the firm (after

all expenses and taxes).

6-51

Return on Investment

Net Profit after Taxes

Total Assets

For Basket Wonders

December 31, 2003

$91 = .042

$2,160

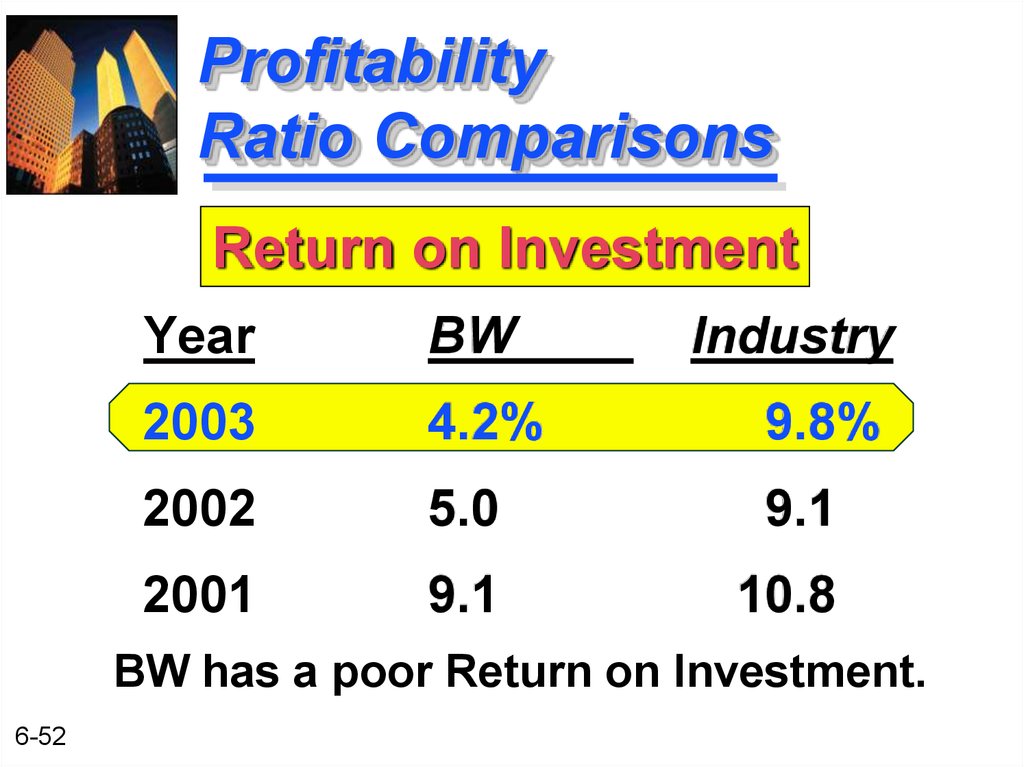

52. Profitability Ratio Comparisons

Return on InvestmentYear

BW

Industry

2003

4.2%

9.8%

2002

5.0

9.1

2001

9.1

10.8

BW has a poor Return on Investment.

