Похожие презентации:

Tax avoidance

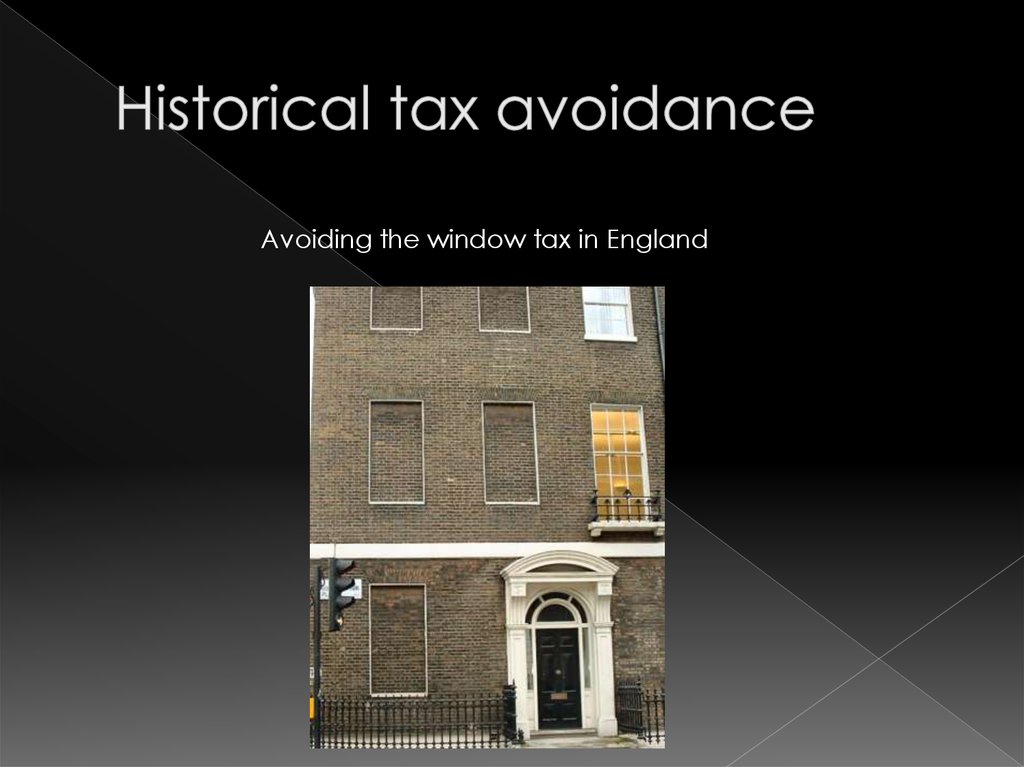

1. Tax avoidance

2. Introduce

3. General Anti-Avoidance Rule

4. Methods

Country of residence&

5. Methods

Double taxationIncome is earned again

in CoR

Income is earned

Taxing

nonresidents

6. Methods

Legal entities7. Methods

Legal vaguenessTax results depend on definitions of legal terms which are usually vague

vagueness

personal

expenses

business

expenses

8. Methods

Tax sheltersTax shelters are investments that allow a

reduction in one's income tax liability

9. Tax avoiders: UK

HMRC estimates that the overall cost of taxavoidance in the UK in 2013-14 was £2.7 billion,

of which £1.4 billion was loss of income tax

Право

Право