Похожие презентации:

Random walk theory and GBM

1.

RANDOM WALKTHEORY AND GBM

Kirill Afanasev (16,67%)

Anastasia Vyunova (16,67%)

Maria Malenkina (16,67%)

Anna Peshkan (16,67%)

Mark Khabarov (16,67%)

Elena Yakovleva (16,67%)

2.

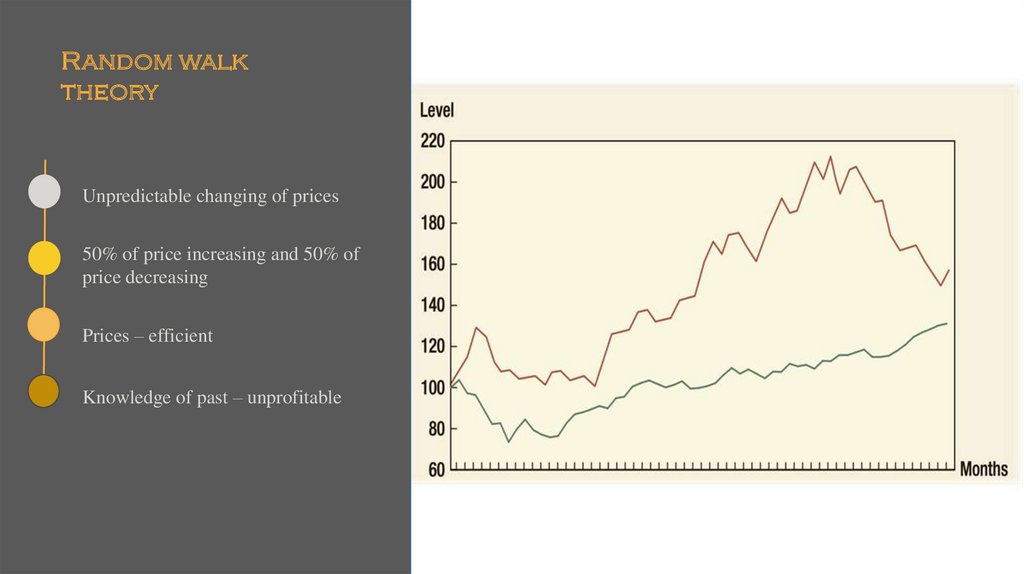

Random walktheory

Unpredictable changing of prices

50% of price increasing and 50% of

price decreasing

Prices – efficient

Knowledge of past – unprofitable

3.

BUBBLEuncontrollable and sharp growthof prices

4.

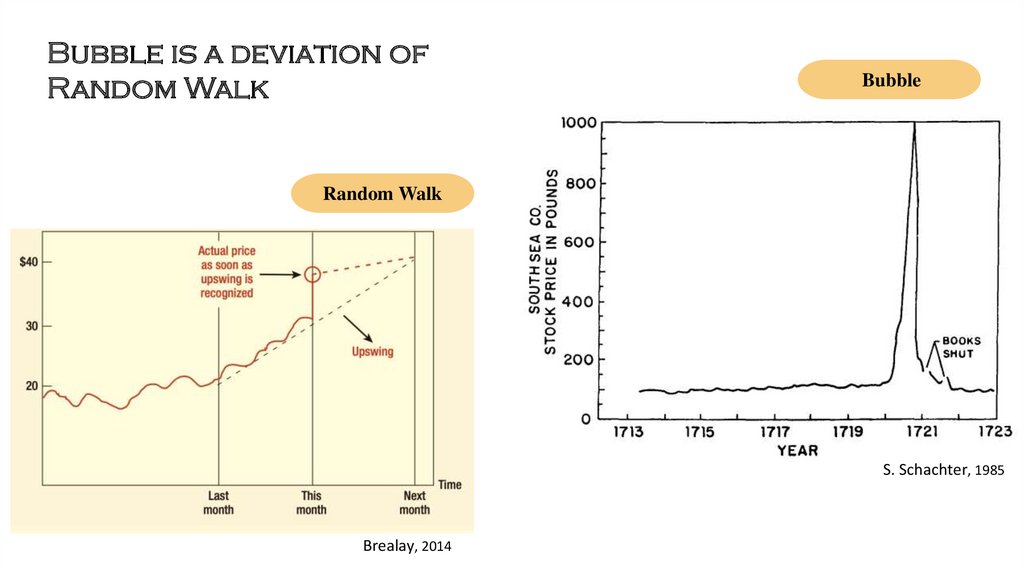

Bubble is a deviation ofRandom Walk

Bubble

Random Walk

S. Schachter, 1985

Brealay, 2014

5.

