Похожие презентации:

The Future for the World Market of Hydrocarbons and MENA

1. The Future for the World Market of Hydrocarbons and MENA 20 of March 2019 Professor Leonid Grigoryev

WWW.LEONIDGRIGORYEV.COM2. MENA – key countries

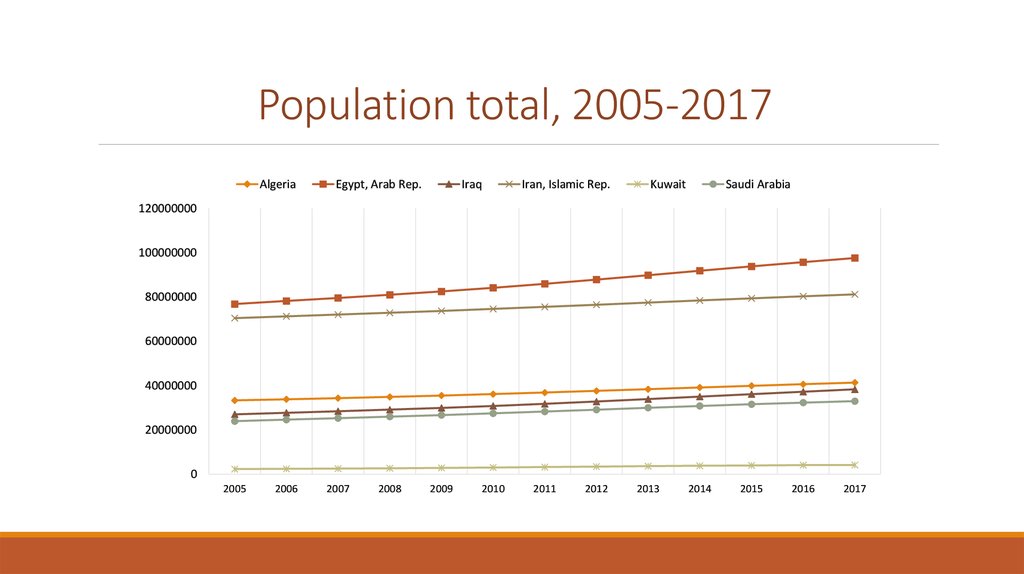

23. Population total, 2005-2017

AlgeriaEgypt, Arab Rep.

Iraq

Iran, Islamic Rep.

Kuwait

Saudi Arabia

120000000

100000000

80000000

60000000

40000000

20000000

0

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

4. Population growth, 2005-2017 (annual %)

AlgeriaEgypt, Arab Rep.

Iraq

Iran, Islamic Rep.

Kuwait

Saudi Arabia

7

6

5

4

3

2

1

0

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

5. GDP nominal growth,2005-2017 (annual %)

AlgeriaEgypt, Arab Rep.

Iraq

Iran, Islamic Rep.

Kuwait

Saudi Arabia

20

15

10

5

0

2005

-5

-10

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

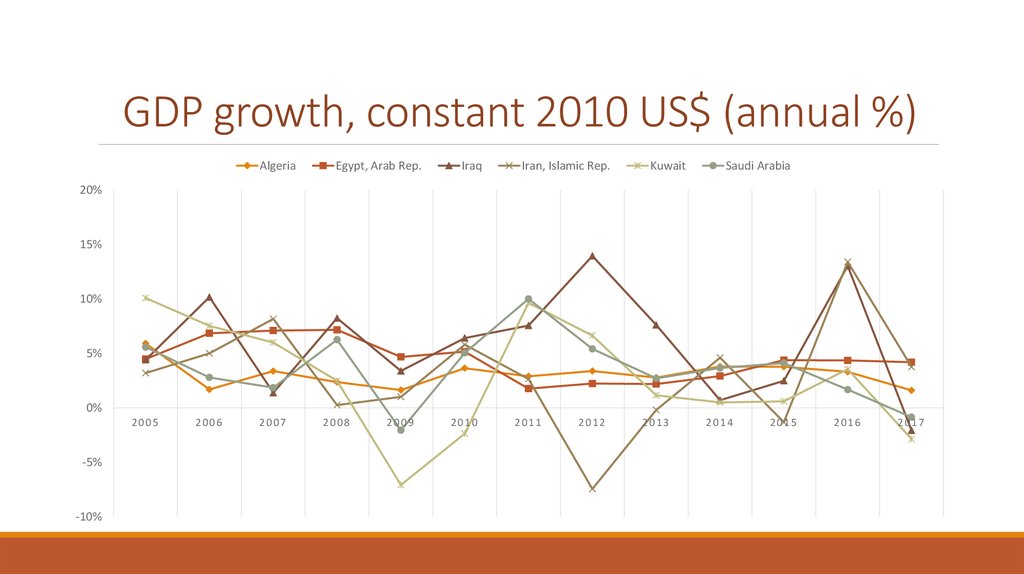

6. GDP growth, constant 2010 US$ (annual %)

AlgeriaEgypt, Arab Rep.

Iraq

Iran, Islamic Rep.

