Похожие презентации:

Risk and Return

1.

Principles ofCorporate

Finance

Chapter 8

Risk and Return

Seventh Edition

Richard A. Brealey

Stewart C. Myers

Slides by

Matthew Will

McGraw Hill/Irwin

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

2. Topics Covered

8- 2Topics Covered

Markowitz Portfolio Theory

Risk and Return Relationship

Testing the CAPM

CAPM Alternatives

McGraw Hill/Irwin

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

3. Markowitz Portfolio Theory

8- 3Markowitz Portfolio Theory

Combining stocks into portfolios can reduce

standard deviation, below the level obtained

from a simple weighted average calculation.

Correlation coefficients make this possible.

The various weighted combinations of stocks

that create this standard deviations constitute

the set of efficient portfolios.

McGraw Hill/Irwin

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

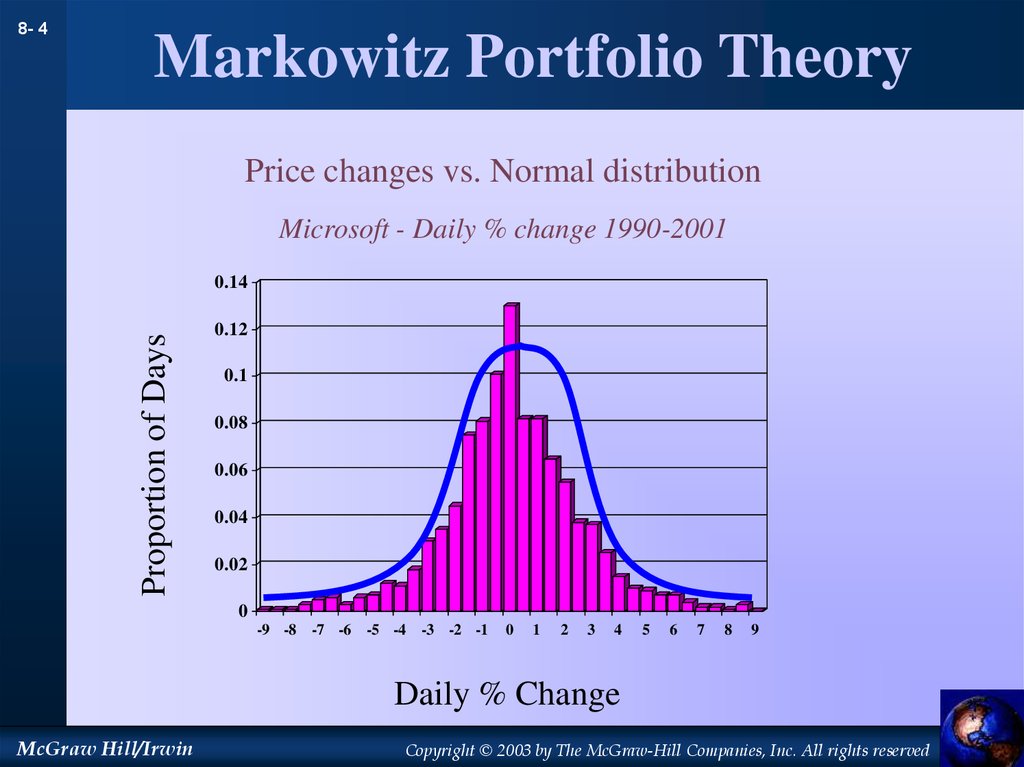

4. Markowitz Portfolio Theory

8- 4Markowitz Portfolio Theory

Price changes vs. Normal distribution

Microsoft - Daily % change 1990-2001

Proportion of Days

0.14

0.12

0.1

0.08

0.06

0.04

0.02

0

-9 -8 -7 -6

-5 -4 -3 -2 -1

0

1

2

3

4

5

6

7

8

9

Daily % Change

McGraw Hill/Irwin

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

5. Markowitz Portfolio Theory

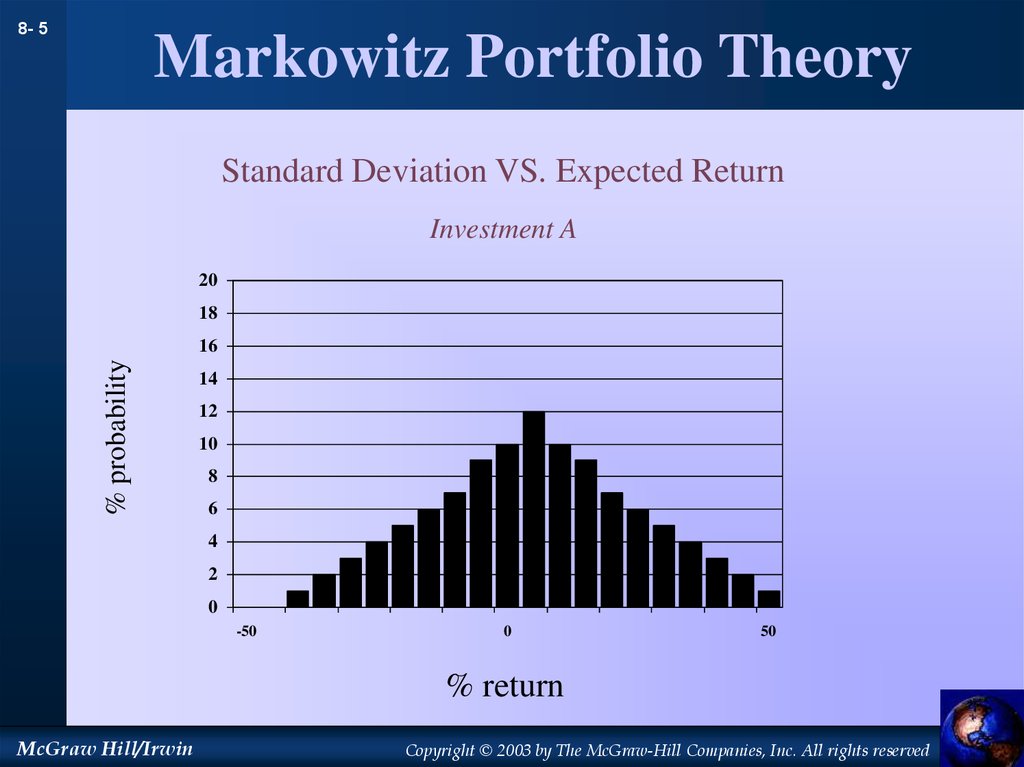

8- 5Markowitz Portfolio Theory

Standard Deviation VS. Expected Return

Investment A

20

18

% probability

16

14

12

10

8

6

4

2

0

-50

0

50

% return

McGraw Hill/Irwin

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

6. Markowitz Portfolio Theory

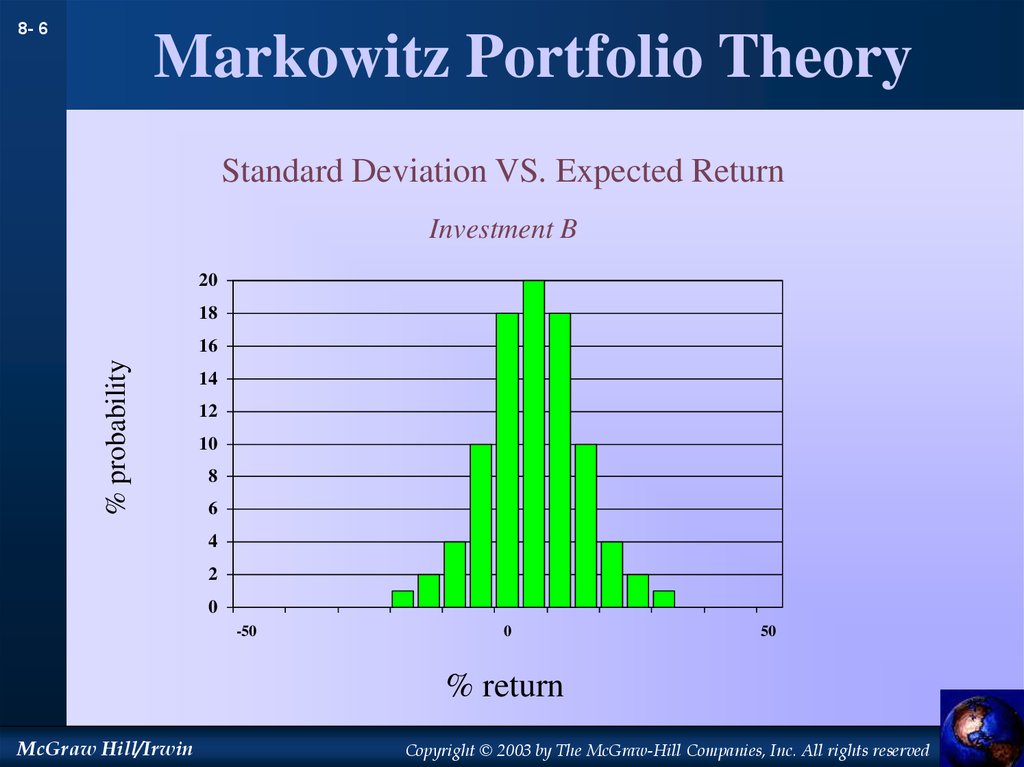

8- 6Markowitz Portfolio Theory

