Похожие презентации:

Analysis of the formation and execution of the state budget of the republic of Kazakhstan

1. Diploma Project

“ANALYSIS OF THE FORMATION AND EXECUTIONOF THE STATE BUDGET OF THE REPUBLIC OF

KAZAKHSTAN”

Prepared by:

Kuttykadam Nuriya - Finance 331

Ibadullayev Adilet - Accounting and Audit 442

Yerlanuly Serzhan - Accounting and Audit 442

Sabirzhanova Diana -Finance 441

1

2.

Customer:Ministry of Finance of the Republic of Kazakhstan

Problem:

Budget deficit in the Republic of Kazakhstan

Hypothesis:

Reduction of state deficit by stabilizing of state revenues

and expenses.

2

3. Aim and tasks of Diploma Project

Aim:• Identify ways of reducing the budget deficit through

the optimization of state revenues and expenses.

Tasks:

• Study theoretical aspects of the state budget

• Review the budget status in the current position

• Offer recommendations to improve the efficiency of

the state budget

3

4. Figure 1. Deficit of the state budget, 2015,million tenge

10,000,000.08,000,000.0

7,711,229.0

7,322,024.7

8,430,909.2

8,388,223.4

6,000,000.0

4,000,000.0

Plan

Fact

2,000,000.0

-1,348,188.6

-915,704.8

0.0

-2,000,000.0

Revenues

Expenses

Deficit

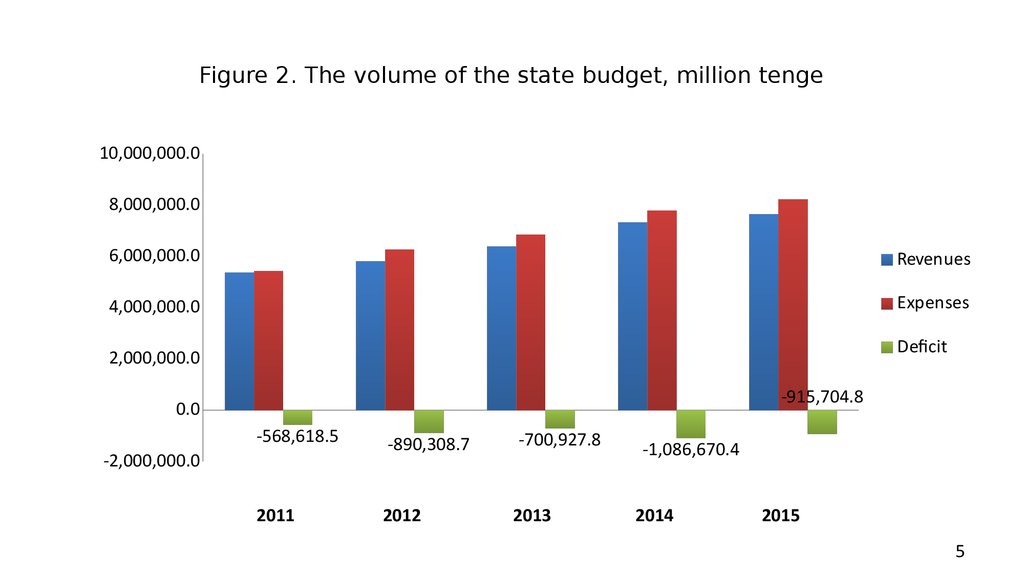

5. Figure 2. The volume of the state budget, million tenge

10,000,000.08,000,000.0

6,000,000.0

Revenues

4,000,000.0

Expenses

Deficit

2,000,000.0

-915,704.8

0.0

-568,618.5

-890,308.7

2011

2012

-2,000,000.0

-700,927.8

2013

-1,086,670.4

2014

2015

5

6. Figure 3. The volume of the state budget, % to GDP

25%25%

20%

