Похожие презентации:

Financial markets: Equity market in details. Lecture 7

1. Lecture 7. Financial markets: Equity market in details

Financial InstrumentsEquity

Lecture 7.

Financial markets: Equity market in details

International finance and globalization

Lecture 7

©Ella Khromova

2.

Financial InstrumentsEquity

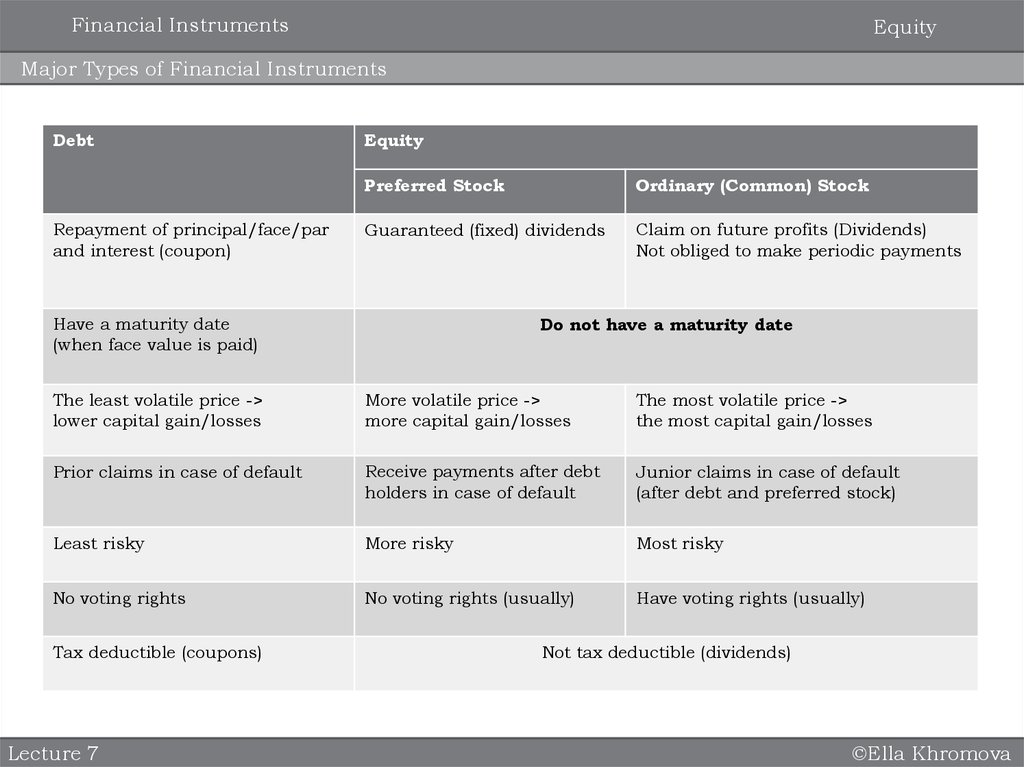

Major Types of Financial Instruments

Debt

Repayment of principal/face/par

and interest (coupon)

Equity

Preferred Stock

Ordinary (Common) Stock

Guaranteed (fixed) dividends

Claim on future profits (Dividends)

Not obliged to make periodic payments

Have a maturity date

(when face value is paid)

Do not have a maturity date

The least volatile price ->

lower capital gain/losses

More volatile price ->

more capital gain/losses

The most volatile price ->

the most capital gain/losses

Prior claims in case of default

Receive payments after debt

holders in case of default

Junior claims in case of default

(after debt and preferred stock)

Least risky

More risky

Most risky

No voting rights

No voting rights (usually)

Have voting rights (usually)

Tax deductible (coupons)

Lecture 7

Not tax deductible (dividends)

©Ella Khromova

3.