Standard Deviation VS. Expected Return

Investment B

20

18

% probability

16

14

12

10

8

6

4

2

0

-50

0

50

% return

McGraw Hill/Irwin

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

7. Markowitz Portfolio Theory

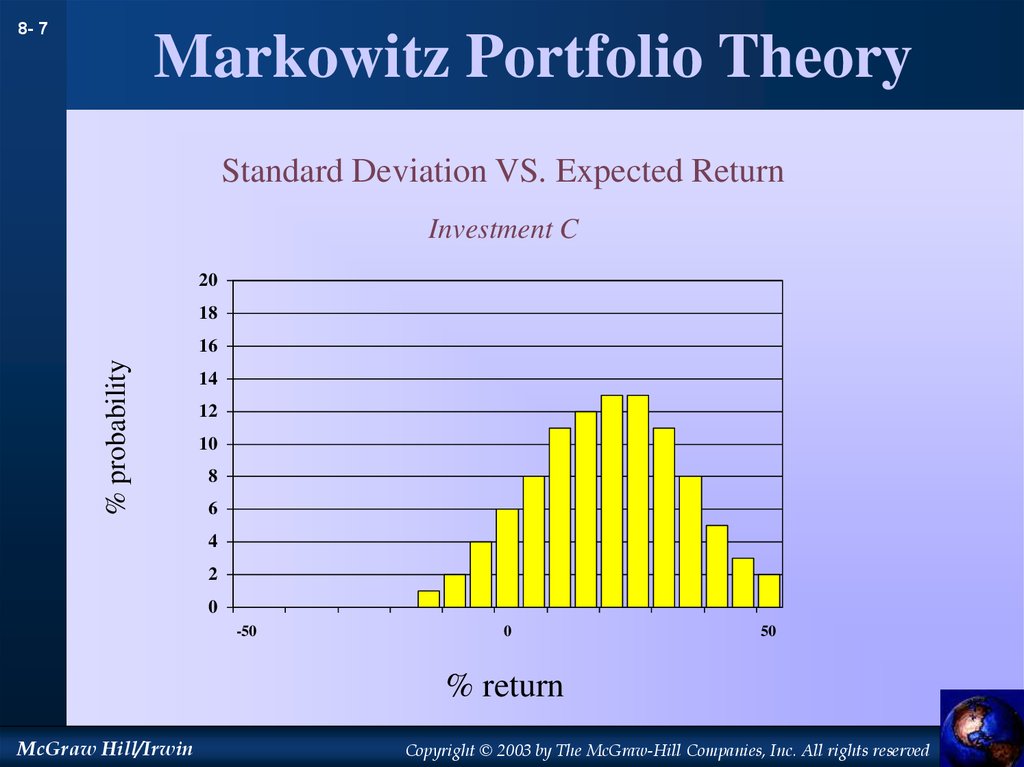

8- 7Markowitz Portfolio Theory

Standard Deviation VS. Expected Return

Investment C

20

18

% probability

16

14

12

10

8

6

4

2

0

-50

0

50

% return

McGraw Hill/Irwin

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

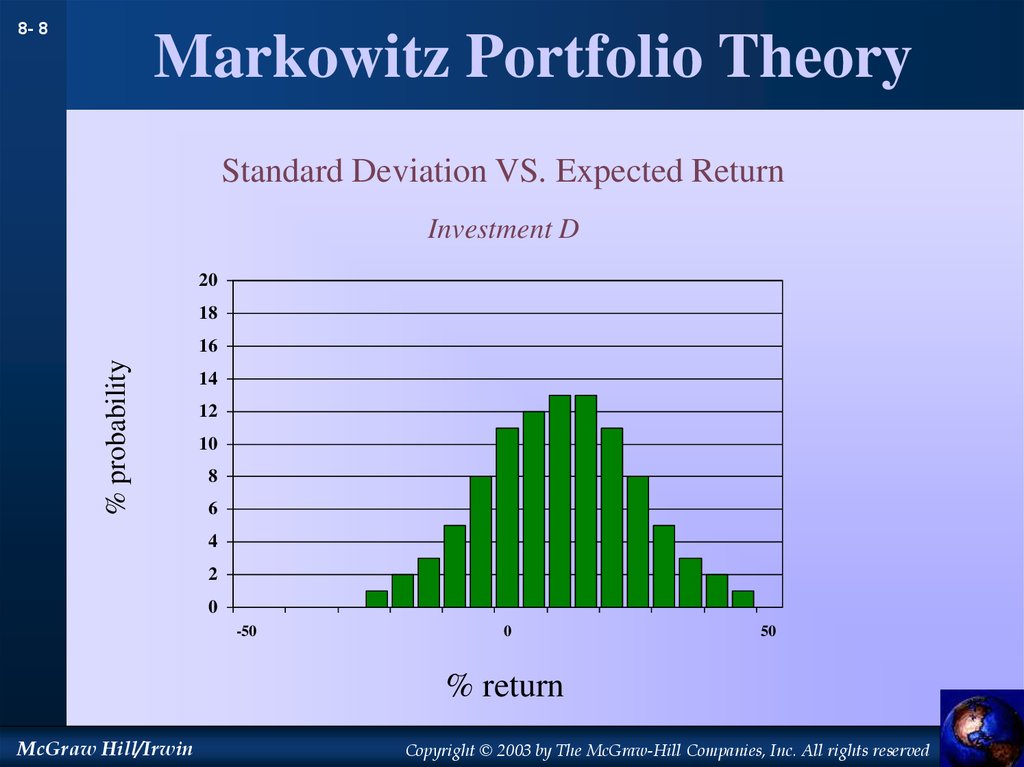

8. Markowitz Portfolio Theory

8- 8Markowitz Portfolio Theory

Standard Deviation VS. Expected Return

Investment D

20

18

% probability

16

14

12

10

8

6

4

2

0

-50

0

50

% return

McGraw Hill/Irwin

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

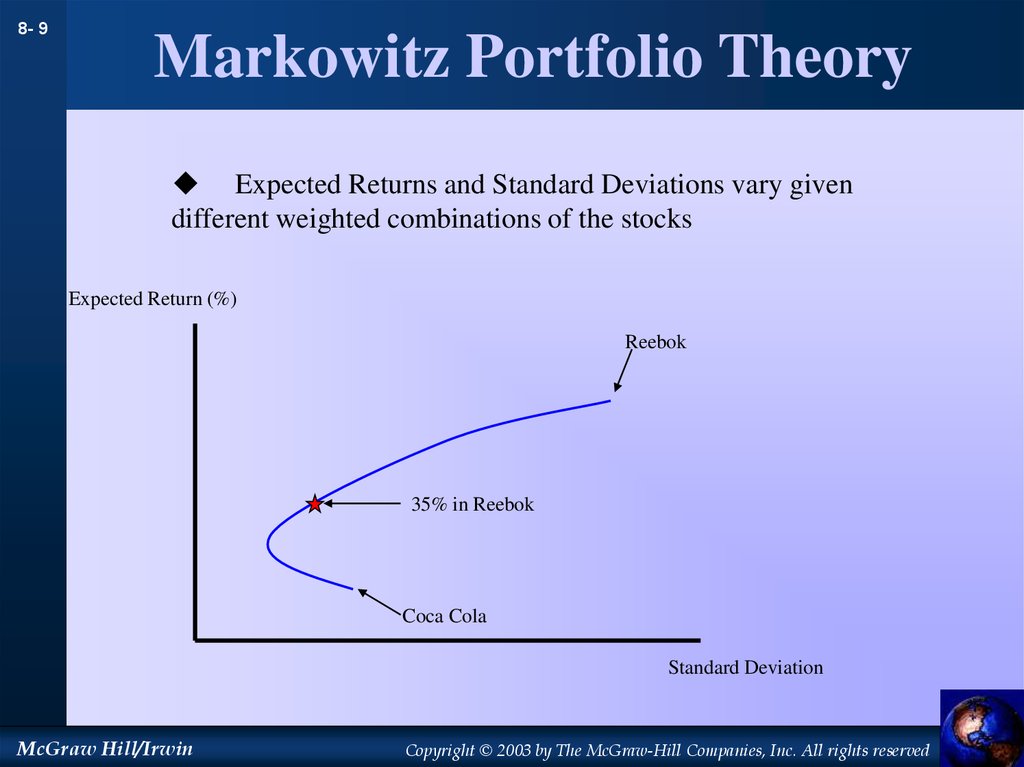

9. Markowitz Portfolio Theory

8- 9Markowitz Portfolio Theory

Expected Returns and Standard Deviations vary given

different weighted combinations of the stocks

Expected Return (%)

Reebok

35% in Reebok

Coca Cola

Standard Deviation

McGraw Hill/Irwin

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

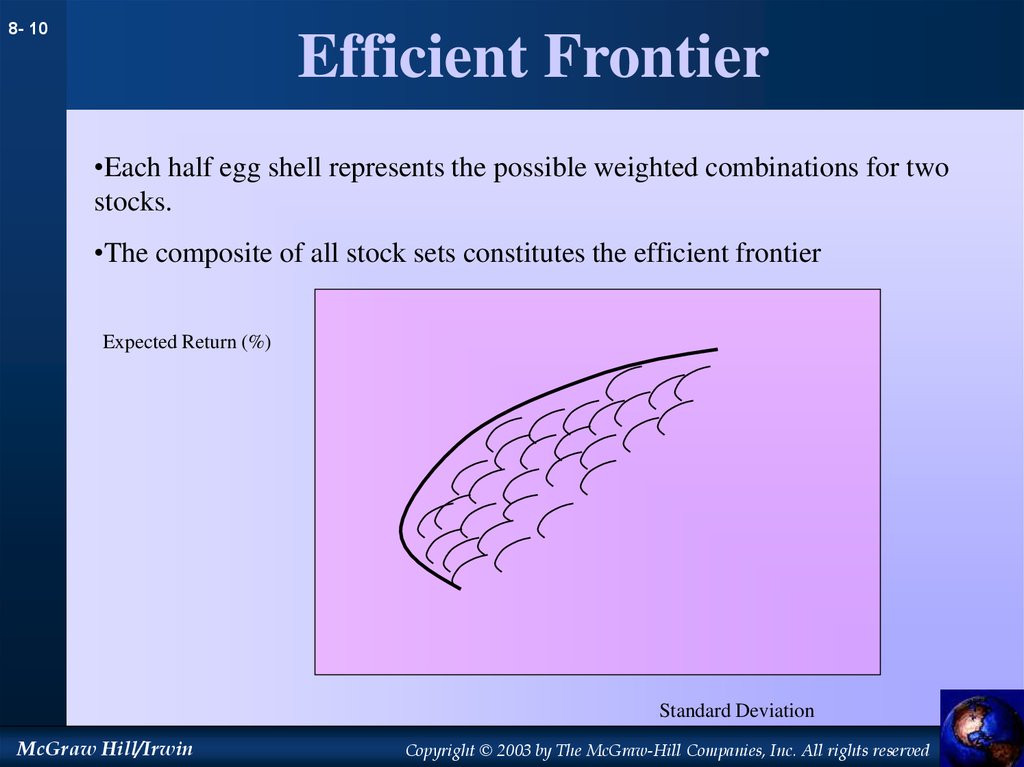

10. Efficient Frontier

8- 10Efficient Frontier

•Each half egg shell represents the possible weighted combinations for two

stocks.

•The composite of all stock sets constitutes the efficient frontier

Expected Return (%)

Standard Deviation

McGraw Hill/Irwin

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

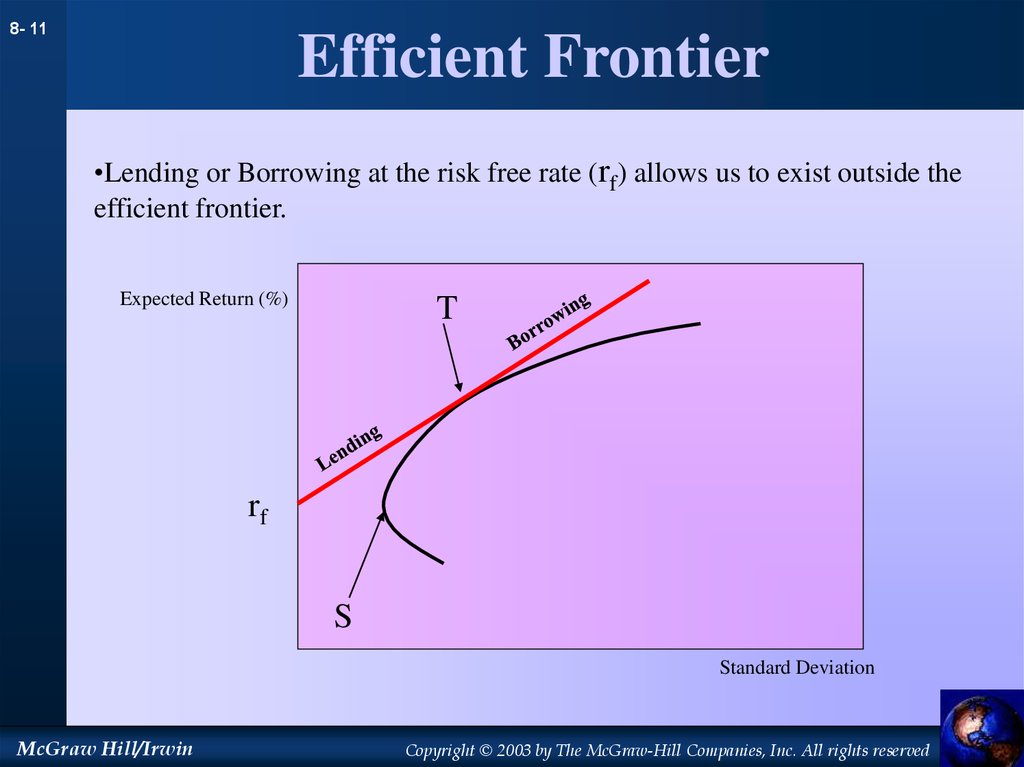

11. Efficient Frontier

8- 11Efficient Frontier

•Lending or Borrowing at the risk free rate (rf) allows us to exist outside the

efficient frontier.

