Похожие презентации:

Profit tax from legal entities. Topic 4

1.

Bukhara State UniversityDepartment of Economics

Topic 4:

PROFIT TAX FROM LEGAL

ENTITIES

(2 hours)

2.

PLAN:1) Economic nature and importance of the profit

tax from legal entities.

2) Payers of profit tax from legal entities, the

object of taxation and the procedure for forming

the tax base.

3) Profit tax benefits and profit tax rates for

legal entities.

4) Procedure for calculation of profit tax from

legal entities and payment of tax.

3.

Economic nature and importance of the profit taxfrom legal entities

Profit as an economic category represents the net income created

in the course of business activity. Profit is the last financial result of

economic entities operating on a commercial basis, and is one of the

main financial sources of the state budget, as well as the main goal

of business activity.

When prices are stable, the increase in profit indicates that the

company is operating efficiently. The increase in the profit volume

expands the financial potential of the enterprise, the development of

production, and the opportunities for financial incentives for workers

and employees.

The profit tax collected from legal entities is a direct tax by its

essence, and a state tax according to the budget.

4.

Economic nature and importance of the profittax from legal entities

The essence of the profit tax is reflected in the financial relations

in the process of taxing the profits of legal entities and charging a

part of their profits to the budget.

The profit of legal entities is determined based on the procedure

for the formation of financial results specified in the accounting

legislation.

Income (profit) tax from legal entities was introduced on the basis

of the Law "On Taxes from Enterprises, Associations and

Organizations" dated February 15, 1991, and has been levied as an

income tax since 1992.

5.

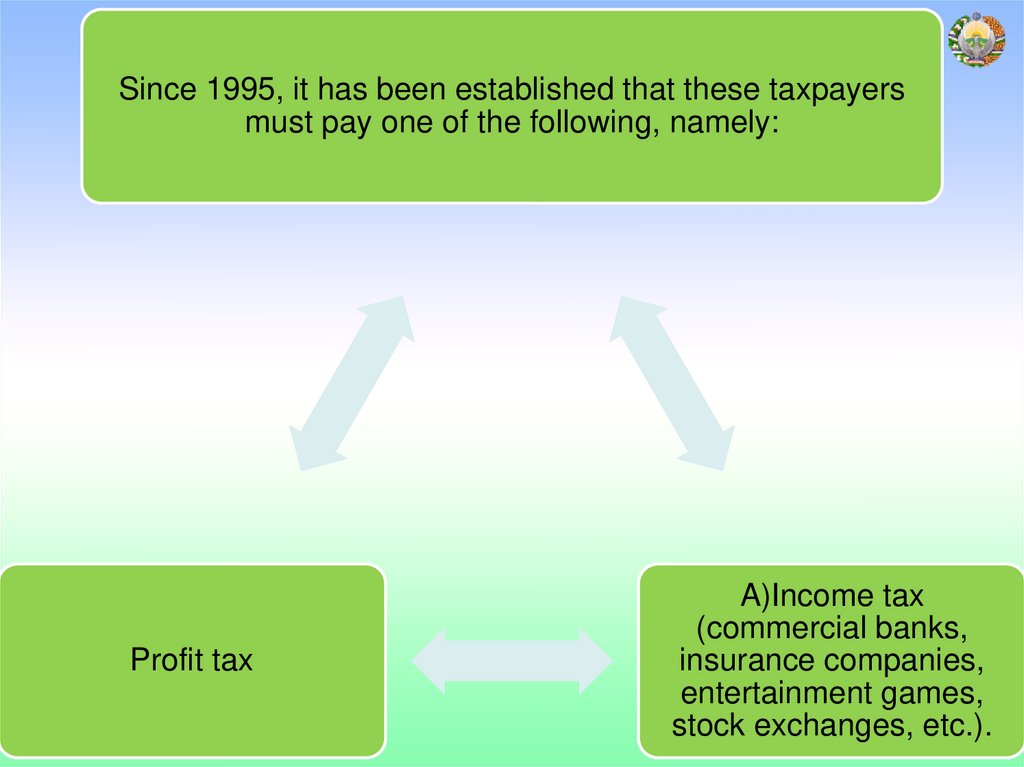

Since 1995, it has been established that these taxpayersmust pay one of the following, namely:

Profit tax

A)Income tax

(commercial banks,

insurance companies,

entertainment games,

stock exchanges, etc.).

6.

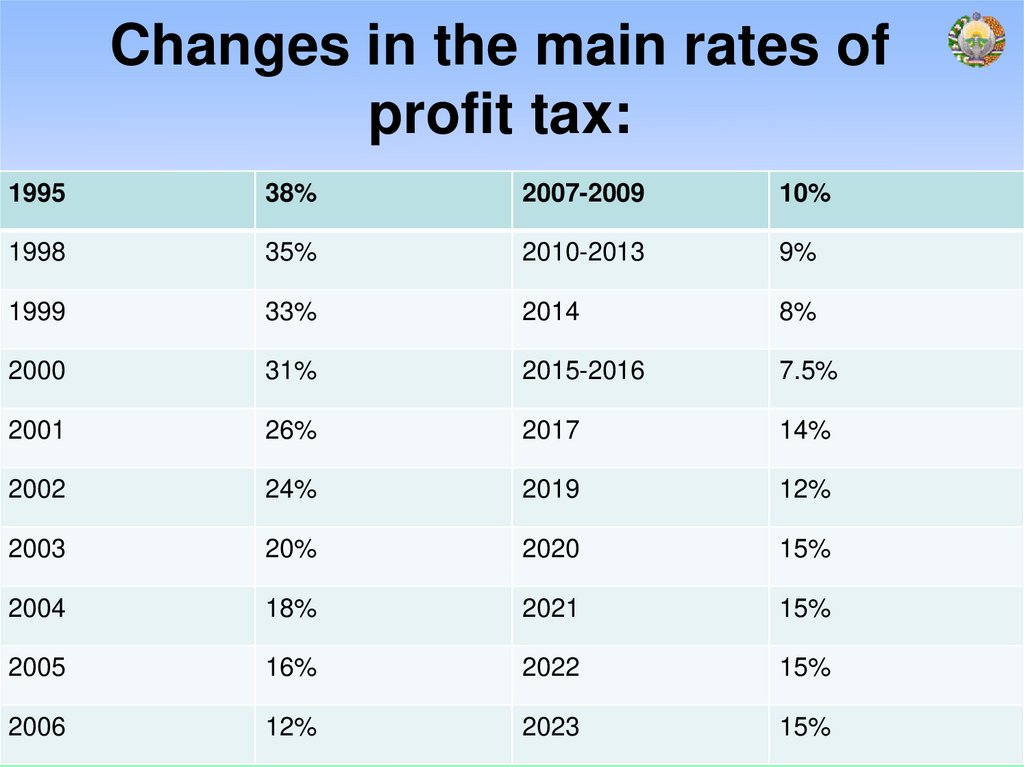

Changes in the main rates ofprofit tax:

1995

38%

2007-2009

10%

1998

35%

2010-2013

9%

1999

33%

2014

8%

2000

31%

2015-2016

7.5%

2001

26%

2017

14%

2002

24%

2019

12%

2003

20%

2020

15%

2004

18%

2021

15%

2005

16%

2022

15%

2006

12%

2023

15%

7.