Kuwait

Saudi Arabia

20%

15%

10%

5%

0%

2005

-5%

-10%

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

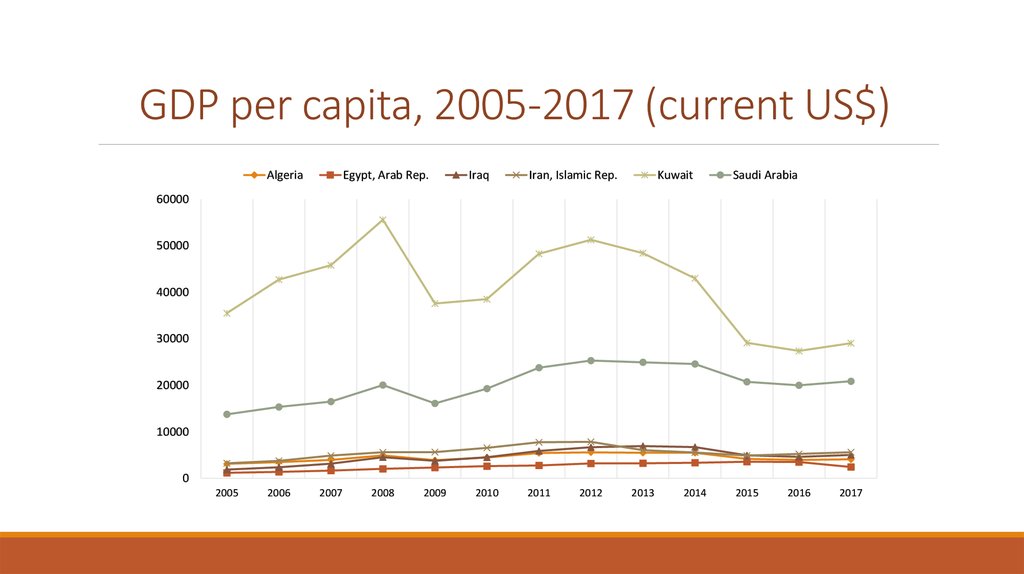

7. GDP per capita, 2005-2017 (current US$)

AlgeriaEgypt, Arab Rep.

Iraq

Iran, Islamic Rep.

Kuwait

Saudi Arabia

60000

50000

40000

30000

20000

10000

0

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

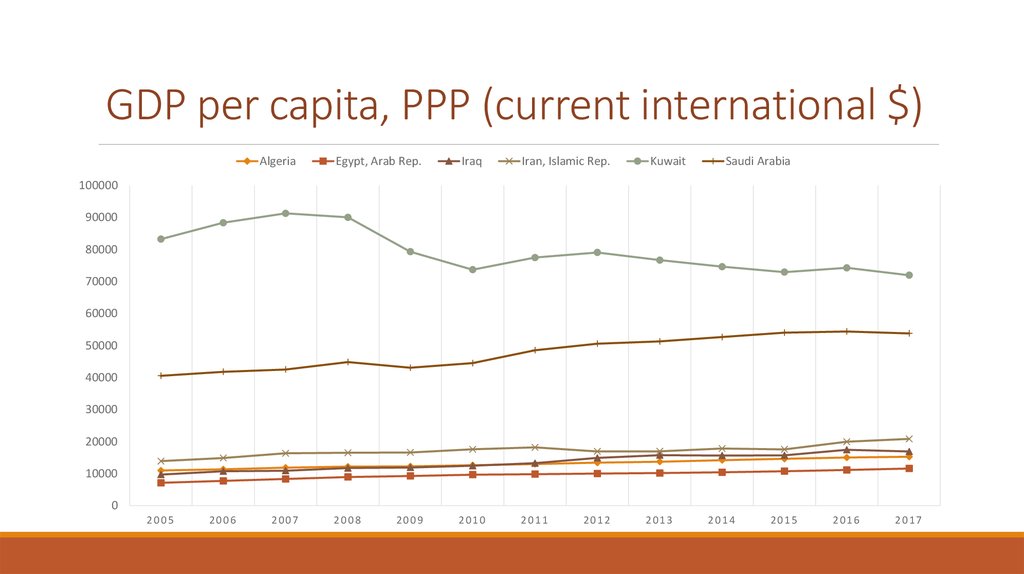

8. GDP per capita, PPP (current international $)

AlgeriaEgypt, Arab Rep.

Iraq

Iran, Islamic Rep.

2008

2010

2011

Kuwait

Saudi Arabia

100000

90000

80000

70000

60000

50000

40000

30000

20000

10000

0

2005

2006

2007

2009

2012

2013

2014

2015

2016

2017

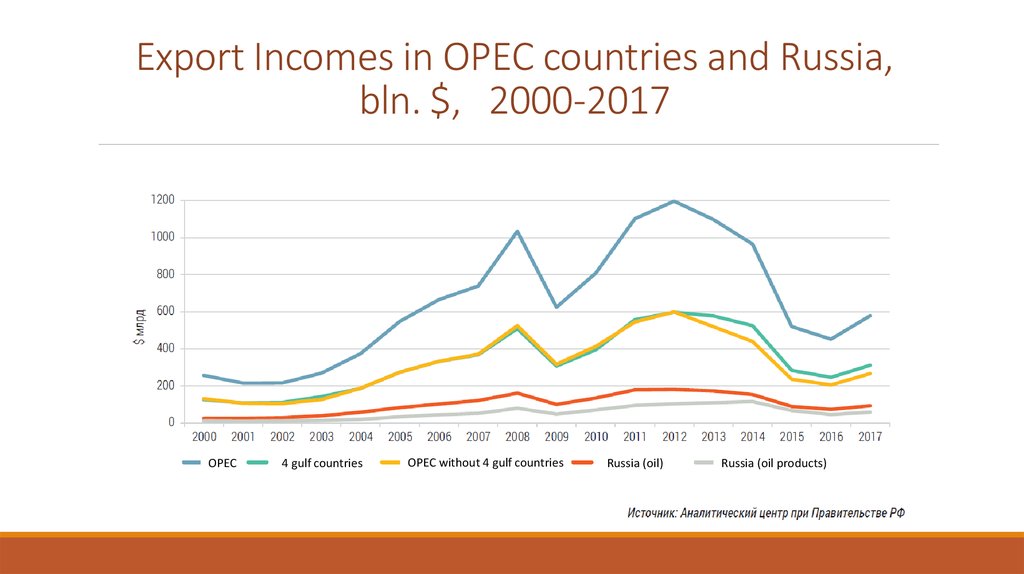

9. Export Incomes in OPEC countries and Russia, bln. $, 2000-2017

OPEC4 gulf countries

OPEC without 4 gulf countries

Russia (oil)