Expected Return (%)

T

rf

S

Standard Deviation

McGraw Hill/Irwin

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

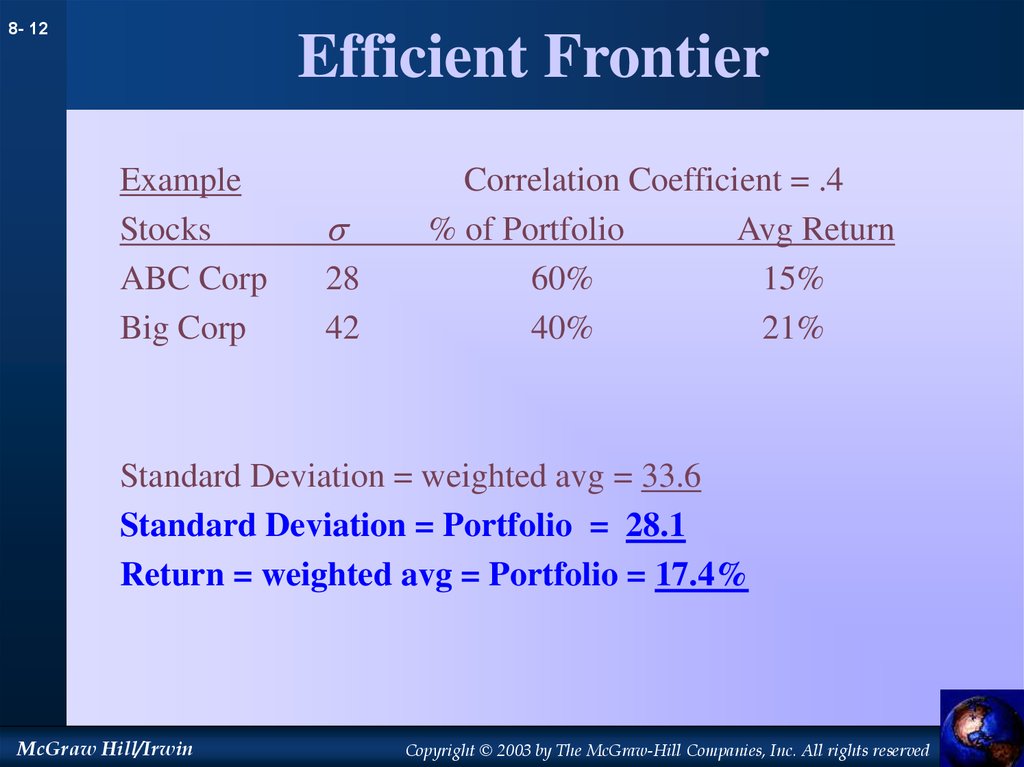

12. Efficient Frontier

8- 12Efficient Frontier

Example

Stocks

ABC Corp

Big Corp

s

28

42

Correlation Coefficient = .4

% of Portfolio

Avg Return

60%

15%

40%

21%

Standard Deviation = weighted avg = 33.6

Standard Deviation = Portfolio = 28.1

Return = weighted avg = Portfolio = 17.4%

McGraw Hill/Irwin

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

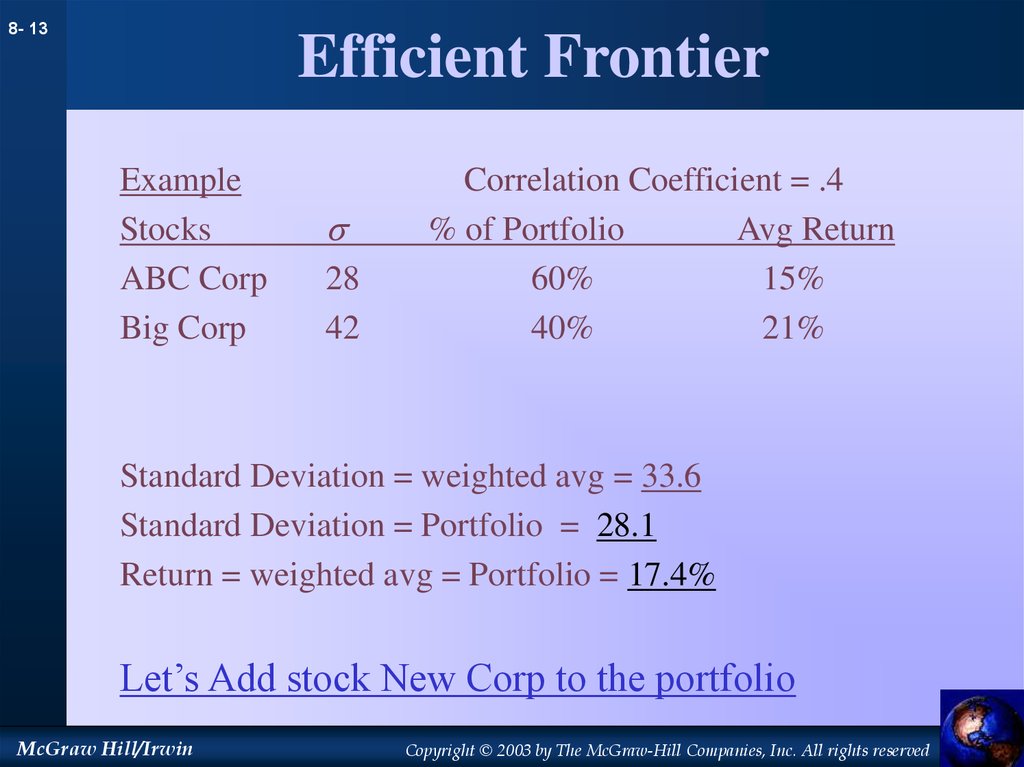

13. Efficient Frontier

8- 13Efficient Frontier

Example

Stocks

ABC Corp

Big Corp

s

28

42

Correlation Coefficient = .4

% of Portfolio

Avg Return

60%

15%

40%

21%

Standard Deviation = weighted avg = 33.6

Standard Deviation = Portfolio = 28.1

Return = weighted avg = Portfolio = 17.4%

Let’s Add stock New Corp to the portfolio

McGraw Hill/Irwin

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

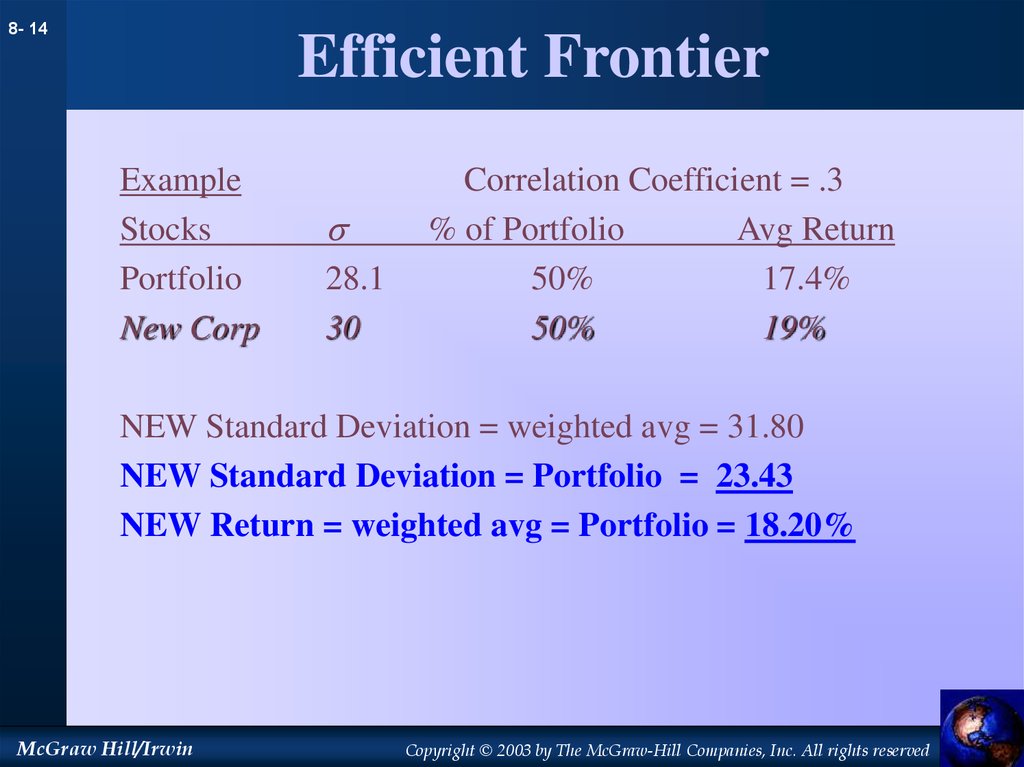

14. Efficient Frontier

8- 14Efficient Frontier

Example

Stocks

Portfolio

New Corp

s

28.1

30

Correlation Coefficient = .3

% of Portfolio

Avg Return

50%

17.4%

50%

19%

NEW Standard Deviation = weighted avg = 31.80

NEW Standard Deviation = Portfolio = 23.43

NEW Return = weighted avg = Portfolio = 18.20%

McGraw Hill/Irwin

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

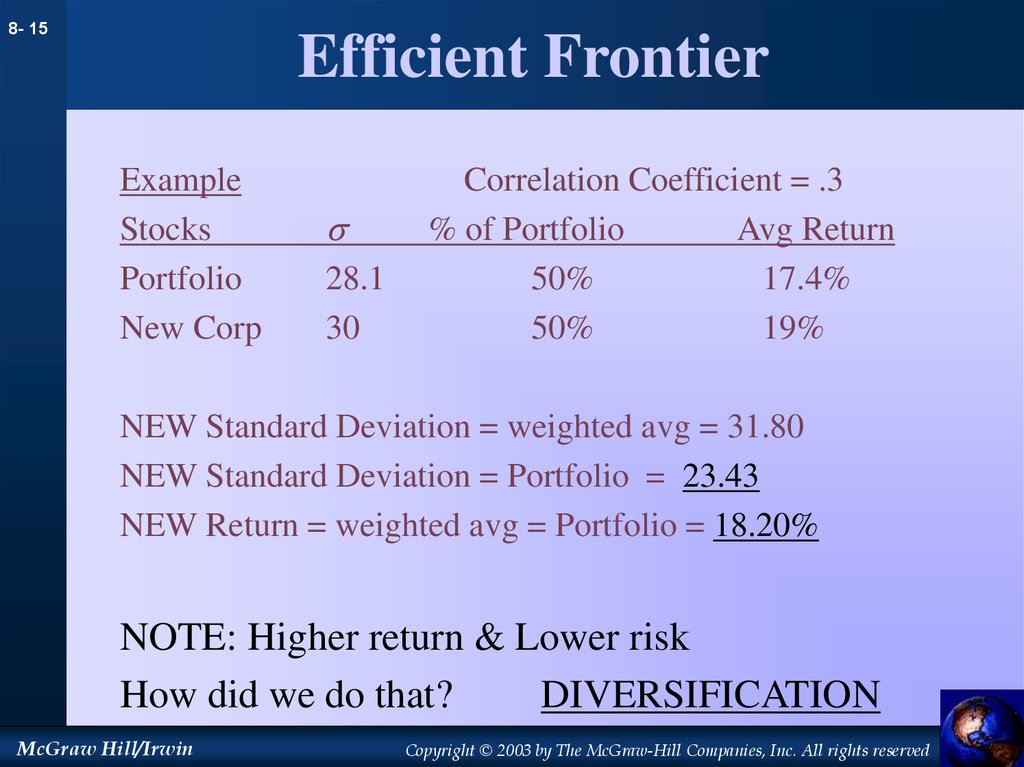

15. Efficient Frontier

8- 15Efficient Frontier

Example

Stocks

Portfolio

New Corp

s

28.1

30

Correlation Coefficient = .3

% of Portfolio

Avg Return

50%

17.4%

50%

19%

NEW Standard Deviation = weighted avg = 31.80

NEW Standard Deviation = Portfolio = 23.43

NEW Return = weighted avg = Portfolio = 18.20%

NOTE: Higher return & Lower risk

How did we do that?

DIVERSIFICATION

McGraw Hill/Irwin

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

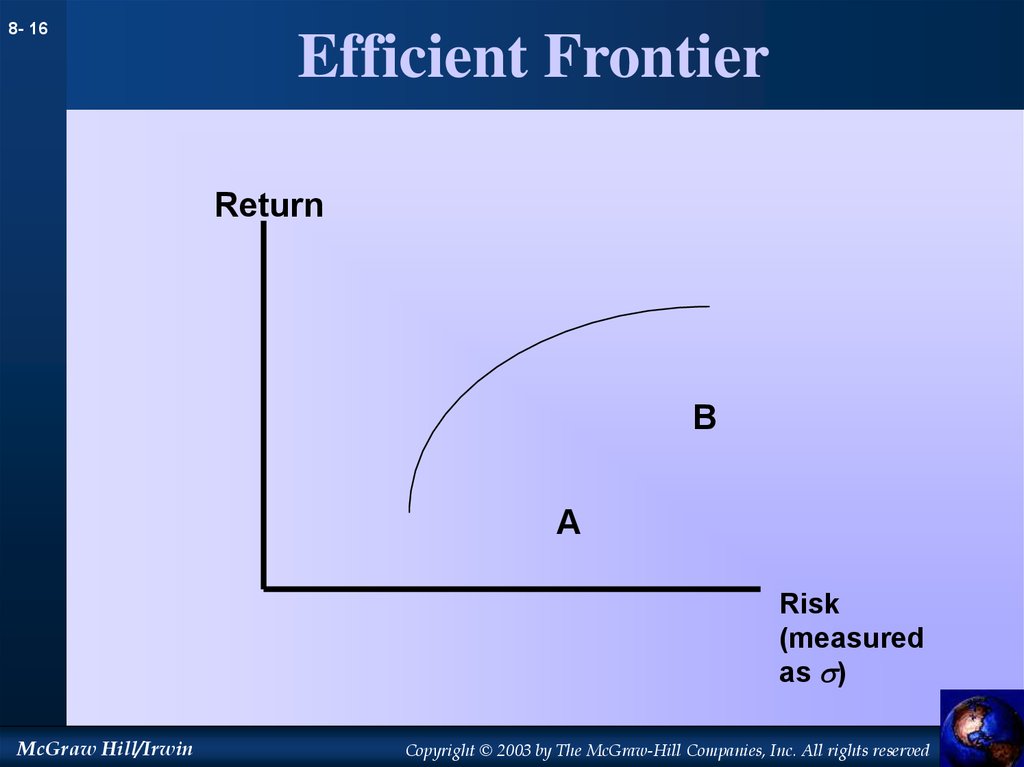

16. Efficient Frontier

8- 16Efficient Frontier

Return

B

A

Risk

(measured

as s)

