Похожие презентации:

Bermuda Triangle

1.

2.

3.

Leonard Nimoy’s “In Search Of…”Featured Triangle in Season 1 1976

4.

Supernatural Explanations—Leftover technology from the lost continent of

Atlantis; Bimini Road near Bimini in Bahamas.

—UFOs & Aliens (Steven Spielberg) ends Close

Encounters with the revelation that Flight 19 was

abducted by the mothership.

5.

6.

7.

8.

9.

Story begins in 1952 Fate Magazine“Sea Mystery at Our Back Door”

10.

Charles Berlitz & Richard Winer1974 Books Fueled the Flames

11.

12.

Flight 19 U.S. Navy TBM AvengersDecember 5, 1945, 5

planes, 14 men

Leader said: “We

are entering white

water, nothing

seems right. We

don’t know where

we are, the water is

green, no white.”

13.

The Unexplained ≠ InexplicableMysterious ≠ Supernatural

14.

1. Depart Ft. Laud.2. Drop bombs at Hen

and Chickens shoals.

3. Proceed on new

heading 346° for

73 nautical miles.

4. Fly on third heading

241° for 120 naut

miles 5. Return to Ft.

Laud. 6. Exact pos.

unknown 7. Radio

triangulation

establishes flight's

approx. position.

8. PBM-5 takes off.

9. PBM-5 explodes

10. The Florida Keys,

where Taylor thought

15.

500-page Navy board of investigation report:—Taylor had mistakenly believed that the small

islands he passed over were the Florida Keys, so

his flight was over the Gulf of Mexico and

heading northeast would take them to Florida.

—It was determined that Taylor had passed

over the Bahamas as scheduled, and he did in

fact lead his flight to the northeast over the

Atlantic.

—Some subordinate officers did likely know

their approximate position as indicated by radio

transmissions stating that flying west would

result in reaching the mainland.

16.

500-page Navy board of investigation report:—Taylor, although an excellent combat pilot and

officer with the Navy, had a tendency to "fly by the

seat of his pants", getting lost several times in the

process. Twice during such times he had to ditch

his plane in the Pacific and be rescued.

—It wasn't Taylor's fault because the compasses

stopped working.

—This report was subsequently amended "cause

unknown" by the Navy after Taylor's mother

contended that the Navy was unfairly blaming her

son for the loss of five aircraft and 14 men when the

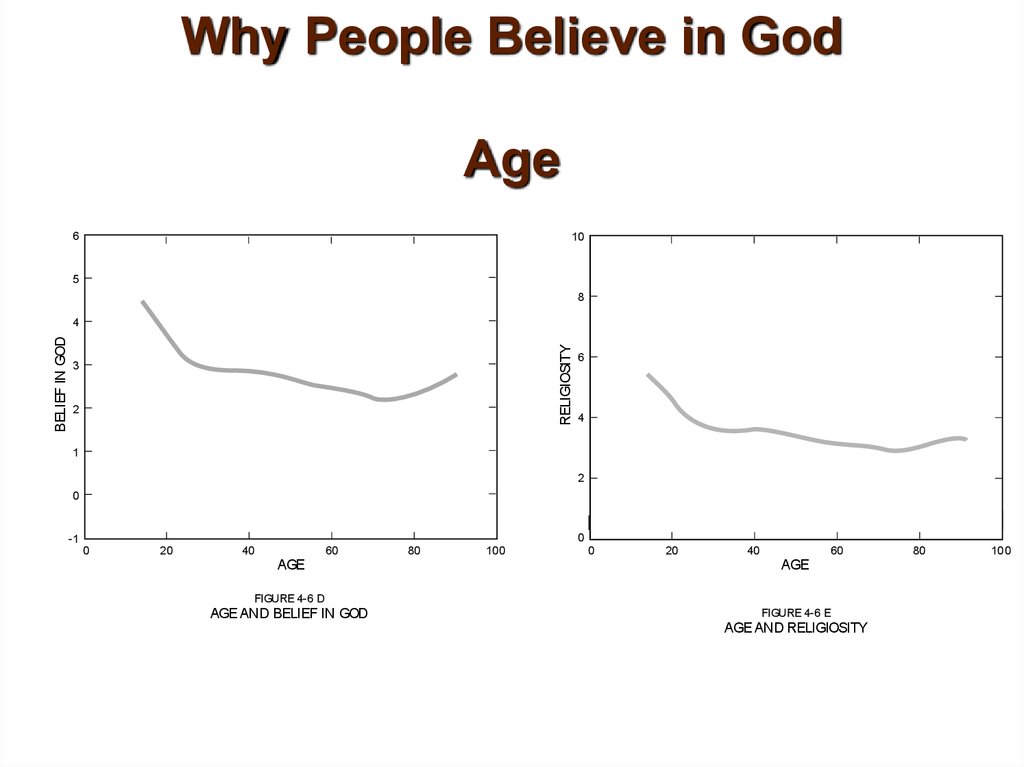

Navy had neither the bodies nor the airplanes as.

17.

