Похожие презентации:

Model of aggregate demand and aggregate supply. Topic 3

1.

TOPIC 3. MODEL OFAGGREGATE DEMAND AND

AGGREGATE SUPPLY

Plan

1. Aggregate demand and its model. Factors determining aggregate demand. AD

curve.

1а. Video – effects for a negative inclination of AD Video – effects for a negative

inclination of AD

2. Aggregate supply in the short and long run. Factors affecting the aggregate

supply. AS curve.

3. Macroeconomic equilibrium in the AD-AS model.

2.

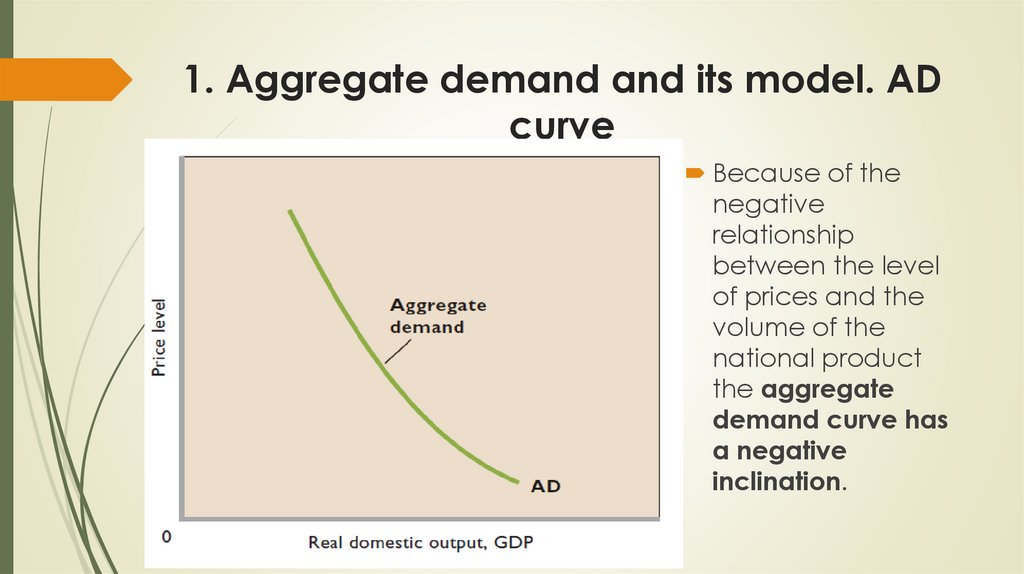

1. Aggregate demand and its model. ADcurve

AGGREGATE DEMAND (AD) – is a schedule or curve

that shows the amounts of real output (real GDP)

that buyers collectively desire to purchase at each

possible price level.

The relationship between the price level (as

measured by the GDP price index) and the amount

of real GDP demanded is inverse or negative: When

the price level rises, the quantity of real GDP

demanded decreases; when the price level falls, the

quantity of real GDP demanded increases.

3.

1. Aggregate demand and its model. ADcurve

Aggregate demand is the planned expenditure in all

sectors of the economy. It contains four components:

1) expenditures of the private sector of the country

for consumption (C) and investment (I);

2) expenditures of the state for the purchase of

goods, payment for services and labor (G);

3) net exports of the country (NE) = export – import

AD = C+I+G+NE

4.

1. Aggregate demand and its model. ADcurve

Because of the

negative

relationship

between the level

of prices and the

volume of the

national product

the aggregate

demand curve has

a negative

inclination.

5.

1. Aggregate demand and its model. ADcurve

AD factors are divided into:

Price related – factors that show how price of the

product influence AD

Non-price related – show how other price factors

except of price of the product influence AD

6.

1. Aggregate demand and its model. ADcurve

Price related factors:

1. Real-Balances Effect (wealth effect)- with the

growth of prices, decreases the purchasing power

of financial assets (cash); buyers reduce their

expenditure and aggregate demand is decreasing

and the opposite.

7.