McGraw Hill/Irwin

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

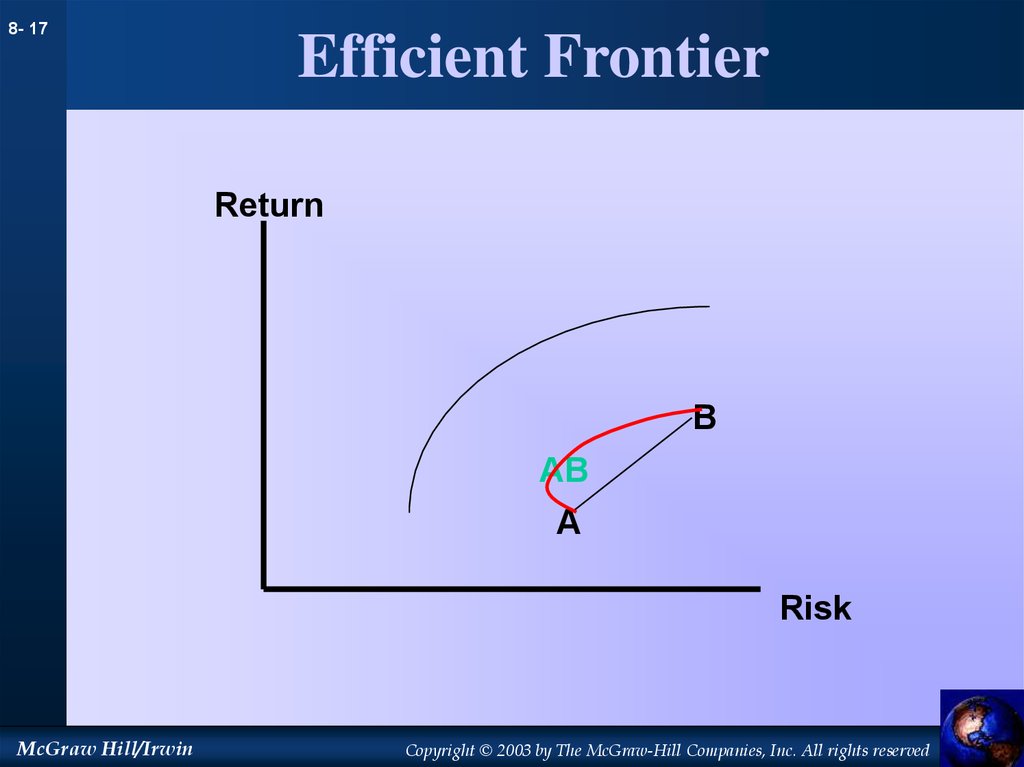

17. Efficient Frontier

8- 17Efficient Frontier

Return

B

AB

A

Risk

McGraw Hill/Irwin

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

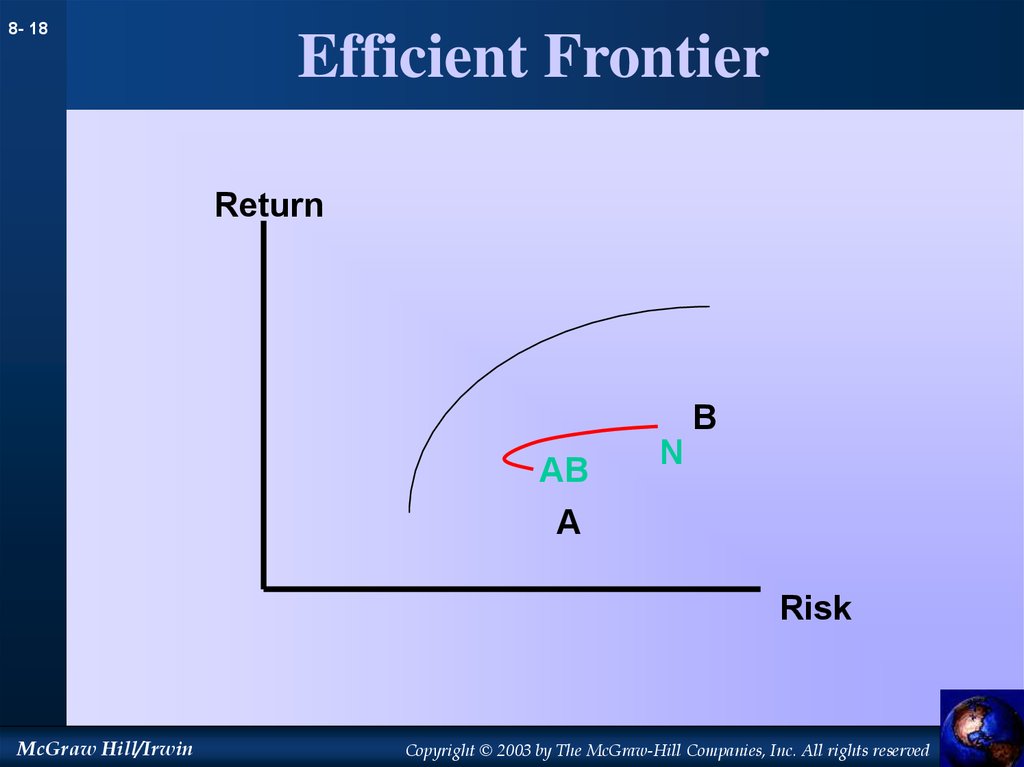

18. Efficient Frontier

8- 18Efficient Frontier

Return

B

AB

N

A

Risk

McGraw Hill/Irwin

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

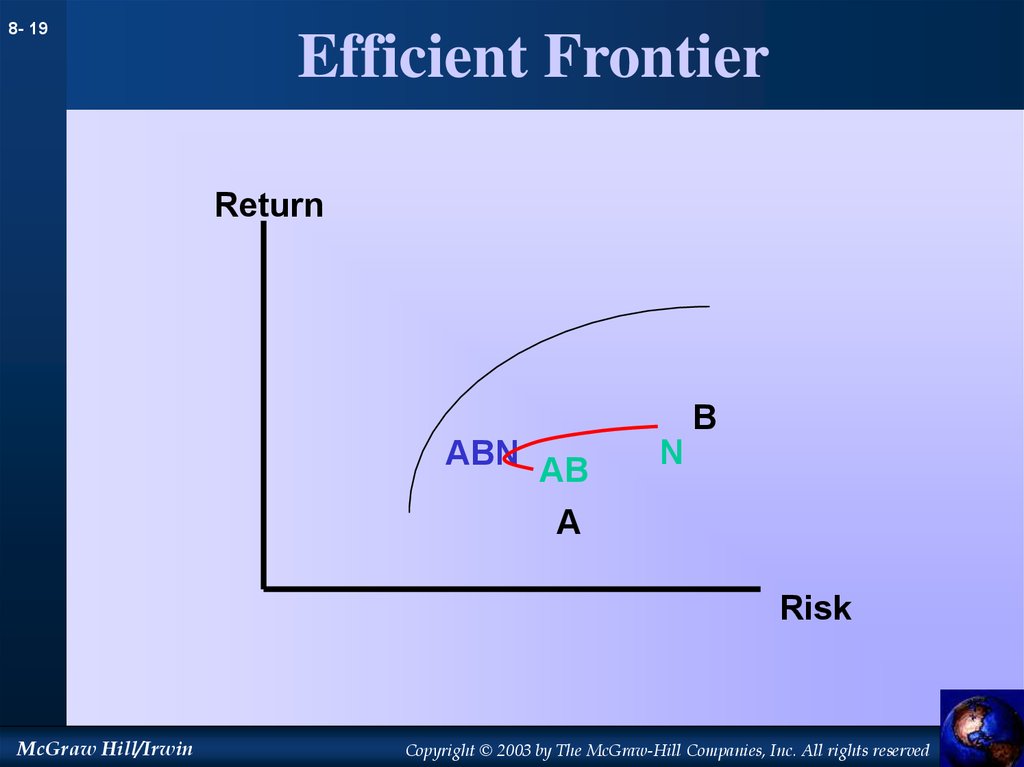

19. Efficient Frontier

8- 19Efficient Frontier

Return

B

ABN AB

N

A

Risk

McGraw Hill/Irwin

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

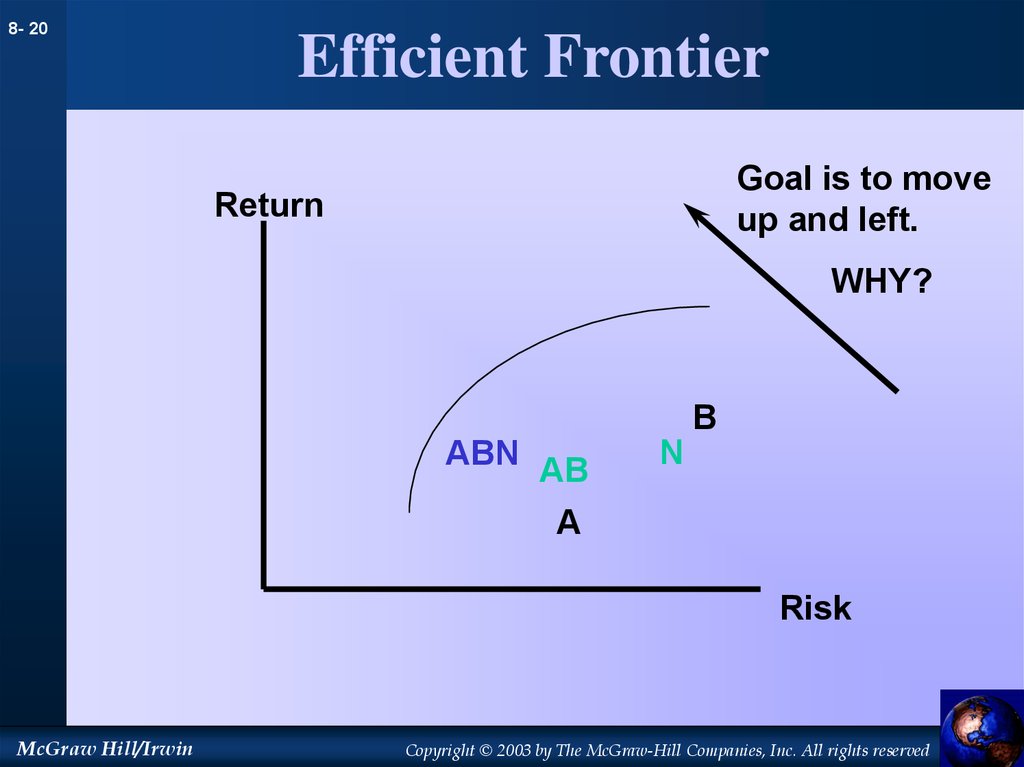

20. Efficient Frontier

8- 20Efficient Frontier

Goal is to move

up and left.

Return

WHY?