Natural Explanations—Compass Variations

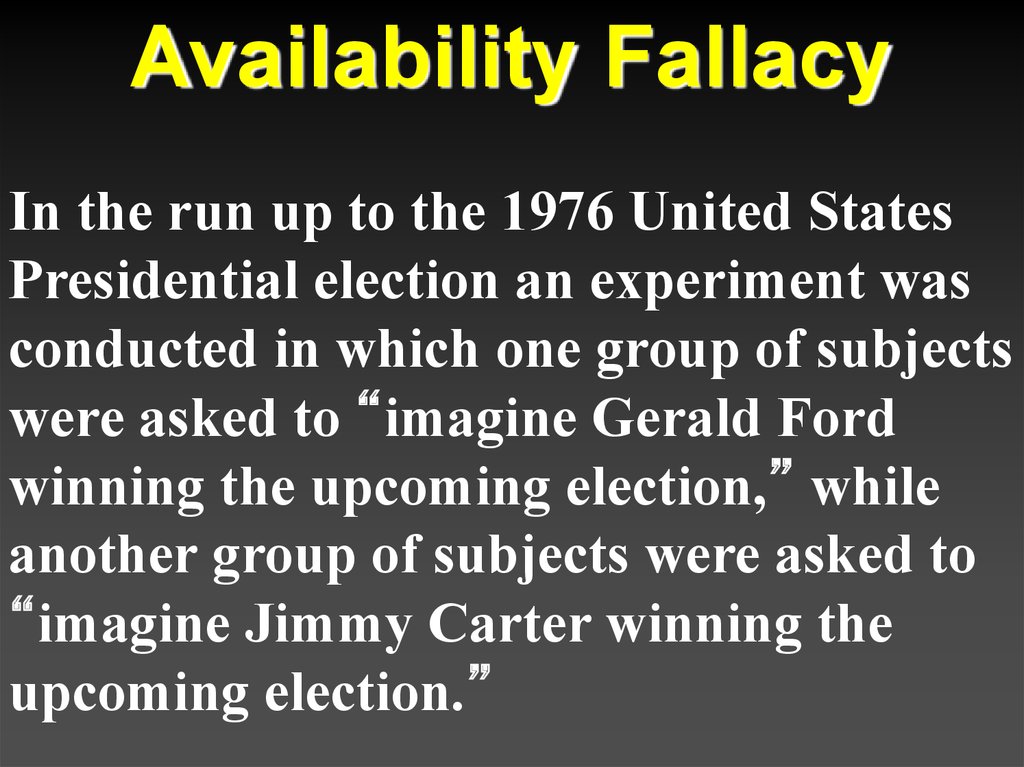

—Hurricanes

—Gulf Stream anomalies

—Methane Eruptions

—Rogue Waves

—Deliberate Acts of Destruction

—Human Error

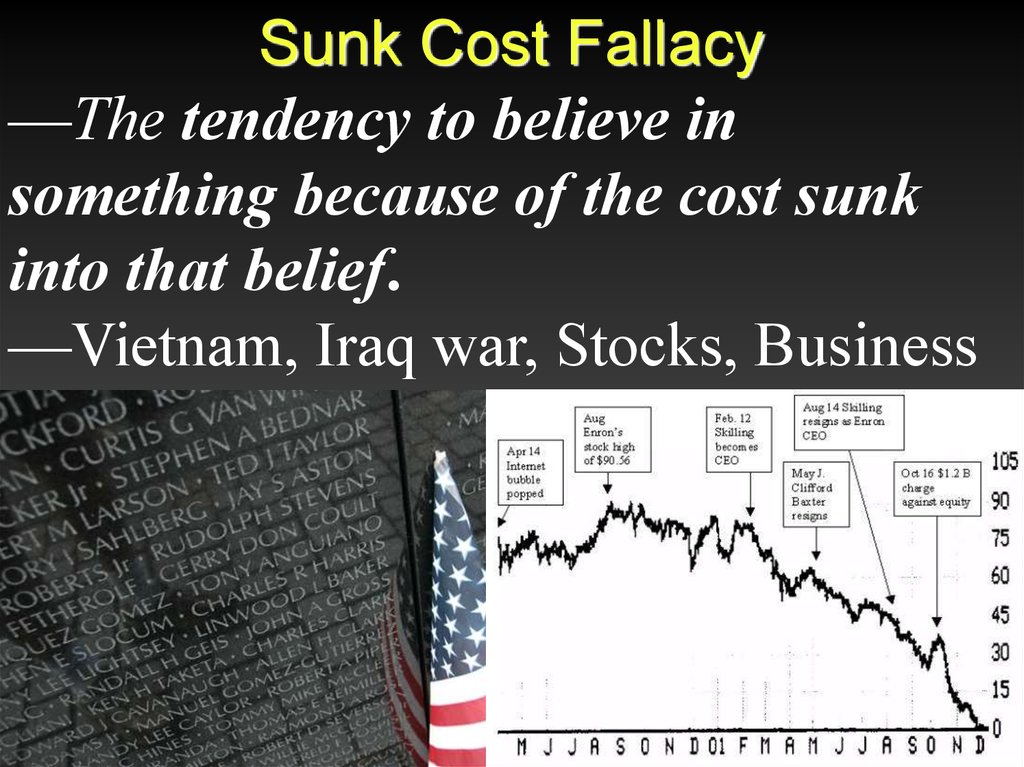

18.

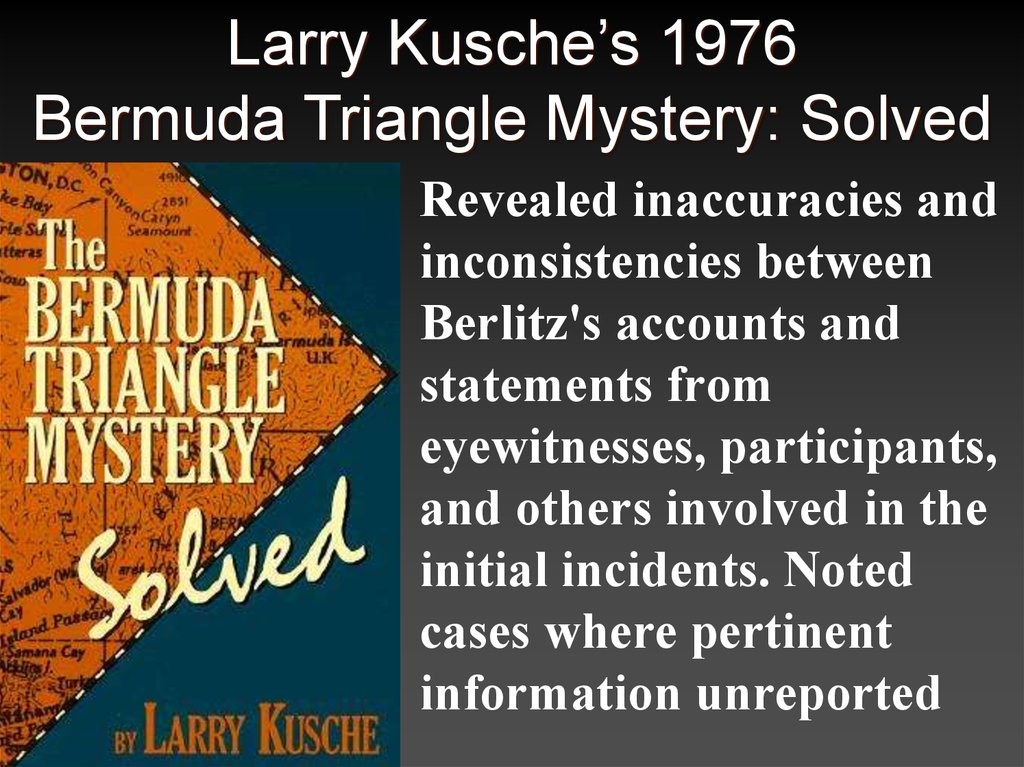

Larry Kusche’s 1976Bermuda Triangle Mystery: Solved

Revealed inaccuracies and

inconsistencies between

Berlitz's accounts and

statements from

eyewitnesses, participants,

and others involved in the

initial incidents. Noted

cases where pertinent

information unreported

19.