1. Aggregate demand and its model. ADcurve

Price related factors:

2. Interest-Rate(Savings) Effect - with the increase of

the general level of prices, the demand for money

for the purchase of more expensive goods and

services increases, which leads to an increase in the

interest rate and a decrease in investments, which in

turn limits the aggregate demand.

p↑→ Мd ↑ → і↑→ І↓→АD↓

And vice versa:

p↓→ Мd ↓→ і↓→ І↑→ АD↑

8.

1. Aggregate demand and its model. ADcurve

3. Foreign Purchases Effect - the increase in the

general level of domestic prices in comparison with

the prices abroad leads to inflation, and,

consequently, the decrease in exports, and the

growth of imports, which will lead to a decrease in

net exports and a decrease in aggregate demand.

9.

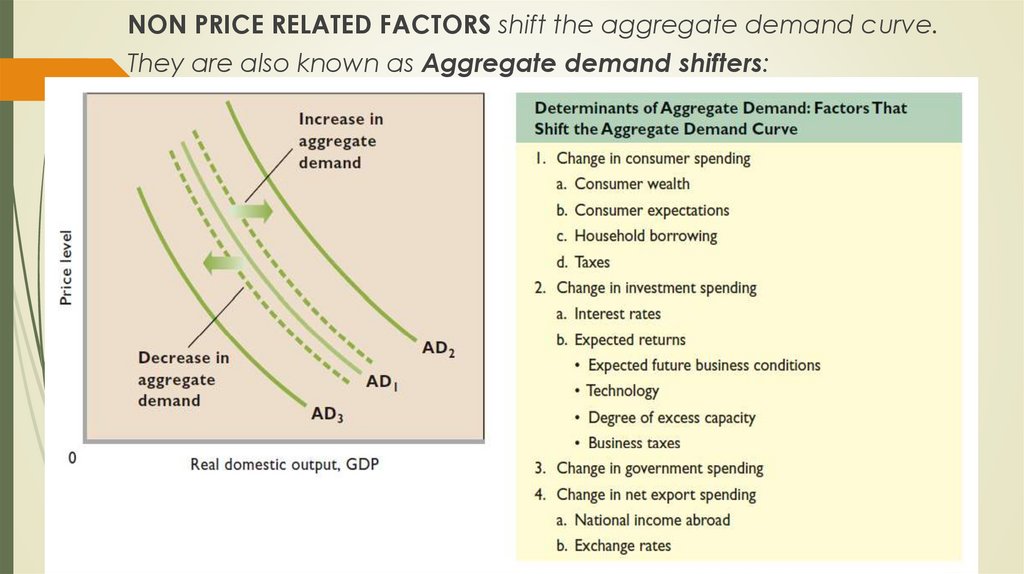

NON PRICE RELATED FACTORS shift the aggregate demand curve.They are also known as Aggregate demand shifters:

10.

1. Aggregate demand and its model. ADcurve

1. Change in consumer spending

Consumer Wealth - is the total dollar value of all assets owned by

consumers in the economy less the dollar value of their liabilities

(debts). Assets include stocks, bonds, and real estate. Liabilities

include mortgages, car loans, and credit card balances.

Household Borrowing. Consumers can increase their consumption

spending by borrowing. Doing so shifts the aggregate demand

curve to the right. By contrast, a decrease in borrowing for

consumption purposes shifts the aggregate demand curve to the

left.

11.

1. Aggregate demand and its model. ADcurve

1. Change in consumer spending

Consumer Expectations .When people expect their future

real incomes to rise, they tend to spend more of their

current incomes. Thus, current consumption spending

increases and the aggregate demand curve shifts to the

right.

Personal Taxes. Tax cuts shift the aggregate demand

curve to the right. Tax increases reduce consumption

spending and shift the curve to the left.

12.

1. Aggregate demand and its model. ADcurve

2. Investment Spending

Real Interest Rates Other things equal, an increase in real

interest rates will lower investment spending and reduce

aggregate demand.

Expected Returns Higher expected returns on investment

projects will increase the demand for capital goods and shift

the aggregate demand curve to the right.

Alternatively, declines in expected returns will decrease

investment and shift the curve to the left.

13.