6-52

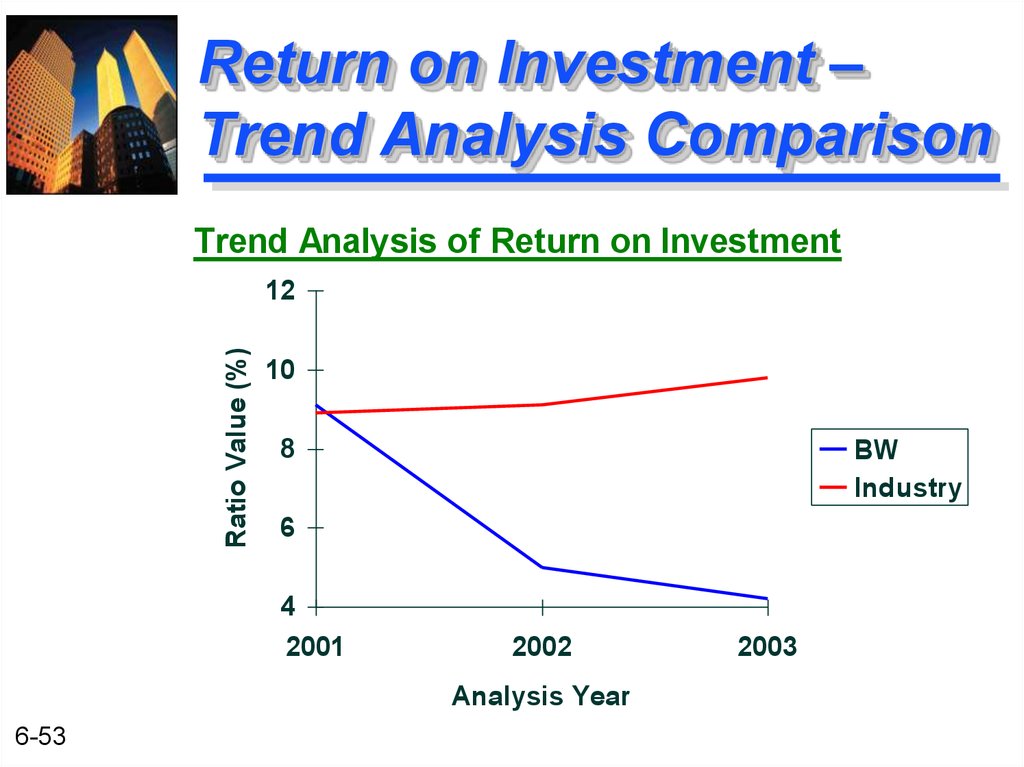

53. Return on Investment – Trend Analysis Comparison

Trend Analysis of Return on InvestmentRatio Value (%)

12

10

8

BW

Industry

6

4

2001

2002

Analysis Year

6-53

2003

54. Profitability Ratios

Income Statement /Balance Sheet

Ratios

Profitability Ratios

Indicates the profitability

to the shareholders of

the firm (after all

expenses and taxes).

6-54

Return on Equity

Net Profit after Taxes

Shareholders’ Equity

For Basket Wonders

December 31, 2003

$91 = .08

$1,139

55. Profitability Ratio Comparisons

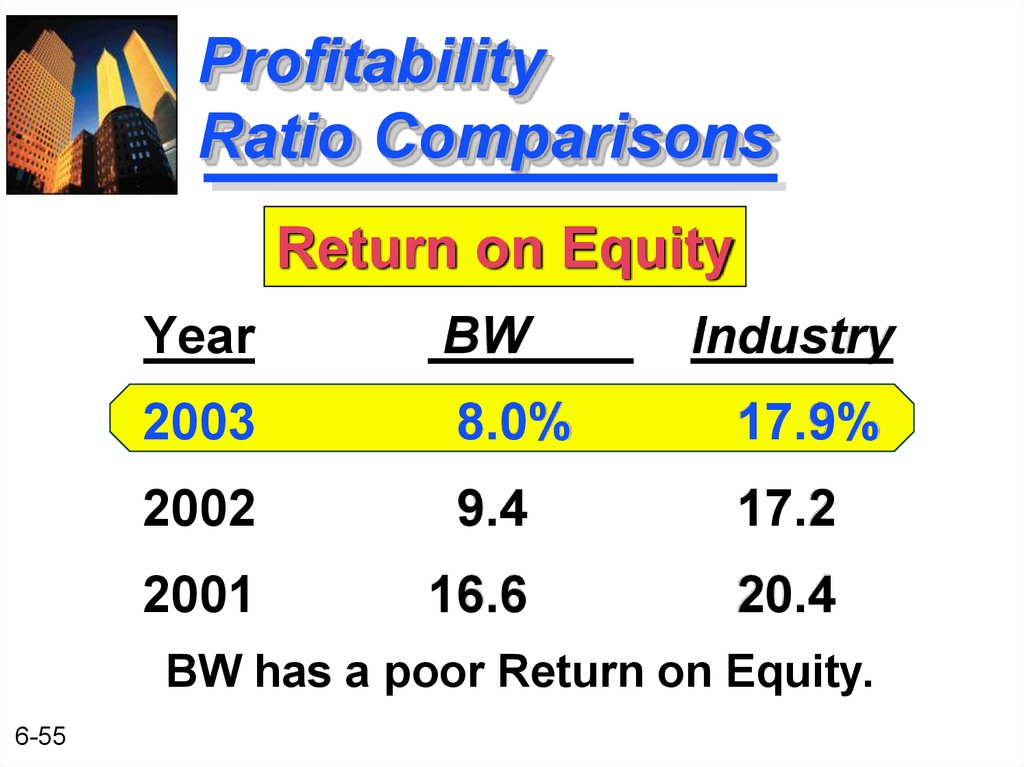

Return on EquityYear

BW

Industry

2003

8.0%

17.9%

2002

9.4

17.2

2001

16.6

20.4

BW has a poor Return on Equity.