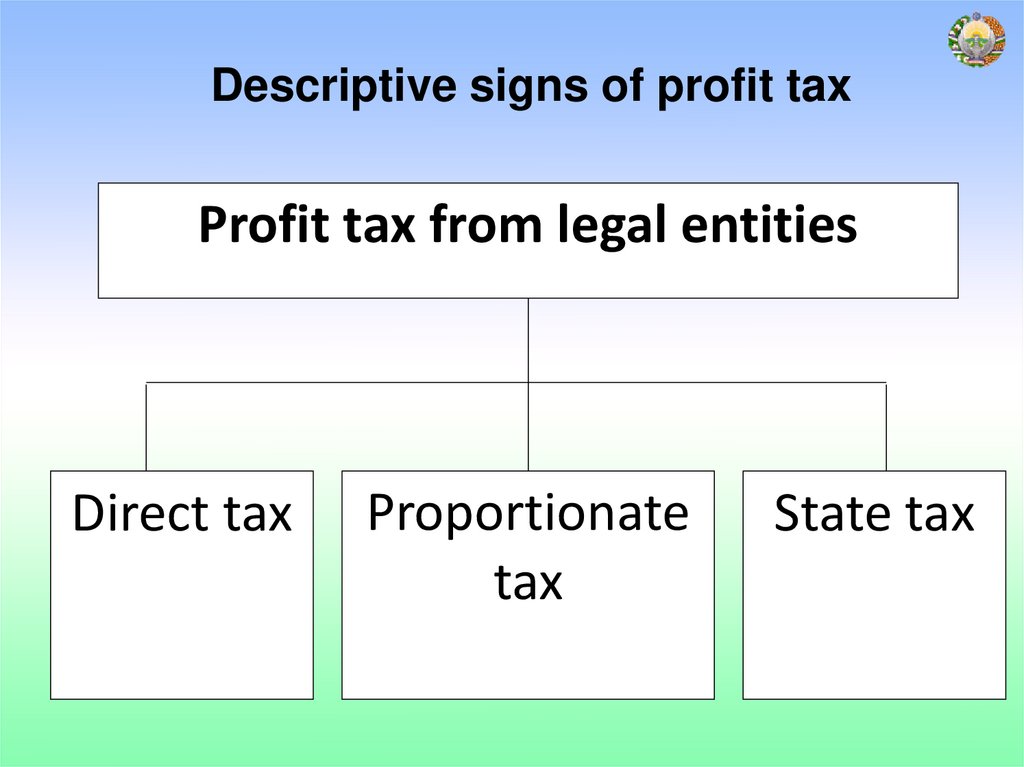

Descriptive signs of profit taxProfit tax from legal entities

Direct tax

Proportionate

tax

State tax

8.

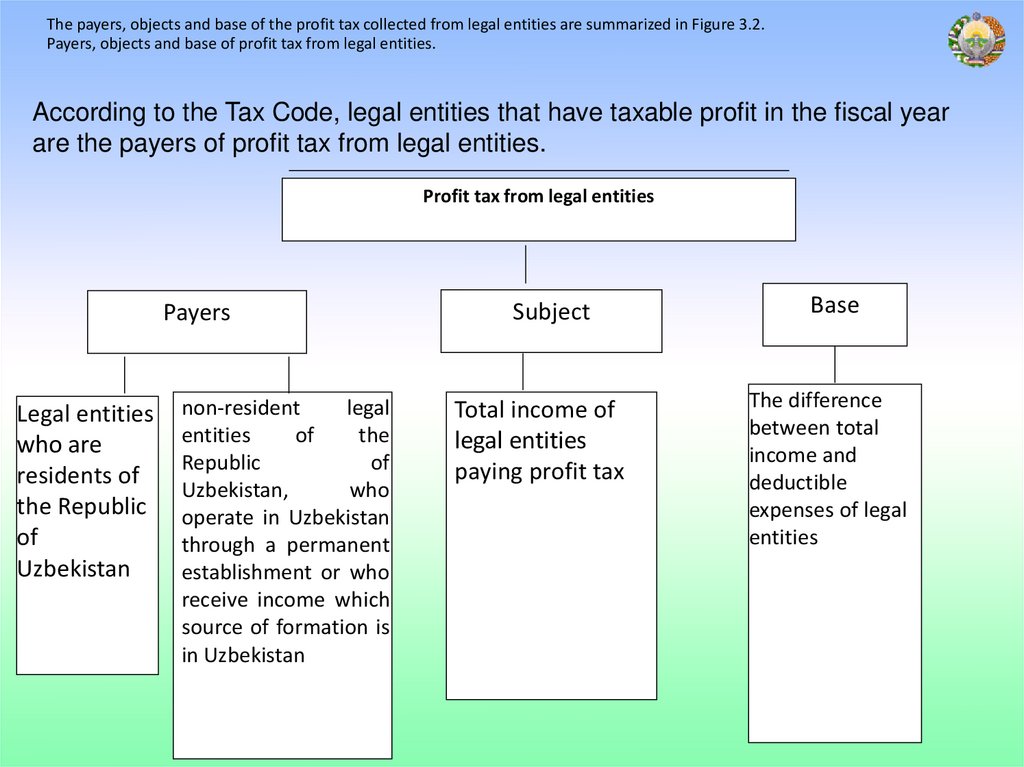

The payers, objects and base of the profit tax collected from legal entities are summarized in Figure 3.2.Payers, objects and base of profit tax from legal entities.

According to the Tax Code, legal entities that have taxable profit in the fiscal year

are the payers of profit tax from legal entities.

Profit tax from legal entities

Payers

Legal entities

who are

residents of

the Republic

of

Uzbekistan

non-resident

legal

entities

of

the

Republic

of

Uzbekistan,

who

operate in Uzbekistan

through a permanent

establishment or who

receive income which

source of formation is

in Uzbekistan

Subject

Base

Total income of

legal entities

paying profit tax

The difference

between total

income and

deductible

expenses of legal

entities

9.