1. Aggregate demand and its model. ADcurve

Expected returns, in turn, are influenced by several factors:

Expectations about future business conditions If firms are optimistic

about future business conditions, they are more likely to forecast high

rates of return on current investment and therefore may invest more

today.

Technology New and improved technologies enhance expected returns

on investment and thus increase aggregate demand.

Degree of excess capacity A rise in excess capacity— unused capital—

will reduce the expected return on new investment and hence

decrease aggregate demand. Other things equal, firms operating

factories at well below capacity have little incentive to build new

factories.

Business taxes An increase in business taxes will reduce after-tax profits

from capital investment and lower expected returns.

14.

1. Aggregate demand and its model. ADcurve

3. Government Spending

An increase in government purchases (for example, more

military equipment) will shift the aggregate demand curve to

the right, as long as tax collections and interest rates do not

change as a result. In contrast, a reduction in government

spending (for example, fewer transportation projects) will shift

the curve to the left.

15.

1. Aggregate demand and its model. ADcurve

4. Net Export Spending

Other things equal, higher U.S. exports mean an

increased foreign demand for U.S. goods.

So a rise in net exports shifts the aggregate demand

curve to the right. In contrast, a decrease in U.S. net

exports shifts the aggregate demand curve

leftward.

16.

1. Aggregate demand and its model. ADcurve

Causes of net exports change:

National Income Abroad Rising national income abroad

encourages foreigners to buy more products, some of which are

made in the United States. U.S. net exports thus rise, and the U.S.

aggregate demand curve shifts to the right.

Exchange Rates Changes in the dollar’s exchange rate—the price

of foreign currencies—may affect exports and therefore

aggregate demand.

Dollar depreciation increases net exports (imports go down;

exports go up) and therefore increases aggregate demand.

Dollar appreciation has the opposite effects: Net exports fall

(imports go up; exports go down) and aggregate demand

declines.

17.

2. Aggregate supply in the short and long run. Factorsaffecting the aggregate supply. AS curve.

AGGREGATE SUPPLY (AS) – is a schedule or curve

showing the relationship between the price level and

the amount of real domestic output that firms in the

economy produce.

The national economy can respond to changes in

aggregate demand either by increasing the volume

of the real product or by changing the price level.

18.

2. Aggregate supply in the short and long run. Factorsaffecting the aggregate supply. AS curve.

FULL EMPLOYMENT OUTPUT LEVEL (Potential GDP) is the

production level when all available resources are used

efficiently. It equals the highest level of production an

economy can sustain for the long-run.

It is also referred to as the full employment production,

natural level of output or long-run aggregate supply.

19.

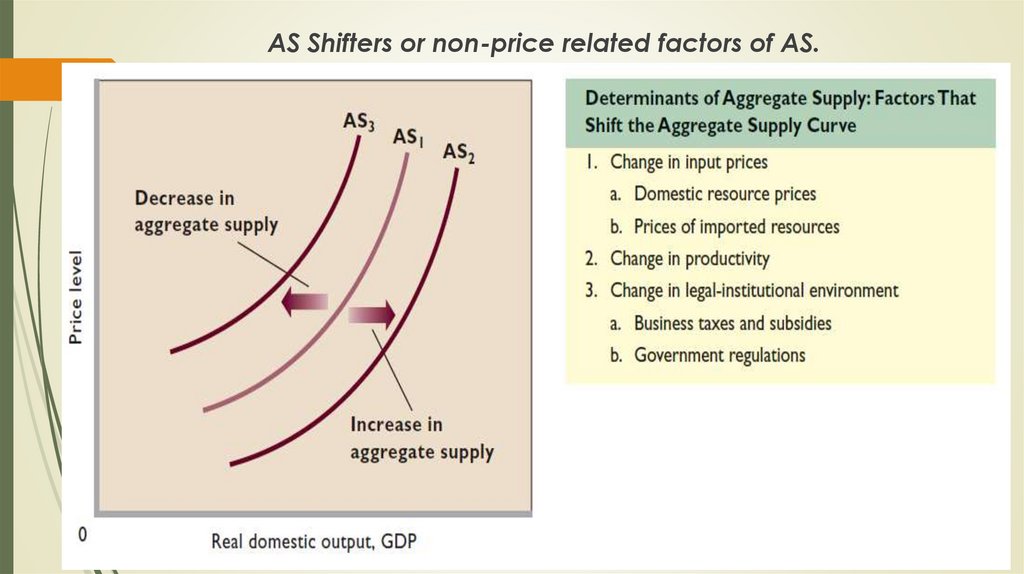

АS Shifters or non-price related factors of AS.20.