Financial InstrumentsEquity

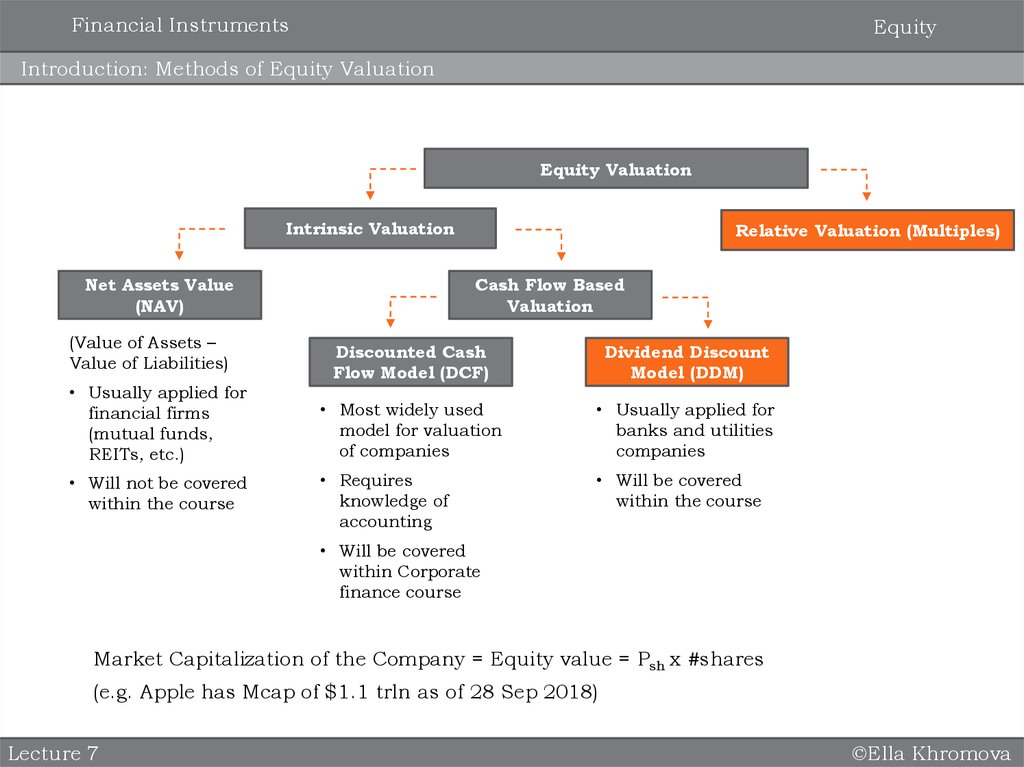

Introduction: Methods of Equity Valuation

Equity Valuation

Intrinsic Valuation

Net Assets Value

(NAV)

(Value of Assets –

Value of Liabilities)

Relative Valuation (Multiples)

Cash Flow Based

Valuation

• Usually applied for

financial firms

(mutual funds,

REITs, etc.)

Discounted Cash

Flow Model (DCF)

Dividend Discount

Model (DDM)

• Most widely used

model for valuation

of companies

• Usually applied for

banks and utilities

companies

• Will not be covered

within the course

• Requires

knowledge of

accounting

• Will be covered

within the course

• Will be covered

within Corporate

finance course

Market Capitalization of the Company = Equity value = Psh x #shares

(e.g. Apple has Mcap of $1.1 trln as of 28 Sep 2018)

Lecture 7

©Ella Khromova

4.