Historical bubble6.

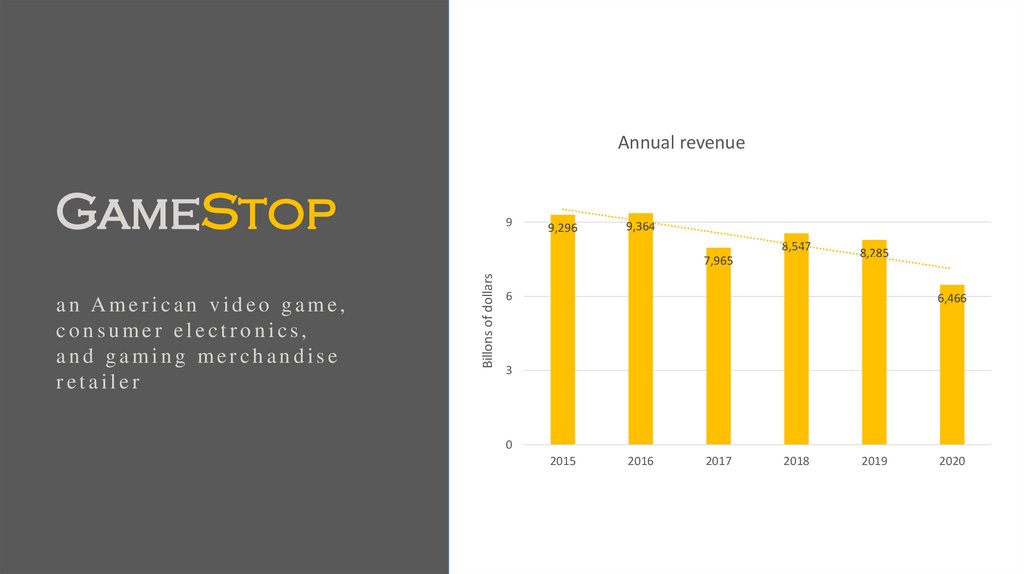

Annual revenueGameStop

9

9,296

9,364

8,547

an American video game,

consumer electronics,

and gaming merchandise

retailer

Billons of dollars

7,965

8,285

6

6,466

3

0

2015

2016

2017

2018

2019

2020

7.