2. Aggregate supply in the short and long run. Factorsaffecting the aggregate supply. AS curve.

1. Input Prices

Input or resource prices—to be distinguished from the output

prices that make up the price level—are a major ingredient of

per-unit production costs and therefore a key determinant of

aggregate supply. These resources can either be domestic or

imported.

Domestic Resource Prices Wages and salaries make up about

75 percent of all business costs. Other things equal, decreases

in wages reduce per-unit production costs. So the aggregate

supply curve shifts to the right. Increases in wages shift the

curve to the left.

21.

2. Aggregate supply in the short and long run. Factorsaffecting the aggregate supply. AS curve.

Prices of Imported Resources

Just as foreign demand for national goods contributes to our

aggregate demand, resources imported from abroad (add to

national aggregate supply.

Added suppliesof resources—whether domestic or imported—

typically reduce per-unit production costs. A decrease in the

price of imported resources increases national aggregate

supply, while an increase in their price reduces national

aggregate supply.

22.

2. Aggregate supply in the short and long run. Factorsaffecting the aggregate supply. AS curve.

2. Change in productivity

Productivity- is a measure of the relationship between

a nation’s level of real output and the amount of

resources used to produce that output.

An increase in productivity enables the economy to

obtain more real output from its limited resources. It

does this by reducing the per-unit cost of output (perunit production cost).

23.

2. Aggregate supply in the short and long run. Factorsaffecting the aggregate supply. AS curve.

3. Change in legal-institutional environment

Business Taxes and Subsidies Higher business taxes, such as sales, and

payroll taxes, increase perunit costs and reduce short-run aggregate

supply in much the same way as a wage increase does.

Similarly, a business subsidy—a payment or tax break by government

to producers—lowers production costs and increases short-run

aggregate supply.

Government Regulation It is usually costly for businesses to comply with

government regulations. More regulation therefore tends to increase

per-unit production costs and shift the aggregate supply curve to the

left.

24.

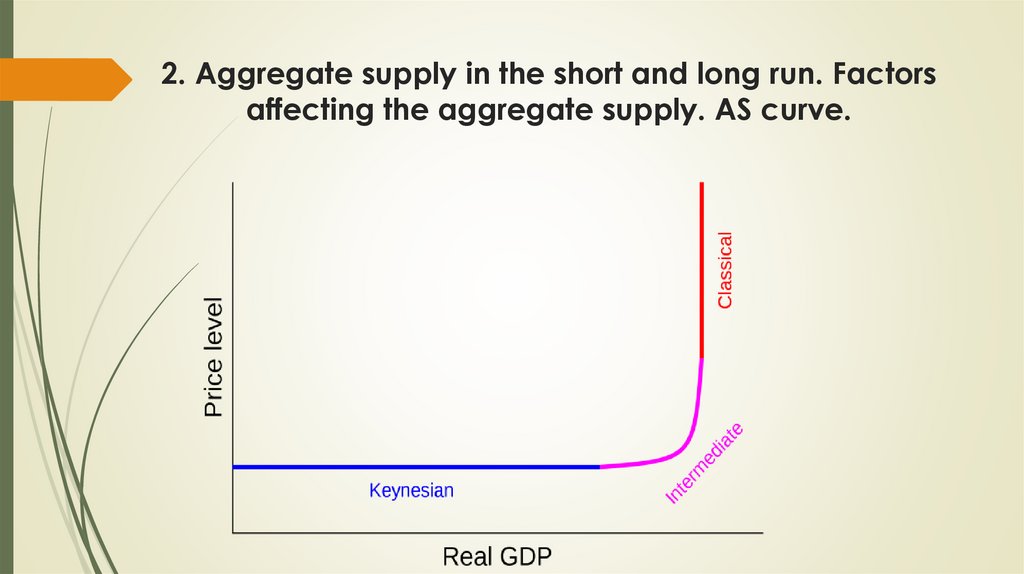

The shape of the AS curve is interpreted differently inClassical and Keynesian theories.