Russia (oil products)

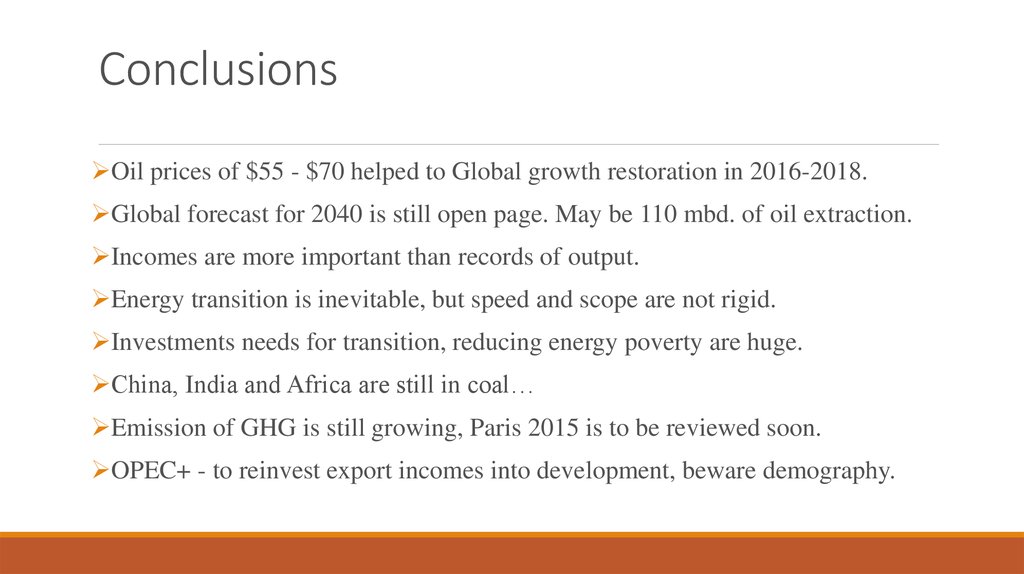

10. Conclusions

Oil prices of $55 - $70 helped to Global growth restoration in 2016-2018.Global forecast for 2040 is still open page. May be 110 mbd. of oil extraction.

Incomes are more important than records of output.

Energy transition is inevitable, but speed and scope are not rigid.

Investments needs for transition, reducing energy poverty are huge.

China, India and Africa are still in coal…

Emission of GHG is still growing, Paris 2015 is to be reviewed soon.

OPEC+ - to reinvest export incomes into development, beware demography.

11. World Energy Transition and Future

•World is undergoing Energy transition, but still not that fast as Green people hope.•Current oil prices are secured the Global Growth in 2016-2018.

•Car are still mostly non-electric in stock and in annual sales.

•Energy sector and any changes in its structure require huge investments.

•One mbd a day per year = looking to 100 mbd in 2019.

•Climate Change prevention V Energy Poverty and Development needs …

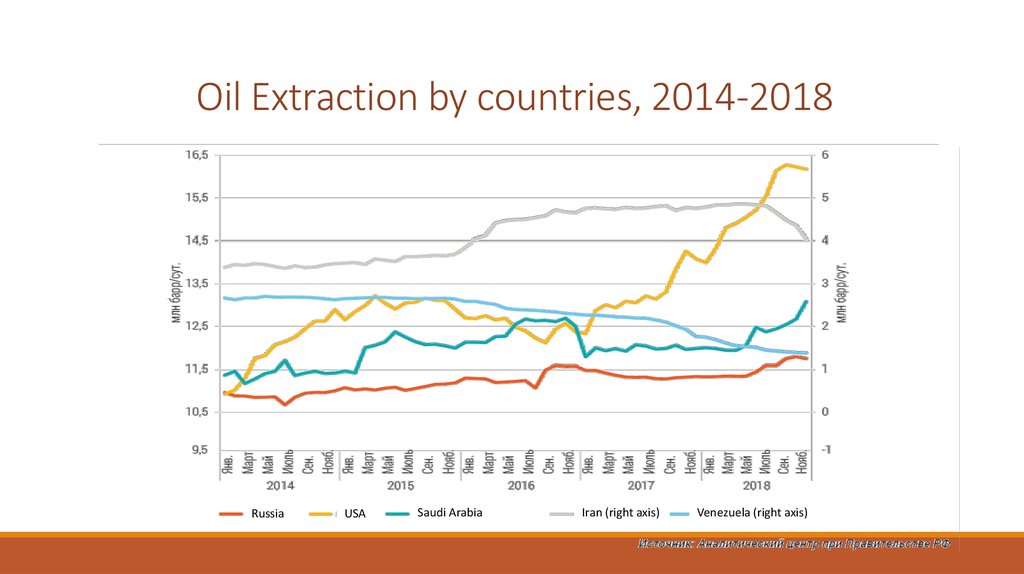

•American oil takes quite a bite from others in 2018.

•Prices are stable due to growing demand and decline of output.

•Sanctions as a factor of pricing – Fall of 2018.

• Stability of pricing corridor depends on coordination – to assure price wars avoidance.