B

ABN AB

N

A

Risk

McGraw Hill/Irwin

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

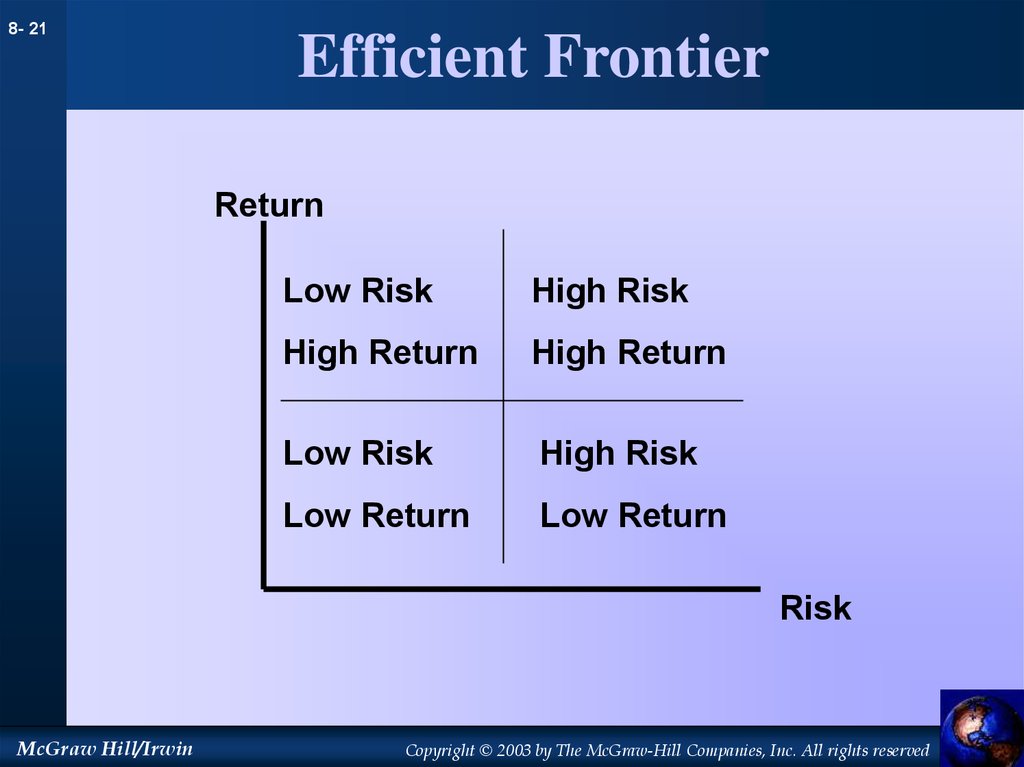

21. Efficient Frontier

8- 21Efficient Frontier

Return

Low Risk

High Risk

High Return

High Return

Low Risk

High Risk

Low Return

Low Return

Risk

McGraw Hill/Irwin

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

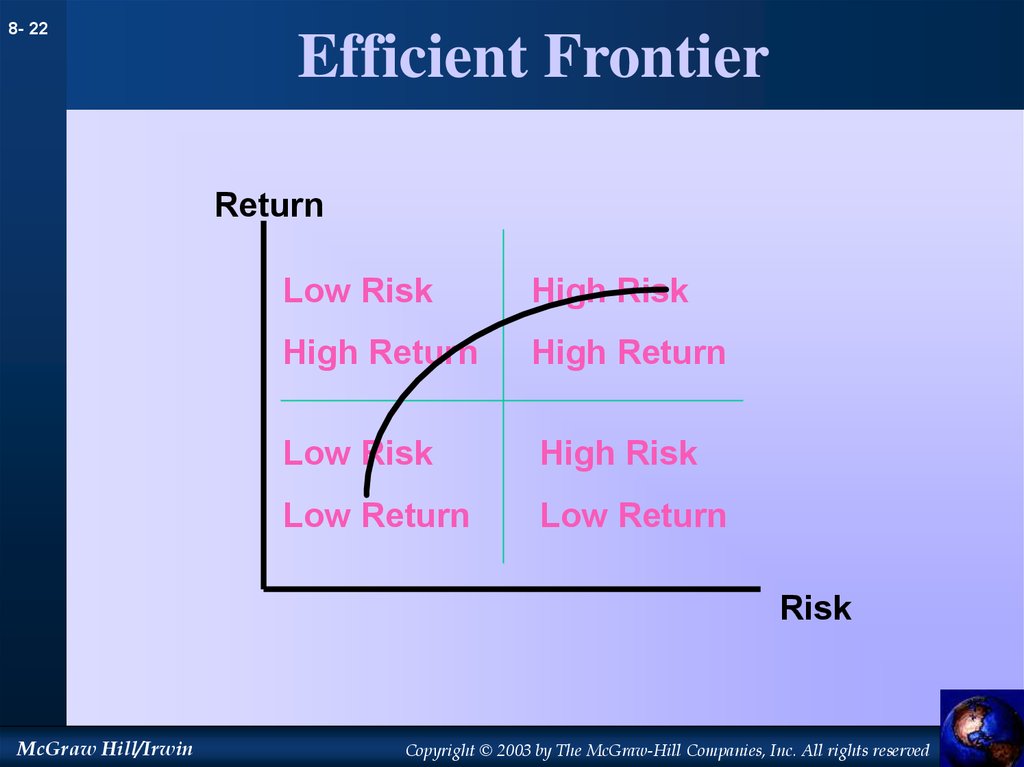

22. Efficient Frontier

8- 22Efficient Frontier

Return

Low Risk

High Risk

High Return

High Return

Low Risk

High Risk

Low Return

Low Return

Risk

McGraw Hill/Irwin

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

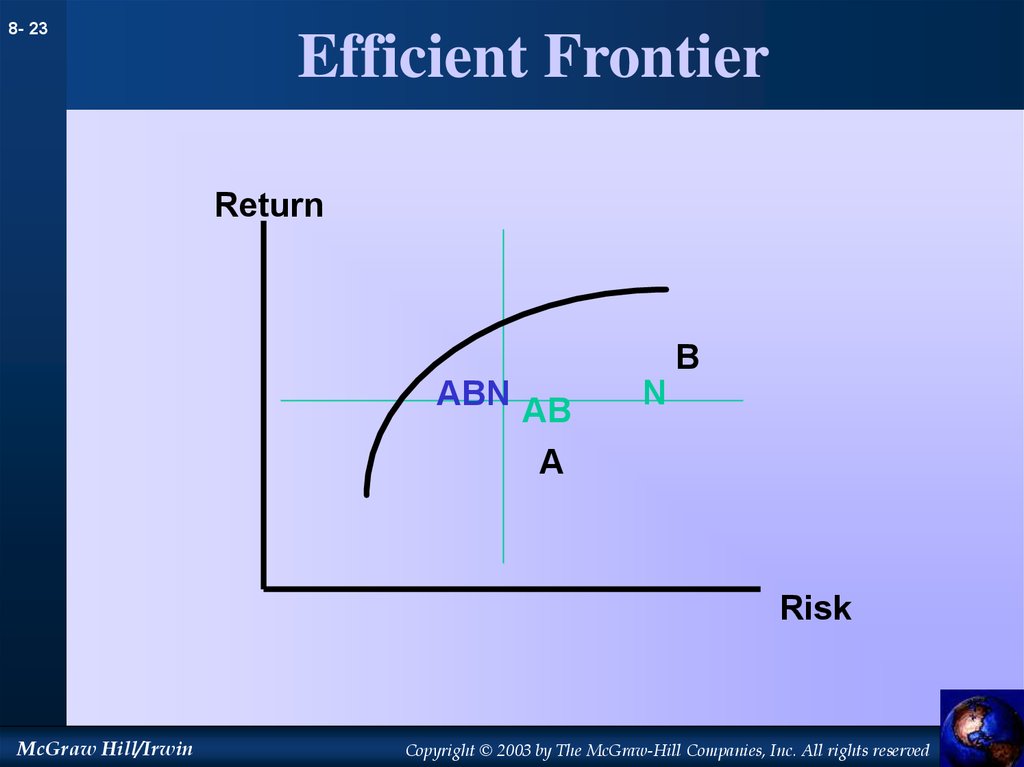

23. Efficient Frontier

8- 23Efficient Frontier

Return

B

ABN AB

A

N

Risk

McGraw Hill/Irwin

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

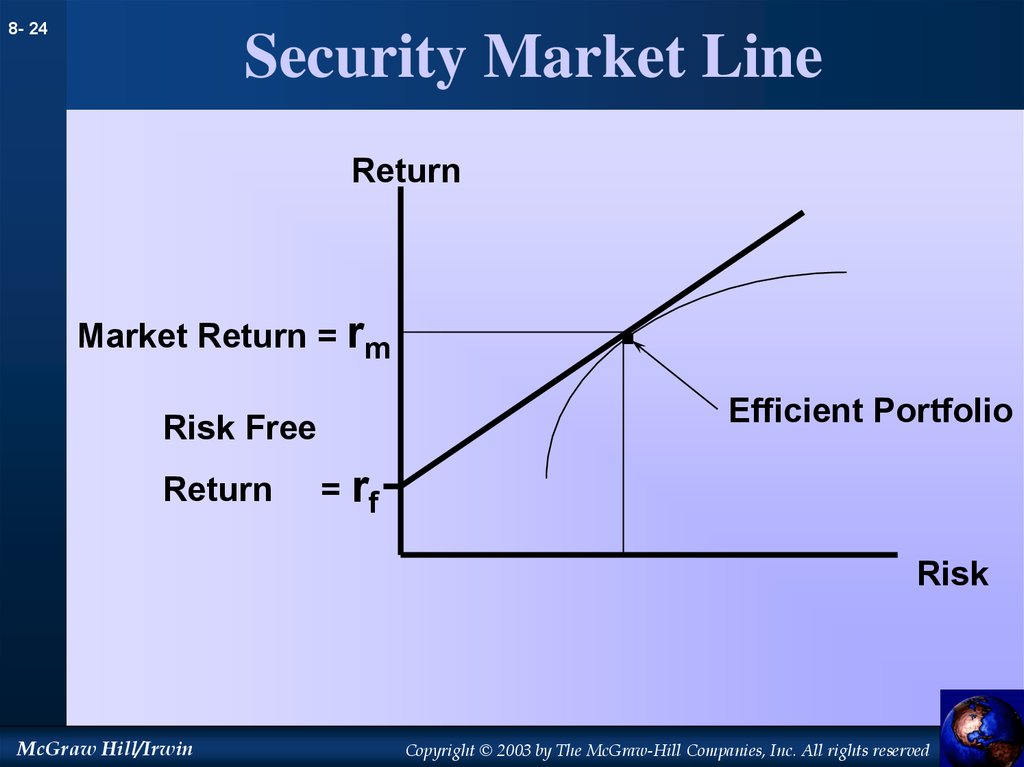

24. Security Market Line

8- 24Security Market Line

Return

Market Return = rm

Efficient Portfolio

Risk Free

Return

.

= rf

Risk

McGraw Hill/Irwin

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

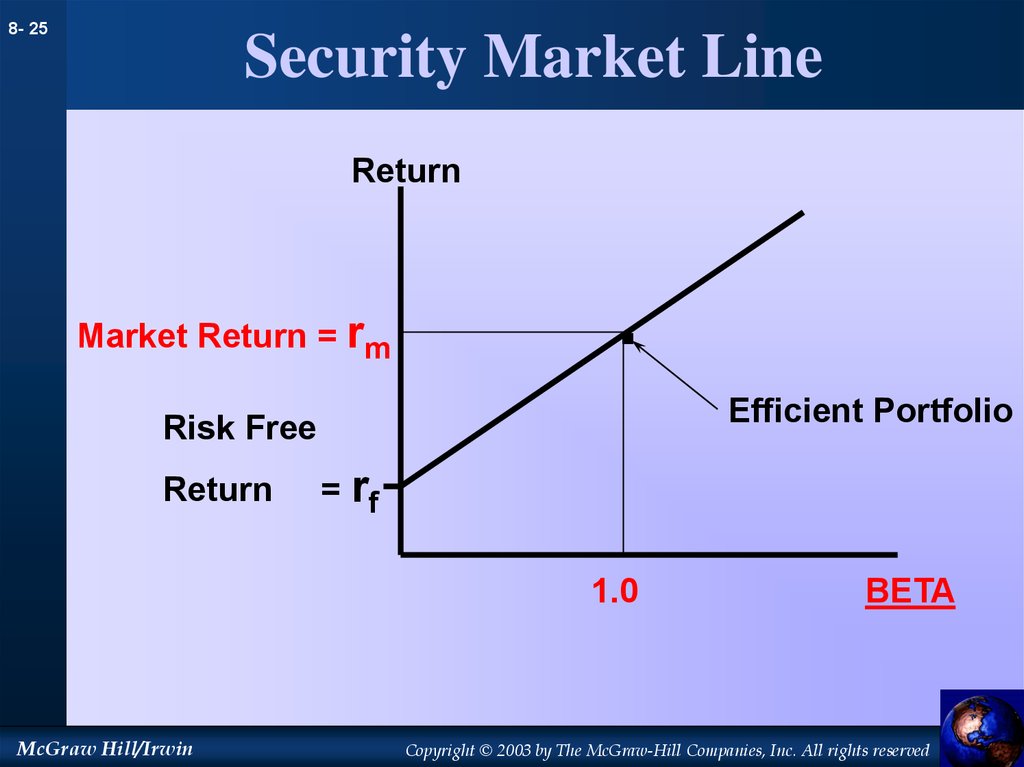

25. Security Market Line

8- 25Security Market Line

Return

Market Return = rm

.

Efficient Portfolio

Risk Free

Return

= rf

1.0

McGraw Hill/Irwin

BETA

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

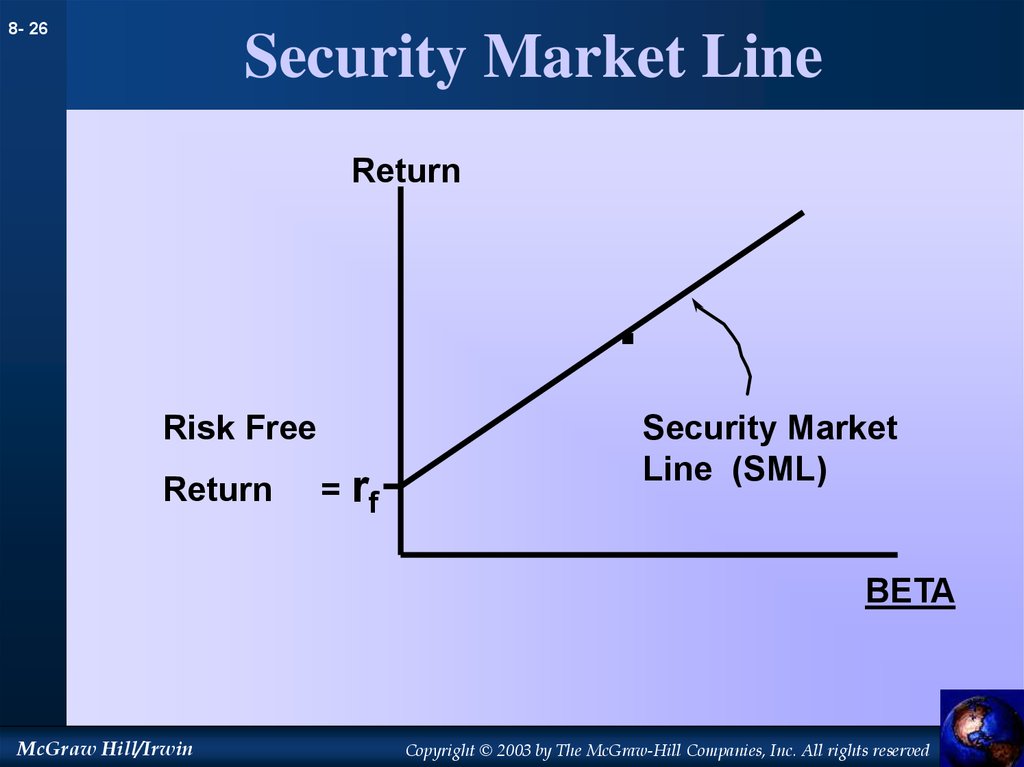

26. Security Market Line

8- 26Security Market Line

Return

.