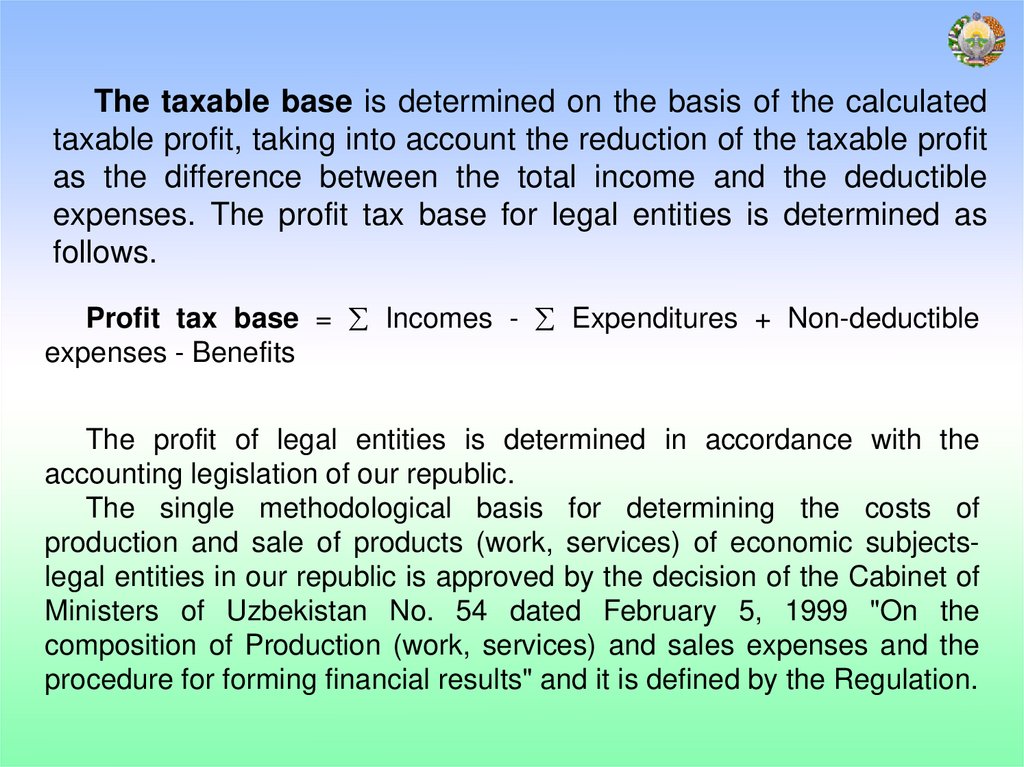

The taxable base is determined on the basis of the calculatedtaxable profit, taking into account the reduction of the taxable profit

as the difference between the total income and the deductible

expenses. The profit tax base for legal entities is determined as

follows.

Profit tax base = Incomes - Expenditures + Non-deductible

expenses - Benefits

The profit of legal entities is determined in accordance with the

accounting legislation of our republic.

The single methodological basis for determining the costs of

production and sale of products (work, services) of economic subjectslegal entities in our republic is approved by the decision of the Cabinet of

Ministers of Uzbekistan No. 54 dated February 5, 1999 "On the

composition of Production (work, services) and sales expenses and the

procedure for forming financial results" and it is defined by the Regulation.

10.

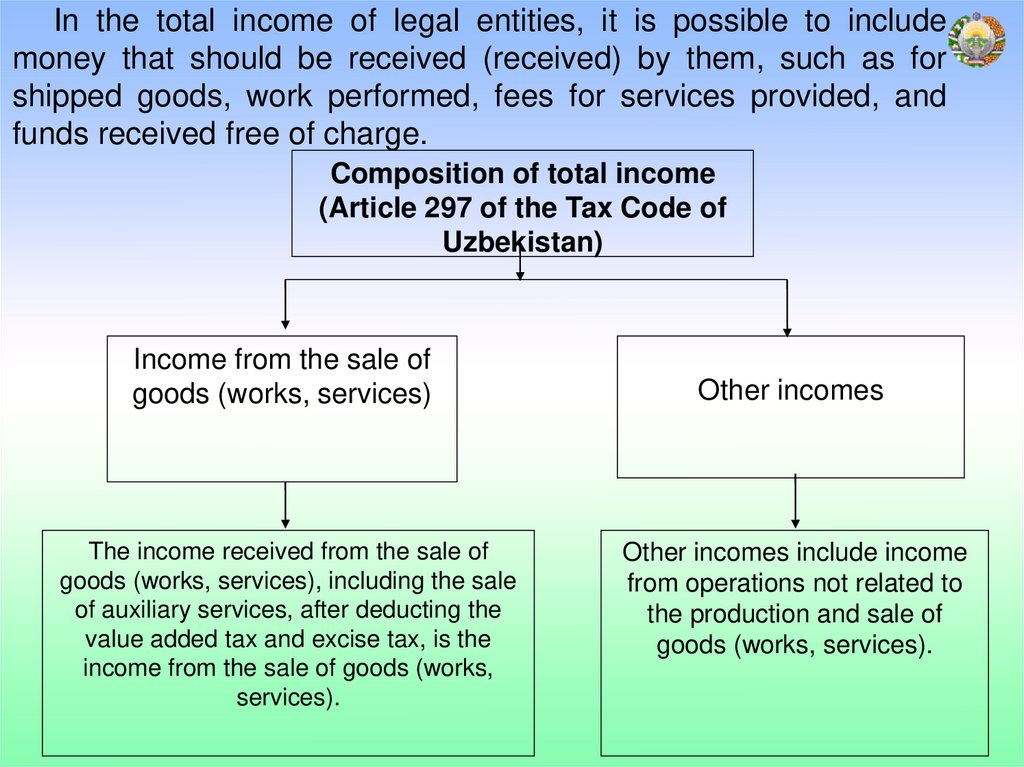

In the total income of legal entities, it is possible to includemoney that should be received (received) by them, such as for

shipped goods, work performed, fees for services provided, and

funds received free of charge.

Composition of total income

(Article 297 of the Tax Code of

Uzbekistan)

Income from the sale of

goods (works, services)

The income received from the sale of

goods (works, services), including the sale

of auxiliary services, after deducting the

value added tax and excise tax, is the

income from the sale of goods (works,

services).

Other incomes

Other incomes include income

from operations not related to

the production and sale of

goods (works, services).

11.