Kusche’s Explanation—The number of ships and aircraft reported

missing in the area was not significantly

greater, proportionally speaking, than in any

other part of the ocean.

—In an area frequented by tropical storms,

the number of disappearances that did occur

were neither disproportionate, unlikely, nor

mysterious; furthermore, Berlitz and other

writers would often fail to mention such

storms.

20.

Kusche’s Explanation—The numbers themselves were exaggerated

by sloppy research. A boat's disappearance,

for example, would be reported, but its

eventual (if belated) return to port may not

have been.

—Some disappearances had, in fact, never

happened. One plane crash was said to have

taken place in 1937 off Daytona Beach FL, in

front of hundreds of witnesses; a check of the

local papers revealed nothing.

21.

Kusche & the Burden of Proof"Say I claim that a parrot has been

kidnapped to teach aliens human language

and I challenge you to prove that is not true.

You can even use Einstein's Theory of

Relativity if you like. There is simply no way

to prove such a claim untrue. The burden of

proof should be on the people who make these

statements, to show where they got their

information from, to see if their conclusions

and interpretations are valid, and if they have

left anything out."

22.

Baseline Rate ExplanationThe Bermuda Triangle is one of the most

heavily traveled shipping lanes in the world:

—Ships cross it daily for ports in the

Americas, Europe, and the Caribbean Islands

—Cruise ships, pleasure craft regularly go

back and forth between Florida and the

islands.

—Also a heavily flown route for commercial

and private aircraft heading towards Florida,

the Caribbean, and South America from

points north.

23.

Lloyd’s of London, who keepsdetailed records of all disasters,

noted in a UK Channel 4 TV special

that there was nothing unusual

about the “triangular” area beyond

chance expectation based on the

baseline rate for amount of traffic in

a given area.

24.

U.S. Coast Guard InvestigationConcluded that the number of supposed

disappearances is relatively insignificant

considering the number of ships and aircraft

that pass through the “triangle.” Noted the

1972 explosion and sinking of the tanker SS

V.A. Fogg in the Gulf of Mexico, Coast Guard

photographed the wreck and recovered

several bodies, in contrast with claim that all

the bodies had vanished, with the exception of

the captain, who was found sitting in his

cabin at his desk, clutching a coffee cup.

25.

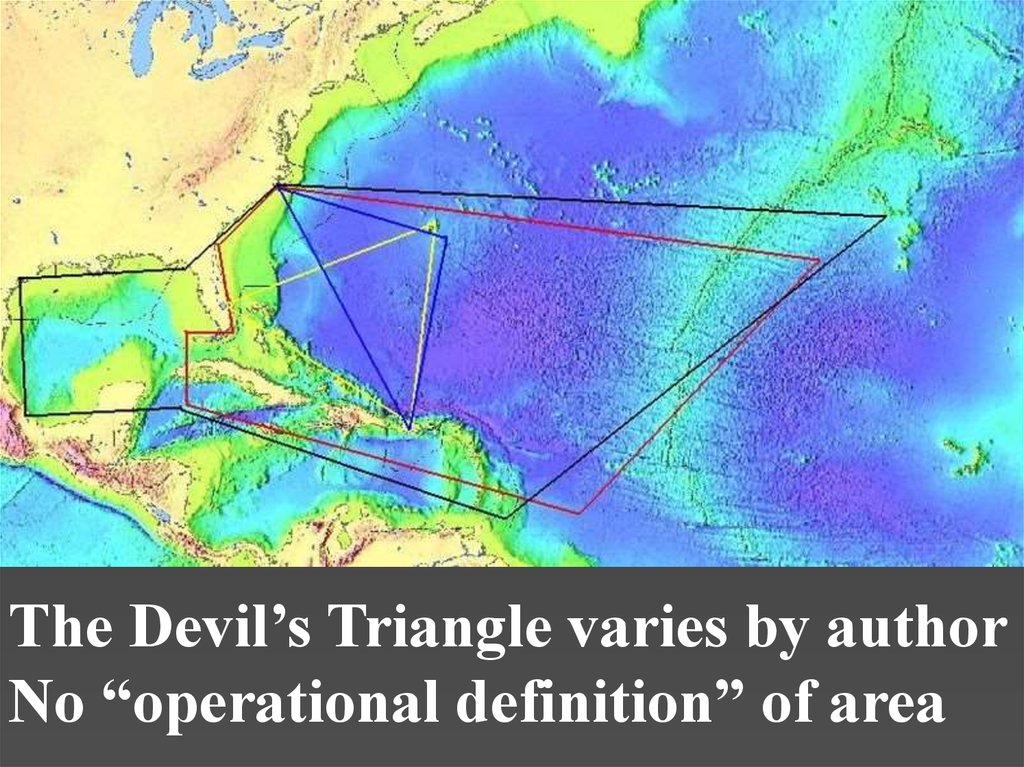

The Devil’s Triangle varies by authorNo “operational definition” of area

26.