Risk Free

Return

= rf

Security Market

Line (SML)

BETA

McGraw Hill/Irwin

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

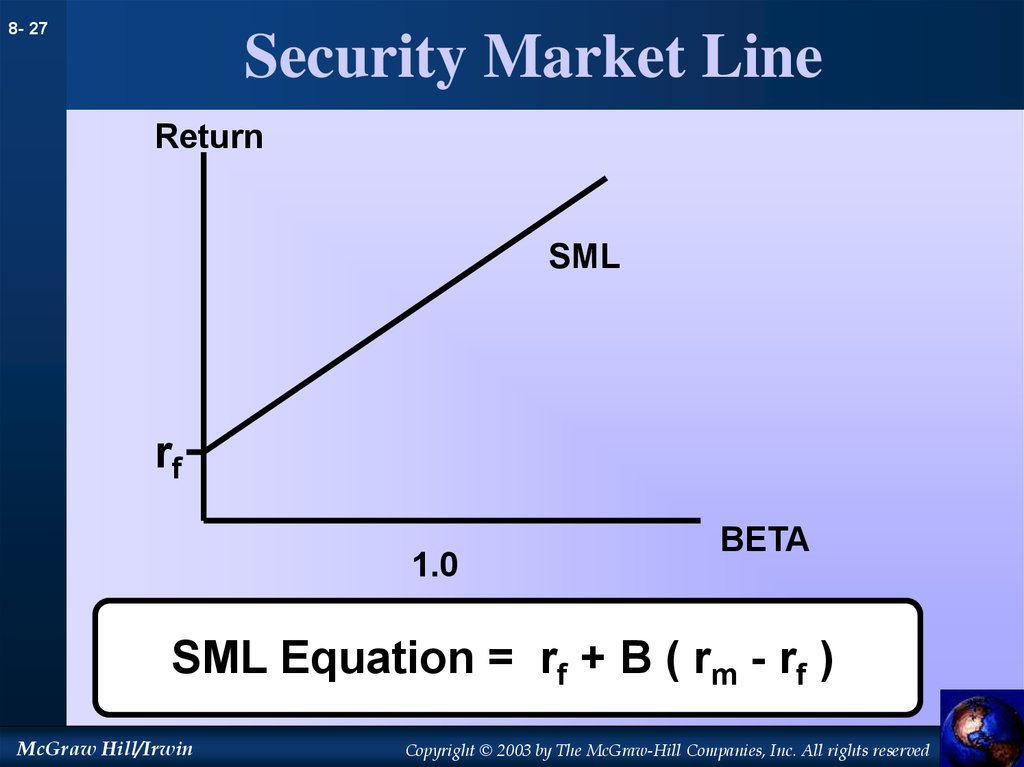

27. Security Market Line

8- 27Security Market Line

Return

SML

rf

1.0

BETA

SML Equation = rf + B ( rm - rf )

McGraw Hill/Irwin

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

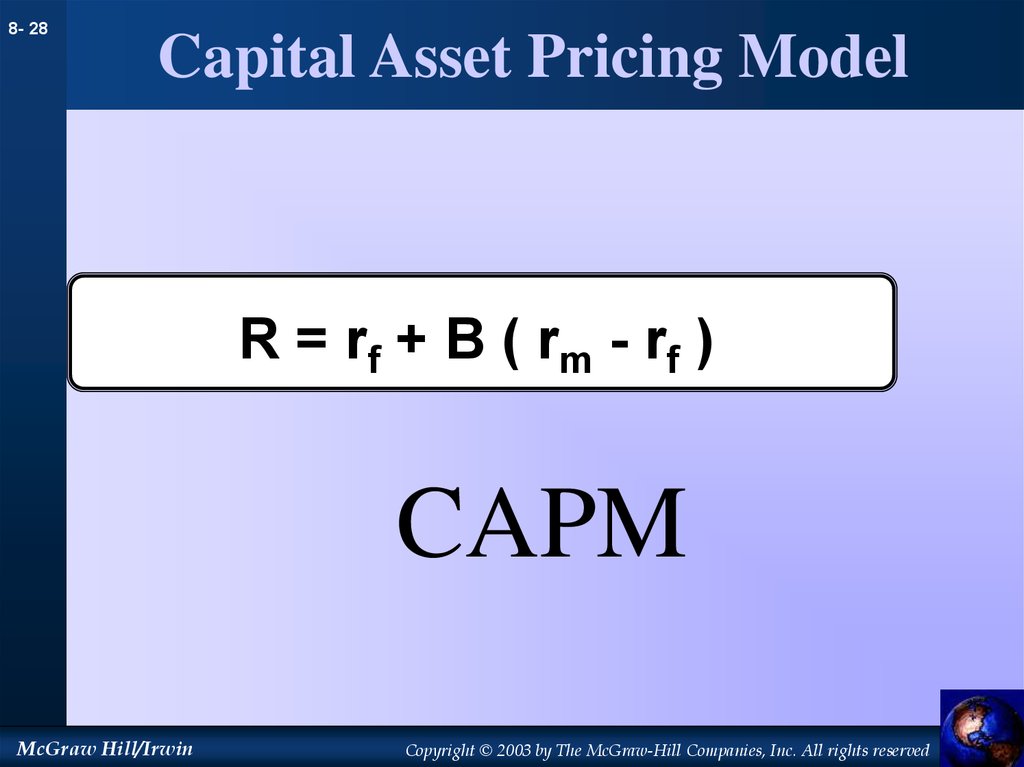

28. Capital Asset Pricing Model

8- 28Capital Asset Pricing Model

R = r f + B ( r m - rf )