6-55

56. Return on Equity -- Trend Analysis Comparison

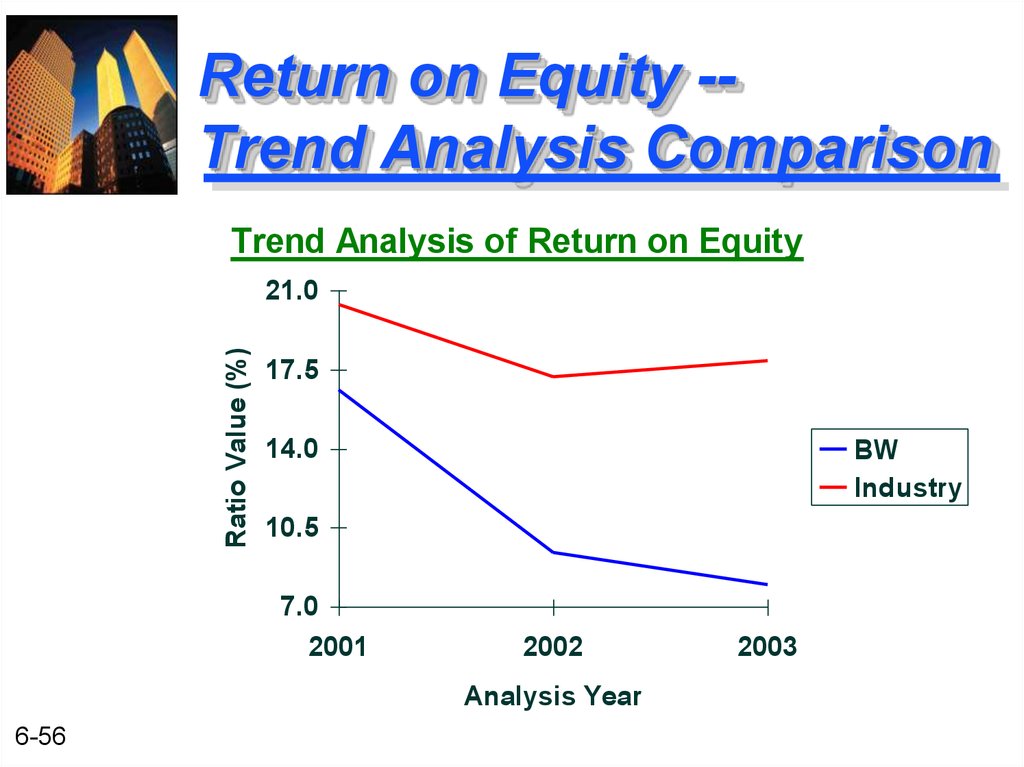

Return on Equity -Trend Analysis ComparisonTrend Analysis of Return on Equity

Ratio Value (%)

