Похожие презентации:

Waste to energy a redeemer for investors, ecologists & environmentalists

1.

WASTE TO ENERGYA

REDEEMER

FOR

INVESTORS, ECOLOGISTS & ENVIRONMENTALISTS

2.

INTRODUCTIONWaste is an inevitable product of society

One of the greatest challenges for future generations - how

to manage large quantities of waste in a sustainable way?

Till now global focus is to minimise the amount of waste

produced and to recycle larger fractions of waste materials.

Still considerable part of undesired end products.

More suitable solution than simple landfilling needs to be

found.

The Waste Management Sector needs to be integrated with

The Energy Sector to meet the growing energy demand.

Waste to be seen not only as an undesired product of

society, but also a valuable energy resource as well.

3.

GLOBAL WASTE SCENARIOGLOBAL WASTE MARKET – Over 32 Billion USD

Annual Growth – 5.5%

WTE technologies based on Thermal Energy Conversion

dominated the market accounting for 88.5% of the total

revenue in 2017.

Europe is the largest and most sophisticated market for WTE

technologies accounting for almost 46% of the total market

revenue.

BIOLOGICAL WTE technologies growth faster

Global Waste Generation expected to be 6 million tons /day

by 2025 and 11 million tons /day by 2050.

4.

Composition of Global MSWGlass

5%

Metal

4%

Organic

46%

Plastic

10%

The major fractions of solid waste

include paper, organic material,

plastics, glass, metal and textiles

As can be seen, nearly half of the

produced waste from society is

organic.

Paper

17%

Other

18%

Specific waste products deriving from

construction, industrial and

commercial waste are not specified in

this figure, but in some cases can

represent the majority of a region’s

waste production.

5.

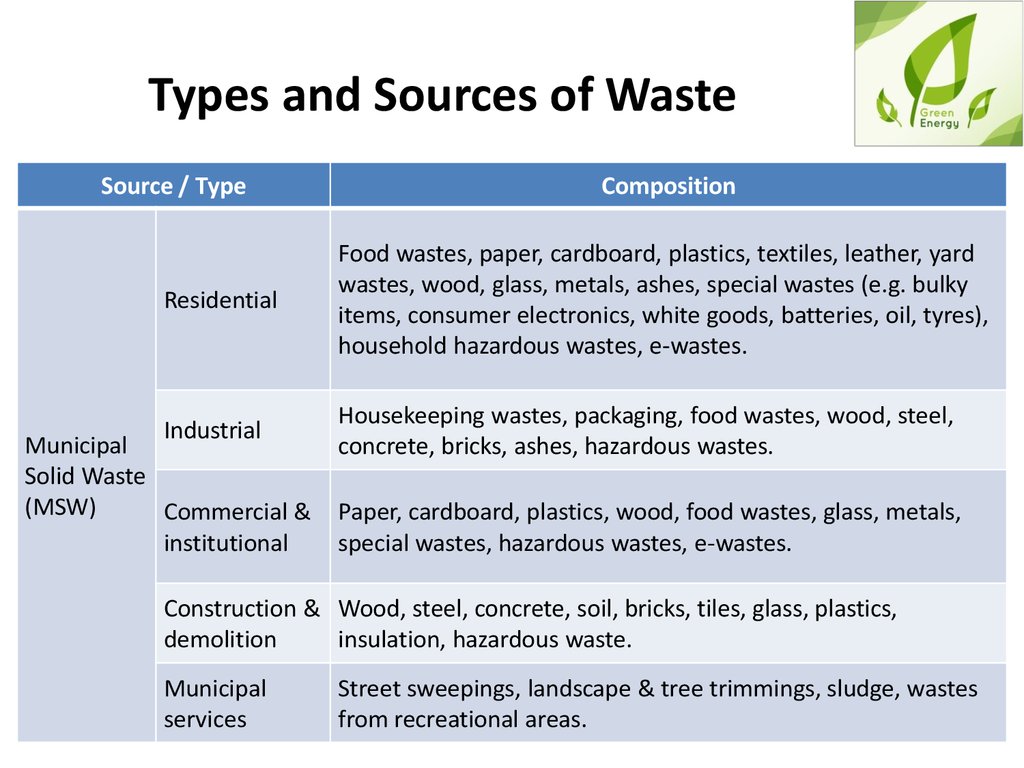

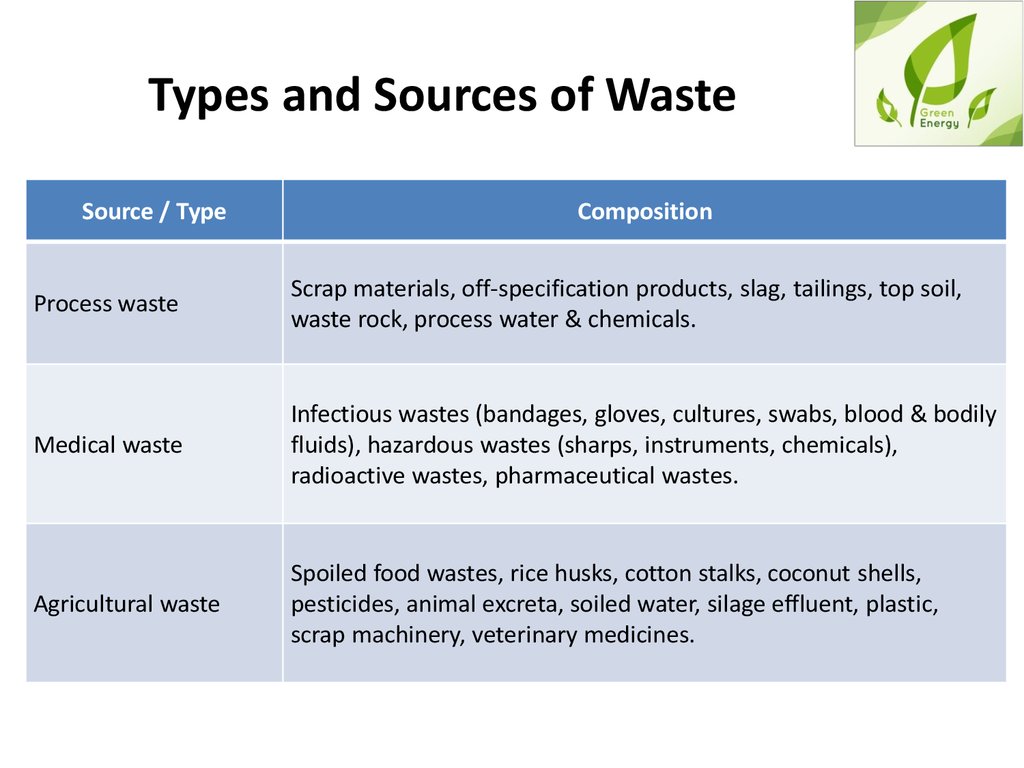

Types and Sources of WasteSource / Type

Composition

Residential

Food wastes, paper, cardboard, plastics, textiles, leather, yard

wastes, wood, glass, metals, ashes, special wastes (e.g. bulky

items, consumer electronics, white goods, batteries, oil, tyres),

household hazardous wastes, e-wastes.

Industrial

Housekeeping wastes, packaging, food wastes, wood, steel,

concrete, bricks, ashes, hazardous wastes.

Municipal

Solid Waste

(MSW)

Commercial &

institutional

Paper, cardboard, plastics, wood, food wastes, glass, metals,

special wastes, hazardous wastes, e-wastes.

Construction & Wood, steel, concrete, soil, bricks, tiles, glass, plastics,

demolition

insulation, hazardous waste.

Municipal

services

Street sweepings, landscape & tree trimmings, sludge, wastes

from recreational areas.

6.

Types and Sources of WasteSource / Type

Composition

Process waste

Scrap materials, off-specification products, slag, tailings, top soil,

waste rock, process water & chemicals.

Medical waste

Infectious wastes (bandages, gloves, cultures, swabs, blood & bodily

fluids), hazardous wastes (sharps, instruments, chemicals),

radioactive wastes, pharmaceutical wastes.

Agricultural waste

Spoiled food wastes, rice husks, cotton stalks, coconut shells,

pesticides, animal excreta, soiled water, silage effluent, plastic,

scrap machinery, veterinary medicines.

7.