Financial InstrumentsEquity

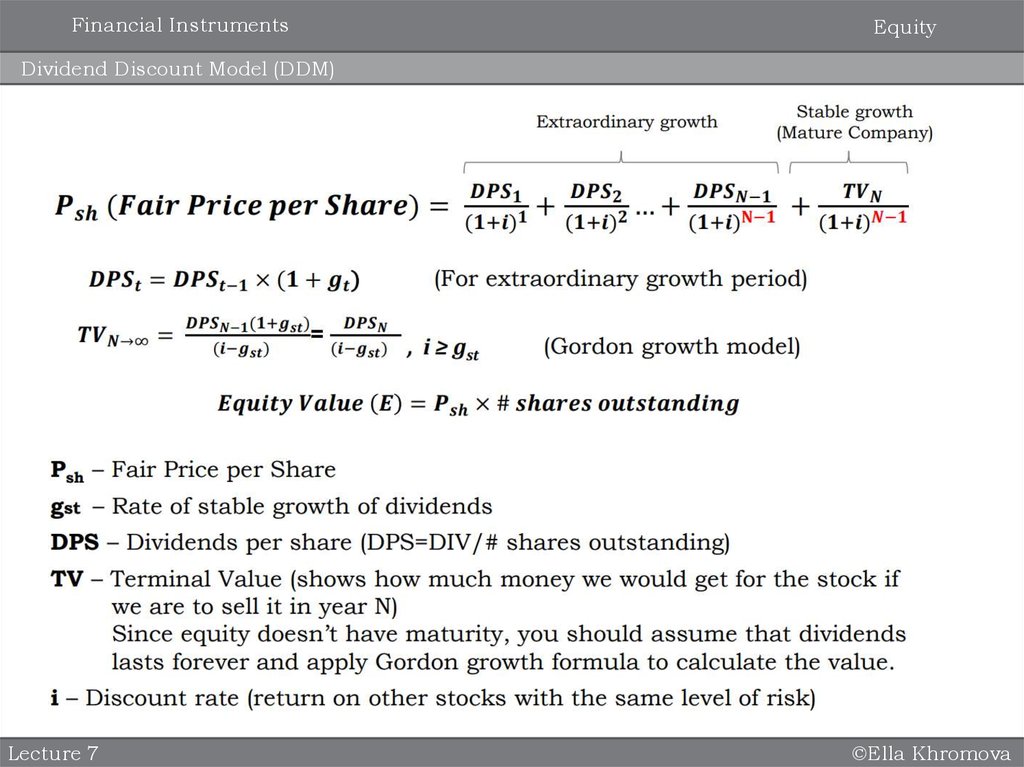

Dividend Discount Model (DDM)

Lecture 7

©Ella Khromova

5.

Financial InstrumentsEquity

DDM: Example 1

Lecture 7

©Ella Khromova

6.

Financial InstrumentsEquity

DDM: Example 2

Consider following stocks:

(A) it is expected to distribute a dividend of $ 10 per share.

(B) it is expected to pay a dividend of $ 5 per share next year. Thereafter,

dividend is expected to grow annually at 4% forever.

(C) it is expected to disburse a dividend of $10 per share next year.

Thereafter, dividend is expected to grow at 20% for five years and

then it settles at that level, i.e. no growth.

If the expected rate of return on equity is 10% for A, B and C, which of

these three stock you find more valuable?

Answer

Price of A, PA = D/r = 100

PB = D1/(r-g) = 5/(.1-.04) = 83.3

Year

1

10

Div for C

10

12

PC = 1.1 + 1.12 + ⋯ +

Lecture 7

24.88

1.16

2

12

+

24.88

0.1

3

14.4

4

17.28

5

20.74

6

24.88

…

T

… 24.88

…

…

= 209.01

©Ella Khromova

7.

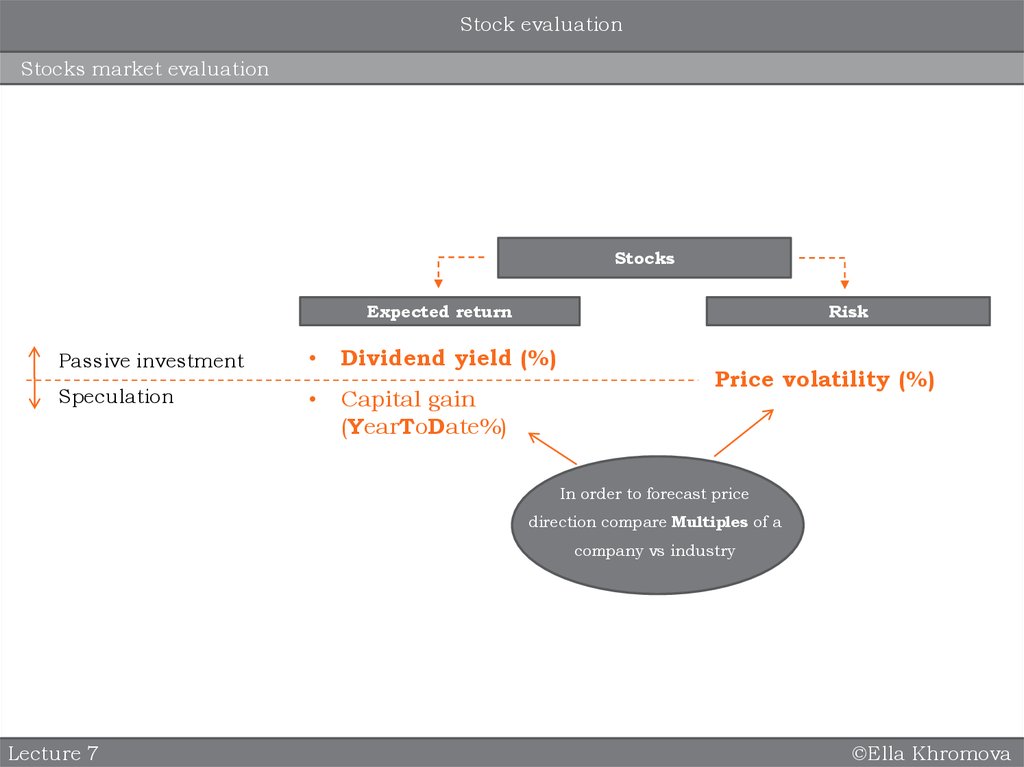

Stock evaluationStocks market evaluation

Stocks

Expected return

Risk

Passive investment

Dividend yield (%)

Speculation

Capital gain

(YearToDate%)

Price volatility (%)

In order to forecast price

direction compare Multiples of a

company vs industry

Lecture 7

©Ella Khromova

8.