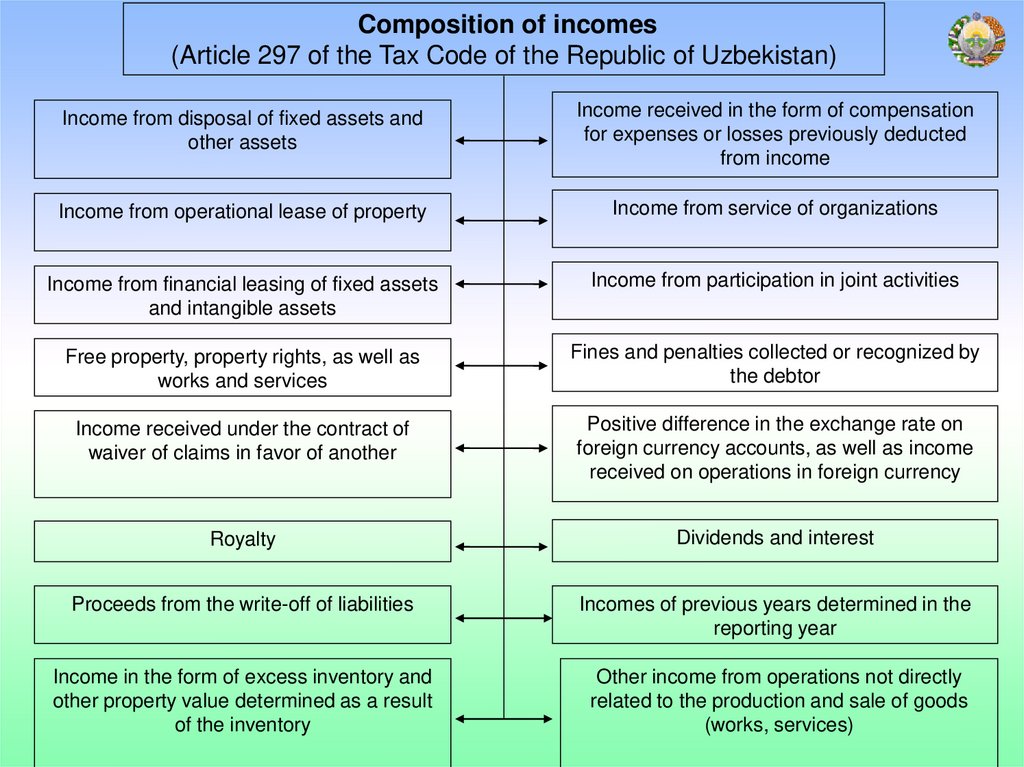

Composition of incomes(Article 297 of the Tax Code of the Republic of Uzbekistan)

Income from disposal of fixed assets and

other assets

Income received in the form of compensation

for expenses or losses previously deducted

from income

Income from operational lease of property

Income from service of organizations

Income from financial leasing of fixed assets

and intangible assets

Income from participation in joint activities

Free property, property rights, as well as

works and services

Fines and penalties collected or recognized by

the debtor

Income received under the contract of

waiver of claims in favor of another

Positive difference in the exchange rate on

foreign currency accounts, as well as income

received on operations in foreign currency

Royalty

Dividends and interest

Proceeds from the write-off of liabilities

Incomes of previous years determined in the

reporting year

Income in the form of excess inventory and

other property value determined as a result

of the inventory

Other income from operations not directly

related to the production and sale of goods

(works, services)

12.

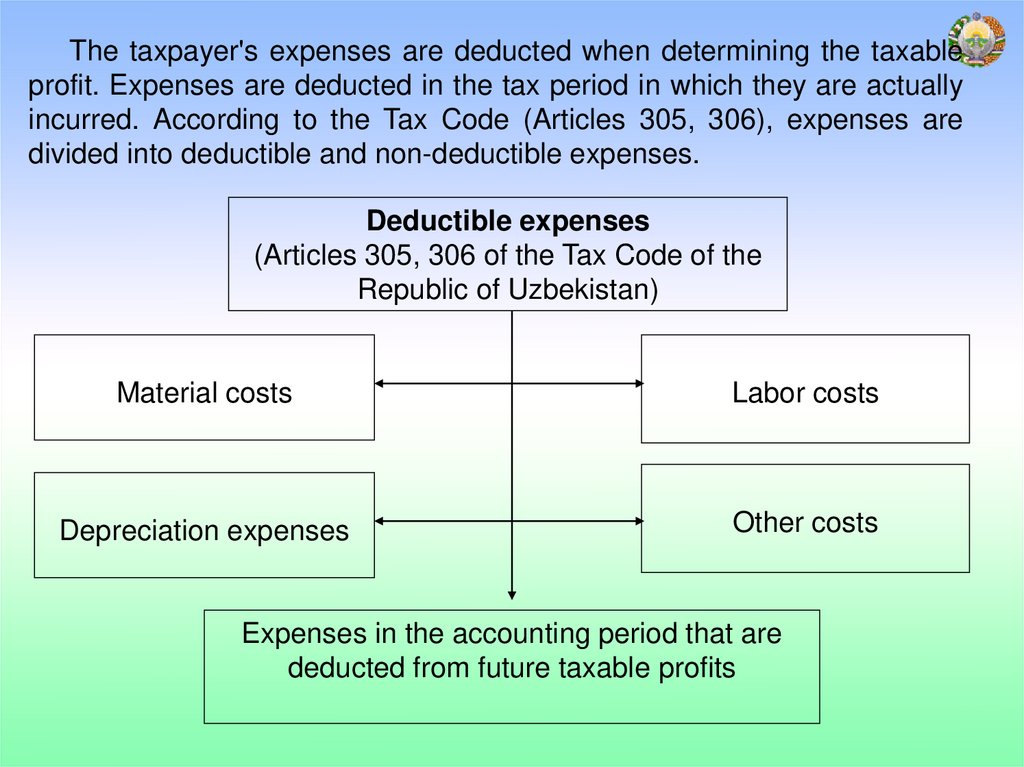

The taxpayer's expenses are deducted when determining the taxableprofit. Expenses are deducted in the tax period in which they are actually

incurred. According to the Tax Code (Articles 305, 306), expenses are

divided into deductible and non-deductible expenses.

Deductible expenses

(Articles 305, 306 of the Tax Code of the

Republic of Uzbekistan)

Material costs

Labor costs

Depreciation expenses

Other costs

Expenses in the accounting period that are

deducted from future taxable profits

13.

