Похожие презентации:

Comparative analysis of the budgets of the two countries: the UK and Russia

1. Comparative analysis of the budgets of the two countries: the UK and Russia

Katya GerasimovaViktoria Ivchenko

2.

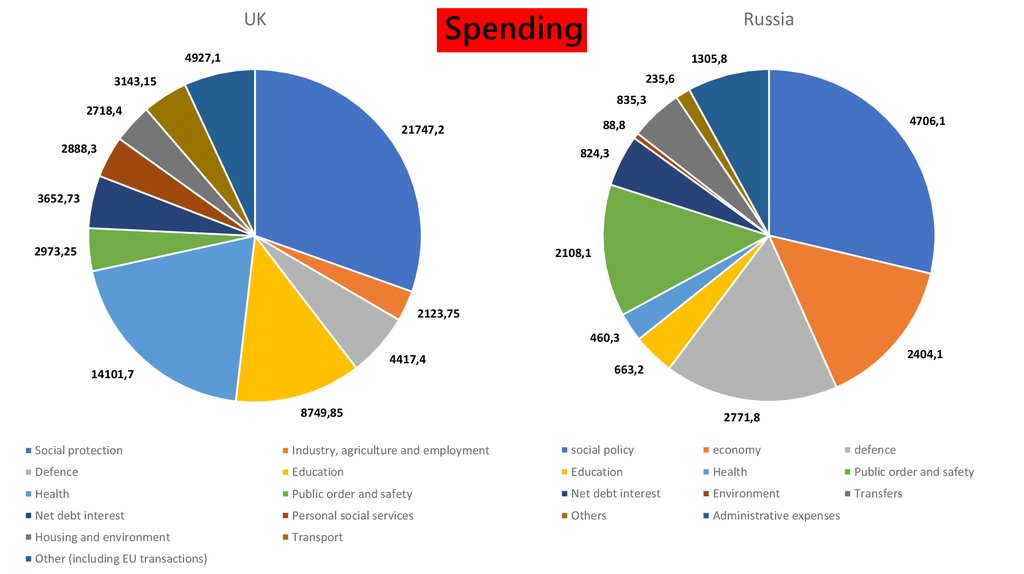

SpendingUK

Russia

4927,1

1305,8

235,6

3143,15

835,3

2718,4

2888,3

4706,1

88,8

21747,2

824,3

3652,73

2973,25

2108,1

2123,75

460,3

2404,1

4417,4

663,2

14101,7

8749,85

2771,8

Social protection

Industry, agriculture and employment

social policy

economy

defence

Defence

Education

Education

Health

Public order and safety

Health

Public order and safety

Net debt interest

Environment

Transfers

Net debt interest

Personal social services

Others

Administrative expenses

Housing and environment

Transport

Other (including EU transactions)

3.

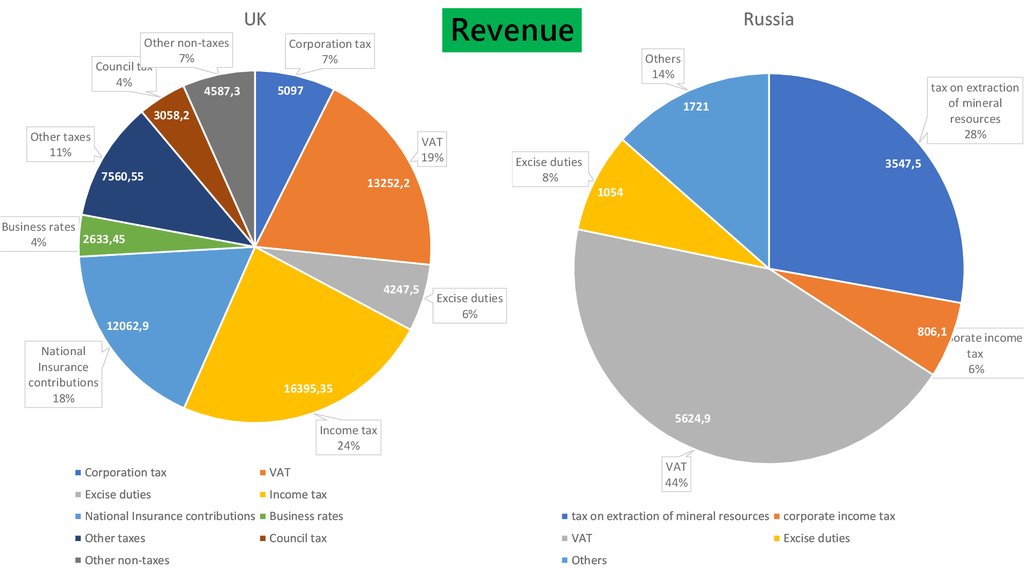

UKOther non-taxes

7%

Council tax

4%

4587,3

Russia

Revenue

Corporation tax

7%

Others

14%

tax on extraction

of mineral

resources

28%

5097

1721

3058,2

Other taxes

11%

VAT

19%

7560,55

13252,2

Excise duties

8%

3547,5

1054

Business rates

2633,45

4%

4247,5

12062,9

National

Insurance

contributions

18%

Excise duties

6%

806,1

corporate income

tax

6%

16395,35

5624,9

Income tax

24%

VAT

44%

Corporation tax

VAT

Excise duties

Income tax

National Insurance contributions

Business rates

tax on extraction of mineral resources

corporate income tax

Other taxes

Council tax

VAT

Excise duties

Other non-taxes

Others

4. BUDGET 2018:

https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/752202/Budget_2018_r

ed_web.pdf

https://www.minfin.ru/common/upload/library/2017/12/main

/BDG_2018_FINAL.pdf

http://investorschool.ru/rejting-stran-po-vvp-2018

References

Экономика

Экономика