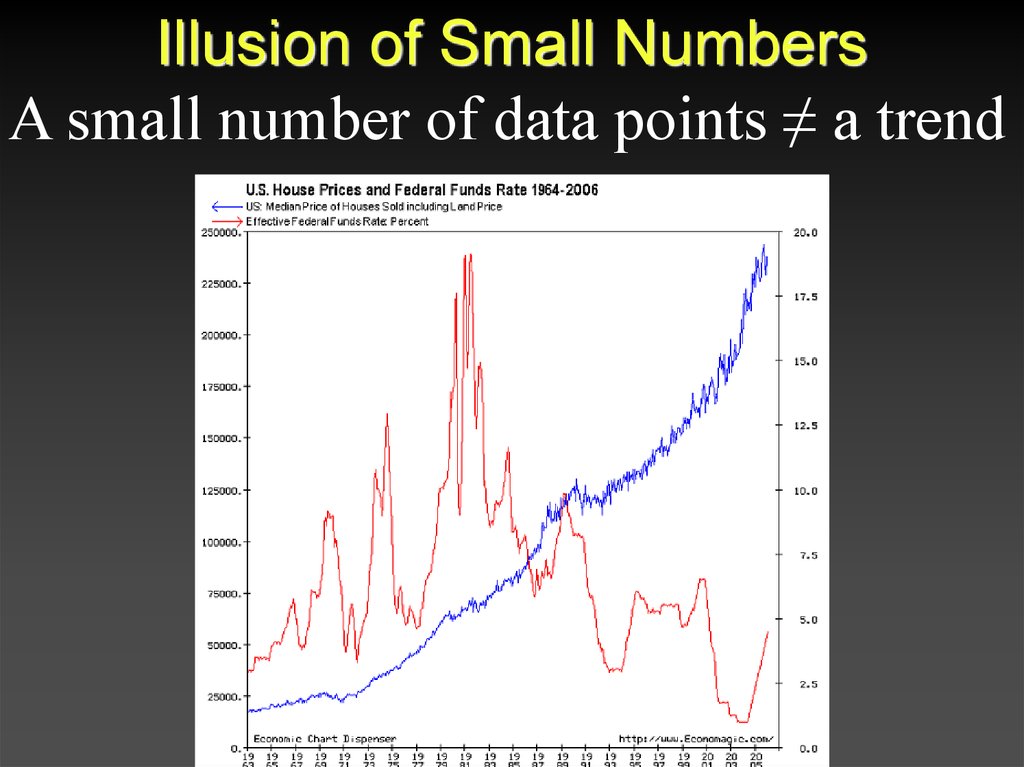

Illusion of Small NumbersA small number of data points ≠ a trend

27.

28.

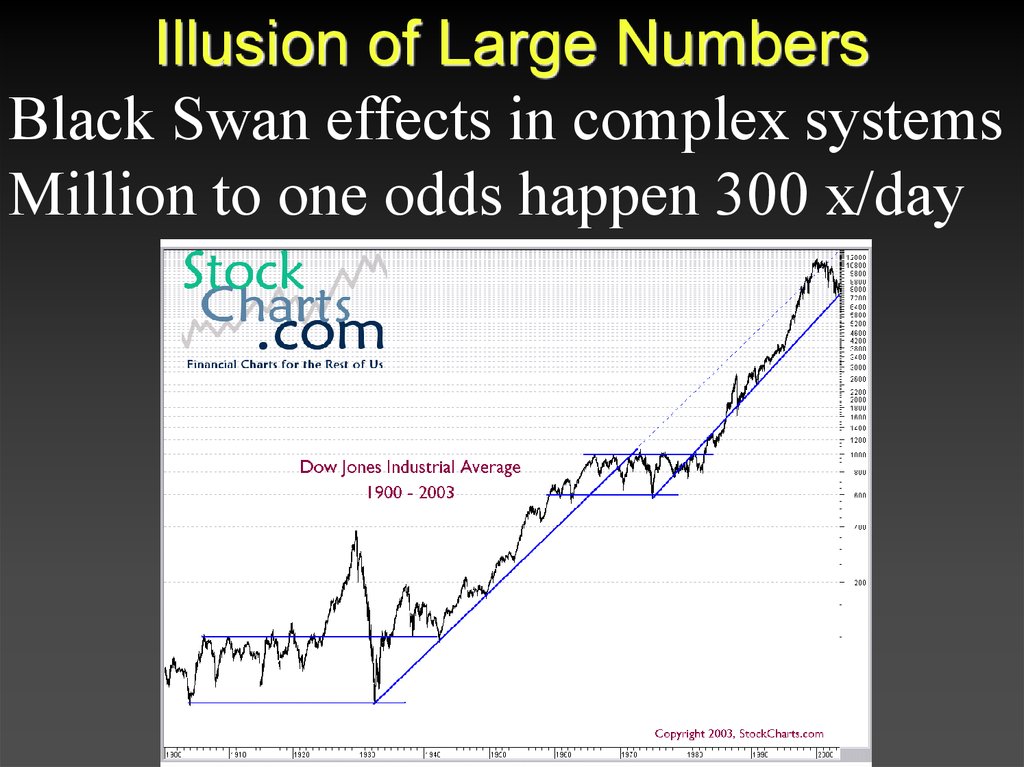

Illusion of Large NumbersBlack Swan effects in complex systems

Million to one odds happen 300 x/day

29. Humans trying to emulate random sequences will almost never place more than four heads (or tails) in a row.

30. In a true random generation, the probability of at least one string of 5 or more identical outcomes is 0.999 and for a sequence

of 6 it is 0.96!31. It is easy to spot which is human generated: it is the one that looks least random!

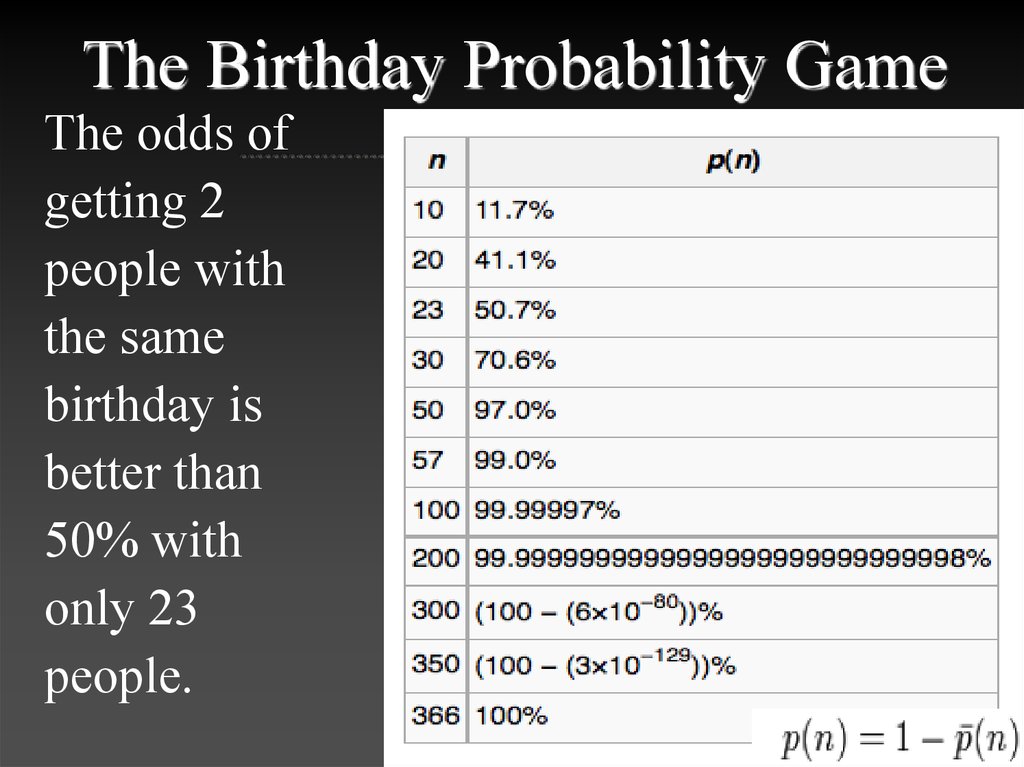

32. The Birthday Probability Game

The odds ofgetting 2

people with

the same

birthday is

better than

50% with

only 23

people.

