Похожие презентации:

National Accounting: definition, concept, tools

1. National Accounting: definition, concept, tools

Smirnova Ekaterina, PhD in EconomicsAccounting team leader

SCHNEIDER GROUP

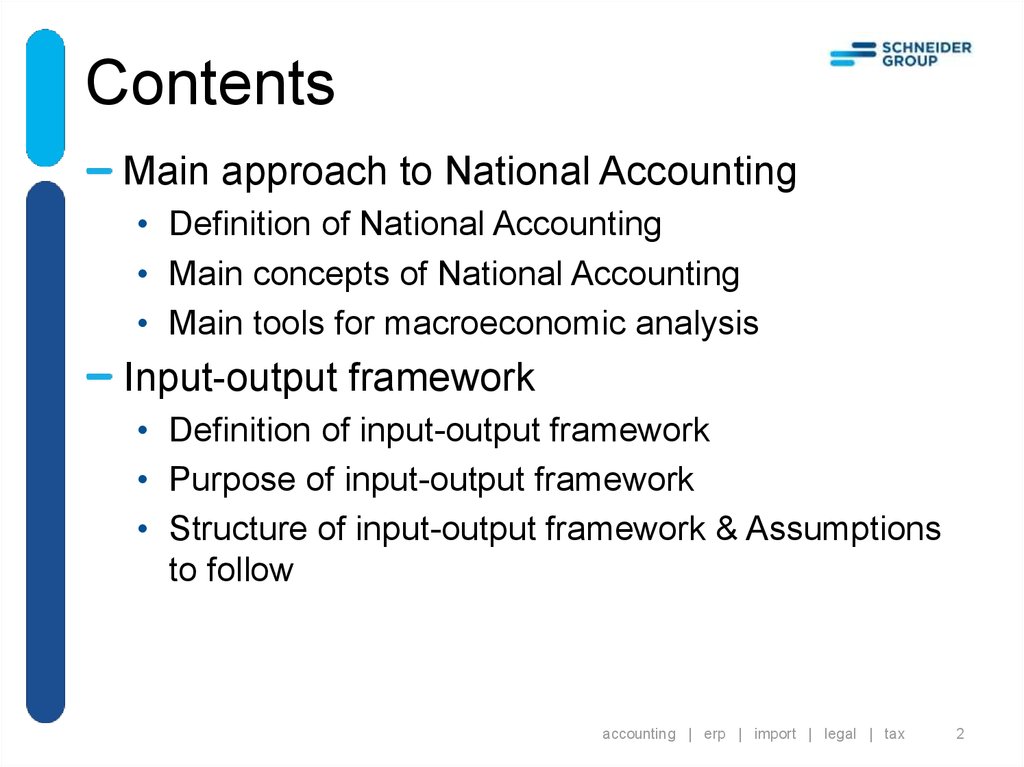

2. Contents

Main approach to National Accounting• Definition of National Accounting

• Main concepts of National Accounting

• Main tools for macroeconomic analysis

Input-output framework

• Definition of input-output framework

• Purpose of input-output framework

• Structure of input-output framework & Assumptions

to follow

accounting | erp | import | legal | tax

2

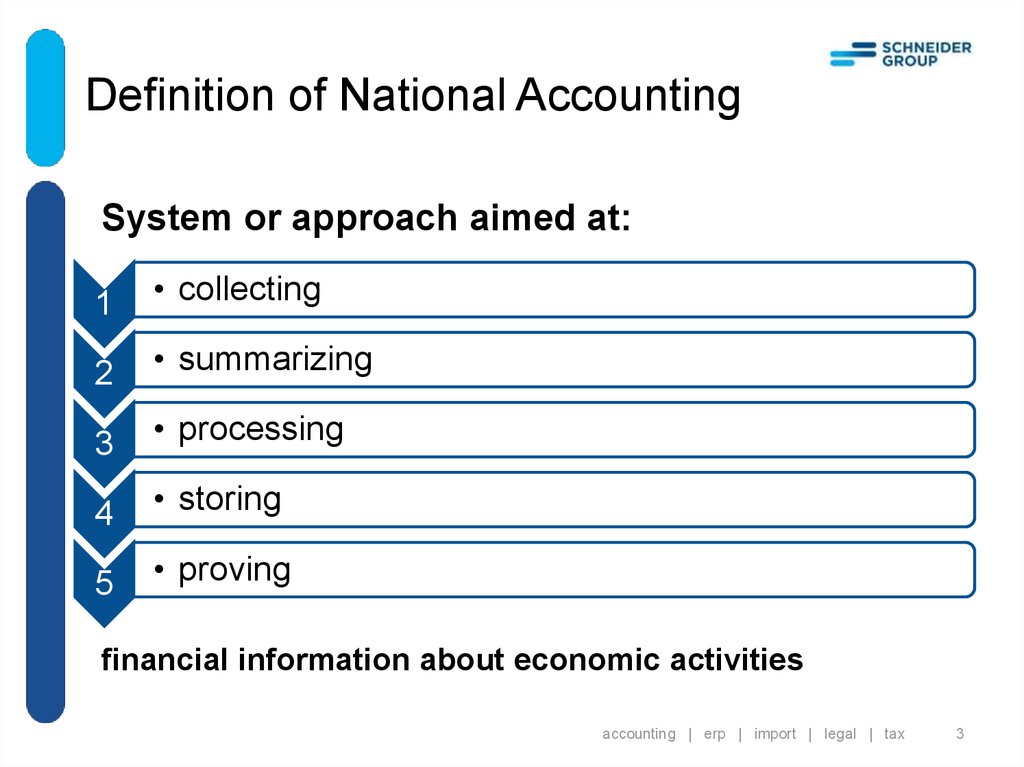

3. Definition of National Accounting

System or approach aimed at:1

• collecting

2

• summarizing

3

• processing

4

• storing

5

• proving