12. Current situation

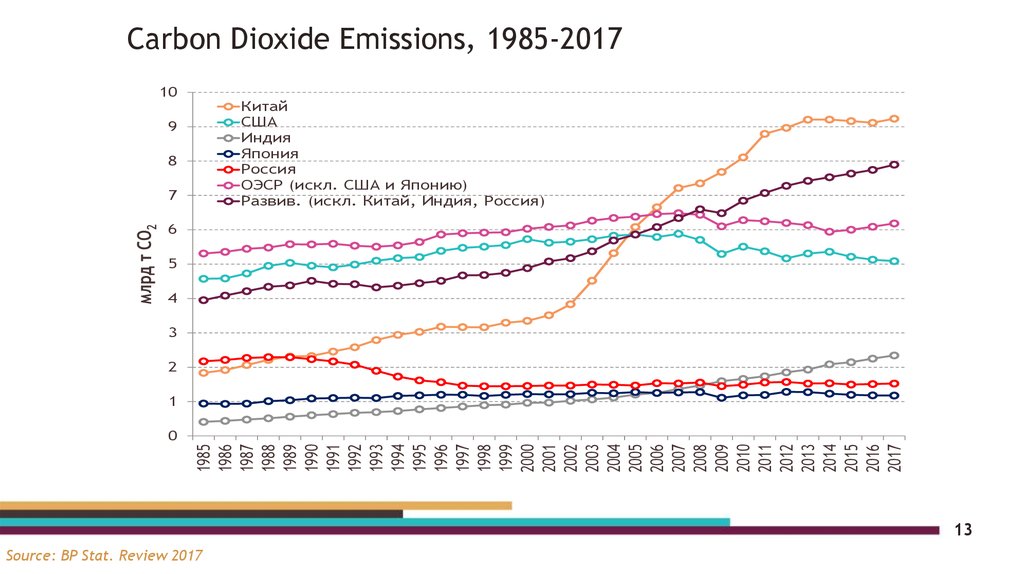

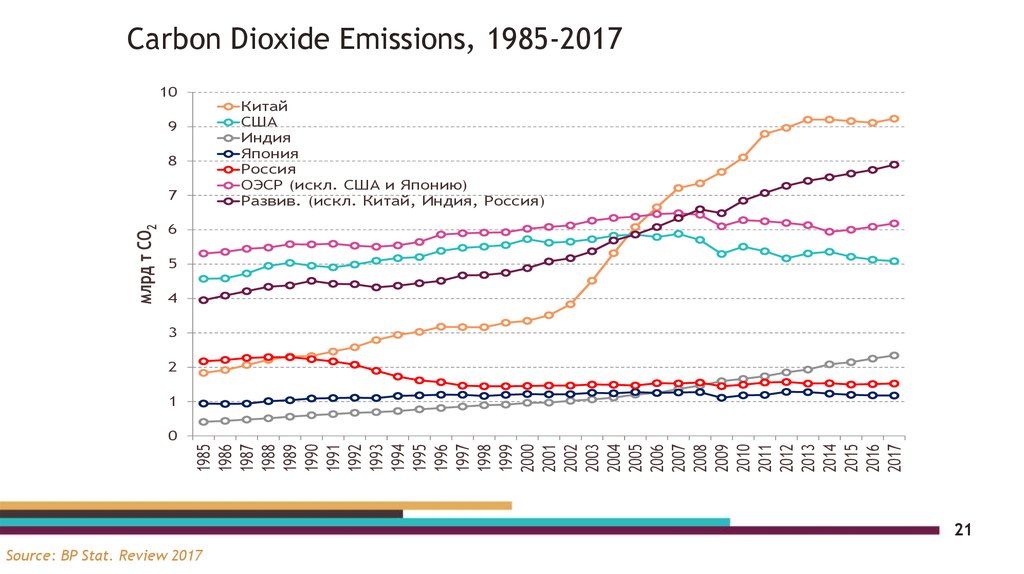

13. Carbon Dioxide Emissions, 1985-2017

10Китай

США

Индия

Япония

Россия

ОЭСР (искл. США и Японию)

Развив. (искл. Китай, Индия, Россия)

9

8

млрд т CO2

7

6

5

4

3

2

1

1985

1986

1987

1988

1989

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

0

13

Source: BP Stat. Review 2017

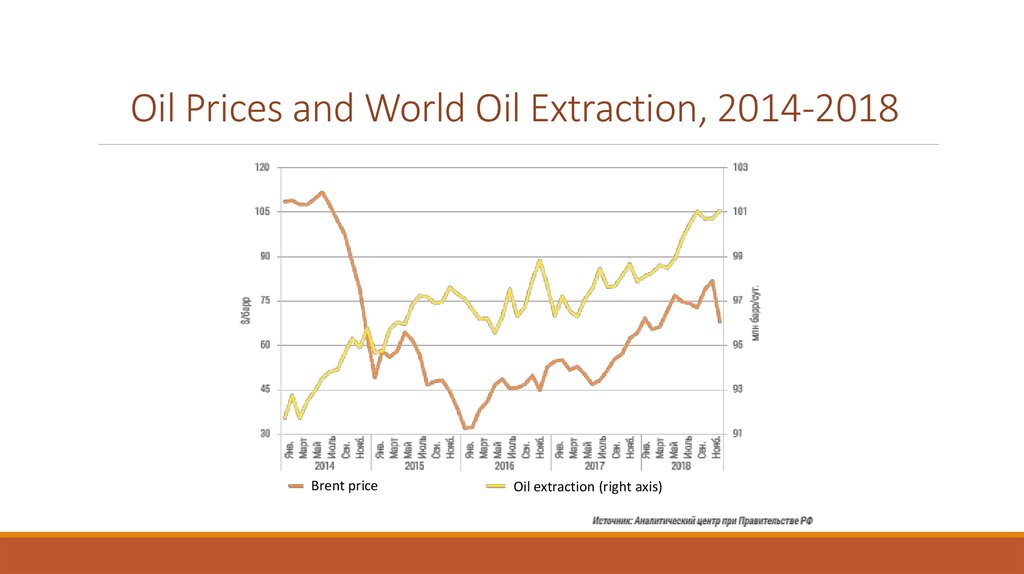

14. Oil Prices and World Oil Extraction, 2014-2018

Brent priceOil extraction (right axis)