33.

“Regression to the Mean”1. Height (2 tall parents: for every 4 children, 3

will be shorter for every one taller)

2. I.Q. (2 smart parents: for every 4 children, 3

will be dumber for every one smarter)

3. Hollywood films (producers and directors get

fired after one bad film, even though their

films under production go on to success)

4. Sports Illustrated Cover Curse (to get on the

cover an athlete has to have a statistically

extraordinary game or season, which is

unlikely to happen again)

34.

The Monty Hall ProblemLet’s Make a Deal!

3 Doors: 1 car, 2 goats

Monty knows what’s behind all 3 doors

Monty will not reveal what’s behind your door

Monty can only show you a goat

You choose Door #1

Monty shows you what’s behind door #2: Goat

Door #1: ?

Door #2: Goat

Door #3: ?

Do you want to keep your choice or switch?

35.

The Monty Hall ProblemAt the start: 1/3rd chance of picking the car

and a 2/3rds chance of picking a goat.

Switching doors is bad only if you 1st

chose the car, which happens only 1/3rd

of the time.

Switching doors is good if you 1st chose a

goat, which happens 2/3rds of the time.

Thus, the probability of winning by

switching is 2/3rds, or double the odds of

not switching.

36.

10 Doors: 1 car, 9 goatsMonty knows what’s behind all 10 doors

You choose Door #1

Monty reveals door #s 2-9: Goats

Door #1: ?

Door #2: Goat Door #3: Goat

Door #5: Goat Door #6: Goat

Door #8: Goat Door #9: Goat

Door #10: ?

Door #4: Goat

Door #7: Goat

Do you want to keep your choice or switch?

37.

Folk Innumeracy & Death Dreams5 dreams/day = 1,825 dreams/year

1/10 remembered dreams = 182.5/year

295 million Americans = 53.8 billion remembered

dreams/year

Each of us knows about 150 people fairly well

Network grid of 44.3 billion personal relationships

Annual U.S. death rate = .008 = 2.6 million/year

Inevitable that some of those 53.8 billion

remembered dreams will be about some of

these 2.6 million deaths among the 295 million

Americans and their 44.3 billion relationships.

It would be a miracle, in fact, if some death

38.

The “hot hand”Illusion

39.

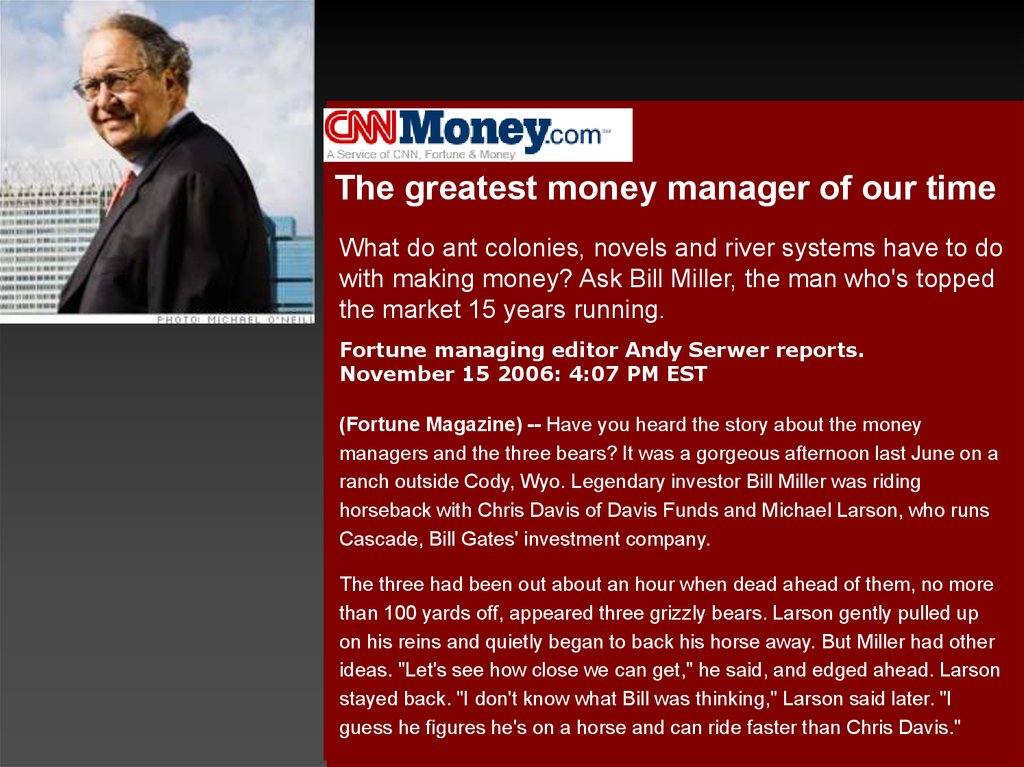

The greatest money manager of our timeWhat do ant colonies, novels and river systems have to do

with making money? Ask Bill Miller, the man who's topped

the market 15 years running.

Fortune managing editor Andy Serwer reports.

November 15 2006: 4:07 PM EST

(Fortune Magazine) -- Have you heard the story about the money

managers and the three bears? It was a gorgeous afternoon last June on a

ranch outside Cody, Wyo. Legendary investor Bill Miller was riding

horseback with Chris Davis of Davis Funds and Michael Larson, who runs

Cascade, Bill Gates' investment company.

The three had been out about an hour when dead ahead of them, no more

than 100 yards off, appeared three grizzly bears. Larson gently pulled up

on his reins and quietly began to back his horse away. But Miller had other

ideas. "Let's see how close we can get," he said, and edged ahead. Larson

stayed back. "I don't know what Bill was thinking," Larson said later. "I

guess he figures he's on a horse and can ride faster than Chris Davis."

40.

“Odds of beating S&P for 13 yearsstraight are 1 in 149,012”

“Odds of beating S&P the 14th year

are 1 in 372,529”

“Greatest fund feat in past 40 years”

41.

The Scientific View:Probability of

Assume random 1 in

2 chance

of beating S&P per

fund manager,

each year…

Bill Miller

beating the S&P 15 years in a row

starting in 1991 = 1 in 32,768…

42.

Thousands of Managers:…

…

…

…

…

.

.

.

43.

Assume random 1 in2 chance

of beating S&P per

fund manager,

each year…

Probability of Someone among all

the managers beating the S&P 15 or

more years in a row starting any year

in the last 40 years = ???... 3/4 or .75

44.