financial information about economic activities

accounting | erp | import | legal | tax

3

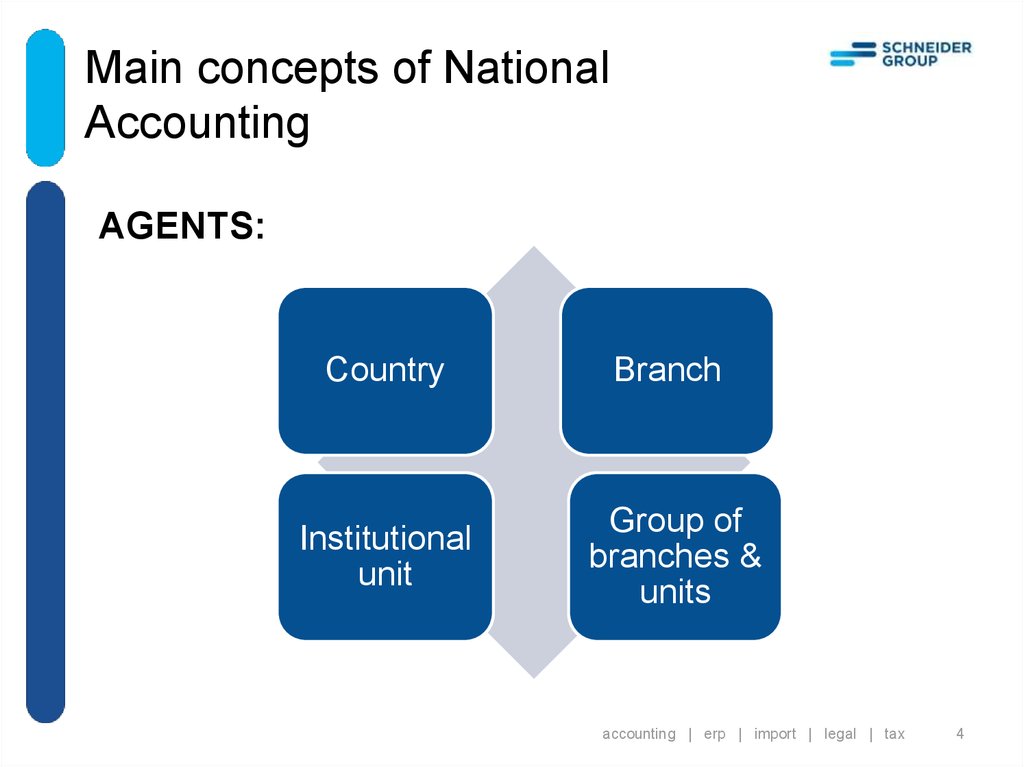

4. Main concepts of National Accounting

AGENTS:Country

Branch

Institutional

unit

Group of

branches &

units

accounting | erp | import | legal | tax

4

5. Main concepts of National Accounting

COMPONENTS:Resources

Uses

accounting | erp | import | legal | tax

5

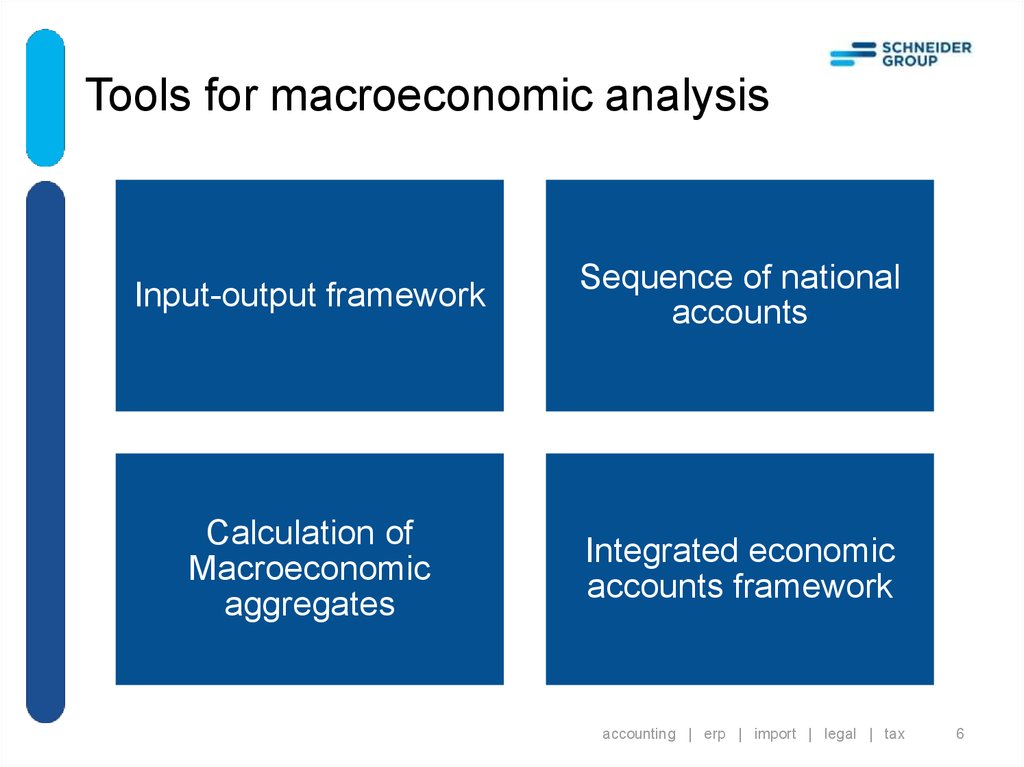

6. Tools for macroeconomic analysis

Input-output frameworkSequence of national

accounts

Calculation of

Macroeconomic

aggregates

Integrated economic

accounts framework

accounting | erp | import | legal | tax

6

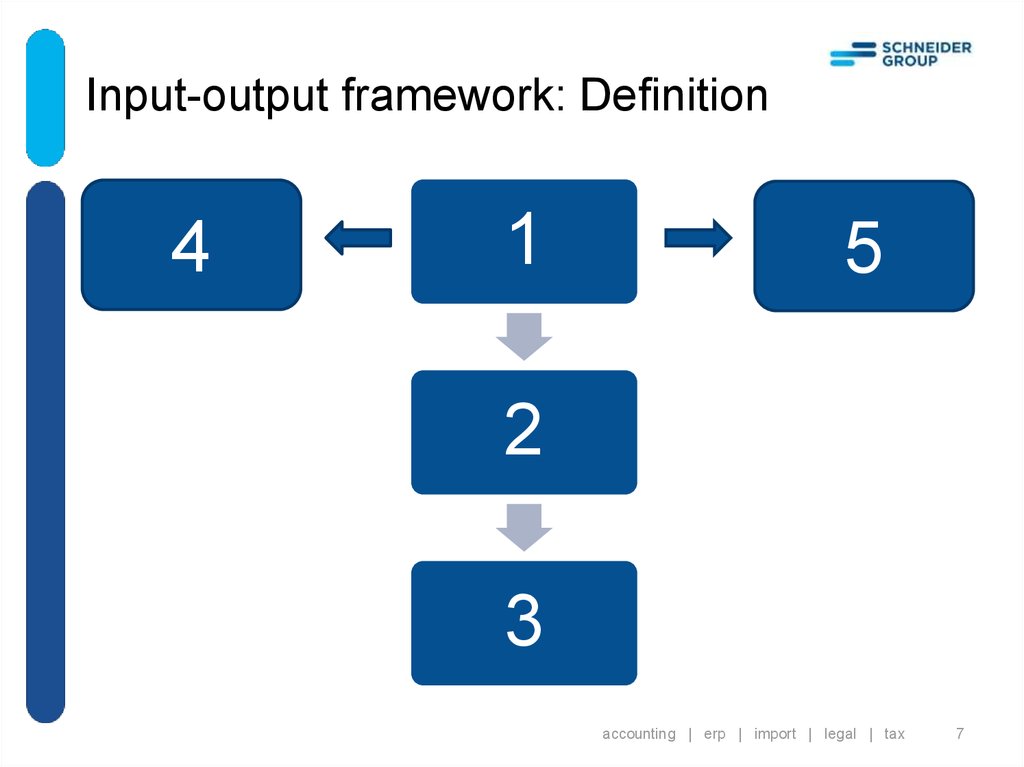

7. Input-output framework: Definition

41

5

2

3

accounting | erp | import | legal | tax

7