CAPM

McGraw Hill/Irwin

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

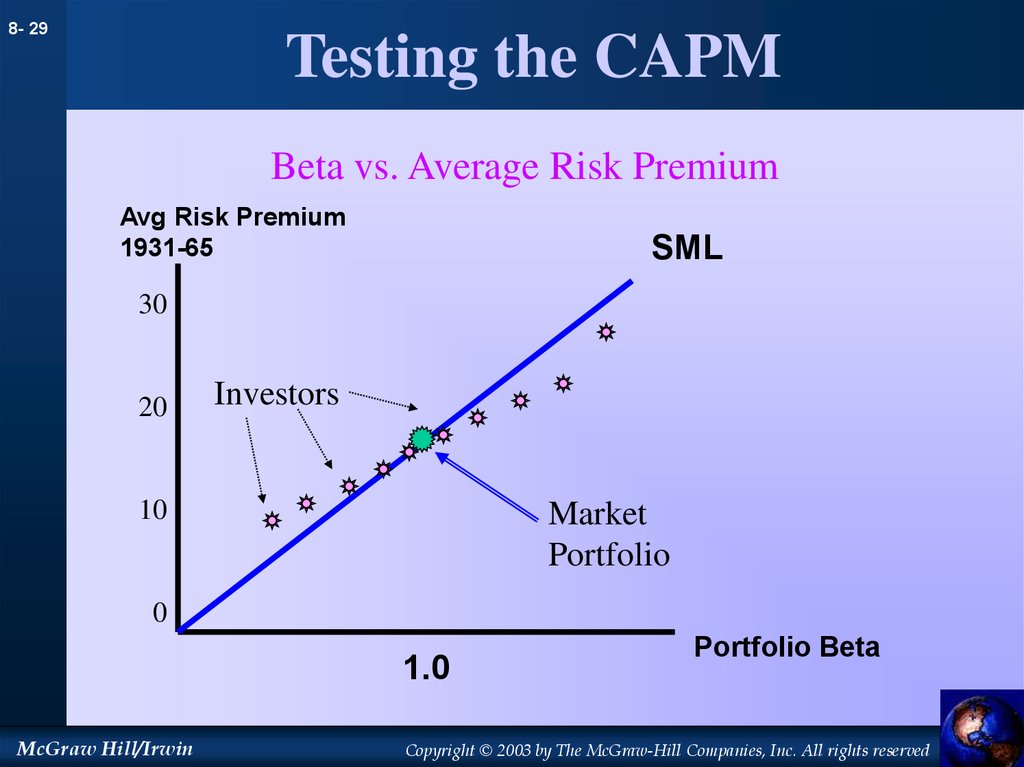

29. Testing the CAPM

8- 29Testing the CAPM

Beta vs. Average Risk Premium

Avg Risk Premium

1931-65

SML

30

20

Investors

10

Market

Portfolio

0

1.0

McGraw Hill/Irwin

Portfolio Beta

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

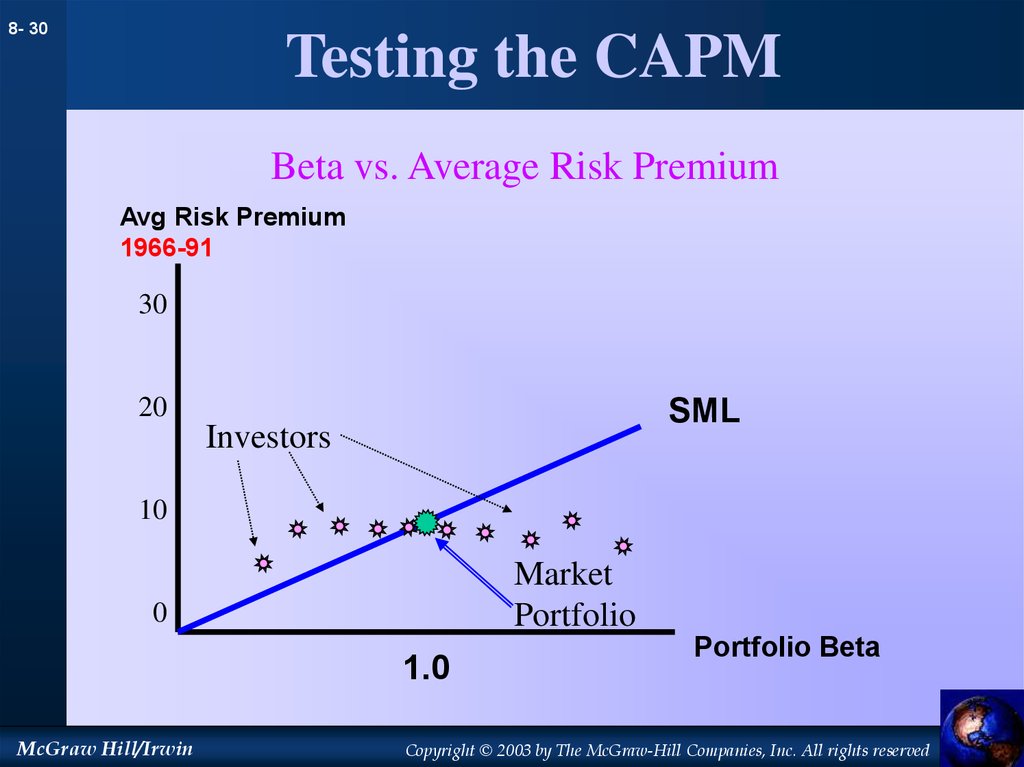

30. Testing the CAPM

8- 30Testing the CAPM

Beta vs. Average Risk Premium

Avg Risk Premium

1966-91

30

20

SML

Investors

10

Market

Portfolio

0

1.0

McGraw Hill/Irwin

Portfolio Beta

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

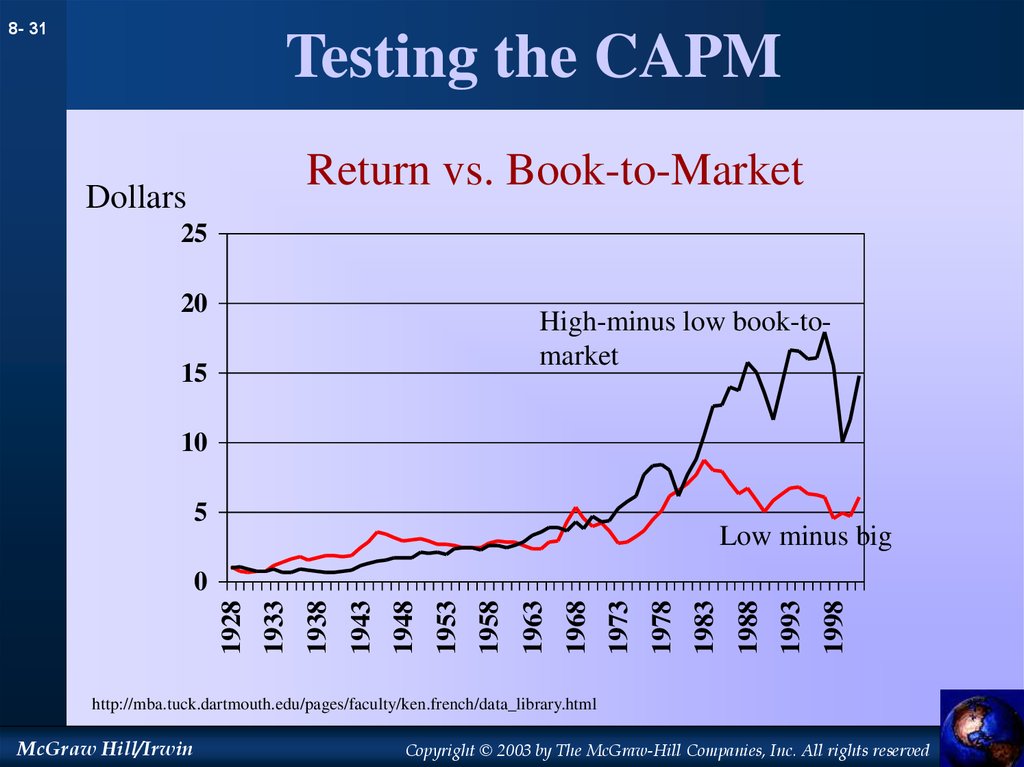

31. Testing the CAPM

8- 31Testing the CAPM

Return vs. Book-to-Market

Dollars

25

20

High-minus low book-tomarket

15

10

5

Low minus big

1998

1993

1988

1983

1978

1973

1968

1963

1958

1953

1948

1943

1938

1933

1928

0

http://mba.tuck.dartmouth.edu/pages/faculty/ken.french/data_library.html

McGraw Hill/Irwin

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

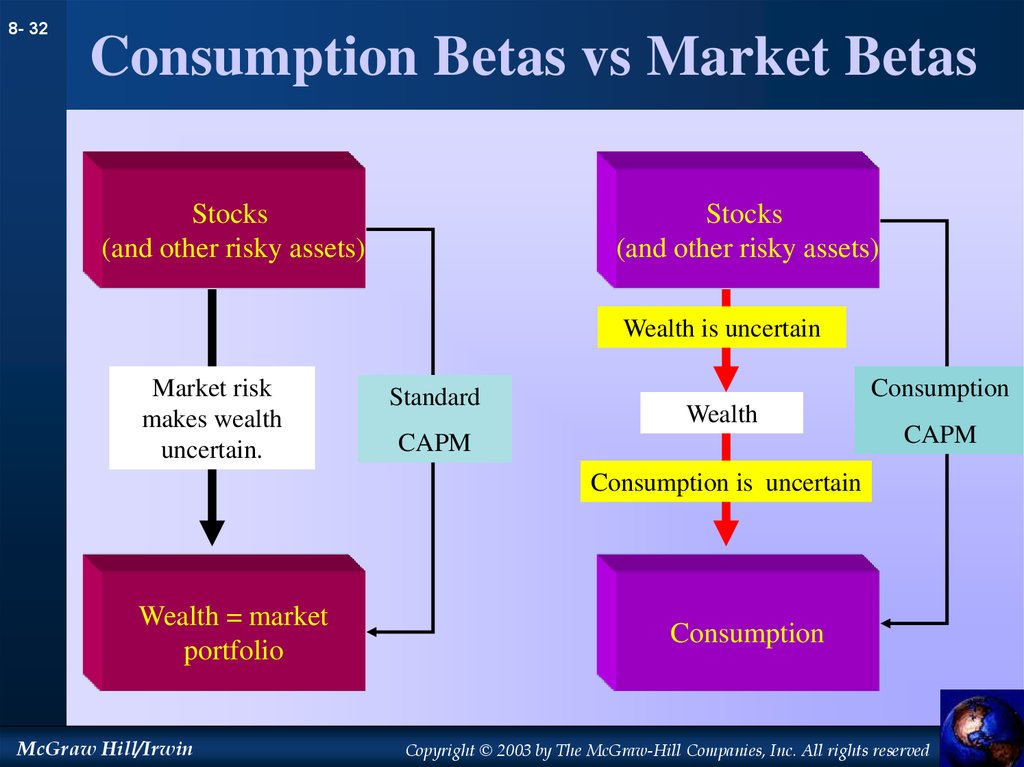