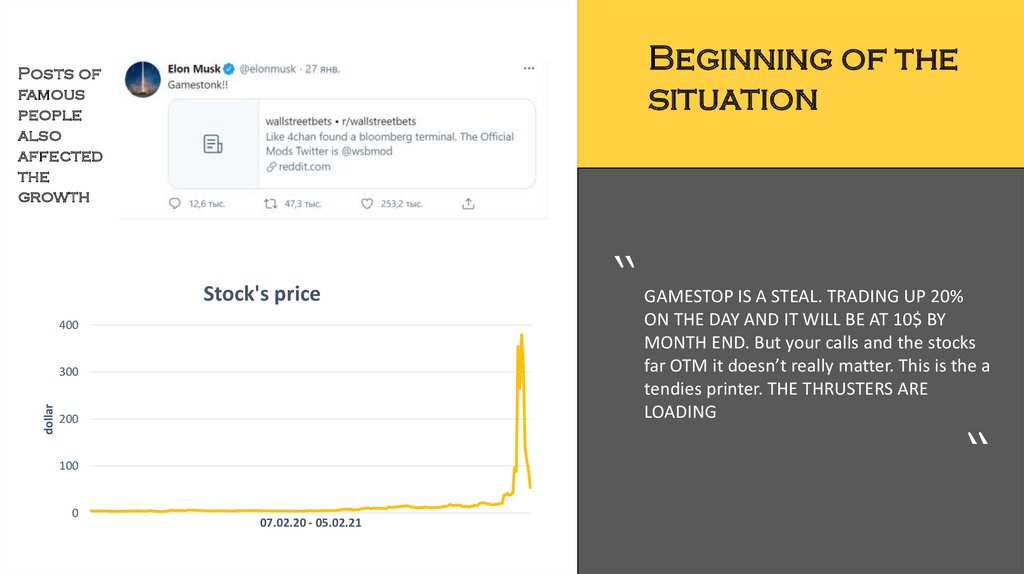

Beginning of thesituation

Posts of

famous

people

also

affected

the

growth

Stock's price

ON THE DAY AND IT WILL BE AT 10$ BY

MONTH END. But your calls and the stocks

far OTM it doesn’t really matter. This is the a

tendies printer. THE THRUSTERS ARE

LOADING

400

“

dollar

300

200

100

0

“ GAMESTOP IS A STEAL. TRADING UP 20%

07.02.20 - 05.02.21

8.

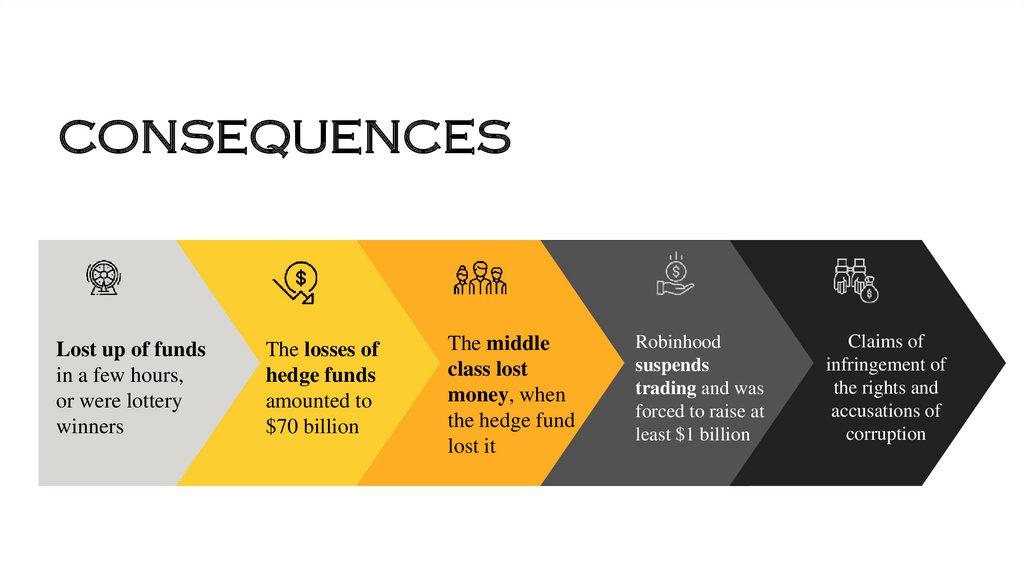

CONSEQUENCESLost up of funds

in a few hours,

or were lottery

winners

The losses of

hedge funds

amounted to

$70 billion

The middle

class lost

money, when

the hedge fund

lost it

Robinhood

suspends

trading and was

forced to raise at

least $1 billion

Claims of

infringement of

the rights and

accusations of

corruption

9.

CURRENT BUBBLE10.

An American PUBLIC COMPANY withthe revenue of $486 million (2019)

INDUSTRY: Business

intelligence and mobile software

The company experienced a burst

of bubble in March 2000

11.