8. Input-output framework: Purpose

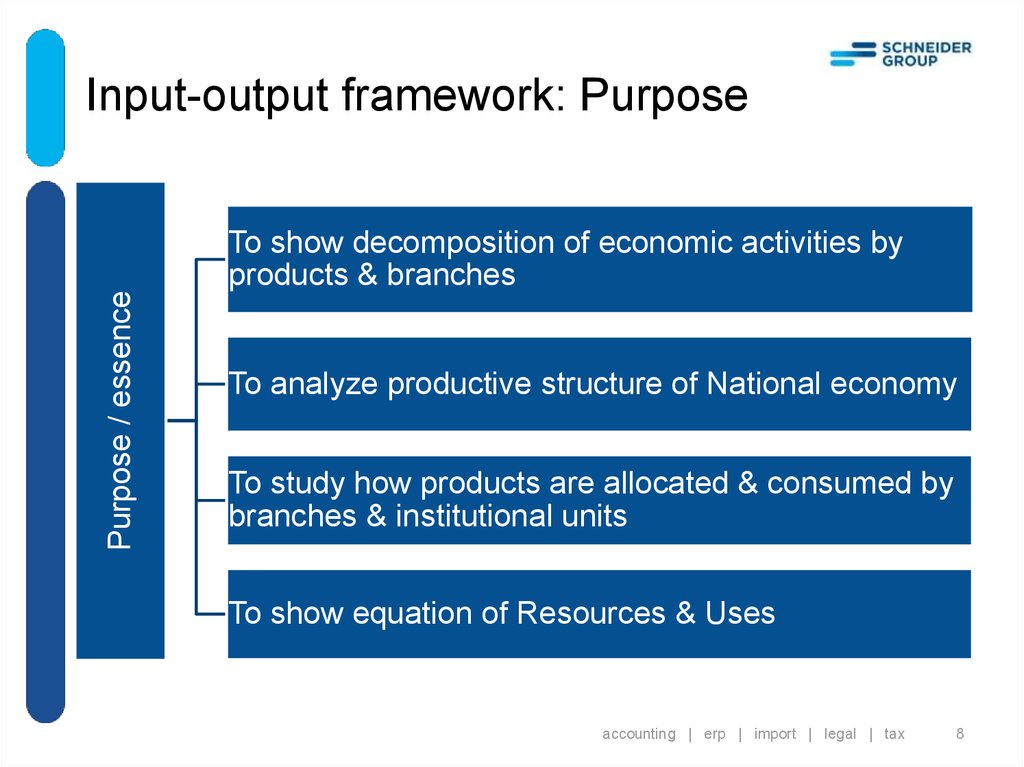

Purpose / essenceInput-output framework: Purpose

To show decomposition of economic activities by

products & branches

To analyze productive structure of National economy

To study how products are allocated & consumed by

branches & institutional units

To show equation of Resources & Uses

accounting | erp | import | legal | tax

8

9. Input-output framework: Structure & assumptions to follow

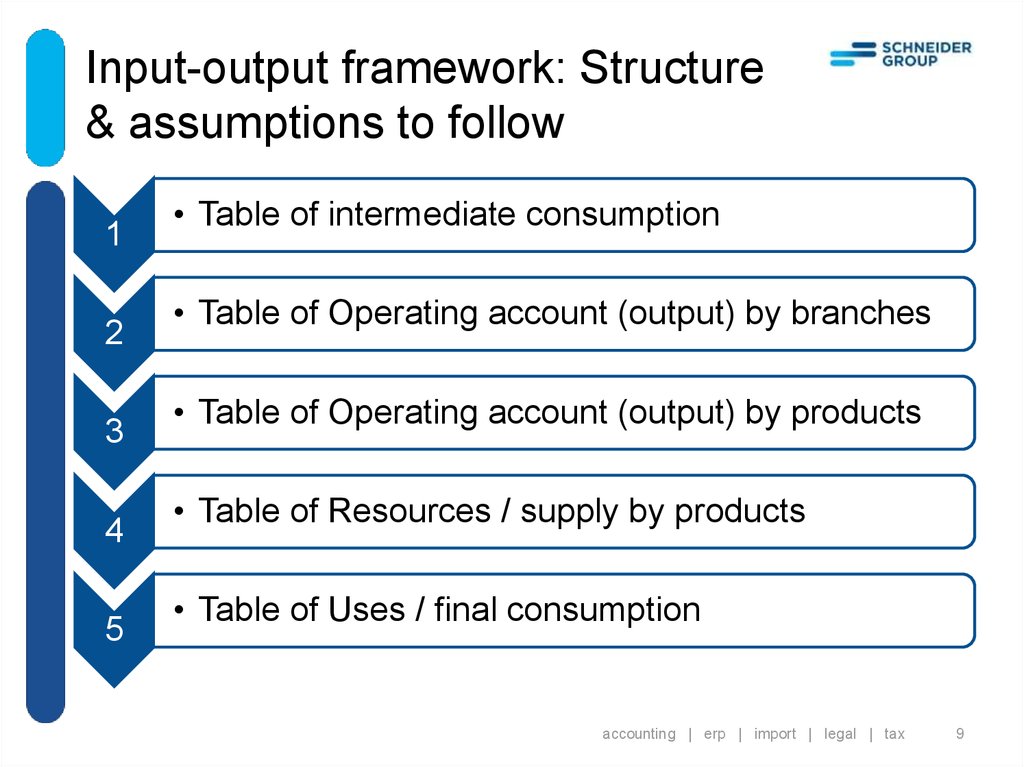

Input-output framework: Structure& assumptions to follow

1

2

3

4

5

• Table of intermediate consumption

• Table of Operating account (output) by branches

• Table of Operating account (output) by products

• Table of Resources / supply by products

• Table of Uses / final consumption