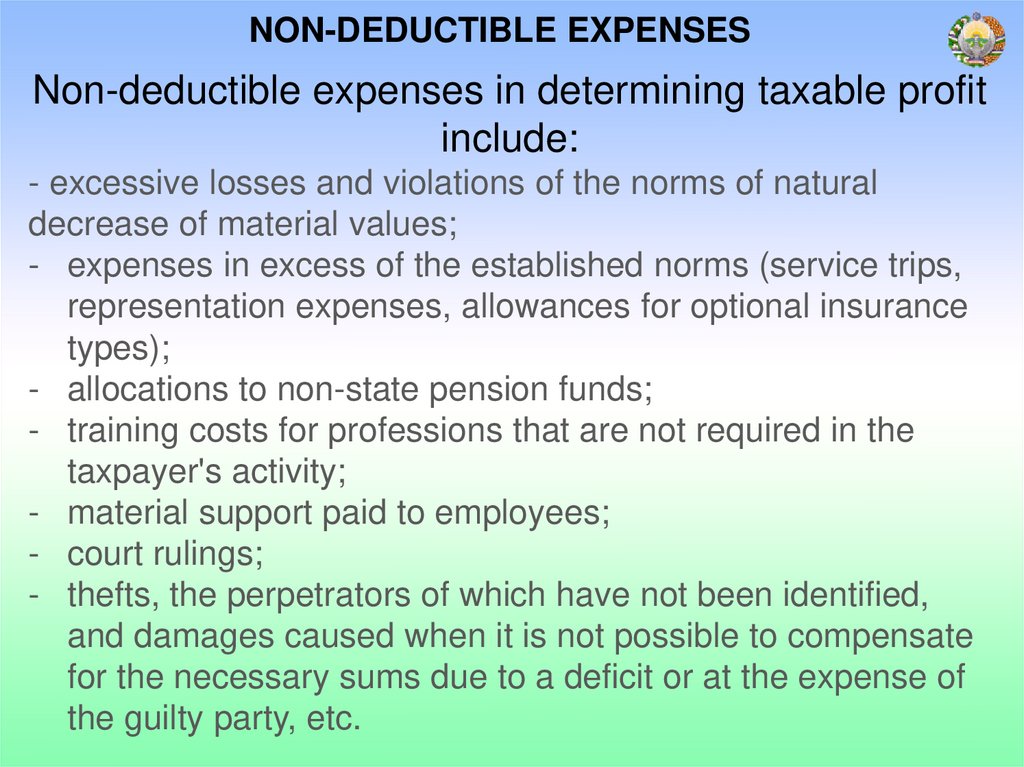

NON-DEDUCTIBLE EXPENSESNon-deductible expenses in determining taxable profit

include:

- excessive losses and violations of the norms of natural

decrease of material values;

- expenses in excess of the established norms (service trips,

representation expenses, allowances for optional insurance

types);

- allocations to non-state pension funds;

- training costs for professions that are not required in the

taxpayer's activity;

- material support paid to employees;

- court rulings;

- thefts, the perpetrators of which have not been identified,

and damages caused when it is not possible to compensate

for the necessary sums due to a deficit or at the expense of

the guilty party, etc.

14.

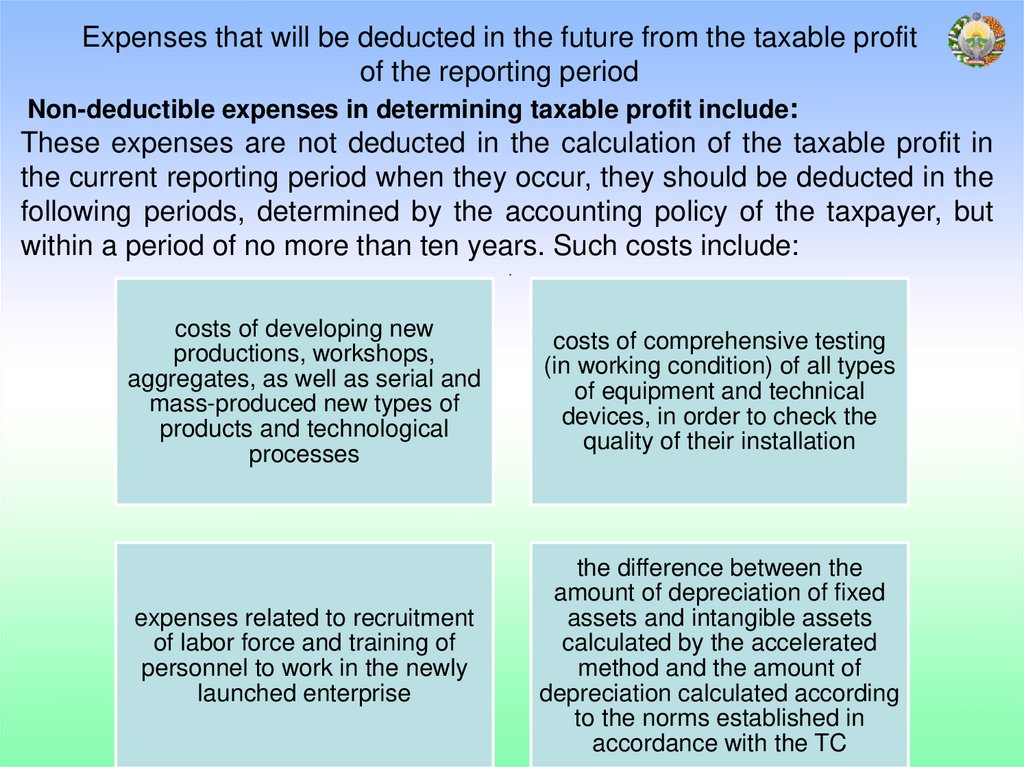

Expenses that will be deducted in the future from the taxable profitof the reporting period

Non-deductible expenses in determining taxable profit include:

These expenses are not deducted in the calculation of the taxable profit in

the current reporting period when they occur, they should be deducted in the

following periods, determined by the accounting policy of the taxpayer, but

within a period of no more than ten years. Such costs include:

costs of developing new

productions, workshops,

aggregates, as well as serial and

mass-produced new types of

products and technological

processes

costs of comprehensive testing

(in working condition) of all types

of equipment and technical

devices, in order to check the

quality of their installation

expenses related to recruitment

of labor force and training of

personnel to work in the newly

launched enterprise

the difference between the

amount of depreciation of fixed

assets and intangible assets

calculated by the accelerated

method and the amount of

depreciation calculated according

to the norms established in

accordance with the TC

15.

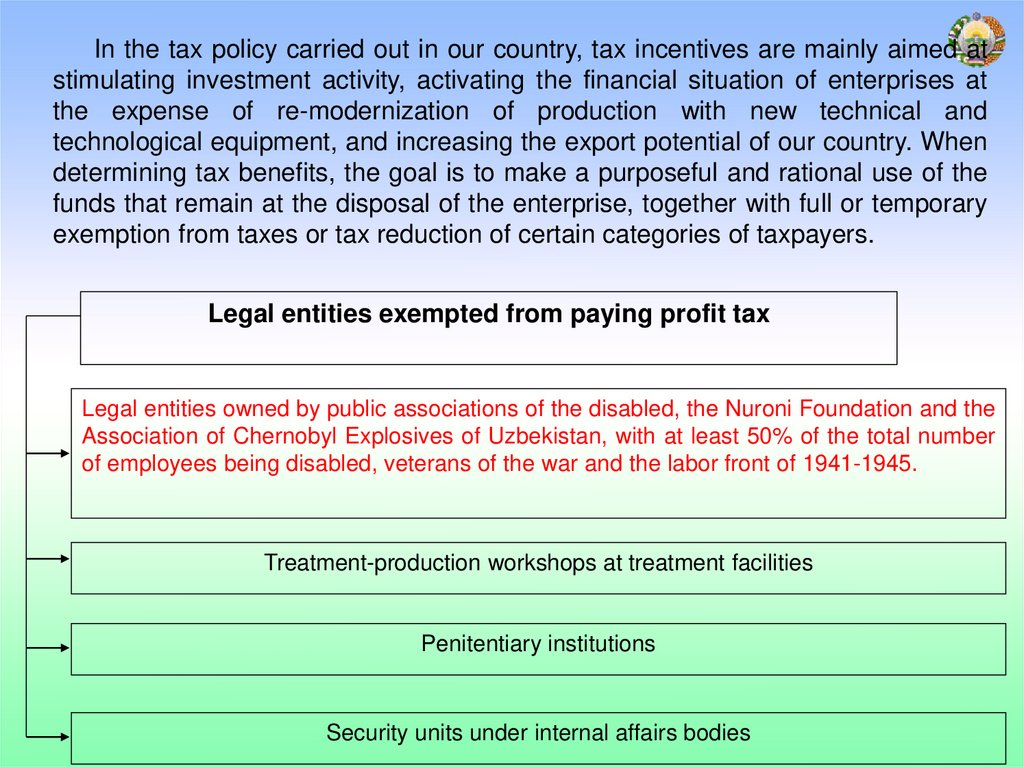

In the tax policy carried out in our country, tax incentives are mainly aimed atstimulating investment activity, activating the financial situation of enterprises at