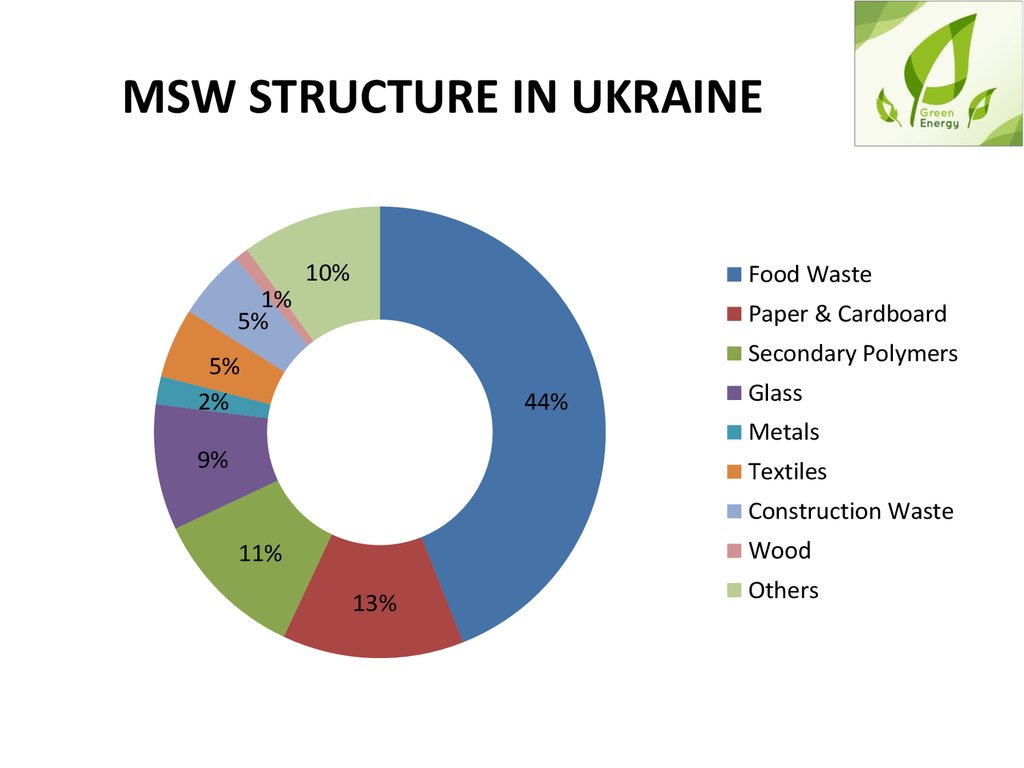

MSW STRUCTURE IN UKRAINE10%

Food Waste

1%

5%

Paper & Cardboard

Secondary Polymers

5%

2%

44%

Glass

Metals

9%

Textiles

Construction Waste

Wood

11%

13%

Others

8.

WTE Market DevelopmentKey Factors

Increase share of Renewable Energy

Reduce Green House Gas Emissions

Raise Environment Consciousness

Protect Environment from Hazards associated with

Landfilling

Advancement in WTE and Waste Management technologies.

9.

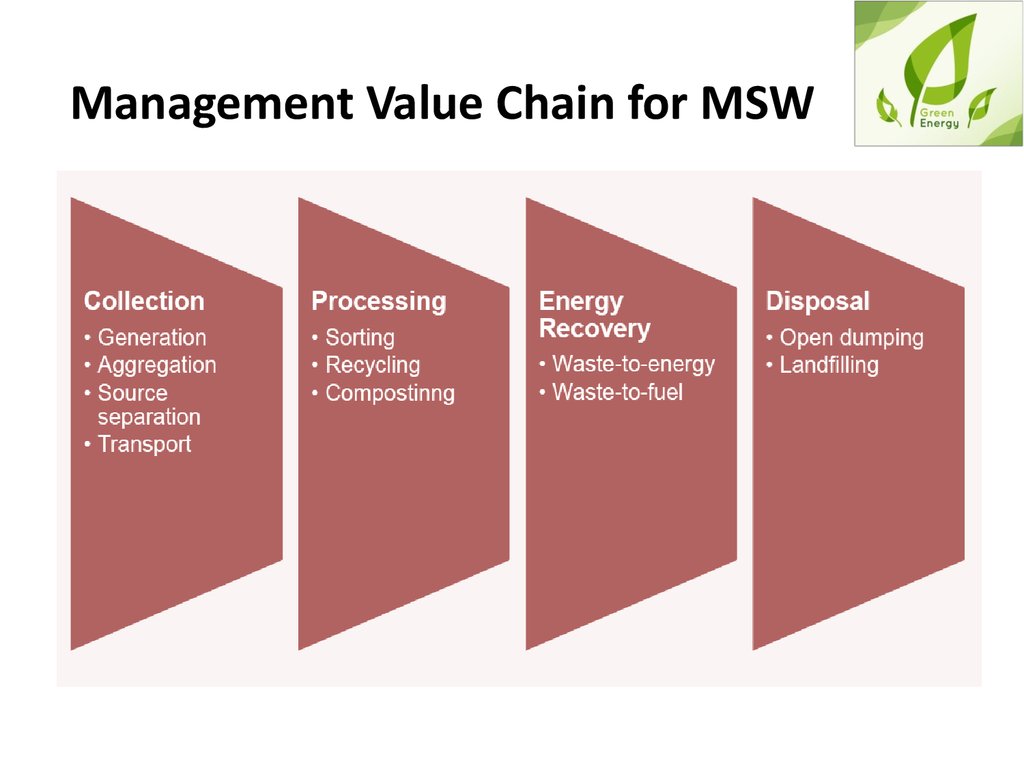

Management Value Chain for MSW10.

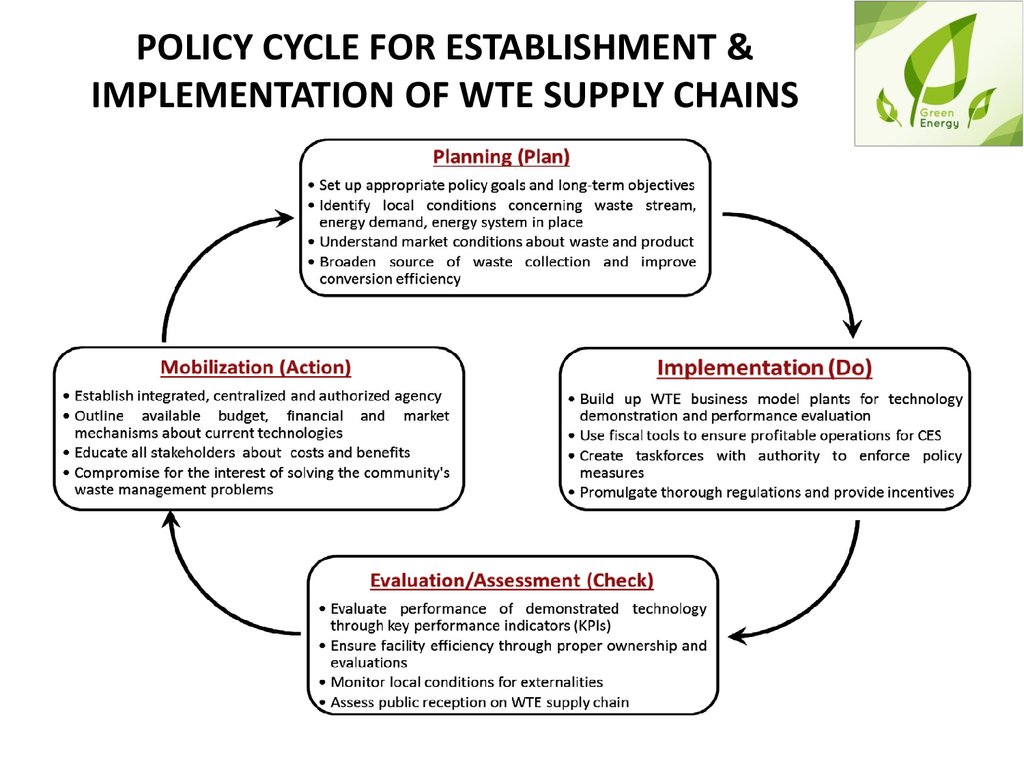

POLICY CYCLE FOR ESTABLISHMENT &IMPLEMENTATION OF WTE SUPPLY CHAINS

11.