accounting | erp | import | legal | tax

9

10. Input-output framework: Table of intermediate consumption

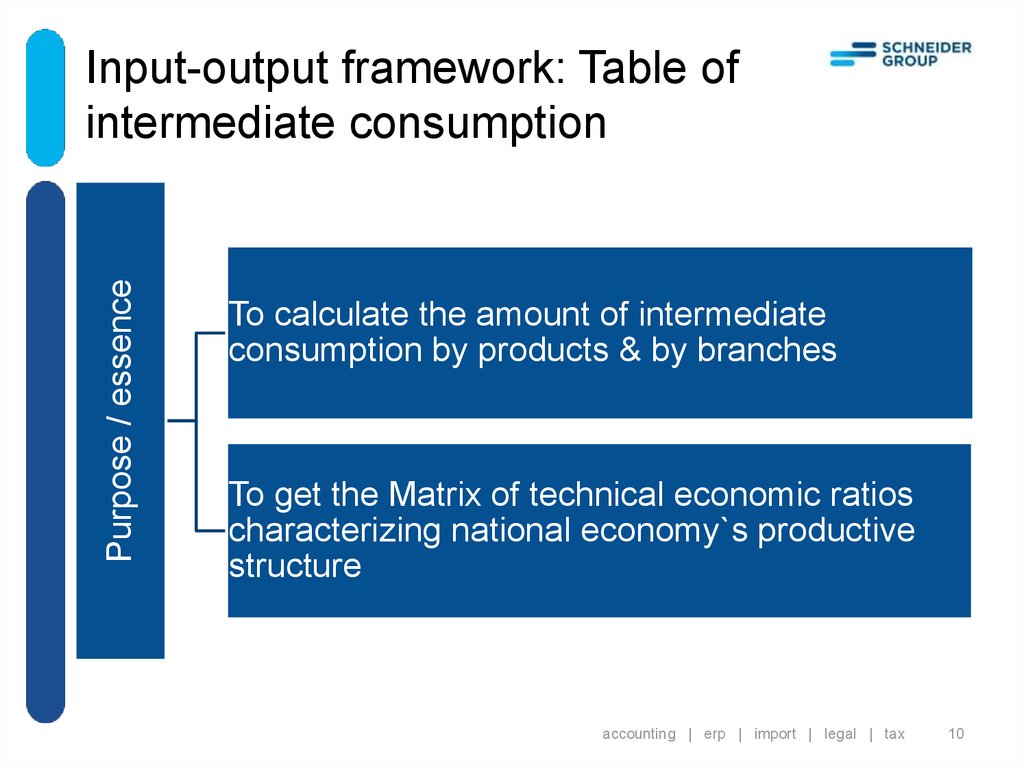

Purpose / essenceInput-output framework: Table of

intermediate consumption

To calculate the amount of intermediate

consumption by products & by branches

To get the Matrix of technical economic ratios

characterizing national economy`s productive

structure

accounting | erp | import | legal | tax

10

11. Input-output framework: Table of intermediate consumption

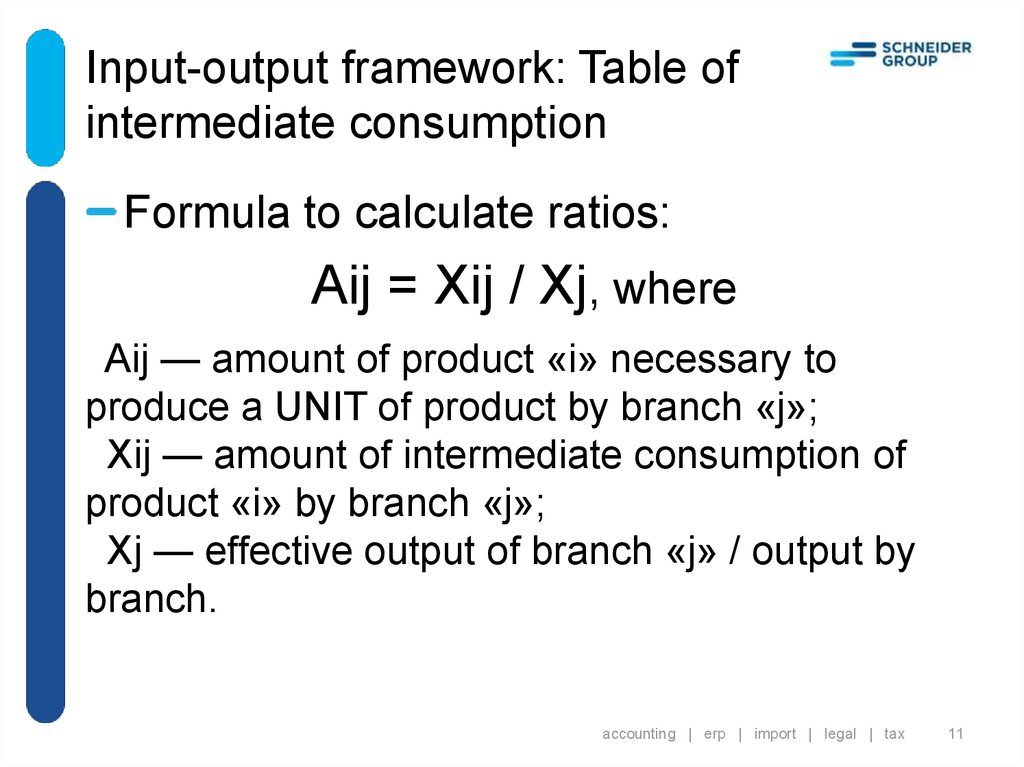

Formula to calculate ratios:Aij = Xij / Xj, where

Aij — amount of product «i» necessary to

produce a UNIT of product by branch «j»;

Xij — amount of intermediate consumption of

product «i» by branch «j»;

Xj — effective output of branch «j» / output by

branch.