32. Consumption Betas vs Market Betas

8- 32Consumption Betas vs Market Betas

Stocks

(and other risky assets)

Stocks

(and other risky assets)

Wealth is uncertain

Market risk

makes wealth

uncertain.

Standard

Consumption

Wealth

CAPM

CAPM

Consumption is uncertain

Wealth = market

portfolio

McGraw Hill/Irwin

Consumption

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

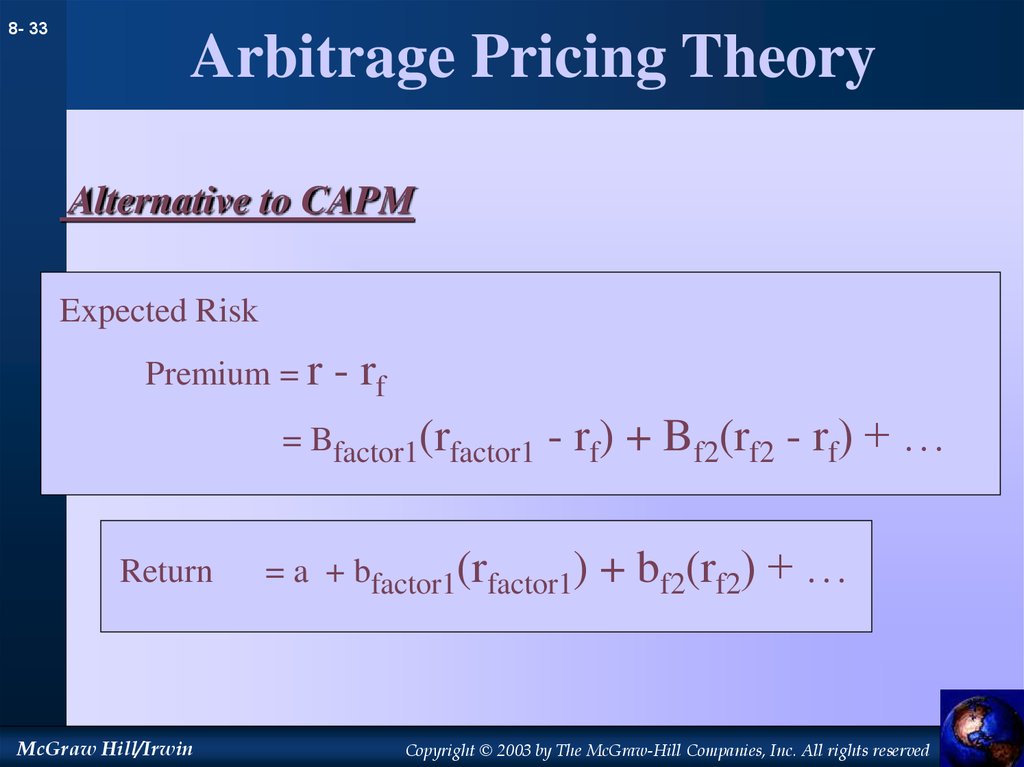

33. Arbitrage Pricing Theory

8- 33Arbitrage Pricing Theory

Alternative to CAPM

Expected Risk

Premium = r

- rf

= Bfactor1(rfactor1

Return

McGraw Hill/Irwin

- rf) + Bf2(rf2 - rf) + …

= a + bfactor1(rfactor1)

+ bf2(rf2) + …

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

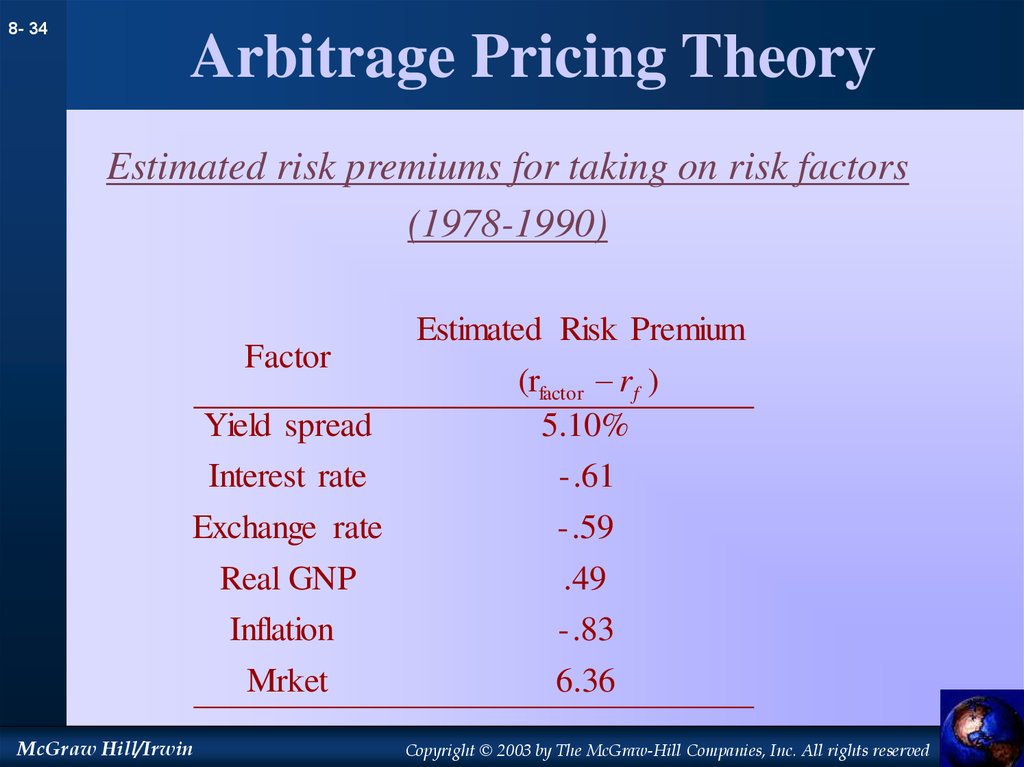

34. Arbitrage Pricing Theory

8- 34Arbitrage Pricing Theory

Estimated risk premiums for taking on risk factors

(1978-1990)

Factor

Estimated Risk Premium

Yield spread

(rfactor rf )

5.10%

Interest rate

- .61

Exchange rate

- .59

Real GNP

.49

Inflation

- .83

Mrket

6.36

McGraw Hill/Irwin

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

Финансы

Финансы