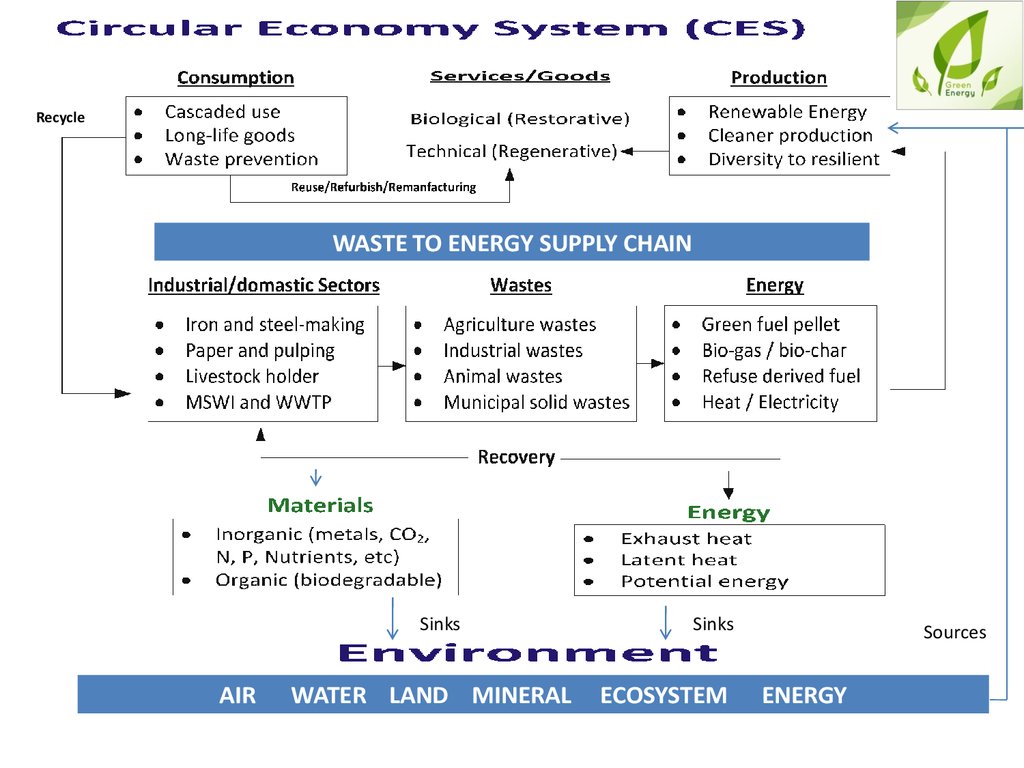

RecycleWASTE TO ENERGY SUPPLY CHAIN

Sinks

AIR

WATER LAND MINERAL

Sinks

ECOSYSTEM

Sources

ENERGY

12.

TECHNO COMMERCIAL ASPECTSCOST OF INSTALLATION (COI)

OPERATION and MAINTENANCE COST – O&M

WASTE HANDLING and TREATMENT COST – WTB

PRICE OF ELECTRICITY

OTHER COSTS

CER’s

13.

Waste Management Hierarchy14.

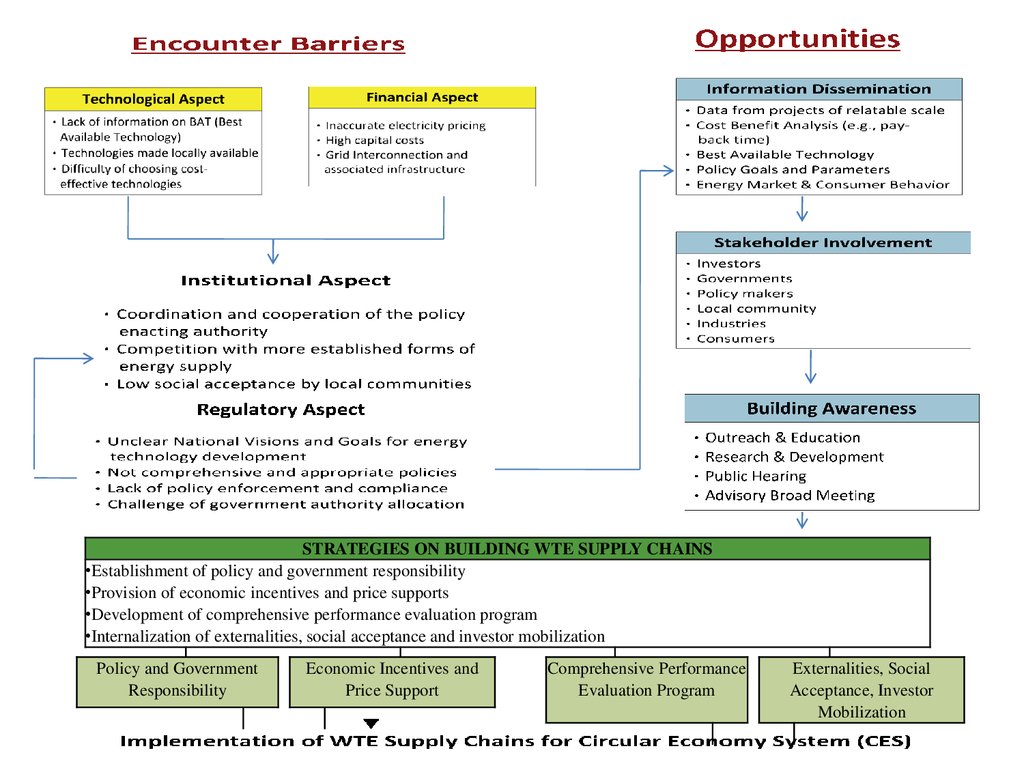

STRATEGIES ON BUILDING WTE SUPPLY CHAINS•Establishment of policy and government responsibility

•Provision of economic incentives and price supports

•Development of comprehensive performance evaluation program

•Internalization of externalities, social acceptance and investor mobilization

Policy and Government

Responsibility

Economic Incentives and

Price Support

Comprehensive Performance

Evaluation Program

Externalities, Social

Acceptance, Investor

Mobilization

15.

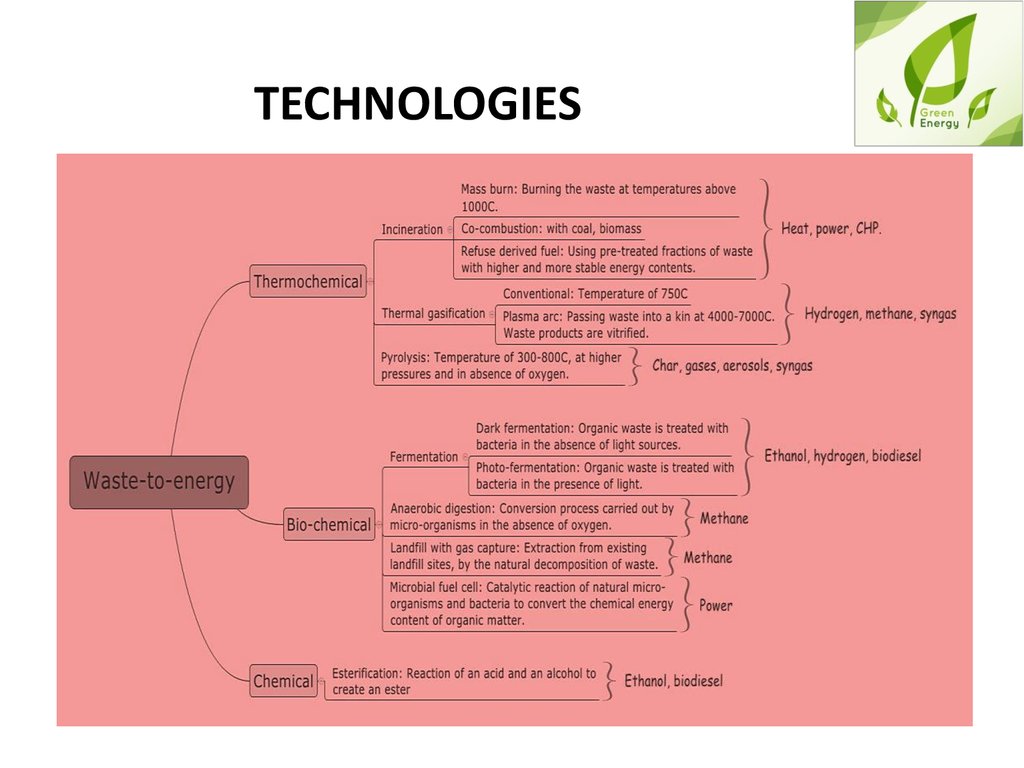

TECHNOLOGIES16.

TECHNOLOGY TREE OF WTE SUPPLYCHAIN FOR BIOENERGY UTILIZATION

17.

CRITERIA for WTE ADOPTIONWaste as a Fuel

Nature and volume of the incoming waste stream.

Energy content (calorific value) of the waste

WtE incineration should only be considered if the incoming waste

stream has an average net calorific value of at least 7 MJ/kg (i.e.

combustion process is self-sustaining).

For optimal operation of the plant, the supply of combustible MSW

should at least amount to 100,000 tonnes/year.