accounting | erp | import | legal | tax

11

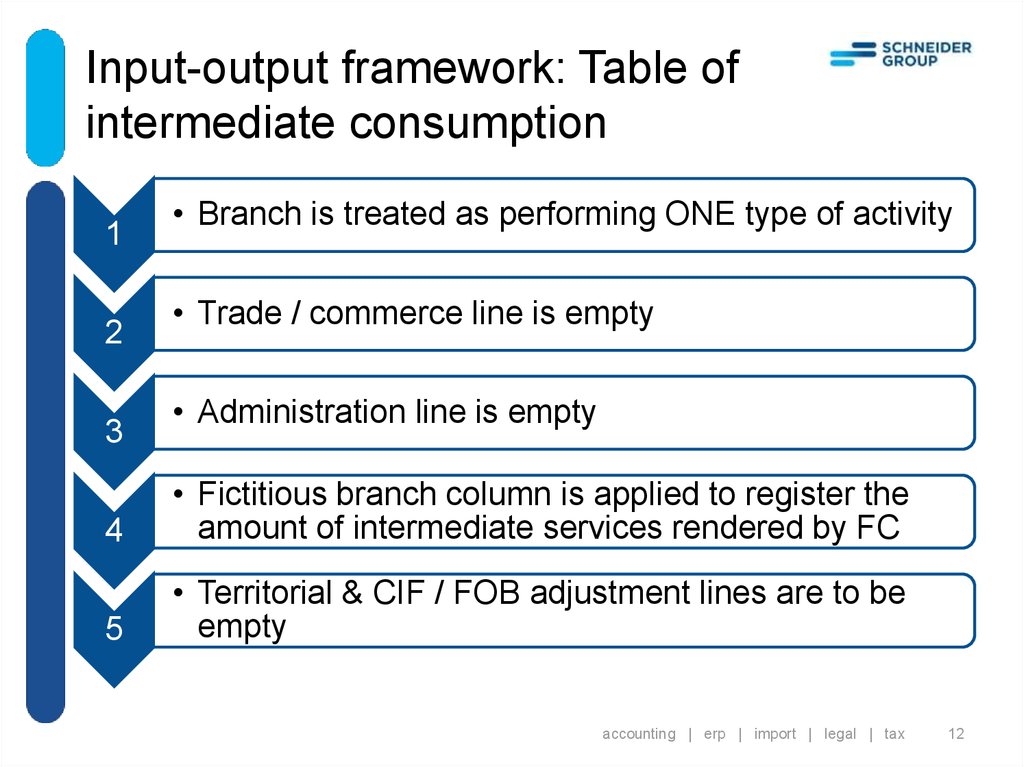

12. Input-output framework: Table of intermediate consumption

12

3

• Branch is treated as performing ONE type of activity

• Trade / commerce line is empty

• Administration line is empty

4

• Fictitious branch column is applied to register the

amount of intermediate services rendered by FC

5

• Territorial & CIF / FOB adjustment lines are to be

empty

accounting | erp | import | legal | tax

12

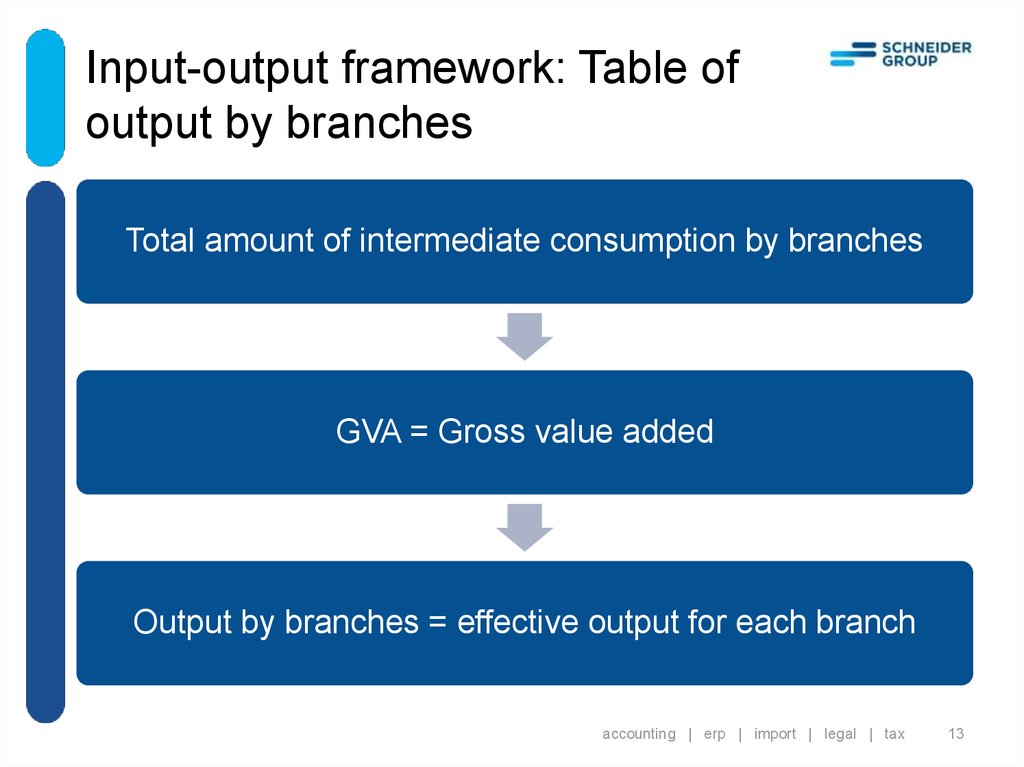

13. Input-output framework: Table of output by branches

Total amount of intermediate consumption by branchesGVA = Gross value added

Output by branches = effective output for each branch

accounting | erp | import | legal | tax

13

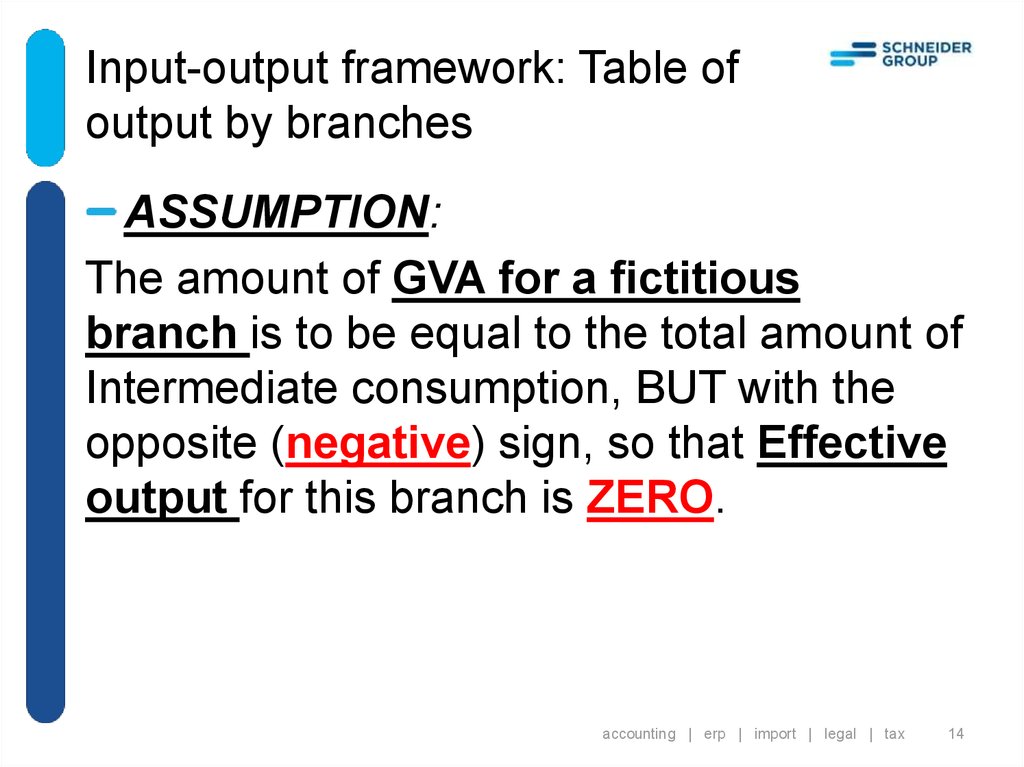

14. Input-output framework: Table of output by branches

ASSUMPTION:The amount of GVA for a fictitious

branch is to be equal to the total amount of

Intermediate consumption, BUT with the

opposite (negative) sign, so that Effective

output for this branch is ZERO.