21.0

17.5

14.0

BW

Industry

10.5

7.0

2001

2002

Analysis Year

6-56

2003

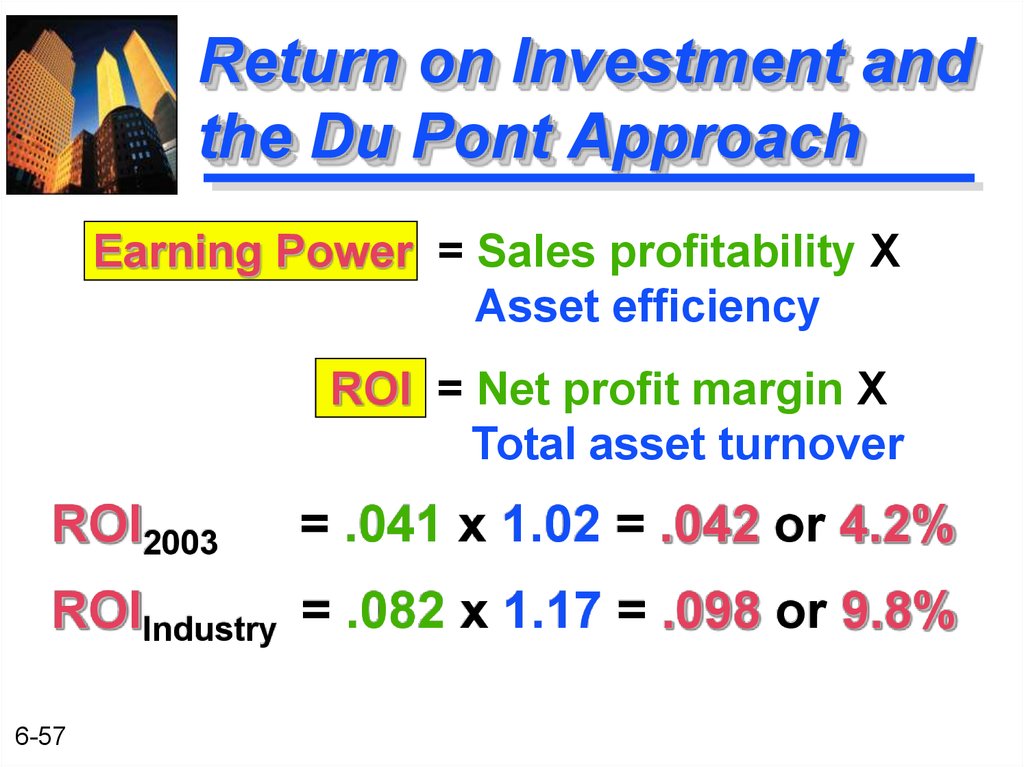

57. Return on Investment and the Du Pont Approach

Earning Power = Sales profitability XAsset efficiency

ROI = Net profit margin X

Total asset turnover

ROI2003

= .041 x 1.02 = .042 or 4.2%

ROIIndustry = .082 x 1.17 = .098 or 9.8%

6-57

58. Return on Equity and the Du Pont Approach

Return On Equity = Net profit margin XTotal asset turnover X

Equity Multiplier

Total Assets

Equity Multiplier =

Shareholders’ Equity

ROE2003

= .041 x 1.02 x 1.90 = .080

ROEIndustry = .082 x 1.17 x 1.88 = .179

6-58

59. Summary of the Profitability Trend Analyses

The profitability ratios for BW have ALLbeen falling since 2001. Each has been

below the industry averages for the past

three years.

This indicates that COGS and

administrative costs may both be too

high and a potential problem for BW.

Note, this result is consistent with the low

interest coverage ratio.

6-59

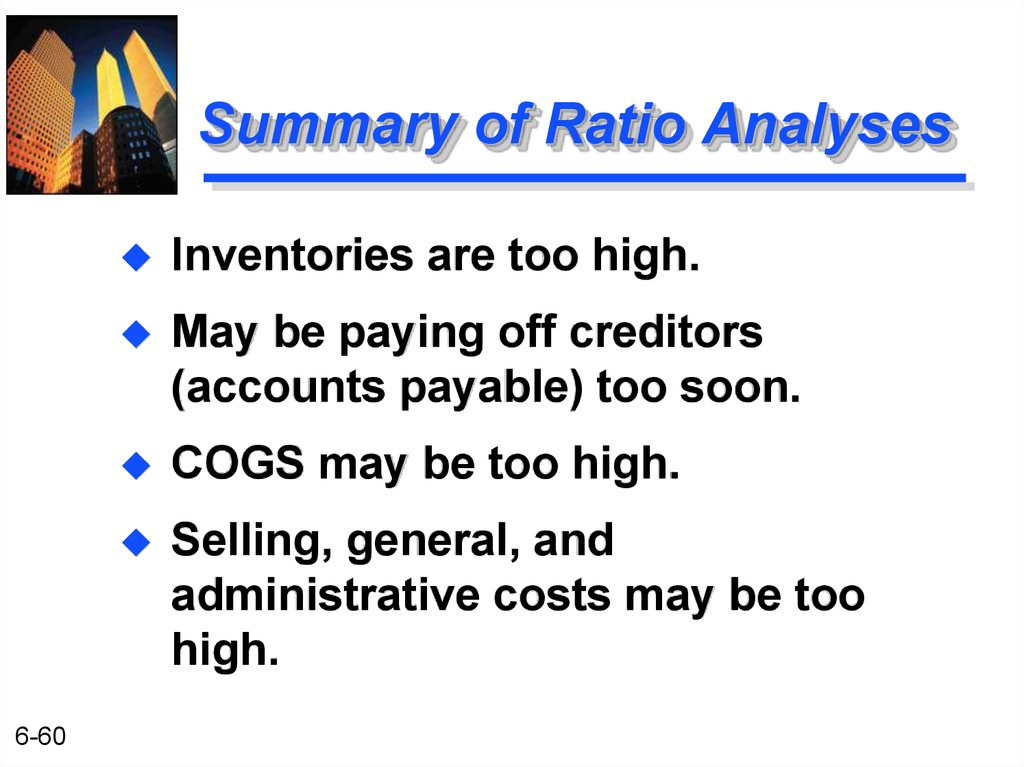

60. Summary of Ratio Analyses

6-60Inventories are too high.

