Похожие презентации:

Information Systems: A Manager’s Guide to Harnessing Technology, V7.0

1. Information Systems: A Manager’s Guide to Harnessing Technology, V7.0

By John Gallaugher©FlatWorld 2018

2.

PUBLISHED BY:FLATWORLD

©2018 BY FLATWORLD. ALL RIGHTS RESERVED. YOUR USE OF THIS WORK IS SUBJECT TO THE LICENSE

AGREEMENT AVAILABLE.

USED, MODIFIED, OR REPRODUCED IN ANY FORM BY ANY MEANS EXCEPT AS EXPRESSLY PERMITTED

UNDER THE LICENSING AGREEMENT.

©FlatWorld 2018

3.

CHAPTER 10The Sharing Economy, Collaborative

Consumption, and Efficient Markets

Through Tech

©FlatWorld 2018

4. Learning Objectives

1. Recognize firms often categorized as part of the “sharing economy”or participating in “collaborative consumption.”

2. Gain a sense of market size, impact, investment, and business

valuation in these sectors.

©FlatWorld 2018

5. Introduction

• Technology allows product and service providers to connect withconsumers.

• Offers far greater reach and efficiency than traditional markets.

• Efforts are enabling a generation of “citizen suppliers.”

• Product owners become providers of rentals.

• New class of micro-entrepreneurs providing personal services.

• Categories of products are “collaboratively consumed.”

• An individual takes possession of an item for a period of time and then returns it

for use by others.

• Internet-enabled market makers.

• Roots in eBay and craigslist.

©FlatWorld 2018

6. Firms Characterized as Part of the “Sharing Economy” or “Collaborative Consumption”

• Examples of firms:©FlatWorld 2018

eBay, craigslist, thredUP

Zilok, Rent The Runway, Chegg

Etsy, CustomMade

UpWork, crowdSPRING

Angie’s List, Handy, TaskRabbit

DoorDash, Grubhub, Instacart, Postmates,

Drizly

Uber, Lyft, Didi

Turo, Zipcar

LiquidSpace, ShareDesk

Airbnb, HomeAway, Couchsurfing

LendingClub, Kiva, Prosper

LendingClub, Kickstarter, GoFundMe,

Indiegogo

7. Firms Characterized as Part of the “Sharing Economy” or “Collaborative Consumption” (cont’d)

• Consumption by Category• RGoods:

Pre-owned: eBay, craigslist (peer-to-peer supplied); thredUP (firm-owned inventory).

Loaner products: Zilok (peer-to-peer supplied); Rent the Runway, Chegg (firm-owned

inventory).

Custom products: Etsy, CustomMade.

• Services:

• Professional services: Upwork, CrowdSpring.

• Personal services: Angie’s List, Handy, TaskRabbit.

• Delivery: DoorDash, Grubhub, Instacart, Postmates (self-employed drivers for

restaurant or grocery delivery), Drizly (drivers and alcohol inventory owned by

suppliers).

©FlatWorld 2018

8. Firms Characterized as Part of the “Sharing Economy” or “Collaborative Consumption” (cont’d)

• Consumption by Category• Transportation:

• Transportation Services: Uber, Lyft, Didi (cars supplied by drivers).

• Loaner Vehicles: Turo (peer-to-peer supplied), Zipcar (firm-owned inventory).

• Office Space:

• Office Space: LiquidSpace, ShareDesk (peer-to-peer supplied inventory).

• Places to Stay: Airbnb, HomeAway, Couchsurfing (peer-to-peer supplied inventory).

• Money and Finance:

• Money Lending: LendingClub, Kiva, Prosper (peer-to-peer loans).

• Crowdfunding: KickStarter, GoFundMe, Indiegogo (peer-to-peer capital).

©FlatWorld 2018

9. Learning Objectives

1. Identify the factors that have contributed to the rise of the sharingeconomy.

2. Understand the competitive factors that influence success in

marketplaces that support collaborative consumption.

©FlatWorld 2018

10.

Share on! Factors Fueling the Rise ofCollaborative Consumption

• Many sharing economy firms were born during a prolonged, worldwide

economic recession.

• Stagnant wages have boosted consumer interest in low-cost alternatives.

• Encouraged a whole new class of laypeople to offer services for hire.

• Many of the services also have an environmental benefit by fostering reuse and

diminished consumption.

©FlatWorld 2018

11.