15. Oil Extraction by countries, 2014-2018

RussiaUSA

Saudi Arabia

Iran (right axis)

Venezuela (right axis)

16. Oil Production and Exports by country, 2016

Oil productionExports

USA

11,7%

1,1%

Russia

13,6%

11,5%

Saudi Arabia

13,8%

16,9%

OPEC

44,1%

56,6%

Source: OPEC Annual Statistical Bulletin

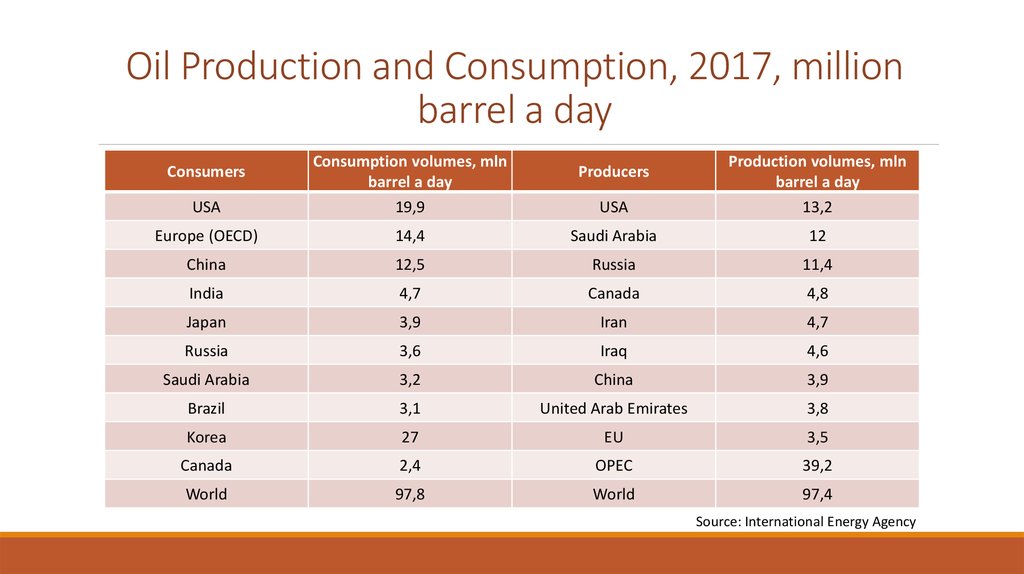

17. Oil Production and Consumption, 2017, million barrel a day

USAConsumption volumes, mln

barrel a day

19,9

USA

Production volumes, mln

barrel a day

13,2

Europe (OECD)

14,4

Saudi Arabia

12

China

12,5

Russia

11,4

India

4,7

Canada

4,8

Japan

3,9

Iran

4,7

Russia

3,6

Iraq

4,6

Saudi Arabia

3,2

China

3,9

Brazil

3,1

United Arab Emirates

3,8

Korea

27

EU

3,5

Canada

2,4

OPEC

39,2

World

97,8

World

97,4

Consumers

Producers

Source: International Energy Agency

18. Global Balance and Future

19.

Global fuel mix is becoming more diversified, gas and RESare demonstrating the highest growth (2016)