May be paying off creditors

(accounts payable) too soon.

COGS may be too high.

Selling, general, and

administrative costs may be too

high.

61. Common-size Analysis

An analysis of percentagefinancial statements where all

balance sheet items are divided

by total assets and all income

statement items are divided by

net sales or revenues.

6-61

62. Basket Wonders’ Common Size Balance Sheets

Regular (thousands of $)Assets

2002

2003

2001

2002

2003

Cash

AR

Inv

Other CA

148

283

322

10

100

410

616

14

90

394

696

15

12.10

23.14

26.33

0.82

4.89

20.06

30.14

0.68

4.15

18.17

32.09

0.69

Tot CA

Net FA

LT Inv

Other LT

763

349

0

111

1,140

631

50

223

1,195

701

50

223

62.39

28.54

0.00

9.08

55.77

30.87

2.45

10.91

55.09

32.32

2.31

10.28

1,223

2,044

2,169

100.0

100.0

100.0

Tot Assets

6-62

2001

Common-Size (%)

63. Basket Wonders’ Common Size Balance Sheets

Regular (thousands of $)Liab+Equity

6-63

2001

2002

2003

Common-Size (%)

2001

2002

2003

Note Pay

Acct Pay

Accr Tax

Other Accr

290

81

13

15

295

94

16

100

290

94

16

100

23.71

6.62

1.06

1.23

14.43

4.60

0.78

4.89

13.37

4.33

0.74

4.61

Tot CL

LT Debt

Equity

399

150

674

505

453

1,086

500

530

1,139

32.62

12.26

55.11

24.71

22.16

53.13

23.05

24.44

52.51

Tot L+E

1,223

2,044

2,169

100.0

100.0

100.0

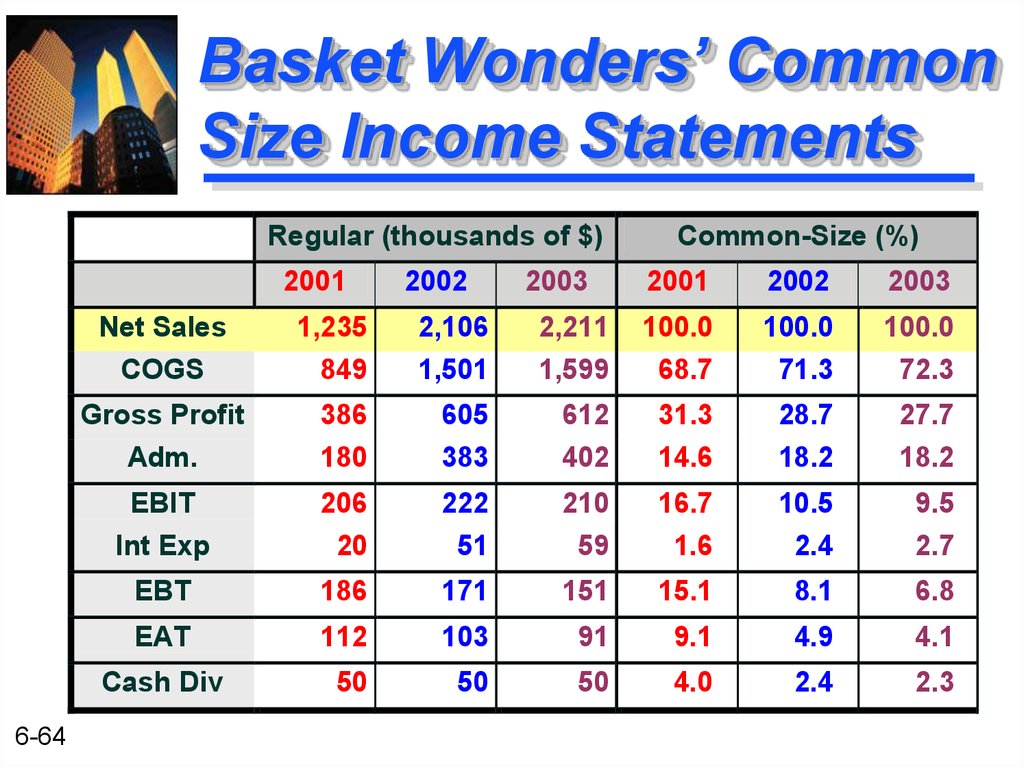

64. Basket Wonders’ Common Size Income Statements

Regular (thousands of $)2001

Net Sales

COGS

6-64

2002

2003

Common-Size (%)

2001

2002

2003

1,235

849

2,106

1,501

2,211

1,599

100.0

68.7

100.0

71.3

100.0

72.3

Gross Profit

Adm.