Classical theory describes the economy in the long run. The analysis of the

aggregate supply in the classical theory is based on the following

conditions:

markets are competitive;

the volume of output depends only on the number of factors of

production (labor and capital) and technology and does not depend

on the price level;

changes in factors of production and technology are slow;

the economy operates at full employment output level;

prices and nominal wages - are flexible, their changes maintain the

balance in the markets.

The AS curve in the long run (LRAS) has vertical form at full employment

output level.

Any fluctuations in aggregate demand are reflected at the price level.

25.

2. Aggregate supply in the short and long run. Factorsaffecting the aggregate supply. AS curve.

26.

2. Aggregate supply in the short and long run. Factorsaffecting the aggregate supply. AS curve.

Keynesian theory considers the functioning of the economy in the

short run. The analysis of aggregate supply in the Keynesian theory is

based on the following conditions:

the economy operates under conditions of partial employment of

factors of production;

prices, nominal wages and other nominal values are relatively rigid,

slowly react to market fluctuations;

real values (output, employment, real wages, etc.) are more mobile,

react more quickly to market fluctuations.

The short-term aggregate curve has two segments - the extreme

Keynesian and ascending

27.

2. Aggregate supply in the short and long run. Factorsaffecting the aggregate supply. AS curve.

The extreme Keynesian segment reflects the situation when the

economy is in decline, and therefore a significant proportion of

production capacity and labor is not used. In this segment, actual

production is smaller than full employment output level. The volume of

the national product is small, and therefore its increase does not lead

to the increase in prices level.

28.

2. Aggregate supply in the short and long run. Factorsaffecting the aggregate supply. AS curve.

The intermediate or ascending segment of the aggregate supply

curve is characterized by the fact that the expansion of production is

accompanied by an increase in the price level.

With the expansion of production and the approach to full utilization

of their capacities, individual enterprises are forced to use less efficient

equipment and insufficiently skilled workers. Thus, the costs per unit of

production are increasing. In order for production to remain profitable,

firms set higher prices for products.

At this segment of the AS curve, an increase in the real volume of the

product is leading to an increase in level of prices.

29.

2. Aggregate supply in the short and long run. Factorsaffecting the aggregate supply. AS curve.

The vertical (classical) segment shows changes in GDP when it

reaches maximum, under full employment conditions (the level of

actual unemployment is equal to natural unemployment), and there is

no additional growth in real GDP, and therefore an inflationary rise in

prices occurs.

30.