Seasonal changes in waste quality (holidays and festivals) impact

waste quality

For countries where waste has significant water content and the

organic fraction of the waste is relatively high and sophisticated waste

collection and transportation structures are not in place, biochemical

methods of energy conversion should be the preferred option.

18.

APPLICATIONSElectricity

Indirect Generation – Waste – Heat – Steam – Electric Power

Efficiency level - 15% to 27%

Incineration Efficiency higher than Gasification

Heat

Waste combustion / Syn Gas – Steam

Upgrade of syngas to methane and injected in the gas network for utilization

in domestic boilers.

CHP

Heat and Power combined increases cycle efficiency to 40%

Proportion of Heat and Power chosen depending on the need.

District heating / Industrial Heat and Power is a typical example.

Transport Fuels

Syngas used in Engines upgraded to bio-methane

Syn Gas – Synthetic Fuel, Jet Fuel, Hydrogen, Ethanol, Bio Diesel

Syn Gas by Advanced Pyrolysis – Oil which by further treatment – Petrol and

Diesel

Purification of Syn Gas is a costly process

19.

Green Supply Chain for resource and heating supply center utilizing green fuelpellets

20.

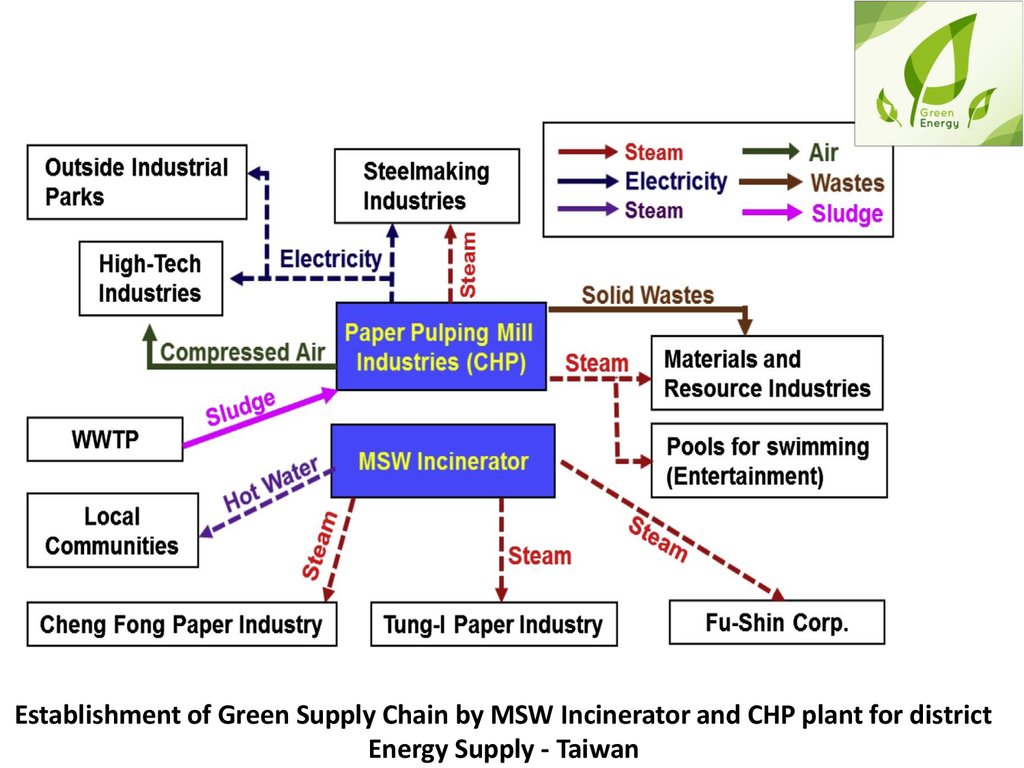

Establishment of WTE supply chain in pulping industry wastes utilized in CHP plantsTaiwan

21.

Establishment of Green Supply Chain by MSW Incinerator and CHP plant for districtEnergy Supply - Taiwan

22.

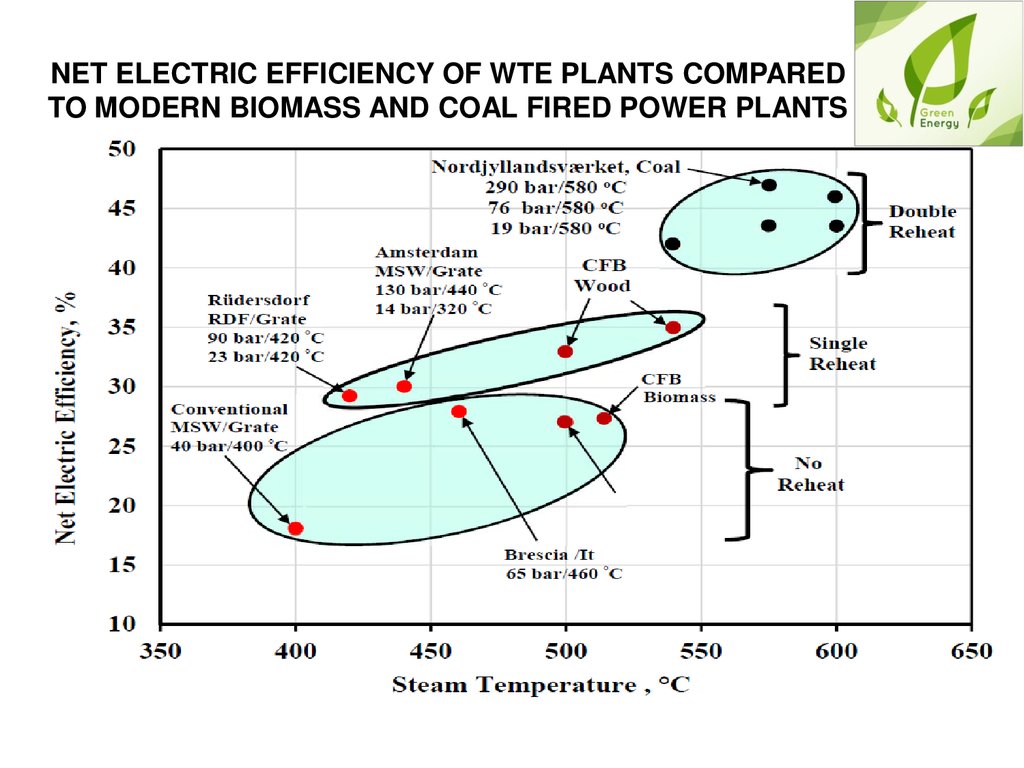

NET ELECTRIC EFFICIENCY OF WTE PLANTS COMPAREDTO MODERN BIOMASS AND COAL FIRED POWER PLANTS

23.

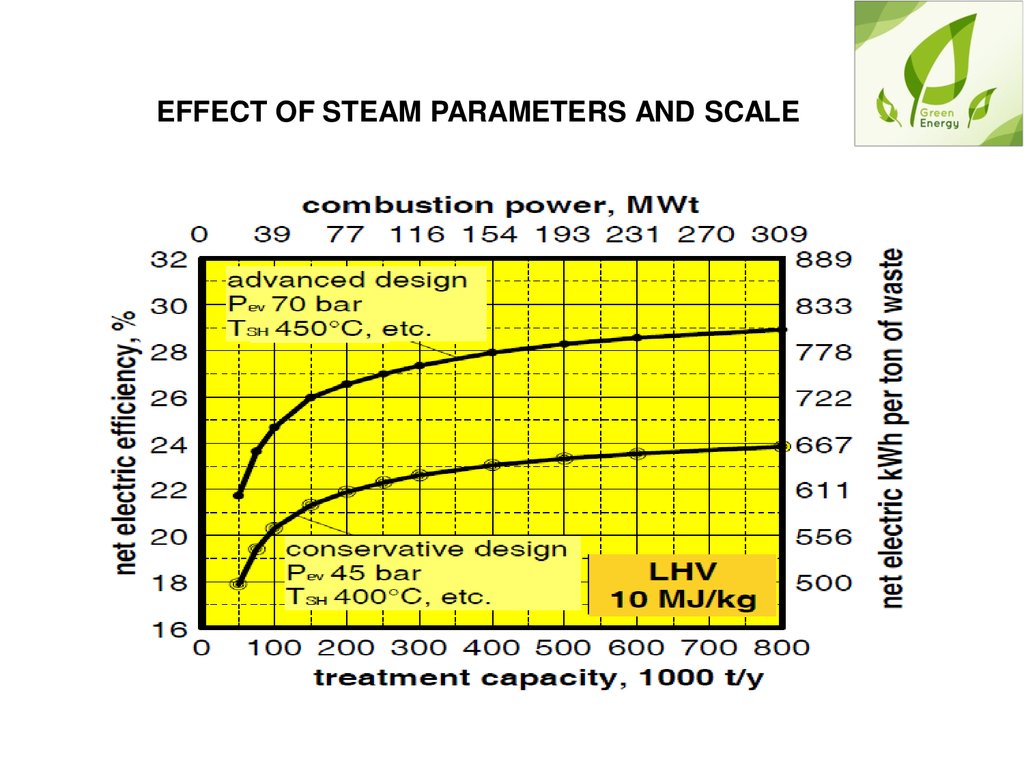

EFFECT OF STEAM PARAMETERS AND SCALE24.