Primary energy demand by fuel

(in 2015 and increase by 2040),

Probable Scenario

Structure of primary energy demand by fuel in 2015 and in

2040, Probable Scenario

2040

mtoe

5 000

11%

2040

4 000

2015

3 000

3%

6%

2%

5%

4%

10%

27%

1%

31%

Oil

Gas

Coal

Nuclear

2 000

Hydro

28%

25%

1 000

Bioenergy

22%

24%

Other renewables

0

Oil

Gas

Coal

Nuclear

Hydro

Bioenergy

Other RES

Source: Global and Russian Energy Outlook-2016, ERI RAS-AC

19

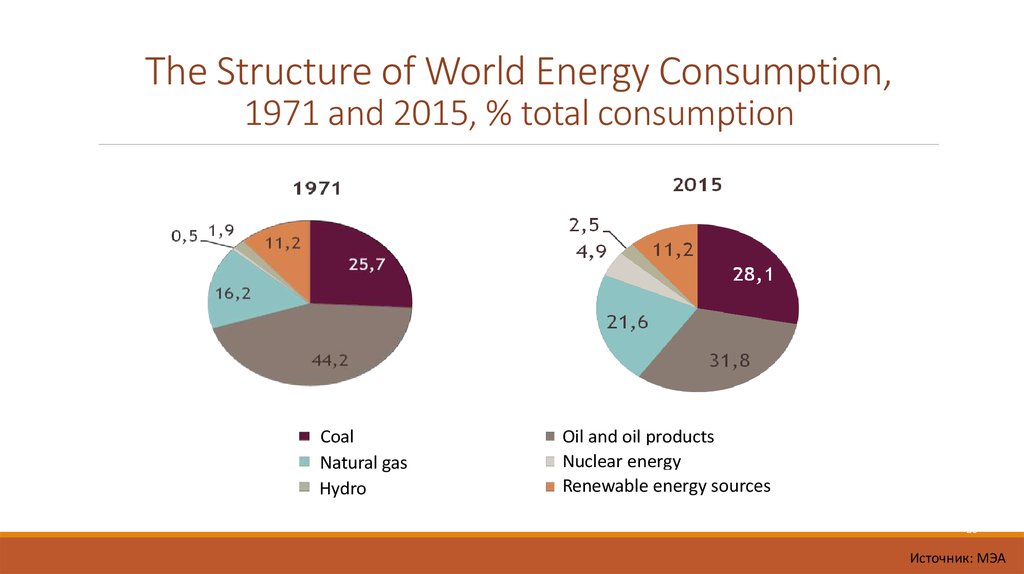

20. The Structure of World Energy Consumption, 1971 and 2015, % total consumption

The Structure of World Energy Consumption,20

1971 and 2015, % total consumption

Coal

Natural gas

Hydro

Oil and oil products

Nuclear energy

Renewable energy sources

20

Источник: МЭА

21. Carbon Dioxide Emissions, 1985-2017

10Китай

США

Индия

Япония

Россия

ОЭСР (искл. США и Японию)

Развив. (искл. Китай, Индия, Россия)

9

8

млрд т CO2

7

6

5

4

3

2

1

1985

1986

1987

1988

1989

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

0

21

Source: BP Stat. Review 2017

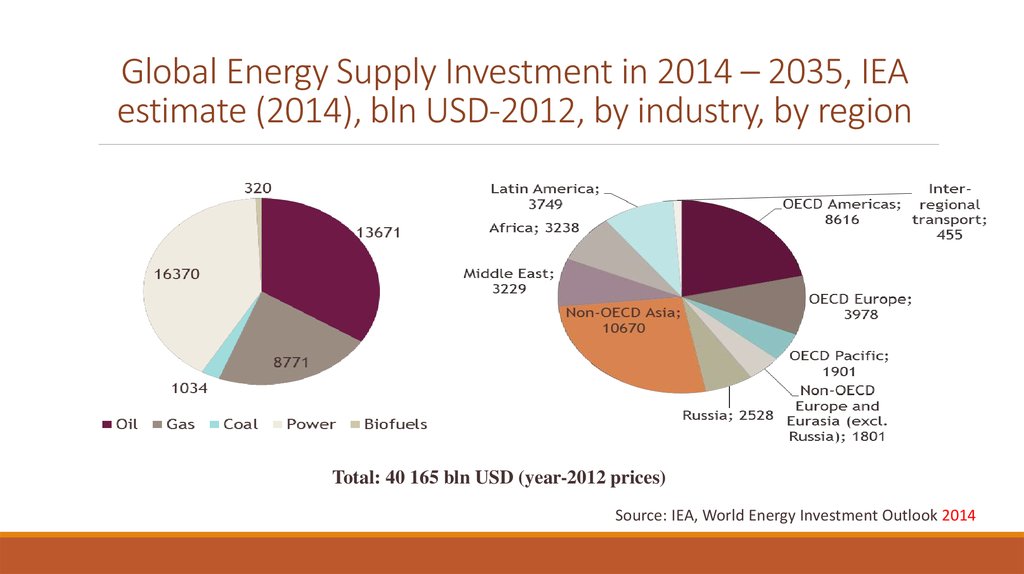

22. Global Energy Supply Investment in 2014 – 2035, IEA estimate (2014), bln USD-2012, by industry, by region

Total: 40 165 bln USD (year-2012 prices)Source: IEA, World Energy Investment Outlook 2014

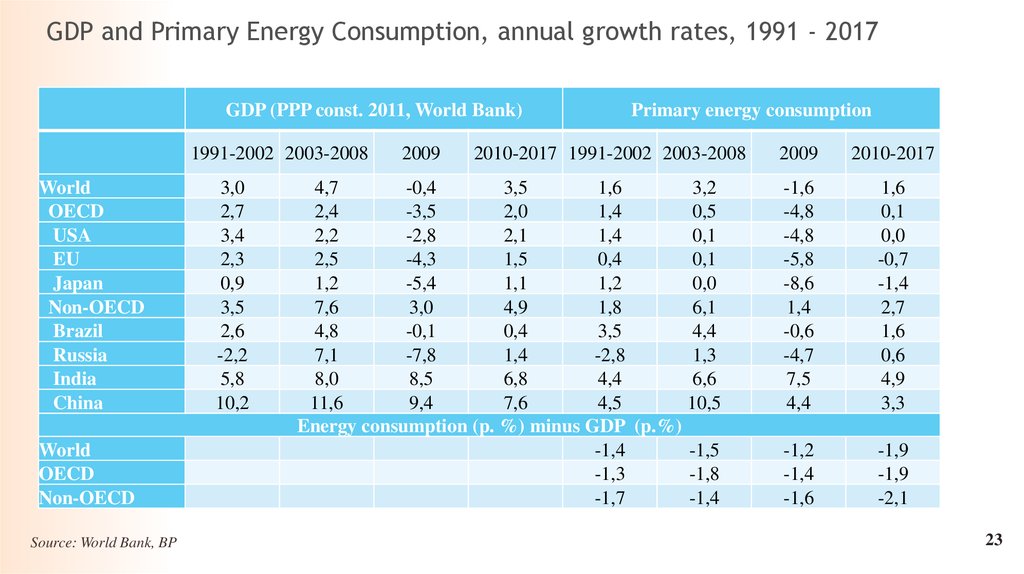

23. GDP and Primary Energy Consumption, annual growth rates, 1991 - 2017

GDP (PPP const. 2011, World Bank)1991-2002 2003-2008

World

OECD

USA

EU

Japan

Non-OECD

Brazil

Russia

India

China

World

OECD

Non-OECD

Source: World Bank, BP

3,0

2,7

3,4

2,3

0,9

3,5

2,6

-2,2

5,8

10,2

2009

Primary energy consumption

2010-2017 1991-2002 2003-2008

4,7

-0,4

3,5

1,6

3,2

2,4

-3,5

2,0

1,4

0,5

2,2

-2,8

2,1

1,4

0,1

2,5

-4,3

1,5

0,4

0,1

1,2

-5,4

1,1

1,2

0,0

7,6

3,0

4,9

1,8

6,1

4,8

-0,1

0,4

3,5

4,4

7,1

-7,8

1,4

-2,8

1,3

8,0

8,5

6,8

4,4

6,6

11,6

9,4

7,6

4,5

10,5

Energy consumption (p. %) minus GDP (p.%)