Headline should NOT be:The greatest money manager of our time

But rather…

Expected 15-year run finally occurs

Bill Miller lucky beneficiary!!

45.

Hindsight BiasMonday Morning

Quarterbacking

—9/11 conspiracy

theories

—Stock market

causal explanations

—Authorized

autobiography

46.

Confirmation BiasThe tendency to seek & find

confirming evidence for

one’s beliefs, and to ignore

disconfirming evidence

47.

48.

49.

Reading Michael Drosnin’sresponse to Michael

Shermer’s column on the

Bible “code” and its ability to

accurately predict the future,

I could not help but laugh. I

have been a writer and

illustrator of comic books for

the past 30 years, and in that

time I have “predicted” the

future so many times in my

work my colleagues have

actually taken to referring to

it as “the Byrne Curse”.

50.

It began in the late 1970s. While working on aSpider-Man series titled “Marvel Team-Up” I

did a story about a blackout in New York. There

was a blackout the month the issue went on sale

(six months after I drew it.) While working on

“Uncanny X-Men” I hit Japan with a major

earthquake, and again the real thing happened

the month the issue hit the stands.

51.

Now, those things are fairly easyto “predict,” but consider

these: When working on the

relaunch of Superman, for DC

Comics, I had the Man of

Steel fly to the rescue when

disaster beset the NASA space

shuttle. The Challenger

tragedy happened almost

immediately thereafter, with

time, fortunately, for the issue

in question to be redrawn,

substituting a “space plane”

for the shuttle.

52.

Most recent, andchilling, came

when I was writing

and drawing

“Wonder Woman”,

and did a story in

which the title

character was

killed, as a prelude

to her becoming a

goddess.

53.

The cover for that issue wasdone as a newspaper

front page, with the

headline “Princess Diana

Dies”. (Diana is Wonder

Woman’s real name).

That issue went on sale on

a Thursday. The

following Saturday. . . I

don't have to tell you, do

I?

54.

My ability as aprognisticator, like

Drosnin's, would seem

assured—provided, of

course, we reference

only the above, and skip

over the hundreds of

other comic books I

have produced which

featured all manner of

catastrophes, large and

small, which did not

come to pass.

—John Byrne

55.

The Wisdom of the CrowdAveraging Errors Over Large Numbers

56.

Change BlindnessWe look for meaning and miss details

57.

Change BlindnessWe look for meaning and miss details

58.

CognitiveDissonance

“What we obtain

too cheap we

esteem too lightly”

—Thomas Paine

Discovered by Leon

Festinger in 1954 in

his investigation of

a UFO cult.

59.

PROPHESY FROM PLANET CLARIONCALL TO CITY: FLEE THAT FLOOD.

IT'LL SWAMP US ON DEC 21 [1954]

OUTER SPACE TELLS SUBURBANITE

60.

Festinger and had infiltrated the Seekers, a smallChicago-area cult whose members thought they were

communicating with aliens—including "Sananda,"

who they believed was the astral incarnation of Jesus

Christ. The group was led by a Dianetics devotee who

transcribed the interstellar messages through

automatic writing. Through her, the aliens had given

the precise date of an Earth-rending cataclysm:

December 21, 1954. Some of her followers quit their

jobs and sold their property, expecting to be rescued

by a flying saucer when the continent split asunder and

a new sea swallowed much of the United States. The

disciples even went so far as to remove brassieres and

rip zippers out of their trousers—the metal, they

believed, would pose a danger on the spacecraft.

61.

December 21, 1954Marion Keech’s

prediction for the

world to end when

aliens arrive

Cognitive dissonance,

or the uncomfortable

tension that comes

from holding two

conflicting thoughts

at the same time.

62.

Leon Festinger: “Suppose an individualbelieves something with his whole heart;

suppose further that he has a commitment to

this belief, that he has taken irrevocable actions

because of it; finally, suppose that he is

presented with evidence, unequivocal and

undeniable evidence, that his belief is wrong:

what will happen? The individual will

frequently emerge, not only unshaken, but even

more convinced of the truth of his beliefs than

ever before. Indeed, he may even show a new

fervor about convincing and converting other

people to his view.”

63.

What to do when Prophecy Fails:1.The date was miscalculated

2.The date was a loose prediction, not a

specific prophecy

3.The date was a warning, not a

prophecy

4.God changed his mind

5.The prediction was just a test of the

members’ faith

6.The prophecy was fulfilled physically,

but not as expected

7.The prophecy was fulfilled…spiritually

64.

Self Justification BiasThe self-justification bias is the tendency to

rationalize decisions after the fact to convince

ourselves that what we did was the best thing

we could have done.

Or as I like to say, smart people believe weird

things because they are better at rationalizing

their beliefs that they hold for non-smart

reasons.

65.

“I acknowledge that mistakeswere made here. I accept that

responsibility.”

—U.S. Attorney General

Alberto R. Gonzales

“Mistakes were quite

possibly made by the

administrations in which I

served.” —Kissinger on

Vietnam, Cambodia, and S.A.

“If, in hindsight, we also

discover that mistakes may

have been made…I am deeply

sorry.” —NY Catholic Cardinal

Edward Egan

66.

Confirmation BiasThe tendency to seek & find

confirming evidence for

one’s beliefs, and to ignore

disconfirming evidence

67.

Social psychologist Geoffrey Cohenquantified this effect in a study in which he

discovered that Democrats are more

accepting of a welfare program if they believe

it was proposed by a fellow Democrat, even

when, in fact, the proposal comes from a

Republican and is quite restrictive.

Predictably, Cohen found the same effect for

Republicans, who were far more likely to

approve of a generous welfare program if

they thought it was proposed by a fellow

Republican.

68.

“You get in the system and you become verycynical. People are lying to you all over the

place. Then you develop a theory of the

crime, and it leads to what we call tunnel

vision. Years later overwhelming evidence

comes out that the guy was innocent. And

you’re sitting there thinking, ‘Wait a minute.

Either this overwhelming evidence is wrong

or I was wrong—and I couldn’t have been

wrong because I’m a good guy.’ That’s a

psychological phenomenon I have seen over

and over.” —NW U. Law Prof Rob Warden

69.

Self-Serving BiasIn one College Entrance Examination Board

survey of 829,000 high school seniors, 60 percent

put themselves in the top 10 percent in “ability to

get along with others,” while 0 percent (not one!)

rated themselves below average.

1997 U.S. News and World Report study on who

Americans believe are most likely to go to heaven:

52 percent said Bill Clinton, 60 percent thought

Princess Diana, 65 percent chose Michael Jordan,

79 percent selected Mother Teresa, and, at 87

percent, the person most likely to go to heaven was

the survey taker!