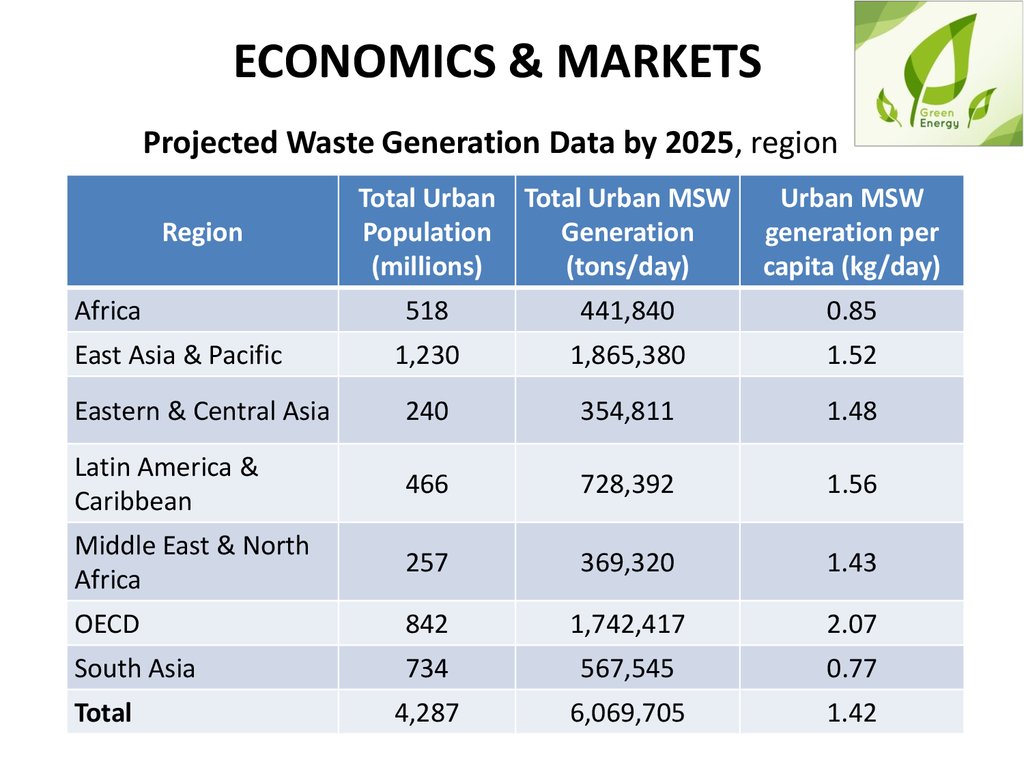

ECONOMICS & MARKETSProjected Waste Generation Data by 2025, region

Total Urban

Population

(millions)

Total Urban MSW

Generation

(tons/day)

Urban MSW

generation per

capita (kg/day)

518

441,840

0.85

1,230

1,865,380

1.52

Eastern & Central Asia

240

354,811

1.48

Latin America &

Caribbean

466

728,392

1.56

Middle East & North

Africa

257

369,320

1.43

OECD

842

1,742,417

2.07

South Asia

734

567,545

0.77

4,287

6,069,705

1.42

Region

Africa

East Asia & Pacific

Total

25.

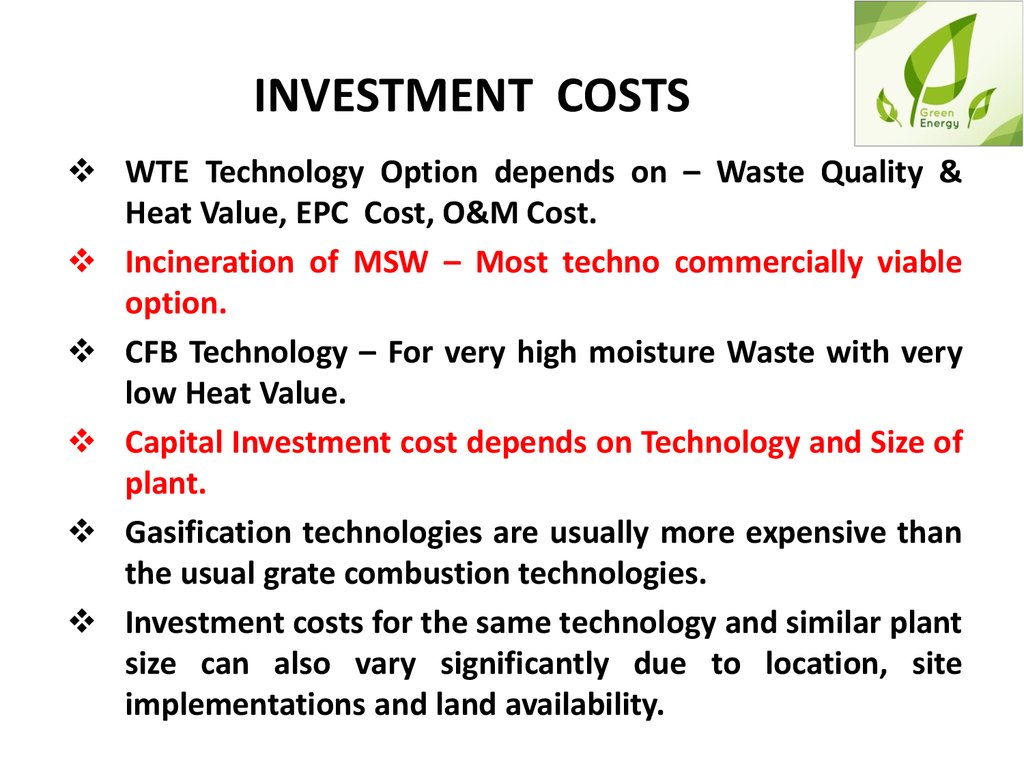

INVESTMENT COSTSWTE Technology Option depends on – Waste Quality &

Heat Value, EPC Cost, O&M Cost.

Incineration of MSW – Most techno commercially viable

option.

CFB Technology – For very high moisture Waste with very

low Heat Value.

Capital Investment cost depends on Technology and Size of

plant.

Gasification technologies are usually more expensive than

the usual grate combustion technologies.

Investment costs for the same technology and similar plant

size can also vary significantly due to location, site

implementations and land availability.

26.

Capital Costs for Thermal WTE PowerGeneration Technologies (15 MW Output)

27.

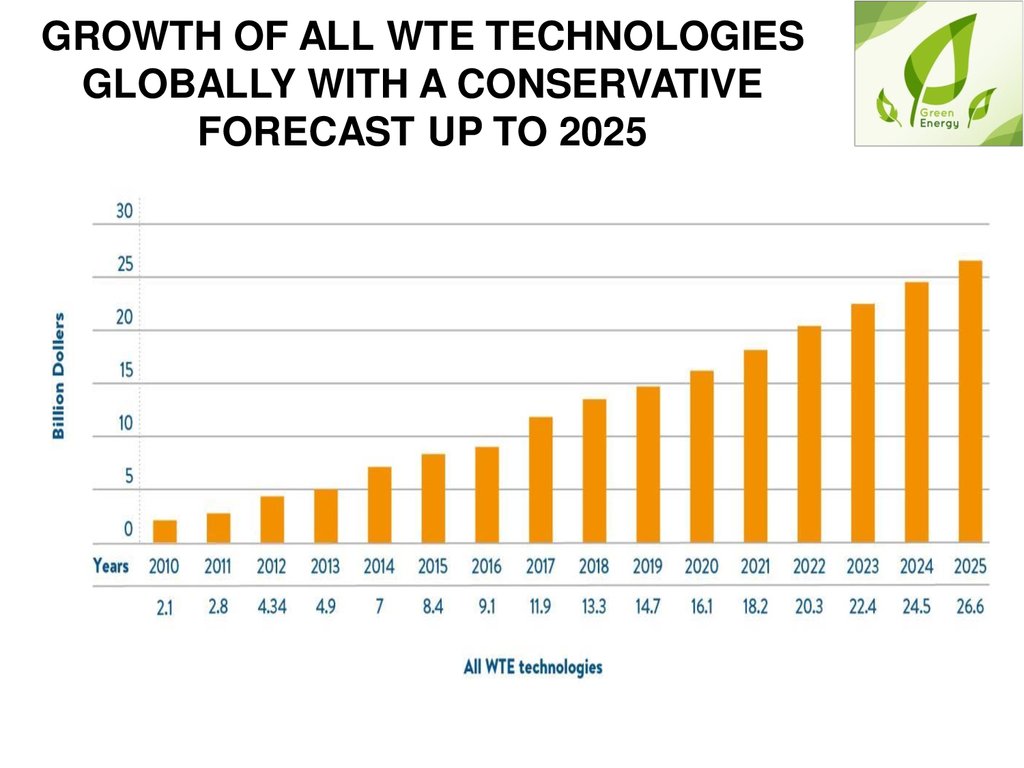

GROWTH OF ALL WTE TECHNOLOGIESGLOBALLY WITH A CONSERVATIVE

FORECAST UP TO 2025

28.