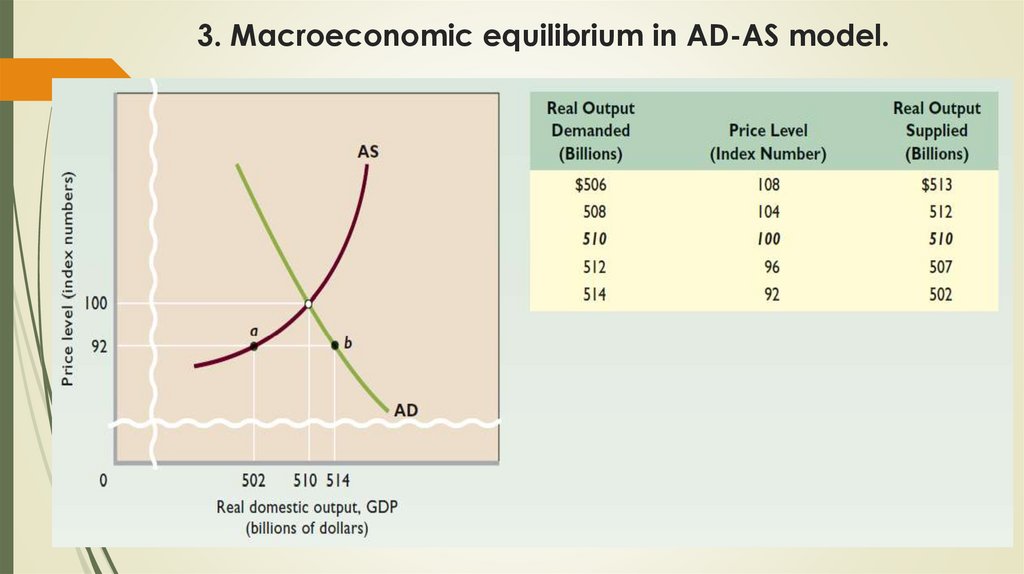

3. Macroeconomic equilibrium in AD-AS model.At the point of intersection of the curves of aggregate

demand and aggregate supply equilibrium level of prices and

the equilibrium volume of production of the national product

are achieved.

31.

3. Macroeconomic equilibrium in AD-AS model.32.

Variants of macroeconomic equilibrium33.

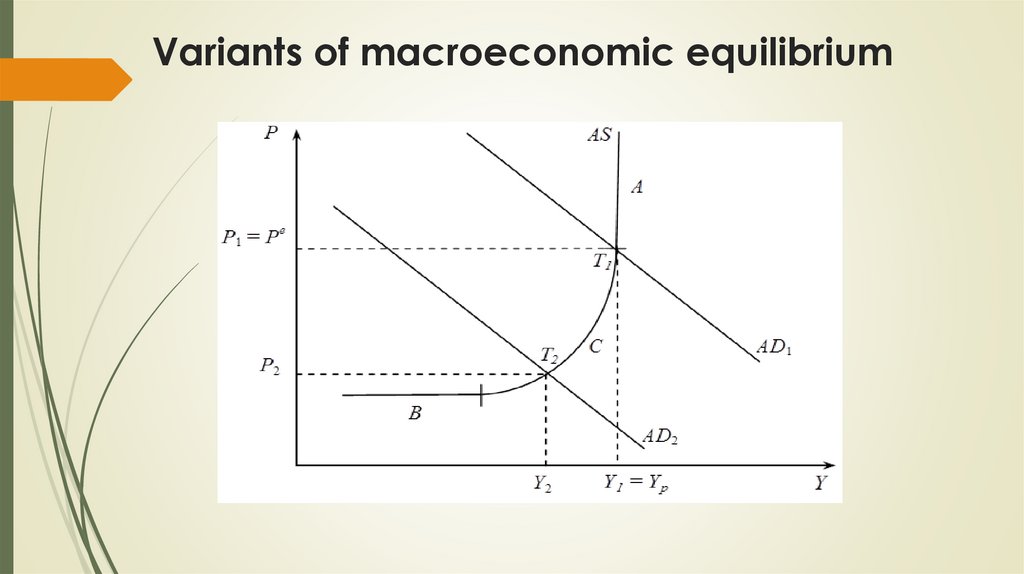

Variants of macroeconomic equilibrium1. If aggregate demand changes within the Keynesian

segment, then the growth of demand leads to an increase

in real domestic production and employment at constant

prices (B).

2. If aggregate demand grows in the intermediate period, it

leads to an increase in real GDP, prices and employment

(C)

3. If aggregate demand grows in the classic segment of AS, it

leads to inflationary growth in prices and nominal GDP with

constant real GDP (because, as already noted, it can not

grow more than the level of "full employment")(A)

34.

3. Macroeconomic equilibrium in AD-AS model.Different variants of macroeconomic equilibrium are possible depending

on employment conditions.

1. In the extreme Keynesian segment, where the aggregate supply

curve is horizontal, the change in aggregate demand mainly affects

the volume of national production, and the level of prices is stable.

2. In the classical segment, the AS curve becomes vertical, and

therefore the change in aggregate demand, for example, its

expansion, leads to higher prices, and real GDP is growing.

3. With the change in aggregate demand in the intermediate

segment of the aggregate supply, both real output and prices grow.

Экономика

Экономика