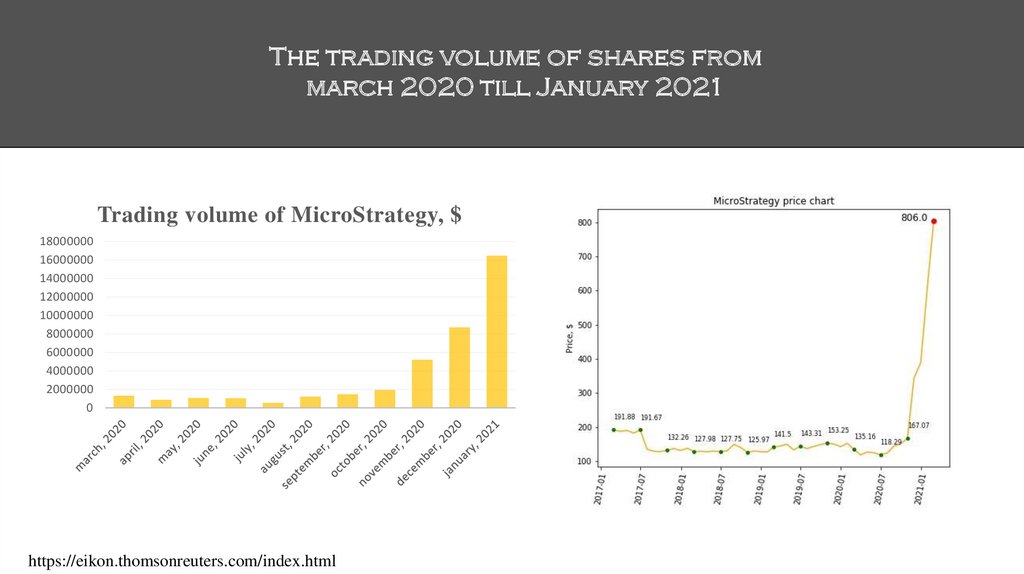

The trading volume of shares frommarch 2020 till January 2021

Trading volume of MicroStrategy, $

18000000

16000000

14000000

12000000

10000000

8000000

6000000

4000000

2000000

0

https://eikon.thomsonreuters.com/index.html

12.

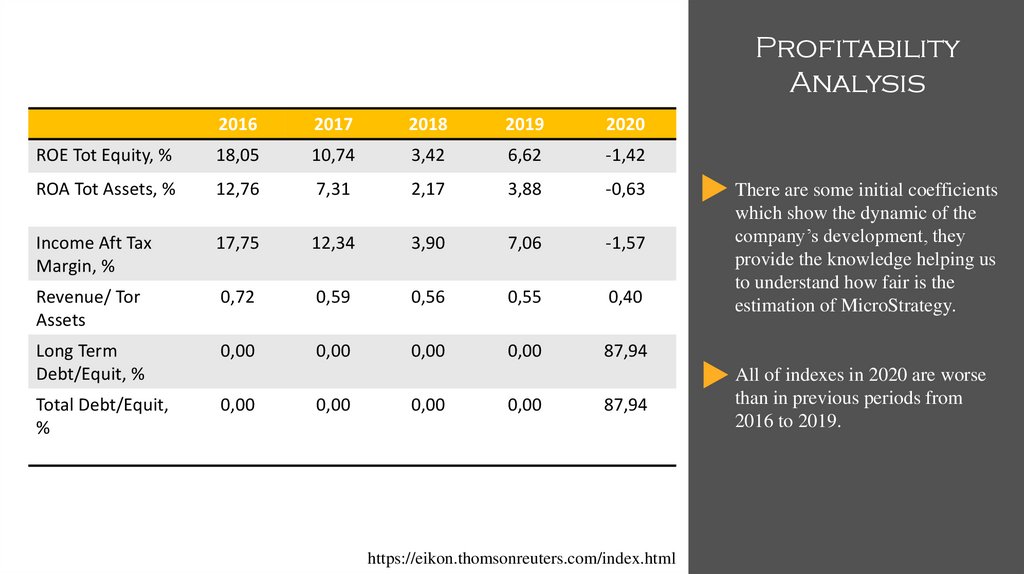

ProfitabilityAnalysis

2016

2017

2018

2019

2020

ROE Tot Equity, %

18,05

10,74

3,42

6,62

-1,42

ROA Tot Assets, %

12,76

7,31

2,17

3,88

-0,63

Income Aft Tax

Margin, %

17,75

12,34

3,90

7,06

-1,57

Revenue/ Tor

Assets

0,72

0,59

0,56

0,55

0,40

Long Term

Debt/Equit, %

0,00

0,00

0,00

0,00

87,94

Total Debt/Equit,

%

0,00

0,00

0,00

0,00

87,94

https://eikon.thomsonreuters.com/index.html

There are some initial coefficients

which show the dynamic of the

company’s development, they

provide the knowledge helping us

to understand how fair is the

estimation of MicroStrategy.

All of indexes in 2020 are worse

than in previous periods from

2016 to 2019.

13.