386

180

605

383

612

402

31.3

14.6

28.7

18.2

27.7

18.2

EBIT

Int Exp

206

20

222

51

210

59

16.7

1.6

10.5

2.4

9.5

2.7

EBT

186

171

151

15.1

8.1

6.8

EAT

112

103

91

9.1

4.9

4.1

Cash Div

50

50

50

4.0

2.4

2.3

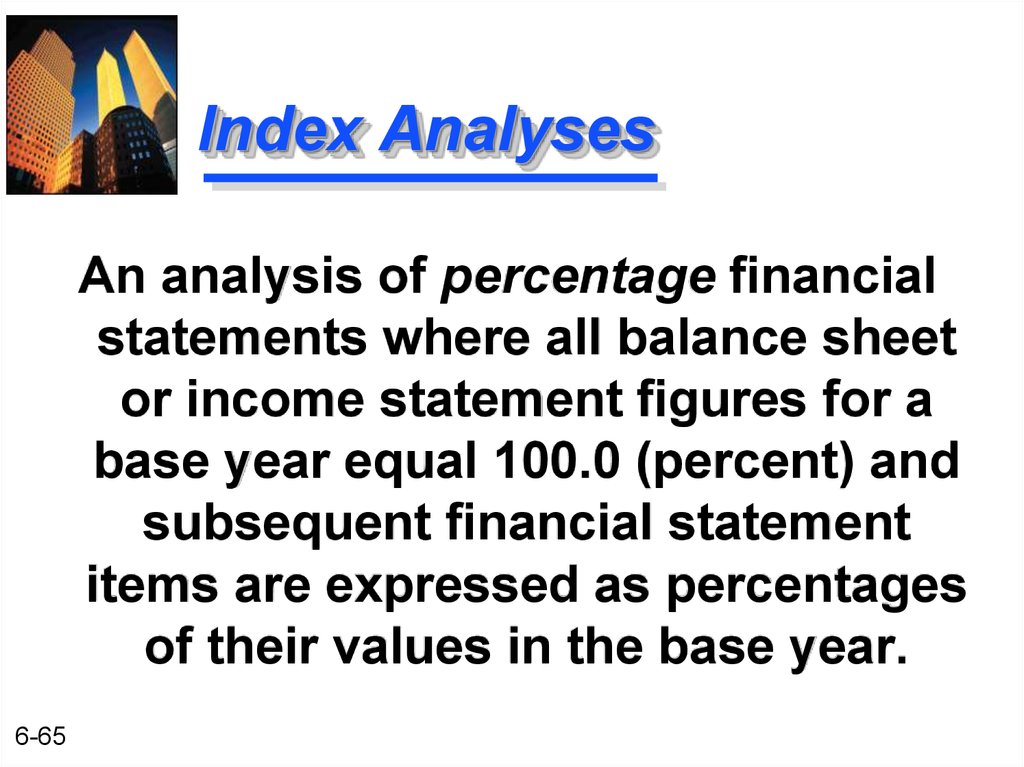

65. Index Analyses

An analysis of percentage financialstatements where all balance sheet

or income statement figures for a

base year equal 100.0 (percent) and

subsequent financial statement

items are expressed as percentages

of their values in the base year.