20%

20%20%

19%

19%

21%

21%

19%

19%

19%

19%

18%

18%

20%

20%

20%

20%

19%

19%

19%

19%

15%

15%

10%

10%

5%

5%

2%

2%

0%

0%

2011

2011

3%

3%

2012

2012

Revenue % to GDP

Revenue % to GDP

2%

3%

3%

2%

2%

2014

2015

2%

2013

2013

Expenses % to GDP

Expenses % to GDP

2014

Deficit % to GDP

Deficit % to GDP

2015

6

7. Figure 4. Revenues of the state budget, million tenge

120.00%100.00%

22.34%

80.00%

0.93%

2.58%

23.74%

0.90%

4.91%

22.02%

0.88%

2.22%

26.70%

0.97%

2.45%

32.17%

Transfers revenues

0.91%

2.94%

60.00%

Proceeds from the sale of fixed

assets

Non-tax revenues

40.00%

74.15%

70.45%

74.88%

69.88%

63.97%

Tax revenues

20.00%

0.00%

2011

2012

2013

2014

2015

7

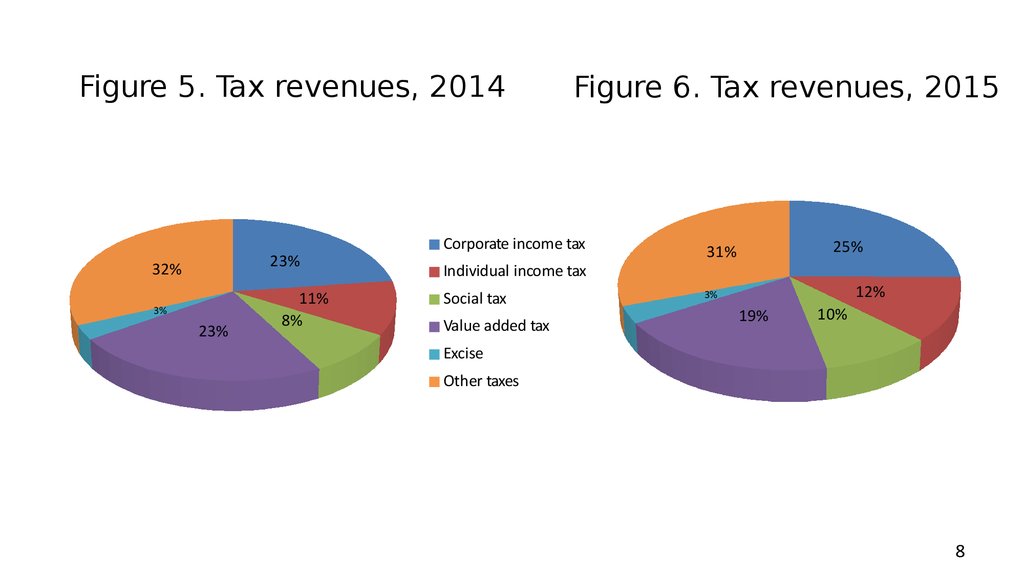

8.

Figure 5. Tax revenues, 201423%

32%

3%

23%

11%

8%

Figure 6. Tax revenues, 2015

Corporate income tax

Individual income tax

Social tax

Value added tax

25%

31%

12%

3%

19%

10%

Excise

Other taxes

8

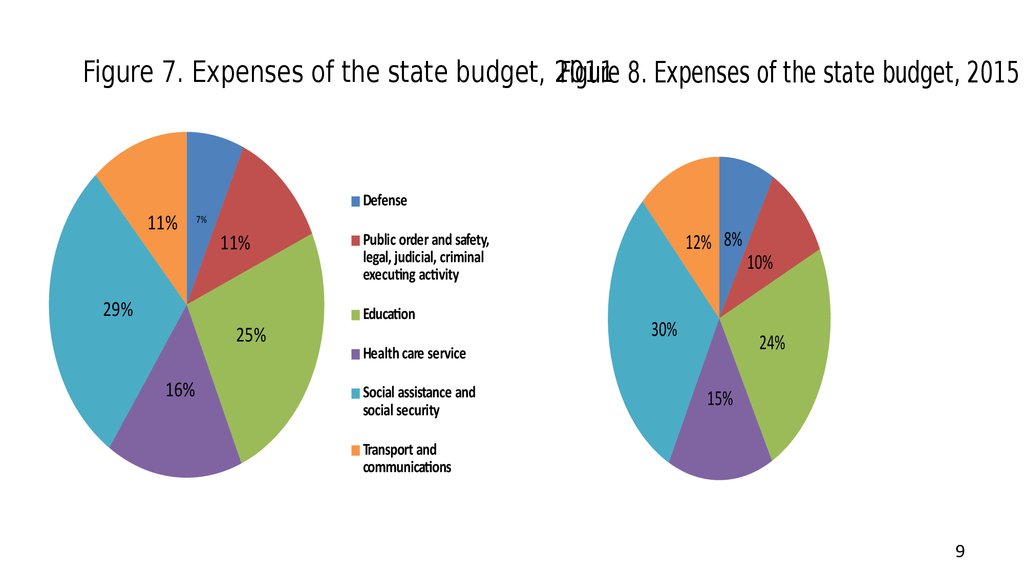

9.

Figure 7. Expenses of the state budget, 2011Figure 8. Expenses of the state budget, 2015

11%

29%

Defense

7%

11%

25%

16%

12% 8%

Public order and safety,

legal, judicial, criminal

executing activity

Education

30%

24%

Health care service

Social assistance and

social security

10%

15%

Transport and

communications

9

10. Recommendations:

• Monitoring and regulation of tax policy.• Targeted use of budgetary funds.

• Attraction of long – term loan from World Bank.

10

Финансы

Финансы Английский язык

Английский язык