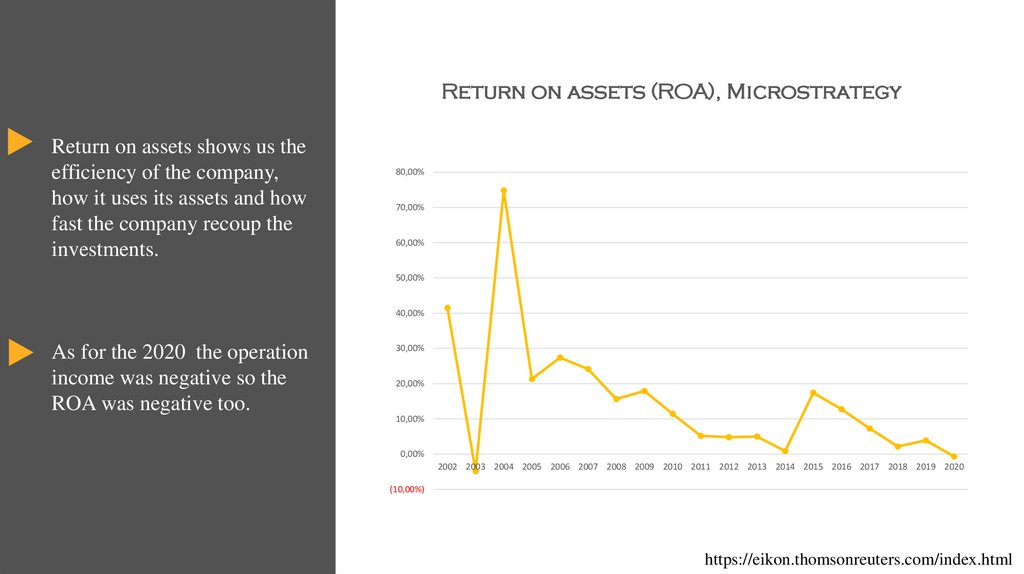

Return on assets (ROA), MicrostrategyReturn on assets shows us the

efficiency of the company,

how it uses its assets and how

fast the company recoup the

investments.

80,00%

70,00%

60,00%

50,00%

40,00%

As for the 2020 the operation

income was negative so the

ROA was negative too.

30,00%

20,00%

10,00%

0,00%

2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020

(10,00%)

https://eikon.thomsonreuters.com/index.html

14.

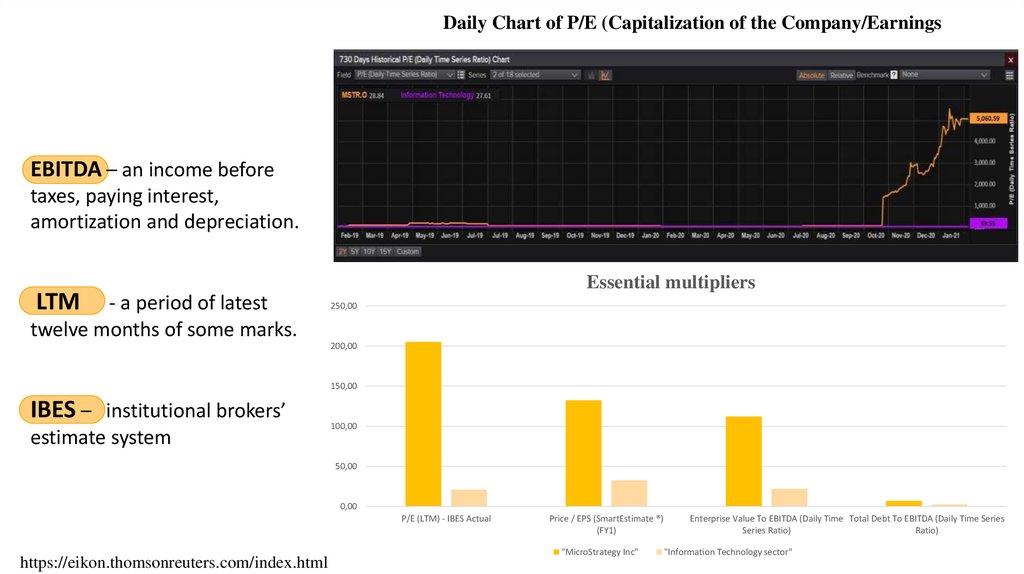

Daily Chart of P/E (Capitalization of the Company/EarningsThe trading volume of shares from

march 2020 till January 2021

EBITDA – an income before

taxes, paying interest,

amortization and depreciation.