6-65

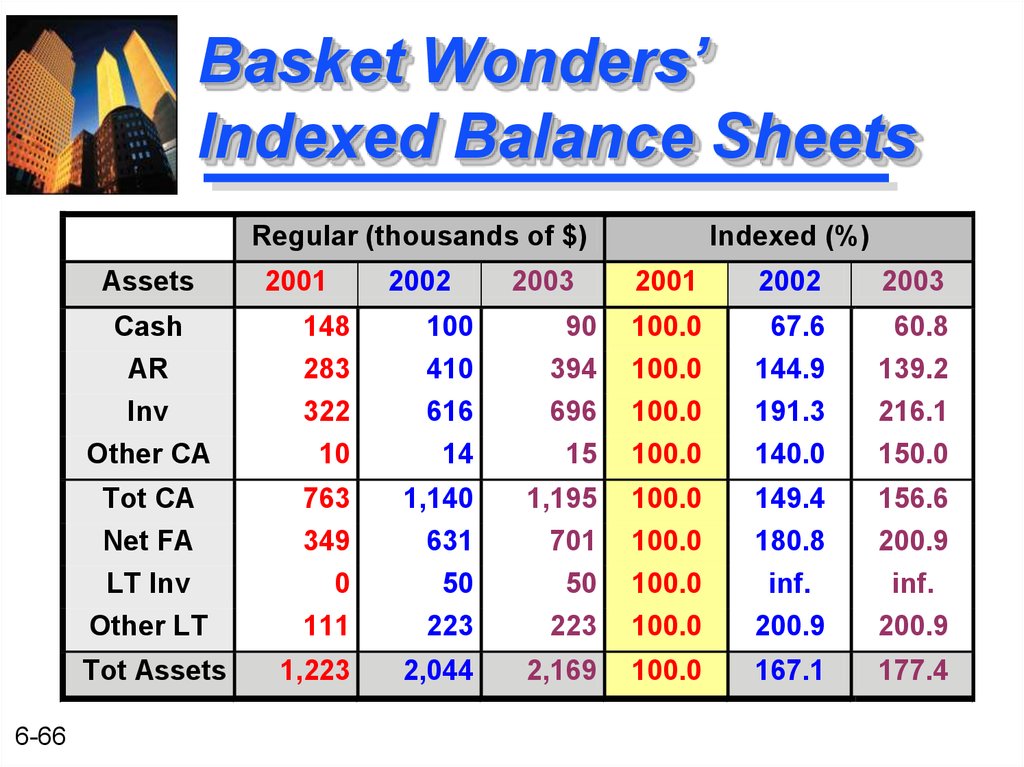

66. Basket Wonders’ Indexed Balance Sheets

Regular (thousands of $)Assets

2002

2003

2001

2002

2003

Cash

AR

Inv

Other CA

148

283

322

10

100

410

616

14

90

394

696

15

100.0

100.0

100.0

100.0

67.6

144.9

191.3

140.0

60.8

139.2

216.1

150.0

Tot CA

Net FA

LT Inv

Other LT

763

349

0

111

1,140

631

50

223

1,195

701

50

223

100.0

100.0

100.0

100.0

149.4

180.8

inf.

200.9

156.6

200.9

inf.

200.9

1,223

2,044

2,169

100.0

167.1

177.4

Tot Assets

6-66

2001

Indexed (%)

67. Basket Wonders’ Indexed Balance Sheets

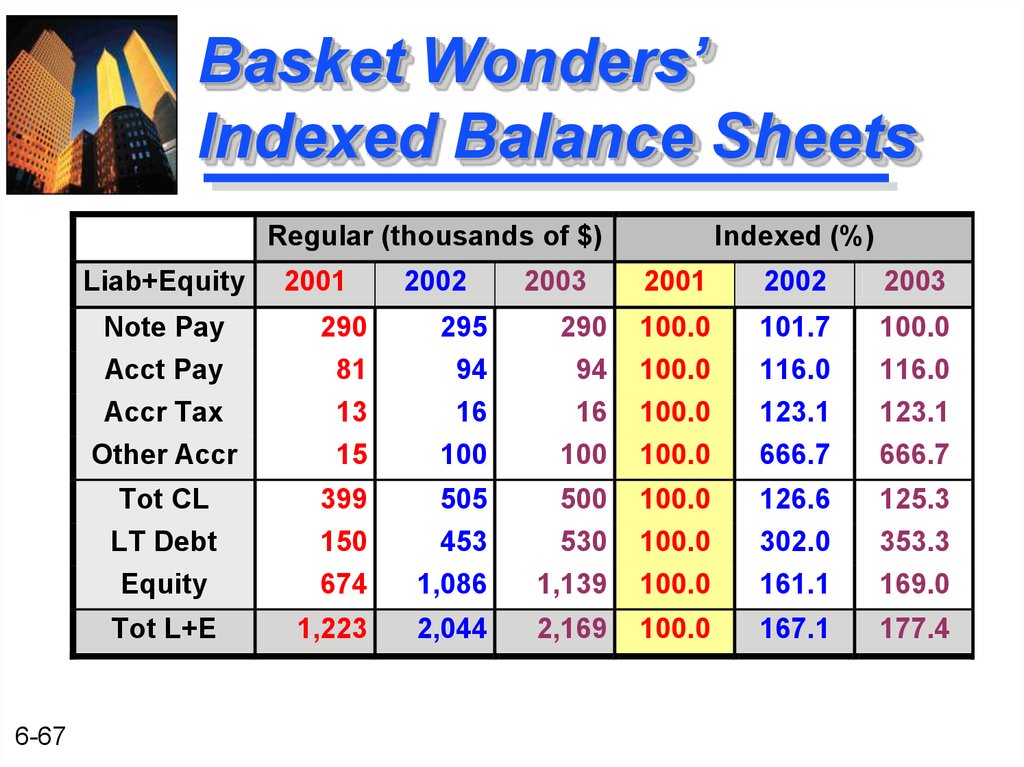

Regular (thousands of $)Liab+Equity

6-67

2001

2002

2003

Indexed (%)