SOCIO ECONOMICSROLE OF GOVERNMENT

Regulations and Targets

Incentives

1.

2.

3.

4.

Energy Production

Tipping Fees

Power Purchase Price

Material Recovery

SOCIO ECONOMIC IMPACTS

SOCIO ECONOMIC BENEFITS

SAFETY

29.

EMISSIONSPARTICULATE MATTER

O3

CO

SOx

NOx

Non- Methane Volatile

(NMVOC)

HYDROCARBONS – CxHy

DIOXINS

Organic

Compounds

30.

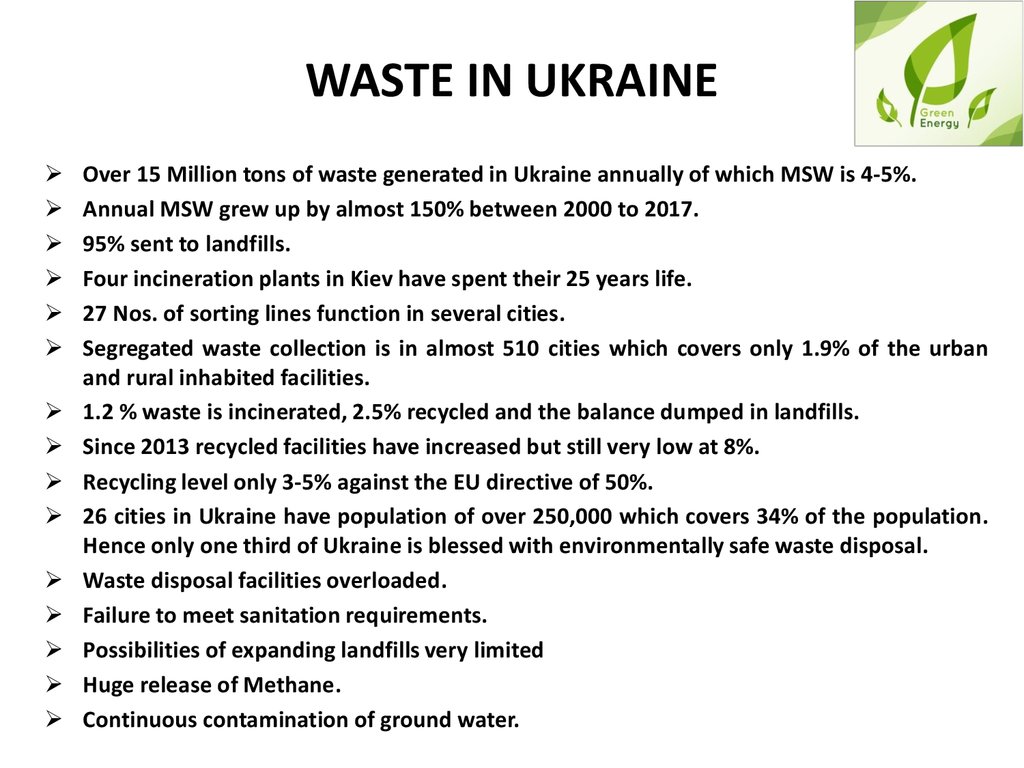

WASTE IN UKRAINEOver 15 Million tons of waste generated in Ukraine annually of which MSW is 4-5%.

Annual MSW grew up by almost 150% between 2000 to 2017.

95% sent to landfills.

Four incineration plants in Kiev have spent their 25 years life.

27 Nos. of sorting lines function in several cities.

Segregated waste collection is in almost 510 cities which covers only 1.9% of the urban

and rural inhabited facilities.

1.2 % waste is incinerated, 2.5% recycled and the balance dumped in landfills.

Since 2013 recycled facilities have increased but still very low at 8%.

Recycling level only 3-5% against the EU directive of 50%.

26 cities in Ukraine have population of over 250,000 which covers 34% of the population.

Hence only one third of Ukraine is blessed with environmentally safe waste disposal.

Waste disposal facilities overloaded.

Failure to meet sanitation requirements.

Possibilities of expanding landfills very limited

Huge release of Methane.

Continuous contamination of ground water.

31.

UKRECORESOURSYState owned enterprise for management of waste as

secondary raw material.

Ensures appropriate functioning of collection, preservation

and utilization of waste.

Ongoing analysis and refinement of existing systems

Monitoring of utilization rates in containers.

Implementation of environment safety principles.

Huge initiatives taken to produce top class polyethylene

tere-phthalate (PET) flocks and polypropylene granules from

recycling.

32.

NATIONAL PROJECTCLEAN CITY

Target to upgrade MSW management system

Construction of 10 recycling complexes in Kyiv, Kharkiv, Dnipropetrovsk,

Chernivtsi, Ternopil, Khmelnytskyi, Lviv, Sumy, Dnipropetrovsk, Donetsk and

Lugansk.

Public – Private Partnership model to be considered.

Legislation proposed that from January 2018 only waste after primary recycling

and incineration can be disposed.

National Waste Management Program 2013-2020 approved by Govt. of

Ukraine.

Introduce new technologies

Implementation of measures for decreasing volume of waste

Grant of 466 million Euros out of which 37% will be financed from Sate budget

and 63% from local budgets.

First phase would focus on removal of dangerous toxic waste.

Second phase would focus on creation of modern infrastructure for waste

management.

33.

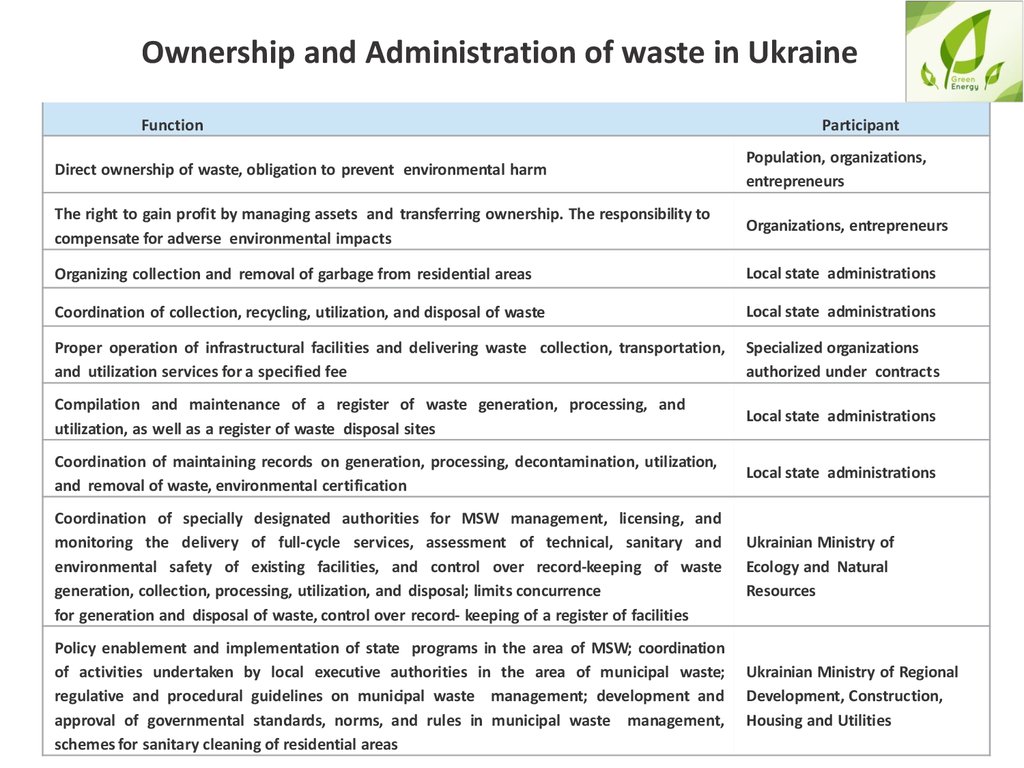

Ownership and Administration of waste in UkraineFunction

Participant

Direct ownership of waste, obligation to prevent environmental harm

Population, organizations,

entrepreneurs

The right to gain profit by managing assets and transferring ownership. The responsibility to