Stock evaluationStocks market evaluation

Lecture 7

©Ella Khromova

9.

Financial InstrumentsEquity

Relative Valuation: Most Commonly used Multiples

Multiples

Attributable to all stakeholders:

debtors and shareholders

(based on enterprise value)

EV/Sales

EV/EBITDA

Lecture 7

Attributable to shareholders only

(based on equity value)

P/E=Price to Earnings=

(Equity Value aka Market

Capitalization / Net Income)

©Ella Khromova

10.

Financial InstrumentsEquity

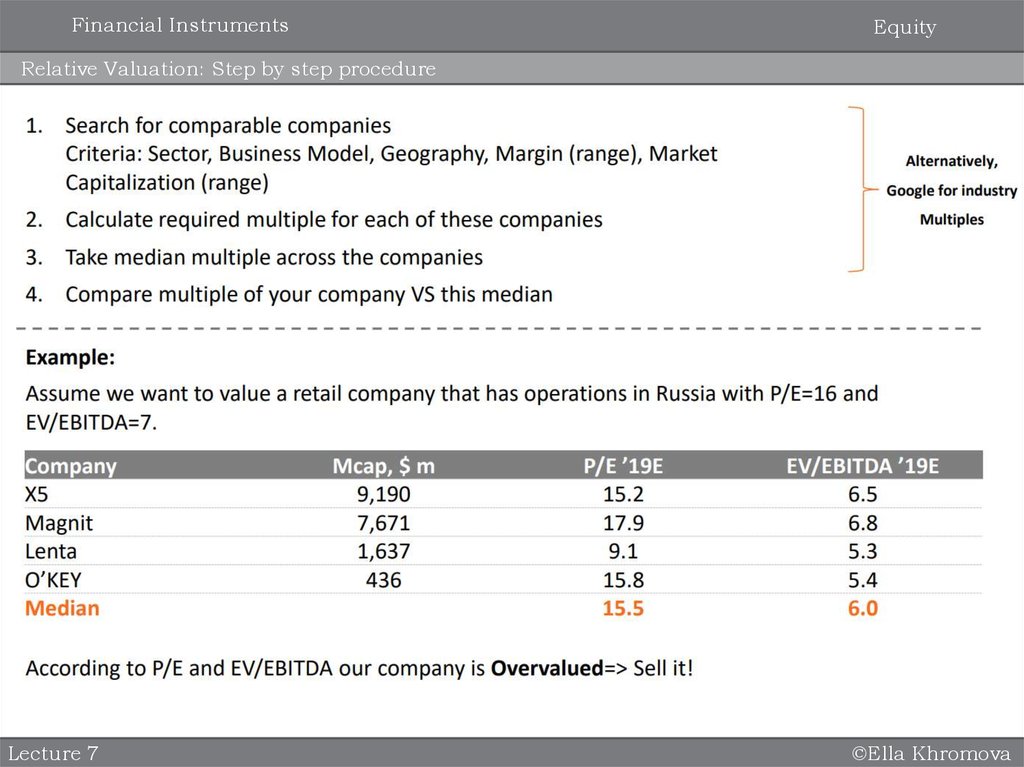

Relative Valuation: Step by step procedure

Lecture 7

©Ella Khromova

11.