70.

Attribution BiasThe tendency to attribute different causes for our

own beliefs and actions than that of others.

71.

Situational attribution bias: We identify thecause of someone’s belief or behavior in the

environment

“Her success is a result of luck, circumstance,

and having connections”.

Dispositional attribution bias: We identify the

cause of our own belief or behavior in our

disposition

“I am successful because I’m hard working,

intelligent, and creative” .

72.

Intellectual attribution bias: We consider ourown beliefs as being rationally motivated.

Emotional attribution bias: We see the beliefs

of others as being emotionally driven.

“I am for gun control because statistics

show that crime decreases when gun

ownership decreases”

“He is for gun control because he is a

bleeding-heart liberal who needs to identify

with the victim” or “he is against gun control

because he’s a heartless conservative who

needs to feel emboldened by a weapon”

73.

Lisa Farwell and Bernard Weiner discoveredin their study on the attribution bias in

political attitudes, with conservatives

justifying their beliefs with rational

arguments but accusing political liberals of

being “bleeding hearts”; liberals, in turn,

offered intellectual justifications for their

positions, while accusing conservatives of

being “heartless.”

Farwell, Lisa and Bernard Weiner. 2000. “Bleeding Hearts and the

Heartless: Popular Perceptions of Liberal and Conservative

Ideologies.” Personality and Social Psychology Bulletin, 26, 845-52.

74.

Why People Believe in GodParental Beliefs

10

6

5

BELIEF IN GOD

RELIGIOSITY

8

6

2

4

3

2

1

4

0

0

0

2

4

6

8

RAISED RELIGIOUS

FIGURE 4-6 B

BEING RAISED RELIGIOUS AND RELIGIOSITY

10

-1

0

2

4

6

8

RAISED RELIGIOUS

FIGURE 4-6 A

BEING RAISED RELIGIOUS AND BELIEF IN GOD

10

75.

Why People Believe in GodEducation

10

RELIGIOSITY

8

6

4

2

0

0

1

2

3

4

EDUCATION

FIGURE 4-6 C

EDUCATION AND RELIGIOSITY

5

6

76.

Why People Believe in GodAge

6

10

5

8

RELIGIOSITY

BELIEF IN GOD

4

3

2

6

4

1

2

0

0

-1

0

20

40

60

AGE

80

100

0

20

40

60

AGE

FIGURE 4-6 D

AGE AND BELIEF IN GOD

FIGURE 4-6 E

AGE AND RELIGIOSITY

80

100

77.

Why People Believe in GodConflict/Harmony with Parents

10

Belief in God

RELIGIOSITY

6

8

6

Raised religiously

4

2

Not raised religiously

0

10

5

4

3

2

1

-8

Low conflict

Raised religiously

-6

-4

-2

PARENTAL CONFLICT

FIGURE 4-6 G

PARENTAL CONFLICT AND RELIGIOSITY

0

Not raised religiously

High

Low

High conflict

Parental Conflict

78.

Attribution of Belief for Self and Others0

Fear

of death

Reward good

punish evil

0

God has a

plan for us

God needed

for morality

Prayers

answered

Raised

to believe

Faith,

need to

believe

Bible

says so

Comfort,

purpose

to life

Experience

of God

Good design

of universe

Percentage

Why People Believe in God

Why People Think Others Believe in God

30

Why People Say They Believe in God

Why People Say Others Believe in God

25

20

15

10

5

0

79.

Availability FallacyThe tendency to assign probabilities of

potential outcomes based on examples

that are immediately available to us,

especially those which are vivid, unusual,

or emotionally charged, which are then

generalized into conclusions upon which

choices are based

80.

Availability FallacyIn the run up to the 1976 United States

Presidential election an experiment was

conducted in which one group of subjects

were asked to “imagine Gerald Ford

winning the upcoming election,” while

another group of subjects were asked to

“imagine Jimmy Carter winning the

upcoming election.”

81.

When subsequently asked to estimate theprobably of each of the candidates winning,

those who were asked to imagine Ford

winning estimated his chances as much

higher than those who were asked to imagine

Carter winning, who, in turn, gave their guy

a much higher probability of victory. This

availability heuristic shows how we assign

probabilities of potential outcomes based on

examples that are immediately available,

which are generalized into conclusions upon

which choices are based.

82.

Conjunction FallacyImagine that you are looking to hire someone for

your company and you are considering for

employment the following candidate:

Linda is 31 years old, single, outspoken, and very

bright. She majored in philosophy. As a student, she

was deeply concerned with issues of discrimination

and social justice, and also participated in antinuclear demonstrations.

Which is more likely? 1. Linda is a bank teller.

2. Linda is a bank teller and is active in the feminist

movement.

83.

Bias Blind SpotThe tendency to recognize the power of cognitive

biases in other people but to be blind to their

influence upon our own beliefs.

Princeton University psychologist Emily

Pronin and her colleagues, subjects were randomly

assigned high or low scores on a “social

intelligence” test. Those given the high marks rated

the test fairer and more useful than those receiving

low marks. When asked if it was possible that they

had been influenced by the score on the test,

subjects responded that other participants had

been far more biased than they were.

84.

Bias Blind SpotEven when subjects admit to having such a bias as

being a member of a partisan group, says Pronin,

this “is apt to be accompanied by the insistence

that, in their own case, this status…has been

uniquely enlightening—indeed, that it is the lack of

such enlightenment that is making those on the

other side of the issue take their misguided

position.”

85.

Sunk Cost Fallacy—The tendency to believe in

something because of the cost sunk

into that belief.

—Vietnam, Iraq war, Stocks, Business

—Failing businesses & relationships

86.

Sunk Cost FallacyLeo Tolstoy: “I know that most men,

including those at ease with problems of the

greatest complexity, can seldom accept even

the simplest and most obvious truth if it be

such as would oblige them to admit the falsity

of conclusions which they have delighted in

explaining to colleagues, which they have

proudly taught to others, and which they

have woven, thread by thread, into the fabric

of their lives.”

87.

Endowment EffectOwners of an item value it roughly

twice as much as potential buyers of the

same item.

88.

Endowment Effect ExperimentSubjects given a coffee mug worth $6

Asked the lowest price they would

take: $5.25.

Other subjects asked how much they

would pay for the same mug: $2.75

89.

Loss AversionLosses hurt twice as much as gains feel

good

90.

Imagine that I gave you $100 and a choicebetween (A) a guaranteed gain of $50 and (B) a

coin flip in which heads gets you another $100

and tails gets you nothing. Do you want A or B?