the expense of re-modernization of production with new technical and

technological equipment, and increasing the export potential of our country. When

determining tax benefits, the goal is to make a purposeful and rational use of the

funds that remain at the disposal of the enterprise, together with full or temporary

exemption from taxes or tax reduction of certain categories of taxpayers.

Legal entities exempted from paying profit tax

Legal entities owned by public associations of the disabled, the Nuroni Foundation and the

Association of Chernobyl Explosives of Uzbekistan, with at least 50% of the total number

of employees being disabled, veterans of the war and the labor front of 1941-1945.

Treatment-production workshops at treatment facilities

Penitentiary institutions

Security units under internal affairs bodies

16.

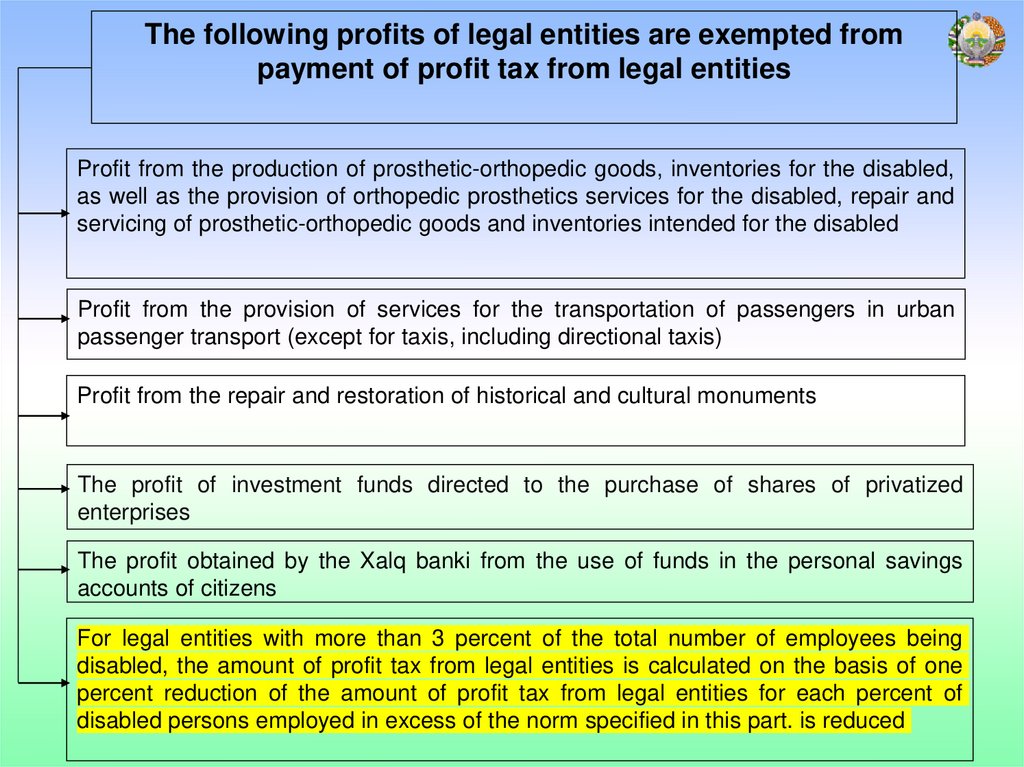

The following profits of legal entities are exempted frompayment of profit tax from legal entities

Profit from the production of prosthetic-orthopedic goods, inventories for the disabled,

as well as the provision of orthopedic prosthetics services for the disabled, repair and

servicing of prosthetic-orthopedic goods and inventories intended for the disabled

Profit from the provision of services for the transportation of passengers in urban

passenger transport (except for taxis, including directional taxis)

Profit from the repair and restoration of historical and cultural monuments

The profit of investment funds directed to the purchase of shares of privatized

enterprises

The profit obtained by the Xalq banki from the use of funds in the personal savings

accounts of citizens

For legal entities with more than 3 percent of the total number of employees being

disabled, the amount of profit tax from legal entities is calculated on the basis of one

percent reduction of the amount of profit tax from legal entities for each percent of

disabled persons employed in excess of the norm specified in this part. is reduced

17.

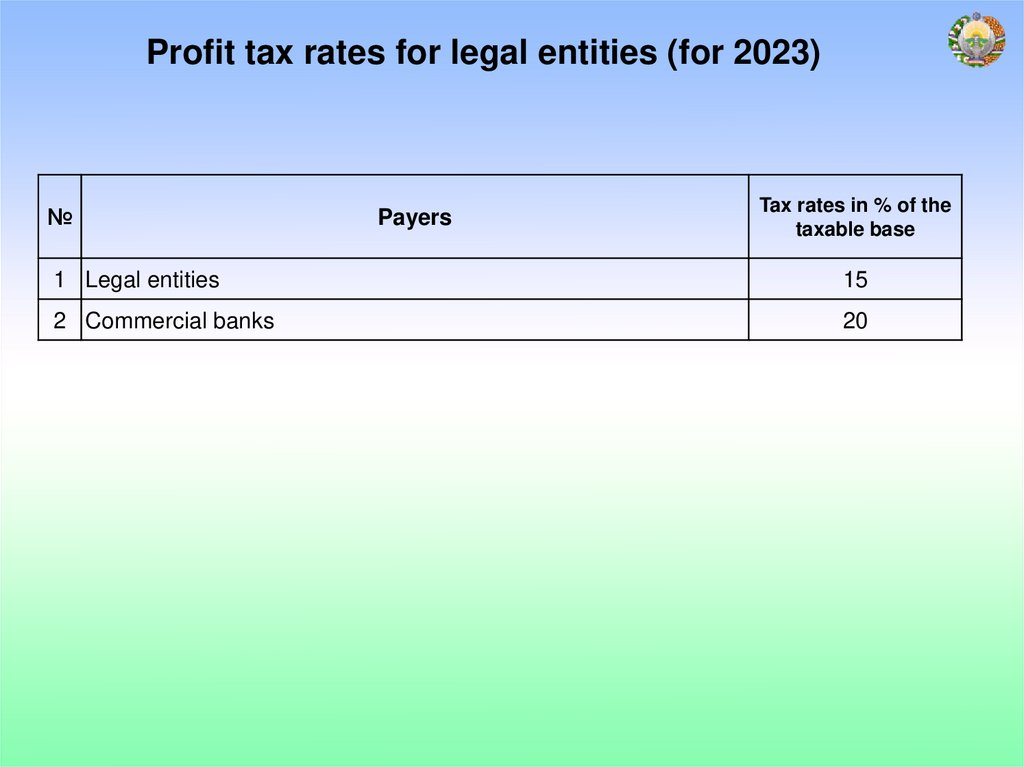

Profit tax rates for legal entities (for 2023)№

Payers

Tax rates in % of the

taxable base

1 Legal entities

15

2 Commercial banks

20

18.