-1,4

-1,5

-1,3

-1,8

-1,7

-1,4

2009

2010-2017

-1,6

-4,8

-4,8

-5,8

-8,6

1,4

-0,6

-4,7

7,5

4,4

1,6

0,1

0,0

-0,7

-1,4

2,7

1,6

0,6

4,9

3,3

-1,2

-1,4

-1,6

-1,9

-1,9

-2,1

23

24. Oil and Gas Consumption, annual growth rates, 1991 - 2017

Oil consumption1991-2002 2003-2008

World

OECD

USA

EU

Japan

Non-OECD

Brazil

Russia

India

China

World

OECD

Non-OECD

1,4

1,2

1,5

0,5

-0,1

1,6

3,4

-6,1

6,1

6,7

2009

Gas consumption

2010-2017 1991-2002 2003-2008

1,5

-1,7

1,3

2,1

3,3

-0,3

-4,9

0,0

2,6

1,6

-0,5

-4,6

0,4

1,5

0,9

-0,1

-5,3

-0,9

2,6

0,9

-2,2

-10,4

-1,6

3,3

3,3

4,0

2,2

2,7

1,5

5,2

4,2

0,2

1,4

14,5

9,6

1,2

-4,1

1,5

-1,1

1,9

4,4

5,1

4,9

6,8

7,1

6,5

3,8

4,2

5,9

19,1

Oil / Gas consumption (poins %) minus GDP (points %)

-1,6

-3,1

-1,3

-2,1

-0,9

-1,4

-1,5

-2,7

-1,4

-2,0

-0,1

-0,8

-1,8

-3,4

-0,8

-2,1

-1,9

-2,3

2009

2010-2017

-2,8

-3,2

-1,8

-6,3

-6,7

-2,4

-19,5

-5,5

20,9

10,1

2,1

1,2

1,9

-1,6

2,4

2,8

4,6

0,1

-1,3

12,0

-2,4

0,4

-5,2

-1,4

-0,7

-2,0

*Calculated index

Source: World Bank, BP

24

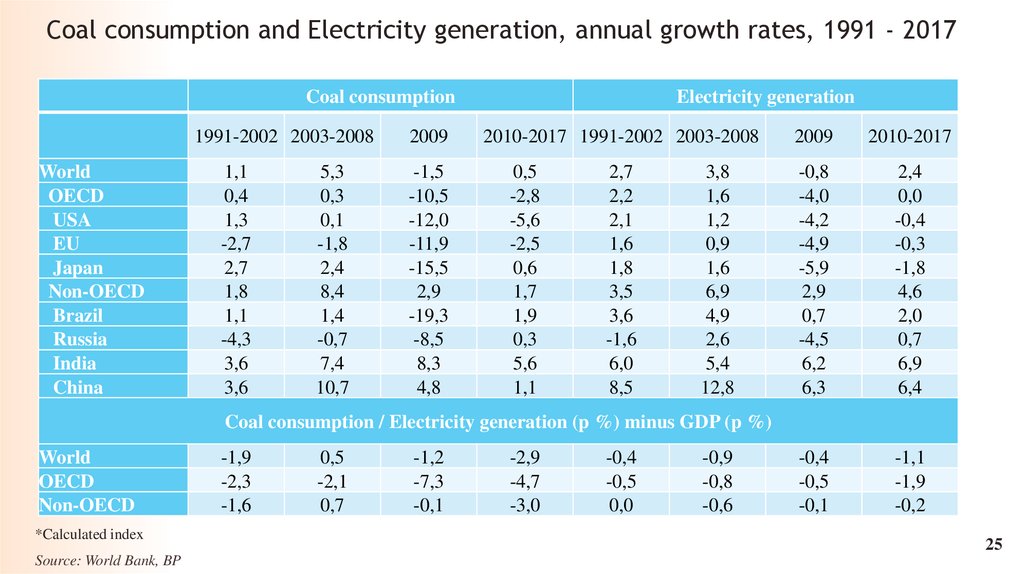

25. Coal consumption and Electricity generation, annual growth rates, 1991 - 2017

Coal consumption1991-2002 2003-2008

World

OECD

USA

EU

Japan

Non-OECD

Brazil

Russia

India

China

1,1

0,4

1,3

-2,7

2,7

1,8

1,1

-4,3

3,6

3,6

5,3

0,3

0,1

-1,8

2,4

8,4

1,4

-0,7

7,4

10,7

2009

-1,5

-10,5

-12,0

-11,9

-15,5

2,9

-19,3

-8,5

8,3

4,8

Electricity generation

2010-2017 1991-2002 2003-2008

0,5

-2,8

-5,6

-2,5

0,6

1,7

1,9

0,3

5,6

1,1

2,7

2,2

2,1

1,6

1,8

3,5

3,6

-1,6

6,0

8,5

3,8

1,6

1,2

0,9

1,6

6,9

4,9

2,6

5,4

12,8

2009

2010-2017

-0,8

-4,0

-4,2

-4,9

-5,9

2,9

0,7

-4,5

6,2

6,3

2,4

0,0

-0,4

-0,3

-1,8

4,6

2,0

0,7

6,9

6,4

-0,4

-0,5

-0,1

-1,1

-1,9

-0,2

Coal consumption / Electricity generation (p %) minus GDP (p %)