compensate for adverse environmental impacts

Organizations, entrepreneurs

Organizing collection and removal of garbage from residential areas

Local state administrations

Coordination of collection, recycling, utilization, and disposal of waste

Local state administrations

Proper operation of infrastructural facilities and delivering waste collection, transportation,

and utilization services for a specified fee

Specialized organizations

authorized under contracts

Compilation and maintenance of a register of waste generation, processing, and

utilization, as well as a register of waste disposal sites

Local state administrations

Coordination of maintaining records on generation, processing, decontamination, utilization,

and removal of waste, environmental certification

Local state administrations

Coordination of specially designated authorities for MSW management, licensing, and

monitoring the delivery of full-cycle services, assessment of technical, sanitary and

environmental safety of existing facilities, and control over record-keeping of waste

generation, collection, processing, utilization, and disposal; limits concurrence

for generation and disposal of waste, control over record- keeping of a register of facilities

Ukrainian Ministry of

Ecology and Natural

Resources

Policy enablement and implementation of state programs in the area of MSW; coordination

of activities undertaken by local executive authorities in the area of municipal waste;

regulative and procedural guidelines on municipal waste management; development and

approval of governmental standards, norms, and rules in municipal waste management,

schemes for sanitary cleaning of residential areas

Ukrainian Ministry of Regional

Development, Construction,

Housing and Utilities

34.

Waste Market Structure in UkraineCoordination of

waste management:

the current state

An operator selected in a

municipal or regional

bidding may experience

difficulties entering the

market

Garbage collection and

transportation operators are

already working directly

with owners

Population, organizations,

entrepreneurs and enterprises

Enterprises determine of their

own which operator to work

with

35.

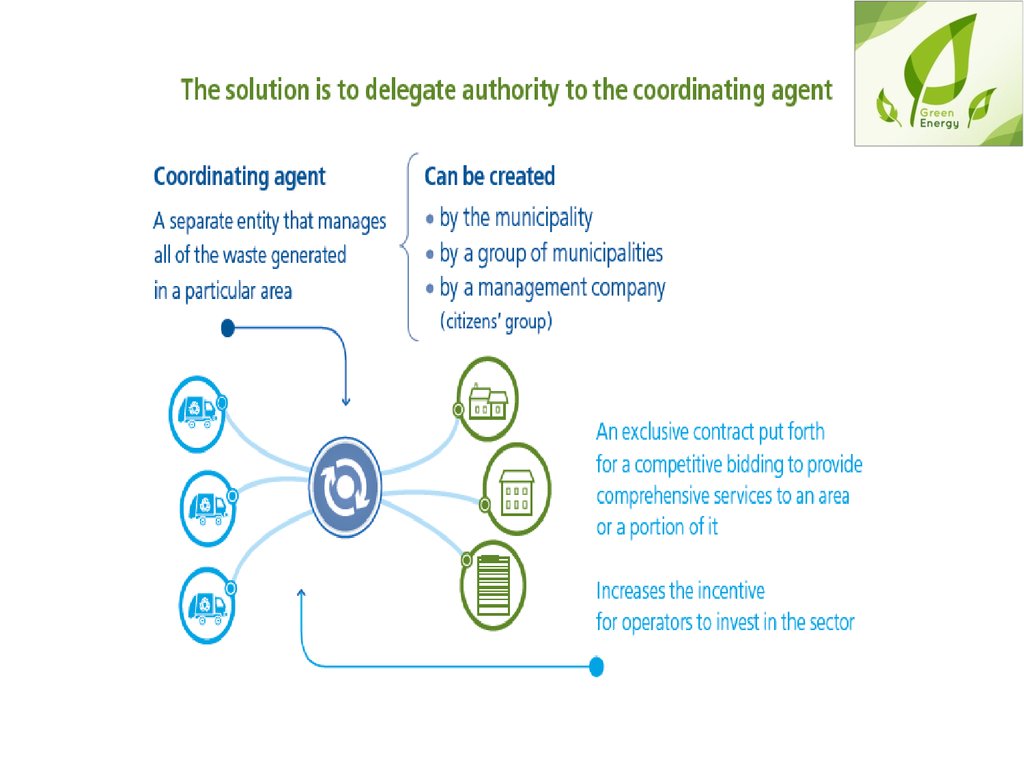

36.

37.

38.

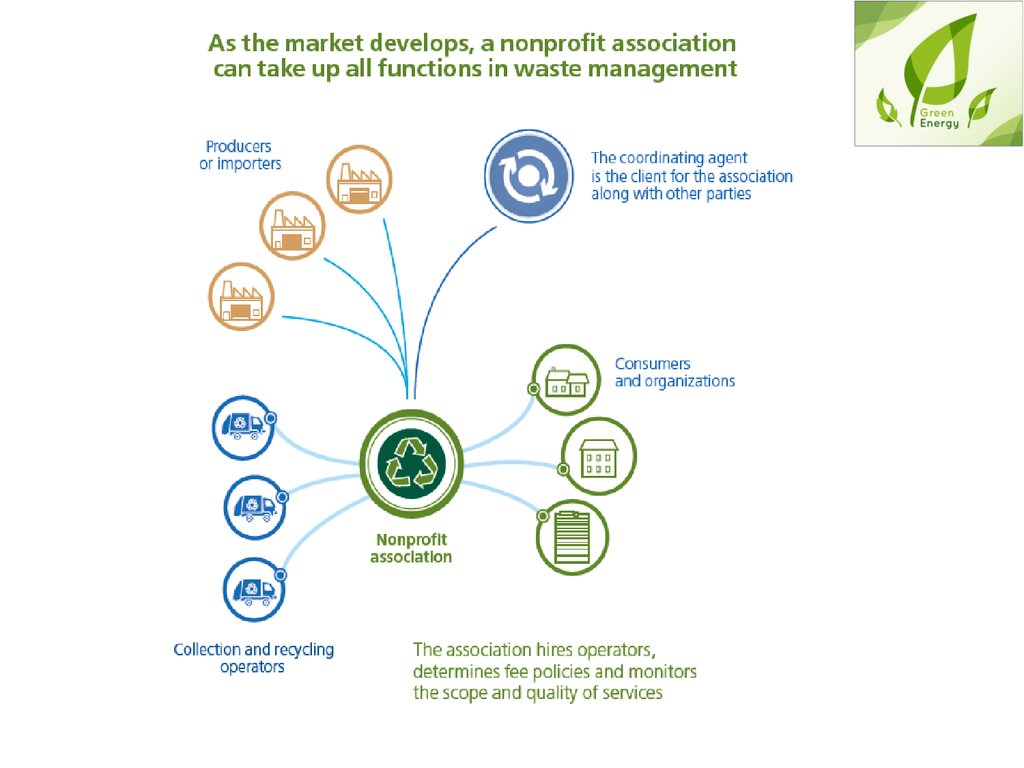

ACTIONS REQUIREDCreating Economic Incentives and Funding Mechanism for

Developing Waste Recycling System.

Invite Developers to Set up Waste to Energy plants on BOT

basis within a reasonable Gate Fee and Green Tariff Regime.

Landfill Gas Utilization to produce Electricity or Heat.

Creating Efficient Data Support System for Decision Making.

Setting up of a Coordinating Agent like Green Dot

organizations and delegating authority.