accounting | erp | import | legal | tax

14

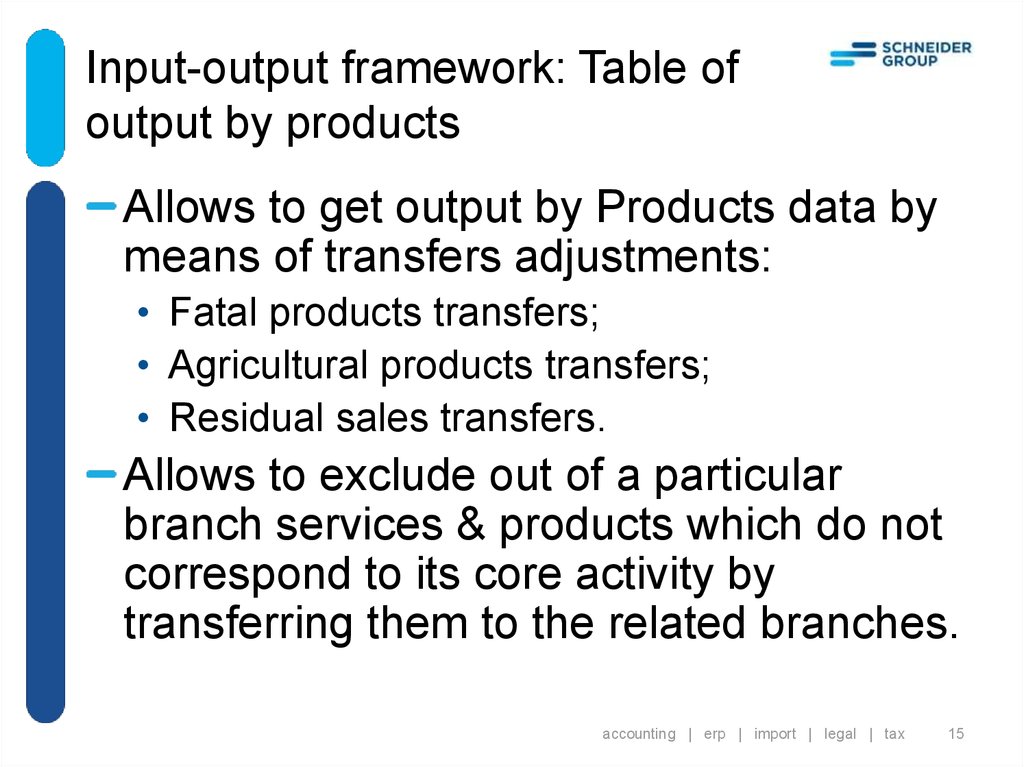

15. Input-output framework: Table of output by products

Allows to get output by Products data bymeans of transfers adjustments:

• Fatal products transfers;

• Agricultural products transfers;

• Residual sales transfers.

Allows to exclude out of a particular

branch services & products which do not

correspond to its core activity by

transferring them to the related branches.