World

OECD

Non-OECD

*Calculated index

Source: World Bank, BP

-1,9

-2,3

-1,6

0,5

-2,1

0,7

-1,2

-7,3

-0,1

-2,9

-4,7

-3,0

-0,4

-0,5

0,0

-0,9

-0,8

-0,6

25

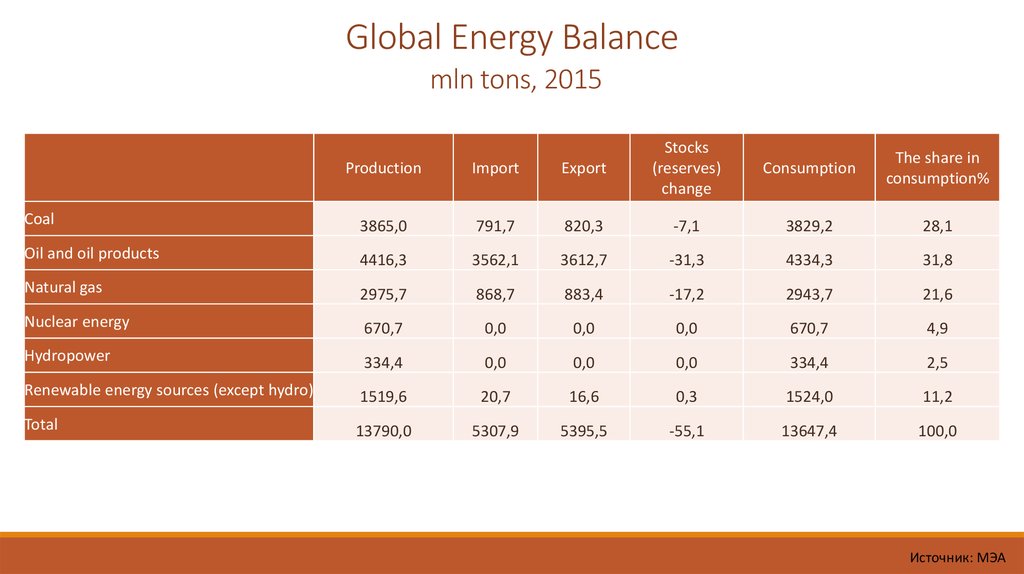

26. Global Energy Balance mln tons, 2015

26Production

Import

Export

Stocks

(reserves)

change

Coal

3865,0

791,7

820,3

-7,1

3829,2

28,1

Oil and oil products

4416,3

3562,1

3612,7

-31,3

4334,3

31,8

Natural gas

2975,7

868,7

883,4

-17,2

2943,7

21,6

Nuclear energy

670,7

0,0

0,0

0,0

670,7

4,9

Hydropower

334,4

0,0

0,0

0,0

334,4

2,5

Renewable energy sources (except hydro)

1519,6

20,7

16,6

0,3

1524,0

11,2

Total

13790,0

5307,9

5395,5

-55,1

13647,4

100,0

Consumption

The share in

consumption%

Источник: МЭА

27. Literature 1

1. Григорьев Л.М., Чапыгина А.В. «Саудовская Аравия – нефть и развитие», «Мировая Энергетическаяполитика», №7, 2002.

2. Григорьев Л.М., Крюков В.А. «Мировая энергетика на перекрестке дорог: какую дорогу выбрать России?»

- «Вопросы экономики», №12, 2009.

3. Россия, Газпром и Центральная Азия-Центр: интересы и отношения. В “Russian Energy Security and Foreign

Policy”, Ed. By A. Dellecker and Th. Gomart, London and New York, IFRI, Routledge, 2011, стр.147-169.

4. «Энергетические субсидии в современном мире». Страны «Группы двадцати», под редакцией Л. М.

Григорьева, А. А. Курдина –, АЦ, 2014.

5. Григорьев Л.М., Курдин А.А. «Дисбаланс нефтяного рынка: технологии, экономика, политика.» «Энергетическая политика», №1, 2015.

6. «Прогноз энергетики мира и России до 2040 года», Научный руководитель А.А.Макаров, Т.А.Митрова,

Л.М.Григорьев и др. ИНЭИ РАН и АЦ, М. 2016.

7. Л.М.Григорьев , «Бочки миллиардов», «Нефтегазовая вертикаль», январь 2019, стр. 74-79.

28. Literature 2

“Domestic Debates on Climate in Russia”, L.Grigoryev, I.Makarov, A.Salmina, “ClimateChange, Sustainable Development, and Human Security”, Ed. Dhirendra K. Vajpeyi,

Lexington Books, 2013, chap. 9, pp. 249-280.

2018

Outlook

for

Energy:

A

View

to

2040

[online]

IEA:

http://cdn.exxonmobil.com/~/media/global/files/outlook-for-energy/2018/2018-outlook-forenergy.pdf.

Макаров И.А., Соколова А.К. «Оценка углеродоемкости внешней торговли России»,

«Экономический журнал ВШЭ», №3, 2014.

I.Makarov and A. Sokolova “Carbon EmissionsEmbodied in Russian trade:

implications for Climate Policy” - Review of European and Russian Affairs 11 (2),

2017.

Английский язык

Английский язык