Now imagine that I gave you $200 and a

choice between (A) a guaranteed loss of $50 and

(B) a coin flip in which heads guarantees you

lose $100 and tails you lose nothing. Do you

want A or B?

The final outcome for both options A and B

in both scenarios is the same so rationally it does

not matter which option you choose, so people

should choose both equally.

91.

Most people choose A in the first scenario (asure gain of $50) and B in the second scenario

(avoiding the sure loss of $50).

Even though there is no difference between

having $100 and a sure or potential gain of $50,

and having $200 and a sure or potential loss of

$50, emotionally there is a difference. That

emotion is called loss aversion, or risk aversion.

On average most people will reject the

prospect of a 50/50 probability of gaining or

losing money unless the amount to be gained is

at least double the amount to be lost, because

losses hurt twice as much as gains feel good.

92.

Loss Aversion in the BrainNeuroeconomists using fMRI brain scans found

areas in the brain that light up (or down) during

profits and losses that are rich in dopamine

receptors, a neurotransmitter associated with

motivation and reward. As the potential for losses

increased they found decreasing activity in these

reward-sensitive areas.

93.

Loss Aversion in MonkeysCapuchin monkeys were given 12 tokens that they

were allowed to trade with the experimenters for

either apple slices or grapes.

In one trial, the monkeys were given the

opportunity to trade tokens with one experimenter

for grapes and with another experimenter for apple

slices. One monkey, for example, traded 7 tokens

for grapes and 5 tokens for apple slices. A baseline

like this was established for each monkey so that

the scientists knew each monkey’s preferences.

94.

Trial #2: monkeys were given additional tokensto trade for food, only to discover that the price

of one of the food items had doubled.

According to the law of supply and

demand, the monkeys should now purchase

more of the relatively cheap food and less of the

relatively expensive food, and that is precisely

what they did.

In another trial in which the experimental

conditions were manipulated in such a way that

the monkeys had a choice of a 50% chance of a

gain or a 50% chance of a loss, the monkeys

were twice as averse to the loss as they were

motivated by the gain.

95.

Question: Why Didn’t RiskAversion Prevent the Financial

Meltdown?

Answer: Risk Signals were

removed in both the public &

private spheres.

96.

Risk Aversion & the Financial MeltdownFederal Reserve Intervention into the price of $$$

Interest Rate manipulation

Price & Wage Controls

Bailouts (signals that losses will be recovered by

someone else, thereby removing loss aversion)

Moral Hazards (government insulates investors and

corporations from risk, thereby removing risk

aversion): GM, Crystler, AIG

Example: Community Reinvestment Act, 1977, to

prevent “redlining” against minorities, led to

government intervention into the housing market

97.

How Financial InstitutionsLost Risk Aversion

(“Toxic”) Mortgage Backed Securities

Credit Default Swaps

Derivatives & Credit Derivatives

Lending agencies passing paper down the line:

A mortgage is given by a loan officer.

A thousand mortgages are bundled and sold as a

mortgage-backed security.

A thousand mortgage-back securities packaged and

sold as a collateral debt obligation (CDO).

A thousand CDOs packaged, sold, and secured

with credit default swaps.

98.

September 30, 1999 New York Times:“Fannie Mae Eases Credit To Aid

Mortgage Lending”

Fannie Mae began a program that

spring to encourage banks “to extend

home mortgages to individuals whose

credit is generally not good enough to

qualify for conventional loans.”

Why?

99.

September 30, 1999 New York Times:“Fannie Mae, the nation’s biggest

underwriter of home mortgages, has been

under increasing pressure from the Clinton

Administration to expand mortgage loans

among low and moderate income people

and felt pressure from stock holders to

maintain its phenomenal growth in profits.”

July, 1999, HUD forced Fannie &

Freddie to increase portfolio of loans to

lower and moderate-income borrowers

from 44% to 50% by 2001.

100.

There’s nothing wrong with taking higher risks,whether under political or profit pressure, as long

as you adjust for it by charging more. The higher

price acts as a risk signal to keep the market in

balance.

Under the new program, higher-risk people

with lower incomes, negligible savings, and poorer

credit ratings could now qualify for a mortgage that

was only one point above a conventional 30-year

fixed rate mortgage (and that added point was

dropped after 2 years of steady payments).

In other words, the normal risk signal sent to

high risk consumers—you can have the loan but

it’s going to cost you a lot more—was removed.

Lower the risk signal and you lower risk aversion.

101.

Entrepreneurial ErrorInvestors buy the wrong stock

Businessmen produce the wrong products

Consumers over-spend, especially during

holidays.

Drivers have accidents.

Ships sink.

Builders don’t meet deadlines.

Economists make false predictions.

Entrepreneurs cut corners, deceive

customers, & embezzle funds.

Economic failure, stupidity, &

incompetence are too common.

102.

Entrepreneurial Error“To make mistakes in pursuing

one’s ends is a widespread human

weakness.” —Ludwig von Mises

“As a rule only some businessmen

suffer losses at any one time; the

bulk either break even or earn

profits.”

—Murray Rothbard

103.

Entrepreneurial ErrorLeads to Business Cycles

104.

Entrepreneurial Error: Boom & Bust105.

Entrepreneurial Errors Level Out106.

Entrepreneurial Errors Level Out107.

Bureaucratic Error108.

Bureaucratic Error109.

Solutions to the Financial Crisis1. Allow the market to determine risk signals

2. Markets, not the Fed, must determine price of $$

3. Losses must be linked directly to those who

make financial decisions, from lenders to CEOs

4. No more bailouts! No one is “too big to fail”

5. No more: “In profits we’re capitalists, in losses

we’re socialists”

6. Evolution & Economics: “Extinction is the rule,

survival the exception.”

7. Economies must be allowed to flourish from the

bottom up, & cannot be controlled from top down

8. Free Trade w/well defined & enforced rules

110.

Bureaucratic Commandments111.

How to See the World Anew1. Think out of the box, change perspectives,

look for the gorilla

2. Look for new patterns, be playful, relaxed,

and see the bigger picture

3. Be curious, ask why, examine the

unexpected

3. Look for disconfirmatory evidence and

alternative explanations

4. Seek peer review, constructive criticism,

and feedback

5. Be willing to change your mind, to say “I

112.

113.

114.

115.

116.

117.

Law of Small NumbersLaw of Large Numbers

Regression to the Mean

Hindsight Bias

Framing Effects

Anchoring Fallacy

Loss Aversion

Sunk Cost Fallacy

Endowment Effect

География

География