2001

2002

2003

Note Pay

Acct Pay

Accr Tax

Other Accr

290

81

13

15

295

94

16

100

290

94

16

100

100.0

100.0

100.0

100.0

101.7

116.0

123.1

666.7

100.0

116.0

123.1

666.7

Tot CL

LT Debt

Equity

399

150

674

505

453

1,086

500

530

1,139

100.0

100.0

100.0

126.6

302.0

161.1

125.3

353.3

169.0

Tot L+E

1,223

2,044

2,169

100.0

167.1

177.4

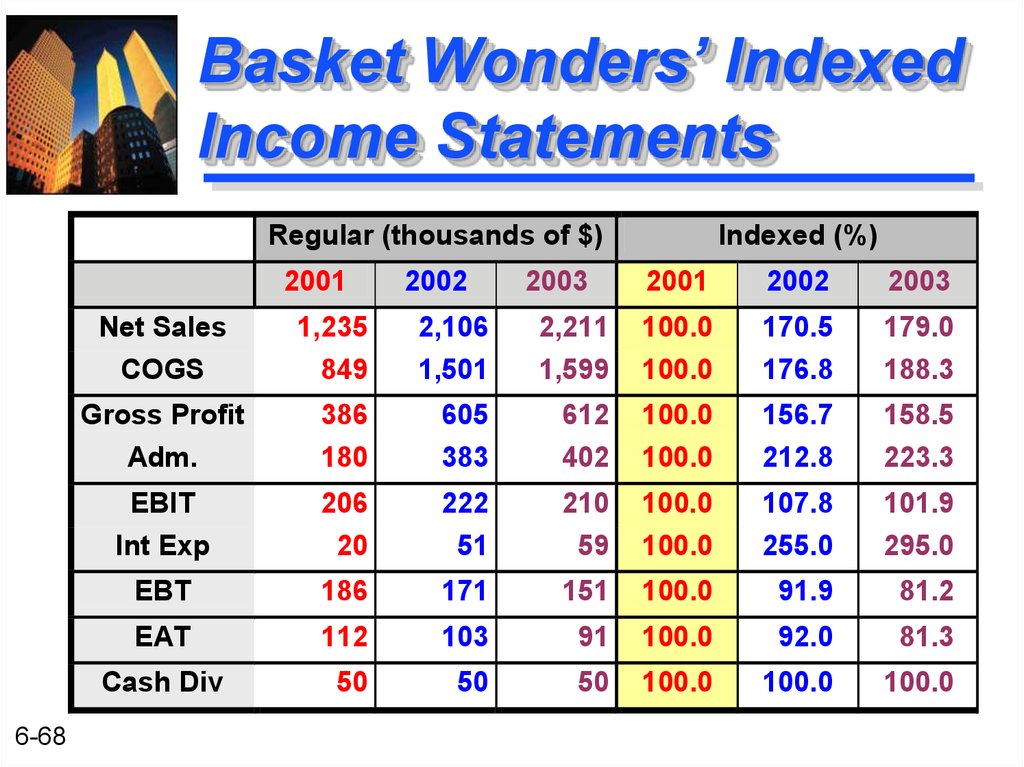

68. Basket Wonders’ Indexed Income Statements

Regular (thousands of $)2001

Net Sales

COGS

6-68

2002

2003

Indexed (%)

2001

2002

2003

1,235

849

2,106

1,501

2,211

1,599

100.0

100.0

170.5

176.8

179.0

188.3

Gross Profit

Adm.

386

180

605

383

612

402

100.0

100.0

156.7

212.8

158.5

223.3

EBIT

Int Exp

206

20

222

51

210

59

100.0

100.0

107.8

255.0

101.9

295.0

EBT

186

171

151

100.0

91.9

81.2

EAT

112

103

91

100.0

92.0

81.3

Cash Div

50

50

50

100.0

100.0

100.0

Финансы

Финансы