accounting | erp | import | legal | tax

15

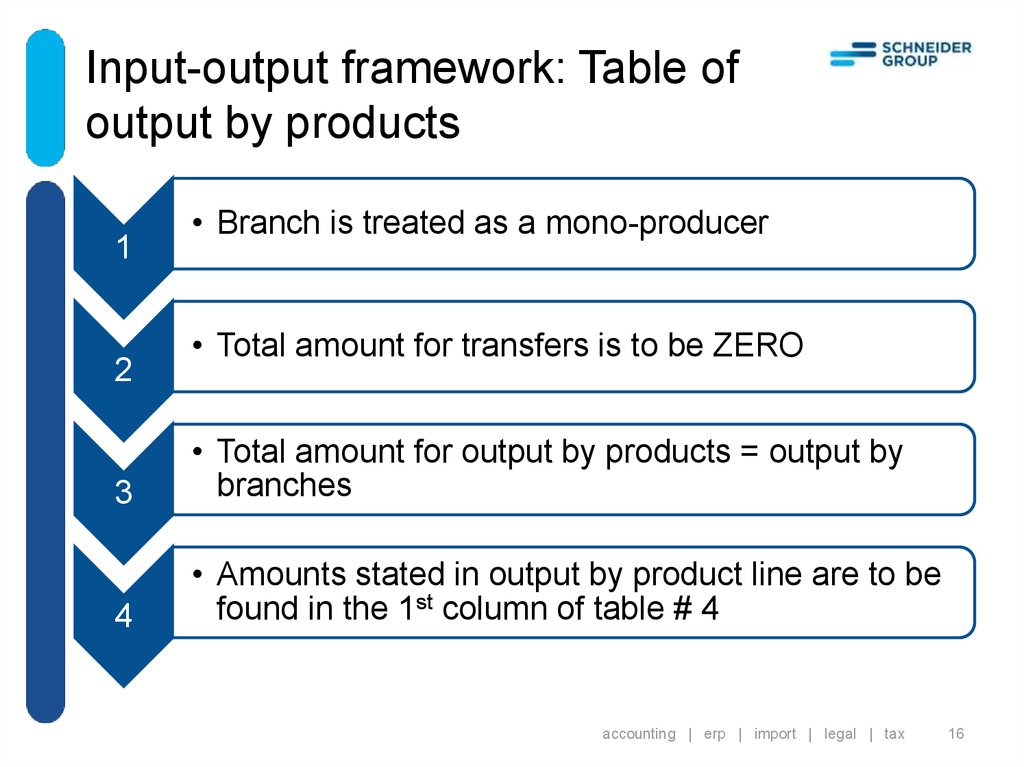

16. Input-output framework: Table of output by products

12

• Branch is treated as a mono-producer

• Total amount for transfers is to be ZERO

3

• Total amount for output by products = output by

branches

4

• Amounts stated in output by product line are to be

found in the 1st column of table # 4

accounting | erp | import | legal | tax

16

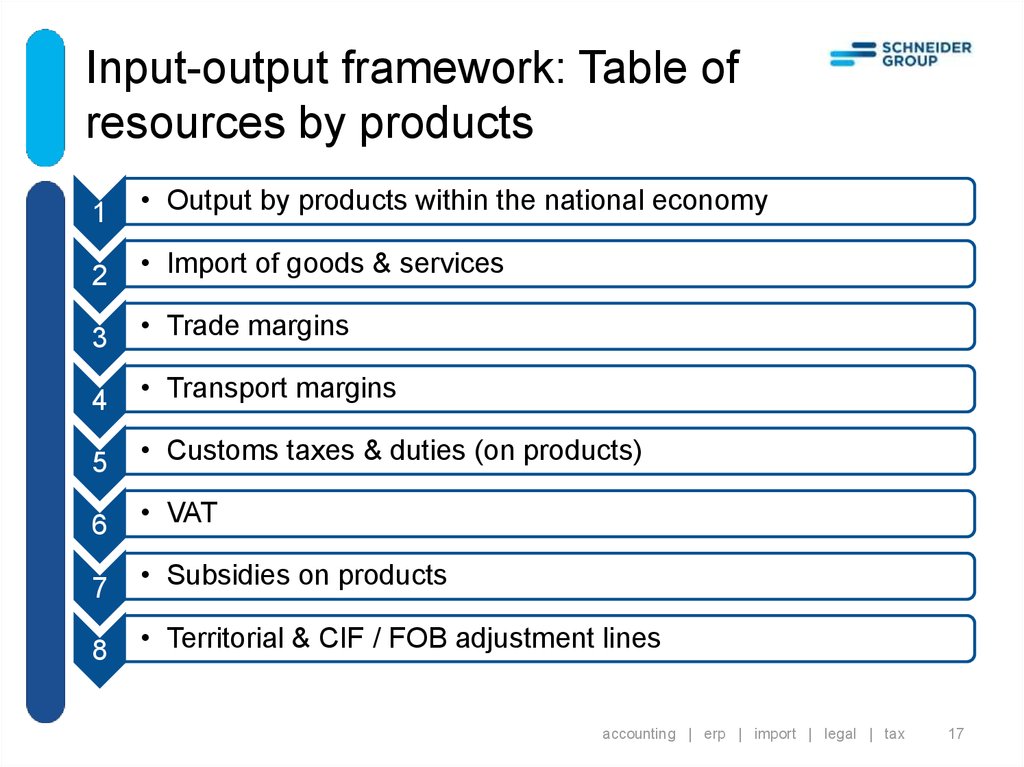

17. Input-output framework: Table of resources by products

1• Output by products within the national economy

2

• Import of goods & services

3

• Trade margins

4

• Transport margins

5

• Customs taxes & duties (on products)

6

• VAT

7

• Subsidies on products

8

• Territorial & CIF / FOB adjustment lines

accounting | erp | import | legal | tax

17

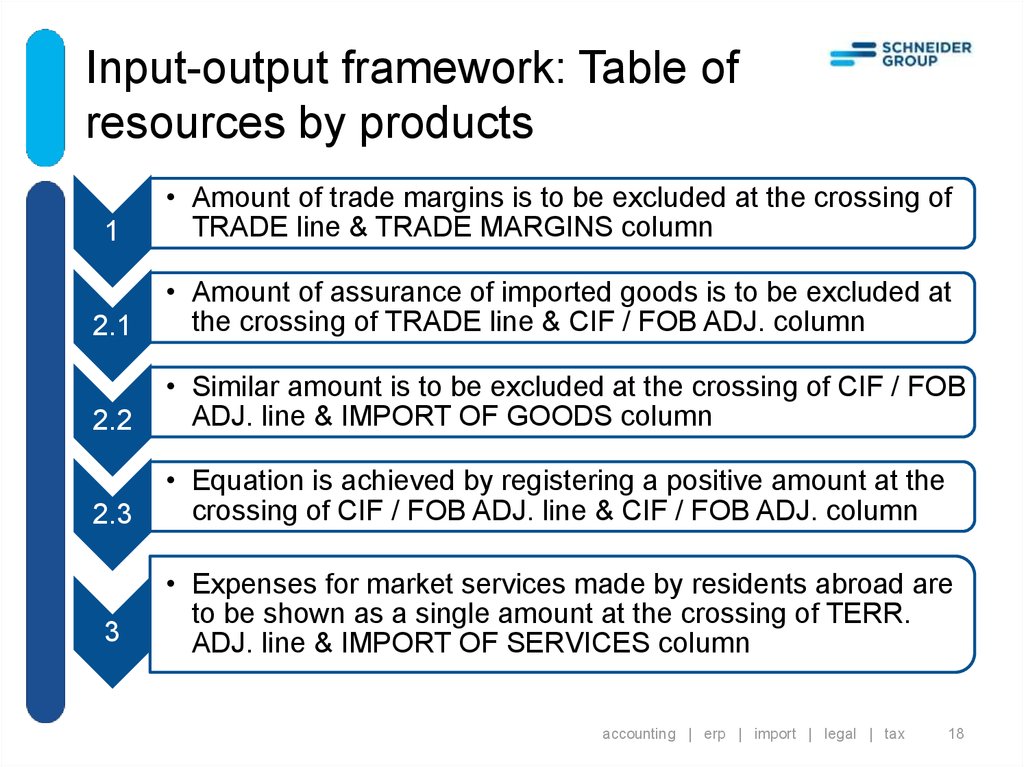

18. Input-output framework: Table of resources by products

1• Amount of trade margins is to be excluded at the crossing of

TRADE line & TRADE MARGINS column

2.1

• Amount of assurance of imported goods is to be excluded at

the crossing of TRADE line & CIF / FOB ADJ. column

2.2

• Similar amount is to be excluded at the crossing of CIF / FOB

ADJ. line & IMPORT OF GOODS column

2.3

• Equation is achieved by registering a positive amount at the

crossing of CIF / FOB ADJ. line & CIF / FOB ADJ. column

3

• Expenses for market services made by residents abroad are

to be shown as a single amount at the crossing of TERR.