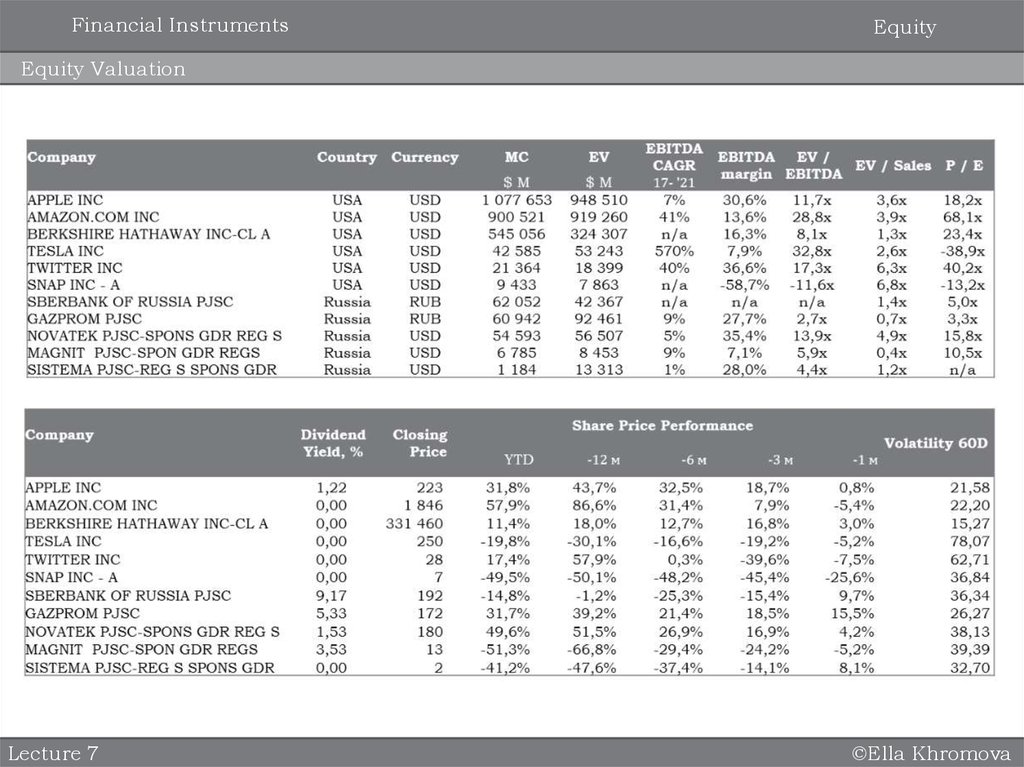

Financial InstrumentsEquity

Equity Valuation

Lecture 7

©Ella Khromova

12.

Financial InstrumentsEquity

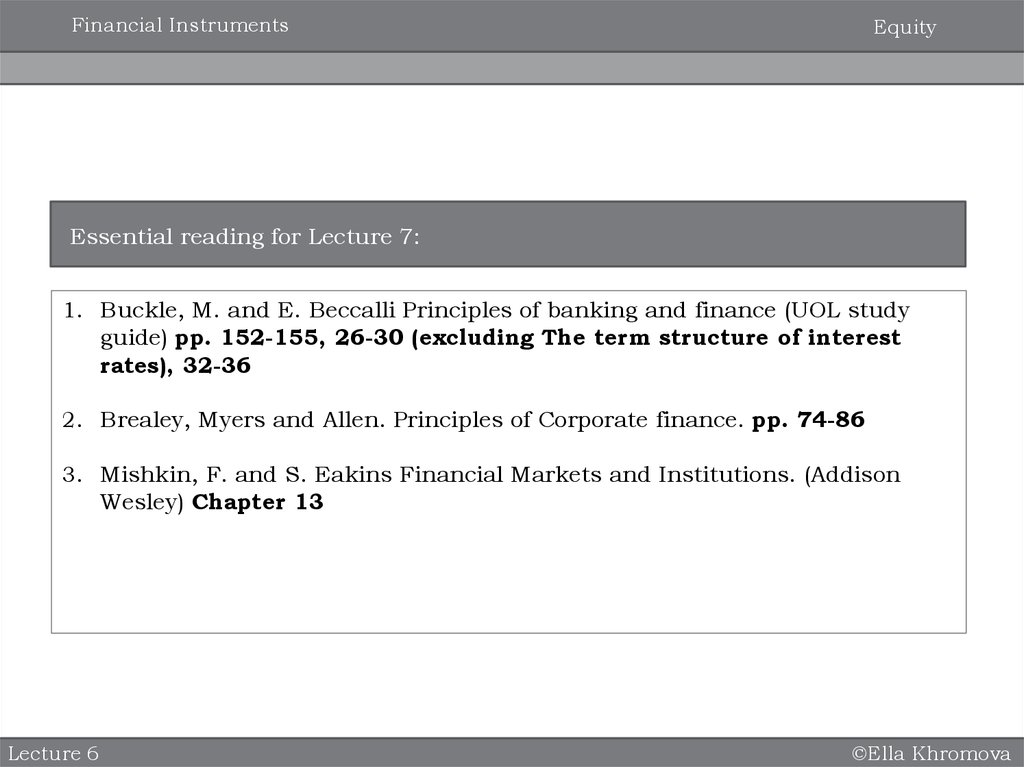

Essential reading for Lecture 7:

1. Buckle, M. and E. Beccalli Principles of banking and finance (UOL study

guide) pp. 152-155, 26-30 (excluding The term structure of interest

rates), 32-36

2. Brealey, Myers and Allen. Principles of Corporate finance. pp. 74-86

3. Mishkin, F. and S. Eakins Financial Markets and Institutions. (Addison

Wesley) Chapter 13

Lecture 6

©Ella Khromova

Финансы

Финансы