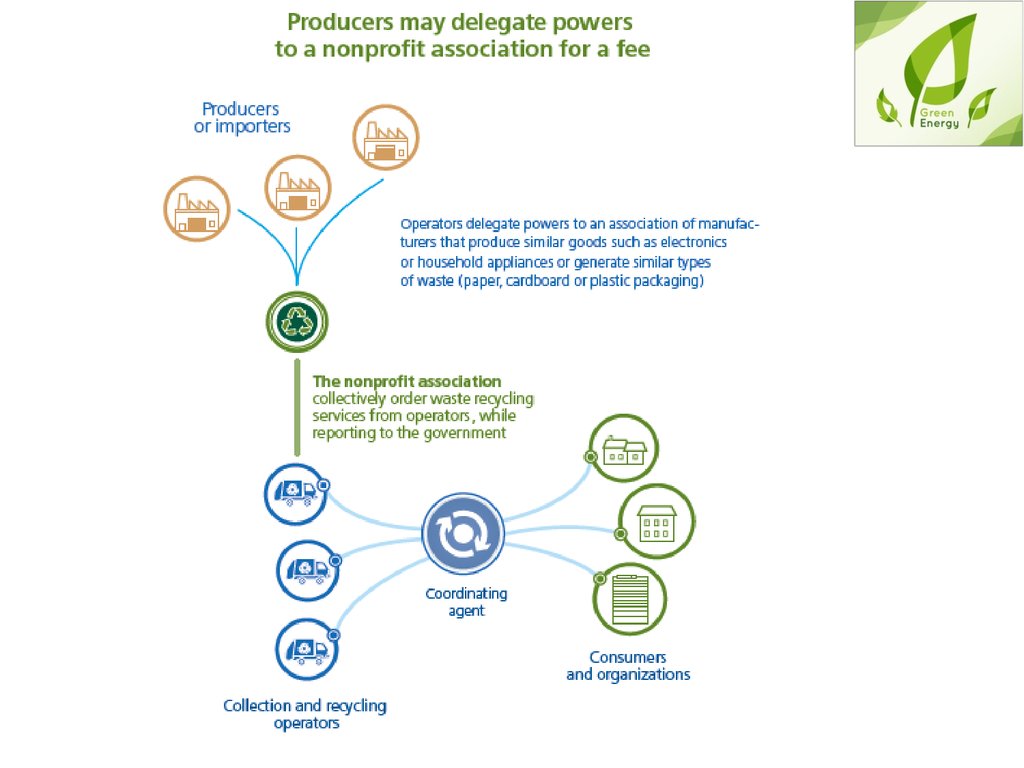

Producers to delegate powers to non-profit organizations for

a fee.

39.

Changes Needed to Ensure InnovativeAdvancement of the MSW Sector in Ukraine

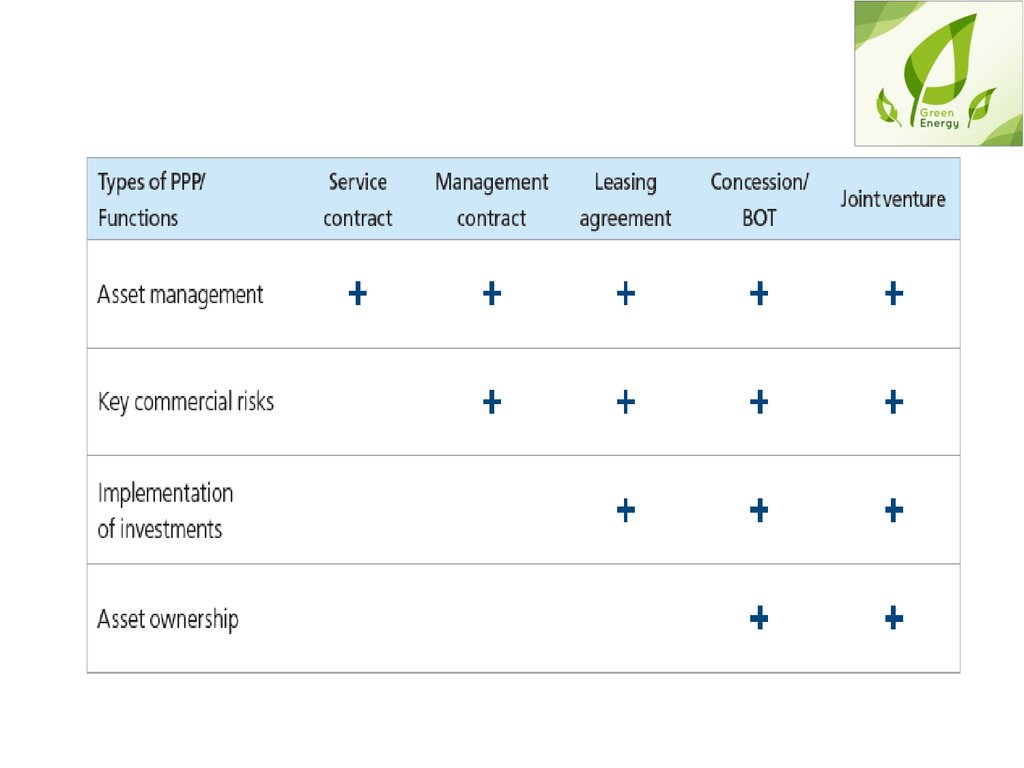

Improvement in Systems of Fees and Payments.

Programmatic and Goal Oriented Approach to Waste Management

Implementing Extended Producer Responsibility (EPR).

Optimal implementation of PPP and IPP projects in the MSW

sector.

Using Data to guide reforms.

Informing the public.

Legal Framework.

Institutional Framework.

Implementation / Enforcement of laws.

Sector Financing.

National Agency for Waste Management.

EPR / Green Dot.

Compulsory Use of / Connection to Main Municipal Services.

Pricing.

40.

41.

42.

43.

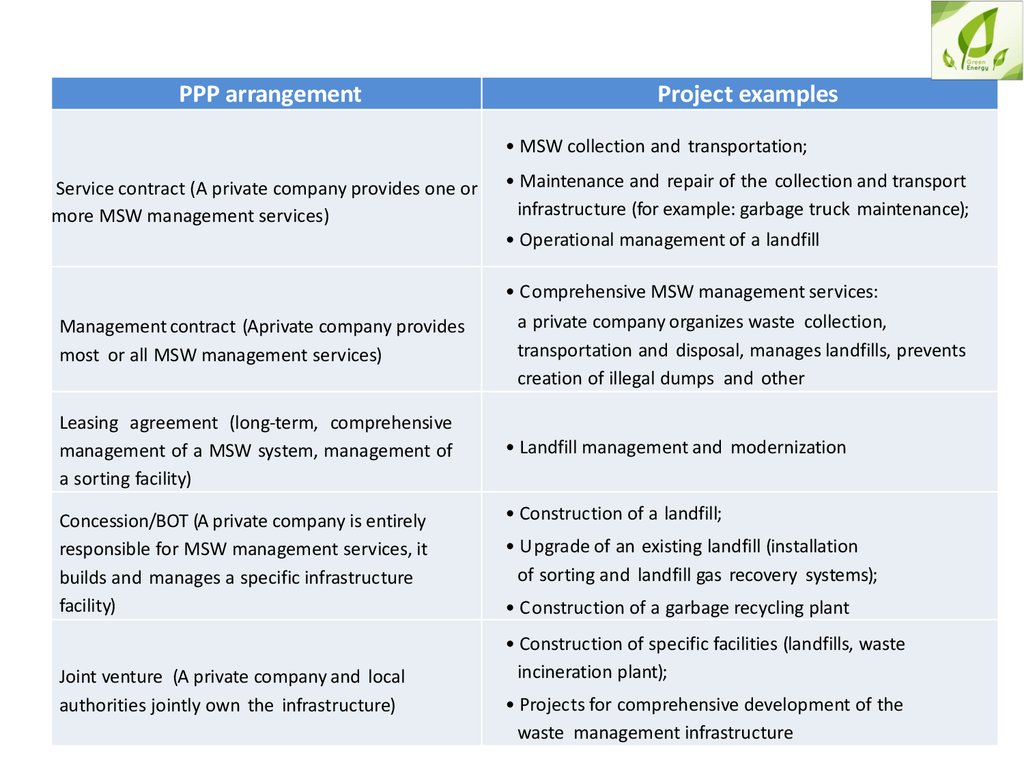

PPP arrangementProject examples

• MSW collection and transportation;

Service contract (A private company provides one or

more MSW management services)

• Maintenance and repair of the collection and transport

infrastructure (for example: garbage truck maintenance);

• Operational management of a landfill

• Comprehensive MSW management services:

Management contract (Aprivate company provides

most or all MSW management services)

Leasing agreement (long-term, comprehensive

management of a MSW system, management of

a sorting facility)

Concession/BOT (A private company is entirely

responsible for MSW management services, it

builds and manages a specific infrastructure

facility)

Joint venture (A private company and local

authorities jointly own the infrastructure)

a private company organizes waste collection,

transportation and disposal, manages landfills, prevents

creation of illegal dumps and other

• Landfill management and modernization

• Construction of a landfill;

• Upgrade of an existing landfill (installation

of sorting and landfill gas recovery systems);

• Construction of a garbage recycling plant

• Construction of specific facilities (landfills, waste

incineration plant);

• Projects for comprehensive development of the

waste management infrastructure

44.

WTEENTERPRENEUR

Экология

Экология