Winning in Electronic Markets• Early players gain scale, brand, and financial

resources.

• Technology allows for peer-to-peer supply

without need for inventory.

• Some services do oversee inventory to gain

more control and offer higher quality.

• In fragmented markets, marketplaces extend

the value chain by connecting suppliers and

customers with search and discovery,

scheduling, payment, reputation management

and more.

©FlatWorld 2018

ClassPass provides choice and

variety for fitness customers.

Source: Image courtesy of ClassPass.

12.

Social Media for Virtuality & Trust Strengthening• Word of mouth through social media accelerates the growth of the

sharing economy.

• One survey reported that 47 percent of participants in the sharing economy

learned about the services they used via word of mouth.

• social proof: Positive influence created when someone finds out that others are

doing something.

• Some concerns include trust and safety issues.

• Audit trails help with trust.

• Ratings can help with trust, safety, and service but ratings can also be be unfairly

biased.

©FlatWorld 2018

13.

Can You Share Nice? Challenges of Safety andRegulation

• Instilling trust doesn’t mean that firms are without safety issues.

• Participating in the sharing economy raises questions for insurers.

• Will firms pay out if there is a “sharing economy” incident with a supplier, or will

they try to refuse?

• Many local firms also benefit from taxes and regulatory fees from

industries threatened by the sharing economy.

• Groups opposed to new, rival efforts can represent very powerful lobbies.

• Another major concern for firms in the sharing economy is uncertainty

around the ability of these firms to continue to consider their workers as

independent contractors and not employees.

• The issue has gained the attention of state and federal agencies and presidential

candidates, and raises the specter of class action lawsuits.

©FlatWorld 2018

14.

WePay Winning Big: Processing Payments and Tamingthe Crowd Through “Social” Security

• WePay is a firm that has stepped up to offer simple payment solutions

that specifically target the challenges of buyer/seller platform operators.

• WePay combats challenges in several ways:

• The firm’s Veda fraud-fighting technology analyzes social profiles to get firms up

and running with payments in a streamlined process.

• WePay can gain a fast read on whether founders and businesses are legitimate.

• Has transaction history from hundreds of thousands of customers currently

sending billions of dollars a year through the firm’s systems.

• The firm’s machine learning technology continually update the firm’s fraud models

to adapt to new patterns it uncovers.

• WePay makes adding payment capabilities to any site as easy as

embedding a YouTube video, with a cut-and-paste of pregenerated

code.

©FlatWorld 2018

15. Learning Objectives

1. Identify and give examples of how large firms are investing in,partnering with, and building their own collaborative consumption

efforts.

2. Gain insight into the advantages of collaborative consumption firms for

traditional industry players, and enhance brainstorming skills for

identifying possibilities for other firms.

©FlatWorld 2018

16. Future Outlook: Established Players Get Collaborative

©FlatWorld 2018

Alphabet & Toyota: Invested in Uber

Alphabet and General Motors: Invested in Lyft

Condé Nast: Invested in Rent the Runway

Walgreens: Task Rabbit partnership

IBM: Worked with Deliv

Avis: Acquired Zipcar

17. Learning Objectives

1. Understand how Airbnb has built a multibillion-dollar sharing economyfirm.

2. Recognize the appeal the firm has for suppliers and consumers.

3. Identify sources of competitive advantage and additional challenges

as the firm continues to grow.

4. Understand how technology can build trust, even in an area as

sensitive as selling stays in private homes.

©FlatWorld 2018

18. Airbnb—Hey Stranger, Why Don’t You Stay at My Place?

• Multibillion-dollar hospitality industry empire.• Over 200 million guests have stayed with Airbnb so far.

• With listings in 81,000 cities and 192 countries, there is no other single

hotel group that approached the firm’s worldwide reach.

• Listings include:

©FlatWorld 2018

Castles

Yurts

Caves

Water towers

Private islands

Igloos

Glass houses

Tree houses

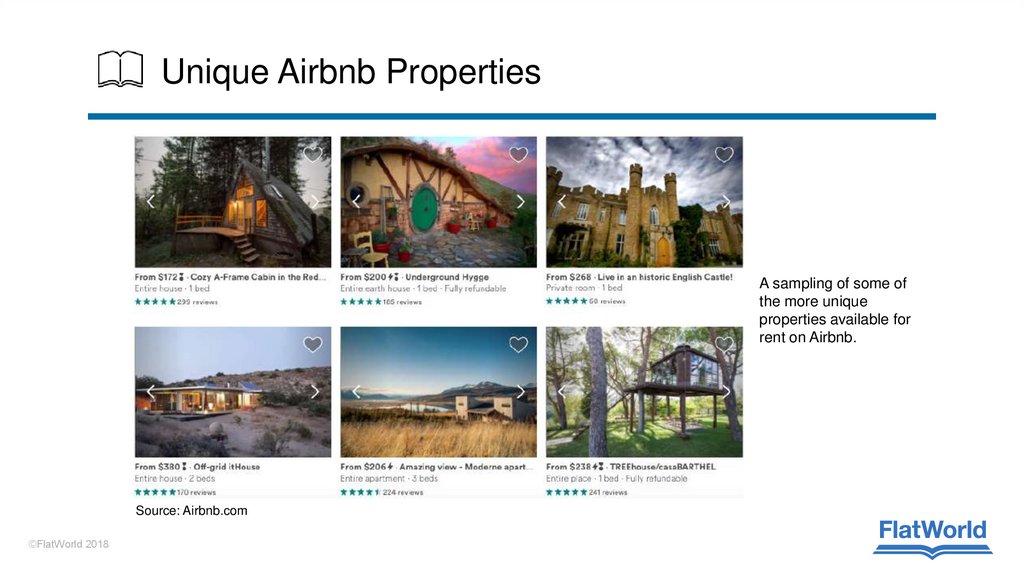

19. Unique Airbnb Properties

A sampling of some ofthe more unique

properties available for

rent on Airbnb.

Source: Airbnb.com

©FlatWorld 2018

20. Airbnb—Hey Stranger, Why Don’t You Stay at My Place?

• Trust is essential for the sharing economy to work.• Negative incidents involving theft and unwanted visitors have attracted plenty of

unwanted press.

• The firm offers a $1 million guarantee for hosts, secure payment guarantees, and

24/7 support phone service.

• Airbnb monitors transactions and communication at a deep level:

©FlatWorld 2018

Reservations

Payment

Host/Guest communication

Subsequent reviewers

Technology hunts for scams

21. A Phenomenal Start, but Not Without Challenges

• In many areas where Airbnb operates, providers of the service arebreaking the law.

• Running a business in an area not zoned for it.

• Health and safety laws governing hotels require things like sprinkler systems, exit

signs, and clean towels.

• Competition looms, including HomeAway.

• Several hotel firms have experimented with homesharing, including Marriott,

Accor Hotels, and Hyatt.

• Travel sites like Booking.com and TripAdvisor now incorporate homestays into

their search.

©FlatWorld 2018

22. Learning Objectives

1. Understand the appeal of Uber both to drivers andconsumers.

2. Discuss how Uber leverages technology to radically

improve on the service and cost structure of traditional

and cab and limo services.

3. Understand the implications of executive behavior and

harmful corporate culture on the firm, its hiring prospects,

investors, and customers.

4. Recognize how technology also empowers a data-driven

enterprise that crafts strong and deepening competitive

advantage over time.

©FlatWorld 2018

23. Uber’s Wild Ride: Sharing Economy Success, and Lessons From a Fallen Founder

• Operating in 633 cities and 76 countries worldwide.• Uber had raised $21 billion so far, and boasts a private valuation of over

$70 billion.

• Uber claims to create over 50,000 new jobs a month.

• Uber drivers in NYC make an average of $90K a year.

• Customers regularly complain of surge pricing:

• Uber raises prices where supply doesn’t meet demand to encourage drivers to

work.

• They cap surging during emergencies at a price that is below the three highestpriced non-emergency days during the preceding two months.

©FlatWorld 2018

24. From Rebel to Revulsion: When Uber Behavior Became Hostile and Required Big Change

• In Silicon Valley, a place known for lionizing the brash disruptor, Uberwas perhaps the firm seen as most brazenly pugilistic.

• Problems began piling up (dishonesty began to be seen as an Uber cultural trait):

• Strikes by drivers, protests by the taxi industry, and aggressive political push-back.

Accusations of the theft of self-driving car tech.

• Rival Lyft accused Uber of unethical behavior, including calling and canceling Lyft

rides to crater the efficiency.

• Culture shown to be hostile to women and minorities.

• Mounting customer complaints of price surging

• It's unclear just how damaging the fallout has been for Uber.