ADJ. line & IMPORT OF SERVICES column

accounting | erp | import | legal | tax

18

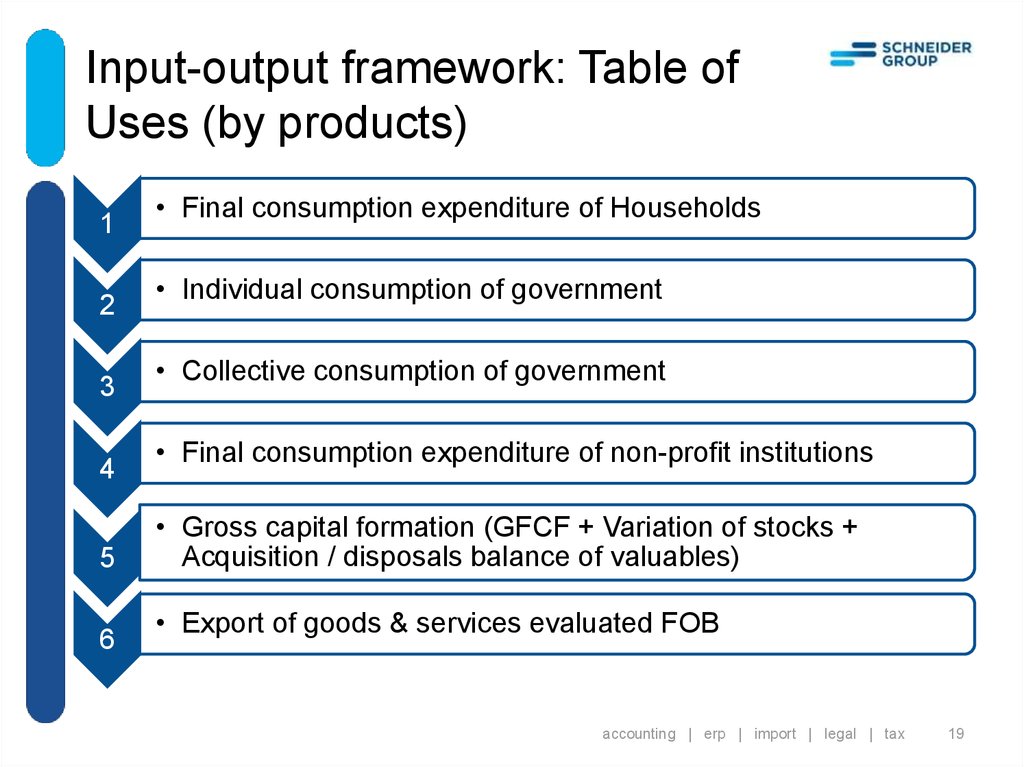

19. Input-output framework: Table of Uses (by products)

12

3

4

5

6

• Final consumption expenditure of Households

• Individual consumption of government

• Collective consumption of government

• Final consumption expenditure of non-profit institutions

• Gross capital formation (GFCF + Variation of stocks +

Acquisition / disposals balance of valuables)

• Export of goods & services evaluated FOB

accounting | erp | import | legal | tax

19

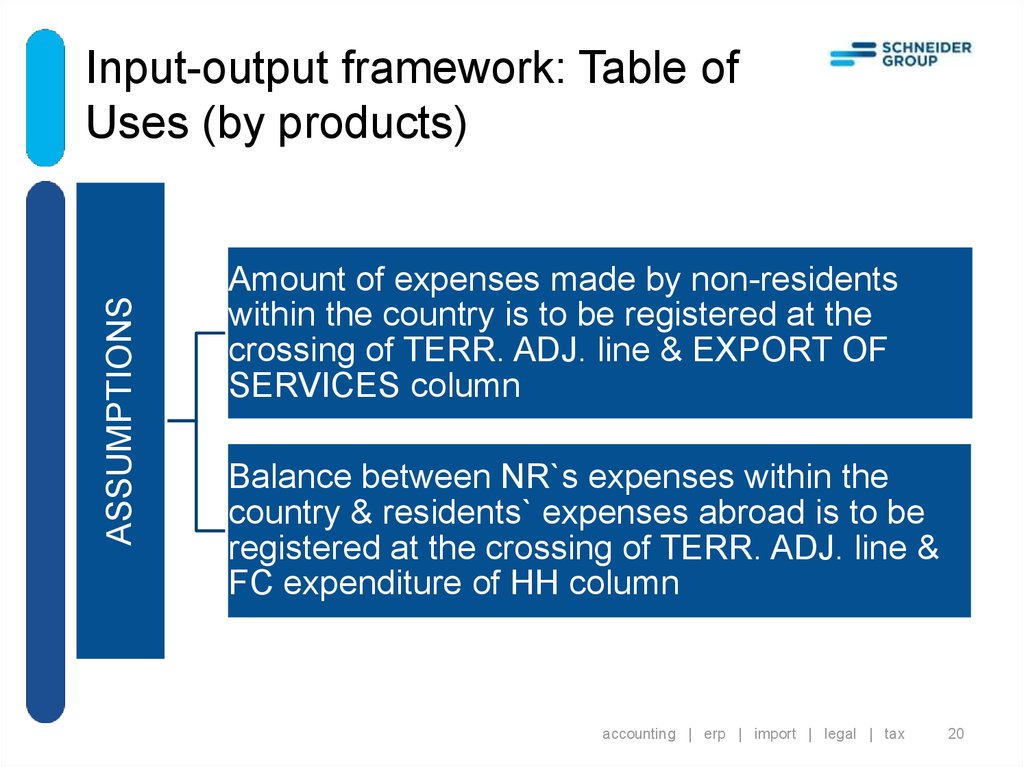

20. Input-output framework: Table of Uses (by products)

ASSUMPTIONSInput-output framework: Table of

Uses (by products)

Amount of expenses made by non-residents

within the country is to be registered at the

crossing of TERR. ADJ. line & EXPORT OF

SERVICES column

Balance between NR`s expenses within the

country & residents` expenses abroad is to be

registered at the crossing of TERR. ADJ. line &

FC expenditure of HH column

accounting | erp | import | legal | tax

20

21. Thank you for your attention

accounting | erp | import | legal | tax21

22.

Smirnova Ekaterina, PhD in EconomicsAccounting team leader

SmirnovaEV@schneider-group.com

Все исключительные права на материалы настоящей презентации, включая права на перевод, воспроизведение,

передачу, распространение или использование иным способом материалов настоящей презентации или

содержащихся в них частей (фрагментов), а также права на логотип и коммерческое имя SCHNEIDER GROUP, в том

числе для публикации в печатном и электронном виде во всех средствах и форматах, существующих на данный

момент и которые могут возникнуть в будущем, а также права на выдачу разрешения третьим сторонам, принадлежат

SCHNEIDER GROUP.

Воспроизведение, размещение, передача или иное распространение или использование материалов настоящей

презентации или любой отдельной части (фрагмента) презентации, а также логотипа или коммерческого имени

SCHNEIDER GROUP, любым способом допускается только с предварительного письменного разрешения

SCHNEIDER GROUP и должно сопровождаться ссылкой на SCHNEIDER GROUP, а именно указанием на копирайт

© SCHNEIDER GROUP www.schneider-group.com

accounting | erp | import | legal | tax

22

23.

актауалматы

астана

берлин

варшава

гамбург

киев

минск

москва

с.-петербург

франкфурт

бухгалтерия |

www.schneider-group.com

erp

|

импорт |

право

|

налоги

Финансы

Финансы