LTM

- a period of latest

twelve months of some marks.

Essential multipliers

250,00

200,00

150,00

IBES – institutional brokers’

estimate system

100,00

50,00

0,00

P/E (LTM) - IBES Actual

https://eikon.thomsonreuters.com/index.html

Price / EPS (SmartEstimate ®)

(FY1)

"MicroStrategy Inc"

Enterprise Value To EBITDA (Daily Time Total Debt To EBITDA (Daily Time Series

Series Ratio)

Ratio)

"Information Technology sector"

15.

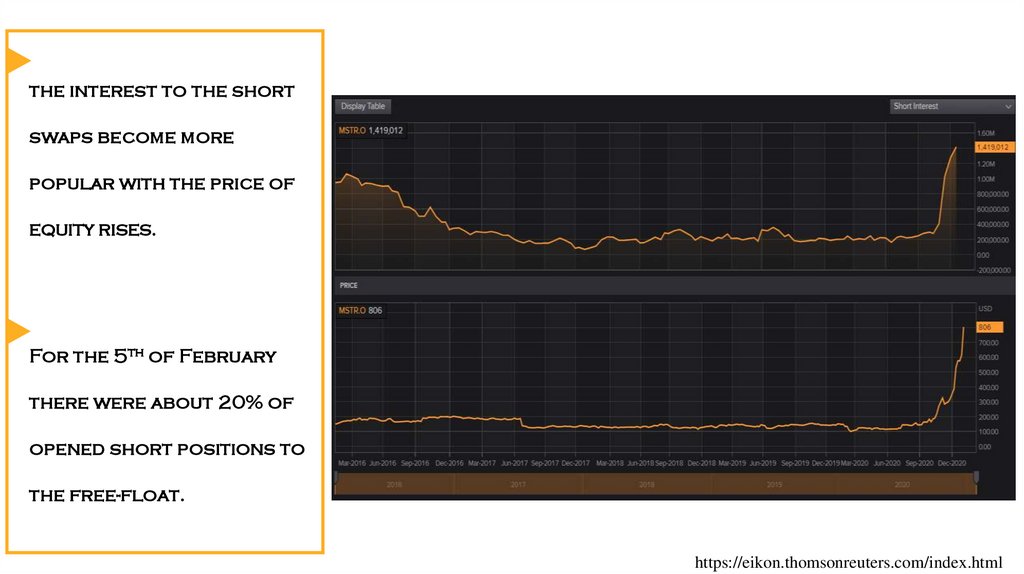

the interest to the shortswaps become more

popular with the price of

equity rises.

For the 5th of February

there were about 20% of

opened short positions to

the free-float.

https://eikon.thomsonreuters.com/index.html

16.

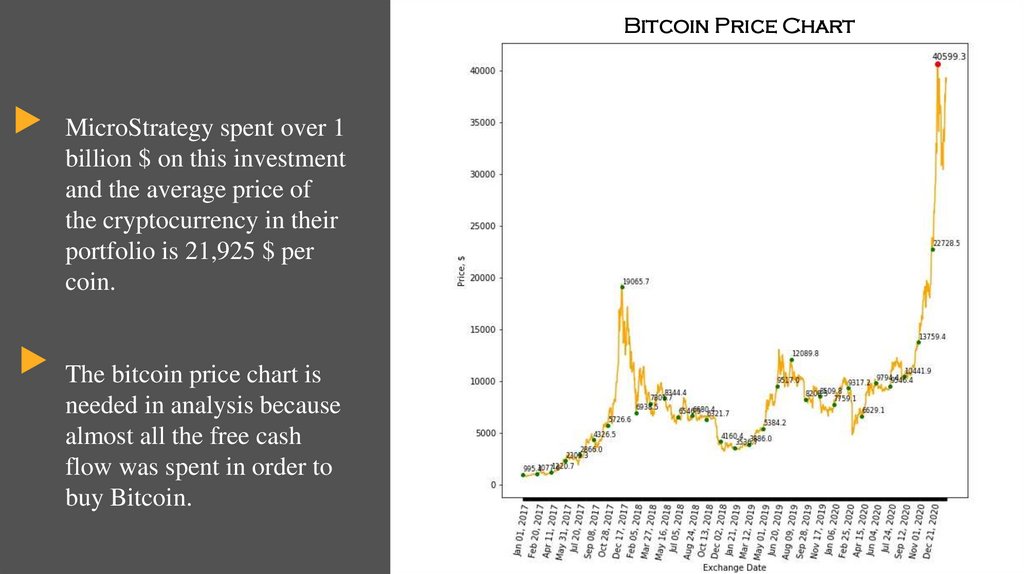

Bitcoin Price ChartMicroStrategy spent over 1

billion $ on this investment

and the average price of

the cryptocurrency in their

portfolio is 21,925 $ per

coin.