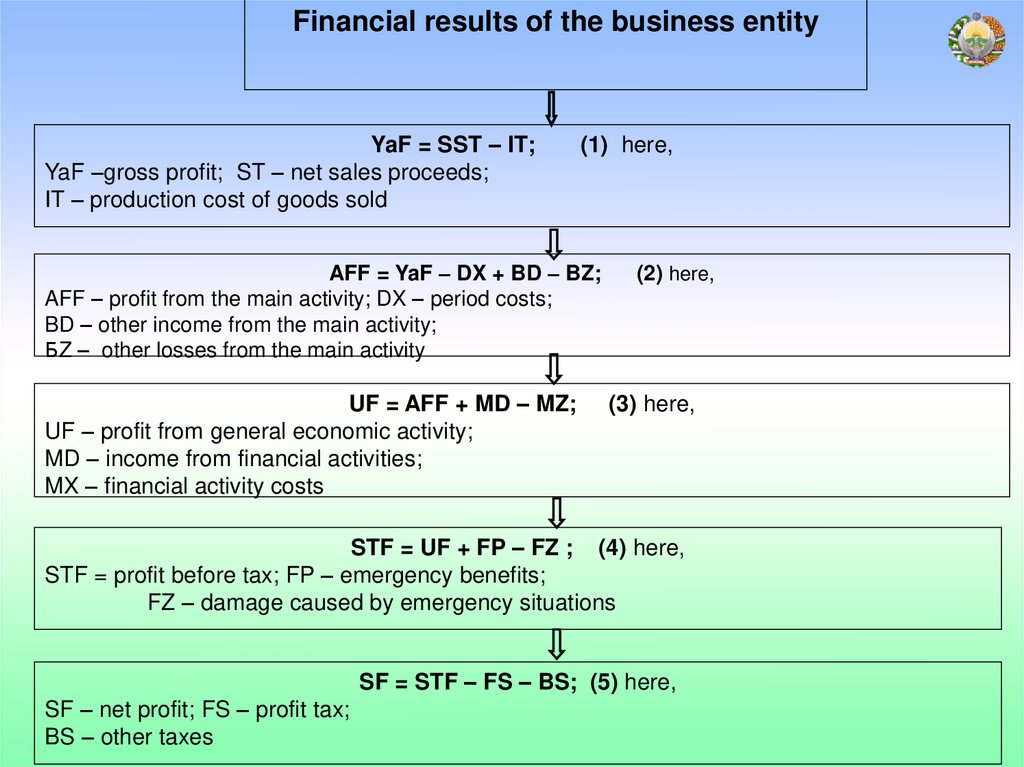

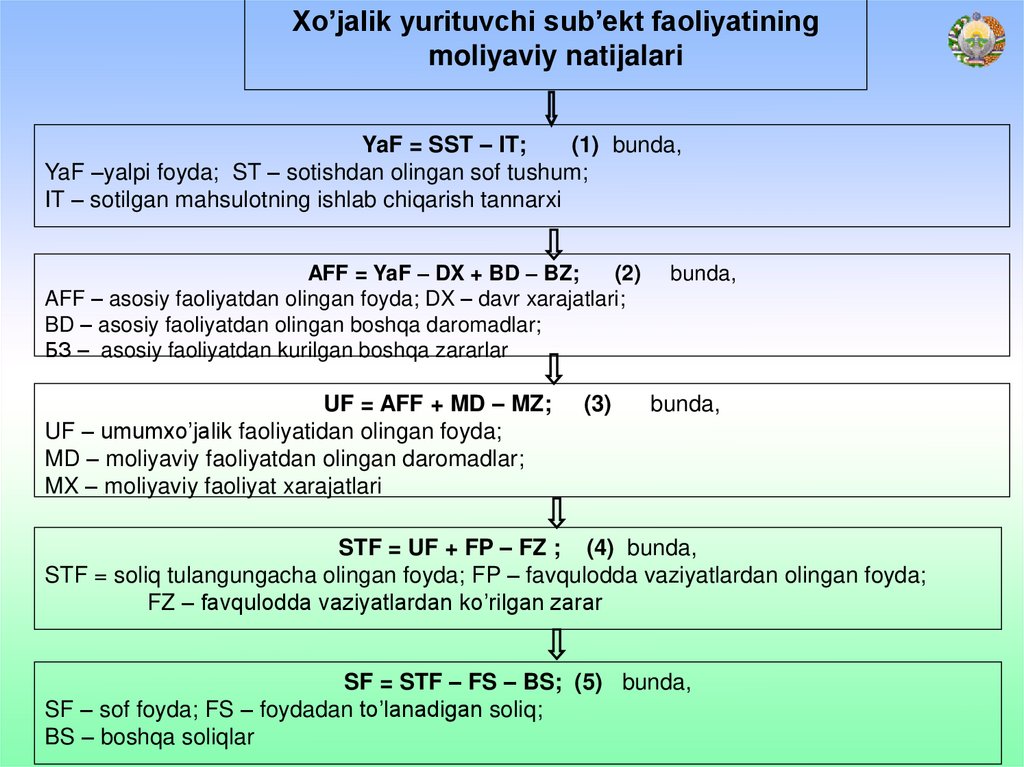

Financial results of the business entityYaF = SST – IT;

YaF –gross profit; ST – net sales proceeds;

IT – production cost of goods sold

(1) here,

AFF = YaF – DX + BD – BZ;

AFF – profit from the main activity; DX – period costs;

BD – other income from the main activity;

БZ – other losses from the main activity

UF = AFF + MD – MZ;

UF – profit from general economic activity;

MD – income from financial activities;

MX – financial activity costs

(2) here,

(3) here,

STF = UF + FP – FZ ; (4) here,

STF = profit before tax; FP – emergency benefits;

FZ – damage caused by emergency situations

SF = STF – FS – BS; (5) here,

SF – net profit; FS – profit tax;

BS – other taxes

19.