• Network effects may make customers stick with a firm, even if they'd rather not

remain, but talent and the fundraising wallet may be far stronger in pushing a firm to

recognize and deal with repellent behavior.

©FlatWorld 2018

25. Tragedy, but Tech Raises the Safety Bar

• Technology actually helps Uber keep a high safety bar, and to continueto raise that bar even higher.

• The Uber app knows who the drivers are at all times, knows who was picked up

and where they were taken.

• Bad performance are exposed and customers (and drivers) empowered to shine

a spotlight on what might have been previously hidden.

• Collectively, this offers a safety bar conventional cabs simply don’t offer.

• Uber continues to invest in new technologies, exploring voice recognition and

biometrics to further strengthen driver verification, and implementing a panic

button linked to emergency services.

©FlatWorld 2018

26. Driven by Data

• Employs mathematicians with PhDs in nuclear physics, astrophysicsand computational biology.

• The staff optimizes algorithms to determine number of drivers, where

demand is, and dynamic pricing.

• The software system shows maps, cars, locations of customers.

• Uber’s massive data haul allows it to cut prices and attract drivers to

power continued growth and expansion.

©FlatWorld 2018

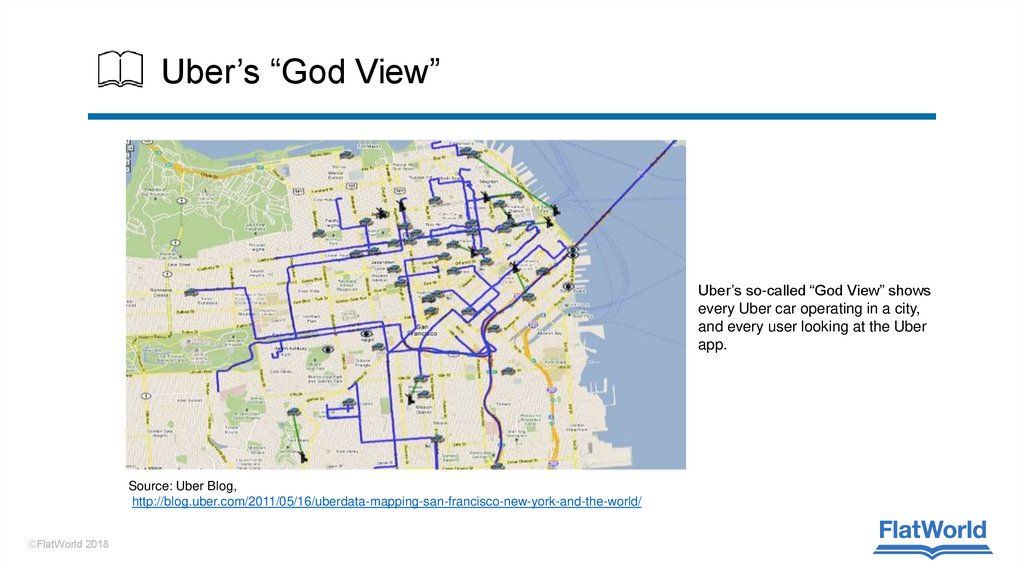

27. Uber’s “God View”

Uber’s so-called “God View” showsevery Uber car operating in a city,

and every user looking at the Uber

app.

Source: Uber Blog,

http://blog.uber.com/2011/05/16/uberdata-mapping-san-francisco-new-york-and-the-world/

©FlatWorld 2018

28. APIs to Expand Reach

• Uber is embedding everywhere in the digital world.• The firm offers an API (application programming interface) that is essentially a

published guideline on how other developers can embed Uber into their own

apps.

• The service launched with eleven partners, including OpenTable, United Airlines,

TripAdvisor, and Hyatt Hotels.

• A new initiative, Uber Health, offers APIs for integration into health care

products.

• Another example of network effects help solidify a firm as a winning platform.

©FlatWorld 2018

29. How Big Can this Thing Get?

• Analysts differ on current valuation of Uber.• Regulatory concerns, maintenance of quality service and the

uncertainty of expanding in global markets where competitors exist are

challenges to be faced.

• Business Insider claims it could grow to a $100 billion company.

• Doubling in size every six months.

• Looking to expand into shipping and logistics.

• Begun to test its own self-driving car technology.

• The firm has shown a prototype vertical take-off and landing vehicle

that’s a cross between a helicopter and prop plan.

©FlatWorld 2018

Английский язык

Английский язык