The bitcoin price chart is

needed in analysis because

almost all the free cash

flow was spent in order to

buy Bitcoin.

17.

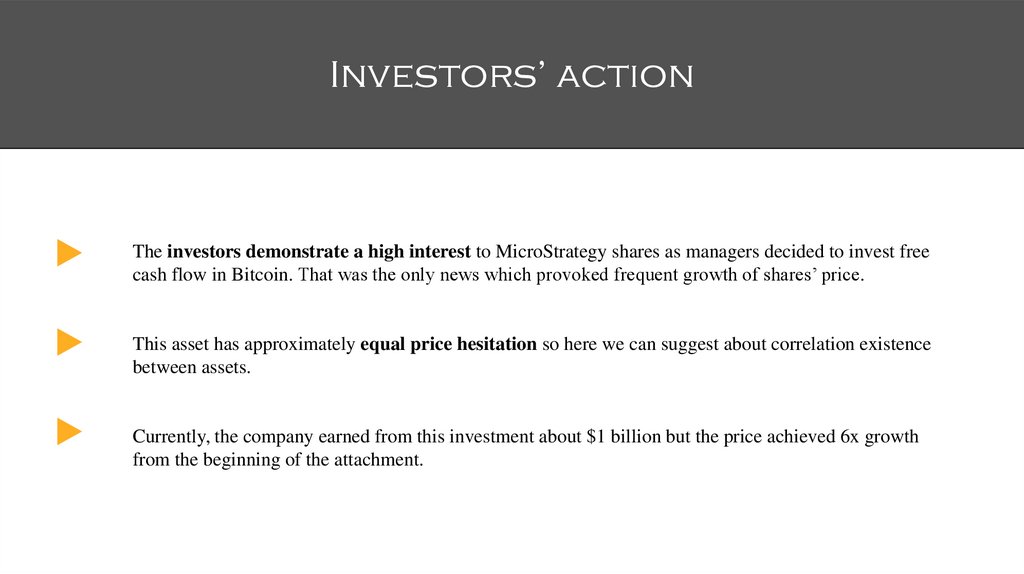

Investors’ actionThe investors demonstrate a high interest to MicroStrategy shares as managers decided to invest free

cash flow in Bitcoin. That was the only news which provoked frequent growth of shares’ price.

This asset has approximately equal price hesitation so here we can suggest about correlation existence

between assets.

Currently, the company earned from this investment about $1 billion but the price achieved 6x growth

from the beginning of the attachment.

18.

Sources1. Schachter, S., Gerin, W., Hood, D. C., & Anderassen, P. (1985a). I. Was the South Sea Bubble a random

walk? Journal of Economic Behavior & Organization, 6(4), 323–329. https://doi.org/10.1016/01672681(85)90001-0

2. Allen, F., Myers, S., & Brealey, R. (2013). Principles of Corporate Finance. McGraw-Hill Education.

3. Kurov, A. (2021, February 6). The dark side of the GameStop bubble: Driving stock prices to the moon

can hurt America. MarketWatch. https://www.marketwatch.com/story/the-dark-side-of-th..

4. Research, M. (2021, February 1). Кто действительно выиграл и проиграл от роста акций GameStop,

и каковы последствия происходящего. Vc.Ru. https://vc.ru/finance/203043-kto-deystvitelno-vyigral..

5. Elon Musk (@elonmusk) | Twitter. (n.d.). Twitter. Retrieved January 27, 2021,

from https://mobile.twitter.com/elonmusk

6. GameStop Revenue 2006-2020 | GME. (n.d.).

MacroTrends. https://www.macrotrends.net/stocks/charts/GME/gamesto..

19.

Thank you for yourattention

Экономика

Экономика