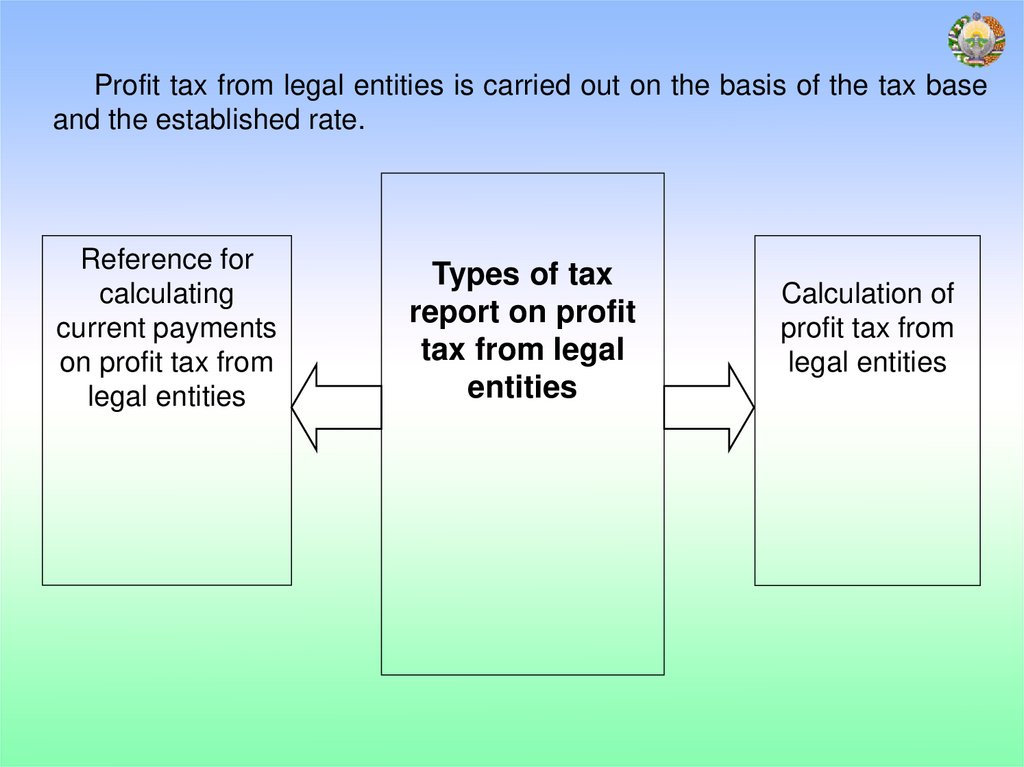

Profit tax from legal entities is carried out on the basis of the tax baseand the established rate.

Reference for

calculating

current payments

on profit tax from

legal entities

Types of tax

report on profit

tax from legal

entities

Calculation of

profit tax from

legal entities

20.

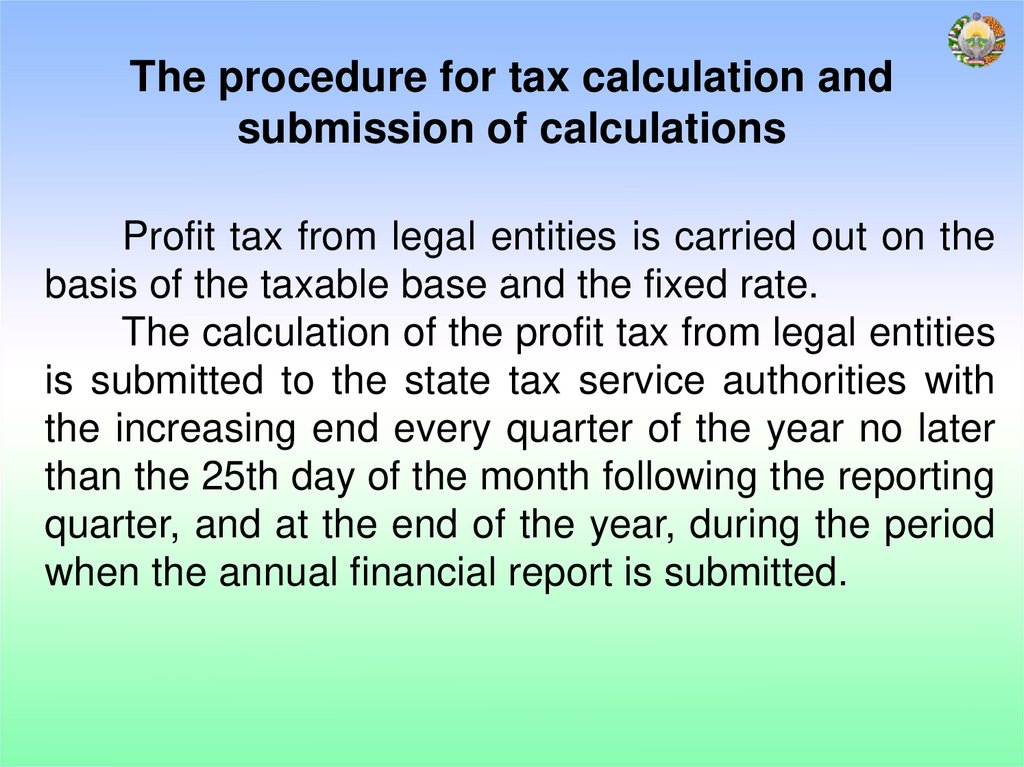

The procedure for tax calculation andsubmission of calculations

Profit tax from legal entities is carried out on the

basis of the taxable base and the fixed rate.

The calculation of the profit tax from legal entities

is submitted to the state tax service authorities with

the increasing end every quarter of the year no later

than the 25th day of the month following the reporting

quarter, and at the end of the year, during the period

when the annual financial report is submitted.

21.

Xo’jalik yurituvchi sub’ekt faoliyatiningmoliyaviy natijalari

YaF = SST – IT;

(1) bunda,

YaF –yalpi foyda; ST – sotishdan olingan sof tushum;

IT – sotilgan mahsulotning ishlab chiqarish tannarxi

AFF = YaF – DX + BD – BZ;

(2)

AFF – asosiy faoliyatdan olingan foyda; DX – davr xarajatlari;

BD – asosiy faoliyatdan olingan boshqa daromadlar;

БЗ – asosiy faoliyatdan kurilgan boshqa zararlar

UF = AFF + MD – MZ;

UF – umumxo’jalik faoliyatidan olingan foyda;

MD – moliyaviy faoliyatdan olingan daromadlar;

MX – moliyaviy faoliyat xarajatlari

(3)

bunda,

bunda,

STF = UF + FP – FZ ; (4) bunda,

STF = soliq tulangungacha olingan foyda; FP – favqulodda vaziyatlardan olingan foyda;

FZ – favqulodda vaziyatlardan ko’rilgan zarar

SF = STF – FS – BS; (5) bunda,

SF – sof foyda; FS – foydadan to’lanadigan soliq;

BS – boshqa soliqlar

Финансы

Финансы Право

Право